As filed with the Securities and Exchange Commission on April 28, 2014

Registration No. 333-178786-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Post-Effective Amendment No. 2

To

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

GREENBACKER RENEWABLE

ENERGY COMPANY LLC

(Exact name of registrant as specified in its governing instruments)

Delaware

(State or other jurisdiction of incorporation or organization)

4911

(Primary Standard Industrial Classification Code Number)

80-0872648

(I.R.S. Employer Identification Number)

369 Lexington Avenue, Suite 312

New York, NY 10017

Tel (646) 237-7884

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Charles Wheeler

c/o Greenbacker Capital Management LLC

369 Lexington Avenue, Suite 312

New York, NY 10017

Tel (646) 237-7884

(Name, address, including zip code and telephone number, including area code, of agent for service)

Copies to:

| | | | |

Timothy P. Selby, Esq. Matthew W. Mamak, Esq. Alston & Bird LLP 90 Park Avenue New York, New York 10016 Tel (212) 210-9494 Fax (212) 922-3894 | | Jay L. Bernstein, Esq. Jacob A. Farquharson, Esq. Clifford Chance US LLP 31 West 52nd Street New York, New York 10019 Tel (212) 878-8000 Fax (212) 878-8375 | | Lauren B. Prevost, Esq. Heath D. Linsky, Esq. Morris, Manning & Martin, LLP 1600 Atlanta Financial Center 3343 Peachtree Road, N.E. Atlanta, Georgia 30326-1044 Tel (404) 233-7000 Fax (404) 365-9532 |

If any securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933 check the following box: x

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a small company filer. See the definitions of “large accelerated filer,” “accelerated filer,” and “small reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | |

Large accelerated filer | | ¨ | | | | | | Accelerated filer | | ¨ | | |

Non-accelerated filer | | x | | | | (Do not check if a smaller reporting company) | | Small reporting company | | ¨ | | |

The registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

| | | | | | | | |

| PROSPECTUS | | Maximum Offering of $1,500,000,000 in Shares Minimum Offering of $2,000,000 in Shares |

| | Greenbacker Renewable Energy Company LLC |

| | |

| | |

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Greenbacker Renewable Energy Company LLC is an energy company that intends to acquire income-generating renewable energy and energy efficiency and sustainable development projects and other energy-related businesses as well as finance the construction and/or operation of these projects and businesses. We will be managed and advised by Greenbacker Capital Management LLC, our advisor.

We are offering up to $1,500,000,000 in shares of our limited liability company interests, or the shares, including up to $250,000,000 pursuant to our distribution reinvestment plan, on a “best efforts” basis through SC Distributors, LLC, the dealer manager, meaning it is not required to sell any specific number or dollar amount of shares. We are publicly offering three classes of shares: Class A shares, Class C shares and Class I shares in any combination with a dollar value up to the maximum offering amount. The share classes have different selling commissions, dealer manager fees and there is an ongoing distribution fee with respect to Class C shares.We will determine our net asset value each quarter commencing with the first full quarter after the minimum offering requirement is satisfied. If our net asset value per share on such valuation date increases above or decreases below our net proceeds per share as stated in this prospectus, we will adjust the offering price of all classes of shares, effective five business days later, to ensure that after the effective date of the new offering prices the offering prices, after deduction of selling commissions, dealer manager fees and organization and offering expenses, are not above or below our net asset value per share on such valuation date. We have adopted a distribution reinvestment plan pursuant to which you may elect to have the full amount of your cash distributions from us reinvested in additional shares. We reserve the right to reallocate the shares offered between Class A, Class C and Class I shares and between this offering and our distribution reinvestment plan.

We will not sell any shares unless we have raised gross offering proceeds of $2.0 million by August 7, 2014. See “Plan of Distribution.” Purchases of Class A shares by our directors, officers and any affiliates of us or GCM (other than GCM’s initial contribution to us) will count toward meeting this minimum threshold. We may sell our shares in this offering until August 7, 2015, unless we decide to extend this offering. In some states, we will need to renew our registration annually in order to continue offering our shares beyond the initial registration period. All subscription payments will be held in an escrow account by UMB Bank, as escrow agent, for our subscribers’ benefit pending release to us upon satisfaction of the minimum offering requirement. As set forth in more detail below, we have special escrow requirements for subscriptions from residents of Pennsylvania and Washington. If we do not satisfy the minimum offering requirement, we will arrange for our escrow agent to promptly return all funds in the escrow account (including interest), and we will stop offering shares. We will not receive any fees or expenses out of any funds returned to investors.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups (JOBS) Act of 2012; however, we do not intend to take advantage of any of the reduced public company reporting requirements afforded by the JOBS Act.

Investing in our shares may be considered speculative and involves a high degree of risk, including the risk of a substantial loss of investment. See“Risk Factors” beginning on page 24 for a discussion of the risks you should consider before investing in shares, including:

| | • | | Our advisor and its respective affiliates, including our officers and some of our directors, will face conflicts of interest including conflicts that may result from compensation arrangements with us and our affiliates, which could result in actions that are not in the best interests of our members. |

| | • | | This offering is initially a “blind pool” offering, and therefore, you will not have the opportunity to evaluate our investments before we make them, which makes an investment in us more speculative. |

| | • | | This is our initial public offering. We have no assets. We have no operating history. No public market currently exists for our shares, nor may a public market ever develop and our shares are illiquid. |

| | • | | Our success will be dependent on the performance of our advisor; however, our advisor has no operating history and no experience managing a public company or maintaining our exemption from registration under the Investment Company Act of 1940, as amended. |

| | • | | We will pay substantial fees and expenses to GCM and the dealer manager, which payments increase the risk that you will not earn a profit on your investment. |

| | • | | The amount of any distributions we may pay is uncertain. We may not be able to pay you distributions, or be able to sustain them once we begin declaring distributions, and our distributions may not grow over time. We may pay distributions from any source and there are no limits on the amount of proceeds we may use to fund distributions. If we pay distributions from sources other than cash flow from operations, we will have less funds available for investments, and your overall return may be reduced. |

| | • | | We may change our investment policies and strategies without prior notice or member approval, the effects of which may be adverse. |

| | • | | Shares are subject to a 9.8% ownership limitation. In addition, our LLC Agreement contains various other restrictions on ownership and transfer of our shares. |

| | • | | You will experience substantial dilution in the net tangible book value of your shares equal to the offering costs associated with your shares. |

Neither the Securities and Exchange Commission, the Attorney General of the State of New York nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense. The use of projections or forecasts in this offering is prohibited. Any representation to the contrary and any predictions, written or oral, as to the amount or certainty of any future benefit or tax consequence that may flow from an investment in our shares is not permitted.

| | | | | | | | | | | | | | | | |

| | | Maximum

Aggregate Price to

Public | | | Maximum

Selling

Commissions(3) | | | Maximum

Dealer

Manager Fee(3) | | | Proceeds,

Before Expenses,

to Us(1)(2)(3) | |

Offering | | | | | | | | | | | | | | | | |

Maximum Offering | | $ | 1,250,000,000 | | | $ | 41,666,667.67 | | | $ | 30,208,333.33 | | | $ | 1,178,125,000 | |

Per Class A Share | | $ | 10.00 | | | $ | 0.700 | | | $ | 0.275 | | | $ | 9.025 | |

Per Class C Share | | $ | 9.576 | | | $ | 0.287 | | | $ | 0.263 | | | $ | 9.025 | |

Per Class I Share | | $ | 9.186 | | | | — | | | $ | 0.161 | | | $ | 9.025 | |

Minimum Offering | | $ | 2,000,000 | | | $ | 66,666.67 | | | $ | 48,333.33 | | | $ | 1,885,000 | |

Distribution Reinvestment Plan | | | | | | | | | | | | | | | | |

Per Class A, C and I Share | | $ | 9,025 | | | | — | | | | — | | | $ | 9,025 | |

Total Maximum | | $ | 1,500,000,000.00 | | | $ | 41,666,667.67 | | | $ | 30,208,333.33 | | | $ | 1,428,125,000 | |

| (1) | The proceeds are calculated before deducting certain organization and offering expenses to us. In addition to selling commissions and dealer manager fees, we estimate that we will incur in connection with this offering approximately $100,000 of expenses (approximately 5.00% of the gross proceeds) if the minimum number of shares is sold and approximately $18.8 million of expenses (approximately 1.5% of the gross proceeds) if the maximum number of shares is sold. We will reimburse our advisor and its affiliates for these costs and for future organization and offering expenses they may incur on our behalf, but only to the extent that the reimbursement would not cause the selling commissions, the dealer manager fee and the other organization and offering expenses borne by us to exceed 15% of gross offering proceeds as of the date of reimbursement. This table excludes the distribution fees for Class C shares, which will be paid over time. With respect to Class C shares, we will pay our dealer manager a distribution fee that accrues daily equal to 1/365th of 0.80% of the amount of the net asset value for the Class C shares for such day on a continuous basis from year to year, until the earlier to occur of the following: (i) a listing of the Class C shares on a national securities exchange, (ii) following the completion of this offering, total underwriting compensation in this offering equaling 10% of the gross proceeds from our primary offering, or (iii) there are no longer any Class C shares outstanding. We may also pay additional underwriting compensation and other fees to our dealer manager. See “Compensation of the Advisor and the Dealer Manager,” “Plan of Distribution” and “Certain Relationships and Related Party Transactions.” |

| (2) | We are offering certain volume discounts resulting in reductions in selling commissions and dealer manager fees payable with respect to sales of shares for certain minimum aggregate purchase amounts to a purchaser. See “Plan of Distribution—Volume Discounts.” |

| (3) | Assumes primary offering gross proceeds come from sales of 1/3 each of Class A, Class C and Class I shares. |

Subject to Completion: Dated April 28, 2014

SUITABILITY STANDARDS

The following are our suitability standards for investors that are required by the Omnibus Guidelines published by the North American Securities Administrators Association in connection with our continuous offering of shares under this registration statement.

Pursuant to applicable state securities laws, shares offered through this prospectus are suitable only as a long-term investment for persons of adequate financial means who have no need for liquidity in this investment. Initially, there is not expected to be any public market for the shares, which means that it may be difficult for members to sell shares. As a result, we have established suitability standards which require investors to have either (i) a net worth (not including home, furnishings, and personal automobiles) of at least $70,000 and an annual gross income of at least $70,000, or (ii) a net worth (not including home, home furnishings, and personal automobiles) of at least $250,000.

Our suitability standards also require that a potential investor (1) can reasonably benefit from an investment in us based on such investor’s overall investment objectives and portfolio structuring; (2) is able to bear the economic risk of the investment based on the prospective member’s overall financial situation; and (3) has apparent understanding of (a) the fundamental risks of the investment, (b) the risk that such investor may lose his or her entire investment, (c) the lack of liquidity and restrictions on transferability of the shares, (d) the background and qualifications of GCM and (e) the tax consequences of the investment. Persons who meet these standards and who seek to diversify their portfolio are most likely to benefit from an investment in our company.

The minimum purchase amount is $2,000 in shares. To satisfy the minimum purchase requirements for retirement plans, unless otherwise prohibited by state law, a husband and wife may jointly contribute funds from their separate individual retirement accounts, or IRAs, provided that each such contribution is a minimum of $500. You should note that an investment in shares will not, in itself, create a retirement plan and that, in order to create a retirement plan, you must comply with all applicable provisions of the Internal Revenue Code.

If you have satisfied the applicable minimum purchase requirement, any additional purchase must be in amounts of at least $500. The investment minimum for subsequent purchases does not apply to shares purchased pursuant to our distribution reinvestment plan.

In the case of sales to fiduciary accounts, these suitability standards must be met by the person who directly or indirectly supplied the funds for the purchase of the shares or by the beneficiary of the account.

These suitability standards are intended to help ensure that, given the long-term nature of an investment in shares, our investment objectives and the relative illiquidity of our shares, our shares are an appropriate investment for those of you who become members. Those selling shares on our behalf must make every reasonable effort to determine that the purchase of our shares is a suitable and appropriate investment for each investor based on information provided by the investor in the subscription agreement. Relevant information for this purpose includes at least the age, investment objectives, investment experience, income, net worth, financial situation and other investments of the prospective investor. Each selected broker-dealer is required to maintain for six years records of the information used to determine that an investment in our shares is suitable and appropriate for an investor.

Certain states have established suitability requirements different from those described above. Shares will be sold to investors in these states only if they meet the special suitability standards set forth below:

Alabama: In addition to the minimum suitability standards, this investment will only be sold to Alabama residents that represent they have a liquid net worth at least ten times their investment in this program and other similar programs and they meet the $70,000 / $70,000 / $250,000 suitability requirement.

i

California: In addition to the minimum suitability standards listed above, a California investor’s maximum investment in us may not exceed 10% of such investor’s net worth.

Iowa: In addition to the minimum suitability standards described above, the state of Iowa requires that each Iowa investor limit his or her investment in us to a maximum of 10% of his or her liquid net worth, which is defined as cash and/or cash equivalents. An Iowa investor must have either (i) a net worth (not including home, furnishings and personal automobiles) of $100,000 and an annual gross income of at least $100,000 or (ii) a net worth of at least $350,000 (not including home, furnishings and personal automobiles).

Kansas:It is recommended by the Office of the Securities Commissioner that Kansas investors limit their aggregate investment in our securities and other non-traded business development companies to not more than 10% of their liquid net worth. For these purposes, liquid net worth shall be defined as that portion of total net worth (total assets minus liabilities) that is comprised of cash, cash equivalents and readily marketable securities, as determined in conformity with generally accepted accounting principles.

Kentucky: In addition to the minimum suitability standards described above, no Kentucky resident shall invest more than 10% of his or her liquid net worth in us.

Maine:In addition to our suitability requirements, it is recommended that Maine investors limit their investment in us and in the securities of similar programs to not more than 10% of their liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities.

Massachusetts:Massachusetts investors may not invest more than 10% of their liquid net worth in us and other non-traded direct participation programs. For Massachusetts residents, “liquid net worth” is that portion of an investor’s net worth (assets minus liabilities) that is comprised of cash, cash equivalents and readily marketable securities.

Michigan:It is recommended by the Michigan Securities Division that Michigan citizens not invest more than 10% of their liquid net worth in us. Liquid net worth is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities that may be converted into cash within one year.

New Mexico:In addition to the minimum suitability standards described above, an investment by a New Mexico resident may not exceed ten percent (10%) of the New Mexico resident’s liquid net worth in us, our affiliates and other similar non-traded direct participation programs.

New Jersey: New Jersey investors must have either, (a) a minimum liquid net worth of at least $150,000 and a minimum annual gross income of not less than $70,000, or (b) a minimum liquid net worth of at least $350,000. For these purposes, “liquid net worth” is defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles, minus total liabilities) that consists of cash, cash equivalents and readily marketable securities. In addition, a New Jersey investor’s investment in us, shares of our affiliates, and other direct participation investments may not exceed ten percent (10%) of his or her liquid net worth.

North Dakota:North Dakota investors must represent that, in addition to the standards listed above, they have a net worth of at least ten times their investment in us.

Oklahoma: In addition to the minimum suitability standards described above, an investment by Oklahoma investors should not exceed 10% of their net worth (not including home, home furnishings and automobiles).

Oregon:In addition to the minimum suitability standards described above, an investment by an Oregon resident may not exceed ten percent (10%) of the Oregon resident’s liquid net worth.

ii

Tennessee: In addition to our suitability requirements, a Tennessee investor must have either (i) a net worth of $85,000 and an annual gross income of at least $85,000, or (ii) a minimum net worth of $350,000 (exclusive of home, home furnishings and personal automobiles).

In purchasing shares, custodians or trustees of employee pension benefit plans or IRAs may be subject to the fiduciary duties imposed by the Employee Retirement Income Security Act of 1974, or ERISA, or other applicable laws and to the prohibited transaction rules prescribed by ERISA and related provisions of the Internal Revenue Code. In addition, prior to purchasing shares, the trustee or custodian of an employee pension benefit plan or an IRA should determine that such an investment would be permissible under the governing instruments of such plan or account and applicable law.

Notice to Residents of Pennsylvania Only

Because the minimum closing amount is less than $50,000,000, you are cautioned to carefully evaluate our ability to fully accomplish our stated objectives and to inquire as to the current dollar volume of our subscriptions.

We will place all Pennsylvania investor subscriptions in escrow until the company has received total subscriptions of at least $62,500,000 (including sales made to residents of other states), or for an escrow period of 120 days, whichever is shorter.

If we have not received total subscriptions of at least $62,500,000 by the end of the escrow period, we must:

A. return the Pennsylvania investors’ funds within 15 calendar days of the end of the escrow period; or

B. notify the Pennsylvania investors in writing by certified mail or any other means whereby receipt of delivery is obtained within 10 calendar days after the end of the escrow period, that the Pennsylvania investors have a right to have their investment returned to them. If such an investor requests the return of such funds within 10 calendar days after receipt of notification, the company must return such funds within 15 calendar days after receipt of the investor’s request.

No interest is payable to an investor who requests a return of funds at the end of the initial 120-day escrow period. Any Pennsylvania investor who requests a return of funds at the end of any subsequent 120-day escrow period will be entitled.

Notice to Residents of Washington Only

We will place all Washington investor subscriptions in escrow until the company has received total subscriptions of at least $10,000,000 (including sales made to residents of other states).

iii

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

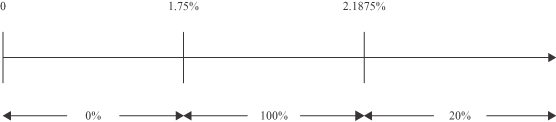

This prospectus is part of a registration statement that we have filed with the SEC to register a continuous offering of our shares. Periodically, as we make material investments or have other material developments, we will provide a prospectus supplement or amend this prospectus that may add, update or change information contained in this prospectus. We will endeavor to avoid interruptions in the continuous offering of shares of our limited liability company interests, but may, to the extent permitted or required under the rules and regulations of the SEC, supplement the prospectus or file an amendment to the registration statement with the SEC if we determine to adjust the prices of our shares because our net asset value per share declines or increases from the amount of the net proceeds per share as stated in the prospectus. In addition, we will file an amendment to the registration statement with the SEC on or before such time as the new offering price per share for any of the classes of our shares being offered by this prospectus represents more than a 20% change in the per share offering price of our shares from the most recent offering price per share. While we will attempt to file such amendment on or before such time in order to avoid interruptions in the continuous offering of our shares, there can be no assurance, however, that our continuous offering will not be suspended while the SEC reviews any such amendment and until it is declared effective.

Any statement that we make in this prospectus may be modified or superseded by us in a subsequent prospectus supplement. The registration statement we have filed with the SEC includes exhibits that provide more detailed descriptions of certain matters discussed in this prospectus. You should read this prospectus and the related exhibits filed with the SEC and any prospectus supplement, together with additional information described in the section entitled “Available Information” in this prospectus. In this prospectus, we use the term “day” to refer to a calendar day, and we use the term “business day” to refer to any day other than Saturday, Sunday, a legal holiday or a day on which banks in New York City are authorized or required to close. In addition, we use certain industry-related terms in this prospectus, which are described in a “Glossary of Certain Industry Terms,” included in this prospectus as Appendix B.

You should rely only on the information contained in this prospectus. Neither we nor the dealer manager has authorized any other person to provide you with different information from that contained in this prospectus. If anyone provides you with different or inconsistent information, you should not rely on it. We are not, and the dealer manager is not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. The information contained in this prospectus is complete and accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or sale of our shares. If there is a material change in the affairs of our company, we will amend or supplement this prospectus.

For information on the suitability standards that investors must meet in order to purchase shares in this offering, see “Suitability Standards.”

- 1 -

PROSPECTUS SUMMARY

This summary highlights selected information contained elsewhere in this prospectus, and does not contain all of the information that you may want to consider when making your investment decision. To understand this offering fully, you should read the entire prospectus carefully, including the section entitled “Risk Factors,” before making a decision to invest in our shares.

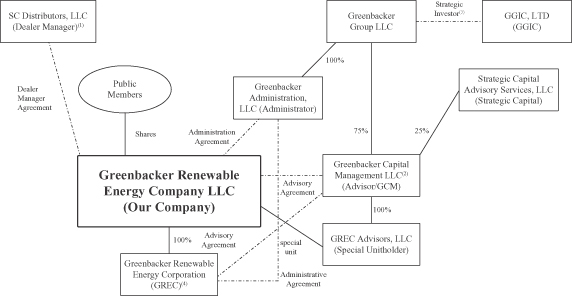

Greenbacker Renewable Energy Company LLC is a Delaware limited liability company formed on December 4, 2012. Unless the context requires otherwise or as otherwise noted, the terms “we,” “us,” “our,” and “our company” refer to Greenbacker Renewable Energy Company LLC, together with its consolidated subsidiaries, including Greenbacker Renewable Energy Corporation, a Maryland Corporation, which we refer to as “GREC”; the term “GCM” and our “advisor” refer to Greenbacker Capital Management LLC, our external advisor; the term “GGIC” and “strategic investor” refers to GGIC, LTD; the term “Special Unitholder” refers to GREC Advisors, LLC, a Delaware limited liability company, which is a subsidiary of our advisor; “special unit” refers to the special unit of limited liability company interest in us entitling the Special Unitholder to an incentive allocation and distribution; the term “SC Distributors” and our “dealer manager” refer to SC Distributors, LLC, our dealer manager; the term “Greenbacker Administration” and our “Administrator” refer to Greenbacker Administration, LLC, our Administrator; the term “LLC Agreement” refers to the limited liability company agreement of our company, a copy of which is attached as Appendix C to this prospectus.

Greenbacker Renewable Energy Company LLC

We are an energy company that intends to acquire income-generating renewable energy and energy efficiency and sustainable development projects and other energy-related businesses as well as finance the construction and/or operation of these projects and businesses. We refer to these projects and businesses, collectively, as our target assets. We will be managed and advised by Greenbacker Capital Management LLC, or GCM, a renewable energy, energy efficiency, sustainability and other energy related project acquisition, consulting and development company that intends to register as an investment adviser under the Investment Advisers Act of 1940, or the Advisers Act no later than it is required to do so pursuant to the Advisers Act. We expect to engage Greenbacker Administration to provide the administrative services necessary for us to operate.

We will seek to capitalize on the significant investing experience of our advisor's management team, including the 24 years of investment banking and renewable energy expertise of Charles Wheeler, our Chief Executive Officer and President, and the Chief Investment Officer and a managing director of GCM. Mr. Wheeler has held various senior positions with Macquarie Group, including Head of Financial Products for North America and Head of Renewables for North America. While serving as Head of Renewables for North America, Mr. Wheeler's experience included evaluating wind project developments, solar asset acquisitions, assisting in the development of wind and solar greenfield projects, and assisting in the preparation of investment analyses for a biomass facility. Before moving to the United States to serve as Head of Financial Products for Macquarie Group in North America, Mr. Wheeler was a Director of the Financial Products Group in Australia with responsibility for the development, distribution and ongoing management of a wide variety of retail financial products, including real estate investment trusts, or REITs, infrastructure bonds, international investment trusts and diversified domestic investment trusts. We expect Mr. Wheeler will bring his extensive background in renewable energy and project and structured finance to help us effectively execute our strategy.

We are organized as a Delaware limited liability company. We will conduct a significant portion of our operations through GREC, of which we are the sole shareholder. We intend to operate our business in a manner that will permit us to maintain our exemption from registration under the Investment Company Act of 1940, as amended, the Investment Company Act.

- 2 -

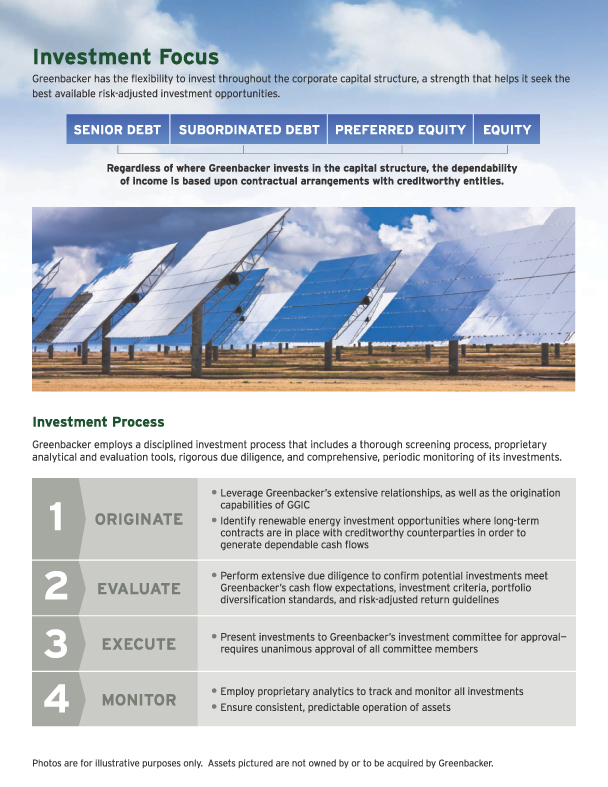

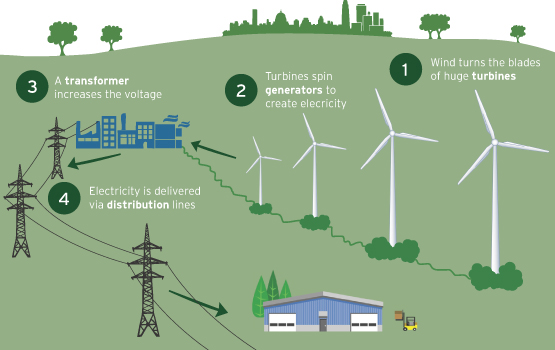

Our Market Opportunity

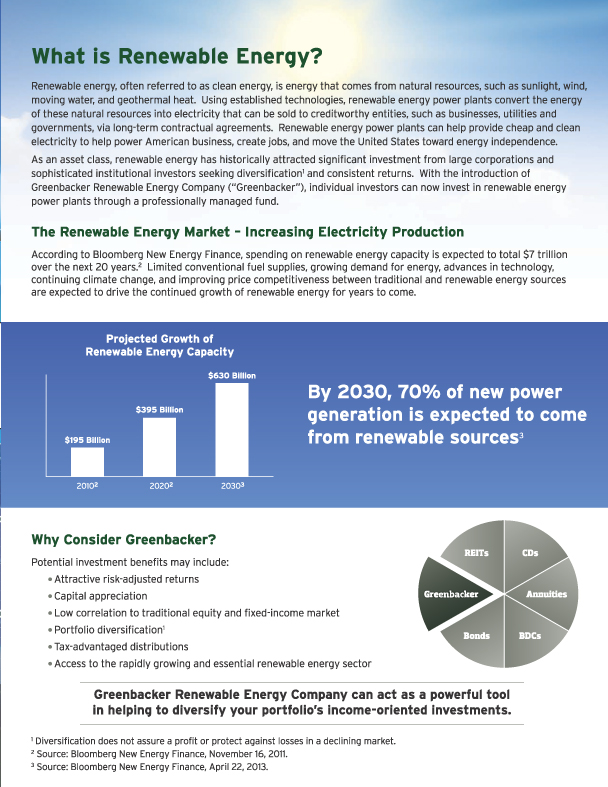

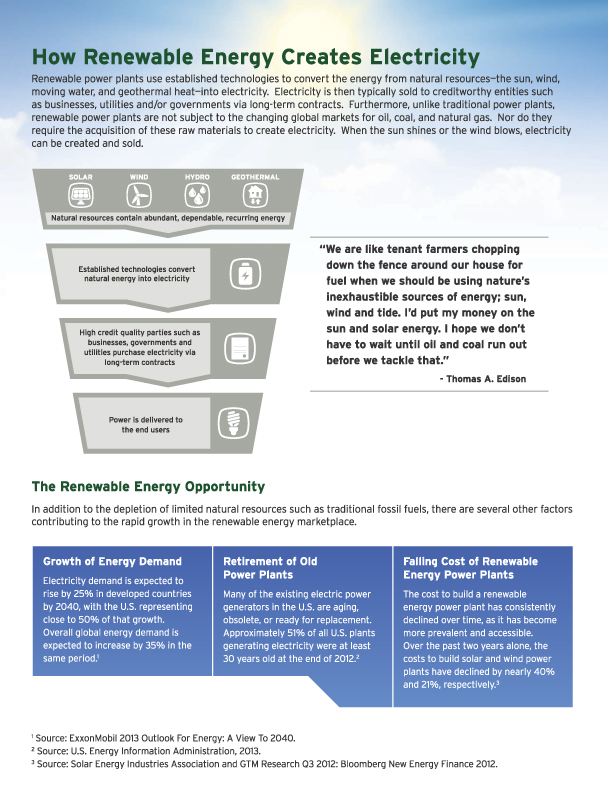

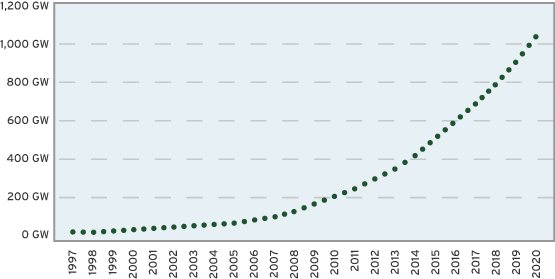

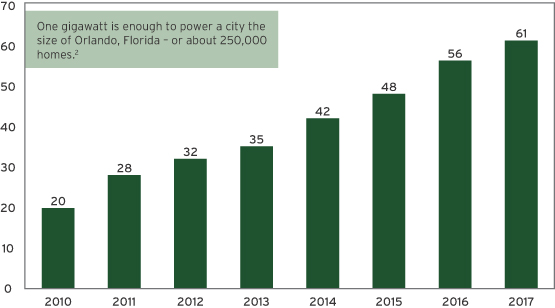

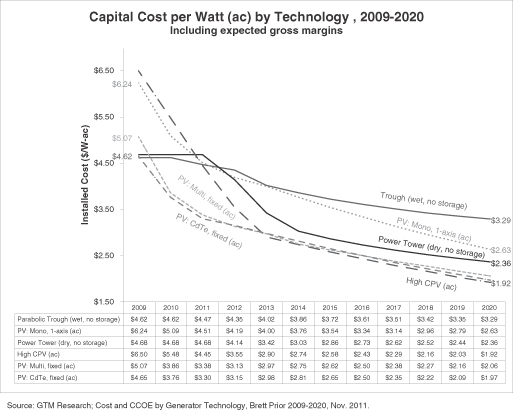

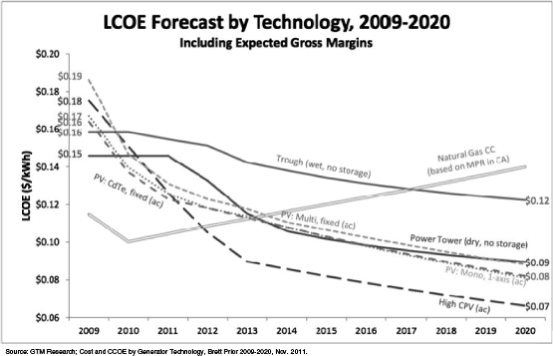

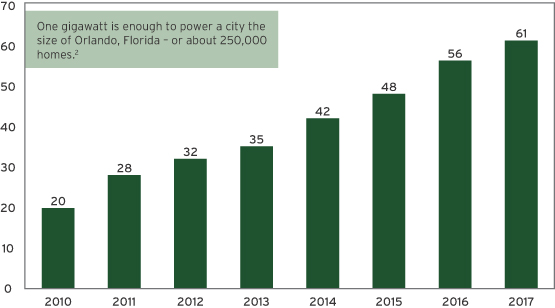

The market for renewable energy has grown rapidly over the past decade. According to the U.S. Department of Energy’s 2011 Renewable Energy Data Book, or the Renewable Energy Data Book, global renewable energy capacity has nearly doubled between 2000 to 2011. Renewable electricity represented nearly 13% of total installed capacity and more than 12% of total electric power generation in the United States in 2011. Since 2000, renewable electricity installations in the United States have more than tripled, and in 2011 represent 146 GW of installed U.S. capacity, according to the Renewable Energy Data Book.

We believe that demand for alternative forms of energy from traditional fossil-fuel energy will continue to grow as countries seek to reduce their dependence on outside sources of energy and as the political and social climate continues to demand social responsibility on environmental matters. According to the Renewable Energy Data Book, the US Energy Administration anticipates in its base case that generation from renewable energy sources will grow by 77% from 2010 to 2035. Notwithstanding this growing demand, we believe that a significant shortage of capital currently exists in the market to satisfy the demands of the renewable energy sector in the United States and around the world, particularly with respect to small andmid-sized projects and businesses that are newly developed. Many of the traditional sources of equity capital for the renewable energy marketplace were attracted to renewable energy projects based on their ability to utilize investment tax credits, or ITCs, and tax deductions. We believe that due to changes in their taxable income profiles that have made these tax incentives less valuable, these traditional sources of equity capital have withdrawn from the market. In addition, much of the capital that is available is focused on larger projects that have long-termoff-take contracts in place, and does not allow project owners to take any “merchant” or investment risk with respect to renewable energy certificates, or RECs. We believe many project developers are not finding or are encountering delays in accessing capital for their projects. As a result, we believe a significant opportunity exists for us to provide new forms of capital to meet this demand.

We also believe that the market for energy efficiency projects is showing growth and opportunity. According to the submission of Steven Nadel, an Executive Director of the American Council for an Energy-Efficient Economy, or the ACEEE, to the Senate Finance Committee, Subcommittee on Energy, Natural Resources and Infrastructure for the Hearing on Tax Reform and Energy Policy in 2012, the ACEEE has estimated that by 2050, energy efficiency measures and practices could reduce U.S. energy use by 42% to 59% relative to current projections. As a result, we believe that a significant opportunity exists for us to finance projects which enhance the efficiency of energy assets, primarily in the United States.

Our Competitive Strengths

We believe that the following key strengths and competitive advantages will enable us to capitalize on the significant opportunities for growth in renewable energy projects.

| | • | | Significant Experience of GCM. The senior management team of our advisor, GCM, has a long track record and broad experience in acquiring, operating and managing income-generating renewable energy and energy efficiency projects and other energy-related businesses as well as financing the construction and/or operation of these projects and businesses. |

| | • | | Attractive Return Profile of Asset Class. We believe that investments in renewable energy assets present the opportunity to generate significant and dependable cash flows and deliver attractive risk-adjusted returns over time. |

| | • | | Unique Focus, Structure, and Early Mover Advantage. We believe that we are one of the firstnon-bank public companies focused on providing capital in the renewable energy sector. Upon completion of this offering, we expect to be a well capitalized public company and, as a result, we believe that we will be uniquely positioned to address the capital shortage problem in the renewable |

- 3 -

| | energy sector. Our organizational structure and tax profile is expected to allow us to capture the premium risk-adjusted returns otherwise demanded by third party tax credit equity providers. |

| | • | | Strategic Relationships and Access to Deal Flow.GCM's senior executives have extensive experience in the renewable energy, capital markets and project finance sectors and as a result have an extensive network of contacts in these sectors. We believe the breadth and depth of GCM's relationships will generate a continual source of attractive investment opportunities for us, which will enable it to enhance our ability to utilize our growth capital in an efficient timeframe. |

| | • | | Alignment of Interests. We have taken multiple steps to structure our relationship with GCM so that our interests and those of GCM are closely aligned including the fact that GCM will not offer its shares for repurchase as long as GCM remains our advisor, as well as the structure of the incentive distribution to which an affiliate of GCM may be entitled. |

In considering our competitive strengths and advantages, you should also consider that an investment in us involves a high degree of risk. See “Risk Factors.” In addition, our advisor and its affiliates, including certain of our officers and directors, will face conflicts of interest including conflicts that may result from compensation arrangements with us. See “Conflicts of Interest” on page 128 of this prospectus.

Our Business Objective and Policies

Our business objective is to generate attractive risk-adjusted returns for our members, consisting of both current income and long-term capital appreciation, by acquiring, and financing the construction and/or operation of income-generating renewable energy, energy efficiency and sustainable development projects, primarily within but also outside of North America. We expect the size of our investments to generally range between approximately $1 million and $100 million. We will seek to maximize our risk-adjusted returns by: (1) capitalizing on underserviced markets; (2) focusing on hard assets that produce significant and dependable cash flows; (3) efficiently utilizing government incentives where available; (4) employing creative deal structuring to optimize capital, tax and ownership structures; (5) partnering with experienced financial, legal, engineering and other professional firms; (6) employing sound due diligence and risk mitigation processes; and (7) monitoring and managing our portfolio of assets on an ongoing basis. We may change our investment policies and strategies without prior notice or member approval. See “We may change our investment policies and strategies without prior notice of member approval, the effects of which may be adverse.” in “Risk Factors—Risks Related to Our Business and Structure” for greater detail.

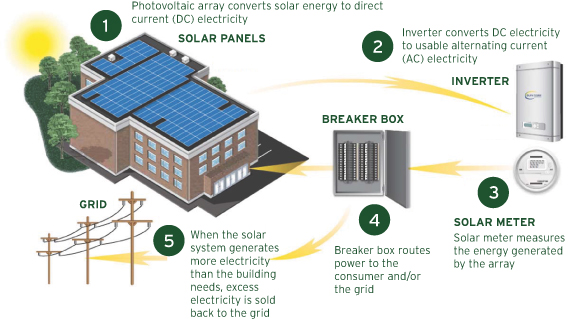

Our goal is to assemble a diversified portfolio of renewable energy, energy efficiency and other sustainability related projects and businesses. Renewable energy projects earn revenue through the sale of generated electricity as well as frequently through the sale of other commodities such as RECs and energy efficiency certificates, or EECs, which are generated by the projects. We expect initially to focus on solar energy and wind energy projects. We believe solar energy projects generally offer more predictable power generations characteristics, due to the relative predictability of sunlight over the course of time compared to other renewable energy classes and therefore we expect they will provide more stable income streams. However, technological advances in wind turbines and government incentives make wind energy projects attractive as well. Solar energy projects provide maximum energy production during the middle of the day and in the summer months when days are longer and nights shorter. Generally, the demand for power tends to be higher at those times due to the use of air conditioning and as a result energy prices tend to be higher. In addition, solar projects are eligible to receive significant government incentives at both the federal and state levels which can be applied to offset project development costs or supplement the price at which power generated by these projects can be sold. Solar energy projects also tend to have minimal environmental impact enabling such projects to be developed close to areas of dense population where electricity demand is highest. Solar technology is scalable and well-established and it will be a relatively simple process to integrate new acquisitions and projects into our portfolio. Over time, we

- 4 -

expect to broaden our strategy to include other types of renewable energy projects and businesses, which may include hydropower assets, geothermal plants, biomass and biofuel assets, combined heat and power technology assets, fuel cell assets and other energy efficiency assets, among others, and to the extent we deem the opportunity attractive, other energy and sustainability related assets and businesses.

Our primary investment strategy is to acquire controlling equity stakes, which we define as ownership of 25% or more of the outstanding voting securities of a company or having greater than 50% representation on a company's board of directors, in our target assets and to oversee and supervise their power generation and distribution processes. However, we will also provide project financing to projects owned by others, including through the provision of secured loans which may or may not include some form of equity participation. We may also provide projects with senior unsecured debt, subordinated secured debt, subordinated unsecured debt, mezzanine debt, convertible debt, convertible preferred equity, and preferred equity, and make minority equity investments. We may also participate in projects by acquiring contractual payment rights or rights to receive a proportional interest in the operating cash flow or net income of a project. Our strategy will be tailored to balance long-term energy price certainty, which we can achieve through long-term power purchase agreements, with shorter term arrangements that allow us to potentially generate higher risk-adjusted returns.

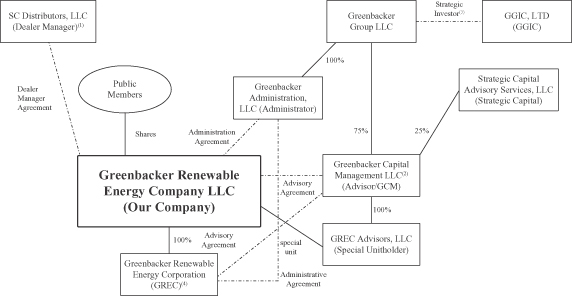

Our Corporate Structure

Our anticipated organizational structure upon completion of the offering will be as follows:

| (1) | Strategic Capital Advisory Services, LLC, a member of our advisor that will provide certain non-investment advisory services, is an affiliate of our dealer manager. |

| (2) | Through each of their ownership interests in Greenbacker Group LLC, Charles Wheeler, our Chief Executive Officer and a member of our board of directors, and David Sher, a member of our board of directors, indirectly own a 14.63% and 9.54% interest, respectively, in our advisor. |

| (3) | GGIC is a strategic investor in GCM. Two representatives of GGIC are members of GCM’s investment committee. |

| (4) | Greenbacker Renewable Energy Company LLC holds all of the outstanding capital stock in GREC. The outstanding capital stock in GREC consists of shares of one class of common stock as well as a class of special preferred stock, which we refer to as the special preferred stock, that provides the holder thereof with the right to receive dividends from GREC, before any dividend is payable in respect of shares of outstanding GREC common stock, in an amount equal to the distributions that are payable in respect of the special unit. See “Advisory Agreement-Management Fee and Incentive Allocation and Distribution.” |

- 5 -

About Greenbacker Capital Management

GCM will manage our investments. GCM is a newly formed renewable energy, energy efficiency, sustainability and other energy related project acquisition, consulting and development company that intends to register under the Advisers Act. GCM is led by its Chief Executive Officer, David Sher, who has four years of experience in the energy infrastructure and project finance sector and 22 years of experience in the financial services sector, its President and Chief Investment Officer, Charles Wheeler, who has 20 years of experience in the energy infrastructure and project finance sector and 26 years of experience in the financial services sector, its General Counsel, Robert Lawsky, who has six years of experience in the energy infrastructure and project finance sector and six years of experience in the financial services sector, and its Managing Director, Robert Sher, who has four years of experience in the energy infrastructure and project finance sector and 22 years of experience in the financial services sector. Robert Sher is the brother of David Sher. Collectively, GCM's management team has 34 years of experience in the energy, infrastructure, and project finance sectors and 76 years of experience in the financial services sector. Over this time, they have developed significant commercial relationships across multiple industries that we believe will benefit us as we implement our business plan. GCM maintains comprehensive renewable energy, project finance, and capital markets databases and has developed proprietary analytical tools and due diligence processes that will enable GCM to identify prospective projects and to structure transactions quickly and effectively on our behalf. Neither GCM, Greenbacker Group LLC nor our senior management team have previously sponsored any other programs, either public ornon-public, or any other programs with similar investment objectives as us.

GCM is a joint venture between Greenbacker Group LLC and Strategic Capital Advisory Services, LLC, or Strategic Capital. The purpose of the joint venture is to permit our advisor to capitalize upon the expertise of the GCM management team as well as the experience of the executives of Strategic Capital in providing advisory services in connection with the formation, organization, registration and operation of entities similar to the company. Strategic Capital will provide certain services to, and on behalf of, our advisor, including but not limited to formation services related to our formation and the structure of this organization, financial and strategic planning advice and analysis, overseeing the development of marketing materials, selecting and negotiating with third party vendors and other administrative and operational services.

A Global Energy Partner

In its role as strategic partner to our advisor, GGIC, LTD (“GGIC”, formerly known as Guggenheim Global Infrastructure Company, LTD) will assist our advisor in identifying and evaluating investment opportunities and monitoring those investments over time. This unique relationship allows our advisor to leverage the relationships, expertise, origination capabilities, and proven investment and monitoring processes used by GGIC.

GGIC is managed by Franklin Park Holdings (FPH), a firm that focuses on investments in the global power and utilities sector and has developed, invested in and managed power and utility projects in the United States, Asia and Latin America. Between 2007 and 2012 FPH was responsible for developing, implementing and managing the businesses of GGIC. FPH and Guggenheim Partners co-own an interest in the operating assets of GGIC, including an investment in our advisor, GCM. In addition to their experience with GGIC, FPH’s management team, Tom Tribone, Sonny Lulla and Robert Venerus are former Senior Executives of The AES Corporation, a Fortune 200 power company. FPH’s management team has extensive transactional and operational experience spanning over $30 billion of power and infrastructure transactions worldwide. Thomas Tribone and Sonny Lulla will serve on GCM’s investment committee.

- 6 -

Our Dealer Manager

SC Distributors, LLC, a Delaware limited liability company formed in March 2009, is an affiliate of our advisor and Strategic Capital and will serve as our dealer manager for this offering. Our dealer manager is a member firm of the Financial Industry Regulatory Authority, or FINRA, and is located at 610 Newport Center Drive, Suite 350, Newport Beach, California 92660.

Classes of Shares

Class A Shares

Each Class A share issued in the primary offering will be subject to a selling commission of up to 7.00% per share and a dealer manager fee of up to 2.75% per share. We will not pay selling commissions or dealer manager fees on Class A shares sold pursuant to our distribution reinvestment plan. Class A shares are available for purchase by the general public through different distribution channels. In addition, our executive officers and board of directors and their immediate family members, as well as officers and employees of our advisor and other affiliates of our advisor and their immediate family members and, if approved by our board of directors, joint venture partners, consultants and other service providers may only purchase Class A shares. The selling commissions that are payable by other investors in this offering will be waived for purchases by our affiliates.

Class C Shares

Each Class C share issued in the primary offering will be subject to a selling commission of up to 3.00% per share and a dealer manager fee of up to 2.75% per share. In addition, for Class C shares, we will pay our dealer manager on a monthly basis a distribution fee that accrues daily equal to 1/365th of 0.80% of the amount of the net asset value for the Class C shares for such day on a continuous basis from year to year. The distribution fee is calculated each day of a month by multiplying (x) the number of Class C shares outstanding each day during such month, multiplied by (y) 1/365th of 0.80% of the net asset value of the Class C shares on the date of calculation. The net asset value of the Class C shares will be calculated, and adjusted if necessary, on a quarterly basis.We will continue paying distribution fees with respect to the Class C shares sold in this offering (including Class C shares sold pursuant to the distribution reinvestment plan) until the earlier to occur of the following: (i) a listing of the Class C shares on a national securities exchange, (ii) following the completion of this offering, total underwriting compensation in this offering equaling 10% of the gross proceeds from our primary offering, or (iii) there are no longer any Class C shares outstanding. For detailed information regarding the underwriting compensation in this offering, see “Plan of Distribution—About the Dealer Manager.” The payment of distribution fees with respect to Class C shares out of cash otherwise distributable to holders of Class C shares will result in a lower amount of distributions being paid with respect to Class C shares. We will not pay selling commissions or dealer manager fees on Class C shares sold pursuant to our distribution reinvestment plan. Class C shares are available for purchase by the general public through different distribution channels.

Class I Shares

No selling commission will be paid for sales of any Class I shares, and we will not pay our dealer manager a distribution fee with respect to the Class I shares. Each Class I share will be subject to a dealer manager fee of up to 1.75% per share. Class I shares are available for purchase to certain institutional clients.

Other than the differing fees with respect to each class described above and the payment of a distribution fee out of cash otherwise distributable to holders of Class C shares, Class A shares, Class C shares, and Class I shares have identical rights and privileges, such as identical voting rights. The net proceeds from the sale of all three classes of shares will be commingled for investment purposes and all earnings from all of the investments will proportionally accrue to each share regardless of the class.

- 7 -

In addition, the net asset value per share will be calculated in the same manner for each share of any class and we anticipate that the net asset value per share of any class will be the same. In the event of any voluntary or involuntary liquidation, dissolution or winding up of our company, or any liquidating distribution of our assets, such assets, or the proceeds thereof, will be distributed among all the members in proportion to the number of shares held by such member. See “Summary of Our LLC Agreement” and “Plan of Distribution” for more details regarding our classes of shares.

We are offering three classes of our shares. The following table is intended to assist investors in understanding the differences in fees and expenses with respect to each class, as well as certain other costs and expenses that an investor will bear, directly or indirectly:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | Initial

Offering

Price(1) | | | Selling Commissions | | | Dealer Manager Fee | | | Distribution

Fee | | | Organizational and

Offering Expenses(4) | |

| | | Per Share(1) | | | % of

Initial

Offering

Price | | | Per Share(1) | | | % of

Initial

Offering

Price | | | % of Net

Asset Value | | | Amount | | | % of

Gross

Offering

Proceeds | |

Class A shares | | $ | 10.00 | (1) | | $ | 0.700 | | | | 7.0 | % | | $ | 0.275 | | | | 2.75 | % | | | — | | | | — | | | | — | |

Class C shares | | $ | 9.576 | (1) | | $ | 0.287 | | | | 3.0 | % | | $ | 0.263 | | | | 2.75 | % | | | 0.80 | %(2) | | | — | | | | — | |

Class I shares | | $ | 9.186 | (1) | | | — | | | | — | | | $ | 0.161 | | | | 1.75 | % | | | — | | | | — | | | | — | |

Minimum Offering(3) | | $ | 2,000,000 | | | $ | 66,667 | | | | 3.33 | %(5) | | $ | 48,333 | | | | 2.42 | %(5) | | | .267 | %(3) | | $ | 100,000 | | | | 5.00 | % |

Maximum Offering(3) | | $ | 1,250,000,000 | | | $ | 41,666,667 | | | | 3.33 | %(5) | | $ | 30,208,333 | | | | 2.42 | %(5) | | | .267 | %(3) | | $ | 18,750,000 | | | | 1.5 | % |

| (1) | The per share figures in the table are calculated based on rounding to three decimal points. |

| (2) | With respect to the Class C shares (including Class C shares sold pursuant to the distribution reinvestment plan), we will pay our dealer manager a distribution fee that accrues daily equal to 1/365th of 0.80% of the amount of the net asset value for the Class C shares for such day on a continuous basis from year to year, until the earlier to occur of the following: (i) a listing of the Class C shares on a national securities exchange, (ii) following the completion of this offering, total underwriting compensation in this offering equaling 10% of the gross proceeds from our primary offering, or (iii) there are no longer any Class C shares outstanding. For a detailed calculation of the distribution fee, see “Plan of Distribution—Compensation of the Dealer Manager and Selected Broker-Dealers—Distribution Fee-Class C Shares Only.” |

| (3) | Figures shown in dollars represent aggregate amounts. Calculated assuming that 1/3 of primary offering gross proceeds come from sales of Class A shares, 1/3 of primary offering gross proceeds come from sales of Class C shares and 1/3 of primary offering gross proceeds come from sales of Class I shares. |

| (4) | See “Estimated Use of Proceeds” and “Compensation of the Advisor and the Dealer Manager” for a detailed description of these organization and offering expenses, which may include registration fees paid to the SEC, FINRA, and state regulatory authorities, and other issuer expenses, such as advertising, sales literature, fulfillment, escrow agent, transfer agent, personnel costs associated with preparing the registration and offering of our shares, reimbursements to the dealer manager and selected dealers for reasonable bona fide due diligence expenses incurred, which are supported by a detailed and itemized invoice and may include certain portions of the formation services fees paid to Strategic Capital. See “Certain Relationships and Related Party Transactions” for more information regarding the formation services fees paid to Strategic Capital. Amounts of certain items of the “Organization and Offering Expenses” are not determinable at this time. |

| (5) | Calculated as a percentage of gross offering proceeds from our primary offering. |

- 8 -

The Offering

| | |

| |

| Maximum Offering Amount: | | $1,250,000,000 in shares, in any combination of

Class A, Class C and Class I shares |

| |

Maximum Amount Issuable Pursuant to Our

Distribution Reinvestment Plan: | | $250,000,000 in shares, in any combination of Class

A, Class C and Class I shares |

| |

Price at Which Shares Initially Will Be Offered in This

Offering: | | $10.00 per Class A share, $9.576 per Class C share

and $9.186 per Class I share |

| |

Price at Which Shares Initially Will Be Offered in Our

Distribution Reinvestment Plan: | | $9.025 per share |

| |

| Suitability Standards: | | (1) Net worth (not including home, home furnishings

and personal automobiles) of at least $70,000 and

annual gross income of at least $70,000; or (2) Net worth (not including home, home furnishings

and personal automobiles) of at least $250,000. Suitability standards may vary from state to state and

by broker-dealer to broker-dealer. See “Suitability

Standards” for more details. |

| |

| Estimated Use of Proceeds: | | Approximately 92.75% (maximum offering) or

approximately 89.25% (minimum offering) will be

used to acquire our target assets. Approximately

7.25% (maximum offering) or approximately 10.75%

(minimum offering) will be used to pay fees and

expenses of the offering, including the payment of

fees to our dealer manager and the payment of fees

and reimbursement of expenses to our advisor. These

estimates assume we sell 1/3 of the maximum

offering amount of each of the Class A, Class C and

Class I shares, and that we incur no leverage. |

We will not sell any shares unless we have raised gross offering proceeds of $2.0 million by August 7, 2014. We refer to this threshold as the minimum offering requirement. After meeting the minimum offering requirement and holding our initial closing, except as described in this prospectus, we will sell our shares on a continuous basis at a price of $10.00 per Class A share, $9.576 per Class C share and $9.186 per Class I share. Commencing with the first full quarter after the minimum offering requirement is satisfied, our advisor and independent valuation firm, subject to the review of the board of directors, will determine our net asset value for each class of our shares. We expect such determination will ordinarily be made within 30 days after each such completed fiscal quarter. To the extent that our net asset value per share on the most recent valuation date increases above or decreases below our net proceeds per share as stated in this prospectus, we will adjust the offering prices of all classes of shares. The adjustments to the per share offering prices, which will become effective five business days after such determination is published, will ensure that after the effective date of the new offering prices the offering prices per share, after deduction of selling commissions, dealer manager fees and organization and offering expenses, are not above or below our net asset value per share as of the most recent valuation date. The purchase price per share to be paid by each investor will be equal to the price that is in effect on the date such investor submits his or her completed subscription agreement to our dealer

- 9 -

manager. We will commence valuations of our assets commencing with the first full quarter after the minimum offering requirement is satisfied. Thereafter, shares will be offered in our primary offering at a price based on the most recent valuation, plus related selling commissions, dealer manager fees and organization and offering expenses. Once we commence valuations, shares will be offered pursuant to our distribution reinvestment plan at a price equal to our then current offering price per each class of shares, less the sales selling commissions and dealer manager fees associated with that class of shares in the primary offering. See “Determination of Net Asset Value.”

Subscription payments received from Pennsylvania residents will be held in escrow until we have an aggregate of $62,500,000 in subscriptions (including sales made to residents of other states). Subscription payments received from Washington residents will be held in escrow until we have an aggregate of $10,000,000 in subscriptions (including sales made to residents of other states). See “Plan of Distribution.”

Corporate Governance and Restrictions on Ownership of Our Shares

We are organized as a Delaware limited liability company under the Delaware Limited Liability Company Act. Our business and affairs are managed under the direction of our board of directors. The board of directors has retained GCM as our advisor, to manage our overall portfolio, acquire and manage our renewable energy and energy efficiency projects, subject to the board's supervision. Our board of directors is not staggered and all of our directors are subject tore-election annually. Holders of our shares have authority (with the requisite minimum number of votes within the applicable time periods) to call special meetings of members, to elect and remove our directors, make certain amendments to the LLC Agreement, and to take certain other actions and exercise certain other rights. The directors owe substantially similar fiduciary duties to us and our members as the directors of a Delaware business corporation owe to the corporation and its stockholders. Our board of directors intends to establish an audit committee, all of the members of which will be independent, and a nominating and corporate governance committee. We will also adopt a code of ethics relating to the conduct of business by our officers and directors. In addition, in general, we are not permitted, without the approval of holders of at least a majority of the outstanding shares, to take any action that a Delaware corporation could not take under the mandatory provisions of the Delaware Business Corporation Law without obtaining the approval of its stockholders.

In order to reduce the risk that our subsidiary, GREC, will be classified as a closely held C corporation for tax purposes, our LLC Agreement generally prohibits, with certain exceptions, any person or group (other than GCM and its affiliates, or a direct or subsequently approved transferee of GCM and its affiliates) from actually or constructively owning more than 9.8% of any class of our shares then outstanding. We refer to this restriction as the ownership limit. In addition, our LLC Agreement provides that any ownership or purported transfer of our shares in violation of the ownership limit will result in that person or group losing its voting rights on all of its shares and the shares may not be voted on any matter and will not be considered to be outstanding when sending notices of a meeting of members, calculating required votes, determining the presence of a quorum or for other similar purposes. However, our LLC Agreement permits exceptions to be made for members provided our board of directors determines such exceptions will not be likely to cause GREC to be classified as a closely held C corporation. See “Summary of Our LLC Agreement—Restrictions on Ownership and Transfer.”

Risk Factors

An investment in our shares involves a high degree of risk and may be considered speculative. Please see “Risk Factors” beginning on page 24 for a more detailed discussion of the risks summarized below and other risks of investment in us.

- 10 -

Risks Related to Our Business and Structure

| | • | | We are a new company and have no operating history or established financing sources and may be unable to successfully implement our investment strategy or generate sufficient cash flow to make distributions to our members. |

| | • | | This offering is initially a “blind pool” offering, and therefore, you will not have the opportunity to evaluate our investments before we make them, which makes an investment in us more speculative. |

| | • | | Our ability to achieve our investment objectives depends on GCM’s ability to manage and support our investment process. If GCM were to lose any members of its senior management team, our ability to achieve our investment objectives could be significantly harmed. |

| | • | | Because our business model depends to a significant extent upon relationships with renewable energy developers, utilities, energy companies, investment banks, commercial banks, individual and institutional investors, consultants, EPC companies, contractors, and renewable energy technology manufacturers (such as panel manufacturers), the inability of GCM to maintain or develop these relationships, or the failure of these relationships to generate business opportunities, could adversely affect our business. |

| | • | | We may face increasing competition for business opportunities, which could delay deployment of our capital, reduce returns and result in losses. |

| | • | | The amount of any distributions we may pay is uncertain. We may not be able to pay you distributions, or be able to sustain them once we begin declaring distributions, and our distributions may not grow over time. We may pay distributions from any source and there are no limits on the amount of proceeds we may use to fund distributions. If we pay distributions from sources other than cash flow from operations, we will have less funds available for investments, and your overall return may be reduced. |

| | • | | We may change our investment policies and strategies without prior notice or member approval, the effects of which may be adverse. |

| | • | | We may experience fluctuations in our quarterly results. |

| | • | | Your investment return may be reduced if we are required to register as an investment company under the Investment Company Act of 1940, as amended, or the Investment Company Act. |

Risks Related to Our Advisor and Its Affiliates

| | • | | Our success will be dependent on the performance of our advisor; however, our advisor has no operating history and no experience managing a public company or maintaining our exemption from registration under the Investment Company Act, which may hinder its ability to achieve our investment objective or result in loss of maintenance of our Investment Company Act exemption. |

| | • | | Our advisor and its respective affiliates, including our officers and some of our directors, will face conflicts of interest including conflicts that may result from compensation arrangements with us and our affiliates, which could result in actions that are not in the best interests of our members. |

| | • | | We pay substantial fees and expenses to GCM and the dealer manager, which payments increase the risk that you will not earn a profit on your investment. See “—Management Fees and Incentive Distributions,” beginning on page 14 of this prospectus. |

Risks Related to Our Investments and the Renewable Energy Industry

| | • | | Our strategic focus will be on the renewable energy and related sectors, which will subject us to more risks than if we were broadly diversified. |

- 11 -

| | • | | Our projects in which we invest that produce renewable energy, such as solar and wind power, may face construction delays. |

| | • | | Renewable energy projects may be subject to the risk of fluctuations in commodity prices. |

| | • | | Existing regulations and policies and changes to these regulations and policies may present technical, regulatory and economic barriers to the purchase and use of energy generation products, including solar and wind energy products, which may significantly reduce our ability to meet our investment objectives. |

| | • | | The reduction or elimination of government economic incentives could impede growth of the renewable energy market. |

| | • | | Certain projects may generate a portion of their revenue from the sales of RECs and EECs, which may be subject to market price fluctuations, and there is a risk of a significant, sustained decline in their market prices. Such a decline may make it more difficult for our projects to grow and become profitable. |

| | • | | For those projects that generate RECs or EECs, all or a portion of the revenues generated from the sale of such RECs or EECs, as the case may be, may not be hedged, and therefore, such projects may be exposed to volatility of REC or EEC prices, as applicable, with respect to those sales. |

| | • | | If renewable energy technology is not suitable for widespread adoption or sufficient demand for renewable energy projects does not develop or takes longer to develop than we anticipate, we may be unable to achieve our investment objectives. |

| | • | | The profitability of our renewable energy projects may be adversely affected if they are subject to regulation by the Federal Energy Regulatory Commission under the Federal Power Act or other regulations that regulate the sale of electricity. |

| | • | | Our projects may often rely on electric transmission lines and other transmission facilities that are owned and operated by third parties. In these situations, our projects will be exposed to transmission facility curtailment risks, including but not limited to curtailment caused by breakdown of the power grid system, which may delay and increase the costs of our projects or reduce the return to us on those investments. |

Risks Related to Investments in the Solar and Wind Power Industries

| | • | | The reduction or elimination of government and economic incentives for solar power production could affect the financial results of our projects that produce solar power. |

| | • | | Our solar power projects may not be able to compete successfully and may lose or be unable to gain market share. |

| | • | | If wind conditions are unfavorable or below our estimates on any of our wind projects, the electricity production on such project and therefore, our income, may be substantially below our estimates. |

Risks Related to Debt Financing

| | • | | If we borrow money, the potential for gain or loss on amounts invested in us will be magnified and may increase the risk of investing in us. Borrowed money may also adversely affect the return on our assets, reduce cash available for distribution to our members, and result in losses. In addition, because GCM is entitled to receive a base management fee that is based on the average of the values of our gross assets for each day of the prior month (including amounts borrowed), to the extent that we incur leverage, the base management fees payable to GCM will increase regardless of our performance. In addition, the |

- 12 -

| | opportunity for the Special Unitholder to receive an incentive allocation and distribution may cause GCM to place undue emphasis on the maximization of net income, including through the use of leverage, at the expense of other criteria, such as preservation of capital, to achieve higher incentive distributions to the Special Unitholder. |

| | • | | We will be exposed to risks associated with changes in interest rates. |

Risks Related to This Offering and Our Shares

| | • | | Since this is a “best-efforts” offering, there is neither any requirement, nor any assurance, that more than the minimum offering amount will be raised. |

| | • | | If we are unable to raise substantially more than the minimum offering requirement, we will be limited in the number and type of investments we may make, and the value of your investment in us will fluctuate with the performance of the target assets we acquire. |

| | • | | The shares sold in this offering will not be listed on an exchange or quoted through a quotation system for the foreseeable future, if ever. Therefore, if you purchase shares in this offering, you will have limited liquidity and may not receive a full return of your invested capital if you sell your shares. |

| | • | | You will experience substantial dilution in the net tangible book value of your shares equal to the offering costs associated with your shares. |

| | • | | Anti-takeover provisions in the limited liability company agreement of our company, or our LLC Agreement, could inhibit changes in control. |

Share Repurchase Program

We do not currently intend to list our shares on any securities exchange and do not expect a public market to develop for the shares in the foreseeable future. We have adopted a discretionary share repurchase program that, from and after the date that is 12 months after we meet the minimum offering requirement, allows our members who hold shares purchased directly from us to request that we redeem their shares subject to the limitations and in accordance with the procedures outlined in this prospectus. See “Share Repurchase Program.”

Our board of directors has the ability, in its sole discretion, to amend or suspend the plan or to waive any specific condition if it is deemed to be in our best interest. See “Share Repurchase Program.”

Liquidity Strategy

We intend to explore a potential liquidity event for our members within five years following the completion of our offering stage, which may includefollow-on offerings after completion of this offering. We will consider our offering stage as complete as of the termination date of our most recent public equity offering, if we have not conducted a public offering in any continuous three-year period. We expect that our board of directors, in the exercise of its fiduciary duty to our members, will determine to pursue a liquidity event when it believes that then-current market conditions are favorable for a liquidity event, and that such an event is in the best interests of our members. A liquidity event could include, but shall not be limited to, (1) the sale of all or substantially all of our assets either on a portfolio basis or individually followed by a liquidation, (2) a listing of our shares, or a transaction in which our members receive shares of a company that is listed, on a national securities exchange or (3) a merger or another transaction approved by our board of directors in which our members will receive cash or shares of a publicly traded company. We refer to the above scenarios as “liquidity events.”

- 13 -

There can be no assurance that a suitable transaction will be available or that market conditions for a liquidity event will be favorable within five years following the completion of our offering stage or ever. There can be no assurance that we will complete a liquidity event.If a liquidity event does not occur, members may have to hold their shares for an extended period of time, or indefinitely. See “Liquidity Strategy.”

Our Relationship With Our Advisor

We will be managed and advised by GCM. GCM and its personnel will conduct ourday-to-day operations and activities, subject to the oversight and supervision of our board of directors.

Management Fees and Incentive Distributions

Pursuant to an advisory agreement, we will pay GCM a base management fee. In addition, the Special Unitholder, an entity affiliated with our advisor, will hold the special unit in our company entitling it to an incentive allocation and distribution, or Incentive Distribution.

The following table summarizes the fees that we will pay to our advisor and the distributions that we may make to the Special Unitholder.

| | | | |

Type of Compensation | | Determination of Amount | | Estimated Amount for

Maximum Offering |

| Base management fee | | The base management fee payable to GCM will be calculated at a monthly rate of 0.167% (2.00% annually) of our gross assets (including amounts borrowed). For services rendered under the advisory agreement, the base management fee will be payable monthly in arrears. The base management fee will be calculated based on the average of the values of our gross assets for each day of the prior month. Base management fees for any partial period will be appropriately pro-rated. | | These amounts cannot be estimated since they are based upon the average of the values of the gross assets held by us. We have not commenced operations and have no prior performance. |

| | |

| Incentive Allocation and Distribution | | Under our limited liability company agreement, the Special Unitholder, an entity affiliated with our advisor, will be entitled to receive the Incentive Distribution based on our performance. The Incentive Distribution is comprised of three parts: the income incentive distribution, the capital gains incentive distribution and the liquidation incentive distribution, as described in detail below. | | |

| | |

| Income Incentive Distribution | | The income incentive distribution will be calculated and payable quarterly in arrears based on ourpre-incentive distribution net investment income for the immediately preceding fiscal quarter. For this purpose,pre-incentive distribution net investment income means (1) interest income, (2) dividend, project and distribution income from equity investments (but excluding that portion of distributions that are treated as a return of capital) and (3) any other income (including any other fees, such as commitment, origination, structuring, diligence and consulting fees or other fees that we receive, but excluding any fees for providing managerial | | These amounts cannot be estimated since they are based upon the performance of the assets held by us. We have not commenced operations and have no prior performance. |

- 14 -

| | | | |

Type of Compensation | | Determination of Amount | | Estimated Amount for

Maximum Offering |

| | |