Exhibit 99.2

REENBACKER RENEWABLE ENERGY COMPANY LLC MANAGEMENT DISCUSSION OF INTERNALIZATION TRANSACTION

FORWARD LOOKING STATEMENTS Various statements in this presentation, including those that express a belief, expectation or intention, as well as those that are not statements of historical fact, are or constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995 and Section 21E of the Securities Exchange Act of 1934, as amendment, and we intend such statement to be covered by the safe harbor provision contained therein. The forward-looking statements may include projections and estimates concerning the timing and success of specific projects, revenues, income and capital spending. We generally identify forward-looking statements with the words “believe,” “intend,” “expect,” “seek,” “may,” “will,” “should,” “would,” “anticipate,” “could,” “estimate,” “plan,” “predict,” “project” or their negatives, and other similar expressions. These statements are not guarantees of future performance, and undue reliance should not be placed on them. Such forward-looking statements necessarily involve known and unknown risks and uncertainties, which may cause actual performance and financial results in future periods to differ materially from any projections of future performance or result expressed or implied by such forward-looking statements. These forward-looking statements are subject to risks and uncertainties that may change at any time, and, therefore, our actual results may differ materially from those that we expected. The forward-looking statements contained in this presentation are largely based on our expectations, which reflect many estimates and assumptions made by our management. These estimates and assumptions reflect our best judgment based on currently known market conditions and other factors. Although we believe such estimates and assumptions are reasonable, we caution that it is very difficult to predict the impact of known factors, and it is impossible for us to anticipate all factors that could affect our actual results. We caution all readers that the forward-looking statements contained in this presentation are not guarantees of future performance, and we cannot assure any reader that such statements will prove correct or that the forward-looking events and circumstances will occur. Actual results may differ materially from those anticipated or implied in the forward-looking statements due to the numerous risks and uncertainties as described under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the fiscal year ended December 31, 2021, and other such risks and uncertainties detailed in such annual report and our other reports and filings with the SEC, and elsewhere in this presentation. All forward-looking statements are based upon information available to us on the date of this presentation. We undertake no obligation to update or revise any forward-looking statements as a result of new information, future events or otherwise, except as otherwise required by law. The risks, contingencies and uncertainties associated with our forward-looking statements relate to, among other matters, the following: (i) the risk that we may not realize the anticipated benefits from the transaction, or that such benefits are less than anticipated as a result of unexpected costs or liabilities that may arise from transaction; (ii) changes in the economy; (iii) the ability to complete the renewable energy projects in which we invest; (iv) our relationships with project developers, lawyers, investment and commercial banks, individual and institutional investors, consultants, diligence specialists, energy, procurement and construction companies, contractors, renewable energy technology manufacturers (such as panel manufacturers), solar insurance specialists, component manufacturers, software providers and other industry participants in the renewable energy, capital markets and project finance sectors; (v) fluctuations in supply, demand, prices and other conditions for electricity, other commodities and renewable energy credits; (vi) public response to and changes in the local, state and federal regulatory framework affecting renewable energy projects, including the potential expiration or extension of the production tax credit, investment tax credit and the related U.S. Treasury grants and potential reductions in renewable portfolio standards requirements; (vii) competition from other energy developers; (viii) the worldwide demand for electricity and the market for renewable energy; (ix) the ability or inability of conventional fossil fuel based generation technologies to meet the worldwide demand for electricity; (x) our competitive position and our expectation regarding key competitive factors; (xi) risks associated with our hedging strategies; (xii) potential environmental liabilities and the cost of compliance with applicable environmental laws and regulations, which may be material; (xiii) our electrical production projections (including assumptions of curtailment and facility availability) for our renewable energy projects; (xiv) our ability to operate our business efficiently, manage costs (including general and administrative expenses) effectively and generate cash flow; (xv) availability of suitable renewable energy resources and other weather conditions that affect our electricity production; (xvi) the effects of litigation, including administrative and other proceedings or investigations relating to the transaction or our renewable energy projects; (xvii) non-payment by customers and enforcement of certain contractual provisions; (xviii) risks associated with possible disruption in our operations or the economy generally due to terrorism or natural disasters; and (xiv) future changes in laws or regulations and conditions in our operating areas. © 2022 of Greenbacker Renewable Energy Corporation

TRANSACTION ANNOUNCEMENT CHARLES WHEELER DAVID SHER CEO - GREC PRESIDENT - GCM NEW YORK, NY - MAY 23rd, 2022 Greenbacker Renewable Energy Company LLC (GREC) We are very excited to announce that a special committee of GREC’s Board of Directors (Board), comprised entirely of independent members, and the full Board have unanimously approved the acquisition of all the assets of Greenbacker Capital Management LLC (GCM), which until today has been the external manager to GREC, as well as the hiring of the entire GCM team to work for GREC. We believe that this transaction, a full “internalization” of all the capabilities of GCM’s 170-person team into GREC, offers several benefits to our shareholders, providing immediate cost savings to the company and enabling us to pursue new and exciting business opportunities that we expect will generate long-term value for our shareholders. Sincerely, Charles Wheeler, David Sher - Co-Founders, GCM

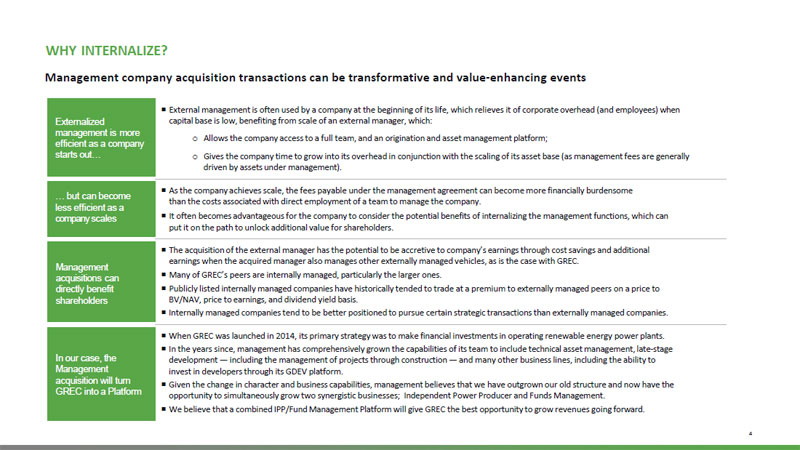

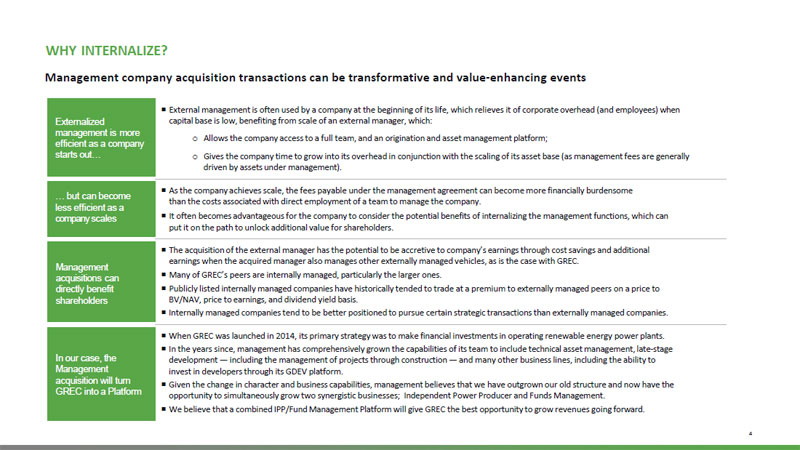

Externalized management is more efficient as a company starts out.. ? Externalmanagement is often used by a company at the beginning of its life, which relieves it of corporate overhead (and employees) when capital base is low, benefiting from scale of an externalmanager, which: o Allows the company access to a full team, and an origination and assetmanagement platform; o Gives the company time to grow into its overhead in conjunctionwith the scaling of its asset base (as management fees are generally driven by assets under management). ..but can become less efficient as a company scales ? As the company achieves scale, the fees payable under the management agreement can becomemore financially burdensome than the costs associatedwith direct employment of a teamtomanage the company. ? It often becomes advantageous for the company to consider the potential benefits of internalizing the management functions, which can put it on the path to unlock additional value for shareholders. Management acquisitions can directly benefit shareholders ? The acquisition of the externalmanager has the potential to be accretive to company's earnings through cost savings and additional earnings when the acquiredmanager alsomanages other externally managed vehicles, as is the case with GREC. ? Many of GREC's peers are internally managed, particularly the larger ones. ? Publicly listed internally managed companies have historically tended to trade at a premium to externally managed peers on a price to BV/NAV, price to earnings, and dividend yield basis. ? Internally managed companies tend to be better positioned to pursue certain strategic transactions than externally managed companies. In our case, the Management acquisition will turn GREC into a Platform ? When GREC was launched in 2014, its primary strategywas tomake financial investments in operating renewable energy power plants. ? In the years since,management has comprehensively grown the capabilities of its teamto include technical assetmanagement, late-stage development-including the management of projects through construction-and many other business lines, including the ability to invest in developers through its GDEV platform. ? Given the change in character and business capabilities,management believes that we have outgrown our old structure and now have the opportunity to simultaneously grow two synergistic businesses; Independent Power Producer and FundsManagement. ? We believe that a combined IPP/FundManagement Platformwill give GREC the best opportunity to grow revenues going forward.

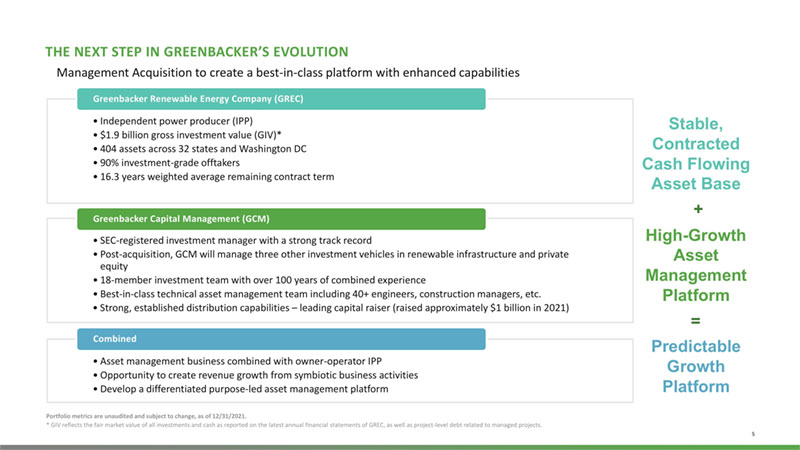

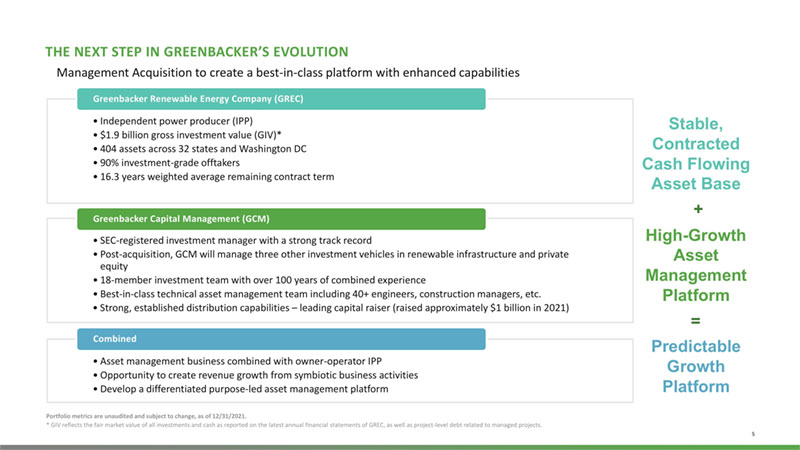

THE NEXT STEP IN GREENBACKER’S EVOLUTION Management Acquisition to create a best-in-class platform with enhanced capabilities Greenbacker Renewable Energy Company (GREC) • Independent power producer (IPP) • $1.9 billion gross investment value (GIV)* • 404 assets across 32 states and Washington DC • 90% investment-grade offtakers • 16.3 years weighted average remaining contract term Greenbacker Capital Management (GCM) • SEC-registered investment manager with a strong track record • Post-acquisition, GCM will manage three other investment vehicles in renewable infrastructure and private equity • 18-member investment team with over 100 years of combined experience • Best-in-class technical asset management team including 40+ engineers, construction managers, etc. • Strong, established distribution capabilities – leading capital raiser (raised approximately $1 billion in 2021) mbined • Asset management business combined with owner-operator IPP • Opportunity to create revenue growth from symbiotic business activities • Develop a differentiated purpose-led asset management platform Portfolio metrics are unaudited and subject to change, as of 12/31/2021. * GIV reflects the fair market value of all investments and cash as reported on the latest annual financial statements of GREC, as well as project-level debt related to managed projects. Stable, Contracted Cash Flowing Asset Base High-Growth Asset Management Platform Predictable Growth Platform

POTENTIAL BENEFITS OF THE TRANSACTION Management believes that the Acquisition offers a number of potential benefits that are expected to provide immediate and long-term advantages to the company. Some of these benefits include: • Cost Savings and Economies of Scale – The completion of the transaction is expected to be modestly accretive to GREC shareholders initially, with increasing benefits as the business grows due to the elimination of annual management fees and certain incentive fees. Management estimates that the savings will total approximately $11.3mm based on 2021 run rate results. In addition, GREC will be able to simplify its overall structure leading to expected greater efficiency and economies of scale. • Stronger Management Alignment and Elimination of Conflicts – An increased equity ownership and incentive structure for both executives and all employees to enhance the alignment of interests of employees with GREC shareholders including mitigating certain perceived or actual conflicts of interest. • Simplified Market Friendly Structure – An internal management structure makes GREC more attractive to the institutional investor community and could improve GREC’s ability to raise capital and execute other transactions on more favorable terms. • Diversification of Revenue Streams – As a result of the transaction, GREC shareholders will benefit from the addition of GCM's asset management platform to its revenue base. Going forward GREC’s business will combine two synergistic businesses, opening new opportunities for innovation, growth, and diversification. • Expanded Ability to Consider Strategic Opportunities – Through the adoption of a new corporate form, management believes that GREC will be better able to take advantage of strategic growth opportunities in this dynamic, rapidly growing segment of the market, including acquisitions of other businesses using shares of GREC Corp as currency in such transactions or other transactions that may open up additional pathways for growth.

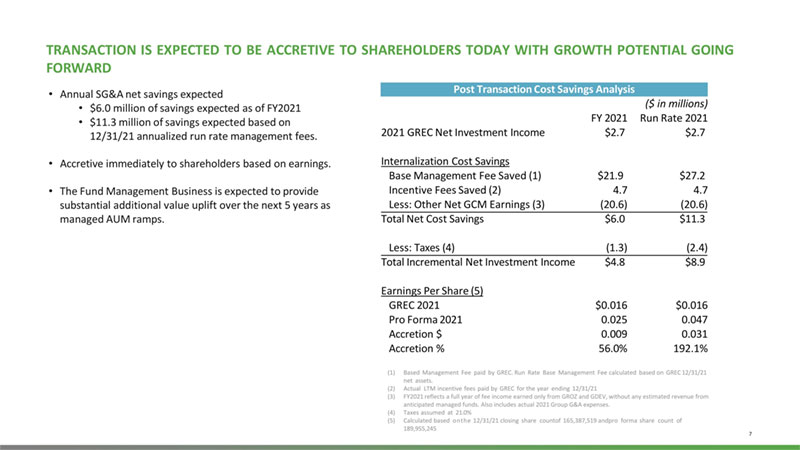

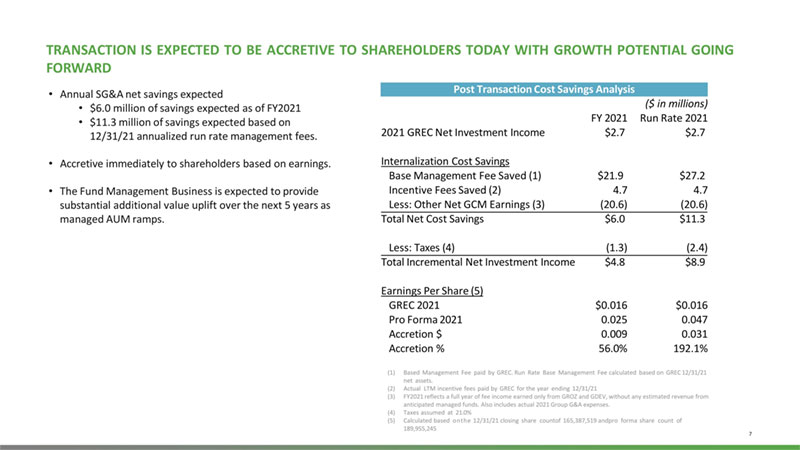

TRANSACTION IS EXPECTED TO BE ACCRETIVE TO SHAREHOLDERS TODAY WITH GROWTH POTENTIAL GOING FORWARD Annual SG&A net savings expected • $6.0 million of savings expected as of FY2021 • $11.3 million of savings expected based on 12/31/21 annualized run rate management fees. • Accretive immediately to shareholders based on earnings. • The Fund Management Business is expected to provide substantial additional value uplift over the next 5 years as managed AUM ramps. Post Transaction Cost Savings Analysis ($ in millions) 2021 Run Rate 2021 21 GREC Net Investment Income .7 .7 Internalization Cost Savings Base Management Fee Saved (1) 1.9 7.2 Incentive Fees Saved (2) 7 7 Less: Other Net GCM Earnings (3) 0.6) 0.6) Total Net Cost Savings .0 1.3 Less: Taxes (4) .3) .4) Total Incremental Net Investment Income .8 .9 Earnings Per Share (5) GREC 2021 .016 .016 Pro Forma 2021 025 047 Accretion $ 009 031 Accretion % .0% 2.1% (1) Based Management Fee paid by GREC. Run Rate Base Management Fee calculated based on GREC 12/31/21 net assets. (2) Actual LTM incentive fees paid by GREC for the year ending 12/31/21 (3) FY2021 reflects a full year of fee income earned only from GROZ and GDEV, without any estimated revenue from anticipated managed funds. Also includes actual 2021 Group G&A expenses. (4) Taxes assumed at 21.0% (5) Calculated based on the 12/31/21 closing share count of 165,387,519 and pro forma share count of 9,955,245 7

RANSACTION DETAILS Transaction Consideration Modified Special it Additional Details The acquisition (Acquisition) of GCM and certain other affiliated companies was implemented under the terms of a contribution agreement between GREC and GCM's parent, Greenbacker Group LLC (Group), a subsequent contribution agreement from GREC into its wholly owned subsidiary, Greenbacker Renewable Energy Corporation (GREC Corp), and certain related agreements. Total consideration will be comprised entirely of GREC shares: ¡ 24,365,133 newly issued Class P-I shares, valued at the March 31, 2022 net asset value of $8.798 per share (with an aggregate value of $214.36 million, net of deal related fees and expense) ¡ 13,071,153 newly issued class of Class EO shares (divided into three separate series), if valued at the March 31, 2022 net asset value of $8.798 per share would imply an aggregate value of $115 million. Class EO shares will initially not be entitled to share in any distributions paid by GREC but will have the potential to participate on a share for share basis with the Class P-l shares, subject to the achievement of separate benchmark quarter-end run-rate targets applicable to each series, or upon the occurrence of certain liquidity events ¡ No cash payable to Group or its owners GREC had previously issued a special unit that was held by a wholly owned subsidiary of GCM, a portion of which, prior to the completion of the Acquisition, entitled the holder to receive 20% of any net asset value premium achieved in a future initial public offering or liquidation transaction (the “Liquidation Performance Feature”). The Liquidation Performance Feature was not contributed in the Acquisition but was carried forward into a new membership interest (the “Liquidation Performance Unit”) and was modified so that any premium amount achieved in any initial public offering or listing will be payable by converting the Liquidation Performance Unit into additional shares of GREC issued at the premium value achieved in the transaction. Consistent with the existing Liquidation Performance Feature, in the case of a liquidation transaction, amounts may be paid in additional shares of GREC, other securities and/or cash. ¡ The Acquisition was negotiated on an arm’s length basis between Group and a Special Committee of GREC’s independent directors ¡ Transaction was approved by the Special Committee and GREC’s full Board of Directors ¡ Greenhill & Co. acted as financial advisor to the Special Committee and provided a fairness opinion to support the terms of the deal ¡ Kirkland & Ellis LLP served as legal advisor to the Special Committee ¡ Group’s advisors included Houlihan Lokey as financial advisor and Clifford Chance US LLP as legal advisor

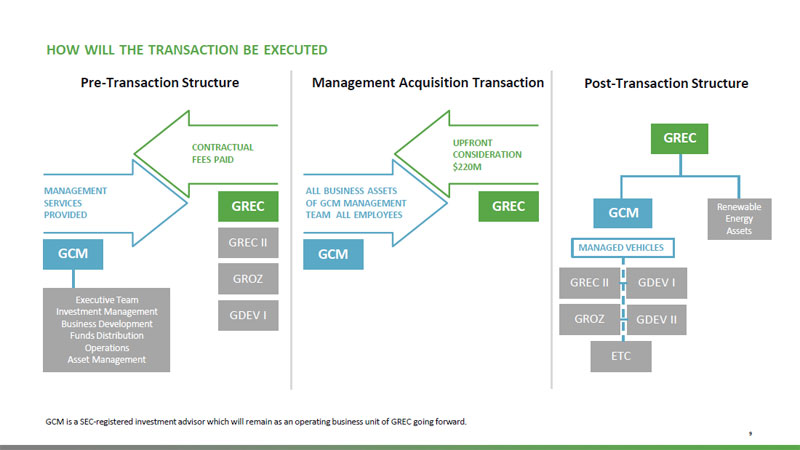

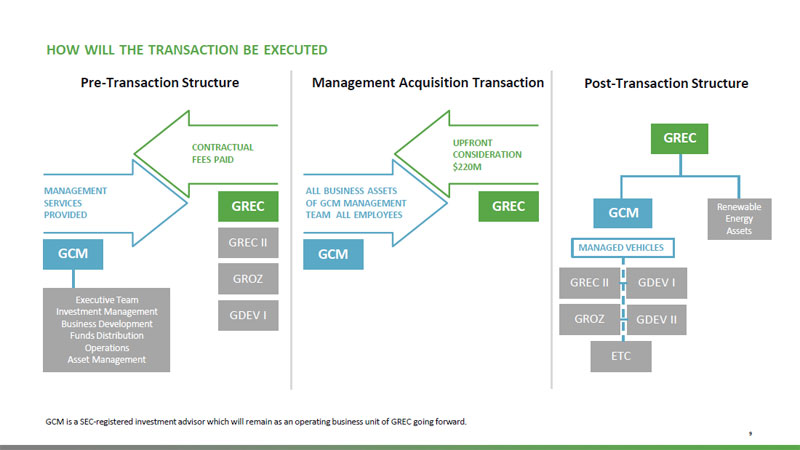

MANAGEMENT SERVICES PROVIDED GREC GRECII GROZ GDEVI CONTRACTUAL FEESPAID ExecutiveTeam InvestmentManagement BusinessDevelopment FundsDistribution Operations Asset Management Pre-TransactionStructureManagementAcquisitionTransaction GREC GREC GCM Post-TransactionStructure GCMisaSEC-registered investmentadvisorwhichwillremainasanoperatingbusinessunitofGRECgoingforward. HOWWILLTHETRANSACTIONBEEXECUTED GRECII GROZ GDEVI GDEVII ETC ALLBUSINESSASSETSOFGCMMANAGEMENT TEAMALLEMPLOYEES GCM UPFRONT CONSIDERATION $220M GCM Renewable Energy Assets MANAGEDVEHICLES 9

TRANSACTION IS THE GATEWAY TO UNLOCKING SHAREHOLDER VALUE x The combined GREC/Manager platform is expected to create additional value for GREC investors through the combination of: • Stable, contracted revenues from a cash-flowing asset base of renewable energy projects: Independent Power Producer (IPP) business. • High growth asset management revenue: Fund Management business. x By becoming a platform, management believes that GREC is better positioned to pursue other transactions over time that may unlock additional value for shareholders. Pre-Transaction One-of-many “fund” model Yield-oriented based upon investments in Projects (Operating asset ownership model) Externally managed, business model is focused on growth of Assets Under Management Asset manager growth stays outside of GREC, with growth benefiting manager Operating leverage and margins constrained by need for fresh capital to maintain growth Post-Transaction Combination of stable cash flows and growth engine Total Return-oriented based on investing in late-stage development, pre-construction, operating assets and funds management (Platform model) Internally managed, high margin growth focused upon return on capital and organic growth Asset manager growth benefits GREC shareholders Operating leverage and margins can grow organically through the addition of new managed investment strategies

THE GREENBACKER PLATFORM - A SEAMLESS PLATFORM THAT CAN DO MORE All elements of the Greenbacker Platform will be managed in one seamless organization, with benefits accruing to GREC’s 10,000+ shareholders. Management will bring to GREC proven expertise in: INVESTMENTS Identifying the most scalable segments of the sustainable infrastructure market, sourcing and growing investment talent CONSTRUCTION & OPERATIONS Skilled technical expertise in constructing and operating renewable energy assets across the US CAPITAL RAISING Direct and indirect wholesale funds distribution resources that can raise billions of dollars per year from multiple channels, from both retail and institutional sources SINESS DEVELOPMENT Creating new fund products and launching other initiatives that take advantage of the rapidly changing market MINISTRATIVE SUPPORT Marketing, accounting, legal and operational expertise to support all areas of the business

A PROVEN MANAGEMENT TEAM AND ORGANIZATION WITH DEEP FUNCTIONAL AND TECHNICAL EXPERTISE CHARLES WHEELER DAVID SHER MEHUL MEHTA MATT MURPHY SPENCER MASH ROBERT SHER NATALLIA CAMARGO -CEO | Board -CEO | Board Chief Investment Chief Operations EVP, Structured EVP, Business Chief People Officer Member Member Officer Officer Finance Development BRANDON PRAZNIK JEFF SHERIDAN RICHARD BUTT MICHAEL JULIANNE HULL BETSY COCHRANE P, Business P, Business Chief Financial Officer LANDENBERGER Chief Compliance Officer P, Senior Counsel Development Development P, CAO & Controller 70 Finance & Technical Asset Employees Accounting Management Legal & Technology Offices Compliance Investments Development Business Marketing Resources Human

The Greenbacker Capital℠ logo is a service mark of Greenbacker Renewable Energy Corporation. © 2022 Greenbacker Renewable Energy Corporation