UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number | 811-22780 |

|

Cohen & Steers MLP Income and Energy Opportunity Fund, Inc. |

(Exact name of registrant as specified in charter) |

|

280 Park Avenue, New York, NY | | 10017 |

(Address of principal executive offices) | | (Zip code) |

|

Tina M. Payne Cohen & Steers Capital Management, Inc. 280 Park Avenue New York, New York 10017 |

(Name and address of agent for service) |

|

Registrant’s telephone number, including area code: | (212) 832-3232 | |

|

Date of fiscal year end: | November 30 | |

|

Date of reporting period: | November 30, 2013 | |

| | | | | | | | |

Item 1. Reports to Stockholders.

[Insert Annual Report here]

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

To Our Shareholders:

We would like to share with you our report for the period ended November 30, 2013. The net asset value (NAV) at that date was $19.44 per common share. The Fund's common stock is traded on the New York Stock Exchange (NYSE) and its share price can differ from its NAV; at year end, the Fund's closing price on the NYSE was $17.38.

The total returns, including income, for the Fund and its comparative benchmarks were:

| | | Six Months Ended

November 30, 2013 | | For the Period

March 26, 2013

(commencement

of operations)

through

November 30, 2013 | |

Cohen & Steers MLP Income and

Energy Opportunity Fund at NAVa | | | 6.01 | % | | | 5.34 | % | |

Cohen & Steers MLP Income and

Energy Opportunity Fund at Market Valuea | | | –10.37 | % | | | –10.06 | % | |

Blended Benchmark—90% Alerian MLP Index—

10% BofA Merril Lynch Fixed Rate

Preferred Securities Indexb | | | 4.90 | % | | | 4.52 | % | |

Alerian MLP Indexb | | | 6.04 | % | | | 5.56 | % | |

S&P 500 Indexb | | | 11.91 | % | | | 17.15 | % | |

The performance data quoted represent past performance. Past performance is no guarantee of future results. The investment return and the principal value of an investment will fluctuate and shares, if sold, may be worth more or less than their original cost. Current performance may be lower or higher than the performance data quoted. Performance results reflect the effects of leverage, resulting from borrowings under a credit agreement. Current total returns of the Fund can be obtained by visiting our website at cohenandsteers.com. The Fund's returns assume the reinvestment of all dividends and distributions at prices obtained under the Fund's dividend reinvestment plan. Index performance does not reflect the deduction of any fees, taxes or expenses. An investor cannot invest directly in an index. Performance figures for periods shorter than one year are not annualized.

The Fund implements fair value pricing when the daily change in a specific U.S. market index exceeds a predetermined percentage. Fair value pricing adjusts the valuation of certain non-U.S. equity holdings to account for such index change following the close of foreign markets. This standard practice has been adopted by a majority of the fund industry. In the event fair value pricing is implemented on the first and/or last day of a performance measurement period, the Fund's return may diverge from the relative performance of its benchmark index, which does not use fair value pricing.

a As a closed-end investment company, the price of the Fund's NYSE-traded shares will be set by market forces and at times may deviate from the NAV per share of the Fund.

b The Alerian MLP Index is a composite of the 50 most prominent energy Master Limited Partnerships (MLPs) that provides investors with an unbiased, comprehensive benchmark for this emerging asset class. The BofA Merrill Lynch Fixed Rate Preferred Securities Index tracks the performance of fixed-rate USD-denominated preferred securities issued in the U.S. domestic market. The S&P 500 Index is an unmanaged index of 500 large capitalization, publicly traded stocks representing a variety of industries that is frequently used as a general measure of stock market performance.

1

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

The Fund makes regular quarterly distributions at a level rate (the Policy). Distributions paid by the Fund are subject to recharacterization for tax purposes and are taxable up to the amount of the Fund's investment company taxable income and net realized gains. As a result of the Policy, the Fund may pay distributions in excess of the Fund's investment company taxable income and realized gains. This excess would be a "return of capital" distributed from the Fund's assets. Due to the Fund's underlying investments, a substantial amount of the Fund's distributions will be classified as return of capital. Distributions of capital decrease the Fund's total assets and, therefore, could have the effect of increasing the Fund's expense ratio. In addition, in order to make these distributions, the Fund may have to sell portfolio securities at a less than opportune time.

Investment Review

Financial markets began the period on a positive note, generally supported in April by low interest rates and signs of a modestly expanding U.S. economy. However, markets came under pressure in May after minutes from the latest Federal Reserve meeting indicated that further bond purchases would be based on the pace of economic growth. Given the general improvement in U.S. economic data, investors interpreted the minutes as suggesting that quantitative easing would be tapered sooner rather than later.

That sentiment eased but then returned, ultimately helping to guide Treasury yields higher. The 10-year Treasury yield rose from 1.9% to 2.8% by period end, which restrained income-related securities, such as higher-yielding equities and fixed income assets. More growth-oriented asset classes did better, generally recovering from May-June weakness to post meaningful gains for the period, aided by the improving economy.

In this environment, midstream energy companies, which have both growth and income characteristics, underperformed the broader equity market but outperformed most fixed income and higher-yielding equity categories. Regarding subsector performance, the gathering and processing group (15.9% total return in the Alerian MLP Indexc) registered strong gains. These companies continued to benefit from increased shale energy production, supported by rising natural gas prices during the period. Marine shipping (11.3%) also advanced, aided by Teekay Offshore Partners, which acquired a 50% interest in a tanker unit operating in waters off of Brazil.

The exploration and production group (–12.4%) was a notable underperformer. EV Energy fell sharply, in part due to disappointing progress toward monetization of its Utica shale acreage. Linn Energy had a sizable decline as some investors questioned the company's accounting and hedging practices. It gained back some of its losses late in the period; investor sentiment improved as the company moved closer towards finalization of its merger agreement with Berry Petroleum.

Companies in the diversified sector (4.9%) generally performed in line with the broader MLP market. Energy Transfer Partners, one of the larger weights in the Alerian MLP Index, gained as investors responded positively to a clarification of its liquid natural gas (LNG) export strategy and efforts towards simplifying its corporate structure.

c Sector returns in U.S. dollars as measured by the Alerian MLP Index.

2

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

New offerings and merger activity continued apace

Initial public offerings (IPOs) and merger and acquisition (M&A) activity in the midstream energy space was visible through the period. In November alone, there were five M&A deals totalling $2.4 billion and three IPOs that raised a total of $700 million. The IPOs included Midcoast Energy Partners, a natural gas and natural gas liquids midstream business and Dynagas LNG Partners, an owner and operator of liquefied natural gas shipping carriers. In our view, the strong deal calendar will continue.

Also noteworthy was a pickup in approvals to export LNG to non-Free Trade Agreement countries. The Department of Energy has approved several LNG export facilities this year after a two-year lull, including 1) a terminal in Louisiana co-owned by Energy Transfer Equity and Energy Transfer Partners; 2) a Maryland terminal operated by Dominion Resources; and 3) conditional approval, in November, allowing Freeport LNG to ship more liquefied natural gas from its proposed Texas terminal. Although the rate of approvals for U.S. companies to export LNG to non-Free Trade Agreement countries has accelerated, we do not expect all projects in the pipeline will be approved. Those companies with a head start will be advantaged.

Fund performance

The Fund outperformed its blended benchmark on an NAV basis. Stock selection was relatively favorable in most subsectors, particularly in the exploration and production, gathering and processing, and natural gas pipelines (2.2% total return in the Alerian MLP Index) groups. Our overweight in the natural gas pipelines companies as a group somewhat lessened the benefit of stock selection in that subsector. Stock selection in the propane subsector (10.2%) modestly detracted from relative performance; our propane holdings had a strong absolute return, but trailed the broader propane group.

The Fund declined based on market price and underperformed its blended benchmark, in a period when the average discount on equity closed-end funds widened from about 3% to 6.6% as of November 30, 2013. The Fund ended the period at a discount of approximately 11% to its NAV.

The Fund employs leverage as part of a yield-enhancement strategy. Leverage, which can increase total return in rising markets (just as it can have the opposite effect in declining markets), contributed to the Fund's NAV performance for the period.

Investment Outlook

We believe the general environment for midstream energy companies should remain supportive. In our view, the ramp-up in oil and natural gas companies' production in North American shale basins will most likely further the need for a redesigned energy grid—driving the development of new and repurposed pipelines, processing plants and storage facilities. The rise in energy supply has been driven by unconventional drilling techniques such as horizontal-drilling and hydraulic-fracturing, which have opened up new reservoirs of crude oil and natural gas liquids once deemed uneconomical to tap. We believe the asset class offers a unique combination of attractive income and visible medium-term growth, and expect these characteristics to support outperformance of the benchmark during the current period of heightened economic and market uncertainty.

3

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

We believe that companies in the midstream portion of the energy sector constitute a unique asset class with attractive characteristics. They tend to generate predictable revenue streams, cash flows and distribution payout potential, derived from the gathering, processing and transportation of oil, natural gas and other energy commodities. At the same time, they offer the "real asset" features typically found in other infrastructure categories—long-lived assets, typically with high barriers to entry supported by the resilient demand for essential services.

Companies in the midstream energy sector can be structured as C-corporations or MLPs, which can enhance the delivery of income through their tax-efficient pass-through structures. Compared with the dividend yields of midstream energy C-Corporations, annual MLP distribution yields tend to be higher (roughly 6%, currently), and their cost of equity capital is generally lower (since they are not taxable entities). Over time, we expect more midstream energy assets to move into this structure, which in our opinion provides efficient income delivery and facilitates capital formation.

Sincerely,

| | | | �� |

| |

| |

| | | | | MARTIN COHEN | | ROBERT H. STEERS | |

| | | | | Co-chairman | | Co-chairman | |

| | | | |

| |

| |

| | | | | ROBERT S. BECKER | | BEN MORTON | |

| | | | | Portfolio Manager | | Portfolio Manager | |

The views and opinions in the preceding commentary are subject to change and are as of the date of publication. There is no guarantee that any market forecast set forth in the commentary will be realized. This material represents an assessment of the market environment at a specific point in time, should not be relied upon as investment advice and is not intended to predict or depict performance of any investment.

Visit Cohen & Steers online at cohenandsteers.com

For more information about any of our funds, visit cohenandsteers.com, where you will find net asset values, fund fact sheets and portfolio highlights. You can also access newsletters, education tools and market updates covering the global real estate, commodities, global natural resource equities, listed infrastructure, utilities, large cap value and preferred securities sectors.

In addition, our website contains comprehensive information about our firm, including our most recent press releases, profiles of our senior investment professionals and an overview of our investment approach.

4

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

Our Leverage Strategy

(Unaudited)

Our current leverage strategy utilizes borrowings up to the maximum permitted by the Investment Company Act of 1940 to provide additional capital for the Fund, with an objective of increasing the net income available for shareholders. As of November 30, 2013, leverage represented 30% of the Fund's managed assets.

Through a combination of variable and fixed rate financing, the Fund has locked in interest rates on a significant portion of this additional capital for periods of four, five and six years (where we effectively reduce our variable rate obligation and lock in our fixed rate obligation over various terms). Locking in a significant portion of our leveraging costs is designed to protect the dividend-paying ability of the Fund. The use of leverage increases the volatility of the Fund's net asset value in both up and down markets. However, we believe that locking in portions of the Fund's leveraging costs for the various terms partially protects the Fund's expenses from an increase in short-term interest rates.

Leverage Factsa

Leverage (as a % of managed assets) | | | 30 | % | |

| % Fixed Rate | | | 70 | % | |

| % Variable Rate | | | 30 | % | |

Weighted Average Rate on Financing | | | 1.6 | % | |

Weighted Average Term on Financingb | | | 3.3 years | | |

The Fund seeks to enhance its dividend yield through leverage. The use of leverage is a speculative technique and there are special risks and costs associated with leverage. The net asset value of the Fund's common shares may be reduced by the issuance and ongoing costs of leverage. So long as the Fund is able to invest in securities that produce an investment yield that is greater than the total cost of leverage, the leverage strategy will produce higher current net investment income for the common shareholders. On the other hand, to the extent that the total cost of leverage exceeds the incremental income gained from employing such leverage, the common shareholders would realize lower net investment income. In addition to the impact on net income, the use of leverage will have an effect of magnifying capital appreciation or depreciation for common shareholders. Specifically, in an up market, leverage will typically generate greater capital appreciation than if the Fund were not employing leverage. Conversely, in down markets, the use of leverage will generally result in greater capital depreciation than if the Fund had been unlevered. To the extent that the Fund is required or elects to reduce its leverage, the Fund may need to liquidate investments, including under adverse economic conditions which may result in capital losses potentially reducing returns to common shareholders. There can be no assurance that a leveraging strategy will be successful during any period in which it is employed.

a Data as of November 30, 2013. Information is subject to change.

b See Note 6 in Notes to Consolidated Financial Statements.

5

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

November 30, 2013

Top Ten Holdingsa

(Unaudited)

| | | Value | | % of

Managed

Assets | |

Enterprise Products Partners LP | | $ | 48,658,178 | | | | 6.5 | | |

Kinder Morgan Management, LLC | | | 47,227,741 | | | | 6.3 | | |

Enbridge Energy Management, LLC | | | 37,249,921 | | | | 5.0 | | |

Buckeye Partners, LP | | | 36,191,197 | | | | 4.8 | | |

MarkWest Energy Partners, LP | | | 33,756,926 | | | | 4.5 | | |

Williams Partners LP | | | 26,640,062 | | | | 3.6 | | |

Energy Transfer Partners, LP | | | 26,308,762 | | | | 3.5 | | |

El Paso Pipeline Partners, LP | | | 25,319,517 | | | | 3.4 | | |

Teekay Offshore Partners LP (Marshall Islands) | | | 25,059,055 | | | | 3.4 | | |

Veresen Inc. (Canada) | | | 22,380,328 | | | | 3.0 | | |

a Top ten holdings are determined on the basis of the value of individual securities held. The Fund may also hold positions in other securities issued by the companies listed above. See the Consolidated Schedule of Investments for additional details on such other positions.

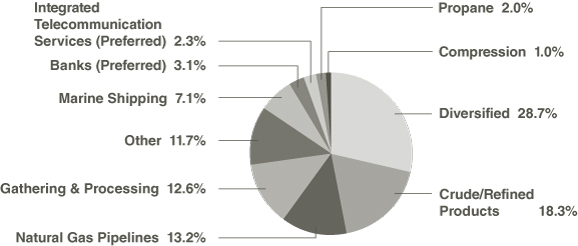

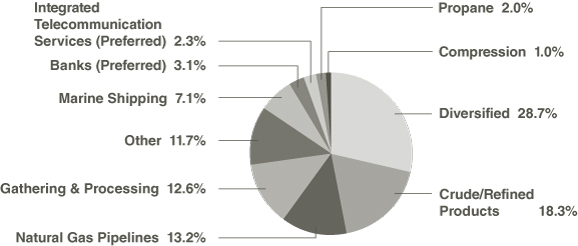

Sector Breakdown

(Based on Managed Assets)

(Unaudited)

6

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS

November 30, 2013

| | | | | Number

of Shares | | Value | |

MASTER LIMITED PARTNERSHIPS AND RELATED COMPANIES | | 126.9% | | | | | | | | | |

COAL | | 1.1% | | | | | | | | | |

Natural Resource Partners L.P.a | | | | | 280,000 | | | $ | 5,625,200 | | |

COMPRESSION | | 1.4% | | | | | | | | | |

Exterran Partners, L.P.b | | | | | 158,460 | | | | 4,409,942 | | |

USA Compression Partners, LPb | | | | | 128,640 | | | | 3,152,966 | | |

| | | | | | | | 7,562,908 | | |

CRUDE/REFINED PRODUCTS | | 26.2% | | | | | | | | | |

Buckeye Partners, LPa,b | | | | | 531,520 | | | | 36,191,197 | | |

Calumet Specialty Products Partners, LPb | | | | | 96,470 | | | | 2,758,077 | | |

Enbridge Energy Management, LLCb,c | | | | | 1,304,245 | | | | 37,249,241 | | |

Enbridge Inc. (Canada)b | | | | | 157,100 | | | | 6,462,605 | | |

Magellan Midstream Partners, LPb | | | | | 129,842 | | | | 8,068,382 | | |

NuStar Energy LPa,b | | | | | 235,008 | | | | 12,537,677 | | |

NuStar GP Holdings, LLCb | | | | | 160,708 | | | | 4,920,879 | | |

Pembina Pipeline Corporation (Canada)b | | | | | 461,400 | | | | 14,655,546 | | |

Plains All American Pipeline, LPb | | | | | 71,980 | | | | 3,712,009 | | |

Plains GP Holdings, L.P.d | | | | | 241,553 | | | | 5,676,495 | | |

Rose Rock Midstream, LPb | | | | | 62,900 | | | | 2,256,223 | | |

SemGroup Corporationb | | | | | 34,000 | | | | 2,086,920 | | |

| | | | | | | | 136,575,251 | | |

DIVERSIFIED | | 41.1% | | | | | | | | | |

Altagas LTD (Canada)b | | | | | 263,640 | | | | 9,622,097 | | |

Energy Transfer Equity, LPb | | | | | 298,541 | | | | 22,321,911 | | |

Energy Transfer Partners, LPb | | | | | 485,760 | | | | 26,308,762 | | |

Enterprise Products Partners LPa,b | | | | | 772,720 | | | | 48,658,178 | | |

Kinder Morgan Inc.b | | | | | 174,270 | | | | 6,193,556 | | |

Kinder Morgan Management, LLCb,c | | | | | 616,792 | | | | 47,227,741 | | |

Martin Midstream Partners, L.P. | | | | | 35,000 | | | | 1,571,850 | | |

NGL Energy Partners LPb | | | | | 251,529 | | | | 8,169,662 | | |

NGL Energy Partners LP (Restricted)e,f | | | | | 80,000 | | | | 2,520,800 | | |

Williams Companies, Incb | | | | | 427,500 | | | | 15,056,550 | | |

Williams Partners LPa,b | | | | | 518,390 | | | | 26,640,062 | | |

| | | | | | | | 214,291,169 | | |

GATHERING & PROCESSING | | 18.1% | | | | | | | | | |

Access Mistream Partners LPb | | | | | 87,470 | | | | 4,913,190 | | |

See accompanying notes to consolidated financial statements.

7

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS—(Continued)

November 30, 2013

| | | | | Number

of Shares | | Value | |

Crestwood Equity Partners LPb | | | | | 117,300 | | | $ | 1,804,074 | | |

Crestwood Midstream Partners LPb | | | | | 301,689 | | | | 6,830,239 | | |

Crosstex Energy, LPb | | | | | 337,100 | | | | 8,980,344 | | |

DCP Midstream Partners, LP | | | | | 45,230 | | | | 2,179,181 | | |

EQT Midstream Partners, LPb | | | | | 52,650 | | | | 2,895,223 | | |

MarkWest Energy Partners, LPa,b | | | | | 488,735 | | | | 33,756,926 | | |

Midcoast Energy Partnersd | | | | | 115,000 | | | | 2,068,850 | | |

PVR Partners, LPb | | | | | 252,950 | | | | 6,247,865 | | |

Regency Energy Partners LPa,b | | | | | 289,620 | | | | 7,060,936 | | |

Southcross Energy Partners, LPb | | | | | 366,739 | | | | 7,107,402 | | |

Tallgrass Energy Partners, LP | | | | | 91,800 | | | | 2,283,984 | | |

Targa Resources Partners LPb | | | | | 162,140 | | | | 8,277,247 | | |

| | | | | | | | 94,405,461 | | |

MARINE SHIPPING | | 10.1% | | | | | | | | | |

Dynagas LNG Partners LPd | | | | | 149,200 | | | | 2,797,500 | | |

Golar LNG Partners LP (Marshall Islands)b | | | | | 552,301 | | | | 17,662,586 | | |

KNOT Offshore Partners LP (Marshall Islands)b | | | | | 170,380 | | | | 4,779,159 | | |

Teekay Offshore Partners LP (Marshall Islands)b | | | | | 763,530 | | | | 25,059,055 | | |

Teekay Shipping Corp (Marshall Islands) | | | | | 60,000 | | | | 2,655,000 | | |

| | | | | | | | 52,953,300 | | |

NATURAL GAS PIPELINES | | 18.8% | | | | | | | | | |

APA Group (Australia)b | | | | | 1,625,950 | | | | 9,057,723 | | |

Boardwalk Pipeline Partners, LPa,b | | | | | 402,700 | | | | 10,607,118 | | |

CorEnergy Infrastructure Trust, Inc.b | | | | | 228,190 | | | | 1,576,793 | | |

El Paso Pipeline Partners, LPa,b | | | | | 608,935 | | | | 25,319,517 | | |

Spectra Energy Corpb | | | | | 408,250 | | | | 13,696,788 | | |

Spectra Energy Partners, LPa,b | | | | | 195,370 | | | | 8,783,835 | | |

TransCanada Corporation (Canada)b | | | | | 157,270 | | | | 6,934,356 | | |

Veresen Inc. (Canada)b | | | | | 1,738,320 | | | | 22,380,328 | | |

| | | | | | | | 98,356,458 | | |

OIL & GAS STORAGE | | 0.4% | | | | | | | | | |

Niska Gas Storage Partners, LLCb | | | | | 130,800 | | | | 1,989,468 | | |

PROPANE | | 2.8% | | | | | | | | | |

Suburban Propane Partners, LPa,b | | | | | 323,730 | | | | 14,855,970 | | |

OTHER | | 6.9% | | | | | | | | | |

Cheniere Energy Partners, LPa,b | | | | | 638,125 | | | | 18,965,075 | | |

See accompanying notes to consolidated financial statements.

8

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS—(Continued)

November 30, 2013

| | | | | Number

of Shares | | Value | |

Dominion Resources, Inc. | | | | | 45,800 | | | $ | 2,972,878 | | |

Pattern Energy Group Inc. | | | | | 37,366 | | | | 911,357 | | |

Seadrill Partners LLC | | | | | 129,000 | | | | 4,073,820 | | |

Sprague Resources LPd | | | | | 425,000 | | | | 7,322,750 | | |

TransAlta Renewables Inc | | | | | 168,500 | | | | 1,696,814 | | |

| | | | | | | | 35,942,694 | | |

TOTAL MASTER LIMITED PARTNERSHIPS AND

RELATED COMPANIES

(Identified cost—$627,783,755) | | | | | | | 662,557,879 | | |

PREFERRED SECURITIES | | 13.5% | | | | | | | | | |

BANKS | | 4.5% | | | | | | | | | |

Banco Bilbao Vizcaya Argentaria SA,

9.00%, due 5/29/49 (Spain)b,f | | | | | 2,400,000 | | | | 2,526,000 | | |

Barclays PLC, 8.25%, due 12/29/49

(United Kingdom)f | | | | | 2,402,000 | | | | 2,479,063 | | |

Commerzbank AG, 8.125%, due 9/19/23 (Germany) | | | | | 1,600,000 | | | | 1,764,000 | | |

Credit Agricole SA, 8.125%, due 9/19/33 (France) | | | | | 1,200,000 | | | | 1,310,280 | | |

Dresdner Funding Trust I, 8.151%, due 6/30/31b | | | | | 5,000,000 | | | | 5,175,000 | | |

Farm Credit Bank, 6.75%, due 12/31/49 | | | | | 23,500 | | | | 2,309,611 | | |

Lloyds TSB Bank PLC,

6.657%, due 1/29/49 (United Kingdom) | | | | | 3,500,000 | | | | 3,377,500 | | |

Wells Fargo, 7.98%, due 3/29/49 | | | | | 4,000,000 | | | | 4,510,000 | | |

| | | | | | | | 23,451,454 | | |

FINANCE | | 1.1% | | | | | | | | | |

Ally Financial Inc., 8.50%, due 12/31/49 | | | | | 125,000 | | | | 3,346,250 | | |

Colony Financial Inc., 8.50%, due 12/31/49 | | | | | 90,308 | | | | 2,284,341 | | |

| | | | | | | | 5,630,591 | | |

INSURANCE | | 1.2% | | | | | | | | | |

La Mondiale, 7.625%, due 4/23/49 (France)b,f | | | | | 5,646,000 | | | | 6,041,220 | | |

INTEGRATED TELECOMMUNICATION SERVICES | | 3.4% | | | | | | | | | |

Centaur Funding Corp.,

9.08%, due 4/21/20 (Cayman Islands) | | | | | 2,500 | | | | 3,048,437 | | |

Embarq Corporation, 7.995%, due 6/1/36 | | | | | 2,500,000 | | | | 2,549,407 | | |

Frontier Communications Corporation,

9.00%, due 8/15/31 | | | | | 5,000,000 | | | | 5,062,500 | | |

See accompanying notes to consolidated financial statements.

9

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

CONSOLIDATED SCHEDULE OF INVESTMENTS—(Continued)

November 30, 2013

| | | | | Number

of Shares | | Value | |

Qwest Corp, 6.125%, due 6/1/53 | | | | | 196,122 | | | $ | 3,934,207 | | |

T-Mobile, 6.125%, due 1/15/22 | | | | | 87,000 | | | | 88,849 | | |

T-Mobile, 6.5%, due 1/15/24 | | | | | 83,000 | | | | 84,245 | | |

T-Mobile, 6.542%, due 4/28/20 | | | | | 2,575,000 | | | | 2,739,156 | | |

| | | | | | | | 17,506,801 | | |

MARINE SHIPPING | | | 1.1% | | | | | | | | | | |

Teekay Offshore Partners L.P.,

7.25%, due 4/30/18 (Marshall Islands)b | | | | | 231,021 | | | | 5,840,211 | | |

NATURAL GAS PIPELINES | | | 1.4% | | | | | | | | | | |

El Paso LLC, 8.05%, due 10/15/30 | | | | | 4,200,000 | | | | 4,333,039 | | |

El Paso LLC, 7.75%, due 1/15/32 | | | | | 2,848,000 | | | | 2,928,376 | | |

| | | | | | | | 7,261,415 | | |

UTILITIES | | | 0.8% | | | | | | | | | | |

Integrys Energy Group, 6.00%, due 8/1/73 | | | | | 105,534 | | | | 2,538,093 | | |

Nextera Energy Capital, 5.625%, due 6/15/72 | | | | | 80,000 | | | | 1,700,000 | | |

Nextera Energy Capital, 5.7%, due 3/1/72 | | | | | 3,936 | | | | 84,545 | | |

| | | | | | | | 4,322,638 | | |

TOTAL PREFERRED SECURITIES

(Identified cost—$71,903,776) | | | | | | | 70,054,330 | | |

TOTAL INVESTMENTS (Identified cost—$699,687,531) | | | 140.4 | % | | | | | | | 732,612,209 | | |

LIABILITIES IN EXCESS OF OTHER ASSETS | | | (40.4 | ) | | | | | | | (210,645,082 | ) | |

NET ASSETS (Equivalent to $19.44 per share based

on 26,856,953 shares of common stock oustanding) | | | 100.0 | % | | | | | | $ | 521,967,127 | | |

Note: Percentages indicated are based on the net assets of the Fund.

a All or a portion of this security is held by the Cohen & Steers MLP Investment Fund, a wholly-owned subsidiary.

b All or a portion of this security has been pledged as collateral in connection with the Fund's line of credit agreement. As of November 30, 2013, the total value of securities pledged as collateral for the line of credit agreement was $449,409,540.

c Distributions are paid-in-kind.

d Non-income producing security.

e Resale is restricted due to a lock-up period on all shares, expiring on February 3, 2014. Aggregate holdings equal 0.5% of the net assets of the Fund, all of which are illiquid.

f Fair valued security. This security has been valued at its fair value as determined in good faith under procedures established by and under the general supervision of the Fund's Board of Directors. Aggregrate fair valued securities represent 2.6% of the net assets of the Fund.

See accompanying notes to consolidated financial statements.

10

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

CONSOLIDATED STATEMENT OF ASSETS AND LIABILITIES

November 30, 2013

ASSETS: | |

Investments in securities, at value (Identified cost—$699,687,531) | | $ | 732,612,209 | | |

Cash | | | 16,377,340 | | |

Foreign currency, at value (Identified cost—$157,312) | | | 155,786 | | |

Receivable for: | |

Investment securities sold | | | 15,575,326 | | |

Dividends and interest | | | 1,282,963 | | |

Other assets | | | 65,048 | | |

Total Assets | | | 766,068,672 | | |

LIABILITIES: | |

Payable for: | |

Revolving credit agreement | | | 225,000,000 | | |

Investment securities purchased | | | 12,621,312 | | |

Investment management fees | | | 610,108 | | |

Administration fees | | | 61,533 | | |

Interest expense | | | 40,542 | | |

Directors' fees | | | 11,953 | | |

Deferred tax liablility | | | 5,309,646 | | |

Other liabilities | | | 446,451 | | |

Total Liabilities | | | 244,101,545 | | |

NET ASSETS | | $ | 521,967,127 | | |

NET ASSETS consist of: | |

Paid-in capital | | $ | 496,030,130 | | |

| Dividends in excess of net investment income, net of income taxes | | | (252,854 | ) | |

| Accumulated net realized loss, net of income taxes | | | (591,109 | ) | |

| Net unrealized appreciation, net of income taxes | | | 26,780,960 | | |

| | | $ | 521,967,127 | | |

NET ASSET VALUE PER SHARE: | |

($521,967,127 ÷ 26,856,953 shares outstanding) | | $ | 19.44 | | |

MARKET PRICE PER SHARE | | $ | 17.38 | | |

MARKET PRICE DISCOUNT TO NET ASSET VALUE PER SHARE | | | (10.60 | )% | |

See accompanying notes to consolidated financial statements.

11

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

CONSOLIDATED STATEMENT OF OPERATIONS

For the Period March 26, 2013a through November 30, 2013

Investment Income: | |

Distributions from master limited partnerships | | $ | 18,055,548 | | |

Less return of capital on distributions | | | (18,032,946 | ) | |

Net distributions from master limited partnerships | | | 22,602 | | |

| Dividend income (net of $374,656 of foreign withholding tax) | | | 4,583,272 | | |

Interest income | | | 1,683,003 | | |

| Total Investment Income | | | 6,288,877 | | |

Expenses: | |

Investment management fees | | | 4,668,050 | | |

Interest expense | | | 2,085,972 | | |

Professional fees | | | 551,281 | | |

Administration fees | | | 427,179 | | |

Line of credit fees | | | 92,452 | | |

Registration and filing fees | | | 58,009 | | |

Shareholder reporting expenses | | | 50,144 | | |

Custodian fees and expenses | | | 44,928 | | |

Directors' fees and expenses | | | 39,869 | | |

Transfer agent fees and expenses | | | 13,137 | | |

Miscellaneous | | | 21,294 | | |

Total Expenses | | | 8,052,315 | | |

Net Investment Loss, before income taxes | | | (1,763,438 | ) | |

Deferred tax benefit | | | 1,088,069 | | |

| Net Investment Loss, net of income taxes | | | (675,369 | ) | |

Net Realized and Unrealized Gain (Loss): | |

Net realized gain (loss) on: | |

| Investments | | | 1,131,905 | | |

Foreign currency transactions | | | (95,465 | ) | |

| Net realized gain, before income taxes | | | 1,036,440 | | |

Deferred tax expense | | | (257,247 | ) | |

| Net realized gain, net of income taxes | | | 779,193 | | |

Net change in unrealized appreciation (depreciation) on: | |

| Investments | | | 36,881,266 | | |

Foreign currency translations | | | (3,959,838 | ) | |

| Net change in unrealized appreciation, before income taxes | | | 32,921,428 | | |

Deferred tax expense | | | (6,140,468 | ) | |

| Net change in unrealized appreciation, net of income taxes | | | 26,780,960 | | |

Net realized and unrealized gain | | | 27,560,153 | | |

Net Increase in Net Assets resulting from Operations | | $ | 26,884,784 | | |

a Commencement of operations.

See accompanying notes to consolidated financial statements.

12

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

CONSOLIDATED STATEMENT OF CHANGES IN NET ASSETS

| | | For the period

March 26, 2013a

through

November 30, 2013 | |

Change in Net Assets: | |

From Operations: | |

Net investment loss, net of income taxes | | $ | (675,369 | ) | |

| Net realized gain, net of income taxes | | | 779,193 | | |

| Net change in unrealized appreciation, net of income taxes | | | 26,780,960 | | |

Net increase in net assets resulting from operations | | | 26,884,784 | | |

Dividends and Distributions to Shareholders from: | |

| Net investment income | | | (1,035,569 | ) | |

| Net realized gain | | | (1,308,799 | ) | |

Return of capital | | | (14,624,000 | ) | |

Total dividends and distributions to shareholders | | | (16,968,368 | ) | |

Capital Stock Transactions: | |

Increase in net assets from Fund share transactions | | | 511,950,436 | | |

Total increase in net assets | | | 521,866,852 | | |

Net Assets: | |

Beginning of period | | | 100,275 | | |

End of periodb | | $ | 521,967,127 | | |

a Commencement of operations.

b Includes dividends in excess of net investment income, net of income taxes, of $252,854.

See accompanying notes to consolidated financial statements.

13

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

CONSOLIDATED STATEMENT OF CASH FLOWS

For the Period March 26, 2013a through November 30, 2013

Increase in Cash: | |

Cash Flows from Operating Activitites | |

Net increase in net assets resulting from operations | | $ | 26,884,784 | | |

Adjustments to reconcile net increase in net assets resulting from

operations to net cash used for operating activities: | |

Purchases of long-term investments | | | (855,615,595 | ) | |

Proceeds from sales of long-term investments | | | 135,871,983 | | |

Return of capital on distributions | | | 18,089,994 | | |

Net amortization of premium | | | 41,070 | | |

Net increase in dividends and interest receivable and other assets | | | (1,348,011 | ) | |

Net increase in interest expense payable, accrued expenses and

other liabilities | | | 1,170,587 | | |

Net increase in deferred tax liability | | | 5,309,646 | | |

| Net change in unrealized appreciation of investment securities | | | (32,924,678 | ) | |

| Net realized gain on investment securities | | | (1,028,997 | ) | |

Cash used for operating activities | | | (703,549,217 | ) | |

Cash Flows from Financing Activities: | |

Increase in net assets from Fund share transactions | | | 511,453,925 | | |

Drawdown on revolving credit agreement | | | 225,000,000 | | |

Dividends and distributions paid | | | (16,471,857 | ) | |

Cash provided by financing activities | | | 719,982,068 | | |

Increase in cash | | | 16,432,851 | | |

Cash at beginning of period | | | 100,275 | | |

Cash at end of period (including foreign currency) | | $ | 16,533,126 | | |

Supplemental Disclosure of Cash Flow Information:

During the period March 26, 2013 (commencement of operations) through November 30, 2013, interest paid was $2,045,430.

The Fund received $3,603,736 from paid-in-kind stock dividends during the period March 26, 2013 (commencement of operations) through November 30, 2013. See Note 1 Organization and Significant Accounting Policies.

During the period March 26, 2013 (commencement of operations) through November 30, 2013, reinvestment of dividends and distributions on common shares was $496,511.

a Commencement of operations.

See accompanying notes to consolidated financial statements.

14

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

CONSOLIDATED FINANCIAL HIGHLIGHTS

The following table includes selected data for a share outstanding throughout the period and other performance information derived from the financial statements. It should be read in conjunction with the financial statements and notes thereto.

Per Share Operating Performance: | | For the period

March 26, 2013a

through

November 30, 2013 | |

Net asset value, beginning of period | | $ | 19.10 | | |

Income (loss) from investment operations: | |

| Net investment loss, net of income taxes | | | (0.03 | )b | |

Net realized and unrealized gain, net of income taxes | | | 1.04 | | |

Total income from investment operations | | | 1.01 | | |

Less dividends and distributions to shareholders from: | |

| Net investment income | | | (0.04 | ) | |

| Net realized gain | | | (0.05 | ) | |

Return of capital | | | (0.54 | ) | |

Total dividends and distributions to shareholders | | | (0.63 | ) | |

Offering costs charged to paid-in capital | | | (0.04 | ) | |

Net increase in net asset value | | | 0.34 | | |

Net asset value, end of period | | $ | 19.44 | | |

Market value, end of period | | $ | 17.38 | | |

Total net asset value return | | | 5.34 | %c,d | |

Total market value return | | | (10.06 | )%c,d | |

See accompanying notes to consolidated financial statements.

15

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

CONSOLIDATED FINANCIAL HIGHLIGHTS—(Continued)

Ratios/Supplemental Data: | | For the period

March 26, 2013a

through

November 30, 2013 | |

Net assets, end of period (in millions) | | $ | 522.0 | | |

| Ratio of expenses to average daily net assets | | | 3.48 | %e,f | |

Ratio of expenses to average daily net assets

(excluding deferred tax expense) | | | 2.42 | %e | |

Ratio of expenses to average daily net assets

(excluding deferred tax expense and interest expense) | | | 1.71 | %e | |

| Ratio of net investment loss to average daily net assets | | | (1.64 | )%e,f | |

| Ratio of expenses to average daily managed assets | | | 2.54 | %e,f,g | |

Portfolio turnover rate | | | 25 | %d | |

Revolving Credit Agreement | |

Asset coverage ratio for revolving credit agreement | | | 332 | % | |

Asset coverage per $1,000 for revolving credit agreement | | $ | 3,320 | | |

a Commencement of operations.

b Calcuation based on average shares outstanding.

c Total net asset value return measures the change in net asset value per share over the period indicated. Total market value return is computed based upon the Fund's New York Stock Exchange market price per share and excludes the effects of brokerage commissions. Dividends and distributions are assumed, for purposes of these calculations, to be reinvested at prices obtained under the Fund's dividend reinvestment plan.

d Not annualized.

e Annualized.

f For the period March 26, 2013 (commencement of operations) through November 30, 2013, the Fund accrued $5,309,646 for net deferred income tax expense.

g Average daily managed assets represent net assets plus the outstanding balance of the credit agreement.

See accompanying notes to consolidated financial statements.

16

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1. Organization and Significant Accounting Policies

Cohen & Steers MLP Income and Energy Opportunity Fund, Inc. (the Fund) was incorporated under the laws of the State of Maryland on December 13, 2012 and is registered under the Investment Company Act of 1940, (the 1940 Act), as amended, as a non-diversified, closed-end management investment company. The Fund's investment objective is to provide attractive total return, comprised of high current income and price appreciation. The Fund had no operations until February 8, 2013 when it sold 5,250 common shares to Cohen & Steers Capital Management Inc. (the investment manager). Investment operations commenced on March 26, 2013.

Cohen & Steers MLP Investment Fund (the Subsidiary), a wholly-owned subsidiary of the Fund organized under the laws of the state of Maryland, was formed on January 30, 2013 and commenced operations on March 26, 2013. The Subsidiary acts as an investment vehicle for the Fund in order to effect certain investments on behalf of the Fund, consistent with the Fund's investment objectives and policies as described in the Fund's prospectus. The Fund expects that it will achieve a significant portion of its exposure to Master Limited Partnerships (MLPs) through investment in the Subsidiary. Unlike the Fund, the Subsidiary may invest without limitation in MLPs. As of November 30, 2013, the Fund held an investment of $137,447,154 in the Subsidiary, representing 21.2% of the Fund's total assets (based on U.S. Federal income tax regulations). The Consolidated Schedule of Investments includes positions of the Fund and the Subsidiary. The financial statements have been consolidated and include the accounts of the Fund and the Subsidiary. Where the context requires, the "Fund" includes both the Fund and Subsidiary. All significant inter-company balances and transactions have been eliminated in consolidation.

The following is a summary of significant accounting policies consistently followed by the Fund in the preparation of its consolidated financial statements. The policies are in conformity with accounting principles generally accepted in the United States of America (GAAP). The preparation of the consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities at the date of the consolidated financial statements and the reported amounts of income and expenses during the reporting period. Actual results could differ from those estimates.

Portfolio Valuation: Investments in securities that are listed on the NYSE are valued, except as indicated below, at the last sale price reflected at the close of the NYSE on the business day as of which such value is being determined. If there has been no sale on such day, the securities are valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price.

Securities not listed on the NYSE but listed on other domestic or foreign securities exchanges are valued in a similar manner. Securities traded on more than one securities exchange are valued at the last sale price reflected at the close of the exchange representing the principal market for such securities on the business day as of which such value is being determined. If after the close of a foreign market, but prior to the close of business on the day the securities are being valued, market conditions change significantly, certain non-U.S. equity securities may be fair valued pursuant to procedures established by the Board of Directors.

Readily marketable securities traded in the over-the-counter market, including listed securities whose primary market is believed by the investment manager to be over-the-counter, are valued at the last sale price on the valuation date as reported by sources deemed appropriate by the Board of Directors to reflect their fair market value. If there has been no sale on such day, the securities are

17

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

valued at the mean of the closing bid and ask prices on such day or, if no ask price is available, at the bid price. However, certain fixed-income securities may be valued on the basis of prices provided by a pricing service when such prices are believed by the investment manager, pursuant to delegation by the Board of Directors, to reflect the fair market value of such securities.

Short-term debt securities with a maturity date of 60 days or less are valued at amortized cost, which approximates fair value. Investments in open-end mutual funds are valued at their closing net asset value.

The policies and procedures approved by the Fund's Board of Directors delegate authority to make fair value determinations to the investment manager, subject to the oversight of the Board of Directors. The investment manager has established a valuation committee (Valuation Committee) to administer, implement and oversee the fair valuation process according to the policies and procedures approved annually by the Board of Directors. Among other things, these procedures allow the Fund to utilize independent pricing services, quotations from securities and financial instrument dealers and other market sources to determine fair value.

Securities for which market prices are unavailable, or securities for which the investment manager determines that the bid and/or ask price does not reflect market value, will be valued at fair value, as determined in good faith by the Valuation Committee, pursuant to procedures approved by the Fund's Board of Directors. Circumstances in which market prices may be unavailable include, but are not limited to, when trading in a security is suspended, the exchange on which the security is traded is subject to an unscheduled close or disruption or material events occur after the close of the exchange on which the security is principally traded. In these circumstances, the Fund determines fair value in a manner that fairly reflects the market value of the security on the valuation date based on consideration of any information or factors it deems appropriate. These may include, but are not limited to, recent transactions in comparable securities, information relating to the specific security and developments in the markets.

Foreign equity fair value pricing procedures utilized by the Fund may cause certain non-U.S. equity securities to be fair valued on the basis of fair value factors provided by a pricing service to reflect any significant market movements between the time the Fund values such securities and the earlier closing of foreign markets.

The Fund's use of fair value pricing may cause the net asset value of Fund shares to differ from the net asset value that would be calculated using market quotations. Fair value pricing involves subjective judgments and it is possible that the fair value determined for a security may be materially different than the value that could be realized upon the sale of that security.

Fair value is defined as the price that the Fund would expect to receive upon the sale of an investment or expect to pay to transfer a liability in an orderly transaction with an independent buyer in the principal market or, in the absence of a principal market, the most advantageous market for the investment or liability. The hierarchy of inputs that are used in determining the fair value of the Fund's investments is summarized below.

• Level 1—quoted prices in active markets for identical investments

• Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, credit risk, etc.)

• Level 3—significant unobservable inputs (including the Fund's own assumptions in determining the fair value of investments)

18

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

For movements between the levels within the fair value hierarchy, the Fund has adopted a policy of recognizing the transfer at the end of the period in which the underlying event causing the movement occurred. Changes in valuation techniques may result in transfers into or out of an assigned level within the disclosure hierarchy. There were no transfers between Level 1 and Level 2 securities as of November 30, 2013.

The following is a summary of the inputs used as of November 30, 2013 in valuing the Fund's investments carried at value:

| | | Total | | Quoted Prices

In Active

Markets for

Identical

Instruments

(Level 1) | | Other

Significant

Observable

Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | |

Investments In Securities | |

Master Limited Partnerships

and Related Companies: | |

Diversified | | $ | 214,291,169 | | | $ | 211,770,369 | | | $ | — | | | $ | 2,520,800 | a | |

| Other | | | 448,266,710 | | | | 448,266,710 | | | | — | | | | — | | |

Preferred Securities: | |

Banks | | | 23,451,454 | | | | — | | | | 23,451,454 | | | | — | | |

Insurance | | | 6,041,220 | | | | — | | | | 6,041,220 | | | | — | | |

Integrated

Telecommunication

Services | | | 17,506,801 | | | | 3,934,207 | | | | 13,572,594 | | | | — | | |

Natural Gas Pipelines | | | 7,261,415 | | | | — | | | | 7,261,415 | | | | — | | |

Other | | | 15,793,440 | | | | 15,793,440 | | | | — | | | | — | | |

Total Investments

In Securitiesb | | $ | 732,612,209 | | | $ | 679,764,726 | | | $ | 50,326,683 | | | $ | 2,520,800 | | |

a Publicly traded common stock classified as Level 3 is valued at a discount to quoted market prices to reflect a lock-up restriction ascribed to those shares.

b Portfolio holdings are disclosed individually on the Consolidated Schedule of Investments.

19

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Following is a reconciliation of investments for which significant unobservable inputs (Level 3) were used in determining fair value:

| | | Total

Investments

in Securities | | Master Limited

Partnerships and

Related

Companies

Diversified— | |

Balance as of March 26, 2013a | | $ | — | | | $ | — | | |

| Purchases | | | 2,367,200 | | | | 2,367,200 | | |

| Change in unrealized appreciation (depreciation) | | | 153,600 | | | | 153,600 | | |

Balance as of November 30, 2013 | | $ | 2,520,800 | | | $ | 2,520,800 | | |

a Commencement of operations.

The change in unrealized appreciation/(depreciation) attributable to securities owned on November 30, 2013 which were valued using significant unobservable inputs (Level 3) amounted to $153,600.

The following table summarized the quantitative inputs and assumptions used for investments categorized in Level 3 of the fair value hierarchy.

| | Fair Value at

November 30, 2013 | | Valuation

Technique | | Unobservable

Inputs | | Input | |

Master Limited Partnerships

and Related

Companies—

Diversified | | $ | 2,520,800 | | |

Market price

less

discount | |

Liquidity

Discount | | | 3.0 | % | |

The significant unobservable input utilized in the fair value measurement of the Fund's Level 3 equity investment in Master Limited Partnerships & Related Companies—Diversified is a discount to quoted market prices to reflect a lock-up restriction ascribed to those shares. Significant changes in these inputs may result in a materially higher or lower fair value measurement.

Security Transactions and Investment Income: Security transactions are recorded on trade date. Realized gains and losses on investments sold are recorded on the basis of identified cost. Interest income is recorded on the accrual basis. Discounts are accreted and premiums are amortized over the life of the respective securities. Dividend income is recorded on the ex-dividend date, except for certain dividends on foreign securities, which are recorded as soon as the Fund is informed after the ex-dividend date. Distributions received from the Fund's investments in MLPs generally are comprised of ordinary income and return of capital from the MLPs. The Fund allocates distributions between investment income and return of capital based on historical information available from each MLP and other industry sources. These estimates may subsequently be revised based on actual allocations received from MLPs after

20

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

their tax reporting periods are concluded. The Fund has estimated approximately 99.6 percent of distributions from MLPs as return of capital.

The Fund receives paid-in-kind stock dividends in the form of additional units from its investment in Enbridge Energy Management, LLC and Kinder Morgan Management, LLC. The additional units are not reflected in investment income during the period received but are recorded as an adjustment to the cost of the security. For the period March 26, 2013 (commencement of operations) through November 30, 2013, the Fund received the following paid-in-kind stock dividends:

Enbridge Energy Management, LLC | | $ | 1,662,343 | | |

Kinder Morgan Management, LLC | | | 1,941,393 | | |

Total paid-in-kind stock dividends | | $ | 3,603,736 | | |

Master Limited Partnerships: Entities commonly referred to as MLPs are generally organized under state law as limited partnerships or limited liability companies. The Fund invests in MLPs receiving partnership taxation treatment under the Internal Revenue Code of 1986, as amended (the "Code"), and whose interest or "units" are traded on securities exchanges like shares of corporate stock. To be treated as a partnership for U.S. federal income tax purposes, an MLP whose units are traded on a securities exchange must receive at least 90% of its income from qualifying sources such as interest, dividends, real property rents, gains on dispositions of real property, income and gains from mineral or natural resources activities, income and gains from the transportation or storage of certain fuels, and, in certain circumstances, income and gains from commodities or futures, forwards and options on commodities. Mineral or natural resources activities include exploration, development, production, processing, mining, refining, marketing and transportation (including pipelines) of oil and gas, minerals, geothermal energy, fertilizer, timber or industrial source carbon dioxide. An MLP consists of a general partner and limited partners (or in the case of MLPs organized as limited liability companies, a managing member and members). The general partner or managing member typically controls the operations and management of the MLP and has an ownership stake in the partnership or limited liability company. The limited partners or members, through their ownership of limited partner or member interests, provide capital to the entity, are intended to have no role in the operation and management of the entity and receive cash distributions. The Fund's investments in MLPs consist only of limited partner or member interests ownership. The MLPs themselves generally do not pay U.S. federal income taxes and unlike investors in corporate securities, direct MLP investors are generally not subject to double taxation (i.e., corporate level tax and tax on corporate dividends). Currently, most MLPs operate in the energy and/or natural resources sector.

Foreign Currency Translation: The books and records of the Fund are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the date of valuation. Purchases and sales of investment securities and income and expense items denominated in foreign currencies are translated into U.S. dollars based upon prevailing exchange rates on the respective dates of such transactions. The Fund does not isolate that portion of the results of operations resulting from fluctuations in foreign

21

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

exchange rates on investments from the fluctuations arising from changes in market prices of securities held. Such fluctuations are included with the net realized and unrealized gain or loss on investments.

Net realized foreign exchange gains or losses arise from sales of foreign currencies, including gains and losses on forward foreign currency exchange contracts, currency gains or losses realized between the trade and settlement dates on securities transactions, and the difference between the amounts of dividends, interest, and foreign withholding taxes recorded on the Fund's books and the U.S. dollar equivalent of the amounts actually received or paid. Net unrealized foreign exchange gains and losses arise from changes in the values of assets and liabilities, other than investments in securities, on the date of valuation, resulting from changes in exchange rates. Pursuant to U.S. federal income tax regulations, certain foreign currency gains/losses included in realized and unrealized gain/loss are included in or are a reduction of ordinary income for federal income tax purposes.

Foreign Securities: The Fund may directly purchase securities of foreign issuers. Investing in securities of foreign issuers involves special risks not typically associated with investing in securities of U.S. issuers. The risks include possible revaluation of currencies, the ability to repatriate funds, less complete financial information about companies and possible future adverse political and economic developments. Moreover, securities of many foreign issuers and their markets may be less liquid and their prices more volatile than securities of comparable U.S. issuers.

Dividends and Distributions to Shareholders: Dividends from net investment income and capital gain distributions are determined in accordance with U.S. federal income tax regulations, which may differ from GAAP. Dividends from net investment income, if any, are declared and paid quarterly. Net realized capital gains, unless offset by any available capital loss carryforward, are typically distributed to shareholders at least annually. Dividends and distributions to shareholders are recorded on the ex- dividend date and are automatically reinvested in full and fractional shares of the Fund in accordance with the Fund's Reinvestment Plan, unless the shareholder has elected to have them paid in cash. Distributions paid by the Fund are subject to recharacterization for tax purposes.

Based upon the results of operations for the period March 26, 2013 (commencement of operations) through November 30, 2013, a significant portion of the dividends have been reclassified to return of capital.

Income Taxes: It is the policy of the Fund to continue to qualify as a regulated investment company, if such qualification is in the best interest of the shareholders, by complying with the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies, and by distributing substantially all of its taxable earnings to its shareholders. Also, in order to avoid the payment of any federal excise taxes, the Fund will distribute substantially all of its net investment income and net realized gains on a calendar year basis. Dividend and interest income from holdings in non-U.S. securities is recorded net of non-U.S. taxes paid. Management has analyzed the Fund's federal tax positions as well as its tax positions in non-U.S. jurisdictions where it trades and has concluded that as of November 30, 2013, no additional provisions for income tax are required in the Fund's consolidated financial statements.

The Subsidiary, which is treated as a C-corporation for U.S. Federal income tax purposes, is obligated to pay federal and state income tax on its taxable income. The Subsidiary invests its assets

22

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

primarily in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in the MLPs, the Subsidiary reports its allocable share of the MLPs taxable income in computing its own taxable income. Deferred income taxes reflect (i) taxes on unrealized gains (losses), which are attributable to the temporary difference between fair market value and tax basis, (ii) the net tax effects of temporary differences between the carrying amounts of assets and liabilities for financial reporting purposes and the amounts used for income tax purposes and (iii) the net tax benefit of accumulated net operating and capital losses. To the extent the Subsidiary has a deferred tax asset; consideration is given as to whether or not a valuation allowance is required. A valuation allowance will be established if it is more likely than not that some portion or the entire deferred tax asset will not be realized. In the assessment for a valuation allowance, consideration is given to all positive and negative evidence related to the realization of the deferred tax asset. This assessment considers, among other matters, the nature, frequency and severity of current and cumulative losses, forecasts of future profitability (which are highly dependent on future cash distributions from the Subsidiary's MLP holdings), the duration of statutory carryforward periods and the associated risk that operating and capital loss carryforwards may expire unused.

The Subsidiary may rely to some extent on information provided by the MLPs, which may not necessarily be timely, to estimate taxable income allocable to the MLP units held in the portfolio and to estimate the associated deferred tax asset or liability. Such estimates are made in good faith. From time to time, as new information becomes available, the Subsidiary modifies its estimates or assumptions regarding the deferred tax asset or liability.

For the current open tax year and for all major jurisdictions, management of the Subsidiary has analyzed and concluded that there are no significant uncertain tax positions that would require recognition in the financial statements. Furthermore, management of the Subsidiary is also not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months. The current tax year remains open and subject to examination by federal and state tax jurisdictions.

Note 2. Investment Management Fees, Administration Fees and Other Transactions with Affiliates

Investment Management Fees: The investment manager serves as the Fund's investment manager pursuant to an investment management agreement (the investment management agreement). Under the terms of the investment management agreement, the investment manager provides the Fund with day-to-day investment decisions and generally manages the Fund's investments in accordance with the stated policies of the Fund, subject to the supervision of the Board of Directors.

For the services provided to the Fund, the investment manager receives a fee, accrued daily and paid monthly, at the annual rate of 1.00% of the average daily managed assets of the Fund. Managed assets are equal to the net assets of the common shares plus the amount of any borrowings, used for leverage, outstanding.

Administration Fees: The Fund has entered into an administration agreement with the investment manager under which the investment manager performs certain administrative functions for the Fund

23

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

and receives a fee, accrued daily and paid monthly, at the annual rate of 0.05% of the Fund's average daily managed assets. For the period March 26, 2013 (commencement of operations) through November 30, 2013, the Fund paid $223,403 in fees under this administration agreement. Additionally, the Fund pays U.S. Bancorp Fund Services, LLC as co-administrator under a fund accounting and administration agreement.

Directors' and Officers' Fees: Certain directors and officers of the Fund are also directors, officers and/or employees of the investment manager. The Fund does not pay compensation to directors and officers affiliated with the investment manager except for the Chief Compliance Officer, who received compensation from the investment manager which was reimbursed by the Fund in the amount of $5,884 for the period March 26, 2013 (commencement of operations) through November 30, 2013.

Note 3. Purchases and Sales of Securities

Purchases and sales of securities, excluding short-term investments, for the period March 26, 2013 (commencement of operations) through November 30, 2013, totaled $868,236,907 and $151,447,309, respectively.

Note 4. Income Tax Information

The tax character of dividends and distributions paid was as follows:

| Ordinary income | | $ | 2,344,368 | | |

| Tax return of capital | | | 14,624,000 | | |

Total dividends and distributions | | $ | 16,968,368 | | |

As of November 30, 2013, the federal tax cost and unrealized appreciation and depreciation in value of securities held were as follows:

Cost for federal income tax purposes | | $ | 700,531,494 | | |

Gross unrealized appreciation | | $ | 48,964,664 | | |

Gross unrealized depreciation | | | (16,887,199 | ) | |

Net unrealized appreciation (depreciation) before taxes | | $ | 32,077,465 | | |

Net unrealized appreciation (depreciation) after taxes | | $ | 25,936,997 | | |

As of November 30, 2013, the Fund had temporary book/tax differences primarily attributable to wash sales and partnership adjustments and permanent book/tax differences primarily attributable to the net income and realized gain/loss from the Subsidiary, currency, and partnership adjustments. To reflect reclassifications arising from the permanent differences, paid-in capital was charged $1,396,581, accumulated net realized loss was charged $61,503 and dividends in excess of net investment income was credited $1,458,084. Net assets were not affected by this reclassification.

24

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

The Subsidiary primarily invests its assets in MLPs, which generally are treated as partnerships for federal income tax purposes. As a limited partner in MLPs, the Subsidiary reports its allocable share of the MLP's taxable income in computing its own taxable income. The Subsidiary's tax expense or benefit is included in the Consolidated Statement of Operations based on the component of income or gains (losses) to which such expense or benefit relates.

Deferred income taxes reflect the net tax effect of temporary differences between the carrying amount of assets and liabilities for financial reporting and tax purposes. Components of the Subsidiary's deferred tax assets and liabilities as of November 30, 2013, are as follows:

Deferred tax assets: | |

Net operating loss | | $ | 501,045 | | |

Deferred tax liabilities: | |

| Unrealized gain on investment securities | | | 5,810,691 | | |

Total net deferred tax liability | | $ | 5,309,646 | | |

Although the Subsidiary currently has a net deferred tax liability, it periodically reviews the recoverability of its deferred tax assets based on the weight of available evidence. When assessing the recoverability of its deferred tax assets, significant weight is given to the effects of potential future realized and unrealized gains on investments and the period over which these deferred tax assets can be realized. Based on the Subsidiary's assessment, it has determined that it is more likely than not that its deferred tax assets will be realized as future taxable income of the appropriate character. Accordingly, no valuation allowance has been established for the Subsidiary's deferred tax asset. Significant declines in the fair value of its portfolio of investments may change the Subsidiary's assessment regarding the recoverability of its deferred tax assets and may result in a valuation allowance. If a valuation allowance is required to reduce any deferred tax asset in the future, it could have a material impact on the Fund's net asset value and results of operations in the period it is recorded.

Total income tax expense (current and deferred) has been computed by applying the federal statutory income tax rate of 35% plus a blended state income tax rate of 2.3% to the Subsidiary's net investment income and realized and unrealized gains (losses) on investments before taxes for the period March 26, 2013 (commencement of operations) through November 30, 2013, as follows:

| | | Deferred | | Total | |

Application of statutory income tax expense | | $ | 4,982,242 | | | $ | 4,982,242 | | |

| State income taxes, net of federal expense | | | 327,404 | | | | 327,404 | | |

Total income tax expense | | $ | 5,309,646 | | | $ | 5,309,646 | | |

As of November 30, 2013, the Subsidiary had a net operating loss of $1,343,284 which may be used to offset the Subsidiary's future taxable income prior to its expiration on November 30, 2033.

25

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Note 5. Capital Stock

The Fund is authorized to issue 250 million shares of common stock at a par value of $0.001 per share.

On March 26, 2013, the Fund completed the initial public offering of 24,000,000 shares of common stock. Proceeds paid to the Fund amounted to $457,440,000 after the deduction of underwriting commissions and offering costs of $22,560,000.

On May 9, 2013, the Fund completed a subsequent offering, in connection with the underwriter's over-allotment option, of 2,915,565 shares of common stock. Proceeds paid to the Fund amounted to $55,570,669 after the deduction of underwriting commissions and offering costs of $2,740,631.

Offering costs of $1,076,623 (representing approximately $0.04 per share) were offset against the proceeds of the offering and over-allotment option and have been charged to paid-in capital in excess of par. The investment manager has paid all organizational costs of approximately $230,000.

The Board of Directors approved the delegation of its authority to management to effect repurchases, pursuant to management's discretion and subject to market conditions and investment considerations, of up to 10% of the Fund's common shares outstanding (Share Repurchase Program) as of the date of the initial public offering through December 31, 2013. During the period March 26, 2013 (commencement of operations) through November 30, 2013, the Fund repurchased 90,049 Treasury shares of its common stock at an average price of $17.29 per share (including brokerage commissions) at a weighted average discount of 9.7%. These repurchases, which had a total cost of $1,556,744, resulted in an increase of $0.002 to the Fund's net asset value per share.

During the period March 26, 2013 (commencement of operations) through November 30, 2013, the Fund issued 26,187 shares of common stock for the reinvestment of dividends and distributions in an amount of $496,511.

Note 6. Borrowings

The Fund and the Subsidiary are each a party to the credit agreement as defined herein and may borrow under its terms. Therefore, for purposes of this note, the Fund and the Subsidiary are collectively referred to as the "Fund". On April 26, 2013, the Fund entered into a $196,000,000 revolving credit agreement (the credit agreement) with BNP Paribas Prime Brokerage International, Ltd. (BNPP) in which the Fund paid a monthly financing charge based on a LIBOR-based variable rate. Effective May 17, 2013, the Fund entered into an amended credit agreement in which the credit line was increased to $225,000,000 and the Fund began paying a monthly financing charge based on a combination of LIBOR-based variable and fixed rates. The Fund also pays a fee of 0.55% per annum on the unused portion of the credit agreement. BNPP may not change certain terms of the credit agreement except upon 360 days' notice; however, if the Fund violates certain conditions, the credit agreement may be terminated. The Fund is required to pledge portfolio securities as collateral in an amount up to two

26

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

times the loan balance outstanding (or more depending on the terms of the credit agreement) and has granted a security interest in the securities pledged to, and in favor of, BNPP as security for the loan balance outstanding. If the Fund fails to meet certain requirements, or maintain other financial covenants required under the credit agreement, the Fund may be required to repay immediately, in part or in full, the loan balance outstanding under the credit agreement, necessitating the sale of portfolio securities at potentially inopportune times.

As of November 30, 2013, the Fund had outstanding borrowings of $225,000,000. The Fund borrowed an average daily balance of approximately $218,200,000 at a weighted average borrowing cost of 1.60%.

Note 7. Concentration of Risk

Under normal circumstances, the Fund may invest up to 25% of its managed assets directly in equity or debt securities of MLPs. The Fund may also invest up to 25% (or such higher amount as permitted by any applicable tax diversification rules) of its managed assets in the Subsidiary, which in turn may invest up to 100% of its assets in equity or debt securities of MLPs, as well as in other securities and investment instruments. MLPs are subject to certain risks, such as supply and demand risk, depletion and exploration risk, tax risk, commodity pricing risk, and the risk associated with the hazards inherent in midstream energy industry activities. A substantial portion of the cash flow received by the Fund is derived from investment in equity securities of MLPs. The amount of cash that a MLP has available for distributions, and the tax character of such distributions, are dependent upon the amount of cash generated by the MLP's operations.

Note 8. Proposed Tax Regulations

On August 2, 2013, the Internal Revenue Service (IRS) issued proposed regulations which, if adopted in their current form, would require the Fund to limit its overall investment in MLPs to no more than 25% of the Fund's total assets, or to change its tax status in order to hold more than 25% in MLPs. The proposed regulations would not limit the Fund's investments in affiliates of MLPs or other Energy Investments structured as corporations rather than as MLPs. The proposal has no immediate impact on the current operations of the Fund. It has not been determined whether, when and in what form these proposed regulations will be adopted, or, if adopted, the impact such regulations may have on the Fund. If ultimately adopted, the regulations are expected to apply 90 days after publication of the new rules.

The Fund's investment manager believes that, in the event the proposed regulations are adopted, the Fund will be able to otherwise continue to pursue its investment objective and strategies by maintaining its status as a regulated investment company or by converting to a C-corporation for tax purposes.

27

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

Note 9. Other

In the normal course of business, the Fund enters into contracts that provide general indemnifications. The Fund's maximum exposure under these arrangements is dependent on claims that may be made against the Fund in the future and, therefore, cannot be estimated; however, based on experience, the risk of material loss from such claims is considered remote.

Note 10. Subsequent Events

On December 10, 2013, the Board of Directors of the Fund approved changing the calculation and publication of the Fund's net asset value (NAV) to daily from weekly. The Board of Directors and the investment manager believe publishing a daily NAV will provide more current performance and valuation information to the market. The Fund began publishing daily NAV's on January 2, 2014.

On December 10, 2013, the Board of Directors approved the continuation of the delegation of its authority to management to effect repurchases, pursuant to management's discretion and subject to market conditions and investment considerations, of up to 10% of the Fund's common shares outstanding (Share Repurchase Program) as of January 1, 2014 through December 31, 2014.

Management has evaluated events and transactions occurring after November 30, 2013 through the date that the financial statements were issued, and has determined that no additional disclosure in the financial statements is required.

28

COHEN & STEERS MLP INCOME AND ENERGY OPPORTUNITY FUND, INC.

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

To the Board of Directors and Shareholders of

Cohen & Steers MLP Income and Energy Opportunity Fund, Inc.