Introduction In Q4, we continued to make progress on our core priorities of growing our community and improving depth of engagement, driving top line revenue growth and diversifying our revenue sources, and building toward our long-term vision for augmented reality (AR). Daily active users (DAU) reached 453 million in Q4, an increase of 39 million year-over-year, and content viewers and total time spent watching content grew year-over-year. The progress we have made with our direct-response (DR) advertising business, and the growth of our Snapchat+ subscription business, contributed to Q4 revenue increasing 14% year-over-year to $1.56 billion. The benefits of our more focused investments are now evident in our improved profitability and Free Cash Flow generation. In Q4, the combination of topline progress and expense discipline translated to $276 million of Adjusted EBITDA and 60% Adjusted EBITDA flow-through, $182 million of Free Cash Flow, and $9 million of Net Income. In 2024, we generated $5.36 billion of revenue, which grew 16% year-over-year, driven primarily by DR ad revenue, which also grew 16% year-over-year for the full year. Snapchat+ grew from 7 million to 14 million subscribers in 2024, and Other Revenue, the majority of which is Snapchat+ subscription revenue, grew 131% year-over-year, exiting the year with an annualized revenue run rate of well over $500 million. We delivered $509 million of Adjusted EBITDA for the full year, marking our fifth consecutive year of positive Adjusted EBITDA. In 2024, we generated $219 million in Free Cash Flow, achieving our fourth consecutive year of positive Free Cash Flow. As we enter 2025, we are focused on key initiatives to build on the momentum we established in 2024. First, our new ad placements, Sponsored Snaps and Promoted Places, provide advertisers with incremental reach while enabling them to connect with our community in unique and personalized ways. Second, we are improving the way we go to market by providing advertising partners with actionable insights and introducing automated campaign optimization tools to enhance performance. Third, we are rolling out a simplified Snapchat experience designed to improve accessibility and usability for our community. Fourth, we will continue to advance our machine learning infrastructure to drive higher-quality ad interactions. Lastly, in 2024 we launched our 5th generation of Spectacles, powered by our new Snap OS operating system, as well as our latest version of Lens Studio, which empower developers to create innovative AR experiences that overlay computing on the real world. In 2025 we will expand our developer ecosystem by enhancing our tools to simplify AR creation, and increase the number of Spectacles experiences that can bring augmented reality into everyday life. We are pleased to announce that Ajit Mohan will be our new Chief Business Officer. Ajit joined Snap over two years ago as President of APAC, where he rapidly grew our business and presence across the region. As Chief Business Officer, Ajit will be responsible for growing our advertising business across all regions, and will lead our revenue product and business operations organizations to help bring greater alignment across our teams responsible for serving our advertising partners. Our progress in 2024 reinforces our confidence in our ability to adapt and innovate in a dynamic environment. We believe that the foundation we’ve built positions Snap to unlock even greater value for our business, community, and partners in the years to come. Community We continued to make progress in growing our global community, reaching 453 million DAU in Q4, an increase of 10 million quarter-over-quarter. DAU in North America was 100 million, compared to 100 million in the prior quarter and 100 million in SNAP INC. | Q4 2024 | INVESTOR LETTER 1

the prior year. DAU in Europe was 99 million, compared to 99 million in the prior quarter and 96 million in the prior year. DAU in Rest of World was 254 million, compared to 244 million in the prior quarter and 218 million in the prior year. Snapping with friends and family is the core of our service and the primary driver of the continued growth and long-term retention of our global community. In Q4, we introduced new features to inspire creation and help our community strengthen their relationships through Snapping. For example, in Q4, we launched new Bitmoji stickers based on new trends for Snapchatters to react and express themselves visually. We also announced new location sharing features in Family Center, our in-app hub for parental tools and resources, making it easier for families to stay connected while on the move. In addition, we launched new and early access Snapchat+ features including Footsteps, which helps Snapchatters keep track of the places they’ve visited on the Snap Map and new app themes and custom backgrounds. In Q4, global time spent watching content grew year-over-year, driven primarily by strong growth in total time spent watching Spotlight. Our focus is now on refining the Simple Snapchat experience in preparation for a broader roll out over the coming year, while also expanding our creator community to foster a vibrant content ecosystem. In Q4, we expanded Simple Snapchat testing to over 25 million Snapchatters in nearly every country where we offer Snapchat. While we will gain further insights from these initial tests in the months ahead, early learnings have already led to feature refinements, including improvements to help Snapchatters more easily locate their subscriptions. These optimizations are aimed at improving the Simple Snapchat experience for our power users in order to make the transition easier for some of our most engaged community members. We continue to see encouraging trends in engagement metrics, including increased content active days among less frequent and more casual users. We are particularly pleased with how Simple Snapchat is driving a shift in behavior, with Snapchatters spending a greater share of their time watching content rather than scrolling to find something to watch. We will continue to test-and-learn, gain insights, and iterate accordingly in the months ahead to ensure a smooth roll out of Simple Snapchat. In Q4, we reaffirmed our commitment to fostering a dynamic and original content ecosystem on Snapchat. By prioritizing authentic creators and timely original content, we proactively balanced near term view time with the long-term health of our platform. For example, comments on Spotlight videos within 24 hours of submission increased significantly over the last three months driven primarily by fresher content, leading to deeper engagement between Snapchatters and content from creators. In addition, more than one billion Snaps were shared publicly on Snapchat every month in Q4 from our community, creators, and media partners. As a part of our broader efforts to grow the creator community, we continue to invest in content creation tools and a diverse set of monetization opportunities. For example, we announced our new unified Monetization Program for creators that allows eligible creators to monetize Spotlight videos, building on our Stories Revenue Share Program that helps creators monetize their Stories. These initiatives are yielding results—over the past year, we onboarded thousands of creators to our Snap Star program, and the number of creators posting content grew more than 40% year-over-year in Q4. While we have onboarded many established creators and celebrities, we’ve also seen significant growth in creators that achieved Snap Star status by growing their following and business organically on Snapchat. For example, Ella Moncrief, a 20-year-old health and adventure enthusiast, increased her Snapchat followers sixfold in just six months and has now established herself as one of our SNAP INC. | Q4 2024 | INVESTOR LETTER 2

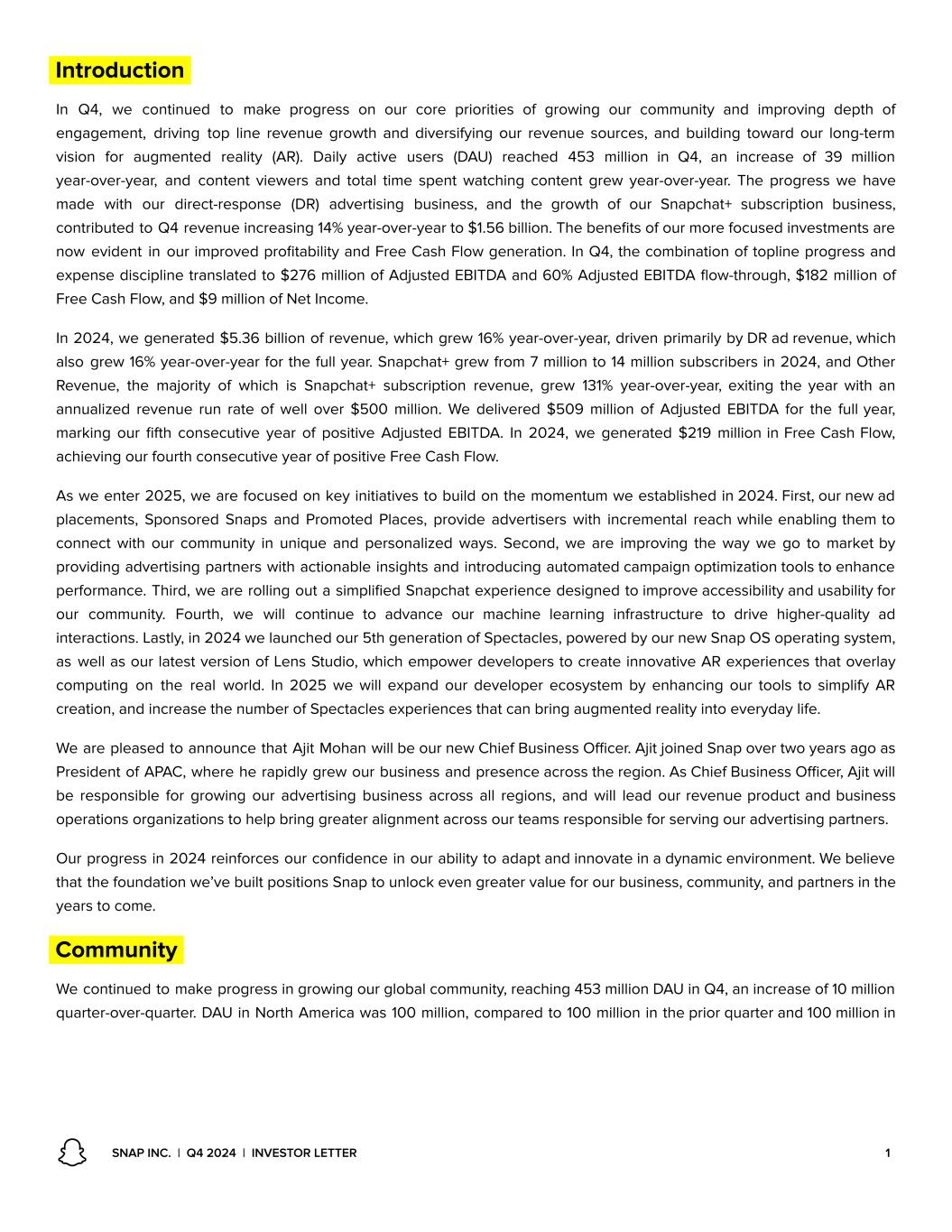

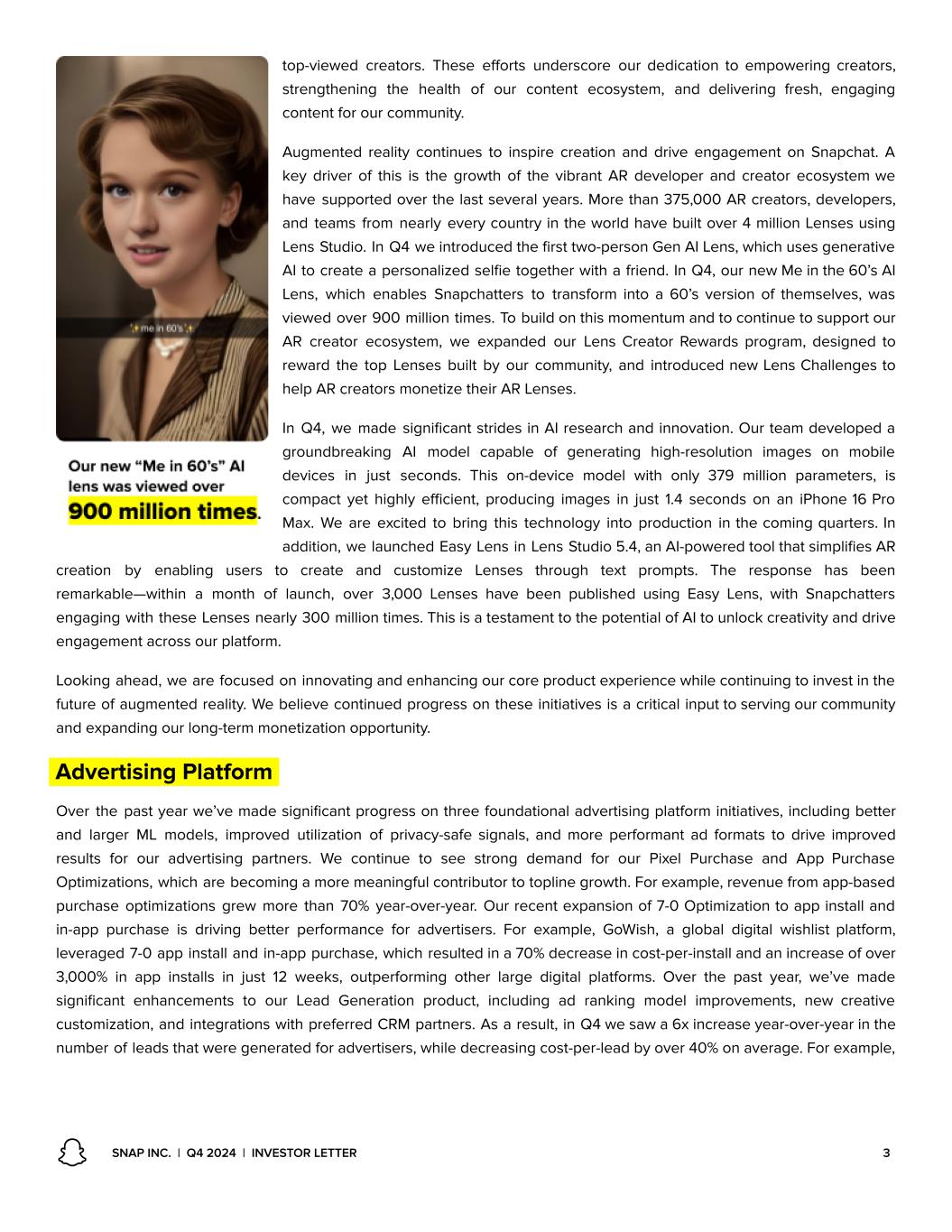

top-viewed creators. These efforts underscore our dedication to empowering creators, strengthening the health of our content ecosystem, and delivering fresh, engaging content for our community. Augmented reality continues to inspire creation and drive engagement on Snapchat. A key driver of this is the growth of the vibrant AR developer and creator ecosystem we have supported over the last several years. More than 375,000 AR creators, developers, and teams from nearly every country in the world have built over 4 million Lenses using Lens Studio. In Q4 we introduced the first two-person Gen AI Lens, which uses generative AI to create a personalized selfie together with a friend. In Q4, our new Me in the 60’s AI Lens, which enables Snapchatters to transform into a 60’s version of themselves, was viewed over 900 million times. To build on this momentum and to continue to support our AR creator ecosystem, we expanded our Lens Creator Rewards program, designed to reward the top Lenses built by our community, and introduced new Lens Challenges to help AR creators monetize their AR Lenses. In Q4, we made significant strides in AI research and innovation. Our team developed a groundbreaking AI model capable of generating high-resolution images on mobile devices in just seconds. This on-device model with only 379 million parameters, is compact yet highly efficient, producing images in just 1.4 seconds on an iPhone 16 Pro Max. We are excited to bring this technology into production in the coming quarters. In addition, we launched Easy Lens in Lens Studio 5.4, an AI-powered tool that simplifies AR creation by enabling users to create and customize Lenses through text prompts. The response has been remarkable—within a month of launch, over 3,000 Lenses have been published using Easy Lens, with Snapchatters engaging with these Lenses nearly 300 million times. This is a testament to the potential of AI to unlock creativity and drive engagement across our platform. Looking ahead, we are focused on innovating and enhancing our core product experience while continuing to invest in the future of augmented reality. We believe continued progress on these initiatives is a critical input to serving our community and expanding our long-term monetization opportunity. Advertising Platform Over the past year we’ve made significant progress on three foundational advertising platform initiatives, including better and larger ML models, improved utilization of privacy-safe signals, and more performant ad formats to drive improved results for our advertising partners. We continue to see strong demand for our Pixel Purchase and App Purchase Optimizations, which are becoming a more meaningful contributor to topline growth. For example, revenue from app-based purchase optimizations grew more than 70% year-over-year. Our recent expansion of 7-0 Optimization to app install and in-app purchase is driving better performance for advertisers. For example, GoWish, a global digital wishlist platform, leveraged 7-0 app install and in-app purchase, which resulted in a 70% decrease in cost-per-install and an increase of over 3,000% in app installs in just 12 weeks, outperforming other large digital platforms. Over the past year, we’ve made significant enhancements to our Lead Generation product, including ad ranking model improvements, new creative customization, and integrations with preferred CRM partners. As a result, in Q4 we saw a 6x increase year-over-year in the number of leads that were generated for advertisers, while decreasing cost-per-lead by over 40% on average. For example, SNAP INC. | Q4 2024 | INVESTOR LETTER 3

the University of Idaho leveraged our Lead Generation objective to help drive applications for its undergraduate programs and saw Snap emerge as the most effective platform, delivering 69% of all undergraduate conversions at a 22% lower cost per conversion compared to other social media platforms. The combination of more performant DR products, improved go-to-market operations optimized for small and medium-sized business (SMB) customers, and a simplified ad buying experience made SMBs the largest contributor to ad revenue growth in 2024. Snap Promote has enabled SMBs and creators to promote their services, content, or products, reach new audiences, and measure ad performance, all within Snapchat on their mobile devices. Recently, we launched automated in-flight campaign recommendations, adaptive templates for campaign set-up, and scaled creative editing to further improve our go-to-market strategy for SMBs. We also continue to invest in our partnerships ecosystem globally by building and deepening partnerships with leading marketing-tech partners. For example, betPARX, an online gaming platform, partnered with Snapchat and Aygo-Tech, a performance-driven marketing agency, to drive lower funnel DR performance. By leveraging advanced optimization features, including granular targeting of high-value, engaged audiences, they achieved a 32% increase in ROAS and a 5x increase in purchases compared to their previous Snapchat campaign. We believe automation is a key driver of advertiser performance, and we remain focused on empowering advertisers to enhance their campaign outcomes through automation. For instance, in Q1, we will be testing our new Smart Budget Optimization feature, which automatically adjusts campaign budgets across ad sets to deliver the best results. We are focused on reaccelerating demand for upper-funnel Brand revenue by continuing to deliver innovative and performant advertising products. We are prioritizing enhanced support for large Brands and Agencies by offering increased collaboration, platform integrations, and advanced measurement tools. For example, last year we launched a first-to-market partnership with media measurement and optimization company VideoAmp to provide our agency partners with reach, planning, and measurement tools. This initiative has since onboarded some of our largest agency partners, including Omnicom Media Group, IPG Mediabrands, and dentsu, enabling them to build cross-screen media plans with Snapchat in mind and assess key metrics like incremental reach. Looking ahead, we remain committed to leveraging the unique ways our audience engages with Snapchat and delivering actionable, differentiated insights to empower our advertising partners and agencies. In Q4, we began testing two new ad placements, Sponsored Snaps and Promoted Places, designed to help advertisers engage with the Snapchat community in unique and impactful ways. Sponsored Snaps enable advertisers to connect visually with Snapchatters, delivering incremental reach and helping brands leave a lasting SNAP INC. | Q4 2024 | INVESTOR LETTER 4

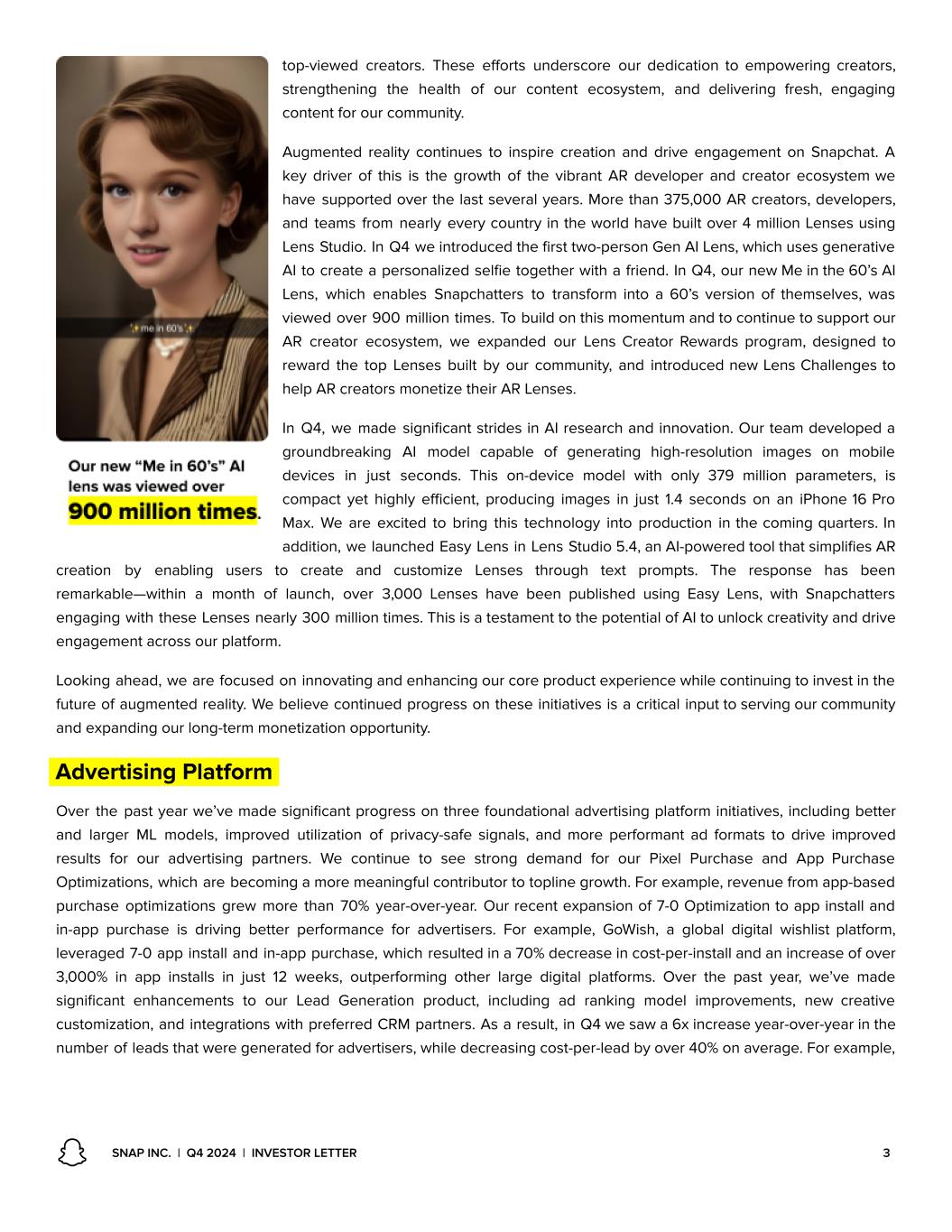

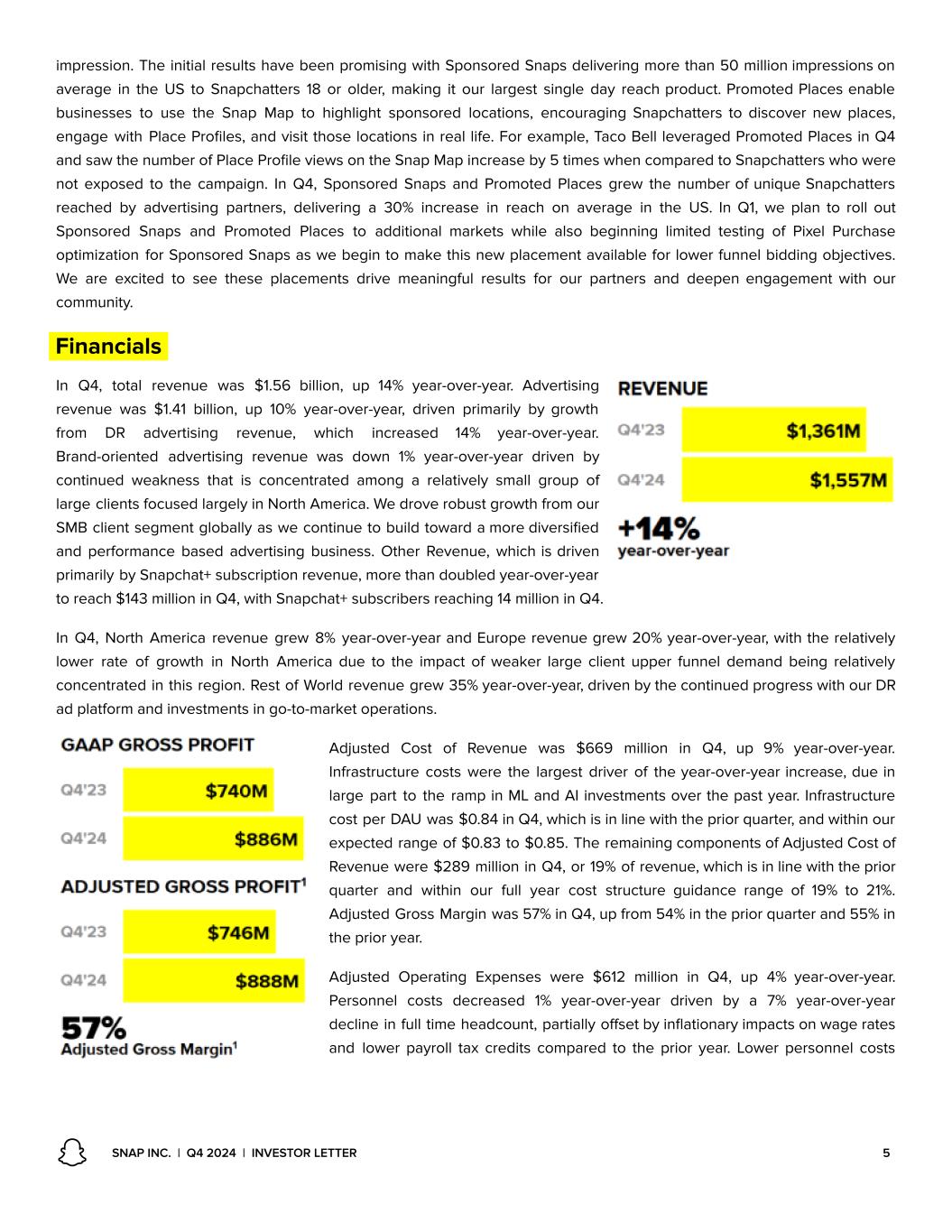

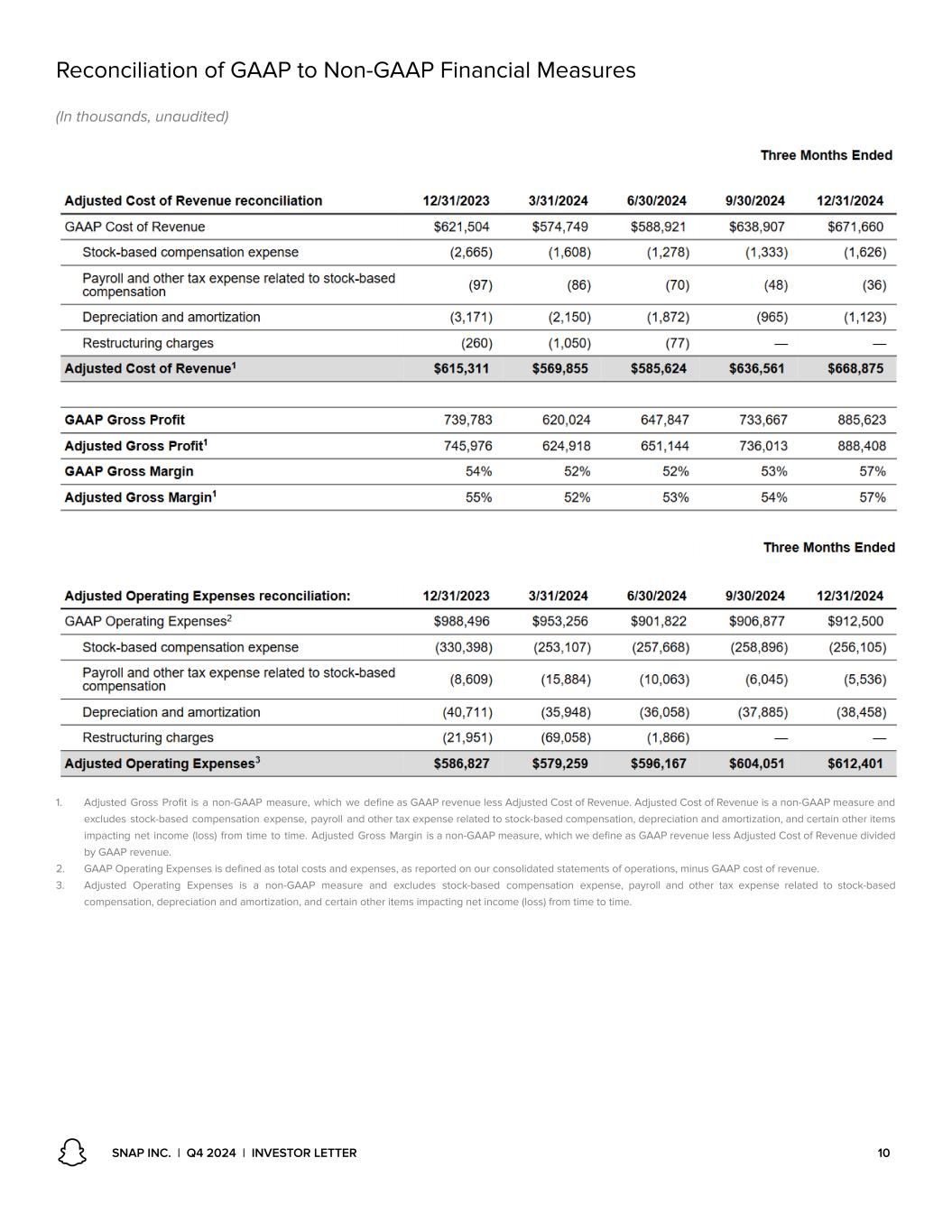

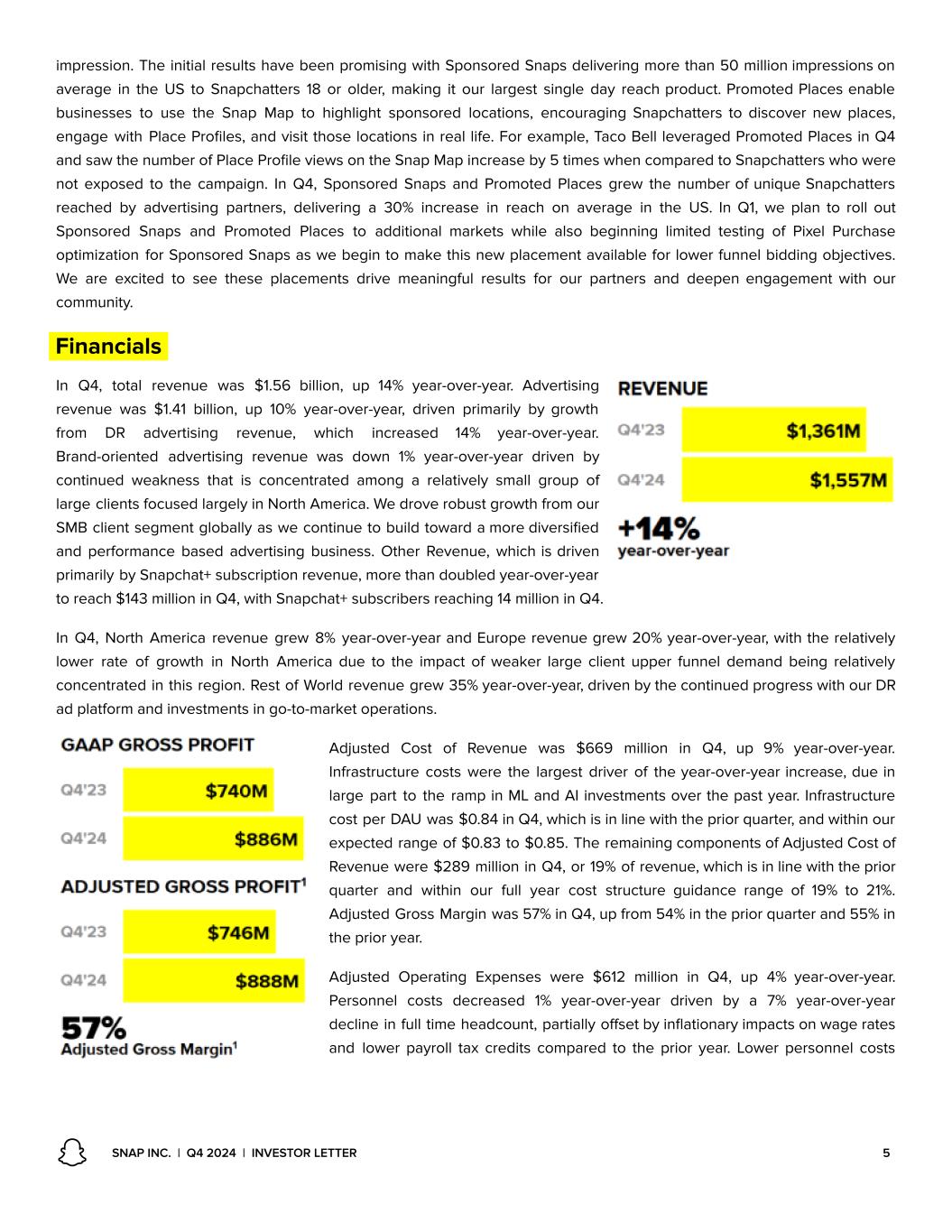

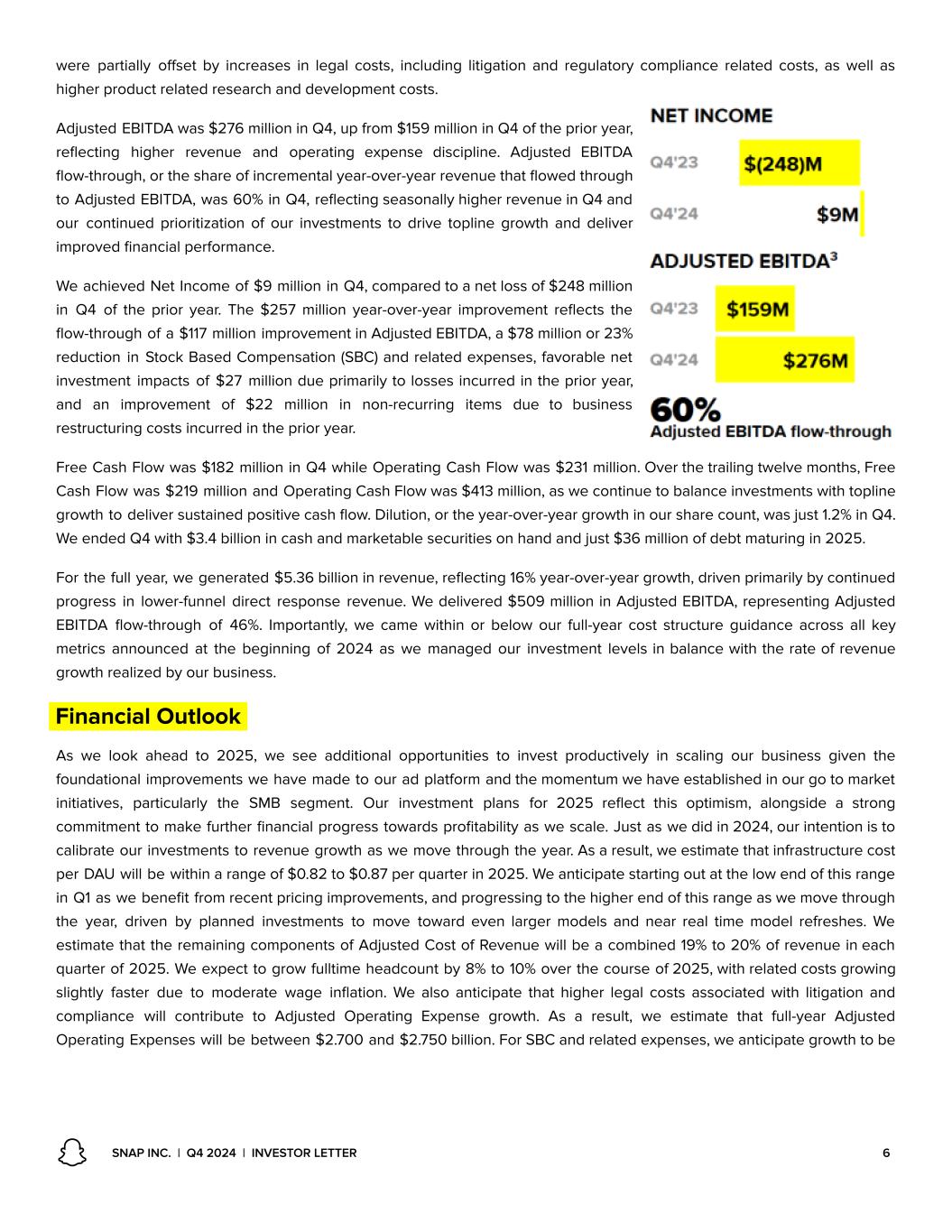

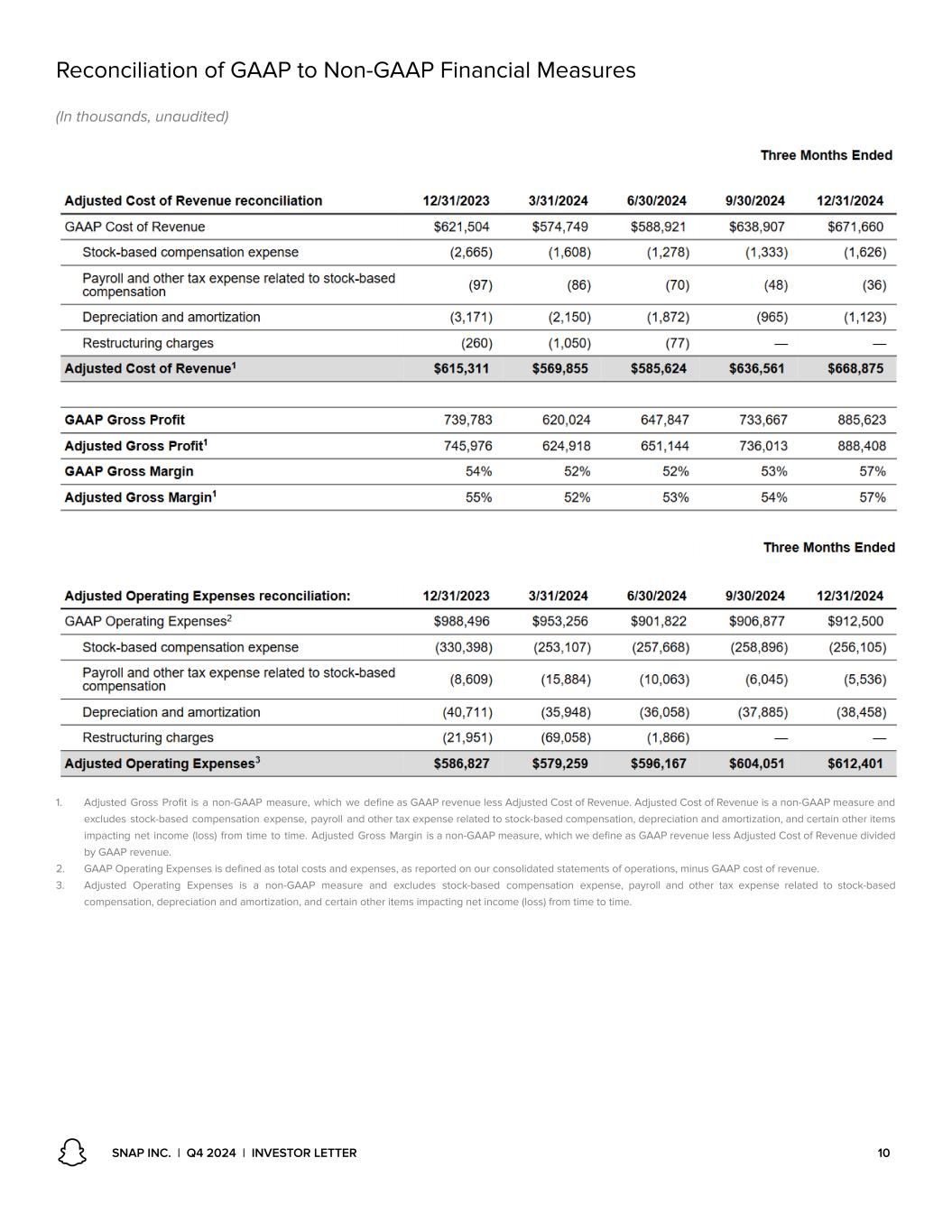

impression. The initial results have been promising with Sponsored Snaps delivering more than 50 million impressions on average in the US to Snapchatters 18 or older, making it our largest single day reach product. Promoted Places enable businesses to use the Snap Map to highlight sponsored locations, encouraging Snapchatters to discover new places, engage with Place Profiles, and visit those locations in real life. For example, Taco Bell leveraged Promoted Places in Q4 and saw the number of Place Profile views on the Snap Map increase by 5 times when compared to Snapchatters who were not exposed to the campaign. In Q4, Sponsored Snaps and Promoted Places grew the number of unique Snapchatters reached by advertising partners, delivering a 30% increase in reach on average in the US. In Q1, we plan to roll out Sponsored Snaps and Promoted Places to additional markets while also beginning limited testing of Pixel Purchase optimization for Sponsored Snaps as we begin to make this new placement available for lower funnel bidding objectives. We are excited to see these placements drive meaningful results for our partners and deepen engagement with our community. Financials In Q4, total revenue was $1.56 billion, up 14% year-over-year. Advertising revenue was $1.41 billion, up 10% year-over-year, driven primarily by growth from DR advertising revenue, which increased 14% year-over-year. Brand-oriented advertising revenue was down 1% year-over-year driven by continued weakness that is concentrated among a relatively small group of large clients focused largely in North America. We drove robust growth from our SMB client segment globally as we continue to build toward a more diversified and performance based advertising business. Other Revenue, which is driven primarily by Snapchat+ subscription revenue, more than doubled year-over-year to reach $143 million in Q4, with Snapchat+ subscribers reaching 14 million in Q4. In Q4, North America revenue grew 8% year-over-year and Europe revenue grew 20% year-over-year, with the relatively lower rate of growth in North America due to the impact of weaker large client upper funnel demand being relatively concentrated in this region. Rest of World revenue grew 35% year-over-year, driven by the continued progress with our DR ad platform and investments in go-to-market operations. Adjusted Cost of Revenue was $669 million in Q4, up 9% year-over-year. Infrastructure costs were the largest driver of the year-over-year increase, due in large part to the ramp in ML and AI investments over the past year. Infrastructure cost per DAU was $0.84 in Q4, which is in line with the prior quarter, and within our expected range of $0.83 to $0.85. The remaining components of Adjusted Cost of Revenue were $289 million in Q4, or 19% of revenue, which is in line with the prior quarter and within our full year cost structure guidance range of 19% to 21%. Adjusted Gross Margin was 57% in Q4, up from 54% in the prior quarter and 55% in the prior year. Adjusted Operating Expenses were $612 million in Q4, up 4% year-over-year. Personnel costs decreased 1% year-over-year driven by a 7% year-over-year decline in full time headcount, partially offset by inflationary impacts on wage rates and lower payroll tax credits compared to the prior year. Lower personnel costs SNAP INC. | Q4 2024 | INVESTOR LETTER 5

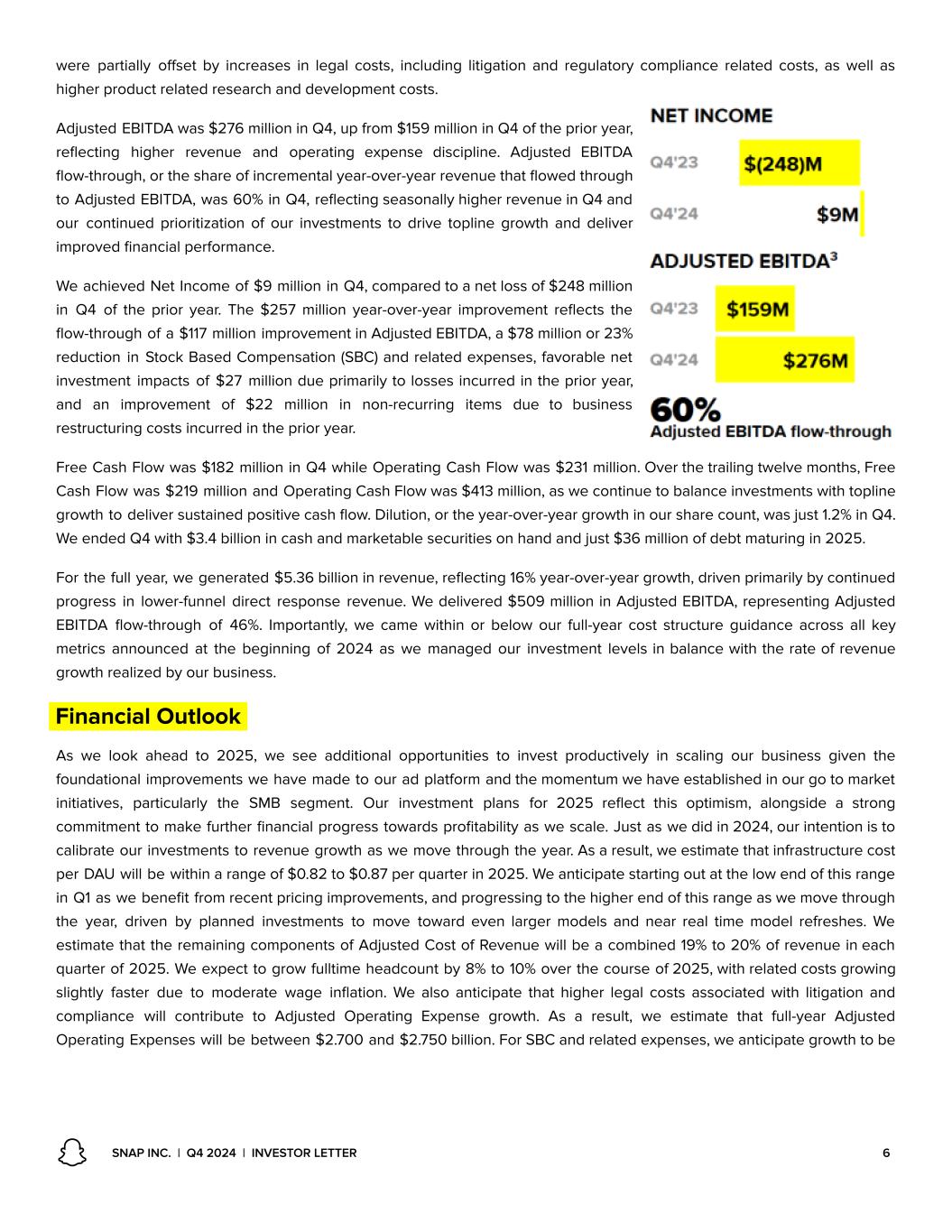

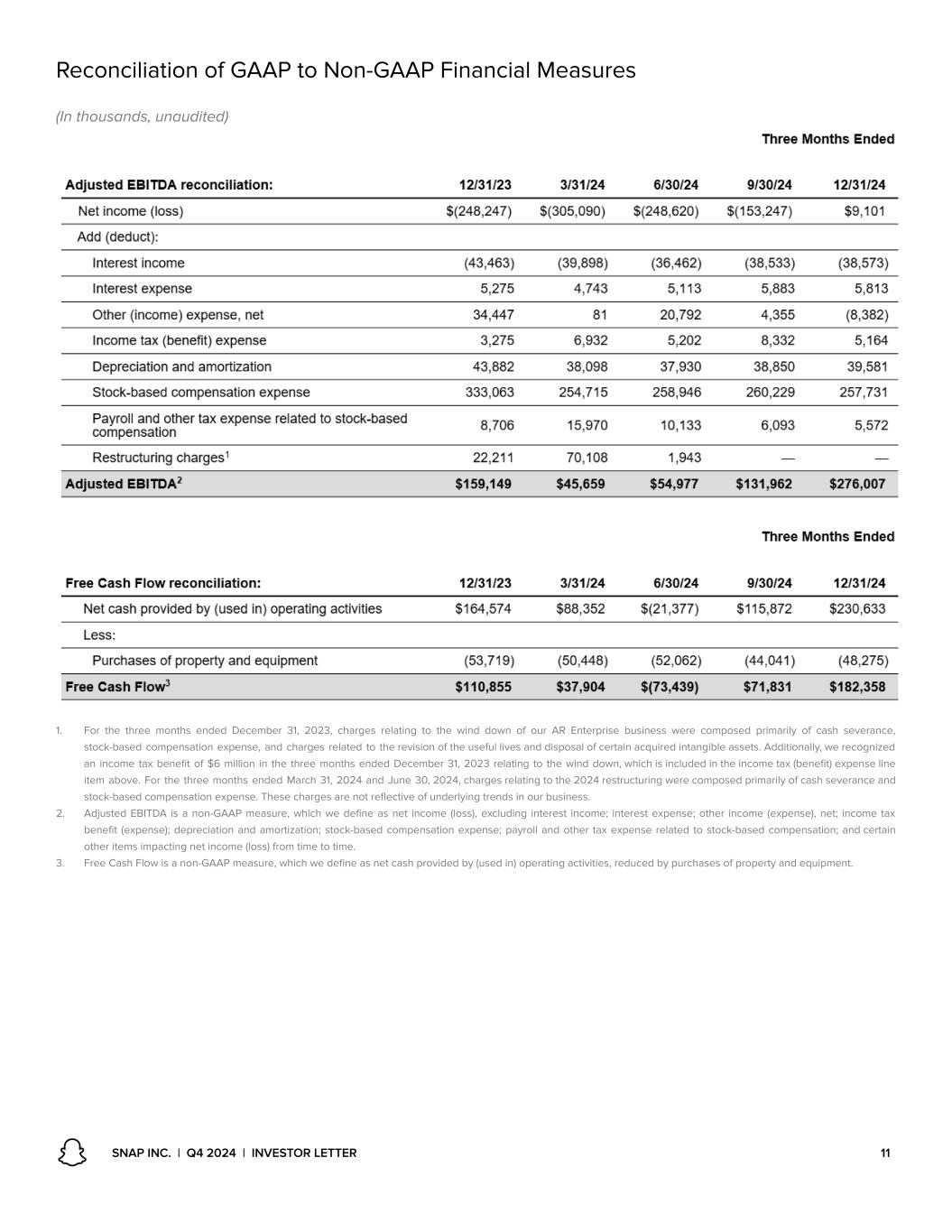

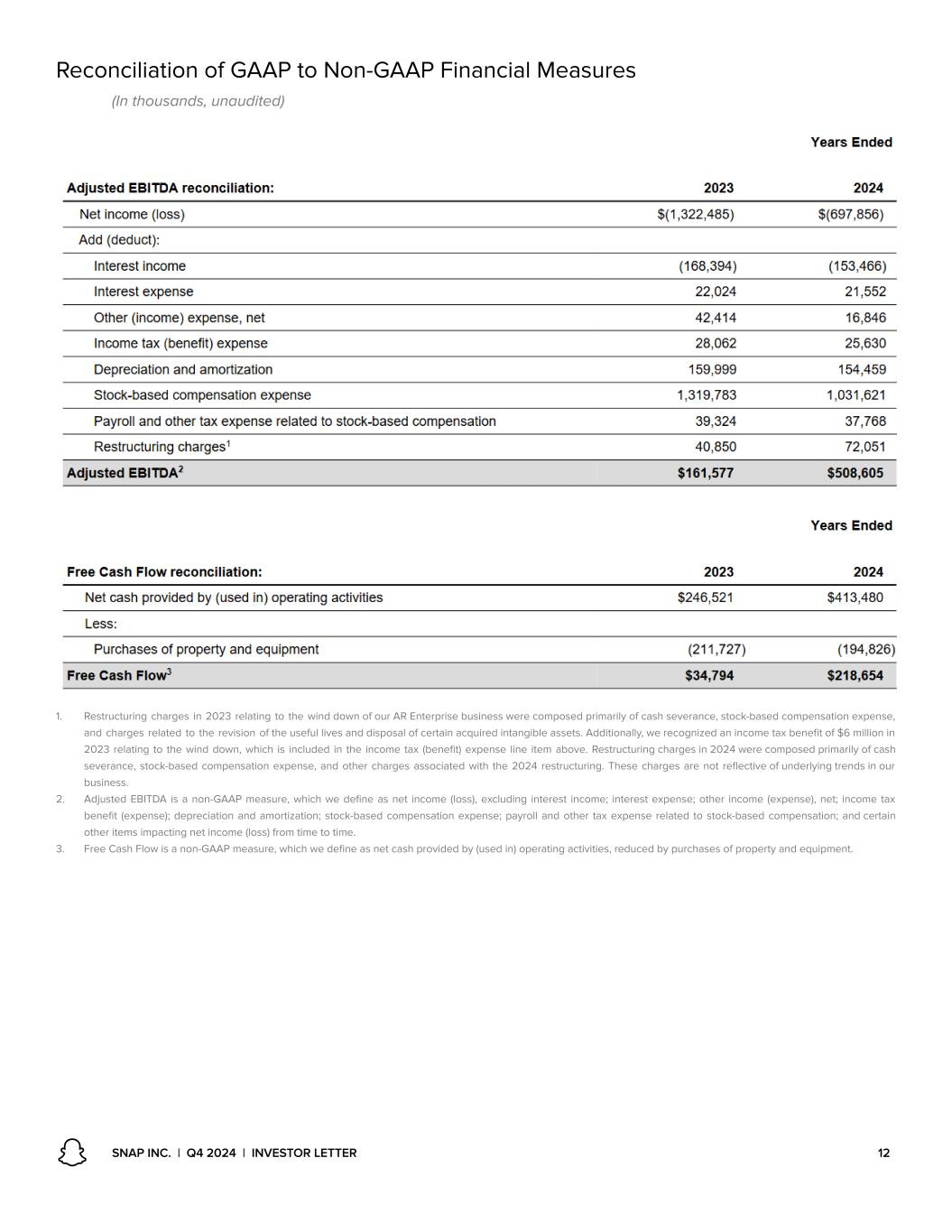

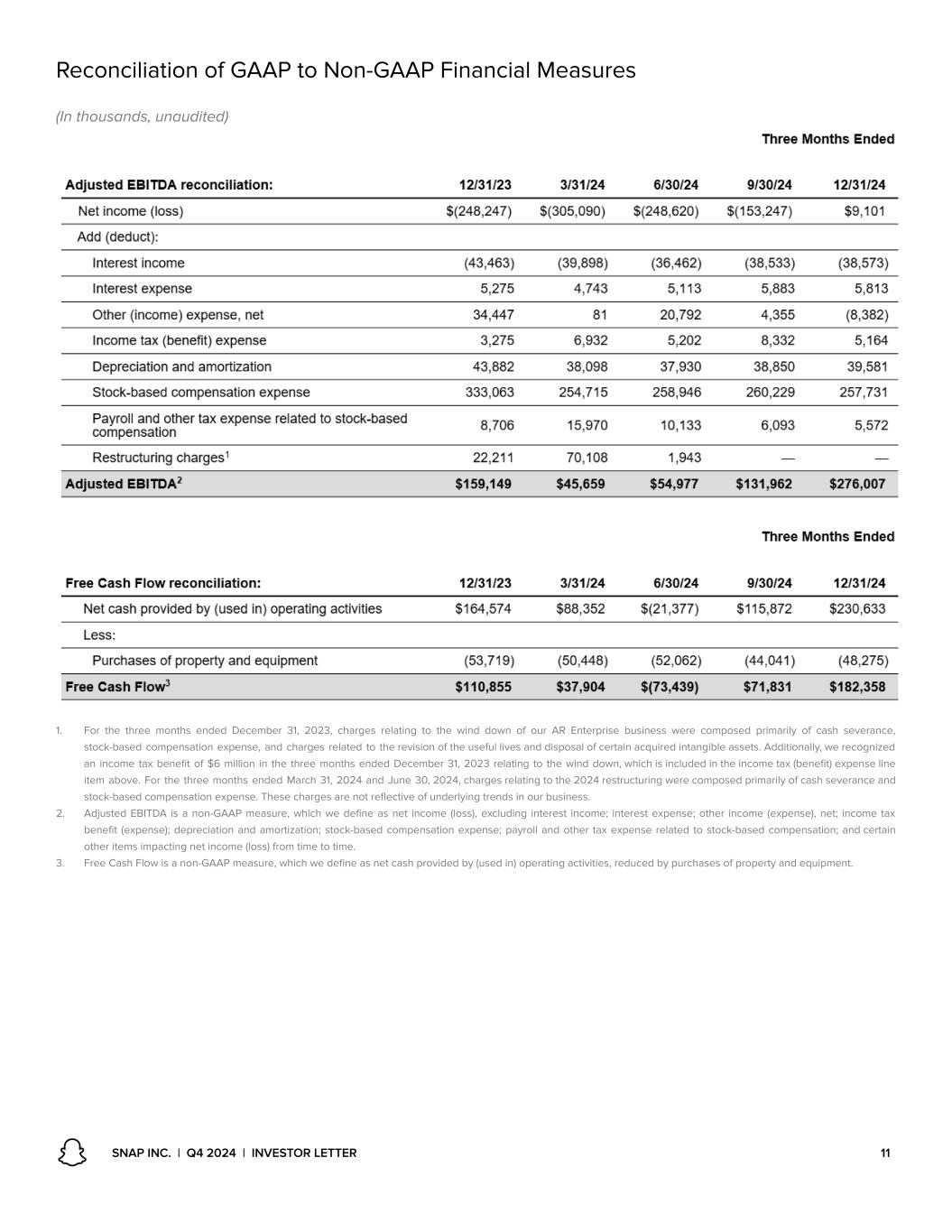

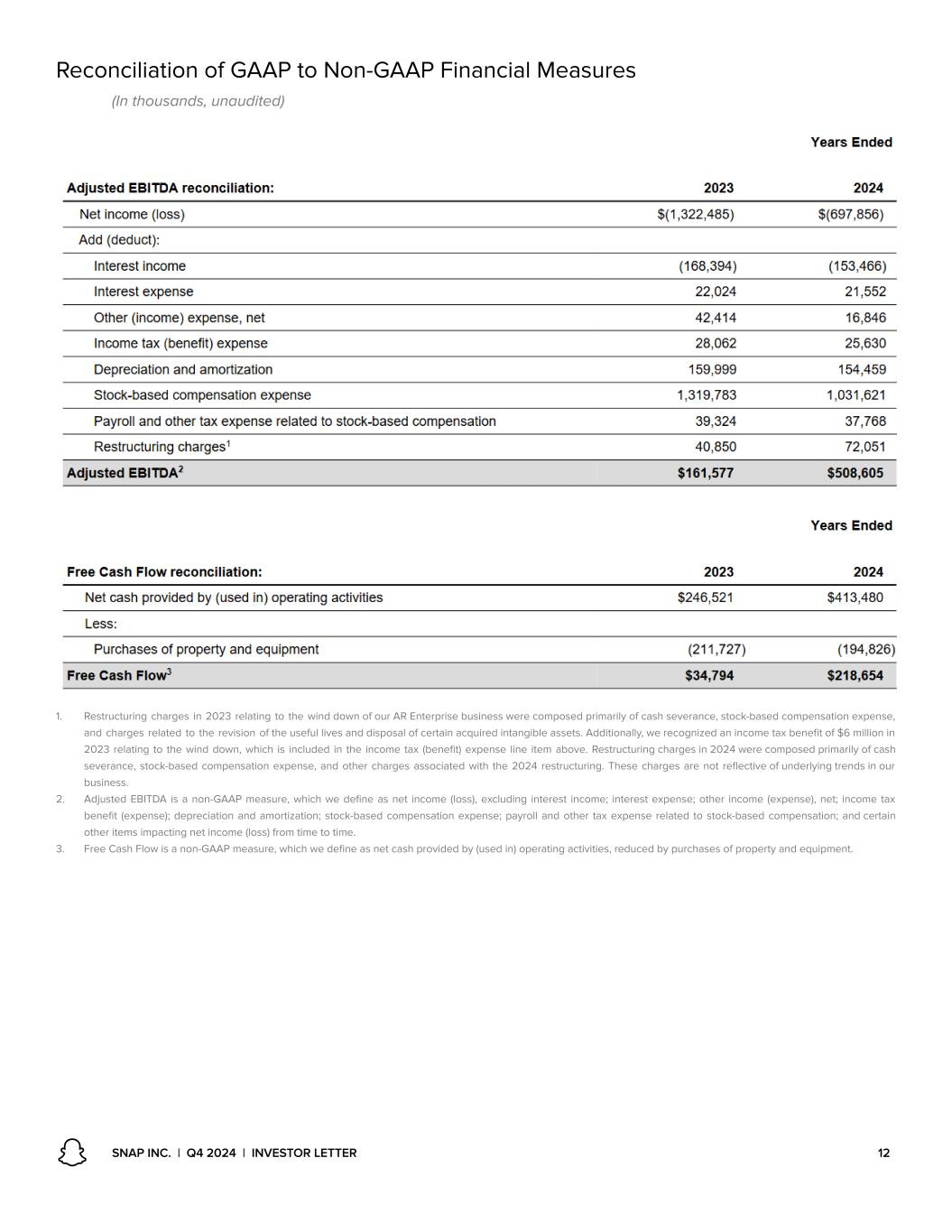

were partially offset by increases in legal costs, including litigation and regulatory compliance related costs, as well as higher product related research and development costs. Adjusted EBITDA was $276 million in Q4, up from $159 million in Q4 of the prior year, reflecting higher revenue and operating expense discipline. Adjusted EBITDA flow-through, or the share of incremental year-over-year revenue that flowed through to Adjusted EBITDA, was 60% in Q4, reflecting seasonally higher revenue in Q4 and our continued prioritization of our investments to drive topline growth and deliver improved financial performance. We achieved Net Income of $9 million in Q4, compared to a net loss of $248 million in Q4 of the prior year. The $257 million year-over-year improvement reflects the flow-through of a $117 million improvement in Adjusted EBITDA, a $78 million or 23% reduction in Stock Based Compensation (SBC) and related expenses, favorable net investment impacts of $27 million due primarily to losses incurred in the prior year, and an improvement of $22 million in non-recurring items due to business restructuring costs incurred in the prior year. Free Cash Flow was $182 million in Q4 while Operating Cash Flow was $231 million. Over the trailing twelve months, Free Cash Flow was $219 million and Operating Cash Flow was $413 million, as we continue to balance investments with topline growth to deliver sustained positive cash flow. Dilution, or the year-over-year growth in our share count, was just 1.2% in Q4. We ended Q4 with $3.4 billion in cash and marketable securities on hand and just $36 million of debt maturing in 2025. For the full year, we generated $5.36 billion in revenue, reflecting 16% year-over-year growth, driven primarily by continued progress in lower-funnel direct response revenue. We delivered $509 million in Adjusted EBITDA, representing Adjusted EBITDA flow-through of 46%. Importantly, we came within or below our full-year cost structure guidance across all key metrics announced at the beginning of 2024 as we managed our investment levels in balance with the rate of revenue growth realized by our business. Financial Outlook As we look ahead to 2025, we see additional opportunities to invest productively in scaling our business given the foundational improvements we have made to our ad platform and the momentum we have established in our go to market initiatives, particularly the SMB segment. Our investment plans for 2025 reflect this optimism, alongside a strong commitment to make further financial progress towards profitability as we scale. Just as we did in 2024, our intention is to calibrate our investments to revenue growth as we move through the year. As a result, we estimate that infrastructure cost per DAU will be within a range of $0.82 to $0.87 per quarter in 2025. We anticipate starting out at the low end of this range in Q1 as we benefit from recent pricing improvements, and progressing to the higher end of this range as we move through the year, driven by planned investments to move toward even larger models and near real time model refreshes. We estimate that the remaining components of Adjusted Cost of Revenue will be a combined 19% to 20% of revenue in each quarter of 2025. We expect to grow fulltime headcount by 8% to 10% over the course of 2025, with related costs growing slightly faster due to moderate wage inflation. We also anticipate that higher legal costs associated with litigation and compliance will contribute to Adjusted Operating Expense growth. As a result, we estimate that full-year Adjusted Operating Expenses will be between $2.700 and $2.750 billion. For SBC and related expenses, we anticipate growth to be SNAP INC. | Q4 2024 | INVESTOR LETTER 6

approximately in line with the employee population growth resulting in an estimated full-year SBC expense of $1.150 to $1.200 billion. For Q1 specifically, we anticipate continued growth of our global community, and our Q1 guidance is built on the assumption that DAU will be approximately 459 million in Q15. Our Q1 guidance range for revenue is $1.325 billion to $1.360 billion. We estimate infrastructure per DAU in Q1 will be at the low end of the full year guidance range while all other cost of revenue as a percent of revenue will be within our full year cost structure range of 19% to 20%. For Adjusted Operating Expenses we estimate year-over-year growth of 11% to 12% in Q1, driven by growth in headcount, higher legal related costs, and a seasonal shift of marketing expenses into Q1 relative to the prior year. In addition, we have committed $5 million to support communities and team members impacted by the recent wildfires to date in Q1, and anticipate we may make further commitments over time. Given the revenue range above, and our investment plans for the quarter ahead, we estimate that Adjusted EBITDA will be between $40 million and $75 million in Q1. As we continue to execute in the quarters ahead, we remain focused on growing and serving our community through innovative and responsible products that foster meaningful connections among Snapchatters, strengthening our DR business to deliver measurable ROAS for our advertising partners, diversifying our revenue streams to drive sustainable top line growth, and scaling our investments strategically to deliver meaningful and sustained profitability and positive Free Cash Flow. 1. Adjusted Gross Profit is a non-GAAP measure, which we define as GAAP revenue less Adjusted Cost of Revenue. Adjusted Gross Margin is a non-GAAP measure, which we define as GAAP revenue less Adjusted Cost of Revenue divided by GAAP revenue. Adjusted Cost of Revenue is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time. 2. Adjusted Operating Expenses is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time. 3. Adjusted EBITDA is a non-GAAP measure, which we define as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other items impacting net income (loss) from time to time. See Appendix for reconciliation of net income (loss) to Adjusted EBITDA. 4. Free Cash Flow is a non-GAAP measure, which we define as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. See Appendix for reconciliation of net cash provided by (used in) operating activities to Free Cash Flow. 5. Our DAU estimate reflects refinements to our processes for recording user activity, which we implemented in Q1 of 2025, to improve precision in reported DAU. If we had applied these refinements to quarters in 2024, it would have resulted in a less than 1% increase in our DAUs for each period, as well as a commensurate immaterial impact on ARPU. We approximate that these refinements will result in an immaterial increase (less than 1%) in our DAUs in Q1. A significant majority of the impact of these refinements is concentrated in Rest of World due to the greater prevalence of network connectivity delays in this region. SNAP INC. | Q4 2024 | INVESTOR LETTER 7 Q1 2025 Outlook Revenue $1.325 to $1.360 billion Adjusted EBITDA $40 to $75 million 2025 Outlook Infrastructure Cost per DAU per Quarter $0.82 to $0.87 cents Content and Developer Partner Costs and Advertising Partner and Other Costs 19% to 20% of revenue Adjusted Operating Expenses $2.700 to $2.750 billion Stock-Based Compensation and Related Charges $1.150 to $1.200 billion

SNAP INC. | Q4 2024 | INVESTOR LETTER 8

Forward Looking Statements This letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this letter, including statements regarding guidance, our future results of operations or financial condition, future stock repurchase programs or stock dividends, business strategy and plans, user growth and engagement, product initiatives, objectives of management for future operations, and advertiser and partner offerings, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “going to,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or the negative of these words or other similar terms or expressions. We caution you that the foregoing may not include all of the forward-looking statements made in this letter. You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this letter primarily on our current expectations and projections about future events and trends, including our financial outlook, macroeconomic uncertainty, and geo-political events and conflicts, that we believe may continue to affect our business, financial condition, results of operations, and prospects. These forward-looking statements are subject to risks and uncertainties related to: our financial performance; our ability to attain and sustain profitability; our ability to generate and sustain positive cash flow; our ability to attract and retain users, partners, and advertisers; competition and new market entrants; managing our growth and future expenses; compliance with new laws, regulations, and executive actions; our ability to maintain, protect, and enhance our intellectual property; our ability to succeed in existing and new market segments; our ability to attract and retain qualified team members and key personnel; our ability to repay or refinance outstanding debt, or to access additional financing; future acquisitions, divestitures, or investments; and the potential adverse impact of climate change, natural disasters, health epidemics, macroeconomic conditions, and war or other armed conflict, as well as risks, uncertainties, and other factors described in “Risk Factors” and elsewhere in our most recent periodic report filed with the U.S. Securities and Exchange Commission, or SEC, which is available on the SEC’s website at www.sec.gov. Additional information will be made available in Snap Inc.’s periodic report that will be filed with the SEC for the period covered by this letter and other filings that we make from time to time with the SEC. In addition, any forward-looking statements contained in this letter are based on assumptions that we believe to be reasonable as of this date. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of this letter or to reflect new information or the occurrence of unanticipated events, including future developments related to geo-political events and conflicts and macroeconomic conditions, except as required by law. Non-GAAP Financial Measures To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use certain non-GAAP financial measures, as described below, to understand and evaluate our core operating performance. These non-GAAP financial measures, which may be different than similarly titled measures used by other companies, are presented to enhance investors’ overall understanding of our financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use the non-GAAP financial measure of Free Cash Flow, which is defined as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. We believe Free Cash Flow is an important liquidity measure of the cash that is available, after capital expenditures, for operational expenses and investment in our business and is a key financial indicator used by management. Additionally, we believe that Free Cash Flow is an important measure since we use third-party infrastructure partners to host our services and therefore we do not incur significant capital expenditures to support revenue generating activities. Free Cash Flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash. Once our business needs and obligations are met, cash can be used to maintain a strong balance sheet and invest in future growth. We use the non-GAAP financial measure of Adjusted EBITDA, which is defined as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other items impacting net income (loss) from time to time. We believe that Adjusted EBITDA helps identify underlying trends in our business that could otherwise be masked by the effect of the expenses that we exclude in Adjusted EBITDA. We use other non-GAAP financial measures such as Adjusted Cost of Revenue and Adjusted Operating Expenses. These measures are defined as their respective GAAP expense line items, excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other items impacting net income (loss) from time to time. We use the non-GAAP financial measure of Adjusted Gross Profit, which we define as GAAP revenue less Adjusted Cost of Revenue. We use the non-GAAP financial measure of Adjusted Gross Margin, which we define as GAAP revenue less Adjusted Cost of Revenue divided by GAAP revenue. Similar to Adjusted EBITDA, we believe these measures help identify underlying trends in our business that could otherwise be masked by the effect of the expenses we exclude in the measure. We believe that these non-GAAP financial measures provide useful information about our financial performance, enhance the overall understanding of our past performance and future prospects, and allow for greater transparency with respect to key metrics used by our management for financial and operational decision-making. We are presenting these non-GAAP measures to assist investors in seeing our financial performance through the eyes of management, and because we believe that these measures provide an additional tool for investors to use in comparing our core financial performance over multiple periods with other companies in our industry. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure, please see “Reconciliation of GAAP to Non-GAAP Financial Measures” included as an Appendix to this letter. Snap Inc., “Snapchat,” and our other registered and common law trade names, trademarks, and service marks are the property of Snap Inc. or our subsidiaries. SNAP INC. | Q4 2024 | INVESTOR LETTER 9

Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, unaudited) 1. Adjusted Gross Profit is a non-GAAP measure, which we define as GAAP revenue less Adjusted Cost of Revenue. Adjusted Cost of Revenue is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time. Adjusted Gross Margin is a non-GAAP measure, which we define as GAAP revenue less Adjusted Cost of Revenue divided by GAAP revenue. 2. GAAP Operating Expenses is defined as total costs and expenses, as reported on our consolidated statements of operations, minus GAAP cost of revenue. 3. Adjusted Operating Expenses is a non-GAAP measure and excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other items impacting net income (loss) from time to time. SNAP INC. | Q4 2024 | INVESTOR LETTER 10

Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, unaudited) 1. For the three months ended December 31, 2023, charges relating to the wind down of our AR Enterprise business were composed primarily of cash severance, stock-based compensation expense, and charges related to the revision of the useful lives and disposal of certain acquired intangible assets. Additionally, we recognized an income tax benefit of $6 million in the three months ended December 31, 2023 relating to the wind down, which is included in the income tax (benefit) expense line item above. For the three months ended March 31, 2024 and June 30, 2024, charges relating to the 2024 restructuring were composed primarily of cash severance and stock-based compensation expense. These charges are not reflective of underlying trends in our business. 2. Adjusted EBITDA is a non-GAAP measure, which we define as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other items impacting net income (loss) from time to time. 3. Free Cash Flow is a non-GAAP measure, which we define as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. SNAP INC. | Q4 2024 | INVESTOR LETTER 11

Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, unaudited) 1. Restructuring charges in 2023 relating to the wind down of our AR Enterprise business were composed primarily of cash severance, stock-based compensation expense, and charges related to the revision of the useful lives and disposal of certain acquired intangible assets. Additionally, we recognized an income tax benefit of $6 million in 2023 relating to the wind down, which is included in the income tax (benefit) expense line item above. Restructuring charges in 2024 were composed primarily of cash severance, stock-based compensation expense, and other charges associated with the 2024 restructuring. These charges are not reflective of underlying trends in our business. 2. Adjusted EBITDA is a non-GAAP measure, which we define as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other items impacting net income (loss) from time to time. 3. Free Cash Flow is a non-GAAP measure, which we define as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. SNAP INC. | Q4 2024 | INVESTOR LETTER 12