Investor Letter Q3 2022 October 20, 2022 This Investor Letter contains forward-looking statements and non-GAAP financial measures, please see Appendix for additional information. Exhibit 99.2

Our business continued to face significant headwinds in the third quarter, and we took action to further focus our business on our three strategic priorities: growing our community and deepening their engagement with our products, reaccelerating and diversifying our revenue growth, and investing in augmented reality. We believe that we can be successful in this new operating environment — with elevated inflation, increasing interest rates, and heightened geopolitical tensions — by rigorously prioritizing our investments and continuing to delight our community with our products while driving success for our advertising partners. Our focus on serving our community contributed to our daily active user growth in Q3, with daily active users (DAU) reaching 363 million, an increase of 57 million or 19% year-over-year. The overall growth and engagement of our community is a fundamental input to our long-term opportunity, and we are working to diversify our community’s engagement with Snapchat across our various platforms, including our map, content, and augmented reality. Historically, we have found that advertising revenues follow engagement, so while we are facing near-term headwinds to our revenue growth, we remain optimistic about our long-term opportunity based on the growth of our community and engagement. Today, we reach more than 75% of 13- to 34-year-olds in over 20 countries, representing over 50% of global advertising spend. Our revenue grew 6% year-over-year to $1.13 billion, and we generated adjusted EBITDA of $73 million and free cash flow of $18 million. While these results are far from our aspirations, we are using this period of reduced demand to pull forward and accelerate changes to our advertising platform and auction dynamics that we believe will deliver better results for our advertising partners over the long term. When auction density is elevated, these enhancements can be more difficult to make because they run the risk of being disruptive in the short term as we experiment with new machine learning (ML) models and user interface elements. We are working closely with our advertising partners through these changes, so that we can continue to deliver strong returns on advertising spend, which is especially important during such a challenging time. Our large and growing community, track record of innovation, strong balance sheet, and the adjustments we have made to drive focus and reduce our cost structure give us the flexibility to think and act long term to best support our advertising partners and make the right investments for our business. We expect that the operating environment will continue to be challenging in the months ahead and believe the actions we are taking provide a clear path forward for Snap. SNAP INC. | Q3 2022 | INVESTOR LETTER 2

DAILY ACTIVE USERS SNAP INC. | Q3 2022 | INVESTOR LETTER 3 Our community grew 19% year-over-year to reach 363 million Snapchatters are creating 5 billion+ Snaps with our camera every day on average Community Growth Our team remains focused on expanding our product offering and deepening engagement with our global community, which increased 19% year-over-year to reach 363 million DAU in Q3. Our community continues to grow, and we continue to deliver rapid product innovation with new features like Snapchat for Web and updated Lens Studio features. We were pleased that our community in North America, Europe, and Rest of World continued to show meaningful growth in Q3. DAU in North America grew by 4 million year-over-year to reach 100 million, DAU in Europe grew by 9 million year-over-year to reach 88 million, and DAU in Rest of World grew by 45 million year-over-year to reach 175 million. Our core product continues to resonate with close friends and family who use our visual messaging tools to stay in touch and build deeper relationships, and we continue to see strong engagement growth around core communication behaviors, with Snapchatters creating more than 5 billion Snaps with our camera every day, on average. The vast majority of our monetization today is driven by engagement with advertising on our content platforms. In Q3, overall time spent watching content globally grew on a year- over-year basis, driven primarily by growth in total time spent watching content on Discover and Spotlight. We grew global time spent across our content platforms by continuing to invest in personalization, driving more subscriptions to creator content, improving content ranking through better understanding of new Snapchatter interests, scaling our Creator and Partner ecosystem, and investing in operations to maximize return on content supply and capacity. We believe that product improvements to Friend Stories, Discover, and Spotlight, as well as increased content diversity and investments in creator success, provide a path to meaningful content time spent growth over the long term. Time spent watching Friend Stories continues to be a headwind to overall growth in time spent watching content, even as the number of Snapchatters viewing Friends Stories has grown year-

LA LIGA We announced a new global partnership with LaLiga, one of the major European football leagues, bringing the best of the game to fans on Snapchat over-year. We have seen the depth of Friend Stories engagement per viewer decrease, and total time spent watching Friend Stories remains below pre-pandemic levels. We are focused on investing in our content experiences to drive the overall depth of engagement with content on our platform through new products such as Spotlight and content publishers through Discover, as well as ongoing improvements to the user experience and personalization. While we are encouraged by the progress we are seeing from these investments, including 55% year-over-year growth in total time spent viewing Spotlight in the most recent quarter, this growth is building on a lower base of engagement when compared to Friend Stories. SNAP INC. | Q3 2022 | INVESTOR LETTER 4 While growth in our global community is helping to offset these headwinds on global time spent, this is not the case in some of our more mature markets. As a result, total time spent watching content in the United States decreased 5% year-over-year as the diminished depth of engagement with Friend Stories was not fully offset by the growth in viewership and growth in time spent with Discover and Spotlight in the US. While depth of engagement with Friend Stories has been a headwind in the US, the number of individual viewers of all content types has continued to grow year-over-year, which we believe is an important input to revenue generation, given the value of incremental reach for advertisers. Friend Stories remain a very popular product for our community, with the number of viewers of Friend Stories increasing year- over-year in the US, and we are seeing positive trends in viewers of Private Stories for groups of friends that we believe are encouraging for this product. In addition, we are working to innovate on our user experience to better help Snapchatters transition from engaging with their closest Friends Stories into retentive content experiences in Discover and Spotlight. Discover’s expansive selection of content is helping to drive engagement with an increasingly diverse global audience. For example, daily average time spent for Snapchatters aged 35 and older engaging with Shows and Publisher content increased

SPOTLIGHT 55% year-over-year growth in total time spent viewing Spotlight in Q3 SNAP INC. | Q3 2022 | INVESTOR LETTER 5 by more than 40% year-over-year. We announced a new global partnership with LaLiga, one of Europe’s major football leagues, bringing the best of the game to fans on Snapchat. Through new broadcast partnerships with beIN SPORTS in Qatar and France, ITV in the UK, MediaPro in Spain, and Bell in Canada, among others, there will be greater official coverage of the 2022 FIFA World Cup on Snapchat in more markets than ever before. Coverage will include localized highlights and every goal from every game available in 29 countries. Complementing this extensive coverage, Snapchat will launch dedicated 2022 FIFA World Cup activations through AR Lenses, Filters, Stickers, Bitmoji experiences, Cameos, and more. We also further strengthened our international content offerings by partnering with top publishers discovery+, Aftonbladet, and Expressen in Sweden. We are excited about the long-term potential of Spotlight. Total time spent watching Spotlight content grew 55% year-over-year and Spotlight monthly active users exceeded 300 million in Q3. We continue to support our growing creator ecosystem, and today, there are many different ways for creators to build a business on Snapchat. Creators can monetize their content by enrolling in our midroll ad program, open shops to sell merchandise, and receive virtual gifts from fans. In addition, we launched our first-ever Snapchat Sounds Creator Fund — a new grant program designed to recognize emerging, independent artists for the critical role they play in driving video creations, inspiring internet trends, and defining cultural moments. The Fund provides monthly grants to top Sounds creators who are distributing music on Snapchat via DistroKid, driving content creation across the platform. The Snap Map is a personalized map that helps Snapchatters stay in touch with their closest friends and find places to visit together. Over the past year, we have added new features to make it easier to discover interesting places, local restaurants, and concerts happening nearby, all personalized for each Snapchatter. We were encouraged to see that Snapchatters opened Places from the map nearly twice as much this quarter when compared to Q3 2021. We

PLACES Snapchatters opened Places nearly twice as much this quarter when compared to Q3 2021 SNAP INC. | Q3 2022 | INVESTOR LETTER 6 believe that growing engagement around Places will expand our monetization opportunity on the Snap Map by providing valuable consumer insights for businesses with a physical location. Our ML-based Place personalization helps our community discover new places on our map by offering Place recommendations based on interactions with friends. We are excited about the work we are doing to grow our community and unify our content experiences to drive overall time spent growth across our application. Snapchat plays an important role in empowering people to express themselves, live in the moment, learn about the world, and have fun together. Diversifying engagement across Snapchat, including visual communication, content, augmented reality, and our map helps make our service more valuable and retentive for our community, more difficult to replicate, and more resilient to competition, while increasing our ARPU opportunity over the long term. Revenue Growth Our revenue growth continued to decelerate in Q3 and continues to be impacted by a number of factors we have noted throughout the past year, including platform policy changes, macroeconomic headwinds, and increased competition. We are finding that our advertising partners across many industries are decreasing their marketing budgets, especially in the face of operating environment headwinds, inflation-driven cost pressures, and rising costs of capital. In some industries where topline growth remains strong, but businesses are experiencing input cost pressure due to inflation, we have observed reduced campaign budgets as businesses seek to offset input cost pressures. In many high- growth sectors, businesses are reassessing investment levels amid the rising cost of capital. We experience this on our advertising platform in the form of decreased brand-oriented advertising spending, but also in the form of lower bids per action and lower overall campaign budgets. We are focused on increasing our share of wallet as growth in

We believe that direct response advertising represents the most defensible marketing investment in a challenged economic environment, and that direct response budgets can scale significantly over the longer term SNAP INC. | Q3 2022 | INVESTOR LETTER 7 the overall digital advertising segment slows. To gain share in a highly competitive and budget constrained environment, we are focused on improving the returns on advertising investments delivered by our direct-response advertising platform. We believe that direct-response advertising represents the most defensible marketing investment in a challenged economic environment, and that direct-response budgets can scale significantly over the long term. Given the measurement limitations introduced by the platform policy changes, more advertisers are focusing on measuring advertising using click-through conversions that are more easily measured by readily available third-party sources such as Google Analytics. Historically, we have driven significant value for advertisers from advertisements that were shown on Snapchat, even when the conversion occurred off-platform or at a later time, and we calibrated our advertising platform to drive results regardless of where the conversion took place. Increasingly, advertisers are looking for on-platform conversions given the measurement limitations from the platform policy changes. As a result, we are evolving our advertising formats, optimization, measurement, and delivery to drive more click- through conversions that are easy for our partners to observe and measure using their preferred measurement solutions. In addition, we are working to ensure that off-platform and out-of- session conversions are better captured by first- and third-party measurement solutions. We believe this longer-term effort will set us up to address a much larger set of advertisers and campaigns over time. Our privacy-preserving first-party measurement tools, including Advanced Conversions (AC) and Estimated Conversions (EC), continue to play an important role in helping our advertising partners scale and manage their marketing investments on our platform by providing more comprehensive, granular, and immediate feedback on campaigns, as well as more flexibility in the parameters for measurement of lift and incrementality.

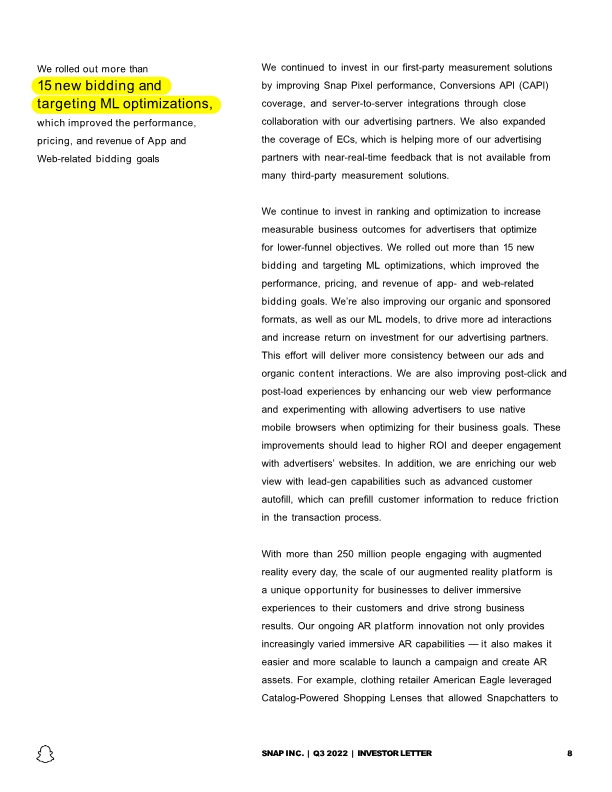

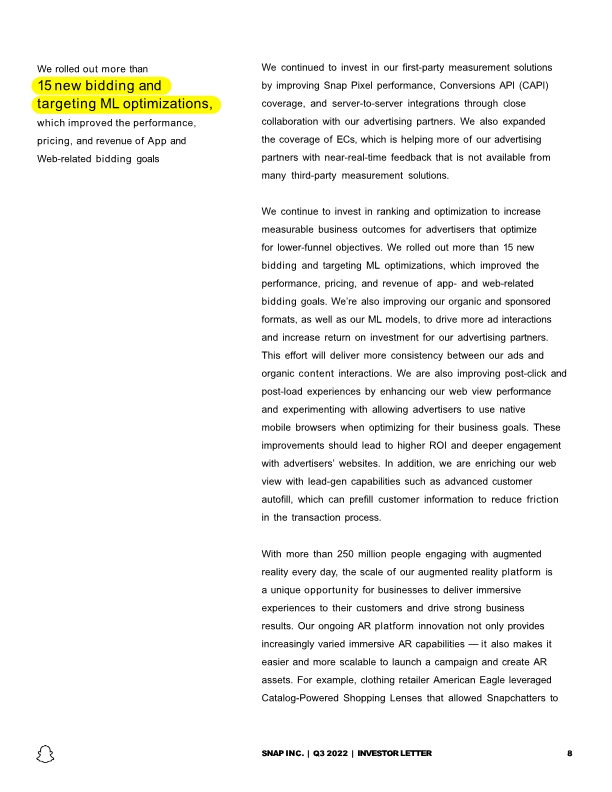

We rolled out more than 15 new bidding and targeting ML optimizations, which improved the performance, pricing, and revenue of App and Web-related bidding goals SNAP INC. | Q3 2022 | INVESTOR LETTER 8 We continued to invest in our first-party measurement solutions by improving Snap Pixel performance, Conversions API (CAPI) coverage, and server-to-server integrations through close collaboration with our advertising partners. We also expanded the coverage of ECs, which is helping more of our advertising partners with near-real-time feedback that is not available from many third-party measurement solutions. We continue to invest in ranking and optimization to increase measurable business outcomes for advertisers that optimize for lower-funnel objectives. We rolled out more than 15 new bidding and targeting ML optimizations, which improved the performance, pricing, and revenue of app- and web-related bidding goals. We’re also improving our organic and sponsored formats, as well as our ML models, to drive more ad interactions and increase return on investment for our advertising partners. This effort will deliver more consistency between our ads and organic content interactions. We are also improving post-click and post-load experiences by enhancing our web view performance and experimenting with allowing advertisers to use native mobile browsers when optimizing for their business goals. These improvements should lead to higher ROI and deeper engagement with advertisers’ websites. In addition, we are enriching our web view with lead-gen capabilities such as advanced customer autofill, which can prefill customer information to reduce friction in the transaction process. With more than 250 million people engaging with augmented reality every day, the scale of our augmented reality platform is a unique opportunity for businesses to deliver immersive experiences to their customers and drive strong business results. Our ongoing AR platform innovation not only provides increasingly varied immersive AR capabilities — it also makes it easier and more scalable to launch a campaign and create AR assets. For example, clothing retailer American Eagle leveraged Catalog-Powered Shopping Lenses that allowed Snapchatters to

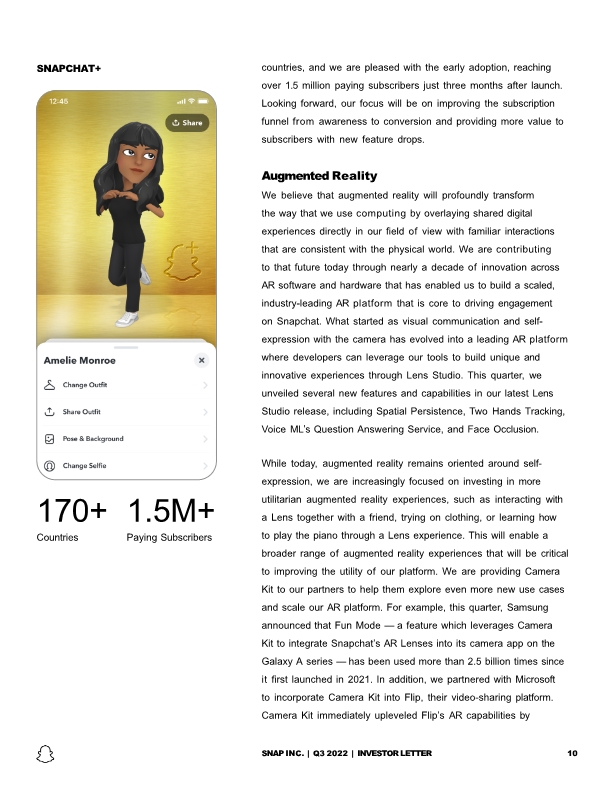

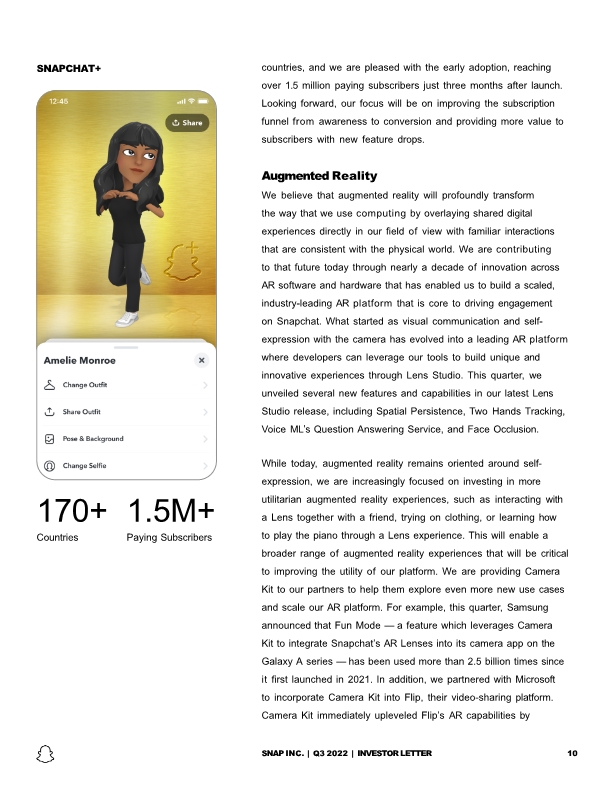

AMERICAN EAGLE American Eagle leveraged Catalog- Powered Shopping Lenses that allowed Snapchatters to engage with and even purchase individual items, driving more than 11 million impressions with an average playtime of nearly 30 seconds SNAP INC. | Q3 2022 | INVESTOR LETTER 9 engage with and even purchase individual items, driving more than 11 million impressions with an average playtime of nearly 30 seconds. In addition, furniture retailer Skeidar developed a Lens where Snapchatters could explore different types of outdoor garden furniture in AR, resulting in an increase of +21 points in brand favorability and +14 points in action intent, which in turn drove a 14x increase in return on ad spend. As we look forward to Q4, we will expand our advertising tests within Spotlight. Businesses are able to submit content to Spotlight, see how it performs with our community, receive direct feedback in comments, and use those learnings to inform their campaigns. We believe that Spotlight offers an exciting new way for brands to experiment with video creative and learn how to make content that inspires the Snapchat community. We are also working on new tools that enable businesses to easily promote their most engaging Spotlight content, drive conversions, and measure their success with Ads Manager. As part of our ongoing reprioritization efforts, we have identified certain advertising products or features that have not scaled well and we are working to wind them down or, in the case of sponsored Filters, replace them with new products like sponsored augmented reality Lenses that are available in our camera and in post-capture. These changes may contribute additional short- term headwinds to the growth of our advertising business, but we believe that having our teams focus on our most performant and scalable products is the right investment for our long-term success. Lastly, we are excited about the early progress we have made to diversify our topline revenue growth through new product innovation. Our premium subscription service, Snapchat+, offers a new way for our community to access exclusive, experimental, and pre-release features. Early features include custom app icons, priority Story replies to Snap Stars, and exclusive profile backgrounds. Snapchat+ is now available in more than 170

SNAPCHAT+ 170+ 1.5M+ Countries Paying Subscribers SNAP INC. | Q3 2022 | INVESTOR LETTER 10 countries, and we are pleased with the early adoption, reaching over 1.5 million paying subscribers just three months after launch. Looking forward, our focus will be on improving the subscription funnel from awareness to conversion and providing more value to subscribers with new feature drops. Augmented Reality We believe that augmented reality will profoundly transform the way that we use computing by overlaying shared digital experiences directly in our field of view with familiar interactions that are consistent with the physical world. We are contributing to that future today through nearly a decade of innovation across AR software and hardware that has enabled us to build a scaled, industry-leading AR platform that is core to driving engagement on Snapchat. What started as visual communication and self- expression with the camera has evolved into a leading AR platform where developers can leverage our tools to build unique and innovative experiences through Lens Studio. This quarter, we unveiled several new features and capabilities in our latest Lens Studio release, including Spatial Persistence, Two Hands Tracking, Voice ML’s Question Answering Service, and Face Occlusion. While today, augmented reality remains oriented around self- expression, we are increasingly focused on investing in more utilitarian augmented reality experiences, such as interacting with a Lens together with a friend, trying on clothing, or learning how to play the piano through a Lens experience. This will enable a broader range of augmented reality experiences that will be critical to improving the utility of our platform. We are providing Camera Kit to our partners to help them explore even more new use cases and scale our AR platform. For example, this quarter, Samsung announced that Fun Mode — a feature which leverages Camera Kit to integrate Snapchat’s AR Lenses into its camera app on the Galaxy A series — has been used more than 2.5 billion times since it first launched in 2021. In addition, we partnered with Microsoft to incorporate Camera Kit into Flip, their video-sharing platform. Camera Kit immediately upleveled Flip’s AR capabilities by

SAMSUNG Samsung's Fun Mode, which uses Camera Kit to integrate Snapchat’s AR Lenses into the Galaxy A's camera, has been used more than 2.5 billion times since it first launched in 2021 SNAP INC. | Q3 2022 | INVESTOR LETTER 11 providing their community with new tools for creativity, expression, and education. We continue to push the boundaries of AR innovation through unique and valuable partnerships. For example, Snapchat brought Vogue World: New York — a first-of-its-kind live fashion experience to celebrate Vogue’s 130th anniversary — to life by casting a new Lens on the traditional runway show that enabled users to enhance the event via AR Lenses. After the event, Vogue Runway app users were able to access virtual versions of eight designs and try them on in the Runway app using Snap AR technology. We also partnered with the LEGO Group to launch a new augmented reality experience across London as part of the toy brand’s 90th anniversary. Snapchatters around London were treated to life-size LEGO models that used the buildings of Central London as their canvas. We are working to deliver value via our new AR Enterprise Solutions offering — a set of services that brings Snap’s world-class AR technology suite into businesses’s owned-and-operated apps and websites and physical locations to transform the way they engage with consumers and drive better business results. Our newly formed AR Enterprise team will drive our go-to-market strategy and product roadmap, and we are excited about the potential to generate incremental revenue outside of advertising over the long term. We will continue to invest in Spectacles, our augmented reality glasses, making long-term bets on new technology and focusing on highly differentiated long-term research and development efforts. Some of our most important investments this year, including Lens Studio, Lens Engine, and Lens Cloud, are all critical in supporting our next-generation device, in addition to being used in Snapchat and by our partners. We are committed to helping developers explore the possibilities enabled via Spectacles, which will further improve the product and experience by integrating that feedback into SnapOS and Lens Studio. Investing over the long term, building highly complex technical solutions, and growing a platform that is increasingly differentiated and difficult to replicate helps us to build

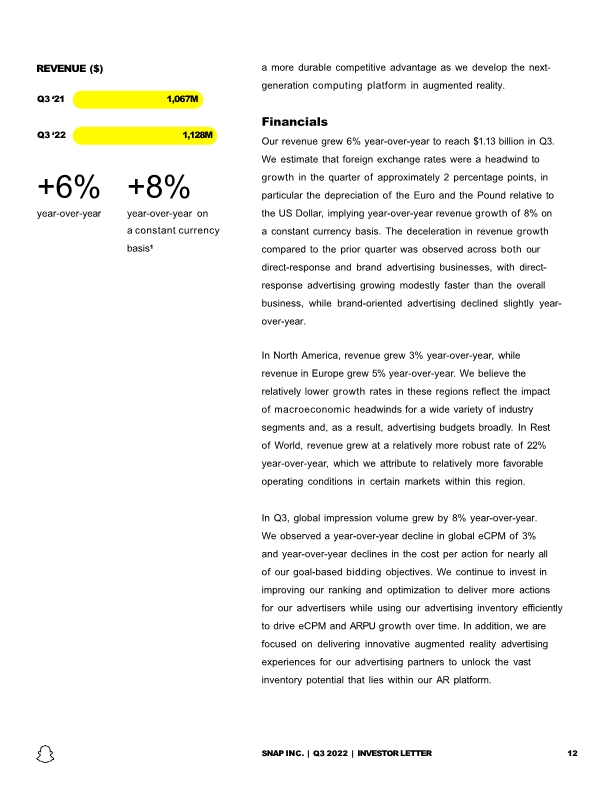

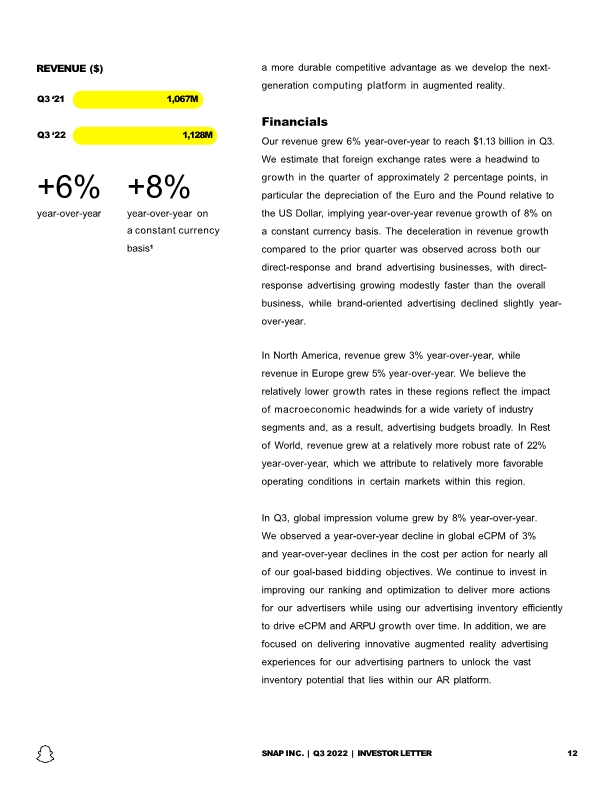

REVENUE ($) Q3 ‘21 1,067M Q3 ‘22 SNAP INC. | Q3 2022 | INVESTOR LETTER 12 1,128M +6% year-over-year +8% year-over-year on a constant currency basis1 a more durable competitive advantage as we develop the next- generation computing platform in augmented reality. Financials Our revenue grew 6% year-over-year to reach $1.13 billion in Q3. We estimate that foreign exchange rates were a headwind to growth in the quarter of approximately 2 percentage points, in particular the depreciation of the Euro and the Pound relative to the US Dollar, implying year-over-year revenue growth of 8% on a constant currency basis. The deceleration in revenue growth compared to the prior quarter was observed across both our direct-response and brand advertising businesses, with direct- response advertising growing modestly faster than the overall business, while brand-oriented advertising declined slightly year- over-year. In North America, revenue grew 3% year-over-year, while revenue in Europe grew 5% year-over-year. We believe the relatively lower growth rates in these regions reflect the impact of macroeconomic headwinds for a wide variety of industry segments and, as a result, advertising budgets broadly. In Rest of World, revenue grew at a relatively more robust rate of 22% year-over-year, which we attribute to relatively more favorable operating conditions in certain markets within this region. In Q3, global impression volume grew by 8% year-over-year. We observed a year-over-year decline in global eCPM of 3% and year-over-year declines in the cost per action for nearly all of our goal-based bidding objectives. We continue to invest in improving our ranking and optimization to deliver more actions for our advertisers while using our advertising inventory efficiently to drive eCPM and ARPU growth over time. In addition, we are focused on delivering innovative augmented reality advertising experiences for our advertising partners to unlock the vast inventory potential that lies within our AR platform.

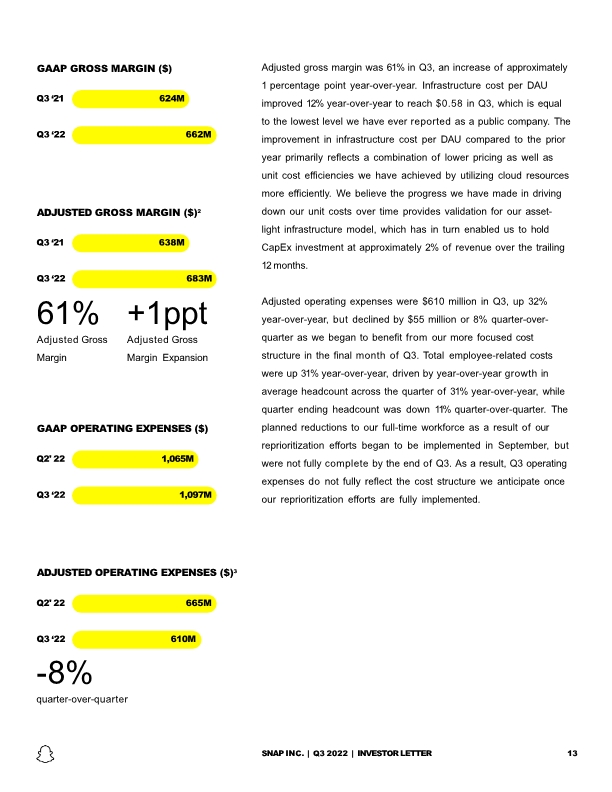

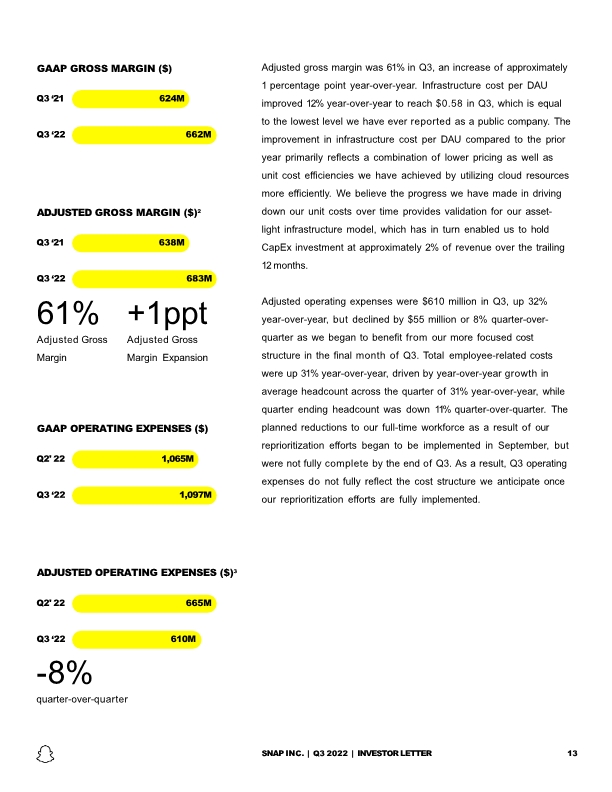

GAAP GROSS MARGIN ($) Q3 ‘21 624M Q3 ‘22 662M ADJUSTED GROSS MARGIN ($)2 Q3 ‘21 638M Q3 ‘22 61% Adjusted Gross Margin 683M +1ppt Adjusted Gross Margin Expansion GAAP OPERATING EXPENSES ($) Q2' 22 1,065M Q3 ‘22 1,097M ADJUSTED OPERATING EXPENSES ($)3 Q2' 22 665M 610M SNAP INC. | Q3 2022 | INVESTOR LETTER 13 Q3 ‘22 -8% quarter-over-quarter Adjusted gross margin was 61% in Q3, an increase of approximately 1 percentage point year-over-year. Infrastructure cost per DAU improved 12% year-over-year to reach $0.58 in Q3, which is equal to the lowest level we have ever reported as a public company. The improvement in infrastructure cost per DAU compared to the prior year primarily reflects a combination of lower pricing as well as unit cost efficiencies we have achieved by utilizing cloud resources more efficiently. We believe the progress we have made in driving down our unit costs over time provides validation for our asset- light infrastructure model, which has in turn enabled us to hold CapEx investment at approximately 2% of revenue over the trailing 12 months. Adjusted operating expenses were $610 million in Q3, up 32% year-over-year, but declined by $55 million or 8% quarter-over- quarter as we began to benefit from our more focused cost structure in the final month of Q3. Total employee-related costs were up 31% year-over-year, driven by year-over-year growth in average headcount across the quarter of 31% year-over-year, while quarter ending headcount was down 11% quarter-over-quarter. The planned reductions to our full-time workforce as a result of our reprioritization efforts began to be implemented in September, but were not fully complete by the end of Q3. As a result, Q3 operating expenses do not fully reflect the cost structure we anticipate once our reprioritization efforts are fully implemented.

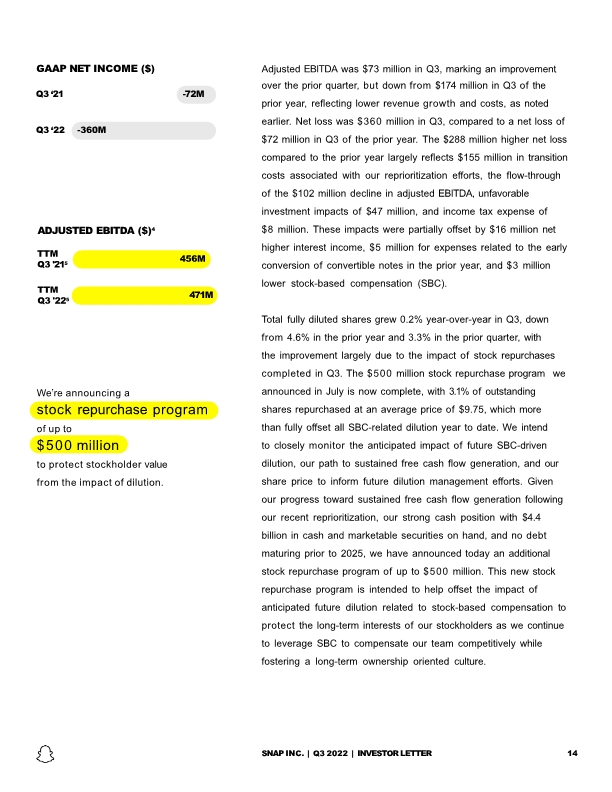

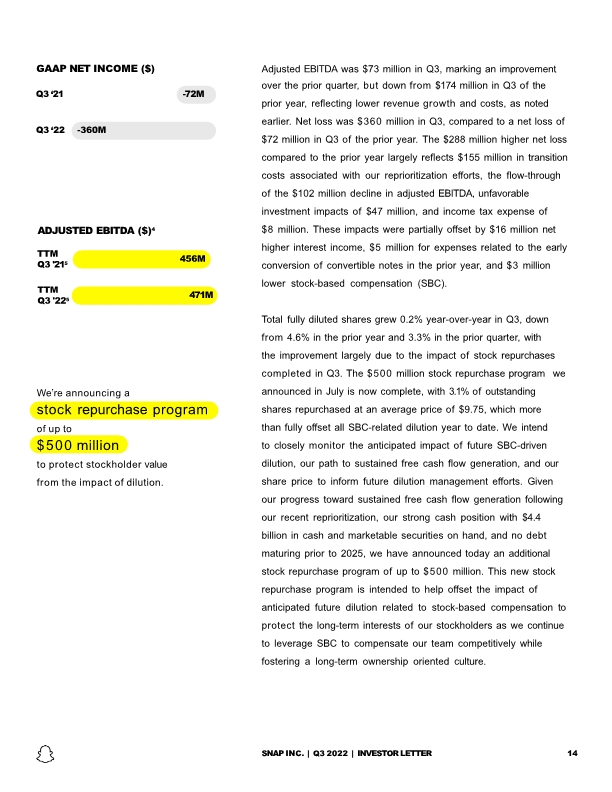

GAAP NET INCOME ($) Q3 ‘21 -72M Q3 ‘22 -360M ADJUSTED EBITDA ($)4 TTM Q3 '215 456M TTM Q3 '225 471M We’re announcing a stock repurchase program of up to $500 million to protect stockholder value from the impact of dilution. SNAP INC. | Q3 2022 | INVESTOR LETTER 14 Adjusted EBITDA was $73 million in Q3, marking an improvement over the prior quarter, but down from $174 million in Q3 of the prior year, reflecting lower revenue growth and costs, as noted earlier. Net loss was $360 million in Q3, compared to a net loss of $72 million in Q3 of the prior year. The $288 million higher net loss compared to the prior year largely reflects $155 million in transition costs associated with our reprioritization efforts, the flow-through of the $102 million decline in adjusted EBITDA, unfavorable investment impacts of $47 million, and income tax expense of $8 million. These impacts were partially offset by $16 million net higher interest income, $5 million for expenses related to the early conversion of convertible notes in the prior year, and $3 million lower stock-based compensation (SBC). Total fully diluted shares grew 0.2% year-over-year in Q3, down from 4.6% in the prior year and 3.3% in the prior quarter, with the improvement largely due to the impact of stock repurchases completed in Q3. The $500 million stock repurchase program we announced in July is now complete, with 3.1% of outstanding shares repurchased at an average price of $9.75, which more than fully offset all SBC-related dilution year to date. We intend to closely monitor the anticipated impact of future SBC-driven dilution, our path to sustained free cash flow generation, and our share price to inform future dilution management efforts. Given our progress toward sustained free cash flow generation following our recent reprioritization, our strong cash position with $4.4 billion in cash and marketable securities on hand, and no debt maturing prior to 2025, we have announced today an additional stock repurchase program of up to $500 million. This new stock repurchase program is intended to help offset the impact of anticipated future dilution related to stock-based compensation to protect the long-term interests of our stockholders as we continue to leverage SBC to compensate our team competitively while fostering a long-term ownership oriented culture.

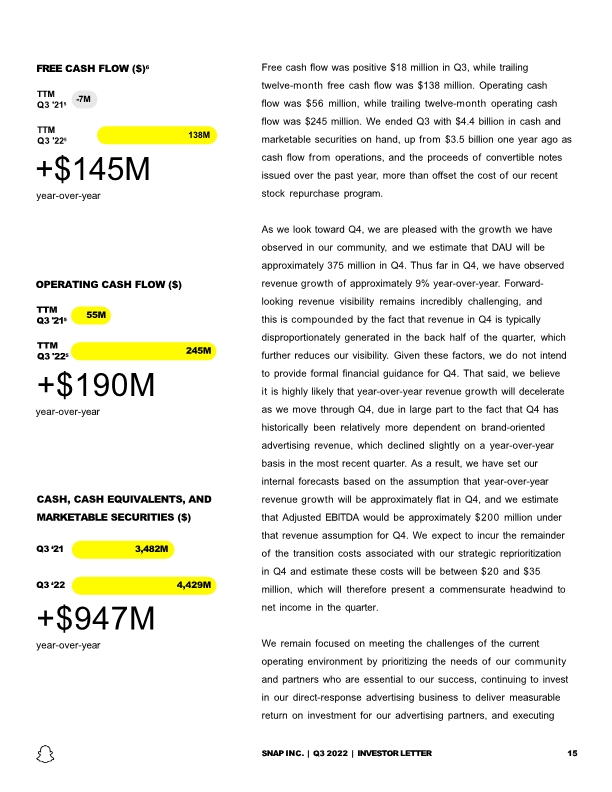

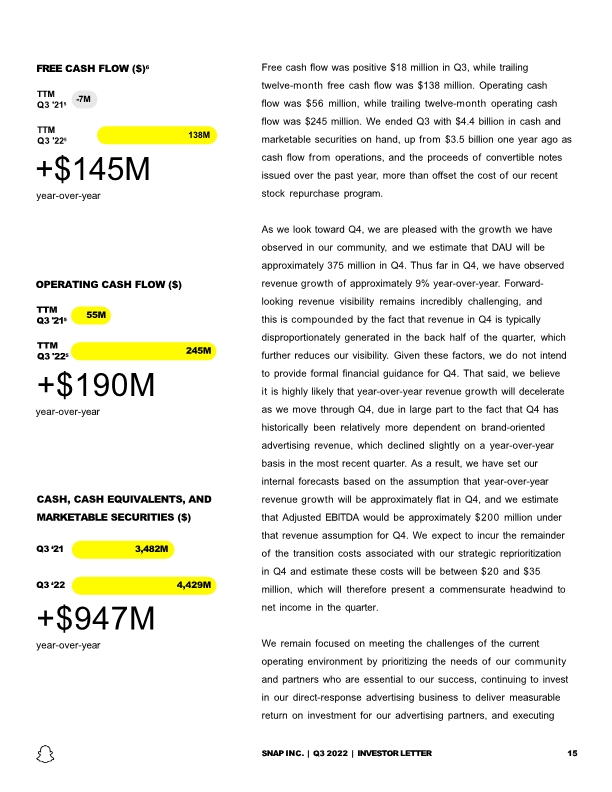

CASH, CASH EQUIVALENTS, AND MARKETABLE SECURITIES ($) Q3 ‘21 3,482M 4,429M Q3 ‘22 +$947M year-over-year OPERATING CASH FLOW ($) 245M TTM Q3 '225 +$190M year-over-year TTM Q3 '215 55M FREE CASH FLOW ($)6 138M TTM Q3 '225 +$145M year-over-year TTM Q3 '215 SNAP INC. | Q3 2022 | INVESTOR LETTER 15 -7M Free cash flow was positive $18 million in Q3, while trailing twelve-month free cash flow was $138 million. Operating cash flow was $56 million, while trailing twelve-month operating cash flow was $245 million. We ended Q3 with $4.4 billion in cash and marketable securities on hand, up from $3.5 billion one year ago as cash flow from operations, and the proceeds of convertible notes issued over the past year, more than offset the cost of our recent stock repurchase program. As we look toward Q4, we are pleased with the growth we have observed in our community, and we estimate that DAU will be approximately 375 million in Q4. Thus far in Q4, we have observed revenue growth of approximately 9% year-over-year. Forward- looking revenue visibility remains incredibly challenging, and this is compounded by the fact that revenue in Q4 is typically disproportionately generated in the back half of the quarter, which further reduces our visibility. Given these factors, we do not intend to provide formal financial guidance for Q4. That said, we believe it is highly likely that year-over-year revenue growth will decelerate as we move through Q4, due in large part to the fact that Q4 has historically been relatively more dependent on brand-oriented advertising revenue, which declined slightly on a year-over-year basis in the most recent quarter. As a result, we have set our internal forecasts based on the assumption that year-over-year revenue growth will be approximately flat in Q4, and we estimate that Adjusted EBITDA would be approximately $200 million under that revenue assumption for Q4. We expect to incur the remainder of the transition costs associated with our strategic reprioritization in Q4 and estimate these costs will be between $20 and $35 million, which will therefore present a commensurate headwind to net income in the quarter. We remain focused on meeting the challenges of the current operating environment by prioritizing the needs of our community and partners who are essential to our success, continuing to invest in our direct-response advertising business to deliver measurable return on investment for our advertising partners, and executing

against our enormous opportunity in augmented reality as we work toward our long-term goal of overlaying computing on the world. We define constant currency revenue as GAAP revenue in the current period translated using the prior period average monthly exchange rates for revenue transactions in currencies other than the U.S. dollar. The constant currency revenue percentage change is determined using current period constant currency revenue and prior period GAAP revenue. We define adjusted gross margin as GAAP revenue less adjusted cost of revenue, and as a percentage, divided by GAAP revenue. Adjusted cost of revenue excludes stock-based compensation expense, payroll and other tax expense related to stock- based compensation, depreciation and amortization, and certain other non-cash or nonrecurring items impacting net income (loss) from time to time of $21 million and $14 million for the three months ended September 30, 2022 and 2021, respectively. Adjusted operating expenses excludes stock-based compensation expense, payroll and other tax expense related to stock-based compensation, depreciation and amortization, and certain other non-cash or non-recurring items impacting net income (loss) from time to time of $487 million and $341 million for the three months ended September 30, 2022 and 2021, respectively. We define Adjusted EBITDA as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other non-cash or non-recurring items impacting net income (loss) from time to time. See Appendix for reconciliation of net loss to Adjusted EBITDA. We define trailing twelve months as the sum of the last four quarters of data for applicable measures. See Appendix for reconciliation of net loss to Adjusted EBITDA and net cash provided by (used in) operating activities to Free Cash Flow. We define Free Cash Flow as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. See Appendix for reconciliation of net cash provided by (used in) operating activities to Free Cash Flow. SNAP INC. | Q3 2022 | INVESTOR LETTER 16

Appendix

This letter contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, or the Securities Act, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act about us and our industry that involve substantial risks and uncertainties. All statements other than statements of historical facts contained in this letter, including statements regarding guidance, our future results of operations or financial condition, our stock repurchase program, future stock dividends, business strategy and plans, user growth and engagement, product initiatives, objectives of management for future operations, and advertiser and partner offerings, are forward-looking statements. In some cases, you can identify forward-looking statements because they contain words such as “anticipate,” “believe,” “contemplate,” “continue,” “could,” “estimate,” “expect,” “going to,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “target,” “will,” or “would” or the negative of these words or other similar terms or expressions. We caution you that the foregoing may not include all of the forward-looking statements made in this letter. You should not rely on forward-looking statements as predictions of future events. We have based the forward-looking statements contained in this letter primarily on our current expectations and projections about future events and trends, including our financial outlook, geo-political conflicts, and the COVID-19 pandemic, that we believe may continue to affect our business, financial condition, results of operations, and prospects. These forward-looking statements are subject to risks and uncertainties related to: our financial performance; our ability to attain and sustain profitability; our ability to generate and sustain positive cash flow; our ability to attract and retain users, publishers, and advertisers; competition and new market entrants; managing our international expansion and our growth and future expenses; compliance with new laws, regulations, and executive actions; our ability to maintain, protect, and enhance our intellectual property; our ability to succeed in existing and new market segments; our ability to attract and retain qualified and key personnel; our ability to repay outstanding debt; future acquisitions, divestitures or investments; and the potential adverse impact of climate change, natural disasters, health epidemics, macroeconomic conditions, and war or other armed conflict, as well as risks, uncertainties, and other factors described in “Risk Factors” and elsewhere in our most recent periodic report filed with the U.S. Securities and Exchange Commission, or SEC, which is available on the SEC’s website at www.sec.gov. Additional information will be made available in Snap Inc.’s periodic report that will be filed with the SEC for the period covered by this letter and other filings that we make from time to time with the SEC. In addition, any forward-looking statements contained in this letter are based on assumptions that we believe to be reasonable as of this date. We undertake no obligation to update any forward-looking statements to reflect events or circumstances after the date of this letter or to reflect new information or the occurrence of unanticipated events, including future developments related to geo-political conflicts, the COVID-19 pandemic, and macroeconomic conditions, except as required by law. SNAP INC. | Q3 2022 | INVESTOR LETTER 18 Forward Looking Statements

To supplement our consolidated financial statements, which are prepared and presented in accordance with GAAP, we use certain non-GAAP financial measures, as described below, to understand and evaluate our core operating performance. These non-GAAP financial measures, which may be different than similarly titled measures used by other companies, are presented to enhance investors’ overall understanding of our financial performance and should not be considered a substitute for, or superior to, the financial information prepared and presented in accordance with GAAP. We use the non-GAAP financial measure of Free Cash Flow, which is defined as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. We believe Free Cash Flow is an important liquidity measure of the cash that is available, after capital expenditures, for operational expenses and investment in our business and is a key financial indicator used by management. Additionally, we believe that Free Cash Flow is an important measure since we use third-party infrastructure partners to host our services and therefore we do not incur significant capital expenditures to support revenue generating activities. Free Cash Flow is useful to investors as a liquidity measure because it measures our ability to generate or use cash. Once our business needs and obligations are met, cash can be used to maintain a strong balance sheet and invest in future growth. We use the non-GAAP financial measure of Adjusted EBITDA, which is defined as net income (loss); excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other non-cash or non-recurring items impacting net income (loss) from time to time. We believe that Adjusted EBITDA helps identify underlying trends in our business that could otherwise be masked by the effect of the expenses that we exclude in Adjusted EBITDA. We use the non-GAAP financial measure of non-GAAP net income (loss), which is defined as net income (loss); excluding amortization of intangible assets; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; certain other non-cash or non-recurring items impacting net income (loss) from time to time; and related income tax adjustments. Non-GAAP net income (loss) and weighted average diluted shares are then used to calculate non- GAAP diluted net income (loss) per share. Similar to Adjusted EBITDA, we believe these measures help identify underlying trends in our business that could otherwise be masked by the effect of the expenses we exclude in the measure. We believe that these non-GAAP financial measures provide useful information about our financial performance, enhance the overall understanding of our past performance and future prospects, and allow for greater transparency with respect to key metrics used by our management for financial and operational decision-making. We are presenting these non-GAAP measures to assist investors in seeing our financial performance through the eyes of management, and because we believe that these measures provide an additional tool for investors to use in comparing our core financial performance over multiple periods with other companies in our industry. For a reconciliation of these non-GAAP financial measures to the most directly comparable GAAP financial measure, please see “Reconciliation of GAAP to Non-GAAP Financial Measures” included as an Appendix to this letter. Snap Inc., “Snapchat,” and our other registered and common law trade names, trademarks, and service marks are the property of Snap Inc. or our subsidiaries. SNAP INC. | Q3 2022 | INVESTOR LETTER 19 Non-GAAP Financial Measures

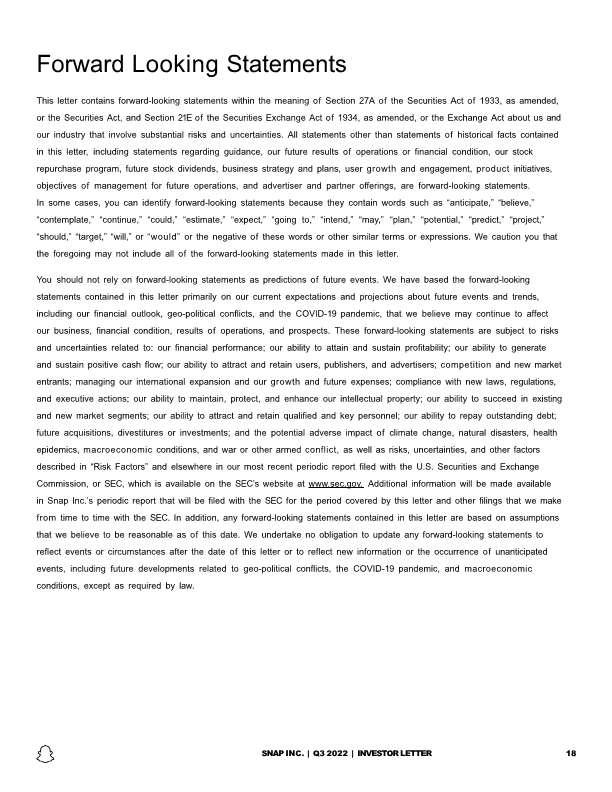

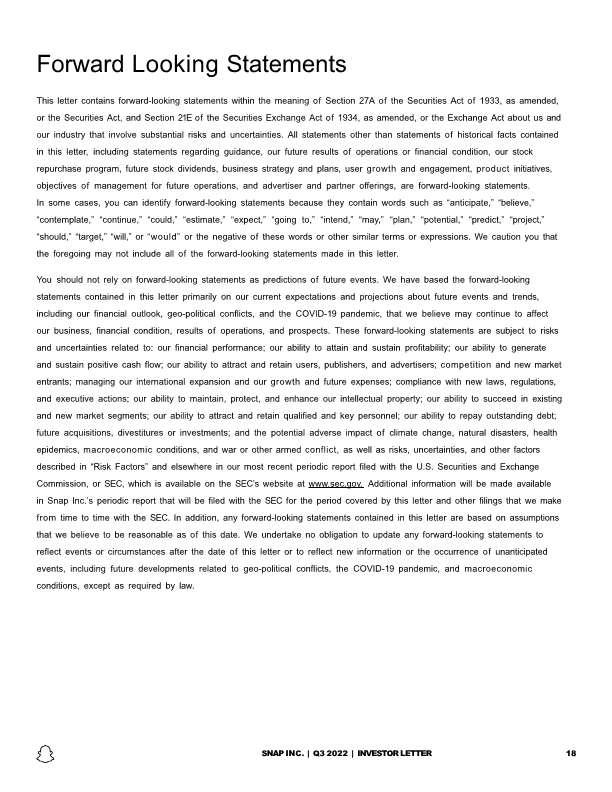

Three Months Ended Three Months Ended Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, unaudited) We define Adjusted EBITDA as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other non-cash or non-recurring items impacting net income (loss) from time to time. Restructuring charges for the three months ended September 30, 2022 were composed primarily of severance and related charges of $91 million, stock-based compensation expense, lease exit and related charges, impairment charges, and contract termination charges. These charges are non-recurring and not reflective of underlying trends in our business. We define Free Cash Flow as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. SNAP INC. | Q3 2022 | INVESTOR LETTER 20

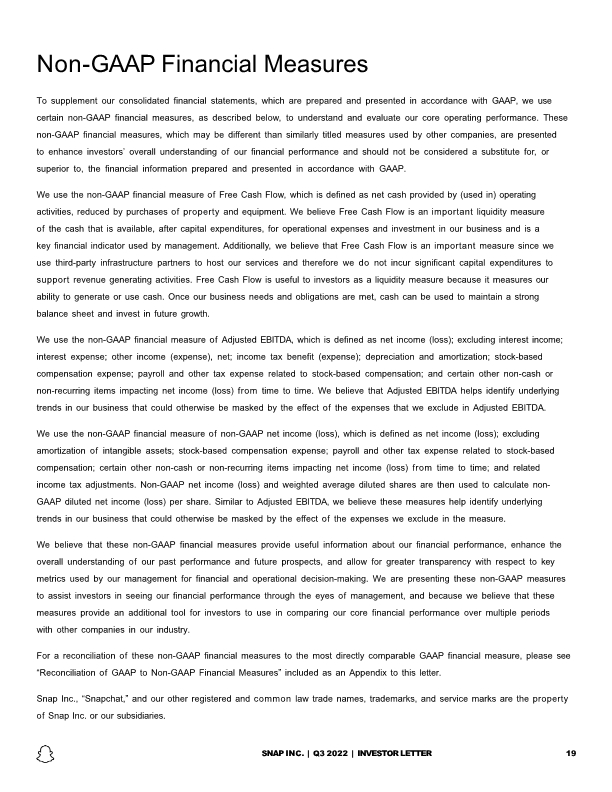

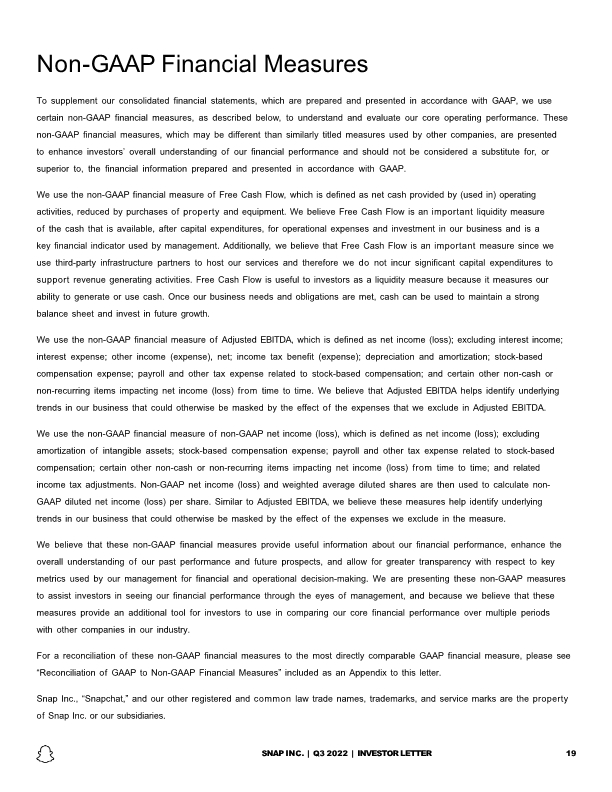

Reconciliation of GAAP to Non-GAAP Financial Measures (In thousands, unaudited) We define Adjusted EBITDA as net income (loss), excluding interest income; interest expense; other income (expense), net; income tax benefit (expense); depreciation and amortization; stock-based compensation expense; payroll and other tax expense related to stock-based compensation; and certain other non-cash or non-recurring items impacting net income (loss) from time to time. Restructuring charges for the trailing twelve months ended September 30, 2022 were composed primarily of severance and related charges of $91 million, stock-based compensation expense, lease exit and related charges, impairment charges, and contract termination charges. These charges are non-recurring and not reflective of underlying trends in our business. We define Free Cash Flow as net cash provided by (used in) operating activities, reduced by purchases of property and equipment. Trailing Twelve Months Ended SNAP INC. | Q3 2022 | INVESTOR LETTER 21 Trailing Twelve Months Ended