Use these links to rapidly review the document

Table of Contents

TABLE OF CONTENTS

Table of Contents

Exhibit 99.1

First Quarter Report

2019

Table of Contents

Table of Contents

| | |

Management's Discussion and Analysis of Results of Operations and Financial Position | | 1 |

Condensed Combined Balance Sheets | | 48 |

Condensed Combined Statements of Net Income | | 49 |

Condensed Combined Statements of Comprehensive Income | | 50 |

Condensed Combined Statements of Unitholders' Equity | | 51 |

Condensed Combined Statements of Cash Flows | | 52 |

Notes to Condensed Combined Financial Statements | | 53 |

Corporate Information | | Inside Back Cover |

Granite REIT 2019 First Quarter Report

Table of Contents

MANAGEMENT'S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL POSITION |

| | |

Basis of Presentation | |

1 |

Financial and Operating Highlights | |

2 |

Business Overview and Strategic Outlook | |

3 |

Significant Matters | |

5 |

Results of Operations | |

8 |

Investment Properties | |

18 |

Liquidity and Capital Resources | |

27 |

Commitments, Contractual Obligations, Contingencies and Off-Balance Sheet Arrangements | |

34 |

Non-IFRS Measures | |

35 |

Significant Accounting Estimates | |

38 |

New Accounting Pronouncements and Developments | |

39 |

Internal Controls over Financial Reporting | |

42 |

Risks and Uncertainties | |

42 |

Quarterly Financial Data | |

43 |

Forward-Looking Statements | |

44 |

Management's Discussion and Analysis of Results of Operations and Financial Position ("MD&A") of Granite Real Estate Investment Trust ("Granite REIT") and Granite REIT Inc. ("Granite GP") summarizes the significant factors affecting the combined operating results, financial condition, liquidity and cash flows of Granite REIT, Granite GP and their subsidiaries (collectively, "Granite" or the "Trust") for the three month period ended March 31, 2019. Unless otherwise noted, all amounts are in millions of Canadian dollars. This MD&A should be read in conjunction with the accompanying unaudited condensed combined financial statements for the three month period ended March 31, 2019 and the audited combined financial statements for the year ended December 31, 2018 prepared in accordance with International Financial Reporting Standards ("IFRS") as issued by the International Accounting Standards Board. The MD&A was prepared as at May 7, 2019 and its contents were approved by the Board of Trustees of Granite REIT and Board of Directors of Granite GP on this date. Additional information relating to Granite, including the Annual Report and Annual Information Form ("AIF") for fiscal 2018, can be obtained from the Trust's website atwww.granitereit.com, on SEDAR atwww.sedar.comand on EDGAR at www.sec.gov.

In addition to using financial measures determined in accordance with IFRS, Granite also uses certain non-IFRS measures in managing its business to measure financial and operating performance as well as for capital allocation decisions and valuation purposes. Granite believes that providing these measures on a supplemental basis to the IFRS results is helpful to investors in assessing the overall performance of Granite's business. These non-IFRS measures include net operating income before lease termination and close-out fees, straight-line rent and tenant incentive amortization ("NOI — cash basis"), same property NOI — cash basis, funds from operations ("FFO"), adjusted funds from operations ("AFFO"), FFO payout ratio, AFFO payout ratio, leverage ratio, interest coverage ratio, net leverage ratio, indebtedness ratio, unencumbered asset coverage ratio and any related per unit amounts. Readers are cautioned that these measures do not have standardized meanings prescribed under IFRS and, therefore, should not be construed as alternatives to net income, cash provided by operating activities or any other measure calculated in accordance with IFRS. Additionally, because these terms do not have standardized meanings prescribed by IFRS, they may not be comparable to similarly titled measures presented by other reporting issuers. Refer to "NON-IFRS MEASURES" for definitions and reconciliations of non-IFRS measures to IFRS financial measures.

| | | Granite REIT 2019 First Quarter Report 1 |

Table of Contents

FINANCIAL AND OPERATING HIGHLIGHTS |

| | | | | | | |

| | | | | | |

For the three months ended March 31,

| | 2019

| | 2018

| |

|---|

| | | | | | |

Operating highlights | | | | | |

Revenue | | $ | 63.4 | | $ | 61.7 | |

NOI — cash basis(1) | | 55.1 | | 52.3 | |

Net income attributable to stapled unitholders | | 78.3 | | 72.4 | |

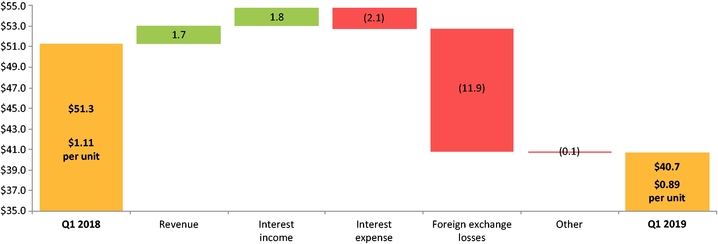

FFO(1)(2) | | 40.7 | | 51.3 | |

AFFO(1)(2) | | 39.3 | | 31.1 | |

Cash flows provided from operating activities | | 39.5 | | 37.6 | |

Monthly distributions paid | | 31.9 | | 31.7 | |

Special distribution paid | | 13.7 | | — | |

FFO payout ratio(1)(3) | | 79% | | 79% | |

AFFO payout ratio(1)(3) | | 82% | | 109% | |

Per unit amounts | |

| |

| |

Diluted FFO(1)(2) | | $ | 0.89 | | $ | 1.11 | |

Diluted AFFO(1)(2) | | $ | 0.86 | | $ | 0.67 | |

Monthly distributions paid | | $ | 0.70 | | $ | 0.68 | |

Special distribution paid | | $ | 0.30 | | — | |

Diluted weighted average number of units | | 45.7 | | 46.3 | |

| | | | | | | | | |

As at March 31, 2019 and December 31, 2018

| |

| |

| |

|---|

| | | | | | |

Financial highlights | | | | | | | |

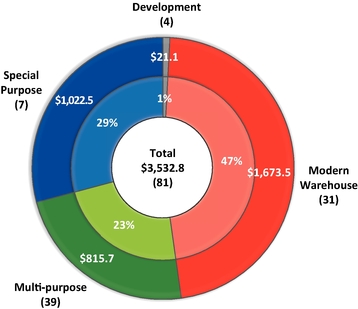

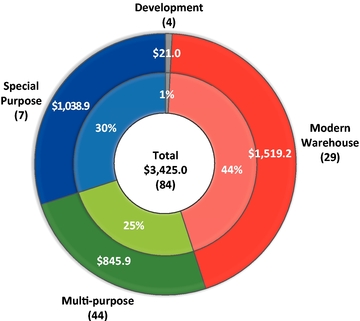

Investment properties — fair value(4) | | | $ | 3,532.8 | | | $ | 3,425.0 | |

Assets held for sale(4) | | | 38.7 | | | 44.2 | |

Cash and cash equivalents | | | 501.0 | | | 658.2 | |

Total debt(5) | | | 1,261.6 | | | 1,303.2 | |

Trading price per unit (TSX: GRT.UN) | | | $ | 63.85 | | | $ | 53.21 | |

Debt metrics, ratings and outlook | | |

| | |

| |

Net leverage ratio(1) | | | 22% | | | 19% | |

Interest coverage ratio(1) | | | 9.3x | | | 9.4x | |

Weighted average cost of debt | | | 2.18% | | | 2.17% | |

Weighted average debt term-to-maturity, in years | | | 4.5 | | | 4.7 | |

DBRS rating and outlook | | BBB stable | | BBB stable | |

Moody's rating and outlook | | Baa2 stable | | Baa2 stable | |

Property metrics(4) | | |

| | |

| |

Number of investment properties | | | 81 | | | 84 | |

Income-producing properties | | | 77 | | | 80 | |

Properties under development | | | 2 | | | 2 | |

Land held for development | | | 2 | | | 2 | |

Gross leasable area ("GLA"), square feet | | | 32.8 | | | 32.2 | |

Occupancy, by GLA | | | 98.8% | | | 99.1% | |

Magna as a percentage of annualized revenue(6) | | | 51% | | | 54% | |

Magna as a percentage of GLA | | | 43% | | | 47% | |

Weighted average lease term, in years by GLA | | | 6.1 | | | 6.0 | |

Overall capitalization rate(7) | | | 6.5% | | | 6.7% | |

| | | | | | |

| 2 Granite REIT 2019 First Quarter Report | | |

Table of Contents

- (1)

- For definitions of Granite's non-IFRS measures, refer to the section "NON-IFRS MEASURES".

- (2)

- For the three months ended March 31, 2019, Granite recognized $0.3 million ($0.01 per unit) in revenue related to a lease termination and close-out fee. For the three months ended March 31, 2018, Granite recognized $1.0 million ($0.02 per unit) in revenue related to a lease termination and close-out fee and a $10.4 million ($0.23 per unit) foreign exchange gain on the remeasurement of US dollar cash proceeds from the sale of investment properties in January 2018. FFO, AFFO and the per unit amounts include the aforementioned items.

In the first quarter of 2018, Granite also paid $9.1 million ($0.19 per unit) related to a tenant incentive allowance for a 2014 lease extension at the Eurostar facility in Graz, Austria. AFFO and AFFO per unit amounts have been reduced by this $9.1 million tenant allowance payment.

- (3)

- The FFO and AFFO payout ratios are calculated as monthly distributions, which exclude the special distribution, declared to unitholders divided by FFO and AFFO, respectively, in a period. For comparative purposes, the FFO payout ratio and AFFO payout ratio exclude the lease termination and close-out fee of $0.3 million for the three months ended March 31, 2019 as well as the lease termination and close-out fee of $1.0 million and the $10.4 million foreign exchange gain on the remeasurement of US dollar cash proceeds from the sale of properties in the prior year period. AFFO payout ratio further excludes the $9.1 million tenant incentive payment made in 2018 in connection with the 2014 lease extension at the Eurostar facility.

- (4)

- Assets held for sale are excluded from investment properties and related property metrics. Accordingly, five such assets that were held for sale at March 31, 2019 and six such assets that were held for sale at December 31, 2018 were excluded from investment properties and related property metrics at March 31, 2019 and December 31, 2018, respectively, throughout this MD&A.

- (5)

- The Trust has adopted IFRS 16,Leases effective January 1, 2019 resulting in the recognition of lease obligations on the combined balance sheet and, thereby, included in total debt (see "NEW ACCOUNTING PRONOUNCEMENTS AND DEVELOPMENTS").

- (6)

- Annualized revenue for each period presented is calculated as rental revenue excluding tenant recoveries, recognized in accordance with IFRS, in the reported month multiplied by 12 months.

- (7)

- Refer to "Valuation Metrics by Investment Property Asset Category" in the "Investment Properties" section.

BUSINESS OVERVIEW AND STRATEGIC OUTLOOK |

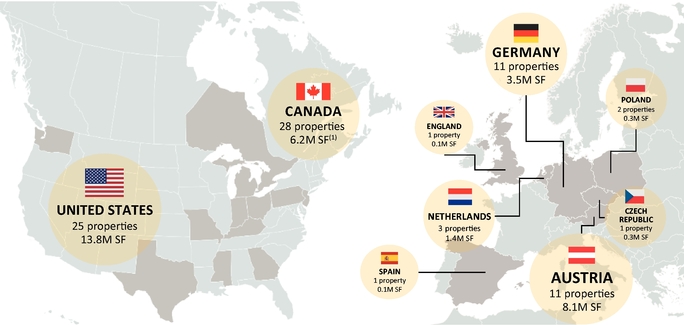

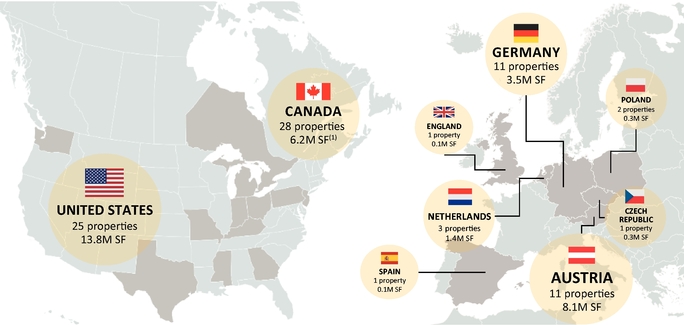

Business Overview

Granite is a Canadian-based real estate investment trust ("REIT") engaged in the acquisition, development, ownership and management of industrial, warehouse and logistics properties in North America and Europe. As at May 7, 2019, Granite owns 83 investment properties in nine countries having approximately 33.8 million square feet of gross leasable area. The tenant base includes Magna International Inc. and its operating subsidiaries (collectively, "Magna") as the largest tenant, in addition to tenants from various other industries. Properties leased to Magna are generally leased to operating subsidiaries of Magna International Inc. and the terms of the leases are not guaranteed by the parent company except for certain leases wherein the parent is the tenant.

Granite's investment properties consist of income-producing properties, properties under development and land held for development (see "INVESTMENT PROPERTIES"). The income-producing properties consist of light industrial properties, heavy industrial manufacturing facilities, warehouse and logistics properties, corporate offices, product development and engineering centres and test facilities. The lease payments are

| | | Granite REIT 2019 First Quarter Report 3 |

Table of Contents

primarily denominated in three currencies: the Canadian dollar ("$"), the Euro ("€") and the US dollar ("US$"). Granite's investment properties (excluding five assets held for sale) by geographic location, property count and square footage as at May 7, 2019 are summarized below:

Investment Properties Summary

Nine countries/83 properties/33.8(1) million square feet

- (1)

- Includes the leasehold interest in two income-producing properties representing 0.9 million of GLA acquired subsequent to March 31, 2019.

Strategic Outlook

Management continues to identify and pursue value creation and investment opportunities that will build on Granite's current foundation, leverage the balance sheet and grow and diversify the asset base.

Granite's long-term strategy is to continue to build an institutional quality and globally diversified industrial real estate business; to grow and diversify its asset base through acquisitions, development, re-development and dispositions; to optimize its balance sheet; and to reduce its exposure to Magna and the special purpose properties (see "INVESTMENT PROPERTIES") over the long-term.

Following the sale of 22 non-core properties in 2018 and 2019 and the recent equity offering, Granite has positioned itself to capitalize on market opportunities within its geographic footprint and execute on its strategy as well as benefit from a net leverage ratio of 22%, liquidity of approximately $1.0 billion, both as at March 31, 2019, and a strong pipeline of acquisition and development opportunities.

As Granite looks to the remainder of 2019, its priorities are as follows:

- •

- Strategically redeploy the proceeds from the recent equity offering and property dispositions;

- •

- Accelerate growth in its target markets in North America and Europe primarily through property, portfolio and corporate acquisitions as well as through joint venture arrangements and development of modern logistics and e-commerce assets;

- •

- Continue to dispose of select non-core assets;

- •

- Maintain a target occupancy in excess of 98%;

- •

- Enhance Granite's global platform;

- •

- Grow net asset value as well as FFO and AFFO per unit; and

- •

- Pursue development opportunities within the existing portfolio and with potential development partners.

| 4 Granite REIT 2019 First Quarter Report | | |

Table of Contents

Executing on these near-term priorities will accelerate the ongoing transformation of Granite into an institutional quality and globally diversified industrial real estate business.

Property Acquisitions

During the three months ended March 31, 2019, Granite acquired two income-producing modern properties in the United States. Subsequent to the quarter-end, Granite acquired the leasehold interest in two properties in Mississauga, Ontario. Property acquisitions consisted of the following:

| | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | |

Acquisitions

(in millions, except as noted)

Property Address

| | Location

| | Sq ft(1)

| | Weighted Average

Lease Term,

in years by

sq ft(1)

| | Date Acquired

| | Property

Purchase

Price

| | In-going

Stabilized

Yield(1)

|

|---|

| | | | | | | | | | | | | |

Acquired during the quarter ended March 31, 2019: | | | | | | | | | | |

201 Sunridge Boulevard | | Wilmer, TX | | | 0.8 | | | 9.5 | | Mar 1, 2019 | | | $ | 58.1 | | 5.1% |

3501 North Lancaster Hutchins Road | | Lancaster, TX | | | 0.2 | | | 10.4 | | Mar 1, 2019 | | | 106.1 | | 6.8% |

Acquired between April 1, 2019 and May 7, 2019: | | |

| |

| | |

| |

|

Leasehold interest in two properties (2020 and 2095 Logistics Drive) — see below | | Mississauga, ON | | | 0.9 | | | 8.7 | | Apr 9, 2019 | | | 154.0 | | 4.5% |

| | | | | | | | | | | | | |

| | | | | 1.9 | | | 9.2 | | | | | $ | 318.2 | | 5.4% |

| | | | | | | | | | | | | |

- (1)

- As at the date of acquisition

On March 1, 2019, Granite acquired two properties in the United States for $164.2 million (US$123.7 million). The first property, 201 Sunridge Boulevard, is a 30-foot clear height distribution centre constructed in 2008 that is situated on 53.4 acres of land and is 100% leased to a subsidiary of Unilever. The excess land on the property can support a building expansion of up to 0.3 million square feet, providing attractive site flexibility and the potential for additional income in the future. The second property, 3501 North Lancaster Hutchins Road, is a 174.6-acre site containing three buildings which are 100% leased to a leading wholesale automotive auction company. The gross leasable area of the existing buildings represents a site coverage ratio of only 2.6%, providing significant potential for future development.

Acquisition, Construction and Development Commitments

Granite had the following property purchase and construction and development commitments as at March 31, 2019:

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | |

Commitments

(in millions, except as noted)

Property Location

| | Additional

sq ft

| | Accruals/

Payments/

Deposits

Made(1)

| | Future

Commitments

| | Total

Cost

| | Year-One

Stabilized

Yield

|

|---|

| | | | | | | | | | | |

Leasehold interest in two properties in Mississauga, ON | | 0.9 | | | $ | 7.0 | | | $ | 147.0 | | $ | 154.0 | | 4.5% |

Demolition phase of property under development in Germany | | — | | | 0.5 | | | 1.1 | | 1.6 | | N/A |

Properties under development in Texas and Indiana as well as other construction commitments | | 1.4 | | | 57.3 | | | 299.3 | | 356.6 | | 5.6% |

| | | | | | | | | | | |

| | 2.3 | | | $ | 64.8 | | | $ | 447.4 | | $ | 512.2 | | 5.3% |

| | | | | | | | | | | |

On April 9, 2019, Granite acquired the leasehold interest in two income-producing properties located in Mississauga, Ontario for total consideration of $154.0 million. Both 40-foot clear height buildings were

| | | Granite REIT 2019 First Quarter Report 5 |

Table of Contents

completed in 2018, are located adjacent to Toronto Pearson International Airport and are fully leased to creditworthy tenants. The contractual rent at 2020 Logistics Drive is significantly below market, providing expected net operating income growth upon lease rollover. The property located at 2095 Logistics Drive is expected to be expanded by approximately 0.1 million square feet by February 2022, generating additional net operating income at an estimated yield of 8.9%.

A deposit of $26.7 million (US$20.0 million) was made during 2018 in connection with a contractual commitment to acquire a property under development in the state of Texas. This commitment to purchase the property under development is subject to specific confidentiality provisions and customary closing conditions including certain purchase rights in favour of the tenant and is expected to close concurrently with the lease commencement in the third quarter of 2019 following construction of the building.

During the first quarter of 2019, Granite entered into an agreement for approximately $1.6 million (€1.1 million) to demolish an existing building on a 15-acre site in Altbach, Germany. As at May 7, 2019, the demolition of the property is substantially complete and construction of a 0.3 million square foot distribution/light industrial facility is expected to commence in the third quarter of 2019, subject to receipt of all required permits and state approval.

As at March 31, 2019, Granite's commitment to purchase these aforementioned properties together with additional contractual commitments related to construction and development projects, including the development of a property in Plainfield, Indiana, amounted to approximately $447.4 million.

Property Dispositions

During the three months ended March 31, 2019, six properties previously classified as assets held for sale were disposed of for approximately $43.8 million. The properties consisted of the following:

| | | | | | | | | | | | | | | | |

| | | | | | | | | | | | |

Dispositions

(in millions, except as noted)

Property Address

| | Location

| | Sq ft

| | Date Disposed

| | Sale Price

| | Annualized

Revenue(1)

| |

|---|

| | | | | | | | | | | | |

3 Walker Drive (a nine-acre parcel of land) | | Brampton, ON | | N/A | | Jan 15, 2019 | | | $ | 13.4 | | | $ | — | |

Iowa properties (four properties): | |

| |

| |

| | |

| | |

| |

403 S 8th Street | | Montezuma, IA | | | | | | | | | | | |

1951 A Avenue | | Victor, IA | | | | | | | | | | | |

408 N Maplewood Avenue | | Williamsburg, IA | | | | | | | | | | | |

411 N Maplewood Avenue | | Williamsburg, IA | | 0.6 | | Feb 25, 2019 | | | 22.3 | | | 2.2 | |

375 Edward Street | |

Richmond Hill, ON | |

0.1 | |

Feb 27, 2019 | | |

8.1 | | |

— | |

| | | | | | | | | | | | |

| | | | 0.7 | | | | | $ | 43.8 | | | $ | 2.2 | |

| | | | | | | | | | | | |

- (1)

- Annualized revenue is calculated as rental revenue excluding tenant recoveries, recognized in accordance with IFRS, in the month the property was first classified as an asset held for sale multiplied by 12 months.

| 6 Granite REIT 2019 First Quarter Report | | |

Table of Contents

Assets Held for Sale

As at March 31, 2019, five investment properties located in the United States were classified as assets held for sale. The five properties, having an aggregate fair value of $38.7 million, consisted of the following:

| | | | | | | | | | | | | | |

| | | | | | | | | | |

Held for Sale

(in millions, except as noted)

Property Address

| | Location

| | Sq ft

| | Fair

Value

| | Annualized

Revenue(1)

| |

|---|

| | | | | | | | | | |

Michigan properties (five properties): | | | | | | | | | | | |

6151 Bancroft Avenue | | Alto, MI | | | | | | | | | |

3501 John F Donnelly Drive | | Holland, MI | | | | | | | | | |

3575 128th Avenue | | Holland, MI | | | | | | | | | |

3601 John F Donnelly Drive | | Holland, MI | | | | | | | | | |

1800 Hayes Street | | Grand Haven, MI | | 0.7 | | | $ | 38.7 | | | $ | 3.6 | |

| | | | | | | | | | |

- (1)

- Annualized revenue is calculated as rental revenue excluding tenant recoveries, recognized in accordance with IFRS, in the month the property was first classified as an asset held for sale multiplied by 12 months.

These aforementioned properties were classified as assets held for sale on the combined balance sheets at March 31, 2019 and were excluded from the value of investment properties. These properties are also excluded from references to investment properties and related property metrics as at March 31, 2019 throughout this MD&A.

Bought Deal Equity Offering

On April 30, 2019, Granite completed an offering of 3,260,000 stapled units at a price of $61.50 per unit for gross proceeds of approximately $200.5 million. On April 26, 2019, the syndicate of underwriters elected, pursuant to the terms of the underwriting agreement in respect of the offering, to exercise its over-allotment option in full, resulting in the issuance of an additional 489,000 stapled units on April 30, 2019 for additional gross proceeds of $30.1 million. The aggregate gross proceeds raised pursuant to the offering, including the exercise of the over-allotment option (the "Offering"), were $230.6 million. The net proceeds received by Granite after deducting the underwriters' fees and the estimated expenses of the Offering were approximately $220.5 million. Subsequent to the Offering and as at May 7, 2019, Granite had 49,443,103 stapled units issued and outstanding.

Granite intends to use the net proceeds of the Offering (i) to partially fund the potential acquisition of two properties in Columbus, Ohio and Calgary, Alberta for total expected costs of $126.3 million (post-development of the Calgary property), (ii) to fund approximately $32 million of development costs associated with the Indiana development project and (iii) for general trust purposes.

Normal Course Issuer Bid

On May 7, 2019, the Board of Trustees/Directors approved the renewal of the normal course issuer bid which will be subject to customary regulatory approvals.

| | | Granite REIT 2019 First Quarter Report 7 |

Table of Contents

Foreign Currency Translation

The majority of Granite's investment properties are located in Europe and the United States and the cash flows derived from such properties are primarily denominated in Euros and US dollars. Accordingly, fluctuations in the Canadian dollar, Granite's reporting currency, relative to the Euro and US dollar will result in fluctuations in the reported values of revenues, expenses, cash flows, assets and liabilities. The most significant foreign currency exchange rates that impact Granite's business are summarized in the following table:

| | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | Average Exchange Rates | | Period End Exchange Rates | |

|---|

| | Three Months Ended March 31, | |

| |

| |

| |

|---|

| | March 31,

2019

| | December 31,

2018

| |

| |

|---|

| | 2019

| | 2018

| | Change

| | Change

| |

|---|

| | | | | | | | | | | | | | |

$ per €1.00 | | 1.509 | | 1.555 | | (3% | ) | 1.500 | | 1.563 | | (4% | ) |

$ per US$1.00 | | 1.329 | | 1.265 | | 5% | | 1.336 | | 1.364 | | (2% | ) |

| | | | | | | | | | | | | | |

For the three months ended March 31, 2019 compared to the prior year period, the average exchange rates of the Canadian dollar relative to the Euro and US dollar were lower and higher, respectively, which on a comparative basis, decreased the Canadian dollar equivalent of revenue and expenses from Granite's European operations and increased the Canadian dollar equivalent of revenue and expenses from Granite's US operations.

The period end exchange rates of the Canadian dollar relative to the Euro and US dollar on March 31, 2019 were lower when compared to the December 31, 2018 exchange rates. As a result, the Canadian dollar equivalent of assets and liabilities from Granite's European and US subsidiaries were lower when compared to December 31, 2018.

On a net basis, the effect of the changes in exchange rates on Granite's operating results for the three month period ended March 31, 2019 was as follows:

Effects of Changes in Exchange Rates on Operating Results

| | | | | |

| | | | |

For the three months ended March 31,

|

|

2019 vs 2018

|

|

|---|

| | | | |

(in millions, except per unit information) | | | | |

Increase in revenue | | | $ | 0.1 | |

Increase in NOI — cash basis | | | 0.1 | |

Increase in net income | | | 0.4 | |

Increase in FFO | | | 0.9 | |

Increase in AFFO | | | 0.7 | |

Increase in FFO per unit | | | $ | 0.02 | |

Increase in AFFO per unit | | | $ | 0.02 | |

| | | | |

| 8 Granite REIT 2019 First Quarter Report | | |

Table of Contents

Operating Results

Revenue

| | | | | | | | | | | | |

| | | | | | | | |

For the three months ended March 31,

|

|

2019

|

|

2018

|

|

$ change

|

|

|---|

| | | | | | | | |

Rental revenue | | $ | 55.8 | | | $ | 53.9 | | | 1.9 | |

Tenant recoveries | | 7.3 | | | 6.8 | | | 0.5 | |

Lease termination and close-out fees | | 0.3 | | | 1.0 | | | (0.7 | ) |

| | | | | | | | |

Revenue | | $ | 63.4 | | | $ | 61.7 | | | 1.7 | |

| | | | | | | | |

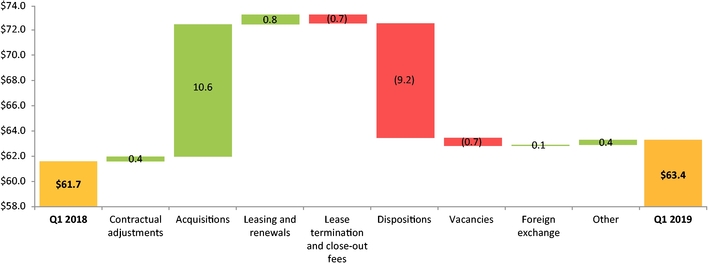

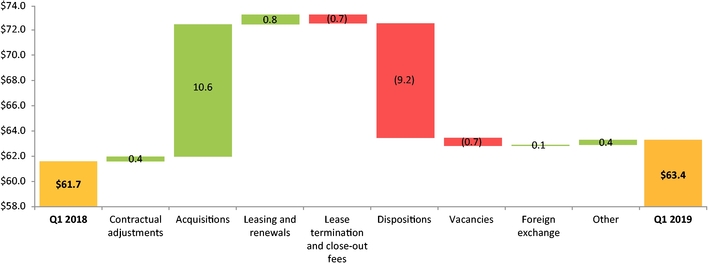

Revenue for the three month period ended March 31, 2019 increased $1.7 million to $63.4 million from $61.7 million in the prior year period. The components contributing to the change in revenue are detailed below:

Additional details pertaining to the components of the change in revenue are as follows:

- •

- contractual rent adjustments included $0.3 million from consumer price index based increases and $0.1 million from fixed contractual adjustments related to rent escalations;

- •

- the acquisitions of properties located in the United States and Germany during 2018 and 2019 increased revenue by $10.6 million, which included $1.1 million of tenant recoveries;

- •

- revenue increased by $0.8 million due to various renewal and re-leasing activities for properties primarily in Canada and the United States;

- •

- revenue decreased by $0.7 million as a result of a $1.0 million lease termination fee received in 2018 for an acquired property in the United States for which the leasable area was re-leased to a new tenant, partially offset by a $0.3 million lease close-out fee received in 2019 for a property in Canada that was recently vacated and sold;

| | | Granite REIT 2019 First Quarter Report 9 |

Table of Contents

- •

- the sale of 22 properties in Canada, the United States and Germany in 2018 and 2019 decreased revenue by $9.2 million of which $1.0 million related to a reduction in property tax and insurance tenant recoveries;

- •

- three lease expiries for properties in Canada and the United States resulted in vacancies that decreased revenue by $0.3 million and $0.4 million, respectively; and

- •

- foreign exchange had a net $0.1 million positive impact as the weakening of the Canadian dollar against the US dollar increased revenue by $0.9 million while the relative strengthening of the Canadian dollar against the Euro decreased revenue by $0.8 million.

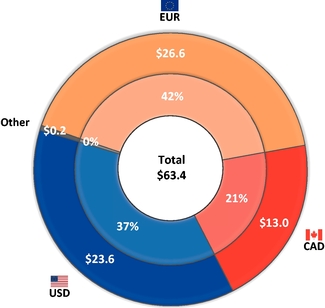

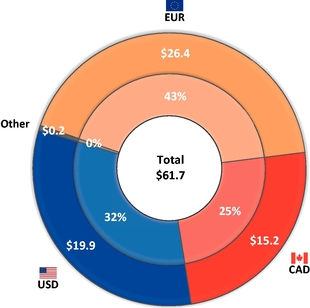

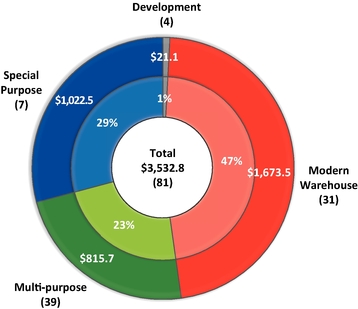

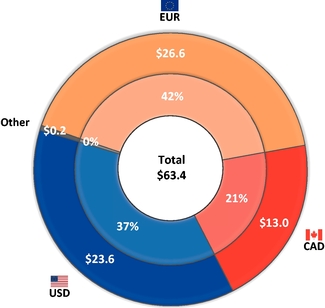

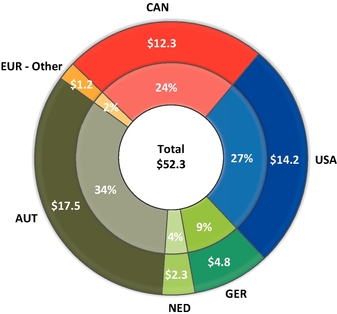

Revenue by major currency for the three months ended March 31, 2019 and 2018 was as follows:

| | |

First Quarter 2019

| | First Quarter 2018

|

|---|

|

|

|

The mix in revenue for the three months ended March 31, 2019 compared to the prior year period has changed primarily with revenue denominated in US dollars increasing and revenue denominated in Canadian dollars decreasing as a result of the recent US acquisitions and Canadian property dispositions.

As a majority of the Trust's revenue is denominated in currencies other than the Canadian dollar, Granite uses derivative financial instruments, including cross currency interest rate swaps and forward currency contracts, to partially hedge its exposure to foreign currencies and reduce the potential impact that foreign currency rate changes may have on Granite's operating results, cash flows and distributions.

Net Operating Income

Net operating income ("NOI") in the three months ended March 31, 2019 was $55.2 million compared to $53.8 million in the three months ended March 31, 2018. NOI — cash basis excludes the impact of lease termination and close-out fees, and straight-line rent and tenant incentive amortization and reflects the cash generated by the income-producing properties excluding lease termination and close-out fees on a period-over-period basis. NOI — cash basis was $55.1 million in the three months ended March 31, 2019 compared with $52.3 million in the prior year period.

| 10 Granite REIT 2019 First Quarter Report | | |

Table of Contents

Same property NOI — cash basis refers to the NOI — cash basis for those properties owned by Granite throughout the entire current and prior year periods under comparison. Same property NOI — cash basis excludes properties that were acquired, disposed of, classified as properties under or held for development or assets held for sale during the periods under comparison. Same property NOI — cash basis in the three months ended March 31, 2019 was $45.1 million compared to $43.4 million in the three months ended March 31, 2018. The changes in NOI, NOI — cash basis and same property NOI — cash basis are detailed below:

Changes in NOI(2), NOI — Cash Basis and Same Property NOI — Cash Basis

| | | | | | | | | | | | | | | |

| | | | | | | | | | |

| |

| | Three Months Ended

March 31, | |

| |

|---|

| | Sq ft(1)

(in millions)

| |

| |

|---|

| | 2019

| | 2018

| | $ change

| |

|---|

| | | | | | | | | | |

Revenue | | | | | $ | 63.4 | | | $ | 61.7 | | 1.7 | |

Less: Property operating costs | | | | | (8.2 | ) | | (7.9 | ) | (0.3 | ) |

| | | | | | | | | | |

NOI(2) | | | | | $ | 55.2 | | | $ | 53.8 | | 1.4 | |

Add (deduct): | | | | | | | | | | | |

Lease termination and close-out fees | | | | | (0.3 | ) | | (1.0 | ) | 0.7 | |

Straight-line rent amortization | | | | | (1.1 | ) | | (1.9 | ) | 0.8 | |

Tenant incentive amortization | | | | | 1.3 | | | 1.4 | | (0.1 | ) |

| | | | | | | | | | |

NOI — cash basis | | 32.8 | | | $ | 55.1 | | | $ | 52.3 | | 2.8 | |

Less NOI — cash basis for: | | | | | | | | | | | |

Acquisitions | | 7.3 | | | (8.9 | ) | | (0.1 | ) | (8.8 | ) |

Dispositions, assets held for sale and developments | | 1.5 | | | (1.1 | ) | | (8.8 | ) | 7.7 | |

| | | | | | | | | | |

Same property NOI — cash basis | | 25.5 | | | $ | 45.1 | | | $ | 43.4 | | 1.7 | |

| | | | | | | | | | |

- (1)

- The square footage relating to the NOI — cash basis represents GLA of 32.8 million square feet as at March 31, 2019. The square footage relating to the same property NOI — cash basis represents the aforementioned GLA excluding the impact from the acquisitions during the relevant periods.

- (2)

- NOI is calculated in accordance with IFRS and is included in the unaudited condensed combined financial statements as at and for the three months ended March 31, 2019. In the prior year period, Granite reported NOI as a non-IFRS financial measure, calculated as set forth above but excluding lease termination and close-out fee revenue. NOI for the quarter ended March 31, 2018 was previously reported as $52.8 million.

Property operating costs include recoverable and non-recoverable costs from tenants and consist of property taxes, utilities, insurance, repairs and maintenance, legal and other property-related expenses. None of Granite's employee compensation expenses are included in property operating costs.

Straight-line rent amortization represents the scheduled fixed rent changes or rent-free periods in leases that are recognized in revenue evenly on a straight-line basis over the term of the lease. Tenant incentive amortization mainly represents allowances provided to tenants that are recognized in revenue evenly on a straight-line basis over the term of the lease and primarily comprises the amortization associated with the cash allowance incentives paid to Magna in respect of the 10-year lease extensions exercised during the 2014 year at the Thondorf and Eurostar properties in Graz, Austria.

NOI — cash basis for the three month period ended March 31, 2019 increased $2.8 million to $55.1 million from $52.3 million in the prior year period largely as a result of the increase in rental revenue as noted previously as well as the reduction in straight-line rent amortization arising from rent-free periods in the prior year period associated with the partial lease-up of vacant space in Novi, Michigan.

| | | Granite REIT 2019 First Quarter Report 11 |

Table of Contents

Same property NOI — cash basis for the three month period ended March 31, 2019 increased $1.7 million (3.9%) to $45.1 million primarily due to the increase in contractual rents, partial lease-up of the property in Novi, Michigan, re-leasing and renewals of various leases for properties located in Canada, the United States and Germany and the favourable foreign exchange impact from the weakening of the Canadian dollar against the US dollar, partially offset by vacancies for properties in Canada and the United States and the unfavourable foreign exchange impact from the strengthening of the Canadian dollar against the Euro. Excluding the impact of foreign exchange, same property NOI — cash basis for the three month period ended March 31, 2019 would have increased by 4.8%.

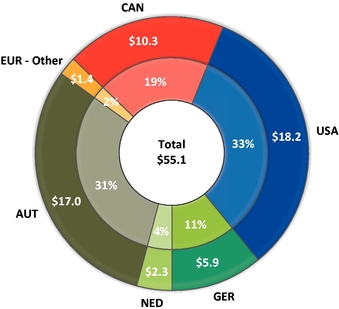

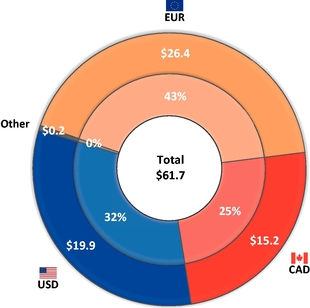

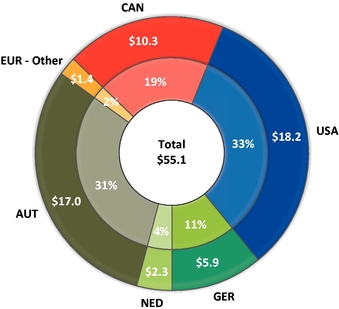

NOI — cash basis for the three month periods ended March 31, 2019 and 2018 by geography was as follows:

NOI — Cash Basis by Geography

| | |

First Quarter 2019

| | First Quarter 2018

|

|---|

|

|

|

The mix in NOI — cash basis for the three months ended March 31, 2019 compared to the prior year period has changed primarily with the percentage attributable to the United States increasing and Canada decreasing as a result of the recent US acquisitions and Canadian property dispositions.

Granite's property portfolio and NOI — cash basis are geographically diversified, which reduces the risk to Granite's operating results from any particular country's economic downturn.

General and Administrative Expenses

General and administrative expenses consisted of the following:

General and Administrative Expenses

| | | | | | | | | | | | | |

| | | | | | | | |

For the three months ended March 31,

|

|

2019

|

|

2018

|

|

$ change

|

|

|---|

| | | | | | | | |

Salaries and benefits | | | $ | 3.0 | | | $ | 4.5 | | | (1.5 | ) |

Audit, legal and consulting | | | 1.3 | | | 0.8 | | | 0.5 | |

Trustee/director fees and related expenses | | | 0.3 | | | 0.3 | | | — | |

Unit-based compensation including distributions and revaluations | | | 2.0 | | | 1.0 | | | 1.0 | |

Other public entity costs | | | 0.4 | | | 0.4 | | | — | |

Office rents including property taxes and common area maintenance costs | | | 0.1 | | | 0.2 | | | (0.1 | ) |

Other | | | 0.8 | | | 0.3 | | | 0.5 | |

| | | | | | | | |

General and administrative expenses | | | $ | 7.9 | | | $ | 7.5 | | | 0.4 | |

| | | | | | | | |

| 12 Granite REIT 2019 First Quarter Report | | |

Table of Contents

General and administrative expenses were $7.9 million for the three month period ended March 31, 2019 and increased $0.4 million in comparison to the prior year period primarily as a result of the following:

- •

- the increase in unit-based compensation costs mainly due to the increase in fair value remeasurement expense resulting from fluctuations in the market price of the Trust's stapled units. For the three months ended March 31, 2019 and 2018, general and administrative expenses included a fair value remeasurement expense of $1.2 million and $0.2 million, respectively, associated with the unit-based compensation plans;

- •

- an increase in audit, legal and consulting costs due to corporate advisory matters including internal reorganizations and administrative matters; and

- •

- an increase in other general and administrative expenses due to various factors, including, among other, recruitment costs for a senior member of management in Europe.

These increases were partially offset by:

- •

- a decrease in salaries and benefits expense mainly due to compensation costs incurred in the prior year period associated with Granite's former Chief Operating Officer.

Interest Income

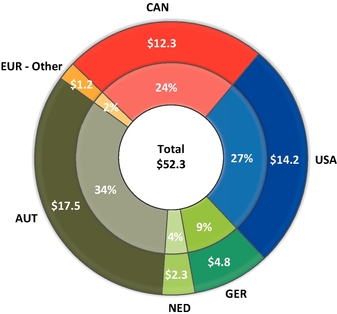

Interest income for the three month periods ended March 31, 2019 and 2018 was $2.9 million and $1.1 million, respectively. The $1.8 million increase is primarily due to interest income earned from higher cash balances resulting from the proceeds from property dispositions and drawdowns from the term loans in December 2018.

Interest Expense and Other Financing Costs

Interest expense and other financing costs for the three month periods ended March 31, 2019 and 2018 were $7.6 million and $5.5 million, respectively. The $2.1 million increase is largely due to interest expense associated with the term loan drawdowns in December 2018, partially offset by the higher interest expense associated with credit facility draws in the prior year period.

As at March 31, 2019, Granite's weighted average cost of interest-bearing debt was 2.18% (March 31, 2018 — 2.53%) and the weighted average debt term-to-maturity was 4.5 years (March 31, 2018 — 4.7 years).

Foreign Exchange Gains/Losses, Net

Granite recognized net foreign exchange losses of $0.5 million and foreign exchange gains of $11.4 million in the three month periods ended March 31, 2019 and 2018, respectively. The $11.9 million increase in net foreign exchange losses is substantially due to the foreign exchange gain recognized in the prior year period relating to the remeasurement of the US dollar cash proceeds received from the sale of three investment properties in January 2018 and, to a lesser extent, the net remeasurement of certain monetary assets of the Trust that are denominated in US dollars or Euros.

| | | Granite REIT 2019 First Quarter Report 13 |

Table of Contents

Fair Value Gains/Losses on Investment Properties, Net

Net fair value gains on investment properties were $50.5 million and $32.3 million in the three month periods ended March 31, 2019 and 2018, respectively. In the three month period ended March 31, 2019, net fair value gains of $50.5 million were attributable to various factors including (i) a compression in terminal capitalization rates for properties located in Austria resulting from the continued market demand for industrial real estate properties, (ii) the positive changes in leasing assumptions associated with lease renewals and fair market rent increases for certain properties located in Canada and (iii) the increase in fair value for the multi-purpose properties classified as assets held for sale in the first quarter of 2019.

The net fair value gains on investment properties in the three month period ended March 31, 2018 of $32.3 million were attributable to several factors, and, in particular, to (i) favourable changes in leasing assumptions from lease renewals at multi-purpose properties located in Canada and Europe, (ii) a compression in discount and terminal capitalization rates for certain multi-purpose properties primarily located in Germany resulting from market demand which led to improved asset pricing and (iii) positive changes in leasing assumptions relating to the contractual rent increases at certain special purpose properties.

Acquisition Transaction Costs

Acquisition transaction costs for the three month period ended March 31, 2019 were $0.4 million compared to $0.2 million for the prior year period. Acquisition transaction costs primarily include land transfer tax, legal and advisory costs associated with completed acquisitions and, to a lesser extent, legal and advisory costs associated with pursuing acquisition opportunities that were not completed. The increase in acquisition transaction costs for the current year period is due to greater overall acquisition activity.

Loss on Sale of Investment Properties

The loss on sale of investment properties for the three month period ended March 31, 2019 was $0.7 million compared to $1.1 million for the prior year period. Loss on sale of investment properties is related to broker commissions and legal and advisory costs associated with the dispositions or planned dispositions of assets held for sale.

| 14 Granite REIT 2019 First Quarter Report | | |

Table of Contents

Income Tax Expense

Income tax expense comprised the following:

| | | | | | | | | | | |

| | | | | | | | |

For the three months ended March 31,

| | 2019

| | 2018

| | $ change

| |

|---|

| | | | | | | | |

Foreign operations | | $ | 1.5 | | $ | 1.6 | | | (0.1 | ) |

Other | | 0.4 | | 0.4 | | | — | |

| | | | | | | | |

Current tax expense | | 1.9 | | 2.0 | | | (0.1 | ) |

Deferred tax expense | | 10.9 | | 8.0 | | | 2.9 | |

| | | | | | | | |

Income tax expense | | $ | 12.8 | | $ | 10.0 | | | 2.8 | |

| | | | | | | | |

For the three months ended March 31, 2019, the current tax expense decreased compared to the prior year period primarily due to the foreign exchange impact resulting from the relative strengthening of the Canadian dollar on Euro denominated tax expense.

The increase in deferred tax expense for the three months ended March 31, 2019 compared to the prior year period was primarily due to an increase in fair value gains in jurisdictions in which deferred taxes are recorded.

Net Income Attributable to Stapled Unitholders

For the three month period ended March 31, 2019, net income attributable to stapled unitholders was $78.3 million compared to $72.4 million in the prior year period. The $5.9 million net increase was primarily due to an $18.2 million increase in net fair value gains on investment properties, partially offset by an $11.9 million increase in net foreign exchange losses. The $5.9 million increase in net income attributable to stapled unitholders is summarized below:

Change in Net Income Attributable to Stapled Unitholders

| | | Granite REIT 2019 First Quarter Report 15 |

Table of Contents

Funds From Operations and Adjusted Funds From Operations

The reconciliation of net income attributable to stapled unitholders to FFO and AFFO for the three months ended March 31, 2019 and 2018 is presented below:

FFO and AFFO Reconciliation

| | | | | | | | | |

| | | | | | | | |

For the three months ended March 31,

| |

| | 2019

| | 2018

| |

|---|

| | | | | | | | |

(in millions, except per unit information) | | | | | | | |

Net income attributable to stapled unitholders | | | |

$ |

78.3 | |

$ |

72.4 | |

Add (deduct): | | | | | | | |

Fair value gains on investment properties, net | | | | (50.5 | ) | (32.3 | ) |

Fair value losses on financial instruments | | | | 0.1 | | 1.9 | |

Acquisition transaction costs | | | | 0.4 | | 0.2 | |

Loss on sale of investment properties | | | | 0.7 | | 1.1 | |

Deferred income tax expense | | | | 10.9 | | 8.0 | |

Fair value remeasurement expense relating to the Executive Deferred Stapled Unit Plan(1) | | | | 0.7 | | — | |

Non-controlling interests relating to the above | | | | 0.1 | | — | |

| | | | | | | | |

FFO | | [A] | | $ | 40.7 | | $ | 51.3 | |

Add (deduct): | | | | | | | |

Maintenance or improvement capital expenditures paid | | | | (1.2 | ) | (8.8 | ) |

Leasing commissions paid | | | | (0.2 | ) | (1.8 | ) |

Tenant incentives paid | | | | (0.2 | ) | (9.1 | ) |

Tenant incentive amortization | | | | 1.3 | | 1.4 | |

Straight-line rent amortization | | | | (1.1 | ) | (1.9 | ) |

| | | | | | | | |

AFFO | | [B] | | $ | 39.3 | | $ | 31.1 | |

| | | | | | | | |

Per unit amounts: | | | |

| |

| |

Basic and Diluted FFO per stapled unit | | [A]/[C] | | $ | 0.89 | | $ | 1.11 | |

Basic and Diluted AFFO per stapled unit | | [B]/[C] | | $ | 0.86 | | $ | 0.67 | |

Basic and Diluted weighted average number of stapled units | | [C] | |

45.7 | |

46.3 | |

| | | | | | | | |

- (1)

- The Executive Deferred Stapled Unit Plan provides equity-based compensation in the form of stapled units to executives and other employees. It is anticipated that the fair value remeasurement relating to the Executive Deferred Stapled Unit Plan will fluctuate and have a greater impact on FFO and AFFO going forward and has, therefore, been adjusted in FFO and AFFO in accordance with the REALPAC White Paper. The comparative amount was not adjusted as it was not significant in the prior year period and the year 2018.

| 16 Granite REIT 2019 First Quarter Report | | |

Table of Contents

Funds From Operations

FFO for the three month period ended March 31, 2019 was $40.7 million ($0.89 per unit) compared to $51.3 million ($1.11 per unit) in the prior year period. The $10.6 million decrease in FFO is summarized below:

FFO for the three months ended March 31, 2019 was $40.7 million ($0.89 per unit). In comparison, excluding the foreign exchange gain on the remeasurement of US dollar cash proceeds from the sale of investment properties in January 2018 of $10.4 million ($0.23 per unit), FFO would have been $40.9 million ($0.88 per unit) in the prior year period.

Adjusted Funds From Operations

As previously detailed in the FFO and AFFO reconciliation table, AFFO for the three month period ended March 31, 2019 was $39.3 million ($0.86 per unit) compared to $31.1 million ($0.67 per unit) in the prior year period. The $8.2 million ($0.19 per unit) increase in AFFO is summarized below:

| | | Granite REIT 2019 First Quarter Report 17 |

Table of Contents

Additional details pertaining to the components of the change in AFFO are as follows:

- •

- the $10.6 million decrease in FFO, as noted previously, partially offset by;

- •

- a $7.6 million decrease in capital expenditures paid largely due to higher payments made in the prior year period relating to an improvement project at a property in Novi, Michigan;

- •

- a $1.6 million decrease in leasing commissions paid primarily due to payments made in the prior year period relating to the developed property in Poland, the partially leased-up property in Novi, Michigan, as well as the early renewal and extension of a lease for a property in the United States;

- •

- an $8.9 million decrease in tenant incentives paid largely due to a 2018 payment relating to a tenant allowance for a 2014 lease extension at the Eurostar facility in Graz, Austria; and

- •

- a $0.8 million increase in AFFO from straight-line rent amortization, primarily from rent-free periods in the prior year period associated with the partial lease-up of vacant space in Novi, Michigan.

AFFO for the three month period ended March 31, 2019 was $39.3 million ($0.86 per unit). In comparison, excluding the foreign exchange gain on the remeasurement of US dollar cash proceeds from the sale of investment properties in January 2018 of $10.4 million ($0.23 per unit) and the payment of the tenant incentive allowance made in connection with a 2014 lease extension at the Eurostar facility in Graz, Austria of $9.1 million ($0.19 per unit), AFFO would have been $29.8 million ($0.63 per unit) in the prior year period.

Granite's investment properties consist of income-producing properties, properties under development and land held for development. Substantially all of the income-producing properties are for industrial use and can be categorized as (i) modern logistics/distribution warehouse facilities ("modern warehouse facilities"), which were recently acquired or newly developed/redeveloped, (ii) multi-purpose facilities, which are tenantable by a wide variety of potential users or (iii) special purpose properties designed and built with specialized features and leased to Magna. The attributes of the income-producing properties are versatile and are based on the needs of the tenant such that an industrial property used by a certain tenant for light or heavy manufacturing can be used by another tenant for other industrial uses after some retrofitting if necessary. Accordingly, the investment property portfolio is substantially for industrial use and, as such, Granite determined that its asset class comprises industrial properties for purposes of financial reporting. The fair value of the industrial properties, as noted below, is based upon the current tenanting, existing use and attributes of such properties.

Properties under development comprise (i) a 15-acre site in Altbach, Germany where the demolition of the property is substantially complete and construction of a 0.3 million square foot distribution/light industrial facility is expected to commence in the third quarter of 2019, subject to receipt of all required permits and state approval, and (ii) an approximately 30-acre parcel of development land in Plainfield, Indiana. The development in Plainfield, Indiana will be a class A warehouse of approximately 0.5 million square feet of gross leasable area and the total project costs, excluding land, are estimated to be approximately $32 million. Granite has obtained its development plan approval and, subject to receipt of all required permits, construction is currently expected to commence in the second quarter of 2019 with shell construction to be substantially completed by the first quarter of 2020.

Land held for development comprise a 16-acre parcel of land located in Wroclaw, Poland that could provide for approximately 0.3 million square feet of logistics-warehouse space as well as 12.9 acres of development land in Ohio, United States that was recently acquired.

| 18 Granite REIT 2019 First Quarter Report | | |

Table of Contents

Summary attributes of the investment properties as at March 31, 2019 and December 31, 2018 were as follows:

Investment Properties Summary(1)

| | | | | | | |

| | | | | | |

As at March 31, 2019 and December 31, 2018

|

|

2019

|

|

2018

|

|

|---|

| | | | | | |

(in millions, except as noted) | | | | | |

Investment properties — fair value | | $ | 3,532.8 | | $ | 3,425.0 | |

Income-producing properties | | 3,511.7 | | 3,404.0 | |

Properties under development | | 17.3 | | 17.0 | |

Land held for development | | 3.8 | | 4.0 | |

Overall capitalization rate | | 6.5% | | 6.7% | |

Number of investment properties | |

81 | |

84 | |

Income-producing properties | | 77 | | 80 | |

Properties under development | | 2 | | 2 | |

Land held for development | | 2 | | 2 | |

Property metrics | |

| |

| |

GLA, square feet | | 32.8 | | 32.2 | |

Occupancy, by GLA | | 98.8% | | 99.1% | |

Weighted average lease term, in years by square footage | | 6.1 | | 6.0 | |

Total number of tenants | | 49 | | 48 | |

Magna as a percentage of annualized revenue(2) | | 51% | | 54% | |

Magna as a percentage of GLA | | 43% | | 47% | |

| | | | | | |

| | | | | | | | | |

| | | | | | |

As at March 31, 2019 and December 31, 2018

|

|

2019

|

|

2018

|

|

|---|

| | | | | | |

(in millions, except as noted) | | | | | | | |

Assets held for sale | | | | | | | |

Fair value | | | $ | 38.7 | | | $ | 44.2 | |

Number of properties | | | 5 | | | 6 | |

GLA, square feet | | | 0.7 | | | 0.7 | |

Magna as a percentage of GLA | | | 100% | | | 94% | |

Annualized revenue(2) | | | $ | 3.6 | | | $ | 2.2 | |

| | | | | | |

- (1)

- Assets held for sale are excluded from investment properties and related property metrics. Accordingly, five such assets that were held for sale as at March 31, 2019 and six such assets that were held for sale as at December 31, 2018 were excluded from investment properties and related property metrics as at March 31, 2019 and December 31, 2018, respectively, throughout this MD&A.

- (2)

- Annualized revenue for each period presented is calculated as rental revenue excluding tenant recoveries, recognized in accordance with IFRS, in the reported month multiplied by 12 months.

| | | Granite REIT 2019 First Quarter Report 19 |

Table of Contents

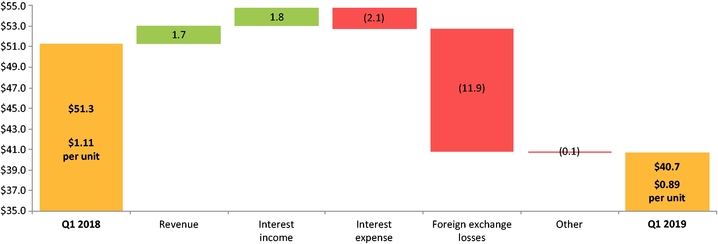

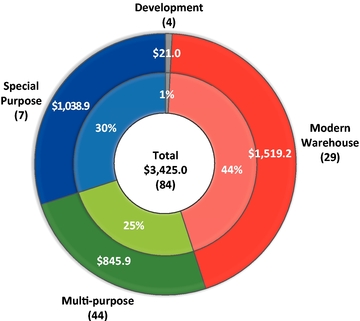

The fair value of the investment properties by asset category as at March 31, 2019 and December 31, 2018 was as follows:

Fair Value of Investment Properties by Asset Category(1)

| | |

March 31, 2019

| | December 31, 2018

|

- (1)

- Number of properties denoted in parentheses

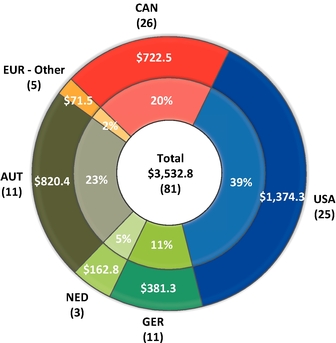

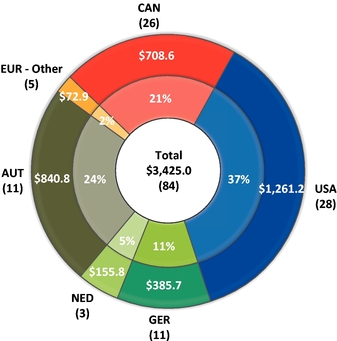

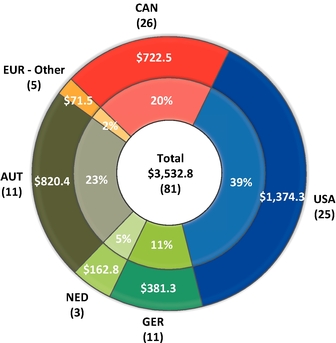

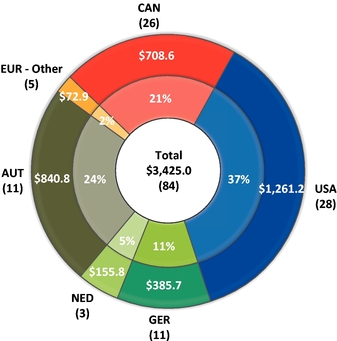

Granite has a specialized and high quality global portfolio of large scale properties strategically located in Canada, the United States and Europe. The fair value of the investment properties by country as at March 31, 2019 and December 31, 2018 was as follows:

Fair Value of Investment Properties by Geography(1)

| | |

March 31, 2019

| | December 31, 2018

|

- (1)

- Number of properties denoted in parentheses

| 20 Granite REIT 2019 First Quarter Report | | |

Table of Contents

The change in the fair value of investment properties by asset category during the three months ended March 31, 2019 was as follows:

Change in Fair Value of Investment Properties by Asset Category

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | January 1, 2019 | |

| |

| |

| |

| |

| |

| | March 31,

2019 | |

|---|

| | Investment

properties

| | Ground

leases

| | Fair value

gains

| | Acquisitions

| | Capital

expenditures

| | Foreign

exchange

losses

| | Other

changes

| | Classified as

assets held

for sale

| | Investment

properties

| |

|---|

| | | | | | | | | | | | | | | | | | | | |

Modern warehouse facilities | | | $ | 1,519.2 | | | 11.8 | | | 12.3 | | | 164.2 | | | 3.3 | | | (38.6 | ) | | 1.3 | | | — | | | $ | 1,673.5 | |

Multi-purpose facilities | | | 845.9 | | | — | | | 21.3 | | | — | | | 0.6 | | | (13.4 | ) | | — | | | (38.7 | ) | | 815.7 | |

Special purpose properties | | | 1,038.9 | | | — | | | 16.6 | | | — | | | — | | | (31.8 | ) | | (1.2 | ) | | — | | | 1,022.5 | |

| | | | | | | | | | | | | | | | | | | | |

Income-Producing Properties | | | 3,404.0 | | | 11.8 | | | 50.2 | | | 164.2 | | | 3.9 | | | (83.8 | ) | | 0.1 | | | (38.7 | ) | | 3,511.7 | |

Properties Under Development | | | 17.0 | | | — | | | — | | | — | | | 0.9 | | | (0.6 | ) | | — | | | — | | | 17.3 | |

Land Held For Development | | | 4.0 | | | — | | | — | | | — | | | — | | | (0.2 | ) | | — | | | — | | | 3.8 | |

| | | | | | | | | | | | | | | | | | | | |

| | | $ | 3,425.0 | | | $ | 11.8 | | | $ | 50.2 | | | $ | 164.2 | | | $ | 4.8 | | | $ | (84.6 | ) | | $ | 0.1 | | | $ | (38.7 | ) | | $ | 3,532.8 | |

| | | | | | | | | | | | | | | | | | | | |

During the three months ended March 31, 2019, the fair value of investment properties increased by $107.8 million, primarily due to:

- •

- the recognition of ground leases effective January 1, 2019 under IFRS 16,Leases has increased the fair value of investment properties by $11.8 million, consisting of $9.1 million in Botlek, Netherlands and $2.7 million in Soest, Germany (see "NEW ACCOUNTING PRONOUNCEMENTS AND DEVELOPMENTS"). The obligations for these two land leases have been recorded on the combined balance sheet with the right-of-use assets recorded in investment properties;

- •

- net fair value gains of $50.2 million which were attributable to various factors including (i) a compression in terminal capitalization rates for properties located in Austria resulting from the continued market demand for industrial real estate properties, (ii) the positive changes in leasing assumptions associated with lease renewals and fair market rent increases for certain properties located in Canada and (iii) the increase in fair value for the multi-purpose properties classified as assets held for sale in the first quarter of 2019;

- •

- the acquisition of two income-producing properties in Texas, United States for $164.2 million (see "SIGNIFICANT MATTERS"); and

- •

- capital expenditures of $4.8 million, of which $3.0 million related to the construction of a 0.3 million square foot recently completed expansion at an acquired property near Columbus, Ohio, $0.9 million related to development capital expenditures for two properties under construction in Altbach, Germany and Indiana, United States and $0.6 million related to improvement capital expenditures for a multi-purpose property located in Michigan, United States. Capital expenditures can include expansion or development expenditures and maintenance or improvement expenditures. Expansion or development capital expenditures are discretionary in nature and are incurred to generate new revenue streams and/or increase the productivity of a property. Maintenance or improvement capital expenditures relate to sustaining the existing earnings capacity of a property.

| | | Granite REIT 2019 First Quarter Report 21 |

Table of Contents

Fair values were primarily determined by discounting the expected future cash flows, generally over a term of 10 years, plus a terminal value based on the application of a capitalization rate to estimated year 11 cash flows. Granite measures its investment properties using valuations prepared by management. Granite does not measure its investment properties based on valuations prepared by external appraisers but uses such external appraisals as data points, together with other external market information accumulated by management, in arriving at its own conclusions on values. Management uses valuation assumptions such as discount rates, terminal capitalization rates and market rental rates applied in external appraisals or sourced from valuation experts; however, the Trust also uses its historical renewal experience with tenants, its direct knowledge of the specialized nature of Granite's portfolio and tenant profile and its knowledge of the actual condition of the properties in making business judgments about lease renewal probabilities, renewal rents and capital expenditures. There has been no change in the valuation methodology used during the three month period ended March 31, 2019. The key valuation metrics for Granite's investment properties including the discount and terminal capitalization rates by jurisdiction are summarized in note 4 to the unaudited condensed combined financial statements for the three month period ended March 31, 2019. In addition, valuation metrics for Granite's income-producing properties (excluding assets held for sale) by asset category as at March 31, 2019 and December 31, 2018 were as follows:

Valuation Metrics by Income-Producing Property Asset Category

| | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | Modern

warehouse

facilities | | Multi-purpose

facilities | | Special

purpose

properties | |

| |

| |

|---|

| | Total | |

|---|

As at March 31, 2019 and December 31, 2018

| |

|---|

| | 2019

| | 2018

| | 2019

| | 2018

| | 2019

| | 2018

| | 2019

| | 2018

| |

|---|

| | | | | | | | | | | | | | | | | | |

Overall capitalization rate(1)(2) | | 5.62% | | 5.66% | | 6.84% | | 7.06% | | 7.63% | | 7.77% | | 6.51% | | 6.65% | |

Terminal capitalization rate(1) | | 6.27% | | 6.25% | | 6.77% | | 6.95% | | 7.22% | | 7.50% | | 6.68% | | 6.81% | |

Discount rate(1) | | 6.28% | | 6.34% | | 6.82% | | 7.02% | | 7.66% | | 7.63% | | 6.81% | | 6.90% | |

| | | | | | | | | | | | | | | | | | |

- (1)

- Weighted based on income-producing property fair value.

- (2)

- Overall capitalization rate is calculated as stabilized net operating income (property revenue less property expenses) divided by the fair value of the property.

| 22 Granite REIT 2019 First Quarter Report | | |

Table of Contents

A sensitivity analysis of the fair value of income-producing properties to changes in the overall capitalization rate, terminal capitalization rate and discount rate at March 31, 2019 is presented below:

Sensitivity Analysis of Fair Value of Income-Producing Properties

| | | | | | | | | | | | | |

| | | | | | | | |

Rate sensitivity

| | Overall capitalization rate

| | Terminal capitalization rate

| | Discount rate

| |

|---|

| | | | | | | | |

+50 bps | | | 3,251.2 | | | 3,379.1 | | | 3,382.6 | |

+25 bps | | | 3,376.2 | | | 3,442.8 | | | 3,446.3 | |

| | | | | | | | |

Base rate | | | $ | 3,511.7 | | | $ | 3,511.7 | | | $ | 3,511.7 | |

| | | | | | | | |

-25 bps | | | 3,659.0 | | | 3,585.7 | | | 3,578.6 | |

-50 bps | | | 3,820.1 | | | 3,666.3 | | | 3,647.2 | |

| | | | | | | | |

Maintenance or Improvement Capital Expenditures and Leasing Costs

Maintenance or improvement capital expenditures relate to sustaining the existing earnings capacity of the property portfolio. Leasing costs include direct leasing costs and lease incentives. Direct leasing costs include broker commissions incurred in negotiating and arranging tenant leases. Lease incentives include the cost of leasehold improvements to tenant spaces and/or cash allowances provided to tenants for leasehold improvement costs.

Maintenance or Improvement Capital Expenditures and Leasing Costs Paid

The maintenance or improvement capital expenditures and leasing costs paid by quarter for the trailing eight quarters were as follows:

Maintenance or Improvement Capital Expenditures and Leasing Costs Paid

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| |

| | Q2'17

| | Q3'17

| | Q4'17

| | Q1'18

| | Q2'18

| | Q3'18

| | Q4'18

| | Q1'19

| |

|---|

| | | | | | | | | | | | | | | | | | | | |

Maintenance or improvement capital expenditures paid | | | | | $ | 0.3 | | | $ | 0.6 | | | $ | 9.3 | | | $ | 8.8 | | | $ | 6.2 | | | $ | 1.6 | | | $ | 1.2 | | | $ | 1.2 | | |

Leasing costs paid | | | | | 0.3 | | | 1.6 | | | 1.4 | | | 10.8 | | | 2.4 | | | 0.5 | | | 0.4 | | | 0.4 | | |

| | | | | | | | | | | | | | | | | | | | |

Total paid | | [A] | | | $ | 0.6 | | | $ | 2.2 | | | $ | 10.7 | | | $ | 19.6 | | | $ | 8.6 | | | $ | 2.1 | | | $ | 1.6 | | | $ | 1.6 | | |

GLA, square feet | | [B] | | | 30.2 | | | 30.2 | | | 29.1 | | | 29.7 | | | 31.8 | | | 32.5 | | | 32.2 | | | 32.8 | | |

$ paid per square feet | | [A]/[B] | | $0.02 | | $0.07 | | $0.37 | | $0.66 | | $0.27 | | $0.06 | | $0.05 | | $0.05 | |

| | | | | | | | | | | | | | | | | | | | |

In the first quarter of 2018, Granite paid $9.1 million related to a tenant incentive allowance for a 2014 lease extension at the 1.1 million square foot Eurostar facility in Graz, Austria.

Commencing with the third quarter of 2017, Granite undertook to re-develop its Novi, MI property which was vacated by Magna in March 2017. Granite leased 71% of the space to Hanon Systems for a minimum lease term of 15 years commencing in January 2018. The 0.3 million square foot facility is one of the very few office properties in Granite's portfolio.

| | | Granite REIT 2019 First Quarter Report 23 |

Table of Contents

Granite has invested a total of $23.3 million in capital commencing 2017 to reposition and lease the Novi, MI flex office property. The following is a summary of the capital expenditures and leasing costs paid by quarter in connection with the Novi, MI property:

Novi, MI Property: Maintenance or Improvement Capital Expenditures and Leasing Costs Paid

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | |

| | Q2'17

| | Q3'17

| | Q4'17

| | Q1'18

| | Q2'18

| | Q3'18

| | Q4'18

| | Q1'19

| |

|---|

| | | | | | | | | | | | | | | | | | |

Maintenance or improvement capital expenditures paid | | | — | | | $ | 0.1 | | | $ | 8.0 | | | $ | 8.4 | | | $ | 3.2 | | | $ | 0.1 | | | $ | 0.5 | | | $ | 0.6 | | |

Leasing costs paid | | | — | | | 1.2 | | | 1.0 | | | 0.2 | | | — | | | — | | | — | | | — | | |

| | | | | | | | | | | | | | | | | | |

Total paid | | | — | | | $ | 1.3 | | | $ | 9.0 | | | $ | 8.6 | | | $ | 3.2 | | | $ | 0.1 | | | $ | 0.5 | | | $ | 0.6 | | |

| | | | | | | | | | | | | | | | | | |

Granite is actively marketing the remaining 0.1 million square feet of available space and anticipates incurring additional cash outflows totaling approximately $5.9 million in capital expenditures and leasing costs during 2019 to complete the Novi, MI facility and lease-up of the remaining available space.

Excluding the non-recurring or unusual items noted above for the Graz, Austria and Novi, MI properties, the maintenance or improvement capital expenditures and leasing costs paid by quarter for the trailing eight quarters were as follows:

Maintenance or Improvement Capital Expenditures and Leasing Costs Paid — Excluding Novi, MI and Graz, Austria

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| |

| | Q2'17

| | Q3'17

| | Q4'17

| | Q1'18

| | Q2'18

| | Q3'18

| | Q4'18

| | Q1'19

| |

|---|

| | | | | | | | | | | | | | | | | | | | |

Maintenance or improvement capital expenditures paid | | | | | $ | 0.3 | | | | $ | 0.5 | | | | $ | 1.3 | | | | $ | 0.4 | | | | $ | 3.0 | | | | $ | 1.5 | | | | $ | 0.7 | | | | $ | 0.6 | | |

Leasing costs paid | | | | | 0.3 | | | | 0.4 | | | | 0.4 | | | | 1.5 | | | | 2.4 | | | | 0.5 | | | | 0.4 | | | | 0.4 | | |

| | | | | | | | | | | | | | | | | | | | |

Total paid | | [C] | | | $ | 0.6 | | | | $ | 0.9 | | | | $ | 1.7 | | | | $ | 1.9 | | | | $ | 5.4 | | | | $ | 2.0 | | | | $ | 1.1 | | | | $ | 1.0 | | |

GLA, square feet | | [D] | | | 30.2 | | | | 29.9 | | | | 28.8 | | | | 29.4 | | | | 31.5 | | | | 32.2 | | | | 31.9 | | | | 32.5 | | |

$ paid per square feet | | [C]/[D] | | | $ | 0.02 | | | | $ | 0.03 | | | | $ | 0.06 | | | | $ | 0.06 | | | | $ | 0.17 | | | | $ | 0.06 | | | | $ | 0.03 | | | | $ | 0.03 | | |

| | | | | | | | | | | | | | | | | | | | |

Leasing Profile

Magna, Granite's Largest Tenant

At March 31, 2019, Magna International Inc. or one of its operating subsidiaries was the tenant at 36 (December 31, 2018 — 41) of Granite's income-producing properties and comprised 51% (December 31, 2018 — 54%) of Granite's annualized revenue and 43% (December 31, 2018 — 47%) of Granite's GLA. According to its public disclosure, Magna International Inc. has a credit rating of A3 with a stable outlook by Moody's Investor Service, A- with a stable outlook by Standard & Poor's and A(low) with a stable outlook by DBRS Limited. Magna International Inc. is a technology company and a global automotive supplier with international manufacturing operations and product development, engineering and sales centres. Its capabilities include body exteriors and structures, power and vision technologies, seating systems and complete vehicle solutions.

Granite's relationship with Magna is an arm's length landlord and tenant relationship governed by the terms of Granite's leases. Granite's properties are generally leased to operating subsidiaries of Magna International Inc. and are not guaranteed by the parent company; however, Magna International Inc. is the

| 24 Granite REIT 2019 First Quarter Report | | |

Table of Contents

tenant under certain of Granite's leases. The terms of the lease arrangements with Magna generally provide for the following:

- •

- the obligation of Magna to pay for costs of occupancy, including operating costs, property taxes and maintenance and repair costs;

- •

- rent escalations based on either fixed-rate steps or inflation;

- •

- renewal options tied to market rental rates or inflation;

- •

- environmental indemnities from the tenant; and

- •

- a right of first refusal in favour of Magna on the sale of a property.

Renewal terms, rates and conditions are typically set out in Granite's leases with Magna and form the basis for tenancies that continue beyond the expiries of the initial lease terms.

According to its public disclosure, Magna's success is primarily dependent upon the levels of North American, European and Chinese car and light truck production by Magna's customers. Granite expects Magna to continuously seek to optimize its global manufacturing footprint and consequently, Magna may or may not renew leases for facilities currently under lease at their expiries.

Other Tenants

In addition to Magna, at March 31, 2019, Granite had 48 other tenants from various industries that in aggregate comprised 49% of the Trust's annualized revenue. Each of these tenants accounted for less than 4% of the Trust's annualized revenue as at March 31, 2019.

Granite's top 10 tenants by annualized revenue at March 31, 2019 are summarized in the table below:

| | | | | | | | |

| | | | | | | | | |

Tenant

| | Annualized Revenue %

| | GLA %

| | WALT (years)

| | Credit Rating(1)(2)

|

|---|

| | | | | | | | | |

Magna | | 51% | | 43% | | 5.9 | | A(low) |

ADESA | | 4% | | 1% | | 10.3 | | BB(low) |

Restoration Hardware | | 3% | | 4% | | 9.1 | | NR |

Ingram Micro | | 3% | | 3% | | 5.8 | | BBB(low) |

Mars Petcare | | 2% | | 4% | | 3.1 | | NR |

Hanon Systems | | 2% | | 1% | | 13.8 | | AA |

Ricoh | | 2% | | 2% | | 6.2 | | BBB(high) |

Grupo Antolin | | 2% | | 3% | | 9.5 | | B(high) |

Samsung | | 2% | | 2% | | 3.0 | | AA(low) |

Ace Hardware | | 2% | | 2% | | 10.8 | | NR |

| | | | | | | | | |

Top 10 Tenants | | 73% | | 65% | | 6.3 | | |

| | | | | | | | | |

- (1)

- Credit rating is quoted on the DBRS equivalent rating scale where publicly available. NR refers to Not Rated.

- (2)

- The credit rating indicated above may, in some instances, apply to an affiliated company of Granite's tenant which may not be the guarantor of the lease.

| | | Granite REIT 2019 First Quarter Report 25 |

Table of Contents

Lease Expiration

As at March 31, 2019, Granite's portfolio had a weighted average lease term by square footage of 6.1 years (December 31, 2018 — 6.0 years) with lease expiries by GLA (in thousands of square feet), lease count and annualized revenue (calculated as rental revenue excluding tenant recoveries, recognized in accordance with IFRS, in March 2019 multiplied by 12 months, in millions) as set out in the table below:

| | | | |

| | | | | |

| |

Lease Maturity Summary

|

| |

| | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| |

| |

| |

| | Vacancies | | 2019 | | 2020 | | 2021 | | 2022 | | 2023 | | 2024 | | 2025 and Beyond | |

|---|

| |

| | Total

Lease

Count

| | Total

Annualized

Revenue $

| |

|---|

Country

| | Total GLA

| | Sq Ft

| | Sq Ft

| | Annualized

Revenue $

| | Sq Ft

| | Annualized

Revenue $

| | Sq Ft

| | Annualized

Revenue $

| | Sq Ft

| | Annualized

Revenue $

| | Sq Ft

| | Annualized

Revenue $

| | Sq Ft

| | Annualized

Revenue $

| | Sq Ft

| | Annualized

Revenue $

| |

|---|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Canada | | 5,215 | | 25 | | 40.8 | | 145 | | 85 | | 0.8 | | 590 | | 3.3 | | 316 | | 2.9 | | 347 | | 2.9 | | 594 | | 3.7 | | 934 | | 6.8 | | 2,204 | | 20.4 | |

United States | | 14,551 | | 37 | | 86.0 | | 241 | | 711 | | 3.6 | | 370 | | 2.7 | | 87 | | 0.7 | | 2,591 | | 12.3 | | 2,731 | | 13.9 | | 1,434 | | 8.2 | | 6,386 | | 44.6 | |

Austria | | 8,101 | | 12 | | 63.0 | | — | | — | | — | | 101 | | 0.6 | | 389 | | 2.7 | | 802 | | 9.6 | | 125 | | 1.2 | | 5,349 | | 38.3 | | 1,335 | | 10.6 | |

Germany | | 3,504 | | 11 | | 24.8 | | — | | — | | — | | 195 | | 1.4 | | 548 | | 3.7 | | 283 | | 2.2 | | 1,947 | | 14.1 | | — | | — | | 531 | | 3.4 | |

Netherlands | | 1,441 | | 3 | | 9.5 | | — | | — | | — | | — | | — | | — | | — | | — | | — | | 314 | | 2.2 | | — | | — | | 1,127 | | 7.3 | |

Other | | 751 | | 8 | | 5.4 | | — | | 45 | | 0.2 | | 133 | | 0.6 | | 336 | | 3.1 | | 56 | | 0.3 | | 90 | | 0.8 | | — | | — | | 91 | | 0.4 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total | | 33,563 | | 96 | | 229.5 | | 386 | | 841 | | 4.6 | | 1,389 | | 8.6 | | 1,676 | | 13.1 | | 4,079 | | 27.3 | | 5,801 | | 35.9 | | 7,717 | | 53.3 | | 11,674 | | 86.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Less: Properties classified as assets held for sale | |

| |

| |

| |

| |

| |

| |

| |

United States | |

(747 |

) |

(5 |

) |

(3.6 |

) |

— | |

— | |

— | |

— | |

— | |

— | |

— | |

(171 |

) |

(0.5 |

) |

(576 |

) |

(3.1 |

) |

— | |

— | |

— | |

— | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

As at March 31, 2019 | | 32,816 | | 91 | | 225.9 | | 386 | | 841 | | 4.6 | | 1,389 | | 8.6 | | 1,676 | | 13.1 | | 3,908 | | 26.8 | | 5,225 | | 32.8 | | 7,717 | | 53.3 | | 11,674 | | 86.7 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

% of portfolio as at March 31, 2019: | |

| |

| |

| |

| |

| |

| |

| |

* by sq ft | |

100% | | | | | |

1.2% | |

2.6% | | | |

4.2% | | | |

5.1% | | | |

11.9% | | | |

15.9% | | | |

23.5% | | | |

35.6% | | | |

* by Annualized Revenue | | | | | | 100% | | | | | | 2.0% | | | | 3.8% | | | | 5.8% | | | | 11.9% | | | | 14.5% | | | | 23.6% | | | | 38.4% | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Acquisition activity between April 1, 2019 and May 7, 2019: | |

| |

| |

| |

| |

| |

| |

| |

As at March 31, 2019 | |

32,816 | |

91 | |

225.9 | |

386 | |

841 | |

4.6 | |

1,389 | |

8.6 | |

1,676 | |

13.1 | |

3,908 | |

26.8 | |

5,225 | |

32.8 | |

7,717 | |

53.3 | |

11,674 | |

86.7 | |

Acquisition of the leasehold interest in two properties in Mississauga, ON(1) (acquired April 9, 2019) | |

| |

| |

| |

| |

| |

| |

| |

— Canada | |

943 | |

2 | |

8.7 | |

— | |

— | |

— | |

— | |

— | |

— | |

— | |

— | |

— | |

— | |

— | |

— | |

— | |

943 | |

8.7 | |