To date in 2021, no deferral requests have been received from tenants. Granite will continue to monitor its portfolio and dialogue with its tenants, where applicable, to understand the ongoing impact of COVID-19 on its tenants’ operations. The dynamic nature of the situation, which continues to evolve day-to-day, makes the longer-term financial impacts on Granite’s operations difficult to predict.

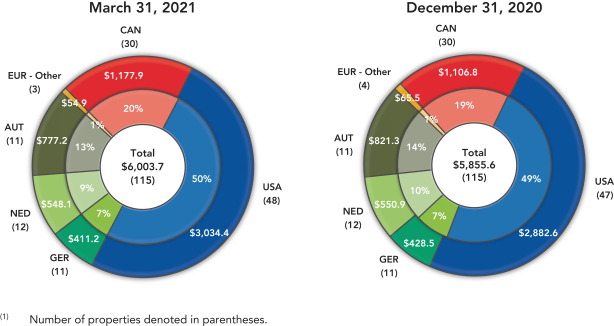

From a liquidity perspective, as at the date of this MD&A, May 5, 2021, Granite has total liquidity of approximately $1.5 billion, including its fully undrawn operating facility which is sufficient to meet its current commitments, development and construction projects. On March 31, 2021, Granite amended its existing unsecured revolving credit facility agreement to extend the maturity date for a new five-year term to March 31, 2026 and increase the facility’s limit from $0.5 billion to $1.0 billion. Granite’s nearest debt maturity of $400.0 million does not occur until November 2023, and Granite’s investment property portfolio of approximately $6.0 billion remains fully unencumbered. Granite believes it is well-positioned to weather any short-term negative impacts on its business; however, Granite will continue to evaluate and monitor its liquidity as the situation prolongs.

From a leasing perspective, as at the date of this MD&A, May 5, 2021, Granite has renewed 95% of its 2021 lease maturities and has 0.1 million square feet outstanding representing less than 1% of its total portfolio. Granite does not believe that the impacts of COVID-19 will materially affect overall leasing activity for 2021 and beyond, including its impact on market rents, tenant demand for space, tenant allowances or incentives and lease terms.

With respect to Granite’s outstanding development projects, most have not been materially impacted by COVID-19. During the first quarter of 2021, Granite completed site servicing at its project in Houston, Texas and Granite expects to commence vertical construction in the second quarter of 2021. With respect to the development project of a distribution/light industrial facility in Altbach, Germany, construction has commenced and is expected to be completed in the first quarter of 2022. In regards to the land acquired in Fort Worth, Texas during 2020, during the three months ended March 31, 2021, Granite completed the planning, permitting and design phases of development and expects to commence vertical construction in the second quarter of 2021. Completion of the project is scheduled for the second quarter of 2022. Despite limited disruption thus far as a result of COVID-19, the active development projects in Altbach, Germany, Houston, Texas and Fort Worth, Texas may be impacted by temporary delays due to work suspensions, labour shortages and delays in supply chains, all of which may impact timing of construction spending and expected completion dates. Further, due to market demand and other macro-economic factors, Granite may also experience delays to the commencement of construction for new development projects including the next phase of the development in Houston, Texas. For more information on Granite’s development projects, please see “SIGNIFICANT MATTERS — Construction, Development and Property Commitments”.

Consistent with its usual practice, Granite continues to review the value of its investment properties. The COVID-19 pandemic has not had a significant negative impact on the valuation of Granite’s investment properties. The duration of the COVID-19 pandemic, including further waves of new infections in the markets where Granite operates that have led to some targeted public health restrictions and additional emergency measures, cannot be predicted. As such, the length and full scope of the economic impact of COVID-19 and other consequential changes it will have on Granite’s business and operations in the long-term cannot be forecasted with certainty at this time. Certain aspects of Granite’s business and operations that could potentially be impacted include rental income, occupancy, capital expenditures, future demand for space and market rents, all of which ultimately impact the underlying valuation of investment properties.

Granite REIT 2021 First Quarter Report 5