Annual Report

2022

Table of Contents

| | | | | |

| |

| Management’s Discussion and Analysis of Results of Operations and Financial Position | 5 |

| Combined Balance Sheets | 82 |

| Combined Statements of Net Income | 83 |

| Combined Statements of Comprehensive Income | 84 |

| Combined Statements of Unitholders’ Equity | 85 |

| Combined Statements of Cash Flows | 86 |

| Notes to Combined Financial Statements | 87 |

| Corporate Information | Inside back cover |

| | | | | |

| 77 King St. W., Suite 4010 P.O. Box 159, TD Centre Toronto, ON, M5K 1H1 Canada |

LETTER TO UNITHOLDERS

Dear Unitholders:

2022 could be described as two distinct years that occurred over 365 days. The early part looked to be a continuation of the market recovery which began in 2021, fueled by ultra-low interest rates, easing of supply-chain disruptions and strong investor and user demand for modern logistics space. In stark contrast, the capital markets rapidly deteriorated in the second quarter, due to a rapid and significant increase in interest rates in response to rising inflation globally, combined with heightened geopolitical risk and economic uncertainty resulting from the Russian invasion of Ukraine. This rapid increase in interest rates negatively impacted discount rates and capitalization rates for all real estate sectors, but the overall impact on asset value was partially, if not fully, moderated by significant increases in Net Operating Income (“NOI”) and market rents for logistics real estate. This divergence in the operating environment from the investment climate continued to widen through the end of 2022, as fundamentals in the sector remained strong in the face of weakening investment conditions.

Despite this challenging environment, portfolio quality remained a priority and continued to improve in 2022. Although we effectively ceased all acquisition activity in the second half of the year, Granite completed over $481 million of acquisitions in 2022 in its target markets of Germany, the U.S., Netherlands and the Greater Toronto Area (the “GTA”). In response to the market headwinds that appeared in the second quarter, Granite refocused its capital allocation accordingly on funding active developments and maintaining liquidity. During 2022, Granite invested over $330 million into its active development and expansion pipeline, including the completion of projects comprising 1.8 million of additional square feet, which were fully occupied as of December 31, 2022 and are expected to generate roughly $14.1 million initially in annualized revenue. Lastly, Granite completed the disposition of two non-core assets in Poland and the Czech Republic for total proceeds of $66 million, which helped to further enhance portfolio diversification.

As a result of external market factors, 2022 was a relatively quiet year for Granite from a financing perspective, but we were able to opportunistically exploit difficult market conditions to drive net asset value (“NAV”) growth. In early 2022, Granite issued $13.4 million of equity using its at-the-market (“ATM”) equity program at an average unit price of $98.77. Conversely, Granite also repurchased over $155.5 million of equity under its normal course issuer bid (“NCIB”) program, representing over 2 million stapled units at an average cost of $71.81. In September 2022, Granite obtained a US$400 million, three year term loan to fully repay the outstanding balance on its Credit Facility with the remaining balance available to fund development and property acquisitions. Granite’s balance sheet at the end of 2022 remains strong, with over $1.1 billion of liquidity and net leverage of 32%.

With respect to our financial performance, Funds from Operations (“FFO”)(1) and Adjusted Funds from Operations (“AFFO”)(1) per unit increased 11% and 8% over 2021 respectively, due primarily to solid increases in same property net operating income - cash basis (“SPNOI - cash basis”)(1), contributions from acquisitions completed in the early part of the year and development stabilizations mentioned above. Granite recorded $220 million in net fair value losses in 2022, due to the expansion of discount and terminal capitalization rates in response to rising interest rates, partially offset by increases in NOI and fair market rents. Fair value reductions in Granite’s investment properties were more than offset by development capital and unrealized foreign exchange gains, resulting in a net increase to investment properties of $0.9 million to $8.8 billion as at December 31, 2022.

2022 was a strong year operationally for Granite, as demonstrated by year over year growth in achieved rental rates and SPNOI. In all, Granite completed 12.7 million square feet of renewals and new leases in 2022 at an average increase in rental rates of 26% and finished the year with an occupancy rate of 99.6%.

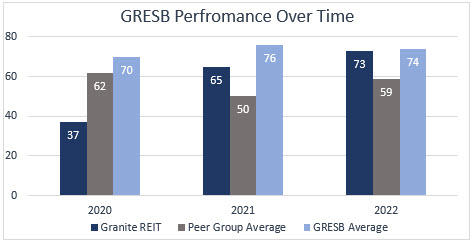

ESG continued to be a major focus in 2022 and progress continued to be made in a number of key areas of our program. Most notably, Granite once again improved its performance in the Global Real Estate Sustainability Benchmark (“GRESB”) Assessment for 2022, where Granite ranked 3rd out of 10 in the United States | Industrial GRESB peer group which evaluates the level of ESG disclosure by listed property companies and REITs. Granite also achieved 2nd out of 9 (improvement of 1 position over 2021) and was the sole Canadian entity, in the North American Industrial | Listed | Tenant Controlled GRESB peer group for Standing Investments with a score of 73 (+8 over 2021). As at December 31, 2022, Granite has allocated approximately $862 million of the net proceeds of the $1.0 billion of prior green bond offerings towards eligible green projects, such as the acquisition and construction of certified green buildings and energy-conservation measures. In 2022, Granite exceeded its initial target to support the production of new renewable energy through the installation of solar PV systems, and as such, has set a more ambitious renewable energy target of peak generation capacity of 24 MW by 2025. Lastly, in 2022, Granite added four properties having BREEAM In-Use certifications and another four properties with Institute of Real Estate Management (IREM) Certified Sustainable Properties (CSP) certifications. As at December 31, 2022 Granite has obtained green-building certifications at 24% of its portfolio by floor area and has committed to achieve 30% by 2030.

I would like to recognize our employees for their commitment and performance in 2022, achieving Granite’s objectives in another challenging environment.

Before moving on to our outlook and a summary of our priorities for 2023, please see below for a recap of major results and activities from 2022.

HIGHLIGHTS FOR 2022

Unitholder Return and Increased Distribution

•-31.9% total return for 2022 (vs -17.0% for the S&P TSX Capped REIT Index and -5.8% for the S&P/TSX Composite Index); and

•3.2% year-over-year increase in the annual amount distributed to unitholders to $3.20 per unit for 2023, marking our eleventh consecutive annual distribution increase. Granite’s AFFO payout ratio remained conservative at 76.5% for 2022.

Strategic Allocation of Capital

•$460 million invested in modern assets in key e-commerce and distribution markets in the GTA, the U.S., Germany and Netherlands at an average stabilized yield of 3.9%;

•US$400.0 million of new unsecured term debt, issued for a 3-year term bearing a fixed interest rate of 5.016% including the impact of the interest rate swap;

•$13.4 million in gross proceeds from ATM equity program issuances, representing 136,100 stapled units issued at an average price of $98.77. Granite has $236.6 million of remaining availability under the ATM to selectively fund the ongoing development program and future acquisitions;

•$155.5 million of equity repurchased under Granite’s NCIB representing 2,165,600 stapled units at an average stapled unit cost of $71.81;

•$1.0 billion of availability on the credit facility, which was amended to extend maturity by two years to March 31, 2028 to provide further liquidity and financial flexibility to execute the Strategic Plan;

•Net leverage ratio of 32%, providing approximately $0.5 billion in debt capacity and $1.1 billion in available liquidity at the end of the year; and

•Credit rating stable at BBB (high) stable by DBRS (Morningstar) and Baa2 Stable by Moody’s, recognizing Granite’s sector-leading credit metrics.

Portfolio Enhancement and Tenant Diversification

•8 income-producing properties totaling 2.8 million square feet acquired (including 4 forward purchases committed in 2021) with an average age of 5.1 years and weighted average lease term of 9.3 years, in key distribution markets in the GTA, the U.S., Germany and Netherlands;

•4 completed development and expansion projects contributing 1.8 million of additional square feet of gross leasable area which are fully leased as of December 31, 2022, generating $14.1 million in expected NOI annually at a yield on cost of 6.8%;

•10 on-going active development and expansion projects and 2 forward property commitments having total projected costs of $489 million and remaining commitments of $158 million. These projects are expected to contribute 3.9 million of additional square feet of gross leasable area and generate a weighted average stabilized yield of 6.0%;

•2 non-core properties disposed for gross proceeds of $66 million; and

•Magna concentration reduced from 22% to 20% as a percentage of gross leasable area and from 29% to 26% as a percentage of annualized revenue.

Financial and Operational Performance

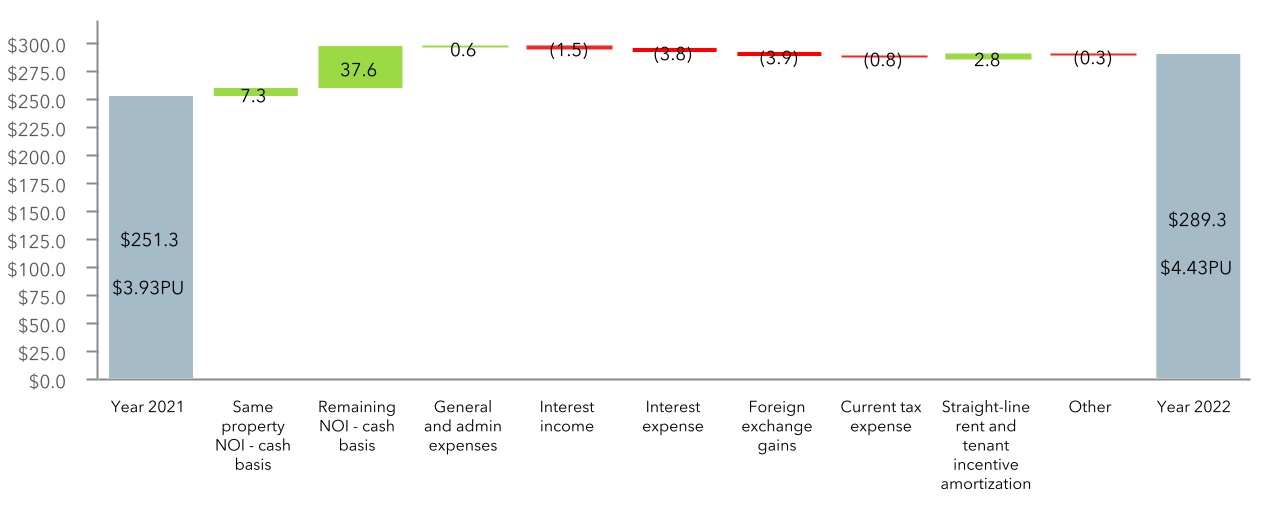

•FFO and AFFO per unit of $4.43 and $4.05, respectively representing a year over year increase of 11% and 8%, respectively;

•SPNOI - cash basis average year-over-year growth, on a constant currency basis, of 4.3%;

•$220 million in net fair value losses taken due to expansion of discount and terminal capitalization rates across all of Granite's markets in response to rising interest rates, partially offset by fair market rent increases across the GTA and selective U.S. and European markets reflecting current market fundamentals. The negative impact on NAV as a result of the fair value losses was offset by contributions from development stabilization and unrealized foreign currency translation gains of $338 million as a result of the relative weakening of the Canadian dollar against the Euro and U.S. dollar from December 31, 2021 to December 31, 2022;

•12.7 million square feet of space renewed or re-leased at an average increase in base rent of 26%; and

•Occupancy rate as at December 31, 2022 of 99.6%.

Environmental, Social, Governance and Resilience (ESG+R) Performance

•Ranked 3rd out of 10 in the United States of America | Industrial GRESB peer group which evaluates the level of ESG disclosure by listed property companies and REITs. Granite’s score increased by 8 points (12%) compared to 2021 improving Granite’s overall position from 3rd to 2nd place out of 9 in the North American Industrial | Listed | Tenant Controlled peer group in 2022. Granite also achieved a score of A in the 2022 GRESB Public Disclosure Report, an increase from 2021’s score of B;

•Published Granite’s 2nd annual comprehensive Corporate ESG+R Report;

•$862.3 million of green bond net proceeds allocated to date towards Eligible Green Projects, as defined by Granite’s Green Bond Framework; representing 100% and 73% of the net proceeds of the 2027 Green Bond and the 2028 Green Bond, respectively; and

•Reinstated in-person connections with Granite’s stakeholders including an establishment of hybrid working model for our staff, property tours, tenant site visits, resumption of an in-person annual general meeting and a company-wide conference in Dallas, Texas.

OUTLOOK

Despite a challenging economic background, Granite finished 2022 on a strong note, with SPNOI - cash basis growth of 6.0% in the fourth quarter as compared with the fourth quarter of 2021, with further growth expected in 2023. Leasing momentum is robust on the back of high demand and strong fundamentals for modern logistics real estate in all of Granite’s markets, which has driven double digit leasing spreads overall on our new and renewal leasing activity. To date, Granite has renewed just over 80% of the 9.7 million square feet of 2023 lease maturities at an average increase in rental rate of approximately 20%. Primarily as a result of the ten-year lease extension of our facilities in Graz, Austria, we have already renewed roughly 55% of our 2024 maturities, which further improves the stability of our cash flow.

Construction continues at Granite’s ten active development and expansion projects and two forward property commitments, with expected completion dates between Q1 2023 and Q1 2024. Leasing momentum remains strong, and pre-leasing currently sits at 53% following roughly 520,000 square feet of new leases signed to date in 2023. The completion of Granite’s active development pipeline is expected to contribute significantly to FFO, AFFO and NAV growth in 2023 and 2024.

Thus far in 2023, risks associated with inflation and geopolitical instability remain elevated. However, as a result of prudent capital allocation, our liquidity and balance sheet capacity remain strong, and we are well positioned to fund our development projects in 2023 and deploy capital selectively on strategic opportunities in our target markets.

For the remainder of 2023, Granite will focus on the following priorities:

•Driving NAV, FFO and AFFO per unit growth while maintaining conservative capital ratios;

•Executing on development, redevelopment and expansion projects in the U.S., Europe and the GTA;

•Selectively pursuing strategic land and income-producing property acquisition opportunities in our target markets;

•Advancing our ESG program and delivering towards our detailed targets for 2023 and beyond; and

•Disposing of select non-core assets.

Successfully executing on these priorities, we believe, will continue to strengthen Granite’s position as one of the sector’s leaders and will ultimately maximize long-term value for our unitholders.

All of us at Granite wish you well and thank you for your continued trust and support.

Sincerely,

Kevan Gorrie,

President and Chief Executive Officer

FFO, AFFO and related per unit amounts, available liquidity, SPNOI — cash basis (same property net operating income — cash basis), constant currency SPNOI — cash basis (constant currency same property net operating income — cash basis) (each of which are non-IFRS performance measures) and net leverage ratio (which is a non-IFRS ratio) are not defined by International Financial Reporting Standards (‘‘IFRS’’) and do not have standard meanings. Please refer to the “Basis of Presentation”, “Non-IFRS Performance Measures” and “Non-IFRS Ratios” sections in the attached MD&A for definitions and reconciliations to IFRS measures.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND FINANCIAL POSITION

TABLE OF CONTENTS

| | | | | | | | | | | | | | |

| Basis of Presentation | | | Commitments, Contractual Obligations, Contingencies and Off-Balance Sheet Arrangements | |

| Financial and Operating Highlights | | | Related Party Transactions | |

| Significant Matters | | | Non-IFRS Performance Measures and Ratios | |

| Business Overview and Strategic Outlook | | | Significant Accounting Estimates | |

| Environmental, Social, Governance, and Resilience (ESG+R) | | | New Accounting Pronouncements and Developments | |

| Results of Operations | | | Internal Controls over Financial Reporting | |

| Investment Properties | | | Risks and Uncertainties | |

| Liquidity and Capital Resources | | | Quarterly Financial Data | |

| | | Forward-Looking Statements | |

BASIS OF PRESENTATION

Management’s Discussion and Analysis of Results of Operations and Financial Position (“MD&A”) of Granite Real Estate Investment Trust (“Granite REIT”) and Granite REIT Inc. (“Granite GP”) summarizes the significant factors affecting the combined operating results, financial condition, liquidity and cash flows of Granite REIT, Granite GP and their subsidiaries (collectively “Granite” or the “Trust”) for the year ended December 31, 2022. Unless otherwise noted, all amounts are in millions of Canadian dollars. This MD&A should be read in conjunction with the accompanying audited combined financial statements for the year ended December 31, 2022 prepared in accordance with International Financial Reporting Standards (“IFRS”) as issued by the International Accounting Standards Board. The MD&A was prepared as at March 8, 2023 and its contents were approved by the Board of Trustees of Granite REIT and Board of Directors of Granite GP on this date. Additional information relating to Granite, including the Annual Report and Annual Information Form (“AIF”) for fiscal 2022 and dated March 8, 2023, can be obtained from the Trust’s website at www.granitereit.com, on SEDAR at www.sedar.com and on EDGAR at www.sec.gov.

In addition to using financial measures determined in accordance with IFRS, Granite also uses certain non-IFRS performance measures and non-IFRS ratios in managing its business to measure financial and operating performance as well as for capital allocation decisions and valuation purposes. Granite believes that providing these measures on a supplemental basis to the IFRS amounts is helpful to investors in assessing the overall performance of Granite’s business.

The non-IFRS performance measures include net operating income before lease termination and close-out fees, straight-line rent and tenant incentive amortization (“NOI - cash basis”), same property NOI - cash basis, constant currency same property NOI, funds from operations (“FFO”), adjusted funds from operations (“AFFO”), adjusted earnings before interest, income taxes, depreciation and amortization (“Adjusted EBITDA”), available liquidity, total debt and net debt. Refer to “NON-IFRS PERFORMANCE MEASURES” for definitions and reconciliations of non-IFRS measures to IFRS financial measures.

The non-IFRS performance ratios include FFO payout ratio, AFFO payout ratio, leverage ratio, interest coverage ratio, net leverage ratio, indebtedness ratio, unencumbered asset coverage ratio and any related per unit amounts. Refer to “NON-IFRS RATIOS” for definitions and reconciliations of non-IFRS ratios to IFRS financial measures.

Readers are cautioned that these measures do not have standardized meanings prescribed under IFRS and, therefore, should not be construed as alternatives to net (loss) income, cash provided by operating activities or any other measure calculated in accordance with IFRS. Additionally, because these terms do not have standardized meanings prescribed by IFRS, they may not be comparable to similarly titled measures presented by other reporting issuers.

FINANCIAL AND OPERATING HIGHLIGHTS

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, | | Year Ended December 31, |

| (in millions, except as noted) | 2022 | 2021 | | 2022 | 2021 | | 2020 |

| Operating highlights | | | | | | | |

| Revenue | $125.6 | $105.3 | | $455.6 | $393.5 | | $340.2 |

| NOI | 102.4 | 86.3 | | 380.4 | 332.7 | | 293.0 |

NOI - cash basis(1) | 99.6 | 85.7 | | 373.9 | 329.0 | | 289.5 |

| Net (loss) income attributable to stapled unitholders | (126.3) | 341.2 | | 155.8 | 1,310.0 | | 429.8 |

FFO(1) | 77.2 | 66.8 | | 289.3 | 251.3 | | 225.4 |

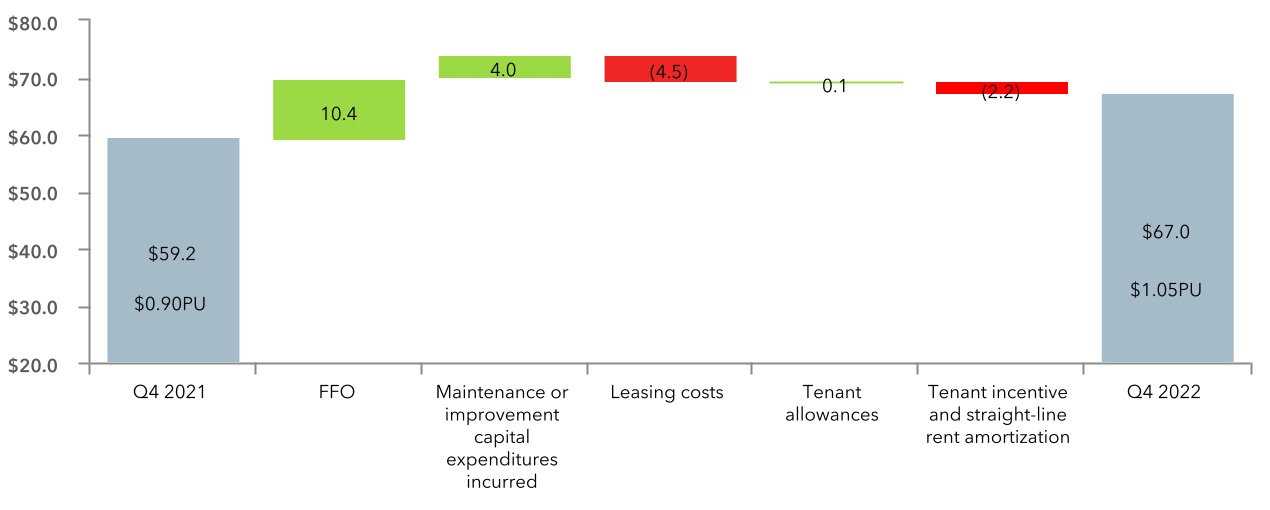

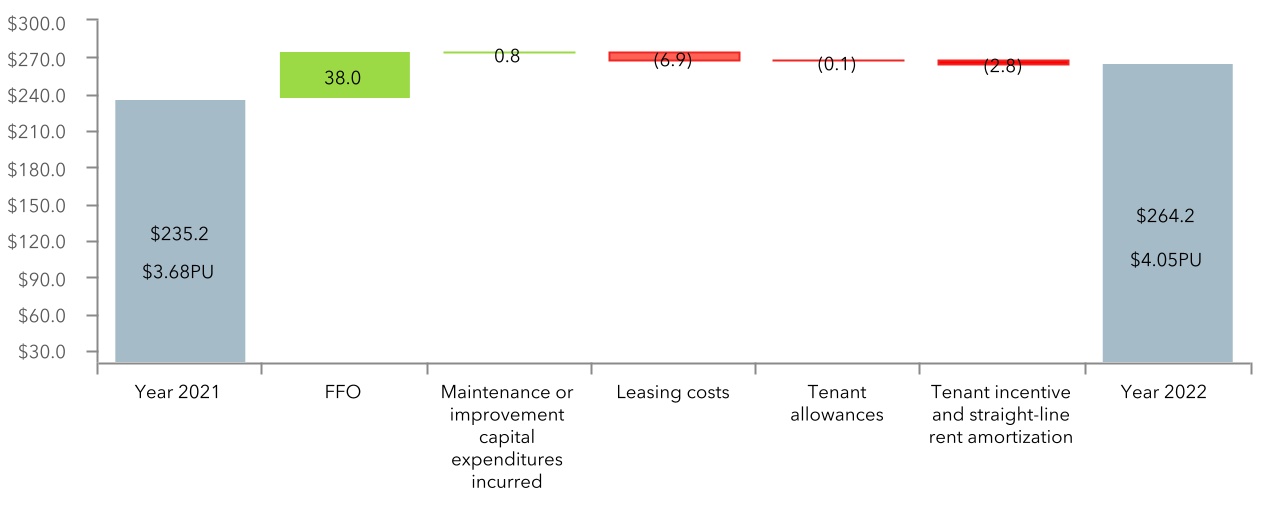

AFFO(1) | 67.0 | 59.2 | | 264.2 | 235.2 | | 215.7 |

| Cash provided by operating activities | 65.5 | 53.7 | | 277.5 | 262.3 | | 249.3 |

| Monthly distributions paid | 49.7 | 49.3 | | 202.3 | 191.1 | | 163.1 |

FFO payout ratio(1)(2) | 65 | % | 75 | % | | 70 | % | 75 | % | | 73 | % |

AFFO payout ratio(1)(2) | 75 | % | 84 | % | | 77 | % | 80 | % | | 77 | % |

| | | | | | | |

| Per unit amounts | | | | | | | |

Diluted FFO(1) | $1.20 | $1.02 | | $4.43 | $3.93 | | $3.98 |

Diluted AFFO(1) | $1.05 | $0.90 | | $4.05 | $3.68 | | $3.81 |

| Monthly distributions paid | $0.78 | $0.75 | | $3.10 | $3.00 | | $2.90 |

| Diluted weighted average number of units | 64.1 | 65.8 | | 65.3 | 64.0 | | 56.7 |

| | | | | | | | | | | |

| | | |

| As at December 31, | 2022 | 2021 | 2020 |

| Financial highlights | | | |

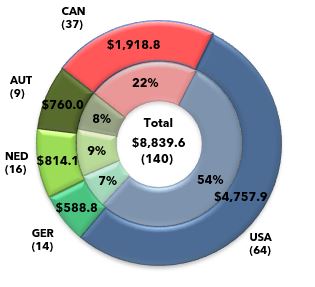

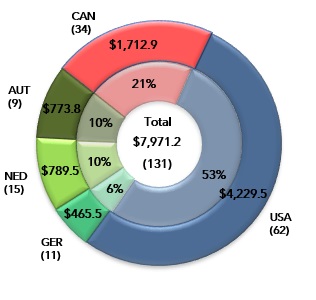

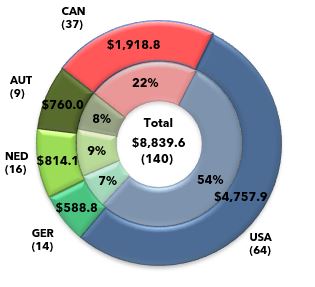

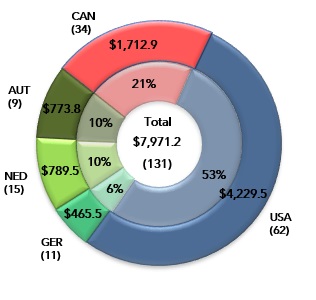

Investment properties - fair value (7) | $8,839.6 | $7,971.2 | $5,855.6 |

Assets held for sale(7) | 41.2 | 64.6 | — |

| Cash and cash equivalents | 135.1 | 402.5 | 831.3 |

Total debt(3) | 2,930.3 | 2,414.0 | 2,297.5 |

| Trading price per unit (TSX: GRT.UN) | $69.03 | $105.20 | $77.90 |

| | | |

| Debt metrics, ratings and outlook | | | |

Net leverage ratio(1) | 32 | % | 25 | % | 25 | % |

Interest coverage ratio(1) | 7.1x | 6.8x | 7.9x |

Indebtedness ratio (total debt to adjusted EBITDA)(1) | 8.3x | 8.1x | 8.7x |

Weighted average cost of debt(4) | 2.28 | % | 1.81 | % | 1.91 | % |

Weighted average debt term-to-maturity, in years(4) | 4.1 | 5.5 | 5.6 |

| DBRS rating and outlook | BBB (high) stable | BBB (high) stable | BBB stable |

| Moody’s rating and outlook | Baa2 Stable | Baa2 stable | Baa2 stable |

| | | |

Property metrics (7) | | | |

| Number of investment properties | 140 | 131 | 115 |

| Income-producing properties | 128 | 119 | 108 |

| Properties under development | 8 | 9 | 3 |

| Land held for development | 4 | 3 | 4 |

| Gross leasable area (“GLA”), square feet | 59.4 | 55.1 | 49.5 |

| Occupancy, by GLA | 99.6 | % | 99.7 | % | 99.6 | % |

Magna as a percentage of annualized revenue(5) | 26 | % | 29 | % | 36 | % |

| Magna as a percentage of GLA | 20 | % | 22 | % | 27 | % |

| Weighted average lease term in years, by GLA | 5.9 | 5.8 | 6.3 |

Overall capitalization rate(6) | 4.9 | % | 4.5 | % | 5.6 | % |

(1) For definitions of Granite’s non-IFRS measures and ratios, refer to the sections “NON-IFRS PERFORMANCE MEASURES” and “NON-IFRS RATIOS”.

(2) The FFO and AFFO payout ratios are calculated as monthly distributions, divided by FFO and AFFO, respectively, in a period.

(3) Total debt includes lease obligations recognized under IFRS 16, Leases.

(4) Excludes lease obligations recognized under IFRS 16, Leases.

(5) Annualized revenue presented is calculated as the contractual base rent for the month subsequent to the quarterly reporting period multiplied by 12 months. Annualized revenue excludes revenue from properties classified as assets held for sale.

(6) Refer to “Valuation Metrics by Asset Category” in the “INVESTMENT PROPERTIES” section.

(7) Assets held for sale are excluded from investment properties and related property metrics. Accordingly, two such assets that were held for sale at December 31, 2022 and three such assets that were held for sale at December 31, 2021 were excluded from investment properties and related metrics at December 31, 2022 and December 31, 2021, respectively, throughout this MD&A.

Property Acquisitions

During the year ended December 31, 2022, Granite acquired eight income-producing industrial properties in Germany, the United States, Canada and Netherlands, one property under development in the United States and one parcel of development land in Canada. Property acquisitions consisted of the following:

| | | | | | | | | | | | | | | | | | | | |

| Acquisitions | | Weighted Average Lease Term, in years by sq ft(1)(3) | | | |

| (in millions, except as noted) | | | | Property Purchase Price(2) | |

| Property Address | Location | Sq ft(1) | Date Acquired | Stabilized Yield(1) |

| | | |

| | | | | | |

| Income-producing properties: | | | | | | |

| Georg-Beatzel Straße 15 | Wiesbaden, GER | 0.2 | | 8.3 | | February 3, 2022 | $ | 62.0 | | 3.4 | % |

| Raiffeisenstraße 28-32 | Korbach, GER | 0.5 | | 8.2 | | February 3, 2022 | 60.3 | | 3.7 | % |

| In der Langen Else 4 | Erfurt, GER | 0.1 | | 1.9 | | February 3, 2022 | 17.6 | | 4.1 | % |

| 10566 Gateway Pt. | Clayton, USA | 0.9 | | 9.8 | | April 14, 2022 | 121.3 | | 4.2 | % |

| 2128 Gateway Pt. | Clayton, USA | 0.4 | | 10.3 | | April 14, 2022 | 57.9 | | 4.4 | % |

| 102 Parkshore Dr. | Brampton, CAN | 0.1 | | 7.0 | | May 24, 2022 | 20.9 | | 4.5 | % |

| 195 Steinway Blvd. | Etobicoke, CAN | 0.1 | | 15.0 | | May 26, 2022 | 17.7 | | 5.0 | % |

| Swaardvenstraat 75 | Tilburg, NL | 0.5 | | 10.0 | | July 1, 2022 | 102.1 | | 3.2 | % |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Property under development: | | | | | |

| 905 Belle Ln. | Bolingbrook, USA | 0.2 | | N/A | May 5, 2022 | 14.5 | | 3.9 | % |

| | | | | | |

| | | | | | |

| | | | | | |

| Development land: | | | | | | |

| 161 Markel Dr. | Brant County, CAN | N/A | N/A | August 19, 2022 | 6.4 | N/A |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | 3.0 | | | | $ | 480.7 | | 3.8 | % |

(1) As at the date of acquisition except as noted in note 3 below.

(2) Purchase price does not include transaction costs associated with property acquisitions.

(3) Weighted average lease term applicable to the occupied space.

Property Dispositions

During the year ended December 31, 2022, Granite disposed of two income-producing properties and a parcel of land located in Poland and the Czech Republic for total proceeds of $66.0 million.

| | | | | | | | | | | | | | | | | |

| Dispositions | | | | |

| (in millions, except as noted) | | | | | |

| Property Address | Location | Sq ft | Date Disposed | Sale Price(1) | Annualized Revenue (2) |

| Disposed during the year ended December 31, 2022: | | | |

| | | | | |

| 10 Topolowa | Mirków, Poland | 0.3 | | February 18, 2022 | $34.5 | | $ | 1.6 | |

378 10 Hospodářský Park, České Velenice (3) | Třeboň, Czech Republic | 0.3 | | June 9, 2022 | 31.5 | | 2.6 | |

| | | | | |

| | 0.6 | | | $66.0 | | $ | 4.2 | |

(1) Sale price does not include transaction costs associated with disposition. |

(2) As at the date of disposition. |

(3) In conjunction with the disposal of the income producing property, the associated carrying value of the non-controlling interest of $1.4 million was derecognized on June 9, 2022. |

Assets Held for Sale

As at December 31, 2022, two income-producing properties located in Canada and the United States were classified as assets held for sale. The properties, having a fair value of $41.2 million and annualized revenue of $1.6 million were classified as assets held for sale on the audited combined balance sheet at December 31, 2022 and were excluded from the value of investment properties. The properties are also excluded from references to investment properties and related property metrics as at December 31, 2022 throughout this MD&A.

Construction, Development and Property Commitments

Granite had the following property purchases and construction and development commitments as at December 31, 2022:

| | | | | | | | | | | | | | | | | |

| Commitments | | Accruals/

Payments/

Deposits Made | | | Year-One Stabilized Yield (2) |

| (in millions, except as noted) | | | |

| Property Location | Additional

sq ft | Future Commitments (1) | Total

Cost |

| As at December 31, 2022: | | | | | |

| Development, construction or expansion: | | | | | |

| Properties under development in Houston, TX | 1.4 | | $ | 132.3 | | $ | 14.1 | | $ | 146.4 | | 6.4 | % |

| Properties under development in Lebanon, TN | 0.5 | | 55.4 | | 16.0 | | 71.4 | | 6.3 | % |

| Property under development in Brantford, ON | 0.4 | | 5.7 | | 63.4 | | 69.1 | | 6.8 | % |

| Property under development in Bolingbrook, IL | 0.2 | | 24.6 | | 12.9 | | 37.5 | | 3.9 | % |

| | | | | |

| Expansion of 555 Beck Cres., Ajax, ON | 0.1 | | 0.7 | | 7.8 | | 8.5 | | 7.6 | % |

| Expansion of 5400 E 500 S, Whitestown, IN | 0.3 | | 33.1 | | 9.3 | | 42.4 | | 5.5 | % |

| | | | | |

| Other construction commitments | — | | 77.8 | | 19.6 | | 97.4 | | — | % |

| | | | | |

| 2.9 | | $ | 329.6 | | $ | 143.1 | | $ | 472.7 | | 6.1 | % |

| | | | | |

| Other property commitments: | | | | |

| Development loan/acquisition of two completed properties in Indiana | 1.0 | $ | 79.3 | | $ | 34.8 | | $ | 114.1 | | 5.7 | % |

| | | | | |

| | | | | |

| | | | | |

| 3.9 | | $ | 408.9 | | $ | 177.9 | | $ | 586.8 | | 6.0 | % |

(1) Includes signed contracts and future budgeted expenditures not yet contracted.(2) Yield based on total cost including land (see “Development and Expansion Projects”).

During the fourth quarter, Granite achieved substantial completion of its 844,000 square foot, 40’ clear height, state-of-the-art modern distribution facility in Murfreesboro, Tennessee that was fully leased starting December 1, 2022 to a leading investment-grade producer of specialized commercial vehicles. This property is included in income-producing properties as at December 31, 2022.

Subsequent to year end, Granite achieved substantial completion of phase one (in March 2023) and phase two (in January 2023) of its development in Houston, Texas. Granite has signed leases with third-party logistics operators for approximately 521,000 square feet of phase one, which consists of two buildings totaling 669,000 square feet. The leases executed range in length between 5 and 7 years. Phase two, comprising of one building that is approximately 689,000 square feet, was pre-leased to a leading e-commerce retailer, and upon completion the lease commenced for an initial term of 10.9 years.

On January 19, 2023, Granite completed the 329,000 square foot, value-enhancing expansion of its approximate 633,000 square foot modern distribution facility in Whitestown, Indiana. Upon completion the lease for the entire facility was extended for a ten year term.

Granite’s other property commitments include a development loan and forward commitment to purchase two industrial properties in Indiana where construction of two buildings totaling 1.0 million square feet is expected to be completed in the first quarter of 2023.

Increase in Distributions

On November 9, 2022, Granite increased its targeted annualized distribution by 3.2% to $3.20 ($0.2667 per month) per stapled unit from $3.10 ($0.2583 per month) per stapled unit to be effective upon the declaration of the distribution in respect of the month of December 2022 and payable in mid-January 2023.

Normal Course Issuer Bid (“NCIB”)

During the fourth quarter, Granite repurchased 1,022,000 stapled units under the NCIB at an average stapled unit cost of $67.60 for total consideration of $69.1 million, excluding commissions.

Subsequent Events

On February 1, 2023, the leases at Granite’s properties in Graz, Austria (the “Graz Facilities”), comprising approximately 5.0 million square feet, were contractually extended for ten years to January 31, 2034. On February 1, 2024 the annual rent for the Graz Facilities for the initial five years of the extension will escalate by the increase in the consumer price index for the 60 month period preceding that date, to a maximum of ten percent.

On March 3, 2023, Granite amended its existing unsecured revolving credit facility (the “Credit Facility”) agreement to extend the maturity date for a new five-year term to March 31, 2028.

Russian Invasion of Ukraine

Granite currently holds investments and operates in Western Europe, specifically in Netherlands, Germany and Austria. Since the commencement of the Russian invasion of Ukraine in late February 2022 and up to the date of this MD&A, the European real estate markets in which Granite operates have remained orderly and Granite has continued to realize stable net operating income growth while continuing to execute on its strategic initiatives.

During the year ended December 31, 2022, and up to the date of this MD&A, there has not been a significant impact on Granite’s operations, assets or liabilities as a result of the war.

Although not directly impacted by the ongoing Russian/Ukraine war thus far, Granite and its tenants are exposed to a broad range of current and evolving risks including:

•slowdown of global economic growth and more specifically in the European region;

•inflationary pressures, including energy, labour and transportation/logistics;

•higher interest rates;

•energy security in Western Europe; and

•supply chain disruptions.

A material deterioration in any of the foregoing could have a material adverse effect on Granite’s tenants and their ability to continue to operate and pay rent, and impact debt and equity markets, either of which could adversely impact Granite’s operations and financial

performance. Granite is continuing to monitor the situation in Ukraine and globally and assessing its potential impact on Granite’s business.

BUSINESS OVERVIEW AND STRATEGIC OUTLOOK

Business Overview

Granite is a Canadian-based real estate investment trust (“REIT”) engaged in the acquisition, development, ownership and management of logistics, warehouse and industrial properties in North America and Europe. As at March 8, 2023, excluding assets held for sale, Granite owns 140 investment properties in five countries having approximately 59.4 million square feet of gross leasable area. Granite has a highly-integrated team of real estate professionals with extensive experience in operations, leasing, development, investment and asset management located at its head office in Toronto, Canada and regional offices in Dallas, United States; Vienna, Austria; and Amsterdam, Netherlands.

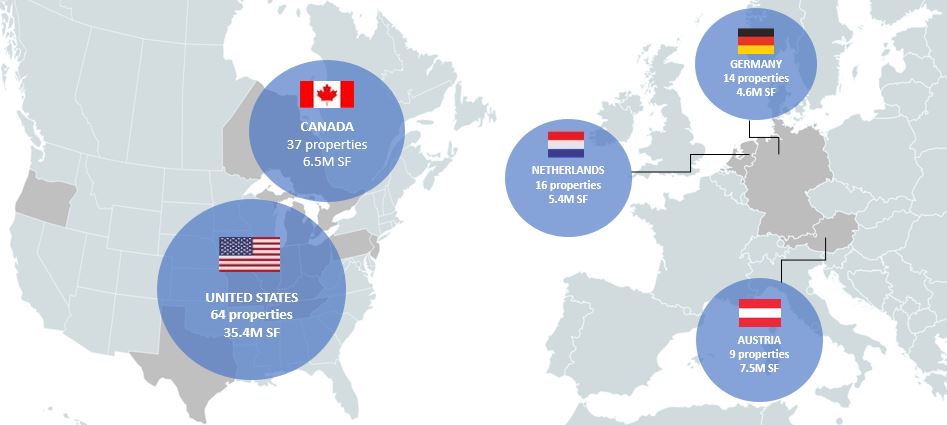

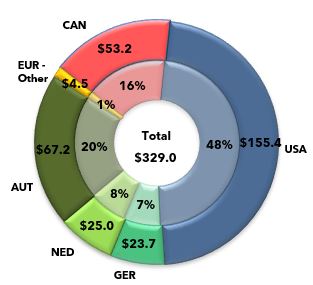

Granite’s investment properties consist of income-producing properties, properties under development and land held for development (see “INVESTMENT PROPERTIES”). The income-producing properties consist primarily of logistics, e-commerce and distribution warehouses, and light industrial and heavy industrial manufacturing properties. Lease payments are primarily denominated in three currencies: the Canadian dollar (“$”), the Euro (“€”) and the US dollar (“US$”). Granite’s investment properties (excluding assets held for sale) by geographic location, property count and square footage as at March 8, 2023 are summarized below:

| | |

| Investment Properties Summary |

| Five countries/140 properties/59.4 million square feet |

Strategic Outlook

Management continues to identify and pursue value creation and investment opportunities that management believes will generate superior long-term total returns for unitholders.

Granite’s long-term strategy is to continue to build an institutional quality and globally diversified industrial real estate business; to grow and diversify its asset base through acquisitions, development, re-development and dispositions; to maintain a conservative balance sheet; and to reduce its exposure to its largest tenant, Magna International Inc. and its operating subsidiaries (collectively, “Magna”) and the special purpose properties (see “INVESTMENT PROPERTIES”).

Granite has positioned itself financially to execute on its strategic plan including to capitalize on any strategic opportunities as they arise, and existing and future development activity within its targeted geographic footprint.

As Granite looks to 2023, its priorities are set out below:

•Driving FFO, AFFO and net asset value per unit growth while maintaining conservative capital ratios;

•Executing on development, redevelopment and expansion projects in the U.S., Europe, and the GTA;

•Selectively pursuing strategic land and income-producing property acquisition opportunities in our target markets;

•Advancing Granite’s Environmental, Social, Governance and Resilience (ESG+R) program and meeting established targets for 2023 and beyond; and

•Disposing of select non-core assets.

ENVIRONMENTAL, SOCIAL, GOVERNANCE, AND RESILIENCE (ESG+R)

Granite recognizes the important role building owners can play in fostering the efficient use of resources and respecting our environment. As a good steward for investors, Granite seeks to practically incorporate sustainability in its actions and decision-making process, while generating returns for unitholders.

Consistent with this principle, Granite applies the following long-term ESG+R objectives in its business:

| | | | | | | | | | | |

| Environmental | Social | Governance | Resilience |

| Promote efficiency and sustainable practices at both our properties and our corporate offices | Engage with our investors, employees, tenants, property managers, and community | Disclose our ESG+R performance as a commitment to transparency and accountability | Identify and mitigate potential climate-related risks within our portfolio |

Granite’s ESG+R program is aligned with SASB1, GRESB2, GRI3 and TCFD4. Data provided herein has been reviewed by a third-party ESG+R consultant and represents a snapshot of current performance.

GRESB

2022 GRESB Public Disclosure Report

GRESB assesses and scores the Environmental, Social, and Governance (“ESG”) performance of real estate portfolios around the world and this year increased to over 1,800 participants. Granite completed its third annual GRESB Real Estate Assessment in June 2022.

In GRESB’s Public Disclosure Report, which evaluates the level of ESG disclosure by listed property companies and REITs, Granite was ranked third in the North American Industrial sector comprised of 10 reporting entities. In comparison to Granite’s 2021 results, its Standing Investments score significantly improved from 65 to 73 points, placing Granite second in the North American Industrial Listed sector comprised of nine reporting entities, Granite being the sole Canadian reporting entity in this sector.

1 Sustainability Accounting Standards Board

2 Global Real Estate Sustainability Benchmarking

3 Global Reporting Initiative

4 Task Force on Climate-related Financial Disclosures

Below is a selection of key actions and performance items of Granite’s ESG+R Program:

Environmental — Actions & Performance

•Work to reduce landlord-controlled energy, operational emissions (scope 1 and 2), and water by 25% on an intensity basis, per square foot, by the beginning of 2030 (or 2.5% annual reduction) at Granite’s properties5;

•Increase the energy, emissions, water and waste data coverage across Granite’s portfolio to 50% of its income-producing portfolio by 2030 by collaborating with tenants, implementing green lease language, and obtaining data directly from the utility companies whenever available;

•Granite has exceeded its target to support the production of new renewable energy through the installation of on-site solar PV systems with the capacity to generate 5 MW of electricity by 20256 as solar PV systems with peak generation capacity of 8.5 MW are currently operational on Granite properties. Granite is setting a more ambitious renewable energy target to have solar PV systems with a peak generation capacity of 24 MW by 2025;

•Beehives have been installed at three properties to promote local biodiversity and engagement with tenants, with a fourth beehive planned to be added in 2023;

•Strategically evaluate and pursue applicable green building certifications at Granite’s properties and achieve 30% third-party green building certifications by floor area by 2030;

•Four properties achieved BREEAM In-Use certifications in 2022. One of the properties, 100 Enterprise Parkway, West Jefferson, Ohio, was the first property to be BREEAM certified in the State of Ohio;

•Four properties achieved Institute of Real Estate Management (IREM) Certified Sustainable Property certifications in 2022;

•Commit that all development projects controlled by Granite will be built to standards consistent with the scope of Granite’s Green Bond Framework and certify 100% of new developments to a third-party green building certification standard (such as LEED, BREEAM, Green Globes, DGNB); and

•Three properties received new construction certifications in 2022.

5 Granite’s emissions reduction targets are aligned with the Paris Climate Accords’ goal of limiting global warming to two degrees Celsius above pre-industrial levels.

6 Onsite solar projects are expected to be installed at 10 Granite assets by 2023.

| | | | | | | | | | | | | | |

| Property | Size (Sq ft) in millions | Location | Certification Type | Level |

| 12 Tradeport Rd. | 1.4 | Hanover Township, USA | BREEAM USA in Use | Good |

| 15 Commerce Pkwy. | 1.3 | West Jefferson, USA | LEED New Construction and Major Renovation; BREEAM USA in Use | Certified; Good |

| 100 Clyde Alexander Lane | 0.7 | Pooler, USA | LEED Core and Shell Development | Certified |

| 100 Enterprise Parkway | 1.2 | West Jefferson, USA | BREEAM USA In Use | Good |

| 101 Clyde Alexander Lane | 0.3 | Pooler, USA | LEED Core and Shell Development | Certified |

| 1201 Allpoints Court | 0.5 | Plainfield, USA | Green Globes New Construction | 2 Green Globes |

| 201 Sunridge Boulevard | 0.8 | Wilmer, USA | IREM Certified Sustainable Property | Certified |

| 501 Airtech Parkway | 0.5 | Plainfield, USA | IREM Certified Sustainable Property | Certified |

| 1243 Gregory Dr. | 0.5 | Antioch, USA | LEED Core and Shell Development | Silver |

| 1301 Chalk Hill Road | 2.3 | Dallas, USA | BREEAM USA In Use | Good |

| 2020 Logistics Drive | 0.8 | Mississauga, Canada | IREM Certified Sustainable Property | Certified |

| Expansion to 2095 Logistics Drive | 0.1 | Mississauga, Canada | Green Globes New Construction | 2 Green Globes |

| 2100 Center Square Rd. | 0.4 | Logan Township, USA | LEED Core and Shell Development | Silver |

| 3501 North Lancaster Hutchins Rd. | 0.2 | Lancaster, USA | LEED New Construction and Major Renovation | Silver |

| 5000 Village Creek Rd. | 0.6 | Fort Worth, USA | Green Globes New Construction | 2 Green Globes |

| 8735 South Crossroads Dr. | 0.9 | Olive Branch, USA | LEED Core and Shell Development | Certified |

| 8740 South Crossroads Dr. | 0.9 | Olive Branch, USA | LEED Core and Shell Development | Certified |

| 18201 NE Portal Way | 0.3 | Portland, USA | IREM Certified Sustainable Property | Certified |

| Aquamarijnweg 2 & 4 | 0.2 | Bleiswijk, Netherlands | BREEAM New Construction | Very Good |

| De Kroonstrat 1 (Phase 1), De Poosthoornstraat 2 (Phase 2) | 0.5 | Tilburg, Netherlands | BREEAM New Construction | Excellent |

| Francis Baconstraat 4 | 0.1 | Ede, Netherlands | BREEAM New Construction | Very Good |

| Im Ghai 36 | 0.3 | Altbach, Germany | DGNB New Construction Logistics Buildings | Gold |

| Oude Graaf 15 | 0.2 | Weert, Netherlands | BREEAM New Construction | Excellent |

Social — Actions & Performance

•Granite administered its 2021 Employee Engagement Survey in April 2021 to gain an understanding of employee engagement and the effectiveness of its workplace practices. Granite intends to follow up with a second employee engagement survey in 2023;

•In 2021, Granite conducted a survey of all tenants to gauge satisfaction levels and identify opportunities for improvement;

•In June 2022, Granite completed its tenant ESG+R surveys;

•Contribute at least $500 local currency (USD/CAD/EUR) per income-producing property in Granite’s portfolio toward charitable donations;

•As part of Granite’s due diligence process, assess 100% of potential acquisitions for ESG+R and identify areas for improvement;

•Granite established a hybrid working model in 2022, providing enhanced work from home flexibility during the work week; and

•Granite held a company-wide conference in Dallas, Texas during the third quarter of 2022 where third-party consultants, Re Tech Advisors (formerly LORD Green Strategies), presented updates and progress on Granite’s ESG+R program and recent market trends and developments to all employees.

Governance — Actions & Performance

•Provide leadership over Granite’s ESG+R Program through the Granite ESG+R Committee;

•Provide transparency to investors by incorporating ESG+R into regular updates to unitholders and stakeholders and through formal reporting frameworks such as GRESB, SASB, CDP, and GRI;

•Monitor asset compliance with government benchmarking requirements and ESG+R related regulations;

•Granite’s 2021 ESG+R Report was issued in August 2022 and follows the GRI framework with TCFD and SASB disclosures;

•Granite submitted to GRESB in June 2022 and is currently preparing for the 2023 submission;

•In June 2022, the Declaration of Trust was amended and restated to, among other things, (i) further align the Declaration of Trust with evolving governance best practices which includes introducing rights and remedies in favour of unitholders consistent with those available to shareholders of a corporation pursuant to the Business Corporations Act; and (ii) enhance unitholders’ rights respecting the process for and procedures at unitholder meetings, including the submission of proposals by unitholders;

•Granite maintains robust policies governing the various aspects of its business activities, which are reviewed annually and updated from time to time in order to reflect regulatory compliance and industry best practices, as appropriate; and

•Granite submitted its second CDP report in 2022.

Resilience — Actions & Performance

•Aligning Granite’s resilience program with the TCFD framework;

•Assess physical and transition climate-change risks during the new acquisition due diligence process and evaluate measures to increase resiliency in Granite’s underwriting process;

•Regular evaluation of Granite for physical and transition climate-change risks and evaluate strategies to mitigate risks; and

•Granite uses the Moody’s ESG Solutions Climate on Demand tool to manage climate-related analytics which generate 1-100 risk scores in six physical categories of climate-related risks: sea-level rise, floods, hurricanes, heat stress, water stress and wildfires.

RESULTS OF OPERATIONS

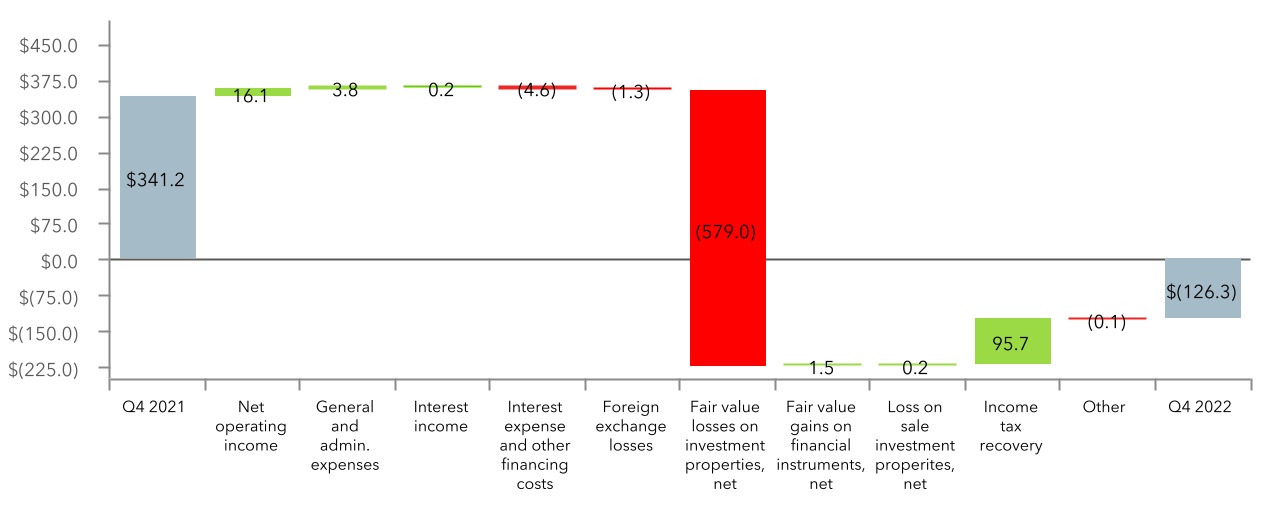

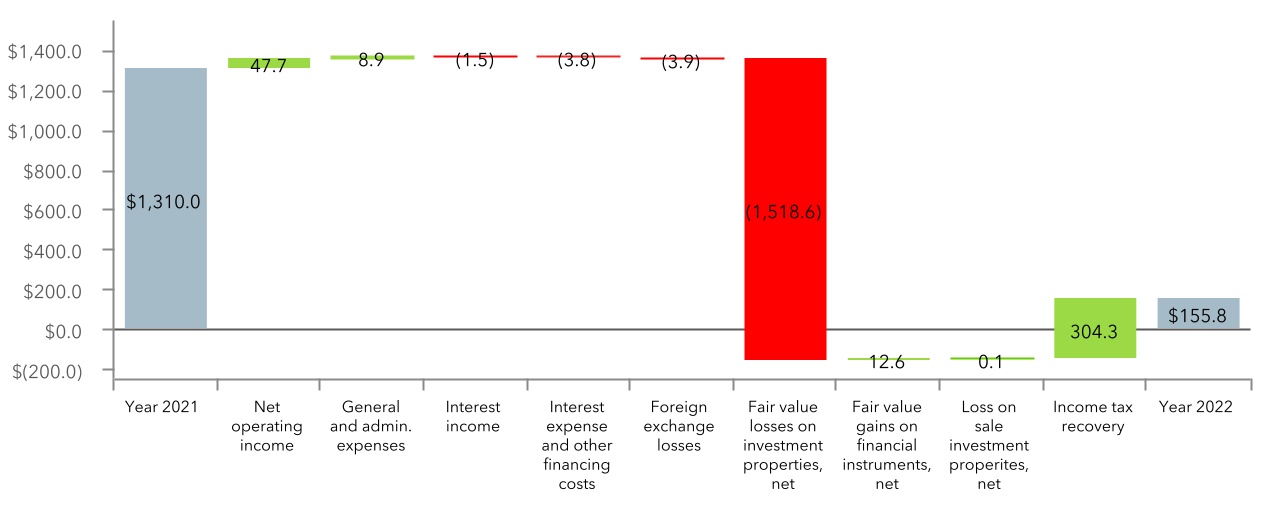

Net (Loss) Income

The following is a summary of financial information from the combined statements of net (loss) income for the three months and years ended December 31, 2022 and 2021, respectively:

| | | | | | | | | | | | | | | | | | | | | | | |

| Net (Loss) Income |

| | | | | | | |

| Three Months Ended December 31, | | Years Ended December 31, |

| (in millions, except as noted) | 2022 | 2021 | $ change | | 2022 | 2021 | $ change |

| Rental revenue | $ | 125.6 | | $ | 105.3 | | 20.3 | | | $ | 455.6 | | $ | 393.5 | | 62.1 | |

| Revenue | 125.6 | | 105.3 | | 20.3 | | | 455.6 | | 393.5 | | 62.1 | |

| Property operating costs | 23.2 | | 19.0 | | 4.2 | | | 75.2 | | 60.8 | | 14.4 | |

| Net operating income | 102.4 | | 86.3 | | 16.1 | | | 380.4 | | 332.7 | | 47.7 | |

| | | | | | | |

| General and administrative expenses | 8.6 | | 12.4 | | (3.8) | | | 29.5 | | 38.4 | | (8.9) | |

| Depreciation and amortization | 0.4 | | 0.2 | | 0.2 | | | 1.6 | | 1.3 | | 0.3 | |

| Interest income | (1.1) | | (0.9) | | (0.2) | | | (1.6) | | (3.1) | | 1.5 | |

| Interest expense and other financing costs | 16.7 | | 12.1 | | 4.6 | | | 51.0 | | 47.2 | | 3.8 | |

| Foreign exchange gains, net | (0.8) | | (2.1) | | 1.3 | | | (1.2) | | (5.1) | | 3.9 | |

| Fair value losses (gains) on investment properties, net | 229.9 | | (349.1) | | 579.0 | | | 219.7 | | (1,298.9) | | 1,518.6 | |

| Fair value (gains) losses on financial instruments, net | (2.1) | | (0.6) | | (1.5) | | | (11.4) | | 1.2 | | (12.6) | |

| Loss on sale of investment properties | — | | 0.2 | | (0.2) | | | 0.7 | | 0.8 | | (0.1) | |

| (Loss) income before income taxes | (149.2) | | 414.1 | | (563.3) | | | 92.1 | | 1,550.9 | | (1,458.8) | |

| Income tax (recovery) expense | (22.9) | | 72.8 | | (95.7) | | | (63.7) | | 240.6 | | (304.3) | |

| Net (loss) income | $ | (126.3) | | $ | 341.3 | | (467.6) | | $ | 155.8 | | $ | 1,310.3 | | (1,154.5) |

| | | | | | | |

| Net (loss) income attributable to: | | | | | | | |

| Stapled unitholders | (126.3) | | 341.2 | | (467.5) | | | 155.8 | | 1,310.0 | | (1,154.2) | |

| Non-controlling interests | — | | 0.1 | | (0.1) | | | — | | 0.3 | | (0.3) | |

| $ | (126.3) | | $ | 341.3 | | (467.6) | | $ | 155.8 | | $ | 1,310.3 | | (1,154.5) |

| | | | | | | |

Foreign Currency Translation

The majority of Granite’s investment properties are located in Europe and the United States and the cash flows derived from such properties are primarily denominated in Euros and US dollars. Accordingly, fluctuations in the Canadian dollar, Granite’s reporting currency, relative to the Euro and US dollar will result in fluctuations in the reported values of revenues, expenses, cash flows, assets and liabilities. The most significant foreign currency exchange rates that impact Granite’s business are summarized in the following table:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Average Exchange Rates | | Period End Exchange Rates |

| Three Months Ended December 31, | | | Years Ended December 31, | | | December 31, | | December 31, | |

| 2022 | | 2021 | Change | | 2022 | | 2021 | Change | | 2022 | | 2021 | Change |

| $ per €1.00 | 1.386 | | | 1.441 | | (4 | %) | | 1.370 | | | 1.482 | | (8 | %) | | 1.447 | | | 1.440 | | — | % |

| $ per US$1.00 | 1.357 | | | 1.261 | | 8 | % | | 1.302 | | | 1.254 | | 4 | % | | 1.353 | | | 1.266 | | 7 | % |

For the three months and year ended December 31, 2022 compared to the prior year periods, the average exchange rate of the Euro relative to the Canadian dollar was lower, which on a comparative basis, decreased the Canadian dollar equivalent of revenue and expenses from Granite’s European operations.

For the three months and year ended December 31, 2022 compared to the prior year periods, the average exchange rate of the US dollar relative to the Canadian dollar was higher, which on a comparative basis, increased the Canadian dollar equivalent of revenue and expenses from Granite’s U.S. operations.

The period end exchange rates of the Euro and the US dollar relative to the Canadian dollar on December 31, 2022 were higher, when compared to the December 31, 2021 exchange rates. As a result, the Canadian dollar equivalent of assets and liabilities from Granite’s European and U.S. operations were higher, when compared to December 31, 2021.

On a net basis, the effect of the changes in exchange rates on Granite’s operating results for the three months and year ended December 31, 2022 was as follows:

| | | | | | | | | | | | | | |

| Effects of Changes in Exchange Rates on Operating Results |

| | | |

| Three Months Ended December 31, | Years Ended December 31, |

| (in millions, except per unit information) | 2022 vs 2021 | 2022 vs 2021 |

| Increase (decrease) in revenue | | $ | 3.7 | | | $ | (1.0) | |

| Increase (decrease) in NOI - cash basis | | 2.4 | | | (3.2) | |

| Decrease in net income | | (1.4) | | | (14.0) | |

| Increase in FFO | | 2.6 | | | 0.1 | |

| Increase (decrease) in AFFO | | 2.0 | | | (1.1) | |

| Increase in FFO per unit | | $0.04 | | — | |

| Increase (decrease) in AFFO per unit | | $0.03 | | $(0.02) |

Operating Results

Revenue

| | | | | | | | | | | | | | | | | | | | |

| Revenue |

| | | | | |

| Three Months Ended December 31, | | Years Ended December 31, | |

| 2022 | 2021 | $ change | 2022 | 2021 | $ change |

Rental revenue and amortization(1) | $ | 103.2 | | $ | 87.6 | | 15.6 | | $ | 382.7 | | $ | 335.2 | | 47.5 | |

| Tenant recoveries | 22.4 | | 17.7 | | 4.7 | | 72.9 | | 58.3 | | 14.6 | |

| | | | | | |

| Revenue | $ | 125.6 | | $ | 105.3 | | 20.3 | | $ | 455.6 | | $ | 393.5 | | 62.1 | |

|

(1) Rental revenue and amortization include base rent, straight-line rent amortization and tenant incentive amortization.

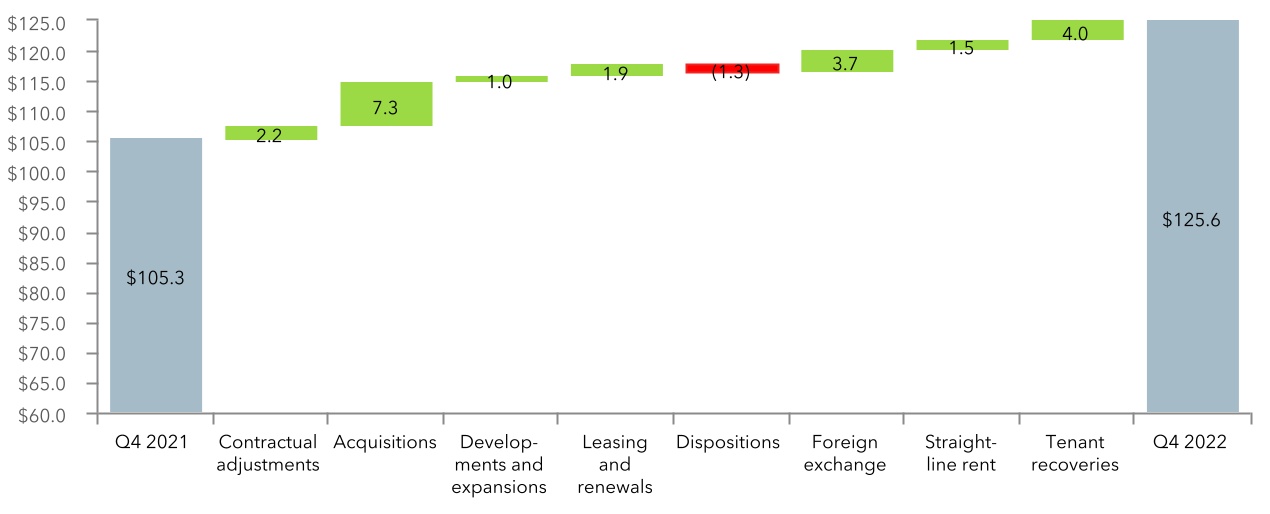

Revenue for the three month period ended December 31, 2022 increased by $20.3 million to $125.6 million from $105.3 million in the prior year period. The components contributing to the change in revenue are detailed below:

| | |

| Q4 2022 vs Q4 2021 Change in Revenue |

Additional details pertaining to the components of the change in revenue are as follows:

•contractual rent adjustments included $1.0 million from consumer price index based increases and $1.2 million from fixed contractual adjustments related to rent escalations;

•the acquisitions of properties located in the United States, Canada, Netherlands and Germany beginning in the fourth quarter of 2021 increased revenue by $7.3 million;

•the completion of one development and one expansion project in Germany and Canada, respectively, increased revenue by $1.0 million;

•revenue increased by $1.9 million due to renewal and re-leasing activities for properties primarily in Canada, the United States and Netherlands;

•the sale of properties located in Austria, Poland and the Czech Republic beginning in the fourth quarter of 2021 decreased revenue by $1.3 million;

•foreign exchange had a net $3.7 million positive impact to revenue primarily due to the relative weakening of the Canadian dollar against the US dollar, partially offset by the relative strengthening of the Canadian dollar against the Euro, which increased revenue by $5.0 million and decreased revenue by $1.3 million, respectively; and

•straight-line rent and tenant recoveries increased revenue by $1.5 million and $4.0 million, respectively.

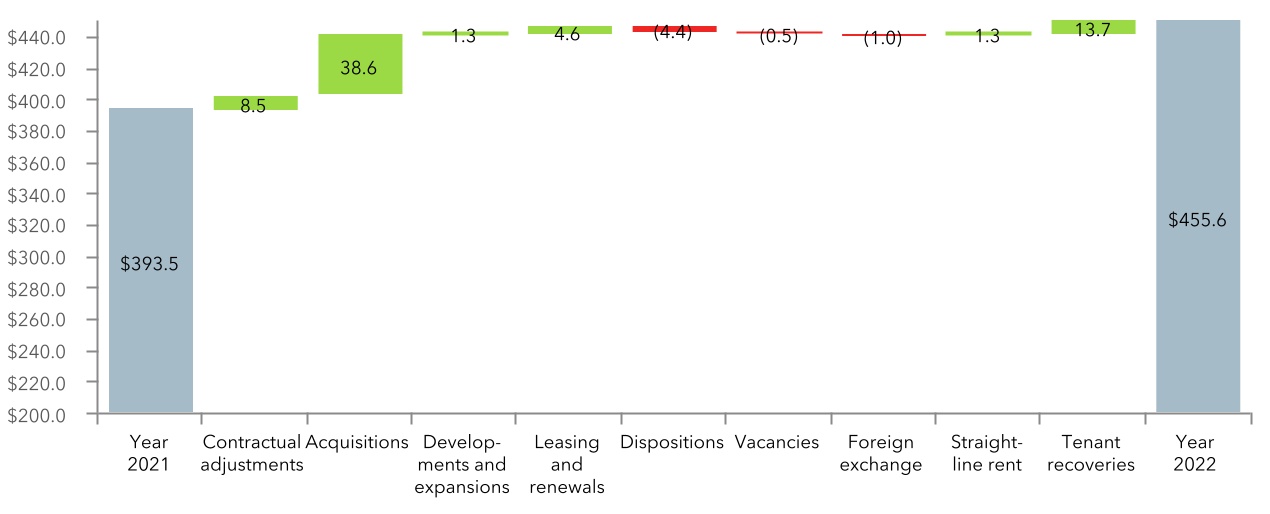

Revenue for the year ended December 31, 2022 increased by $62.1 million to $455.6 million from $393.5 million in the prior year period. The components contributing to the change in revenue are detailed below:

| | |

| Year 2022 vs Year 2021 Change in Revenue |

Additional details pertaining to the components of the change in revenue are as follows:

•contractual rent adjustments included $3.5 million from consumer price index based increases and $5.0 million from fixed contractual adjustments related to rent escalations;

•the acquisitions of properties located in the United States, Canada, Netherlands and Germany during 2021 and 2022 increased revenue by $38.6 million;

•the completion of one development and one expansion projects in Germany and Canada, respectively, increased revenue by $1.3 million;

•revenue increased by $4.6 million due to renewal and re-leasing activities for properties primarily in Canada, the United States, Netherlands and Germany;

•the sale of properties located in Austria, the United Kingdom, Poland and the Czech Republic during 2021 and 2022 decreased revenue by $4.4 million;

•vacancies at two properties in the United States decreased revenue by $0.5 million;

•foreign exchange had a net $1.0 million negative impact to revenue primarily due to the relative strengthening of the Canadian dollar against the Euro, partially offset by the relative weakening of the Canadian dollar against the US dollar, which decreased revenue by $10.6 million and increased revenue by $9.6 million, respectively; and

•straight-line rent and tenant recoveries increased revenue by $1.3 million and $13.7 million, respectively.

Net Operating Income

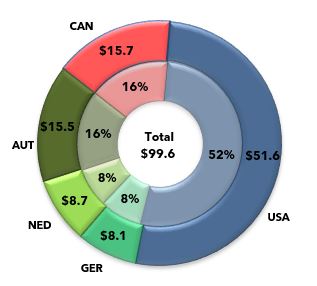

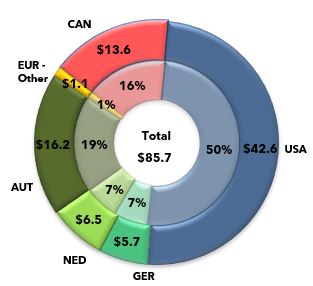

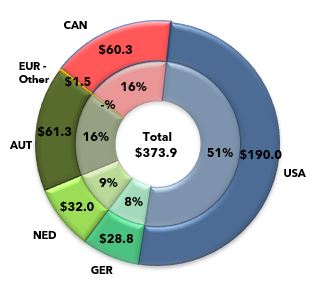

Net operating income (“NOI”) during the three months ended December 31, 2022 was $102.4 million compared to $86.3 million during the three months ended December 31, 2021. NOI for the year ended December 31, 2022 was $380.4 million compared to $332.7 million for the year ended December 31, 2021. NOI - cash basis excludes the impact of lease termination, close-out fees, straight-line rent and tenant incentive amortization and reflects the cash generated by the income-producing properties excluding lease termination and close-out fees on a period-over-period basis. NOI - cash basis was $99.6 million during the three months ended

December 31, 2022 compared with $85.7 million during the prior year period, an increase of 16.2%. NOI — cash basis was $373.9 million for the year ended December 31, 2022 compared with $329.0 million for the prior year period, an increase of 13.6%.

Same property NOI - cash basis refers to the NOI - cash basis for those properties owned by Granite throughout the entire current and prior year periods under comparison. Same property NOI - cash basis excludes the impact of properties that were acquired, disposed of and classified as held for sale, or properties under development during the periods under comparison. Same property NOI - cash basis for the three months ended December 31, 2022 was $90.6 million, compared with $83.3 million for the prior year period. Same property NOI — cash basis for the year ended December 31, 2022 was $318.9 million, compared to $311.6 million for the year ended December 31, 2021. The changes in NOI, NOI - cash basis and same property NOI - cash basis are detailed below:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Same Property NOI |

| | | | | | | | | |

| Sq ft(1) | Three Months Ended December 31, | Sq ft(1) | Years Ended December 31, |

| (in millions) | 2022 | 2021 | $ change | % change | (in millions) | 2022 | 2021 | $ change | % change |

| Revenue | | $ | 125.6 | | $ | 105.3 | | 20.3 | | | | $ | 455.6 | | $ | 393.5 | | 62.1 | | |

| Less: Property operating costs | | 23.2 | | 19.0 | | 4.2 | | | | 75.2 | | 60.8 | | 14.4 | | |

| NOI | | $ | 102.4 | | $ | 86.3 | | 16.1 | | 18.7 | % | | $ | 380.4 | | $ | 332.7 | | 47.7 | | 14.3 | % |

| Add (deduct): | | | | | | | | | | |

| Straight-line rent amortization | | (3.6) | | (1.8) | | (1.8) | | | | (10.6) | | (8.8) | | (1.8) | | |

| Tenant incentive amortization | | 0.8 | | 1.2 | | (0.4) | | | | 4.1 | | 5.1 | | (1.0) | | |

| NOI - cash basis | 59.4 | | $ | 99.6 | | $ | 85.7 | | 13.9 | | 16.2 | % | 59.4 | | $ | 373.9 | | $ | 329.0 | | 44.9 | | 13.6 | % |

| Less NOI - cash basis for: | | | | | | | | | | |

| Acquisitions | 4.8 | | (7.8) | | (0.5) | | (7.3) | | | 10.5 | (50.8) | | (9.2) | | (41.6) | | |

| Developments | 0.9 | | (0.6) | | — | | (0.6) | | | 0.9 | | (0.5) | | (0.1) | | (0.4) | | |

| Dispositions and assets held for sale | 1.1 | | (0.6) | | (1.9) | | 1.3 | | | 1.1 | | (3.7) | | (8.1) | | 4.4 | | |

| Same property NOI - cash basis | 53.7 | | $ | 90.6 | | $ | 83.3 | | 7.3 | | 8.8 | % | 48.0 | $ | 318.9 | | $ | 311.6 | | 7.3 | | 2.3 | % |

Constant currency same property NOI - cash basis(2) | 53.7 | | $ | 90.6 | | $ | 85.5 | | 5.1 | | 6.0 | % | 48.0 | $ | 318.9 | | $ | 308.5 | | 10.4 | | 3.4 | % |

(1) The square footage relating to the NOI — cash basis represents GLA of 59.4 million square feet as at December 31, 2022. The square footage relating to the same property NOI — cash basis represents the aforementioned GLA excluding the impact from the acquisitions, dispositions, assets held for sale and developments during the relevant period.

(2) Constant currency same property NOI - cash basis is calculated by converting the comparative same property NOI - cash basis at current period average foreign exchange rates.

Property operating costs include recoverable and non-recoverable costs from tenants and consist of property taxes, utilities, insurance, repairs and maintenance, legal and other property-related expenses.

Straight-line rent amortization represents the scheduled fixed rent changes or rent-free periods in leases that are recognized in revenue evenly on a straight-line basis over the term of the lease. Tenant incentive amortization mainly represents allowances provided to tenants that are

recognized in revenue evenly on a straight-line basis over the term of the lease and primarily comprises the amortization associated with the cash allowance incentives paid to Magna in respect of the 10-year lease extensions exercised during the 2014 year at the Thondorf and Eurostar properties in Graz, Austria.

NOI - cash basis for the three months ended December 31, 2022 increased by $13.9 million to $99.6 million from $85.7 million in the prior year period, representing an increase of 16.2%. NOI - cash basis for the year ended December 31, 2022 increased by $44.9 million to $373.9 million from $329.0 million in the prior year period, representing an increase of 13.6%. The increase in NOI - cash basis was largely a result of the increase in rental revenue as noted previously, partially offset by an increase in property operating costs primarily relating to the properties acquired in 2021 and 2022.

Same property NOI - cash basis for the three months ended December 31, 2022 increased by $7.3 million (8.8%) to $90.6 million from $83.3 million primarily due to the increase in contractual rents arising from both consumer price index and fixed rent increases, re-leasing and renewals of leases for properties primarily located in Canada, the United States, Germany and Netherlands, and the favourable foreign exchange impact from the weakening of the Canadian dollar against the US dollar, partially offset by the unfavourable foreign exchange impact from the strengthening of the Canadian dollar against the Euro. Excluding the impact of foreign exchange, same property NOI - cash basis for the three month period ended December 31, 2022 increased by $5.1 million (6.0%) from the prior year period.

Same property NOI - cash basis for the year ended December 31, 2022 increased by $7.3 million (2.3%) to $318.9 million from $311.6 million primarily due to the increase in contractual rents arising from both consumer price index and fixed rent increases, re-leasing and renewals of leases for properties primarily located in Canada, the United States, Netherlands and Germany, and the favourable foreign exchange impact from the weakening of the Canadian dollar against the US dollar, partially offset by the unfavourable foreign exchange impact from the strengthening of the Canadian dollar against the Euro. Excluding the impact of foreign exchange, same property NOI - cash basis for the year ended December 31, 2022 increased by $10.4 million (3.4%) from the prior year period.

NOI - cash basis for the three month periods and years ended December 31, 2022 and 2021 by geography was as follows:

| | |

| NOI - Cash Basis by Geography |

| | | | | |

| Fourth Quarter 2022 | Fourth Quarter 2021 |

Granite’s property portfolio and NOI - cash basis are geographically diversified, which reduces the risk to Granite’s operating results from any particular country’s economic downturn.

Same property NOI - cash basis for the three month periods and years ended December 31, 2022 and 2021 by geography was as follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Same Property NOI - Cash Basis by Geography |

| | | | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2022 | 2021 | % change | | 2022 | 2021 | % change |

| | | | | | | |

| Canada | $14.0 | | $13.2 | | 6.1 | % | | $54.3 | | $52.3 | | 3.8 | % |

| United States | 48.4 | | 42.1 | | 15.0 | % | | 156.1 | | 145.5 | | 7.3 | % |

| Austria | 15.6 | | 16.1 | | (3.1) | % | | 61.3 | | 65.7 | | (6.7) | % |

| Germany | 6.1 | | 5.7 | | 7.0 | % | | 23.5 | | 23.7 | | (0.8) | % |

| Netherlands | 6.5 | | 6.2 | | 4.8 | % | | 23.7 | | 24.4 | | (2.9) | % |

| Same Property NOI - cash basis | $90.6 | | $83.3 | | 8.8 | % | | $318.9 | | $311.6 | | 2.3 | % |

Constant currency same property NOI - cash basis for the three month periods and years ended December 31, 2022 and 2021 by geography was as follows, which is calculated by converting the comparative same property NOI - cash basis at current foreign exchange rates:

| | | | | | | | | | | | | | | | | | | | | | | |

| Constant Currency Same Property NOI - Cash Basis by Geography |

| | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2022 | 2021 | % change | | 2022 | 2021 | % change |

| | | | | | | |

| Canada | $14.0 | $13.2 | 6.1 | % | | $54.3 | $52.3 | 3.8 | % |

| United States | 48.4 | | 45.3 | | 6.8 | % | | 156.1 | | 151.1 | | 3.3 | % |

| Austria | 15.6 | | 15.5 | | 0.6 | % | | 61.3 | | 60.7 | | 1.0 | % |

| Germany | 6.1 | | 5.5 | | 10.9 | % | | 23.5 | | 21.9 | | 7.3 | % |

| Netherlands | 6.5 | | 6.0 | | 8.3 | % | | 23.7 | | 22.5 | | 5.3 | % |

Constant Currency Same Property NOI - cash basis (1) | $90.6 | | $85.5 | 6.0 | % | | $318.9 | | $308.5 | 3.4 | % |

(1) Constant currency same property NOI - cash basis is calculated by converting the comparative same property NOI - cash basis at current period average foreign exchange rates.

General and Administrative Expenses

General and administrative expenses consisted of the following:

| | | | | | | | | | | | | | | | | | | | | | | |

| General and Administrative Expenses |

| | | | | |

| Three Months Ended December 31, | | Year Ended December 31, |

| 2022 | 2021 | $ change | | 2022 | 2021 | $ change |

| Salaries and benefits | $ | 4.5 | | $ | 4.9 | | (0.4) | | | $ | 18.2 | | $ | 17.1 | | 1.1 | |

| Audit, legal and consulting | 0.6 | | 0.9 | | (0.3) | | | 3.2 | | 3.5 | | (0.3) | |

| Trustee/director fees and related expenses | 0.4 | | 0.4 | | — | | | 1.7 | | 1.6 | | 0.1 | |

| Executive unit-based compensation expense including distributions | 0.9 | | 1.2 | | (0.3) | | | 4.6 | | 5.0 | | (0.4) | |

| Fair value remeasurement of trustee/director and executive unit-based compensation plans | — | | 3.6 | | (3.6) | | | (6.3) | | 6.1 | | (12.4) | |

| Other public entity costs | 0.3 | | 0.5 | | (0.2) | | | 2.6 | | 2.0 | | 0.6 | |

| Office rents including property taxes and common area maintenance costs | 0.2 | | 0.1 | | 0.1 | | | 0.5 | | 0.4 | | 0.1 | |

| Capital tax | 0.3 | | 0.2 | | 0.1 | | | 0.9 | | 0.6 | | 0.3 | |

| Information technology | 0.6 | | 0.5 | | 0.1 | | | 2.2 | | 1.8 | | 0.4 | |

| Other | 1.0 | | 0.4 | | 0.6 | | | 2.8 | | 1.0 | | 1.8 | |

| $ | 8.8 | | $ | 12.7 | | (3.9) | | | $ | 30.4 | | $ | 39.1 | | (8.7) | |

| Less: capitalized general and administrative expenses | (0.2) | | (0.3) | | 0.1 | | | (0.9) | | (0.7) | | (0.2) | |

| General and administrative expenses | $ | 8.6 | | $ | 12.4 | | (3.8) | | | $ | 29.5 | | $ | 38.4 | | (8.9) | |

General and administrative expenses were $8.6 million for the three month period ended December 31, 2022 and decreased $3.8 million in comparison to the prior year period primarily as a result of the following:

•a decrease in the fair value remeasurement expense associated with the trustee/director and executive unit-based compensation plans resulting from a slight increase in the market price of the Trust’s stapled units in the current year period compared to a larger increase in the market price of the Trust’s stapled units in the fourth quarter of 2021;

•a decrease in salaries and benefits expense primarily due to higher incentive compensation recorded in the prior year period, partially offset by an increase in headcount in North America and Europe;

•a decrease in audit, legal and consulting expenses primarily due to a decrease in professional fees relating to higher transactional activity in the prior year period; and

•a decrease in executive unit-based compensation expense primarily due to the decrease in the fair value of the performance stapled units (“PSU”) resulting in a lower compensation expense of the PSU grants, partially offset by;

•an increase in other general and administrative expenses primarily relating to the resumption of travel and property tours.

General and administrative expenses were $29.5 million for the year ended December 31, 2022 and decreased $8.9 million in comparison to the prior year period primarily as a result of the following:

•an increase in the fair value remeasurement recovery associated with the trustee/director and executive unit-based compensation plans resulting from a decrease in the market price of the Trust’s stapled units in the current year period compared to the increase in the market price of the Trust’s stapled units in the prior year period;

•a decrease in executive unit-based compensation expense primarily due to the decrease in the fair value of the performance stapled units (“PSU”) resulting in a lower compensation expense of the PSU grants; and

•a decrease in audit, legal and consulting expenses primarily due to a decrease in professional fees relating to higher transactional activity in the prior year period, partially offset by;

•an increase in salaries and benefits expense primarily due to an increase in headcount in North America and Europe;

•an increase in other public entity costs primarily due to the special business conducted at Granite’s in-person Annual General and Special Meeting, and higher public entity listing and ESG+R reporting fees; and

•an increase in other general and administrative expenses primarily relating to costs associated with the exploration of potential acquisitions, increased travelling expenses upon the resumption of property tours and staff travel, and recruiting fees as a result of the additional employees in North America and Europe.

Interest Income

Interest income for the three month period ended December 31, 2022 increased $0.2 million to $1.1 million from $0.9 million in the prior year period. The $0.2 million increase is primarily due to interest income earned from higher interest rates in the current year period relative to the prior year period, partially offset by lower invested cash balances on hand in the current year relative to the prior year. Interest income for the year ended December 31, 2022 decreased $1.5 million to $1.6 million from $3.1 million in the prior year period. The $1.5 million decrease is primarily due to lower invested cash balances on hand in the current year relative to the prior year, partially offset by higher interest rates in the current year.

Interest Expense and Other Financing Costs

Interest expense and other financing costs for the three month period ended December 31, 2022 increased $4.6 million to $16.7 million from $12.1 million in the prior year period. The increase was primarily due to the drawdown of the 2025 Term Loan (as defined herein) in September 2022 and higher interest costs due to an increase in borrowing rates in the current year period relative to the prior year period.

Interest expense and other financing costs for the year ended December 31, 2022 increased $3.8 million to $51.0 million from $47.2 million in the prior year period. The increase was primarily due to the issuance of the 2028 Debentures (as defined herein) in August 2021, draws on the Credit Facility, the drawdown of the 2025 Term Loan in September 2022 and higher interest costs due to an increase in borrowing rates in the current year relative to the prior year, partially offset by a decrease related to a $4.0 million early redemption premium for the $250.0 million aggregate principal amount of 3.788% Series 2 senior debentures due July 5, 2021 (“the 2021 Debentures”) recorded in the first quarter of 2021.

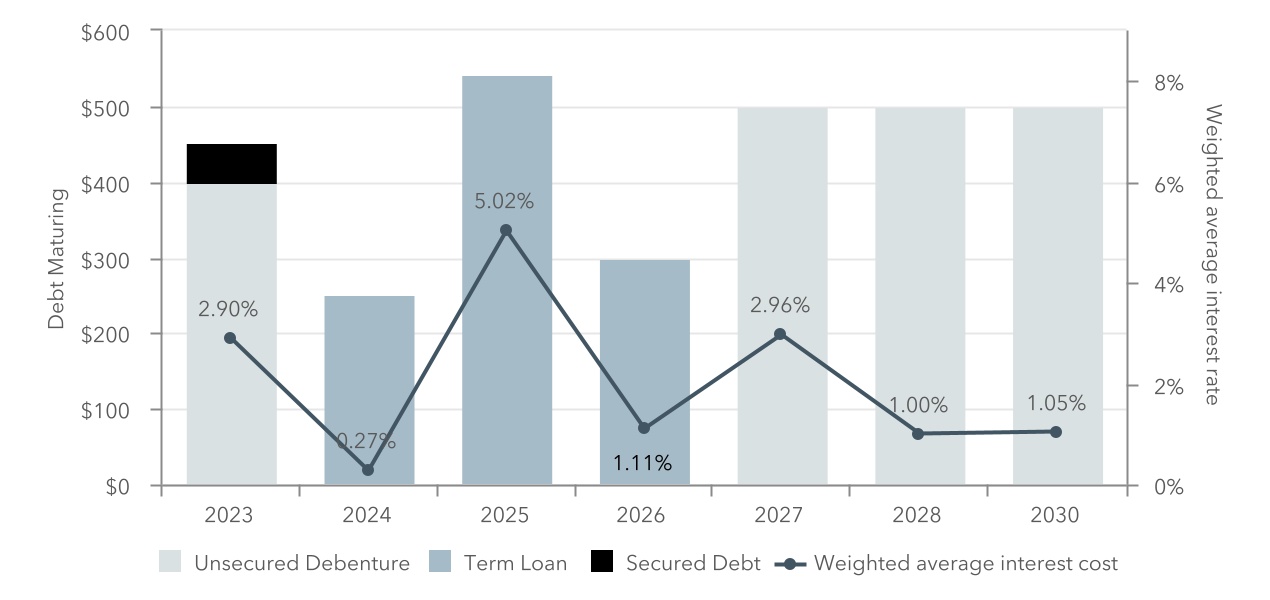

As at December 31, 2022, Granite’s weighted average cost of interest-bearing debt was 2.28% (December 31, 2021 - 1.81%) and the weighted average debt term-to-maturity was 4.1 years (December 31, 2021 - 5.5 years).

Foreign Exchange Gains and Losses, Net

Granite recognized net foreign exchange gains of $0.8 million and $2.1 million in the three months ended December 31, 2022 and 2021, respectively. The $1.3 million decrease in net foreign exchange gains is primarily due to the decrease in foreign exchange gains from the settlement of foreign exchange collar contracts of $0.7 million when compared to the prior year period and the remeasurement of certain monetary assets and liabilities of the Trust that are denominated in US dollars and Euros.

Granite recognized net foreign exchange gains of $1.2 million and $5.1 million in the years ended December 31, 2022 and 2021, respectively. The $3.9 million decrease in net foreign exchange gains is primarily due to the decrease in foreign exchange gains from the settlement of foreign exchange collar contracts of $4.5 million when compared to the prior year period, partially offset by the remeasurement of certain monetary assets and liabilities of the Trust that are denominated in US dollars and Euros.

Fair Value Gains and Losses on Investment Properties, Net

Net fair value losses on investment properties were $229.9 million and net fair value gains on investment properties were $349.1 million in the three months ended December 31, 2022 and 2021, respectively. In the three months ended December 31, 2022, net fair value losses of $229.9 million were primarily attributable to the expansion in discount and terminal capitalization rates across all of Granite’s markets in response to rising interest rates, partially offset by fair market rent increases across the GTA and selective U.S. and European markets reflecting current market fundamentals.

Net fair value gains on investment properties in the three months ended December 31, 2021 of $349.1 million were primarily attributable to favourable changes in fair market rent assumptions as well as compression in discount and terminal capitalization rates for properties located in the GTA and across the United States and Europe.

Net fair value losses on investment properties were $219.7 million and net fair value gains on investment properties were $1,298.9 million in the years ended December 31, 2022 and 2021, respectively. The net fair value losses recorded in the second, third and fourth quarters of 2022 exceeded the net fair value gains on investment properties of $490.6 million recognized during the first quarter of 2022, resulting in a net fair value loss on investment properties of $219.7 million in the year ended December 31, 2022.

Net fair value gains on investment properties in the year ended December 31, 2021 of $1,298.9 million were primarily attributable to various factors including (i) favourable changes in leasing assumptions associated with fair market rent increases for properties located in Canada and the United States and (ii) compression in discount and terminal capitalization rates for properties located in the GTA, across the United States and Europe resulting from the continued market demand for industrial real estate properties.

Fair Value Gains and Losses on Financial Instruments, Net

The net fair value gains on financial instruments were $2.1 million and $0.6 million for the three month periods ended December 31, 2022 and 2021, respectively. The net fair value gains on financial instruments for the year ended December 31, 2022 were $11.4 million and the net fair value losses on financial instruments for the year ended December 31, 2021 were $1.2 million. The net fair value gains on financial instruments for the three months ended December 31, 2022 are related to fair value gains from the 2024 Cross Currency Interest Rate Swap (as

defined herein) and net fair value gains on the foreign exchange collar contracts, partially offset by the fair value loss from the ineffective hedge portion of the combination of the 2025 Term Loan and 2025 Interest Rate Swap. The net fair value gains on financial instruments for the year ended December 31, 2022 are related to fair value gains from the 2024 Cross Currency Interest Rate Swap (as defined herein), partially offset by the net fair value losses on the foreign exchange collar contracts and fair value loss from the ineffective hedge portion of the combination of the 2025 Term Loan and 2025 Interest Rate Swap. The Trust partially employed or did not employ hedge accounting for the derivatives and foreign exchange collars, therefore the change in fair value is recognized in fair value (gains) losses on financial instruments, net, in the combined statements of net (loss) income.

The net fair value gains on financial instruments for the three months ended December 31, 2021 are related to the fair value movements of the 2024 Cross Currency Interest Rate Swap, partially offset by net fair value losses on foreign exchange collar contracts. The net fair value losses on financial instruments for the year ended December 31, 2021 are related the net fair value losses associated with the fair value movements of the 2021 Cross Currency Interest Rate Swap and the fair value losses on the foreign exchange collar contracts, partially offset by the fair value gains on the 2024 Cross Currency Interest Rate Swap. The Trust partially employed or did not employ hedge accounting for the derivatives and foreign exchange collars, therefore the change in fair value is recognized in fair value (gains) losses on financial instruments, net, in the combined statements of net (loss) income.

Loss on Sale of Investment Properties

There were no property dispositions during the three months ended December 31, 2022. The loss on sale of investment properties for the three months ended December 31, 2021 was $0.2 million and is primarily related to broker commissions and legal advisory costs associated with the disposition of the property in Ebergassing, Austria on November 20, 2021.