Exhibit 99.2 NASDAQ: IBTX Earnings Presentation July 28, 2020

Safe Harbor Statement This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of Independent Bank Group, Inc. (“IBTX”). Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on IBTX’s current expectations and assumptions regarding IBTX’s business, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, risks, and changes in circumstances that are difficult to predict. Many possible events or factors could affect IBTX’s future financial results and performance and could cause actual results or performance to differ materially from anticipated results or performance. Such risks and uncertainties include, among others, risks relating to the coronavirus (COVID-19) pandemic and its effect on U.S. and world financial markets, potential regulatory actions, changes in consumer behaviors and impacts on and modifications to the operations and business of IBTX relating thereto, and the business, economic and political conditions in the markets in which IBTX operates. Except to the extent required by applicable law or regulation, IBTX disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information regarding IBTX and factors which could affect the forward-looking statements contained herein can be found in IBTX’s Annual Report on Form 10-K, as amended, for the fiscal year ended December 31, 2019, its Quarterly Report on Form 10-Q for the period ended March 31, 2020, and its other filings with the Securities and Exchange Commission. NASDAQ: IBTX 2

Today's Presenters David R. Brooks Chairman of the Board, CEO and President, Director • 40 years in the financial services industry; 32 years at Independent Bank • Active in community banking since the early 1980s - led the investor group that acquired Independent Bank in 1988 Daniel W. Brooks Vice Chairman, Chief Risk Officer, Director • 37 years in the financial services industry; 31 years at Independent Bank • Active in community banking since the early 1980s Michelle S. Hickox Executive Vice President, Chief Financial Officer • 30 years in the financial services industry; 8 years at Independent Bank • Formerly a Financial Services Audit Partner at RSM US LLP • Certified Public Accountant NASDAQ: IBTX 3

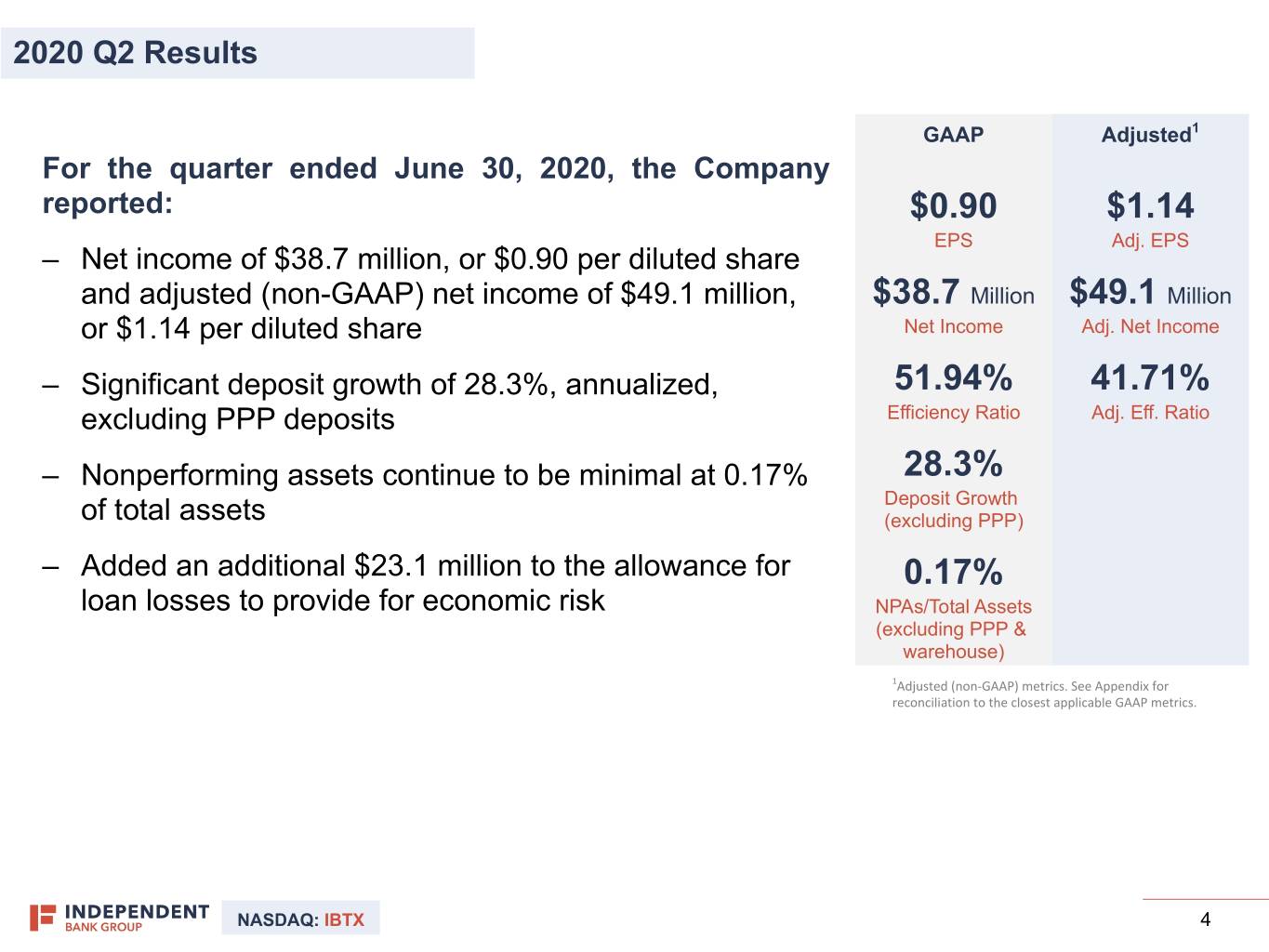

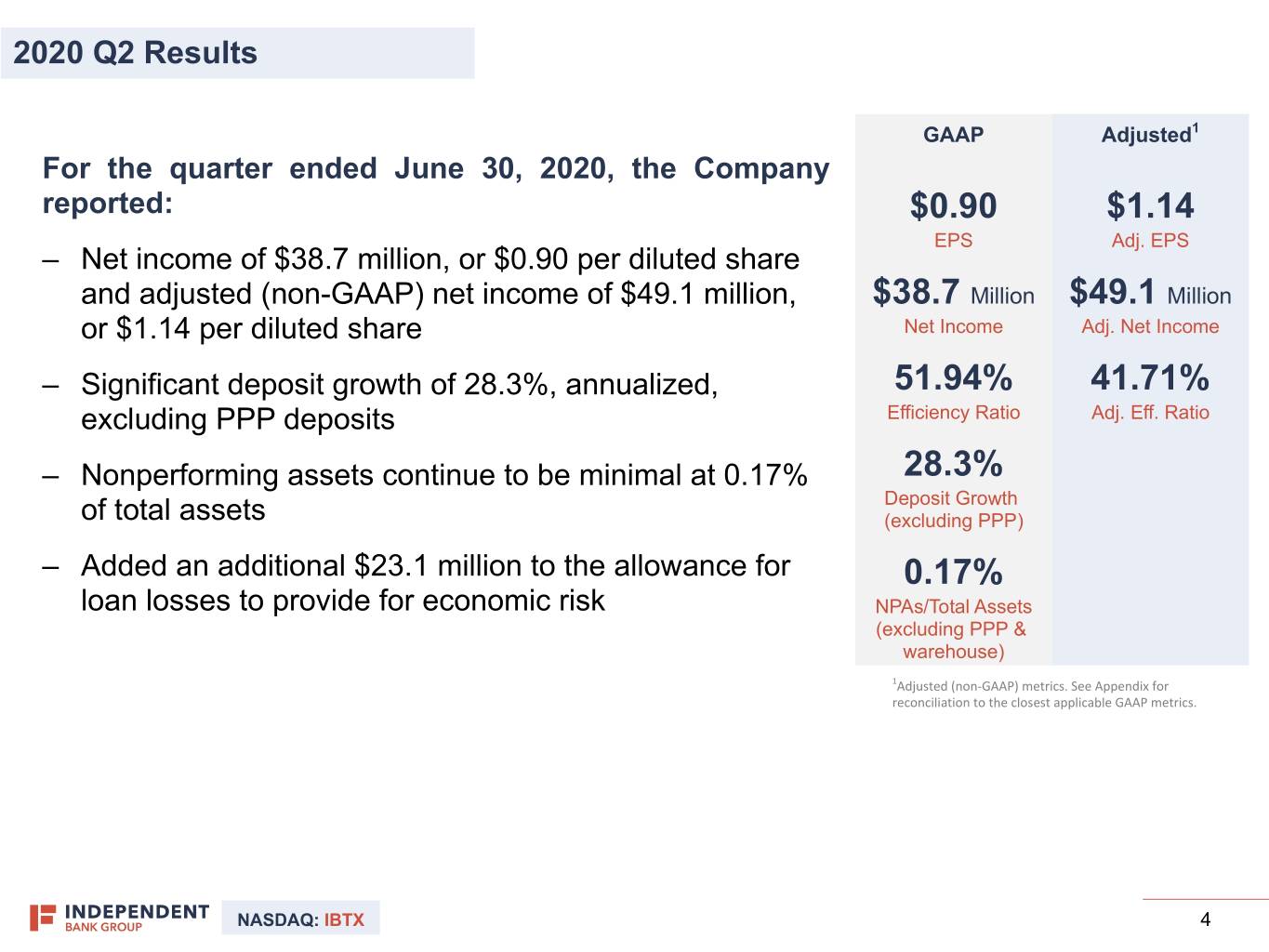

2020 Q2 Results GAAP Adjusted1 For the quarter ended June 30, 2020, the Company reported: $0.90 $1.14 EPS Adj. EPS – Net income of $38.7 million, or $0.90 per diluted share and adjusted (non-GAAP) net income of $49.1 million, $38.7 Million $49.1 Million or $1.14 per diluted share Net Income Adj. Net Income – Significant deposit growth of 28.3%, annualized, 51.94% 41.71% excluding PPP deposits Efficiency Ratio Adj. Eff. Ratio – Nonperforming assets continue to be minimal at 0.17% 28.3% Deposit Growth of total assets (excluding PPP) – Added an additional $23.1 million to the allowance for 0.17% loan losses to provide for economic risk NPAs/Total Assets (excluding PPP & warehouse) 1Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. NASDAQ: IBTX 4

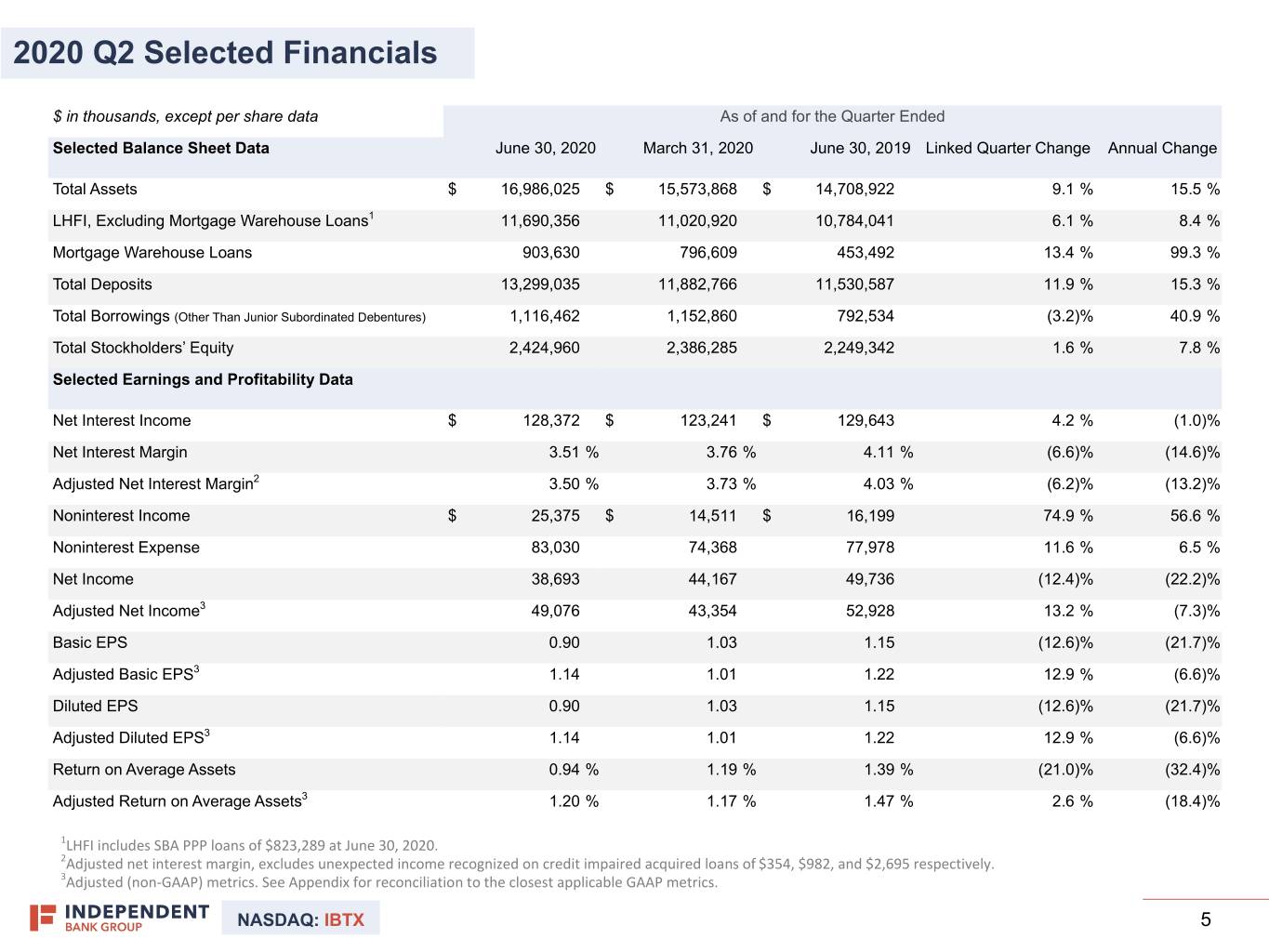

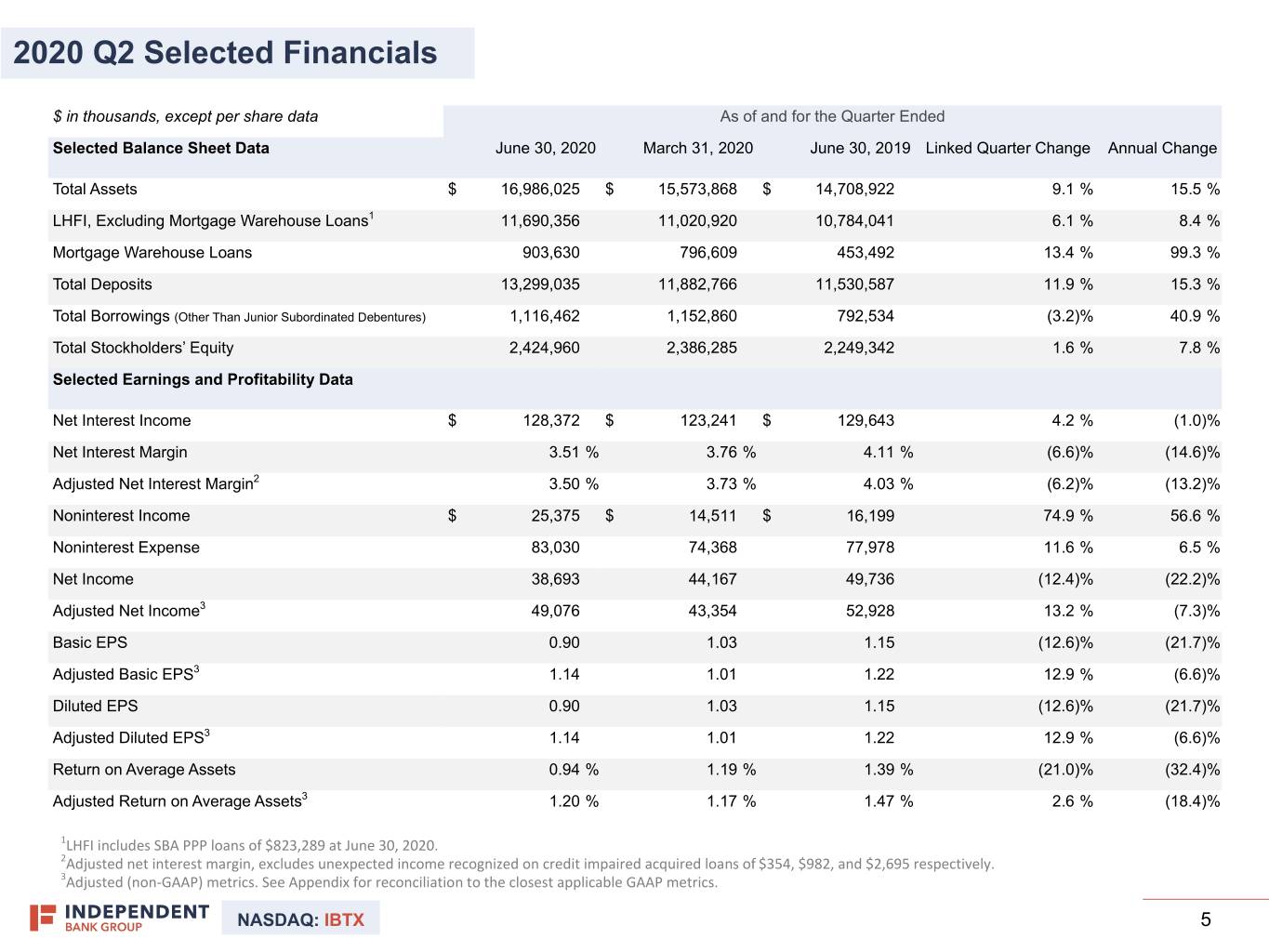

2020 Q2 Selected Financials $ in thousands, except per share data As of and for the Quarter Ended Selected Balance Sheet Data June 30, 2020 March 31, 2020 June 30, 2019 Linked Quarter Change Annual Change Total Assets $ 16,986,025 $ 15,573,868 $ 14,708,922 9.1 % 15.5 % LHFI, Excluding Mortgage Warehouse Loans1 11,690,356 11,020,920 10,784,041 6.1 % 8.4 % Mortgage Warehouse Loans 903,630 796,609 453,492 13.4 % 99.3 % Total Deposits 13,299,035 11,882,766 11,530,587 11.9 % 15.3 % Total Borrowings (Other Than Junior Subordinated Debentures) 1,116,462 1,152,860 792,534 (3.2) % 40.9 % Total Stockholders’ Equity 2,424,960 2,386,285 2,249,342 1.6 % 7.8 % Selected Earnings and Profitability Data Net Interest Income $ 128,372 $ 123,241 $ 129,643 4.2 % (1.0) % Net Interest Margin 3.51 % 3.76 % 4.11 % (6.6) % (14.6) % Adjusted Net Interest Margin2 3.50 % 3.73 % 4.03 % (6.2) % (13.2) % Noninterest Income $ 25,375 $ 14,511 $ 16,199 74.9 % 56.6 % Noninterest Expense 83,030 74,368 77,978 11.6 % 6.5 % Net Income 38,693 44,167 49,736 (12.4) % (22.2) % Adjusted Net Income3 49,076 43,354 52,928 13.2 % (7.3) % Basic EPS 0.90 1.03 1.15 (12.6) % (21.7) % Adjusted Basic EPS3 1.14 1.01 1.22 12.9 % (6.6) % Diluted EPS 0.90 1.03 1.15 (12.6) % (21.7) % Adjusted Diluted EPS3 1.14 1.01 1.22 12.9 % (6.6) % Return on Average Assets 0.94 % 1.19 % 1.39 % (21.0) % (32.4) % Adjusted Return on Average Assets3 1.20 % 1.17 % 1.47 % 2.6 % (18.4) % 1LHFI includes SBA PPP loans of $823,289 at June 30, 2020. 2Adjusted net interest margin, excludes unexpected income recognized on credit impaired acquired loans of $354, $982, and $2,695 respectively. 3Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. NASDAQ: IBTX 5

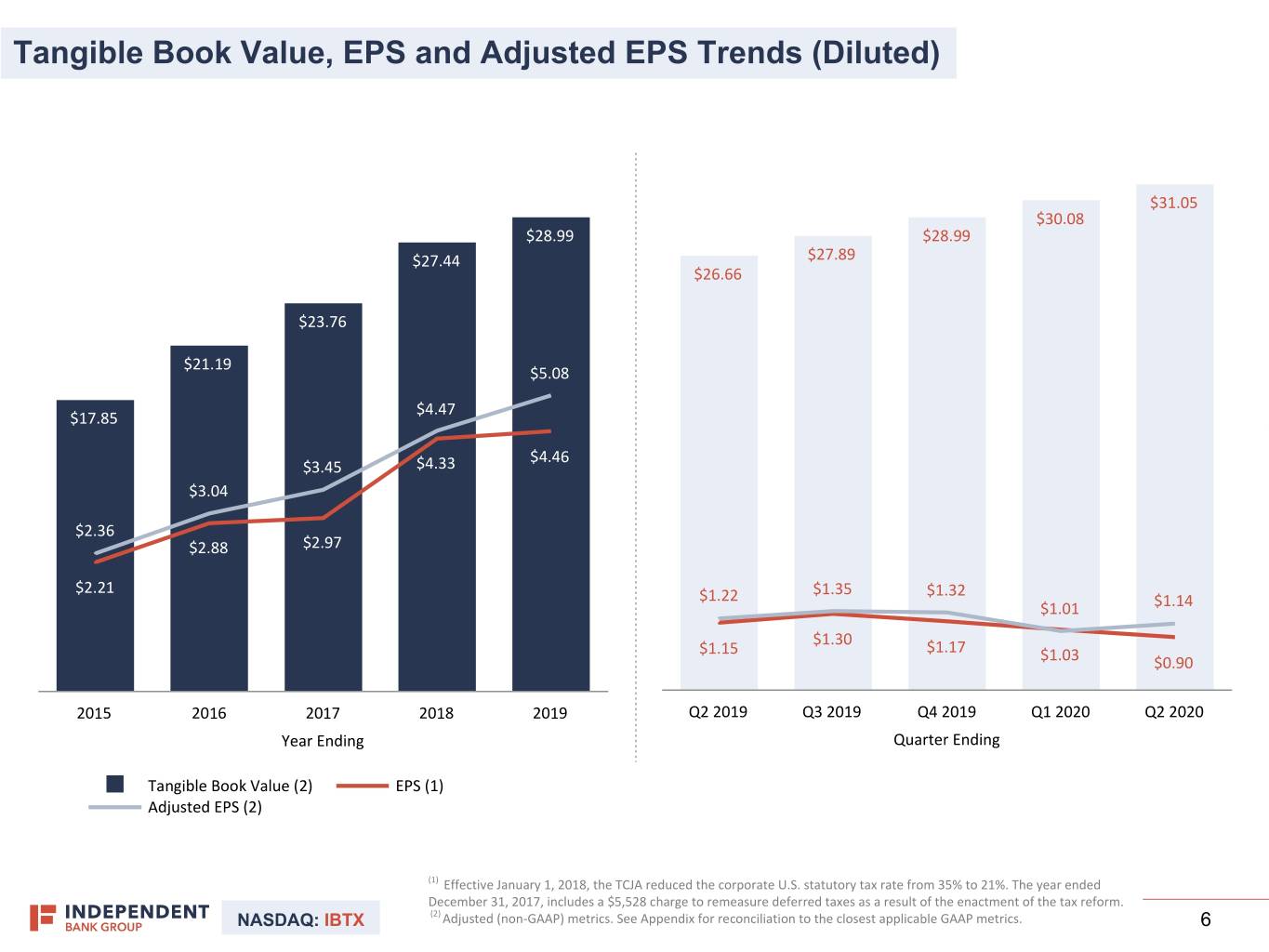

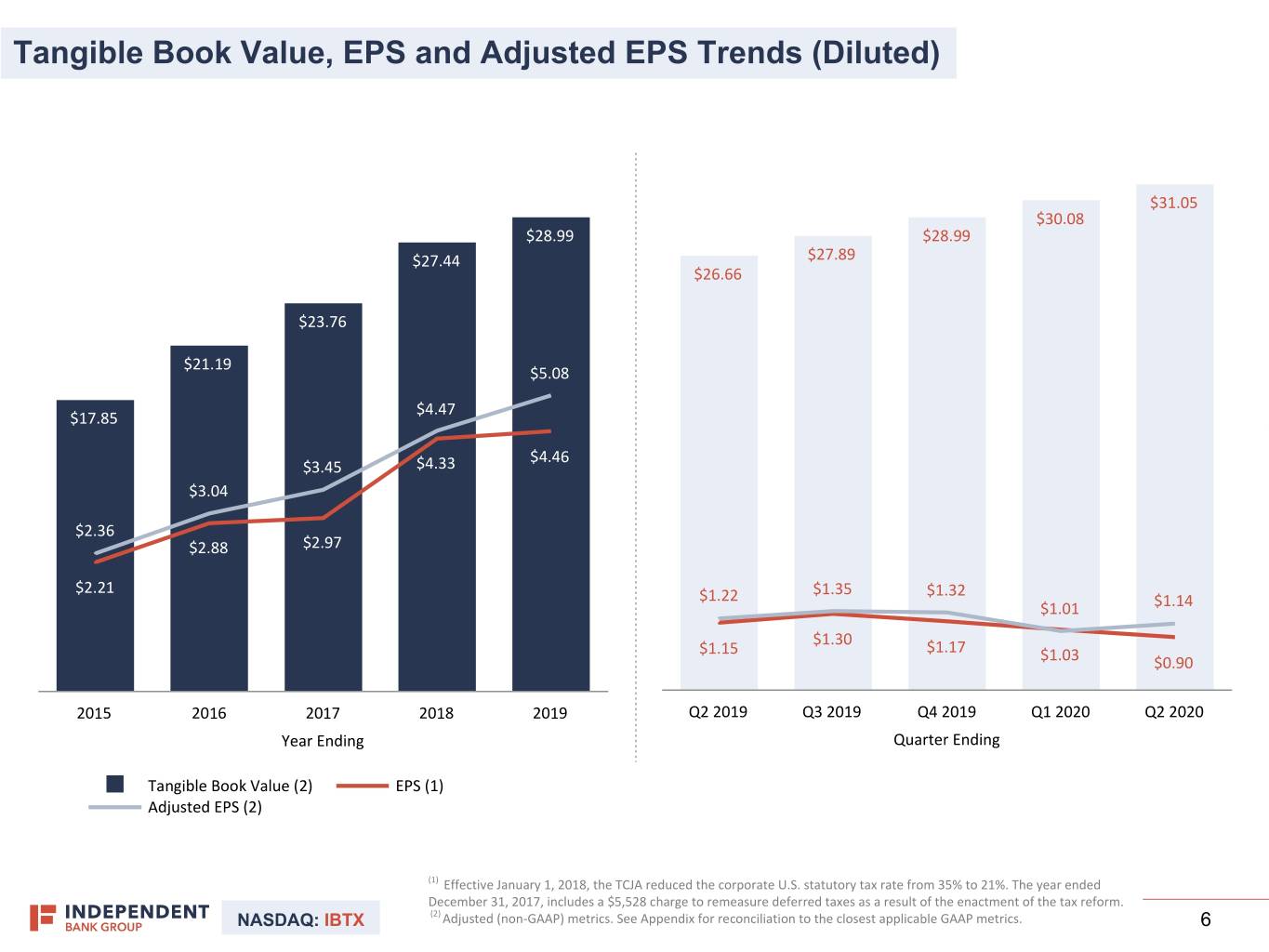

Tangible Book Value, EPS and Adjusted EPS Trends (Diluted) $31.05 $30.08 $28.99 $28.99 $27.44 $27.89 $26.66 $23.76 $21.19 $5.08 $4.47 $17.85 $4.46 $3.45 $4.33 $3.04 $2.36 $2.88 $2.97 $2.21 $1.22 $1.35 $1.32 $1.01 $1.14 $1.30 $1.15 $1.17 $1.03 $0.90 2015 2016 2017 2018 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Year Ending Quarter Ending Tangible Book Value (2) EPS (1) Adjusted EPS (2) (1) Effective January 1, 2018, the TCJA reduced the corporate U.S. statutory tax rate from 35% to 21%. The year ended December 31, 2017, includes a $5,528 charge to remeasure deferred taxes as a result of the enactment of the tax reform. NASDAQ: IBTX (2) Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. 6 6

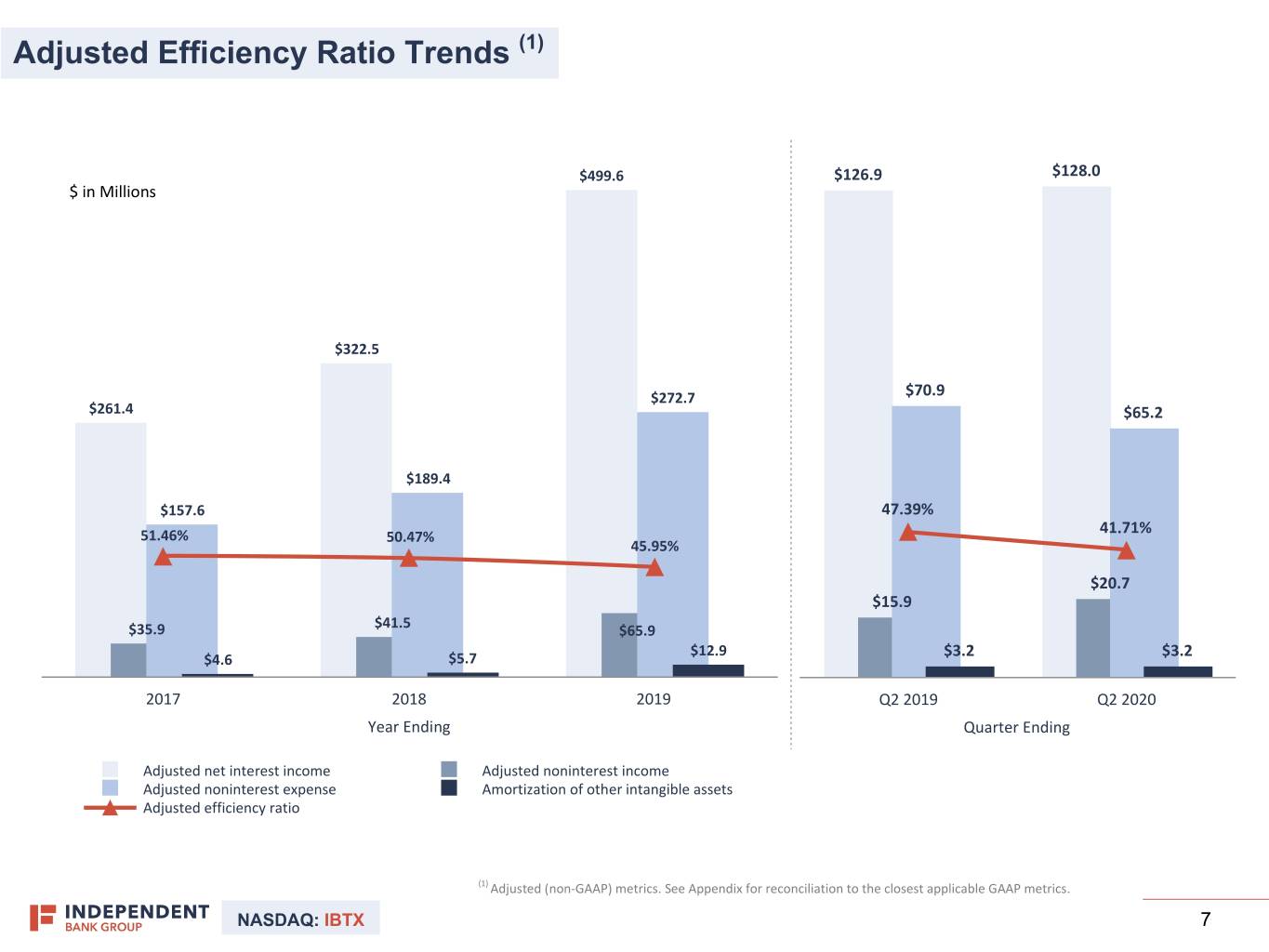

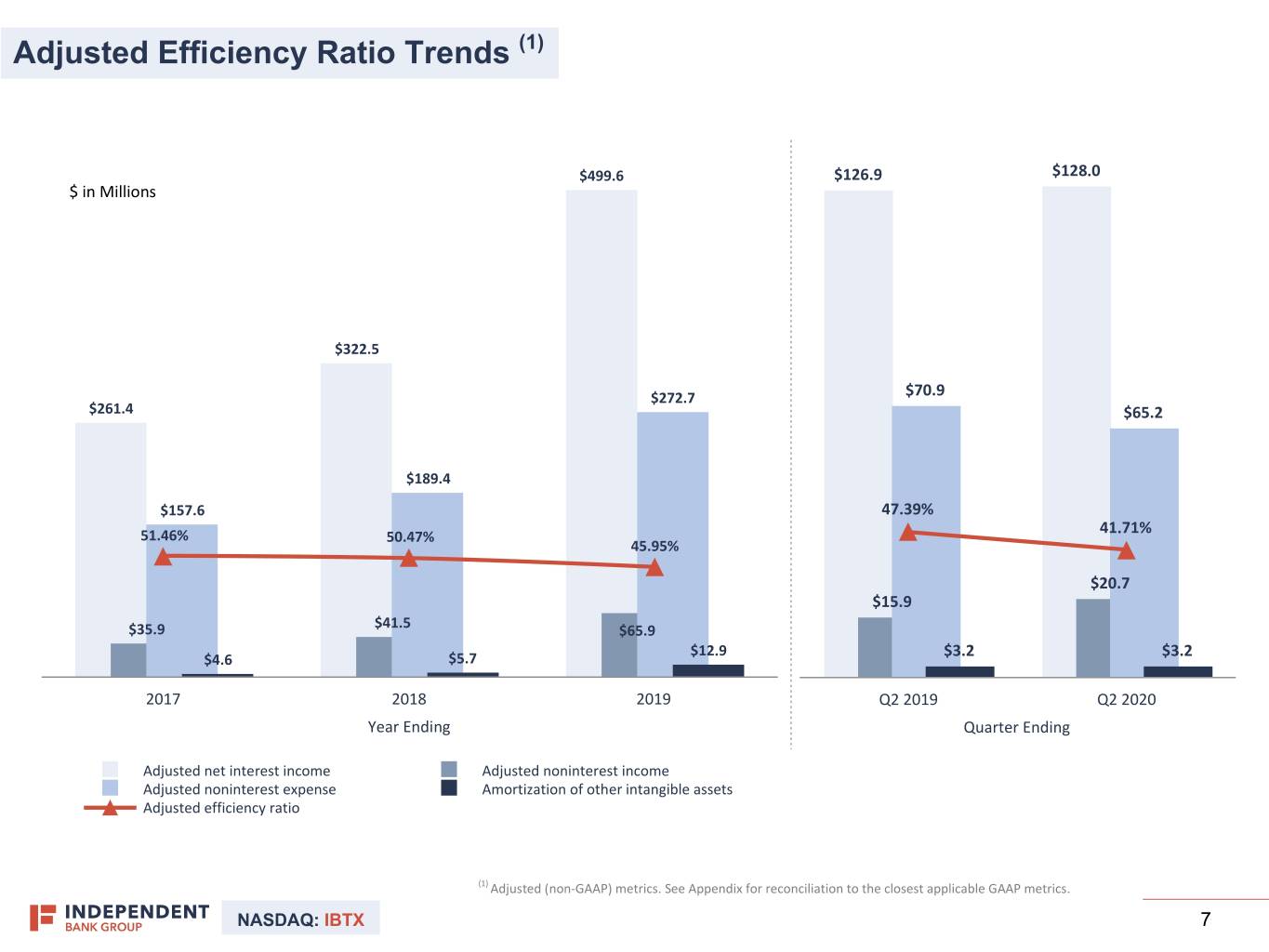

Adjusted Efficiency Ratio Trends (1) $499.6 $126.9 $128.0 $ in Millions $322.5 $272.7 $70.9 $261.4 $65.2 $189.4 $157.6 47.39% 41.71% 51.46% 50.47% 45.95% $20.7 $15.9 $35.9 $41.5 $65.9 $12.9 $3.2 $3.2 $4.6 $5.7 2017 2018 2019 Q2 2019 Q2 2020 Year Ending Quarter Ending Adjusted net interest income Adjusted noninterest income Adjusted noninterest expense Amortization of other intangible assets Adjusted efficiency ratio (1) Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. NASDAQ: IBTX 7 7

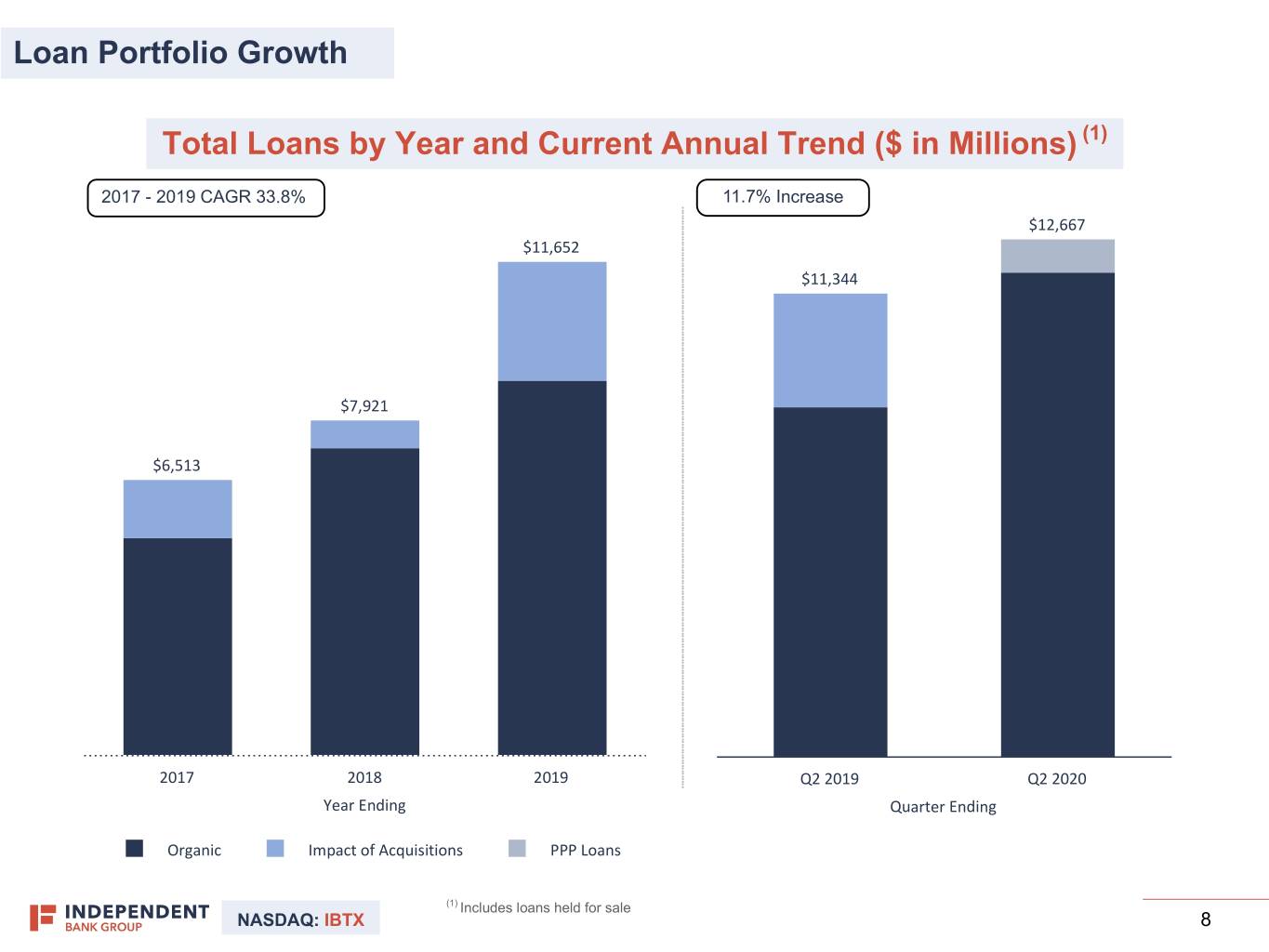

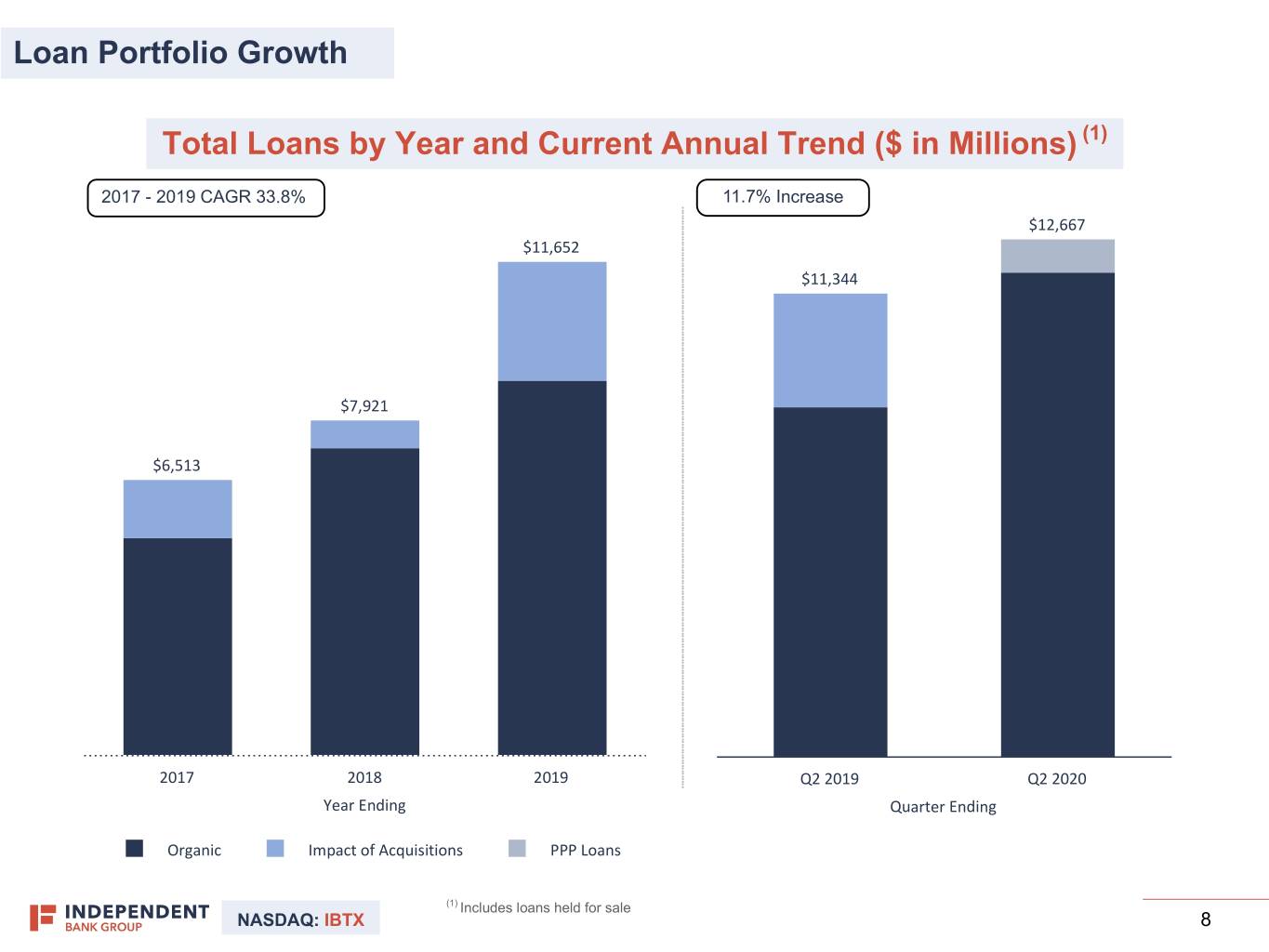

Loan Portfolio Growth Total Loans by Year and Current Annual Trend ($ in Millions) (1) 2017 - 2019 CAGR 33.8% 11.7% Increase $12,667 $11,652 $11,344 $7,921 $6,513 2017 2018 2019 Q2 2019 Q2 2020 Year Ending Quarter Ending Organic Impact of Acquisitions PPP Loans (1) Includes loans held for sale NASDAQ: IBTX 8 8

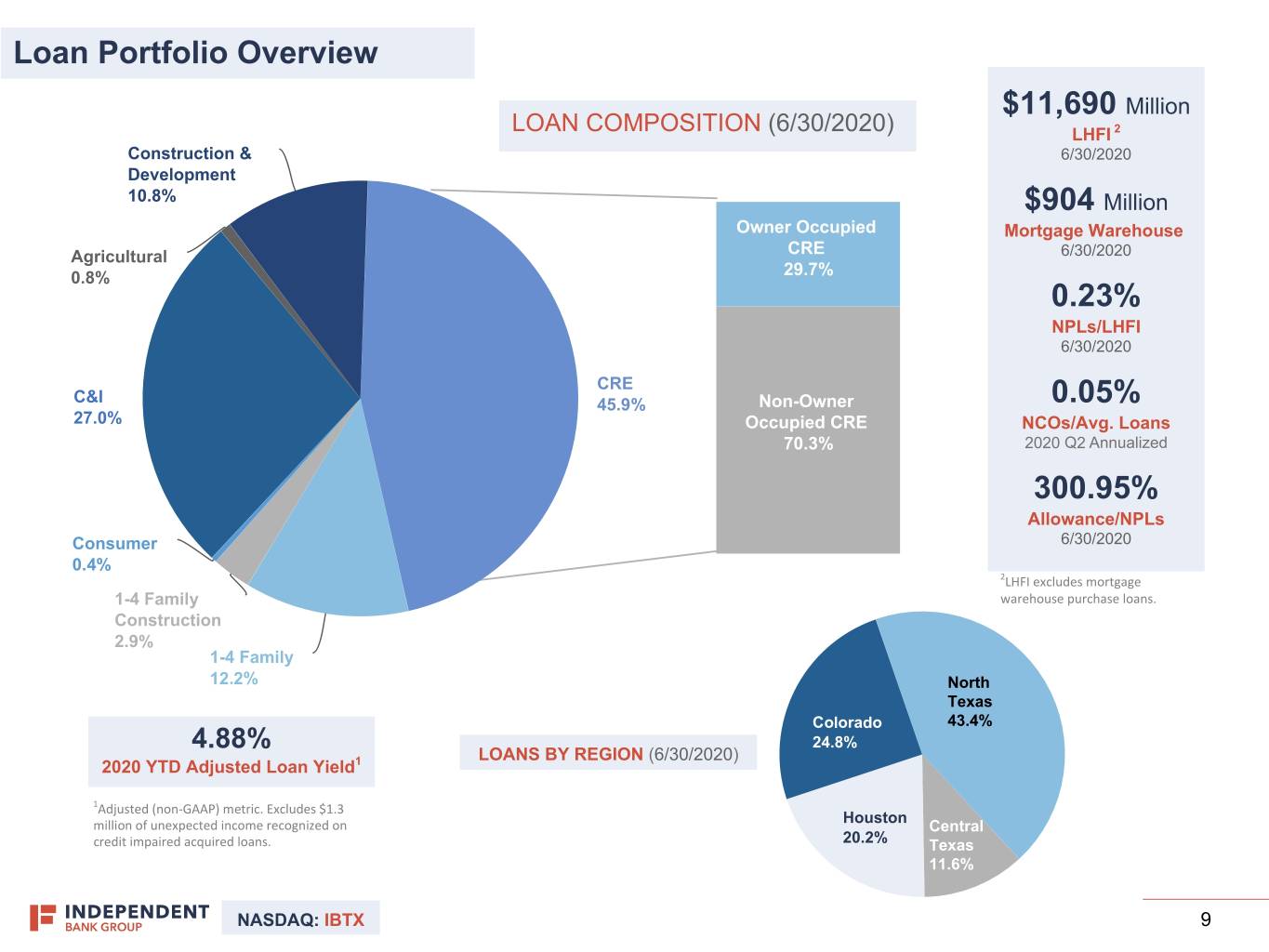

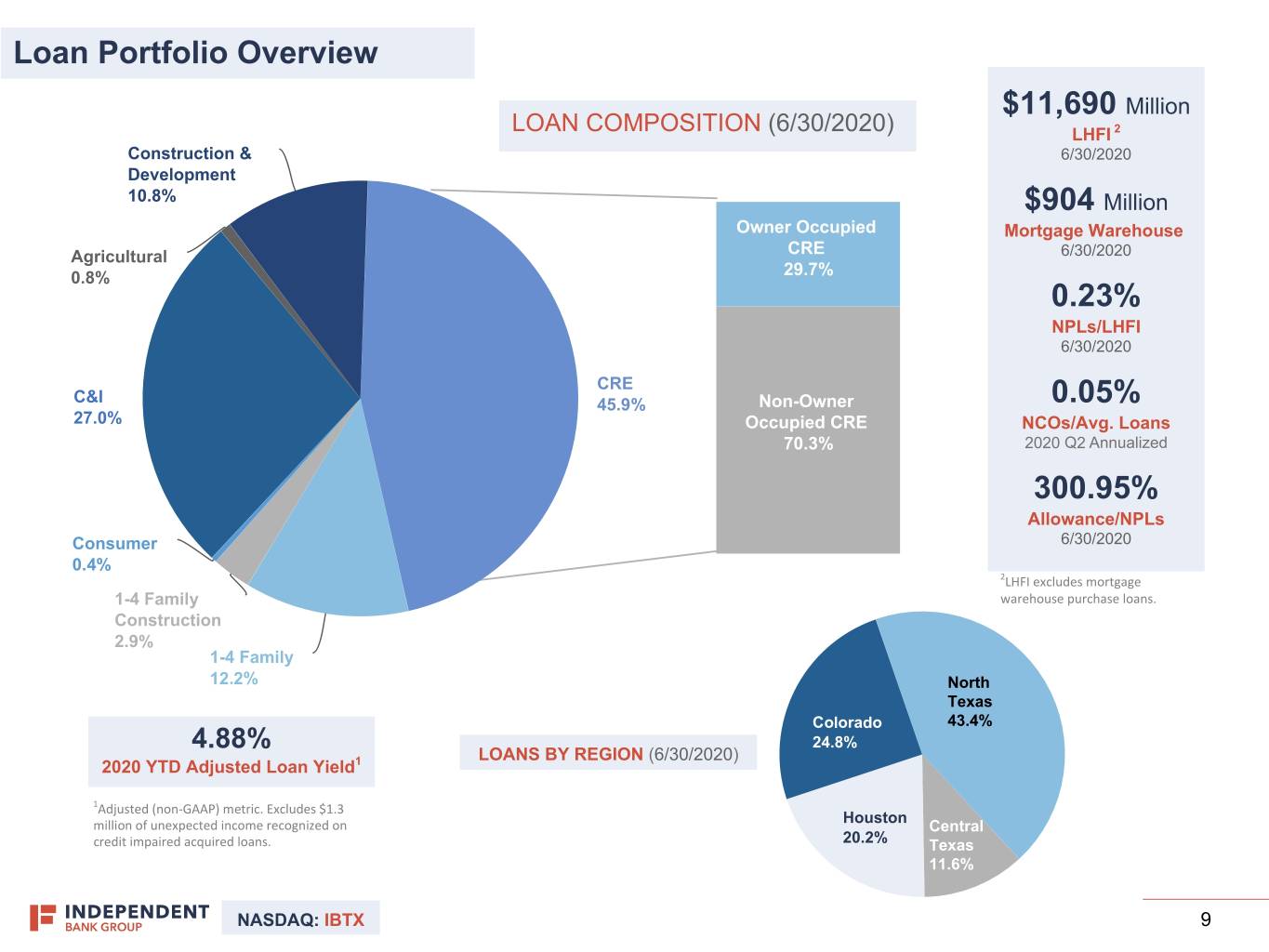

Loan Portfolio Overview $11,690 Million LOAN COMPOSITION (6/30/2020) LHFI 2 Construction & 6/30/2020 Development 10.8% $904 Million Owner Occupied Mortgage Warehouse Agricultural CRE 6/30/2020 0.8% 29.7% 0.23% NPLs/LHFI 6/30/2020 CRE C&I 45.9% Non-Owner 0.05% 27.0% Occupied CRE NCOs/Avg. Loans 70.3% 2020 Q2 Annualized 300.95% Allowance/NPLs Consumer 6/30/2020 0.4% 2LHFI excludes mortgage 1-4 Family warehouse purchase loans. Construction 2.9% 1-4 Family 12.2% North Texas Colorado 43.4% 4.88% 24.8% LOANS BY REGION (6/30/2020) 2020 YTD Adjusted Loan Yield1 1Adjusted (non-GAAP) metric. Excludes $1.3 Houston million of unexpected income recognized on Central credit impaired acquired loans. 20.2% Texas 11.6% NASDAQ: IBTX 9

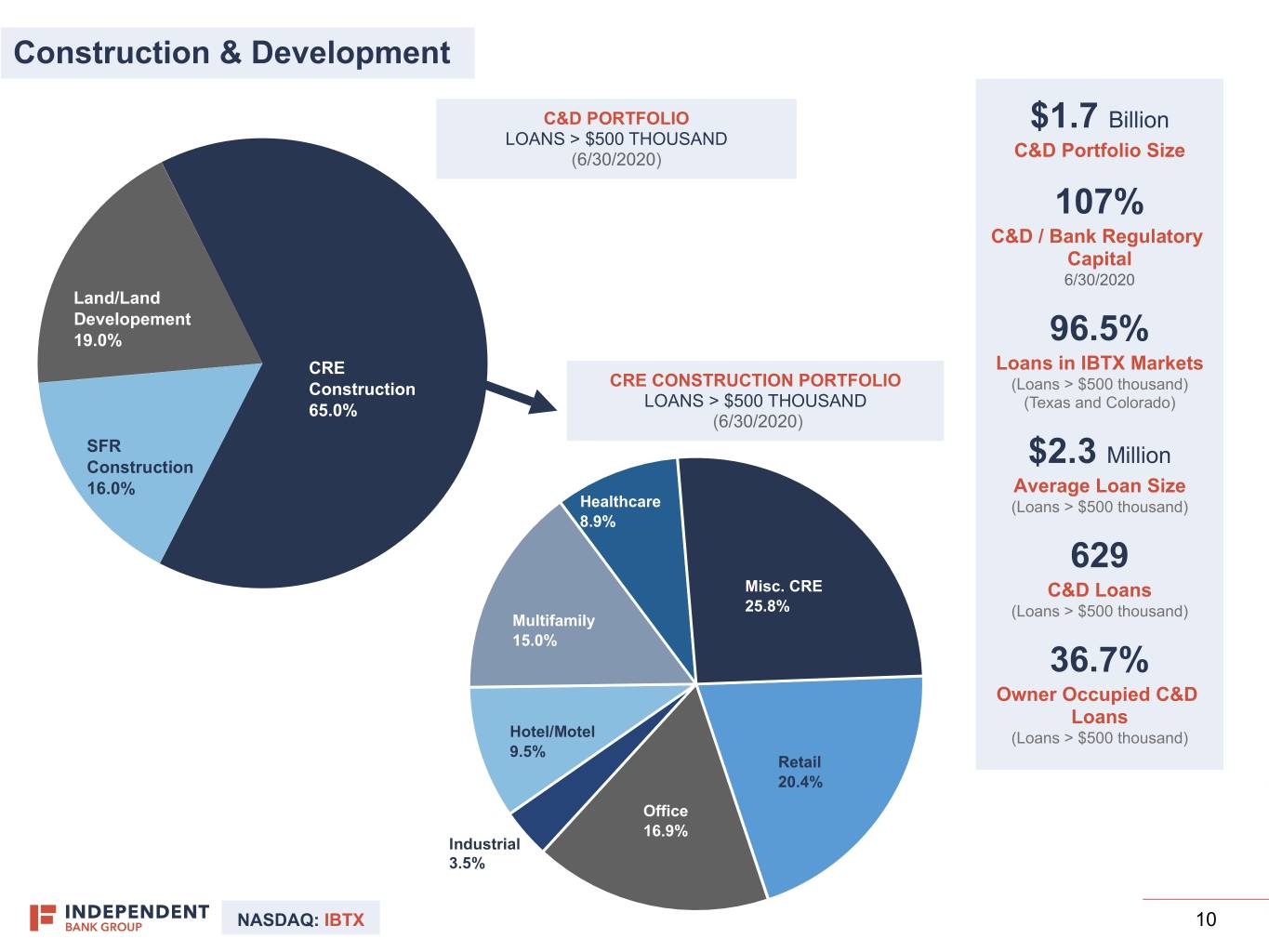

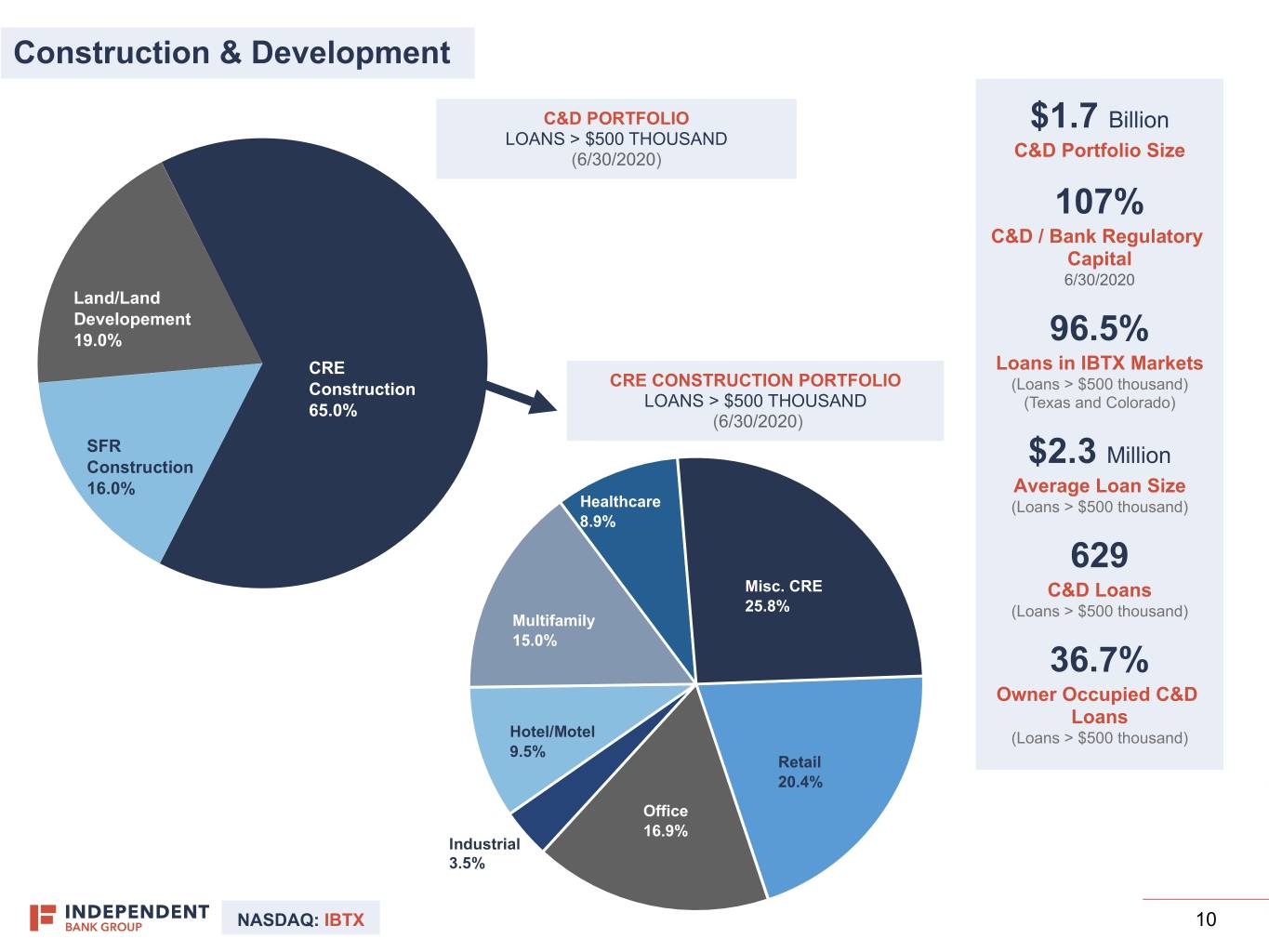

Construction & Development C&D PORTFOLIO $1.7 Billion LOANS > $500 THOUSAND (6/30/2020) C&D Portfolio Size 107% C&D / Bank Regulatory Capital 6/30/2020 Land/Land Developement 19.0% 96.5% CRE Loans in IBTX Markets Construction CRE CONSTRUCTION PORTFOLIO (Loans > $500 thousand) LOANS > $500 THOUSAND 65.0% (Texas and Colorado) (6/30/2020) SFR Million Construction $2.3 16.0% Average Loan Size Healthcare (Loans > $500 thousand) 8.9% 629 Misc. CRE C&D Loans 25.8% (Loans > $500 thousand) Multifamily 15.0% 36.7% Owner Occupied C&D Loans Hotel/Motel (Loans > $500 thousand) 9.5% Retail 20.4% Office 16.9% Industrial 3.5% NASDAQ: IBTX 10

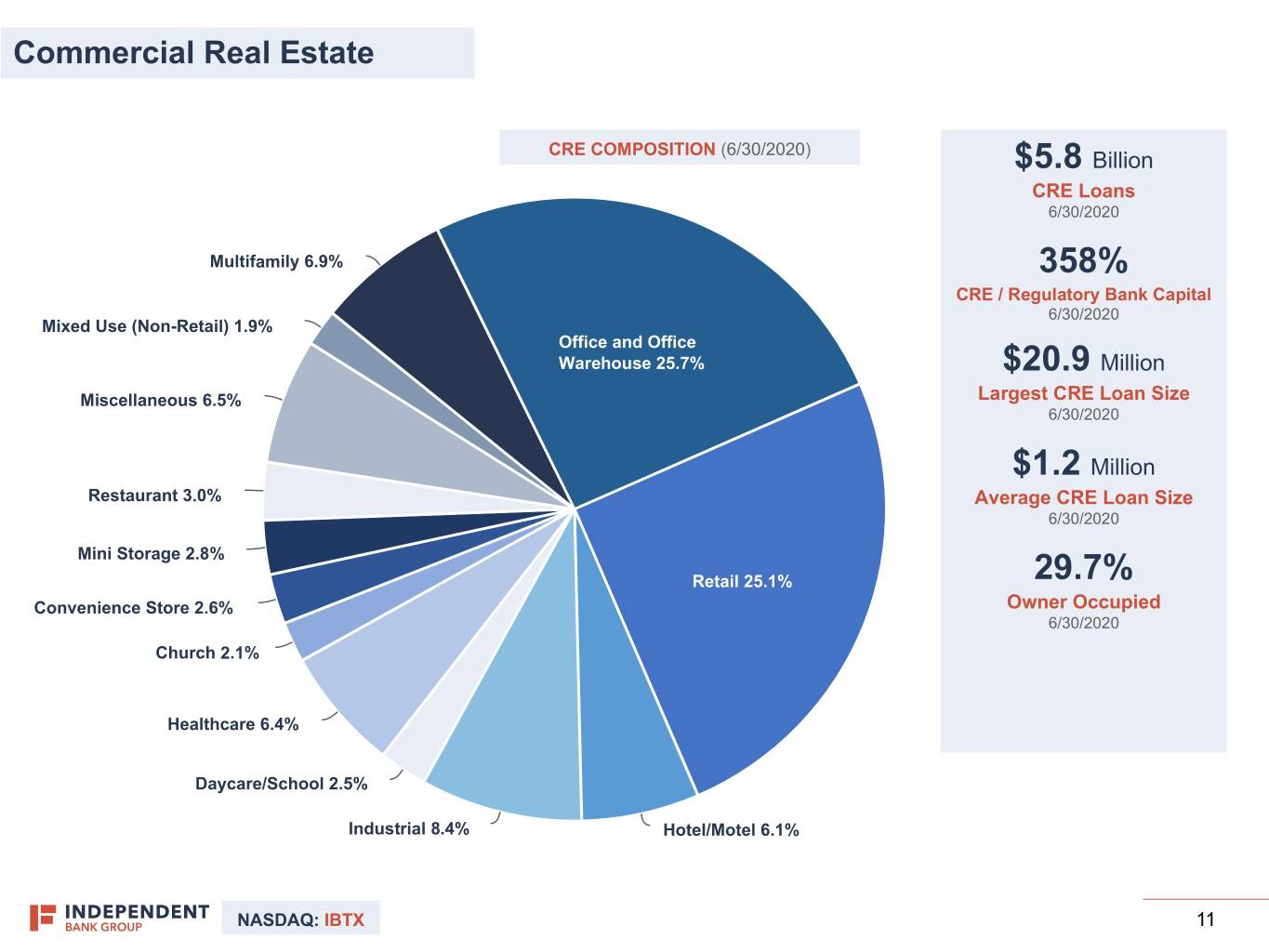

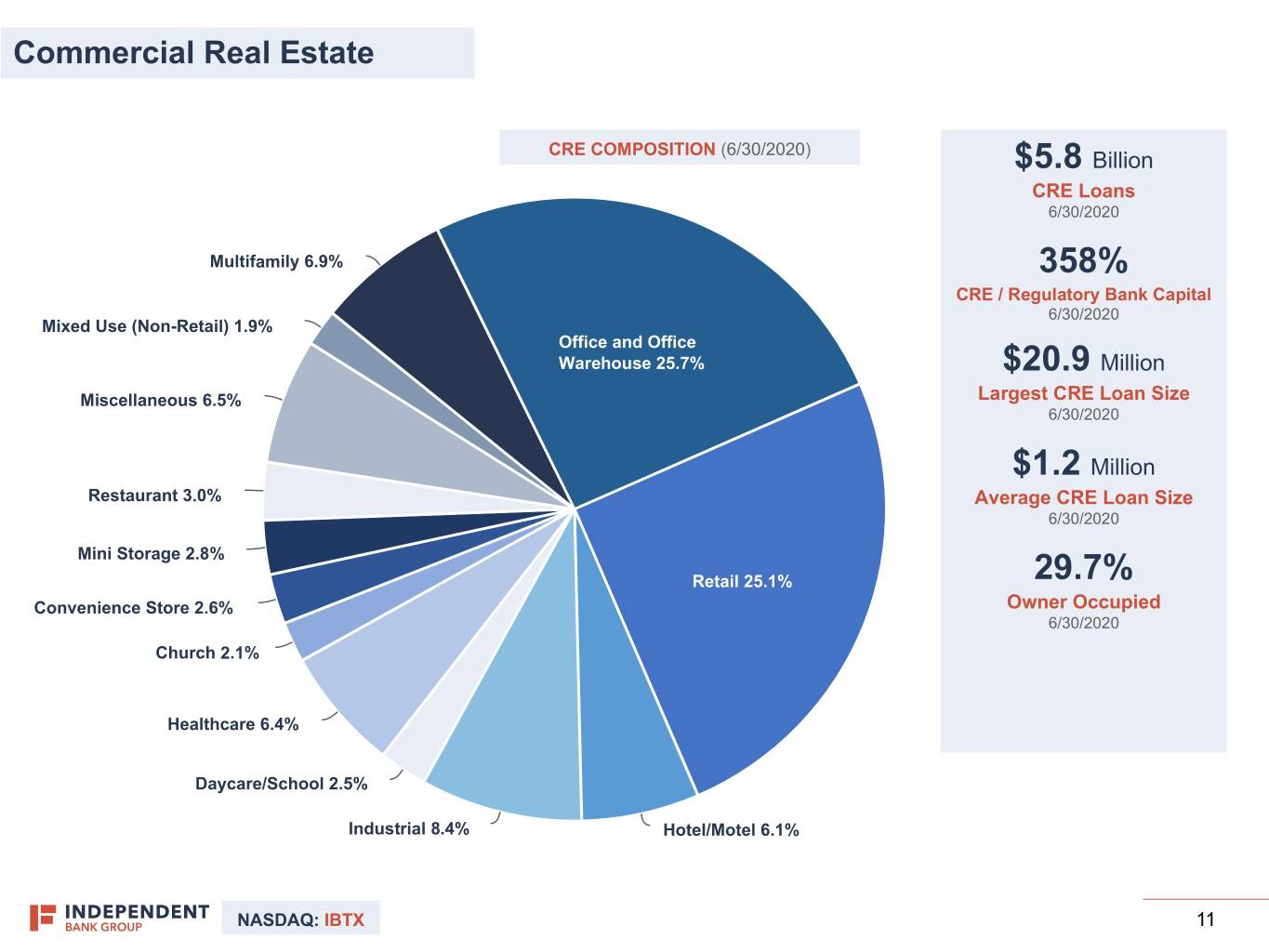

Commercial Real Estate CRE COMPOSITION (6/30/2020) $5.8 Billion CRE Loans 6/30/2020 Multifamily 6.9% 358% CRE / Regulatory Bank Capital 6/30/2020 Mixed Use (Non-Retail) 1.9% Office and Office Warehouse 25.7% $20.9 Million Miscellaneous 6.5% Largest CRE Loan Size 6/30/2020 $1.2 Million Restaurant 3.0% Average CRE Loan Size 6/30/2020 Mini Storage 2.8% Retail 25.1% 29.7% Convenience Store 2.6% Owner Occupied 6/30/2020 Church 2.1% Healthcare 6.4% Daycare/School 2.5% Industrial 8.4% Hotel/Motel 6.1% NASDAQ: IBTX 11

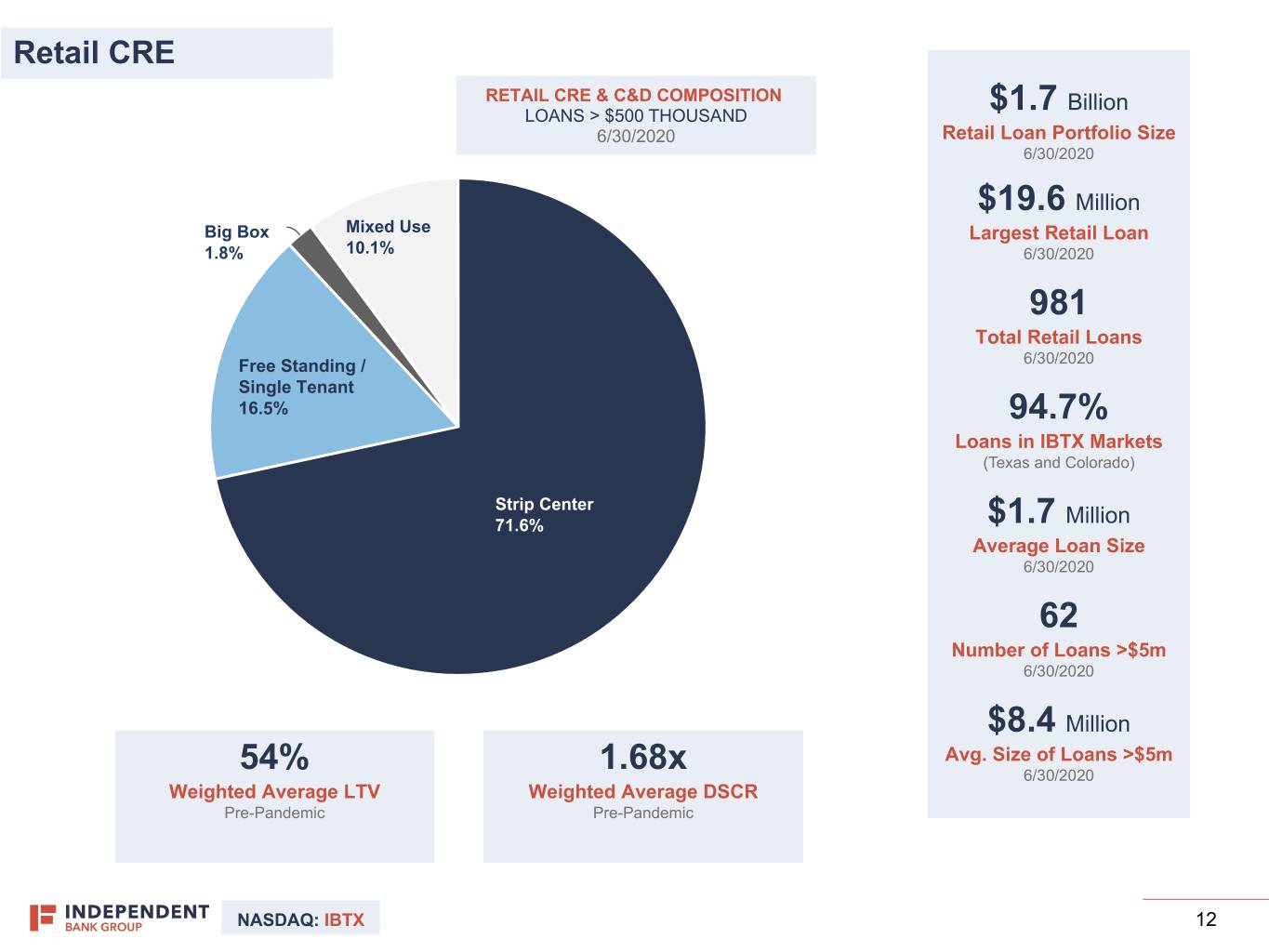

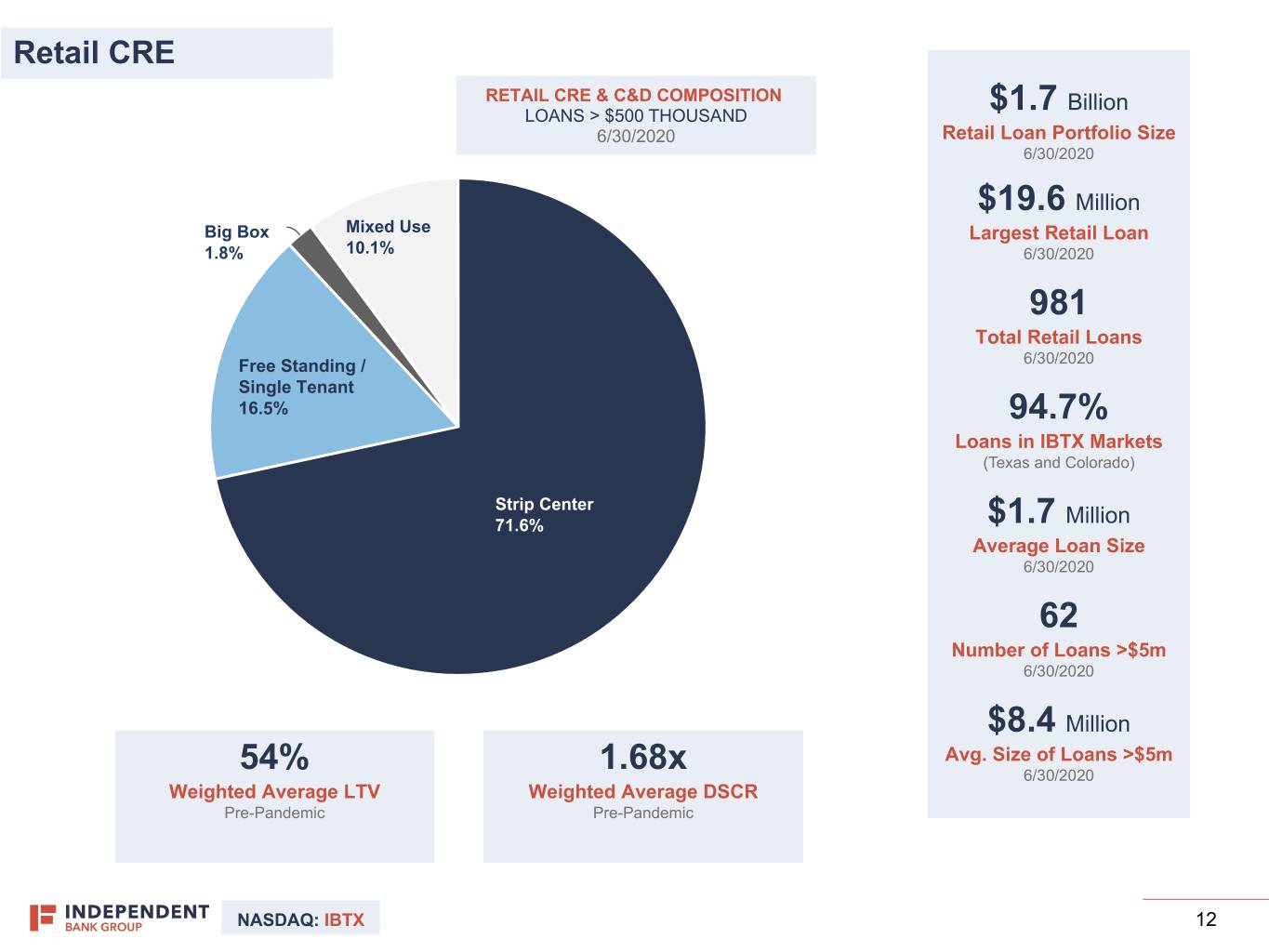

Retail CRE RETAIL CRE & C&D COMPOSITION Billion LOANS > $500 THOUSAND $1.7 6/30/2020 Retail Loan Portfolio Size 6/30/2020 $19.6 Million Big Box Mixed Use Largest Retail Loan 1.8% 10.1% 6/30/2020 981 Total Retail Loans Free Standing / 6/30/2020 Single Tenant 16.5% 94.7% Loans in IBTX Markets (Texas and Colorado) Strip Center 71.6% $1.7 Million Average Loan Size 6/30/2020 62 Number of Loans >$5m 6/30/2020 $8.4 Million Avg. Size of Loans >$5m 54% 1.68x 6/30/2020 Weighted Average LTV Weighted Average DSCR Pre-Pandemic Pre-Pandemic NASDAQ: IBTX 12

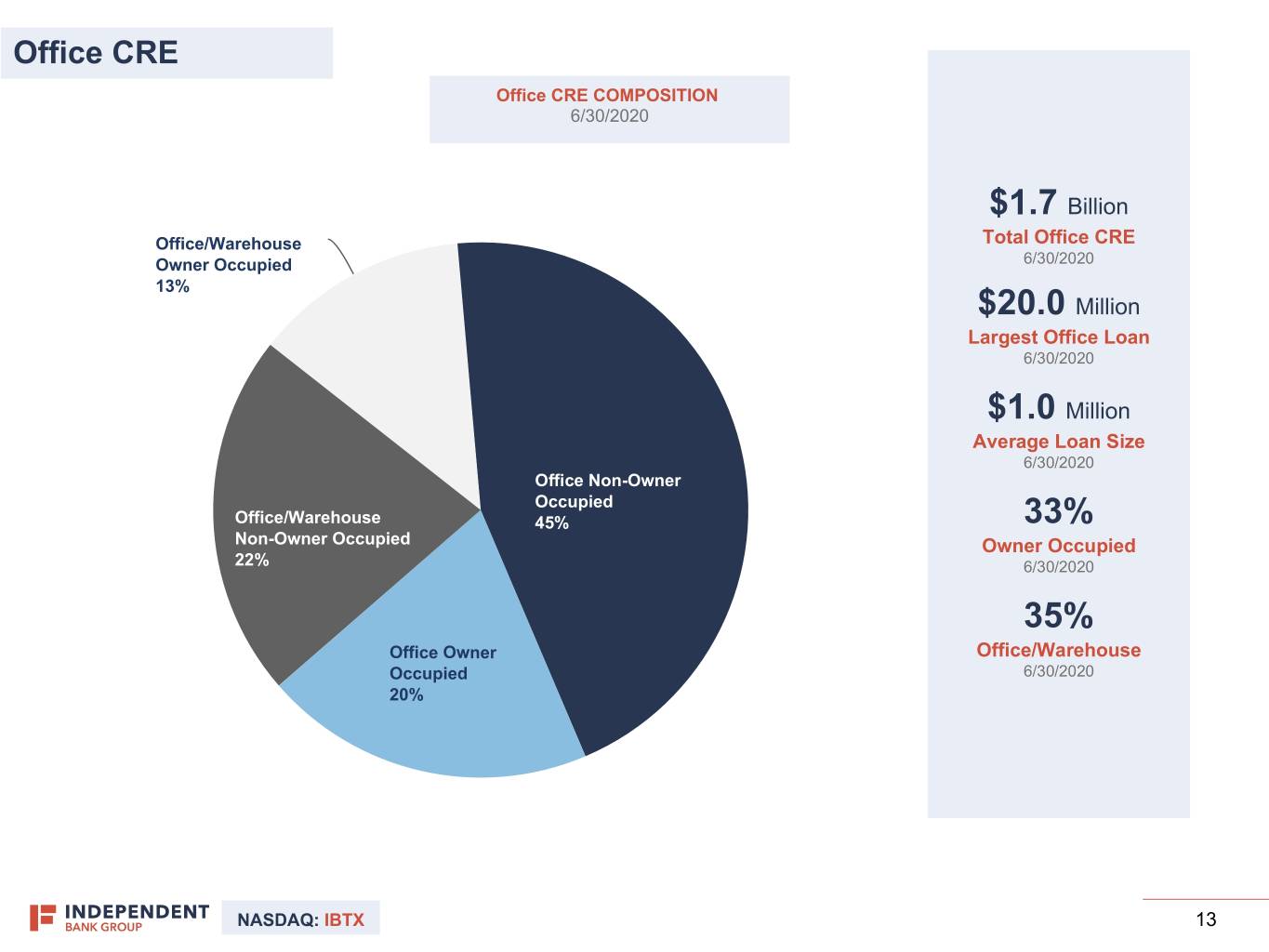

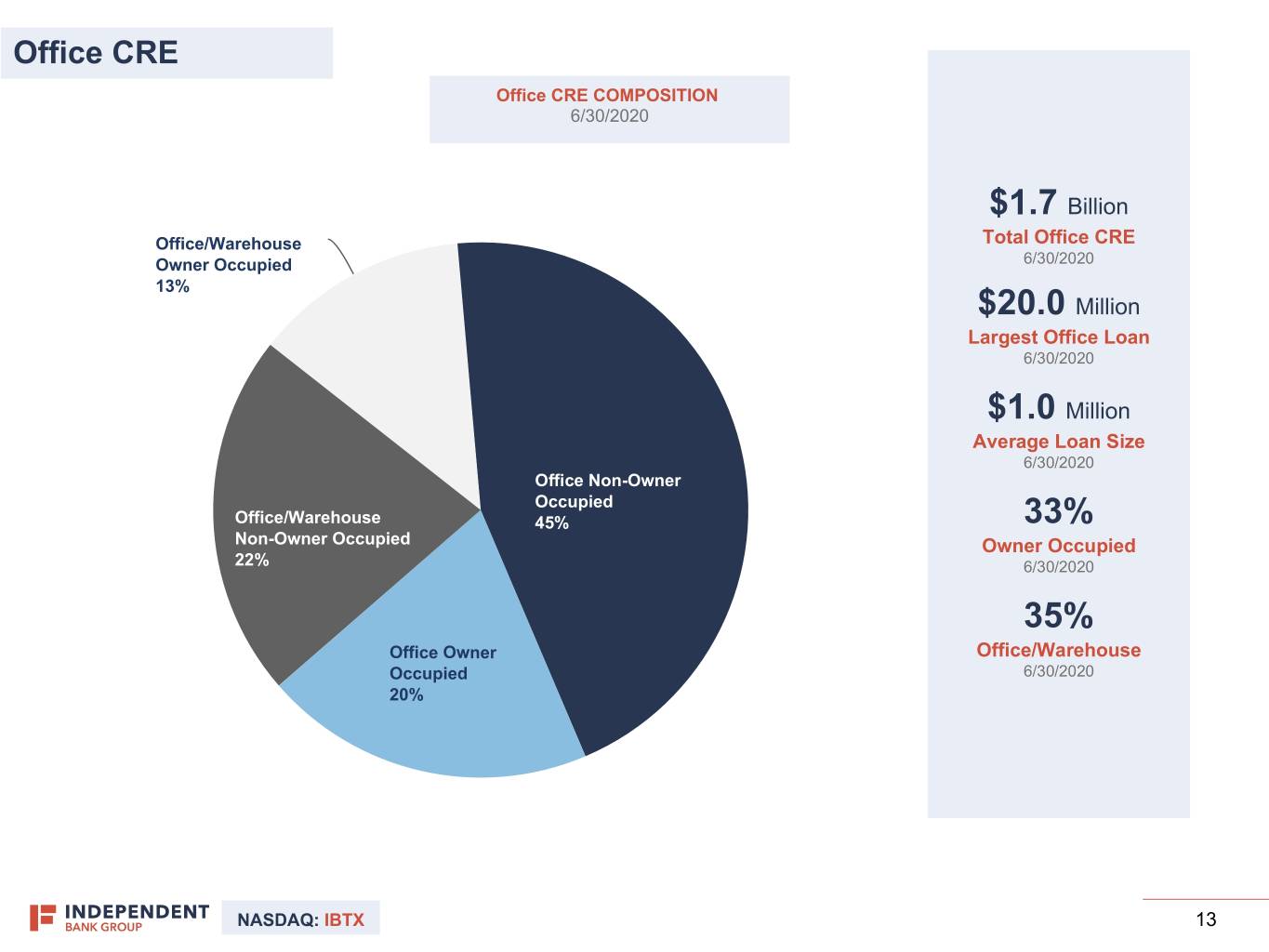

Office CRE Office CRE COMPOSITION 6/30/2020 $1.7 Billion Office/Warehouse Total Office CRE Owner Occupied 6/30/2020 13% $20.0 Million Largest Office Loan 6/30/2020 $1.0 Million Average Loan Size 6/30/2020 Office Non-Owner Occupied Office/Warehouse 45% 33% Non-Owner Occupied Owner Occupied 22% 6/30/2020 35% Office Owner Office/Warehouse Occupied 6/30/2020 20% NASDAQ: IBTX 13

Hotel & Motel $441.5 Million Hotel & Motel Loan Portfolio Size – We maintain a granular book of hotel loans in our markets, the majority of 6/30/2020 which are branded, limited/select service properties in our core markets across Texas and Colorado. $5.5 Million Average Loan Size 6/30/2020 – We have very limited exposure to those segments of the hotel industry that have been most impacted by the COVID-19 pandemic (i.e. resort and conference hotels). 57.3% Average LTV 6/30/2020 – While we anticipate many of our hotel borrowers to need additional time to recover from pandemic-related economic dislocation, we remain encouraged 1.78x by the early signs of recovery in occupancy rates. Weighted Average DSCR pre-COVID Hotel Loans by Type Hotel Loans by Property Hotel Loans by Product Location Type 79.4% 14.3% 40.1% 8.3% 77.4% 20.6% 9.0% 50.9% Full Service Brand CRE Limited/Selected Service Brand Construction & Development Texas Colorado Other Boutique/Independent NASDAQ: IBTX 14

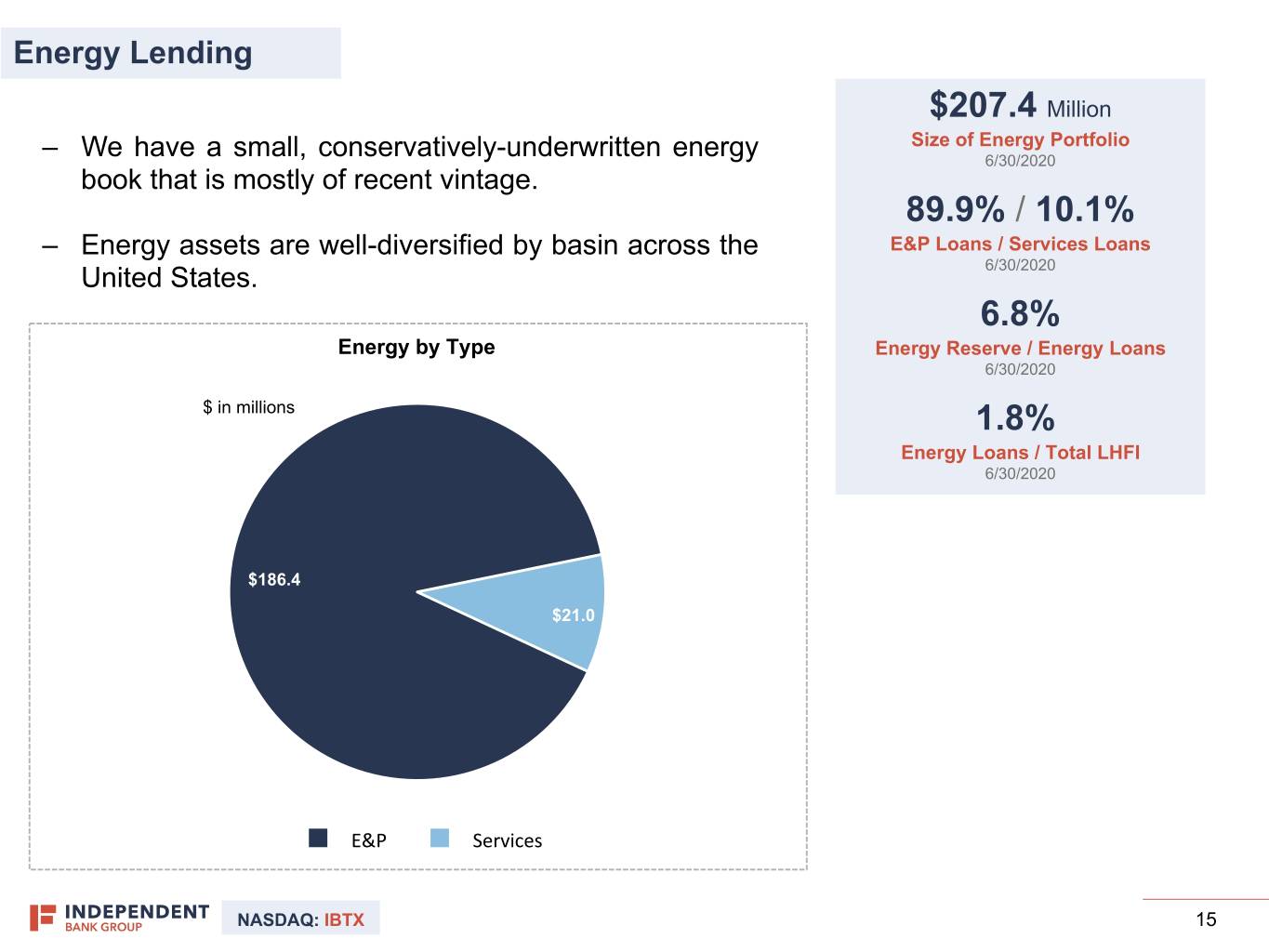

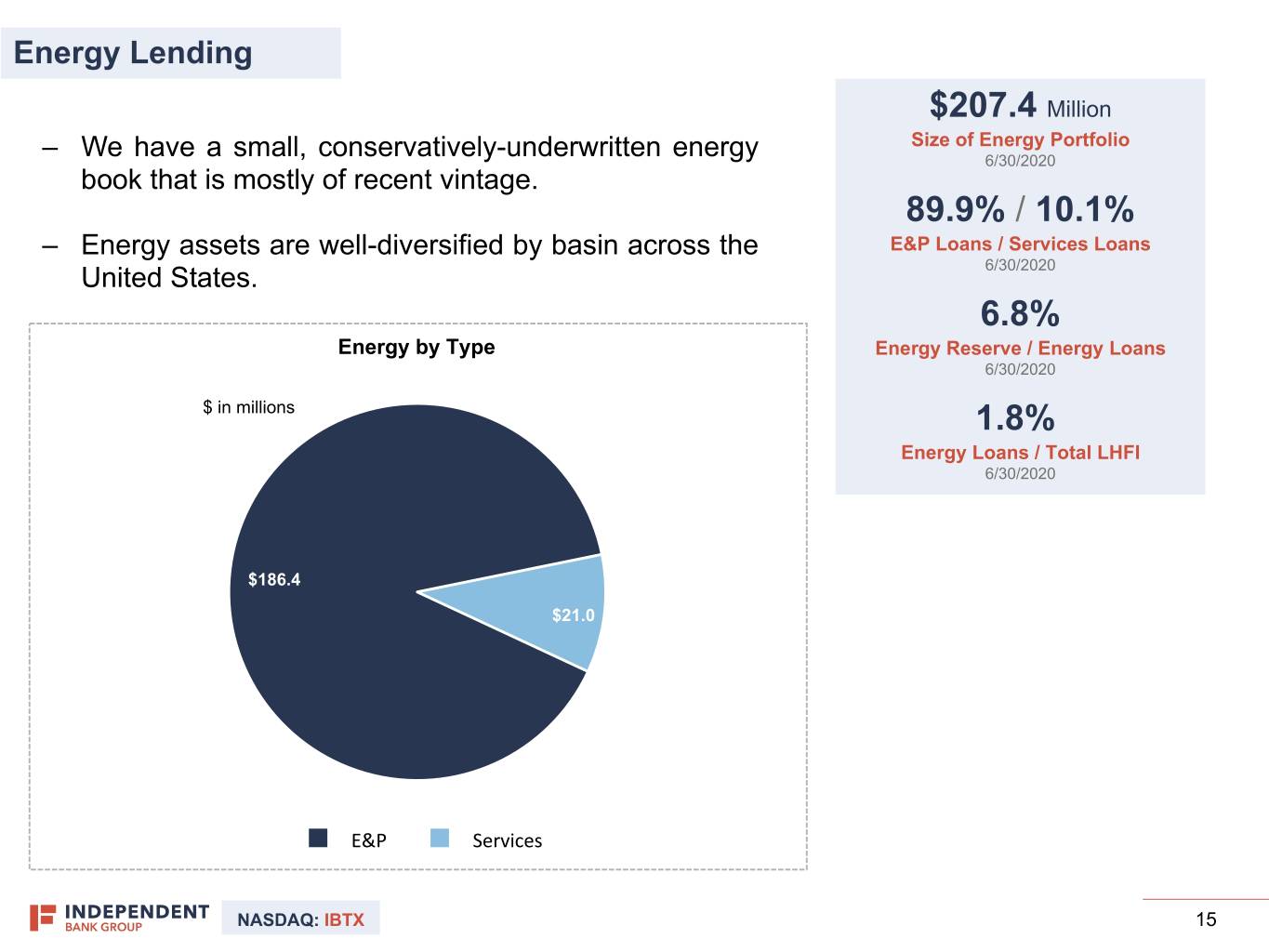

Energy Lending $207.4 Million Size of Energy Portfolio – We have a small, conservatively-underwritten energy 6/30/2020 book that is mostly of recent vintage. 89.9% / 10.1% – Energy assets are well-diversified by basin across the E&P Loans / Services Loans United States. 6/30/2020 6.8% Energy by Type Energy Reserve / Energy Loans 6/30/2020 $ in millions 1.8% Energy Loans / Total LHFI 6/30/2020 $186.4 $21.0 E&P Services NASDAQ: IBTX 15

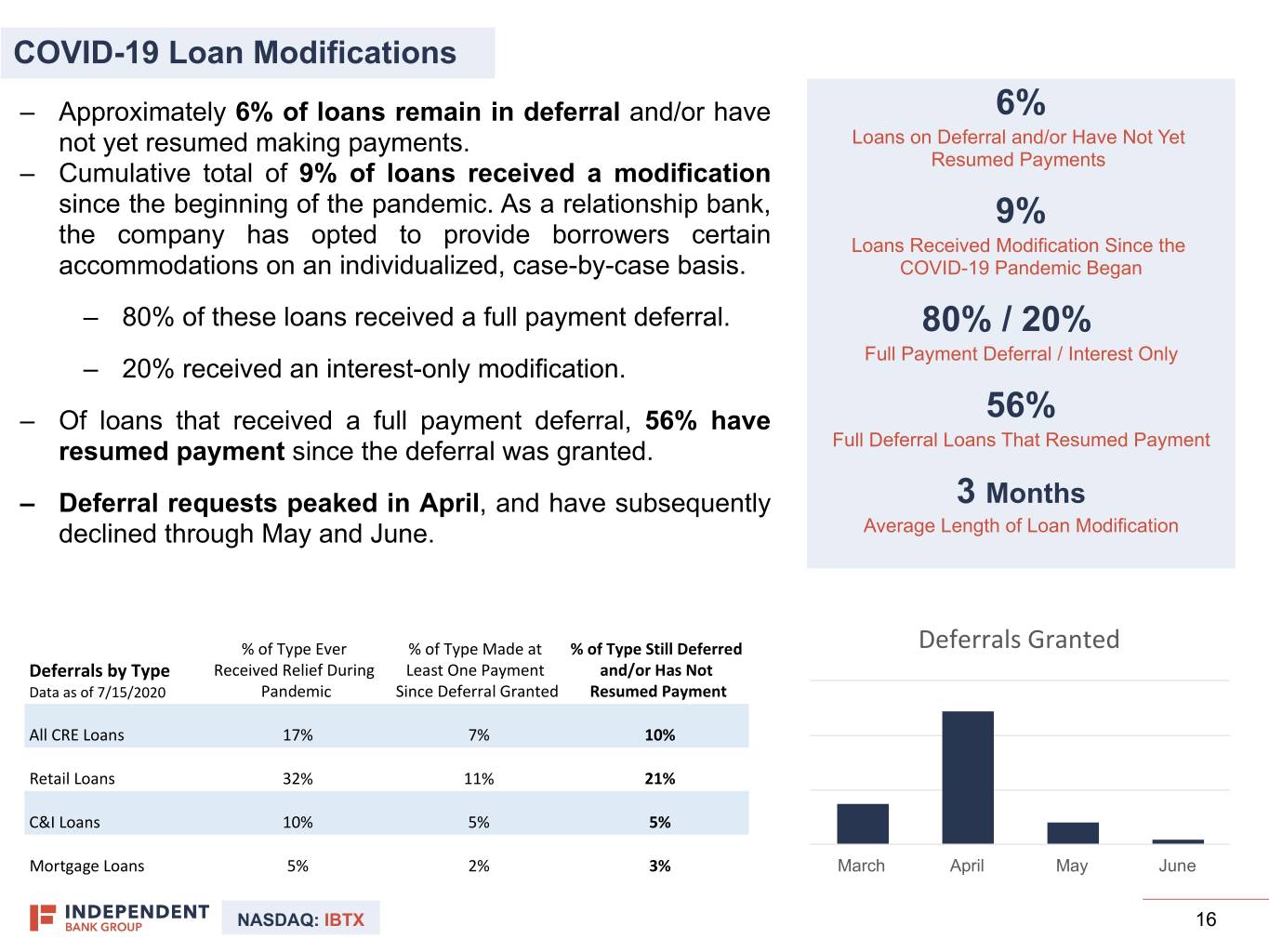

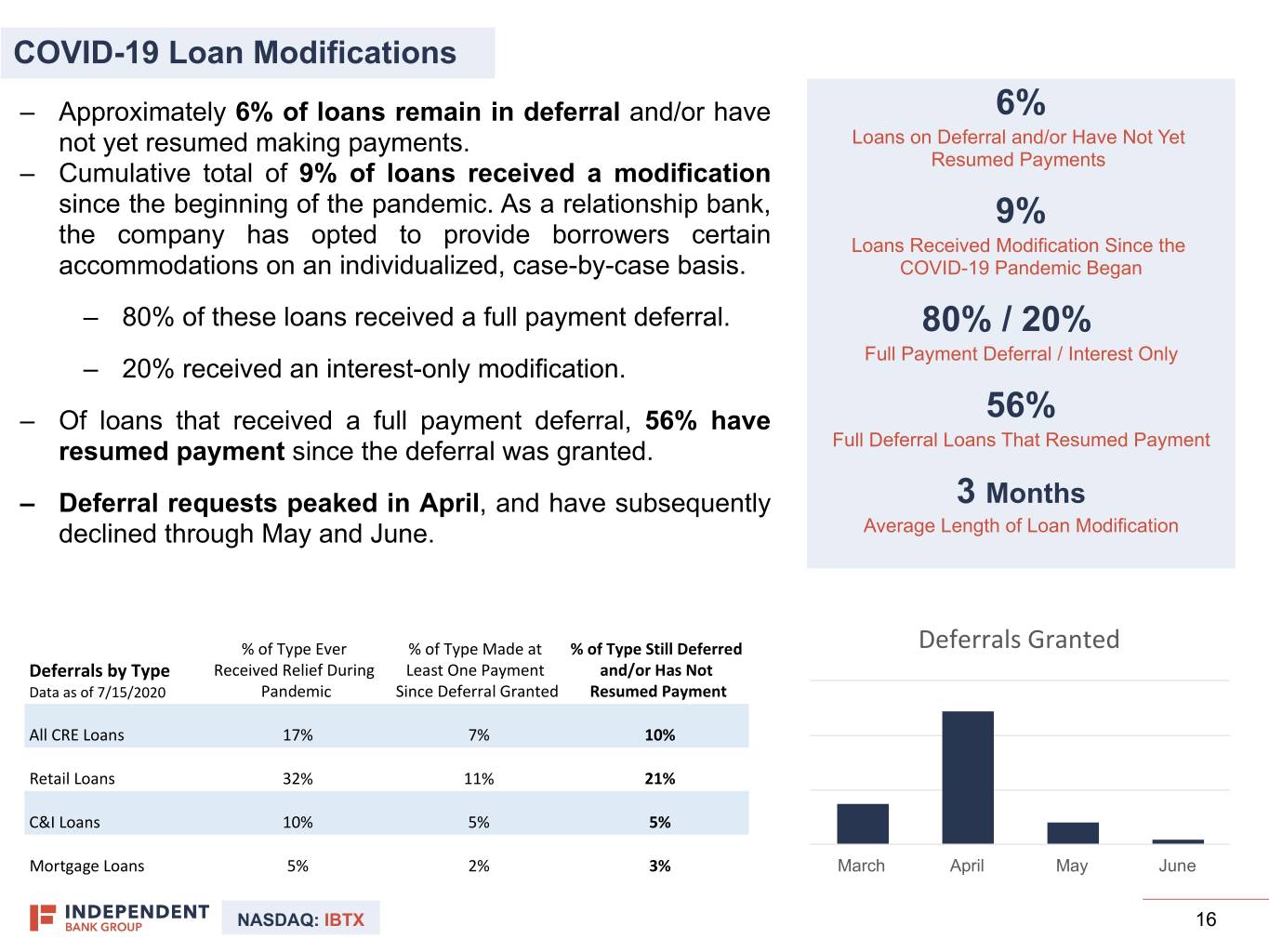

COVID-19 Loan Modifications – Approximately 6% of loans remain in deferral and/or have 6% not yet resumed making payments. Loans on Deferral and/or Have Not Yet Resumed Payments – Cumulative total of 9% of loans received a modification since the beginning of the pandemic. As a relationship bank, 9% the company has opted to provide borrowers certain Loans Received Modification Since the accommodations on an individualized, case-by-case basis. COVID-19 Pandemic Began – 80% of these loans received a full payment deferral. 80% / 20% Full Payment Deferral / Interest Only – 20% received an interest-only modification. – Of loans that received a full payment deferral, 56% have 56% resumed payment since the deferral was granted. Full Deferral Loans That Resumed Payment – Deferral requests peaked in April, and have subsequently 3 Months declined through May and June. Average Length of Loan Modification % of Type Ever % of Type Made at % of Type Still Deferred Deferrals Granted Deferrals by Type Received Relief During Least One Payment and/or Has Not Data as of 7/15/2020 Pandemic Since Deferral Granted Resumed Payment All CRE Loans 17% 7% 10% Retail Loans 32% 11% 21% C&I Loans 10% 5% 5% Mortgage Loans 5% 2% 3% March April May June NASDAQ: IBTX 16

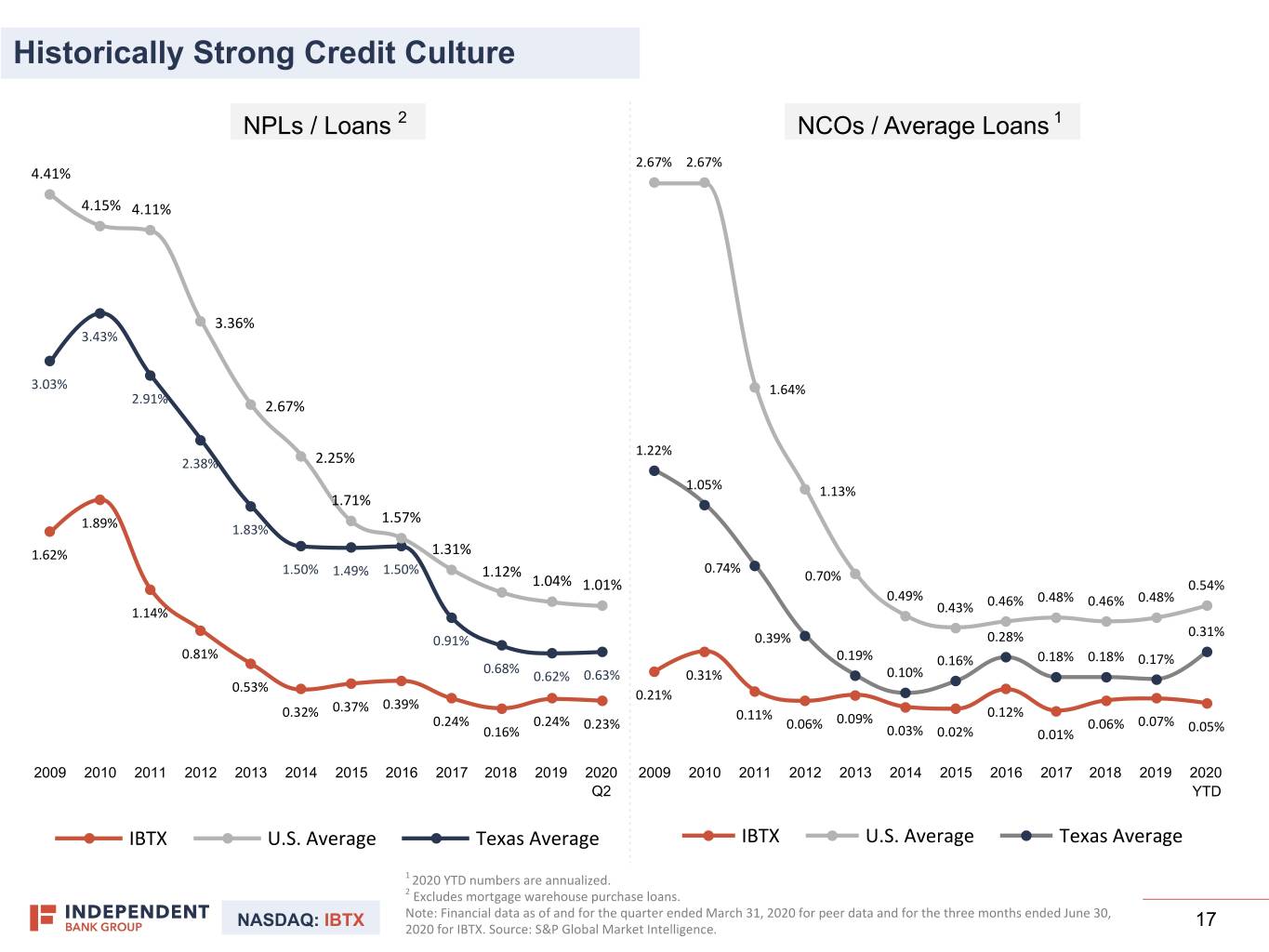

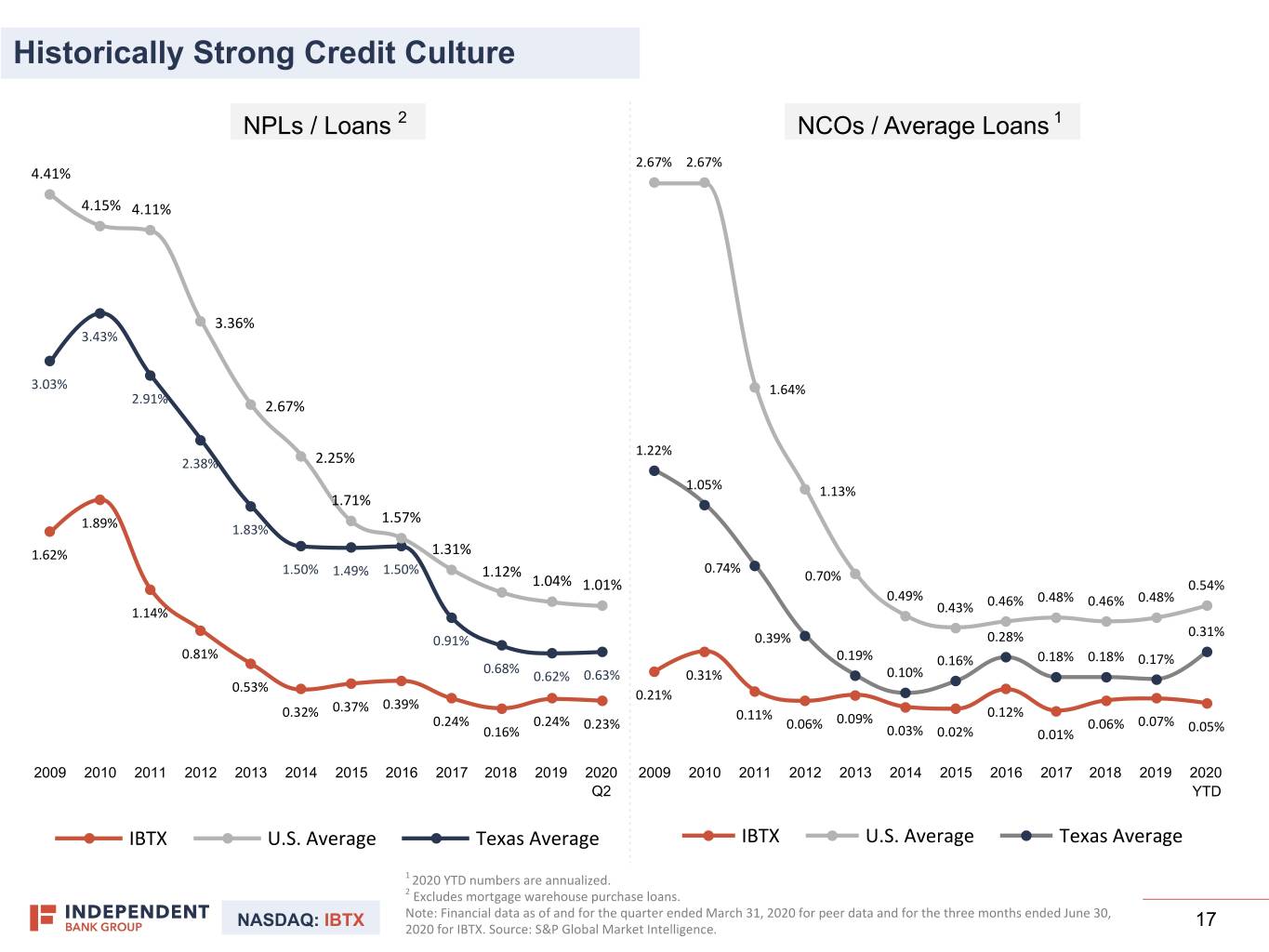

Historically Strong Credit Culture NPLs / Loans 2 NCOs / Average Loans 1 2.67% 2.67% 4.41% 4.15% 4.11% 3.36% 3.43% 3.03% 1.64% 2.91% 2.67% 1.22% 2.38% 2.25% 1.05% 1.13% 1.71% 1.57% 1.89% 1.83% 1.62% 1.31% 0.74% 1.50% 1.49% 1.50% 1.12% 0.70% 1.04% 1.01% 0.54% 0.49% 0.46% 0.48% 0.46% 0.48% 1.14% 0.43% 0.31% 0.91% 0.39% 0.28% 0.81% 0.19% 0.16% 0.18% 0.18% 0.17% 0.68% 0.62% 0.63% 0.31% 0.10% 0.53% 0.21% 0.37% 0.39% 0.32% 0.11% 0.09% 0.12% 0.24% 0.24% 0.23% 0.06% 0.06% 0.07% 0.05% 0.16% 0.03% 0.02% 0.01% 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 Q2 YTD IBTX U.S. Average Texas Average IBTX U.S. Average Texas Average 1 2020 YTD numbers are annualized. 2 Excludes mortgage warehouse purchase loans. NASDAQ: IBTX Note: Financial data as of and for the quarter ended March 31, 2020 for peer data and for the three months ended June 30, 17 2020 for IBTX. Source: S&P Global Market Intelligence.

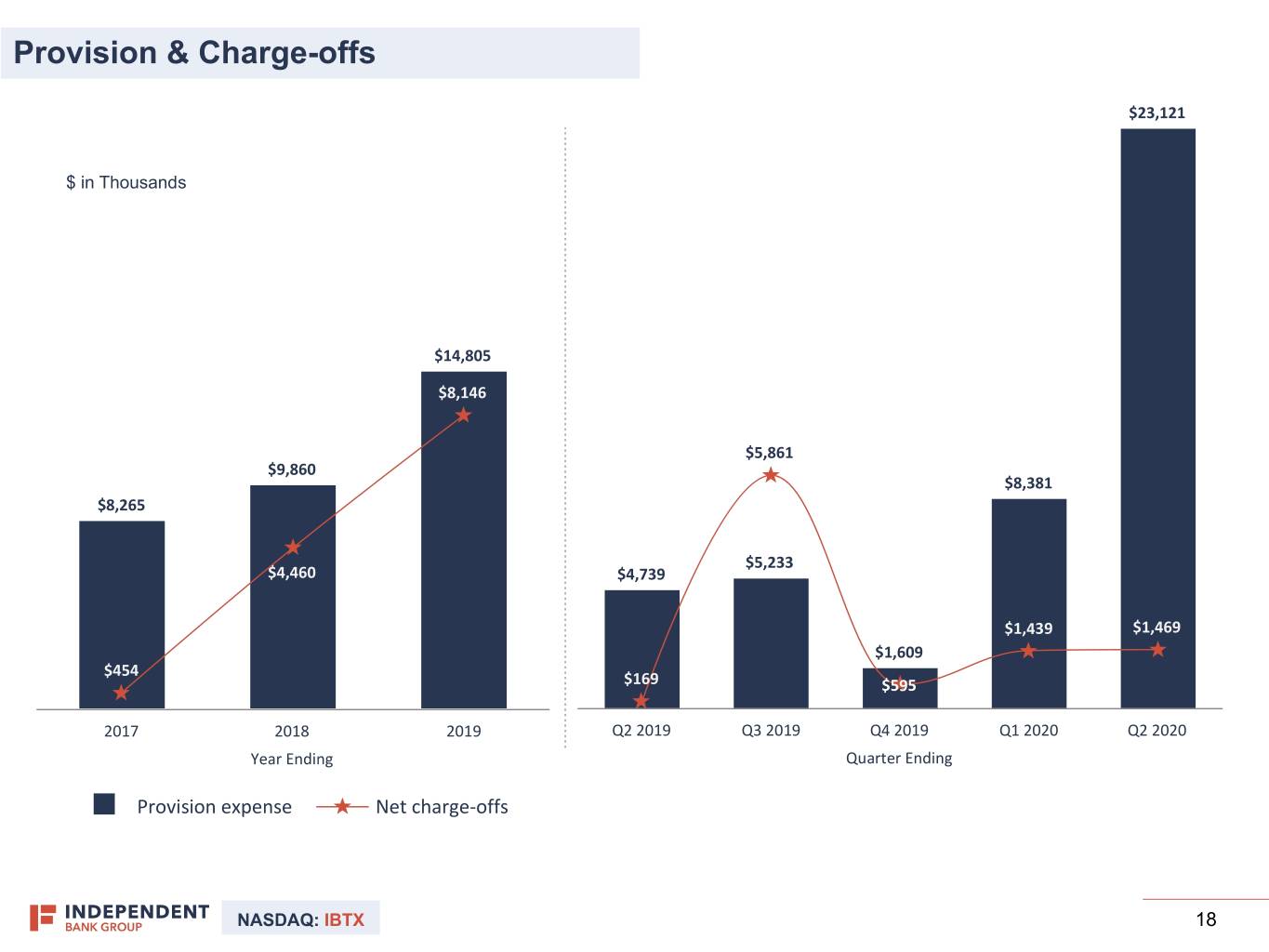

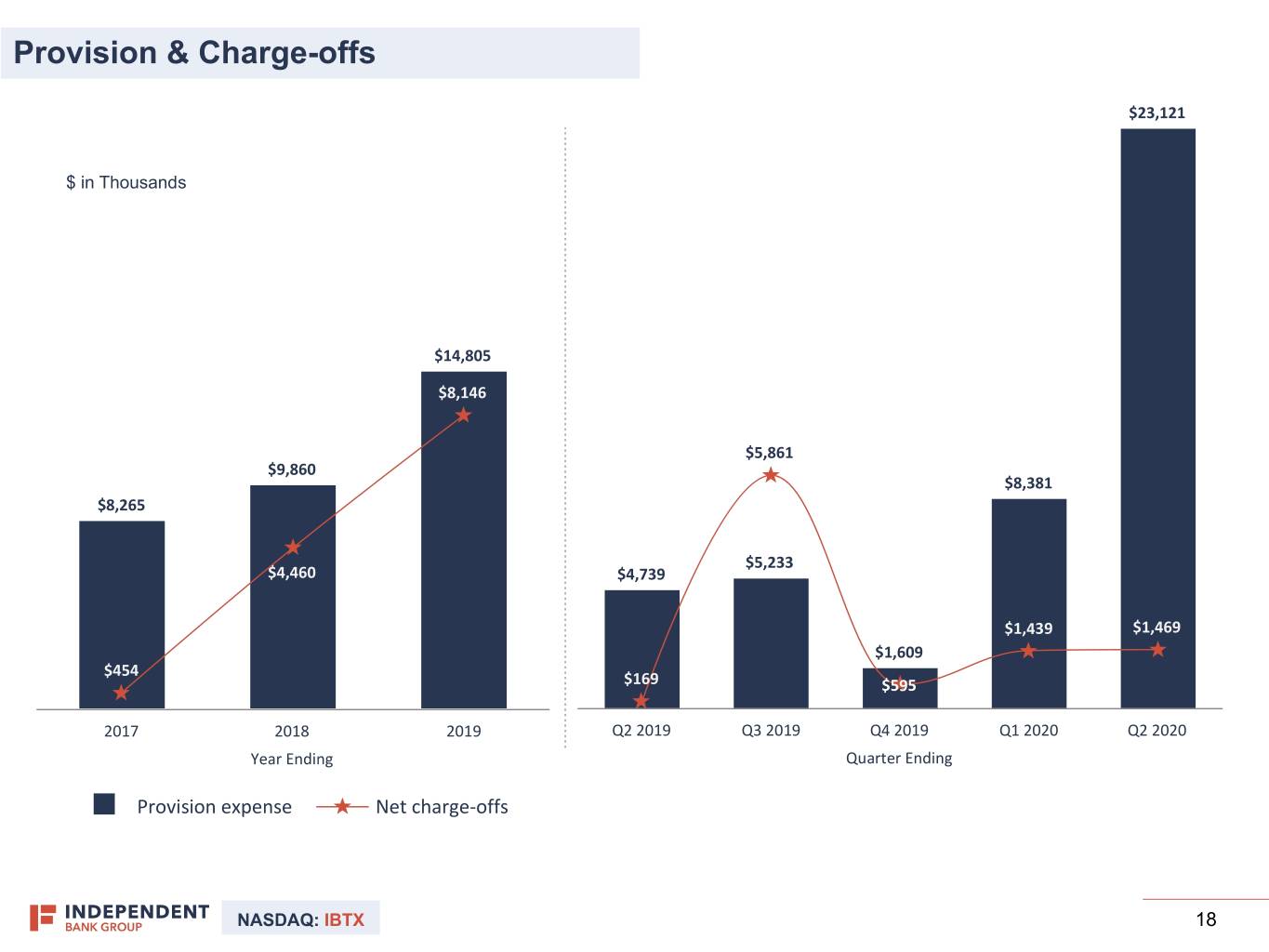

Provision & Charge-offs $23,121 $ in Thousands $14,805 $8,146 $5,861 $9,860 $8,381 $8,265 $5,233 $4,460 $4,739 $1,439 $1,469 $1,609 $454 $169 $595 2017 2018 2019 Q2 2019 Q3 2019 Q4 2019 Q1 2020 Q2 2020 Year Ending Quarter Ending Provision expense Net charge-offs NASDAQ: IBTX 18 18

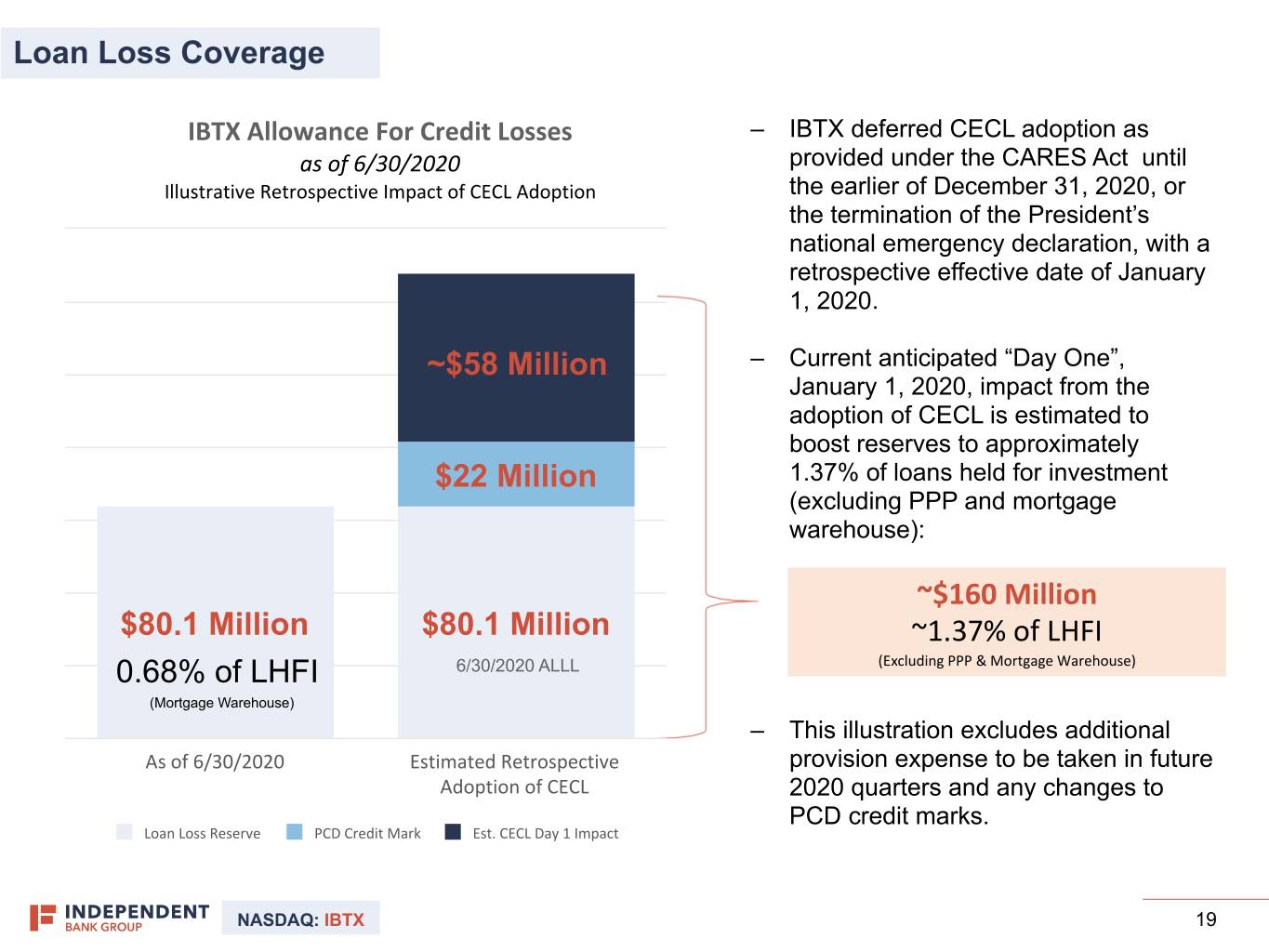

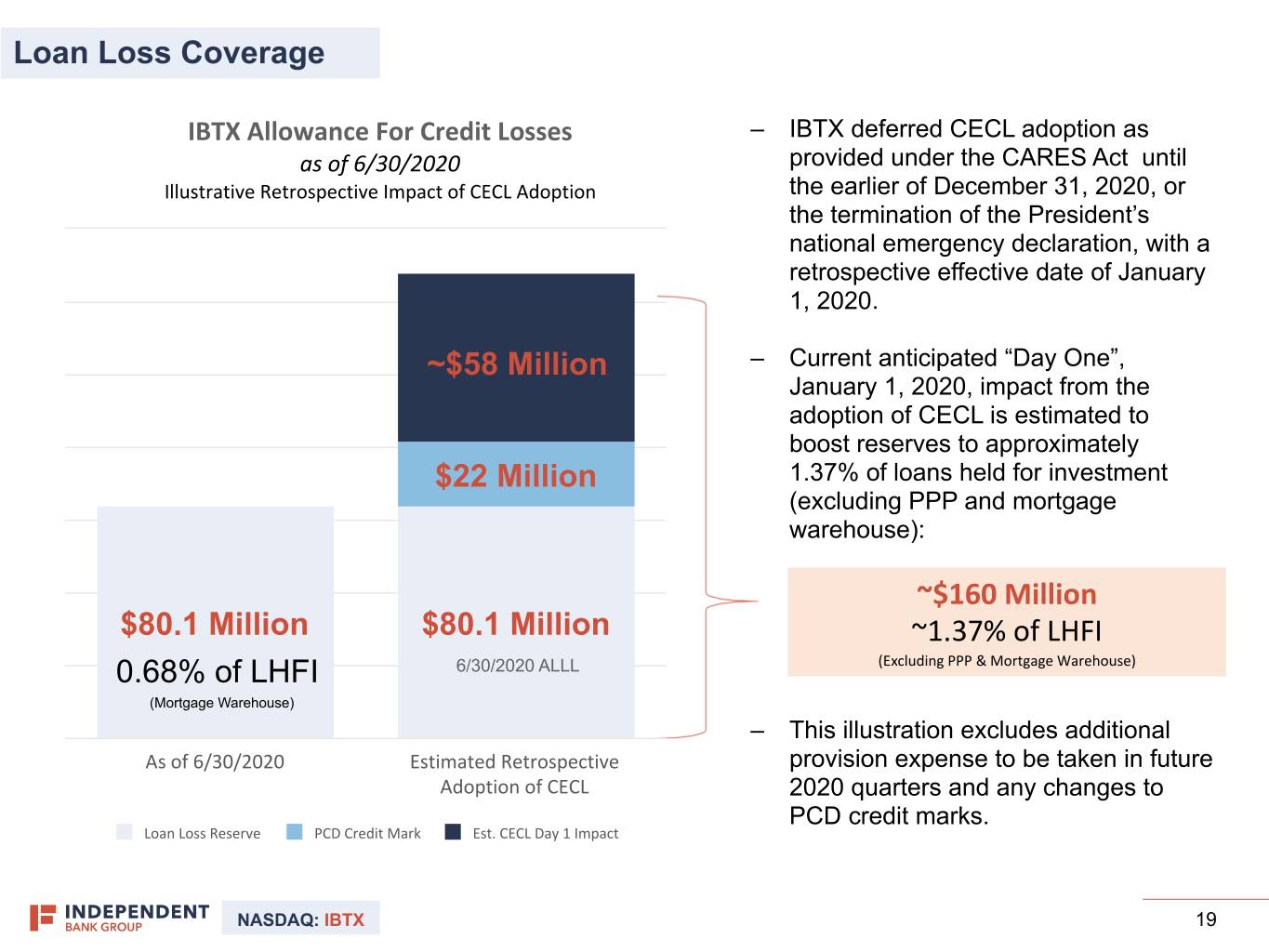

Loan Loss Coverage IBTX Allowance For Credit Losses – IBTX deferred CECL adoption as as of 6/30/2020 provided under the CARES Act until Illustrative Retrospective Impact of CECL Adoption the earlier of December 31, 2020, or the termination of the President’s national emergency declaration, with a retrospective effective date of January 1, 2020. ~$58 Million – Current anticipated “Day One”, January 1, 2020, impact from the adoption of CECL is estimated to boost reserves to approximately $22 Million 1.37% of loans held for investment (excluding PPP and mortgage warehouse): ~$160 Million $80.1 Million $80.1 Million ~1.37% of LHFI 0.68% of LHFI 6/30/2020 ALLL (Excluding PPP & Mortgage Warehouse) (Mortgage Warehouse) – This illustration excludes additional As of 6/30/2020 Estimated Retrospective provision expense to be taken in future Adoption of CECL 2020 quarters and any changes to PCD credit marks. Loan Loss Reserve PCD Credit Mark Est. CECL Day 1 Impact NASDAQ: IBTX 19

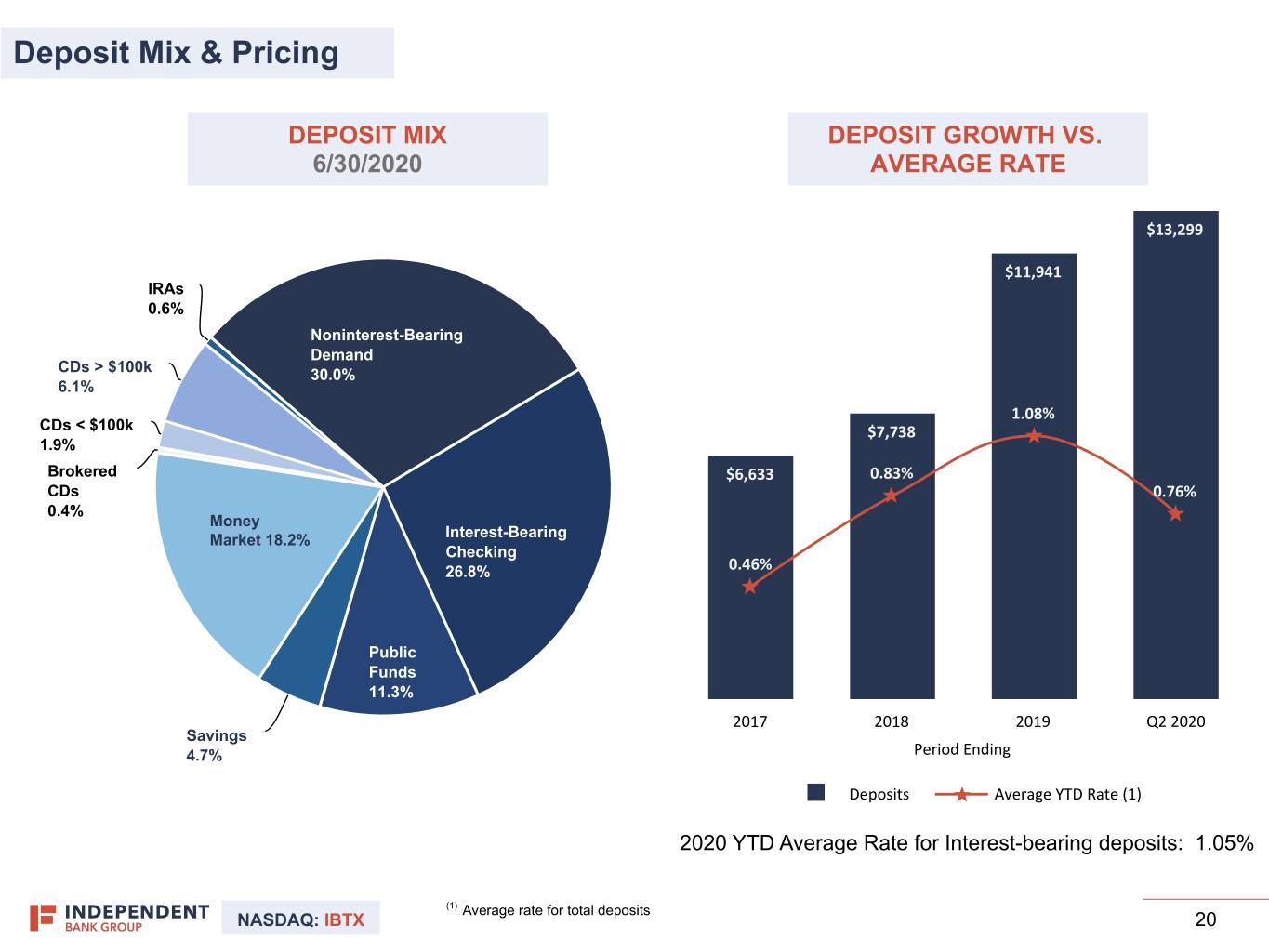

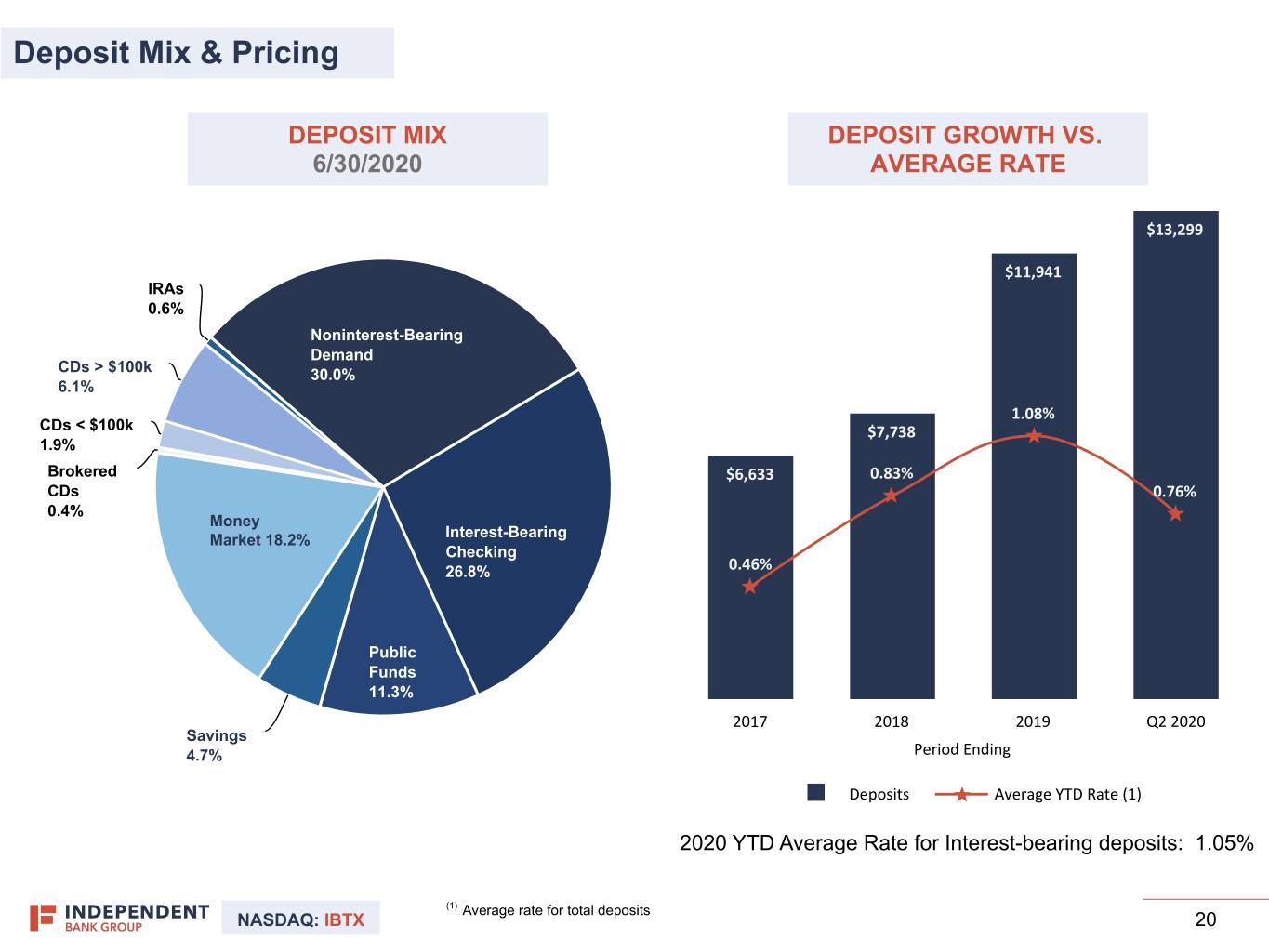

Deposit Mix & Pricing DEPOSIT MIX DEPOSIT GROWTH VS. 6/30/2020 AVERAGE RATE $13,299 $11,941 IRAs 0.6% Noninterest-Bearing Demand CDs > $100k 30.0% 6.1% 1.08% CDs < $100k $7,738 1.9% Brokered $6,633 0.83% CDs 0.76% 0.4% Money Market 18.2% Interest-Bearing Checking 26.8% 0.46% Public Funds 11.3% 2017 2018 2019 Q2 2020 Savings 4.7% Period Ending Deposits Average YTD Rate (1) 2020 YTD Average Rate for Interest-bearing deposits: 1.05% (1) Average rate for total deposits NASDAQ: IBTX 20 20

Securities Portfolio As of June 30, 2020: Our investment portfolio consists of a diversified mix of liquid, low-risk securities designed to help augment the bank’s liquidity position and 2.6% manage interest rate risk toward our target “net neutral” position. Yield 3.71 Duration INVESTMENT PORTFOLIO COMPOSITION 6/30/2020 U.S. Treasury 6.2% Securities of Total Assets 4.8% CRA $1.0 Billion 0.1% Agency Portfolio Size Securities Corporates 14.9% 1.0% Taxable Municipals 2.4% Mortgage-Backed Securities Tax-Exempt 43.5% Municipals 33.4% NASDAQ: IBTX 21

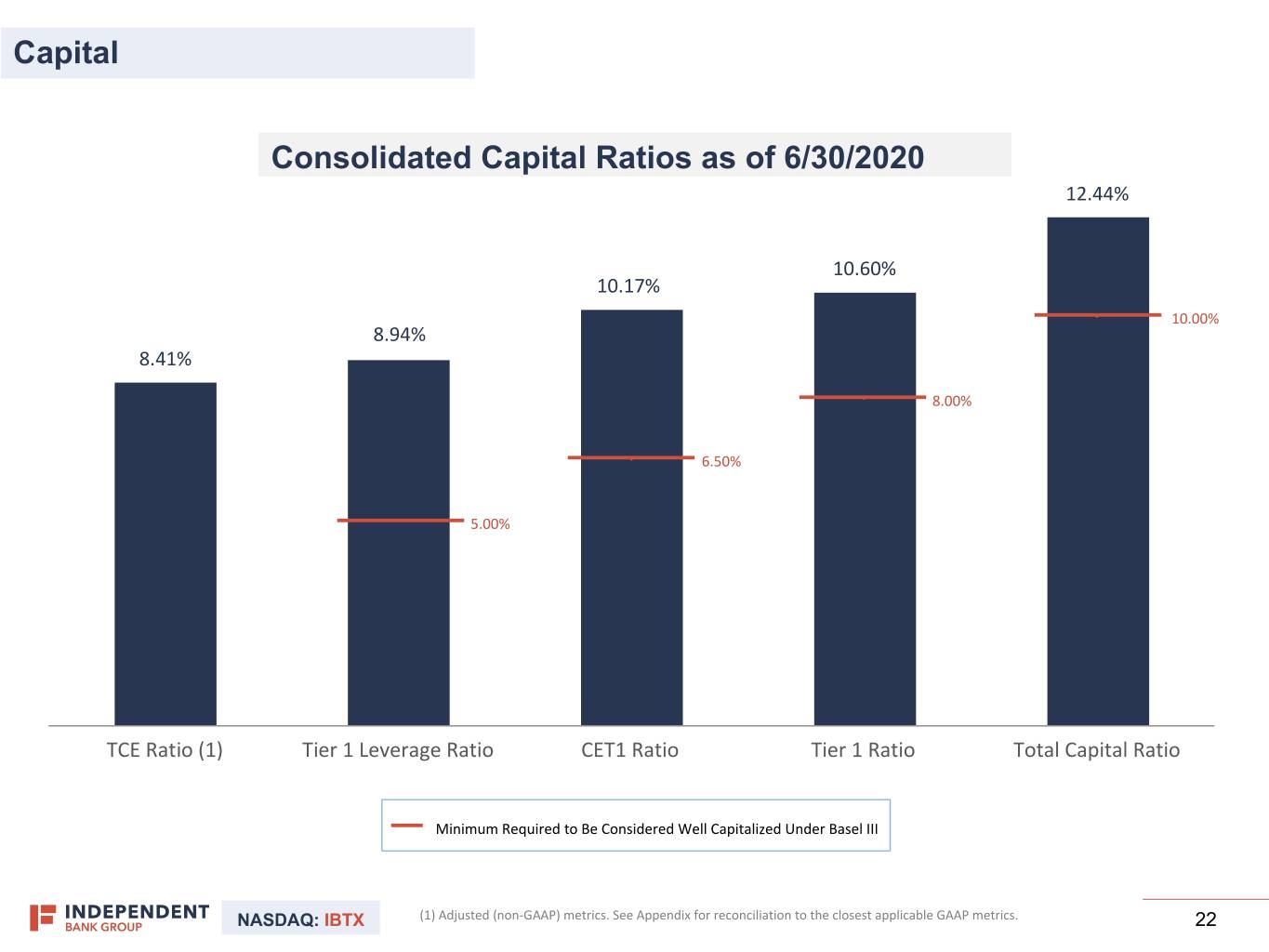

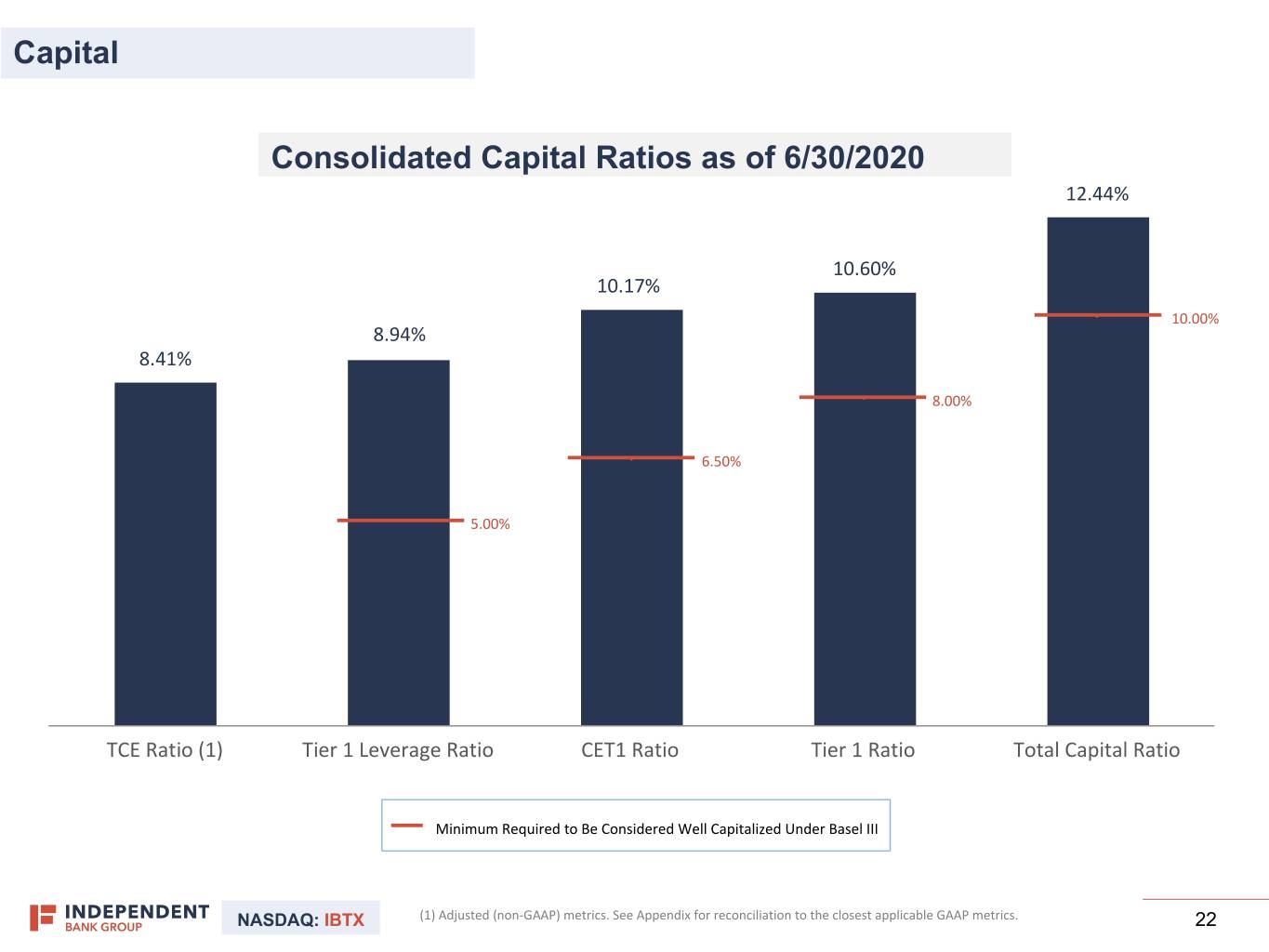

Capital Consolidated Capital Ratios as of 6/30/2020 12.44% 10.60% 10.17% 10.00% 8.94% 8.41% 8.00% 6.50% 5.00% TCE Ratio (1) Tier 1 Leverage Ratio CET1 Ratio Tier 1 Ratio Total Capital Ratio Minimum Required to Be Considered Well Capitalized Under Basel III NASDAQ: IBTX (1) Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. 22

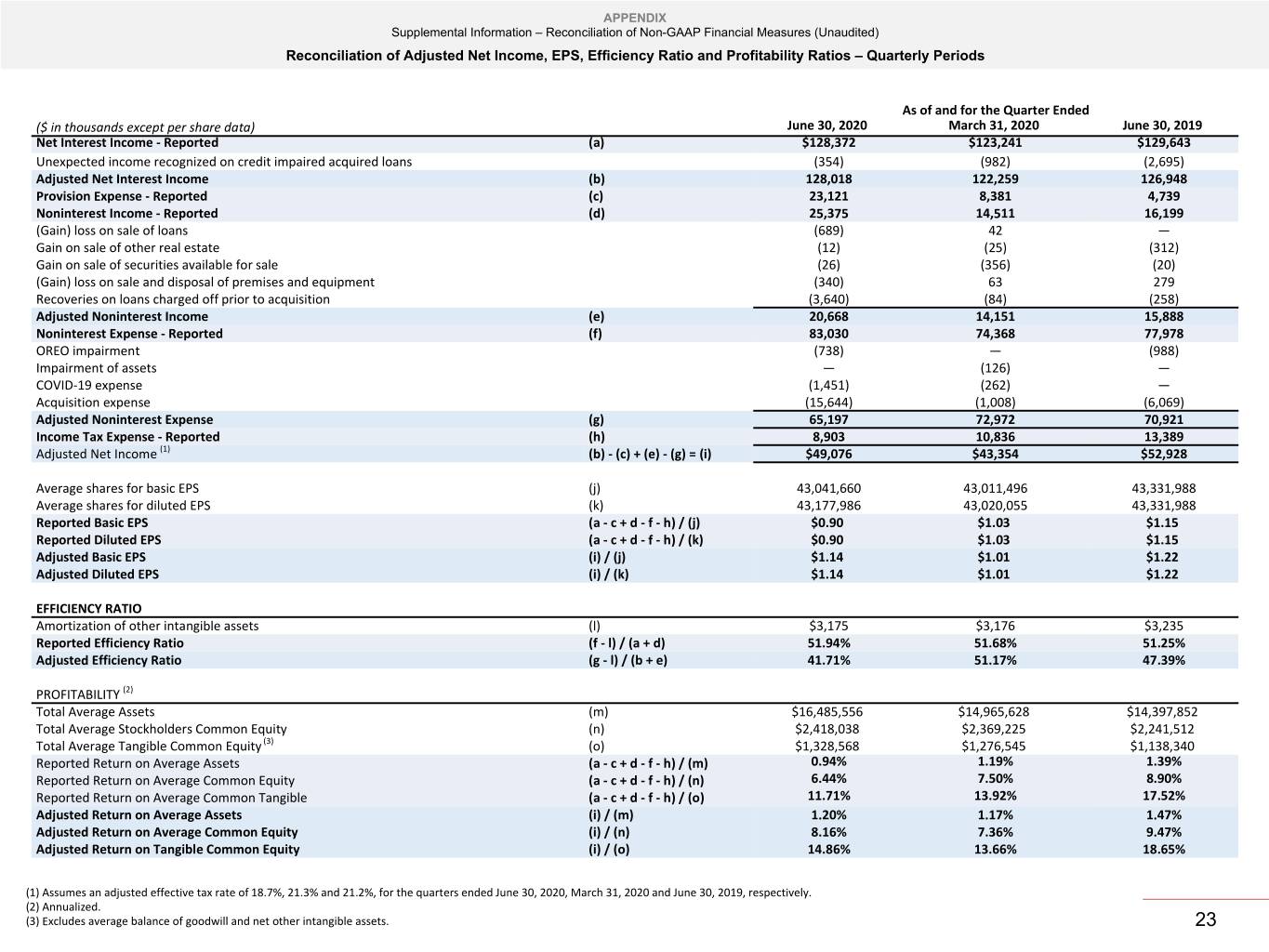

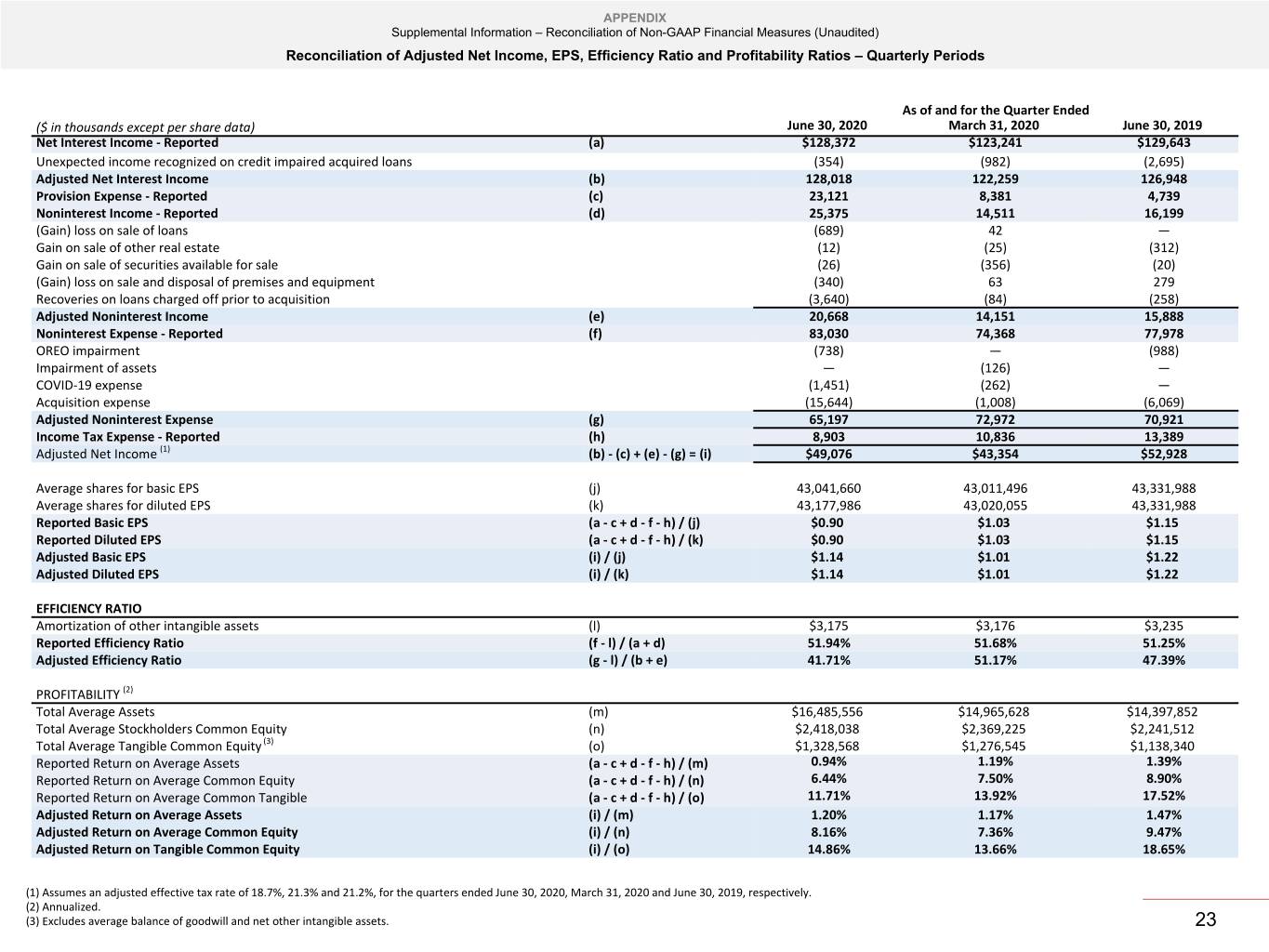

APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Adjusted Net Income, EPS, Efficiency Ratio and Profitability Ratios – Quarterly Periods As of and for the Quarter Ended ($ in thousands except per share data) June 30, 2020 March 31, 2020 June 30, 2019 Net Interest Income - Reported (a) $128,372 $123,241 $129,643 Unexpected income recognized on credit impaired acquired loans (354) (982) (2,695) Adjusted Net Interest Income (b) 128,018 122,259 126,948 Provision Expense - Reported (c) 23,121 8,381 4,739 Noninterest Income - Reported (d) 25,375 14,511 16,199 (Gain) loss on sale of loans (689) 42 — Gain on sale of other real estate (12) (25) (312) Gain on sale of securities available for sale (26) (356) (20) (Gain) loss on sale and disposal of premises and equipment (340) 63 279 Recoveries on loans charged off prior to acquisition (3,640) (84) (258) Adjusted Noninterest Income (e) 20,668 14,151 15,888 Noninterest Expense - Reported (f) 83,030 74,368 77,978 OREO impairment (738) — (988) Impairment of assets — (126) — COVID-19 expense (1,451) (262) — Acquisition expense (15,644) (1,008) (6,069) Adjusted Noninterest Expense (g) 65,197 72,972 70,921 Income Tax Expense - Reported (h) 8,903 10,836 13,389 Adjusted Net Income (1) (b) - (c) + (e) - (g) = (i) $49,076 $43,354 $52,928 Average shares for basic EPS (j) 43,041,660 43,011,496 43,331,988 Average shares for diluted EPS (k) 43,177,986 43,020,055 43,331,988 Reported Basic EPS (a - c + d - f - h) / (j) $0.90 $1.03 $1.15 Reported Diluted EPS (a - c + d - f - h) / (k) $0.90 $1.03 $1.15 Adjusted Basic EPS (i) / (j) $1.14 $1.01 $1.22 Adjusted Diluted EPS (i) / (k) $1.14 $1.01 $1.22 EFFICIENCY RATIO Amortization of other intangible assets (l) $3,175 $3,176 $3,235 Reported Efficiency Ratio (f - l) / (a + d) 51.94% 51.68% 51.25% Adjusted Efficiency Ratio (g - l) / (b + e) 41.71% 51.17% 47.39% PROFITABILITY (2) Total Average Assets (m) $16,485,556 $14,965,628 $14,397,852 Total Average Stockholders Common Equity (n) $2,418,038 $2,369,225 $2,241,512 Total Average Tangible Common Equity (3) (o) $1,328,568 $1,276,545 $1,138,340 Reported Return on Average Assets (a - c + d - f - h) / (m) 0.94% 1.19% 1.39% Reported Return on Average Common Equity (a - c + d - f - h) / (n) 6.44% 7.50% 8.90% Reported Return on Average Common Tangible (a - c + d - f - h) / (o) 11.71% 13.92% 17.52% Adjusted Return on Average Assets (i) / (m) 1.20% 1.17% 1.47% Adjusted Return on Average Common Equity (i) / (n) 8.16% 7.36% 9.47% Adjusted Return on Tangible Common Equity (i) / (o) 14.86% 13.66% 18.65% (1) Assumes an adjusted effective tax rate of 18.7%, 21.3% and 21.2%, for the quarters ended June 30, 2020, March 31, 2020 and June 30, 2019, respectively. (2) Annualized. (3) Excludes average balance of goodwill and net other intangible assets. 23

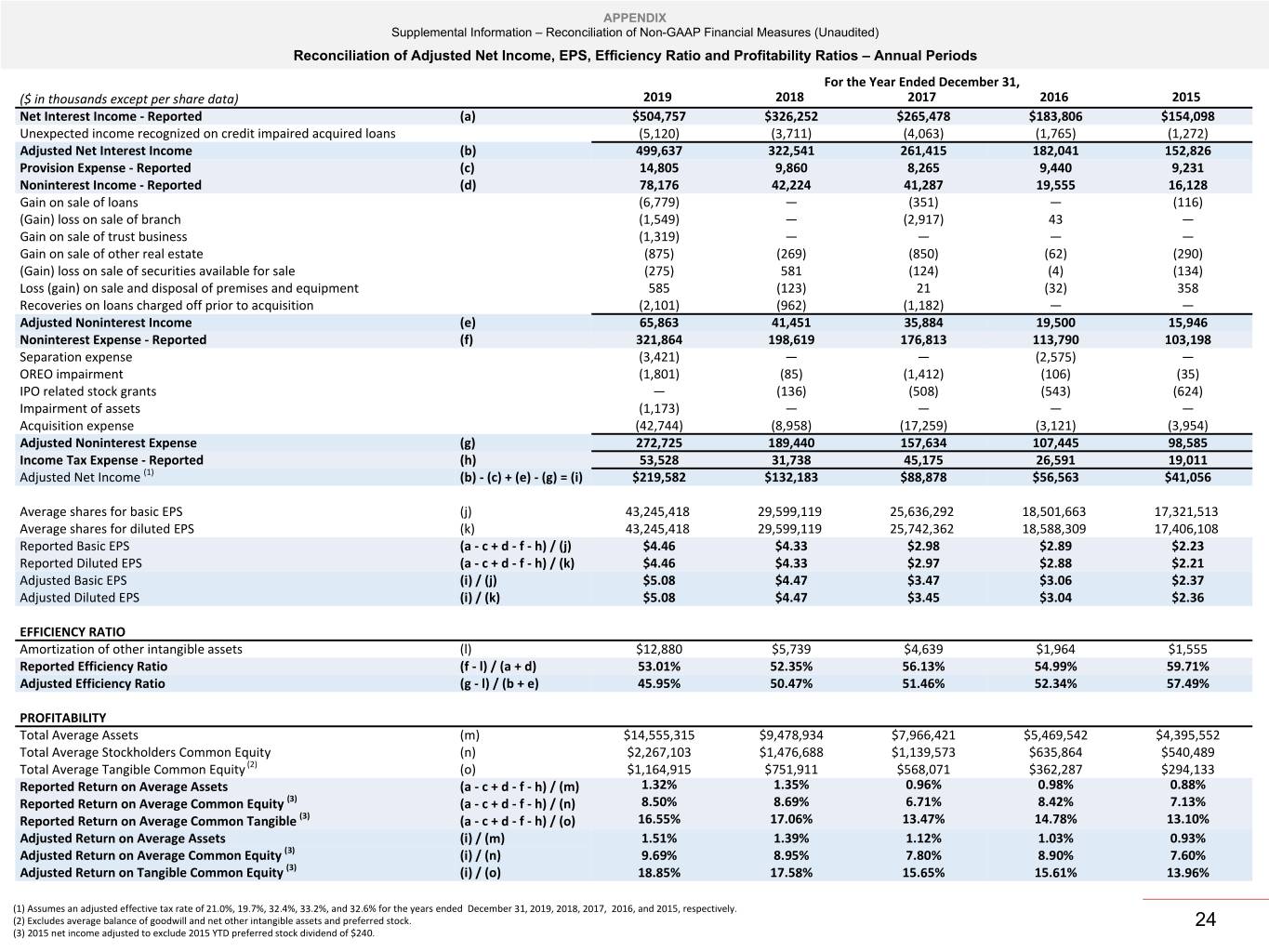

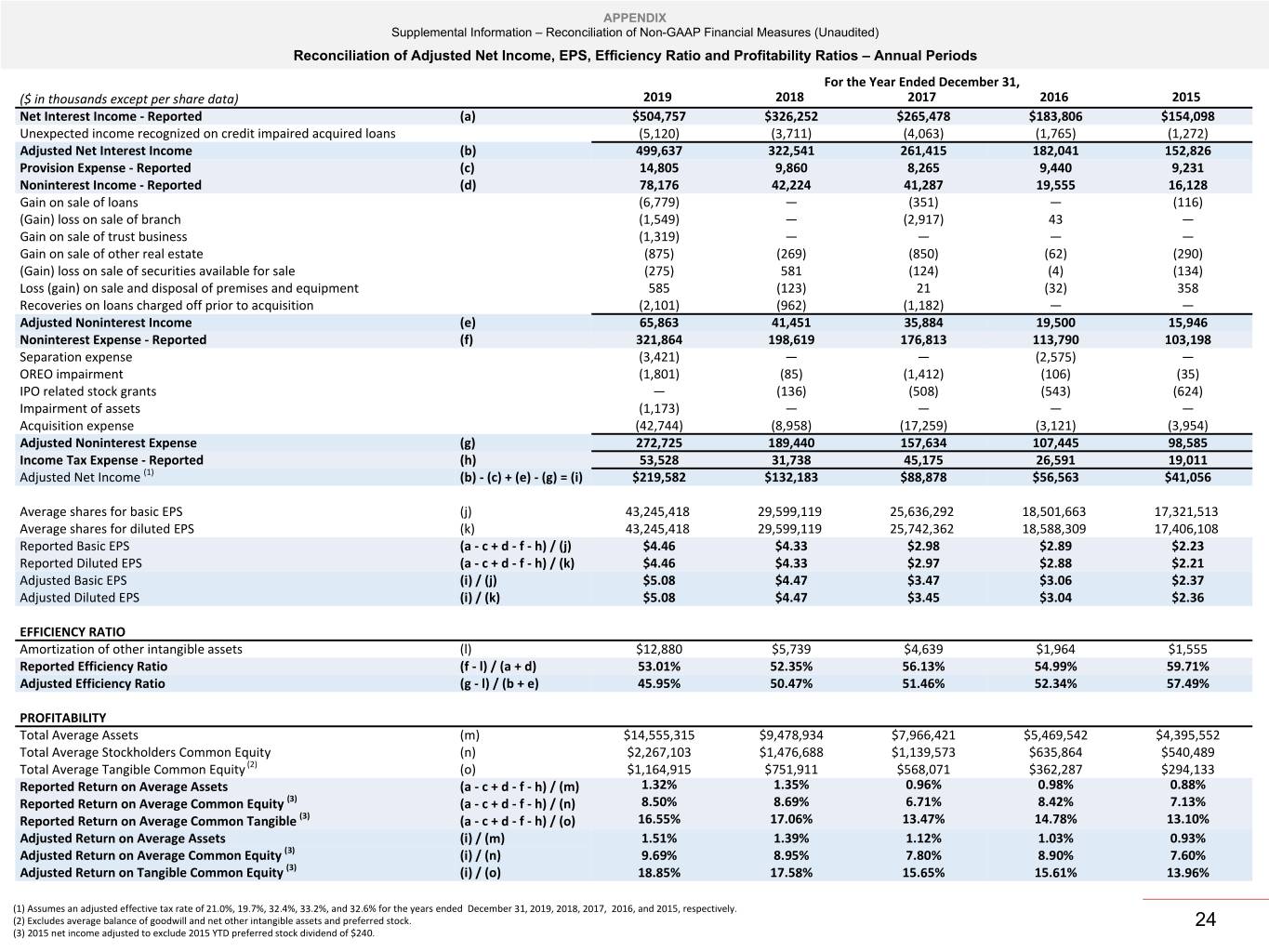

APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Adjusted Net Income, EPS, Efficiency Ratio and Profitability Ratios – Annual Periods For the Year Ended December 31, ($ in thousands except per share data) 2019 2018 2017 2016 2015 Net Interest Income - Reported (a) $504,757 $326,252 $265,478 $183,806 $154,098 Unexpected income recognized on credit impaired acquired loans (5,120) (3,711) (4,063) (1,765) (1,272) Adjusted Net Interest Income (b) 499,637 322,541 261,415 182,041 152,826 Provision Expense - Reported (c) 14,805 9,860 8,265 9,440 9,231 Noninterest Income - Reported (d) 78,176 42,224 41,287 19,555 16,128 Gain on sale of loans (6,779) — (351) — (116) (Gain) loss on sale of branch (1,549) — (2,917) 43 — Gain on sale of trust business (1,319) — — — — Gain on sale of other real estate (875) (269) (850) (62) (290) (Gain) loss on sale of securities available for sale (275) 581 (124) (4) (134) Loss (gain) on sale and disposal of premises and equipment 585 (123) 21 (32) 358 Recoveries on loans charged off prior to acquisition (2,101) (962) (1,182) — — Adjusted Noninterest Income (e) 65,863 41,451 35,884 19,500 15,946 Noninterest Expense - Reported (f) 321,864 198,619 176,813 113,790 103,198 Separation expense (3,421) — — (2,575) — OREO impairment (1,801) (85) (1,412) (106) (35) IPO related stock grants — (136) (508) (543) (624) Impairment of assets (1,173) — — — — Acquisition expense (42,744) (8,958) (17,259) (3,121) (3,954) Adjusted Noninterest Expense (g) 272,725 189,440 157,634 107,445 98,585 Income Tax Expense - Reported (h) 53,528 31,738 45,175 26,591 19,011 Adjusted Net Income (1) (b) - (c) + (e) - (g) = (i) $219,582 $132,183 $88,878 $56,563 $41,056 Average shares for basic EPS (j) 43,245,418 29,599,119 25,636,292 18,501,663 17,321,513 Average shares for diluted EPS (k) 43,245,418 29,599,119 25,742,362 18,588,309 17,406,108 Reported Basic EPS (a - c + d - f - h) / (j) $4.46 $4.33 $2.98 $2.89 $2.23 Reported Diluted EPS (a - c + d - f - h) / (k) $4.46 $4.33 $2.97 $2.88 $2.21 Adjusted Basic EPS (i) / (j) $5.08 $4.47 $3.47 $3.06 $2.37 Adjusted Diluted EPS (i) / (k) $5.08 $4.47 $3.45 $3.04 $2.36 EFFICIENCY RATIO Amortization of other intangible assets (l) $12,880 $5,739 $4,639 $1,964 $1,555 Reported Efficiency Ratio (f - l) / (a + d) 53.01% 52.35% 56.13% 54.99% 59.71% Adjusted Efficiency Ratio (g - l) / (b + e) 45.95% 50.47% 51.46% 52.34% 57.49% PROFITABILITY Total Average Assets (m) $14,555,315 $9,478,934 $7,966,421 $5,469,542 $4,395,552 Total Average Stockholders Common Equity (n) $2,267,103 $1,476,688 $1,139,573 $635,864 $540,489 Total Average Tangible Common Equity (2) (o) $1,164,915 $751,911 $568,071 $362,287 $294,133 Reported Return on Average Assets (a - c + d - f - h) / (m) 1.32% 1.35% 0.96% 0.98% 0.88% Reported Return on Average Common Equity (3) (a - c + d - f - h) / (n) 8.50% 8.69% 6.71% 8.42% 7.13% Reported Return on Average Common Tangible (3) (a - c + d - f - h) / (o) 16.55% 17.06% 13.47% 14.78% 13.10% Adjusted Return on Average Assets (i) / (m) 1.51% 1.39% 1.12% 1.03% 0.93% Adjusted Return on Average Common Equity (3) (i) / (n) 9.69% 8.95% 7.80% 8.90% 7.60% Adjusted Return on Tangible Common Equity (3) (i) / (o) 18.85% 17.58% 15.65% 15.61% 13.96% (1) Assumes an adjusted effective tax rate of 21.0%, 19.7%, 32.4%, 33.2%, and 32.6% for the years ended December 31, 2019, 2018, 2017, 2016, and 2015, respectively. (2) Excludes average balance of goodwill and net other intangible assets and preferred stock. 24 (3) 2015 net income adjusted to exclude 2015 YTD preferred stock dividend of $240.

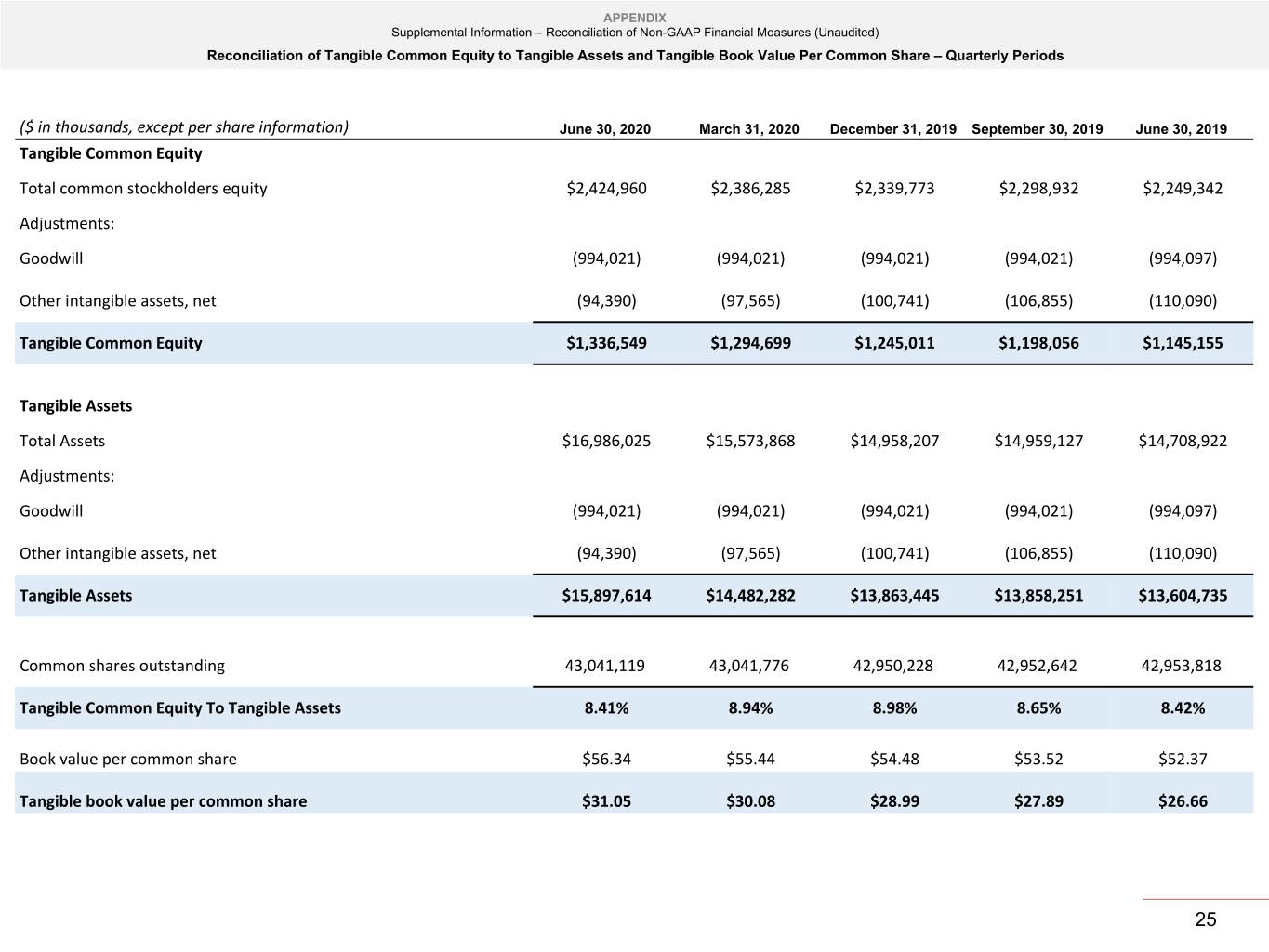

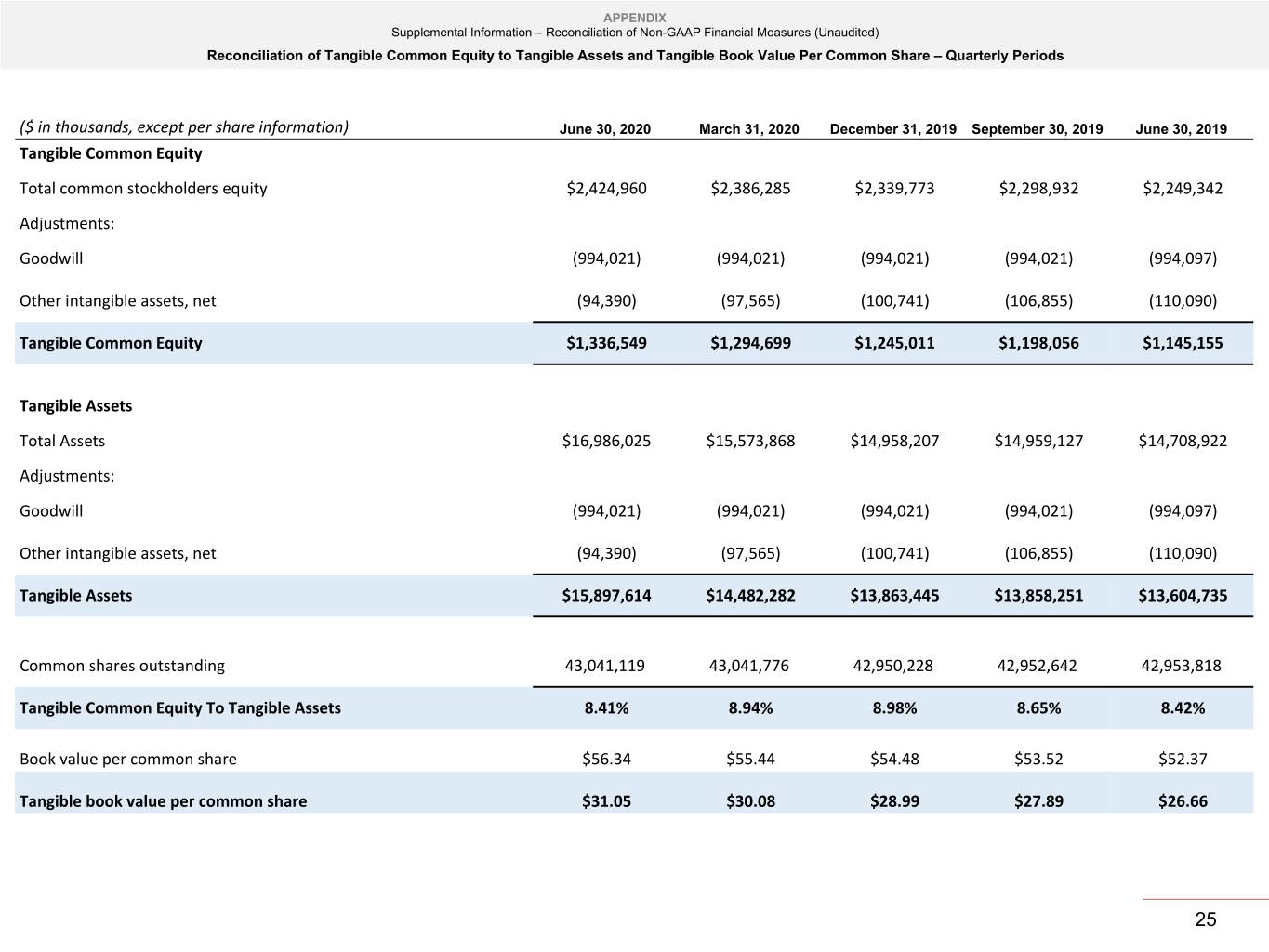

APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Tangible Common Equity to Tangible Assets and Tangible Book Value Per Common Share – Quarterly Periods ($ in thousands, except per share information) June 30, 2020 March 31, 2020 December 31, 2019 September 30, 2019 June 30, 2019 Tangible Common Equity Total common stockholders equity $2,424,960 $2,386,285 $2,339,773 $2,298,932 $2,249,342 Adjustments: Goodwill (994,021) (994,021) (994,021) (994,021) (994,097) Other intangible assets, net (94,390) (97,565) (100,741) (106,855) (110,090) Tangible Common Equity $1,336,549 $1,294,699 $1,245,011 $1,198,056 $1,145,155 Tangible Assets Total Assets $16,986,025 $15,573,868 $14,958,207 $14,959,127 $14,708,922 Adjustments: Goodwill (994,021) (994,021) (994,021) (994,021) (994,097) Other intangible assets, net (94,390) (97,565) (100,741) (106,855) (110,090) Tangible Assets $15,897,614 $14,482,282 $13,863,445 $13,858,251 $13,604,735 Common shares outstanding 43,041,119 43,041,776 42,950,228 42,952,642 42,953,818 Tangible Common Equity To Tangible Assets 8.41% 8.94% 8.98% 8.65% 8.42% Book value per common share $56.34 $55.44 $54.48 $53.52 $52.37 Tangible book value per common share $31.05 $30.08 $28.99 $27.89 $26.66 25

APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Tangible Common Equity to Tangible Assets and Tangible Book Value Per Common Share – Annual Periods ($ in thousands, except per share information) December 31, 2019 December 31, 2018 December 31, 2017 December 31, 2016 December 31, 2015 Tangible Common Equity Total common stockholders equity $2,339,773 $1,606,433 $1,336,018 $672,365 $603,371 Adjustments: Goodwill (994,021) (721,797) (621,458) (258,319) (258,643) Other intangible assets, net (100,741) (45,042) (43,244) (14,177) (16,357) Tangible Common Equity $1,245,011 $839,594 $671,316 $399,869 $328,371 Tangible Assets Total Assets $14,958,207 $9,849,965 $8,684,463 $5,852,801 $5,055,000 Adjustments: Goodwill (994,021) (721,797) (621,458) (258,319) (258,643) Other intangible assets, net (100,741) (45,042) (43,244) (14,177) (16,357) Tangible Assets $13,863,445 $9,083,126 $8,019,761 $5,580,305 $4,780,000 Common shares outstanding 42,950,228 30,600,582 28,254,893 18,870,312 18,399,194 Tangible Common Equity To Tangible Assets 8.98% 9.24% 8.37% 7.17% 6.87% Book value per common share $54.48 $52.50 $47.28 $35.63 $32.79 Tangible book value per common share $28.99 $27.44 $23.76 $21.19 $17.85 26