Earnings Presentation July 25, 2022 NASDAQ: IBTX Exhibit 99.2

NASDAQ: IBTX 2 Safe Harbor Statement The numbers as of and for the quarter ended June 30, 2022 are unaudited. This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of Independent Bank Group, Inc. (“IBTX”). Words such as “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward-looking statements. These forward-looking statements are based on IBTX’s current expectations and assumptions regarding IBTX’s business, the economy, and other future conditions. Because forward-looking statements relate to future results and occurrences, they are subject to inherent uncertainties, assumptions, risks, and changes in circumstances that are difficult to predict. Many possible events or factors could materialize or IBTX’s underlying assumptions could prove incorrect and affect IBTX’s future financial results and performance and could cause actual results or performance to differ materially from anticipated results or performance. Such risks and uncertainties include, among others, risks relating to the conflict between Russia and the Ukraine, risks relating to the coronavirus (COVID-19) pandemic and its effect on U.S. and world financial markets, potential regulatory actions, changes in consumer behaviors and impacts on and modifications to the operations and business of IBTX relating thereto, and the business, economic and political conditions in the markets in which IBTX operates. Except to the extent required by applicable law or regulation, IBTX disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information regarding IBTX and factors which could affect the forward-looking statements contained herein can be found in IBTX’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, its Quarterly Report on Form 10-Q for the period ended March 31, 2022 and its other filings with the Securities and Exchange Commission.

NASDAQ: IBTX 3 Safe Harbor Statement (cont.) Non-GAAP Financial Measures In addition to results presented in accordance with GAAP, this presentation contains certain non-GAAP financial measures. These measures and ratios include “adjusted net income,” “tangible book value,” “tangible book value per common share,” “adjusted efficiency ratio,” “tangible common equity to tangible assets,” “return on tangible common equity,” “adjusted return on average assets,” “adjusted return on average common equity,” “adjusted return on tangible common equity,” “adjusted earnings per share,” “adjusted diluted earnings per share,” “adjusted net interest margin,” “adjusted net interest income,” “adjusted noninterest expenses” and “adjusted noninterest income” and are supplemental measures that are not required by, or are not presented in accordance with, accounting principles generally accepted in the United States. We believe that these measures provide useful information to management and investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with GAAP; however we acknowledge that our financial measures have a number of limitations relative to GAAP financial measures. Certain non-GAAP financial measures exclude items of income, expenditures, expenses, assets, or liabilities, including provisions for credit losses and the effect of goodwill, other intangible assets and income from accretion on acquired loans arising from purchase accounting adjustments, that we believe cause certain aspects of our results of operations or financial condition to be not indicative of our primary operating results. All of these items significantly impact our financial statements. Additionally, the items that we exclude in our adjustments are not necessarily consistent with the items that our peers may exclude from their results of operations and key financial measures and therefore may limit the comparability of similarly named financial measures and ratios. We compensate for these limitations by providing the equivalent GAAP measures whenever we present the non-GAAP financial measures and by including a reconciliation of the impact of the components adjusted for in the non-GAAP financial measure so that both measures and the individual components may be considered when analyzing our performance. A reconciliation of our non-GAAP financial measures to the comparable GAAP financial measures is included at the end of this presentation.

NASDAQ: IBTX 4 David R. Brooks Chairman of the Board and CEO, Director • 42 years in the financial services industry; 34 years at Independent Bank • Active in community banking since the early 1980s - led the investor group that acquired Independent Bank in 1988 Michelle S. Hickox Executive Vice President, Chief Financial Officer • 32 years in the financial services industry; 10 years at Independent Bank • Formerly a Financial Services Audit Partner at RSM US LLP • Certified Public Accountant Daniel W. Brooks Vice Chairman, Director • 39 years in the financial services industry; 33 years at Independent Bank • Active in community banking since the early 1980s Today's Presenters

NASDAQ: IBTX 5 2022 Q2 Results GAAP $1.25 EPS $52.4 Million Net Income 1.19% Return on Average Assets 8.62% Return on Average Equity 12.24% Total Capital Ratio 9.28% Leverage Ratio Non-GAAP1 $1.28 Adj. EPS $53.3 Million Adj. Net Income 1.21% Adj. Return on Average Assets 8.78% Adj. Return on Average Equity 15.32% Return on Tangible Equity 7.63% TCE Highlights • Net income of $52.4 million, or $1.25 per diluted share and adjusted (non-GAAP) net income of $53.3 million, or $1.27 per diluted share • Robust organic loan growth of 36.0% annualized for the quarter (excluding warehouse and PPP) • Net interest income grew 5.2% over the linked quarter • Increase in the net interest margin to 3.51%, up from 3.22% in linked quarter • Repurchased over 1.6 million shares of common stock for $115.2 million aggregate during the quarter 1Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics.

NASDAQ: IBTX 6 2022 Q2 Selected Financials $ in thousands, except per share data As of and for the Quarter Ended Selected Balance Sheet Data June 30, 2022 March 31, 2022 June 30, 2021 Linked Quarter Change Annual Change Total Assets $ 18,107,093 $ 17,963,253 $ 18,447,721 0.8 % (1.8) % LHFI, Excluding Mortgage Warehouse Loans 1 12,979,938 11,958,759 11,576,332 8.5 % 12.1 % Mortgage Warehouse Loans 538,190 569,554 894,324 (5.5) % (39.8) % Total Deposits 15,063,948 14,850,271 15,063,791 1.4 % — % Total Borrowings (Other Than Junior Subordinated Debentures) 509,718 419,545 681,023 21.5 % (25.2) % Total Stockholders’ Equity 2,364,335 2,522,460 2,542,885 (6.3) % (7.0) % Selected Earnings and Profitability Data Net Interest Income $ 137,999 $ 131,148 $ 129,297 5.2 % 6.7 % Net Interest Margin 3.51 % 3.22 % 3.14 % 9.0 % 11.8 % Noninterest Income $ 13,877 $ 12,885 $ 15,926 7.7 % (12.9) % Noninterest Expense 85,925 82,457 78,013 4.2 % 10.1 % Net Income 52,360 50,740 58,243 3.2 % (10.1) % Adjusted Net Income 2 53,304 52,130 58,243 2.3 % (8.5) % Basic EPS 1.25 1.19 1.35 5.0 % (7.4) % Adjusted Basic EPS 2 1.28 1.22 1.35 4.9 % (5.2) % Diluted EPS 1.25 1.18 1.35 5.9 % (7.4) % Adjusted Diluted EPS 2 1.27 1.22 1.35 4.1 % (5.9) % Return on Average Assets 1.19 % 1.12 % 1.28 % 6.2 % (7.0) % Adjusted Return on Average Assets 2 1.21 % 1.15 % 1.28 % 5.2 % (5.5) % 1 LHFI excludes mortgage warehouse purchase loans and includes SBA PPP loans of $26,669, $67,011 and $490,485, respectively. 2 Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics.

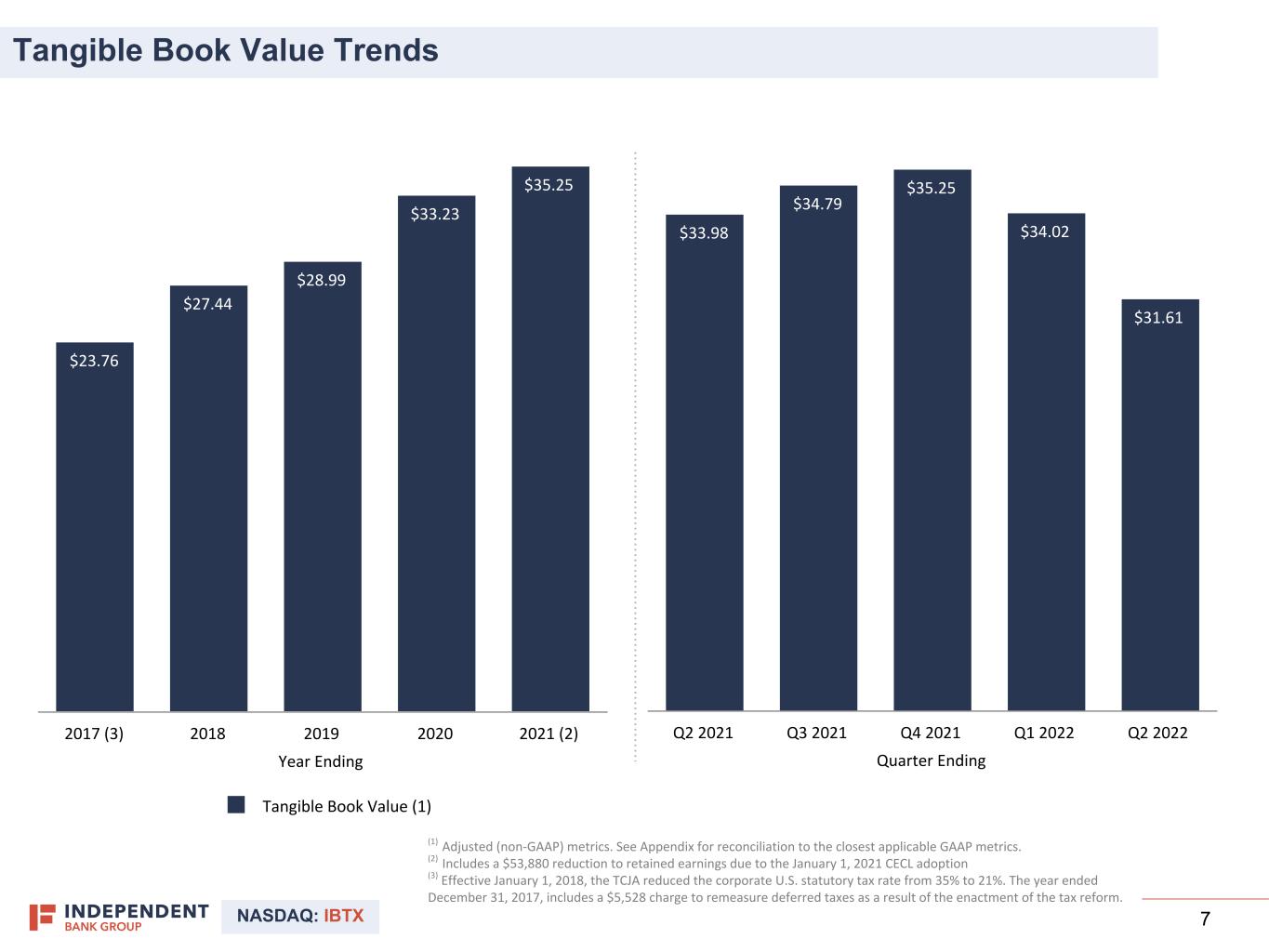

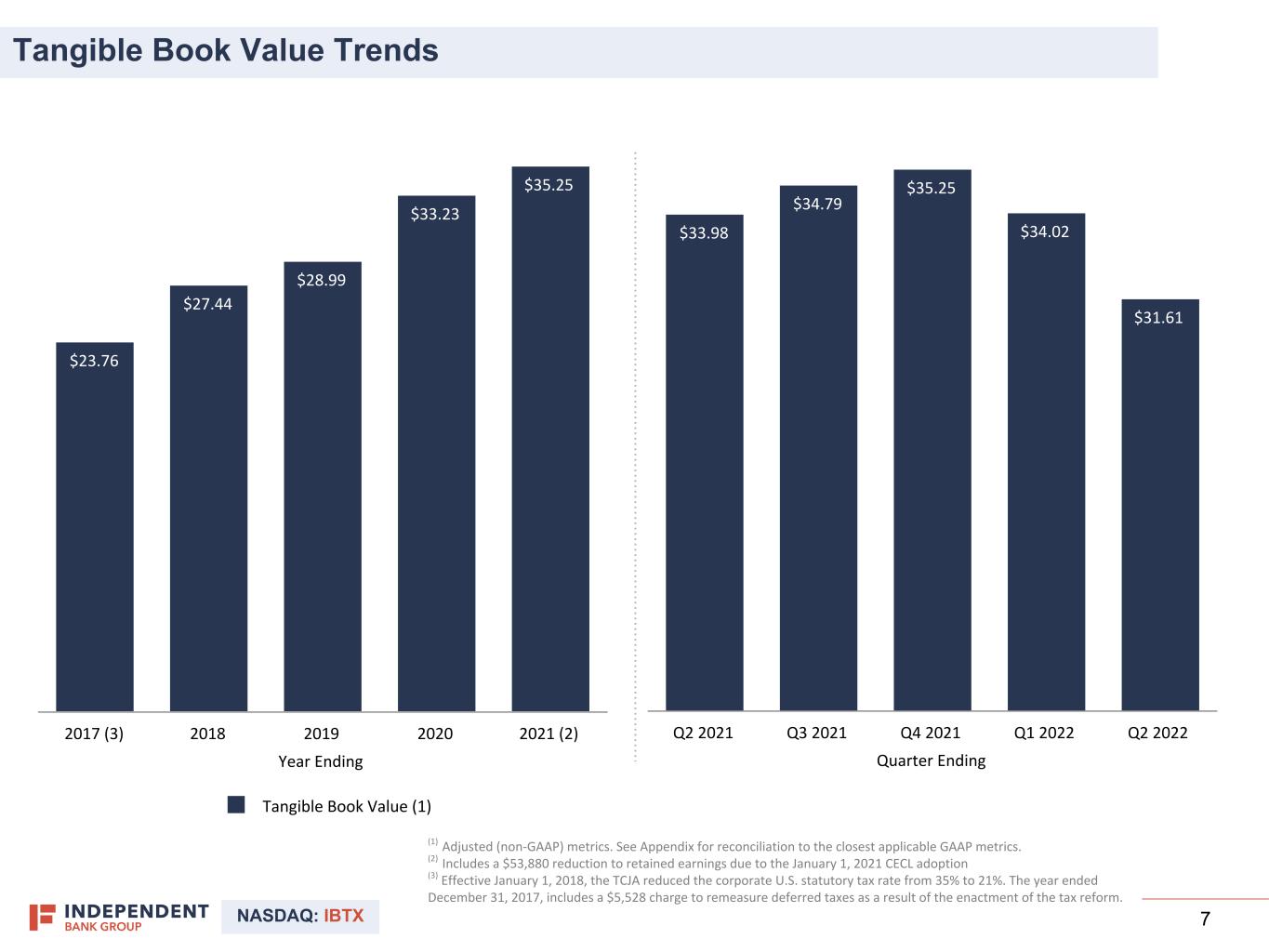

NASDAQ: IBTX 7 (1) Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. (2) Includes a $53,880 reduction to retained earnings due to the January 1, 2021 CECL adoption (3) Effective January 1, 2018, the TCJA reduced the corporate U.S. statutory tax rate from 35% to 21%. The year ended December 31, 2017, includes a $5,528 charge to remeasure deferred taxes as a result of the enactment of the tax reform. 7 Year Ending $23.76 $27.44 $28.99 $33.23 $35.25 Tangible Book Value (1) 2017 (3) 2018 2019 2020 2021 (2) Quarter Ending $33.98 $34.79 $35.25 $34.02 $31.61 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Tangible Book Value Trends

NASDAQ: IBTX 8 Quarter Ending $129.3 $138.0 $15.7 $13.9 $77.8 $84.8 $3.1 $3.1 51.48% 53.75% Q2 2021 Q2 2022 Year Ending $499.6 $513.2 $520.3 $65.9 $79.7 $66.3 $272.7 $285.7 $312.0 $12.9 $12.7 $12.6 45.95% 46.04% 51.04% Adjusted net interest income Adjusted noninterest income Adjusted noninterest expense Amortization of other intangible assets Adjusted efficiency ratio 2019 2020 2021 (1) Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. 8 $ in Millions Adjusted Efficiency Ratio Trends (1)

NASDAQ: IBTX 9 Total Loans by Year and Current Annual Trend ($ in Millions)(1) Quarter Ending $12,514 $13,545 Q2 2021 Q2 2022 (1) Includes loans held for sale 9 Year Ending $11,652 $13,159 $12,472 Organic Mortgage warehouse purchase loans PPP Loans Impact of Acquisitions 2019 2020 2021 8.2% Total Increase (12.43% Increase, net PPP)2019 - 2021 CAGR 3.5% Loan Portfolio Growth

NASDAQ: IBTX 10 Owner Occupied CRE 23.4% CRE 54.7% Mortgage Warehouse 4.0% 1-4 Family 11.0% 1-4 Family Construction 3.4% Consumer 0.6% C&I 15.9% Agricultural 0.9% Construction & Development 9.5% North Texas 39.1% Central Texas 12.6% Houston 23.6% Colorado 24.7% As of June 30, 2022: $12,980 Million LHFI 1 $538 Million Mortgage Warehouse 0.54% NPLs/LHFI 0.09% NCOs/Avg. Total Loans 2022 Q2 Annualized 206.28% Allowance/NPLs LOANS BY REGION (6/30/2022) Non-Owner Occupied CRE 76.6% LOAN COMPOSITION (6/30/2022) 1 LHFI excludes mortgage warehouse purchase loans. Loan Portfolio Overview 4.26% 2022 YTD Loan Yield

NASDAQ: IBTX 11 Land/Land Development 27.1% CRE Construction 51.5% SFR Construction 21.4% Retail 17.5% Office 22.3% Industrial 3.4% Hotel/Motel 4.1% Multifamily 20.4% Healthcare 5.8% Misc. CRE 26.5% Construction & Development As of June 30, 2022: $1.8 Billion C&D Portfolio Size 88% C&D / Bank Regulatory Capital 95.4% # Loans in IBTX Markets1 (Texas and Colorado) $2.0 Million Average Loan Size1 717 C&D Loans1 38.0% Owner Occupied C&D Loans1 CRE CONSTRUCTION PORTFOLIO LOANS > $500 THOUSAND (6/30/2022) C&D PORTFOLIO LOANS > $500 THOUSAND (6/30/2022) 1Loans > $500 thousand

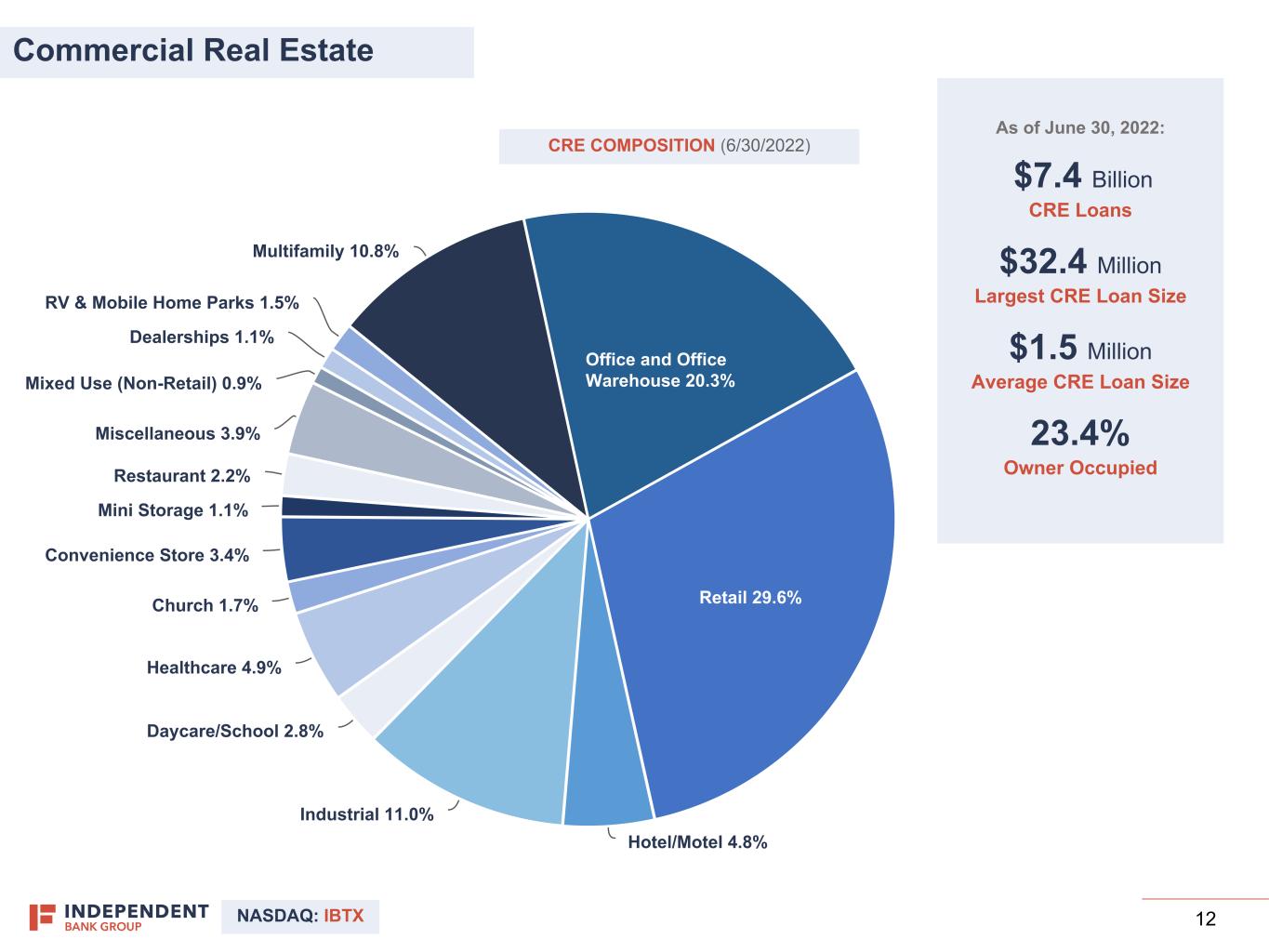

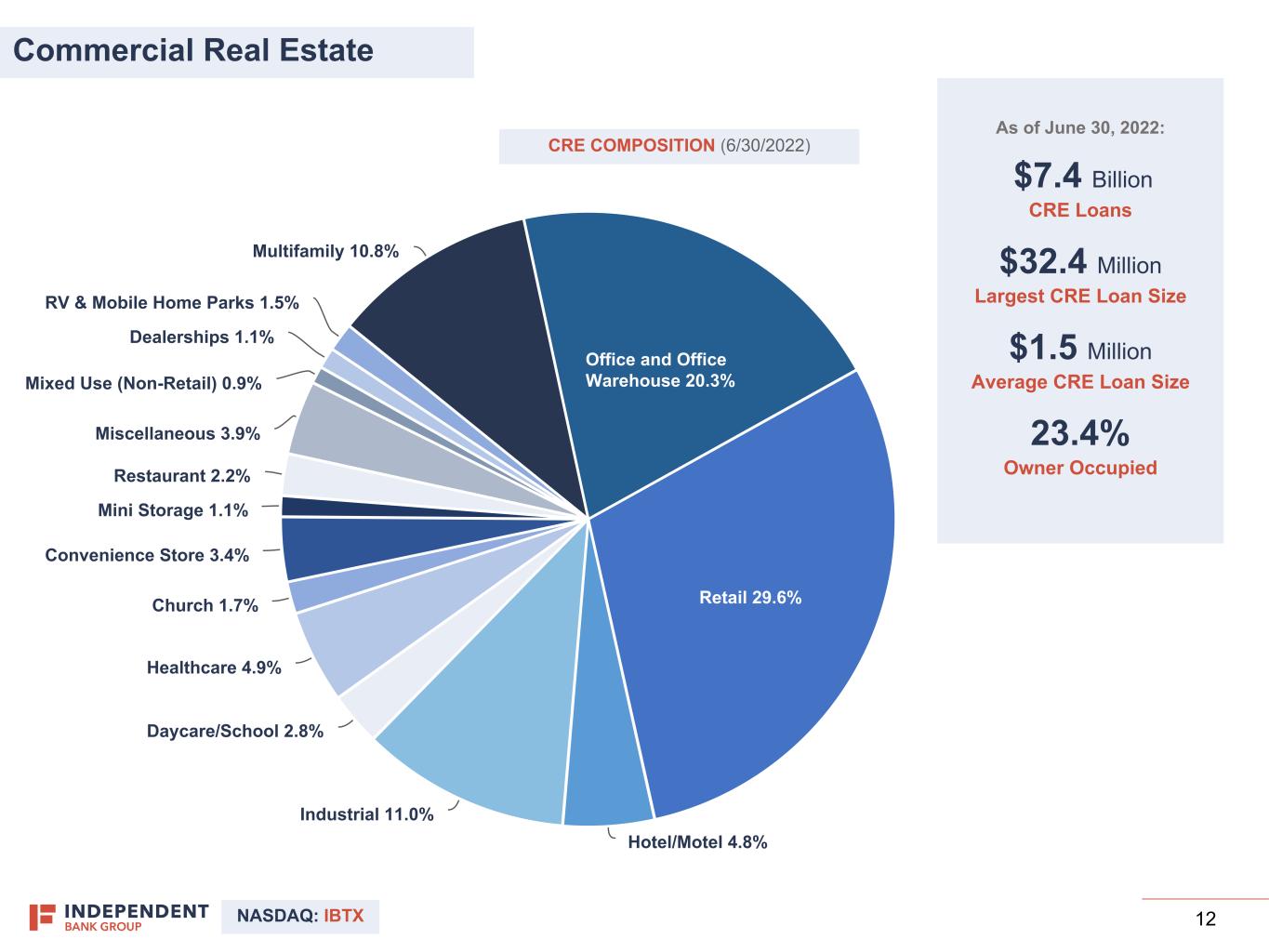

NASDAQ: IBTX 12 Multifamily 10.8% Office and Office Warehouse 20.3% Retail 29.6% Hotel/Motel 4.8% Industrial 11.0% Daycare/School 2.8% Healthcare 4.9% Church 1.7% Convenience Store 3.4% Mini Storage 1.1% Restaurant 2.2% Miscellaneous 3.9% Mixed Use (Non-Retail) 0.9% Dealerships 1.1% RV & Mobile Home Parks 1.5% Commercial Real Estate CRE COMPOSITION (6/30/2022) As of June 30, 2022: $7.4 Billion CRE Loans $32.4 Million Largest CRE Loan Size $1.5 Million Average CRE Loan Size 23.4% Owner Occupied

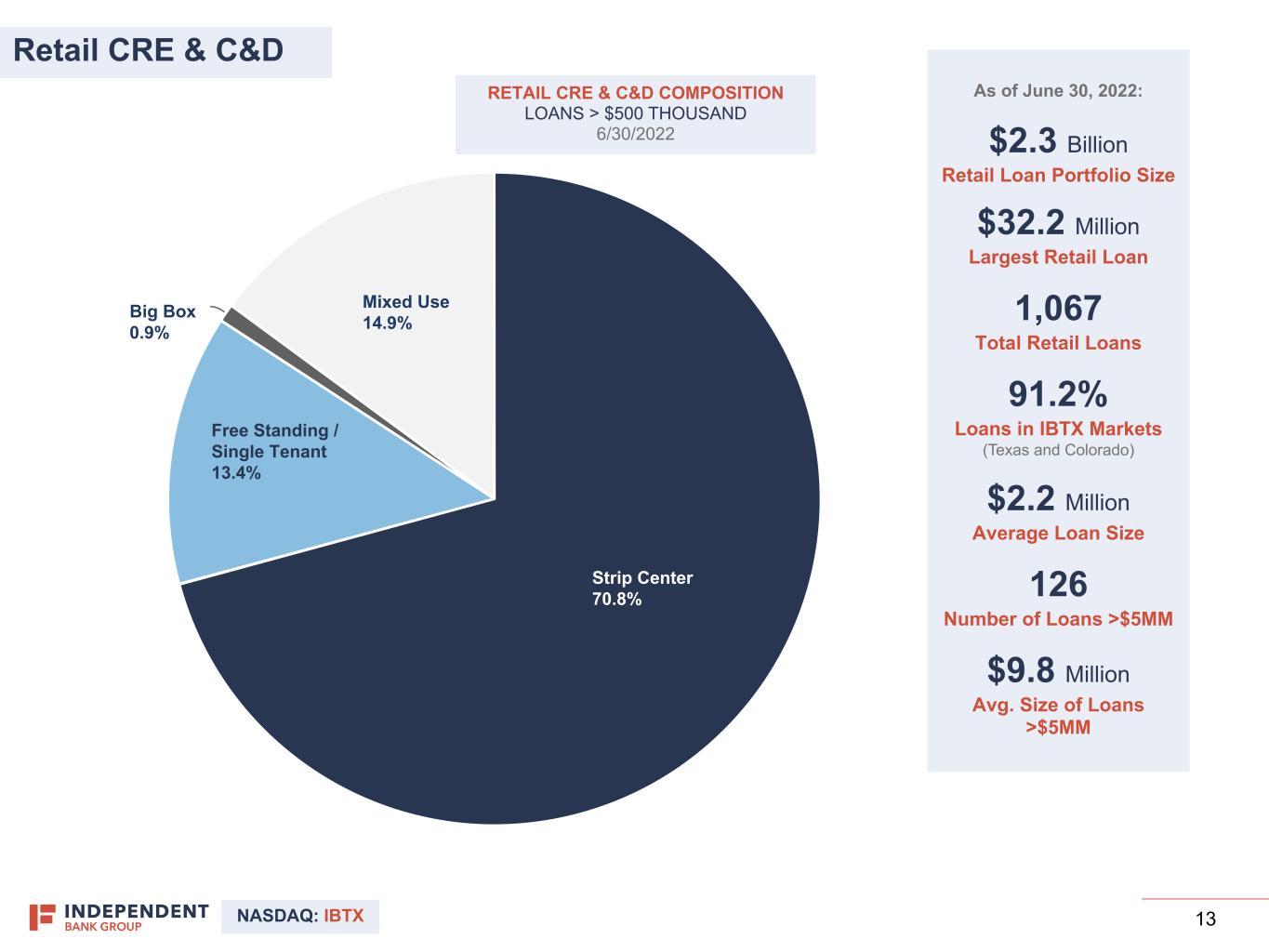

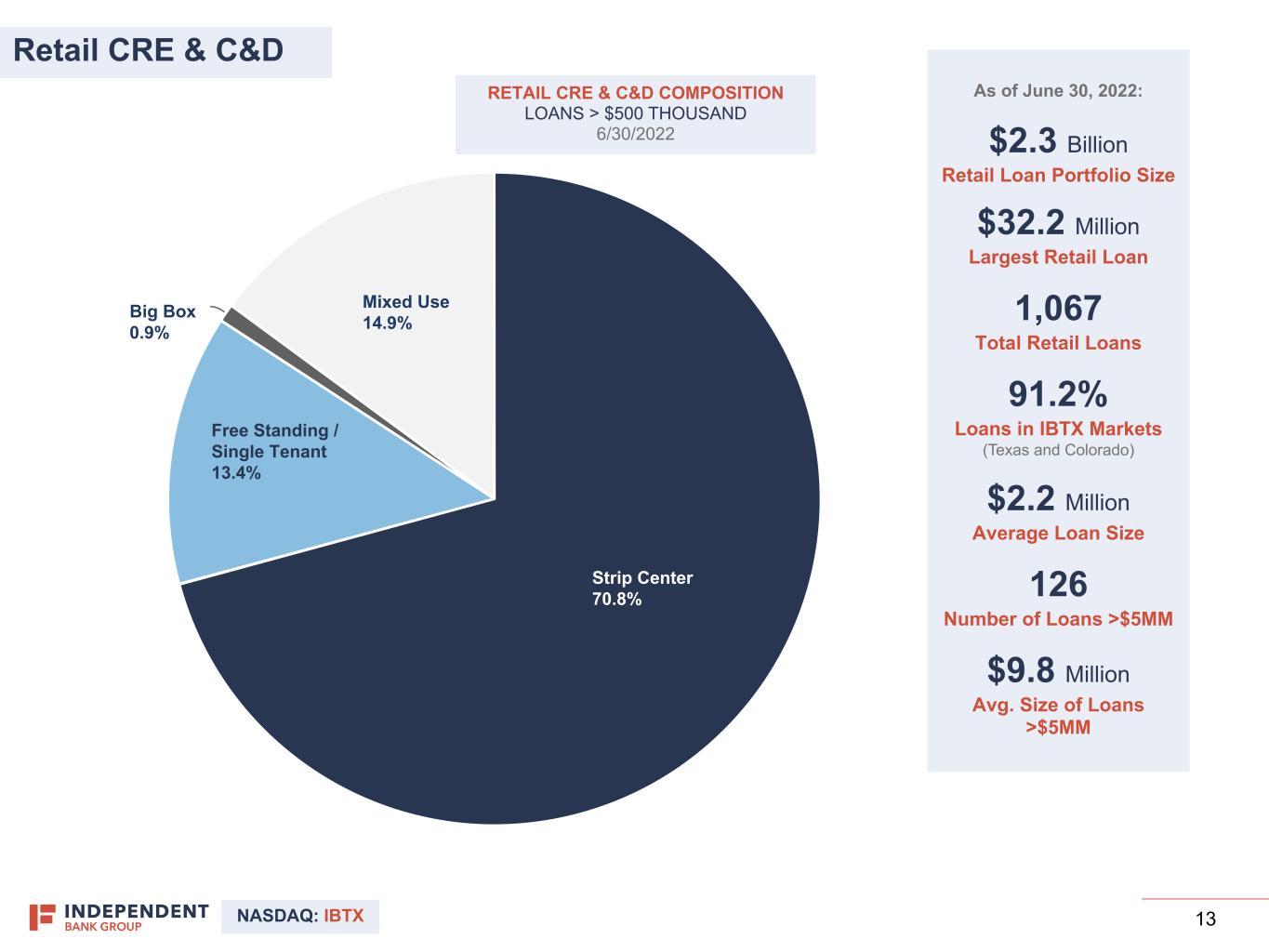

NASDAQ: IBTX 13 Retail CRE & C&D As of June 30, 2022: $2.3 Billion Retail Loan Portfolio Size $32.2 Million Largest Retail Loan 1,067 Total Retail Loans 91.2% Loans in IBTX Markets (Texas and Colorado) $2.2 Million Average Loan Size 126 Number of Loans >$5MM $9.8 Million Avg. Size of Loans >$5MM Strip Center 70.8% Big Box 0.9% Mixed Use 14.9% Free Standing / Single Tenant 13.4% RETAIL CRE & C&D COMPOSITION LOANS > $500 THOUSAND 6/30/2022

NASDAQ: IBTX 14 Office Non-Owner Occupied 45.3% Office Owner Occupied 16.6% Office/Warehouse Non- Owner Occupied 24.8% Office/Warehouse Owner Occupied 13.3% Office CRE & C&D As of June 30, 2022: $1.7 Billion Total Office CRE & C&D $25.8 Million Largest Office Loan $1.2 Million Average Loan Size 29.9% Owner Occupied 38.1% Office/Warehouse OFFICE CRE & C&D COMPOSITION 6/30/2022

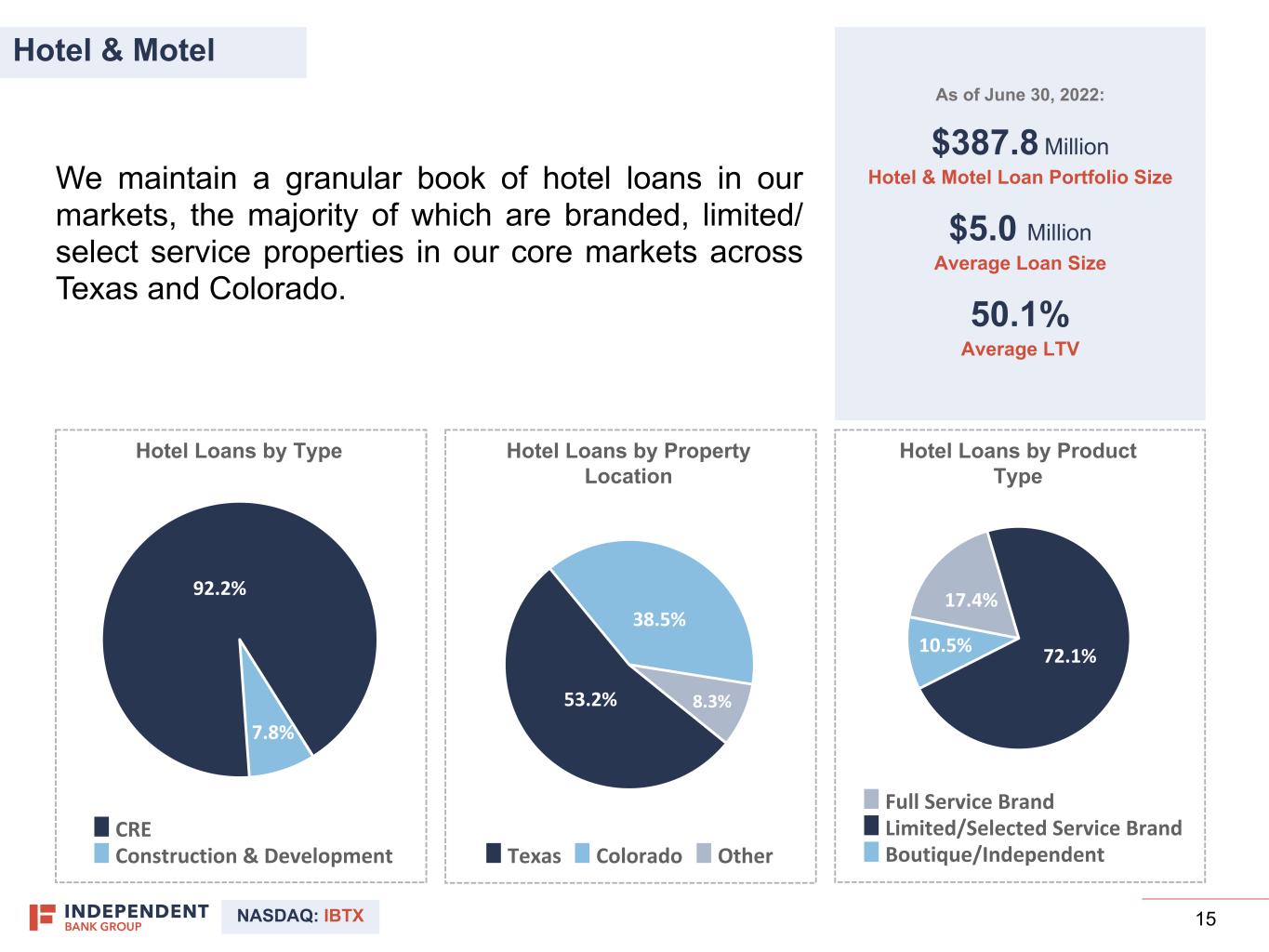

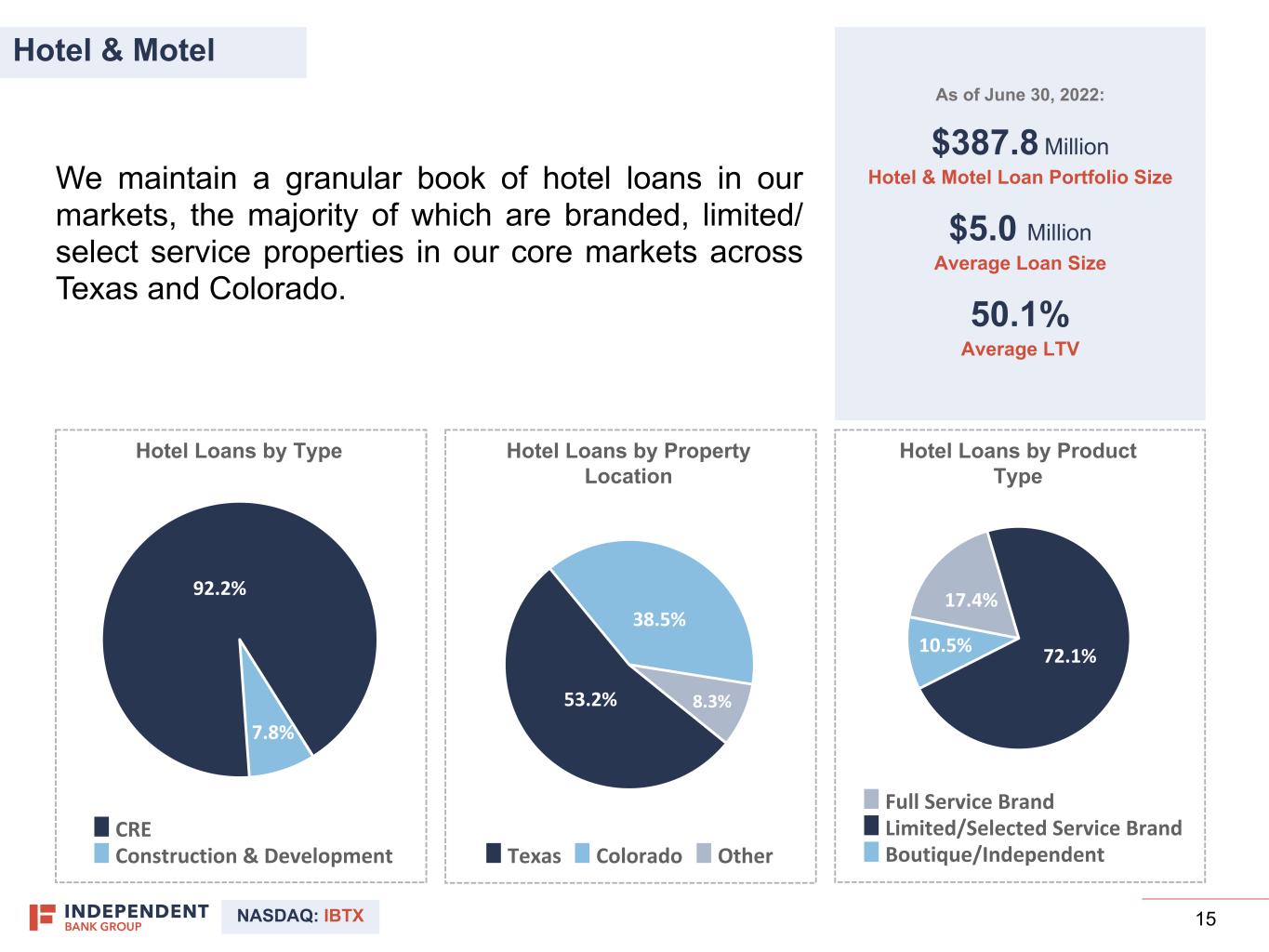

NASDAQ: IBTX 15 Hotel Loans by Property Location 53.2% 38.5% Texas Colorado Other Hotel & Motel As of June 30, 2022: $387.8 Million Hotel & Motel Loan Portfolio Size $5.0 Million Average Loan Size 50.1% Average LTV We maintain a granular book of hotel loans in our markets, the majority of which are branded, limited/ select service properties in our core markets across Texas and Colorado. Hotel Loans by Type 92.2% 7.8% CRE Construction & Development 8.3% Hotel Loans by Product Type 17.4% 72.1%10.5% Full Service Brand Limited/Selected Service Brand Boutique/Independent

NASDAQ: IBTX 16 Energy Lending As of June 30, 2022: $467.0 Million Size of Energy Portfolio 98.2% / 1.8% E&P Loans / Services Loans 6.3% Energy ACL / Energy Loans 3.6% Energy Loans / Total LHFI Energy assets are well-diversified by basin across the United States. Energy by Type $458.4 $8.6 E&P Services $ in millions

NASDAQ: IBTX 17 3.03% 3.43% 2.91% 2.36% 1.83% 1.44% 1.49% 1.50% 0.91% 0.68% 0.64% 0.76% 0.53% 0.52% 4.41% 4.15% 4.11% 3.36% 2.67% 2.07% 1.71% 1.57% 1.31% 1.12% 0.98% 1.22% 0.94% 0.91% 1.62% 1.89% 1.14% 0.81% 0.53% 0.32% 0.37% 0.39% 0.24% 0.16% 0.24% 0.44% 0.49% 0.54% IBTX U.S. Average Texas Average 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Q2 1.22% 1.05% 0.74% 0.40% 0.19% 0.11% 0.16% 0.28% 0.18% 0.18% 0.16% 0.26% 0.05% 0.05% 2.67% 2.67% 1.64% 1.12% 0.70% 0.49% 0.43% 0.46% 0.48% 0.46% 0.49% 0.49% 0.24% 0.21% 0.21% 0.31% 0.11% 0.06% 0.09% 0.03% 0.02% 0.12% 0.01% 0.06% 0.07% 0.05% 0.06% 0.05% IBTX U.S. Average Texas Average 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 YTD Historically Strong Credit Culture Source: S&P Capital IQ. Note: Financial data as of and for the YTD period ended March 31, 2022 for U.S. and Texas banking industry aggregate data and June 30, 2022 for IBTX. (1) LHFI excludes mortgage warehouse purchase loans. NCOs / Average Total LoansNPLs / LHFI (1)

NASDAQ: IBTX 18 Quarter Ending $(6,500) $— $— $(1,443) $— $3,916 $99 $2,997 $193 $2,891 Q2 2021 Q3 2021 Q4 2021 Q1 2022 Q2 2022 Year Ending $14,805 $42,993 $(9,000) $8,146 $6,634 $7,420 Provision expense Net charge-offs 2019 2020 2021 $ in Thousands 18 Provision & Charge-offs 0.07% 0.06%0.05% 0.01% 0.09%0.13% 0.10%—% NCOs / Avg. Total Loans (1) (1) Quarterly metrics are annualized.

NASDAQ: IBTX 19 Period Ending $7,738 $11,941 $14,399 $15,554 $15,064 0.83% 1.08% 0.59% 0.29% 0.18% Deposits Average YTD Rate (1) 2018 2019 2020 2021 Q2 2022 Noninterest-Bearing Demand 34.0% Interest-Bearing Checking 29.9% Public Funds 11.5%Savings 5.3% Money Market 14.4% CDs < $100k 1.1% CDs > $100k 3.3% IRAs 0.5% (1) Average rate for total deposits 19 2022 YTD Average Rate for Interest-bearing deposits: 0.28% Total cost of deposits QTD (1) Q2 2022: 0.22% Deposit Mix & Pricing DEPOSIT MIX 6/30/2022 DEPOSIT GROWTH VS. AVERAGE RATE $ in Millions

NASDAQ: IBTX 20 20 Deposit Funding Vertical Trends $4,954 $6,734 $721 $1,172 $1,973 $5,014 $6,860 $437 $1,120 $1,633 December 31, 2021 June 30, 2022 Branch Deposits - Non- Interest Bearing Branch Deposits - Interest Bearing Brokered Deposits Non-Brokered Specialty Treasury Deposits Public Funds $ in Millions

NASDAQ: IBTX 21 27.8% 72.2% CRA 0.1% Agency Securities 20.3% Tax-Exempt Municipals 21.4% Mortgage- Backed Securities 42.5% Taxable Municipals 1.6% U.S. Treasury Securities 11.9% Corporates 2.2% 58.3% 41.7% Securities Portfolio As of June 30, 2022: 2.05% QTD Yield 7.70 Duration in Years 11.3% of Total Assets $1.8 Billion AFS Portfolio Size $208.0 Million HTM Portfolio Size INVESTMENT PORTFOLIO COMPOSITION 6/30/2022 HTM AFS HTM AFS

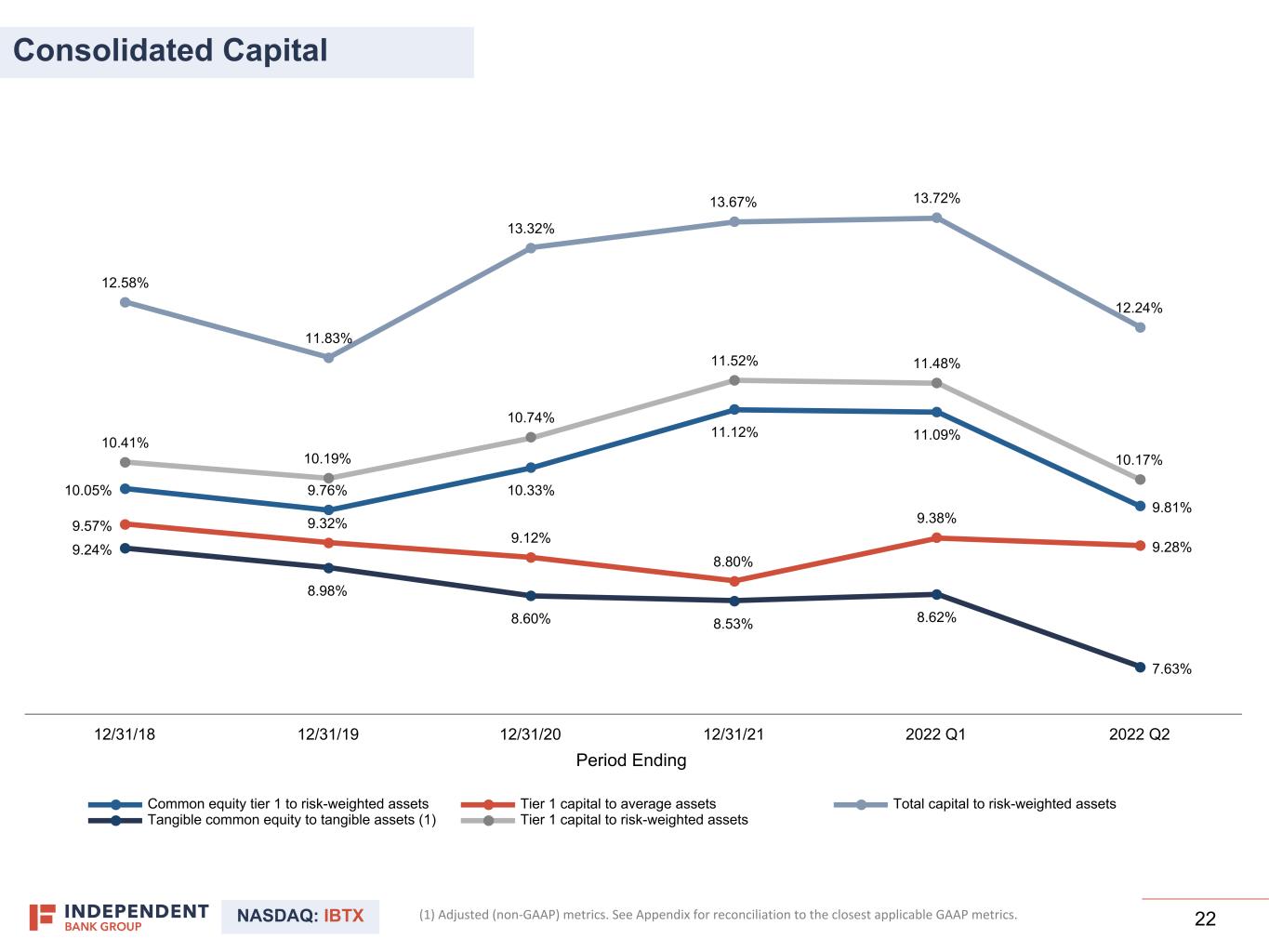

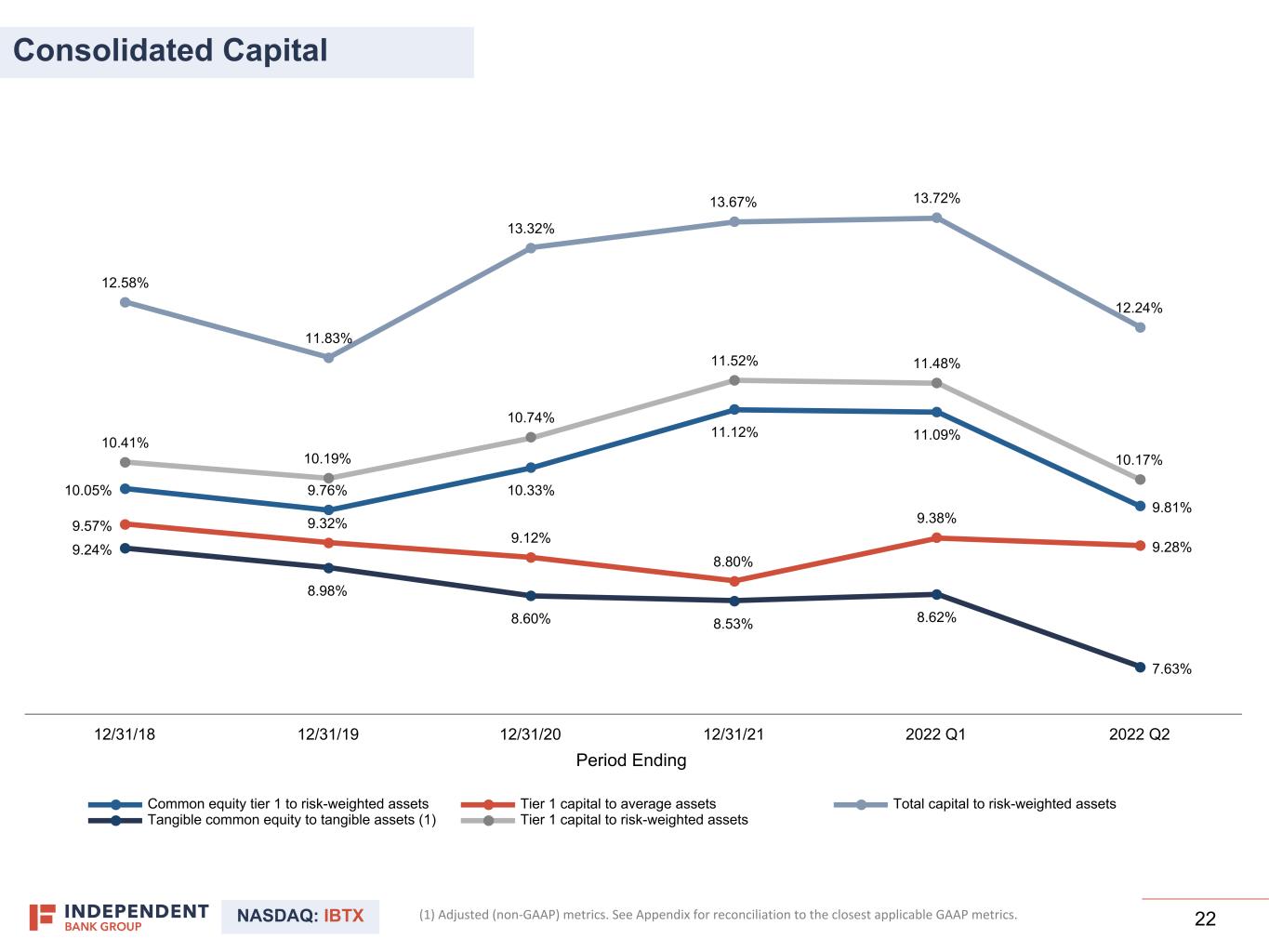

NASDAQ: IBTX 22 Consolidated Capital (1) Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. Period Ending 10.05% 9.76% 10.33% 11.12% 11.09% 9.81% 9.57% 9.32% 9.12% 8.80% 9.38% 9.28% 12.58% 11.83% 13.32% 13.67% 13.72% 12.24% 9.24% 8.98% 8.60% 8.53% 8.62% 7.63% 10.41% 10.19% 10.74% 11.52% 11.48% 10.17% Common equity tier 1 to risk-weighted assets Tier 1 capital to average assets Total capital to risk-weighted assets Tangible common equity to tangible assets (1) Tier 1 capital to risk-weighted assets 12/31/18 12/31/19 12/31/20 12/31/21 2022 Q1 2022 Q2

23 APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Adjusted Net Income, EPS, Efficiency Ratio and Profitability Ratios – Quarterly Periods As of and for the Quarter Ended ($ in thousands except per share data) June 30, 2022 March 31, 2022 June 30, 2021 Net Interest Income - Reported (a) $137,999 $131,148 $129,297 Provision Expense - Reported (b) — (1,443) (6,500) Noninterest Income - Reported (c) 13,877 12,885 15,926 Loss (gain) on sale of loans 17 1,484 (26) Loss on sale and disposal of premises and equipment 46 163 13 Recoveries on loans charged off prior to acquisition (45) (51) (204) Adjusted Noninterest Income (d) 13,895 14,481 15,709 Noninterest Expense - Reported (e) 85,925 82,457 78,013 Executive separation expense (1,106) — — Acquisition expense (1) (65) (130) (217) Adjusted Noninterest Expense (f) 84,754 82,327 77,796 Income Tax Expense - Reported (g) 13,591 12,279 15,467 Net Income - Reported (a) - (b) + (c) - (e) - (g) = (h) $52,360 $50,740 $58,243 Adjusted Net Income (2) (a) - (b) + (d) - (f) = (i) $53,304 $52,130 $58,243 Average shares for basic EPS (j) 41,737,534 42,768,079 43,188,050 Average shares for diluted EPS (k) 41,813,443 42,841,471 43,247,195 Reported Basic EPS (h) / (j) $1.25 $1.19 $1.35 Reported Diluted EPS (h) / (k) $1.25 $1.18 $1.35 Adjusted Basic EPS (i) / (j) $1.28 $1.22 $1.35 Adjusted Diluted EPS (i) / (k) $1.27 $1.22 $1.35 EFFICIENCY RATIO Amortization of other intangible assets (l) $3,118 $3,145 $3,145 Reported Efficiency Ratio (e - l) / (a + c) 54.52% 55.07% 51.55% Adjusted Efficiency Ratio (f - l) / (a + d) 53.75% 54.37% 51.48% PROFITABILITY (3) Total Average Assets (m) $17,715,989 $18,439,352 $18,283,775 Total Average Stockholders Common Equity (n) $2,435,117 $2,575,784 $2,520,003 Total Average Tangible Common Equity (4) (o) $1,370,825 $1,508,370 $1,443,130 Reported Return on Average Assets (h) / (m) 1.19% 1.12% 1.28% Reported Return on Average Common Equity (h) / (n) 8.62% 7.99% 9.27% Reported Return on Average Common Tangible Equity (h) / (o) 15.32% 13.64% 16.19% Adjusted Return on Average Assets (5) (i) / (m) 1.21% 1.15% 1.28% Adjusted Return on Average Common Equity (5) (i) / (n) 8.78% 8.21% 9.27% Adjusted Return on Tangible Common Equity (5) (i) / (o) 15.60% 14.02% 16.19% (1) Acquisition expenses includes compensation related expenses. (2) Assumes an adjusted effective tax rate of 20.6%, 19.5% and 21.0%, respectively. (3) Annualized. (4) Excludes average balance of goodwill and net other intangible assets. (5) Calculated using adjusted net income.

24 APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Adjusted Net Income, EPS, Efficiency Ratio and Profitability Ratios – Annual Periods For the Year Ended December 31, ($ in thousands except per share data) 2021 2020 2019 Net Interest Income - Reported (a) $520,322 $516,446 $504,757 Unexpected income recognized on credit impaired acquired loans (1) — (3,209) (5,120) Adjusted Net Interest Income (b) 520,322 513,237 499,637 Provision Expense - Reported (c) (9,000) 42,993 14,805 Noninterest Income - Reported (d) 66,517 85,063 78,176 Gain on sale of loans (56) (356) (6,779) Gain on sale of branch — — (1,549) Gain on sale of trust business — — (1,319) (Gain) loss on sale of other real estate (63) 36 (875) Gain on sale of securities available for sale (13) (382) (275) Loss (gain) on sale and disposal of premises and equipment 304 (370) 585 Recoveries on loans charged off prior to acquisition (381) (4,312) (2,101) Adjusted Noninterest Income (e) 66,308 79,679 65,863 Noninterest Expense - Reported (f) 313,606 306,134 321,864 Executive separation expense — — (3,421) OREO impairment — (784) (1,801) Impairment of assets (124) (462) (1,173) COVID-19 expense (2) (614) (1,915) — Acquisition expense (3) (900) (17,294) (42,744) Adjusted Noninterest Expense (g) 311,968 285,679 272,725 Income Tax Expense - Reported (h) 57,483 51,173 53,528 Net Income - Reported (a) - (c) + (d) - (f) - (h) = (i) $224,750 $201,209 $192,736 Adjusted Net Income (4) (b) - (c) + (e) - (g) = (j) $225,893 $210,017 $219,582 Average shares for basic EPS (k) 43,070,452 43,116,965 43,245,418 Average shares for diluted EPS (l) 43,129,237 43,116,965 43,245,418 Reported Basic EPS (i) / (k) $5.22 $4.67 $4.46 Reported Diluted EPS (i) / (l) $5.21 $4.67 $4.46 Adjusted Basic EPS (j) / (k) $5.24 $4.87 $5.08 Adjusted Diluted EPS (j) / (l) $5.24 $4.87 $5.08 EFFICIENCY RATIO Amortization of other intangible assets (m) $12,580 $12,671 $12,880 Reported Efficiency Ratio (f - m) / (a + d) 51.30% 48.79% 53.01% Adjusted Efficiency Ratio (g - m) / (b + e) 51.04% 46.04% 45.95% PROFITABILITY Total Average Assets (n) $18,558,168 $16,357,736 $14,555,315 Total Average Stockholders Common Equity (o) $2,536,658 $2,435,474 $2,267,103 Total Average Tangible Common Equity (5) (p) $1,461,400 $1,347,584 $1,164,915 Reported Return on Average Assets (i) / (n) 1.21% 1.23% 1.32% Reported Return on Average Common Equity (i) / (o) 8.86% 8.26% 8.50% Reported Return on Average Common Tangible Equity (i) / (p) 15.38% 14.93% 16.55% Adjusted Return on Average Assets (6) (j) / (n) 1.22% 1.28% 1.51% Adjusted Return on Average Common Equity (6) (j) / (o) 8.91% 8.62% 9.69% Adjusted Return on Tangible Common Equity (6) (j) / (p) 15.46% 15.58% 18.85% (1) This is not applicable starting in 2021 under the adoption of CECL. (2) COVID-19 expense includes expenses for COVID testing kits, vaccination incentive bonuses, and personal protection and cleaning supplies. (3) Acquisition expenses includes compensation related expenses. (4) Assumes an adjusted effective tax rate of 20.4%, 20.5% and 21.0%, respectively. (5) Excludes average balance of goodwill and net other intangible assets and preferred stock. (6) Calculated using adjusted net income.

25 APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Tangible Common Equity to Tangible Assets and Tangible Book Value Per Common Share – Quarterly Periods ($ in thousands, except per share information) June 30, 2022 March 31, 2022 December 31, 2021 September 30, 2021 June 30, 2021 Tangible Common Equity Total common stockholders equity $2,364,335 $2,522,460 $2,576,650 $2,566,693 $2,542,885 Adjustments: Goodwill (994,021) (994,021) (994,021) (994,021) (994,021) Other intangible assets, net (69,227) (72,345) (75,490) (78,635) (81,780) Tangible Common Equity $1,301,087 $1,456,094 $1,507,139 $1,494,037 $1,467,084 Tangible Assets Total Assets $18,107,093 $17,963,253 $18,732,648 $18,918,225 $18,447,721 Adjustments: Goodwill (994,021) (994,021) (994,021) (994,021) (994,021) Other intangible assets, net (69,227) (72,345) (75,490) (78,635) (81,780) Tangible Assets $17,043,845 $16,896,887 $17,663,137 $17,845,569 $17,371,920 Common shares outstanding 41,156,261 42,795,228 42,756,234 42,941,715 43,180,607 Tangible Common Equity To Tangible Assets 7.63% 8.62% 8.53% 8.37% 8.45% Book value per common share $57.45 $58.94 $60.26 $59.77 $58.89 Tangible book value per common share $31.61 $34.02 $35.25 $34.79 $33.98

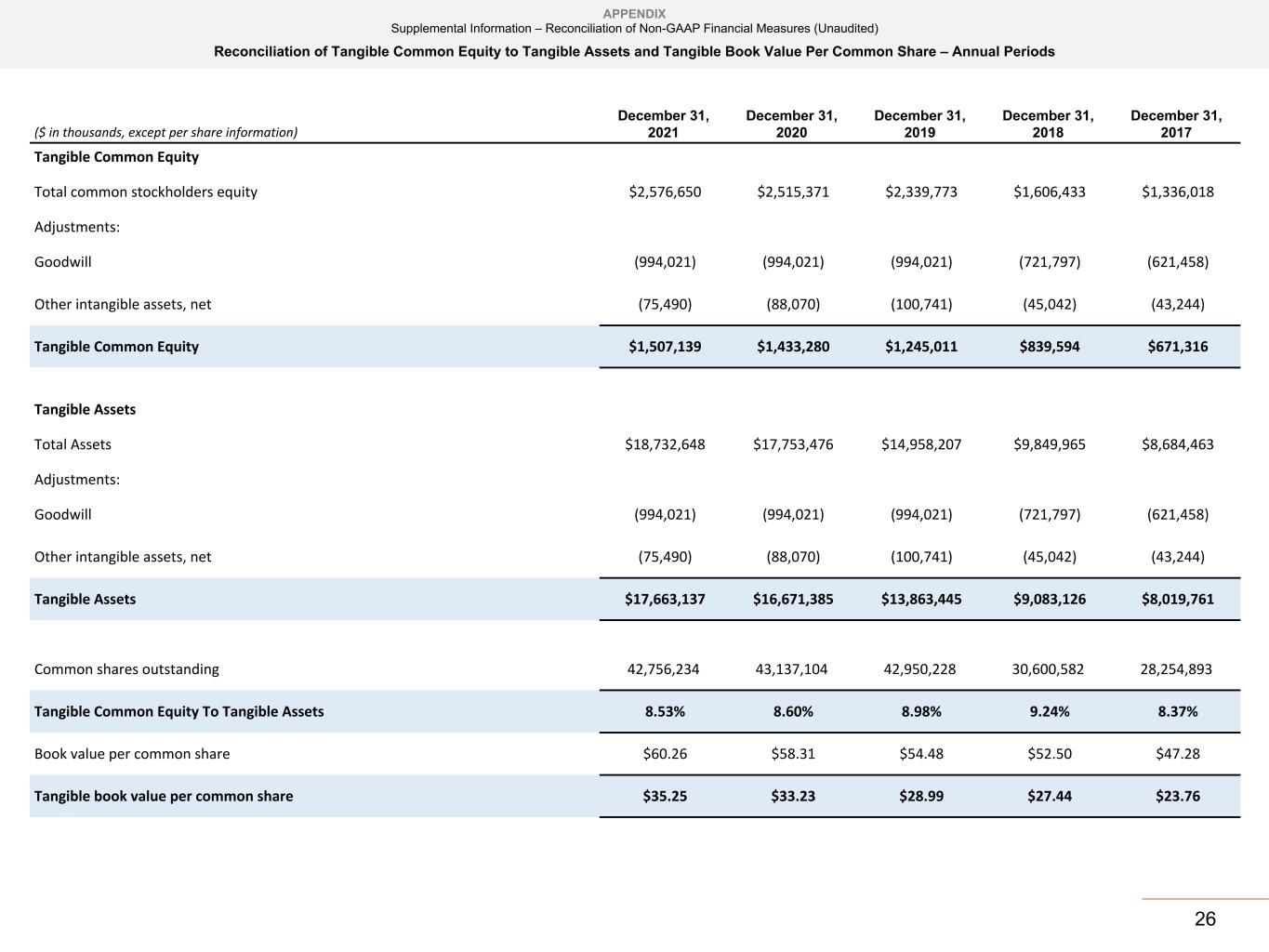

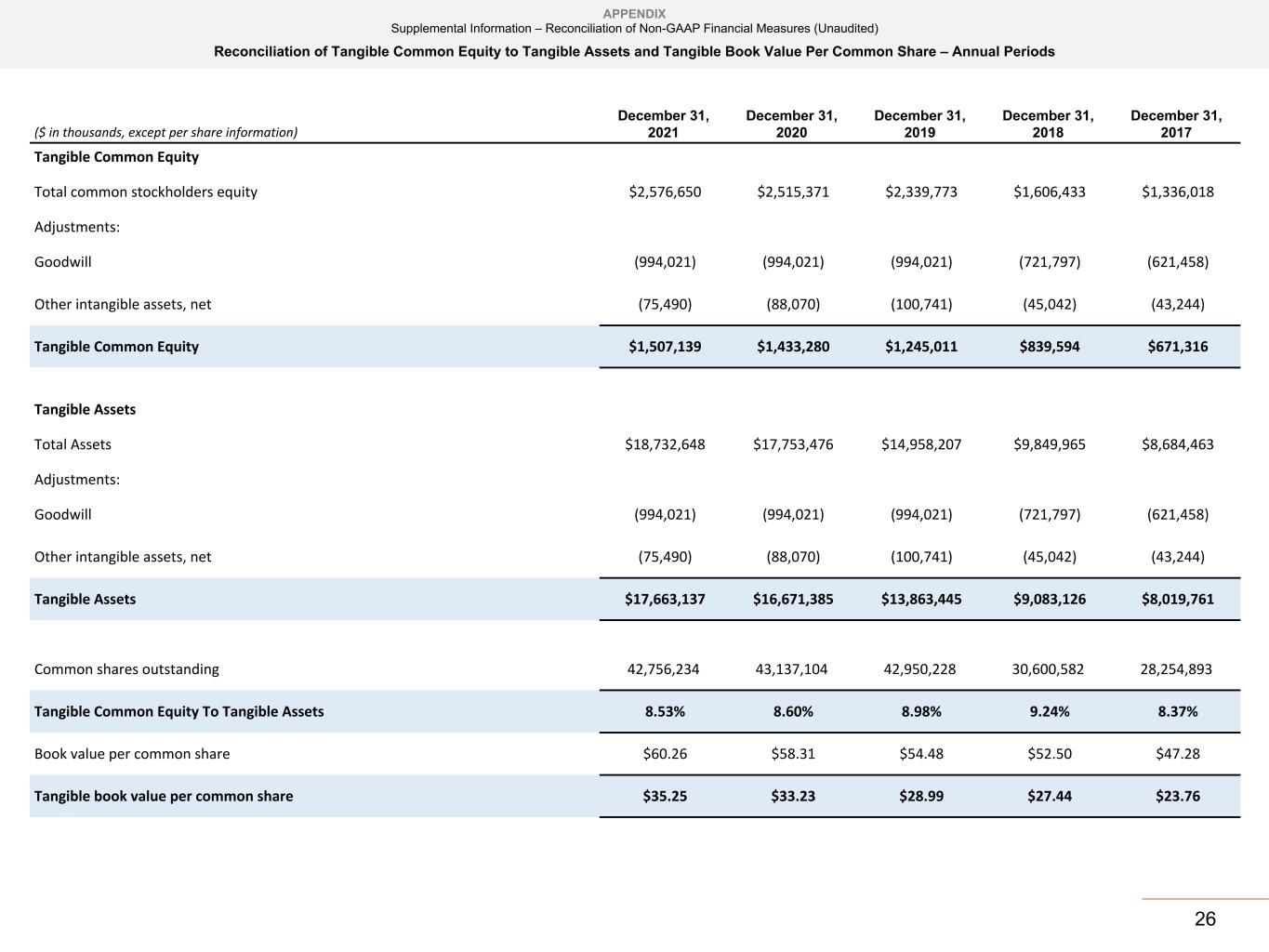

26 APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Tangible Common Equity to Tangible Assets and Tangible Book Value Per Common Share – Annual Periods ($ in thousands, except per share information) December 31, 2021 December 31, 2020 December 31, 2019 December 31, 2018 December 31, 2017 Tangible Common Equity Total common stockholders equity $2,576,650 $2,515,371 $2,339,773 $1,606,433 $1,336,018 Adjustments: Goodwill (994,021) (994,021) (994,021) (721,797) (621,458) Other intangible assets, net (75,490) (88,070) (100,741) (45,042) (43,244) Tangible Common Equity $1,507,139 $1,433,280 $1,245,011 $839,594 $671,316 Tangible Assets Total Assets $18,732,648 $17,753,476 $14,958,207 $9,849,965 $8,684,463 Adjustments: Goodwill (994,021) (994,021) (994,021) (721,797) (621,458) Other intangible assets, net (75,490) (88,070) (100,741) (45,042) (43,244) Tangible Assets $17,663,137 $16,671,385 $13,863,445 $9,083,126 $8,019,761 Common shares outstanding 42,756,234 43,137,104 42,950,228 30,600,582 28,254,893 Tangible Common Equity To Tangible Assets 8.53% 8.60% 8.98% 9.24% 8.37% Book value per common share $60.26 $58.31 $54.48 $52.50 $47.28 Tangible book value per common share $35.25 $33.23 $28.99 $27.44 $23.76