Earnings Presentation January 22, 2024 NASDAQ: IBTX Exhibit 99.2

NASDAQ: IBTX 2 Safe Harbor Statement The numbers as of and for the quarter ended December 31, 2023 are unaudited. This communication contains “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 regarding the financial condition, results of operations, business plans and the future performance of Independent Bank Group, Inc. (“IBTX”). Words such as "aim," “anticipates,” “believes,” “estimates,” “expects,” “forecasts,” "guidance," “intends,” “plans,” “projects,” “could,” “may,” “should,” “will” or other similar words and expressions are intended to identify these forward- looking statements. These forward-looking statements are based on IBTX’s current expectations and assumptions regarding IBTX’s business, the economy, and other future conditions. Because forward- looking statements relate to future results and occurrences, they are subject to inherent uncertainties, assumptions, risks, and changes in circumstances that are difficult to predict. Many possible events or factors could materialize or IBTX’s underlying assumptions could prove incorrect and affect IBTX’s future financial results and performance and could cause actual results or performance to differ materially from anticipated results or performance. Such risks and uncertainties include, among others, effects of and changes in trade and monetary and fiscal policies and laws, including the interest rate policies of the Federal Reserve Board, potential regulatory actions, changes in consumer behaviors and impacts on and modifications to the operations and business of IBTX relating thereto, and the impact of business, economic and political conditions in the markets in which IBTX operates. Except to the extent required by applicable law or regulation, IBTX disclaims any obligation to update such factors or to publicly announce the results of any revisions to any of the forward-looking statements included herein to reflect future events or developments. Further information regarding IBTX and additional factors which could affect the forward-looking statements contained herein can be found in IBTX’s Annual Report on Form 10-K for the fiscal year ended December 31, 2022, Quarterly Reports on Form 10-Q for the periods ended March 31, 2023, June 30, 2023, September 30, 2023 and its other filings with the Securities and Exchange Commission.

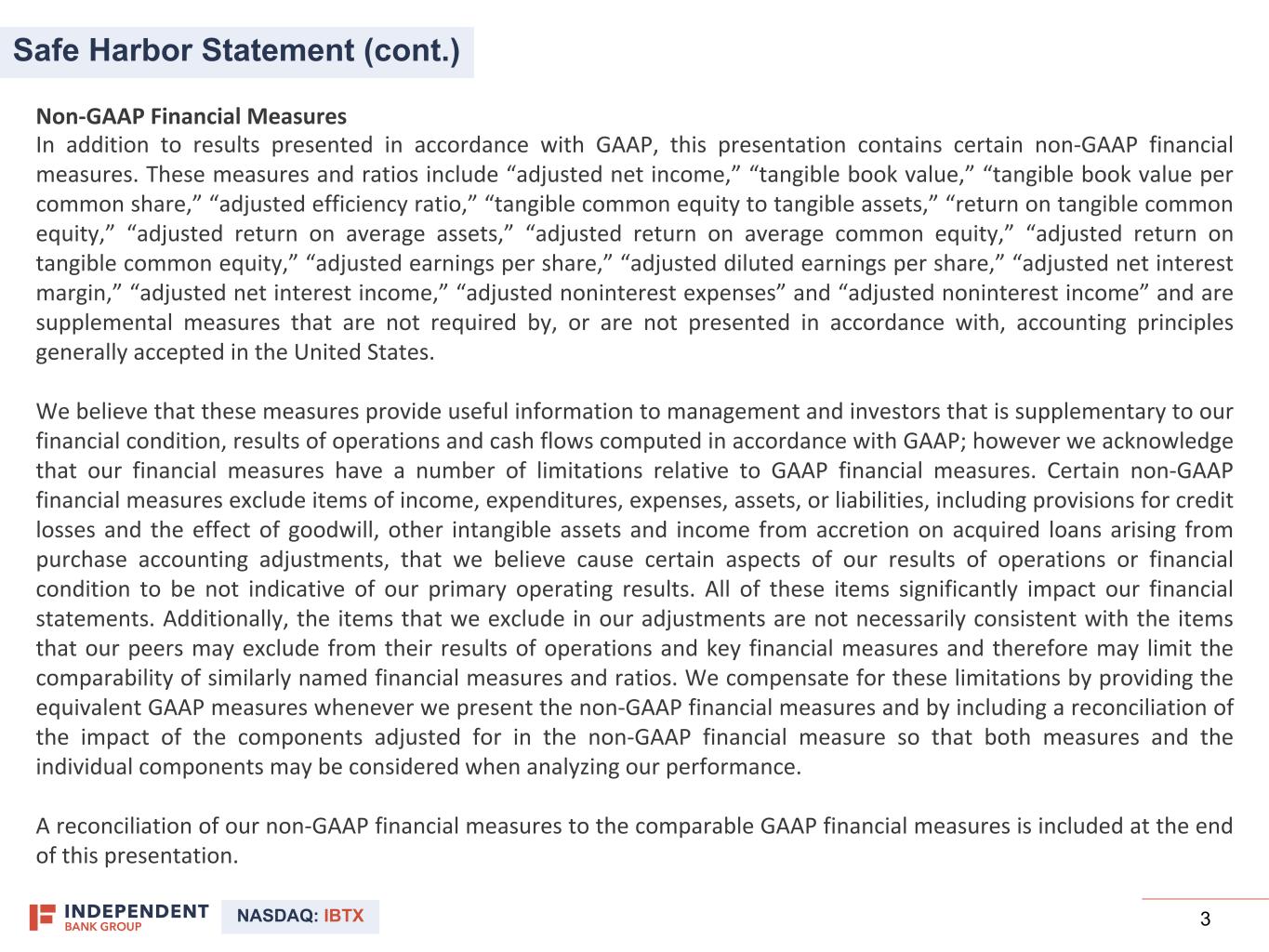

NASDAQ: IBTX 3 Safe Harbor Statement (cont.) Non-GAAP Financial Measures In addition to results presented in accordance with GAAP, this presentation contains certain non-GAAP financial measures. These measures and ratios include “adjusted net income,” “tangible book value,” “tangible book value per common share,” “adjusted efficiency ratio,” “tangible common equity to tangible assets,” “return on tangible common equity,” “adjusted return on average assets,” “adjusted return on average common equity,” “adjusted return on tangible common equity,” “adjusted earnings per share,” “adjusted diluted earnings per share,” “adjusted net interest margin,” “adjusted net interest income,” “adjusted noninterest expenses” and “adjusted noninterest income” and are supplemental measures that are not required by, or are not presented in accordance with, accounting principles generally accepted in the United States. We believe that these measures provide useful information to management and investors that is supplementary to our financial condition, results of operations and cash flows computed in accordance with GAAP; however we acknowledge that our financial measures have a number of limitations relative to GAAP financial measures. Certain non-GAAP financial measures exclude items of income, expenditures, expenses, assets, or liabilities, including provisions for credit losses and the effect of goodwill, other intangible assets and income from accretion on acquired loans arising from purchase accounting adjustments, that we believe cause certain aspects of our results of operations or financial condition to be not indicative of our primary operating results. All of these items significantly impact our financial statements. Additionally, the items that we exclude in our adjustments are not necessarily consistent with the items that our peers may exclude from their results of operations and key financial measures and therefore may limit the comparability of similarly named financial measures and ratios. We compensate for these limitations by providing the equivalent GAAP measures whenever we present the non-GAAP financial measures and by including a reconciliation of the impact of the components adjusted for in the non-GAAP financial measure so that both measures and the individual components may be considered when analyzing our performance. A reconciliation of our non-GAAP financial measures to the comparable GAAP financial measures is included at the end of this presentation.

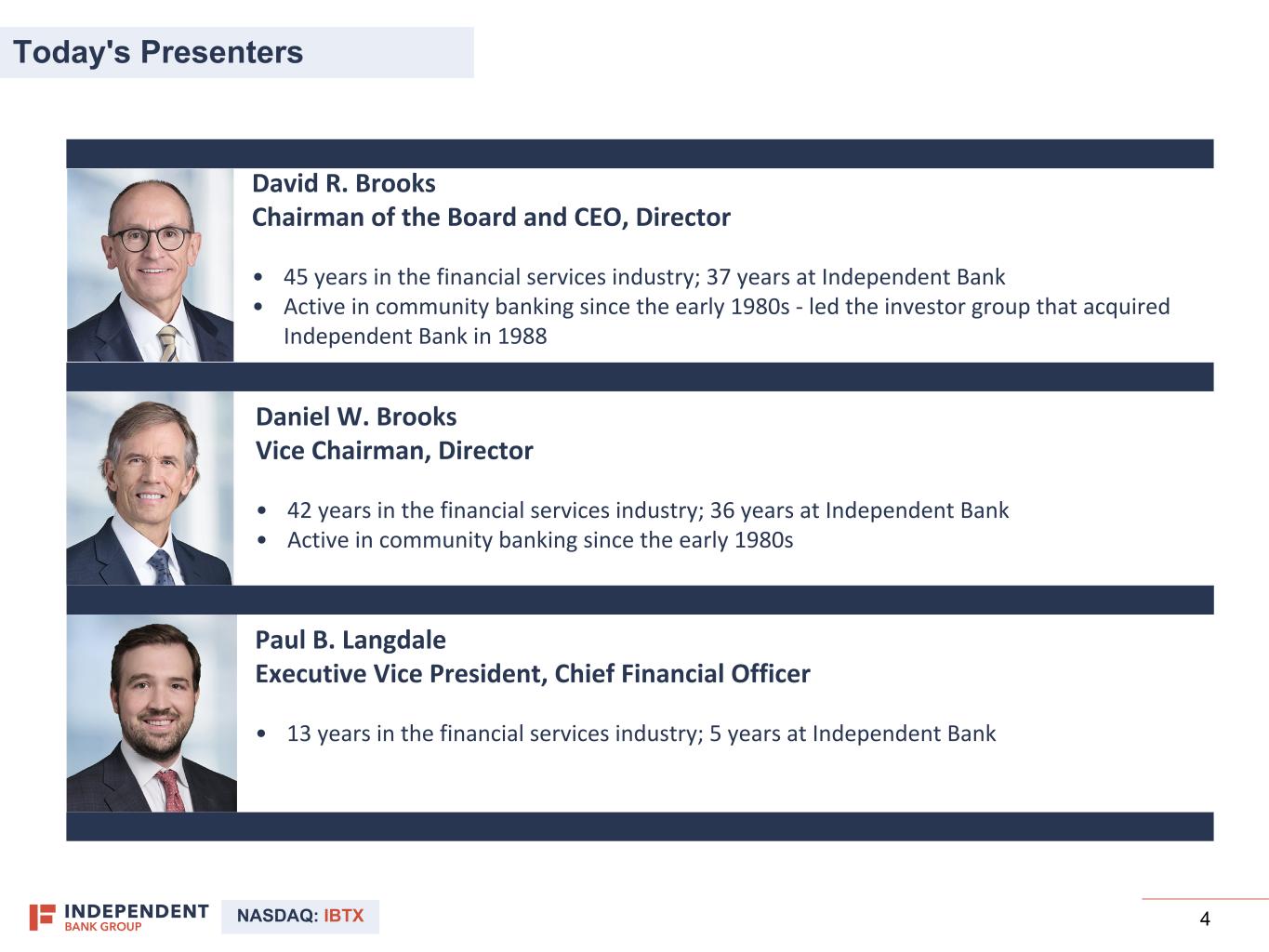

NASDAQ: IBTX 4 David R. Brooks Chairman of the Board and CEO, Director • 45 years in the financial services industry; 37 years at Independent Bank • Active in community banking since the early 1980s - led the investor group that acquired Independent Bank in 1988 Paul B. Langdale Executive Vice President, Chief Financial Officer • 13 years in the financial services industry; 5 years at Independent Bank Daniel W. Brooks Vice Chairman, Director • 42 years in the financial services industry; 36 years at Independent Bank • Active in community banking since the early 1980s Today's Presenters

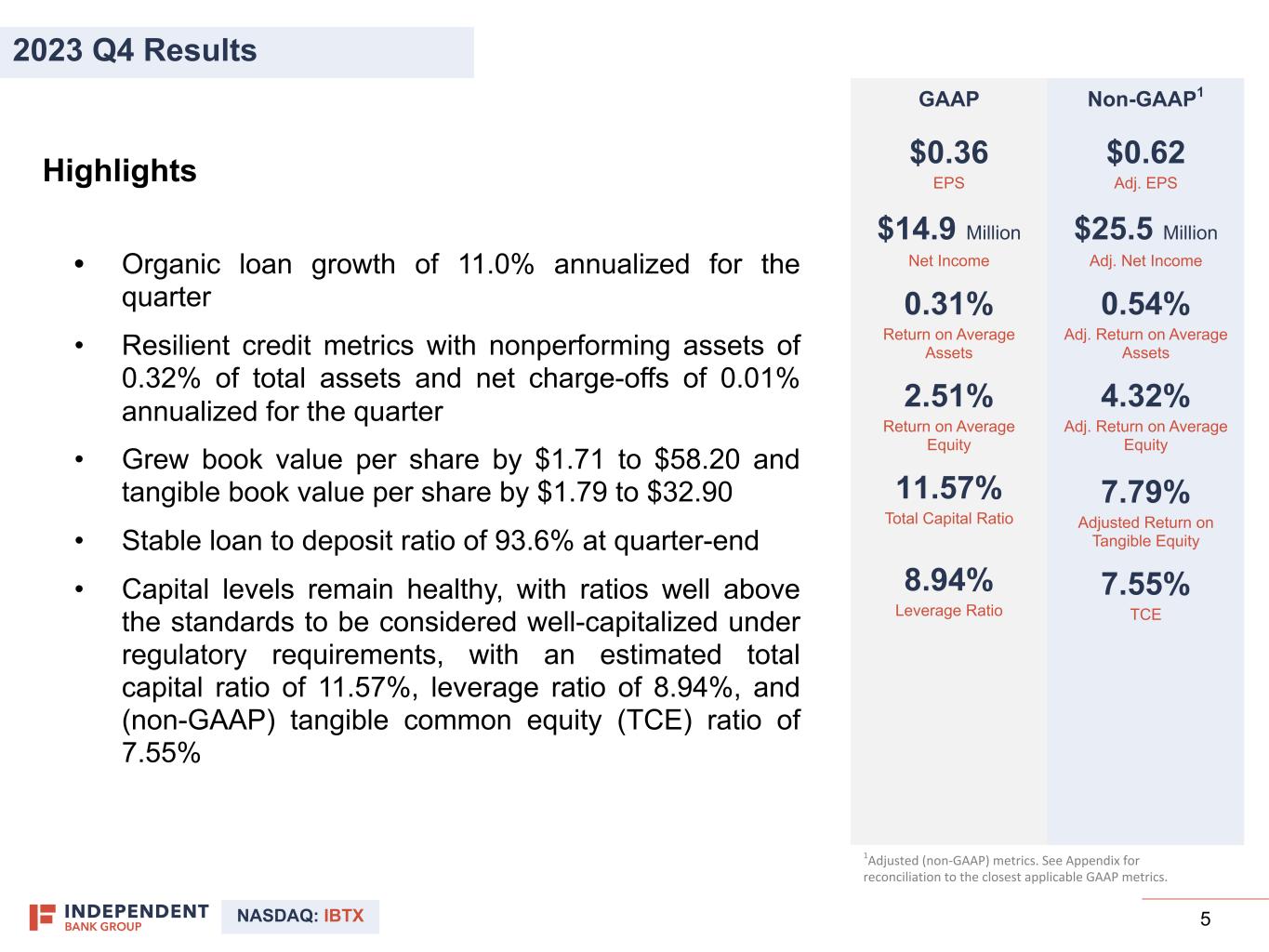

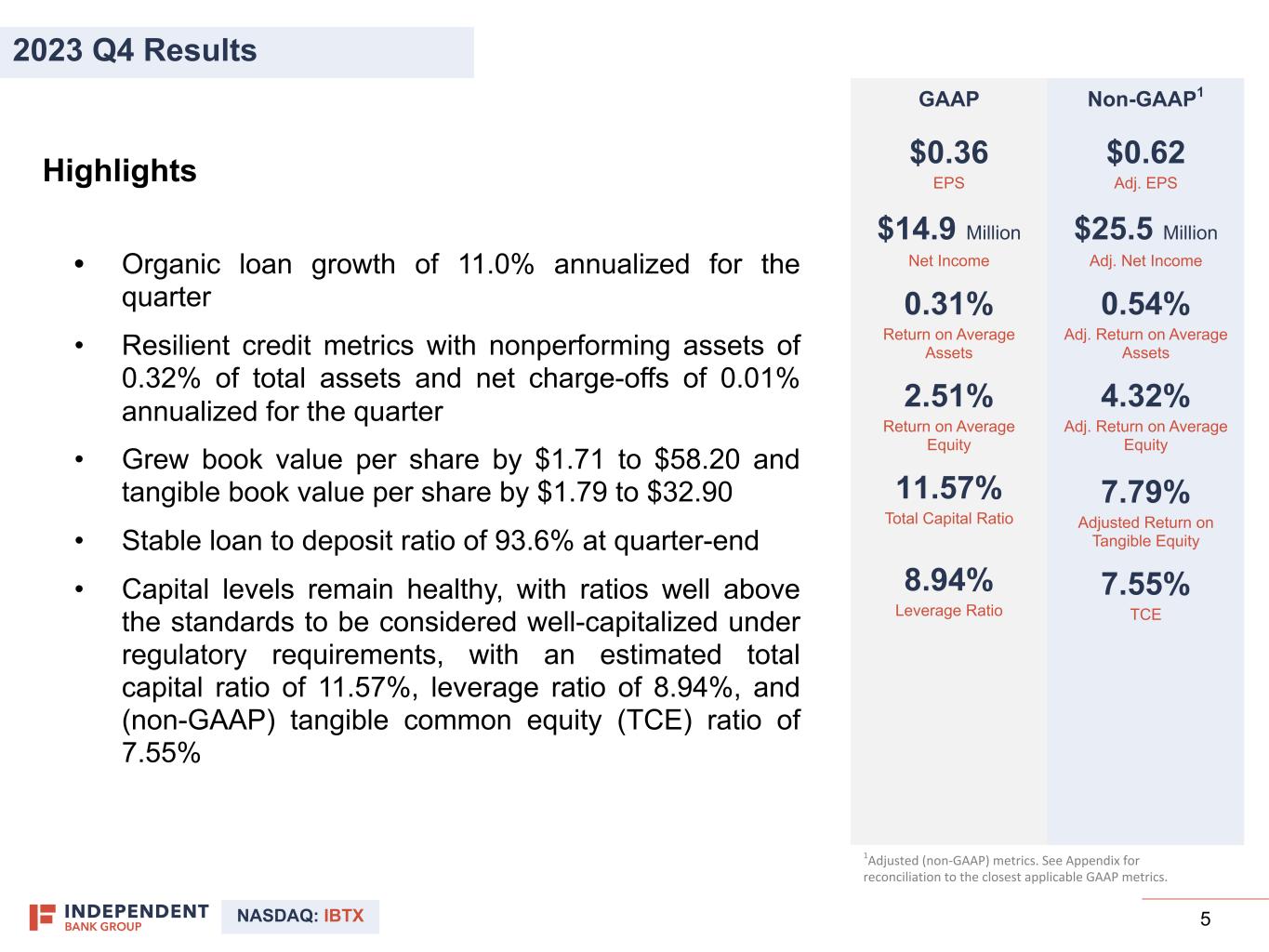

NASDAQ: IBTX 5 2023 Q4 Results GAAP $0.36 EPS $14.9 Million Net Income 0.31% Return on Average Assets 2.51% Return on Average Equity 11.57% Total Capital Ratio 8.94% Leverage Ratio Non-GAAP1 $0.62 Adj. EPS $25.5 Million Adj. Net Income 0.54% Adj. Return on Average Assets 4.32% Adj. Return on Average Equity 7.79% Adjusted Return on Tangible Equity 7.55% TCE Highlights • Organic loan growth of 11.0% annualized for the quarter • Resilient credit metrics with nonperforming assets of 0.32% of total assets and net charge-offs of 0.01% annualized for the quarter • Grew book value per share by $1.71 to $58.20 and tangible book value per share by $1.79 to $32.90 • Stable loan to deposit ratio of 93.6% at quarter-end • Capital levels remain healthy, with ratios well above the standards to be considered well-capitalized under regulatory requirements, with an estimated total capital ratio of 11.57%, leverage ratio of 8.94%, and (non-GAAP) tangible common equity (TCE) ratio of 7.55% 1Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics.

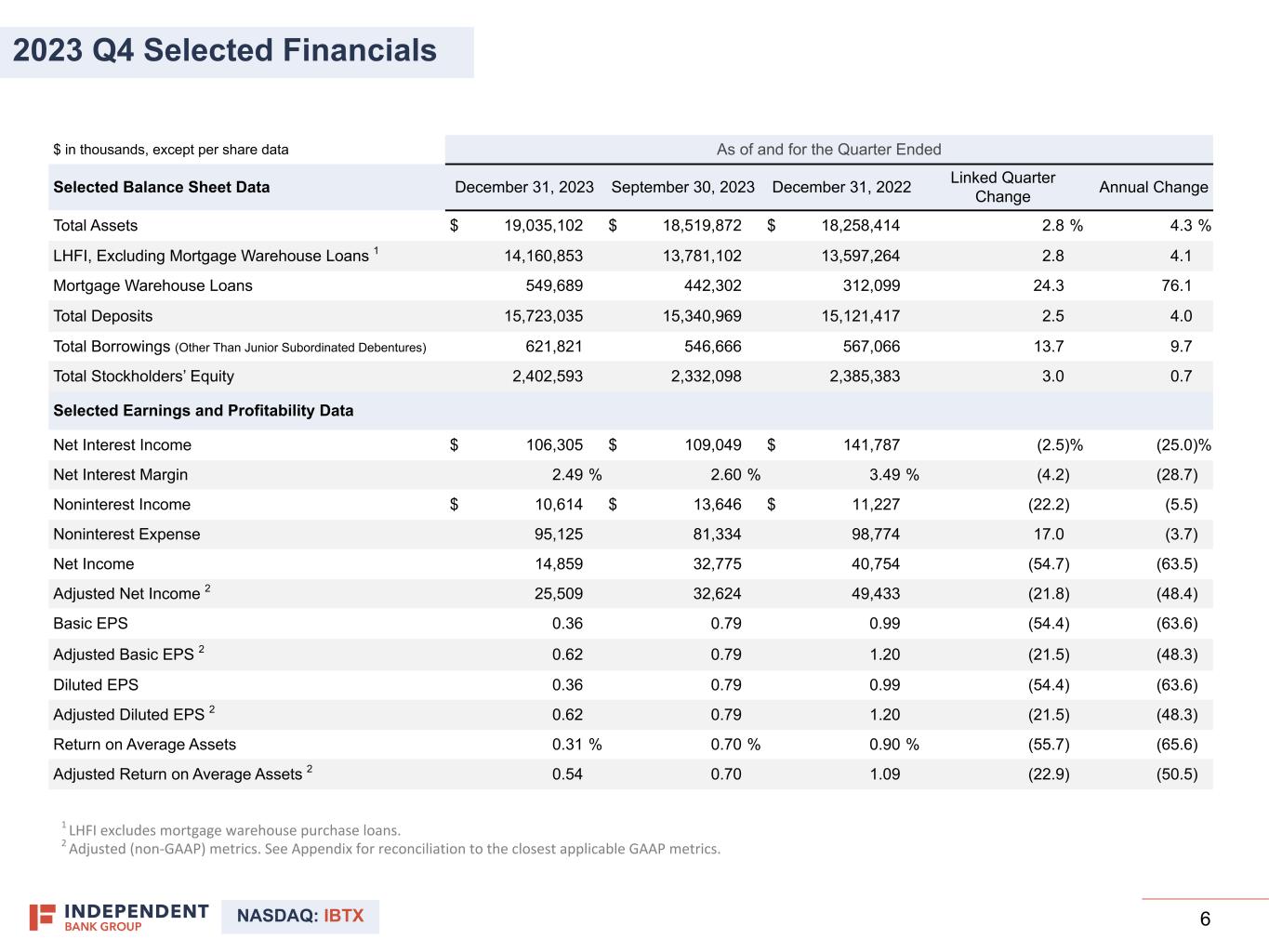

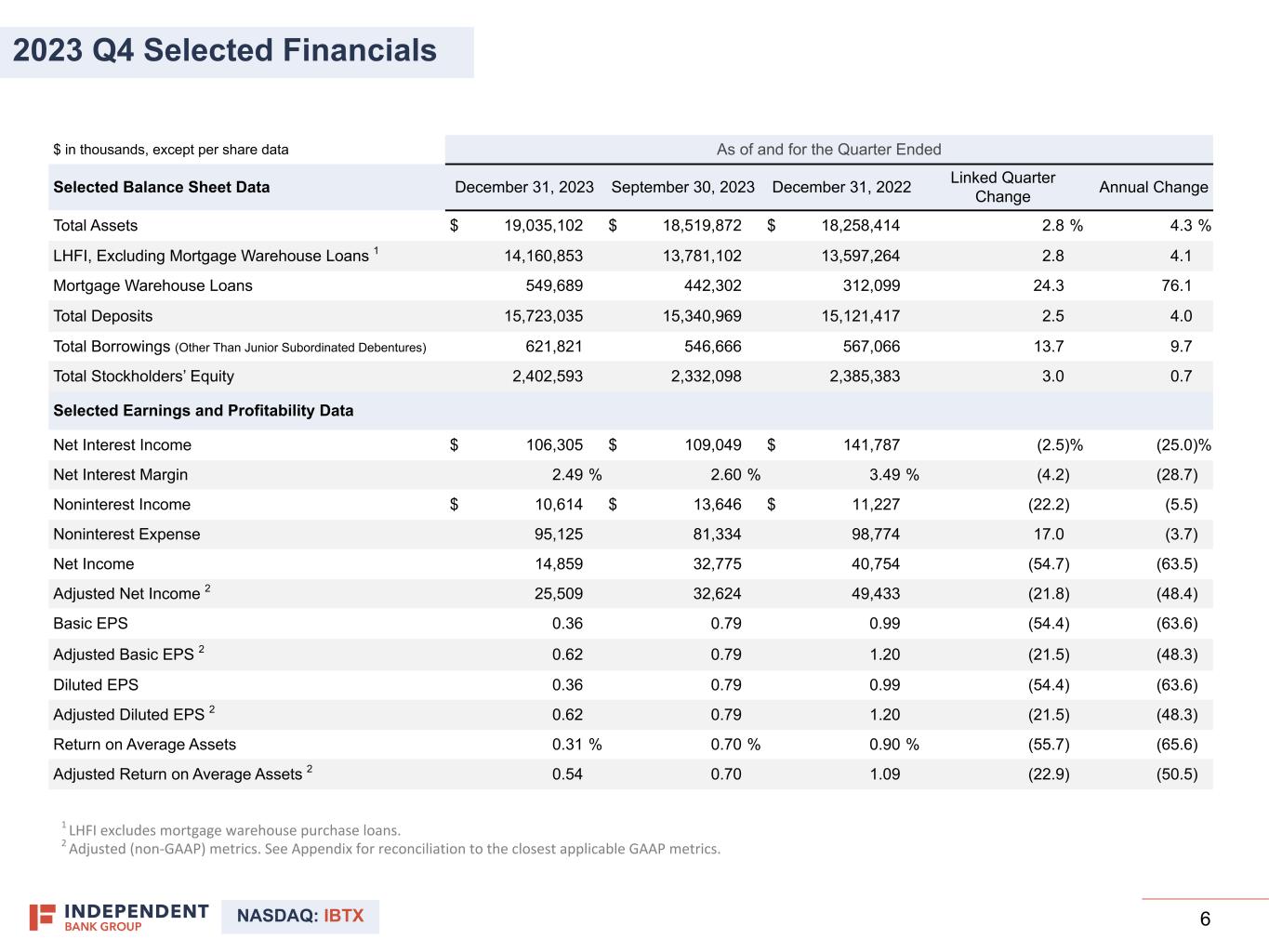

NASDAQ: IBTX 6 2023 Q4 Selected Financials $ in thousands, except per share data As of and for the Quarter Ended Selected Balance Sheet Data December 31, 2023 September 30, 2023 December 31, 2022 Linked Quarter Change Annual Change Total Assets $ 19,035,102 $ 18,519,872 $ 18,258,414 2.8 % 4.3 % LHFI, Excluding Mortgage Warehouse Loans 1 14,160,853 13,781,102 13,597,264 2.8 4.1 Mortgage Warehouse Loans 549,689 442,302 312,099 24.3 76.1 Total Deposits 15,723,035 15,340,969 15,121,417 2.5 4.0 Total Borrowings (Other Than Junior Subordinated Debentures) 621,821 546,666 567,066 13.7 9.7 Total Stockholders’ Equity 2,402,593 2,332,098 2,385,383 3.0 0.7 Selected Earnings and Profitability Data Net Interest Income $ 106,305 $ 109,049 $ 141,787 (2.5) % (25.0) % Net Interest Margin 2.49 % 2.60 % 3.49 % (4.2) (28.7) Noninterest Income $ 10,614 $ 13,646 $ 11,227 (22.2) (5.5) Noninterest Expense 95,125 81,334 98,774 17.0 (3.7) Net Income 14,859 32,775 40,754 (54.7) (63.5) Adjusted Net Income 2 25,509 32,624 49,433 (21.8) (48.4) Basic EPS 0.36 0.79 0.99 (54.4) (63.6) Adjusted Basic EPS 2 0.62 0.79 1.20 (21.5) (48.3) Diluted EPS 0.36 0.79 0.99 (54.4) (63.6) Adjusted Diluted EPS 2 0.62 0.79 1.20 (21.5) (48.3) Return on Average Assets 0.31 % 0.70 % 0.90 % (55.7) (65.6) Adjusted Return on Average Assets 2 0.54 0.70 1.09 (22.9) (50.5) 1 LHFI excludes mortgage warehouse purchase loans. 2 Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics.

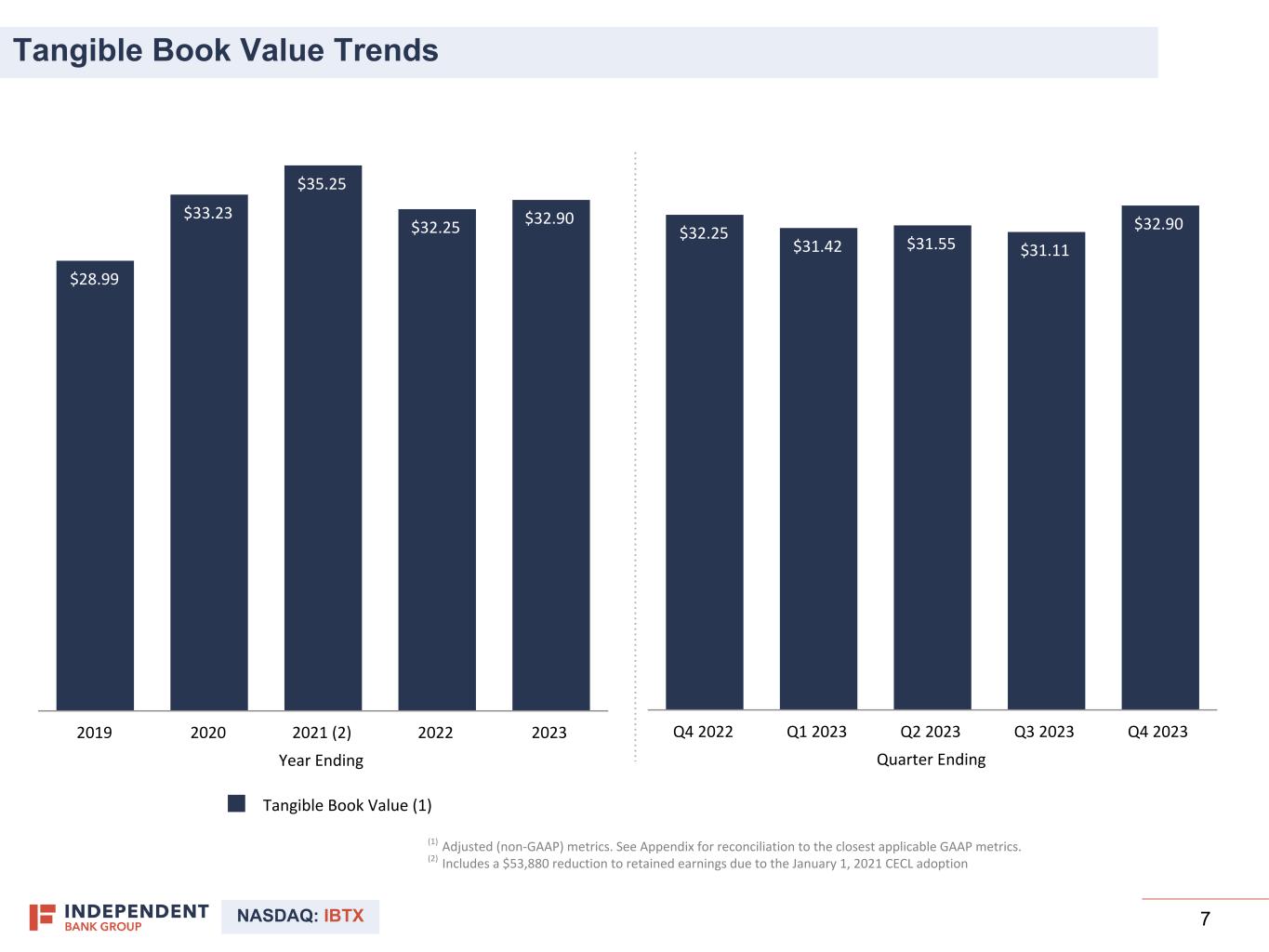

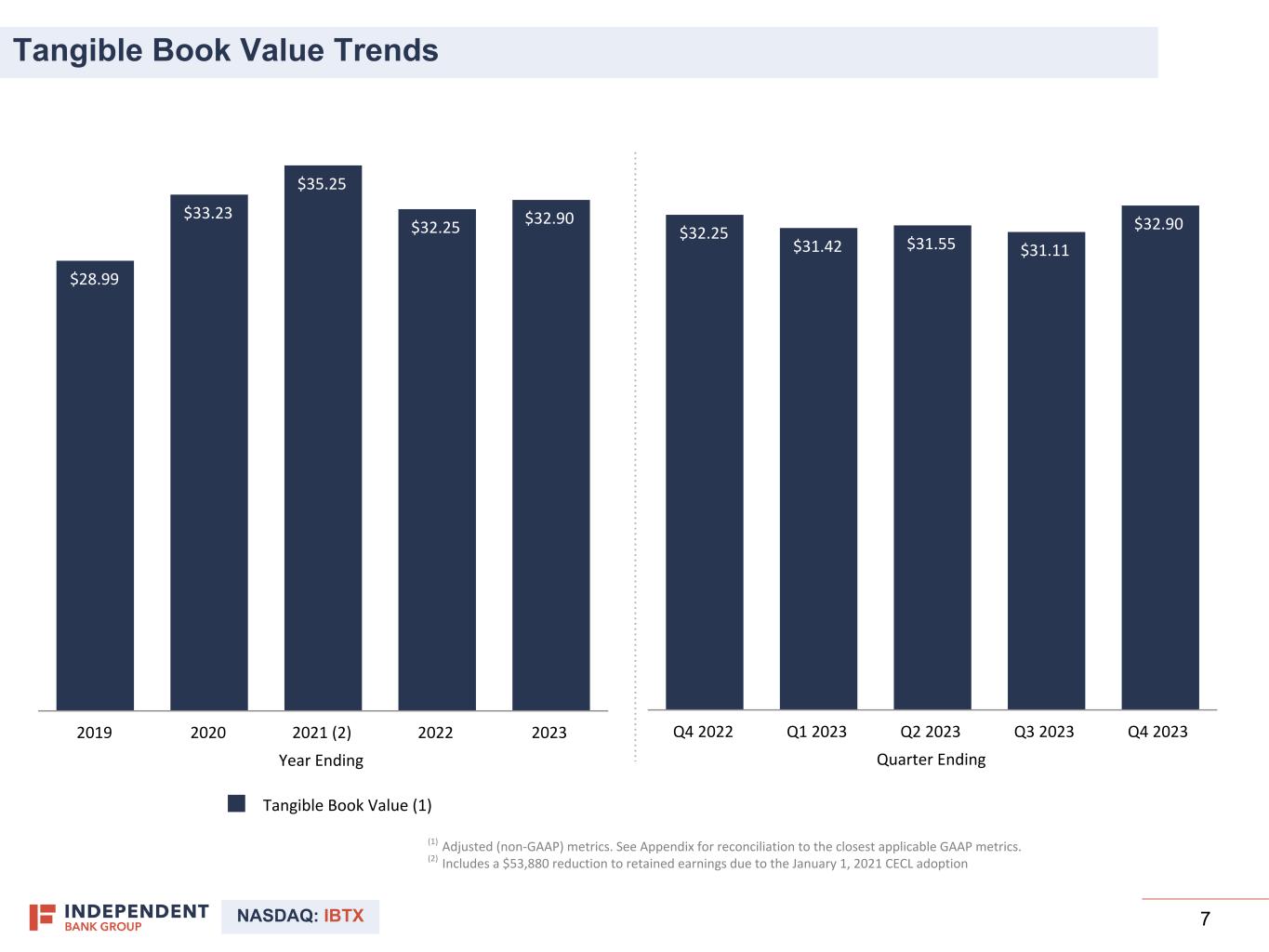

NASDAQ: IBTX 7 (1) Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. (2) Includes a $53,880 reduction to retained earnings due to the January 1, 2021 CECL adoption 7 Year Ending $28.99 $33.23 $35.25 $32.25 $32.90 Tangible Book Value (1) 2019 2020 2021 (2) 2022 2023 Quarter Ending $32.25 $31.42 $31.55 $31.11 $32.90 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023 Tangible Book Value Trends

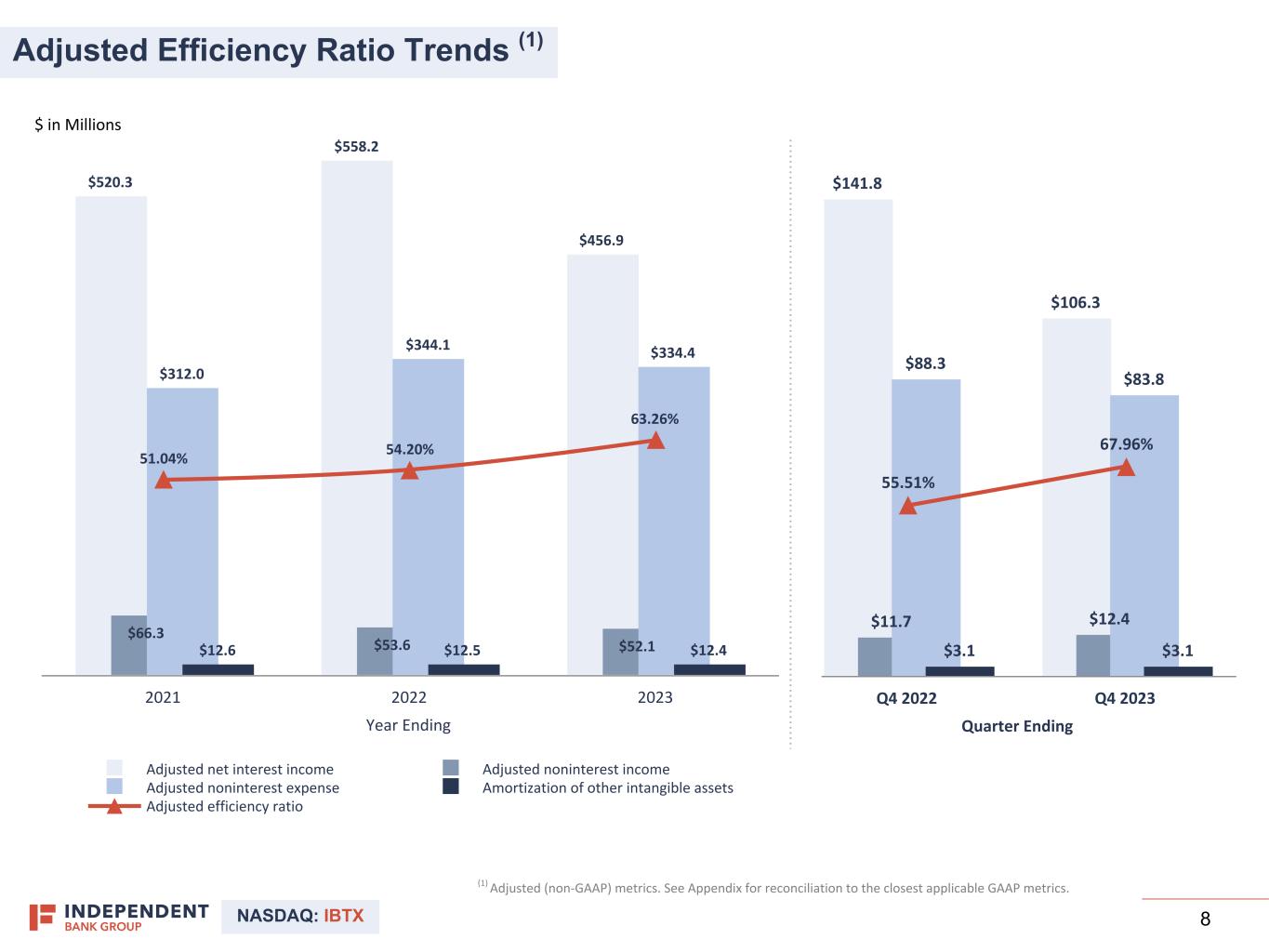

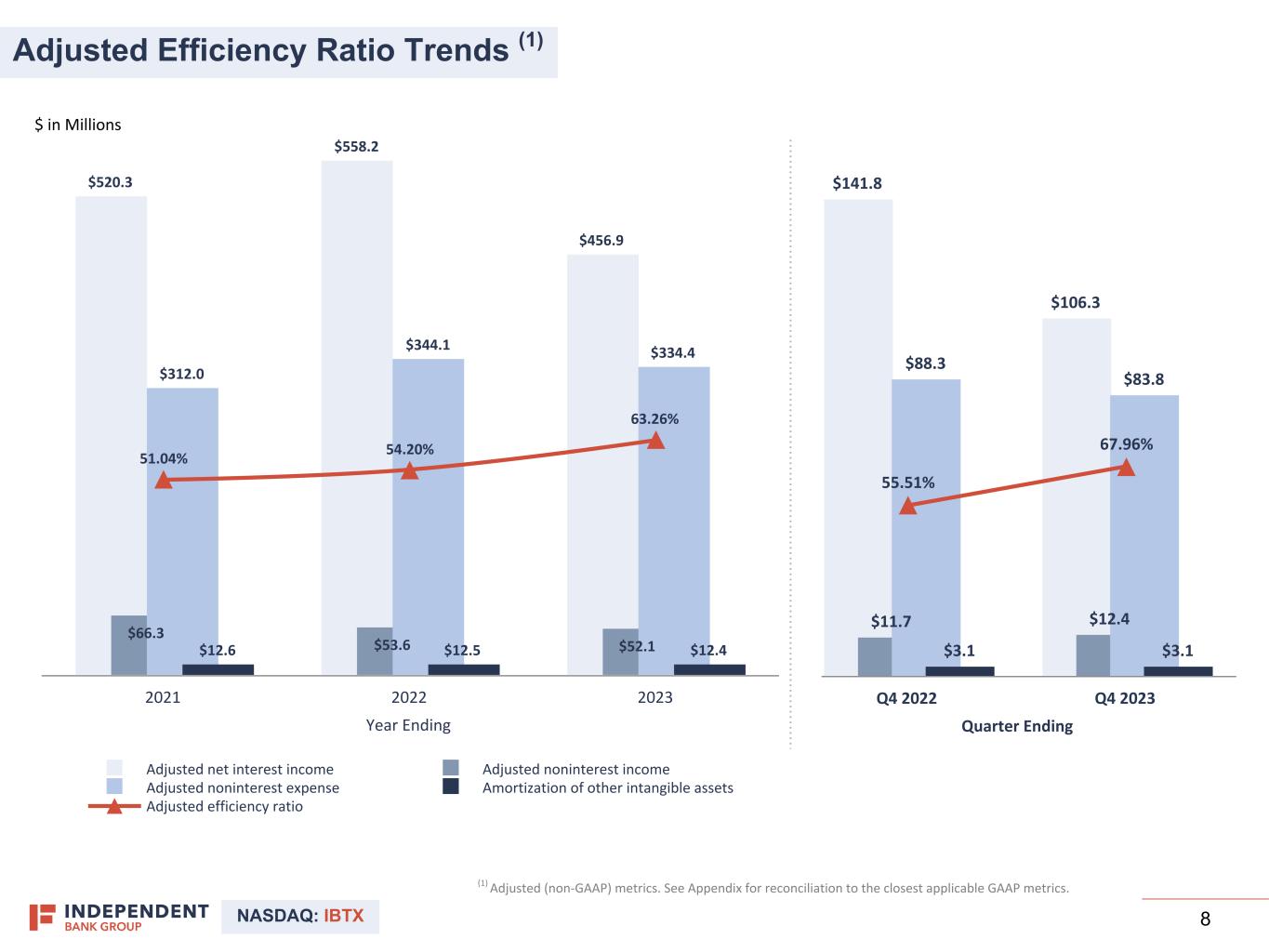

NASDAQ: IBTX 8 Quarter Ending $141.8 $106.3 $11.7 $12.4 $88.3 $83.8 $3.1 $3.1 55.51% 67.96% Q4 2022 Q4 2023 Year Ending $520.3 $558.2 $456.9 $66.3 $53.6 $52.1 $312.0 $344.1 $334.4 $12.6 $12.5 $12.4 51.04% 54.20% 63.26% Adjusted net interest income Adjusted noninterest income Adjusted noninterest expense Amortization of other intangible assets Adjusted efficiency ratio 2021 2022 2023 (1) Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. 8 $ in Millions Adjusted Efficiency Ratio Trends (1)

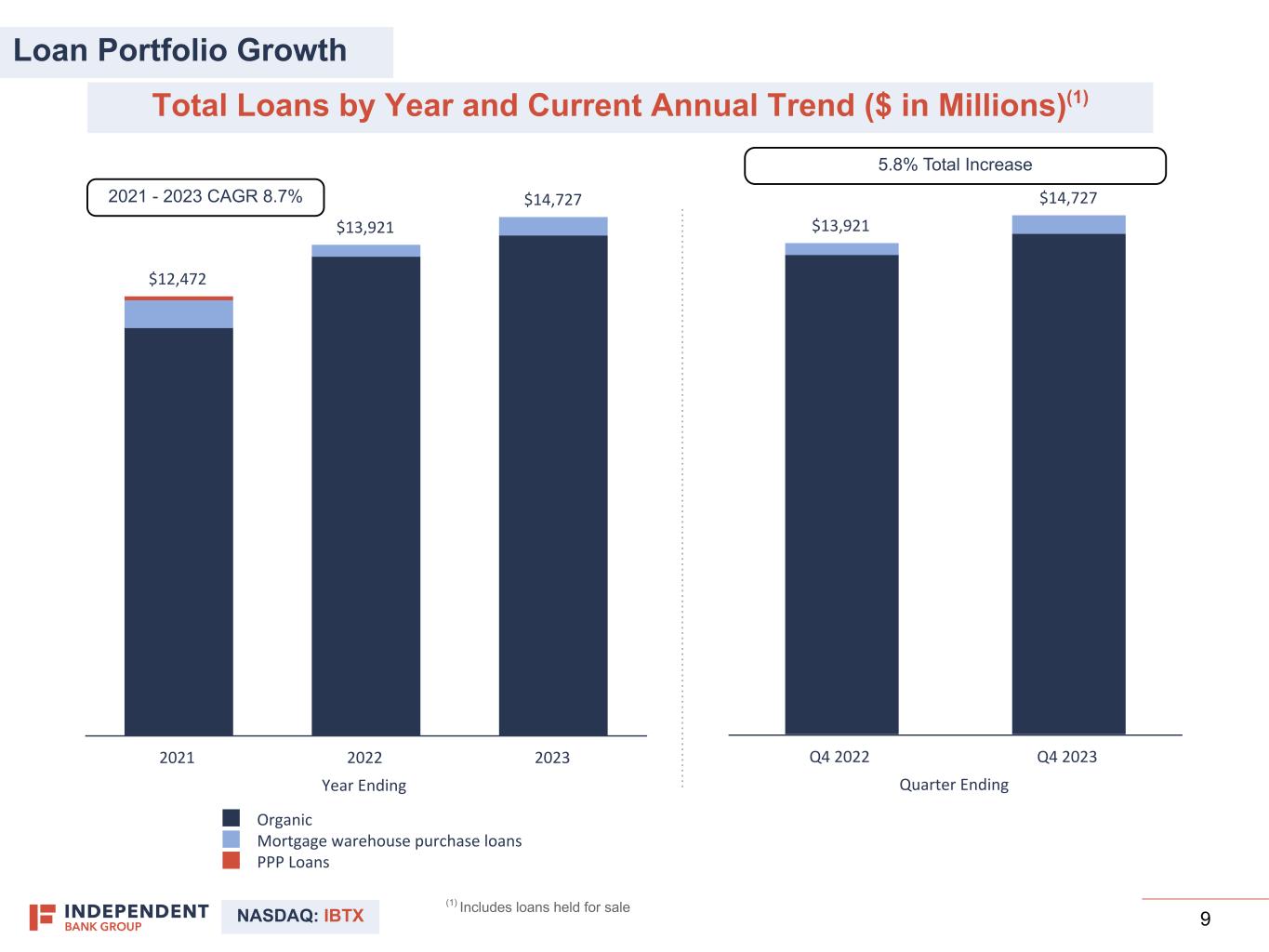

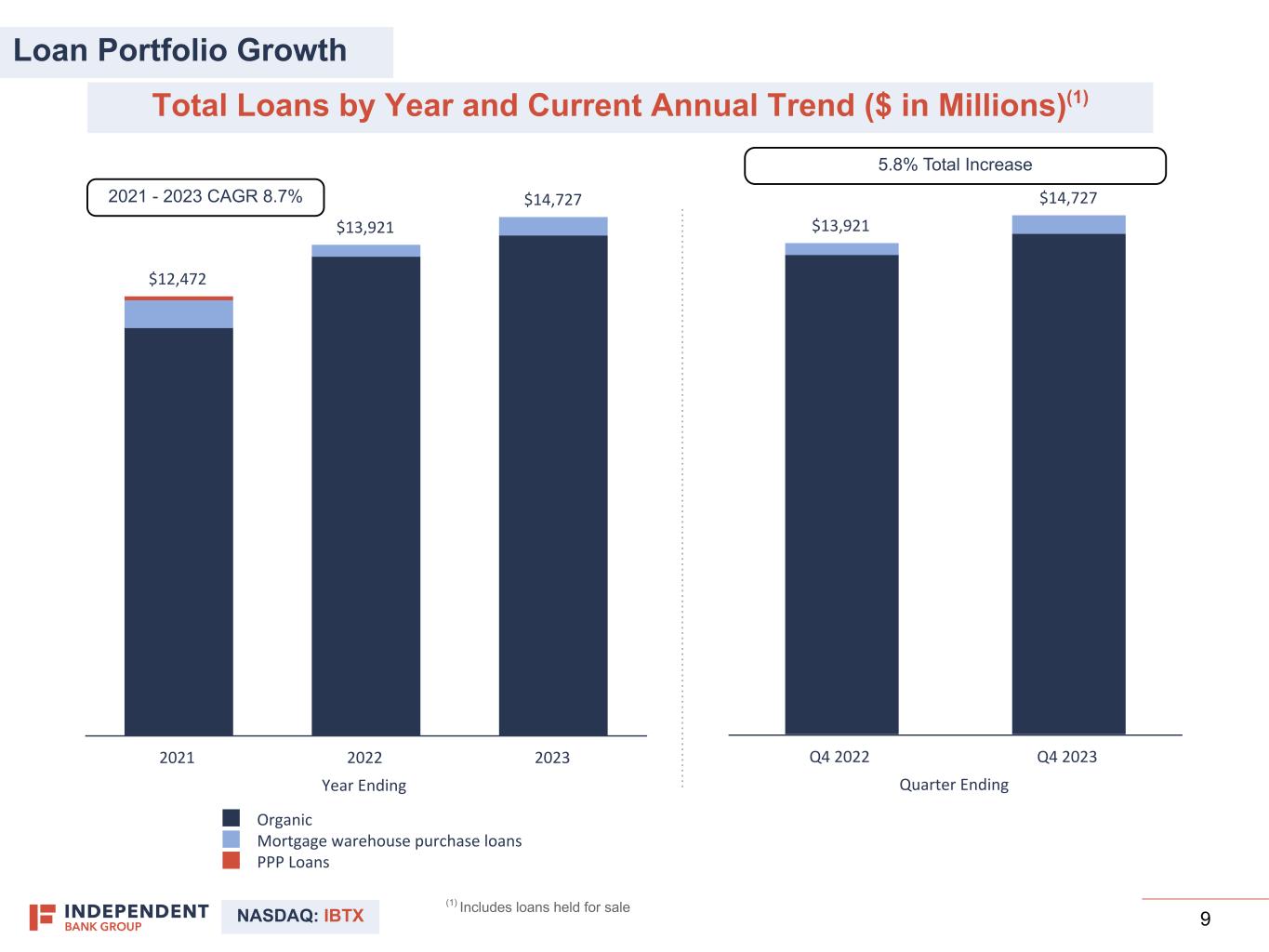

NASDAQ: IBTX 9 Total Loans by Year and Current Annual Trend ($ in Millions)(1) Quarter Ending $13,921 $14,727 Q4 2022 Q4 2023 (1) Includes loans held for sale 9 Year Ending $12,472 $13,921 $14,727 Organic Mortgage warehouse purchase loans PPP Loans 2021 2022 2023 5.8% Total Increase 2021 - 2023 CAGR 8.7% Loan Portfolio Growth

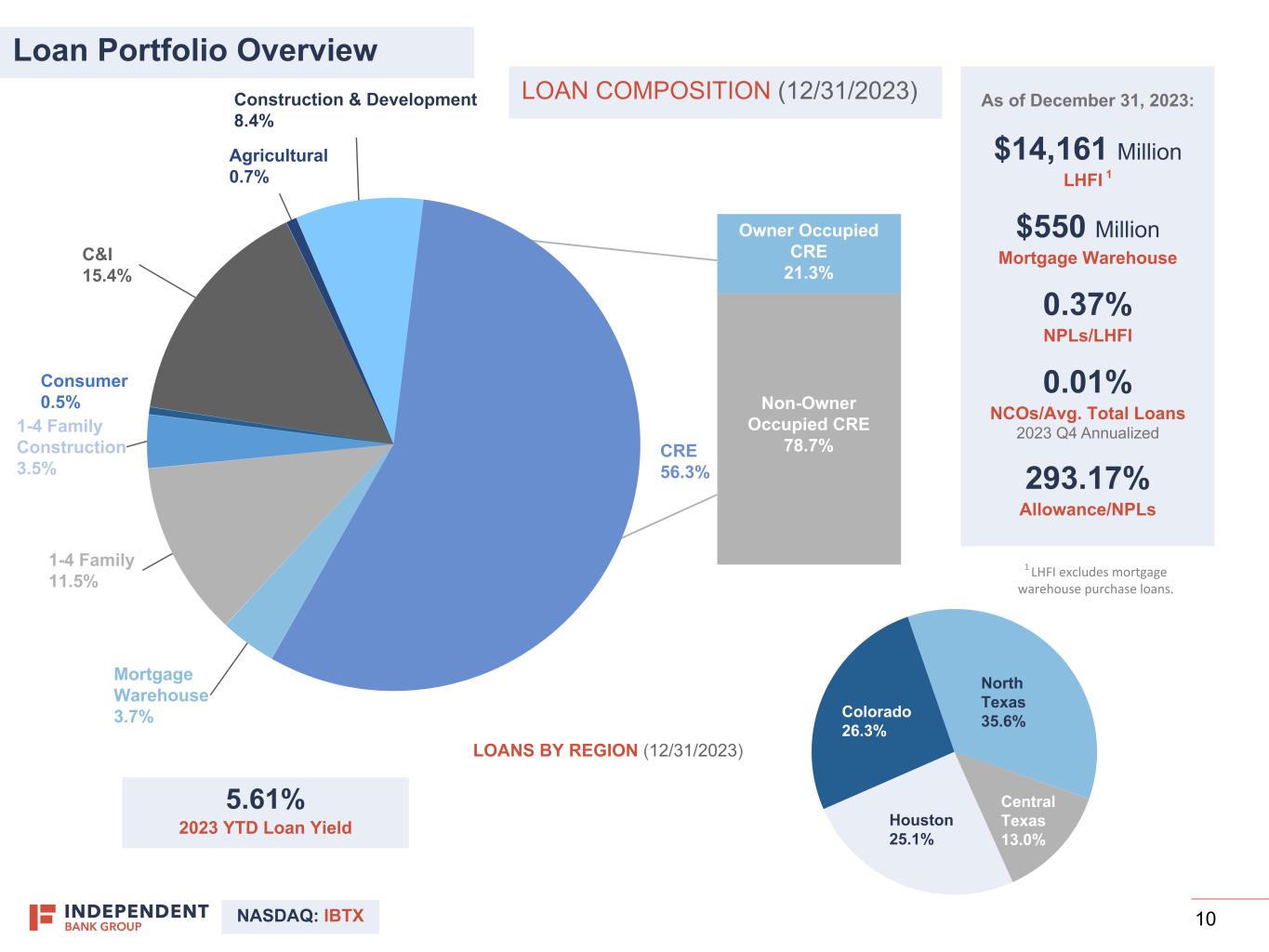

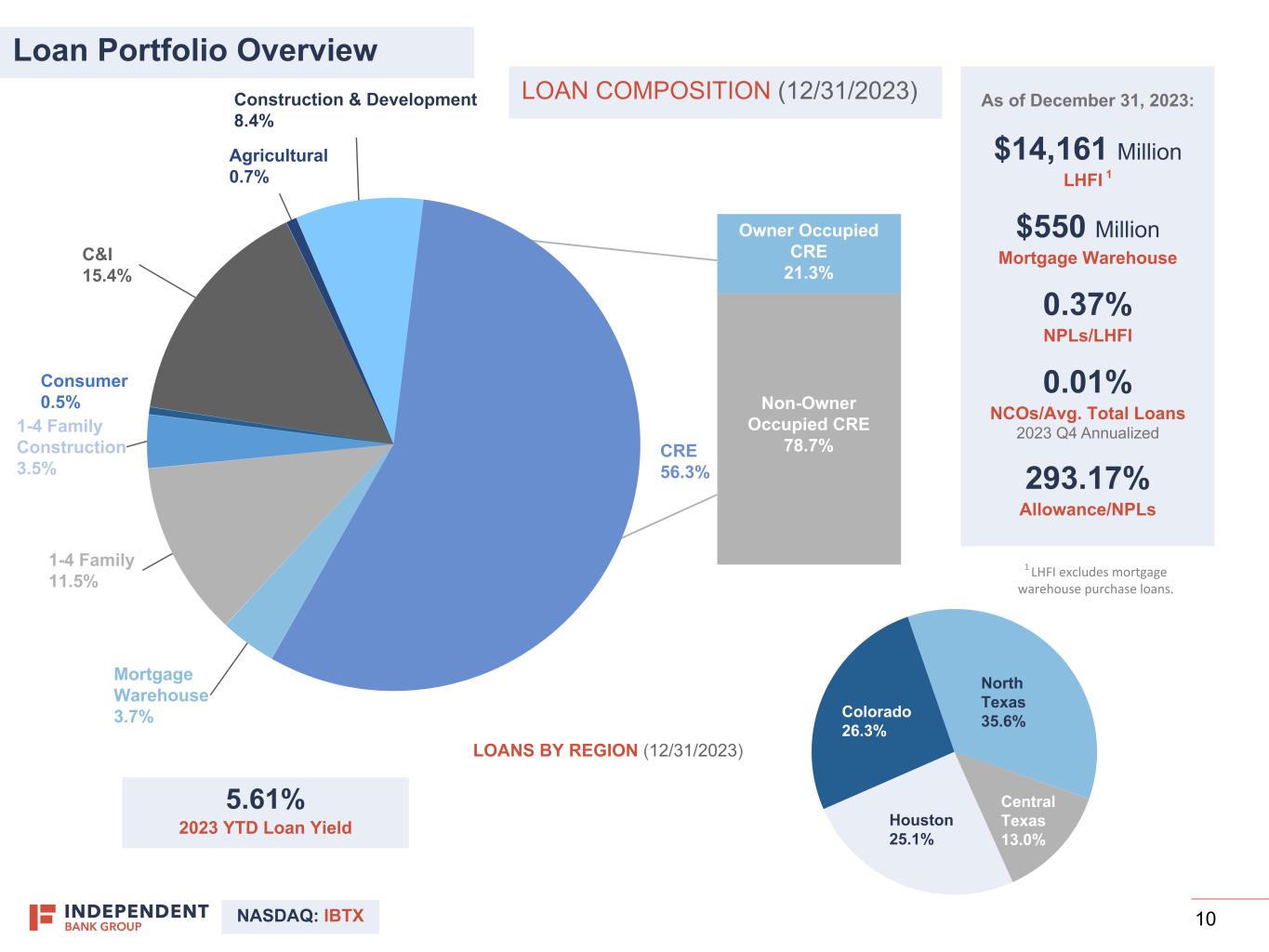

NASDAQ: IBTX 10 CRE 56.3% Mortgage Warehouse 3.7% 1-4 Family 11.5% 1-4 Family Construction 3.5% Consumer 0.5% C&I 15.4% Agricultural 0.7% Construction & Development 8.4% Non-Owner Occupied CRE 78.7% Owner Occupied CRE 21.3% North Texas 35.6% Central Texas 13.0% Houston 25.1% Colorado 26.3% As of December 31, 2023: $14,161 Million LHFI 1 $550 Million Mortgage Warehouse 0.37% NPLs/LHFI 0.01% NCOs/Avg. Total Loans 2023 Q4 Annualized 293.17% Allowance/NPLs LOANS BY REGION (12/31/2023) LOAN COMPOSITION (12/31/2023) 1 LHFI excludes mortgage warehouse purchase loans. Loan Portfolio Overview 5.61% 2023 YTD Loan Yield

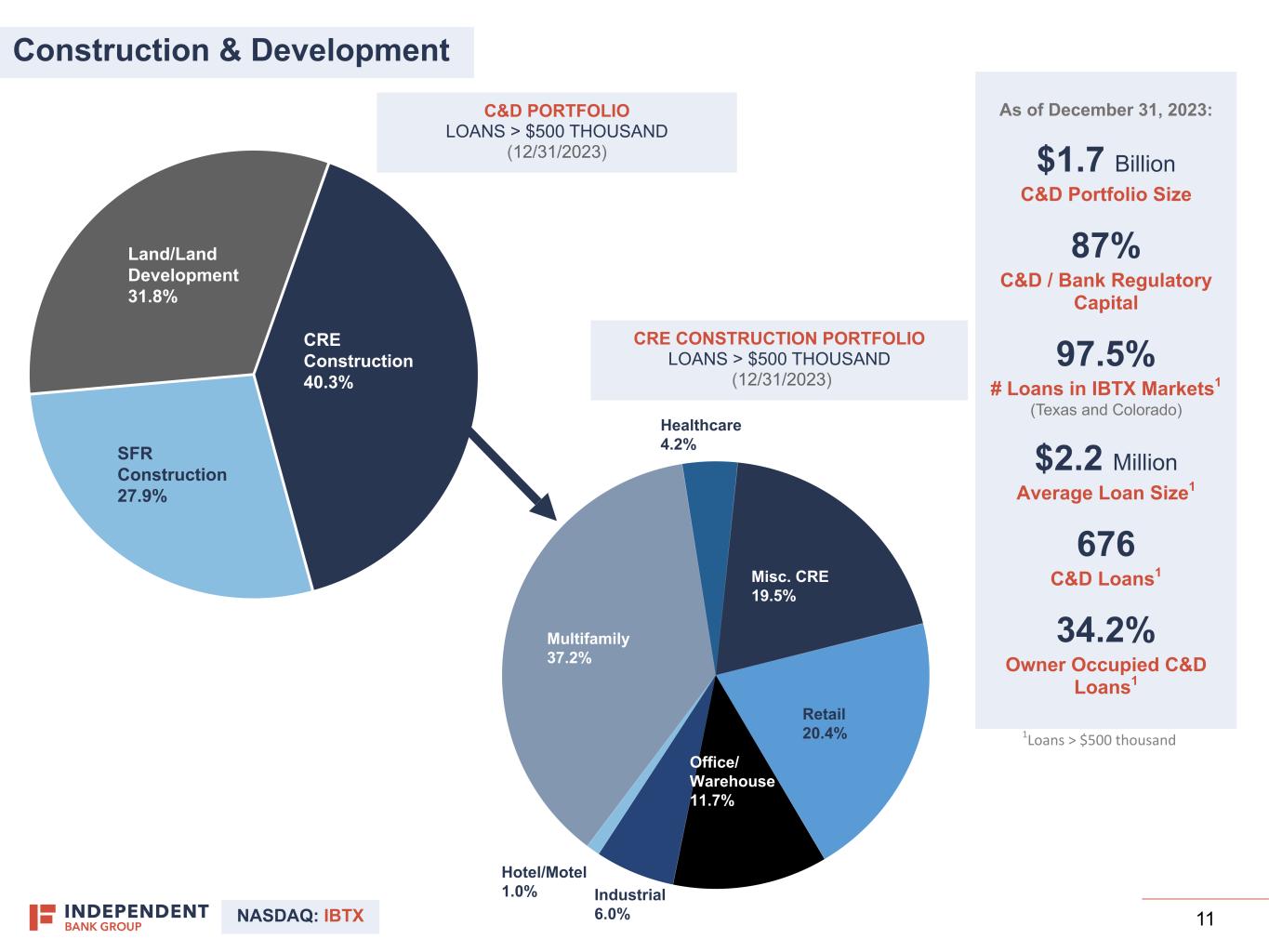

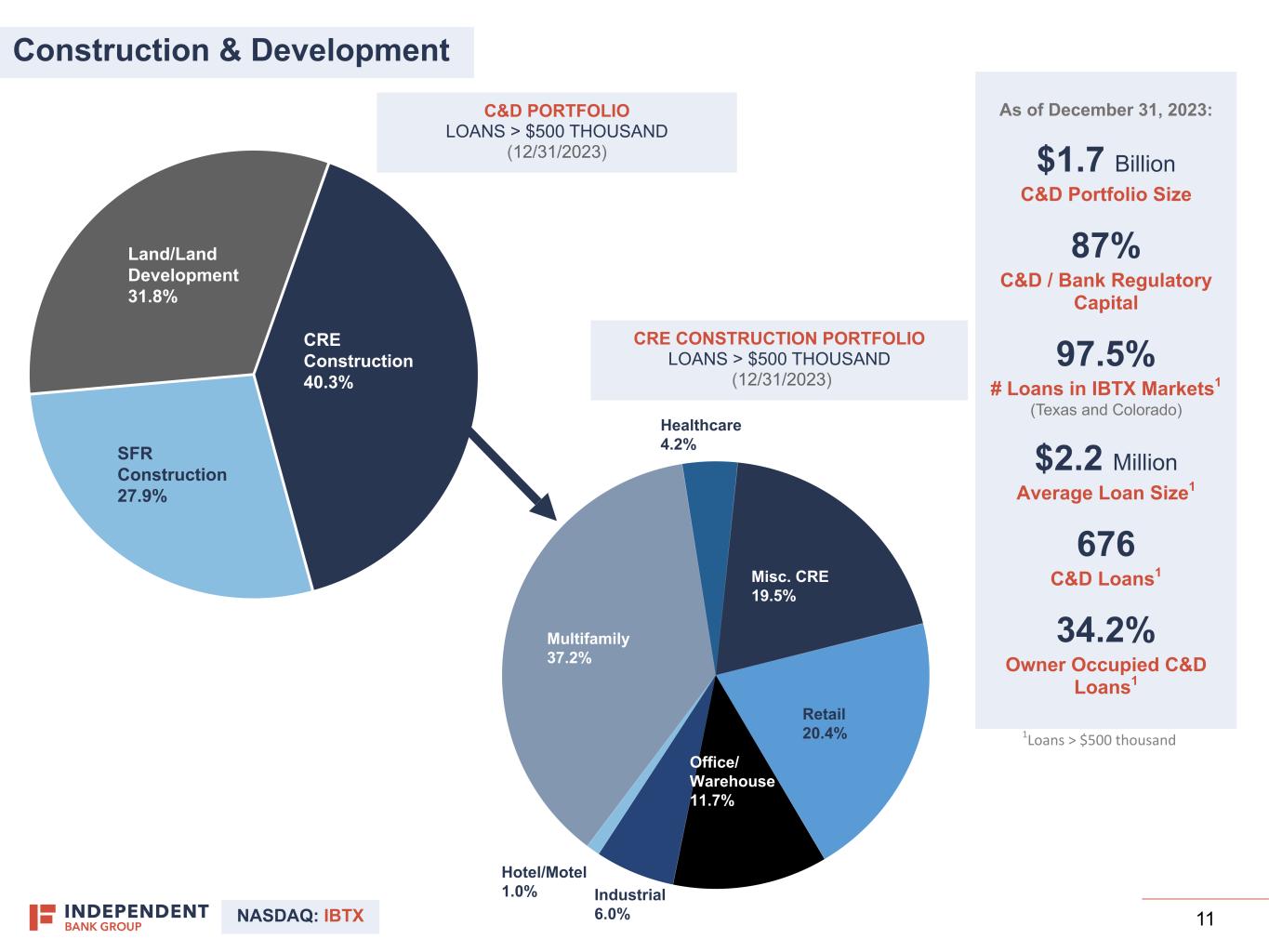

NASDAQ: IBTX 11 Land/Land Development 31.8% CRE Construction 40.3% SFR Construction 27.9% Retail 20.4% Office/ Warehouse 11.7% Industrial 6.0% Hotel/Motel 1.0% Multifamily 37.2% Healthcare 4.2% Misc. CRE 19.5% Construction & Development As of December 31, 2023: $1.7 Billion C&D Portfolio Size 87% C&D / Bank Regulatory Capital 97.5% # Loans in IBTX Markets1 (Texas and Colorado) $2.2 Million Average Loan Size1 676 C&D Loans1 34.2% Owner Occupied C&D Loans1 CRE CONSTRUCTION PORTFOLIO LOANS > $500 THOUSAND (12/31/2023) C&D PORTFOLIO LOANS > $500 THOUSAND (12/31/2023) 1Loans > $500 thousand

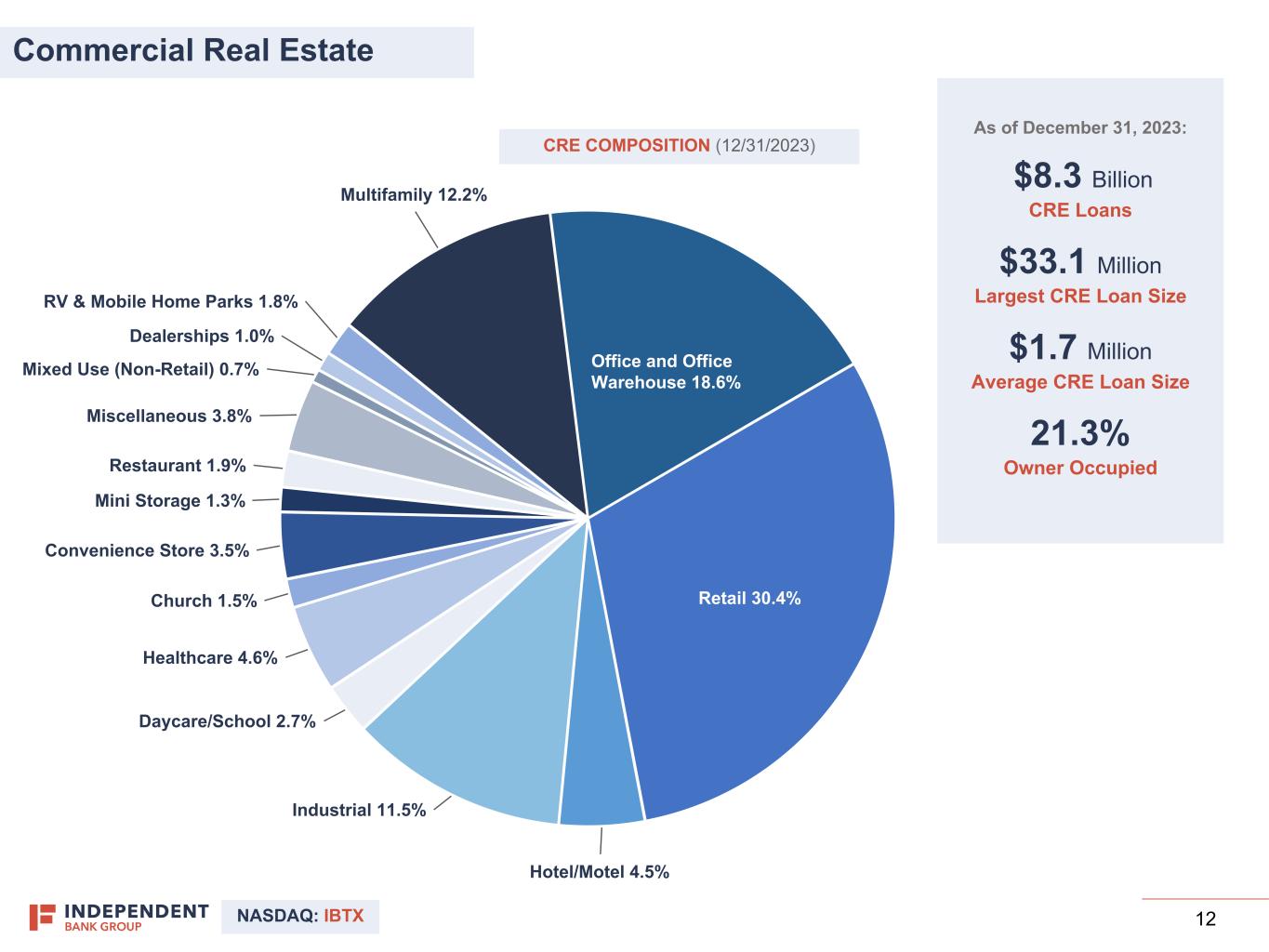

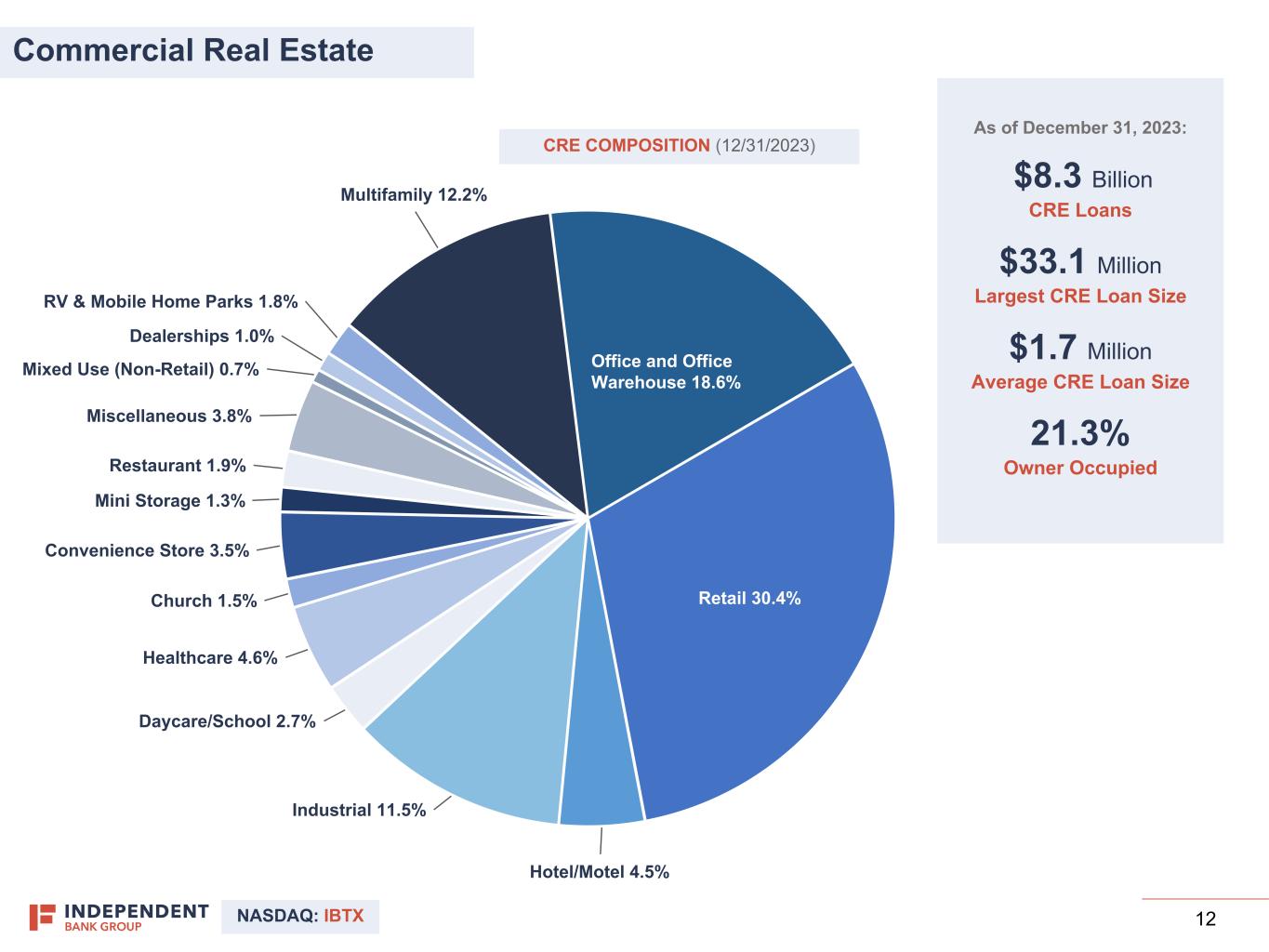

NASDAQ: IBTX 12 Multifamily 12.2% Office and Office Warehouse 18.6% Retail 30.4% Hotel/Motel 4.5% Industrial 11.5% Daycare/School 2.7% Healthcare 4.6% Church 1.5% Convenience Store 3.5% Mini Storage 1.3% Restaurant 1.9% Miscellaneous 3.8% Mixed Use (Non-Retail) 0.7% Dealerships 1.0% RV & Mobile Home Parks 1.8% Commercial Real Estate CRE COMPOSITION (12/31/2023) As of December 31, 2023: $8.3 Billion CRE Loans $33.1 Million Largest CRE Loan Size $1.7 Million Average CRE Loan Size 21.3% Owner Occupied

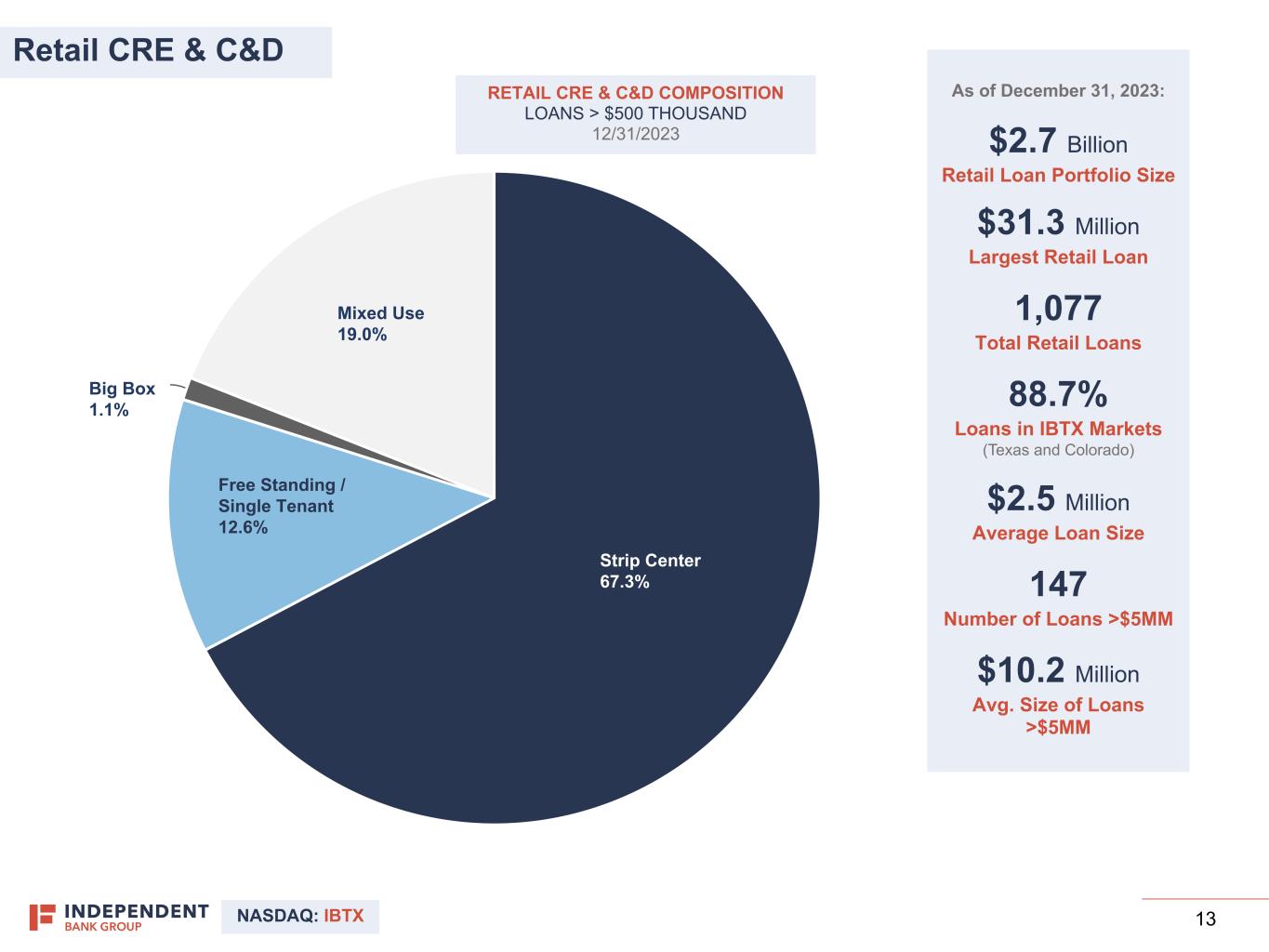

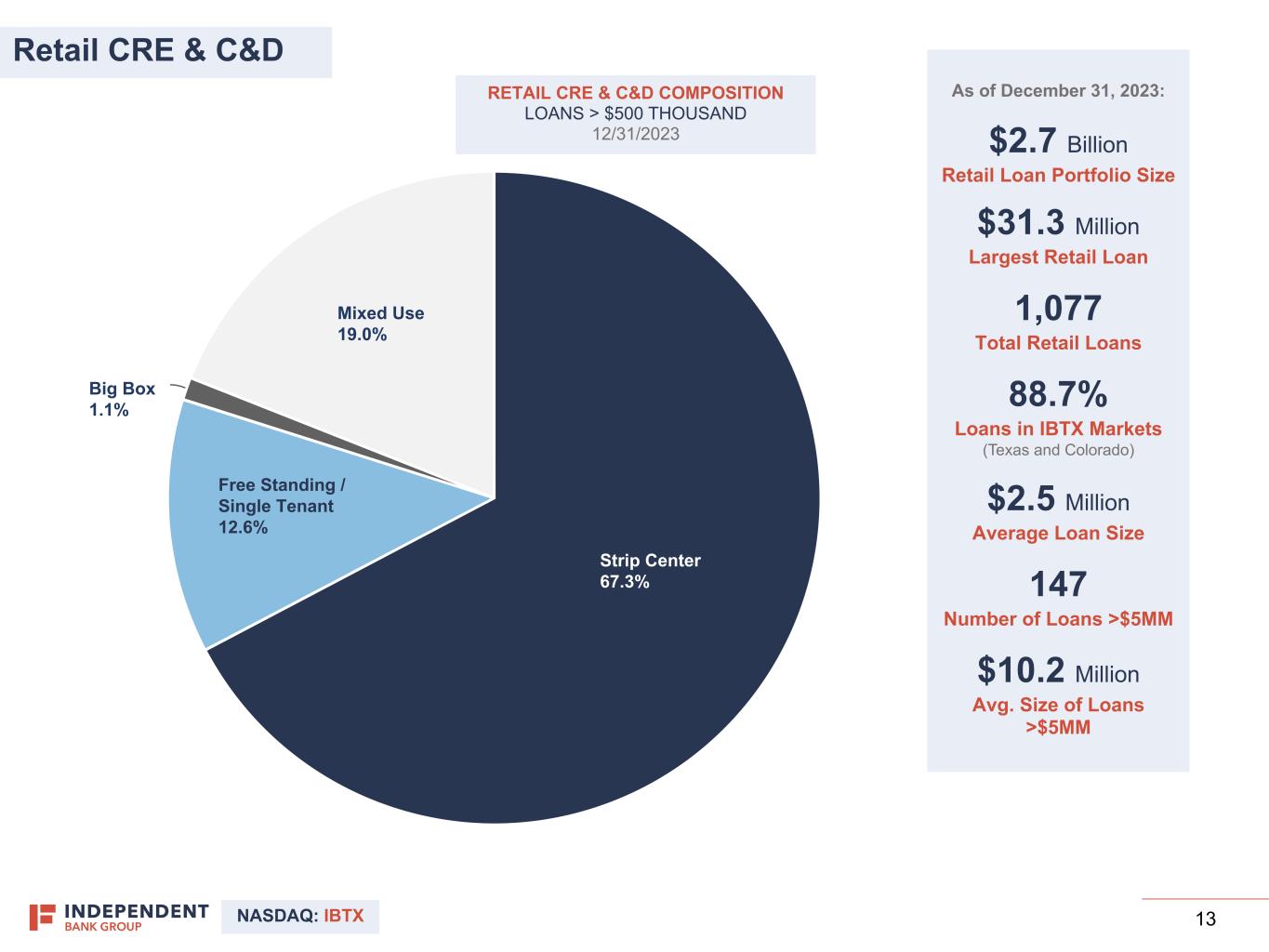

NASDAQ: IBTX 13 Retail CRE & C&D As of December 31, 2023: $2.7 Billion Retail Loan Portfolio Size $31.3 Million Largest Retail Loan 1,077 Total Retail Loans 88.7% Loans in IBTX Markets (Texas and Colorado) $2.5 Million Average Loan Size 147 Number of Loans >$5MM $10.2 Million Avg. Size of Loans >$5MM Strip Center 67.3% Big Box 1.1% Mixed Use 19.0% Free Standing / Single Tenant 12.6% RETAIL CRE & C&D COMPOSITION LOANS > $500 THOUSAND 12/31/2023

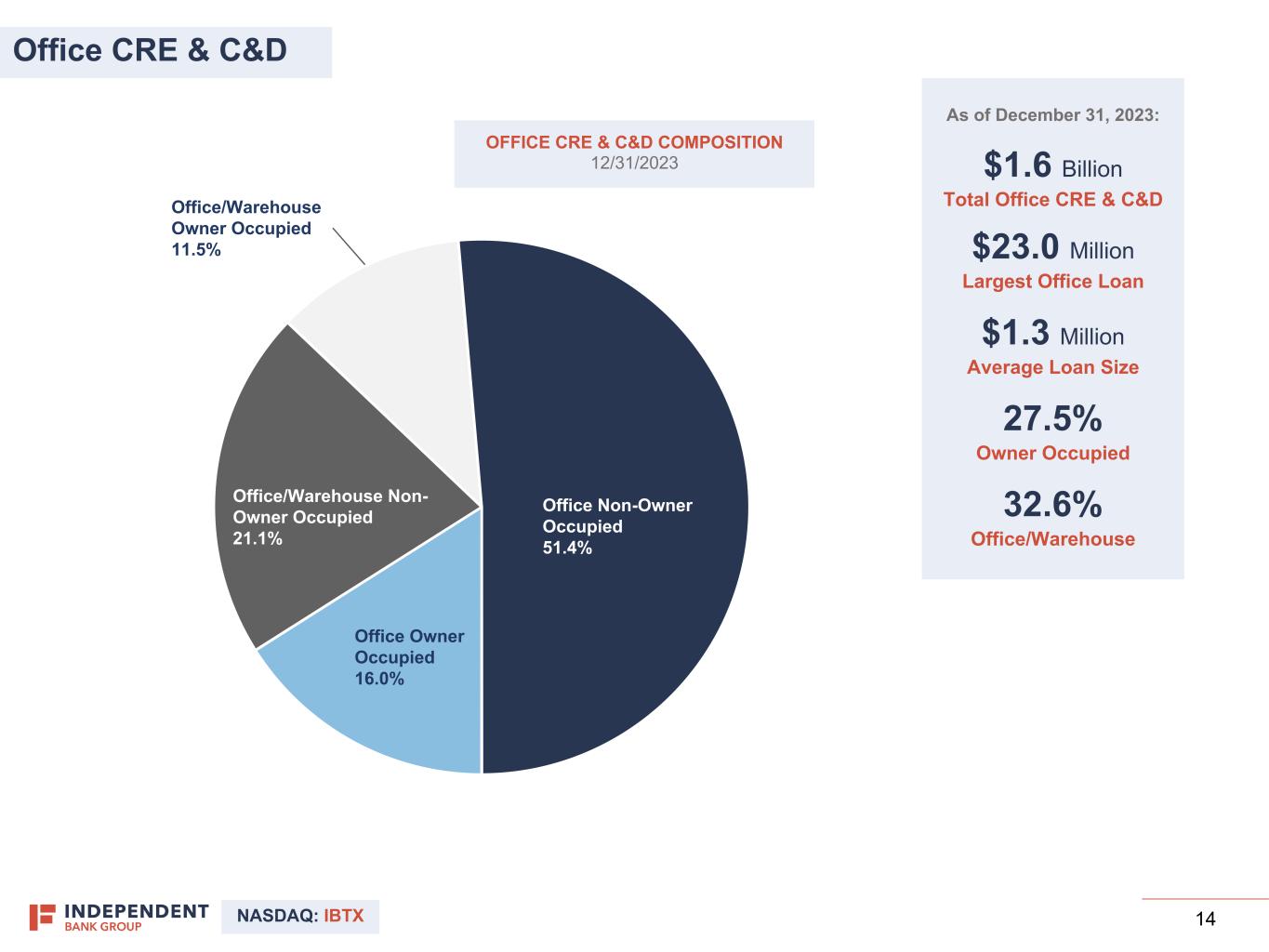

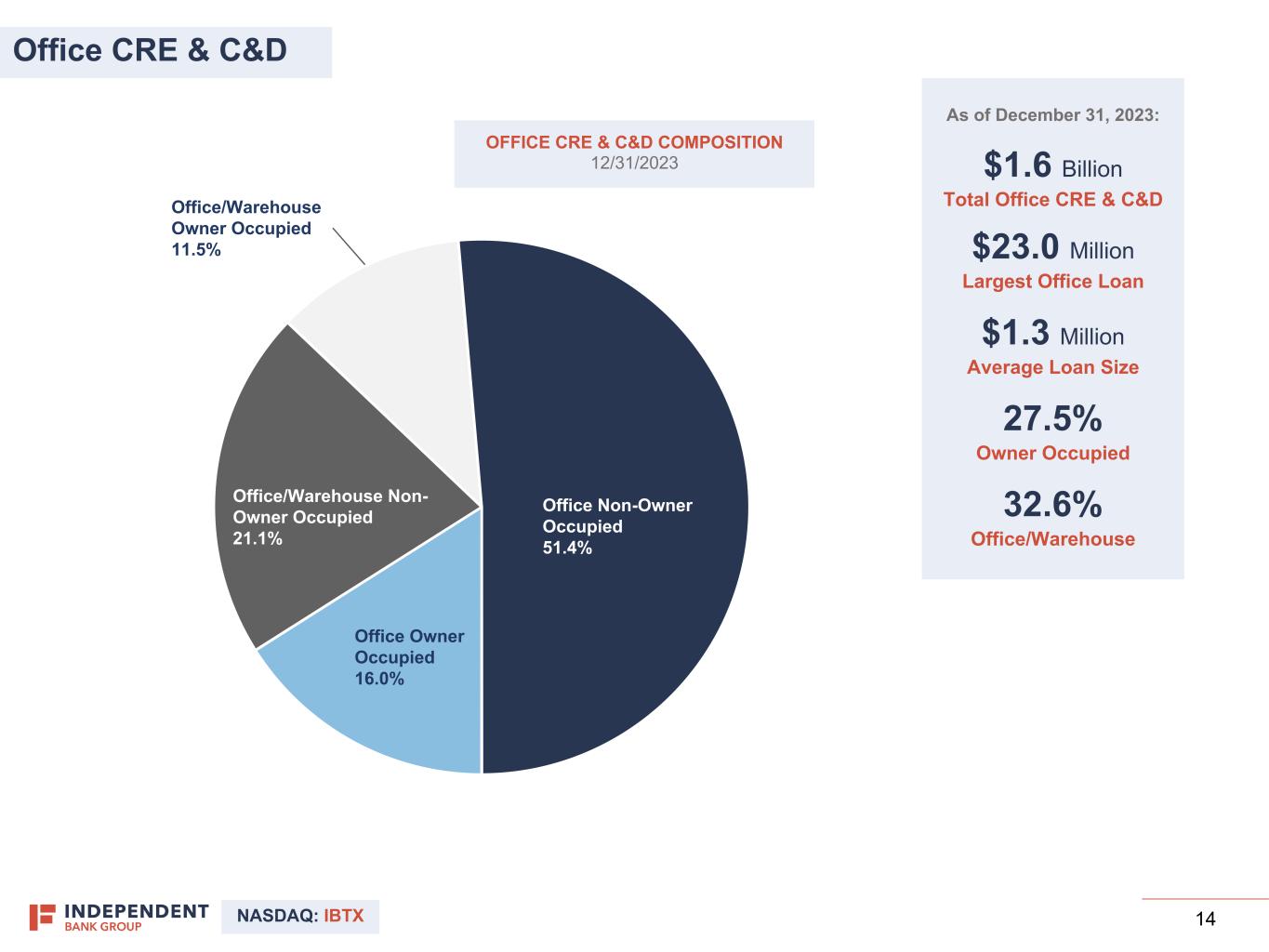

NASDAQ: IBTX 14 Office Non-Owner Occupied 51.4% Office Owner Occupied 16.0% Office/Warehouse Non- Owner Occupied 21.1% Office/Warehouse Owner Occupied 11.5% Office CRE & C&D As of December 31, 2023: $1.6 Billion Total Office CRE & C&D $23.0 Million Largest Office Loan $1.3 Million Average Loan Size 27.5% Owner Occupied 32.6% Office/Warehouse OFFICE CRE & C&D COMPOSITION 12/31/2023

NASDAQ: IBTX 15 Hotel Loans by Property Location 47.3% 37.6% Texas Colorado Other Hotel & Motel As of December 31, 2023: $381.5 Million Hotel & Motel Loan Portfolio Size $5.7 Million Average Loan Size 51.6% Average LTV We maintain a granular book of hotel loans in our markets, the majority of which are branded, limited/ select service properties in our core markets across Texas and Colorado. Hotel Loans by Type 98.4% 1.6% CRE Construction & Development 15.1% Hotel Loans by Product Type 18.0% 75.7% 6.3% Full Service Brand Limited/Selected Service Brand Boutique/Independent

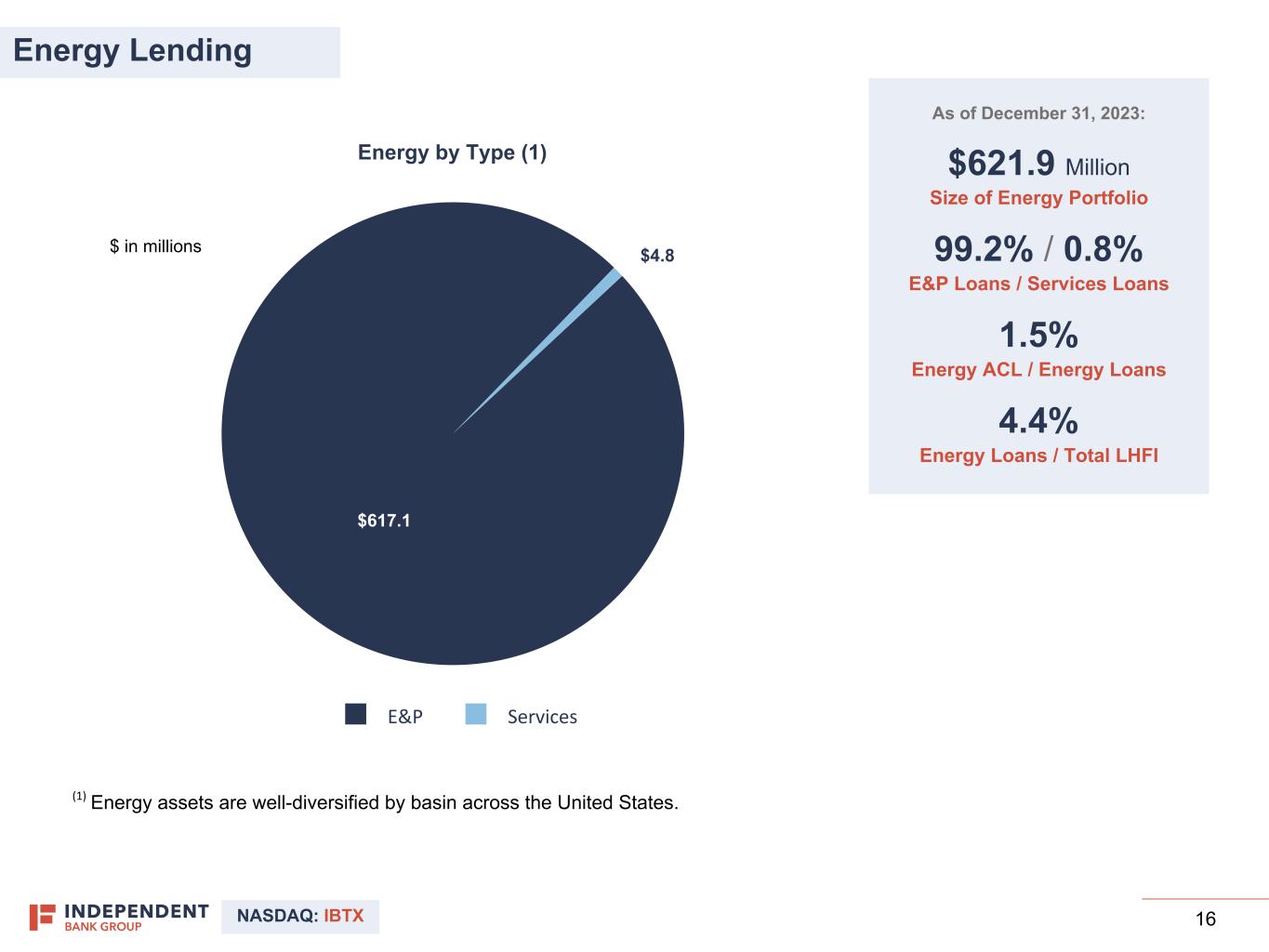

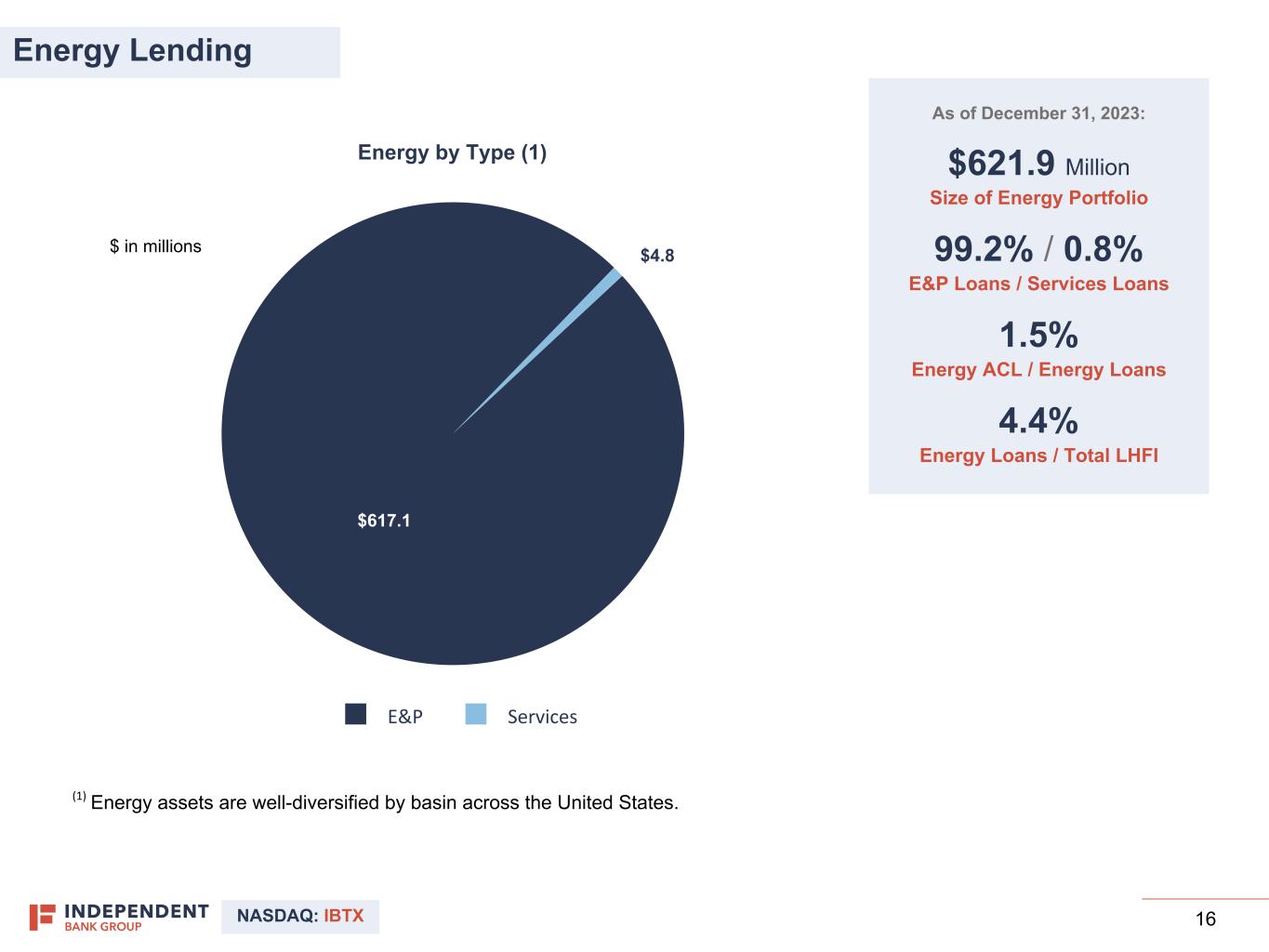

NASDAQ: IBTX 16 Energy Lending As of December 31, 2023: $621.9 Million Size of Energy Portfolio 99.2% / 0.8% E&P Loans / Services Loans 1.5% Energy ACL / Energy Loans 4.4% Energy Loans / Total LHFI Energy by Type (1) $617.1 $4.8 E&P Services $ in millions (1) Energy assets are well-diversified by basin across the United States.

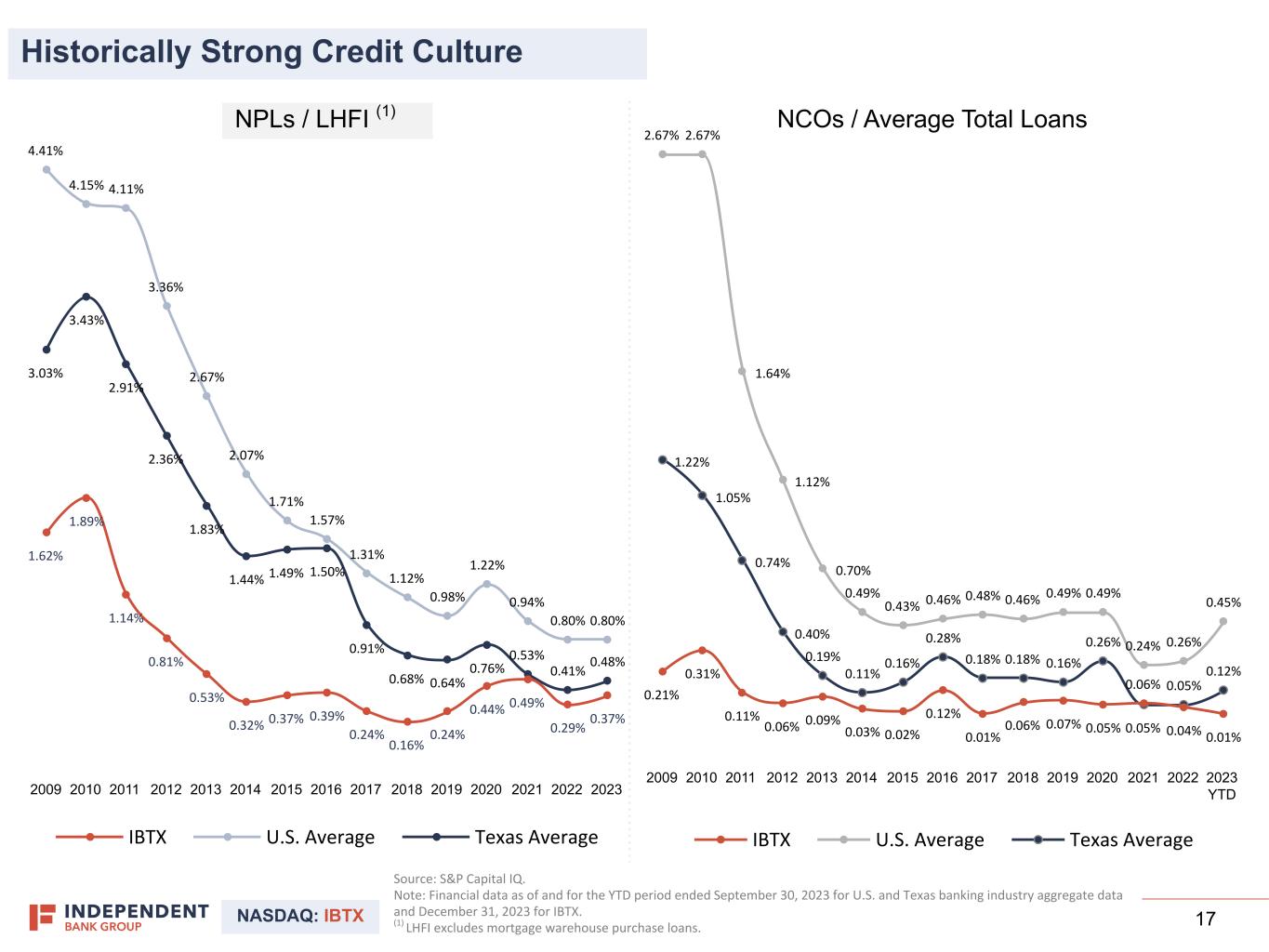

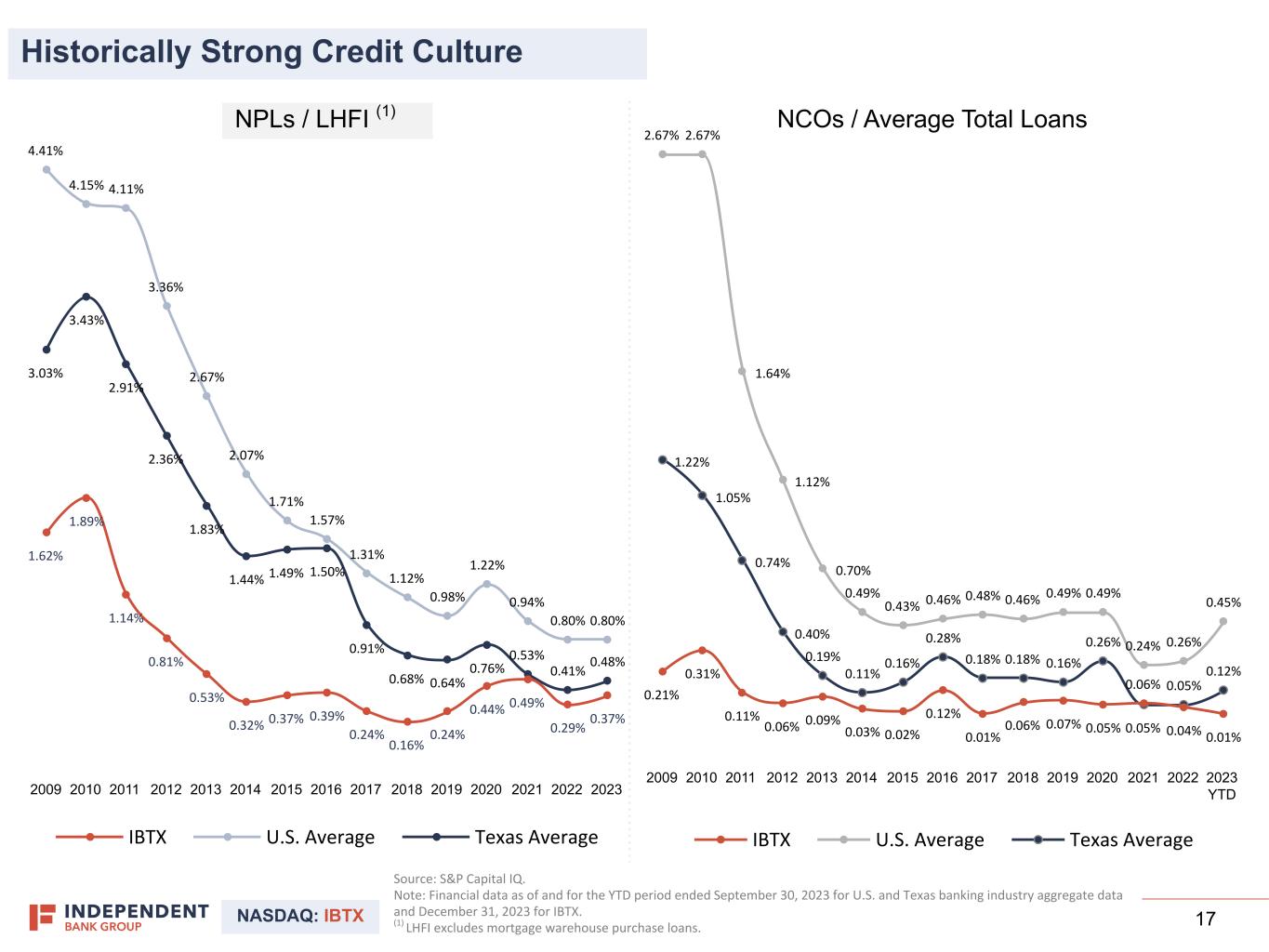

NASDAQ: IBTX 17 3.03% 3.43% 2.91% 2.36% 1.83% 1.44% 1.49% 1.50% 0.91% 0.68% 0.64% 0.76% 0.53% 0.41% 0.48% 4.41% 4.15% 4.11% 3.36% 2.67% 2.07% 1.71% 1.57% 1.31% 1.12% 0.98% 1.22% 0.94% 0.80% 0.80% 1.62% 1.89% 1.14% 0.81% 0.53% 0.32% 0.37% 0.39% 0.24% 0.16% 0.24% 0.44% 0.49% 0.29% 0.37% IBTX U.S. Average Texas Average 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 1.22% 1.05% 0.74% 0.40% 0.19% 0.11% 0.16% 0.28% 0.18% 0.18% 0.16% 0.26% 0.05% 0.05% 0.12% 2.67% 2.67% 1.64% 1.12% 0.70% 0.49% 0.43% 0.46% 0.48% 0.46% 0.49% 0.49% 0.24% 0.26% 0.45% 0.21% 0.31% 0.11% 0.06% 0.09% 0.03% 0.02% 0.12% 0.01% 0.06% 0.07% 0.05% 0.06% 0.04% 0.01% IBTX U.S. Average Texas Average 2009 2010 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 YTD Historically Strong Credit Culture Source: S&P Capital IQ. Note: Financial data as of and for the YTD period ended September 30, 2023 for U.S. and Texas banking industry aggregate data and December 31, 2023 for IBTX. (1) LHFI excludes mortgage warehouse purchase loans. NCOs / Average Total LoansNPLs / LHFI (1)

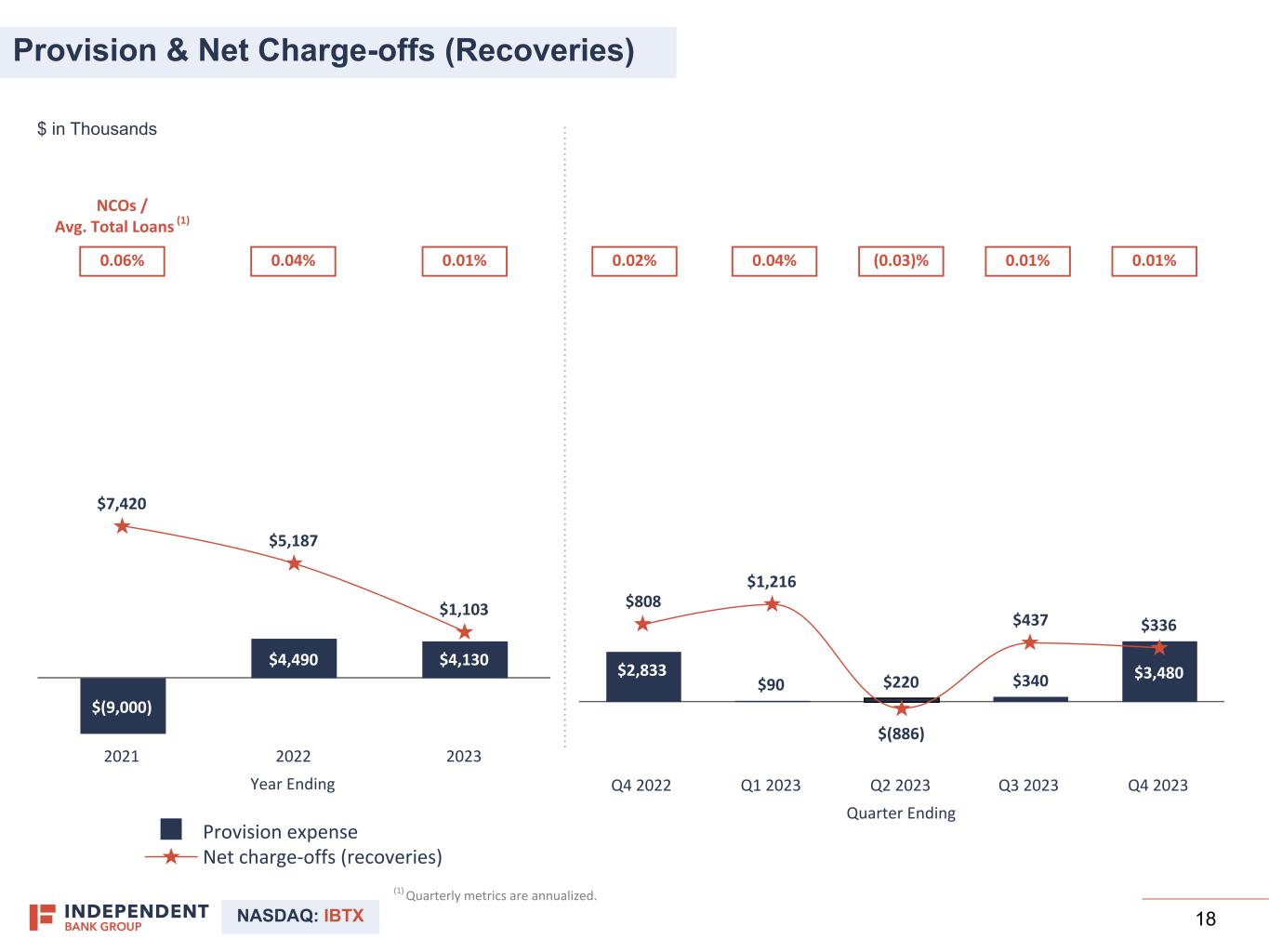

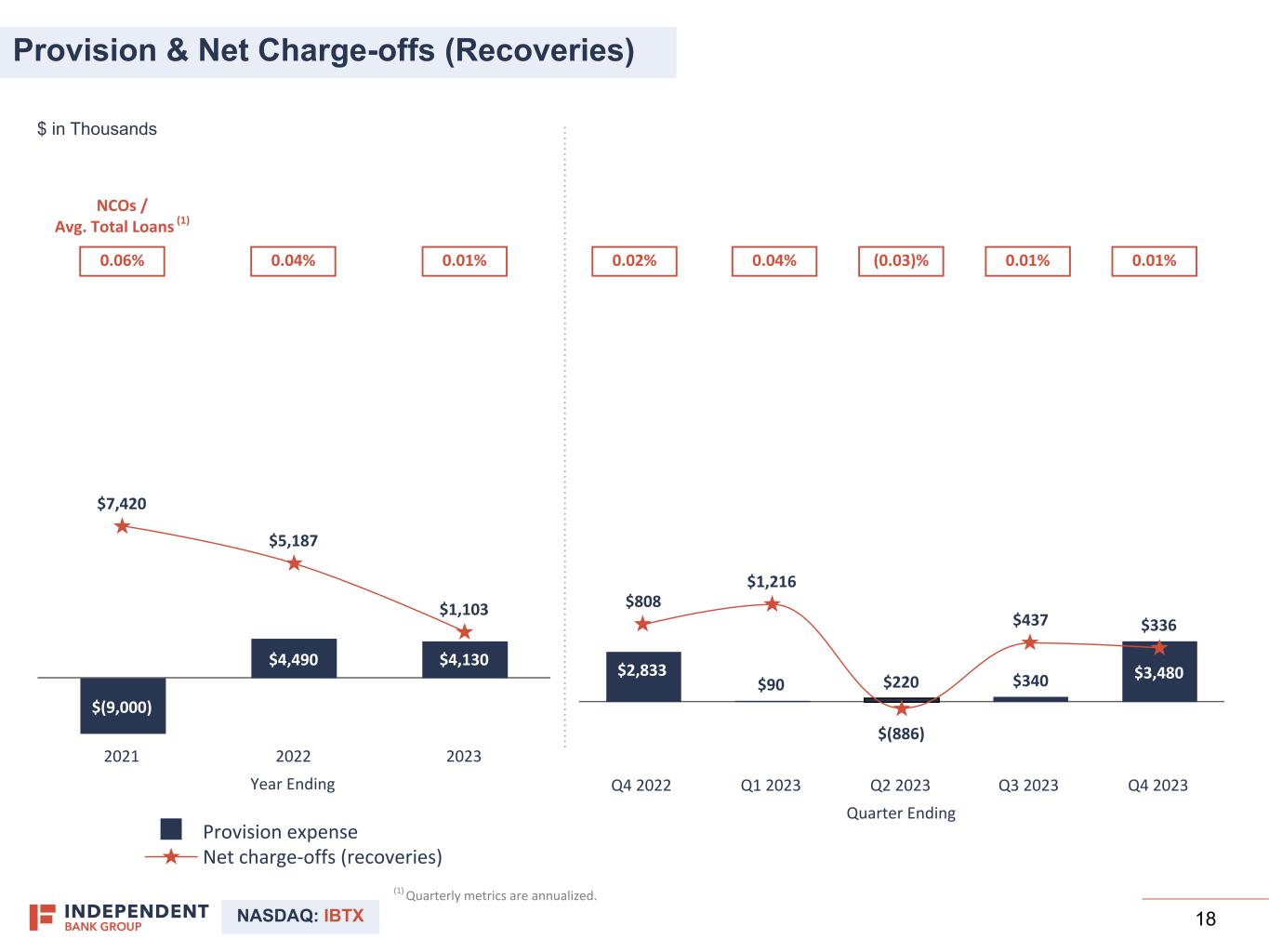

NASDAQ: IBTX 18 Quarter Ending $2,833 $90 $220 $340 $3,480 $808 $1,216 $(886) $437 $336 Q4 2022 Q1 2023 Q2 2023 Q3 2023 Q4 2023Year Ending $(9,000) $4,490 $4,130 $7,420 $5,187 $1,103 Provision expense Net charge-offs (recoveries) 2021 2022 2023 $ in Thousands 18 Provision & Net Charge-offs (Recoveries) 0.06% 0.01%0.04% 0.01% 0.01%0.02% (0.03)%0.04% NCOs / Avg. Total Loans (1) (1) Quarterly metrics are annualized.

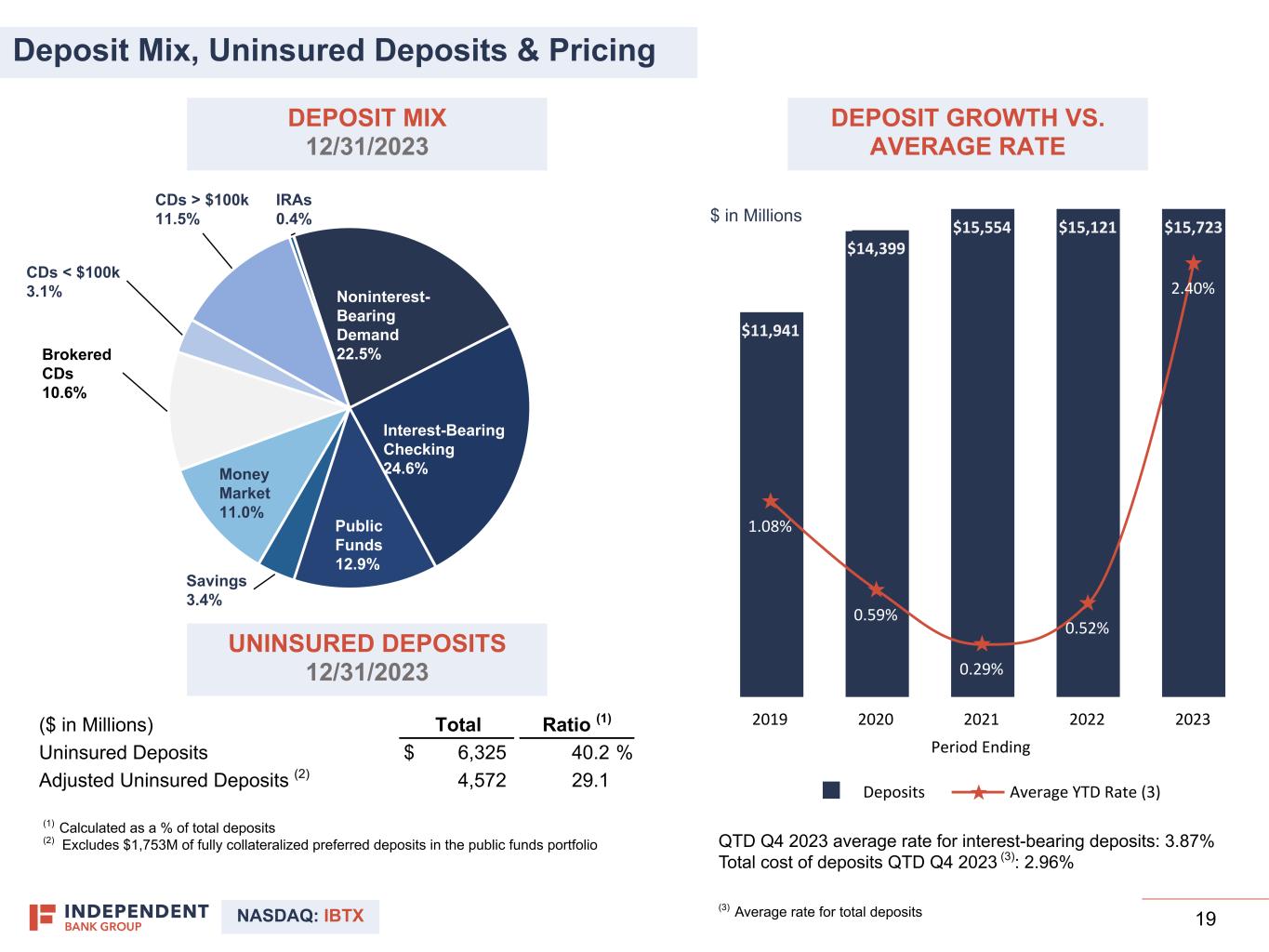

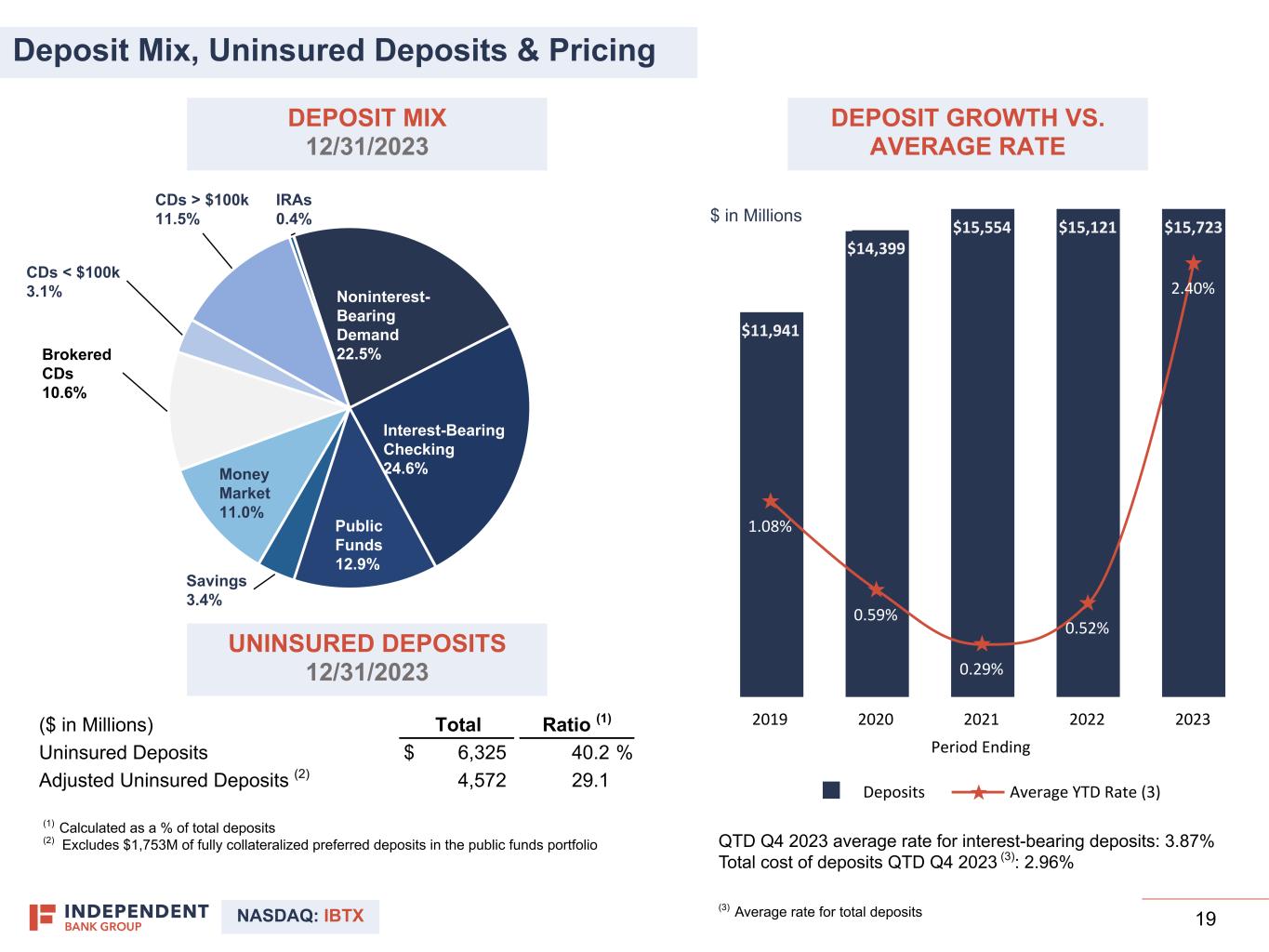

NASDAQ: IBTX 19 Period Ending $11,941 $14,399 $15,554 $15,121 $15,723 1.08% 0.59% 0.29% 0.52% 2.40% Deposits Average YTD Rate (3) 2019 2020 2021 2022 2023 Noninterest- Bearing Demand 22.5% Interest-Bearing Checking 24.6% Public Funds 12.9% Savings 3.4% Money Market 11.0% Brokered CDs 10.6% CDs < $100k 3.1% CDs > $100k 11.5% IRAs 0.4% (3) Average rate for total deposits 19 QTD Q4 2023 average rate for interest-bearing deposits: 3.87% Total cost of deposits QTD Q4 2023 (3): 2.96% Deposit Mix, Uninsured Deposits & Pricing DEPOSIT MIX 12/31/2023 DEPOSIT GROWTH VS. AVERAGE RATE $ in Millions ($ in Millions) Total Ratio (1) Uninsured Deposits $ 6,325 40.2 % Adjusted Uninsured Deposits (2) 4,572 29.1 UNINSURED DEPOSITS 12/31/2023 (1) Calculated as a % of total deposits (2) Excludes $1,753M of fully collateralized preferred deposits in the public funds portfolio

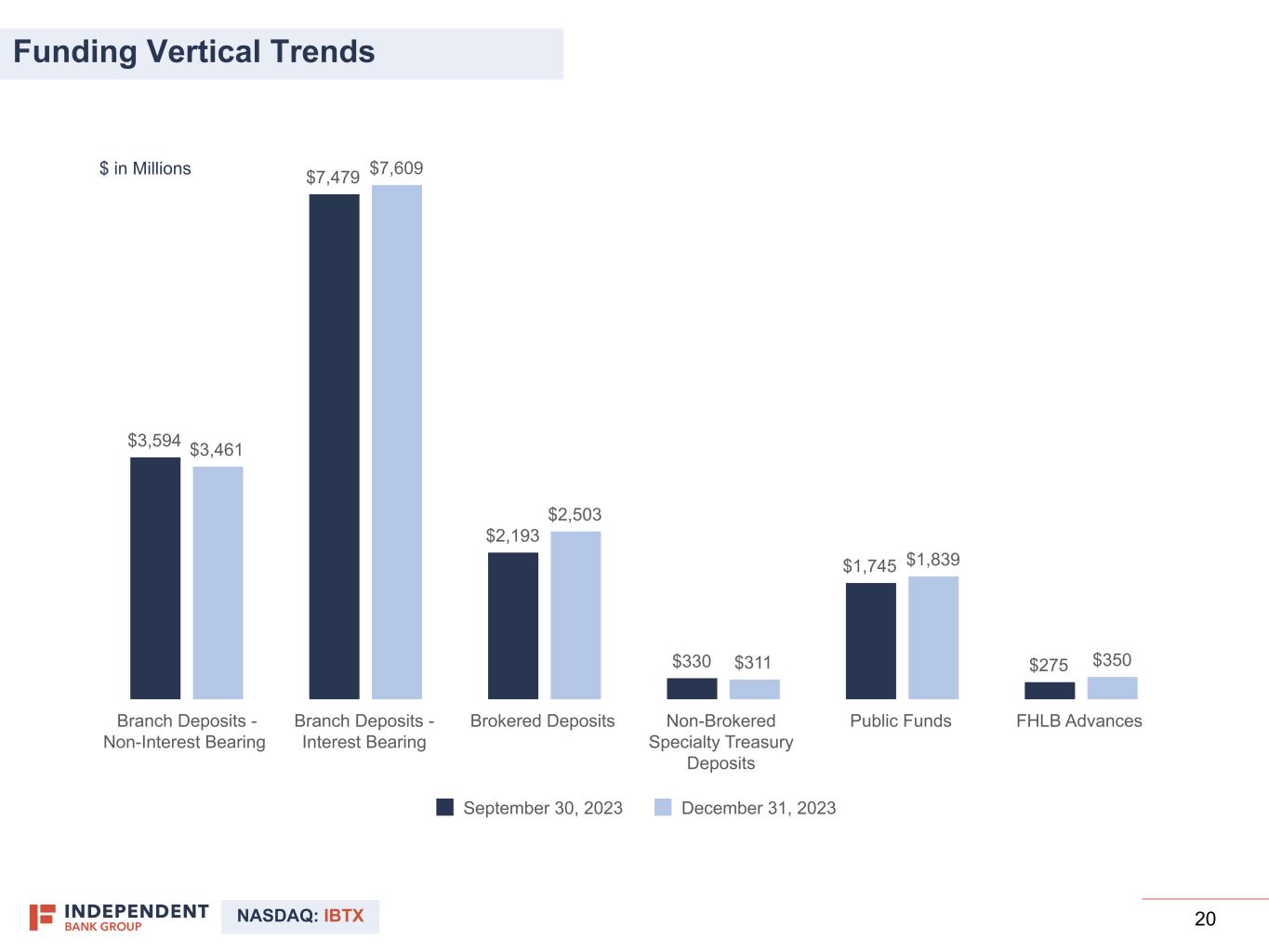

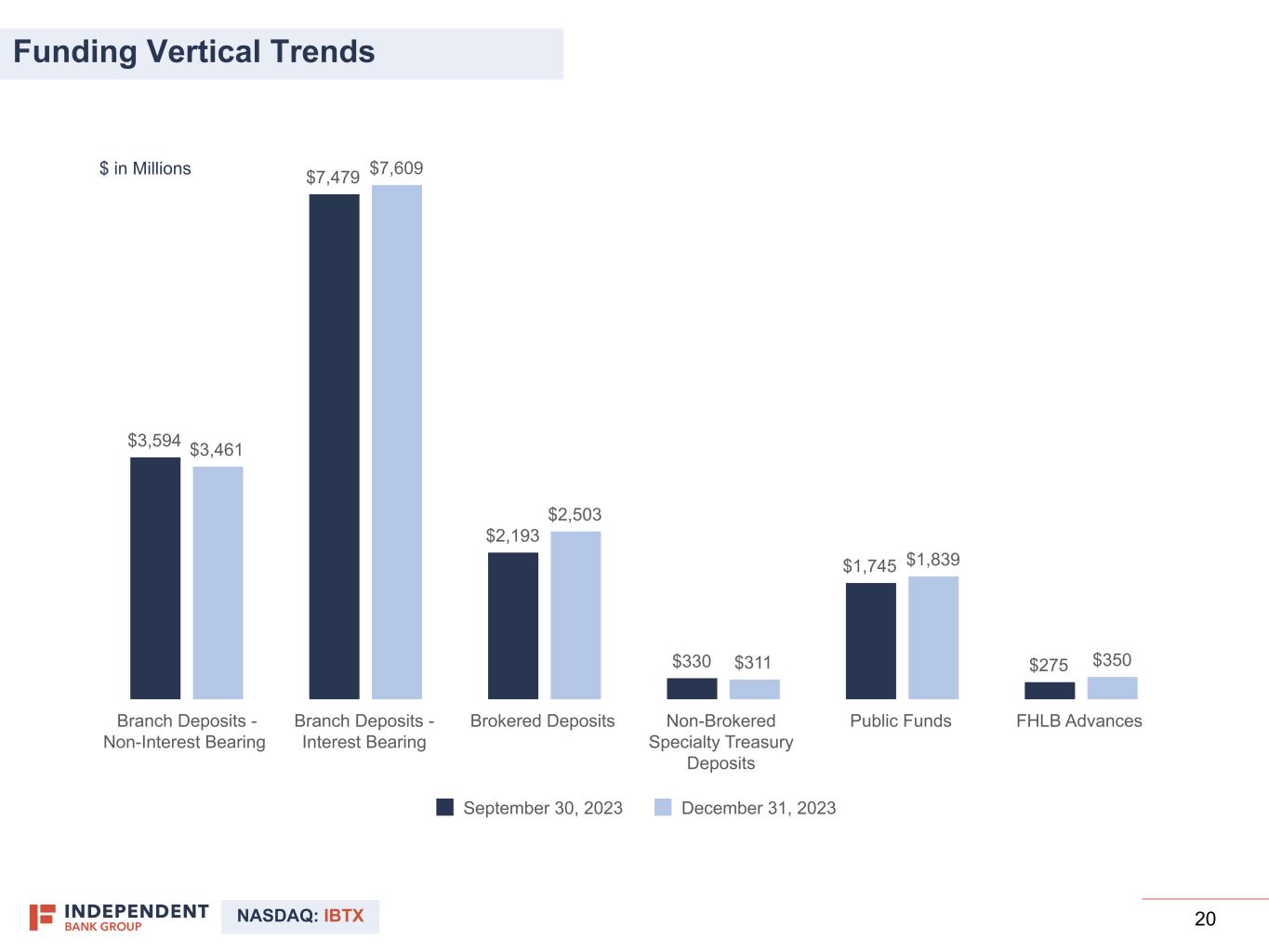

NASDAQ: IBTX 20 20 Funding Vertical Trends $3,594 $7,479 $2,193 $330 $1,745 $275 $3,461 $7,609 $2,503 $311 $1,839 $350 September 30, 2023 December 31, 2023 Branch Deposits - Non-Interest Bearing Branch Deposits - Interest Bearing Brokered Deposits Non-Brokered Specialty Treasury Deposits Public Funds FHLB Advances $ in Millions

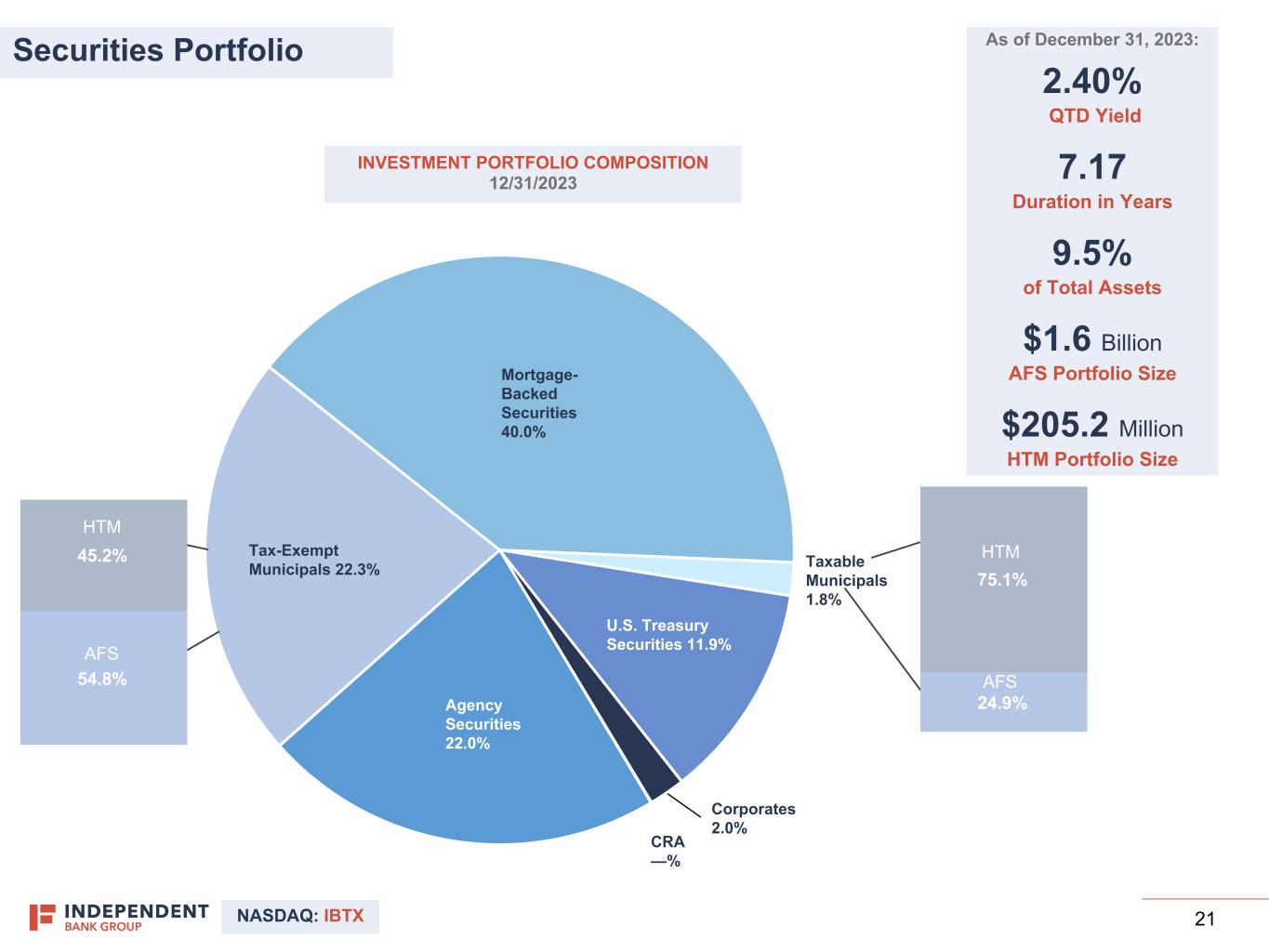

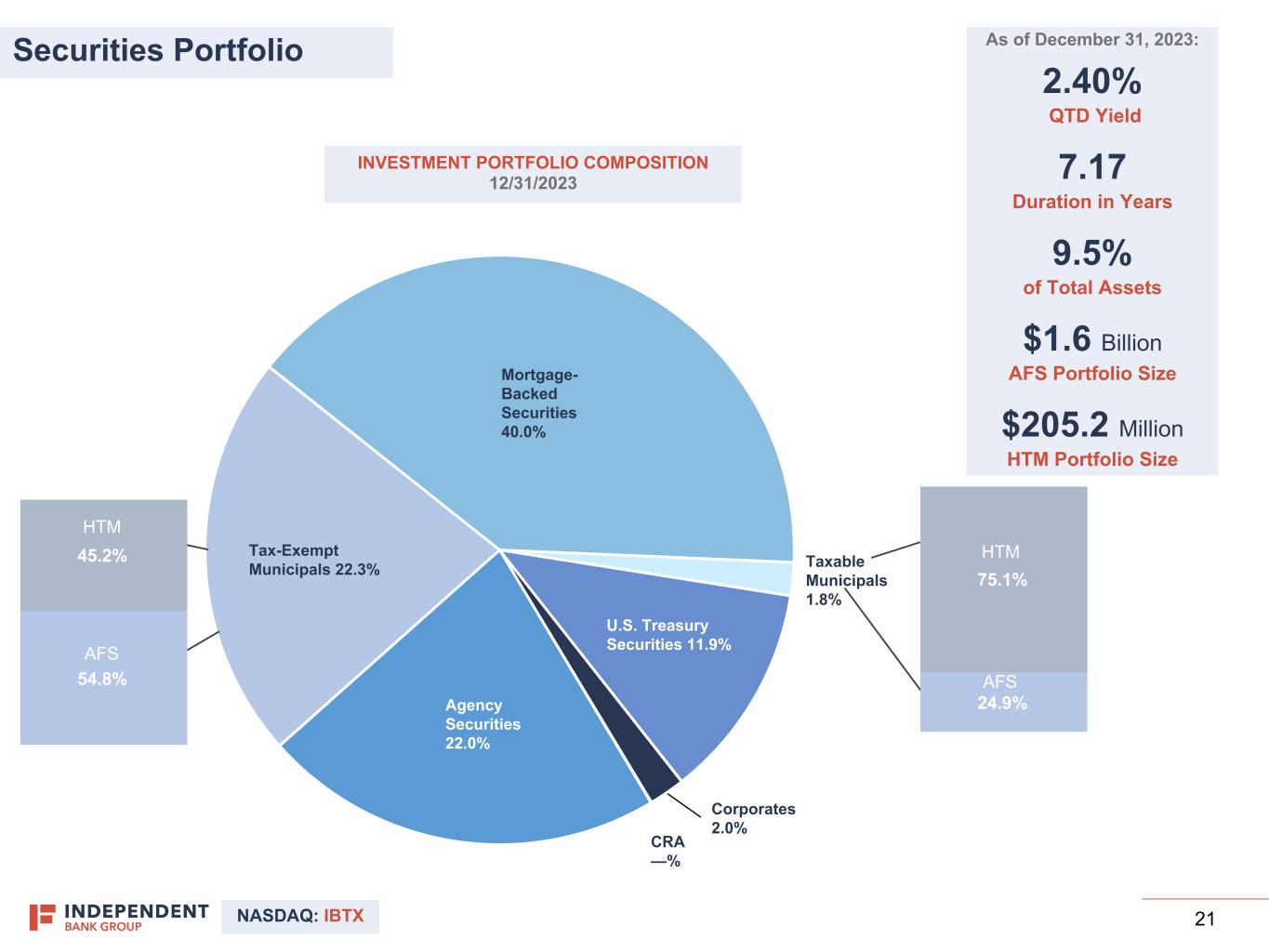

NASDAQ: IBTX 21 CRA —% Agency Securities 22.0% Tax-Exempt Municipals 22.3% Mortgage- Backed Securities 40.0% Taxable Municipals 1.8% U.S. Treasury Securities 11.9% Corporates 2.0% 24.9% 75.1% 54.8% 45.2% Securities Portfolio As of December 31, 2023: 2.40% QTD Yield 7.17 Duration in Years 9.5% of Total Assets $1.6 Billion AFS Portfolio Size $205.2 Million HTM Portfolio Size INVESTMENT PORTFOLIO COMPOSITION 12/31/2023 HTM AFS HTM AFS

NASDAQ: IBTX 22 Consolidated Capital (1) Adjusted (non-GAAP) metrics. See Appendix for reconciliation to the closest applicable GAAP metrics. Period Ending 9.76% 10.33% 11.12% 10.09% 9.70% 9.78% 9.86% 9.58%9.32% 9.12% 8.80% 9.49% 9.01% 8.92% 9.09% 8.94% 11.83% 13.32% 13.67% 12.35% 11.88% 11.95% 11.89% 11.57% 8.98% 8.60% 8.53% 7.72% 7.31% 7.37% 7.35% 7.55% 10.19% 10.74% 11.52% 10.45% 10.05% 10.13% 10.21% 9.93% Common equity tier 1 to risk-weighted assets Tier 1 capital to average assets Total capital to risk-weighted assets Tangible common equity to tangible assets (1) Tier 1 capital to risk-weighted assets 12/31/19 12/31/20 12/31/21 12/31/22 2023 Q1 2023 Q2 2023 Q3 2023 Q4

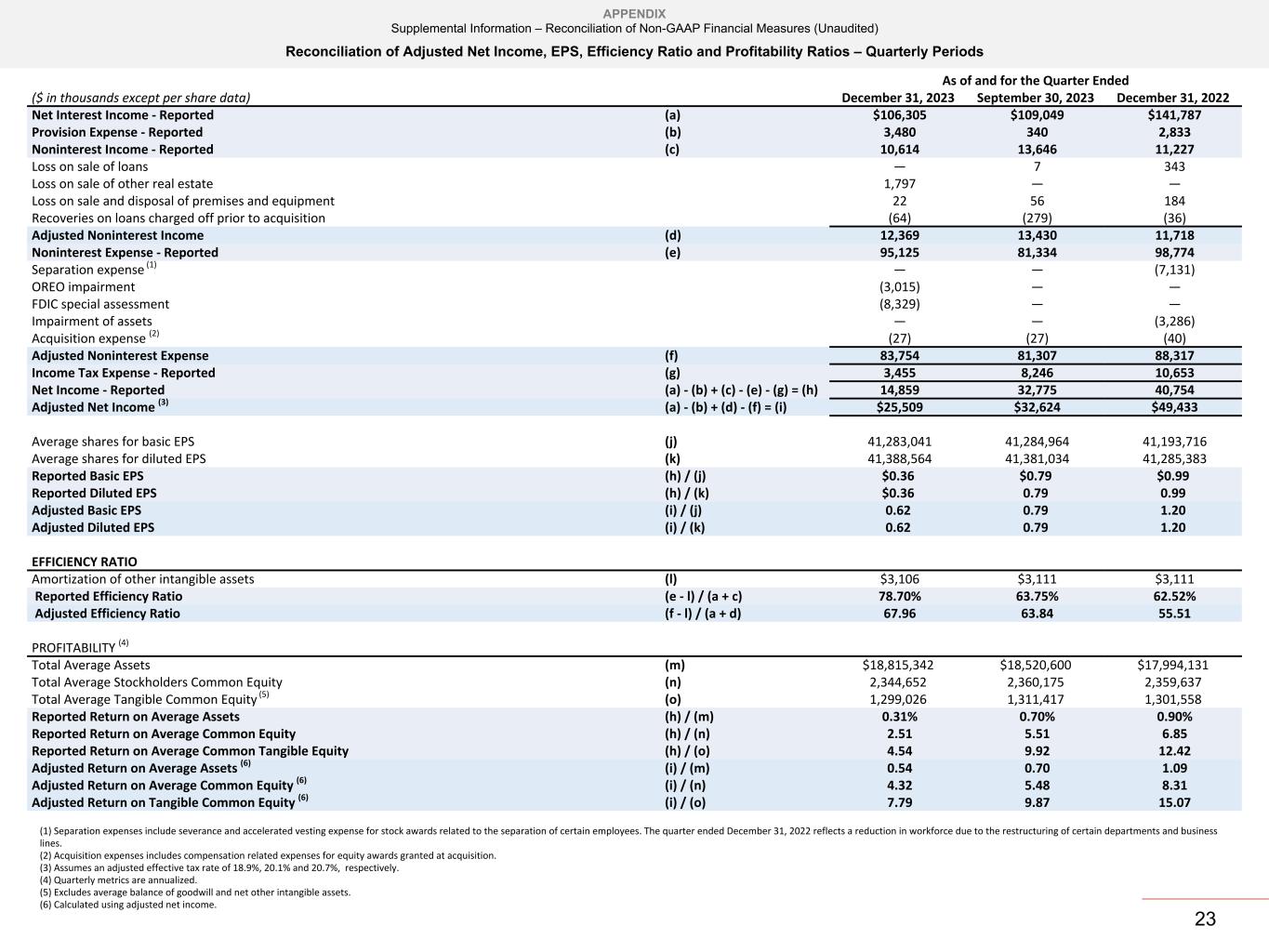

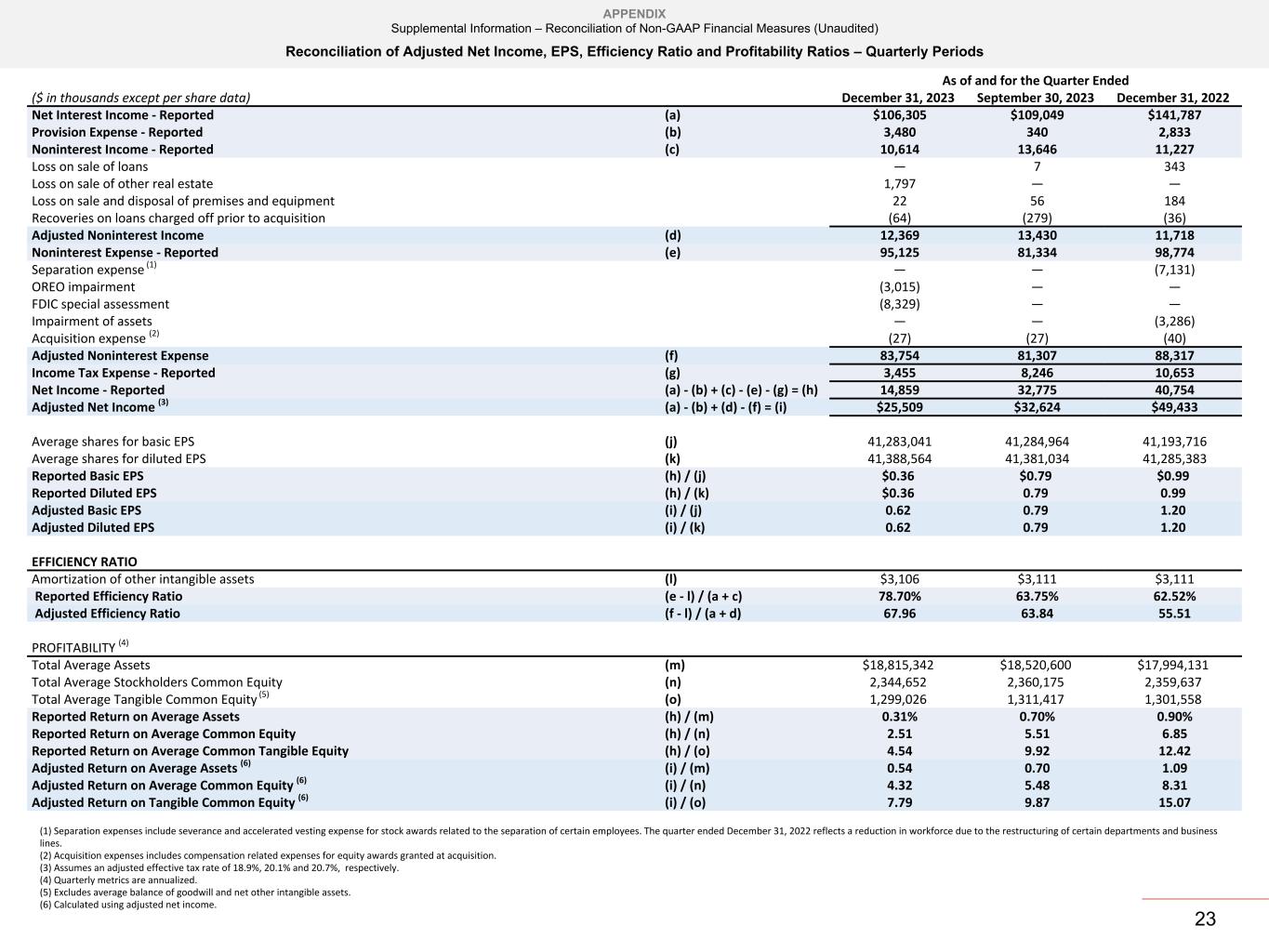

23 APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Adjusted Net Income, EPS, Efficiency Ratio and Profitability Ratios – Quarterly Periods As of and for the Quarter Ended ($ in thousands except per share data) December 31, 2023 September 30, 2023 December 31, 2022 Net Interest Income - Reported (a) $106,305 $109,049 $141,787 Provision Expense - Reported (b) 3,480 340 2,833 Noninterest Income - Reported (c) 10,614 13,646 11,227 Loss on sale of loans — 7 343 Loss on sale of other real estate 1,797 — — Loss on sale and disposal of premises and equipment 22 56 184 Recoveries on loans charged off prior to acquisition (64) (279) (36) Adjusted Noninterest Income (d) 12,369 13,430 11,718 Noninterest Expense - Reported (e) 95,125 81,334 98,774 Separation expense (1) — — (7,131) OREO impairment (3,015) — — FDIC special assessment (8,329) — — Impairment of assets — — (3,286) Acquisition expense (2) (27) (27) (40) Adjusted Noninterest Expense (f) 83,754 81,307 88,317 Income Tax Expense - Reported (g) 3,455 8,246 10,653 Net Income - Reported (a) - (b) + (c) - (e) - (g) = (h) 14,859 32,775 40,754 Adjusted Net Income (3) (a) - (b) + (d) - (f) = (i) $25,509 $32,624 $49,433 Average shares for basic EPS (j) 41,283,041 41,284,964 41,193,716 Average shares for diluted EPS (k) 41,388,564 41,381,034 41,285,383 Reported Basic EPS (h) / (j) $0.36 $0.79 $0.99 Reported Diluted EPS (h) / (k) $0.36 0.79 0.99 Adjusted Basic EPS (i) / (j) 0.62 0.79 1.20 Adjusted Diluted EPS (i) / (k) 0.62 0.79 1.20 EFFICIENCY RATIO Amortization of other intangible assets (l) $3,106 $3,111 $3,111 Reported Efficiency Ratio (e - l) / (a + c) 78.70% 63.75% 62.52% Adjusted Efficiency Ratio (f - l) / (a + d) 67.96 63.84 55.51 PROFITABILITY (4) Total Average Assets (m) $18,815,342 $18,520,600 $17,994,131 Total Average Stockholders Common Equity (n) 2,344,652 2,360,175 2,359,637 Total Average Tangible Common Equity (5) (o) 1,299,026 1,311,417 1,301,558 Reported Return on Average Assets (h) / (m) 0.31% 0.70% 0.90% Reported Return on Average Common Equity (h) / (n) 2.51 5.51 6.85 Reported Return on Average Common Tangible Equity (h) / (o) 4.54 9.92 12.42 Adjusted Return on Average Assets (6) (i) / (m) 0.54 0.70 1.09 Adjusted Return on Average Common Equity (6) (i) / (n) 4.32 5.48 8.31 Adjusted Return on Tangible Common Equity (6) (i) / (o) 7.79 9.87 15.07 (1) Separation expenses include severance and accelerated vesting expense for stock awards related to the separation of certain employees. The quarter ended December 31, 2022 reflects a reduction in workforce due to the restructuring of certain departments and business lines. (2) Acquisition expenses includes compensation related expenses for equity awards granted at acquisition. (3) Assumes an adjusted effective tax rate of 18.9%, 20.1% and 20.7%, respectively. (4) Quarterly metrics are annualized. (5) Excludes average balance of goodwill and net other intangible assets. (6) Calculated using adjusted net income.

24 APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Adjusted Net Income, EPS, Efficiency Ratio and Profitability Ratios – Annual Periods For the Year Ended December 31, ($ in thousands except per share data) 2023 2022 2021 Net Interest Income - Reported (a) $456,883 $558,208 $520,322 Provision Expense - Reported (c) 4,130 4,490 (9,000) Noninterest Income - Reported (d) 51,109 51,466 66,517 Loss (gain) on sale of loans 14 1,844 (56) Loss (gain) on sale of other real estate 1,797 — (63) Gain on sale of securities available for sale — — (13) (Gain) loss on sale and disposal of premises and equipment (323) 494 304 Recoveries on loans charged off prior to acquisition (473) (192) (381) Adjusted Noninterest Income (e) 52,124 53,612 66,308 Noninterest Expense - Reported (f) 451,544 358,889 313,606 Separation expense (1) — (11,046) — Litigation Settlement (102,500) — — Economic development employee incentive grant — 1,000 — OREO impairment (5,215) — — FDIC special assessment (8,329) — Impairment of assets (955) (4,442) (124) COVID-19 expense (2) — — (614) Acquisition expense (3) (107) (300) (900) Adjusted Noninterest Expense (g) 334,438 344,101 311,968 Income Tax Expense - Reported (h) 9,117 50,004 57,483 Net Income - Reported (a) - (c) + (d) - (f) - (h) = (i) 43,201 196,291 224,750 Adjusted Net Income (4) (b) - (c) + (e) - (g) = (j) $135,942 $209,747 $225,893 Average shares for basic EPS (k) 41,268,134 41,710,829 43,070,452 Average shares for diluted EPS (l) 41,362,543 41,794,088 43,129,237 Reported Basic EPS (i) / (k) $1.05 $4.71 $5.22 Reported Diluted EPS (i) / (l) 1.04 4.70 5.21 Adjusted Basic EPS (j) / (k) 3.29 5.03 5.24 Adjusted Diluted EPS (j) / (l) 3.29 5.02 5.24 EFFICIENCY RATIO Amortization of other intangible assets (m) $12,439 $12,491 $12,580 Reported Efficiency Ratio (f - m) / (a + d) 86.44% 56.82% 51.30% Adjusted Efficiency Ratio (g - m) / (b + e) 63.26 54.20 51.04 PROFITABILITY Total Average Assets (n) $18,555,748 $18,009,090 $18,558,168 Total Average Stockholders Common Equity (o) 2,361,267 2,442,315 2,536,658 Total Average Tangible Common Equity (5) (p) 1,311,000 1,379,603 1,461,400 Reported Return on Average Assets (i) / (n) 0.23% 1.09% 1.21% Reported Return on Average Common Equity (i) / (o) 1.83 8.04 8.86 Reported Return on Average Common Tangible Equity (i) / (p) 3.30 14.23 15.38 Adjusted Return on Average Assets (6) (j) / (n) 0.73 1.16 1.22 Adjusted Return on Average Common Equity (6) (j) / (o) 5.76 8.59 8.91 Adjusted Return on Tangible Common Equity (6) (j) / (p) 10.37 15.20 15.46 (1) Separation expenses include severance and accelerated vesting expense for stock awards related to the separation of certain employees. The year ended December 31, 2022 reflects a reduction in workforce due to the restructuring of certain departments and business lines, payments made due to the separation of executive officers and payments made related to the dissolution of a Company department. (2) COVID-19 expense includes expenses for COVID testing kits, vaccination incentive bonuses, and personal protection and cleaning supplies. (3) Acquisition expenses includes compensation related expenses for equity awards granted at acquisition. (4) Assumes an adjusted effective tax rate of 20.2%, 20.3% and 20.4%, respectively. (5) Excludes average balance of goodwill and net other intangible assets and preferred stock. (6) Calculated using adjusted net income.

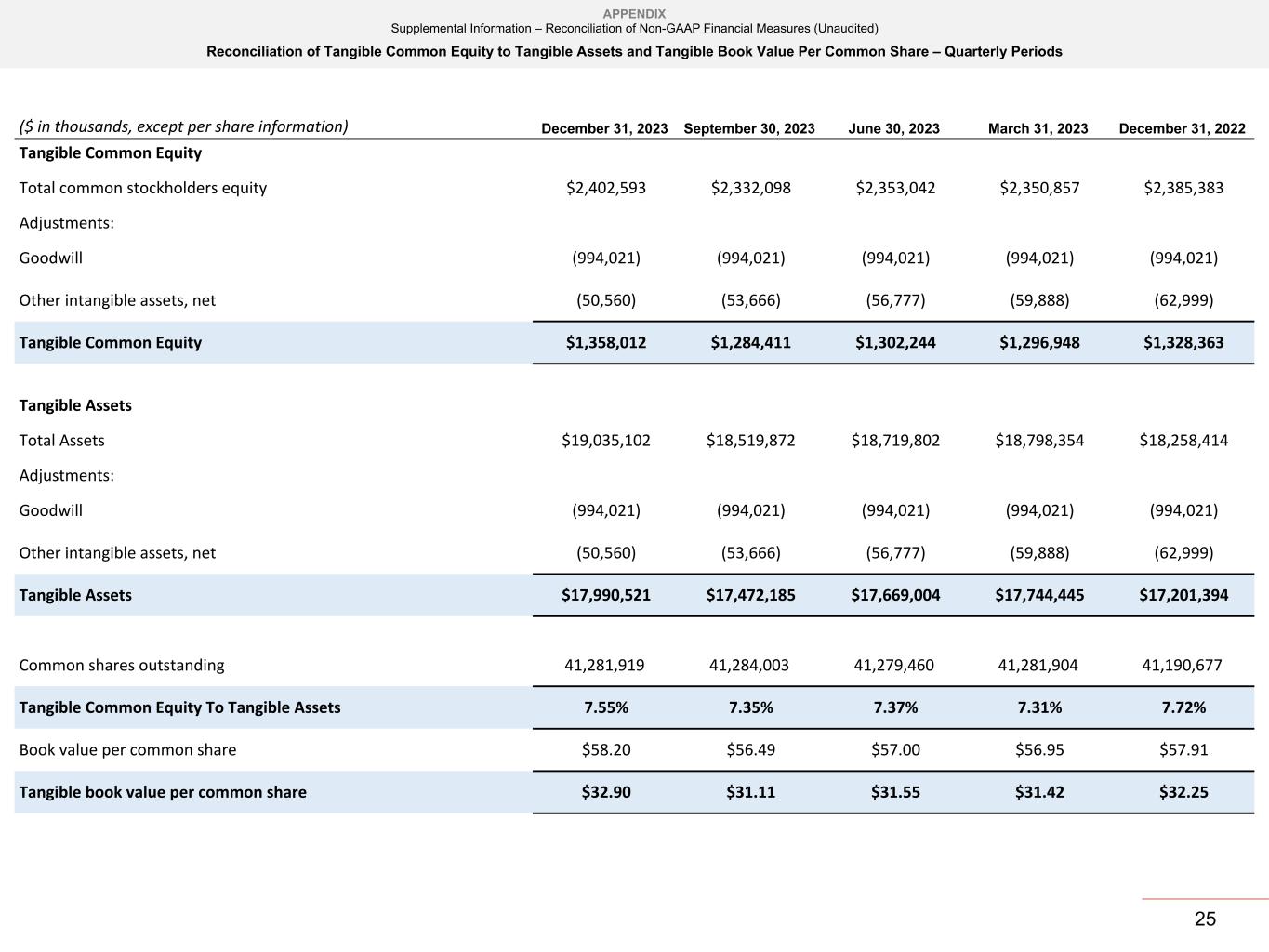

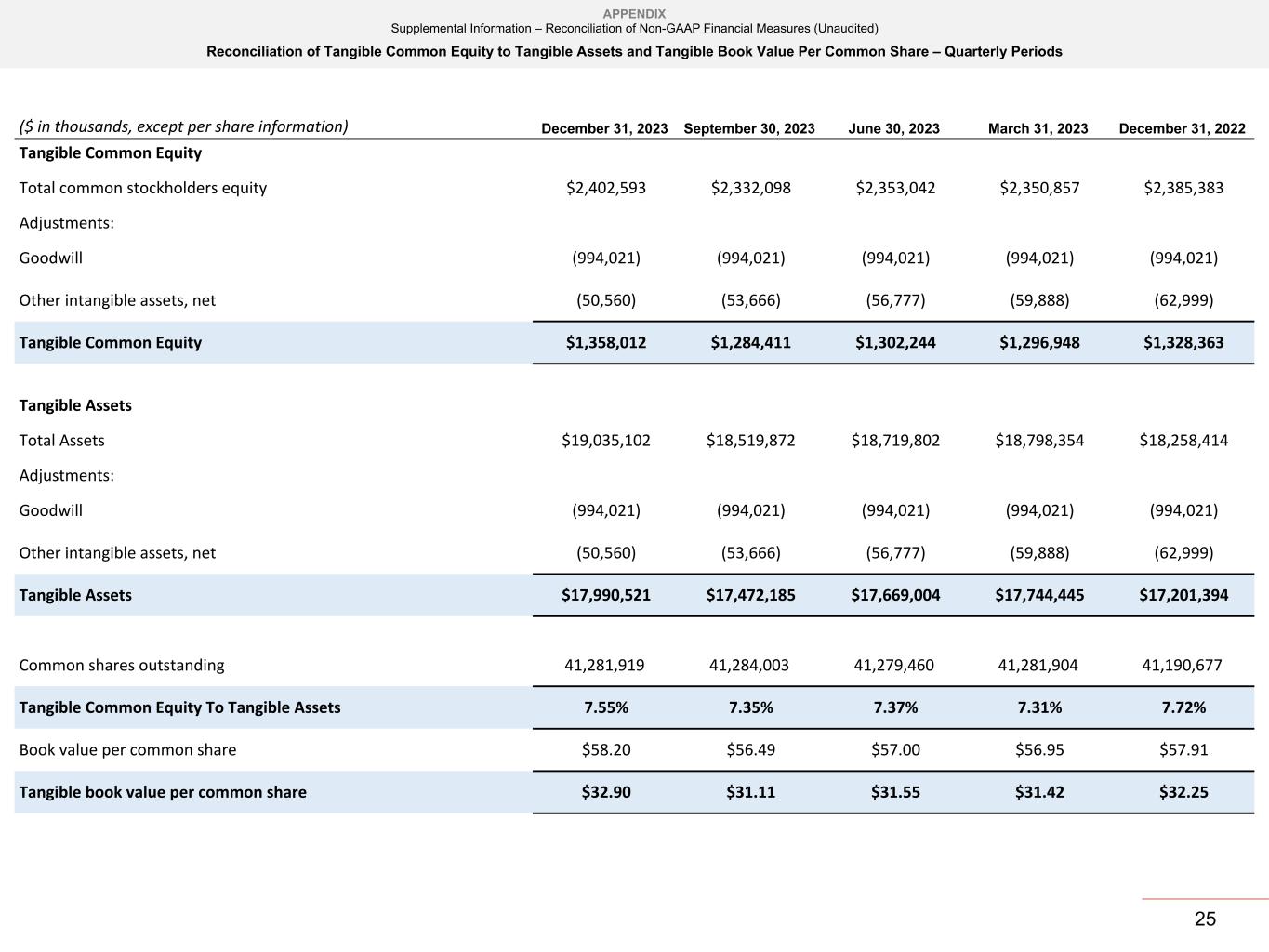

25 APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Tangible Common Equity to Tangible Assets and Tangible Book Value Per Common Share – Quarterly Periods ($ in thousands, except per share information) December 31, 2023 September 30, 2023 June 30, 2023 March 31, 2023 December 31, 2022 Tangible Common Equity Total common stockholders equity $2,402,593 $2,332,098 $2,353,042 $2,350,857 $2,385,383 Adjustments: Goodwill (994,021) (994,021) (994,021) (994,021) (994,021) Other intangible assets, net (50,560) (53,666) (56,777) (59,888) (62,999) Tangible Common Equity $1,358,012 $1,284,411 $1,302,244 $1,296,948 $1,328,363 Tangible Assets Total Assets $19,035,102 $18,519,872 $18,719,802 $18,798,354 $18,258,414 Adjustments: Goodwill (994,021) (994,021) (994,021) (994,021) (994,021) Other intangible assets, net (50,560) (53,666) (56,777) (59,888) (62,999) Tangible Assets $17,990,521 $17,472,185 $17,669,004 $17,744,445 $17,201,394 Common shares outstanding 41,281,919 41,284,003 41,279,460 41,281,904 41,190,677 Tangible Common Equity To Tangible Assets 7.55% 7.35% 7.37% 7.31% 7.72% Book value per common share $58.20 $56.49 $57.00 $56.95 $57.91 Tangible book value per common share $32.90 $31.11 $31.55 $31.42 $32.25

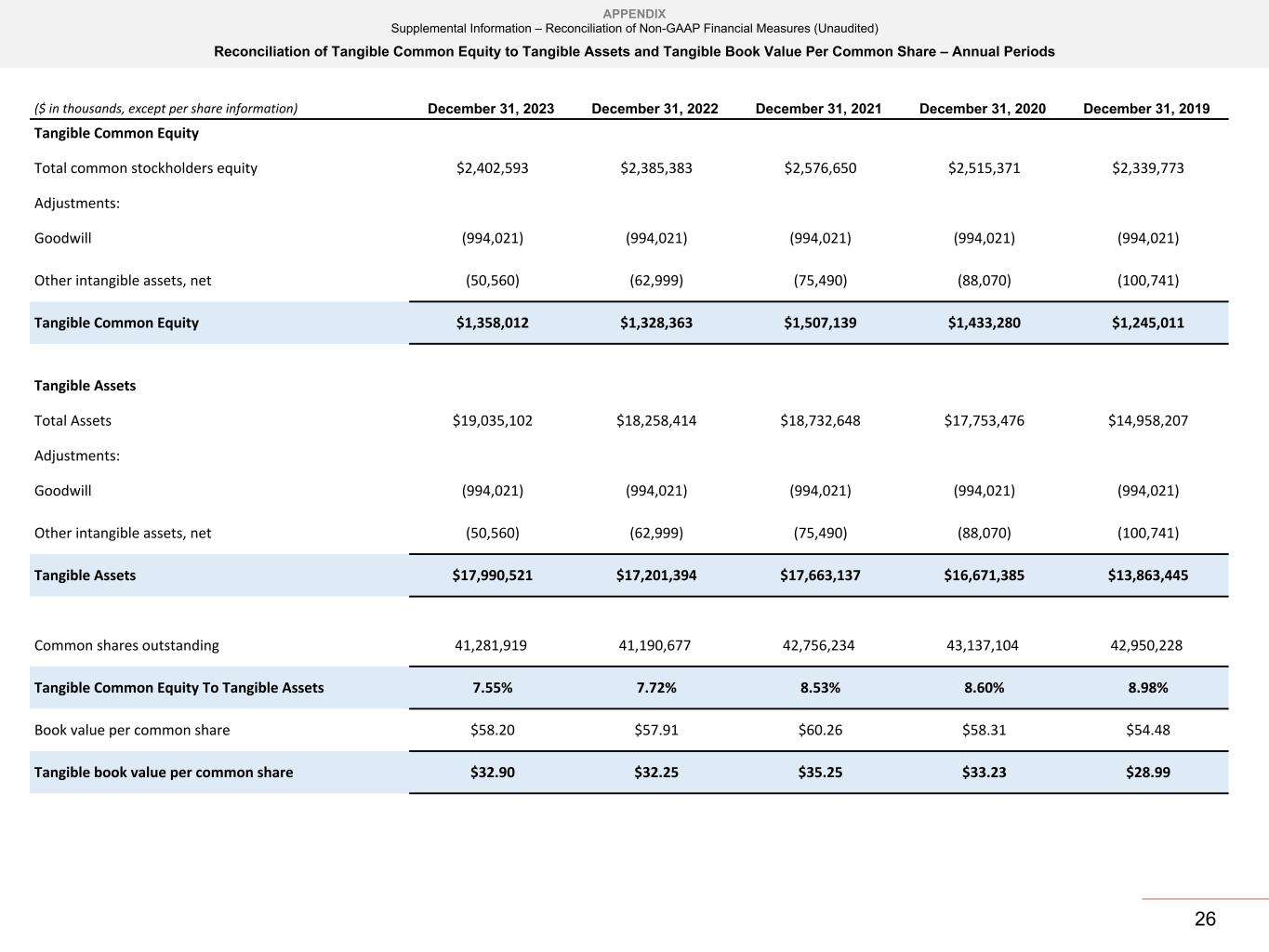

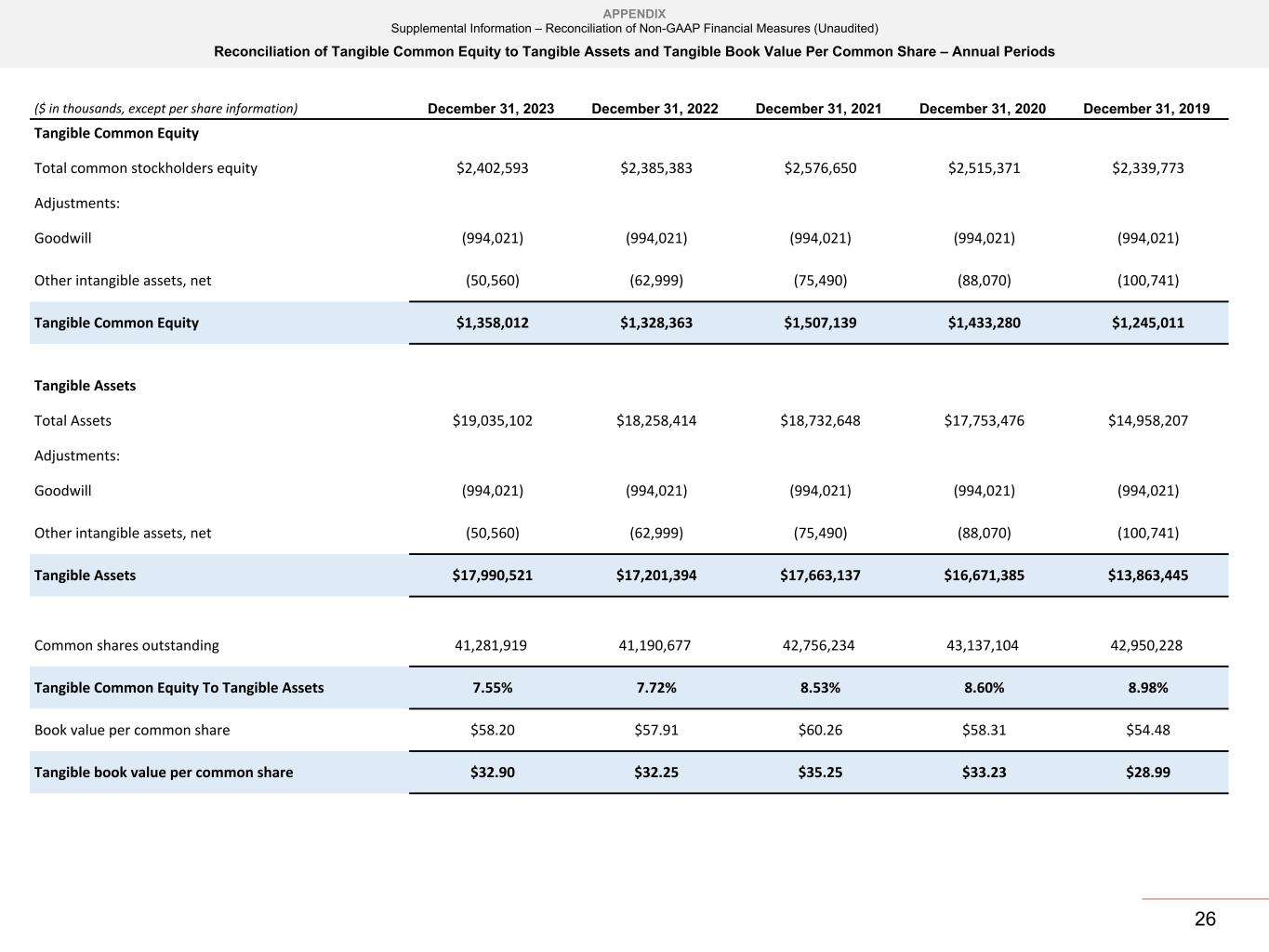

26 APPENDIX Supplemental Information – Reconciliation of Non-GAAP Financial Measures (Unaudited) Reconciliation of Tangible Common Equity to Tangible Assets and Tangible Book Value Per Common Share – Annual Periods ($ in thousands, except per share information) December 31, 2023 December 31, 2022 December 31, 2021 December 31, 2020 December 31, 2019 Tangible Common Equity Total common stockholders equity $2,402,593 $2,385,383 $2,576,650 $2,515,371 $2,339,773 Adjustments: Goodwill (994,021) (994,021) (994,021) (994,021) (994,021) Other intangible assets, net (50,560) (62,999) (75,490) (88,070) (100,741) Tangible Common Equity $1,358,012 $1,328,363 $1,507,139 $1,433,280 $1,245,011 Tangible Assets Total Assets $19,035,102 $18,258,414 $18,732,648 $17,753,476 $14,958,207 Adjustments: Goodwill (994,021) (994,021) (994,021) (994,021) (994,021) Other intangible assets, net (50,560) (62,999) (75,490) (88,070) (100,741) Tangible Assets $17,990,521 $17,201,394 $17,663,137 $16,671,385 $13,863,445 Common shares outstanding 41,281,919 41,190,677 42,756,234 43,137,104 42,950,228 Tangible Common Equity To Tangible Assets 7.55% 7.72% 8.53% 8.60% 8.98% Book value per common share $58.20 $57.91 $60.26 $58.31 $54.48 Tangible book value per common share $32.90 $32.25 $35.25 $33.23 $28.99