[•], 2024

Dear Fellow Stockholders,

On behalf of your Board of Directors, we want to thank you for your investment in News Corp.

Fiscal 2024 was another outstanding year for our Company. Even in the face of headwinds and disruption in the industry, News Corp has continued to thrive and transform into a global media and information services company, underpinned by an increasingly diversified and balanced revenue mix, a commitment to digital expansion, a strategic international focus, and the creation and distribution of premium content.

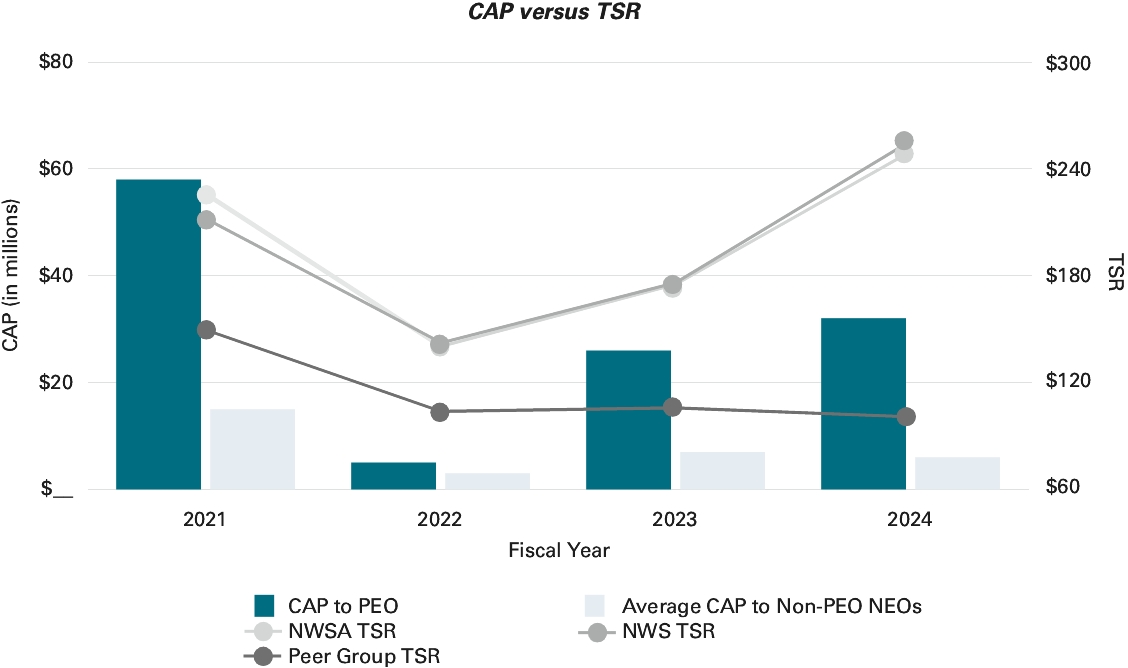

News Corp delivered higher revenues and robust earnings growth and created substantial shareholder value in fiscal 2024, our second-most profitable year on record. For the second consecutive year, digital revenues continued to account for over half of total revenues, in a trend we expect to continue. Overall, total digital subscriptions have more than doubled since 2020.

News Corp’s shares have reflected this strong sustained performance, gaining over 40% in fiscal 2024 and appreciating over 100% since fiscal 2019. In fact, over the last five years, News Corp’s stock price outperformed both the S&P 500 and its designated peer group.

Looking at specific business unit performance, Dow Jones delivered the strongest financials since the acquisition, led by its surging B2B business, which accounted for more than half of segment profitability. REA Group posted exceptional results with revenues rising 19% compared to the prior year. Book Publishing was a significant driver of growth, with segment EBITDA up 61% from the prior year, benefiting from improved consumer demand and higher digital revenues. Paying streaming subscribers at Foxtel Group reached 3.2 million, up 5% year-on-year, with Kayo Sports and BINGE achieving record highs.

The Company also took significant steps to prepare for and prosper in the future. Among those steps is a landmark multi-year agreement with OpenAI as well as an extension of our existing partnership with Google on content licensing. Additionally, we continued to ensure robust free cash flow generation and a strong balance sheet to support both reinvestment and stockholder returns moving forward. We are confident in the Company’s long-term prospects as we enter fiscal 2025 from a position of strength.

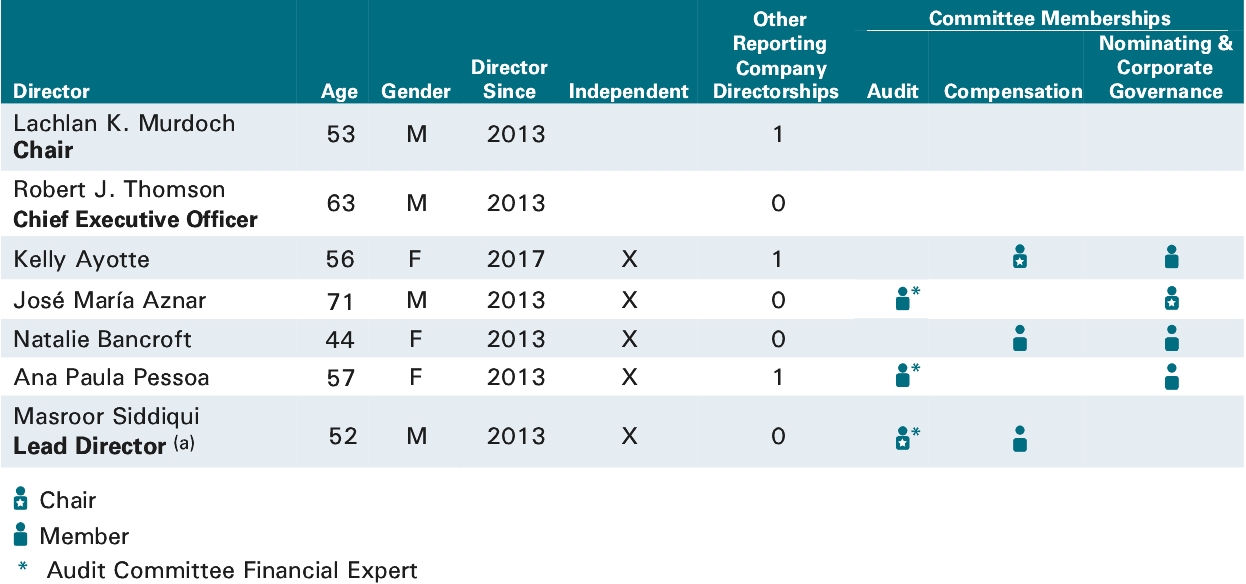

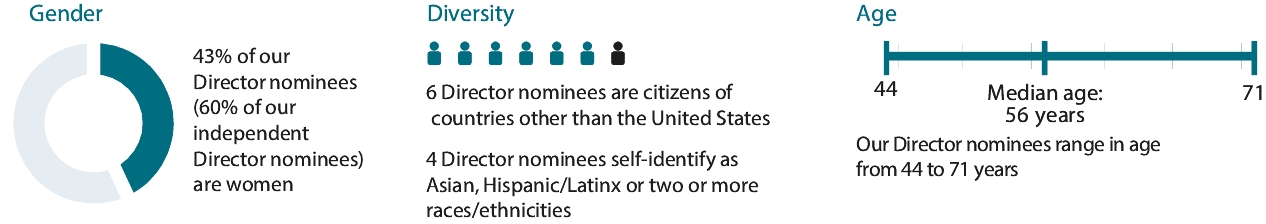

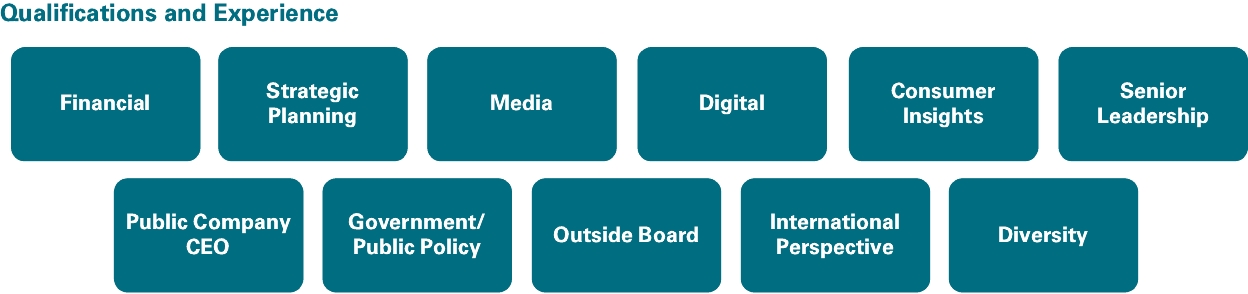

News Corp’s Board of Directors and senior management are dedicated to sustaining these results. Your Board is composed of an engaged, energetic and dynamic group of leaders, whose skillsets are closely aligned with the key drivers of our business, including in-depth knowledge of the media industry, digital expertise, publishing experience, strategic leadership, international perspective and public policy knowledge.

Additionally, your Board remains committed to effective independent oversight of the Company as it continues to drive News Corp’s digital transformation. To this end, the Board has instituted numerous corporate governance best practices, including an annually elected Board, majority voting, a strong independent Lead Director, and key standing Board Committees comprised solely of independent directors.

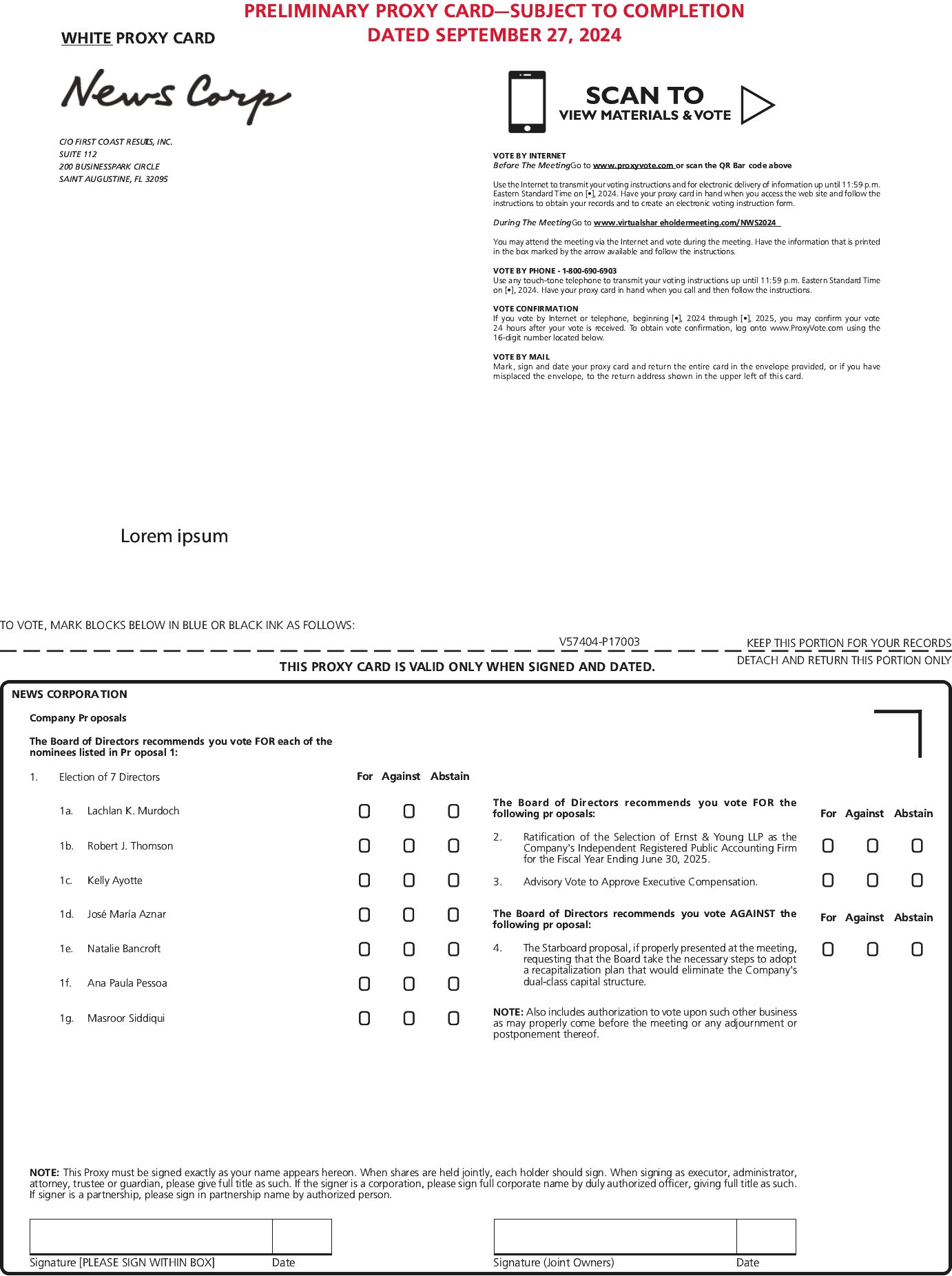

Your vote is especially important at this year’s Annual Meeting. As you may have seen, Starboard Value and Opportunity Master Fund Ltd (“Starboard”) has announced its intent to submit for consideration at the Annual Meeting a nonbinding proposal requesting that the Board take the necessary steps to adopt a recapitalization plan that would eliminate the Company’s dual-class capital structure (the “Starboard Proposal”).

Your Board does not endorse the Starboard Proposal, and believes that the Company’s dual-class capital structure, which has been in place since the Company’s inception and is prevalent among media and technology companies, has significantly enabled the Company’s long-term business strategy and facilitated the creation of value for all stockholders.

News Corp’s Board of Directors unanimously recommends that you vote “Against” the Starboard Proposal, “For” the nominees proposed by the Board of Directors and named in this proxy statement, and “For” the other proposals recommended by your Board, using the WHITE proxy card.