Q1’ 14 Results Earnings Call 11 - 7 - 13

© 2012 WR HAMBRECHT + CO SAFE HARBOR 1 This presentation for the first quarter ended September 30 , 2013 contain forward - looking statements within the meaning of Section 27 A of the Securities Act of 1933 , as amended, and Section 21 E of the Exchange Act of 1934 , as amended, that are made as of the date of this press release based upon our current expectations . All statements, other than statements of historical fact, regarding our strategy, future operations, financial position, estimated revenue, projected costs, prospects, plans, opportunities, and objectives constitute “forward - looking statements . ” The words “may,” “will,” “expect,” “intend,” “plan,” “anticipate,” “believe,” “estimate,” “potential” or “continue” and similar types of expressions identify such statements, although not all forward - looking statements contain these identifying words . Such forward - looking statements include expectations regarding revenue, income, expenses, and other guidance for fiscal 2014 , ended June 30 , 2014 and any future periods . These forward - looking statements involve known and unknown risks, uncertainties and other factors that may cause the actual results to differ materially from any future results, performance or achievements expressed or implied by such forward - looking statements . Important factors that could cause such differences include, but are not limited to, a reduction in the supply of grapes and bulk wine available to us ; significant competition ; any change in our relationships with retailers could harm our business ; we may not achieve or maintain

profitability in the future ; the loss of key employees ; a reduction in our access to, or an increase in the cost of, the third - party services we use to produce our wine could harm our business ; credit facility restrictions on our current and future operations ; failure to protect, or infringement of, tra

demarks and proprietary rights ; these factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report . We undertake no obligation to publicly update or review any forward - looking statement, whether as a result of new information, future developments or otherwise . This presentation should be read in conjunction with our most recent annual report on Form 10 - K filed on September 27 , 2013 , and our other reports currently on file with the Securities and Exchange Commission, which contain more detailed discussion of risks and uncertainties that may affect future results . We do not undertake to update any forward - looking statements unless otherwise required by law .

© 2012 WR HAMBRECHT + CO PRESENTORS 2 Phillip L. Hurst Chief Executive Officer James D. Bielenberg Chief Financial Officer

© 2012 WR HAMBRECHT + CO AGENDA •

Market Overview/Company Update Phillip L. Hurst President and CEO • Financial Results James D. Bielenberg Chief Financial Officer • Questions Participants • Closing Remarks Phillip L. Hurst, President and CEO 3

© 2012 WR HAMBRECHT + CO TRUETT - HURST, INC • NASDAQ: THST • Recent price at November 6, 2013: $X.XX • 52 week range: $4.60 to $6.00 • Market Capitalization $12.50 million • Average daily trading volume 500 4

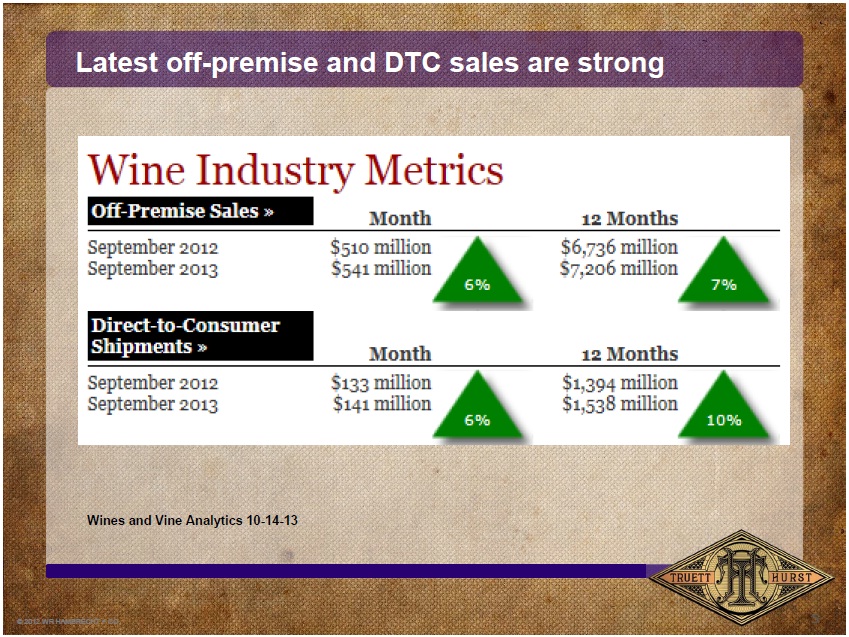

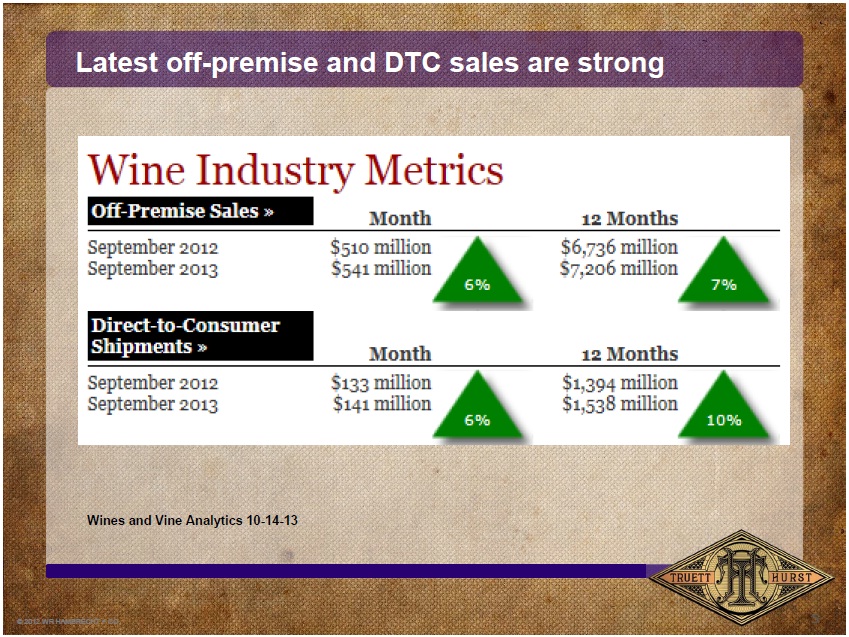

© 2012 WR HAMBRECHT + CO Latest off - premise and DTC sales are strong 5 Wines and Vine Analytics 10 - 14 - 13

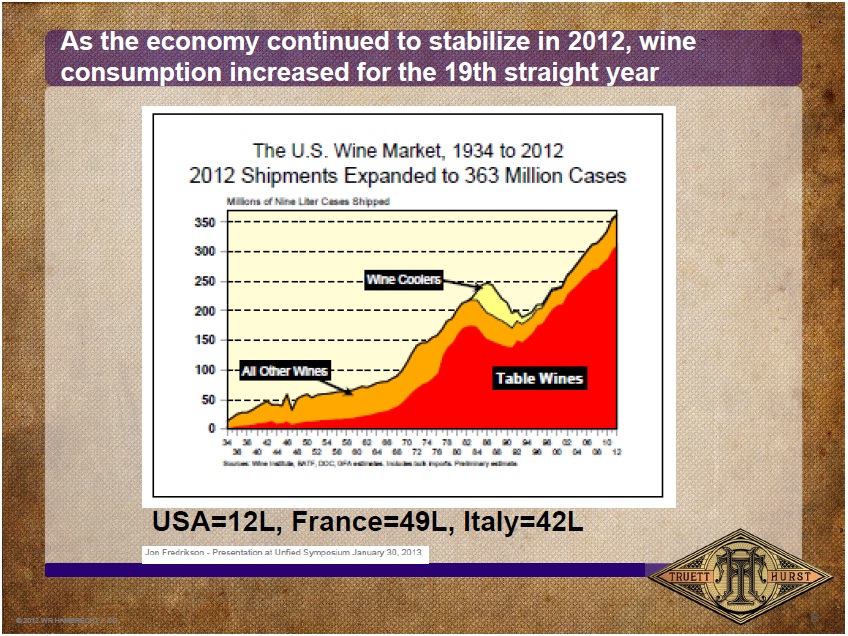

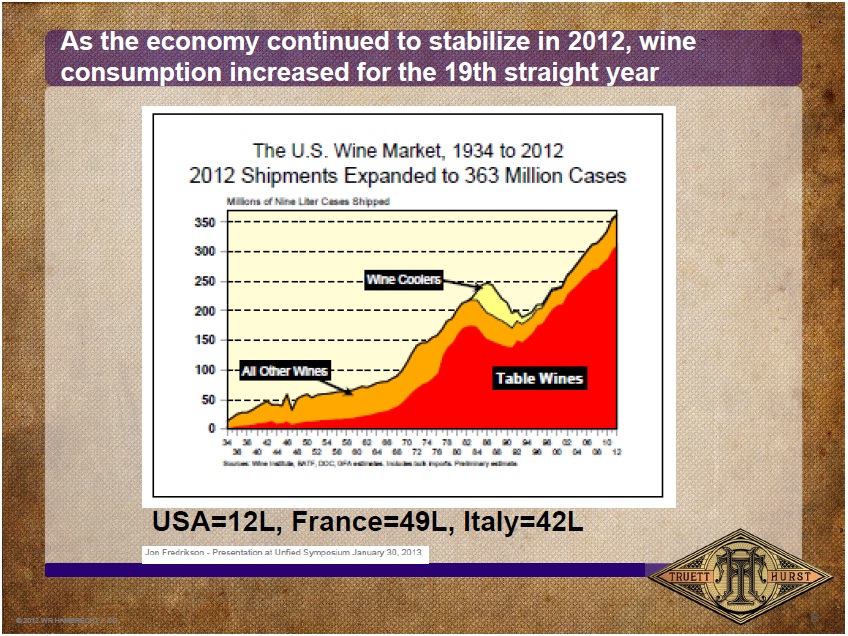

© 2012 WR HAMBRECHT + CO As the economy continued to stabilize in 2012, wine consumption increased for the 19th straight year 6 USA=12L, France=49L, Italy=42L

© 2012 WR HAMBRECHT + CO 7 Direct - to - Consumer wine shipments see further success, contributing $1.4 billion to the industry. “ What started out as a primary way for boutique wineries to get their product to the public has gotten the attention of larger wineries as well ,” says Adam Rogers, senior research analyst at The Beverage Information Group. “ These larger wineries are choosing direct shipping as wholes

alers consolidate .”

© 2012 WR HAMBRECHT + CO 8 8 Truett - Hurst, Inc : Ongoing Strategic Plan • Fast growing super - premium and ultra - premium wine company • Focused on the highest growth categories of the wine industry – Private Label, Direct To Consumer • Pioneering innovative, industry changing products • We have the team and the retailer relationships to achieve scale

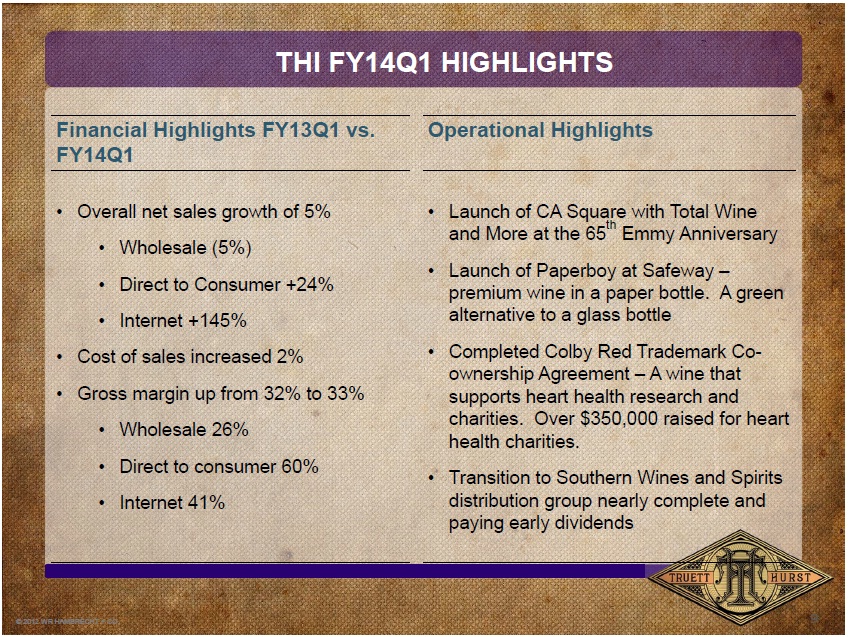

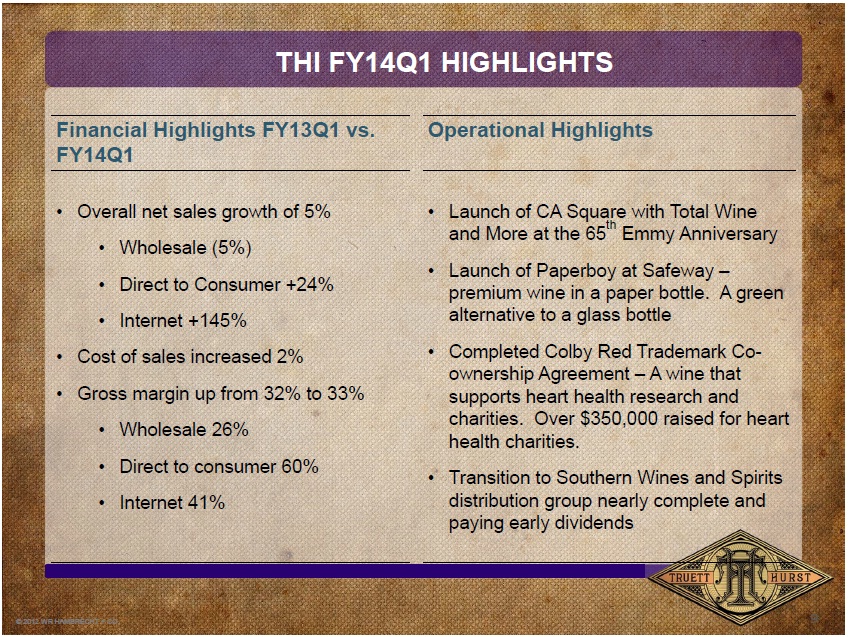

© 2012 WR HAMBRECHT + CO THI FY14Q1 HIGHLIGHTS 9 Financial Highlights FY13Q1 vs. FY14Q1 Operational Highlights • Overall net sales growth of 5% • Wholesale (5%) • Direct to Consumer +24% • Internet +145% • Cost of sales increased 2% • Gross margin up from 32% to 33% • Wholesale 26% • Direct to consumer 60% • Internet 41% • Launch of CA Square with Total Wine and More at the 65 th Emmy Anniversary •

Launch of Paperboy at Safeway – premium wine in a paper bottle. A green alternative to a glass bottle • Completed Colby Red License Agreement – A wine that supports heart health research and charities. Over $350,000 raised for heart health charities. • Transition to Southern Wines and Spirits distribution group nearly complete and paying early dividends

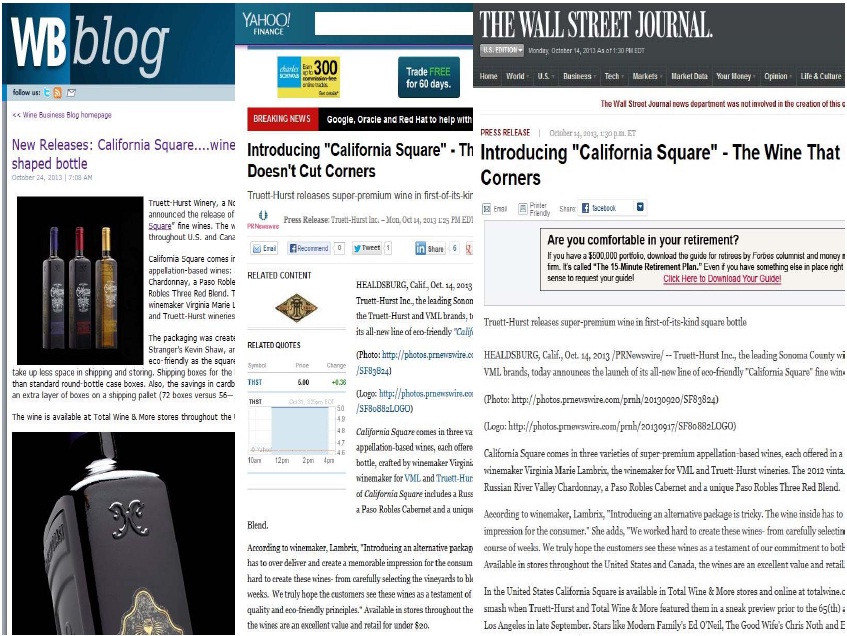

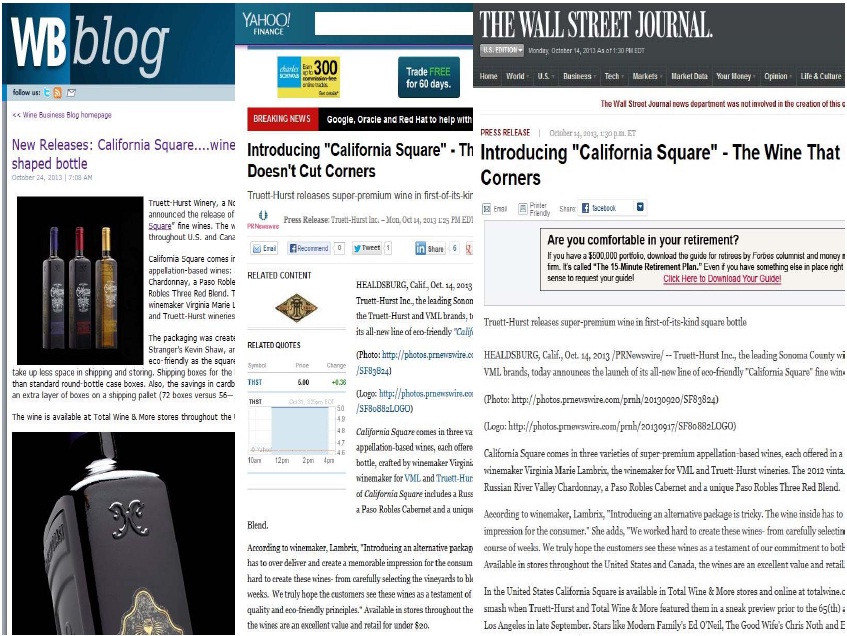

© 2012 WR HAMBRECHT + CO Revolutionary Square Bottle Launch •

Partnership with leading retailer, Total Wine and More – CA Square largest ever new wine launch • Introduction at 65 th Annual Emmy Awards • Major displays for OND in every store 10

© 2012 WR HAMBRECHT + CO Revolutionary Paper Bottle Launch – PaperBoy 11 • World’s first paper wine bottle – bag in box technology, 80% lighter than glass • Huge response from retail buyers and consumers around the US • Initial launch in Safeway stores, broad market next year

© 2012 WR HAMBRECHT + CO Focus on Profitable Growth – Colby Red Partnership 14 • A major cause marketing brand in USA • 20,000 - 30,000 cases annually • Profitable and accretive • Strategic synergies – distribution, retailers

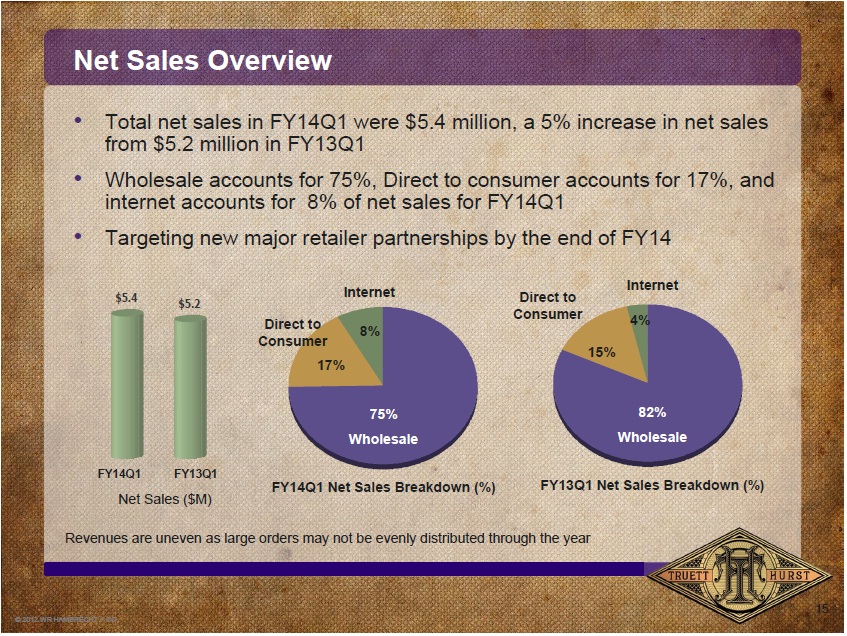

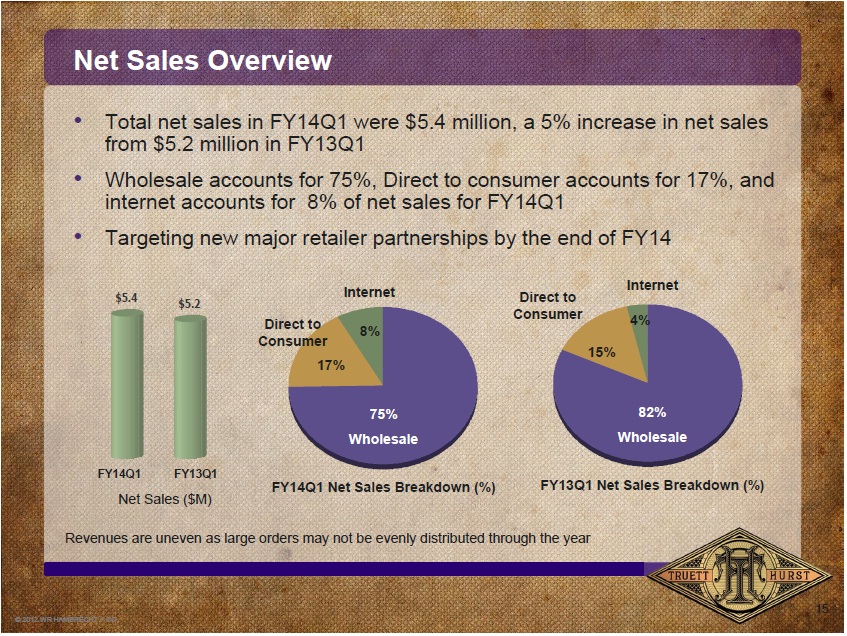

) $5.4 $5.2 FY14Q1 FY13Q1 17% 75% Wholesale Direct to Consumer 8% Internet FY14Q1 Net Sales Breakdown (%) Revenues are uneven as large orders may not be evenly distributed through the year FY13Q1 Net Sales Breakdown (%) 82% Wholesale Internet Direct to Consumer 4% 15%

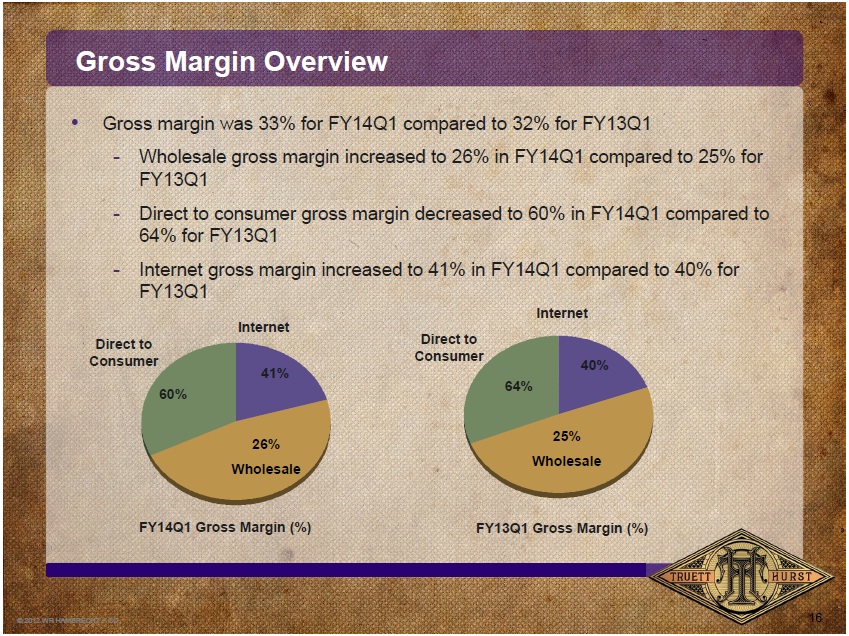

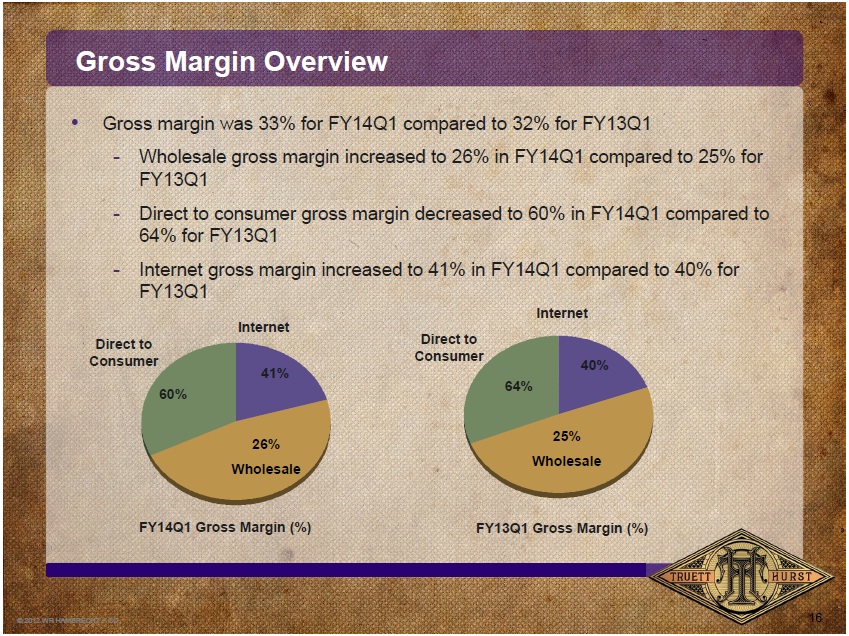

© 2012 WR HAMBRECHT + CO 16 Gross Margin Overview • Gross margin was 33% for FY14Q1 compared to 32% for FY13Q1 - Wholesale gross margin increased to 26% in FY14Q1 compared to 25% for FY13Q1 - Direct to consumer gross margin decreased to 60% in FY14Q1 compared to 64% for FY13Q1 - Internet gross margin increased to 41% in FY14Q1 compared to 40% for FY13Q1 60% 26% Wholesale 41% Internet FY14Q1 Gross Margin (%) Direct to Consumer FY13Q1 Gross Margin (%) Direct to Consumer Internet 25% Wholesale 40% 64%

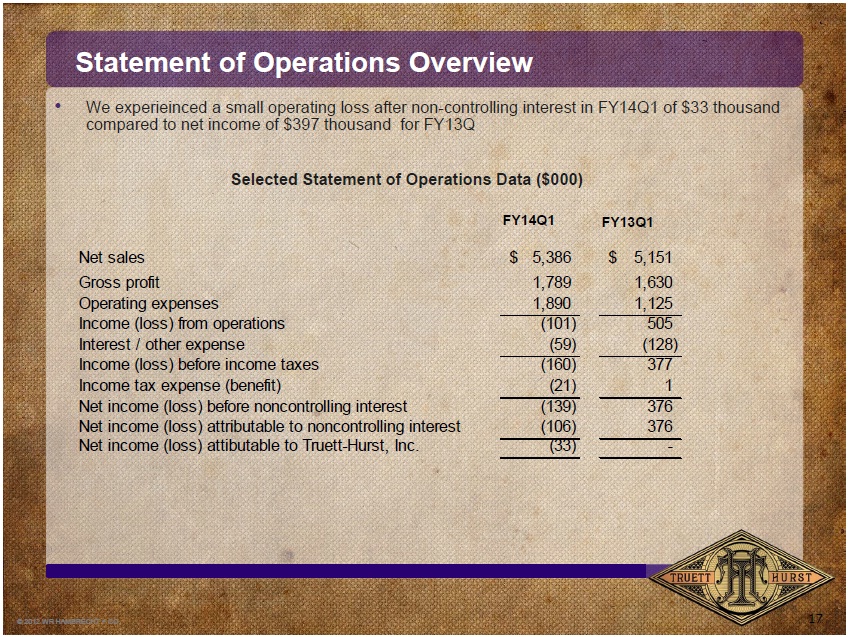

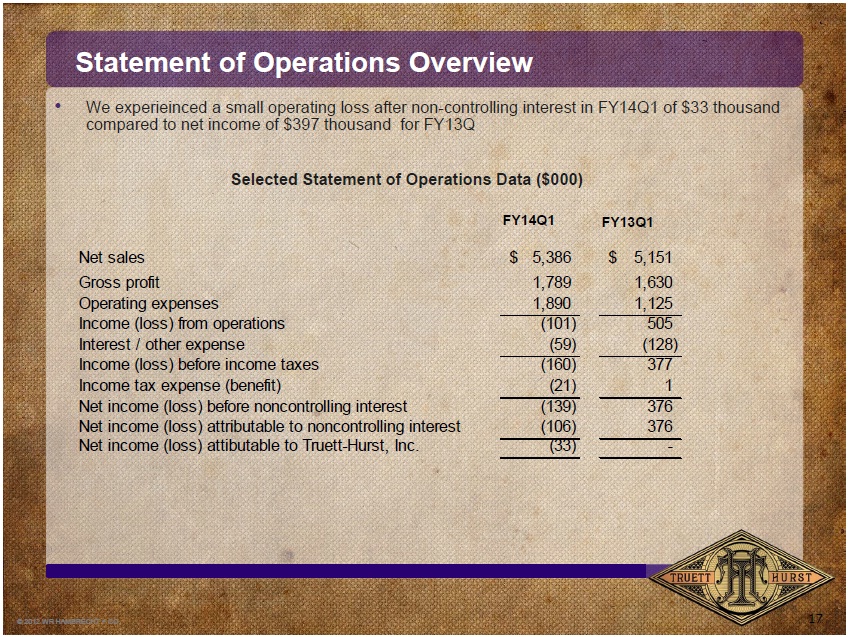

© 2012 WR HAMBRECHT + CO 17 Statement of Operations Overview • We achieved a small operating loss after non - controlling interest in FY14Q1 of $33 thousand compared to net income of $397 thousand for FY13Q Selected Statement of Operations Data ($000) Net sales 5,386$ 5,151$ Gross profit 1,789 1,630 Operating expenses 1,890 1,125 Income (loss) from operations (101) 505 Interest / other expense (59) (128) Incom

e (loss) before income taxes (160) 377 Income tax expense (benefit) (21) 1 Net income (loss) before noncontrolling interest (139) 376 Net income (loss) attributable to noncontrolling interest (106) 376 Net income (loss) attibutable to Truett-Hurst, Inc. (33) - FY13Q1 FY14Q1

© 2012 WR HAMBRECHT + CO 18 NET LOSS PER SHARE OVERVIEW FY14Q1 1 GAAP Net income (loss) $(33) GAAP EPS $(0.01) GAAP Shares Outstanding (basic) 2,700,000 GAAP Net Sales $(33) 2 Non - GAAP EPS $(0.00) 3 Non - GAAP Shares Outstanding (fully diluted) 7,054,644 1. Truett - Hurst, Inc. became a public company on June 26, 2013. EPS is not applicable for the first quarter fiscal 2013 2. Non - GAAP (fully diluted) shares ou

tstanding includes outstanding common shares, convertible LLC units and unvested restricted stock units as of September 30, 2013. (in thousands except per share and share data)

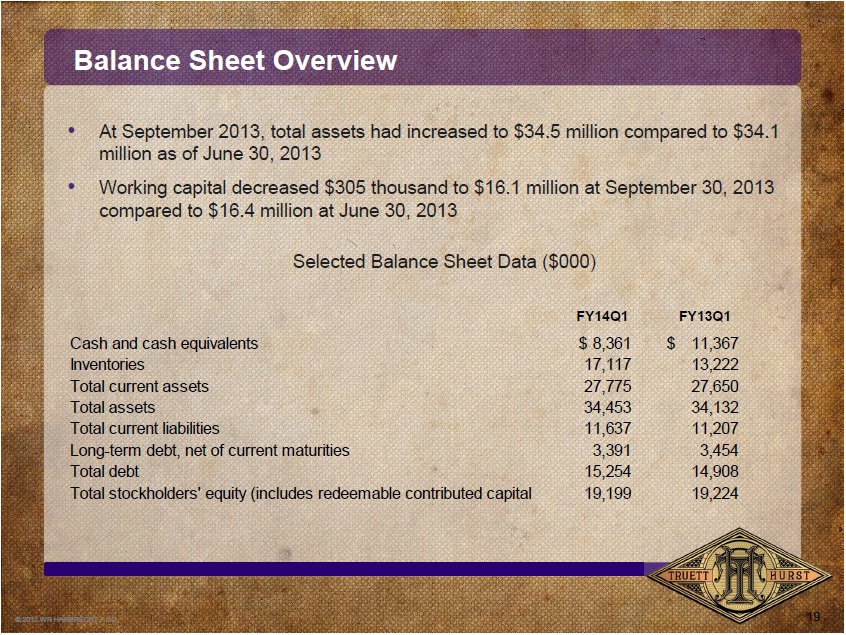

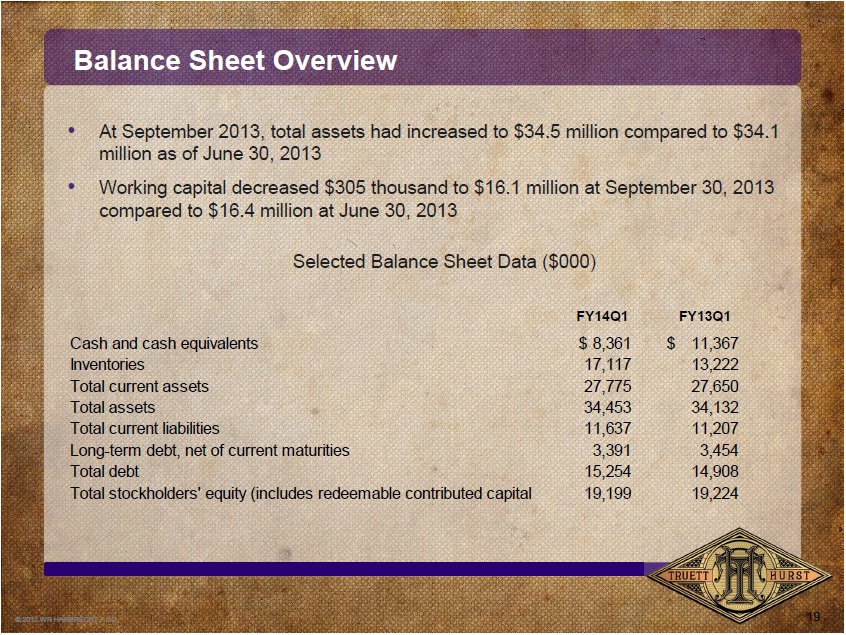

© 2012 WR HAMBRECHT + CO 19 Balance Sheet Overview • At September 2013, total assets had increased to $34.5 million compared to 34.1 million as of June 30, 2013 • Working capital decreased $305 thousand to 16.1 million at September 30, 2013 compared to $16.4 million at June 30, 2013 Selected Balance Sheet Data ($000) FY13Q1 FY14Q1 Cash and cash equivalents 8,361$ 11,367$ Inventories 17,117 13,222 Total current

assets 27,775 27,650 Total assets 34,453 34,132 Total current liabilities 11,637 11,207 Long-term debt, net of current maturities 3,391 3,454 Total debt 15,254 14,908 Total stockholders' equity (includes redeemable contributed capital 19,199 19,224

© 2012 WR HAMBRECHT + CO THANK YOU! • On behalf of our extremely hardworking team at Truett - Hurst Inc. I would like to thank you all for your ongoing support • FY14 is shaping up well and will be the foundation for our future growth based on the launch of several exciting new projects • But we’re not done! We are continuing to work with our partners, namely Kevin Shaw our designer, to push ourselves to bring mor

e innovation to the wine industry – #1 in strategic objectives for most large retailers today 20

November 7, 2013 Q&A

© 2012 WR HAMBRECHT + CO 22 CONFERENCE CALL PLAYBACK INFORMATION Transcript, when available, at www.truetthurstinc.com Webcast/PowerPoint / Replay available at: www.truetthurstinc.com/investors Transcript available until November 21, 2013.