Truett - Hurst, Inc. FY14Q3 Earnings Call May 7, 2014 NASDAQ - THST 1

Safe Harbor Statement This presentation (including the presentation and any subsequent questions and answers) contains statements that are forward - looking within the meaning of Section 27 A of the Securities Act of 1933 and Section 21 E of the Securities Exchange Act of 1934 . Such forward - looking statements are only predictions and are not guarantees of future performance . Any such forward - looking statements are and will be, as the case may be, subject to many risks, uncertainties, certain assumptions and factors relating to the operations and business environments of Truett - Hurst, Inc . and its subsidiaries that may cause the actual results of the companies to be materially different from any future results expressed or implied in such forward - looking statements . These risk factors, include, but are not limited to, a reduction in the supply of grapes and bulk wine available to us ; significant competition ; any change in our relationships with retailers could harm our business ; we may not achieve or maintain profitability in the future ; the loss of key employees ; a reduction in our access to, or an increase in the cost of, the third - party services we use to produce our wine could harm our business ; credit facility restrictions on our current and future operations ; failure to protect, or infringement of, trademarks and proprietary rights ; these factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this report or detailed in the Company’s periodic filings (including Forms 8 - K, 10 - K and 10 - Q) or other documents filed with the Securities and Exchange Commission . For more detailed information on the Company, please refer to the Company filings with the Securities and Exchange Commission, which are readily available at http : //www . sec . gov, or through the Company’s Investor Relations website at http : //www . truetthurstinc . com . This presentation is intended to be viewed in conjunction with the Truett - Hurst, Inc . third quarter 2014 earnings call . The Company undertakes no obligation to publicly update any forward - looking statement, whether as a result of new information, future events or otherwise . 2

FY14Q3 & YTD Earnings Call Agenda Wine Industry & Business Phillip L. Hurst Overview President and CEO Financial Highlights James D. Bielenberg Chief Financial Officer Q&A Closing Remarks Phillip L. Hurst, President and CEO 3

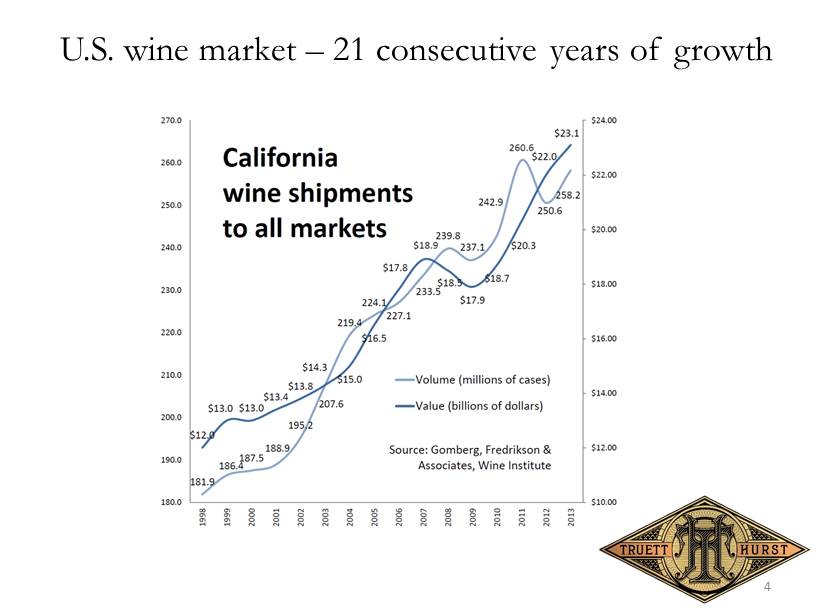

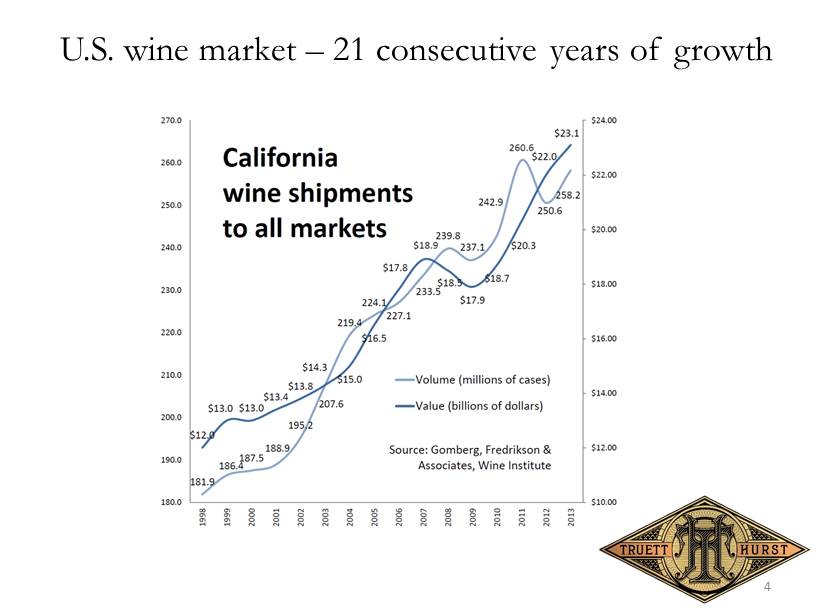

U.S. wine market – 21 consecutive years of growth 4

Wine Industry Overview* • Retail outlets increased by 62,000 locations over the last five years, up 12% to 550,000 outlets • Most popular varieties were: Chardonnay , with 20% share of sales; Cabernet Sauvignon , 13%; Merlot , 9%; red blends or sweet red wines, 9%, Pinot G rigio , 9%; followed by M oscato , 6%; White Zinfandel , 5%; Pinot Noir , 4%; and Sauvignon Blanc , 4% • U.S. wine exports, 90 percent from California, reached $1.55 billion in winery revenues in 2013, an increase of 16.4% compared with 2012 • The European Union was the top destination for U.S. wine exports, accounting for $617 million, up 31% compared to the previous year; followed by Canada, $454 million, up 12% *Source: ACNielsen 5

Continued strong growth +44% Gross margin 34% Expense leverage as a percent of net sales One time loss on deposit Retailer relationships and innovation Long - term view Truett Hurst FY14Q3 6

FY14Q3 Truett Hurst Accomplishments • Increased points of distribution (U.S./Canada) - California Square, PaperBoy and Evocative Wraps • New Retailer Exclusive Programs - 2 line extensions replacing 2 brands, 1 exclusive and VML brand - 1 line extension and 5 exclusive brands under review - 4 Exclusive brands under review with a new customer • New innovation development - One product innovation under review with a top 5 U.S. retailer and international buying group. 7

• Top selling wrapped wine in the U.S., Canada • Now selling in wrapped and unwrapped versions • Chardonnay line extension • Continued retailer promotional support Wrapped Wine: Curious Beasts 8

Bottling - June 2014 U.S. Release - July 2014 Curious Beasts Chardonnay 9

• 9 months of retailer exclusivity, now being launched into broad market: • U.S. and Canada • Finalist in Total Wine & More March Madness • Interest from large national retailers • Stylish and Eco - Friendly • Re - use options California Square 10

Napa Valley Cabernet - Rutherford Appellation Target $34.99 MSRP Bottling June, launch July 2014 Stonegate 11

Russian River Valley Pinot Noir – Single vineyard Target $39.99 MSRP Bottling in August, launch October 2014 Bewitched Reserve 12

• Ultra green • Wine for people on the go • Rolling out to national distribution – New national accounts • Customer awareness building • Outside Lands Sponsorship PaperBoy 13

THST Growing Media Attention 14

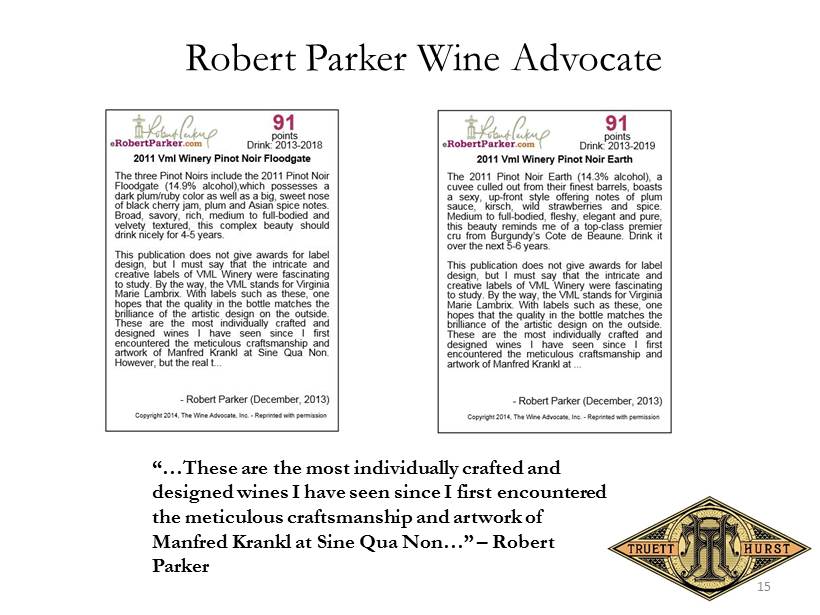

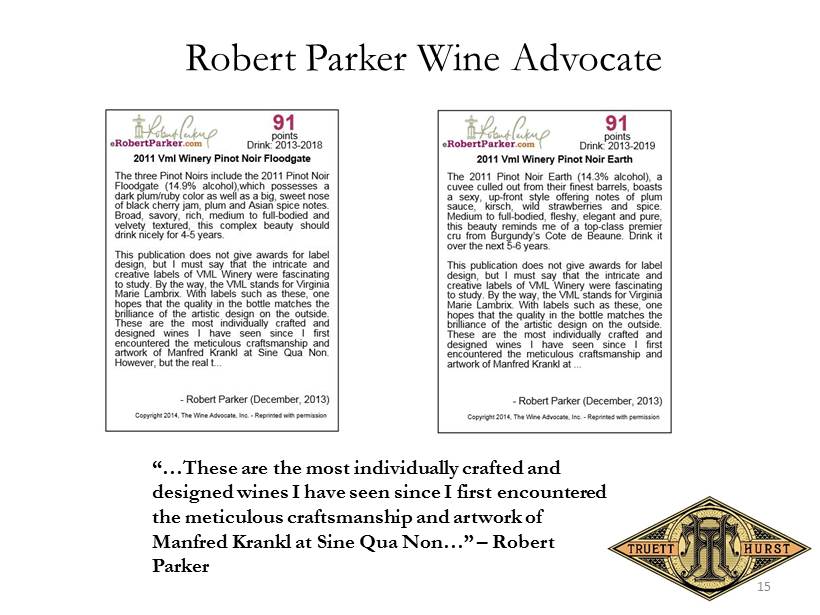

“…These are the most individually crafted and designed wines I have seen since I first encountered the meticulous craftsmanship and artwork of Manfred Krankl at Sine Qua Non…” – Robert Parker Robert Parker Wine Advocate 15

Net Sales by Channel 2,277 3,511 8,741 11,890 849 993 2,357 3,012 448 656 1,037 1,640 $- $2,000 $4,000 $6,000 $8,000 $10,000 $12,000 $14,000 $16,000 $18,000 Q3 FY13 Q3 FY14 FY13 YTD FY14 YTD Wholesale DTC Internet ----------------- Q3 ------------------ ----------------- YTD ------------------ $3,574 $12,135 $5,160 $16,542 Sales growth ($000) 16

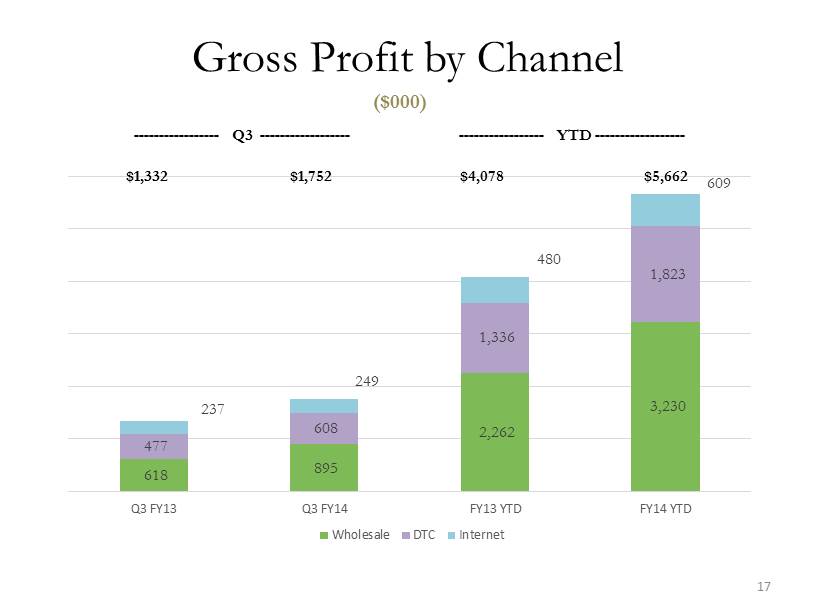

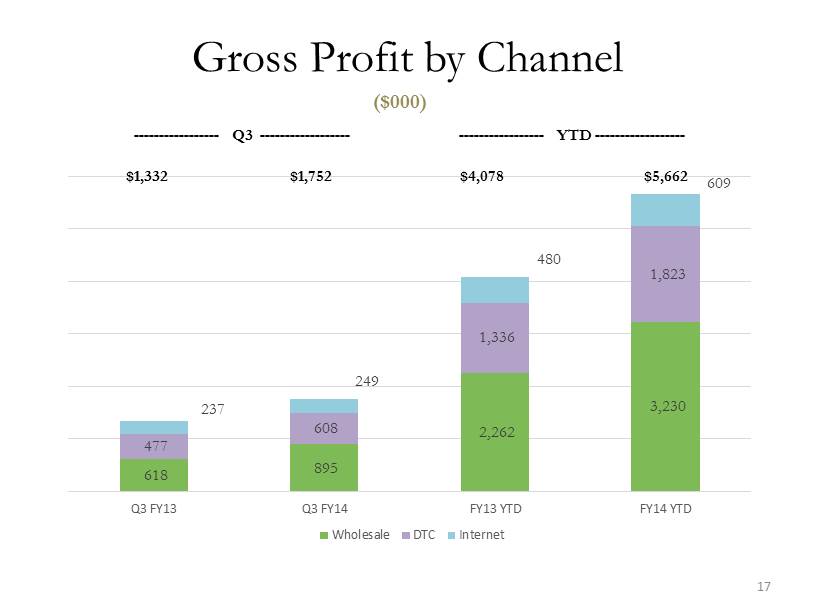

Gross Profit by Channel 618 895 2,262 3,230 477 608 1,336 1,823 237 249 480 609 Q3 FY13 Q3 FY14 FY13 YTD FY14 YTD Wholesale DTC Internet ----------------- Q3 ------------------ ----------------- YTD ------------------ $1,332 $1,752 $4,078 $5,662 ($000) 17

Sales and Marketing Expense 28.1% 24.3% 21.9% 21.7% Q3 FY13 Q3 FY14 FY13 YTD FY14 YTD ----------------- YTD ------------------ ----------------- Q3 ------------------ % of Net Sales 18

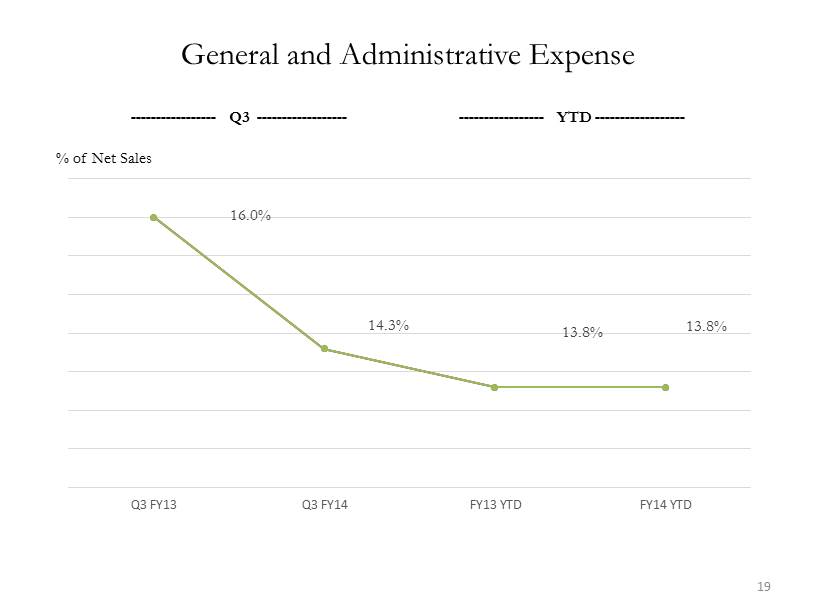

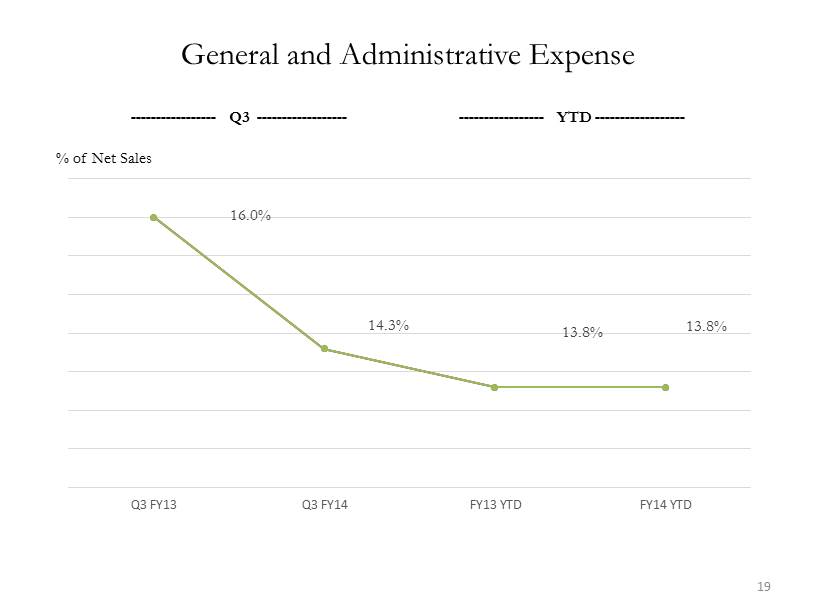

General and Administrative Expense 16.0% 14.3% 13.8% 13.8% Q3 FY13 Q3 FY14 FY13 YTD FY14 YTD ----------------- Q3 ------------------ ----------------- YTD ------------------ % of Net Sales 19

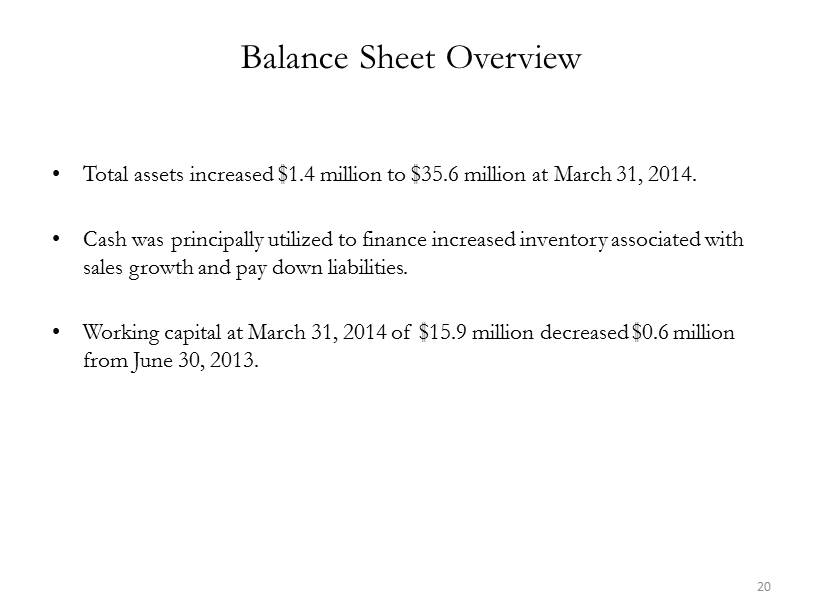

Balance Sheet Overview • Total assets increased $1.4 million to $ 35.6 million at March 31 , 2014. • Cash was principally utilized to finance increased inventory associated with sales growth and pay down liabilities. • Working capital at March 31, 2014 of $ 15.9 million decreased $ 0.6 million from June 30, 2013. 20

Positioned for Continued Growth: Evocative Wraps, California Square, PaperBoy Retailer Exclusive Broad Market International Innovation • Top retailers seeking increased margin, exclusivity and first to market • THI recognized as an industry leader • THI owns the IP • Proven brands with buyer awareness and high quality wine • Leverage our distributor partners • National accounts need RE’s and Brands • US/Abroad • National Distribution Agreement in Canada • $0.7 million Net Sales for nine months • New listings in Canada • Investigating UK distribution • Research and development to identify consumer trends • Retailer seeking to differentiate • Design, product packaging 21

Positioned for Continued Growth: Direct to Consumer, Internet Internet DTC 22 • 2 tasting rooms located in Healdsburg, CA (voted #2 “Best small town to visit” Smithsonian Magazine, 4/2014) • Increased customer traffic / wine clubs • VML & Truett Hurst brands (retail exclusive & test marketing) • www.thewinespies.com • Deal of the day & online store • Highly curated limited production top quality wine offerings • Analytics and marketing testing

Q&A 23

APPENDIX 1. Contact Information 2. Conference Call Playback Information 3. Pro forma Basic and Diluted EPS & Market Cap – Quarter 4. Pro forma Basic and Diluted EPS & Market Cap – Nine Months 24

Appendix I - Contact Information Phillip L. Hurst Chief Executive Officer, President Email: Phil@truetthurst.com T: 707.433.4408 M: 707.318.7480 James D. Bielenberg Chief Financial Officer Email: James@truetthurst.com T: 707.431.4423 M: 707.477.1623 www.truetthurstinc.com ir@truetthurstinc.com 25

Appendix II – Call Playback Information Transcript, when available, at: www.truetthurstinc.com Webcast/PowerPoint / Replay available at: www.truetthurstinc.com/investors Transcript available until May 19, 2014. 26

Appendix III – Adjusted Pro Forma EPS & Market Cap Quarter Ended March 31, 2014 Net loss attributable to Truett-Hurst, Inc. and H.D.D. LLC (612)$ Adjusted Pro Forma Basic & Diluted Loss Per Share Weighted average Class A common stock 2,936,894 Weighted average LLC units on a pro forma basis assuming 100% LLC membership conversion 3,286,866 Total weighted average basic pro forma shares outstanding 6,223,760 Adjusted Pro Forma Basic Earnings Per Share Calculation (0.01)$ Adjusted Market Capital based on March 31, 2014 Class A common stock closing price of $4.98 30,994,325$ TRUETT-HURST INC. AND SUBSIDIARIES (Prior to June 26, 2013, H.D.D. LLC and Subsidiary) Adjusted Pro Forma Basic and Diluted Earnings Per Share & Market Cap Quarter Ended March 31, 2014 (assumes 100% conversion of LLC units to THI stock) 27

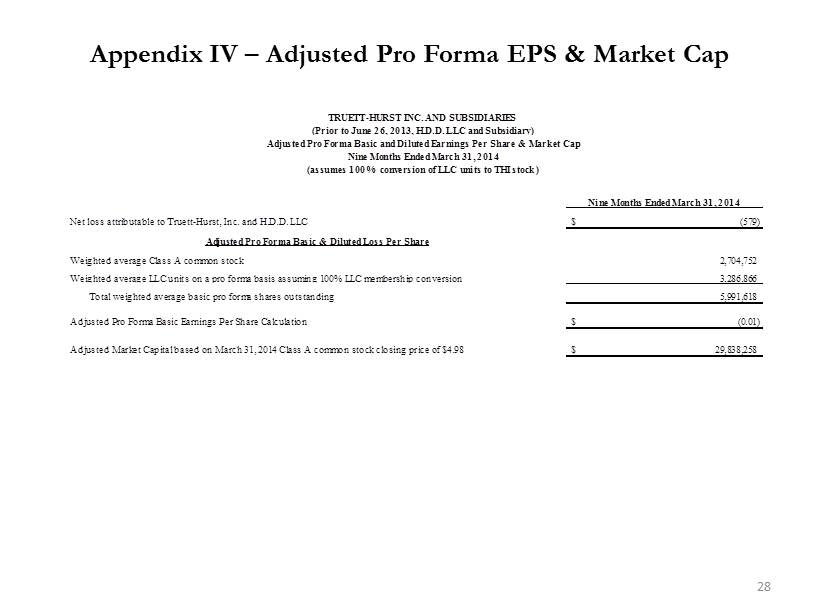

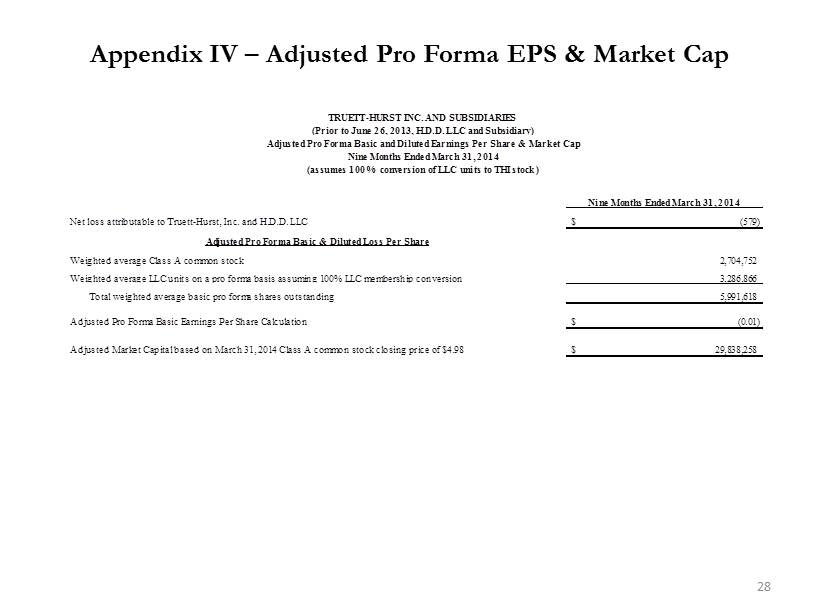

Appendix IV – Adjusted Pro Forma EPS & Market Cap Nine Months Ended March 31, 2014 Net loss attributable to Truett-Hurst, Inc. and H.D.D. LLC (579)$ Adjusted Pro Forma Basic & Diluted Loss Per Share Weighted average Class A common stock 2,704,752 Weighted average LLC units on a pro forma basis assuming 100% LLC membership conversion 3,286,866 Total weighted average basic pro forma shares outstanding 5,991,618 Adjusted Pro Forma Basic Earnings Per Share Calculation (0.01)$ Adjusted Market Capital based on March 31, 2014 Class A common stock closing price of $4.98 29,838,258$ TRUETT-HURST INC. AND SUBSIDIARIES (Prior to June 26, 2013, H.D.D. LLC and Subsidiary) Adjusted Pro Forma Basic and Diluted Earnings Per Share & Market Cap Nine Months Ended March 31, 2014 (assumes 100% conversion of LLC units to THI stock) 28