| 1290 AVENUE OF THE AMERICAS NEW YORK, NY 10104-0050 TELEPHONE: 212.468.8000 FACSIMILE: 212.468.7900 WWW.MOFO.COM | morrison & foerster llp new york, san francisco, los angeles, palo alto, sacramento, san diego, denver, northern virginia, washington, d.c. tokyo, london, brussels, beijing, shanghai, hong kong, singapore |

| June 11, 2013 | | Writer’s Direct Contact 212.468.8179 apinedo@mofo.com |

Via EDGAR

Tiffany Piland

Securities and Exchange Commission

100 F Street, NE

Mailstop #3561

Washington, D.C. 20549

| | Registration Statement on Form S-1 (the “Registration Statement”) |

| | Registration No. 333-187164 |

Dear Ms. Piland:

On behalf of our client, Truett-Hurst, Inc. (the “Company”), we submit to the Securities and Exchange Commission (the “Commission”) the attached proposed changes to the Company’s Registration Statement on Form S-1 referenced above (the “Amendment”). The Amendment incorporates responses to the comments transmitted by the Staff to us on June 6, 2013 on the Company’s Registration Statement filed with the Commission on June 5, 2013. Below, we identify in bold the Staff’s comment and note in regular type our response.

General

1. | We partially reissue comment 2 in our letter dated May 30, 2013. We note that certain of the existing owners may purchase in this offering up to 7.0% of the Class A common stock to be outstanding following the offering. Please clarify on the prospectus cover page that up to 189,608 shares may be purchased by the existing owners in order to meet the all or none sales threshold of 2,700,000 shares. |

The Company has amended the prospectus cover page to state that up to 189,608 shares may be purchased by the existing owners in order to meet the all or none sales threshold of 2,700,000 shares.

Securities and Exchange Commission

June 11, 2013

Page Two

Recent Developments, page 6

| 2. | We note that you have disclosed an expected range of net sales for the three months ending June 30, 2013. However, a single financial measure is insufficient disclosure without appropriate disclosures putting that number into context. It also appears that this disclosure does not comply with Item 10(b)(2) of Regulation S-K. Please revise to comply with Item 10(b) of Regulation S-K and also include a detailed analysis explaining the reasonable basis for such a range. |

We understand the Staff’s view; however, given the proximity of potential pricing of the offering to the Company’s fiscal year end, and the desire to provide investors with insight into financial results that investors may consider material to their investment decision, the Company has provided capsule information based on the best available information at this time. In response to the staff’s comment, the Company has included expected ranges of net income and earnings per share for the three months and fiscal year ended June 30, 2013. The Company believes that the financial measures it has included are those that would be most relevant to a potential investor. The Company has also included a discussion of the reasonable basis for the projections included. Please see page 6 of the prospectus.

| 3. | To the extent that the range reveals a significant change from the prior period, please expand your disclosure to explain, both quantitatively and qualitatively, the factors that led to the change and ensure that you have provided sufficient context so that the range you present is not misleading. Also expand your disclosure if the range reveals any new trends that will have, or are reasonably likely to have, a material impact on your financial condition, operating performance, revenues or income or result in your liquidity decreasing or increasing in any material way. |

The Company notes that the ranges disclosed do not reveal a significant change compared to recent prior periods or any new material trends in the Company’s business or financial results, and, therefore, respectfully submit that the expansion suggested by the Staff’s comment is inapplicable at this time.

| 4. | Please confirm your understanding that if prior to the effective date of your registration statement, more precise numbers become available, they must be included in your registration statement. |

The Company confirms its understanding that if more precise numbers become available prior to seeking effectiveness, it will review those numbers and evaluate revisions to the current disclosure.

Securities and Exchange Commission

June 11, 2013

Page Three

H.D.D., LLC Financial Statements

Notes to Consolidated Financial Statements

1. Description of Operations, page F-12

| 5. | We have reviewed your response to comment 6 in our letter dated May 30, 2013. Your response did not address our comment as you only discussed the tax year end of H.D.D. LLC. As such, please clarify for us the fiscal year end of H.D.D. LLC and how such year end compares with that disclosed in Section 8.3 of H.D.D. LLC’s operating agreement filed as Exhibit 3.4 (e.g., December 31). Further, if H.D.D. LLC’s fiscal year end is December 31, please tell us why your presentation of H.D.D. LLC’s financial statements as of and for the years ended June 30 is consistent with the requirements of Article 3 of Regulation S-X or revise. |

As we have discussed with the Staff, H.D.D. LLC is a privately held limited liability company, and underwent its first audit in connection with this proposed offering. In response to the Staff’s comment, we have updated the financial statements of H.D.D. LLC to clarify that the fiscal year end is currently December 31 and to disclose that, contemporaneously with the consummation of the IPO, the Company will change the fiscal year end of H.D.D. LLC to June 30.

Article 3 of Regulation S-X requires the registrant to present financial statements on a fiscal year basis. However, H.D.D. LLC is not the registrant, nor is it currently a subsidiary of the registrant. Upon completion of the IPO, H.D.D. LLC will be a subsidiary of the registrant and its financial statements will be consolidated with the registrant’s financial statements. Upon completion of the IPO and in accordance with paragraph 310.3 A-02 of Regulation S-X, the financial statements of H.D.D. LLC would be prepared using a period corresponding with the fiscal year end of the registrant. However, while not required by Regulation S-X to do so, H.D.D. LLC will, contemporaneously with the consummation of the IPO, amend its operating agreement to change its fiscal year-end to June 30 to be consistent with the fiscal year-end of the registrant.

From the perspective of a potential investor, given that the registrant’s fiscal year end will be June 30, we believe that the financial information for H.D.D. LLC provided as of June 30 is most helpful in promoting an understanding of the financial results of the enterprise as a whole once the IPO is completed.

Given that the offering is expected to be completed within a few days, and that the first filing was made in January 2013, it would pose a substantial hardship on the Company to undertake additional work to revise the financial presentation for the H.D.D. LLC entity and, in our view, would result in a presentation that was not as helpful to a potential investor.

Securities and Exchange Commission

June 11, 2013

Page Four

We appreciate in advance your time and attention to this Amendment, as well as to our comment responses. Should you have any additional questions or concerns, please call me at 212-468-8179.

Sincerely,

Anna T. Pinedo

cc: Gary J. Kocher

Michael Hedge

As filed with the Securities and Exchange Commission on June 5,11, 2013

Registration No. 333-187164

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________

AMENDMENT NO. 78

TO

FORM S-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

_____________________

Truett-Hurst, Inc.

(Exact Name of Registrant as Specified in Its Charter)

| Delaware | 2080 | 46-1561499 |

(State or Other Jurisdiction of Incorporation or Organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification Number) |

5610 Dry Creek Road Healdsburg, CA 95448 (707) 433-9545 (Address, Including Zip Code, and Telephone Number, Including Area Code, of Registrant’s Principal Executive Offices) |

| |

Phillip L. Hurst President and Chief Executive Officer Truett-Hurst, Inc. 5610 Dry Creek Road Healdsburg, CA 95448 (707) 433-9545 (Name, Address, Including Zip Code, and Telephone Number, Including Area Code, of Agent For Service) |

Copies to:

Anna T. Pinedo, Esq. James R. Tanenbaum, Esq. Morrison & Foerster LLP 1290 Avenue of the Americas New York, New York 10104 Tel: (212) 468-8000 | Michael A. Hedge, Esq. Gary J. Kocher, Esq. K&L Gates LLP 925 Fourth Avenue, Suite 2900 Seattle, Washington 98104 Tel: (206) 623-7580 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after the effective date of this Registration Statement.

If any of the securities being registered on this form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box. o

If this form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer o | Accelerated filer o |

Non-accelerated filer o (Do not check if a smaller reporting company) | Smaller reporting company x |

_____________________

CALCULATION OF REGISTRATION FEE

Title of Each Class of Securities to be Registered | Amount to be Registered (1) | Proposed Maximum Aggregate Offering Price (2) | Amount of Registration Fee |

Class A Common Stock, par value $0.001 per share | | | |

| (1) | This Registration Statement also covers the re-offer and sale of Class A common stock on an ongoing basis after their initial sale in market-making transactions by WRHambrecht + Co, LLC, an affiliate of the Registrant. All such market-making transactions with respect to these shares of Class A common stock are being made pursuant to this Registration Statement. |

| (2) | Estimated solely for the purposes of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (3) | Previously estimated and paid based on the registration of 2,902,557 shares of Class A common stock. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED JUNE 5,11, 2013.

| Truett-Hurst, Inc. 2,700,000 Shares of Class A Common Stock |

This is our initial public offering and no public market currently exists for our shares. We are selling 2,700,000 shares of our Class A common stock. We expect that the initial public offering price will be between $6.00 and $8.00 per share. Immediately following this offering, our Class A common stock will collectively represent 100% of the economic interests in Truett-Hurst, Inc. and approximately 38.3% of the voting power of Truett-Hurst, Inc. Our Class B common stock will represent approximately 58.2% of the voting power of Truett-Hurst, Inc. Certain of our existing owners may purchase in this offering up to 7.0%, or 189,608 shares, of the Class A common stock to be outstanding following the offering in order to meet the all or none sales threshold of 2,700,000 shares. Our Class A common stock has been approved for listing on the Nasdaq Capital Market under the symbol “THST.” We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act and, as such, may elect to comply with certain reduced reporting requirements after this offering. | OpenIPO® and Best Efforts Offering: The method of distribution being used by the underwriters in this offering differs somewhat from that traditionally employed in underwritten public offerings. The public offering price and allocation of shares will be determined primarily by an auction process conducted by the underwriters participating in this offering. The underwriters have agreed to use their best efforts to procure potential purchasers for the shares of Class A common stock offered pursuant to this prospectus. The shares are being offered on an all or none basis. All investor funds received prior to the closing will be deposited into a non-interest bearing escrow account with an escrow agent until closing. If investor funds for the full amount of the offering are not received at closing, the offering will terminate and any funds received will be returned promptly. The auction will close and a public offering price will be determined after the registration statement becomes effective. The auction will remain open no longer than 30 days following effectiveness. The minimum size of any bid is 100 shares. A more detailed description of this process is included in “The OpenIPO Auction Process” beginning on page 25 and in “Plan of Distribution” beginning on page 113. |

| THE OFFERING | PER SHARE | TOTAL |

| Initial Public Offering Price | $ | $ |

| Placement Agents’ Fee | $ | $ |

| Proceeds to Truett-Hurst, Inc. | $ | $ |

| The underwriters expect to deliver the shares of Class A common stock on , 2013. |

Investing in our Class A common stock involves a high degree of risk. See “Risk Factors” beginning on page 12.

| |

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

| |

| Sidoti & Company, LLC | CSCA |

The date of this prospectus is , 2013.

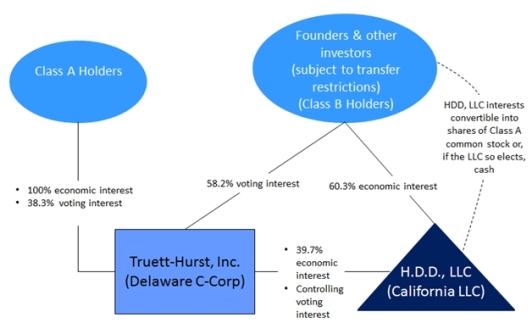

The diagram below depicts our organizational structure immediately following this offering:

The voting power of the Class A holders shown in the above diagram includes up to an aggregate 189,608 shares of our Class A common stock to be purchased by certain of our existing owners and a third party in this offering. These shares of our Class A common stock will be purchased for investment purposes, and not with a view to a distribution or resale, and will be purchased at the clearing price established through the OpenIPO process. See “The OpenIPO Auction Process.” In order to avoid having these potential purchases influence the auction outcome, the existing owners and the third party will not submit their indications through the OpenIPO website, but will agree to purchase at the clearing price set through the auction process.

In connection with the offering, Truett-Hurst, Inc. will enter into a tax receivable agreement with our existing owners that provides for the payment from time to time by Truett-Hurst, Inc. to our existing owners of 90% of the amount of the benefits, if any, that Truett-Hurst, Inc. is deemed to realize as a result of (i) increases in tax basis resulting from our exchange of LLC Units and (ii) certain other tax benefits related to our entering into the tax receivable agreement, including tax benefits attributable to payments under the tax receivable agreement. The actual increase in tax basis, as well as the amount and timing of any payments under the tax receivable agreement, will vary depending upon a number of factors, including the timing of exchanges, the price of shares of our Class A common stock at the time of the exchange, the extent to which such exchanges are taxable, and the amount and timing of our income. A chart estimating the amounts of such payments appears on page 93 of this prospectus. See “Certain Relationships and Related Party Transactions—Tax Receivable Agreement.”

Recent Developments

Financial results for periods aftersubsequent to March 31, 2013 are not currently available. However, we expect to report between $3.74.0 million and $4.34.9 million in net sales for the three months ending June 30, 2013, compared to net sales of $2.3 million for the three months ended June 30, 2012. The increase in net sales is expected to be attributable to increases in our wholesale, direct to consumer and internet segments. These are only estimated results. Our actual results are dependent upon many factors, and may differ from these estimates.In addition, we expect to report between $16.1 million and $17.0 million in net sales for the fiscal year ending June 30, 2013, compared to net sales of $12.7 million for the fiscal year ended June 30, 2012. We have based our estimate of net sales for these periods on orders shipped to date, orders received and not shipped, commitments by customers, and estimates based on historical recurring orders and sales.

We expect to report between $145,000 in net income attributable to H.D.D. LLC members and $115,000 in net loss attributable to H.D.D. LLC members for the three months ending June 30, 2013, compared to a net loss attributable to H.D.D. LLC members of $224,098 for the three months ended June 30, 2012. In addition, we expect to report between $335,000 and $595,000 in net loss attributable to H.D.D. LLC members for the fiscal year ending June 30, 2013 compared to net income attributable to H.D.D. LLC members of $26,462 for the fiscal year ended June 30, 2012. We have based our estimates of net losses and income for these periods on actual and historical cost of goods sold, sales and marketing and general administrative expenses posted to date, estimated expenses related to this offering and other one-time expenses, netted against estimated net sales.

After giving effect to the Recapitalization and the Offering Transactions, we expect to have 7,054,644 shares of Class A common stock outstanding (assumes the exchange of all LLC Units for shares of Class A common stock). We expect to report between $0.02 in earnings per share and $0.02 in losses per share on a weighted average basis for the three months ending June 30, 2013. In addition, we expect to report between $0.05 and $0.08 in losses per share on a weighted average basis for the fiscal year ending June 30, 2013.

These are only estimated results. Our actual results depend upon many factors, and may differ from these estimates.

Summary of Risk Factors

Our business is subject to numerous risks, which are described in the section entitled “Risk Factors” immediately following this prospectus summary on page 12. You should carefully consider these risks before making an investment. In particular, the following considerations, among others, may offset our competitive strengths or have a negative effect on our growth strategy, which could cause a decline in the price of our Class A common stock and result in a loss of all or a portion of your investment:

| | · | A reduction in the supply of grapes and bulk wine available to us from the independent grape growers and bulk wine suppliers could reduce our annual production of wine. |

| | · | We face significant competition which could adversely affect our profitability. |

| | · | Because a significant amount of our business is made through our direct to retailer partnerships, any change in our relationships with them could harm our business. |

| | · | We have a history of losses and we may not achieve or maintain profitability in the future. |

| | · | The loss of Mr. Hurst, Mr. Bielenberg, Ms. Lambrix, Mr. Dolan or other key employees would damage our reputation and business. |

| | · | A reduction in our access to, or an increase in the cost of, the third-party services we use to produce our wine could harm our business. |

| | · | The terms of our credit facility may restrict our current and future operations; we have breached our existing loan covenants under the terms of this facility. |

| | · | Because our existing owners will retain significant control over Truett-Hurst after this offering, new investors will not have as much influence on corporate decisions as they would if control were less concentrated. |

| | · | Many of our transactions are with related parties, including our founders, executive officers, principal stockholders and other related parties, and present conflicts of interest. |

| | · | Several of our executive officers and key team members have outside business interests which may create conflicts of interest. |

H.D.D. LLC

Notes to Consolidated Financial Statements

| 1. | Description of Operations |

H.D.D. LLC (“we,” “us,” “our,” or the “Company”) was organized in the state of California in 2007. We own and operate Truett-Hurst winery located in the Dry Creek Valley and lease and operate VML winery, located in the Russian River Valley. We produce and sell premium, super-premium and ultra-premium wines from grapes grown on our estate vineyard, purchased from growers, bulk wine procured under contracts or on a spot basis, and finished goods from both import and domestic producers. These consolidated financial statements are presented as of June 30, 2011 and 2012, and for each of the years in the two-year period ended June 30, 2012.

As further described under Note 17, H.D.D. LLC has formed a C corporation, Truett-Hurst, Inc. (“Truett-Hurst” or the “Corporation”) which we anticipate will complete a public offering (the “IPO”) in the near future. Following the IPO and related transactions, H.D.D. LLC will be a consolidated subsidiary of the Corporation. While H.D.D. LLC’s fiscal year-end is currently December 31 for tax purposes,31, the fiscal year-end of the Corporation is June 30. For the purposes of comparability, we have presented audited financial statements of H.D.D. LLC as of June 30, 2011 and 2012 and for each of the years in the two-year period ended June 30, 2012 so that they will be directly comparable with the audited consolidated financial statements of Truett-Hurst, Inc. after the offering. H.D.D. LLC will amend its operating agreement to change its fiscal year end to June 30 upon completion of the IPO.

| 2. | Summary of Significant Accounting Policies |

Basis of Accounting

The consolidated financial statements are prepared on the accrual basis of accounting in accordance with accounting principles generally accepted in the United States of America (GAAP). As of and for the nine month period ended March 31, 2013, we have consolidated the operations of our 50% owned subsidiary (see Note 8) from the date of acquisition. All significant intercompany balances and transactions have been eliminated in consolidation and our non-controlling interest has been appropriately disclosed on all of the related statements. The Company has reclassified certain prior period amounts to conform to the current period's presentation. These reclassifications had no effect on the reported results of operations.

Use of Estimates

The preparation of consolidated financial statements in conformity with GAAP requires our management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosures of contingent assets and liabilities at the date of the consolidated financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from these estimates.

Unaudited Interim Financial Information

The accompanying interim consolidated balance sheet as of March 31, 2013, the interim consolidated statements of operations and cash flows for the nine months ended March 31, 2012 and 2013, and the interim consolidated statements of changes in redeemable contributed capital and members’ equity (deficit) for the nine months ended March 31, 2013 are unaudited. The unaudited interim consolidated financial statements have been prepared on the same basis as the consolidated financial statements as of June 30, 2011 and 2012, and for each of the years in the two-year period ended June 30, 2012 and, in the opinion of management, reflect all adjustments, which include only normal recurring adjustments, necessary to present fairly our financial position as of March 31, 2013 and the results of operations and cash flows for the nine months ended March 31, 2012 and 2013. The financial data and the other financial information disclosed in these notes to the consolidated financial statements related to the nine month periods are unaudited. The results of operations for the nine months ended March 31, 2013 are not necessarily indicative of the results to be expected for the year ending June 30, 2013 or for any other future year or interim period.

Item 16. Exhibits and Financial Statement Schedules.

(a) Exhibits

| Form of Placement Agency Agreement+ |

| Form of Escrow Agreement+ |

| Restated Certificate of Incorporation of Truett-Hurst, Inc., dated December 28, 2012+ |

| Form of Amended and Restated Certificate of Incorporation of Truett-Hurst, Inc.+ |

| Form of Bylaws of Truett-Hurst, Inc.+ |

| Articles of Organization of H.D.D. LLC+ |

| Third Amended and Restated Operating Agreement of H.D.D. LLC+ |

| Form of Class A common stock certificate+ |

| Form of Class B common stock certificate+ |

| Opinion of Morrison & Foerster LLP+ |

| Wine Supply Agreement by and between H.D.D. LLC and Robert Hall Winery, dated March 10, 2012+ |

| Member Interest Purchase Agreement by and between Brandon Stauber and H.D.D. LLC, dated August 1, 2012+ |

| Loan and Security Agreement by and between H.D.D. LLC and Bank of the West, dated July 16, 2012+ |

| Security Agreement (Trademark) by and between H.D.D. LLC and Bank of the West, dated July 16, 2012+ |

| Deed of Trust, Security Agreement, Assignment of Leases, Rents, and Profits, and Fixture Filing by and between H.D.D. LLC and First Santa Clara Corporation for the use and benefit of Bank of the West, dated July 16, 2012+ |

| Line of Credit Note, in the principal amount of $9,000,000, dated July 16, 2012+ |

| Term Note, in the principal amount of $3,381,000, dated July 16, 2012+ |

| Equipment Purchase Line of Credit Note, in the principal amount of $300,000, dated July 16, 2012+ |

| Modification Agreement, by and between H.D.D. LLC and Bank of the West, dated October 3, 2012+ |

| Foreign Exchange Note, in the principal amount of $100,000, dated July 16, 2012+ |

| Master Equipment Financing Agreement by and between H.D.D. LLC and Bank of the West, dated October 2, 2012+ |

| Agreement by and between H.D.D. LLC and West Coast Paper Company, dated August 24, 2012+ |

| Lease by and between H.D.D. LLC and Hambrecht Wine Group L.P., dated February 8, 2011+ |

| 2012 Stock Incentive Plan+ |

| Form of Exchange Agreement+ |

| Form of Tax Receivable Agreement+ |

| Form of Registration Rights Agreement+ |

| Supply of Goods Agreement by and between H.D.D. LLC and GreenBottle Limited, dated February 26, 2013+ |

| Convertible Promissory Note, payable to the Carroll-Obremskey Trust, in the principal amount of $150,000, dated March 1, 2013+ |

| Convertible Promissory Note, payable to the Hurst Trust, in the principal amount of $150,000, dated March 1, 2013+ |

| Convertible Promissory Note, payable to the Dolan 2003 Trust, in the principal amount of $25,000, dated March 1, 2013+ |

| Convertible Promissory Note, payable to the Dolan 2005 Trust, in the principal amount of $25,000, dated March 1, 2013+ |

| Agreement, by and between Truett-Hurst, Inc. and the Carroll-Obremskey Trust, dated March 26, 2013+ |

| Code of Business Conduct and Ethics+ |

| Subsidiaries of the Registrant+ |

| Consent of Burr Pilger Mayer, Inc., Independent Registered Public Accounting Firm for Truett-Hurst, Inc. |

| Consent of Burr Pilger Mayer, Inc., Independent Registered Public Accounting Firm for H.D.D. LLC |

| Consent of Morrison & Foerster LLP* |

| |

__________________________

*Contained in Exhibit 5.1

+Previously filed

(b) Financial Statement Schedules

Schedules not listed above have been omitted because the information required to be set forth therein is not applicable or is shown in the financial statements or notes thereto.

Signatures

Pursuant to the requirements of the Securities Act of 1933, as amended, we have duly caused this Amendment No. 78 to Registration Statement on Form S-1 to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of Healdsburg, State of California, on the 511th day of June, 2013.

| | | |

| | | TRUETT-HURST, INC. | |

| | | | |

| | | /s/ Phillip L. Hurst | |

| | | Phillip L. Hurst Chief Executive Officer | |

| | | | |

| | | | |

| Signature | | Title | | Date |

| | | | | |

| /s/ Phillip L. Hurst | | Chief Executive Officer and Chairman | | June 5,11, 2013 |

| Phillip L. Hurst | | (Principal Executive Officer) | | |

| | | | | |

| /s/ James D. Bielenberg | | Chief Financial Officer | | June 5,11, 2013 |

| James D. Bielenberg | | (Principal Financial Officer and | | |

| | Principal Accounting Officer) | | |

| * | | Director | | June 5,11, 2013 |

| Paul E. Dolan, III | | | | |

| | | | | |

| * | | Director | | June 5,11, 2013 |

| Barrie Graham | | | | |

| | | | | |

| * | | Director | | June 5,11, 2013 |

| William R. Hambrecht | | | | |

| | | | | |

| * | | Director | | June 5,11, 2013 |

| Daniel A. Carroll | | | | |

| | | | | |

| * | | Director | | June 5,11, 2013 |

| Heath E. Dolan | | | | |

| | | | | |

| * | | Director | | June 5,11, 2013 |

| John D. Fruth | | | | |

| | | | | |

| * | | Director | | June 5,11, 2013 |

| James F. Verhey | | | | |

| *By: | /s/ Phillip L. Hurst | | | |

| | Phillip L. Hurst | | | |

| | Attorney-in-Fact | | | |