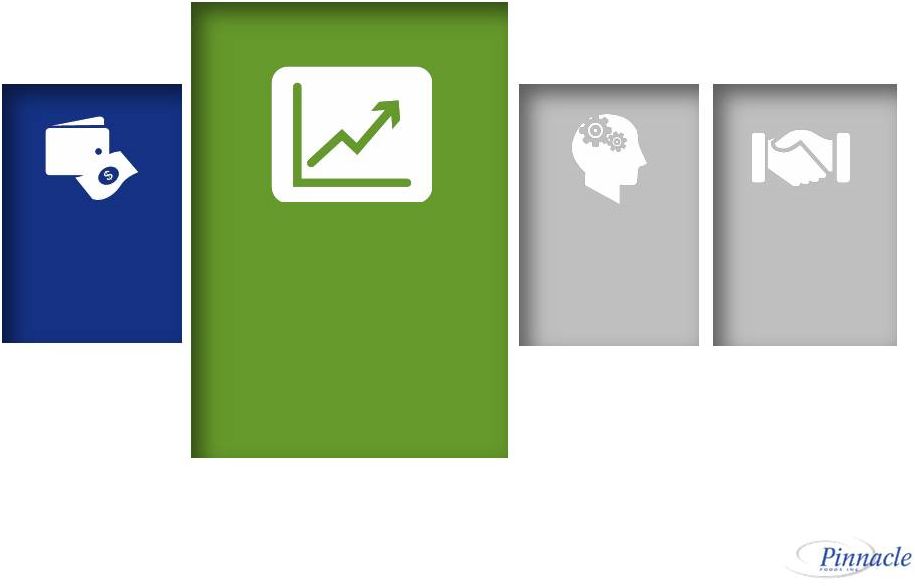

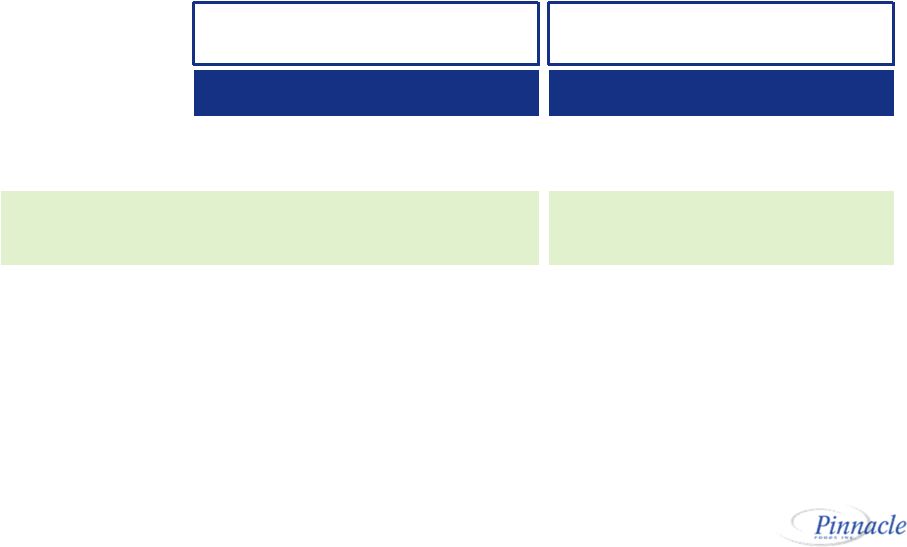

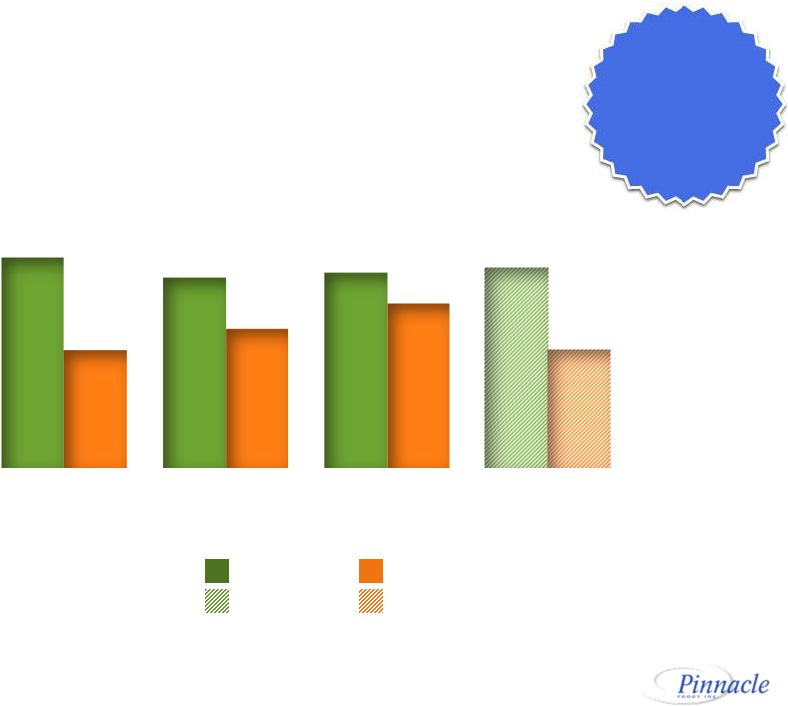

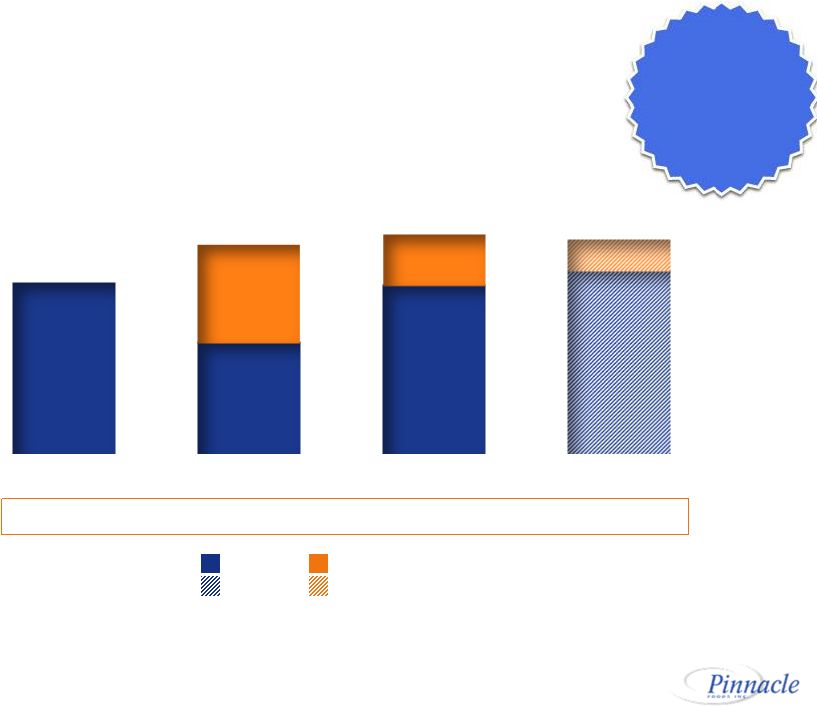

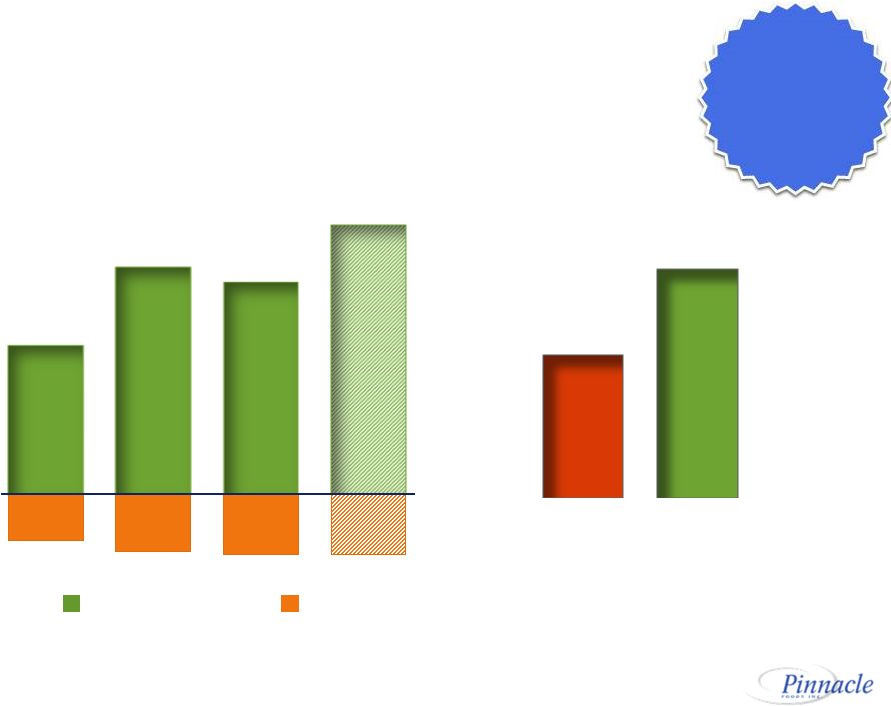

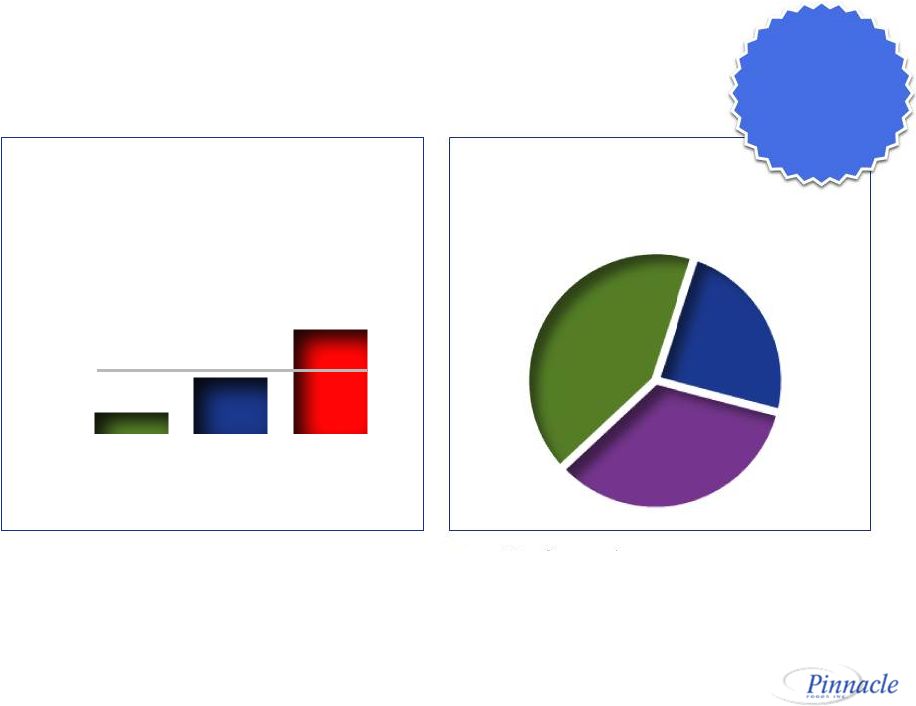

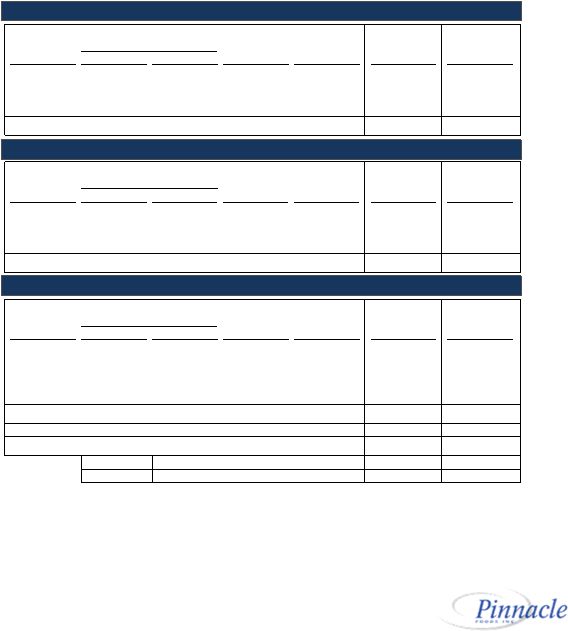

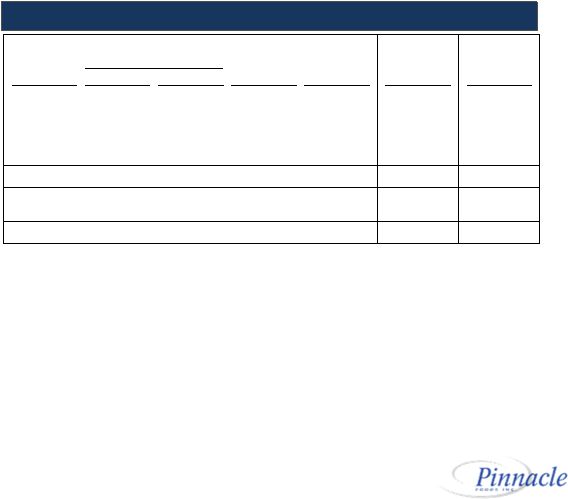

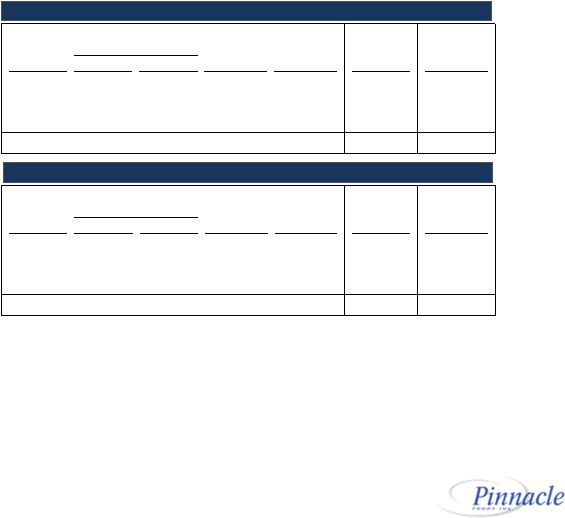

($ in millions) 9 Months Ending LTM Pinnacle Foods 2013 2014 2015 9/27/2015 9/25/2016 9/25/2016 GAAP Net Income $89.3 $248.4 $212.5 $133.3 $123.0 $202.2 Interest Expense, Net 132.2 96.1 88.3 66.0 103.5 125.8 Income Tax 71.5 167.8 123.9 76.8 79.9 127.0 Depreciation & Amortization 78.2 80.6 89.7 67.4 78.7 101.0 GAAP EBITDA $371.3 $592.9 $514.4 $343.5 $385.1 $555.9 Unrealized (Gains) Losses Resulting from Hedging Activities (0.7) 12.5 (2.0) (0.2) (9.2) (11.0) Adjustments Related to Application of Purchase Accounting 6.3 0.6 -- -- 10.4 10.4 Tradename Impairment Charges -- -- -- -- 11.2 11.2 Non-Cash Compensation Charges -- 27.2 1.6 1.6 -- -- Unrealized Foreign Exchange Losses -- 0.7 4.7 3.7 (1.0) 0.0 Acquisition or Other Non-Recurring Merger Costs 9.5 (144.5) 2.7 1.1 6.8 8.4 Restructuring, Integration, and Business Optimization Expenses 8.0 11.0 9.5 6.9 31.7 34.3 Employee Severance 4.7 3.5 0.7 0.2 -- 0.5 Management, Monitoring, Consulting and Advisory Fees 19.2 -- -- -- -- -- Other 34.2 0.2 -- -- -- -- Adjusted EBITDA $452.4 $504.0 $531.6 $356.8 $434.9 $582.2 Wish-Bone, Gardein Protein, and Boulder acquisition adjustments 54.7 25.3 60.5 37.9 24.1 46.8 Non-Cash Equity-Based Compensation 7.9 8.8 13.6 9.9 9.4 13.0 Covenant Compliance EBITDA per Credit Agreement Definition $515.0 $538.1 $605.7 $404.5 $468.4 $669.5 Non-cash (gains) / losses resulting from mark-to-market adjustments of obligations under derivative contracts Additional COPS to write-up to fair market value of inventories acquired through acquisitions Non-cash employee incentives and retention charges from termination of Hillshire merger agreement and equity-based compensation charges from liquidity event with associated with the reduction in December 2014 of Blackstone’s ownership to 16.5% Foreign exchange losses resulting from intra-entity loans anticipated to be settled in the foreseeable future Expenses related to secondary offerings of common stock and receipt of Hillshire merger termination fee. For the three- months ended March 27, 2016, represents integration costs of Boulder acquisition Integration costs of Gardein, Wish-Bone, and Boulder and gain from sales of Millsboro and Tacoma Facilities Severance costs paid or accrued to terminated employees 1 2 1 4 5 7 8 2 3 4 5 6 Management/advisory fees paid to an affiliate of Blackstone, including fees relating to the termination of the advisory agreement in connection with the IPO 9 Premium and fees paid for redemptions of notes and costs for the recall of Aunt Jemima product of $2.1 million 10 7 8 6 9 11 Pro Forma Net Cost Savings projected to be realized from the Gardein, Wish-Bone, and Boulder acquisitions 11 10 Represents tradename impairment on Celeste ($7.3 million), Aunt Jemima ($3.0 million), and Synder of Berlin ($0.9 million) 3 Reconciliation from GAAP to Adjusted Financial Measures 52 |