UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number | 811-22784 |

| |

| Dreyfus Municipal Bond Infrastructure Fund, Inc.; | |

| (Exact name of Registrant as specified in charter) | |

| | |

| c/o The Dreyfus Corporation 200 Park Avenue New York, New York 10166 | |

| (Address of principal executive offices) (Zip code) | |

| | |

| John Pak, Esq. 200 Park Avenue New York, New York 10166 | |

| (Name and address of agent for service) | |

|

Registrant's telephone number, including area code: | (212) 922-6000 |

| |

Date of fiscal year end: | 2/28(9) | |

Date of reporting period: | 8/31/13 | |

| | | | | | | |

FORM N-CSR

Item 1. Reports to Stockholders.

| | Contents |

| | THE FUND |

| 2 | A Letter from the President |

| 3 | Discussion of Fund Performance |

| 6 | Statement of Investments |

| 15 | Statement of Assets and Liabilities |

| 16 | Statement of Operations |

| 17 | Statement of Cash Flows |

| 18 | Statement of Changes in Net Assets |

| 19 | Financial Highlights |

| 20 | Notes to Financial Statements |

| 28 | Information About the Approval of the Fund’s Management Agreement |

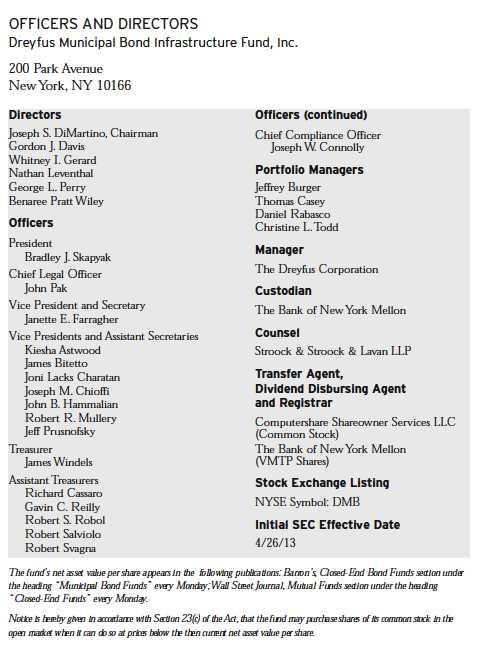

| 33 | Officers and Directors |

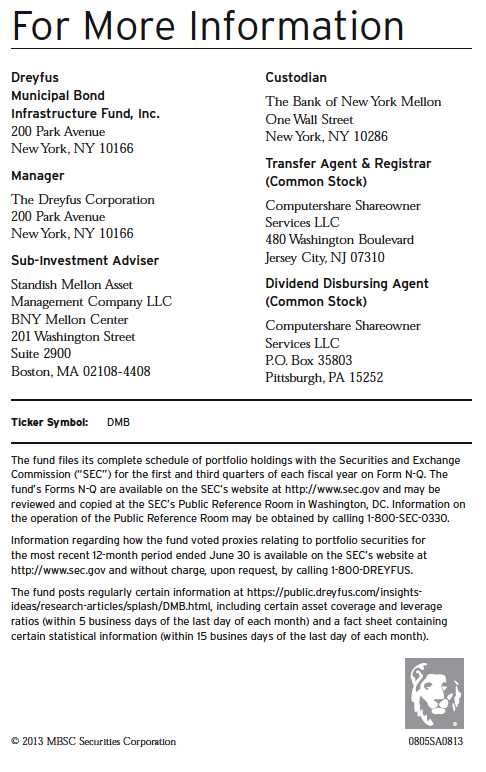

| | FOR MORE INFORMATION |

| | Back Cover |

Dreyfus

Municipal Bond

Infrastructure Fund, Inc.

The Fund

A LETTER FROM THE PRESIDENT

Dear Shareholder:

We are pleased to present this semiannual report for Dreyfus Municipal Bond Infrastructure Fund, Inc., covering the period from April 26, 2013, through August 31, 2013. For information about how the fund performed during the reporting period, as well as general market perspectives, we provide a Discussion of Fund Performance on the pages that follow.

U.S. fixed-income markets, including municipal bonds, encountered heightened volatility over the past year as long-term interest rates climbed in response to accelerating economic growth and expectations that the Federal Reserve Board will begin to back away from the open-ended quantitative easing program it launched last fall. Indeed, the U.S. economy has responded positively to low interest rates amid muted inflationary pressures, helping to drive the unemployment rate lower and housing markets higher.

In our analysis, the U.S. economy is nearing an inflection point to a somewhat faster growth rate.We expect a reduced fiscal drag in 2014 and beyond, and the stimulative monetary policy of the past five years should continue to support economic expansion, particularly in interest rate-sensitive industry groups. For information on how these developments may affect your fixed-income investments, we urge you to discuss these matters with your financial advisor.

Thank you for your continued confidence and support.

Sincerely,

J. Charles Cardona

President

The Dreyfus Corporation

September 16, 2013

2

DISCUSSION OF FUND PERFORMANCE

For the period of April 26, 2013, through August 31, 2013, as provided by Daniel Rabasco and Jeffrey Burger, Primary Portfolio Managers

Fund and Market Performance Overview

From its inception on April 26, 2013, through the end of its semiannual reporting period on August 31, 2013, Dreyfus Municipal Bond Infrastructure Fund, Inc. achieved a total return of –22.03% on a net-asset-value basis.1 Over the same period, the fund provided aggregate income dividends of $0.125 per share, which reflects a distribution rate of 3.51%.2

Due to investors’ concerns regarding actual and anticipated changes in interest rates, selling pressure in the municipal bond market intensified in the weeks following the fund’s inception, causing liquidity conditions to become more challenging and yield differences to widen significantly along the market’s credit-quality spectrum. In this environment of declining bond prices, the fund’s negative performance was amplified by its emphasis on longer dated and lower rated securities and its use of leverage in seeking to provide high levels of current income.

The Fund’s Investment Approach

The fund seeks to provide as high a level of current income exempt from regular federal income tax as is consistent with the preservation of capital. The fund’s portfolio is composed principally of investments that finance the development, support, or improvement of America’s infrastructure.

Under normal circumstances, the fund invests at least 80% of its Managed Assets3 in municipal bonds issued to finance infrastructure sectors and projects in the United States. Also, under normal circumstances, the fund will invest at least 50% of its Managed Assets in investment grade municipal bonds, meaning that up to 50% of Managed Assets can be invested in below investment grade municipal bonds. Projects in which the fund may invest include (but are not limited to) those in the transportation, energy and utilities, social infrastructure, and water and environmental sectors. We focus on identifying undervalued sectors and securities and minimize the use of interest rate forecasting.We select municipal bonds using fundamental credit analysis to estimate the relative value and attractiveness of various sectors and securities and to exploit pricing inefficiencies.

The Fund 3

DISCUSSION OF FUND PERFORMANCE (continued)

The fund employs leverage by issuing preferred stock and participating in tender option bond programs. Leverage has the effect of “leveraging” the portfolio, which can magnify gain and loss potential depending on market conditions.

Selling Pressure Intensified After Fund’s Inception

Municipal bonds generally encountered heightened volatility over the reporting period. In the weeks after the fund began operations, long-term interest rates trended higher in response to improved economic trends, causing investors to shift assets away from fixed-income markets and putting downward pressure on municipal bond prices. In late May, remarks by Federal Reserve Board Chairman Ben Bernanke were widely interpreted by investors as a signal that the central bank would back away from its ongoing quantitative easing program sooner than expected. This development sent longer term interest rates higher, which sparked a broad and severe sell-off of municipal bonds. Prices declined broadly as the market oversold.

In July, decades of economic decay and subsequent population loss culminated in a bankruptcy filing by the city of Detroit. Despite this bankruptcy filing, credit conditions generally have improved for most states and municipalities. For example, the State of California received credit-rating upgrades after voters approved a measure to raise certain taxes, and many issuers of revenue-backed bonds reported solid revenue growth in the recovering economy.

Higher Yielding Bonds Undermined Fund Performance

Although our focus on lower quality, higher yielding municipal bonds helped boost the fund’s ability to generate competitive levels of tax-exempt income, it hurt total return performance. In addition to the impact of the recent sell-off, bonds issued to finance the states’ settlement of litigation with U.S. tobacco companies and securities from Puerto Rico dampened results, as did an underweighted position in high-quality escrowed bonds. Overweighted exposure to maturities in the 20- to 30-year range also hurt performance when long-term interest rates climbed.The fund’s leveraging strategy magnified weakness in these areas.

The fund achieved better results from its security selection strategy among bonds backed by revenues from airports, industrial business districts, and hospitals.

4

Finding Attractive Values Among Beaten Down Securities

Municipal bonds generally ended the reporting period with attractive valuations compared to comparable-term U.S.Treasury securities, suggesting that they may have been punished more severely than was warranted by then-underlying market fundamentals. Indeed, in our judgment, recent bouts of market volatility have provided compelling opportunities to purchase higher yielding, fundamentally sound infrastructure bonds at relatively low prices as investors refocus on underlying market and issuer fundamentals. In addition, we anticipate more favorable supply-and-demand dynamics due to the dampening effects of higher interest rates on refinancing activity.

Therefore, the fund is positioned for a rebound in municipal bond prices with a continued emphasis on lower rated and longer term revenue bonds, albeit among what are perceived to be better “value” holdings. In addition, in an attempt to sustain the fund’s ability to generate competitive levels of current income, we recently reconfigured its leveraging strategy by locking in higher rates through a combination of tender option bond programs and variable municipal term preferred shares. In our judgment, these strategies should enable the fund to participate more fully in market rallies as investors refocus on underlying fundamentals of individual municipal bond issuers.

September 16, 2013

Bond funds are subject generally to interest rate, credit, liquidity, and market risks, to varying degrees, all of which are more fully described in the fund’s prospectus. Generally, all other factors being equal, bond prices are inversely related to interest-rate changes, and rate increases can cause price declines.

High yield bonds are subject to increased credit risk and are considered speculative in terms of the issuer’s perceived ability to continue making interest payments on a timely basis and to repay principal upon maturity.

The use of leverage may magnify the fund’s gains or losses. For derivatives with a leveraging component, adverse changes in the value or level of the underlying asset can result in a loss that is much greater than the original investment in the derivative.

|

| 1 Total return includes reinvestment of dividends and any capital gains paid, based upon net asset value per share. Past |

| performance is no guarantee of future results. Income may be subject to state and local taxes, and some income may be |

| subject to the federal alternative minimum tax (AMT) for certain investors. Capital gains, if any, are fully taxable. |

| 2 Distribution rate per share is based upon dividends per share paid from net investment income during the period, |

| annualized, divided by the market price per share at the end of the period, adjusted for any capital gain distributions. |

| 3 “Managed Assets” of the fund means the fund’s total assets, including any assets attributable to effective leverage, |

| minus certain defined accrued liabilities. |

The Fund 5

STATEMENT OF INVESTMENTS

August 31, 2013 (Unaudited)

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments—154.7% | Rate (%) | Date | Amount ($) | | Value ($) |

| Alaska—4.7% | | | | | |

| Alaska Industrial Development and | | | | | |

| Export Authority, Revenue | | | | | |

| (Providence Health and Services) | | | | | |

| (Morgan Stanley Municipal Trust | | | | | |

| Program Residual Series 3334) | 5.00 | 10/1/40 | 10,000,000 | a,b | 9,529,298 |

| Arizona—6.6% | | | | | |

| Pima County Industrial Development | | | | | |

| Authority, Education Revenue | | | | | |

| (American Charter Schools | | | | | |

| Foundation Project) | 5.63 | 7/1/38 | 5,585,000 | | 4,562,498 |

| Pima County Industrial Development | | | | | |

| Authority, Education Revenue | | | | | |

| (Arizona Charter Schools | | | | | |

| Refunding Project) | 5.38 | 7/1/31 | 4,490,000 | | 4,303,351 |

| Salt Verde Financial Corporation, | | | | | |

| Senior Gas Revenue | 5.00 | 12/1/37 | 5,000,000 | | 4,578,300 |

| California—9.2% | | | | | |

| Golden State Tobacco | | | | | |

| Securitization Corporation, | | | | | |

| Tobacco Settlement | | | | | |

| Asset-Backed Bonds | 5.75 | 6/1/47 | 8,000,000 | | 5,908,240 |

| Long Beach Bond Finance Authority, | | | | | |

| Natural Gas Purchase Revenue | 5.50 | 11/15/37 | 5,000,000 | | 4,977,700 |

| Riverside County Transportation | | | | | |

| Commission, Senior Lien | | | | | |

| Toll Revenue | 5.75 | 6/1/44 | 3,000,000 | c | 2,915,460 |

| University of California Regents, | | | | | |

| Medical Center Pooled Revenue | 5.00 | 5/15/43 | 5,000,000 | | 4,863,900 |

| Colorado—3.3% | | | | | |

| City and County of Denver, | | | | | |

| Airport System | | | | | |

| Subordinate Revenue | 5.25 | 11/15/43 | 5,000,000 | c | 4,802,200 |

| Colorado Health Facilities | | | | | |

| Authority, Health Facilities | | | | | |

| Revenue (The Evangelical | | | | | |

| Lutheran Good Samaritan | | | | | |

| Society Project) | 5.00 | 12/1/33 | 1,960,000 | | 1,808,414 |

6

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| District of Columbia—.8% | | | | | |

| District of Columbia, | | | | | |

| Revenue (Knowledge is | | | | | |

| Power Program, District | | | | | |

| of Columbia Issue) | 6.00 | 7/1/43 | 1,700,000 | | 1,711,815 |

| Florida—1.8% | | | | | |

| Broward County, | | | | | |

| Airport System Revenue | 5.00 | 10/1/42 | 3,750,000 | c | 3,627,075 |

| Illinois—1.8% | | | | | |

| Chicago, | | | | | |

| Customer Facility Charge | | | | | |

| Senior Lien Revenue (Chicago | | | | | |

| O’Hare International Airport) | 5.75 | 1/1/43 | 3,750,000 | c | 3,631,013 |

| Indiana—6.9% | | | | | |

| Indiana Finance Authority, | | | | | |

| HR (The King’s Daughters’ | | | | | |

| Hospital and Health Services) | 5.50 | 8/15/40 | 7,425,000 | | 6,410,522 |

| Indiana Finance Authority, | | | | | |

| Private Activity Bonds (Ohio | | | | | |

| River Bridges East End | | | | | |

| Crossing Project) | 5.00 | 7/1/44 | 5,000,000 | c | 4,185,050 |

| Indiana Finance Authority, | | | | | |

| Revenue (Baptist Homes of | | | | | |

| Indiana Senior Living) | 6.00 | 11/15/41 | 3,500,000 | | 3,361,925 |

| Iowa—5.6% | | | | | |

| Iowa Finance Authority, | | | | | |

| Midwestern Disaster Area | | | | | |

| Revenue (Alcoa Inc. Project) | 4.75 | 8/1/42 | 6,495,000 | | 5,223,019 |

| Iowa Finance Authority, | | | | | |

| Midwestern Disaster Area | | | | | |

| Revenue (Iowa Fertilizer | | | | | |

| Company Project) | 5.25 | 12/1/25 | 7,000,000 | | 6,106,870 |

| Louisiana—.9% | | | | | |

| Louisiana Public Facilities | | | | | |

| Authority, Dock and | | | | | |

| Wharf Revenue (Impala | | | | | |

| Warehousing LLC Project) | 6.50 | 7/1/36 | 2,000,000 | b | 1,809,280 |

The Fund 7

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| Massachusetts—4.5% | | | | | |

| Massachusetts Development Finance | | | | | |

| Agency, Revenue (North Hill | | | | | |

| Communities Issue) | 6.50 | 11/15/43 | 2,000,000 | | 1,860,600 |

| Massachusetts Port Authority, | | | | | |

| Special Facilities Revenue | | | | | |

| (Delta Air Lines, Inc. | | | | | |

| Project) (Insured; AMBAC) | 5.00 | 1/1/27 | 8,210,000 | | 7,344,748 |

| Michigan—9.2% | | | | | |

| Detroit, | | | | | |

| Water Supply System Senior | | | | | |

| Lien Revenue | 5.25 | 7/1/41 | 5,000,000 | | 4,291,200 |

| Kent Hospital Finance Authority, | | | | | |

| Revenue (Metropolitan | | | | | |

| Hospital Project) | 6.25 | 7/1/40 | 5,750,000 | | 5,567,955 |

| Michigan Finance Authority, | | | | | |

| HR (Trinity Health Credit Group) | 5.00 | 12/1/39 | 5,000,000 | | 4,829,500 |

| Michigan Tobacco Settlement | | | | | |

| Finance Authority, Tobacco | | | | | |

| Settlement Asset-Backed Bonds | 6.00 | 6/1/34 | 5,000,000 | | 3,865,900 |

| Mississippi—9.6% | | | | | |

| Southern Mississippi Educational | | | | | |

| Building Corporation, Revenue | | | | | |

| (Residence Hall Construction | | | | | |

| and Refunding Project) (Morgan | | | | | |

| Stanley Municipal Trust Program | | | | | |

| Residual Series 3335) | 5.00 | 3/1/43 | 19,490,000 | a,b | 19,490,000 |

| Missouri—1.5% | | | | | |

| Saint Louis County Industrial | | | | | |

| Development Authority, Senior | | | | | |

| Living Facilities Revenue | | | | | |

| (Friendship Village Sunset Hills) | 5.00 | 9/1/42 | 3,500,000 | | 3,062,780 |

| New Jersey—3.1% | | | | | |

| New Jersey Economic Development | | | | | |

| Authority, Special Facility | | | | | |

| Revenue (Continental | | | | | |

| Airlines, Inc. Project) | 5.13 | 9/15/23 | 2,500,000 | c | 2,301,250 |

| New Jersey Economic Development | | | | | |

| Authority, Special Facility | | | | | |

| Revenue (Continental | | | | | |

| Airlines, Inc. Project) | 5.25 | 9/15/29 | 4,500,000 | c | 4,027,140 |

8

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| New York—13.9% | | | | | |

| Deutsche Bank Spears/Lifers | | | | | |

| Trust (Series DBE-1177) | | | | | |

| (Metropolitan Transportation | | | | | |

| Authority, Transportation Revenue) | 5.00 | 11/15/38 | 15,000,000 | a,b,c | 14,766,450 |

| New York City Industrial | | | | | |

| Development Agency, | | | | | |

| PILOT Revenue (Queens | | | | | |

| Baseball Stadium Project) | | | | | |

| (Insured; AMBAC) | 5.00 | 1/1/36 | 8,000,000 | | 6,842,560 |

| Niagara Area Development | | | | | |

| Corporation, Solid Waste | | | | | |

| Disposal Facility Revenue | | | | | |

| (Covanta Energy Project) | 5.25 | 11/1/42 | 7,870,000 | | 6,466,858 |

| Ohio—7.2% | | | | | |

| Buckeye Tobacco Settlement | | | | | |

| Financing Authority, Tobacco | | | | | |

| Settlement Asset-Backed Bonds | 6.25 | 6/1/37 | 7,000,000 | | 5,071,290 |

| Muskingum County, | | | | | |

| Hospital Facilities Revenue | | | | | |

| (Genesis HealthCare System | | | | | |

| Obligated Group Project) | 5.00 | 2/15/44 | 7,000,000 | | 5,492,200 |

| Rickenbacker Port Authority, | | | | | |

| Capital Funding Revenue (Ohio | | | | | |

| Association of School Business | | | | | |

| Officials Expanded Asset | | | | | |

| Pooled Financing Program) | 5.38 | 1/1/32 | 4,340,000 | | 4,024,525 |

| Pennsylvania—10.4% | | | | | |

| Clairton Municipal Authority, | | | | | |

| Sewer Revenue | 5.00 | 12/1/37 | 4,000,000 | | 3,643,880 |

| Deutsche Bank Spears/Lifers | | | | | |

| Trust (Series DBE-1179) | | | | | |

| (Pennsylvania Turnpike | | | | | |

| Commission, Motor License | | | | | |

| Fund-Enhanced Turnpike | | | | | |

| Subordinate Special Revenue) | 5.00 | 12/1/42 | 13,000,000 | a,b,c | 12,565,310 |

| Pennsylvania Turnpike Commission, | | | | | |

| Motor License Fund-Enhanced | | | | | |

| Turnpike Subordinate Special | | | | | |

| Revenue (Insured; Assured | | | | | |

| Guaranty Municipal Corp.) | 5.00 | 12/1/42 | 5,000,000 | c | 4,806,550 |

The Fund 9

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| South Carolina—3.2% | | | | | |

| South Carolina Jobs-Economic | | | | | |

| Development Authority, Health | | | | | |

| Facilities Revenue (The | | | | | |

| Lutheran Homes of South | | | | | |

| Carolina, Inc.) | 5.13 | 5/1/48 | 1,750,000 | | 1,406,212 |

| South Carolina Public Service | | | | | |

| Authority, Revenue Obligations | | | | | |

| (Santee Cooper) | 5.13 | 12/1/43 | 5,000,000 | | 4,991,100 |

| Texas—13.5% | | | | | |

| Austin Convention | | | | | |

| Enterprises, Inc., Convention | | | | | |

| Center Hotel First Tier | | | | | |

| Revenue (Insured; XLCA) | 5.00 | 1/1/34 | 5,000,000 | | 4,438,200 |

| Deutsche Bank Spears/Lifers | | | | | |

| Trust (Series DBE-1182) | | | | | |

| (Dallas and Fort Worth, | | | | | |

| Joint Improvement Revenue | | | | | |

| (Dallas/Fort Worth | | | | | |

| International Airport)) | 5.00 | 11/1/45 | 15,000,000 | a,b | 13,479,000 |

| JPMorgan Chase Putters/Drivers | | | | | |

| Trust (Series 4314) (Tarrant | | | | | |

| County Cultural Education | | | | | |

| Facilities Finance Corporation, | | | | | |

| HR (Baylor Health Care | | | | | |

| System Project)) | 5.00 | 11/15/20 | 7,410,000 | a,b | 7,162,135 |

| Texas Transportation Commission, | | | | | |

| Central Texas Turnpike System | | | | | |

| First Tier Revenue | 5.00 | 8/15/41 | 2,500,000 | c | 2,336,025 |

| Virginia—5.4% | | | | | |

| Lexington Industrial Development | | | | | |

| Authority, Residential Care | | | | | |

| Facilities Mortgage Revenue | | | | | |

| (Kendal at Lexington) | 5.50 | 1/1/37 | 5,400,000 | | 4,936,464 |

| Virginia Small Business Financing | | | | | |

| Authority, Senior Lien Revenue | | | | | |

| (95 Express Lanes LLC Project) | 5.00 | 1/1/40 | 7,640,000 | c | 6,082,128 |

10

| | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) |

| Washington—2.3% | | | | | |

| Washington Health Care Facilities | | | | | |

| Authority, Revenue (Providence | | | | | |

| Health and Services) | 5.00 | 10/1/42 | 5,000,000 | | 4,729,000 |

| Wisconsin—14.1% | | | | | |

| Public Finance Agency, | | | | | |

| Senior Airport Facilities | | | | | |

| Revenue (Transportation | | | | | |

| Infrastructure Properties, LLC | | | | | |

| Obligated Group) | 5.00 | 7/1/42 | 5,000,000 | | 4,245,450 |

| Wisconsin Health and Educational | | | | | |

| Facilities Authority, Revenue | | | | | |

| (Aurora Health Care, Inc.) | 5.25 | 4/15/35 | 5,000,000 | | 4,796,950 |

| Wisconsin Health and Educational | | | | | |

| Facilities Authority, Revenue | | | | | |

| (Beaver Dam Community | | | | | |

| Hospitals, Inc.) | 5.25 | 8/15/34 | 5,700,000 | | 5,241,435 |

| Wisconsin Health and Educational | | | | | |

| Facilities Authority, Revenue | | | | | |

| (Froedtert Health, Inc. | | | | | |

| Obligated Group) (Morgan | | | | | |

| Stanley Municipal Trust | | | | | |

| Program Residual Series 3333) | 5.00 | 4/1/42 | 10,375,000 | a,b | 9,918,695 |

| Wisconsin Health and Educational | | | | | |

| Facilities Authority, Revenue | | | | | |

| (Sauk-Prairie Memorial | | | | | |

| Hospital, Inc. Project) | 5.38 | 2/1/48 | 5,000,000 | | 4,296,650 |

| U.S. Related—15.2% | | | | | |

| Guam Power Authority, | | | | | |

| Revenue | 5.00 | 10/1/34 | 5,015,000 | | 4,721,974 |

| Puerto Rico Aqueduct and Sewer | | | | | |

| Authority, Senior Lien Revenue | 5.75 | 7/1/37 | 6,500,000 | | 4,752,670 |

| Puerto Rico Aqueduct and Sewer | | | | | |

| Authority, Senior Lien Revenue | 6.00 | 7/1/44 | 6,200,000 | | 4,557,310 |

| Puerto Rico Electric Power | | | | | |

| Authority, Power Revenue | 5.00 | 7/1/32 | 4,500,000 | | 3,210,795 |

The Fund 11

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | | | | | |

| Long-Term Municipal | Coupon | Maturity | Principal | | | |

| Investments (continued) | Rate (%) | Date | Amount ($) | | Value ($) | |

| U.S. Related (continued) | | | | | | |

| Puerto Rico Electric Power | | | | | | |

| Authority, Power Revenue | 6.75 | 7/1/36 | 2,500,000 | | 2,181,175 | |

| Puerto Rico Electric Power | | | | | | |

| Authority, Power Revenue | 5.05 | 7/1/42 | 7,480,000 | | 5,020,426 | |

| Puerto Rico Highways and | | | | | | |

| Transportation Authority, | | | | | | |

| Transportation Revenue | | | | | | |

| (Insured; FGIC) | 5.25 | 7/1/39 | 9,120,000 | c | 6,329,918 | |

| |

| Total Investments (cost $353,285,861) | | | 154.7 | % | 313,470,338 | |

| Liabilities, Less Cash and Receivables | | | (30.0 | %) | (60,798,873 | ) |

| Preferred Stock, at redemption value | | | (24.7 | %) | (50,000,000 | ) |

| Net Assets Applicable to | | | | | | |

| Common Shareholders | | | 100.0 | % | 202,671,465 | |

|

| a Collateral for floating rate borrowings. |

| b Securities exempt from registration pursuant to Rule 144A under the Securities Act of 1933.These securities may be |

| resold in transactions exempt from registration, normally to qualified institutional buyers.At August 31, 2013, these |

| securities were valued at $88,720,168 or 43.8% of net assets applicable to Common Shareholders. |

| c At August 31, 2013, the fund had $72,375,569 or 35.7% of net assets applicable to Common Shareholders |

| invested in securities whose payment of principal and interest is dependent upon revenues generated from |

| transportation services. |

12

| | | |

| Summary of Abbreviations | | |

| |

| ABAG | Association of Bay Area | ACA | American Capital Access |

| | Governments | | |

| AGC | ACE Guaranty Corporation | AGIC | Asset Guaranty Insurance Company |

| AMBAC | American Municipal Bond | ARRN | Adjustable Rate |

| | Assurance Corporation | | Receipt Notes |

| BAN | Bond Anticipation Notes | BPA | Bond Purchase Agreement |

| CIFG | CDC Ixis Financial Guaranty | COP | Certificate of Participation |

| CP | Commercial Paper | DRIVERS | Derivative Inverse |

| | | | Tax-Exempt Receipts |

| EDR | Economic Development | EIR | Environmental Improvement |

| | Revenue | | Revenue |

| FGIC | Financial Guaranty | FHA | Federal Housing |

| | Insurance Company | | Administration |

| FHLB | Federal Home | FHLMC | Federal Home Loan Mortgage |

| | Loan Bank | | Corporation |

| FNMA | Federal National | GAN | Grant Anticipation Notes |

| | Mortgage Association | | |

| GIC | Guaranteed Investment | GNMA | Government National Mortgage |

| | Contract | | Association |

| GO | General Obligation | HR | Hospital Revenue |

| IDB | Industrial Development Board | IDC | Industrial Development Corporation |

| IDR | Industrial Development | LIFERS | Long Inverse Floating |

| | Revenue | | Exempt Receipts |

| LOC | Letter of Credit | LOR | Limited Obligation Revenue |

| LR | Lease Revenue | MERLOTS | Municipal Exempt Receipts |

| | | | Liquidity Option Tender |

| MFHR | Multi-Family Housing Revenue | MFMR | Multi-Family Mortgage Revenue |

| PCR | Pollution Control Revenue | PILOT | Payment in Lieu of Taxes |

| P-FLOATS | Puttable Floating Option | PUTTERS | Puttable Tax-Exempt Receipts |

| | Tax-Exempt Receipts | | |

| RAC | Revenue Anticipation Certificates | RAN | Revenue Anticipation Notes |

| RAW | Revenue Anticipation Warrants | ROCS | Reset Options Certificates |

| RRR | Resources Recovery Revenue | SAAN | State Aid Anticipation Notes |

| SBPA | Standby Bond Purchase Agreement | SFHR | Single Family Housing Revenue |

| SFMR | Single Family Mortgage Revenue | SONYMA | State of New York Mortgage Agency |

| SPEARS | Short Puttable Exempt | SWDR | Solid Waste Disposal Revenue |

| | Adjustable Receipts | | |

| TAN | Tax Anticipation Notes | TAW | Tax Anticipation Warrants |

| TRAN | Tax and Revenue Anticipation Notes | XLCA | XL Capital Assurance |

The Fund 13

STATEMENT OF INVESTMENTS (Unaudited) (continued)

| | | | | |

| Summary of Combined Ratings (Unaudited) | |

| |

| Fitch | or | Moody’s | or | Standard & Poor’s | Value (%)† |

| AA | | Aa | | AA | 26.9 |

| A | | A | | A | 20.3 |

| BBB | | Baa | | BBB | 25.7 |

| BB | | Ba | | BB | 15.1 |

| B | | B | | B | 6.6 |

| Not Ratedd | | Not Ratedd | | Not Ratedd | 5.4 |

| | | | | | 100.0 |

|

| † Based on managed assets. |

| d Securities which, while not rated by Fitch, Moody’s and Standard & Poor’s, have been determined by the Manager to |

| be of comparable quality to those rated securities in which the fund may invest. |

See notes to financial statements.

14

STATEMENT OF ASSETS AND LIABILITIES

August 31, 2013 (Unaudited)

| | | |

| | Cost | Value | |

| Assets ($): | | | |

| Investments in securities—See Statement of Investments | 353,285,861 | 313,470,338 | |

| Cash | | 2,486,322 | |

| Interest receivable | | 4,061,896 | |

| Prepaid expenses | | 128,725 | |

| | | 320,147,281 | |

| Liabilities ($): | | | |

| Due to The Dreyfus Corporation and affiliates—Note 2(b) | | 198,503 | |

| Payable for floating rate notes issued—Note 3 | | 65,865,000 | |

| Dividends payable to Common Shareholders | | 1,148,874 | |

| Interest and expense payable related | | | |

| to floating rate notes issued—Note 3 | | 140,371 | |

| Dividends payable to Preferred Shareholders | | 55,439 | |

| Accrued expenses | | 67,629 | |

| | | 67,475,816 | |

| Preferred Stock, Variable Rate Muni Term Preferred Shares | | | |

| (VMTP Shares) $.001 par value per share (500 shares issued | | |

| and outstanding at $100,000 per share liquidation value)—Note 1 | 50,000,000 | |

| Net Assets applicable to Common Shareholders ($) | | 202,671,465 | |

| Composition of Net Assets ($): | | | |

| Common Stock, par value, $.001 per share | | | |

| (18,381,981 shares issued and outstanding) | | 18,382 | |

| Paid-in capital | | 262,752,243 | |

| Accumulated undistributed investment income—net | | 1,522,079 | |

| Accumulated net realized gain (loss) on investments | | (21,805,716 | ) |

| Accumulated net unrealized appreciation | | | |

| (depreciation) on investments | | (39,815,523 | ) |

| Net Assets applicable to Common Shareholders ($) | | 202,671,465 | |

| Shares Outstanding | | | |

| (250 million shares of $.001 par value Common Stock authorized) | 18,381,981 | |

| Net Asset Value, per share of Common Stock ($) | | 11.03 | |

| |

| See notes to financial statements. | | | |

The Fund 15

STATEMENT OF OPERATIONS

From April 26, 2013 (commencement of operations)

to August 31, 2013 (Unaudited)

| | |

| Investment Income ($): | | |

| Interest Income | 5,056,238 | |

| Expenses: | | |

| Management fee—Note 2(a) | 774,367 | |

| Interest and expense related to | | |

| floating rate notes issued—Note 3 | 283,179 | |

| Professional fees | 41,783 | |

| Shareholders’ reports | 26,060 | |

| Directors’ fees and expenses—Note 2(c) | 16,305 | |

| Custodian fees—Note 2(b) | 12,000 | |

| Shareholder servicing costs | 6,933 | |

| Miscellaneous | 14,962 | |

| Total Expenses | 1,175,589 | |

| Investment Income—Net | 3,880,649 | |

| Realized and Unrealized Gain (Loss) on Investments—Note 3 ($): | | |

| Net realized gain (loss) on investments | (21,805,716 | ) |

| Net unrealized appreciation (depreciation) on investments | (39,815,523 | ) |

| Net Realized and Unrealized Gain (Loss) on Investments | (61,621,239 | ) |

| Dividends to Preferred Shareholders | (60,822 | ) |

| Net (Decrease) in Net Assets Applicable to | | |

| Common Shareholders Resulting from Operations | (57,801,412 | ) |

| |

| See notes to financial statements. | | |

16

STATEMENT OF CASH FLOWS

August 31, 2013 (Unaudited)

| | | | |

| Cash Flows from Operating Activities ($): | | | | |

| Interest received | 1,388,747 | | | |

| Operating expenses paid | (755,003 | ) | | |

| Dividends paid to Preferred Shareholders | (5,383 | ) | | |

| Purchases of long-term portfolio securities | (456,951,841 | ) | | |

| Proceeds from sales of long-term portfolio securities | 147,330,859 | | | |

| Net Cash Used by Operating Activities | | | (308,992,621 | ) |

| Cash Flows from Financing Activities ($): | | | | |

| Dividends paid to Common Shareholders | (1,148,874 | ) | | |

| Proceeds from issuance of Common Stock | 262,670,625 | | | |

| Proceeds from issuance of Preferred Stock | 50,000,000 | | | |

| Interest and expense related to | | | | |

| floating rate notes issued paid | (142,808 | ) | | |

| Net cash provided by financing activities | | | 311,378,943 | |

| Increase in cash | | | 2,386,322 | |

| Cash at beginning of period | | | 100,000 | |

| Cash at end of period | | | 2,486,322 | |

| Reconciliation of Net Decrease in Net Assets Applicable to | | | | |

| Common Shareholders Resulting from Operations to | | | | |

| Net Cash Provided by Operating Activities ($): | | | | |

| Net Decrease in Net Assets Applicable to Common | | | | |

| Shareholders Resulting From Operations | | | (57,801,412 | ) |

| Adjustments to reconcile net increase in net assets applicable | | | | |

| to common shareholders resulting from operations to | | | | |

| net cash provided by operating activities ($): | | | | |

| Increase in investments in securities, at cost | | | (353,680,265 | ) |

| Increase in interest receivable | | | (4,061,896 | ) |

| Increase in accrued expenses | | | 67,629 | |

| Increase in prepaid expenses | | | (128,725 | ) |

| Increase in Due to The Dreyfus Corporation and affiliates | | | 198,503 | |

| Increase in dividends payable to Preferred Shareholders | | | 55,439 | |

| Interest and expense related to floating rate notes issued | | | 283,179 | |

| Increase in payable for floating rate notes issued | | | 65,865,000 | |

| Net unrealized depreciation on investments | | | 39,815,523 | |

| Net amortization of premiums on investments | | | 394,404 | |

| Net Cash Provided by Operating Activities | | | (308,992,621 | ) |

| |

| See notes to financial statements. | | | | |

The Fund 17

STATEMENT OF CHANGES IN NET ASSETS

From April 26, 2013 (commencement of operations)

to August 31, 2013 (Unaudited)

| | |

| Operations ($): | | |

| Investment income—net | 3,880,649 | |

| Net realized gain (loss) on investments | (21,805,716 | ) |

| Net unrealized appreciation | | |

| (depreciation) on investments | (39,815,523 | ) |

| Dividends to Preferred Shareholders | (60,822 | ) |

| Net Increase (Decrease) in Net Assets Applicable | | |

| to Common Shareholders Resulting from Operations | (57,801,412 | ) |

| Dividends to Common Shareholders from ($) | | |

| Investment income—net | (2,297,748 | ) |

| Capital Stock Transactions ($): | | |

| Net proceeds from shares sold | 263,221,875 | |

| Offering costs charged to paid-in capital | (551,250 | ) |

| Increase (Decrease) in Net Assets | | |

| from Capital Stock Transactions | 262,670,625 | |

| Total Increase (Decrease) in Net Assets | | |

| Applicable to Common Shareholders | 202,571,465 | |

| Net Assets Applicable to Common Shareholders ($): | | |

| Beginning of Period | 100,000 | |

| End of Period | 202,671,465 | |

| Undistributed investment income—net | 1,522,079 | |

| Capital Share Transactions (Shares): | | |

| Shares sold | 18,375,000 | |

| |

| See notes to financial statements. | | |

18

FINANCIAL HIGHLIGHTS (Unaudited)

The following table describes the performance for the fiscal period from April 26, 2013 (commencement of operations) to August 31, 2013. Total return shows how much your investment in the fund would have increased (or decreased) during each period, assuming you had reinvested all dividends and distributions. These figures have been derived from the fund’s financial statements, and with respect to common stock, market price data for the fund’s common shares.

| | |

| Per Share Data ($): | | |

| Net asset value, beginning of period | 14.33 | |

| Investment Operations: | | |

| Investment income—neta | .22 | |

| Net realized and unrealized gain (loss) on investments | (3.36 | ) |

| Dividends to Preferred Shareholders | | |

| from investment income—net | (.00 | )b |

| Total from Investment Operations | 11.19 | |

| Distributions to Common Shareholders: | | |

| Dividends from investment income—net | (.13 | ) |

| Offering costs charged to paid-in capital | (.03 | ) |

| Net asset value, end of period | 11.03 | |

| Market value, end of period | 10.15 | |

| Total Return (%)c | (31.53 | )d |

| Ratios/Supplemental Data (%): | | |

| Ratio of total expenses to average | | |

| net assets applicable to Common Stocke | 1.46 | f |

| Ratio of net expenses to average | | |

| net assets applicable to Common Stocke | 1.46 | f |

| Ratio of interest and expense related to | | |

| floating rate notes issued to average | | |

| net assets applicable to Common Stocke | .35 | f |

| Ratio of net investment income to average | | |

| net assets applicable to Common Stocke | 4.83 | f |

| Ratio of total expenses to total average net assets | 1.38 | f |

| Ratio of net expenses to total average net assets | 1.38 | f |

| Ratio of interest and expense related to | | |

| floating rate notes issued to total average net assets | .33 | f |

| Ratio of net investment income to total average net assets | 4.56 | f |

| Portfolio Turnover Rate | 72.42 | d |

| Asset coverage of Preferred Stock, end of period | 505 | |

| Net Assets, applicable to Common Shareholders, end of period ($ x 1,000) | 202,671 | |

| Preferred Stock outstanding, end of period ($ x 1,000) | 50,000 | |

| Floating Rate Notes outstanding ($ x 1,000) | 65,865 | |

| |

| a | Based on average shares outstanding. |

| b | Amount represents less than $.01 per share. |

| c | Calculated based on market value. |

| d | Not annualized. |

| e | Does not reflect the effect of dividends to Preferred Shareholders. |

| f | Annualized. |

See notes to financial statements.

The Fund 19

NOTES TO FINANCIAL STATEMENTS (Unaudited)

NOTE 1—Significant Accounting Policies:

Dreyfus Municipal Bond Infrastructure Fund, Inc. (the “fund”) had no operations until April 26, 2013 (commencement of operations) other than matters relating to its organization and registration as a non-diversified closed-end management investment company under the Investment Company Act of 1940, as amended (the “Act”).The fund’s investment objective is to seek to provide as high a level of current income exempt from regular federal income tax as is consistent with the preservation of capital.The Dreyfus Corporation (the “Manager” or “Dreyfus”), a wholly-owned subsidiary of The Bank of New York Mellon Corporation (“BNY Mellon”), serves as the fund’s investment adviser. Standish Mellon Asset Management Company LLC (“Standish”) serves as the fund’s sub-investment adviser. Standish is an affiliate of Dreyfus. The fiscal year end of the fund is February 28. The fund’s Common Stock trades on the NewYork Stock Exchange (the “NYSE”) under the ticker symbol DMB.

The fund sold 16,950,000 shares of Common Stock at $15.00 per share through an initial offering which settled on April 26, 2013. Subsequently, an additional 1,425,000 shares of Common Stock at $15.00 per share were also issued to cover over-allotments to the underwriters on June 10, 2013. Costs associated with the initial underwriting of $551,250 were charged against the proceeds of the offering.

The fund has outstanding 500 Variable Rate Muni Term Preferred Shares (“VMTP Shares”), with a liquidation preference of $100,000 per share (plus an amount equal to accumulated but unpaid dividends upon liquidation). The fund issued the VMTP Shares on July 29, 2013. The fund entered into a Redemption and Paying Agent Agreement withThe Bank of NewYork Mellon, a subsidiary of BNY Mellon and an affiliate of the Managers, with respect toVMTP Shares.

The fund is subject to certain restrictions relating to theVMTP Shares. Failure to comply with these restrictions could preclude the fund from declaring any distributions to Common Shareholders or repurchasing

20

common shares and/or could trigger the mandatory redemption of VMTP Shares at liquidation value.Thus, redemptions of VMTP Shares may be deemed to be outside of the control of the fund.

The Financial Accounting Standards Board (“FASB”) Accounting Standards Codification is the exclusive reference of authoritative U.S. generally accepted accounting principles (“GAAP”) recognized by the FASB to be applied by nongovernmental entities. Rules and interpretive releases of the Securities and Exchange Commission (“SEC”) under authority of federal laws are also sources of authoritative GAAP for SEC registrants. The fund’s financial statements are prepared in accordance with GAAP, which may require the use of management estimates and assumptions.Actual results could differ from those estimates.

The fund enters into contracts that contain a variety of indemnifications. The fund’s maximum exposure under these arrangements is unknown.The fund does not anticipate recognizing any loss related to these arrangements.

(a) Portfolio valuation: The fair value of a financial instrument is the amount that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date (i.e., the exit price). GAAP establishes a fair value hierarchy that prioritizes the inputs of valuation techniques used to measure fair value.This hierarchy gives the highest priority to unadjusted quoted prices in active markets for identical assets or liabilities (Level 1 measurements) and the lowest priority to unobservable inputs (Level 3 measurements).

Additionally, GAAP provides guidance on determining whether the volume and activity in a market has decreased significantly and whether such a decrease in activity results in transactions that are not orderly. GAAP requires enhanced disclosures around valuation inputs and techniques used during annual and interim periods.

The Fund 21

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

Various inputs are used in determining the value of the fund’s investments relating to fair value measurements.These inputs are summarized in the three broad levels listed below:

Level 1—unadjusted quoted prices in active markets for identical investments.

Level 2—other significant observable inputs (including quoted prices for similar investments, interest rates, prepayment speeds, credit risk, etc.).

Level 3—significant unobservable inputs (including the fund’s own assumptions in determining the fair value of investments).

The inputs or methodology used for valuing securities are not necessarily an indication of the risk associated with investing in those securities.

Changes in valuation techniques may result in transfers in or out of an assigned level within the disclosure hierarchy. Valuation techniques used to value the fund’s investments are as follows:

Investments in securities are valued each business day by an independent pricing service (the “Service”) approved by the fund’s Board of Directors (the “Board”). Investments for which quoted bid prices are readily available and are representative of the bid side of the market in the judgment of the Service are valued at the mean between the quoted bid prices (as obtained by the Service from dealers in such securities) and asked prices (as calculated by the Service based upon its evaluation of the market for such securities). Other investments (which constitute a majority of the portfolio securities) are carried at fair value as determined by the Service, based on methods which include consideration of the following: yields or prices of municipal securities of comparable quality, coupon, maturity and type; indications as to values from dealers; and general market conditions. All of the preceding securities are categorized within Level 2 of the fair value hierarchy.

The Service’s procedures are reviewed by Dreyfus under the general supervision of the Board.

When market quotations or official closing prices are not readily available, or are determined not to reflect accurately fair value, such as when

22

the value of a security has been significantly affected by events after the close of the exchange or market on which the security is principally traded, but before the fund calculates its net asset value, the fund may value these investments at fair value as determined in accordance with the procedures approved by the Board. Certain factors may be considered when fair valuing investments such as: fundamental analytical data, the nature and duration of restrictions on disposition, an evaluation of the forces that influence the market in which the securities are purchased and sold, and public trading in similar securities of the issuer or comparable issuers.These securities are either categorized within Level 2 or 3 of the fair value hierarchy depending on the relevant inputs used.

For restricted securities where observable inputs are limited, assumptions about market activity and risk are used and are categorized within Level 3 of the fair value hierarchy.

The following is a summary of the inputs used as of August 31, 2013 in valuing the fund’s investments:

| | | | | | |

| | | Level 2—Other | | Level 3— | | |

| | Level 1— | Significant | | Significant | | |

| | Unadjusted | Observable | | Unobservable | | |

| | Quoted Prices | Inputs | | Inputs | Total | |

| Assets ($) | | | | | | |

| Investments in Securities: | | | | | |

| Municipal Bonds | — | 313,470,338 | | — | 313,470,338 | |

| Liabilities ($) | | | | | | |

| Floating Rate Notes† | — | (65,865,000 | ) | — | (65,865,000 | ) |

| |

| † | Certain of the fund’s liabilities are held at carrying amount, which approximates fair value for |

| | financial reporting purposes. |

At August 31, 2013, there were no transfers between Level 1 and Level 2 of the fair value hierarchy.

(b) Securities transactions and investment income: Securities transactions are recorded on a trade date basis. Realized gains and losses from securities transactions are recorded on the identified cost basis. Interest income, adjusted for accretion of discount and amortization of premium

The Fund 23

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

on investments, is earned from settlement date and recognized on the accrual basis. Securities purchased or sold on a when issued or delayed delivery basis may be settled a month or more after the trade date.

(c) Dividends to shareholders of Common Stock (“Common Shareholders(s)”): Dividends are recorded on the ex-dividend date. Dividends from investment income-net are normally declared and paid monthly. Dividends from net realized capital gains, if any, are normally declared and paid annually, but the fund may make distributions on a more frequent basis to comply with the distribution requirements of the Internal Revenue Code of 1986, as amended (the “Code”).To the extent that net realized capital gains can be offset by capital loss carryovers, it is the policy of the fund not to distribute such gains. Income and capital gain distributions are determined in accordance with income tax regulations, which may differ from GAAP.

Common shareholders will receive distributions as additional shares of the fund unless they opt out of the dividend reinvestment plan, in which case they will receive all distributions in cash. After the fund declares a distribution, Computershare Trust Company, N.A., acting as the Plan Agent for the common shareholders, will, either (i) receive the cash payment and use it to buy common shares in the open market for shareholder's accounts (if, on the payment date, the net asset value per share exceeds the market price per common share plus estimated brokerage commissions), or (ii) distribute newly issued common shares of the fund on behalf of shareholders (if, on the payment date the market price per share plus estimated brokerage commissions equals or exceeds the net asset value per share).When the fund issues shares, the number of shares to be issued will be determined at a per share rate equal to the greater of either the net asset value or 95% of the closing price per common share on the payment date.

On August 5, 2013, the Board declared a cash dividend of $.0625 per share from investment income-net, payable on September 3, 2013 to Common Shareholders of record as of the close of business on August 19, 2013.

24

(d) Dividends to shareholders ofVMTP Shares: Dividends onVMTP Shares are declared daily and paid monthly.The Applicable Rate is equal to the rate per annum that results from the sum of the (a) Applicable Base Rate and (b) Ratings Spread as determined pursuant to the Applicable Rate Determination for the VMTP Shares on the Rate Determination Date immediately preceding such Subsequent Rate Period. The Applicable Rate for the initial rate period of the VMTP Shares was equal to the sum of 1.25% per annum plus the Securities Industry and Financial Markets Association (SIFMA) Municipal Swap Index rate of .06% on July 24, 2013.The dividend rate as of August 31, 2013 forVMTP Shares was 1.31%.

(e) Federal income taxes: It is the policy of the fund to qualify as a regulated investment company, which can distribute tax-exempt dividends, by complying with the applicable provisions of the Code, and to make distributions of income and net realized capital gain sufficient to relieve it from substantially all federal income and excise taxes.

As of and during the period ended August 31, 2013, the fund did not have any liabilities for any uncertain tax positions.The fund recognizes interest and penalties, if any, related to uncertain tax positions as income tax expense in the Statement of Operations. During the period, the fund did not incur any interest or penalties.

The components of accumulated earnings on a tax basis and tax character of current year distributions will be determined at the end of the current fiscal year.

NOTE 2—Management Fee and Other Transactions With Affiliates:

(a) Pursuant to a management agreement with the Manager, the management fee is computed at the annual rate of .65% of the value of the fund’s daily total assets minus the sum of accrued liabilities (other than the aggregate indebtedness constituting financial leverage) (the “Managed

The Fund 25

NOTES TO FINANCIAL STATEMENTS (Unaudited) (continued)

Assets”) and is payable monthly. During the period ended August 31, 2013, there was no expense reimbursement pursuant to the Agreement.

Pursuant to a sub-investment advisory agreement between Dreyfus and Standish, Dreyfus pays Standish a fee at the annual rate of .27% of the value of the fund’s average daily Managed Assets and is payable monthly.

(b) The fund compensates The Bank of NewYork Mellon under a custody agreement for providing custodial services for the fund. During the period ended August 31, 2013, the fund was charged $12,000 pursuant to the custody agreement.

The fund has an arrangement with the custodian whereby the fund may receive earnings credits when positive cash balances are maintained, which are used to offset custody fees. For financial reporting purposes, the fund includes net earnings credits as an expense offset in the Statement of Operations.

During the period ended August 31, 2013, the fund was charged $4,670 for services performed by the Chief Compliance Officer and his staff.

The components of “Due to The Dreyfus Corporation and affiliates” in the Statement of Assets and Liabilities consist of: management fees $180,913, custodian fees $11,418 and Chief Compliance Officer fees $6,172.

(c) Each Board member also serves as a board member of other funds within the Dreyfus complex. Annual retainer fees and attendance fees are allocated to each fund based on net assets.

NOTE 3—Securities Transactions:

The aggregate amount of purchases and sales of investment securities, excluding short-term securities, during the period ended August 31, 2013, amounted to $456,951,841 and $147,330,859, respectively.

26

Inverse Floater Securities: The fund participates in secondary inverse floater structures in which fixed-rate, tax-exempt municipal bonds are transferred to a trust.The trust subsequently issues two or more variable rate securities that are collateralized by the cash flows of the fixed-rate, tax-exempt municipal bonds. One or more of these variable rate securities pays interest based on a short-term floating rate set by a remarketing agent at predetermined intervals.A residual interest tax-exempt security is also created by the trust, which is transferred to the fund, and is paid interest based on the remaining cash flow of the trust, after payment of interest on the other securities and various expenses of the trust.

The fund accounts for the transfer of bonds to the trust as secured borrowings, with the securities transferred remaining in the fund’s investments, and the related floating rate certificate securities reflected as fund liabilities in the Statement of Assets and Liabilities.

The average amount of borrowings outstanding under the inverse floater structure during the period ended August 31, 2013, was approximately $98,200,000, with a related weighted average annualized interest rate of .82%.

At August 31, 2013, accumulated net unrealized depreciation on investments was $39,815,523, consisting of $128,926 gross unrealized appreciation and $39,944,449 gross unrealized depreciation.

At August 31, 2013, the cost of investments for federal income tax purposes was substantially the same as the cost for financial reporting purposes (see the Statement of Investments).

The Fund 27

INFORMATION ABOUT THE APPROVAL OF THE

FUND’S MANAGEMENT AGREEMENT (Unaudited)

At a meeting of the fund’s Board held on March 7, 2013, the Board considered the approval, through its renewal date of August 31, 2014, of the fund’s Management Agreement, pursuant to which Dreyfus will provide the fund with investment advisory and administrative services, and the Sub-Investment Advisory Agreement between Dreyfus and Standish (the “Sub-Adviser”) (together, the “Agreements”), pursuant to which the Sub-Adviser will provide day-to-day management of the fund’s investments.The Board members who are not “interested persons” (as defined in the Act) of the fund, were assisted in their review by independent legal counsel and met with counsel in executive session separate from representatives of Dreyfus and the Sub-Adviser. In considering the approval of the Agreements, the Board considered all factors that it believed to be relevant, including, among other things, the factors discussed below.

Analysis of Nature, Extent and Quality of Services To Be Provided to the Fund. The Board members considered information previously provided to them in a presentation from representatives of Dreyfus regarding services provided to other funds in the Dreyfus fund complex, and representatives of Dreyfus confirmed that there had been no material changes in this information. The Board also discussed the nature, extent and quality of the services to be provided to the fund pursuant to its Management Agreement and by the Sub-Adviser pursuant to the Sub-Advisory Agreement.

The Board members considered the Sub-Adviser’s research and portfolio management capabilities and that Dreyfus also provides oversight of day-to-day fund operations, including fund accounting and administration and assistance in meeting legal and regulatory requirements. The Board members also considered Dreyfus’ extensive administrative, accounting and compliance infrastructure, as well as Dreyfus’ supervisory activities over the Sub-Adviser. The Board also considered Dreyfus’ and the Sub-Adviser’s brokerage policies and practices, including the standards applied in seeking best execution.

28

Comparative Analysis of the Fund’s Performance and Management Fee and Expense Ratio.As the fund had not yet commenced operations, the Board members were not able to review the fund’s performance.The Board discussed with representatives of Dreyfus the portfolio management team and the investment strategies to be employed in the management of the fund’s assets.The Board members noted Dreyfus’ and the Sub-Adviser’s reputation and experience.

The Board members reviewed the fund’s management fee and anticipated expense ratio and reviewed the management fees and expense ratios of funds in a group of funds independently prepared by Lipper Inc. that were part of the Lipper General & Insured Municipal Debt Fund (Leveraged) category (the “Comparison Group”) and discussed the results of the comparisons. The Board members noted that the fund’s contractual and actual management fees, based on common assets alone and together with assets obtained through leverage, were above the Expense Group medians. The Board members also noted that the fund’s estimated total expenses, based on common assets alone and together with assets obtained through leverage, were below the Expense Group medians (net of expenses associated with the issuance of preferred shares by any fund, which are not included in the expense ratios calculated and provided by Lipper).

Representatives of Dreyfus informed the Board members that there were no other investment companies or separate accounts managed by Dreyfus, the Sub-Adviser or their affiliates with similar policies and strategies as the fund.

Analysis of Profitability and Economies of Scale. As the fund had not yet commenced operations, Dreyfus’ representatives were not able to review the dollar amount of expenses allocated and profit received by Dreyfus, or any economies of scale. The Board members considered potential benefits to Dreyfus and the Sub-Adviser from acting as investment adviser and sub-investment adviser, respectively.The Board

The Fund 29

INFORMATION ABOUT THE APPROVAL OF THE FUND’S

MANAGEMENT AGREEMENT (Unaudited) (continued)

members noted the uncertainty of the estimated asset levels and discussed the renewal requirements for advisory agreements and their ability to review the management fee and related profitability and any economies of scale annually after an initial term of the Agreements.

At the conclusion of these discussions, the Board agreed that it had been furnished with sufficient information to make an informed business decision with respect to approving the Agreements. Based on the discussions and considerations as described above, the Board made the following conclusions and determinations.

The Board concluded that the nature, extent and quality of the services to be provided by Dreyfus and the Sub-Adviser are adequate and appropriate.

The Board concluded that, since the fund had not yet commenced operations, its performance could not be measured and was not a factor.The Board considered Dreyfus’ and Sub-Adviser’s experience and reputation.

The Board concluded that the fees to be paid to Dreyfus were rea- sonable, in light of the services to be provided, comparative expense and advisory fee information, and benefits anticipated to be derived by Dreyfus and the Sub-Adviser from their relationship with the fund, and that the fee paid by Dreyfus to the Sub-Adviser was reasonable and appropriate.

The Board determined that because the fund had not commenced operations, economies of scale were not a factor, but, to the extent that material economies of scale are not shared with the fund in the future, the Board would seek to do so in connection with future renewals.

The Board members considered these conclusions and determinations, and, without any one factor being dispositive, the Board determined that approval of the Agreements was in the best interests of the fund and its shareholders.

30

TheFund 33

Item 2. Code of Ethics.

Not applicable.

Item 3. Audit Committee Financial Expert.

Not applicable.

Item 4. Principal Accountant Fees and Services.

Not applicable.

Item 5. Audit Committee of Listed Registrants.

Not applicable.

Item 6. Investments.

(a) Not applicable.

Item 7. Disclosure of Proxy Voting Policies and Procedures for Closed-End Management Investment Companies.

Not applicable.

Item 8. Portfolio Managers of Closed-End Management Investment Companies.

Not applicable.

Item 9. Purchases of Equity Securities by Closed-End Management Investment Companies and Affiliated Purchasers.

Not applicable. [CLOSED END FUNDS ONLY]

Item 10. Submission of Matters to a Vote of Security Holders.

There have been no material changes to the procedures applicable to Item 10.

Item 11. Controls and Procedures.

(a) The Registrant's principal executive and principal financial officers have concluded, based on their evaluation of the Registrant's disclosure controls and procedures as of a date within 90 days of the filing date of this report, that the Registrant's disclosure controls and procedures are reasonably designed to ensure that information required to be disclosed by the Registrant on Form N-CSR is recorded, processed, summarized and reported within the required time periods and that information required to be disclosed by the Registrant in the reports that it files or submits on Form N-CSR is accumulated and communicated to the Registrant's management, including its principal executive and principal financial officers, as appropriate to allow timely decisions regarding required disclosure.

(b) There were no changes to the Registrant's internal control over financial reporting that occurred during the second fiscal quarter of the period covered by this report that have materially affected, or are reasonably likely to materially affect, the Registrant's internal control over financial reporting.

Item 12. Exhibits.

(a)(1) Not applicable.

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Investment Company Act of 1940.

(a)(3) Not applicable.

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Investment Company Act of 1940.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the Registrant has duly caused this Report to be signed on its behalf by the undersigned, thereunto duly authorized.

Dreyfus Municipal Bond Infrastructure Fund, Inc.;

By: /s/ Bradley J. Skapyak |

Bradley J. Skapyak, President |

Date: | October 23, 2013 |

|

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this Report has been signed below by the following persons on behalf of the Registrant and in the capacities and on the dates indicated. |

|

By: /s/ Bradley J. Skapyak |

Bradley J. Skapyak, President |

Date: | October 23, 2013 |

|

By: /s/ James Windels |

James Windels, Treasurer |

Date: | October 23, 2013 |

|

EXHIBIT INDEX

(a)(2) Certifications of principal executive and principal financial officers as required by Rule 30a-2(a) under the Investment Company Act of 1940. (EX-99.CERT)

(b) Certification of principal executive and principal financial officers as required by Rule 30a-2(b) under the Investment Company Act of 1940. (EX-99.906CERT)