Filed Pursuant to Rule 424(b)(3)

Registration No. 333-190956

Prospectus Supplement No. 7

(to Prospectus dated October 8, 2013)

MAGNUM HUNTER RESOURCES CORPORATION

Offer to Exchange $600,000,000 Registered 9.750% Senior Notes due 2020 and Related Guarantees

for

$600,000,000 Outstanding 9.750% Senior Notes due 2020 and Related Guarantees

This Prospectus Supplement No. 7, dated January22, 2014 (this “Supplement”), is being filed to update, amend and supplement the information previously included in our prospectus, dated October 8, 2013 (the “Prospectus”), as supplemented by Prospectus Supplement No. 1 dated November 12, 2013, Prospectus Supplement No. 2 dated November 27, 2013, Prospectus Supplement No. 3 dated December 12, 2013, Prospectus Supplement No. 4 dated December 19, 2013, Prospectus Supplement No. 5 dated January 6, 2014 and Prospectus Supplement No. 6 dated January 16, 2014, with the information contained in the Form 8-K filed with the Securities and Exchange Commission on January22, 2014 (the “Form 8-K”). Any other documents, exhibits or information contained in the Form 8-K that have been deemed furnished and not filed pursuant to General Instruction B.2 of Form 8-K or otherwise in accordance with SEC rules shall not be included in this Supplement. We have attached the Form 8-K to this Supplement. This Supplement is not complete without, and may not be delivered or used except in connection with, the Prospectus, including all amendments and supplements thereto.

We urge you to carefully review the “Risk Factors” beginning on page 8 of the Prospectus.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

___________

Date of Report (Date of earliest event reported):

January 22, 2014

__________

MAGNUM HUNTER RESOURCES CORPORATION

(Exact Name of Registrant as Specified in its Charter)

Delaware (State or Other Jurisdiction of Incorporation) | 001-32997 (Commission File Number) | 86-0879278 (I.R.S. Employer Identification Number) |

777 Post Oak Boulevard, Suite 650

Houston, Texas 77056

(Address of principal executive offices, including zip code)

(832) 369-6986

(Registrant’s telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligations of the registrant under any of the following provisions:

£ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

£ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

£ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

£ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

On January 15, 2014, Magnum Hunter Resources Corporation (the “Company”) issued a press release announcing (a) the Company’s estimated total proved oil and natural gas reserves totaling 75.9 million barrels of oil equivalent at December 31, 2013 and (b) the present value of estimated future cash flows, before income taxes, such proved reserves, discounted at 10% ("PV-10"), of $922.1 million at December 31, 2013 (the “Reserves Release”). A copy of the Reserves Release is filed as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference herein.

This Current Report on Form 8-K and the Reserves Release contain certain financial measures that are non-GAAP measures. The Company has provided reconciliations within this Current Report on Form 8-K and the Reserves Release of the non-GAAP financial measures to the most directly comparable GAAP financial measures. These non-GAAP financial measures should be considered in addition to, but not as a substitute for, measures for financial performance prepared in accordance with GAAP that are presented in this Current Report on Form 8-K and in the Reserves Release.

PV-10 is the present value of the estimated future cash flows from estimated total proved reserves after deducting estimated production and ad valorem taxes, future capital costs and operating expenses, but before deducting any estimates of future income taxes. The estimated future cash flows are discounted at an annual rate of 10% to determine their "present value." The Company believes PV-10 to be an important measure for evaluating the relative significance of its oil and gas properties and that the presentation of the non-GAAP financial measure of PV-10 provides useful information to investors because it is widely used by professional analysts and investors in evaluating oil and gas companies. Because there are many unique factors that can impact an individual company when estimating the amount of future income taxes to be paid, the Company believes the use of a pre-tax measure is valuable for evaluating the Company. We believe that PV-10 is a financial measure routinely used and calculated similarly by other companies in the oil and gas industry. However, PV-10 should not be considered as an alternative to the standardized measure as computed under GAAP.

The standardized measure of discounted future net cash flows and a reconciliation of the PV-10 to the standardized measure relating to the Company's total proved oil and natural gas reserves at December 31, 2013, are as follows:

| | | As of December 31, 2013 |

| Future cash inflows | | $ | 3,711,260 | |

| Future production costs | | | (1,423,306 | ) |

| Future development costs | | | (421,797 | ) |

| Future income tax expense | | | (149,367 | ) |

| Future net cash flows | | | 1,716,790 | |

| 10% annual discount for estimated | | | | |

| timing of cash flows | | | (872,280 | ) |

| Standardized measure of discounted future | | | | |

| net cash flows related to proved reserves | | $ | 844,510 | |

| | | | | |

| Reconciliation of Non-GAAP Measure | | | | |

| PV-10 | | $ | 922,071 | |

| Less: Income taxes | | | | |

| Undiscounted future income taxes | | | (149,367 | ) |

| 10% discount factor | | | 71,806 | |

| Future discounted income taxes | | | (77,561 | ) |

| | | | | |

| Standardized measure of discounted future net cash flows | | $ | 844,510 | |

This Current Report on Form 8-K includes “forward-looking statements.” All statements other than statements of historical facts included or incorporated herein may constitute forward-looking statements. Actual results could vary significantly from those expressed or implied in such statements and are subject to a number of risks and uncertainties. Although the Company believes that the expectations reflected in the forward-looking statements are reasonable, the Company can give no assurance that such expectations will prove to be correct. The forward-looking statements involve risks and uncertainties that affect operations, financial performance, and other factors as discussed in filings made by the Company with the Securities and Exchange Commission (the “SEC”). Among the factors that could cause results to differ materially are those risks discussed in the periodic reports filed by the Company with the SEC, including the Company’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012 and its Quarterly Reports on Form 10-Q for the fiscal quarters ended after such fiscal year. Readers are urged to carefully review and consider the cautionary statements and other disclosures made in those filings, specifically those under the heading “Risk Factors.” Forward-looking statements speak only as of the date of the document in which they are contained, and the Company does not undertake any duty to update any forward-looking statements except as may be required by law.

| Item 9.01. | Financial Statements and Exhibits. |

(d) Exhibits

| Exhibit Number | | Description |

| 99.1 | | Press Release of the Company dated January 15, 2014. |

SIGNATURES

In accordance with the requirements of the Securities Exchange Act of 1934, as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| | MAGNUM HUNTER RESOURCES CORPORATION |

| | |

| Date: January 22, 2014 | /s/ Gary C. Evans |

| | Gary C. Evans, |

| | Chairman and Chief Executive Officer |

index to exhibits

| Exhibit Number | | Description |

| 99.1 | | Press Release of the Company dated January 15, 2014. |

Exhibit 99

| News Release | | News Release |

|---|

| | | |

Magnum Hunter Resources Reports

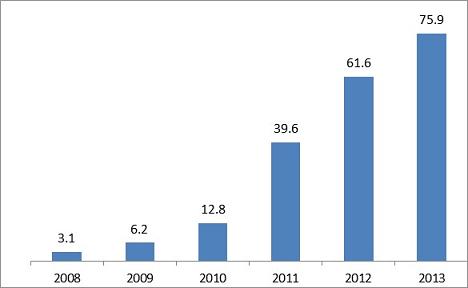

Total Proved Reserves of 75.9 MMBoe at Year-End 2013

Proved Reserves Up 23% From Year-End 2012*

Present Value (PV-10) Up 22% From Year-End 2012 to $922 Million*

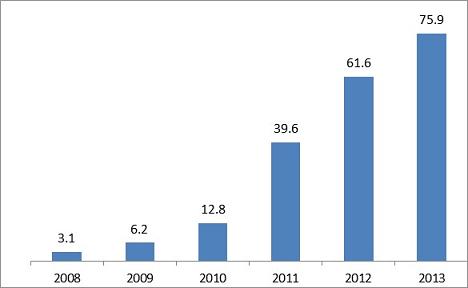

HOUSTON, Texas – (Marketwire) – January 15, 2014 – Magnum Hunter Resources Corporation (NYSE: MHR) (NYSE MKT: MHR.PRC; MHR.PRD; MHR.PRE) (“Magnum Hunter” or the “Company”) announced today a 23% increase in the quantity of the Company's estimated total proved oil and natural gas reserves at December 31, 2013, as compared to such reserves at December 31, 2012 (as adjusted for the Company’s Eagle Ford divestiture described below). The present value of estimated future cash flows, before income taxes, of the Company's estimated total proved reserves as of year-end 2013, discounted at 10% ("PV-10"), also increased 22% or $168.7 million to $922.1 million, as compared to the PV-10 of such reserves at year-end 2012 (as adjusted for such divestiture) (see “Non-GAAP Financial Measures and Reconciliations” below). Please note the Company's December 31, 2012 total proved reserves decreased from 73.1 million barrels of oil equivalent (“MMBoe”) to 61.6 MMBoe as a result of the Company’s Eagle Ford divestiture that was completed on April 24, 2013. The Company divested its ownership interests in approximately 19,000 net acres located in Gonzales and Lavaca Counties of South Texas in April 2013 for approximately $401 million (before purchase price adjustments).

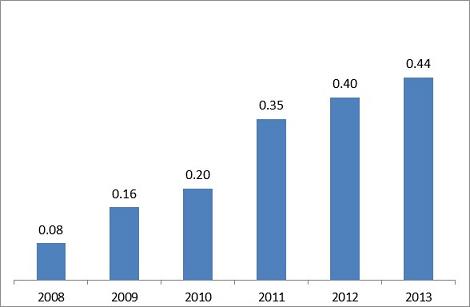

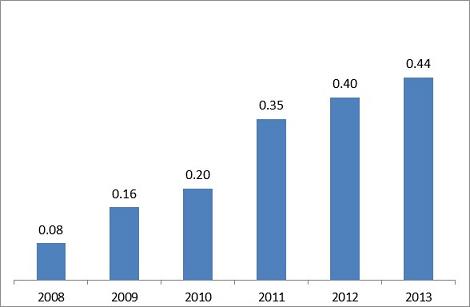

Magnum Hunter's total proved reserves increased by 14.3 MMBoe to 75.9 MMBoe (46% crude oil and NGLs; 52% proved developed producing) at December 31, 2013, as compared to 61.6 MMBoe (57% crude oil and NGLs; 56% proved developed producing) at December 31, 2012. Proved developed producing reserves increased 16% to 39.6 MMBoe as of December 31, 2013, predominately as a result of the Company’s continued execution of its development drilling program in the Appalachian Basin. Proved undeveloped reserves increased 23% to 27.4 MMBoe primarily due to the execution and delineation of the Company’s existing lease acreage position in the Marcellus Shale. The Company’s reserve life (R/P ratio) of its proved reserves based on current production is approximately 11.9 years.

As of December 31, 2013, there were proved reserves attributable to only one Utica Shale well included in the new reserve report. The Company expects to significantly increase reserves in the Utica Shale, where it presently owns over 97,000 net leasehold acres, during 2014 as a result of “pad” drilling and delineation of its lease acreage position in this region. The Appalachian Basin accounted for 70% of Magnum Hunter’s proved reserve volumes at December 31, 2013, the Williston Basin accounted for 28% and other legacy assets, including the Company’s remaining assets in South Texas, accounted for the remaining 2%.

The PV-10 of the Company's proved reserves at December 31, 2013 increased by $168.7 million or 22% to $922.1 million from $753.4 million at December 31, 2012 (see “Non-GAAP Financial Measures and Reconciliations” below). Under SEC guidelines, the commodity prices used in the December 31, 2013 and December 31, 2012 PV-10 estimates were based on the 12-month unweighted arithmetic average of the first day of the month prices for the period January 1, 2013 through December 31, 2013, and for the period January 1, 2012 through December 31, 2012, respectively, adjusted by lease for transportation fees and regional price differentials. For crude oil and NGL volumes, the average West Texas Intermediate posted price of $96.78 per barrel used to calculate PV-10 at December 31, 2013, was up 2% from the average price of $94.71 per barrel used to calculate PV-10 at December 31, 2012. For natural gas volumes, the average price of the Henry Hub spot price of $3.67 per million British thermal units ("MMBTU") used to calculate PV-10 at December 31, 2013 was up 33% from the average price of $2.75 per MMBTU used to calculate PV-10 at December 31, 2012. All prices were held constant throughout the estimated economic life of the properties.

The estimates of Magnum Hunter's total proved reserves as of December 31, 2013 were prepared by the Company’s independent engineering consultant, Cawley Gillespie & Associates, Inc., and include Marcellus, Utica and Williston Basin/Bakken/Sanish Shales reserves.

Management Comments

Mr. Gary C. Evans, Chairman and Chief Executive Officer of Magnum Hunter, commented, "This past year’s growth in proved reserves was primarily attributable to our success in the Marcellus Shale Play of West Virginia and Southeastern Ohio. We were successful at replacing over 100% of the reserves lost in 2013 due to asset divestitures which included our Eagle Ford Division ($401 million). We had three new Marcellus wells that have been estimated to have over 10.5 Bcfe of proved reserves per well and one of those wells was estimated to have 11.7 Bcfe of proved reserves. Approximately 55% of our Marcellus wells exceed the average estimated cumulative proved reserves of 7.8 Bcfe each. Every year since initiating operations in the Marcellus Shale Play back in 2010, we have been successful at increasing the ultimate recoveries on new drills. This is a testimony of not only the quality of our lease acreage position, but also management’s ability to continue improving upon our well completion methods. A significant point to note is that none of the proved reserves announced today include the Utica Shale Play where we hold close to 100,000 net leasehold acres with the exception of one well that had only a partial completion due to downhole issues. Therefore, with our greatly expanded Appalachian drilling budget, we are confident in our ability to continue to grow our proved reserves in both of these two exciting resources plays in a significant way during 2014.”

* Excludes approximately 11.5 MMBoe of proved reserves associated with the Eagle Ford divestiture.

| • | | Calculation based on weighted average common shares outstanding during the specified year. |

Non-GAAP Financial Measures and Reconciliations

This press release contains certain financial measures that are non-GAAP measures. We have provided reconciliations within this release of the non-GAAP financial measures to the most directly comparable GAAP financial measures. These non-GAAP financial measures should be considered in addition to, but not as a substitute for, measures for financial performance prepared in accordance with GAAP that are presented in this release.

PV-10 is the present value of the estimated future cash flows from estimated total proved reserves after deducting estimated production and ad valorem taxes, future capital costs and operating expenses, but before deducting any estimates of future income taxes. The estimated future cash flows are discounted at an annual rate of 10% to determine their "present value." We believe PV-10 to be an important measure for evaluating the relative significance of our oil and gas properties and that the presentation of the non-GAAP financial measure of PV-10 provides useful information to investors because it is widely used by professional analysts and investors in evaluating oil and gas companies. Because there are many unique factors that can impact an individual company when estimating the amount of future income taxes to be paid, we believe the use of a pre-tax measure is valuable for evaluating the Company. We believe that PV-10 is a financial measure routinely used and calculated similarly by other companies in the oil and gas industry. However, PV-10 should not be considered as an alternative to the standardized measure as computed under GAAP.

The standardized measure of discounted future net cash flows relating to Magnum Hunter's total proved oil and natural gas reserves is as follows:

| | | As of December 31, 2013 |

| Future cash inflows | | $ | 3,711,260 | |

| Future production costs | | | (1,423,306 | ) |

| Future development costs | | | (421,797 | ) |

| Future income tax expense | | | (149,367 | ) |

| Future net cash flows | | | 1,716,790 | |

| 10% annual discount for estimated | | | | |

| timing of cash flows | | | (872,280 | ) |

| Standardized measure of discounted future | | | | |

| net cash flows related to proved reserves | | $ | 844,510 | |

| | | | | |

| Reconciliation of Non-GAAP Measure | | | | |

| PV-10 | | $ | 922,071 | |

| Less: Income taxes | | | | |

| Undiscounted future income taxes | | | (149,367 | ) |

| 10% discount factor | | | 71,806 | |

| Future discounted income taxes | | | (77,561 | ) |

| | | | | |

| Standardized measure of discounted future net cash flows | | $ | 844,510 | |

Certain Definitions

The SEC requires oil and natural gas companies, in filings made with the SEC, to disclose proved reserves, which are those quantities of oil and natural gas that by analysis of geoscience and engineering data can be estimated with reasonable certainty to be economically producible from a given date forward, from known reservoirs, and under existing economic conditions, operating methods, and government regulations.

About Magnum Hunter Resources Corporation

Magnum Hunter Resources Corporation and subsidiaries are a Houston, Texas-based independent exploration and production company engaged in the acquisition, development and production of crude oil, natural gas and natural gas liquids, primarily in the States of West Virginia, Ohio, Kentucky, and North Dakota. The Company is presently active in three of the most prolific unconventional shale resource plays in North America, namely the Marcellus Shale, Utica Shale, and Williston Basin/Bakken Shale.

Availability of Information on the Company’s Website

Magnum Hunter is providing a reminder that it makes available on its website (at www.magnumhunterresources.com) a variety of information for investors, analysts and the media, including the following:

| • | | annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K and any amendments to those reports as soon as reasonably practicable after the material is electronically filed with or furnished to the Securities and Exchange Commission; |

| • | | the most recent version of the Company’s Investor Presentation slide deck; |

| • | | announcements of conference calls, webcasts, investor conferences, speeches and other events at which Company executives may discuss the Company and its business and archives or transcripts of such events; |

| • | | press releases regarding annual and quarterly earnings, operational developments, legal developments and other matters; and |

| • | | corporate governance information, including the Company’s corporate governance guidelines, committee charters, code of conduct and other governance-related matters. |

Magnum Hunter’s goal is to maintain its website as the authoritative portal through which visitors can easily access current information about the Company. Over time, the Company intends for its website to become a primary channel for public dissemination of important information about the Company. Investors, analysts, media and other interested persons are encouraged to visit the Company’s website frequently.

Certain information included on the Company’s website constitutes forward-looking statements and is subject to the qualifications under the heading “Forward-Looking Statements” below and in the Company’s Investor Presentation slide deck.

Forward-Looking Statements

This press release includes “forward-looking statements.” All statements other than statements of historical facts included or incorporated herein may constitute forward-looking statements. Actual results could vary significantly from those expressed or implied in such statements and are subject to a number of risks and uncertainties. Although Magnum Hunter believes that the expectations reflected in the forward-looking statements are reasonable, Magnum Hunter can give no assurance that such expectations will prove to be correct. The forward-looking statements involve risks and uncertainties that affect operations, financial performance, and other factors as discussed in filings made by Magnum Hunter with the Securities and Exchange Commission (SEC). Among the factors that could cause results to differ materially are those risks discussed in the periodic reports filed by Magnum Hunter with the SEC, including Magnum Hunter’s Annual Report on Form 10-K for the fiscal year ended December 31, 2012 and its Quarterly Reports on Form 10-Q for the fiscal quarters ended after such fiscal year. You are urged to carefully review and consider the cautionary statements and other disclosures made in those filings, specifically those under the heading “Risk Factors.” Forward-looking statements speak only as of the date of the document in which they are contained, and Magnum Hunter does not undertake any duty to update any forward-looking statements except as may be required by law.

Contact:

Cham KingAVP, Investor Relations

ir@magnumhunterresources.com(832) 203-4560Chris BentonVP, Finance and Capital Markets(832) 203-4539