Exhibit 99.1

PBF Energy Inc.Morgan Stanley Refining Corporate Access DayMay 16, 2013

This presentation contains forward-looking statements made by PBF Energy Inc. (the “Company” or “PBF”) and its management. Such statements are based on current expectations, forecasts and projections, including, but not limited to, anticipated financial and operating results, plans, objectives, expectations and intentions that are not historical in nature. Forward-looking statements should not be read as a guarantee of future performance or results, and may not necessarily be accurate indications of the times at, or by which, such performance or results will be achieved. Forward-looking statements are based on information available at the time, and are subject to various risks and uncertainties that could cause the Company’s actual performance or results to differ materially from those expressed in such statements. Factors that could impact such differences include, but are not limited to, changes in general economic conditions; volatility of crude oil and other feedstock prices; fluctuations in the prices of refined products; actions taken or non-performance by third parties, including suppliers, contractors, operators, transporters and customers; adequacy, availability and cost of capital; work stoppages or other labor interruptions; operating hazards, natural disasters, weather-related delays, casualty losses and other matters beyond our control; inability to complete capital expenditures, or construction projects that exceed anticipated or budgeted amounts; inability to successfully integrate acquired refineries or other acquired businesses or operations; effects of existing and future laws and governmental regulations, including environmental, health and safety regulations; effects of litigation; and, various other factors.Forward-looking statements reflect information, facts and circumstances only as of the date they are made. The Company assumes no responsibility or obligation to update forward-looking statements to reflect actual results, changes in assumptions or changes in other factors affecting forward-looking information after such date.

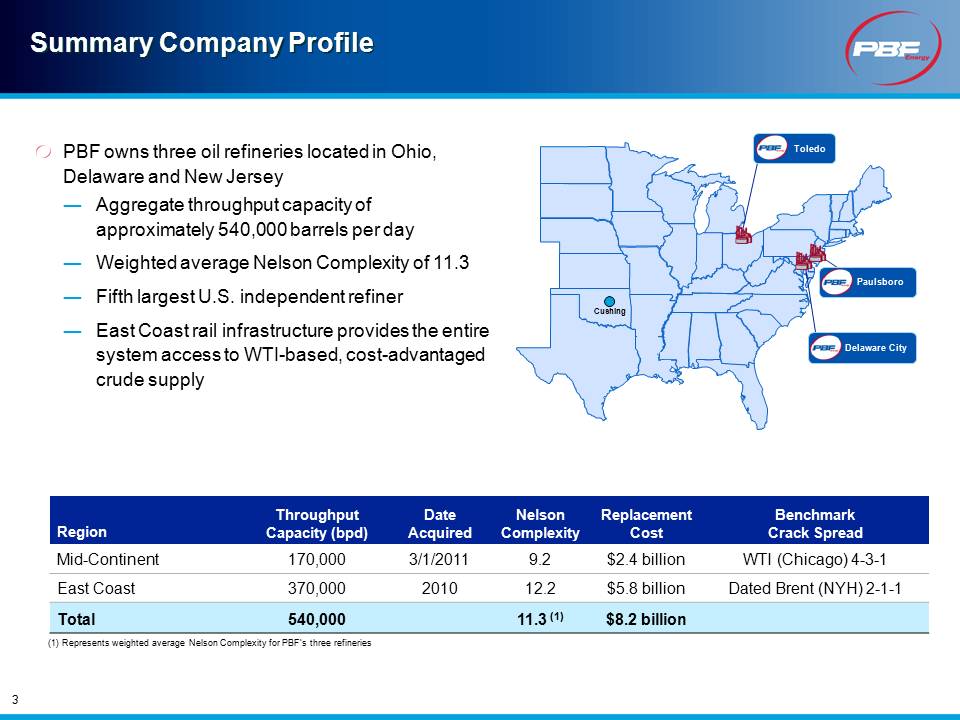

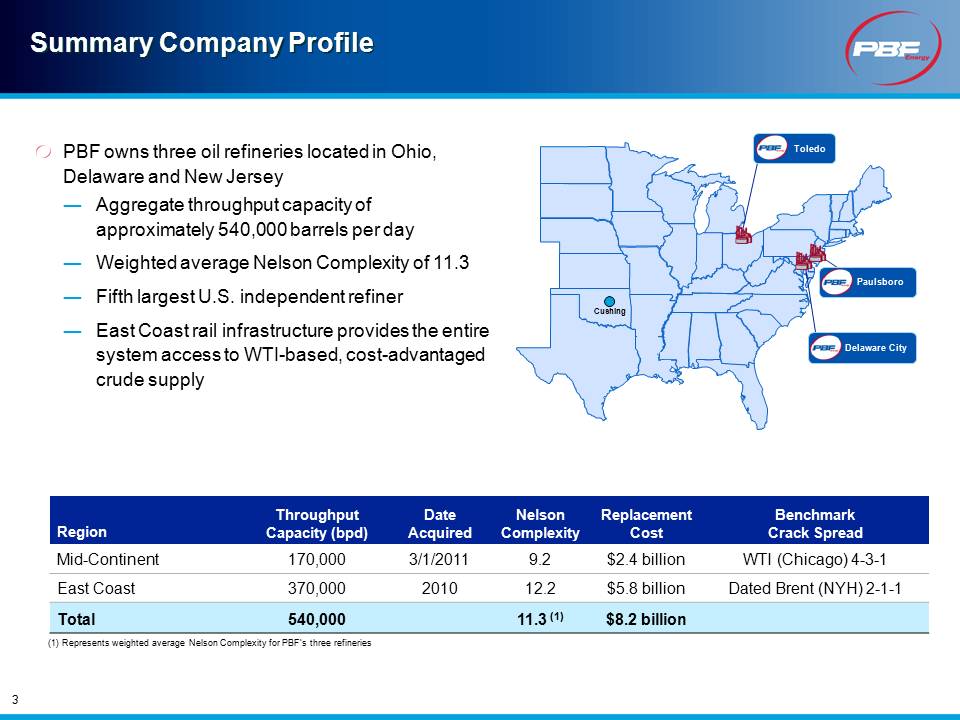

PBF owns three oil refineries located in Ohio, Delaware and New JerseyAggregate throughput capacity of approximately 540,000 barrels per dayWeighted average Nelson Complexity of 11.3Fifth largest U.S. independent refiner East Coast rail infrastructure provides the entire system access to WTI-based, cost-advantaged crude supply Summary Company Profile (Gp:) Cushing (Gp:) Toledo (Gp:) Paulsboro (Gp:) Delaware City (1) Represents weighted average Nelson Complexity for PBF’s three refineries

Our History: Key Events and Milestones March 2011Completed acquisition of Toledo Refinery December 2010Completed acquisition of Paulsboro Refinery October 2011Delaware City Refinery operational June 2010Completed acquisition of Delaware City Refinery 2008O’Malley and team form PBF Energy 2008 2009 2010 2011 2012 2013 September 2012Completed first two phases of East Coast rail infrastructure Q1 2013Completed rail project at Delaware City Company Formation Acquisitions & Improvement Growth & Optimization December 2012Successful IPO at $26/share

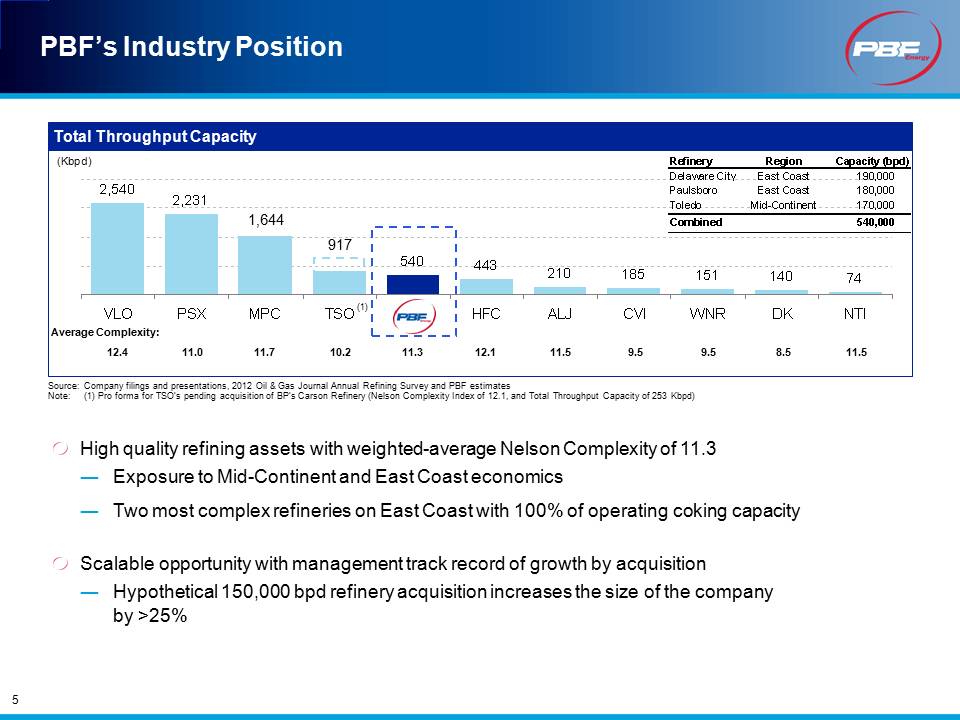

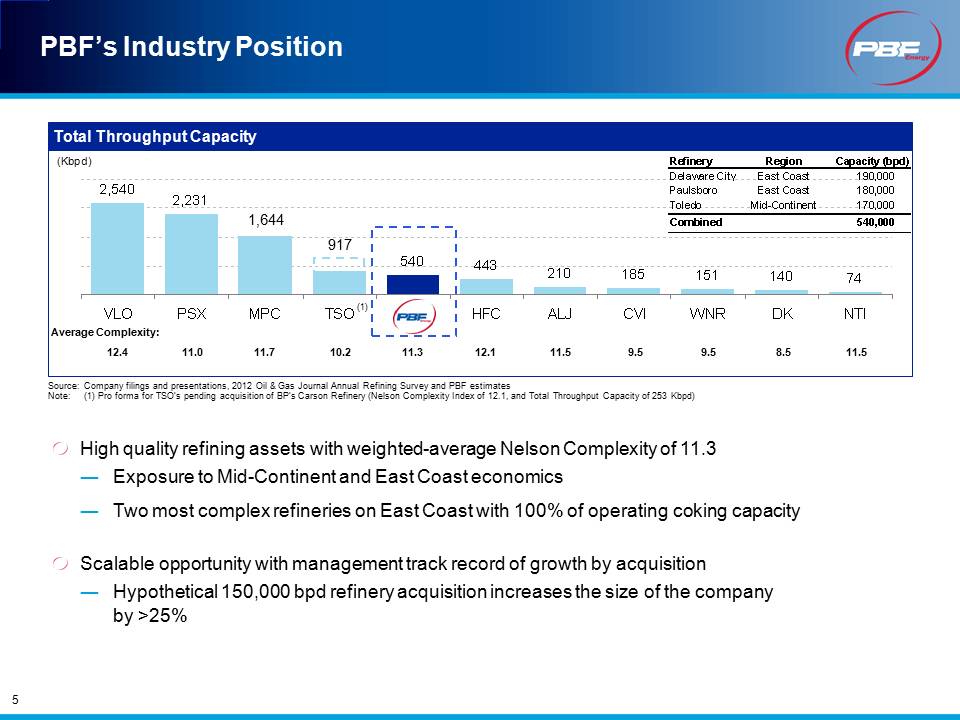

High quality refining assets with weighted-average Nelson Complexity of 11.3Exposure to Mid-Continent and East Coast economicsTwo most complex refineries on East Coast with 100% of operating coking capacityScalable opportunity with management track record of growth by acquisitionHypothetical 150,000 bpd refinery acquisition increases the size of the company by >25% PBF’s Industry Position Total Throughput Capacity (Kbpd) Average Complexity: 12.4 11.0 11.7 10.2 11.3 12.1 11.5 9.5 9.5 8.5 11.5 Source: Company filings and presentations, 2012 Oil & Gas Journal Annual Refining Survey and PBF estimatesNote: (1) Pro forma for TSO’s pending acquisition of BP’s Carson Refinery (Nelson Complexity Index of 12.1, and Total Throughput Capacity of 253 Kbpd) (1) 1,644 917

U.S. Refining Industry Strengths InexpensiveNatural Gas Growth in supply driving decline in U.S. natural gas pricingU.S. natural gas currently priced more than 60% below Europe~$0.10 / bbl benefit to domestic refiners for every $1 / MMBtu difference in natural gas price North American CrudeOil Production Secular growth in North American crude oil productionFavorable price dislocations between North American crude and rest of world ComplexRefineries U.S. average refinery Nelson Complexity of 10.9 versus Western European average refinery Nelson Complexity of 7.8 ProductExports Cost and technological advantages have spurred export opportunitiesEast Coast to Europe, West Africa, and Latin America Why will the U.S. refining industry prosper for the next 5 years?

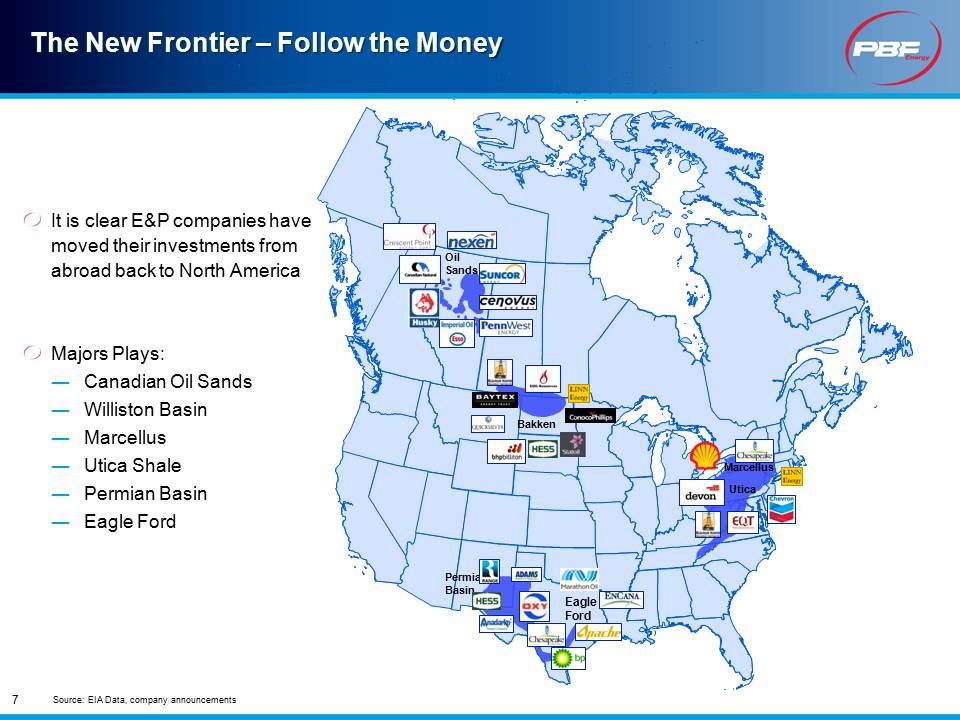

PermianBasin EagleFord OilSands Bakken Utica Marcellus Source: EIA Data, company announcements

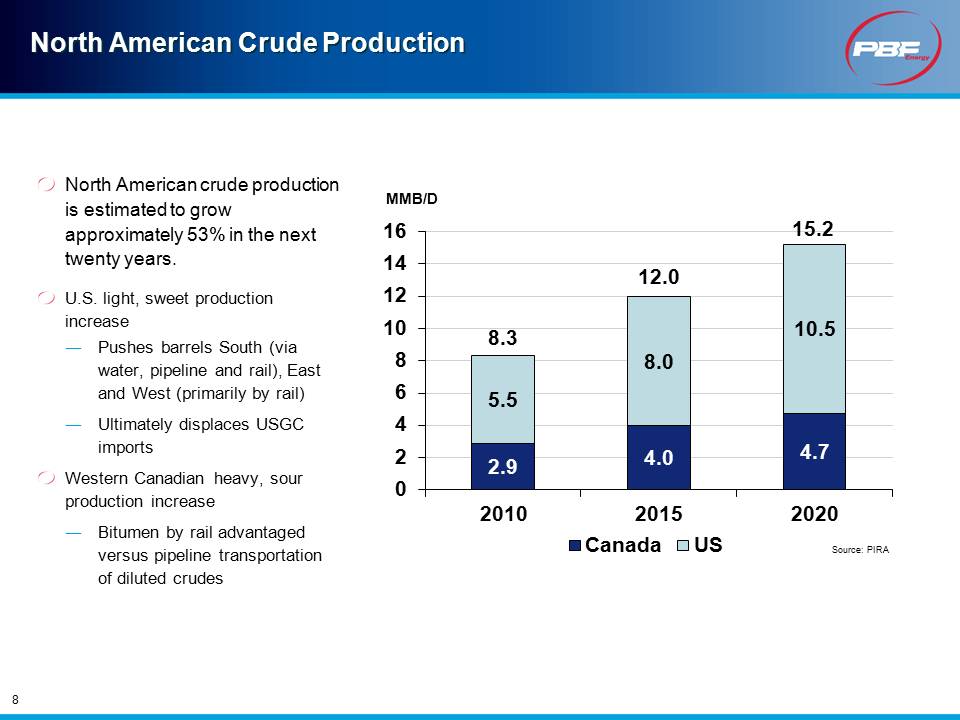

North American Crude Production Other Placeholder: North American crude production is estimated to grow approximately 53% in the next twenty years.U.S. light, sweet production increasePushes barrels South (via water, pipeline and rail), East and West (primarily by rail)Ultimately displaces USGC importsWestern Canadian heavy, sour production increaseBitumen by rail advantaged versus pipeline transportation of diluted crudes

Increasing Access to Cost-advantaged North American Crudes is the Key. Delaware City Rail Facility

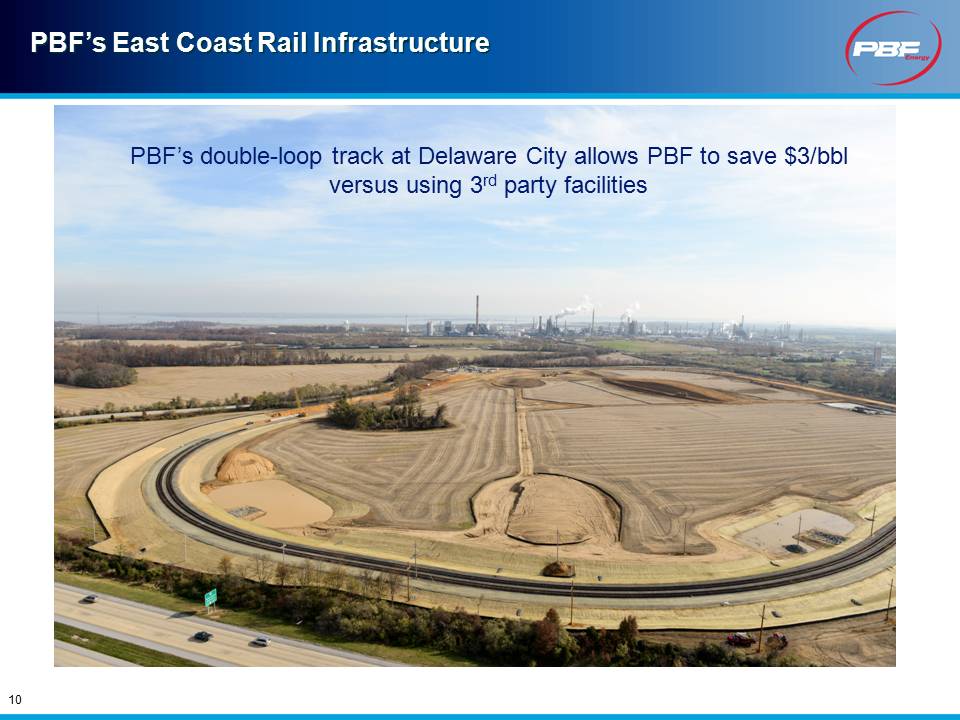

PBF’s East Coast Rail Infrastructure. PBF’s double-loop track at Delaware City allows PBF to save $3/bblversus using 3rd party facilities

Unit Trains Arriving at Double-Loop Track The dual-loop track light crude unloading facility is capable of discharging a unit train in approximately 14 hours Discharge capacity is expected to reach 100,000 bpd by the end of 2013

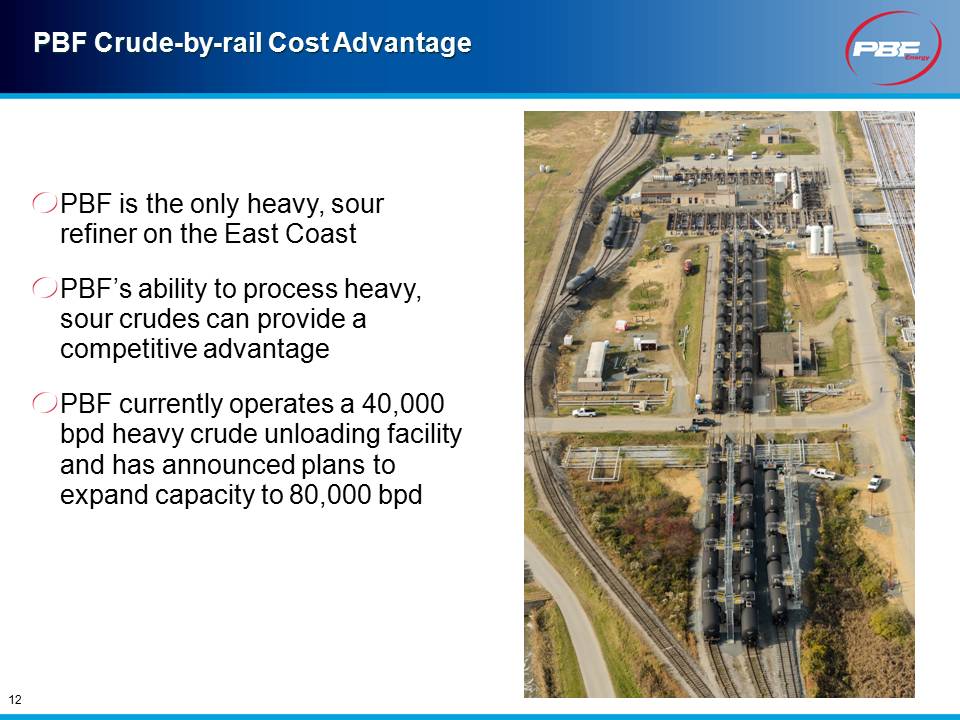

PBF Crude-by-rail Cost Advantage PBF is the only heavy, sour refiner on the East Coast PBF’s ability to process heavy, sour crudes can provide a competitive advantagePBF currently operates a 40,000 bpd heavy crude unloading facility and has announced plans to expand capacity to 80,000 bpd

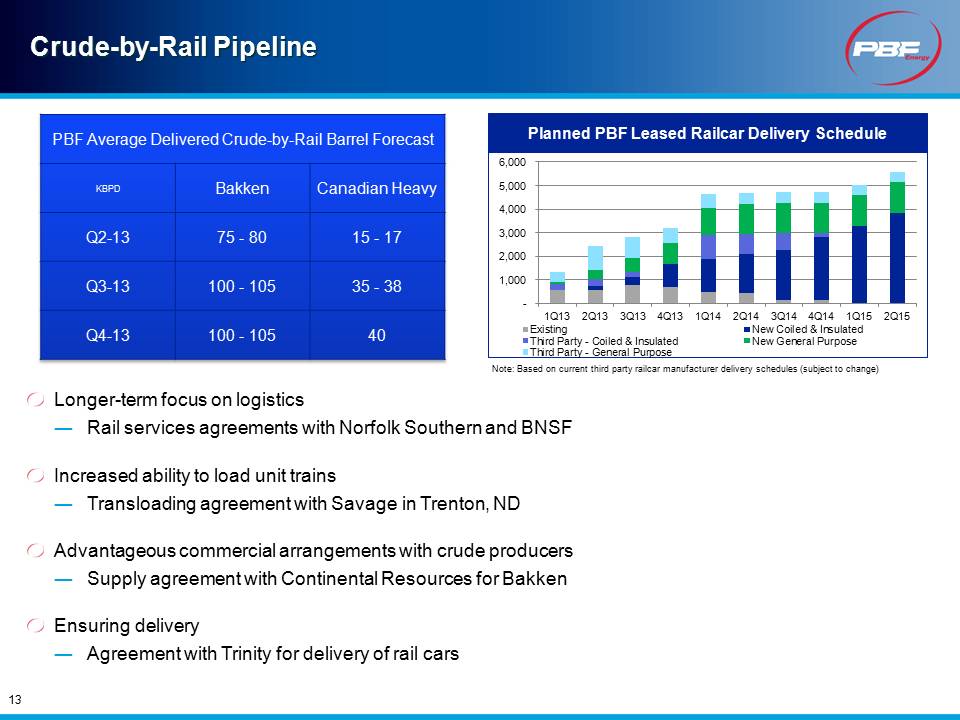

Crude-by-Rail Pipeline Planned PBF Leased Railcar Delivery Schedule Note: Based on current third party railcar manufacturer delivery schedules (subject to change) Longer-term focus on logisticsRail services agreements with Norfolk Southern and BNSFIncreased ability to load unit trainsTransloading agreement with Savage in Trenton, NDAdvantageous commercial arrangements with crude producersSupply agreement with Continental Resources for BakkenEnsuring deliveryAgreement with Trinity for delivery of rail cars

System-wide Operational Efficiency and Effectiveness PBF is focused on a series of low-cost, high-return projects to boost the earnings power of our refineriesMid-continentEnhanced production distribution facilitiesIncreased flexibility for crude oil storageIncreased production of high-value chemicalsEast CoastHigh-value nonene productionIncreased production of ULSD/ULSHO

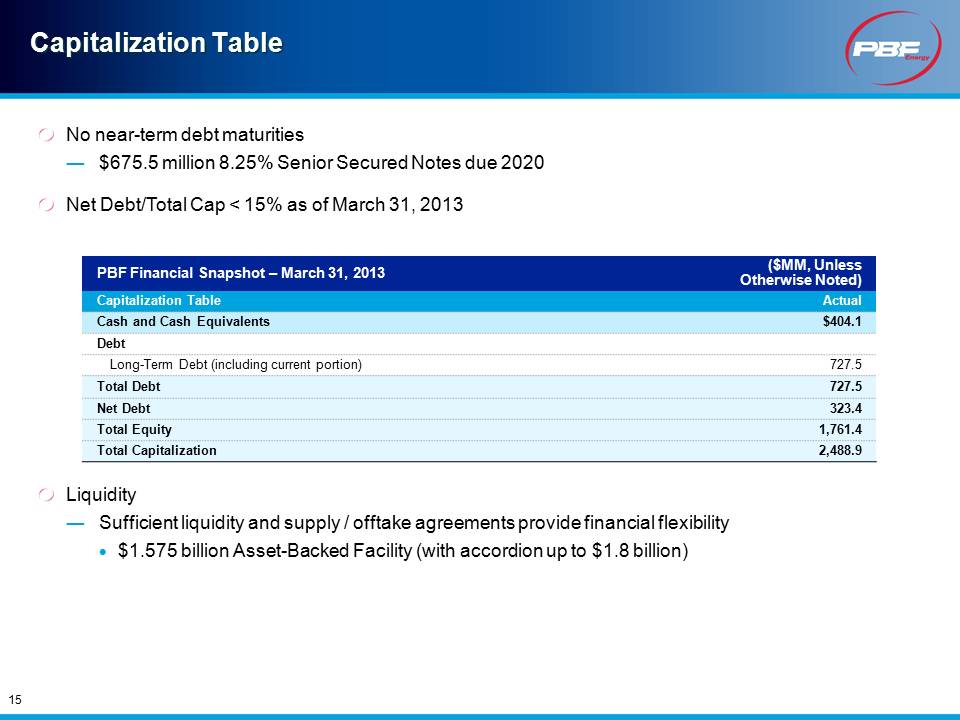

Capitalization Table No near-term debt maturities $675.5 million 8.25% Senior Secured Notes due 2020 Net Debt/Total Cap < 15% as of March 31, 2013 PBF Financial Snapshot – March 31, 2013 ($MM, Unless Otherwise Noted) Capitalization Table Actual Cash and Cash Equivalents $404.1 Debt Long-Term Debt (including current portion) 727.5 Total Debt 727.5 Net Debt 323.4 Total Equity 1,761.4 Total Capitalization 2,488.9 Liquidity Sufficient liquidity and supply / offtake agreements provide financial flexibility $1.575 billion Asset-Backed Facility (with accordion up to $1.8 billion)

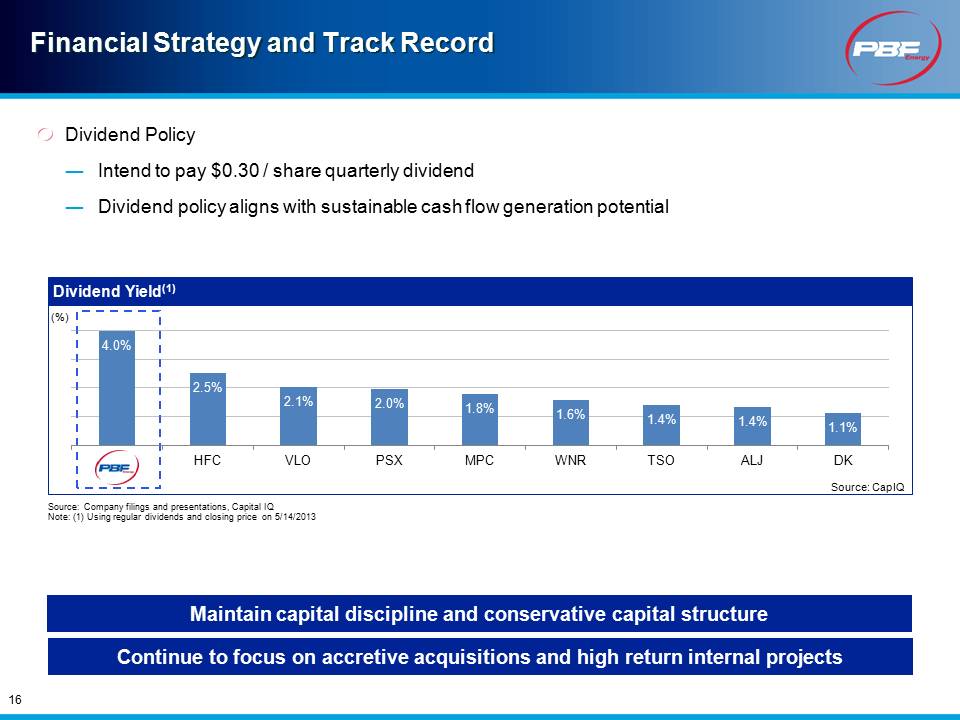

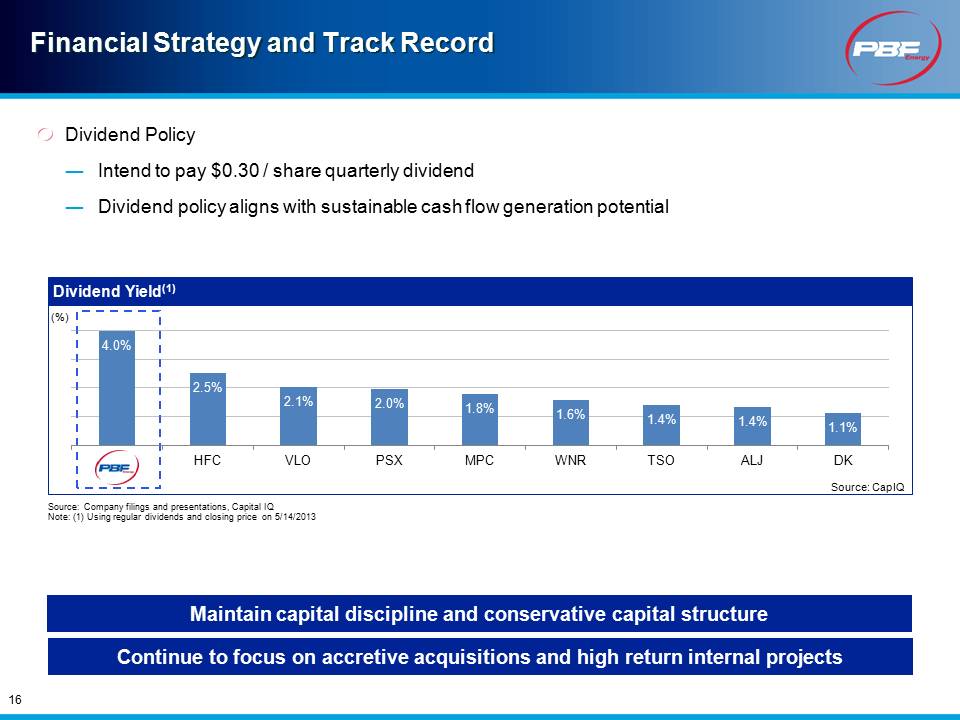

Dividend PolicyIntend to pay $0.30 / share quarterly dividendDividend policy aligns with sustainable cash flow generation potential Title: Financial Strategy and Track Record Maintain capital discipline and conservative capital structure Continue to focus on accretive acquisitions and high return internal projects Dividend Yield(1) (%) Source: Company filings and presentations, Capital IQNote: (1) Using regular dividends and closing price on 5/14/2013

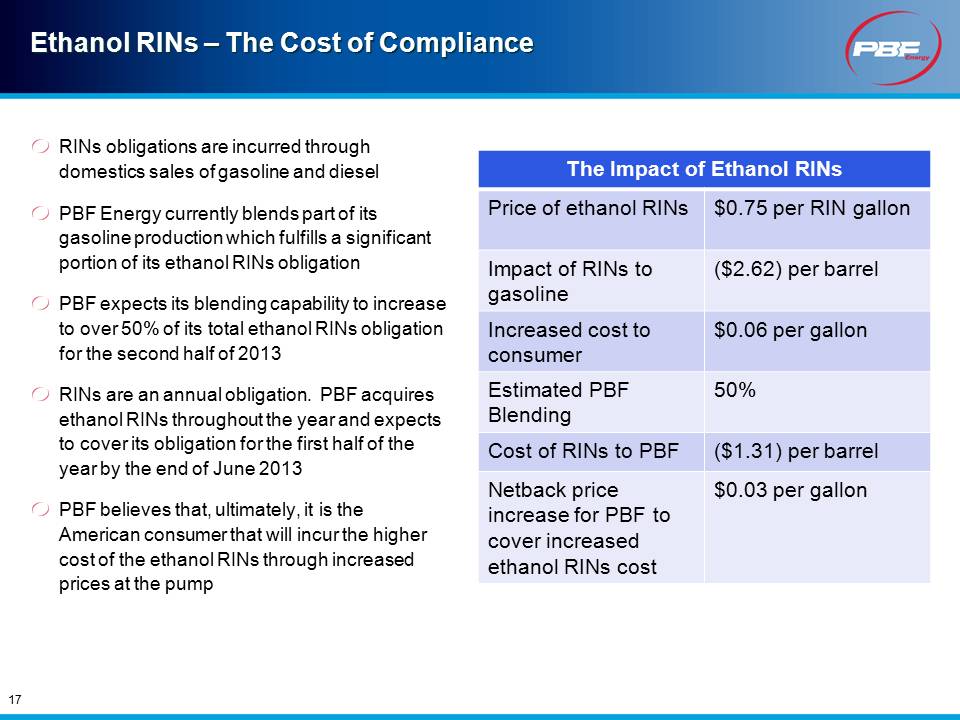

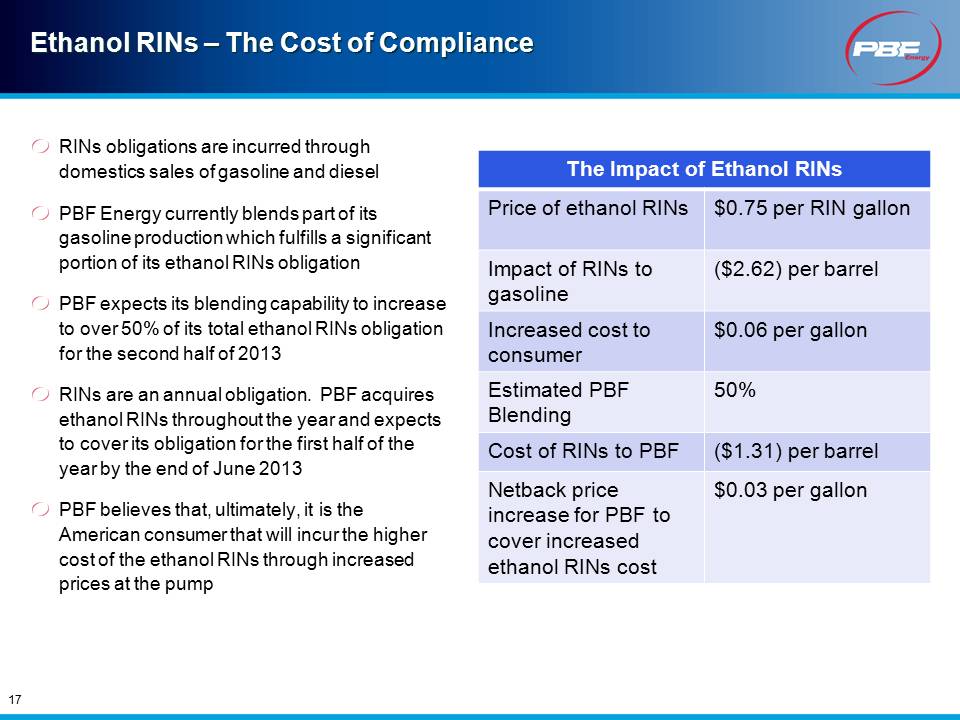

Ethanol RINs – The Cost of Compliance Other Placeholder: RINs obligations are incurred through domestics sales of gasoline and dieselPBF Energy currently blends part of its gasoline production which fulfills a significant portion of its ethanol RINs obligationPBF expects its blending capability to increase to over 50% of its total ethanol RINs obligation for the second half of 2013RINs are an annual obligation. PBF acquires ethanol RINs throughout the year and expects to cover its obligation for the first half of the year by the end of June 2013PBF believes that, ultimately, it is the American consumer that will incur the higher cost of the ethanol RINs through increased prices at the pump

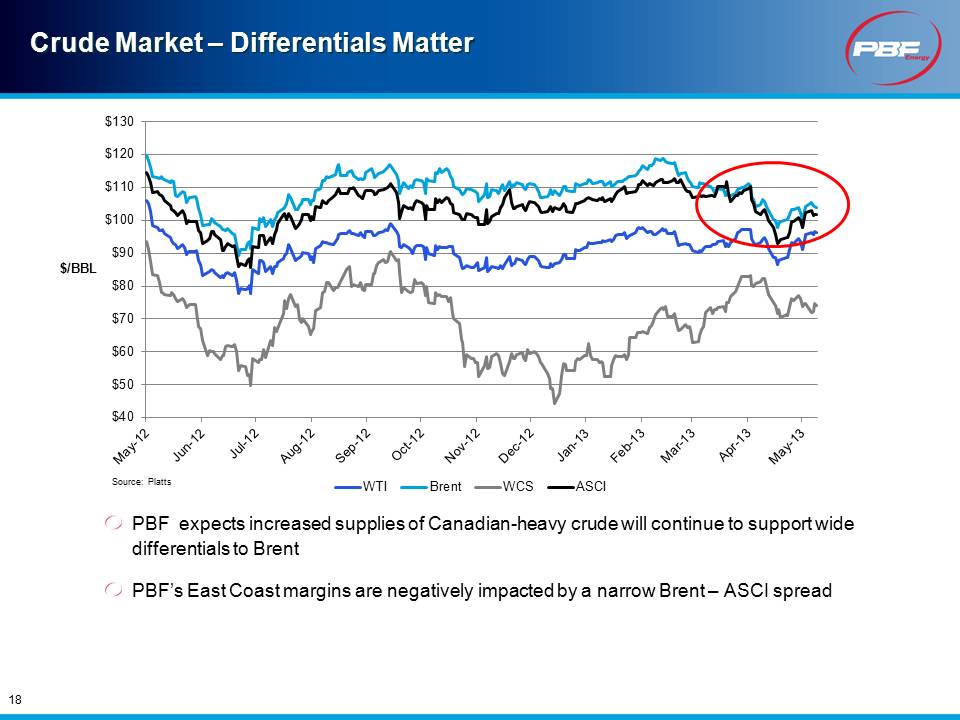

Crude Market – Differentials Matter PBF expects increased supplies of Canadian-heavy crude will continue to support wide differentials to BrentPBF’s East Coast margins are negatively impacted by a narrow Brent – ASCI spread Source: Platts $/BBL

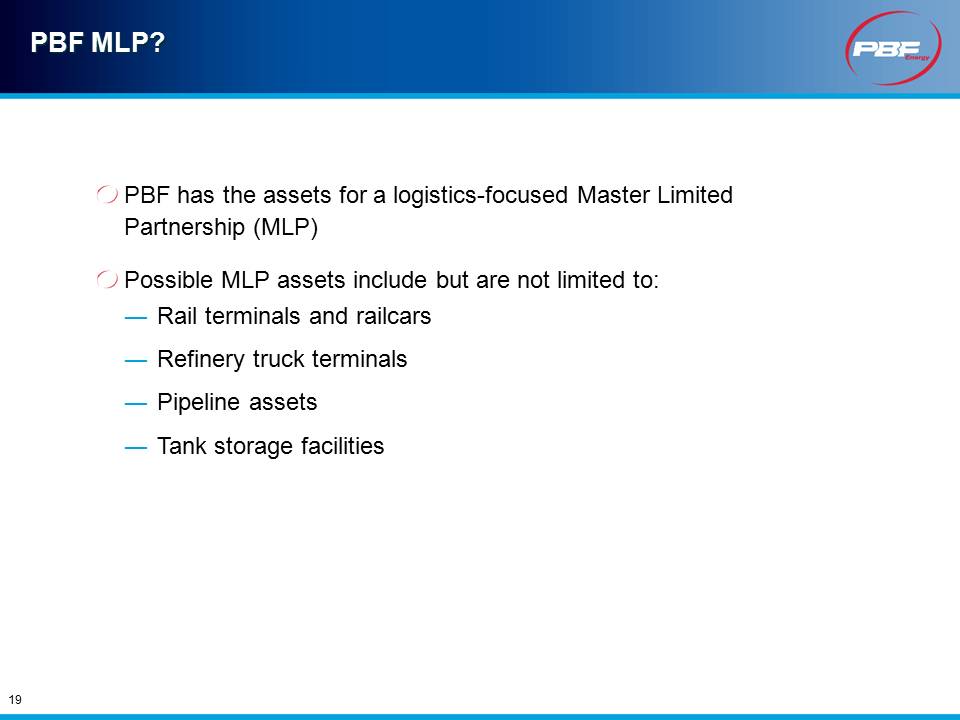

PBF MLP? PBF has the assets for a logistics-focused Master Limited Partnership (MLP)Possible MLP assets include but are not limited to:Rail terminals and railcarsRefinery truck terminalsPipeline assetsTank storage facilities