- FSTX Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

-

ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

F-star Therapeutics (FSTX) DEF 14ADefinitive proxy

Filed: 22 Apr 22, 4:05pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

☐ | Preliminary Proxy Statement |

|

|

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

|

|

☒ | Definitive Proxy Statement |

|

|

☐ | Definitive Additional Materials |

|

|

☐ | Soliciting Material Under Rule 14a-12 |

F-star Therapeutics, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required. | |

|

|

|

☐ | Fee paid previously with preliminary materials. | |

|

| |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |

|

|

|

April 22, 2022

To Our Stockholders:

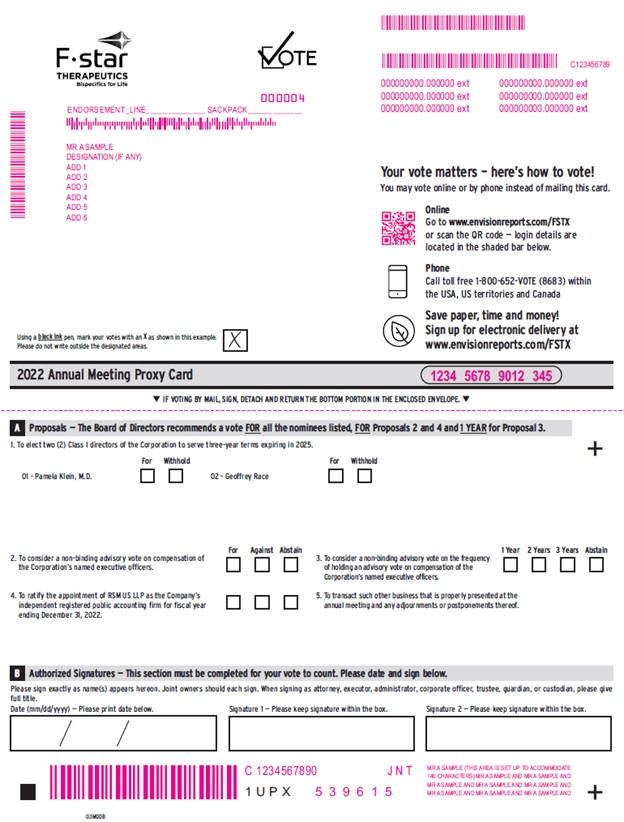

You are cordially invited to attend the 2022 Annual Meeting of Stockholders of F-star Therapeutics, Inc. to be held at 9:00 a.m. Eastern Time on Friday, June 16, 2022. This year’s Annual Meeting will be conducted solely via live audio webcast on the internet. You will be able to attend the virtual Annual Meeting, vote and submit your questions during the Annual Meeting by visiting www.meetnow.global/MFY57C6, no password required. You will not be able to attend the Annual Meeting in person.

Details regarding the meeting, the business to be conducted at the meeting, and information about F-star Therapeutics, Inc. that you should consider when you vote your shares are described in this proxy statement.

At the Annual Meeting, two (2) persons will be elected to our Board of Directors. In addition, we will ask stockholders to approve, on a non-binding advisory basis, the compensation of our named executive officers as described in the proxy statement and to recommend, on a non-binding advisory basis, the frequency of holding an advisory vote on the compensation of our named executive officers. In addition, we will ask stockholders to approve and to ratify the appointment of RSM US LLP as our independent registered public accounting firm for our fiscal year ending December 31, 2022. The Board of Directors recommends the approval of each of these proposals. Such other business will be transacted as may properly come before the Annual Meeting.

Under Securities and Exchange Commission rules that allow companies to furnish proxy materials to stockholders over the Internet, we have elected to deliver our proxy materials to most of our stockholders over the Internet. This delivery process allows us to provide stockholders with the information they need, while at the same time conserving natural resources and lowering the cost of delivery. On or about May 2, 2022, we will commence sending to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our 2022 Annual Meeting of Stockholders and our 2021 annual report to stockholders. The Notice also provides instructions on how to vote online or by telephone and how to access the virtual Annual Meeting and includes instructions on how to receive a paper copy of the proxy materials by mail.

We hope you will be able to attend the virtual Annual Meeting. Whether you plan to attend the Annual Meeting or not, it is important that you cast your vote either in person at the virtual Annual Meeting or by proxy. You may vote over the Internet as well as by telephone or by mail. When you have finished reading the proxy statement, you are urged to vote in accordance with the instructions set forth in this proxy statement. We encourage you to vote by proxy so that your shares will be represented and voted at the meeting, whether or not you can attend.

Thank you for your continued support of F-star Therapeutics, Inc.

Sincerely,

|

Eliot Forster |

President and Chief Executive Officer |

F-STAR THERAPEUTICS, INC.

Eddeva B920, Babraham Research Campus

Cambridge, CB22 3AT, United Kingdom

+44-1223-497400

April 22, 2022

NOTICE OF 2022 ANNUAL MEETING OF STOCKHOLDERS

TIME: 9:00 a.m. Eastern Time

DATE: Thursday, June 16, 2022

ACCESS: This year’s Annual Meeting will be a virtual meeting which will be conducted solely online via webcast on the Internet. You will be able to attend and participate in the Annual Meeting online, vote your shares electronically and submit your questions prior to and during the meeting by visiting www.meetnow.global/MFY57C6, no password required, at the meeting date and time described in the accompanying proxy statement. There is no physical location for the Annual Meeting.

We are excited to embrace the latest technology to provide expanded access, improved communication and cost savings for our stockholders and the company. We believe that hosting a virtual meeting will enable greater stockholder attendance and participation from any location around the world. For further information about the virtual Annual Meeting, please see the Questions and Answers about the Meeting beginning on page 2.

PURPOSES:

WHO MAY VOTE:

You may vote if you were the record owner of F-star Therapeutics, Inc. common stock at the close of business on April 20, 2022.

If you are a stockholder of record, you may vote in one of the following ways:

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to vote at the Annual Meeting virtually on the Internet. You may attend the meeting as a guest but must register in advance of the meeting if intending to vote.

To register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your F-star Therapeutics, Inc. holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on June 13, 2022.

You will receive a confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to us at the following:

By email:

Forward the email from your broker, or attach an image of your legal proxy, to

legalproxy@computershare.com.

By mail to:

Computershare

F-star Therapeutics, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

A list of stockholders of record will be available at the Annual Meeting and, during the 10 days prior to the Annual Meeting, by sending a written request to: Attention: Corporate Secretary, Eddeva B920, Babraham Research Campus, Cambridge, CB22 3AT, Cambridge, United Kingdom. All stockholders are cordially invited to attend the virtual Annual Meeting. Whether you plan to attend the Annual Meeting or not, we urge you to vote by following the instructions in the Notice of Internet Availability of Proxy Materials and submit your proxy by the Internet, telephone or mail in order to ensure the presence of a quorum. You may change or revoke your proxy at any time before it is voted at the meeting.

BY ORDER OF THE BOARD OF DIRECTORS |

|

Darlene Deptula-Hicks |

Chief Financial Officer, Treasurer and Secretary |

TABLE OF CONTENTS

| PAGE |

2 | |

Security Ownership of Certain Beneficial Owners and Management | 8 |

9 | |

19 | |

25 | |

26 | |

27 | |

29 | |

30 | |

31 | |

Proposal No. 4 - Ratification of Appointment of Independent Registered Public Accounting Firm | 32 |

34 | |

34 |

F-STAR THERAPEUTICS, INC.

Eddeva B920, Babraham Research Campus

Cambridge, CB22 3AT, United Kingdom

+44-1223-497400

PROXY STATEMENT FOR F-STAR THERAPEUTICS, INC.

2022 ANNUAL MEETING OF STOCKHOLDERS TO BE HELD ON JUNE 16, 2022

This proxy statement, along with the accompanying notice of 2022 Annual Meeting of Stockholders, contains information about the 2022 Annual Meeting of Stockholders of F-star Therapeutics, including any adjournments or postponements of the Annual Meeting. We are holding the Annual Meeting at 9:00 a.m. Eastern time, on Thursday, June 16, 2022. This year’s Annual Meeting will be a virtual meeting via live webcast on the Internet. You will be able to attend the Annual Meeting, vote and submit your questions during the meeting by www.meetnow.global/MFY57C6, no password required, and entering the 15-digit control number included in the Notice of Internet Availability or proxy card that you receive.

In this proxy statement, we refer to F-star Therapeutics, Inc. as “F-star,” “the Company,” “we” and “us.”

This proxy statement relates to the solicitation of proxies by our Board of Directors, or our Board, for use at the Annual Meeting.

On or about May 2, 2022, we intend to commence sending the Important Notice Regarding the Availability of Proxy Materials containing instructions on how to access our proxy statement for our 2022 Annual Meeting of stockholders and our 2021 annual report to stockholders to all stockholders entitled to vote at the Annual Meeting.

IMPORTANT NOTICE REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR THE

STOCKHOLDER MEETING TO BE HELD ON THURSDAY, JUNE 16, 2022

This proxy statement, the Notice of Annual Meeting of Stockholders, our form of proxy card and our 2021 annual report to stockholders are available for viewing, printing and downloading at www.envisionreports.com/FSTX. To view these materials please have your 15-digit control number(s) available that appears on your Notice or proxy card. On this website, you can also elect to receive future distributions of our proxy statements and annual reports to stockholders by electronic delivery.

Additionally, you can find a copy of our Annual Report on Form 10-K, which includes our financial statements, for the fiscal year ended December 31, 2021 on the website of the Securities and Exchange Commission, or the SEC, at www.sec.gov, or in the “Annual Stockholder Meeting” section of the “Investors” section of our website at www.f-star.com. You may also obtain a printed copy of our Annual Report on Form 10-K, including our financial statements, free of charge, from us by following the instructions included on the Important Notice Regarding the Availability of Proxy Materials or by sending a written request to: Attention: Corporate Secretary, Eddeva B920, Babraham Research Campus, Cambridge, CB22 3AT, United Kingdom. Exhibits will be provided upon written request and payment of an appropriate processing fee.

IMPORTANT INFORMATION ABOUT THE ANNUAL MEETING AND VOTING

Why is the Company Soliciting My Proxy?

The Board of Directors of F-star is soliciting your proxy to vote at the 2022 Annual Meeting of Stockholders to be held virtually on Thursday, June 16, 2022 at 9:00 a.m. Eastern Time and any adjournments of the meeting, which we refer to as the Annual Meeting. The proxy statement along with the accompanying Notice of Annual Meeting of Stockholders summarizes the purposes of the meeting and the information you need to know to vote at the Annual Meeting.

This year, our Annual Meeting will be held in a virtual meeting format only. To attend the virtual Annual Meeting, go to www.meetnow.global/MFY57C6, no password required, shortly before the meeting time, and follow the instructions for downloading the Webcast. You need not attend the Annual Meeting in order to vote.

We have made available to you on the Internet or have sent you this proxy statement, the Notice of Annual Meeting of Stockholders, the proxy card and a copy of our Annual Report on Form 10-K for the fiscal year ended December 31, 2021 because you owned shares of F-star common stock on the record date. We intend to commence distribution of the Important Notice Regarding the Availability of Proxy Materials, which we refer to throughout this proxy statement as the Notice, and, if applicable, the proxy materials to stockholders on or about May 2, 2022.

How do I register to attend the Annual Meeting virtually on the Internet?

If you are a registered stockholder (i.e., you hold your shares through our transfer agent, Computershare), you do not need to register to attend the Annual Meeting virtually on the Internet. Please follow the instructions on the notice or proxy card that you received.

If you hold your shares through an intermediary, such as a bank or broker, you must register in advance to attend the Annual Meeting virtually on the Internet.

To register to attend the Annual Meeting online by webcast you must submit proof of your proxy power (legal proxy) reflecting your F-star Therapeutics, Inc. holdings along with your name and email address to Computershare. Requests for registration must be labeled as “Legal Proxy” and be received no later than 5:00 p.m., Eastern Time, on June 13, 2022.

You will receive a confirmation of your registration by email after we receive your registration materials.

Requests for registration should be directed to us at the following:

By email:

Forward the email from your broker, or attach an image of your legal proxy, to

legalproxy@computershare.com.

By mail to:

Computershare

F-star Therapeutics, Inc. Legal Proxy

P.O. Box 43001

Providence, RI 02940-3001

Why is the Company holding a virtual meeting instead of a physical meeting?

We have designed our virtual format to enhance, rather than constrain, stockholder access, participation and communication. Stockholders will be able to attend the meeting online and submit questions by visiting www.meetnow.global/MFY57C6, no password required. Stockholders will also be able to vote their shares electronically during the meeting.

What Happens if There Are Technical Difficulties during the Annual Meeting?

The virtual meeting platform is fully supported across browsers (MS Edge, Firefox, Chrome and Safari) and devices (desktops, laptops, tablets and cell phones) running the most up-to-date version of applicable software and plugins. Note: Internet Explorer is not a supported browser. Participants should ensure that they have a strong WiFi connection wherever they intend to participate in the meeting. We encourage you to access the meeting prior to the start time. For further assistance during the Annual Meeting please call 1-888-724-2416.

2

Why Did I Receive a Notice in the Mail Regarding the Internet Availability of Proxy Materials Instead of a Full Set of Proxy Materials?

As permitted by the rules of the U.S. Securities and Exchange Commission, or the SEC, we may furnish our proxy materials to our stockholders by providing access to such documents on the Internet, rather than mailing printed copies of these materials to each stockholder. Most stockholders will not receive printed copies of the proxy materials unless they request them. We believe that this process should expedite stockholders’ receipt of proxy materials, lower the costs of the Annual Meeting and help to conserve natural resources. If you received a Notice by mail or electronically, you will not receive a printed or email copy of the proxy materials, unless you request one by following the instructions included in the Notice. Instead, the Notice instructs you as to how you may access and review all of the proxy materials, how to access the virtual meeting, and submit your proxy on the Internet. If you requested a paper copy of the proxy materials, you may authorize the voting of your shares by following the instructions on the proxy card, in addition to the other methods of voting described in this proxy statement.

Who Can Vote?

Only stockholders who owned our common stock at the close of business on April 20, 2022 are entitled to vote at the Annual Meeting. On this record date, there were 21,557,771 shares of our common stock outstanding and entitled to vote. Our common stock is our only class of voting stock.

You do not need to attend the Annual Meeting to vote your shares. Shares represented by valid proxies, received in time for the Annual Meeting and not revoked prior to the Annual Meeting, will be voted at the Annual Meeting. For instructions on how to change or revoke your proxy, see “May I Change or Revoke My Proxy?” below.

How Many Votes Do I Have?

Each share of our common stock that you own entitles you to one vote.

How Do I Vote?

Whether you plan to attend the Annual Meeting or not, we urge you to vote by proxy. All shares represented by valid proxies that we receive through this solicitation, and that are not revoked, will be voted in accordance with your instructions on the proxy card or as instructed via Internet or telephone. You may specify whether your shares should be voted for or withheld for each nominee for director and whether your shares should be voted for, against or abstain with respect to the other proposal. If you properly submit a proxy without giving specific voting instructions, your shares will be voted in accordance with the Board’s recommendations as noted below. Voting by proxy will not affect your right to attend the Annual Meeting. If your shares are registered directly in your name through our stock transfer agent, Computershare Trust Company, N.A., you may vote:

3

Telephone and Internet voting facilities for stockholders of record will be available 24 hours a day and will close at 11:59 p.m. Eastern Time on June 15, 2022.

If your shares are held in “street name” (held in the name of a bank, broker or other holder of record), you will receive instructions from the holder of record. You must follow the instructions of the holder of record in order for your shares to be voted. Telephone and Internet voting also will be offered to stockholders owning shares through certain banks and brokers. If your shares are not registered in your own name and you plan to vote your shares in person at the virtual Annual Meeting, you will need the 15-digit control number included in your Notice of Proxy Materials or on the instructions that accompanied your proxy materials. The meeting webcast will begin promptly at 9:00 a.m. Eastern Time. We encourage you to access the meeting prior to the start time. Online check-in will begin at 8:45 a.m. Eastern Time, and you should allow ample time to test your computer and for the check-in procedures.

How Does the Board of Directors Recommend That I Vote on the Proposals?

The Board of Directors recommends that you vote as follows:

If any other matter is presented at the Annual Meeting, your proxy provides that your shares will be voted by the proxy holder listed in the proxy in accordance with his best judgment. At the time this proxy statement was first made available, we knew of no matters that needed to be acted on at the Annual Meeting, other than those discussed in this proxy statement.

May I Change or Revoke My Proxy?

If you give us your proxy, you may change or revoke it at any time before the Annual Meeting. You may change or revoke your proxy in any one of the following ways:

Your most current vote, whether by telephone, Internet or proxy card, is the one that will be counted.

What if I Receive More Than One Notice or Proxy Card?

You may receive more than one Notice or proxy card if you hold shares of our common stock in more than one account, which may be in registered form or held in street name. Please vote in the manner described above under “How Do I Vote?” for each account to ensure that all of your shares are voted.

Will My Shares be Voted if I Do Not Vote?

If your shares are registered in your name or if you have stock certificates, they will not be counted if you do not vote as described above under “How Do I Vote?” If your shares are held in street name and you do not provide voting instructions to the bank, broker or other nominee that holds your shares as described above, the bank, broker or other nominee that holds your shares has the authority to vote your unvoted shares only on the ratification of the appointment of our independent registered public accounting firm (Proposal 4 of this proxy statement) without receiving instructions from you. Therefore, we encourage you to provide voting instructions to your bank, broker or other nominee. This ensures your shares will be voted at the Annual

4

Meeting and in the manner you desire. A “broker non-vote” will occur if your broker cannot vote your shares on a particular matter because it has not received instructions from you and does not have discretionary voting authority on that matter or because your broker chooses not to vote on a matter for which it does have discretionary voting authority.

Your bank, broker or other nominee does not have the ability to vote your uninstructed shares in the election of directors. Therefore, if you hold your shares in street name it is critical that you cast your vote if you want your vote to be counted for the election of directors (Proposal 1 of this proxy statement).

What Vote is Required to Approve Each Proposal and How are Votes Counted?

Proposal 1: Elect Directors | The two nominees for director who receive the most votes (also known as a “plurality” of the votes cast) will be elected. You may vote either FOR both of the nominees, WITHHOLD your vote from both of the nominees or WITHHOLD your vote from either one of the nominees. Votes that are withheld will not be included in the vote tally for the election of the directors. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name for the election of the directors. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes will have no effect on the results of this vote. |

Proposal 2: Advisory vote on approval of executive compensation as disclosed in this proxy statement | The affirmative vote of a majority of the votes virtually present or represented by proxy and entitled to vote at the Annual Meeting and voting affirmatively or negatively on this matter is required to approve, on an advisory basis, the compensation of our named executive officers, as described in this proxy statement. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes, as well as abstentions, will have no effect on the results of this vote. Although the advisory vote is non-binding, the Compensation Committee and our Board of Directors will review the voting results and take them into consideration when making future decisions regarding executive compensation. |

|

|

Proposal 3: Advisory vote on approval of the frequency of holding an advisory vote on the compensation of our named executive officers | The frequency of holding an advisory vote on the compensation of our named executive officers — every year, every two years or every three years — receiving the majority of votes cast will be the frequency approved by our stockholders. Brokerage firms do not have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. As a result, any shares not voted by a customer will be treated as a broker non-vote. Such broker non-votes, as well as abstentions, will have no effect on the results of this vote. Although the advisory vote is non-binding, the Compensation Committee and our Board of Directors will review the voting results and take them into consideration when determining the frequency of holding an advisory vote on the compensation of our named executive officers for the next six years. |

|

|

Proposal 4: Ratify Appointment of RSM US LLP as Independent Registered Public Accounting Firm | The affirmative vote of a majority of the votes virtually present or represented by proxy and entitled to vote at the Annual Meeting and voting affirmatively or negatively on this matter is required to ratify the appointment of RSM US LLP as our independent registered public accounting firm. Abstentions will have no effect on the results of this vote. Brokerage firms have authority to vote customers’ unvoted shares held by the firms in street name on this proposal. If a broker does not exercise this authority, such broker non-votes will have no effect on the results of this vote. We are not required to obtain the approval of our stockholders to appoint our independent registered public accounting firm. However, if our stockholders do not ratify the appointment of RSM US LLP as our independent registered public accounting firm for 2022, our Audit Committee of our Board of Directors will reconsider its appointment. |

5

Where Can I Find the Voting Results of the Annual Meeting?

The preliminary voting results may be announced at the Annual Meeting. We will publish preliminary, or final results if available, in a Current Report on Form 8-K within four business days of the Annual Meeting. If final results are unavailable at the time we file the Form 8-K, then we will file an amended report on Form 8-K to disclose the final voting results within four business days after the final voting results are known. In addition, we are required to file on a Current Report on Form 8-K no later than the earlier of 150 calendar days after the Annual Meeting or 60 calendar days prior to the deadline for submission of stockholder proposals set forth on page 34 of this proxy statement under the heading “Stockholder Proposals and Nominations for Director” our decision on how frequently we will include a stockholder vote on the compensation of our named executive officers in our proxy materials.

What Are the Costs of Soliciting these Proxies?

We will pay all of the costs of soliciting these proxies. Our directors and employees may solicit proxies in person or by telephone, fax or email. We will pay these employees and directors no additional compensation for these services. We will ask banks, brokers and other institutions, nominees and fiduciaries to forward these proxy materials to their principals and to obtain authority to execute proxies. We will then reimburse them for their expenses.

What Constitutes a Quorum for the Annual Meeting?

The presence, virtually in person or by proxy, of the holders of a majority of the voting power of all outstanding shares of our common stock entitled to vote at the Annual Meeting is necessary to constitute a quorum at the Annual Meeting. Votes of stockholders of record who are virtually present at the Annual Meeting in person or by proxy, abstentions, and broker non-votes are counted for purposes of determining whether a quorum exists.

What Does it Mean if I Receive More than One Proxy Card or Voting Instruction Form?

It means that you have multiple accounts at the transfer agent or with brokers. Please complete and return all proxy cards or voting instruction forms to ensure that all of your shares are voted.

6

What is Householding of Annual Disclosure Documents?

SEC rules concerning the delivery of annual disclosure documents allow us or your broker to send a single Notice or, if applicable, a single set of our proxy materials to any household at which two or more of our stockholders reside, if we or your broker believe that the stockholders are members of the same family. This practice, referred to as “householding,” benefits both you and us. It reduces the volume of duplicate information received at your household and helps to reduce our expenses. The rule applies to our Notices, annual reports, proxy statements and information statements. Once you receive notice from your broker or from us that communications to your address will be “householded,” the practice will continue until you are otherwise notified or until you revoke your consent to the practice. Stockholders who participate in householding will continue to have access to and utilize separate proxy voting instructions.

If your household received a single Notice or, if applicable, a single set of proxy materials this year, but you would prefer to receive your own copy, please contact us at our principal executive offices, Eddeva B920, Babraham Research Campus, Cambridge, CB22 3AT, United Kingdom, telephone: +44-1223-497400.

If you do not wish to participate in “householding” and would like to receive your own Notice or, if applicable, set of F-star’s proxy materials in future years, follow the instructions described below. Conversely, if you share an address with another F-star stockholder and together both of you would like to receive only a single Notice or, if applicable, set of proxy materials, follow these instructions:

What are the implications of being a “smaller reporting company”?

We are a “smaller reporting company” as defined under the Securities Exchange Act of 1934, as amended, or the Exchange Act. We may take advantage of certain of the scaled disclosures available to smaller reporting companies. These include, but are not limited to, reduced disclosure obligations regarding executive compensation in our periodic and annual reports, exemption from the requirement to provide a compensation discussion and analysis describing compensation practices and procedures, and reduced financial statement disclosure in our registration statements, which must include two years of audited financial statements rather than the three years of audited financial statements that are required for other public reporting companies. Smaller reporting companies are also eligible to provide such reduced financial statement disclosure in annual reports on Form 10-K. We will be able to take advantage of these scaled disclosures and exemptions for so long as (i) our voting and non-voting common stock held by non-affiliates is less than $250.0 million measured on the last business day of our second fiscal quarter or (ii) our annual revenue is less than $100.0 million during the most recently completed fiscal year and our voting and non-voting common stock held by non-affiliates is less than $700.0 million measured on the last business day of our second fiscal quarter.

Previously, we were an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, until December 31, 2021.

7

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth certain information with respect to the beneficial ownership of our common stock as of March 31, 2022 for (a) the executive officers named in the Summary Compensation Table contained elsewhere in this proxy statement, (b) each of our directors and director nominees, (c) all of our current directors and executive officers as a group and (d) each stockholder known by us to own beneficially more than 5% of our common stock. Beneficial ownership is determined in accordance with the rules of the SEC and includes voting or investment power with respect to the securities. We deem shares of common stock that may be acquired by an individual or group within 60 days of March 31, 2022 pursuant to the exercise of options, warrants or convertible notes to be outstanding for the purpose of computing the percentage ownership of such individual or group, but those shares are not deemed to be outstanding for the purpose of computing the percentage ownership of any other person shown in the table. Except as indicated in footnotes to this table, we believe that the stockholders named in this table have sole voting and investment power with respect to all shares of common stock shown to be beneficially owned by them based on information provided to us by these stockholders. Percentage of ownership is based on 21,597,948 shares of common stock outstanding on March 31, 2022.

Unless otherwise indicated, the address of each beneficial owner listed in the table below is c/o F-star Therapeutics, Inc., Eddeva B920, Babraham Research Campus, Cambridge, CB22 3AT, United Kingdom. Beneficial ownership representing less than one percent of our outstanding common stock is denoted with an “*.”

Name and Address of Beneficial Owner |

| Number of |

|

| Percentage |

| ||

5%+ Stockholders: |

|

|

|

|

|

| ||

Ridgeback Capital Investments(1) |

|

| 1,834,360 |

|

|

| 8.5 | % |

Named Executive Officers and Directors: |

|

|

|

|

|

| ||

Eliot Forster, Ph.D. President and Chief Executive Officer(2) |

|

| 219,355 |

|

| 1% |

| |

Darlene Deptula-Hicks, Chief Financial Officer, Treasurer and Secretary(3) |

|

| 50,647 |

|

| * |

| |

Louis Kayitalire, M.D., Chief Medical Officer(4) |

|

| 44,470 |

|

| * |

| |

Neil Brewis, PhD., DSc, Chief Scientific Officer(5) |

|

| 70,834 |

|

| * |

| |

Nessan Bermingham, Ph.D.(6) |

|

| 147,179 |

|

| * |

| |

Edward Benz Jr., M.D.(7) |

|

| 26,655 |

|

| * |

| |

Patrick Krol(8) |

|

| 18,333 |

|

| * |

| |

Geoffrey Race(9) |

|

| 22,270 |

|

| * |

| |

David Arkowitz(10) |

|

| 27,815 |

|

| * |

| |

Pamela Klein, M.D.(11) |

|

| 18,333 |

|

| * |

| |

Todd Brady, M.D., Ph.D.(12) |

|

| 33,337 |

|

| * |

| |

All Current Executive Officers and Directors as a group (11 persons) |

|

| 679,228 |

|

|

| 3.2 | % |

8

MANAGEMENT AND CORPORATE GOVERNANCE

The Board of Directors

Our amended and restated bylaws provide that our business is to be managed by or under the direction of our Board of Directors. Our Board of Directors is divided into three classes for purposes of election. One class is elected at each Annual Meeting of Stockholders to serve for a three-year term. Our Board of Directors currently consists of eight (8) members, classified into three classes as follows: (1) Pamela Klein, M.D., Geoffrey Race and Patrick Krol constitute a class with a term ending at the 2022 Annual Meeting; (2) Eliot Forster, Ph.D., David Arkowitz and Nessan Bermingham, Ph.D. constitute a class with a term ending at the 2023 Annual Meeting; and (3) Todd Brady, M.D., Ph.D. and Edward Benz, Jr., M.D., constitute a class with a term ending at the 2024 Annual Meeting.

On March 31, 2022, our Board of Directors accepted the recommendation of the Nominating and Corporate Governance Committee and voted to nominate Pamela Klein, M.D. and Geoffrey Race for election at the Annual Meeting for a term of three years to serve until the 2025 Annual Meeting of Stockholders, and until their respective successors have been elected and qualified. Patrick Krol will not stand for reelection at the Annual Meeting at the expiration of his term. This was not a result of any disagreement between Mr. Krol and the Company.

Our restated certificate of incorporation and amended and restated bylaws provide that the authorized number of directors may be changed only by resolution of the Board of Directors. Any additional directorships resulting from an increase in the number of directors will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the directors. The division of our Board of Directors into three classes with staggered three-year terms may delay or prevent a change of our management or a change in control of our company. Our directors may be removed only for cause by the affirmative vote of the holders of at least two-thirds of our outstanding voting stock entitled to vote in the election of directors. Any vacancy on our Board of Directors, including a vacancy resulting from an enlargement of our Board of Directors, may be filled only by vote of a majority of our directors then in office.

In selecting Board members, our Board may consider many factors, such as personal and professional integrity, ethics and values; experience in corporate management, such as serving as an officer or former officer of a publicly held company; experience as a Board member or executive officer of another publicly held company; diversity of expertise and experience in substantive matters pertaining to our business relative to other Board members; and diversity of background and perspective, including, but not limited to, with respect to age, gender, race, place of residence and specialized experience.

Set forth below are the names and ages (as of April 20, 2022) of the persons nominated as directors and directors whose terms do not expire this year, their ages, their offices in the Company, if any, their principal occupations or employment for at least the past five years, the length of their tenure as directors and the names of other public companies in which such persons hold or have held directorships during the past five years. In addition to the detailed information presented below for each of our directors, we also believe that each of our directors is qualified to serve on our Board and has the integrity, business acumen, knowledge and industry experience, diligence, freedom from conflicts of interest and the ability to act in the interests of our stockholders. There are no familial relationships among any of our directors, nominees for director or executive officers. Additionally, information about the specific experience, qualifications, attributes or skills that led to our Board of Directors’ conclusion at the time of filing of this proxy statement that each person listed below should serve as a director is set forth below:

Name |

| Age |

| Positions |

Eliot Forster, Ph.D. |

| 56 |

| President and Chief Executive Officer, Director |

Nessan Bermingham, Ph.D.(2)(3) |

| 49 |

| Chairman of the Board |

David Arkowitz(1)(2) |

| 60 |

| Director |

Todd Brady, M.D., Ph.D.(1) |

| 50 |

| Director |

Pamela Klein, M.D.(3) |

| 60 |

| Director |

Edward Benz Jr., M.D. |

| 75 |

| Director |

Geoffrey Race(1)(2) |

| 61 |

| Director |

9

Nominees for Election as Class I Directors:

Pamela Klein, M.D. became a member of the Spring Bank Board of Directors in July 2019 and joined our Board of Directors in November 2020. Dr. Klein is a principal and founder of PMK BioResearch, which offers strategic consulting in oncology drug development to corporate boards, management teams and the investment community, a position she has held since 2008. From 2009-2011, she served as Chief Medical Officer of Intellikine, which was acquired by Takeda. Previously, Dr. Klein spent seven years at the National Cancer Institute as Research Director of the NCI-Navy Breast Care Center, after which she joined Genentech in 2001. While at Genentech, she held roles of increasing responsibility including Vice President, Development. Dr. Klein currently serves as a member of various scientific advisory boards and also serves on the board of directors of Argenx SE, Jiya Acquisition Corporation and I-Mab Biopharma, all publicly traded biotechnology companies. Dr. Klein is also a board member of Patrys Limited, a biotechnology company located in Australia. Dr. Klein holds a B.A. in biology from California State University and an M.D. from Stritch School of Medicine, Loyola University Chicago, and is trained in internal medicine and medical oncology. We believe that Dr. Klein is qualified to serve on our Board of Directors because of her decades of experience with drug development and biotechnology companies.

Geoffrey Race joined the F-star Board of Directors in December 2019. Mr. Race brings more than 20 years of experience at both the Chief Financial and Chief Executive Officer level in the life sciences industry. Mr. Race serves as President of Minerva Neurosciences Inc., a company he co-founded in 2013 through the merger of Cyrenaic Inc. and Sonkei Inc. which was subsequently listed on Nasdaq in 2014. He previously served as Chief Executive Officer of Funxional Therapeutics Ltd. He also served as Chief Financial Officer at PanGenetics B.V. between 2006 and 2010. Mr. Race is a director of Sensyne Health plc, and is a founder and Chairman of Huq Industries Limited. He is a Fellow of the Chartered Institute of Management Accountants and earned his M.B.A. from Durham University Business School. We believe that Mr. Race’s experience as a financial executive in the life sciences industry qualifies him to serve on the Board of Directors.

Directors Continuing in Office:

Class II Directors

David Arkowitz became a member of the Spring Bank Board of Directors in January 2014 and joined our Board of Directors in November 2020. Since June 2020, Mr. Arkowitz has served as the Chief Financial Officer and Head of Business Development of Seres Therapeutics, Inc. (Nasdaq: MCRB), a biotechnology company. Prior to his time at Seres Therapeutics, Inc., Mr. Arkowitz served as the Chief Financial Officer and Treasurer of Flexion Therapeutics, Inc., a biotechnology company, which was acquired by Pacira Biosciences (Nasdaq: PCRX) in November 2021. Prior to that, Mr. Arkowitz served as Chief Operating Officer and Chief Financial Officer of Visterra, Inc., which was acquired by Otsuka Pharmaceutical Co., Ltd., a biotechnology company, from September 2013 to May 2018. Prior to joining Visterra, he served as Chief Financial Officer and General Manager at Mascoma Corporation, which was acquired by Lallemand, Inc., a bioconversion company, from 2011 to 2013. From 2007 to 2011, Mr. Arkowitz was Executive Vice President, Chief Financial Officer and Chief Business Officer of AMAG Pharmaceuticals, a specialty pharmaceutical company. Prior to his tenure at AMAG, he served as Chief Financial Officer and Treasurer of Idenix Pharmaceuticals, Inc., a biopharmaceutical company, which was acquired by Merck & Co. Earlier in his career, he spent more than 13 years at Merck & Co. including as Vice President and Controller of the U.S. Human Health division and as Controller of the Global Research and Development division. Mr. Arkowitz currently serves on the board of directors of Yumanity Therapeutics, Inc. (Nasdaq: YMTX). Mr. Arkowitz has a BA in Mathematics from Brandeis University and an M.B.A. in Finance from Columbia University Business School. We believe that Mr. Arkowitz is qualified to serve on our Board of Directors because he brings more than 30 years of finance and operations leadership experience in the healthcare, life sciences and biotechnology industries.

Eliot Forster, Ph.D. has served as F-star’s Chief Executive Officer since October 2018 and as a member of F-star’s Board of Directors since May 2019. From January 2015 to February 2018, Dr. Forster served as Chief Executive Officer of Immunocore Limited. Prior to that, he served as Chief Executive Officer of Creabilis S.A. (which was subsequently acquired by Sienna Biopharmaceuticals, Inc.) from May 2010 to January 2015. From May 2007 to May 2010, Dr. Forster served as Chief Executive Officer of Solace Pharmaceuticals Inc. Dr. Forster also served as Head of Development and Operations for the European Union and Asia at Pfizer Inc. from 1996 to 2007. Since June 2018, Dr. Forster has served as non-executive chairman of Avacta Group plc, which is publicly traded on the London Stock Exchange. Since September 2020, Dr Forster has served as non-executive director of Immatics NV (Nasdaq: IMTX). Dr. Forster is an Honorary Visiting Professor of Molecular and Clinical Cancer Medicine at the University of Liverpool, an honorary professor at the University of Pavia (Italy) and a board member of the Office for Strategic Coordination of Health Research and the National Genomics Board. He holds a Ph.D. from University of Liverpool, an M.B.A. from Henley Management College, and a B.Sc. with honors from University of Liverpool. We believe that Dr. Forster is qualified to serve on the Board of Directors due to his business and technical expertise, along with his strategic insight into F-star’s business as its current Chief Executive Officer.

10

Nessan Bermingham, Ph.D. has served as a member of F-star’s Board of Directors and as its chairman since May 2019. Dr. Bermingham previously served on the board of directors of F-star Alpha, F-star Beta and F-star Delta from April 2018 to May 2019. Dr. Bermingham also served as a member of the supervisory board of F-star GmbH until May 2019. Dr. Bermingham currently serves as President, Chief Executive Officer and director of Triplet Therapeutics since November 2018 and as a Partner at Khosla Ventures since December 2021. From May 2014 to December 2017, Dr. Bermingham served as co-founder, President and Chief Executive Officer of Intellia Therapeutics, Inc. Prior to Intellia, from 2002 to 2007 and 2012 to 2014 Dr. Bermingham held various positions at Atlas Ventures including a member of the Atlas Venture Investment Team from 2002 to 2007. Dr. Bermingham currently serves as the executive chairman of Korro Bio, Inc. Dr. Bermingham received a Ph.D. in Molecular Biology from Imperial College London and received a B.S. from Queen’s University Belfast. We believe that Dr. Bermingham’s experience in the life sciences industry, as well as his scientific background, qualifies him to serve on the Board of Directors.

Class III Directors

Todd Brady, M.D., Ph.D. became a member of the Spring Bank Board of Directors in July 2016 and joined our Board of Directors in November 2020. He currently serves as Chief Executive Officer, President, and Director of Aldeyra Therapeutics, Inc., a publicly traded biotechnology company focused on the development of novel drugs for the treatment of immune-mediated diseases. Dr. Brady was appointed President and Chief Executive Officer of Aldeyra Therapeutics in 2012, having been a member of the board of directors since 2005. Dr. Brady also served as Entrepreneur in Residence at Domain Associates, LLC, a healthcare venture capital firm, where he was a Principal from 2004 to 2013. Dr. Brady also currently serves on the board of directors of Evoke Pharma, Inc., a publicly traded specialty pharmaceutical company, and has previously served on the board of directors of Oncobiologics, Inc. and numerous privately traded biotechnology companies. Dr. Brady holds a Ph.D. in pathology from Duke University Graduate School, a M.D. from Duke University Medical School, and an A.B. in Philosophy and Psychology from Dartmouth College. We believe that Dr. Brady is qualified to serve on our Board of Directors because of his board of directors’ experience at other biotechnology companies, as well as his leadership experience in healthcare operations, investing, and research, including his specific experience as president and chief executive officer of Aldeyra Therapeutics, Inc.

Edward Benz, Jr., M.D. joined the F-star Board of Directors in December 2019 and is a renowned leader in the field of hematology and oncology with a distinguished career spanning more than 40 years across industry and academia. Dr. Benz has been President and Chief Executive Officer Emeritus of the Dana-Farber Cancer Institute, Boston, MA since October 2016. He has also served as the Richard and Susan Smith Distinguished Professor of Medicine, Professor of Pediatrics, Professor of Genetics and Faculty Dean Emeritus for Oncology at Harvard Medical School since November 2000. Dr. Benz currently serves as an independent director on the boards of Deciphera Pharmaceuticals, Renovacore, and Candel Therapeutics and he serves on the non-profit boards of trustees of Rockefeller University (emeritus), Mount Desert Island Hospital and MDI Biolabs. Former associate editor of the New England Journal of Medicine, Dr. Benz has authored over 300 peer-reviewed publications and holds several senior positions on various academic boards. He received his Doctor of Medicine from Harvard Medical School and holds an M.A. from Yale University and a B.S. from Princeton University. We believe that Dr. Benz’s extensive experience in the field of oncology qualifies him to serve on the Board of Directors.

Director Independence

Rule 5605 of the Nasdaq Listing Rules requires a majority of a listed company’s board of directors to be comprised of independent directors. In addition, the Nasdaq Listing Rules require that, subject to specified exceptions, each member of a listed company’s Audit, Compensation and Nominating and Corporate Governance Committees be independent under the Exchange Act. Under Rule 5605(a)(2), a director will only qualify as an “independent director” if, in the opinion of our Board of Directors, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Audit Committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Exchange Act. In order to be considered independent for purposes of Rule 10A-3, a member of an Audit Committee of a listed company may not, other than in his or her capacity as a member of the Audit Committee, the Board of Directors, or any other board committee: (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or (2) be an affiliated person of the listed company or any of its subsidiaries.

Compensation Committee members must also satisfy the independence criteria set forth in Rule 10C-1 under the Exchange Act. In order to be considered independent for purposes of Rule 10C-1, a board must consider, for each member of a Compensation Committee of a listed company, all factors specifically relevant to determining whether a director has a relationship to such company which is material to that director’s ability to be independent from management in connection

11

with the duties of a Compensation Committee member, including, but not limited to: the source of compensation of the director, including any consulting advisory or other compensatory fee paid by such company to the director; and whether the director is affiliated with the company or any of its subsidiaries or affiliates.

Our Board of Directors has reviewed the composition of our Board of Directors and its committees and the independence of each director. Based upon information requested from and provided by each director concerning his background, employment and affiliations, including family relationships, and the materiality of any relationship that each of our directors has with F-star, our Board of Directors has determined that each of our directors, with the exception of Dr. Forster, our Chief Executive Officer, is an “independent director” as defined under Rule 5605(a)(2) of the Nasdaq Listing Rules. Thus, our Board of Directors has determined that each of David Arkowitz, Todd Brady, MD., Ph.D., Pamela Klein, M.D., Nessan Bermingham, Ph.D., Edward Benz, Jr., M.D. and Geoffrey Race are each independent. Our Board of Directors determined that David Arkowitz, Dr. Brady and Geoffrey Race, who comprise our Audit Committee, and Dr. Bermingham, David Arkowitz, and Geoffrey Race who comprise our Compensation Committee, satisfy the applicable independence standards for such committees established by the SEC and the Nasdaq Listing Rules, as applicable. In making such determinations, our Board of Directors considered the relationships that each such non-employee director has with our Company and all other facts and circumstances our Board of Directors deemed relevant in determining independence, including the beneficial ownership of our capital stock by each non-employee director.

Board of Directors, Committees and Meetings

During the fiscal year ended December 31, 2021 there were thirteen meetings of our Board of Directors. No director attended fewer than 75% of the total number of meetings of the Board and of committees of the Board on which he or she served during the year ended December 31, 2021. The non-employee directors met in executive session during each of the regularly scheduled Board of Directors meetings during the year ended December 31, 2021.

Continuing directors and nominees for election as directors are strongly encouraged to attend each Annual Meeting of Stockholders. All of our directors that were then serving on our Board of Directors attended our Annual Meeting of Stockholders held in June 2021.

We have established an Audit Committee, a Compensation Committee and a Nominating and Corporate Governance Committee. Each of these committees operates under a charter that has been approved by our Board of Directors and satisfies any applicable rules and regulations of the SEC and the applicable listing standards of the Nasdaq Stock Market. A copy of each charter can be found under the “Investors & News — Corporate Governance” section of our website at www.f-star.com. Members will serve on these committees until their resignation or as otherwise determined by our Board of Directors.

Audit Committee

David Arkowitz, Todd Brady and Geoffrey Race, each of whom is a non-employee member of our Board of Directors, comprise our Audit Committee. Mr. Arkowitz is the chair of our Audit Committee. Our Board of Directors has determined that Messrs. Arkowitz, Brady and Race satisfy the requirements for independence under Rule 10A-3 promulgated under the Exchange Act. Our Board of Directors has determined that Mr. Arkowitz qualifies as an “audit committee financial expert,” as defined in the SEC rules, and satisfies the financial sophistication requirements of the Nasdaq Stock Market. Our Audit Committee held six meetings during 2021. The Audit Committee is responsible for, among other things:

12

Please also see the Report of Audit Committee set forth elsewhere in this proxy statement. A copy of the Audit Committee’s written charter is publicly available on our website at https://investors.f-star.com/corporate-governance.

Compensation Committee

Geoffrey Race, Nessan Bermingham and David Arkowitz, each of whom is a non-employee member of our Board of Directors, comprise our Compensation Committee. Mr. Race is the chair of our Compensation Committee. Our Board of Directors has determined that Messrs. Race, Bermingham and Arkowitz meet the requirements for independence as currently defined in Rule 5605(d)(2)(A) of the Nasdaq listing standards. The Board has adopted a written Compensation Committee charter that is available on the Company’s website at https://investors.f-star.com/corporate-governance. Our Compensation Committee held nine meetings during 2021. The Compensation Committee acting on behalf of the Board is responsible for, among other things:

In addition, the Board has also determined that each member of the Compensation Committee is a “non-employee director” defined in Rule 16b-3 promulgated under the Exchange Act.

Compensation Committee Processes and Procedures

The agenda for each meeting is usually developed by the Chair of the Compensation Committee, in consultation with the Chief Executive Officer and the Chief Financial Officer. The Compensation Committee meets regularly in executive session. However, from time to time, various members of management and other employees as well as outside advisors or consultants may be invited by the Compensation Committee to make presentations, to provide financial or other background information or advice, or to otherwise participate in Compensation Committee meetings. The Chief Executive Officer may not participate in, or be present during, any deliberations or determinations of the Compensation Committee regarding his compensation. The Compensation Committee has full access to all books, records, facilities, and personnel of the Company.

The Compensation Committee has adopted processes and procedures that the Compensation Committee considers in the determination of executive compensation, as described in “Executive and Director Compensation — Executive Compensation — Narrative Disclosure to Summary Compensation Table” below.

13

The Compensation Committee has the authority to directly retain the services of independent consultants and other experts to assist in fulfilling its responsibilities. The Compensation Committee has engaged Pearl Meyer as its independent compensation consultant. Pearl Meyer provides analysis and recommendations to the Compensation Committee regarding:

Pearl Meyer performs services solely on behalf of the Compensation Committee and has no relationship with the Company or management except as it may relate to performing such services. When requested, Pearl Meyer consultants attend meetings of the Compensation Committee, including executive sessions in which executive compensation related matters are discussed without the presence of management. Pearl Meyer reports to the Compensation Committee and not to management, although Pearl Meyer meets with management for purposes of gathering information for its analyses and recommendations.

In determining to engage Pearl Meyer, the Compensation Committee considered the independence of Pearl Meyer, taking into consideration relevant factors, including the absence of other services provided to the Company by Pearl Meyer, the amount of fees the Company paid to Pearl Meyer, the policies and procedures of Pearl Meyer that are designed to prevent conflicts of interest, any business or personal relationship of the individual compensation advisors employed by Pearl Meyer with any executive officer of the Company, any business or personal relationship the individual compensation advisors employed by Pearl Meyer have with any member of the Compensation Committee, and any stock of the Company owned by Pearl Meyer or the individual compensation advisors employed by Pearl Meyer. The Compensation Committee has determined, based on its analysis and in light of all relevant factors, including the factors listed above, that the work of Pearl Meyer and the individual compensation advisors employed by Pearl Meyer as compensation consultants to the Compensation Committee has not created any conflicts of interest, and that Pearl Meyer is independent pursuant to the independence standards set forth in the Nasdaq listing standards promulgated pursuant to Section 10C of the Exchange Act.

Nominating and Corporate Governance Committee

Nessan Bermingham and Pamela Klein comprise our Nominating and Corporate Governance Committee. Our Board of Directors has determined that Dr. Bermingham and Dr. Klein meet the requirements for independence under the rules of the Nasdaq Stock Market. Dr. Bermingham is the chair of our Nominating and Corporate Governance Committee. Our Nominating and Corporate Governance Committee held two meetings during 2021. The Nominating and Corporate Governance Committee is responsible for, among other things:

A copy of the Nominating and Corporate Governance Committee’s written charter is publicly available on our website at https://investors.f-star.com/corporate-governance.

14

Corporate Governance Guidelines

Our Board of Directors has adopted corporate governance guidelines to assist in the exercise of its duties and responsibilities and to serve the best interests of the Company and our stockholders. These guidelines, which provide a framework for the conduct of our Board of Directors’ business, provide that:

Director Nomination Process

The process followed by our Nominating and Corporate Governance Committee to identify and evaluate director candidates includes requests to Board members and others for recommendations, meetings from time to time to evaluate biographical information and background material relating to potential candidates and interviews of selected candidates by members of the Committee and our Board of Directors.

In considering whether to recommend any particular candidate for inclusion in our Board’s slate of recommended director nominees, our Nominating and Corporate Governance Committee applies the criteria set forth in our corporate governance guidelines. Consistent with these criteria, our Nominating and Corporate Governance Committee expects every nominee to have the following attributes or characteristics: integrity, business acumen, good judgment, and a commitment to understand our business and industry. We also value experience on other public company boards of directors and board committees.

The biography for each of the director nominees included herein indicates each nominee’s experience, qualifications, attributes and skills that led our Nominating and Corporate Governance Committee and our Board of Directors to conclude each such director should continue to serve as a director of our Company. Our Nominating and Corporate Governance Committee and our Board of Directors believe that each of the nominees has the individual attributes and characteristics required of each of our directors, and the nominees as a group possess the skill sets and specific experience desired of our Board of Directors as a whole.

Our Nominating and Corporate Governance Committee does not have a policy (formal or informal) with respect to diversity, but believes that our Board of Directors, taken as a whole, should embody a diverse set of skills, experiences and backgrounds. In this regard, the Committee also takes into consideration the value of diversity (with respect to gender, race, national origin and other factors) of our Board members. The Nominating and Corporate Governance Committee does not make any particular weighting of diversity or any other characteristic in evaluating nominees and directors.

Stockholders may recommend individuals to our Nominating and Corporate Governance Committee for consideration as potential director candidates by following the procedures described in our amended and restated bylaws, including submitting the names of director candidates, together with appropriate biographical information and background materials, and information with respect to the stockholder or group of stockholders making the recommendation, including the number of shares of common stock owned by such stockholder or group of stockholders, as well as other information required by our amended and restated bylaws. Such recommendations shall be sent to Corporate Secretary, F-star Therapeutics, Inc., Eddeva B920, Babraham Research Campus, Cambridge, CB22 3AT, United Kingdom. Assuming that appropriate biographical and background material has been provided on a timely basis, the Committee will evaluate stockholder-recommended candidates by following substantially the same process, and applying substantially the same criteria, as it follows for candidates submitted by others.

Stockholders also have the right under our amended and restated bylaws to directly nominate director candidates, without any action or recommendation on the part of the Committee or our Board of Directors, by following the procedures set forth under the heading “Stockholder Proposals and Nominations for Director” in this proxy statement.

15

Board Leadership Structure

Our corporate governance guidelines do not provide that we are required to have any specific board structure, and our Board of Directors is given the flexibility to select its chairman and our chief executive officer in the manner that it believes is in the best interests of our stockholders. Accordingly, the positions of chairman and the chief executive officer may be filled by either one individual or two individuals. Our Board of Directors has separated the positions of chairman and chief executive officer such that Dr. Bermingham holds the position of Chairman of our Board of Directors and Dr. Forster remains our President and Chief Executive Officer.

Dr. Bermingham has authority, among other things, to call and preside over meetings of our Board of Directors, including executive sessions of our non-employee independent directors, to set meeting agendas and to determine materials to be distributed to our Board of Directors. Accordingly, our chairman has substantial ability to shape the work of the Board of Directors. Our Board of Directors believes that this structure serves the interests of our stockholders because it allows our Chief Executive Officer to focus primarily on our business strategy and operations and most effectively leverages the experience of the Chairman. The separation of these positions also reinforces the independence of the Board of Directors in its oversight of our business and affairs. In addition, the Board of Directors believes having an independent chairman can create an environment that is more conducive to objective evaluation and oversight of management’s performance, potentially increasing management accountability and improving the ability of our Board of Directors to monitor whether management’s actions are in the best interests of the Company and its stockholders. As a result, our Board of Directors believes having an independent chairman can enhance the effectiveness of our Board of Directors as a whole.

Board Diversity Matrix

The following table sets forth information on each director’s voluntary self-identified characteristics in a tabular format.

Board Diversity Matrix (As of March 31, 2022) | ||||

Total Number of Directors |

|

|

|

|

| Female | Male | Non-Binary | Did Not Disclose Gender |

Gender: |

|

|

|

|

Directors | 1 | 7 |

|

|

Number of Directors Who Identify in Any of the Categories Below: |

|

|

|

|

African American or Black |

|

|

|

|

Alaskan Native or Native American |

|

|

|

|

Asian (other than South Asian) |

|

|

|

|

South Asian |

|

|

|

|

Hispanic or Latinx |

|

|

|

|

Native Hawaiian or Pacific Islander |

|

|

|

|

White | 1 | 7 |

|

|

Two or More Races or Ethnicities |

|

|

|

|

LGBTQ+ |

|

|

|

|

Persons with Disabilities |

|

|

|

|

Communications from Stockholders

Our Board of Directors will give appropriate attention to written communications that are submitted by stockholders and will respond if and as appropriate. The Chairman of our Nominating and Corporate Governance Committee, with the advice and assistance from our legal counsel, is primarily responsible for monitoring communications from stockholders and for providing copies or summaries to the other directors as he considers appropriate.

Communications are forwarded to all directors if they relate to important substantive matters and include suggestions or comments that the Chairman of the Board considers to be important for the directors to know. In general, communications relating to corporate governance and corporate strategy are more likely to be forwarded than communications relating to ordinary business affairs, personal grievances and matters as to which we receive repetitive or duplicative communications.

16

Stockholders who wish to send communications on any topic to our Board of Directors should address such communications to Board of Directors, F-star Therapeutics, Eddeva B920, Babraham Research Campus, Cambridge, CB22 3AT, United Kingdom.

Stockholder Engagement

Senior management regularly engages with our stockholders at industry conferences and investor meetings. In response to feedback gained through these meetings, we remain focused on delivering on our growth strategy, and we continue to enhance the transparency and disclosure of our financial, operational and governance performance.

Our senior management team keeps the Board regularly updated on the views of stockholders and provides reports from financial and other advisers concerning institutional stockholder feedback.

Oversight of Risk

Our Board of Directors oversees our risk management processes directly and through its committees. Our management is responsible for risk management on a day-to-day basis. The role of our Board of Directors and its committees is to oversee the risk management activities of management. They fulfill this duty by discussing with management the policies and practices utilized by management in assessing and managing risks and providing input on those policies and practices. In general, our Board of Directors oversees risk management activities relating to business strategy, acquisitions, capital allocation, organizational structure and certain operational risks; our Audit Committee oversees risk management activities related to financial controls and legal and compliance risks; our Compensation Committee oversees risk management activities relating to our compensation policies and practices; and our Nominating and Corporate Governance Committee oversees risk management activities relating to Board of Directors composition and management succession planning. Each committee reports to the full Board of Directors on a regular basis, including reports with respect to the committee’s risk oversight activities, as appropriate. In addition, since risk issues often overlap, committees from time to time request that the full Board of Directors discuss particular risks.

Our Compensation Committee has discussed the concept of risk as it relates to our compensation programs, including our executive compensation program. Our Compensation Committee believes that our compensation programs do not encourage excessive or inappropriate risk taking and that any risks arising from our employee compensation policies and practices are not reasonably likely to have a material adverse effect on our Company. Our Compensation Committee believes that any such risks are mitigated by:

Code of Business Conduct and Ethics

Our Board of Directors has adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including our chief executive officer, chief financial officer and our other executive and senior financial officers. The full text of our code of business conduct and ethics is available on the “Investors — Governance” page on our website. We intend to post any amendment to our code of business conduct and ethics, and any waivers of such code for directors and executive officers, on our website and will be included in a Current Report on Form 8-K within four business days following the date of the amendment or waiver, unless website posting or the issuance of a press release of such amendments or waivers is then permitted by the rules of The Nasdaq Stock Market.

Hedging and Pledging

Our directors and executive officers are prohibited from (1) selling our securities “short” at any time, (2) buying or selling puts, calls or similar instruments on our securities and (3) engaging in any other hedging transactions with respect to our securities. Directors and executive officers may not hold our stock in a margin account. In addition, unless the transaction has been approved by our Audit Committee, directors and executive officers may not at any time pledge our stock as collateral for a loan.

17

Executive Officers

The following table sets forth certain information regarding our executive officers. All executive officers are at-will employees.

Name |

| Age |

| Positions |

Eliot Forster, Ph.D. * |

| 56 |

| President and Chief Executive Officer |

Darlene Deptula-Hicks |

| 64 |

| Chief Financial Officer, Treasurer and Secretary |

Louis Kayitalire, M.D. |

| 64 |

| Chief Medical Officer |

Neil Brewis, PhD., DSc |

| 55 |

| Chief Scientific Officer |

* Dr. Forster is a member of our Board of Directors. See “Management and Corporate Governance — The Board of Directors” for more information about Dr. Forster.

Darlene Deptula-Hicks has served as F-star’s Chief Financial Officer since May 2019. Since January 2018, Ms. Deptula-Hicks has operated Crimson Consulting LLC, a strategic and financial consulting services company, and has served as acting Chief Financial Officer for Northern Biologics, Inc. From May 2017 to January 2018, she served as Senior Vice President and Chief Financial Officer of T2 Biosystems, Inc., (Nasdaq:TTOO) and from December 2014 to February 2017, Ms. Deptula-Hicks was Senior Vice President and Chief Financial Officer of Pieris Pharmaceuticals, Inc. (Nasdaq:PIRS) From 2012 until November 2014, she served as Vice President and Chief Financial Officer of Microline Surgical, Inc. Ms. Deptula-Hicks received an M.B.A. from Rivier University and a B.S in Accounting from Southern New Hampshire University. Ms. Deptula-Hicks currently serves on the board of directors and audit committee chair of Abcuro, Inc, and Aerami Therapeutics, Inc. and previously served on the board of directors and as audit committee chair of Giner Life Sciences and Xentic Biosciences (Nasdaq:XBIO), US Falcon, Inc., Technest Holdings, Inc. (AMEX:TCNH) and, IMCOR Pharmaceuticals (Nasdaq:IMPH).

Louis Kayitalire, M.D. brings over 25 years’ experience in oncology and immuno-oncology, joining F-star in June 2019 from Bristol-Myers Squibb where he was responsible for the clinical research strategy for broad development of oncology assets and advancing clinical research efforts with a team of medical directors from March 2016 to June 2019. Prior to that, Dr. Kayitalire held senior positions at major pharmaceutical companies including Celgene from September 2013 to March 2016. Dr. Kayitalire completed his medical training at Butare University, Rwanda and later as Assistant Professor in Oncology at the Paris XI University of France. He is an active member of the American Society of Clinical Oncology (ASCO), the American Association for Cancer Research (AACR) and the Society for Immunotherapy of Cancer (STIC).

Neil Brewis, Ph.D., DSc has served as F-star’s Chief Scientific Officer since November 2015. He also serves on the board of directors of F-star Therapeutics LLC. From 2007 to October 2015, Dr. Brewis served as Vice President, Head of Biopharmaceuticals Research at GlaxoSmithKline plc. Prior to that, Dr. Brewis served as Head of Research at Domantis Ltd. from 2002 to 2007, when the company was acquired by GlaxoSmithKline plc. Dr. Brewis is an Honorary Doctor of Science from Hertfordshire University. He received a Ph.D. in Biochemistry from Dundee University and a B.Sc. with honors in Applied Biology from Hertfordshire University.

18

EXECUTIVE OFFICER AND DIRECTOR COMPENSATION

Executive Compensation

This section discusses material components of our executive compensation program for the following individuals, each of whom is one of our “named executive officers” for 2021:

2021 Summary Compensation Table

The following table provides information regarding the compensation paid or accrued to each of our named executive officers for the fiscal years ended December 31, 2021 and December 31, 2020. Our named executive officers include our principal executive officer, our principal financial officer and our two next most highly compensated executive officers who served during the fiscal years ended December 31, 2021 and 2020.

Name and Principal Position |

| Year |

| Salary |

|

| Bonus |

|

| Option |

|

| Stock |

|

| All Other |

|

| Total |

| ||||||

Eliot Forster, Ph.D |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

President and |

| 2021 |

| $ | 665,408 |

|

| $ | 196,662 |

|

| $ | 718,933 |

|

| $ | 1,216,940 |

|

| $ | 3,952 |

| (4) | $ | 2,801,894 |

|

|

| 2020 |

| $ | 645,243 |

|

| $ | 402,361 |

|

| $ | 3,491,600 |

|

| $ | — |

|

| $ | 1,943 |

| (4) | $ | 4,541,147 |

|

Darlene Deptula-Hicks |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Chief Financial Officer, |

| 2021 |

| $ | 636,390 |

|

| $ | 103,300 |

|

| $ | 145,524 |

|

| $ | 257,100 |

|

| $ | — |

|

| $ | 1,142,314 |

|

|

| 2020 |

| $ | 521,875 |

|

| $ | 150,500 |

|

| $ | — |

|

| $ | 310,200 |

|

| $ | — |

|

| $ | 982,575 |

|

Louis Kayitalire, M.D. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Chief Medical Officer |

| 2021 |

| $ | 451,344 |

|

| $ | 117,000 |

|

| $ | 72,386 |

|

| $ | 248,530 |

|

| $ | 44,398 |

| (4) | $ | 933,657 |

|

|

| 2020 |

| $ | 450,000 |

|

| $ | 246,250 |

|

| $ | — |

|

| $ | 310,200 |

|

| $ | 20,645 |

| (4) | $ | 1,027,095 |

|

Neil Brewis, PhD., DSc |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||

Chief Scientific Officer |

| 2021 |

| $ | 412,685 |

|

| $ | 107,821 |

|

| $ | 126,793 |

|

| $ | 154,260 |

|

| $ | 36,857 |

| (4) | $ | 838,416 |

|

|

| 2020 |

| $ | 320,937 |

|

| $ | 247,500 |

|

| $ | 1,075,000 |

|

| $ | — |

|

| $ | 25,965 |

| (4) | $ | 1,669,402 |

|

19

Narrative Disclosure to Summary Compensation Table