As filed with the Securities and Exchange Commission on May 28, 2014

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-22790

DoubleLine Equity Funds

(Exact name of registrant as specified in charter)

333 South Grand Avenue, Suite 1800

Los Angeles, CA 90071

(Address of principal executive offices) (Zip code)

Ronald R. Redell

President

DoubleLine Equity Funds

333 South Grand Avenue, Suite 1800

Los Angeles, CA 90071

(Name and address of agent for service)

(213) 633-8200

Registrant’s telephone number, including area code

Date of fiscal year end: March 31

Date of reporting period: March 31, 2014

Item 1. Reports to Stockholders.

Annual Report

March 31, 2014

DoubleLine Equities Small Cap Growth Fund

DBESX (I-share)

DLESX (N-share)

DoubleLine Equities Growth Fund

DBEGX (I-share)

DLEGX (N-share)

DoubleLine Equities Technology Fund

DBETX (I-share)

DLETX (N-share)

| | |

| DoubleLine Equity LP | | 333 S. Grand Avenue 18th Floor Los Angeles, California 90071 doubleline.com |

Table of Contents

| | | | | | |

| | Annual Report | | March 31, 2014 | | 3 |

President’s Letter

Dear DoubleLine Funds Shareholder,

On behalf of the DoubleLine Equity Funds, I am pleased to deliver the Annual Report for the period ending March 31st, 2014. On the following pages you will find specific information regarding each Fund’s operations and holdings. In addition, we discuss each Fund’s investment performance and the main drivers of that performance during the reporting period.

April 1, 2014 marks the one-year anniversary of the DoubleLine Equity Funds launch. We continue to broadly offer the DoubleLine Equities Small Cap Growth Fund (DBESX/DLESX) and the DoubleLine Equities Growth Fund (DBEGX/DLEGX) in two share classes (Class I and Class N). We launched the DoubleLine Equities Technology Fund (DBETX/DLETX) on August 9th, 2013 to employees, officers and Trustees of the Equity Funds and their family members; employees and officers of DoubleLine Equity LP or DoubleLine Group LP and their family members; and affiliates of DoubleLine Equity LP or DoubleLine Group LP. As we build out our equity platform we will look to more broadly launch the Fund.

If you have any questions regarding the DoubleLine Funds please don’t hesitate to call us at 877-DLine11 (877-354-6311), or visit our website www.doublelinefunds.com to hear our investment management team offer deeper insights and analysis on relevant capital market activity impacting investors today. We value the trust that you have placed with us, and we will continue to strive to offer thoughtful investment solutions to our shareholders.

Sincerely,

Ronald R. Redell, CFA

President

DoubleLine Equity Funds

May 1, 2014

| | | | | | |

| 4 | | DoubleLine Equity Funds | | | | |

| | |

| Financial Markets Highlights | | |

Looking back over the twelve months ended March 31, 2014, the U.S. equity market can best be described as a “Goldilocks Market,” with the economy warm enough to support continued growth in corporate earnings but not so warm as to prompt the Fed “taper” too quickly. By late March, the S&P 500® Index benchmark was setting new all time highs, and in total was up almost 22% for the 12-month period. Another important milestone was reached: in April, the S&P 500® Index surpassed the highs it had set over five years earlier in November 2007. Those highs were essentially the same highs the market had set in 2000 – therefore by April 2013 the S&P 500® Index was at least positive in nominal terms on a trailing 13-year basis.

The 12-month period was dominated by a focus on the Federal Reserve (the “Fed”), particularly the transition to Fed Chair Janet Yellen, and the initiation of a “taper” from the extraordinary policies of quantitative easing (QE). In June, then Fed Chair Bernanke began publically suggesting a wind down of QE and the capital markets did not respond well. The S&P 500® Index quickly lost 5% of its value, and significant areas within fixed income markets saw greater declines. Within days, Fed officials had backed away from taper talk and the equity markets resumed their upward climb. The Fed had effectively put a short-term floor under the equity markets.

Macroeconomic data firmed throughout the calendar year; and while not enough to call the economy robust, it was enough to slowly reduce unemployment. By the time the taper was announced on December 18th, the markets had discounted it. For instance, the yield on 10-year U.S. Treasuries had already risen 78% from its lows. The equity markets, in contrast to June, rallied subsequent to the December announcement of the taper.

In general, the equity markets had a strong bias towards growth stocks over this 12-month period. This was reflected in the sectors which outperformed and underperformed within the broader index. The weakest sectors were those that are generally perceived as the most defensive and/or favored for their dividend yields over capital appreciation potential: Telecom, Utilities, and Consumer Staples. In contrast, the growth-oriented sectors led the outperformance. Industrials were the best performers, with this segment of the S&P 500® Index up almost 30%. Healthcare (up 27%), Technology (up 26%) and Materials (up 25%) were all outperformers, which was a trend mirrored at the security level too. Within Technology, for instance, the leadership stocks were those competing in the faster-growing areas such as Internet, social media, and software-as-a-service. After the market hit all-time highs, cracks began to form by mid-March. Growth stocks began to underperform value stocks and the best performing industries, such as Biotech and Software, began to see significant declines.

| | | | | | |

| | Annual Report | | March 31, 2014 | | 5 |

| | |

| Management’s Discussion of Fund Performance | | |

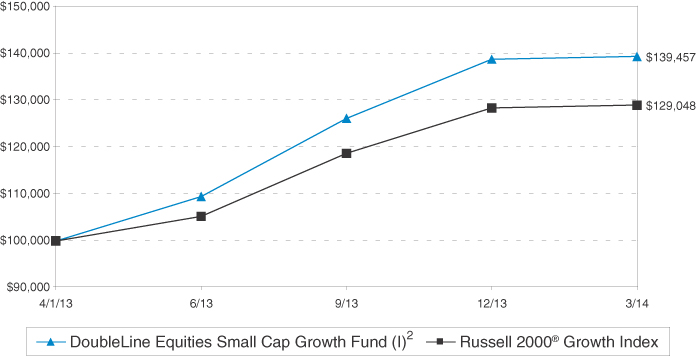

DoubleLine Equities Small Cap Growth Fund

During its first year, the Fund outperformed the Russell 2000® Growth Index benchmark by approximately 10%, and returned approximately 39%. The vast majority of this outperformance was due to stock selection. From an allocation standpoint, our relative returns benefitted from our overweight positions in Consumer Staples and underweight position in Materials. Financials, Consumer Discretionary, and Industrials benefited the portfolio. In Financials, both Artisan Partners and SVB Financial provided the greatest relative lift, while Gentherm, Harman, and Restoration Hardware helped in Consumer Discretionary. Our stock selection in Industrials was positive and broad based with Astronics and DXP Enterprises providing the greatest positive impact in that sector. Two sectors were a drag on relative performance: Energy and Information Technology. Positive stock selection in our exploration and production holding were not enough to offset negative performance in our service name GeoSpace Technologies in Energy. While Mellanox Technologies, Fotinet, and Aruba Networks hurt performance in Information Technology. Since the end of the reporting period, we have sold both Mellanox and Fortinet and increased our position in Aruba Networks.

| | | | | | |

| Period Ended 3-31-14 | | | | 1-Year | |

I-Share | | | | | 39.46% | |

N-Share | | | | | 39.16% | |

Russell 2000® Growth Index | | | | | 29.05% | |

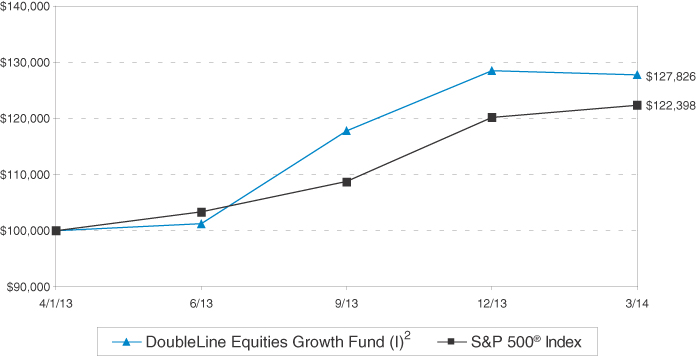

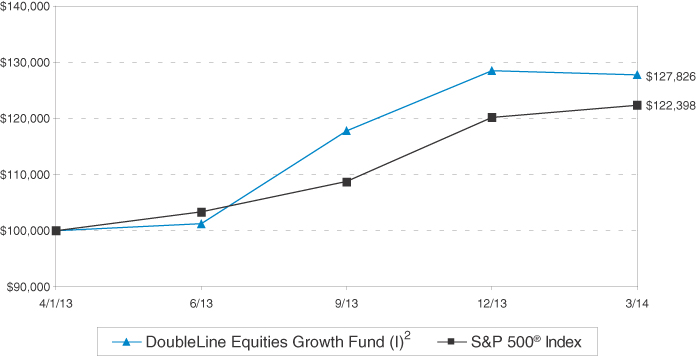

DoubleLine Equities Growth Fund

During its first year, the Fund outperformed the S&P 500® Index benchmark by approximately 5%, and returned 27.83%. The vast majority of this outperformance was due to stock selection. The balance was due to our sector allocations. Specifically, our relative returns benefitted from our overweight positions in three of the S&P 500® Index strongest sectors, Industrials, Healthcare and Technology. Our lack of investments in the Telecommunications and Utilities sectors also benefited relative performance. While we are discussing sectors in this paragraph, we note that we do not actively sector rotate. Rather our sector weights are a function of our individual security selections.

Information Technology was the greatest contributor to relative performance, with Facebook, Alliance Data Systems and Palo Alto Networks providing the greatest relative lift. ARM Holdings, LinkedIn and F5 Networks were a drag on performance. Energy, despite being an underperforming sector in the benchmark, was the second greatest source of relative performance. Lufkin Industries (which was acquired during the period by GE), Continental Resources and Core Laboratories were our best performers in Energy. Consumer Discretionary was our third best sector, led by Under Armour (which we sold during the reporting period). Within this sector, Lululemon Athletica (which we sold during the reporting period) was a drag on performance. Consumer Staples also helped relative performance, with Whole Foods (which we sold during the reporting period) more than offsetting our recently-added position in Sprouts Farmers Market.

Two sectors were a drag on relative performance: Financials and Industrials. Industrials was the best performing sector in the S&P 500® Index, and our positions did not keep pace. In particular, Fastenal, Kansas City Southern, and Roper were underperformers. Similarly, our Financial Services holdings, while all had positive performance, failed to keep pace with the benchmark.

| | | | | | |

| Period Ended 3-31-14 | | | | 1-Year | |

I-Share | | | | | 27.83% | |

N-Share | | | | | 27.63% | |

S&P 500® Index | | | | | 22.40% | |

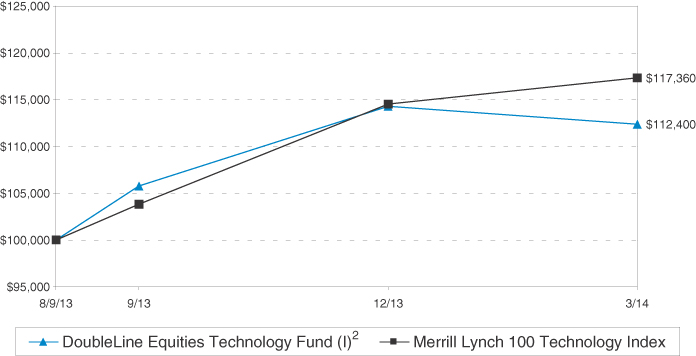

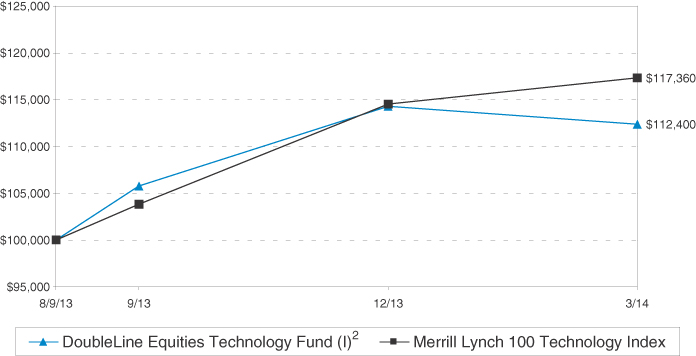

DoubleLine Equities Technology Fund

Since inception in August of 2013 through March 31, 2014, the Fund has underperformed the Merrill Lynch Technology 100 Index by almost 5%. Our investments in the Hardware and Equipment industry contributed positively to relative performance, owing to strong returns from Palo Alto Networks and Faro Technologies. Universal Display and Nimble Storage were a drag on relative performance. Our investments in the Software and Services industry, representing over half of the portfolio, were roughly neutral to performance. We had some investments in that industry that performed exceptionally well during the period, such as Facebook, ServiceNow, FireEye, Splunk,

| | | | | | |

| 6 | | DoubleLine Equity Funds | | | | |

Salesforce.com and Alliance data. We also had a number of investments in this industry that underperformed, such as InfoBlox, Ellie Mae, Qlik Technologies and Cornerstone. Our investments in the Semiconductor Industry also hurt relative performance, owing to our investment in Mellanox.

| | | | | | |

| Period Ended 3-31-14 | | | | Since Inception 8-9-2013 (Not Annualized) | |

I-Share | | | | | 12.40% | |

N-Share | | | | | 12.20% | |

Merrill Lynch 100 Technology Index | | | | | 17.36% | |

Past performance is not a guarantee of future results.

Opinions expressed herein are as of March 31, 2014 and are subject to change at any time, are not guaranteed and should not be considered investment advice.

The performance shown assumes the reinvestment of all dividends and distributions and does not reflect any reductions for taxes. Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

Fund holdings and sector allocations are subject to change at any time and are not recommendations to buy or sell any security. Please refer to the Schedules of Investments for a complete list of Fund holdings.

This report is for the information of shareholders of the Funds. It may also be used as sales literature when preceded or accompanied by the current prospectus.

Mutual fund investing involves risk. Principal loss is possible. The DoubleLine Equities Small Cap Growth Fund, DoubleLine Equities Growth Fund and DoubleLine Equities Technology Fund may invest in foreign securities, which involve political, economic, and currency risks, greater volatility, and differences in accounting methods. These risks are greater for investments in emerging markets. The Funds may use certain types of exchange traded funds or investment derivatives. Derivatives involve risks different from, and in certain cases, greater than the risks presented by more traditional investments. ETF investments involve additional risks such as the market price trading at a discount to its net asset value, an active secondary trading market may not develop or be maintained, or trading may be halted by the exchange in which they trade, which may impact a fund’s ability to sell its shares. The Funds invest in smaller capitalization companies, which involve additional risks such as limited liquidity and greater volatility. Investments in debt securities typically decrease in value when interest rates rise. This risk is usually greater for longer-term debt securities. Investment by the Funds in lower-rated and non-rated securities presents a greater risk of loss to principal and interest than higher rated securities. Equities may decline in value due to both real and perceived general market, economic and industry conditions. The Equities Technology Fund may concentrate investments in technology companies which may be highly volatile.

Merrill Lynch 100 Technology Index: the Index is an equal-dollar weighted index of 100 stocks designed to measure the performance of a cross section of large, actively traded technology stocks and American depositary receipts.

Russell 2000® Growth Index: this Index measures the performance of the small-cap growth segment of the U.S. equity universe. It includes those Russell 2000 Index companies with higher price-to-value ratios and higher forecasted growth values.

S&P 500 Index: the Index is a capitalized-weighted index of 500 stocks.

A direct investment cannot be made in an index. The performance of any index mentioned in this commentary has not been adjusted for ongoing management, distribution and operating expenses applicable to mutual fund investments.

The DoubleLine Equity Funds are distributed by Quasar Distributors, LLC.

DoubleLine® is a registered trademark of DoubleLine Capital LP.

This commentary may include statements that constitute “forward-looking statements” under the U.S. securities laws. Forward-looking statements include, among other things, projections, estimates, and information about possible or future results related to a Fund and market or regulatory developments. The views expressed above are not guarantees of future performance or economic results and involve certain risks, uncertainties and assumptions that could cause actual outcomes and results to differ materially from the views expressed herein.

DoubleLine has no obligation to provide revised assessments in the event of changed circumstances. While we have gathered this information from sources believed to be reliable, DoubleLine cannot guarantee the accuracy of the information provided. Securities discussed are not recommendations and are presented as examples of issue selection or portfolio management processes. They have been picked for comparison or illustration purposes only. No security presented within is either offered for sale or purchase. DoubleLine reserves the right to change its investment perspective and outlook without notice as market conditions dictate or as additional information becomes available.

Investment strategies may not achieve the desired results due to implementation lag, other timing factors, portfolio management decision making, economic or market conditions or other unanticipated factors. The views and forecasts expressed in this material are as of the date indicated, are subject to change without notice, may not come to pass and do not represent a recommendation or offer of any particular security, strategy, or investment. Past performance is no guarantee of future results.

| | | | | | |

| | Annual Report | | March 31, 2014 | | 7 |

| | |

| Schedule of Investments DoubleLine Equities Small Cap Growth Fund | | March 31, 2014 |

| | | | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | | | VALUE $ | |

| | COMMON STOCKS 97.1% | |

| | |

| | AEROSPACE & DEFENSE 4.1% | |

| | 5,950 | | | Astronics Corporation* | | | | | 377,290 | |

| | 5,996 | | | HEICO Corporation | | | | | 360,719 | |

| | | | | | | | | | |

| | | | | | | | | 738,009 | |

| | | | | | | | | | |

| | AUTO COMPONENTS 2.8% | |

| | 14,693 | | | Gentherm, Inc.* | | | | | 510,141 | |

| | | | | | | | | | |

| | BIOTECHNOLOGY 7.3% | |

| | 3,537 | | | ACADIA Pharmaceuticals, Inc.* | | | | | 86,055 | |

| | 4,308 | | | Akebia Therapeutics, Inc.* | | | | | 84,265 | |

| | 7,538 | | | Aquinox Pharmaceuticals, Inc.* | | | | | 95,959 | |

| | 5,365 | | | Foundation Medicine, Inc.* | | | | | 173,665 | |

| | 3,477 | | | Incyte Corporation Ltd.* | | | | | 186,089 | |

| | 5,591 | | | Insmed, Inc.* | | | | | 106,453 | |

| | 11,509 | | | Neurocrine Biosciences, Inc.* | | | | | 185,295 | |

| | 1,867 | | | Puma Biotechnology, Inc.* | | | | | 194,429 | |

| | 5,309 | | | Sarepta Therapeutics, Inc.* | | | | | 127,575 | |

| | 3,098 | | | Versartis, Inc.* | | | | | 93,095 | |

| | | | | | | | | | |

| | | | | | | | | 1,332,880 | |

| | | | | | | | | | |

| | BUILDING PRODUCTS 1.0% | |

| | 2,575 | | | Trex Company, Inc.* | | | | | 188,387 | |

| | | | | | | | | | |

| | CAPITAL MARKETS 6.3% | |

| | 8,906 | | | Artisan Partners Asset Management, Inc. | | | | | 572,210 | |

| | 5,355 | | | Financial Engines, Inc. | | | | | 271,927 | |

| | 16,626 | | | Marcus & Millichap, Inc.* | | | | | 296,608 | |

| | | | | | | | | | |

| | | | | | | | | 1,140,745 | |

| | | | | | | | | | |

| | COMMERCIAL BANKS 1.4% | |

| | 1,935 | | | SVB Financial Group* | | | | | 249,189 | |

| | | | | | | | | | |

| | COMMERCIAL SERVICES & SUPPLIES 3.0% | |

| | 14,511 | | | US Ecology, Inc. | | | | | 538,648 | |

| | | | | | | | | | |

| | COMMUNICATIONS EQUIPMENT 5.0% | |

| | 23,605 | | | Aruba Networks, Inc.* | | | | | 442,594 | |

| | 6,919 | | | Palo Alto Networks, Inc.* | | | | | 474,643 | |

| | | | | | | | | | |

| | | | | | | | | 917,237 | |

| | | | | | | | | | |

| | COMPUTERS & PERIPHERALS 3.4% | |

| | 10,475 | | | Nimble Storage, Inc.* | | | | | 396,898 | |

| | 2,020 | | | Stratasys Ltd.* | | | | | 214,302 | |

| | | | | | | | | | |

| | | | | | | | | 611,200 | |

| | | | | | | | | | |

| | DIVERSIFIED FINANCIAL SERVICES 1.5% | |

| | 4,567 | | | MarketAxess Holdings, Inc. | | | | | 270,458 | |

| | | | | | | | | | |

| | ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS 4.6% | |

| | 5,681 | | | Cognex Corporation* | | | | | 192,359 | |

| | 6,911 | | | FARO Technologies, Inc.* | | | | | 366,283 | |

| | 21,043 | | | Maxwell Technologies, Inc.* | | | | | 271,875 | |

| | | | | | | | | | |

| | | | | | | | | 830,517 | |

| | | | | | | | | | |

| | ENERGY EQUIPMENT & SERVICES 4.2% | |

| | 15,959 | | | Frank’s International N.V. (Netherlands) | | | | | 395,464 | |

| | 5,604 | | | Geospace Technologies Corporation* | | | | | 370,817 | |

| | | | | | | | | | |

| | | | | | | | | 766,281 | |

| | | | | | | | | | |

| | FOOD & STAPLES RETAILING 2.0% | |

| | 5,183 | | | United Natural Foods, Inc.* | | | | | 367,578 | |

| | | | | | | | | | |

| | FOOD PRODUCTS 2.0% | |

| | 3,954 | | | Hain Celestial Group, Inc.* | | | | | 361,672 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | | | VALUE $ | |

| | HEALTH CARE EQUIPMENT & SUPPLIES 5.1% | |

| | 4,122 | | | Align Technology, Inc.* | | | | | 213,479 | |

| | 3,677 | | | DexCom, Inc.* | | | | | 152,081 | |

| | 20,998 | | | Endologix, Inc.* | | | | | 270,244 | |

| | 8,292 | | | LDR Holding Corporation* | | | | | 284,664 | |

| | | | | | | | | | |

| | | | | | | | | 920,468 | |

| | | | | | | | | | |

| | HEALTH CARE PROVIDERS & SERVICES 1.3% | |

| | 6,518 | | | ExamWorks Group, Inc.* | | | | | 228,195 | |

| | | | | | | | | | |

| | HOTELS, RESTAURANTS & LEISURE 2.2% | |

| | 13,813 | | | Multimedia Games Holding Company, Inc.* | | | | | 401,130 | |

| | | | | | | | | | |

| | HOUSEHOLD DURABLES 0.8% | |

| | 1,310 | | | Harman International Industries, Inc. | | | | | 139,384 | |

| | | | | | | | | | |

| | INSURANCE 1.7% | |

| | 5,946 | | | eHealth, Inc.* | | | | | 302,057 | |

| | | | | | | | | | |

| | INTERNET SOFTWARE & SERVICES 5.7% | |

| | 7,431 | | | Benefitfocus, Inc.* | | | | | 349,034 | |

| | 5,613 | | | Envestnet, Inc.* | | | | | 225,530 | |

| | 5,933 | | | Q2 Holdings, Inc.* | | | | | 92,140 | |

| | 2,998 | | | SPS Commerce, Inc.* | | | | | 184,227 | |

| | 7,375 | | | Textura Corporation* | | | | | 185,924 | |

| | | | | | | | | | |

| | | | | | | | | 1,036,855 | |

| | | | | | | | | | |

| | LEISURE EQUIPMENT & PRODUCTS 2.3% | |

| | 33,678 | | | Black Diamond, Inc.* | | | | | 411,882 | |

| | | | | | | | | | |

| | MACHINERY 3.6% | |

| | 8,014 | | | Altra Industrial Motion Corporation | | | | | 286,100 | |

| | 5,668 | | | RBC Bearings, Inc.* | | | | | 361,051 | |

| | | | | | | | | | |

| | | | | | | | | 647,151 | |

| | | | | | | | | | |

| | METALS & MINING 1.5% | |

| | 4,162 | | | Carpenter Technology Corporation | | | | | 274,858 | |

| | | | | | | | | | |

| | PHARMACEUTICALS 2.4% | |

| | 9,769 | | | AcelRx Pharmaceuticals, Inc.* | | | | | 117,326 | |

| | 7,299 | | | Relypsa, Inc.* | | | | | 217,583 | |

| | 5,541 | | | Repros Therapeutics, Inc.* | | | | | 98,297 | |

| | | | | | | | | | |

| | | | | | | | | 433,206 | |

| | | | | | | | | | |

| | ROAD & RAIL 2.0% | |

| | 3,832 | | | Genesee & Wyoming, Inc.* | | | | | 372,930 | |

| | | | | | | | | | |

| | SOFTWARE 10.5% | |

| | 19,012 | | | Ellie Mae, Inc.* | | | | | 548,306 | |

| | 12,114 | | | Gigamon, Inc.* | | | | | 368,144 | |

| | 3,138 | | | Imperva, Inc.* | | | | | 174,787 | |

| | 13,321 | | | Infoblox, Inc.* | | | | | 267,219 | |

| | 8,850 | | | PROS Holdings, Inc.* | | | | | 278,864 | |

| | 6,263 | | | SolarWinds, Inc.* | | | | | 266,992 | |

| | | | | | | | | | |

| | | | | | | | | 1,904,312 | |

| | | | | | | | | | |

| | SPECIALTY RETAIL 5.9% | |

| | 8,611 | | | Container Store Group, Inc.* | | | | | 292,344 | |

| | 9,742 | | | Five Below, Inc.* | | | | | 413,840 | |

| | 5,044 | | | Restoration Hardware Holdings, Inc.* | | | | | 371,188 | |

| | | | | | | | | | |

| | | | | | | | | 1,077,372 | |

| | | | | | | | | | |

| | | | | | |

| 8 | | DoubleLine Equity Funds | | | | The accompanying notes are an integral part of these financial statements. |

| | | | | | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | | | | VALUE $ | |

| | TEXTILES, APPAREL & LUXURY GOODS 3.5% | |

| | 7,723 | | | Kate Spade & Company* | | | | | | | 286,446 | |

| | 9,790 | | | Steven Madden Ltd.* | | | | | | | 352,244 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 638,690 | |

| | | | | | | | | | | | |

| | | | Total Common Stocks

(Cost $16,512,060) | | | | | | | 17,611,432 | |

| | | | | | | | | | | | |

| | SHORT TERM INVESTMENTS 3.4% | |

| | 612,284 | | | BlackRock Institutional Liquidity Funds FedFund Portfolio | | | 0.01% | ¨ | | | 612,284 | |

| | | | | | | | | | | | |

| | | | Total Short Term Investments

(Cost $612,284) | | | | 612,284 | |

| | | | | | | | | | | | |

| | | | Total Investments 100.5%

(Cost $17,124,344) | | | | 18,223,716 | |

| | | | Liabilities in Excess of Other Assets (0.5)% | | | | (86,090 | ) |

| | | | | | | | | | | | |

| | | | NET ASSETS 100.0% | | | | | | $ | 18,137,626 | |

| | | | | | | | | | | | |

| | | | |

| INDUSTRY BREAKDOWN as a % of Net Assets: | |

Software | | | 10.5% | |

Biotechnology | | | 7.3% | |

Capital Markets | | | 6.3% | |

Specialty Retail | | | 5.9% | |

Internet Software & Services | | | 5.7% | |

Health Care Equipment & Supplies | | | 5.1% | |

Communications Equipment | | | 5.0% | |

Electronic Equipment, Instruments & Components | | | 4.6% | |

Energy Equipment & Services | | | 4.2% | |

Aerospace & Defense | | | 4.1% | |

Machinery | | | 3.6% | |

Textiles, Apparel & Luxury Goods | | | 3.5% | |

Short Term Investments | | | 3.4% | |

Computers & Peripherals | | | 3.4% | |

Commercial Services & Supplies | | | 3.0% | |

Auto Components | | | 2.8% | |

Pharmaceuticals | | | 2.4% | |

Leisure Equipment & Products | | | 2.3% | |

Hotels, Restaurants & Leisure | | | 2.2% | |

Road & Rail | | | 2.0% | |

Food & Staples Retailing | | | 2.0% | |

Food Products | | | 2.0% | |

Insurance | | | 1.7% | |

Metals & Mining | | | 1.5% | |

Diversified Financial Services | | | 1.5% | |

Commercial Banks | | | 1.4% | |

Health Care Providers & Services | | | 1.3% | |

Building Products | | | 1.0% | |

Household Durables | | | 0.8% | |

Other Assets and Liabilities | | | (0.5)% | |

| | | | |

| | | 100.0% | |

| | | | |

| ¨ | Seven-day yield as of March 31, 2014 |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2014 | | 9 |

| | |

| Schedule of Investments DoubleLine Equities Growth Fund | | March 31, 2014 |

| | | | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | | | VALUE $ | |

| | COMMON STOCKS 94.2% | |

| | |

| | AEROSPACE & DEFENSE 3.8% | |

| | 482 | | | Precision Castparts Corporation | | | | | 121,830 | |

| | | | | | | | | | |

| | BEVERAGES 1.0% | | | | | | |

| | 393 | | | Constellation Brands, Inc.* | | | | | 33,393 | |

| | | | | | | | | | |

| | BIOTECHNOLOGY 10.6% | | | | | | |

| | 318 | | | Biogen Idec, Inc.* | | | | | 97,267 | |

| | 664 | | | Celgene Corporation* | | | | | 92,695 | |

| | 1,170 | | | Gilead Sciences, Inc.* | | | | | 82,906 | |

| | 1,579 | | | Seattle Genetics, Inc.* | | | | | 71,939 | |

| | | | | | | | | | |

| | | | | | | | | 344,807 | |

| | | | | | | | | | |

| | CHEMICALS 3.9% | | | | | | |

| | 1,121 | | | Monsanto Company | | | | | 127,536 | |

| | | | | | | | | | |

| | COMMERCIAL BANKS 3.2% | | | | | | |

| | 1,953 | | | First Republic Bank | | | | | 105,442 | |

| | | | | | | | | | |

| | COMMUNICATIONS EQUIPMENT 5.6% | | | | | | |

| | 1,338 | | | Palo Alto Networks, Inc.* | | | | | 91,787 | |

| | 1,146 | | | QUALCOMM, Inc. | | | | | 90,373 | |

| | | | | | | | | | |

| | | | | | | | | 182,160 | |

| | | | | | | | | | |

| | COMPUTERS & PERIPHERALS 3.0% | | | | | | |

| | 183 | | | Apple, Inc. | | | | | 98,223 | |

| | | | | | | | | | |

| | ELECTRICAL EQUIPMENT 2.9% | | | | | | |

| | 1,854 | | | AMETEK, Inc. | | | | | 95,462 | |

| | | | | | | | | | |

| | ENERGY EQUIPMENT & SERVICES 5.7% | | | | | | |

| | 326 | | | Core Laboratories N.V. (Netherlands) | | | | | 64,692 | |

| | 2,809 | | | Frank’s International N.V. (Netherlands) | | | | | 69,607 | |

| | 719 | | | Oceaneering International, Inc. | | | | | 51,667 | |

| | | | | | | | | | |

| | | | | | | | | 185,966 | |

| | | | | | | | | | |

| | FOOD & STAPLES RETAILING 5.7% | | | | | | |

| | 799 | | | Costco Wholesale Corporation | | | | | 89,233 | |

| | 2,673 | | | Sprouts Farmers Market, Inc.* | | | | | 96,308 | |

| | | | | | | | | | |

| | | | | | | | | 185,541 | |

| | | | | | | | | | |

| | HEALTH CARE TECHNOLOGY 3.5% | | | | | | |

| | 706 | | | athenahealth, Inc.* | | | | | 113,129 | |

| | | | | | | | | | |

| | INSURANCE 3.3% | | | | | | |

| | 1,078 | | | ACE Ltd. (Switzerland) | | | | | 106,787 | |

| | | | | | | | | | |

| | INTERNET & CATALOG RETAIL 3.5% | | | | | | |

| | 336 | | | Amazon.com, Inc.* | | | | | 113,071 | |

| | | | | | | | | | |

| | INTERNET SOFTWARE & SERVICES 9.0% | | | | | | |

| | 1,578 | | | Facebook, Inc.* | | | | | 95,059 | |

| | 95 | | | Google, Inc.* | | | | | 105,878 | |

| | 502 | | | LinkedIn Corporation* | | | | | 92,840 | |

| | | | | | | | | | |

| | | | | | | | | 293,777 | |

| | | | | | | | | | |

| | IT SERVICES 1.9% | | | | | | |

| | 230 | | | Alliance Data Systems Corporation* | | | | | 62,663 | |

| | | | | | | | | | |

| | LIFE SCIENCES TOOLS & SERVICES 2.3% | | | | | | |

| | 495 | | | Illumina, Inc.* | | | | | 73,587 | |

| | | | | | | | | | |

| | MACHINERY 2.4% | | | | | | |

| | 517 | | | Cummins, Inc. | | | | | 77,028 | |

| | | | | | | | | | |

| | | | | | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | | | | VALUE $ | |

| | OIL, GAS & CONSUMABLE FUELS 2.7% | | | | | | | | |

| | 696 | | | Continental Resources, Inc.* | | | | | | | 86,492 | |

| | | | | | | | | | | | |

| | PHARMACEUTICALS 3.0% | | | | | | | | |

| | 1,868 | | | AbbVie, Inc. | | | | | | | 96,015 | |

| | | | | | | | | | | | |

| | ROAD & RAIL 1.3% | | | | | | | | |

| | 414 | | | Kansas City Southern | | | | | | | 42,253 | |

| | | | | | | | | | | | |

| | SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT 3.7% | | | | | | | | |

| | 2,377 | | | ARM Holdings PLC (United Kingdom) - ADR | | | | | | | 121,156 | |

| | | | | | | | | | | | |

| | SOFTWARE 3.8% | | | | | | | | |

| | 1,045 | | | Salesforce.com, Inc.* | | | | | | | 59,659 | |

| | 683 | | | Workday, Inc.* | | | | | | | 62,447 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 122,106 | |

| | | | | | | | | | | | |

| | SPECIALTY RETAIL 6.2% | | | | | | | | |

| | 2,163 | | | CarMax, Inc.* | | | | | | | 101,229 | |

| | 1,424 | | | Tractor Supply Company | | | | | | | 100,577 | |

| | | | | | | | | | | | |

| | | | | | | | | | | 201,806 | |

| | | | | | | | | | | | |

| | TRADING COMPANIES & DISTRIBUTORS 2.2% | | | | | | | | |

| | 1,463 | | | Fastenal Company | | | | | | | 72,155 | |

| | | | | | | | | | | | |

| | | | Total Common Stocks (Cost $2,783,735) | | | | 3,062,385 | |

| | | | | | | | | | | | |

| | SHORT TERM INVESTMENTS 7.4% | |

| | 239,094 | | | BlackRock Institutional Liquidity Funds FedFund Portfolio | | | 0.01% | ¨ | | | 239,094 | |

| | | | | | | | | | | | |

| | | | Total Short Term Investments

(Cost $239,094) | | | | 239,094 | |

| | | | | | | | | | | | |

| | | | Total Investments 101.6%

(Cost $3,022,829) | | | | 3,301,479 | |

| | | | Liabilities in Excess of Other Assets (1.6)% | | | | (50,509 | ) |

| | | | | | | | | | | | |

| | | | NET ASSETS 100.0% | | | $ | 3,250,970 | |

| | | | | | | | | | | | |

| | | | | | |

| 10 | | DoubleLine Equity Funds | | | | The accompanying notes are an integral part of these financial statements. |

| | | | |

| INDUSTRY BREAKDOWN as a % of Net Assets: | |

Biotechnology | | | 10.6% | |

Internet Software & Services | | | 9.0% | |

Short Term Investments | | | 7.4% | |

Specialty Retail | | | 6.2% | |

Energy Equipment & Services | | | 5.7% | |

Food & Staples Retailing | | | 5.7% | |

Communications Equipment | | | 5.6% | |

Chemicals | | | 3.9% | |

Software | | | 3.8% | |

Aerospace & Defense | | | 3.8% | |

Semiconductors & Semiconductor Equipment | | | 3.7% | |

Health Care Technology | | | 3.5% | |

Internet & Catalog Retail | | | 3.5% | |

Insurance | | | 3.3% | |

Commercial Banks | | | 3.2% | |

Computers & Peripherals | | | 3.0% | |

Pharmaceuticals | | | 3.0% | |

Electrical Equipment | | | 2.9% | |

Oil, Gas & Consumable Fuels | | | 2.7% | |

Machinery | | | 2.4% | |

Life Sciences Tools & Services | | | 2.3% | |

Trading Companies & Distributors | | | 2.2% | |

IT Services | | | 1.9% | |

Road & Rail | | | 1.3% | |

Beverages | | | 1.0% | |

Other Assets and Liabilities | | | (1.6)% | |

| | | | |

| | | 100.0% | |

| | | | |

| ADR | American Depositary Receipt |

| ¨ | Seven-day yield as of March 31, 2014 |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2014 | | 11 |

| | |

| Schedule of Investments DoubleLine Equities Technology Fund | | March 31, 2014 |

| | | | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | | | VALUE $ | |

| | COMMON STOCKS 110.3% | |

| | |

| | BIOTECHNOLOGY 1.3% | |

| | 266 | | | Foundation Medicine, Inc.* | | | | | 8,610 | |

| | | | | | | | | | |

| | CAPITAL MARKETS 1.4% | | | | | | |

| | 181 | | | Financial Engines, Inc. | | | | | 9,191 | |

| | | | | | | | | | |

| | COMMUNICATIONS EQUIPMENT 6.9% | | | | | | |

| | 253 | | | Palo Alto Networks, Inc.* | | | | | 17,356 | |

| | 341 | | | QUALCOMM, Inc. | | | | | 26,891 | |

| | | | | | | | | | |

| | | | | | | | | 44,247 | |

| | | | | | | | | | |

| | COMPUTERS & PERIPHERALS 7.8% | | | | | | |

| | 56 | | | Apple, Inc. | | | | | 30,058 | |

| | 181 | | | Nimble Storage, Inc.* | | | | | 6,858 | |

| | 123 | | | Stratasys Ltd.* | | | | | 13,049 | |

| | | | | | | | | | |

| | | | | | | | | 49,965 | |

| | | | | | | | | | |

| | ELECTRONIC EQUIPMENT, INSTRUMENTS & COMPONENTS 4.8% | | | | | | |

| | 392 | | | Cognex Corporation* | | | | | 13,273 | |

| | 259 | | | FARO Technologies, Inc.* | | | | | 13,727 | |

| | 118 | | | Universal Display Corporation* | | | | | 3,765 | |

| | | | | | | | | | |

| | | | | | | | | 30,765 | |

| | | | | | | | | | |

| | ENERGY EQUIPMENT & SERVICES 2.6% | | | | | | |

| | 231 | | | Oceaneering International, Inc. | | | | | 16,600 | |

| | | | | | | | | | |

| | HEALTH CARE TECHNOLOGY 1.7% | | | | | | |

| | 69 | | | athenahealth, Inc.* | | | | | 11,057 | |

| | | | | | | | | | |

| | INSURANCE 1.3% | | | | | | |

| | 166 | | | ehealth, Inc.* | | | | | 8,433 | |

| | | | | | | | | | |

| | INTERNET & CATALOG RETAIL 3.9% | | | | | | |

| | 74 | | | Amazon.com, Inc.* | | | | | 24,902 | |

| | | | | | | | | | |

| | INTERNET SOFTWARE & SERVICES 28.1% | | | | | | |

| | 289 | | | Akamai Technologies, Inc.* | | | | | 16,823 | |

| | 152 | | | Benefitfocus, Inc.* | | | | | 7,139 | |

| | 412 | | | Care.com, Inc.* | | | | | 6,818 | |

| | 304 | | | Cornerstone OnDemand, Inc.* | | | | | 14,552 | |

| | 103 | | | CoStar Group, Inc.* | | | | | 19,234 | |

| | 198 | | | Cvent, Inc.* | | | | | 7,158 | |

| | 259 | | | Envestnet, Inc.* | | | | | 10,407 | |

| | 457 | | | Facebook, Inc.* | | | | | 27,530 | |

| | 23 | | | Google, Inc.* | | | | | 25,634 | |

| | 122 | | | LinkedIn Corporation* | | | | | 22,563 | |

| | 440 | | | Rackspace Hosting, Inc.* | | | | | 14,441 | |

| | 145 | | | SPS Commerce, Inc.* | | | | | 8,910 | |

| | | | | | | | | | |

| | | | | | | | | 181,209 | |

| | | | | | | | | | |

| | IT SERVICES 4.7% | | | | | | |

| | 111 | | | Alliance Data Systems Corporation* | | | | | 30,242 | |

| | | | | | | | | | |

| | | | | | | | | | |

| SHARES | | | SECURITY DESCRIPTION | | | | VALUE $ | |

| | PROFESSIONAL SERVICES 3.1% | | | | | | |

| | 357 | | | WageWorks, Inc.* | | | | | 20,031 | |

| | | | | | | | | | |

| | SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT 7.1% | | | | | | |

| | 623 | | | ARM Holdings PLC (United Kingdom) - ADR | | | | | 31,754 | |

| | 351 | | | Mellanox Technologies Ltd. (Israel)* | | | | | 13,735 | |

| | | | | | | | | | |

| | | | | | | | | 45,489 | |

| | | | | | | | | | |

| | SOFTWARE 35.6% | | | | | | |

| | 179 | | | ANSYS, Inc.* | | | | | 13,787 | |

| | 136 | | | Concur Technologies, Inc.* | | | | | 13,474 | |

| | 619 | | | Ellie Mae, Inc.* | | | | | 17,852 | |

| | 245 | | | FireEye, Inc.* | | | | | 15,085 | |

| | 323 | | | Gigamon, Inc.* | | | | | 9,816 | |

| | 222 | | | Imperva, Inc.* | | | | | 12,365 | |

| | 244 | | | NetSuite, Inc.* | | | | | 23,139 | |

| | 250 | | | PROS Holdings, Inc.* | | | | | 7,877 | |

| | 506 | | | Salesforce.com, Inc.* | | | | | 28,888 | |

| | 370 | | | ServiceNow, Inc.* | | | | | 22,170 | |

| | 292 | | | Splunk, Inc.* | | | | | 20,875 | |

| | 203 | | | Tableau Software, Inc.* | | | | | 15,444 | |

| | 74 | | | Ultimate Software Group, Inc.* | | | | | 10,138 | |

| | 201 | | | Workday, Inc.* | | | | | 18,377 | |

| | | | | | | | | | |

| | | | | | | | | 229,287 | |

| | | | | | | | | | |

| | | | Total Common Stocks

(Cost $654,647) | | | | | 710,028 | |

| | | | | | | | | | |

| | | | Total Investments 110.3%

(Cost $654,647) | | | | | 710,028 | |

| | | | Liabilities in Excess of Other Assets (10.3)% | | | | | (66,320 | ) |

| | | | | | | | | | |

| | | | NET ASSETS 100.0% | | | | $ | 643,708 | |

| | | | | | | | | | |

| | | | |

| INDUSTRY BREAKDOWN as a % of Net Assets: | |

Software | | | 35.6% | |

Internet Software & Services | | | 28.1% | |

Computers & Peripherals | | | 7.8% | |

Semiconductors & Semiconductor Equipment | | | 7.1% | |

Communications Equipment | | | 6.9% | |

Electronic Equipment, Instruments & Components | | | 4.8% | |

IT Services | | | 4.7% | |

Internet & Catalog Retail | | | 3.9% | |

Professional Services | | | 3.1% | |

Energy Equipment & Services | | | 2.6% | |

Health Care Technology | | | 1.7% | |

Capital Markets | | | 1.4% | |

Biotechnology | | | 1.3% | |

Insurance | | | 1.3% | |

Other Assets and Liabilities | | | (10.3)% | |

| | | | |

| | | 100.0% | |

| | | | |

| ADR | American Depositary Receipt |

| | | | | | |

| 12 | | DoubleLine Equity Funds | | | | The accompanying notes are an integral part of these financial statements. |

| | |

| Statements of Assets and Liabilities | | March 31, 2014 |

| | | | | | | | | | | | |

| | | DoubleLine

Equities Small Cap

Growth Fund | | | DoubleLine

Equities

Growth Fund | | | DoubleLine

Equities

Technology Fund | |

| | | |

ASSETS | | | | | | | | | | | | |

Investments in Securities, at Value* | | $ | 17,611,432 | | | $ | 3,062,385 | | | $ | 710,028 | |

Short-term Securities* | | | 612,284 | | | | 239,094 | | | | — | |

Receivable for Investments Sold | | | 500,778 | | | | — | | | | 12,373 | |

Receivable for Fund Shares Sold | | | 38,245 | | | | 3,041 | | | | 558 | |

Investment Advisory Fees Receivable | | | 8,762 | | | | 4,942 | | | | 4,113 | |

Interest and Dividends Receivable | | | 246 | | | | 798 | | | | 11 | |

Total Assets | | | 18,771,747 | | | | 3,310,260 | | | | 727,083 | |

| | | |

LIABILITIES | | | | | | | | | | | | |

Payable for Investments Purchased | | | 545,530 | | | | — | | | | — | |

Accrued Expenses | | | 60,975 | | | | 46,587 | | | | 68,122 | |

Transfer Agent Expenses Payable | | | 10,554 | | | | 10,971 | | | | 7,377 | |

Administration, Fund Accounting and Custodian Fees Payable | | | 9,028 | | | | 823 | | | | 759 | |

Distribution Fees Payable | | | 4,767 | | | | 559 | | | | 35 | |

Registration Fees Payable | | | 3,267 | | | | 350 | | | | 242 | |

Due to Custodian | | | — | | | | — | | | | 6,840 | |

Total Liabilities | | | 634,121 | | | | 59,290 | | | | 83,375 | |

Net Assets | | $ | 18,137,626 | | | $ | 3,250,970 | | | $ | 643,708 | |

| | | |

NET ASSETS CONSIST OF: | | | | | | | | | | | | |

Paid-in Capital | | $ | 15,684,076 | | | $ | 2,878,424 | | | $ | 583,461 | |

Undistributed (Accumulated) Net Investment Income (Loss) | | | — | | | | — | | | | — | |

Accumulated Net Realized Gain (Loss) | | | 1,354,178 | | | | 93,896 | | | | 4,866 | |

Net Unrealized Appreciation (Depreciation) on Investments in Securities | | | 1,099,372 | | | | 278,650 | | | | 55,381 | |

Net Assets | | $ | 18,137,626 | | | $ | 3,250,970 | | | $ | 643,708 | |

| | | |

*Identified Cost: | | | | | | | | | | | | |

Investments in Securities | | $ | 16,512,060 | | | $ | 2,783,735 | | | $ | 654,647 | |

Short-term Securities | | $ | 612,284 | | | $ | 239,094 | | | $ | — | |

| | | |

Class I (unlimited shares authorized): | | | | | | | | | | | | |

Net Assets | | $ | 5,984,631 | | | $ | 1,821,443 | | | $ | 621,269 | |

Shares Outstanding | | | 438,028 | | | | 144,184 | | | | 55,285 | |

Net Asset Value, Offering and Redemption Price per Share | | $ | 13.66 | | | $ | 12.63 | | | $ | 11.24 | |

| | | |

Class N (unlimited shares authorized): | | | | | | | | | | | | |

Net Assets | | $ | 12,152,995 | | | $ | 1,429,527 | | | $ | 22,439 | |

Shares Outstanding | | | 891,914 | | | | 113,390 | | | | 2,000 | |

Net Asset Value, Offering and Redemption Price per Share | | $ | 13.63 | | | $ | 12.61 | | | $ | 11.22 | |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2014 | | 13 |

| | |

| Statements of Operations | | Period Ended March 31, 2014 |

| | | | | | | | | | | | |

| | | DoubleLine

Equities Small Cap

Growth Fund1 | | | DoubleLine

Equities

Growth Fund1 | | | DoubleLine

Equities

Technology Fund2 | |

| | | |

INVESTMENT INCOME | | | | | | | | | | | | |

Income: | | | | | | | | | | | | |

Dividends | | $ | 45,153 | | | $ | 11,257 | | | $ | 752 | |

Interest | | | 30 | | | | 2 | | | | 3 | |

Total Investment Income | | | 45,183 | | | | 11,259 | | | | 755 | |

Expenses: | | | | | | | | | | | | |

Professional Fees | | | 109,007 | | | | 106,262 | | | | 46,840 | |

Investment Advisory Fees | | | 102,160 | | | | 16,375 | | | | 3,178 | |

Shareholder Reporting Expenses | | | 82,981 | | | | 53,417 | | | | 44,563 | |

Registration Fees | | | 52,261 | | | | 34,800 | | | | 46,028 | |

Transfer Agent Expenses | | | 45,942 | | | | 38,005 | | | | 22,612 | |

Trustees’ Fees and Expenses | | | 41,222 | | | | 9,542 | | | | 1,143 | |

Administration, Fund Accounting and Custodian Fees | | | 22,155 | | | | 2,740 | | | | 2,051 | |

Distribution Fees - Class N | | | 18,033 | | | | 1,331 | | | | 35 | |

Miscellaneous Expenses | | | 13,665 | | | | 11,415 | | | | 7,384 | |

Total Expenses | | | 487,426 | | | | 273,887 | | | | 173,834 | |

Less: Fees Waived | | | (338,855 | ) | | | (251,064 | ) | | | (169,688 | ) |

Net Expenses | | | 148,571 | | | | 22,823 | | | | 4,146 | |

| | | |

Net Investment Income | | | (103,388 | ) | | | (11,564 | ) | | | (3,391 | ) |

| | | |

REALIZED & UNREALIZED GAIN (LOSS) | | | | | | | | | | | | |

Net Realized Gain (Loss) on Investments in Securities | | | 1,764,742 | | | | 135,119 | | | | 8,257 | |

Net Change in Unrealized Appreciation (Depreciation) on Investments in Securities | | | 1,099,372 | | | | 278,650 | | | | 55,381 | |

Net Realized and Unrealized Gain (Loss) | | | 2,864,114 | | | | 413,769 | | | | 63,638 | |

| | | |

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS | | $ | 2,760,726 | | | $ | 402,205 | | | $ | 60,247 | |

| 1 | Commencement of operations on April 1, 2013 |

| 2 | Commencement of operations on August 9, 2013 |

| | | | | | |

| 14 | | DoubleLine Equity Funds | | | | The accompanying notes are an integral part of these financial statements. |

| | |

| Statements of Changes in Net Assets | | Period Ended March 31, 2014 |

| | | | | | | | | | | | |

| | | DoubleLine

Equities Small Cap

Growth Fund1 | | | DoubleLine

Equities

Growth Fund1 | | | DoubleLine

Equities

Technology Fund2 | |

| | | |

OPERATIONS | | | | | | | | | | | | |

Net Investment Income | | $ | (103,388 | ) | | $ | (11,564 | ) | | $ | (3,391 | ) |

Net Realized Gain (Loss) | | | 1,764,742 | | | | 135,119 | | | | 8,257 | |

Net Change in Unrealized Appreciation (Depreciation) | | | 1,099,372 | | | | 278,650 | | | | 55,381 | |

Net Increase (Decrease) in Net Assets Resulting from Operations | | | 2,760,726 | | | | 402,205 | | | | 60,247 | |

| | | |

DISTRIBUTIONS TO SHAREHOLDERS | | | | | | | | | | | | |

From Net Realized Gain | | | | | | | | | | | | |

Class I | | | (93,599 | ) | | | (21,187 | ) | | | — | |

Class N | | | (213,577 | ) | | | (8,472 | ) | | | — | |

Total Distributions to Shareholders | | | (307,176 | ) | | | (29,659 | ) | | | — | |

| | | |

NET SHARE TRANSACTIONS | | | | | | | | | | | | |

Class I | | | 4,910,811 | | | | 1,500,621 | | | | 563,461 | |

Class N | | | 10,773,265 | | | | 1,377,803 | | | | 20,000 | |

Increase (Decrease) in Net Assets Resulting from Net Share Transactions | | | 15,684,076 | | | | 2,878,424 | | | | 583,461 | |

| | | |

Total Increase (Decrease) in Net Assets | | $ | 18,137,626 | | | $ | 3,250,970 | | | $ | 643,708 | |

| | | |

NET ASSETS | | | | | | | | | | | | |

Beginning of Period3 | | $ | — | | | $ | — | | | $ | — | |

End of Period | | $ | 18,137,626 | | | $ | 3,250,970 | | | $ | 643,708 | |

| | | |

Accumulated (Undistributed) Net Investment Income (Loss) | | $ | — | | | $ | — | | | $ | — | |

| 1 | Commencement of operations on April 1, 2013 |

| 2 | Commencement of operations on August 9, 2013 |

| 3 | Amount does not reflect the value of the Adviser’s seed money investment on March 8, 2013. |

| | | | | | |

| The accompanying notes are an integral part of these financial statements. | | Annual Report | | March 31, 2014 | | 15 |

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | DoubleLine

Equities Small Cap Growth Fund1 | | | DoubleLine

Equities Growth Fund1 | | | DoubleLine

Equities Technology Fund2 | |

| | | Year Ended

March 31, 2014 | | | Year Ended

March 31, 2014 | | | Period Ended

March 31, 2014 | |

| | | Class I | | | Class N | | | Class I | | | Class N | | | Class I | | | Class N | |

| | | | | | |

Net Asset Value, Beginning of Period | | $ | 10.00 | | | $ | 10.00 | | | $ | 10.00 | | | $ | 10.00 | | | $ | 10.00 | | | $ | 10.00 | |

| | | | | | |

Income (Loss) from Investment Operations: | | | | | | | | | | | | | | | | | | | | | | | | |

Net Investment Income (Loss) 5 | | | (0.12 | ) | | | (0.12 | ) | | | (0.07 | ) | | | (0.07 | ) | | | (0.07 | ) | | | (0.07 | ) |

Net Gain (Loss) on Investments

(Realized and Unrealized) | | | 4.05 | | | | 4.02 | | | | 2.85 | | | | 2.83 | | | | 1.31 | | | | 1.29 | |

Total from Investment Operations | | | 3.93 | | | | 3.90 | | | | 2.78 | | | | 2.76 | | | | 1.24 | | | | 1.22 | |

| | | | | | |

Less Distributions: | | | | | | | | | | | | | | | | | | | | | | | | |

Distributions from Net Realized Gain | | | (0.27 | ) | | | (0.27 | ) | | | (0.15 | ) | | | (0.15 | ) | | | — | | | | — | |

Total Distributions | | | (0.27 | ) | | | (0.27 | ) | | | (0.15 | ) | | | (0.15 | ) | | | — | | | | — | |

Net Asset Value, End of Period | | $ | 13.66 | | | $ | 13.63 | | | $ | 12.63 | | | $ | 12.61 | | | $ | 11.24 | | | $ | 11.22 | |

Total Return | | | 39.46% | | | | 39.16% | | | | 27.83% | | | | 27.63% | | | | 12.40% | | | | 12.20% | |

| | | | | | |

Supplemental Data: | | | | | | | | | | | | | | | | | | | | | | | | |

Net Assets, End of Period (000’s) | | $ | 5,985 | | | $ | 12,153 | | | $ | 1,821 | | | $ | 1,430 | | | $ | 621 | | | $ | 22 | |

Ratios to Average Net Assets: | | | | | | | | | | | | | | | | | | | | | | | | |

Expenses Before Fees Waived | | | 4.14% | | | | 4.39% | | | | 13.32% | | | | 13.57% | | | | 46.49% | 4 | | | 46.74% | 4 |

Expenses After Fees Waived | | | 1.15% | | | | 1.40% | | | | 1.05% | | | | 1.30% | | | | 1.10% | 4 | | | 1.35% | 4 |

Net Investment Income (Loss) | | | (0.92% | ) | | | (0.90% | ) | | | (0.58% | ) | | | (0.53% | ) | | | (0.91% | )4 | | | (0.91% | )4 |

Portfolio Turnover Rate | | | 181% | | | | 181% | | | | 54% | | | | 54% | | | | 28% | 3 | | | 28% | 3 |

| 1 | Commencement of operations on April 1, 2013 |

| 2 | Commencement of operations on August 9, 2013 |

| 5 | Calculated based on average shares outstanding during the period. |

| | | | | | |

| 16 | | DoubleLine Equity Funds | | | | The accompanying notes are an integral part of these financial statements. |

| | |

| Notes to Financial Statements | | March 31, 2014 |

1. Organization

DoubleLine Equity Funds, a Massachusetts business trust (the “Trust”), is an open-end investment management company registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust consists of three funds, DoubleLine Equities Small Cap Growth Fund, DoubleLine Equities Growth Fund and DoubleLine Equities Technology Fund (each a “Fund” and collectively the “Funds”). Each Fund offers two classes of shares, Class N shares and Class I shares. Shares of the DoubleLine Equities Technology Fund are only available for purchase by advisory clients of DoubleLine Equity LP and its affiliates; employees and officers of DoubleLine Equity LP and its affiliates and their family members; and DoubleLine Equity LP and its affiliates.

The DoubleLine Equities Small Cap Growth Fund and DoubleLine Equities Growth Fund commenced operations on April 1, 2013. The DoubleLine Equities Technology Fund commenced operations on August 9, 2013.

Each Fund’s investment objective is to seek long-term capital appreciation.

2. Significant Accounting Policies

The following is a summary of the significant accounting policies of the Funds. These policies are in conformity with accounting principles generally accepted in the United States of America (“US GAAP”).

A. Security Valuation. The Funds have adopted US GAAP fair value accounting standards which establish a definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion of changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below:

| | • | | Level 1—Unadjusted quoted market prices in active markets for identical securities |

| | • | | Level 2—Quoted prices for identical or similar assets in markets that are not active, or inputs derived from observable market data |

| | • | | Level 3—Significant unobservable inputs (including the reporting entity’s estimates and assumptions) |

Assets and liabilities may be transferred between levels. The Funds use end of period timing recognition to account for any transfers.

Common stocks, exchange-traded funds and financial derivative instruments, such as futures contracts or options contracts, that are traded on a national securities or commodities exchange, are typically valued at the last reported sales price, in the case of common stocks and exchange-traded funds, or, in the case of futures contracts or options contracts, the settlement price determined by the relevant exchange. To the extent these securities are actively traded and valuation adjustments are not applied, they are categorized as Level 1 of the fair value hierarchy.

Investments in registered open-end management investment companies will be valued based upon the net asset value (“NAV”) of such investments and are categorized as Level 1 of the fair value hierarchy. Investments in private investment funds typically will be valued based upon the NAVs of such investments and are categorized as Level 2 of the fair value hierarchy. As of March 31, 2014, the Funds did not hold any investments in private investment funds.

Short-term debt investments having a maturity of 60 days or less are generally valued at amortized cost which approximates fair market value. These investments are categorized as Level 2 of the fair value hierarchy.

Certain securities may be fair valued in accordance with the fair valuation procedures approved by the Board of Trustees (the “Board”). The Valuation Committee is generally responsible for overseeing the day to day valuation processes and reports periodically to the Board. The Valuation Committee is authorized to make all necessary determinations of the fair values of portfolio securities and other assets for which market quotations are not readily available or if it is deemed that the prices obtained from brokers and dealers or independent pricing services are deemed to be unreliable indicators of market value. As of March 31, 2014, the Funds did not hold securities fair valued by the Valuation Committee.

| | | | | | |

| | Annual Report | | March 31, 2014 | | 17 |

Notes to Financial Statements (Cont.)

The following is a summary of the fair valuations according to the inputs used to value the Funds’ investments as of March 31, 20141:

| | | | | | | | | | | | | | |

| Category | | | | DoubleLine

Equities Small Cap

Growth Fund | | | DoubleLine

Equities

Growth Fund | | | DoubleLine

Equities

Technology Fund | |

Investments in Securities | | | | | | | | | | | | | | |

Level 1 | | | | | | | | | | | | | | |

Common Stock | | | | $ | 17,611,432 | | | $ | 3,062,385 | | | $ | 710,028 | |

Money Market Funds | | | | | 612,284 | | | | 239,094 | | | | — | |

Total Level 1 | | | | | 18,223,716 | | | | 3,301,479 | | | | 710,028 | |

Level 2 | | | | | — | | | | — | | | | — | |

Level 3 | | | | | — | | | | — | | | | — | |

Total | | | | | 18,223,716 | | | | 3,301,479 | | | | 710,028 | |

| See | the Schedules of Investments for further disaggregation of investment categories. |

| 1 | There were no transfers into and out of Level 1, 2 or 3 during the period ended March 31, 2014. |

B. Federal Income Taxes. Each Fund has elected to be taxed as a “regulated investment company” and intends to distribute substantially all of its taxable income to its shareholders and otherwise comply with the provisions of Subchapter M of the Internal Revenue Code applicable to regulated investment companies. Therefore, no provision for federal income taxes has been made.

The Funds may be subject to a nondeductible 4% excise tax calculated as a percentage of certain undistributed amounts of net investment income and net capital gains.

The Funds have adopted financial reporting rules that require the Funds to analyze all open tax years, as defined by the applicable statute of limitations, for all major jurisdictions. Open tax years, 2014 for the Funds, are those that are open for exam by taxing authorities. As of March 31, 2014 the Funds have no examinations in progress.

Management has analyzed the Funds’ tax positions, and has concluded that no liability should be recorded related to uncertain tax positions expected to be taken on the tax return for the fiscal year-ended March 31, 2014. The Funds identify their major tax jurisdictions as U.S. Federal and the State of California. The Funds are not aware of any tax positions for which it is reasonably possible that the total amounts of unrecognized tax benefits will significantly change in the next twelve months.

C. Security Transactions, Investment Income. Investment securities transactions are accounted for on trade date. Gains and losses realized on sales of securities are determined on a specific identification basis. Interest income is recorded on an accrual basis. Dividend income and corporate action transactions, if any, are recorded on the ex-date. Non-cash dividends included in dividend income, if any, are recorded at the fair market value of securities received.

D. Dividends and Distributions to Shareholders. Dividends from the net investment income each Fund will be declared and paid at least annually. The Funds will distribute any net realized long or short-term capital gains at least annually. Distributions are recorded on the ex-dividend date.

Income and capital gain distributions are determined in accordance with income tax regulations which may differ from US GAAP. Permanent book and tax basis differences relating to shareholder distributions will result in reclassifications between paid-in capital, undistributed (accumulated) net investment income (loss), and/or accumulated net realized gain (loss). Undistributed (accumulated) net investment income or loss may include temporary book and tax basis differences which will reverse in a subsequent period. Any taxable income or capital gain remaining at fiscal year end is distributed in the following year.

E. Use of Estimates. The preparation of financial statements in conformity with US GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statements, as well as the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

F. Share Valuation. The NAV per share of a class of shares of a Fund is calculated by dividing the sum of the value of the securities held by the Fund, plus cash and other assets, attributable to that class, minus all liabilities (including estimated accrued expenses) attributable to that class by the total number of shares of that class outstanding, rounded to the nearest cent. The Fund’s NAV will not be calculated on the days on which the New York Stock Exchange is closed for trading.

G. Guarantees and Indemnifications. Under the Trust’s organizational documents, each Trustee and officer of the Fund is indemnified, to the extent permitted by the 1940 Act, against certain liabilities that may arise out of performance of their duties to the Fund. Additionally, in the normal course of business, the Funds enter into contracts that contain a variety of indemnification clauses. Each Fund’s maximum exposure under these arrangements is unknown as this would involve future claims that may be made against the Funds that have not yet occurred. However, the Funds have not had prior claims or losses pursuant to these contracts.

| | | | | | |

| 18 | | DoubleLine Equity Funds | | | | |

March 31, 2014

H. Other. Each share class of a Fund is charged for those expenses that are directly attributable to that share class. Expenses that are not directly attributable to a Fund are allocated among all appropriate Funds in proportion to their respective net assets or on another reasonable basis. Investment income, expenses which are not class-specific, and realized and unrealized gains and losses are allocated directly to each class based upon the relative net assets of the classes.

3. Related Party Transactions

DoubleLine Equity LP (the “Adviser”) provides the Funds with investment management services under an Investment Management Agreement (the “Agreement”). Under the Agreement, the Adviser manages the investment of the assets of each Fund, places orders for the purchase and sale of its portfolio securities and is responsible for the day-to-day management of the Trust’s business affairs. As compensation for its services, the Adviser is entitled to a monthly fee at the annual rate of 0.90%, 0.80%, and 0.85% of the average daily net assets of the DoubleLine Equities Small Cap Growth Fund, DoubleLine Equities Growth Fund and DoubleLine Equities Technology Fund, respectively. The Adviser has arrangements with DoubleLine Group LP to provide personnel and other resources to the Funds.

The Adviser has contractually agreed to limit the DoubleLine Equities Small Cap Growth Fund’s ordinary operating expenses so that its ratio of such expenses to average net assets will not exceed 1.15% for the Class I shares and 1.40% for the Class N shares. The Adviser has contractually agreed to limit the DoubleLine Equities Growth Fund’s ordinary operating expenses so that its ratio of such expenses to average net assets will not exceed 1.05% for the Class I shares and 1.30% for the Class N shares. The Adviser has contractually agreed to limit the DoubleLine Equities Technology Fund’s ordinary operating expenses so that its ratio of such expenses to average net assets will not exceed 1.10% for the Class I shares and 1.35% for the Class N shares. For the purposes of the expense limitation agreement between the Adviser and the Funds, “ordinary operating expenses” excludes taxes, commissions, mark-ups, litigation expenses, indemnification expenses, interest expenses, acquired fund fees and expenses, and any extraordinary expenses. Each Fund’s expense limitation may be terminated during its term only by a majority vote of the disinterested Trustees of the Board.

The Adviser is permitted to be reimbursed for fee waivers and/or expense reimbursements it made to a Fund in the prior three fiscal years. Each Fund must pay its current ordinary operating expenses before the Adviser is entitled to any reimbursement of fees waived and/or expenses reimbursed. Any such reimbursement requested by the Adviser is subject to review by the Board and will be subject to the Fund’s expense limitations in place when the fees were waived or the expenses were reimbursed.

The Adviser contractually waived a portion of its fees or reimbursed certain operating expenses and may recapture a portion of the amounts no later than the dates as stated below:

| | | | | | | | | | | | | | |

| Year of Expiration | | | | DoubleLine

Equities Small Cap Growth Fund | | | DoubleLine

Equities

Growth Fund | | | DoubleLine

Equities

Technology Fund | |

March 31, 2017 | | | | $ | 338,855 | | | $ | 251,064 | | | $ | 169,688 | |

All officers and two of the trustees of the Trust are officers or employees of DoubleLine Group LP. The Trust pays a fee only to those trustees who are not affiliated with DoubleLine Group LP or the Adviser.

4. Distribution, Sales Charge and Redemption Fees

Class N shares of the Funds make payments under a distribution plan (“Distribution Plan”) adopted pursuant to Rule 12b-1 under the 1940 Act. Pursuant to the Distribution Plan, each Fund compensates the Fund’s distributor for distribution and related services at an annual rate equal to 0.25% of the average daily net assets of the Fund attributable to its Class N shares. The fees may be used to pay the Fund’s distributor for distribution services and sales support services provided in connection with Class N shares.

5. Purchases and Sales of Securities

Investment transactions (excluding short-term investments) for the period ended March 31, 2014 were as follows:

| | | | | | | | | | |

| | | | | Purchases at

Cost | | | Sales or

Maturity

Proceeds | |

DoubleLine Equities Small Cap Growth Fund | | | | $ | 35,966,515 | | | $ | 21,219,197 | |

DoubleLine Equities Growth Fund | | | | | 3,747,691 | | | | 1,099,075 | |

DoubleLine Equities Technology Fund | | | | | 820,872 | | | | 174,482 | |

There were no U.S. Government transactions during the period. U.S. Government transactions are defined as those involving U.S. Treasury bills, bonds, and notes.

| | | | | | |

| | Annual Report | | March 31, 2014 | | 19 |

Notes to Financial Statements (Cont.)

6. Income Tax Information

The tax character of distributions for the Funds were as follows:

| | | | | | | | | | | | | | |

| | | | | DoubleLine

Equities Small Cap

Growth Fund | | | DoubleLine

Equities

Growth Fund | | | DoubleLine

Equities

Technology Fund | |

| | | | | Year Ended

March 31, 2014 | | | Year Ended

March 31, 2014 | | | Period Ended

March 31, 2014 | |

Distributions Paid From: | | | | | | | | | | | | | | |

Ordinary Income | | | | $ | 307,176 | | | $ | 29,659 | | | $ | — | |

Total Distributions Paid | | | | $ | 307,176 | | | $ | 29,659 | | | $ | — | |

The cost basis of investments for federal income tax purposes as of March 31, 2014 was as follows:

| | | | | | | | | | | | | | |

| | | | | DoubleLine

Equities Small Cap

Growth Fund | | | DoubleLine

Equities

Growth Fund | | | DoubleLine

Equities

Technology Fund | |

Tax Cost of Investments | | | | $ | 17,344,762 | | | $ | 3,023,801 | | | $ | 655,210 | |

Gross Tax Unrealized Appreciation | | | | | 1,848,927 | | | | 342,636 | | | | 83,295 | |

Gross Tax Unrealized Depreciation | | | | | (969,973 | ) | | | (64,958 | ) | | | (28,477 | ) |

Net Tax Unrealized Appreciation (Depreciation) | | | | $ | 878,954 | | | $ | 277,678 | | | $ | 54,818 | |

As of March 31, 2014, the components of accumulated earnings (losses) for income tax purposes were as follows:

| | | | | | | | | | | | | | |

| | | | | DoubleLine

Equities Small Cap

Growth Fund | | | DoubleLine

Equities

Growth Fund | | | DoubleLine

Equities

Technology Fund | |

Net Tax Unrealized Appreciation (Depreciation) | | | | $ | 878,954 | | | $ | 277,678 | | | $ | 54,818 | |

Undistributed Ordinary Income | | | | | 1,573,760 | | | | 94,868 | | | | 5,429 | |

Undistributed Long Term Capital Gain | | | | | 836 | | | | — | | | | — | |

Total Distributable Earnings | | | | | 1,574,596 | | | | 94,868 | | | | 5,429 | |

Other Accumulated Gains (Losses) | | | | | — | | | | — | | | | — | |

Total Accumulated Earnings (Losses) | | | | $ | 2,453,550 | | | $ | 372,546 | | | $ | 60,247 | |

Under the Regulated Investment Company Modernization Act of 2010, capital losses incurred by the Funds after January 1, 2011 will not be subject to expiration. In addition, such losses must be utilized prior to the losses incurred in the years preceding enactment.

As of March 31, 2014, the Funds did not have any available capital loss carryforwards.

The Funds may elect to defer to the first day of the next taxable year all or part of any late-year ordinary losses or post-October capital losses. As of March 31, 2014, the Funds deferred, on a tax basis, no post-October losses.

Additionally, US GAAP require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or net asset value per share. The permanent differences primarily relate to net operating losses. For the period ended March 31, 2014, the following table shows the reclassifications made:

| | | | | | | | | | | | | | |

| | | | | Undistributed

Net

Investment

Income (Loss) | | | Accumulated

Net Realized

Gain (Loss) | | | Paid In

Capital | |

DoubleLine Equities Small Cap Growth Fund | | | | $ | 103,388 | | | $ | (103,388 | ) | | $ | — | |

DoubleLine Equities Growth Fund | | | | | 11,564 | | | | (11,564 | ) | | | — | |

DoubleLine Equities Technology Fund | | | | | 3,391 | | | | (3,391 | ) | | | — | |

| | | | | | |

| 20 | | DoubleLine Equity Funds | | | | |

March 31, 2014

7. Share Transactions

Transactions in each Fund’s shares were as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | DoubleLine

Equities Small Cap Growth Fund | | | DoubleLine

Equities

Growth Fund | | | DoubleLine

Equities

Technology Fund | |

| | | | | Year Ended March 31, 2014 | | | Year Ended March 31, 2014 | | | Period Ended March 31, 2014 | |

| | | | | Shares | | | Amount | | | Shares | | | Amount | | | Shares | | | Amount | |

Shares Sold | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class I | | | | | 732,882 | | | $ | 8,647,009 | | | | 171,576 | | | $ | 1,839,841 | | | | 55,285 | | | $ | 563,461 | |

Class N | | | | | 1,370,064 | | | | 16,866,700 | | | | 135,704 | | | | 1,654,362 | | | | 2,000 | | | | 20,000 | |

Reinvested Dividends | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class I | | | | | 7,237 | | | | 92,630 | | | | 999 | | | | 12,264 | | | | — | | | | — | |

Class N | | | | | 16,479 | | | | 210,431 | | | | 625 | | | | 7,664 | | | | — | | | | — | |

Shares Redeemed | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class I | | | | | (302,091 | ) | | | (3,828,828 | ) | | | (28,391 | ) | | | (351,484 | ) | | | — | | | | — | |

Class N | | | | | (494,629 | ) | | | (6,303,866 | ) | | | (22,939 | ) | | | (284,223 | ) | | | — | | | | — | |

Net Increase (Decrease) Resulting From Fund Share Transactions | | | | | 1,329,942 | | | $ | 15,684,076 | | | | 257,574 | | | $ | 2,878,424 | | | | 57,285 | | | $ | 583,461 | |

8. Credit Facility

U.S. Bank, N.A. (the “Bank”) has made available to the Trust, along with another affiliated trust, an uncommitted, $450,000,000 credit facility for short term liquidity in connection with shareholder redemptions. Under the terms of the credit facility, borrowings for each Fund are limited to one-third of the total assets (including the amount borrowed) of the respective Fund. Fifty percent of the credit facility is available to all of the Funds, as well as the funds in the affiliated trust, on a first come, first served basis. The remaining 50% of the credit facility is allocated among the Funds and the funds in the affiliated trust in accordance with procedures adopted by the Board. Borrowings under this credit facility bear interest at the Bank’s prime rate less 0.50% (weighted average rate of 2.75% for the period ended March 31, 2014).

For the year ended of March 31, 2014, the Funds’ credit facility activity is as follows:

| | | | | | | | | | | | | | |

| | | | | Average

Borrowings | | | Maximum

Amount

Outstanding | | | Interest

Expense | |

DoubleLine Equities Small Cap Growth Fund | | | | $ | 822,933 | | | $ | 4,027,000 | | | $ | 1,886 | |

9. Significant Shareholder Holdings

As of March 31, 2014, shareholders affiliated with the Funds and/or Adviser owned shares of the Funds as follows:

| | | | | | | | | | | | | | |

| | | | | Shares | | | Percent of Total

Outstanding

Shares—Per

Class | | | Percent of Total

Outstanding

Shares—Total

Fund | |

DoubleLine Equities Small Cap Growth Fund—Class I | | | | | 117,740 | | | | 27% | | | | 9% | |

DoubleLine Equities Small Cap Growth Fund—Class N | | | | | 49,222 | | | | 6% | | | | 4% | |

DoubleLine Equities Growth Fund—Class I | | | | | 97,632 | | | | 68% | | | | 38% | |

DoubleLine Equities Technology Fund—Class I | | | | | 43,603 | | | | 79% | | | | 76% | |

DoubleLine Equities Technology Fund—Class N | | | | | 2,000 | | | | 100% | | | | 3% | |

Investment activities of these shareholders could have a material affect on each Fund.

10. Principal Risks

Below are summaries of the principal risks of investing in one or more of the Funds, each of which could adversely affect a Fund’s net asset value, yield and total return. Each risk listed below does not necessarily apply to each Fund, and you should read each Fund’s prospectus carefully for a description of the principal risks associated with investing in a particular Fund.

| | • | cash position risk: to the extent that a Fund holds assets in cash, cash equivalents, and other short-term investments, the ability of the Fund to meet its objective may be limited. |

| | | | | | |

| | Annual Report | | March 31, 2014 | | 21 |

Notes to Financial Statements (Cont.)

| | • | concentration risk: concentrating investments in technology-related companies increases the risk of loss because the stocks of many or all of those companies may decline in value due to developments adversely affecting the industries in which they operate. |

| | • | convertible securities risk: investing in convertible bonds and securities includes the risk that the issuer may default in the payment of principal and/or interest and the risk that the value of the investment may decline if interest rates rise. |

| | • | depositary receipts risk: investments in depositary receipts may be less liquid than the underlying shares in their primary trading market. |

| | • | derivatives risk: the risk that an investment in derivatives will not perform as anticipated, cannot be closed out at a favorable time or price, or will increase a Fund’s volatility; that derivatives may create investment leverage; that, when a derivative is used as a substitute for or alternative to a direct cash investment, the transaction may not provide a return that corresponds precisely with that of the cash investment; or that, when used for hedging purposes, derivatives will not provide the anticipated protection, causing a Fund to lose money on both the derivatives transaction and the exposure the Fund sought to hedge. |

| | • | emerging market country risk: the risk that investing in emerging markets will be subject to greater political and economic instability, greater volatility in currency exchange rates, less developed securities markets, possible trade barriers, currency transfer restrictions, a more limited number of potential buyers, an emerging market country’s dependence on revenue from particular commodities or international aid, less governmental supervision and regulation, unavailability of currency hedging techniques, differences in auditing and financial reporting standards, and less developed legal systems than in many more developed countries. |

| | • | equity issuer risk: the risk that the market price of common stocks and other equity securities may go up or down, sometimes rapidly or unpredictably, including due to factors affecting equity securities markets generally, particular industries represented in those markets, or the issuer itself. |

| | • | foreign currency risk: the risk that fluctuations in exchange rates may adversely affect the value of the Fund’s investments denominated in foreign currencies. |

| | • | foreign investing risk: the risk that a Fund’s investments will be affected by political, regulatory, and economic risks not present in domestic investments. In addition, if a Fund buys securities denominated in a foreign currency, there are special risks such as changes in currency exchange rates and the risk that a foreign government could regulate or restrict foreign exchange transactions. |

| | • | growth securities risk: the risk that growth securities will be more sensitive to changes in current or expected earnings than other types of securities and tend to be more volatile than the market in general because their prices tend to reflect future investor expectations rather than just current profits. |

| | • | investment company and exchange-traded fund risk: the risk that an investment company, including any exchange-traded fund (“ETF”), in which a Fund invests will not achieve its investment objective or execute its investment strategies effectively or that large purchase or redemption activity by shareholders of such an investment company might negatively affect the value of the investment company’s shares. A Fund must pay its pro rata portion of an investment company’s fees and expenses. |

| | • | large shareholder risk: the risk that certain account holders, including funds or accounts over which the Adviser has investment discretion, may from time to time own or control a significant percentage of a Fund’s shares. A Fund is subject to the risk that a redemption by those shareholders of all or a portion of their Fund shares will adversely affect the Fund’s performance if it is forced to sell portfolio securities or invest cash when it would not otherwise do so. Redemptions of a large number of shares may affect the liquidity of a Fund’s portfolio, increase a Fund’s transaction costs, and accelerate the realization of taxable income and/or gains to shareholders. |

| | • | limited operating history risk: the risk that a newly formed fund has a limited operating history to evaluate and may not attract sufficient assets to achieve or maximize investment and operational efficiencies. |

| | • | liquidity risk: the risk that a Fund may be unable to sell a portfolio investment at a desirable time or at the value the Fund has placed on the investment. |

| | • | market capitalization risk: the risk that investing substantially in issuers in one market capitalization category (large, medium or small) may adversely affect a Fund because of unfavorable market conditions particular to that category of issuers, such as larger, more established companies being unable to respond quickly to new competitive challenges or attain the high growth rates of successful smaller companies, or, conversely, stocks of smaller companies being more volatile than those of larger companies due to, among other things, narrower product lines, more limited financial resources, fewer experienced managers and there typically being less publicly available information about small capitalization companies. |

| | • | market risk: the risk that the overall market will perform poorly or that the returns from the securities in which a Fund invests will underperform returns from the general securities markets or other types of investments. |