- LGMK Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

LogicMark (LGMK) PRE 14APreliminary proxy

Filed: 25 Feb 25, 4:51pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_____________________________________

SCHEDULE 14A

(RULE 14a-101)

_____________________________________

SCHEDULE 14A INFORMATION

PROXY STATEMENT PURSUANT TO SECTION 14(a) OF THE

SECURITIES EXCHANGE ACT OF 1934

(AMENDMENT NO. )

Filed by the Registrant | ☒ | |

Filed by a Party other than the Registrant | ☐ |

Check the appropriate box:

☒ | Preliminary Proxy Statement | |

☐ | Confidential, For Use of the Commission Only (as Permitted by Rule 14a-6(e)(2)) | |

☐ | Definitive Proxy Statement | |

☐ | Definitive Additional Materials | |

☐ | Soliciting Material under §240.14a-12 |

LogicMark, Inc.

(Name of Registrant as Specified In Its Charter)

___________________________________________________________

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

☒ | No fee required | |

☐ | Fee paid previously with preliminary materials. | |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

2801 Diode Lane

Louisville, KY 40299

(502) 442-7911

Important Notice Regarding the Availability of Proxy Materials

for the Special Meeting of Stockholders to Be Held on March 27, 2025

The Notice of Special Meeting and Proxy Statement

are available at:

https://web.viewproxy.com/LGMK/2025SM

NOTICE OF SPECIAL MEETING OF STOCKHOLDERS

TO BE HELD ON March 27, 2025

To the Stockholders of LogicMark, Inc.:

NOTICE IS HEREBY GIVEN that a Special Meeting of Stockholders (“Special Meeting”) of LogicMark, Inc., a Nevada corporation (the “Company”), will be held on March 27, 2025 at 9:00 a.m. (Eastern Time) in the offices of Sullivan & Worcester LLP at 1251 Avenue of the Americas, 19th Floor, New York, NY 10020. The Special Meeting is being held for the following purposes:

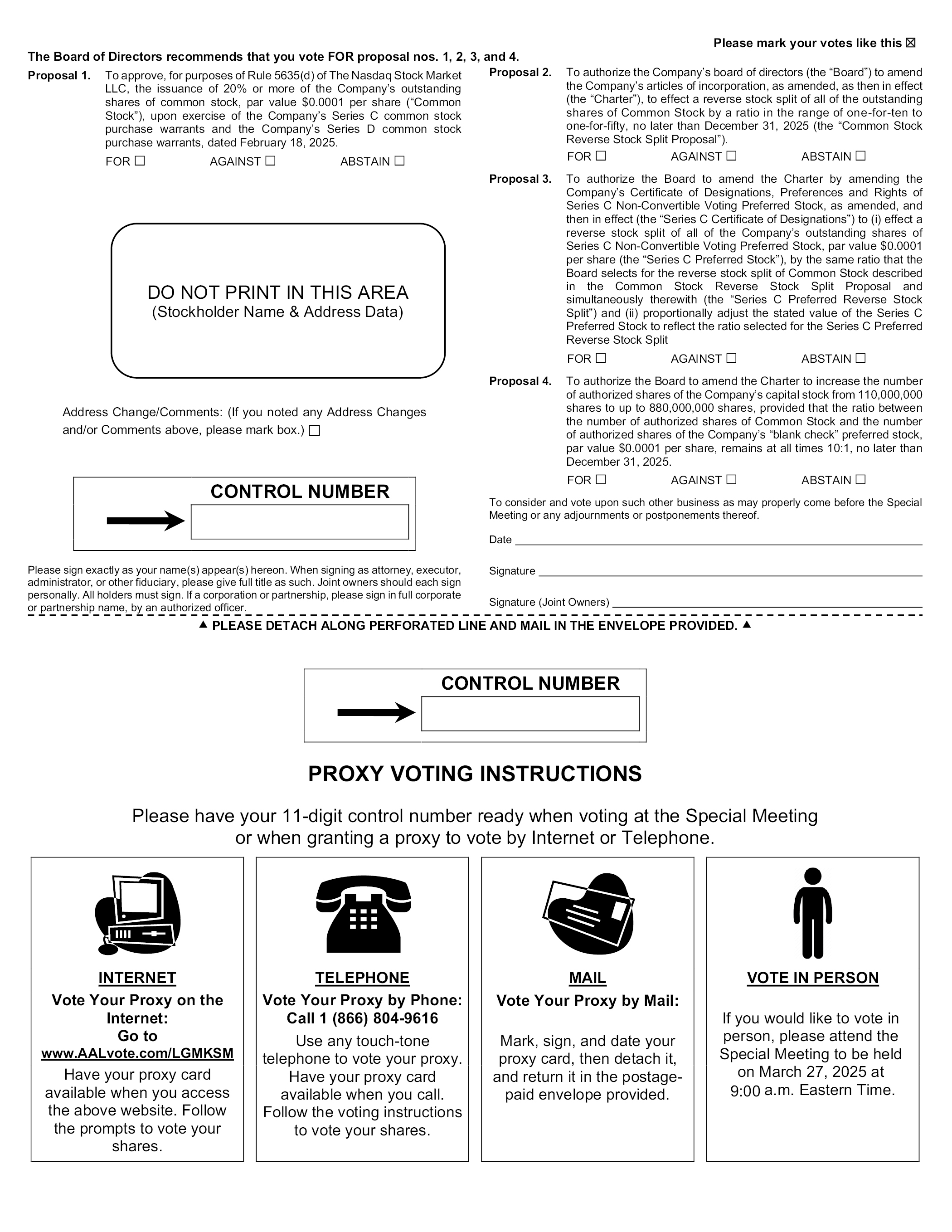

1. To approve, for purposes of Rule 5635(d) of The Nasdaq Stock Market LLC, the issuance of 20% or more of the Company’s outstanding shares of common stock, par value $0.0001 per share (“Common Stock”), upon exercise of the Company’s Series C common stock purchase warrants (the “Series C Warrants”) and the Company’s Series D common stock purchase warrants (the “Series D Warrants” and collectively, the “Warrants”), dated February 18, 2025 (“Proposal No. 1”);

2. To authorize the Company’s board of directors (the “Board”) to amend the Company’s articles of incorporation, as amended, as then in effect (the “Charter”), to effect a reverse stock split of all of the outstanding shares of Common Stock by a ratio in the range of one-for-ten to one-for-fifty, no later than December 31, 2025 (“Proposal No. 2”);

3. To authorize the Board to amend the Charter by amending the Company’s Certificate of Designations, Preferences and Rights of Series C Non-Convertible Voting Preferred Stock, as amended, and then in effect (the “Series C Certificate of Designations”) to (i) effect a reverse stock split of all of the Company’s outstanding shares of Series C Non-Convertible Voting Preferred Stock, par value $0.0001 per share (the “Series C Preferred Stock”), by the same ratio that the Board selects for the reverse stock split of Common Stock described in Proposal No. 2 and simultaneously therewith (the “Series C Preferred Reverse Stock Split”) and (ii) proportionally adjust the stated value of the Series C Preferred Stock to reflect the ratio selected for the Series C Preferred Reverse Stock Split (collectively, “Proposal No. 3”);

4. To authorize the Board to amend the Charter to increase the number of authorized shares of the Company’s capital stock from 110,000,000 shares to up to 880,000,000 shares, provided that the ratio between the number of authorized shares of Common Stock and the number of authorized shares of the Company’s “blank check” preferred stock, par value $0.0001 per share, remains at all times 10:1, no later than December 31, 2025 (“Proposal No. 4”); and

5. To consider and act upon such other business as may properly come before the Special Meeting or any adjournment thereof.

The foregoing items of business are more fully described in the Proxy Statement that is attached and made a part of this Notice. Only stockholders of record of shares of Common Stock, stockholders of record of the Company’s Series C Preferred Stock, and stockholders of record of the Company’s Series F Convertible Preferred Stock, par value $0.0001 per share (the “Series F Preferred Stock”), at the close of business on February 18, 2025 (the “Record Date”) will be entitled to notice of, and to vote at, the Special Meeting or any adjournment thereof.

Our Board of Directors recommends that you vote “FOR” each of the proposals.

All stockholders who are record or beneficial owners of shares of Common Stock, the one record holder of shares of Series C Preferred Stock and the one record holder of shares of Series F Preferred Stock on the Record Date are cordially invited to attend the Special Meeting in person. Your vote is important regardless of the number of shares of Common Stock, Series C Preferred Stock and/or Series F Preferred Stock that you own. Only record or beneficial owners of the Common Stock, Series C Preferred Stock and/or Series F Preferred Stock as of the Record Date may attend the Special Meeting in person. When you arrive at the Special Meeting, you must present photo identification, such as a driver’s license. Beneficial owners also must provide evidence of stockholdings as of the Record Date, such as a recent brokerage account or bank statement.

Whether or not you expect to attend the Special Meeting, please complete, sign, date and return the enclosed proxy card in the enclosed postage-paid envelope in order to ensure representation of your shares of Common Stock, Series C Preferred Stock and/or Series F Preferred Stock. It will help in our preparations for the Special Meeting if you would check the box on the form of proxy if you plan on attending the Special Meeting. If you desire to submit your vote via internet or telephone, follow the instructions at https://web.viewproxy.com/LGMK/2025SM and in the proxy materials, and use the 11-digit control number provided in the proxy materials. Your proxy is revocable in accordance with the procedures set forth in the Proxy Statement. Please be advised that if you are not a record or beneficial owner of shares of Common Stock, Series C Preferred Stock or Series F Preferred Stock on the Record Date, you are not entitled to vote and any proxies received from persons who are not record or beneficial owners of shares of Common Stock, Series C Preferred Stock or Series F Preferred Stock on the Record Date will be disregarded.

Louisville, Kentucky | By Order of the Board of Directors, | |

___________, 2025 |

| |

Mark Archer | ||

Chief Financial Officer |

WHETHER OR NOT YOU PLAN TO ATTEND THE SPECIAL MEETING, WE ENCOURAGE YOU TO READ THE PROXY STATEMENT AND CAST YOUR PROXY VOTE PROMPTLY BY RETURNING YOUR SIGNED PROXY CARD EITHER ONLINE, OVER THE PHONE OR BY MAIL AS SOON AS POSSIBLE SO THAT YOUR SHARES MAY BE REPRESENTED AT THE SPECIAL MEETING. NO POSTAGE NEED BE AFFIXED IF THE PROXY CARD IS MAILED IN THE UNITED STATES.

Page | ||

1 | ||

Information Concerning the Proxy Materials and the Special Meeting | 1 | |

2 | ||

3 | ||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 4 | |

7 | ||

7 | ||

7 | ||

8 | ||

9 | ||

9 | ||

9 | ||

10 | ||

10 | ||

11 | ||

13 | ||

14 | ||

16 | ||

16 | ||

16 | ||

17 | ||

17 | ||

18 | ||

18 | ||

18 | ||

19 | ||

19 | ||

Implementation of the Series C Preferred Reverse Stock Split | 20 | |

Adjustment in the Stated Value of the Series C Preferred Stock | 20 | |

21 | ||

22 | ||

22 | ||

22 | ||

22 | ||

22 | ||

22 | ||

24 | ||

24 | ||

26 | ||

Potential Anti-Takeover Effect of the Proposed Authorized Share Increase | 26 | |

26 |

i

Page | ||

26 | ||

27 | ||

27 | ||

27 | ||

A-1 | ||

B-1 | ||

C-1 |

ii

PROXY STATEMENT FOR SPECIAL MEETING OF STOCKHOLDERS

In this proxy statement (“Proxy Statement”), LogicMark, Inc., a Nevada corporation, is referred to as “LogicMark,” the “Company,” “we,” “us” and “our.”

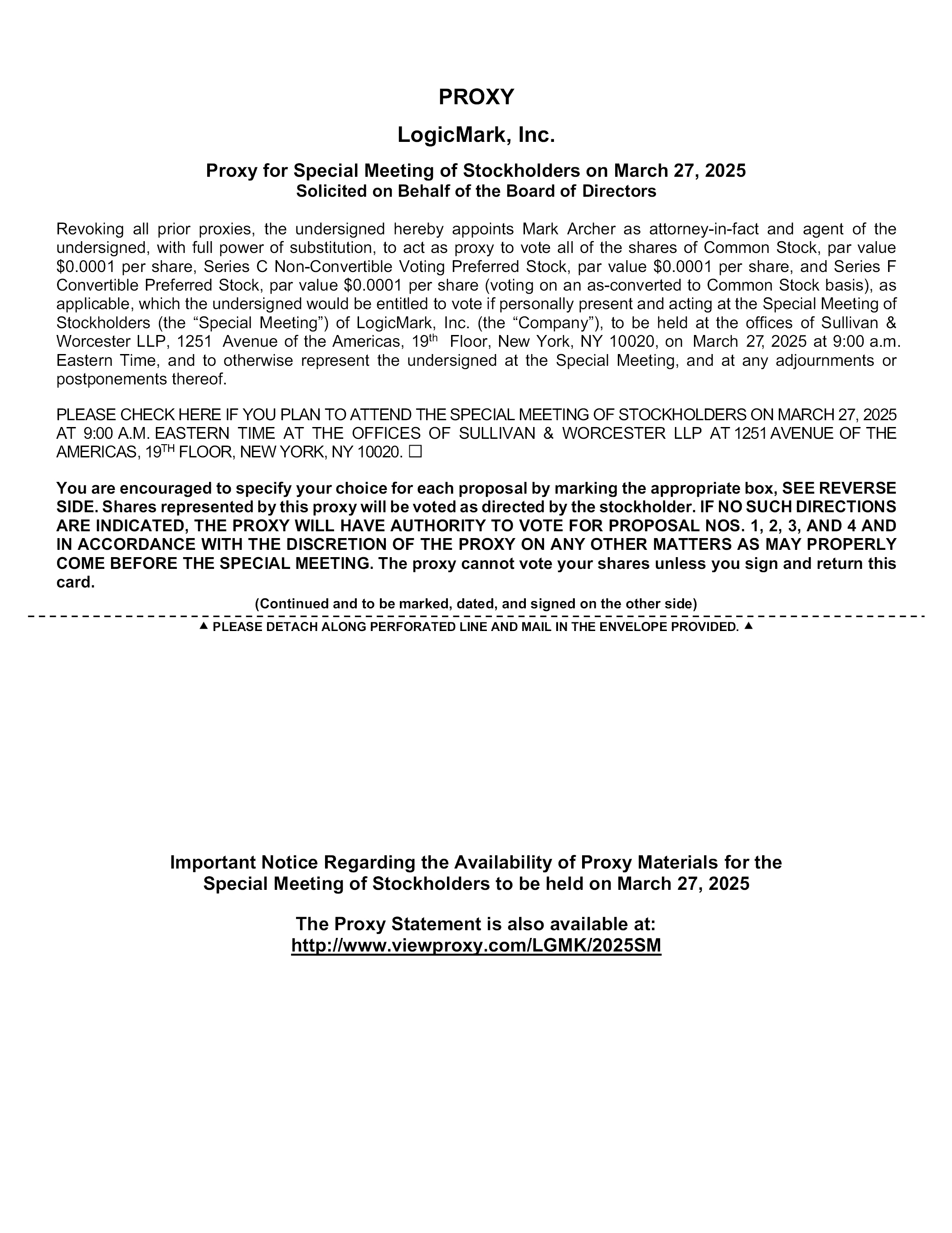

Information Concerning the Proxy Materials and the Special Meeting

Proxies are being solicited by our board of directors (the “Board”) for use at our Special Meeting of Stockholders (the “Special Meeting”) to be held at 9:00 a.m. (Eastern Time) on March 27, 2025 in the offices of Sullivan & Worcester LLP at 1251 Avenue of the Americas, 19th Floor, New York, NY 10020, and at any adjournment thereof. Your vote is very important. For this reason, our Board is requesting that you permit your shares of common stock, par value $0.0001 per share (the “Common Stock”), your shares of Series C Non-Convertible Voting Preferred Stock, par value $0.0001 per share (the “Series C Preferred Stock”), and/or your shares of Series F Convertible Preferred Stock, par value $0.0001 per share (the “Series F Preferred Stock”), to be represented at the Special Meeting by the proxies named on the proxy card. This Proxy Statement contains important information for you to consider when deciding how to vote on the matters brought before the Special Meeting. Please read it carefully.

Voting materials, which include this Proxy Statement and the enclosed proxy card, will be first mailed to stockholders on or about _________, 2025.

Only stockholders of record of our shares of Common Stock, Series C Preferred Stock and Series F Preferred Stock as of the close of business on February 18, 2025 (the “Record Date”) will be entitled to notice of, and to vote at, the Special Meeting. As of the Record Date, 6,582,474 shares of Common Stock were issued and outstanding, 1 share of Series C Preferred Stock was issued and outstanding, held by one record holder, and 106,333 shares of Series F Preferred Stock were issued and outstanding, held by one record holder. Holders of shares of Common Stock and the holder of the one share of Series C Preferred Stock are entitled to one (1) vote per share for each share of Common Stock and share of Series C Preferred Stock held by them, respectively. The holder of shares of Series F Preferred Stock will be entitled to vote on an as-converted to Common Stock basis with respect to 82 votes for the shares of Series F Preferred Stock held by such holder. Stockholders may vote in person or by proxy; however, granting a proxy does not in any way affect a stockholder’s right to attend the Special Meeting and vote in person. Any stockholder giving a proxy has the right to revoke that proxy by (i) filing a later-dated proxy or a written notice of revocation with us at our principal office at any time before the original proxy is exercised or (ii) attending the Special Meeting and voting in person.

Mark Archer is named as attorney-in-fact in the proxy. Mr. Archer is our Chief Financial Officer (“CFO”) and will vote all shares represented by properly executed proxies returned in time to be counted at the Special Meeting, as described below under “Voting Procedures and Vote Required.” Where a vote has been specified in the proxy with respect to the matters identified in the Notice of Special Meeting, the shares represented by the proxy will be voted in accordance with those voting specifications. If no voting instructions are indicated, your shares will be voted as recommended by our Board on all matters, and as the proxy holders may determine in their discretion with respect to any other matters properly presented for a vote before the Special Meeting.

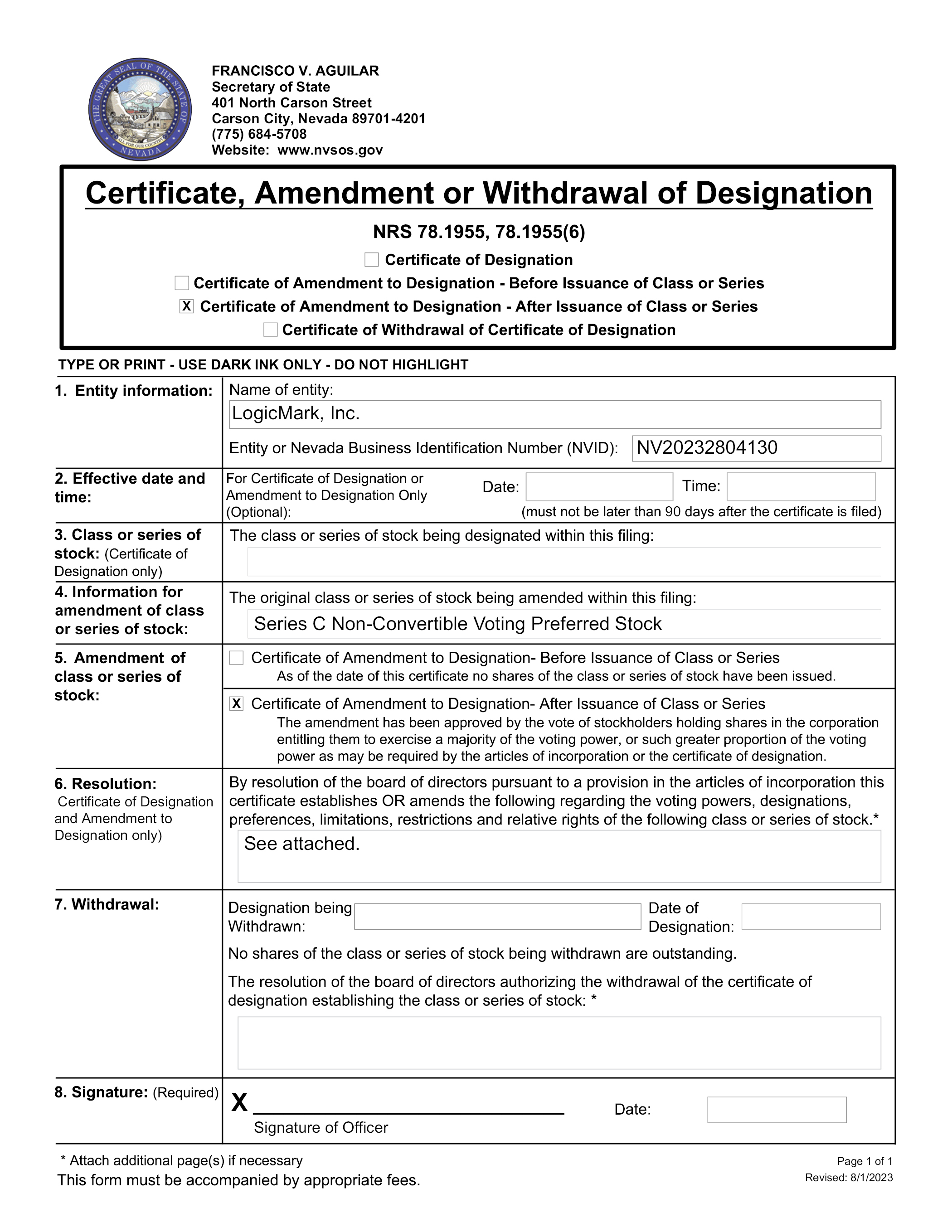

The stockholders will consider and vote upon (i) a proposal to approve, for purposes of Rule 5635(d) of The Nasdaq Stock Market LLC (“Nasdaq”), the issuance of 20% or more of our outstanding shares of Common Stock upon exercise of (a) the Company’s Series C common stock purchase warrants, (the “Series C Warrants”), and (b) the Company’s Series D common stock purchase warrants (the “Series D Warrants” and collectively with the Series C Warrants, the “Warrants”), issued by the Company to certain holders (each, a “Holder”) on February 18, 2025 (“Proposal No. 1”); (ii) a proposal to authorize the Board to amend the Company’s articles of incorporation, as then in effect (the “Charter”), to effect a reverse stock split of all of the outstanding shares of Common Stock by a ratio in the range of one-for-ten to one-for-fifty, no later than December 31, 2025 (the “Common Stock Reverse Stock Split”, and such proposal, “Proposal No. 2”); (iii) a proposal to authorize the Board to amend the Charter by amending the Company’s Certificate of Designations, Preferences and Rights of Series C Non-Convertible Voting Preferred Stock, as amended, and then in effect (the “Series C Certificate of Designations”) to (a) effect a reverse stock split of all of the Company’s outstanding shares of Series C Preferred Stock by the same ratio that the Board selects for the Common Stock Reverse

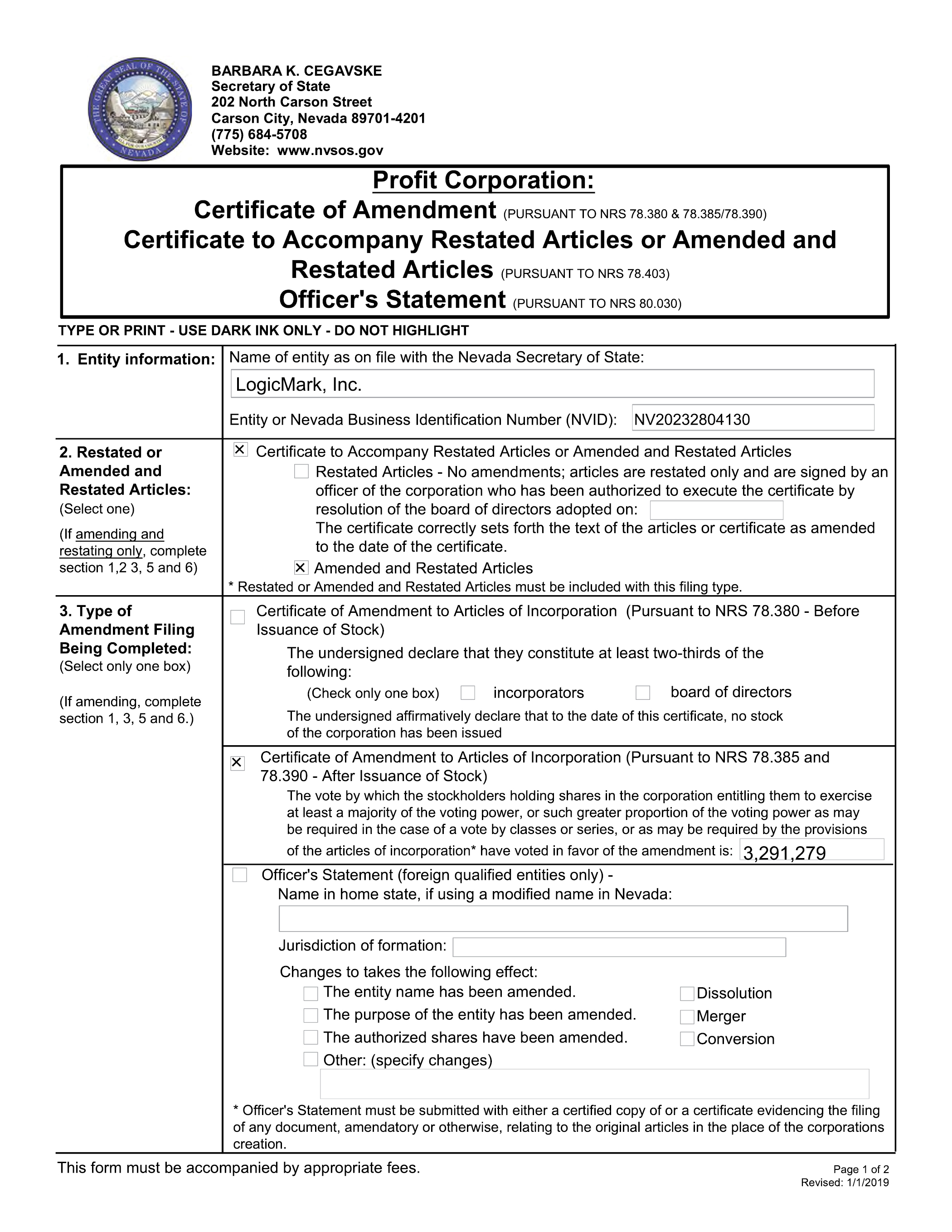

1

Stock Split and simultaneously therewith (the “Series C Preferred Reverse Stock Split”) and (b) proportionally adjust the stated value of the Series C Preferred Stock to reflect the ratio selected for the Series C Preferred Reverse Stock Split (collectively, “Proposal No. 3”); and (iv) a proposal to authorize the Board to amend the Charter to increase the number of authorized shares of our capital stock from 110,000,000 shares to up to 880,000,000 shares, provided that the ratio between the number of authorized shares of Common Stock and the number of authorized shares of the Company’s “blank check” preferred stock, par value $0.0001 per share (“Preferred Stock”), remains at all times 10:1 (“Authorized Share Increase” and such proposal, “Proposal 4”). Stockholders also will consider and act upon such other business as may properly come before the Special Meeting.

Voting Procedures and Vote Required

Instructions regarding each method of voting are provided in the notice of Special Meeting and stockholders can access such proxy materials and vote at https://web.viewproxy.com/LGMK/2025SM. If you desire to submit your vote via internet or telephone, follow the instructions at https://web.viewproxy.com/LGMK/2025SM and use the stockholder identification number provided in such proxy materials.

Mr. Archer will vote all shares represented by properly executed proxies returned in time to be counted at the Special Meeting. The presence, in person or by proxy, of at least one-third (1/3) of the issued and outstanding shares of Common Stock, Series C Preferred Stock and Series F Preferred Stock, in the aggregate, entitled to vote at the Special Meeting is necessary to establish a quorum for the transaction of business. Shares represented by proxies which contain an abstention and “broker non-vote” shares (described below) are counted as present for purposes of determining the presence of a quorum for the Special Meeting.

All properly executed proxies delivered pursuant to this solicitation and not revoked will be voted at the Special Meeting as specified in such proxies.

Vote Required for the Approval of the Issuance of All Shares of Common Stock Upon Exercise of the Warrants (Proposal No. 1).

Our Bylaws provide that, on all matters (other than the election of directors and except to the extent otherwise required by our Charter, Bylaws or applicable law), the affirmative vote of a majority of all votes cast by the holders of shares of stock entitled to vote will be required for approval. Accordingly, the affirmative vote of a majority of the votes cast by holders of the shares of Common Stock and Series C Preferred Stock, as well as the Series F Preferred Stock on an as-converted to Common Stock basis, in the aggregate, and entitled to vote on the matter, will be required to approve this proposal. Abstentions and broker non-votes, if any, will have no effect on the outcome of this proposal.

Vote Required for Authorization of the Board to Amend the Charter to Effect a Reverse Stock Split of All Outstanding Shares of Common Stock by a Ratio in the Range of One-for-Ten to One-for-Fifty, No Later than December 31, 2025 (Proposal No. 2).

Nevada law and our Bylaws provide that a proposal to amend the Charter to effect a reverse stock split of all outstanding shares of Common Stock shall be determined by the affirmative vote of a majority of all votes cast by the holders of shares of stock entitled to vote. Accordingly, the affirmative vote of a majority of the votes cast by holders of the shares of Common Stock and Series C Preferred Stock, as well as the Series F Preferred Stock on an as-converted to Common Stock basis, in the aggregate, entitled to vote on the matter, will be required to approve this proposal. Abstentions and broker non-votes, if any, will have no effect on the outcome of this proposal.

Vote Required for Authorization of the Board to Amend the Charter by Amending the Series C Certificate of Designations to (i) Effect a Reverse Stock Split of All Outstanding Shares of Series C Preferred Stock by the Same Ratio that the Board Selects for the Common Stock Reverse Stock Split and Simultaneously Therewith and (ii) Proportionally Adjust the Stated Value of the Series C Preferred Stock to Reflect the Ratio Selected for the Series C Preferred Reverse Stock Split (collectively, Proposal No. 3).

Nevada law and our Bylaws provide that, on all matters (other than the election of directors and except to the extent otherwise required by our Charter, Bylaws or applicable law), the affirmative vote of a majority of all votes cast by the holders of the shares entitled to vote will be required for approval. Additionally, pursuant to the provisions of the Series C Certificate of Designations and the applicable provisions of Chapter 78 of the Nevada Revised Statutes, as amended (“NRS”), as long as the Series C Preferred Reverse Stock Split is implemented at the same ratio as

2

the Common Stock Reverse Stock Split described in Proposal No. 2 and is conditioned upon our implementing the Common Stock Reverse Stock Split, the affirmative vote of a majority of the votes cast by holders of the shares of Common Stock and the Series C Preferred Stock, as well as the Series F Preferred Stock on an as-converted to Common Stock basis, in the aggregate, entitled to vote on the matter will be required to approve the Series C Preferred Reverse Stock Split.

Vote Required for Authorization of the Board to Amend the Charter to Increase the Number of Authorized Shares of Our Capital Stock from 110,000,000 Shares to Up to 880,000,000 Shares, Provided That the Ratio Between the Number of Authorized Shares of Common Stock and the Number of Authorized Shares of Preferred Stock Remains At All Times 10:1, No Later than December 31, 2025 (Proposal No. 4).

Nevada law provides that the affirmative vote of the holders of a majority of the voting power of the shares of Common Stock issued and outstanding as of the Record Date will be required to approve the Authorized Share Increase. Accordingly, the affirmative vote of the holders of a majority of the outstanding shares of Common Stock and Series C Preferred Stock, as well as Series F Preferred Stock on an as-converted to Common Stock basis, in the aggregate, entitled to vote on the matter, will be required to approve this proposal. Abstentions and broker non-votes by holders of Common Stock will have the same effect as votes against this proposal.

If you hold shares beneficially in street name and do not provide your broker with voting instructions, your shares may constitute “broker non-votes.” Generally, broker non-votes occur on a matter when a broker is not permitted to vote on that matter without instructions from the beneficial owner and instructions are not given. Brokers that have not received voting instructions from their clients cannot vote on their clients’ behalf on “non-routine” proposals.

The vote on Proposal No. 1 is considered “non-routine” and the votes on Proposals No. 2, No. 3 and No. 4 are considered “routine”.

Abstentions are counted as “shares present” at the Special Meeting for purposes of determining the presence of a quorum. Abstentions only have an effect on the outcome of any matter being voted on that requires a certain level of approval based on our total voting stock outstanding. Thus, abstentions will have no effect on any of the proposals except for Proposal No. 4, in which case, abstentions by holders of Common Stock, Series C Preferred Stock and Series F Preferred Stock on an as-converted to Common Stock basis, are counted as a vote against such proposal.

Votes at the Special Meeting will be tabulated by one or more inspectors of election appointed by the Chief Financial Officer.

Stockholders will not be entitled to dissenter’s rights with respect to any proposal to be considered and voted on at the Special Meeting.

Delivery of Documents to Stockholders Sharing an Address

We will provide only one set of Special Meeting materials and other corporate mailings to stockholders who share a single address unless we received contrary instructions from any stockholder at that address. This practice, known as “householding,” is designed to reduce printing and postage costs. However, the Company will deliver promptly upon written or oral request a separate copy of the Special Meeting proxy materials to a stockholder at a shared address to which a single copy of the Special Meeting materials was delivered. You may make such a written or oral request by sending a written notification stating (i) your name, (ii) your shared address and (iii) the address to which the Company should direct any additional copy of the Special Meeting proxy materials to the Company at Corporate Secretary, 2801 Diode Lane, Louisville, KY 40299, telephone: (502) 442-7911, email: legal@logicmark.com.

3

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth, as of February 21, 2025, information regarding beneficial ownership of our capital stock by:

• each person, or group of affiliated persons, known by us to beneficially own more than 5% of our outstanding voting securities;

• each of our named executive officers;

• each of our directors; and

• all of our named executive officers and directors as a group.

The percentage ownership information shown in the table is based upon 17,421,634 shares of Common Stock, 1 share of Series C Preferred Stock, and 106,333 shares of Series F Preferred outstanding as of February 21, 2025. Beneficial ownership is determined according to the rules of the Securities and Exchange Commission (the “SEC’) and generally means that a person has beneficial ownership of a security if he, she or it possesses sole or shared voting or investment power of that security, including securities that are exercisable for shares of Common Stock, Series C Preferred Stock or Series F Preferred Stock within sixty (60) days of February 21, 2025. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the holders named in the table below have sole voting and investment power with respect to all shares of Common Stock, Series C Preferred Stock or Series F Preferred Stock shown that they beneficially own, subject to community property laws where applicable.

For purposes of computing the percentage of outstanding shares of our Common Stock, Series C Preferred Stock and Series F Preferred Stock held by each holder or group of holders named above, any shares of Common Stock, Series C Preferred Stock or Series F Preferred Stock that such holder or holders has the right to acquire within sixty (60) days of February 21, 2025 is deemed to be outstanding, but is not deemed to be outstanding for the purpose of computing the percentage ownership of any other holder. The inclusion herein of any shares of Common Stock, Series C Preferred Stock or Series F Preferred Stock listed as beneficially owned does not constitute an admission of beneficial ownership. Unless otherwise identified, the address of each beneficial owner listed in the table below is c/o LogicMark, Inc., 2801 Diode Lane, Louisville, KY 40299.

Shares Beneficially Owned | ||||||||||||||||||

Common Stock | Series C | Series F | % Total | |||||||||||||||

Name of Beneficial Owner | Shares(1) | %(1) | Shares | % | Shares | % | ||||||||||||

Non-Director or Officer 5% Stockholders: |

|

|

|

| ||||||||||||||

Alpha Capital Anstalt(3) | 7,751 | * |

| — | — |

| 106,333 | 100 | % | * |

| |||||||

Giesecke+Devrient Mobile Security America, Inc.(4) | — | — |

| 1 | 100 | % | — | — |

| * |

| |||||||

Directors and Executive Officers: |

|

|

|

| ||||||||||||||

Chia-Lin Simmons, Chief Executive Officer and Director(5) | 145,689 | * |

| — | — |

| — | — |

| * |

| |||||||

Mark Archer, Chief Financial Officer(6) | 64,671 | * |

| — | — |

| — | — |

| * |

| |||||||

Robert A. Curtis, Director(7) | 34,841 | * |

| — | — |

| — | — |

| * |

| |||||||

John Pettitt, Director(8) | 34,786 | * |

| — | — |

| — | — |

| * |

| |||||||

Barbara Gutierrez, Director(9) | 34,776 | * |

| — | — |

| — | — |

| * |

| |||||||

Carine Schneider, Director(10) | 34,049 | * |

| — | — |

| — | — |

| * |

| |||||||

Directors and Executive Officers as a Group (6 persons) | 348,812 | 1.98 | % | — | — |

| — | — |

| 1.98 | % | |||||||

____________

* Less than 1%

(1) The number of shares owned and the beneficial ownership percentages set forth in these columns are based on 17,421,634 shares of Common Stock issued and outstanding as of February 21, 2025. Shares of Common Stock issuable pursuant to options, preferred stock or warrants currently exercisable or exercisable within sixty (60) days are considered outstanding for purposes of computing the percentage beneficial ownership of the holder of such options, preferred stock or warrants; they are not considered outstanding for purposes of computing the percentage of any other stockholder. Exercises of certain warrants and conversions of certain shares of preferred stock held by certain stockholders listed above are subject

4

to certain beneficial ownership limitations, which provide that a holder of such securities will not have the right to exercise or convert any portion of such securities, as applicable, if such holder, together with such holder’s affiliates, would beneficially own in excess of 4.99% or 9.99%, as applicable, of the number of shares of Common Stock outstanding immediately after giving effect to such exercise, provided that upon at least 61 days’ prior notice to the Company, such holder may increase or decrease such limitation up to a maximum of 9.99% of the number of shares of Common Stock outstanding. As a result, the number of shares of Common Stock reflected in these columns as beneficially owned by the applicable stockholders includes (a) any outstanding shares of Common Stock held by such stockholder, and (b) if any, the securities convertible into or exercisable for shares of Common Stock that may be held by such stockholder, in each case which such stockholder has the right to acquire as of February 21, 2025 and without such holder or any of such holder’s affiliates beneficially owning more than 4.99% or 9.99%, as applicable, of the number of outstanding shares of Common Stock as of February 21, 2025.

(2) Percentage of total voting power represents voting power with respect to all shares of Common Stock, Series C Preferred Stock and Series F Preferred Stock. The holders of our Common Stock and Series C Preferred Stock are entitled to one vote per share. The holders of our Series F Preferred Stock vote on as as-converted to Common Stock basis.

(3) Beneficial ownership consists of 3,713 shares of Common Stock, an aggregate of 3,931 shares of Common Stock issuable upon exercise of all such holder’s warrants and 107 shares of Common Stock issuable upon conversion of such holder’s shares of Series F Preferred Stock. Konrad Ackermann has voting and investment control over the securities held by Alpha Capital Anstalt. The principal business address of Alpha Capital Anstalt is Altenbach 8 -9490 Vaduz, Principality of Liechtenstein.

(4) Giesecke+Devrient Mobile Security America, Inc. (“G&D”) is the sole holder of our Series C Preferred Stock and thus has 100% of the voting power of our outstanding shares of Series C Preferred Stock, which have the same voting rights as our shares of Common Stock (one vote per share). The address for G&D is 45925 Horseshoe Drive, Dulles, VA 20166.

(5) Beneficial ownership consists of (i) 534 shares of restricted stock granted outside the 2013 Long Term Incentive Plan (the “2013 LTIP”) and the 2017 Stock Incentive Plan (the “2017 SIP”), which vest over a period of 48 months, with one quarter which vested on the anniversary of the grant and 1/16 vesting each subsequent quarter until all shares have vested, so long as Ms. Simmons remains in the service of the Company, (ii) 409 shares of restricted stock granted under the 2013 LTIP, which shares vest over a period of three (3) years commencing on January 3, 2022, with 68 shares having vested on July 3, 2022, and thereafter, 34 shares to vest on the first day of each subsequent quarter until the entire award has vested, so long as Ms. Simmons remains in the service of the Company for each such quarter, (iii) 2,480 shares of restricted stock granted pursuant to the Company’s 2023 Stock Incentive Plan (the “2023 SIP”), which shares vest over a period commencing on July 3, 2023, with 1/4 of such shares vesting on July 3, 2024, and thereafter, 1/16 of such shares to vest on the first day of each subsequent three-month period until the entire award has vested, so long as Ms. Simmons remains in the service of the Company for each such quarter, (iv) 1,848 shares of restricted stock granted pursuant to the 2023 SIP, which shares vest over a period commencing on April 3, 2024, with 1/4 of such shares to vest on April 3, 2025, and thereafter, 1/16 of such shares to vest on the first day of each subsequent three-month period until the entire award has vested, so long as Ms. Simmons remains in the service of the Company for each such quarter, (v) 116,900 shares of restricted stock granted pursuant to the Company’s 2023 SIP, which shares vest over a period commencing on January 2, 2025, with 1/4 of such shares to vest on January 2, 2026, and thereafter, 1/16 of such shares to vest on the first day of each subsequent three-month period until the entire award has vested, so long as Ms. Simmons remains in the service of the Company for each such quarter, (vi) an aggregate of 22,658 shares of Common Stock issuable upon the exercise of Series A and Series B warrants at a weighted exercise price of $0.60 per share issued in the Company’s August 2024 best efforts public offering (the “August 2024 Offering”), and (vii) 860 shares of Common Stock issued in the August 2024 Offering.

(6) Beneficial ownership consists of (i) 259 shares of restricted stock granted outside the 2013 LTIP and the 2017 SIP, which vest over a period of 48 months, with one quarter on the anniversary of the grant and 1/16 each subsequent quarter until all shares have vested, so long as Mr. Archer remains in the service of the Company, (ii) 836 shares of restricted stock granted pursuant to the 2023 SIP, which vest commencing on July 3, 2023, with 1/4 of such shares vesting on July 3, 2024, and thereafter, 1/16 of such shares to vest on the first day of each subsequent three-month period until the entire award has vested, so long as Mr. Archer remains in the service of the Company for each such quarter, (iii) 38,000 shares of restricted stock granted pursuant to the 2023 SIP, which vest commencing on January 2, 2025, with 1/4 of such shares to vest on January 2, 2026, and thereafter, 1/16 of such shares to vest on the first day of each subsequent three-month period until the entire award has vested, so long as Mr. Archer remains in the service of the Company for each such quarter, (iv) 860 shares of Common Stock issued in the August 2024 Offering and (v) an aggregate of 22,658 shares of Common Stock issuable upon the exercise of Series A and Series B warrants at a weighted exercise price of $0.60 per share issued in the August 2024 Offering. In addition, FLG Partners, of which Mr. Archer is a partner, was granted (i) 14 restricted shares of Common Stock outside the 2013 LTIP and the 2017 SIP, 1/4 of which vested on July 15, 2022, and 1/16 of such shares vesting for each three-month period thereafter, (ii) 44 restricted shares of Common Stock, pursuant to the 2023 SIP, which vest commencing on July 3, 2023, with 1/4 of such shares vesting on July 3, 2024, and thereafter, 1/16 of such shares to vest on the first day of each subsequent three-month period until the entire award has vested, and (iii) 2,000 restricted shares of Common Stock, pursuant to the 2023 SIP, which vest commencing on January 2, 2025, with 1/4 of such shares to vest on January 2, 2026, and thereafter, 1/16 of such shares to vest on the first day of each subsequent three-month period until the entire award has vested. Mr. Archer disclaims beneficial ownership of such shares of Common Stock granted to FLG Partners.

5

(7) Beneficial ownership consists of (i) 876 shares of Common Stock, (ii) stock options exercisable for 11,307 shares of Common Stock at a weighted exercise price of $19.82 per share, and (iii) an aggregate of 22,658 shares of Common Stock issuable upon the exercise of Series A and Series B warrants at a weighted exercise price of $0.60 per share issued in the August 2024 Offering.

(8) Beneficial ownership consists of (i) 860 shares of Common Stock, (ii) stock options exercisable for 11,268 shares of Common Stock at a weighted exercise price of $10.96 per share, and (iii) an aggregate of 22,658 shares of Common Stock issuable upon the exercise of Series A and Series B warrants at a weighted exercise price of $0.60 per share issued in the August 2024 Offering.

(9) Beneficial ownership consists of (i) 860 shares of Common Stock, (ii) stock options exercisable for 11,258 shares of Common Stock at a weighted exercise price of $10.00 per share, and (iii) an aggregate of 22,658 shares of Common Stock issuable upon the exercise of Series A and Series B warrants at a weighted exercise price of $0.60 per share issued in the August 2024 Offering.

(10) Beneficial ownership consists of (i) 880 shares of Common Stock, (ii) stock options exercisable for 10,511 shares of Common Stock at a weighted exercise price of $4.57 per share, and (iii) an aggregate of 22,658 shares of Common Stock issuable upon the exercise of Series A and Series B warrants at a weighted exercise price of $0.60 per share issued in the August 2024 Offering.

6

APPROVAL OF THE ISSUANCE OF SHARES OF COMMON STOCK

UPON EXERCISE OF THE WARRANTS

(Proposal No. 1)

The Company is seeking stockholder approval, for purposes of complying with Nasdaq Rule 5635(d), for the issuance of all shares of Common Stock upon exercise of each of the Warrants issued in a public financing that closed on February 18, 2025, including (i) all shares of Common Stock issuable pursuant to all anti-dilutive adjustment provisions and other price adjustment provisions in each of the Warrants, and (ii) all shares of Common Stock issuable pursuant to the “alternative cashless exercise” provision in the Series D Warrants, in each case as described in more detail below and the Current Report on Form 8-K filed by the Company with the SEC on February 18, 2025 (the “Form 8-K”).

The information set forth in this proposal is further qualified in its entirety by reference to the full text of the form of the Series C Warrant and the form of Series D Warrant, attached as Exhibits 4.1 and 4.2, respectively, to the Form 8-K. Stockholders are urged to carefully read these documents.

Background and Description of the Warrants

On February 18, 2025, the Company, in connection with a best efforts public offering (the “Offering”), sold an aggregate of (x) 2,260,000 units of the Company (the “Units”) at an offering price of $0.59 per Unit, consisting of (i) 2,260,000 shares (the “Shares”) of Common Stock, (ii) Series C Warrants to purchase up to 2,260,000 shares of Common Stock at $0.59 per share, and (iii) Series D Warrants to purchase up to 2,260,000 shares of Common Stock at $0.885 per share; and (y) 22,146,750 pre-funded units of the Company (the “Pre-Funded Units”) at an offering price of $0.589 per Pre-Funded Unit, consisting of (i) pre-funded common stock purchase warrants to purchase up to 22,146,750 shares of Common Stock at $0.001 per share (the “Pre-Funded Warrants”), (ii) Series C Warrants exercisable for up to 22,146,750 shares of Common Stock and (iii) Series D Warrants exercisable for up to 22,146,750 shares of Common Stock, pursuant to the Registration Statement (as defined below) and securities purchase agreements, each dated February 18, 2025 (the “Purchase Agreements”), between the Company and each of the Holders. The Shares and the Warrants included in the Units, and the Pre-Funded Warrants and the Warrants included in the Pre-Funded Units, are immediately separable from one another and were issued separately in the Offering.

The Units, the Pre-Funded Units, the Shares, the Warrants and the Pre-Funded Warrants included in the Units and the Pre-Funded Units, as applicable, as well as all shares of Common Stock issuable upon exercise of each of the Warrants (the “Warrant Shares”) and the Pre-Funded Warrants, were offered and sold to investors in the Offering and registered pursuant to (i) the Company’s registration statement on Form S-1, as amended (File No. 333-284135) (the “Initial Registration Statement”), filed by the Company with the SEC under the Securities Act of 1933, as amended (the “Securities Act”), which the SEC declared effective on February 14, 2025, and (ii) the registration statement on Form S-1MEF (File No. 333-284997) filed by the Company with the SEC on February 14, 2025 pursuant to Rule 462(b) of the Securities Act (together with the Initial Registration Statement, the “Registration Statement”).

The Series C Warrants are exercisable at a per share price of $0.59 and the Series D Warrants are exercisable at a per share price of $0.885, on or after the date on which (A) stockholder approval is obtained by the Company (“Stockholder Approval”) in order to approve (i) the issuance of all Warrant Shares, solely to the extent required under Nasdaq Rule 5635(b) and (ii) a reverse stock split of the outstanding shares of Common Stock or an increase in the number of authorized shares of Common Stock, in either case so that there are a sufficient number of shares of Common Stock reserved for issuance upon exercise of the Warrants (each, a “Capital Event”); and (B) a certificate of amendment to the Charter is filed and deemed effective by the Secretary of State of the State of Nevada to give effect to a Capital Event. The Series C Warrants expire on the fifth anniversary of their issuance and the Series D Warrants expire two and one-half years after their issuance. The Series D Warrants include an “alternative cashless exercise” provision pursuant to which the holders thereof have the option not to pay a cash purchase price upon exercise, but instead receive upon such exercise three (3) shares of Common Stock for every Series D Warrant exercised.

The exercise price of (i) each Series C Warrant is subject to adjustment in the event that the Company sells or enters into an agreement to sell, or grant or otherwise dispose of or issue (or announce any offer, sale, grant or any option to purchase or other disposition), any shares of Common Stock or Common Stock Equivalents (as defined in the Series C Warrants), at an effective price per share below the exercise price of the Series C Warrant then in effect, in which case

7

the exercise price of the Series C Warrants will be reduced to such effective price, subject to a floor price of $0.118 per share, subject to standard adjustments (the “Floor Price”), solely with respect to the calculation of the number of Warrant Shares issuable thereunder; (ii) each Series C Warrant and Series D Warrant is subject to a one-time adjustment upon the next reverse stock split of the Common Stock after each such Series D Warrant’s issuance, such that in the event that the lowest VWAP (as defined in the Series D Warrants) during the five trading day period before and after such reverse stock split is lower than the exercise price of the Series D Warrants then in effect, the exercise price of the Series D Warrants will be reduced to such lowest price during such 11-trading day period, subject to the Floor Price (solely with respect to the calculation of the number of Warrant Shares issuable thereunder); (iii) each Series C Warrant and Series D Warrant is subject to a one-time adjustment upon the date on which Stockholder Approval is obtained, such that in the event that the lowest VWAP during the five trading day period before and after Stockholder Approval is obtained is lower than the exercise price of the Warrants then in effect, the exercise price of the Warrants will be reduced to such lowest price during such 11-trading day period, subject to the Floor Price; and (iv) each Series C Warrant and Series D Warrant is subject to a one-time adjustment to the greater of (x) the Floor Price and (y) the lowest VWAP during the five trading day period immediately preceding the thirtieth (30th) trading day immediately following the issuance date of such Warrant. Further, upon each such exercise price adjustment described above, the number of Warrant Shares issuable upon exercise of such Warrants will increase such that the aggregate exercise price payable under the Warrants, after taking into account such decreased exercise price, will equal the aggregate exercise price of such Warrants on the date of their issuance; provided that in the event that such adjustment pursuant to either (ii) or (iii) above would result in an increase in such exercise price, no adjustment shall be made and if the Warrants are exercised during any relevant determining 11-trading day period, solely with respect to such portion of the Warrants exercised on such applicable exercise date, such applicable determining period shall be deemed to have ended on, and included, the trading day immediately prior to such exercise date and the exercise price on such applicable exercise date will be the lowest VWAP of the Common Stock immediately during such determining period prior to such exercise date and ending on, and including the trading day immediately prior to such exercise date.

Each of the Series C Warrants, Series D Warrants and Pre-Funded Warrants were also issued in accordance with a warrant agency agreement, dated February 18, 2025, between the Company and Nevada Agency and Transfer Company (the “Warrant Agency Agreement”), the form of which is filed as Exhibit 10.2 to the Form 8-K.

The Board has determined that the Warrants, and the Company’s ability to issue Common Stock upon exercise of the Warrants, are in the best interests of the Company and its stockholders because the sale of the Warrants provided the Company with significant capital. Accordingly, we are seeking stockholder approval of this proposal in order to comply with the terms of the Purchase Agreements and Nasdaq Rule 5635(d), to the extent applicable. In addition, in order for the Holders to fully exercise the Warrants, pursuant to the terms of the Purchase Agreements, the Company is seeking stockholder approval, concurrently with Proposal No. 1, of (i) Proposals No. 2 and No. 3 (collectively) and/or (ii) Proposal No. 4, so that in the event that the Company obtains stockholder approval of Proposal No. 1, the Company would be permitted to file a certificate of change to the Charter to either effect a Common Stock Reverse Stock Split or an Authorized Share Increase in order for there to be a sufficient number of shares of Common Stock reserved for issuance upon full exercise of the Warrants, including issuances of shares of Common Stock in accordance with the Warrants as a result of anti-dilution and alternative cashless exercise provisions in such Warrants, as applicable.

Nasdaq Rule 5635(d) requires stockholder approval in connection with a transaction, other than a public offering, involving the sale or issuance by the issuer of Common Stock (or securities convertible into or exchangeable for Common Stock) equal to 20% or more of the Common Stock or 20% or more of the voting power of such company outstanding before the issuance for a price that is less than the lower of: (i) the closing price of the Common Stock immediately preceding the signing of the binding agreement for the issuance of such securities and (ii) the average closing price of the Common Stock for the five trading days immediately preceding the signing of the binding agreement for the issuance of such securities.

Therefore, the Company is seeking stockholder approval to issue more than 20% of the Company’s outstanding Common Stock pursuant to the Warrants in compliance with Nasdaq Rule 5635(d).

8

Potential Consequences if this Proposal is Not Approved

If the Company does not obtain Stockholder Approval at the Special Meeting, the Company is required pursuant to the terms of the Warrants to hold a subsequent annual or special meeting every sixty (60) days thereafter to seek Stockholder Approval until the earlier of the date Stockholder Approval is obtained or the Warrants are no longer outstanding. If the stockholders do not approve this proposal at the Special Meeting, the Company will not be able to issue shares of Common Stock to the investors upon the receipt of a notice of exercise of the Warrants, thereby requiring the Company to hold another meeting seeking stockholder approval at further expense to the Company. Accordingly, if stockholder approval of this proposal is not obtained, the Company may need to seek alternative sources of financing, which financing may not be available on advantageous terms, or at all, and which may result in the incurrence of additional transaction expenses. The Company’s ability to successfully implement its business plans and ultimately generate value for its stockholders is dependent on its ability to maximize capital raising opportunities.

Potential Adverse Effects of this Proposal

Each share of Common Stock that would be issuable upon exercise of the Warrants would have the same rights and privileges as each currently outstanding share of Common Stock. The issuance to the investors of the Warrants or the Common Stock upon exercise of the Warrants will not affect the rights of the holders of outstanding shares of Common Stock, but such issuances will have a dilutive effect on the Company’s existing stockholders, including the voting power and economic rights of existing stockholders, and may result in a decline in the Company’s stock price or greater price volatility. Further, due to the fact that the Warrants include certain mechanisms such as (i) an alternative cashless exercise provision in the Series D Warrants and (ii) certain anti-dilution adjustment and other price adjustment provisions (with proportional share adjustment features), stockholders may experience an even greater dilutive effect.

Vote Required and Recommendation of Board

Our Bylaws provide that all matters (other than the election of directors and except to the extent otherwise required by our Charter, Bylaws or applicable law) shall be determined by a majority of the votes cast and entitled to vote thereon. Accordingly, the affirmative vote of a majority of all votes cast by the holders of the shares of Common Stock and Series C Preferred Stock, as well as the Series F Preferred Stock on an as-converted to Common Stock basis, in the aggregate, and entitled to vote on the matter, will be required to approve this proposal. Abstentions and broker non-votes, if any, will have no effect on the outcome of this proposal.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE TO APPROVE THE ISSUANCE OF ALL OF THE SHARES OF COMMON STOCK ISSUABLE UPON EXERCISE OF THE WARRANTS.

9

BOARD TO AMEND THE

CHARTER TO EFFECT A REVERSE STOCK SPLIT OF ALL

OUTSTANDING SHARES OF COMMON STOCK, NO LATER THAN DECEMBER 31, 2025

(Proposal No. 2)

Our Board has unanimously approved a proposal to amend the Charter to effect a reverse stock split of all of our outstanding shares of Common Stock by a ratio in the range of one-for-ten to one-for-fifty, to be determined in the Board’s sole discretion (the “Common Stock Reverse Stock Split”), and in any event, no later than December 31, 2025. The proposal provides that if the Common Stock Reverse Stock Split is approved by stockholders, the Board will implement the Common Stock Reverse Stock Split, as soon as practicable or as otherwise required after such approval, for the purposes of (i) maintaining the listing of our Common Stock on the Nasdaq Capital Market, and (ii) to assure that there are a sufficient number of authorized shares of Common Stock available to reserve for issuance upon exercise and conversion of all outstanding warrants and convertible securities, including, without limitation, upon exercise of all of the Warrants in the event of the triggering of certain anti-dilution and other price adjustment provisions contained therein and/or the alternative cashless exercise provision contained in the Series D Warrants, which provisions are further described in Proposal No. 1.

Our Common Stock is currently listed on Nasdaq. In order to maintain that listing, we must satisfy minimum financial and other continued listing requirements and standards, including those regarding director independence and independent committee requirements, minimum stockholders’ equity, minimum share price, and certain corporate governance requirements. For example, on January 17, 2025, the SEC approved the rule change that Nasdaq proposed in August 2024 to modify the delisting process for certain listed stocks that fail to regain compliance with the minimum bid price requirement for continued listing on the Nasdaq Capital Market, as set forth under Nasdaq Rule 5550(a)(2) (the “Minimum Bid Price Requirement”). Due to such recent rule change, in the event that the Common Stock trades below $1.00 per share for thirty (30) consecutive trading days within one year of any reverse stock split of outstanding shares of Common Stock, or the Company has previously implemented two reverse splits of its Common Stock over the applicable prior two-year period with a cumulative ratio of 250 shares or more to one, the Common Stock may be immediately delisted, and unless such determination is appealed, the Company would not be eligible for any compliance period during which it could regain compliance with such continued listing rule.

On April 21, 2023, the Company effected a one-for-twenty reverse stock split of Common Stock and a corresponding one-for-twenty reverse stock split of all of the Series C Preferred Stock (both reverse stock splits, collectively, the “April 2023 Reverse Stock Splits”). For more information on the April 2023 Reverse Stock Splits, see the Current Report on Form 8-K filed by the Company with the SEC on April 27, 2023.

On November 18, 2024, the Company effected a one-for-twenty-five reverse stock split of Common Stock and a corresponding one-for-twenty-five reverse stock split of all of the Series C Preferred Stock (both reverse stock splits, collectively, the “November 2024 Reverse Stock Splits”). For more information on the November 2024 Reverse Stock Splits, see the Current Report on Form 8-K filed by the Company with the SEC on November 18, 2024.

In light of the April 2023 Reverse Stock Splits and the November 2024 Reverse Stock Splits and the recent trading prices of the Common Stock as of the date of this Proxy Statement, which have been below $1.00 per share, the Company may not be able to maintain compliance with the Minimum Bid Price Requirement or maintain its listing on the Nasdaq Capital Market by conducting another reverse stock split of the Common Stock in the event that it fails to comply with the Minimum Bid Price Requirement. Consequently, there is a possibility that the Common Stock may be subject to immediate delisting and the Company cannot provide any assurance that any appeal would be successful.

Given the foregoing, the Board has determined that it is in the best interests of the Company and its stockholders to seek stockholder approval now for the Common Stock Reverse Stock Split, In addition, the Common Stock Reverse Stock Split would enable the Company to reserve a sufficient number of authorized shares of Common Stock for issuance upon exercise or conversion of all outstanding warrants and other convertible securities, including upon exercise of all of the Warrants.

10

The exact ratio of the Common Stock Reverse Stock Split shall be set at a whole number within the above range as determined by our Board in its sole discretion. Our Board believes that the availability of alternative reverse stock split ratios will provide it with the flexibility to implement the Common Stock Reverse Stock Split in a manner designed to maximize the anticipated benefits for the Company and its stockholders. In determining how to implement the Common Stock Reverse Stock Split following the receipt of stockholder approval, our Board may consider, among other things, factors such as:

• the historical trading price and trading volume of our Common Stock;

• the then-prevailing trading price and trading volume of our Common Stock and the anticipated impact of the Common Stock Reverse Stock Split on the trading market for our Common Stock;

• our ability to have our shares of Common Stock remain listed on the Nasdaq Capital Market;

• the number of shares of Common Stock needed to reserve for issuance upon exercise and conversion of all outstanding warrants and convertible securities, including, without limitation, the Warrants;

• the anticipated impact of the Common Stock Reverse Stock Split on our ability to raise additional financing; and

• prevailing general market and economic conditions.

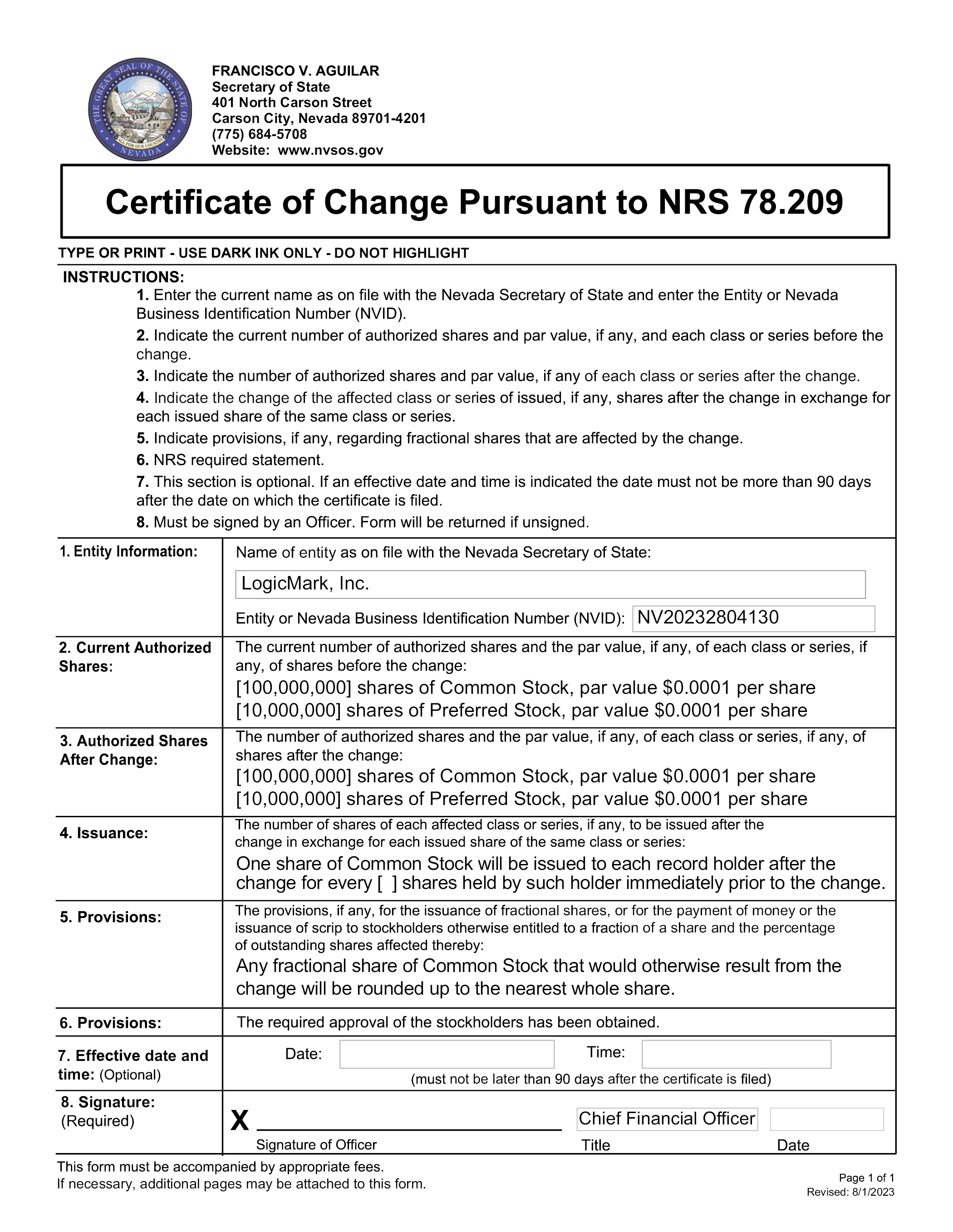

The Common Stock Reverse Stock Split will become effective upon filing of a certificate of change to our Charter (the “Common Stock Reverse Stock Split Amendment”) with the Secretary of State of the State of Nevada, if applicable and required pursuant to NRS 78.2055. The Common Stock Reverse Stock Split Amendment filed thereby will set forth the number of shares of Common Stock to be combined into one share of our Common Stock, within the limits set forth in this proposal. Except for adjustments that may result from the treatment of fractional shares as described below, each holder of our shares of Common Stock will hold the same percentage of our outstanding Common Stock immediately following the Common Stock Reverse Stock Split as such stockholder holds immediately prior to the Common Stock Reverse Stock Split.

The text of the form of Common Stock Reverse Stock Split Amendment, which would be filed with the Secretary of State of the State of Nevada to effect the Common Stock Reverse Stock Split, if applicable and required pursuant to NRS 78.2055, is substantially as set forth in Appendix A to this Proxy Statement. The text of such form of Common Stock Reverse Stock Split Amendment accompanying this Proxy Statement is, however, subject to modification to reflect the exact ratio for the Common Stock Reverse Stock Split and any changes that may be required by the office of the Secretary of State of the State of Nevada, or that the Board may determine to be necessary or advisable ultimately to comply with applicable law and to effect the Common Stock Reverse Stock Split.

Our Board believes that approval of the amendment to the Charter to effect the Common Stock Reverse Stock Split is in the best interests of the Company and our stockholders and has unanimously recommended that such proposal be presented to our stockholders for approval.

Board Requirement to Implement the Common Stock Reverse Stock Split

If this Proposal No. 2 and the Common Stock Reverse Stock Split is approved, the Common Stock Reverse Stock Split will be effected as soon as practicable or otherwise required after approved (with an exchange ratio determined by our Board as described above) in order (i) to maintain the listing of our Common Stock on the Nasdaq Capital Market, and (ii) to assure that there are a sufficient number of authorized shares of Common Stock available to reserve for issuance upon exercise and conversion of all outstanding warrants and convertible securities, including, without limitation, upon exercise of all of the Warrants in the event of the triggering of certain anti-dilution and other price adjustment provisions contained therein and/or the alternative cashless exercise provision contained in the Series D Warrants (which provisions are further described in Proposal No. 1). Such determination shall be based upon certain factors, including, but not limited to, the historical trading price and trading volume of our Common Stock, the then-prevailing trading price and trading volume of our Common Stock and the anticipated impact of the Common Stock Reverse Stock Split on the trading market for our Common Stock, our ability to have our shares of Common Stock remain listed on the Nasdaq Capital Market, the number of authorized and unissued shares of Common Stock available, the anticipated impact of the Common Stock Reverse Stock Split on our ability to raise additional financing, and prevailing general market and economic conditions. No further action on the part of stockholders would be required to either implement or not implement the Common Stock Reverse Stock

11

Split. If our stockholders approve the proposal, we would communicate to the public, prior to the Effective Date (as defined below), additional details regarding the Common Stock Reverse Stock Split, including the specific ratio selected by the Board. If the Board does not implement the Common Stock Reverse Stock Split by December 31, 2025, the authority granted in this proposal to implement the Common Stock Reverse Stock Split will terminate. The Board is requesting authorization to implement the Common Stock Reverse Stock Split up until such time in the event the Company needs to utilize this Proposal No. 2.

Effective Date

If the proposed amendment to the Charter to give effect to the Common Stock Reverse Stock Split is approved at the Special Meeting, subject to the conditions set out in this Proposal No. 2 and any changes to timing that may be required by the office of the Secretary of State of the State of Nevada, then the Common Stock Reverse Stock Split will become effective, as of 5:30 p.m. Eastern Time on the effective date of the Common Stock Reverse Stock Split Amendment filed with the office of the Secretary of State of the State of Nevada, if applicable and required pursuant to NRS 78.2055, which we would expect to be the date of filing (the “Effective Date”). Except as explained below with respect to fractional shares, each issued share of Common Stock immediately prior to the Effective Date will automatically be changed, as of the Effective Date, into a fraction of a share of Common Stock, based on the exchange ratio within the approved range determined by the Board.

Purposes of the Reverse Stock Split

The primary purpose for the Common Stock Reverse Stock Split is based on the Board’s belief that the Common Stock Reverse Stock Split will be necessary to maintain the listing of our Common Stock on the Nasdaq Capital Market. The Company also needs to assure that there are a sufficient number of authorized shares available for any future issuance of Common Stock upon the exercise or conversion of its outstanding warrants and convertible securities, including, without limitation, upon exercise of all of the Warrants in the event of the triggering of certain anti-dilution and other price adjustment provisions contained therein as well as the alternative cashless exercise provision contained in the Series D Warrants, which provisions are further described in Proposal No. 1. The Common Stock Reverse Stock Split would not change the number of authorized shares of our Common Stock or the par value of the Common Stock. The Board believes that the Common Stock Reverse Stock Split could also improve the marketability and liquidity of the Common Stock.

Maintain our listing on the Nasdaq Capital Market. Our Common Stock is traded on the Nasdaq Capital Market. On January 17, 2025, the SEC approved the rule change that Nasdaq proposed in August 2024 to modify the delisting process for certain listed stocks that fail to regain compliance with the Minimum Bid Price Requirement. Due to such recent rule change, in the event that the Common Stock trades below $1.00 per share for thirty (30) consecutive trading days within one year of any reverse stock split of outstanding shares of Common Stock, or the Company has previously implemented two reverse splits of its Common Stock over the applicable prior two-year period with a cumulative ratio of 250 shares or more to one, the Common Stock may be immediately delisted, and unless such determination is appealed, the Company would not be eligible for any compliance period during which it could regain compliance with such continued listing rule. On April 21, 2023, the Company effected the April 2023 Reverse Stock Splits. On November 18, 2024, the Company effected the November 2024 Reverse Stock Splits. In light of the April 2023 Reverse Stock Splits and the November 2024 Reverse Stock Splits and the recent trading prices of the Common Stock as of the date of this Proxy Statement, which have been below $1.00 per share, the Company may not be able to maintain compliance with the Minimum Bid Price Requirement or maintain its listing on the Nasdaq Capital Market by conducting another reverse stock split of the Common Stock in the event that it fails to comply with the Minimum Bid Price Requirement. Consequently, there is a possibility that the Common Stock may be subject to immediate delisting and the Company cannot provide any assurance that any appeal would be successful. The Board has considered the potential harm to the Company and its stockholders should Nasdaq delist our Common Stock from the Nasdaq Capital Market. Delisting our Common Stock could adversely affect the liquidity of our Common Stock because alternatives, such as the OTC Bulletin Board, OTC Markets, and the Pink Sheets, are generally considered to be less efficient markets. An investor likely would find it less convenient to sell, or to obtain accurate quotations in seeking to buy our Common Stock on an over-the-counter market. Many investors likely would not buy or sell our Common Stock due to difficulty in accessing over-the-counter markets, policies preventing them from trading in securities not listed on a national exchange or other reasons. The Board believes that the Common Stock Reverse Stock Split is an effective means for us to maintain compliance with the rules of Nasdaq and to avoid, or at least mitigate, the likely adverse consequences of our Common Stock being delisted from the Nasdaq Capital Market by producing the immediate effect of increasing the bid price of our Common Stock.

12

Improve the marketability and liquidity of the Common Stock. If this proposal is approved by the stockholders at the Special Meeting and the Common Stock Reverse Stock Split is implemented, we also believe that the increased market price of our Common Stock expected as a result of implementing the Common Stock Reverse Stock Split will improve the marketability and liquidity of our Common Stock and will encourage interest and trading in our Common Stock. The Common Stock Reverse Stock Split could allow a broader range of institutions to invest in our Common Stock (namely, funds that are prohibited from buying stocks whose price is below a certain threshold), potentially increasing the liquidity of our Common Stock. The Common Stock Reverse Stock Split could also help increase analyst and broker interest in our stock as their policies can discourage them from following or recommending companies with low stock prices. Because of the trading volatility often associated with low-priced stocks, many brokerage houses and institutional investors have internal policies and practices that either prohibit them from investing in low-priced stocks or tend to discourage individual brokers from recommending low-priced stocks to their customers. Some of those policies and practices may function to make the processing of trades in low-priced stocks economically unattractive to brokers. Additionally, because brokers’ commissions on low-priced stocks generally represent a higher percentage of the stock price than commissions on higher-priced stocks, the current average price per share of our Common Stock can result in individual stockholders paying transaction costs representing a higher percentage of their total share value than would be the case if the share price were substantially higher. It should be noted, however, that the liquidity of our Common Stock may in fact be adversely affected by the proposed Common Stock Reverse Stock Split given the reduced number of shares of Common Stock that would be outstanding after the Common Stock Reverse Stock Split.

For the above reasons, we believe that will help us regain and maintain compliance with the Nasdaq listing requirements and, as a result, could also improve the marketability and liquidity of our Common Stock, is in the best interests of the Company and our stockholders.

Risks of the Common Stock Reverse Stock Split

We cannot assure you that the proposed Common Stock Reverse Stock Split will increase our stock price and have the desired effect of maintaining compliance with the rules of Nasdaq. The Board expects that the Common Stock Reverse Stock Split of our Common Stock will increase the market price of our Common Stock so that we are able to maintain compliance with the Minimum Bid Price Requirement. However, the effect of the Common Stock Reverse Stock Split upon the market price of our Common Stock cannot be predicted with any certainty, and the history of similar reverse stock splits for companies in like circumstances is varied.

It is possible that the per share price of our Common Stock after the Common Stock Reverse Stock Split will not rise in proportion to the reduction in the number of shares of our Common Stock outstanding resulting from the Common Stock Reverse Stock Split, and the market price per post-Common Stock Reverse Stock Split share may not exceed or remain in excess of the $1.00 minimum bid price for a sustained period of time, and the Common Stock Reverse Stock Split may not result in a per share price that would attract brokers and investors who do not trade in lower priced stocks. Even if we effect the Common Stock Reverse Stock Split, the market price of our Common Stock may decrease due to factors unrelated to the Common Stock Reverse Stock Split. In any case, the market price of our Common Stock may also be based on other factors which may be unrelated to the number of shares outstanding, including our future performance. If the Common Stock Reverse Stock Split is consummated and the trading price of the Common Stock declines, the percentage decline as an absolute number and as a percentage of our overall market capitalization may be greater than would occur in the absence of the Common Stock Reverse Stock Split. Even if the market price per post-Common Stock Reverse Stock Split share of our Common Stock remains in excess of $1.00 per share, we may be delisted due to a failure to meet other continued listing requirements, including Nasdaq requirements related to the minimum stockholders’ equity, the minimum number of shares that must be in the public float, the minimum market value of the public float and the minimum number of round lot holders.

The Common Stock Reverse Stock Split may decrease the liquidity of our Common Stock. The liquidity of our Common Stock may be harmed by the Common Stock Reverse Stock Split given the reduced number of shares of Common Stock that would be outstanding after the Common Stock Reverse Stock Split, particularly if the stock price does not increase as a result of the Common Stock Reverse Stock Split. In addition, investors might consider the increased proportion of unissued authorized shares of Common Stock to issued shares to have an anti-takeover effect under certain circumstances, because the proportion allows for dilutive issuances which could prevent certain stockholders from changing the composition of the Board or render tender offers for a combination with another entity more difficult to successfully complete. The Board does not intend for the Common Stock Reverse Stock Split to have any anti-takeover effects.

13

The Common Stock Reverse Stock Split may increase the dilutive impact of the Warrants outlined in Proposal No. 1. Pursuant to the terms of the Series C Warrants and Series D Warrants, upon the implementation of the Common Stock Reverse Stock Split, the exercise price of each of the Warrants may be subject to a one-time adjustment such that in the event that the lowest VWAP (as defined in the Warrants) during the five trading day period before and after such reverse stock split is lower than the exercise price of the Warrants then in effect, the exercise price of the Warrants will be reduced to such lowest price during such 11-trading day period, subject to the Floor Price (solely with respect to the calculation of the number of Warrant Shares issuable thereunder). Further, upon such an exercise price adjustment, the number of shares issuable upon exercise of the Warrants will increase such that the aggregate exercise price payable under the Warrants, after taking into account such decreased exercise price, will equal the aggregate exercise price of such Warrants on the date of their issuance; provided that in the event that such adjustment would result in an increase in such exercise price, the exercise price of the Warrants will be reduced to such lowest price during the five trading day period prior to and ending on the date of such exercise. Accordingly, the Common Stock Reverse Stock Split, if implemented, may increase the dilutive impact of the Warrants outlined in Proposal No 1.

Principal Effects of the Common Stock Reverse Stock Split

Common Stock. If this proposal is approved by the stockholders at the Special Meeting and the Common Stock Reverse Stock Split is implemented, subject to the conditions set out in this Proposal No. 2, the Company will file a certificate of change to the Charter with the Secretary of State of the State of Nevada, if applicable and required pursuant to NRS 78.2055. Except for adjustments that may result from the treatment of fractional shares as described below, each issued share of Common Stock immediately prior to the Effective Date will automatically be changed, as of the Effective Date, into a fraction of a share of Common Stock based on the exchange ratio within the approved range determined by the Board. In addition, proportional adjustments will be made to the maximum number of shares of Common Stock issuable under, and other terms of, (i) our stock plans, and (ii) the number of shares of Common Stock issuable under, and the exercise price of, our outstanding preferred stock, options and warrants.

Except for adjustments that may result from the treatment of fractional shares of Common Stock as described below, because the Common Stock Reverse Stock Split would apply to all issued shares of our Common Stock, and assuming Proposal No. 3 is approved by the Company’s stockholders and the Board implements the Series C Preferred Reverse Stock Split at the same ratio that the Board sets for the Common Stock Reverse Stock Split, as described in Proposal No. 3, the Common Stock Reverse Stock Split would not alter the relative rights and preferences of our existing stockholders nor affect any stockholder’s proportionate equity interest in the Company. For example, a holder of two percent (2%) of the voting power of the outstanding shares of our Common Stock and Series C Preferred Stock, in the aggregate, immediately prior to the effectiveness of the Common Stock Reverse Stock Split will generally continue to hold two percent (2%) of the voting power of the outstanding shares of our Common Stock and Series C Preferred Stock, in the aggregate, immediately after the Common Stock Reverse Stock Split. Moreover, the number of stockholders of record of the Company’s Common Stock and Series C Preferred Stock will not be affected by the Common Stock Reverse Stock Split. The Common Stock Reverse Stock Split would not result in a change to the number of authorized shares of our Common Stock or the par value of the Common Stock. The Common Stock Reverse Stock Split will have the effect of creating additional unreserved shares of our authorized Common Stock. Although at present we have no current arrangements or understandings providing for the issuance of the additional shares of Common Stock that would be made available for issuance upon effectiveness of the Common Stock Reverse Stock Split, other than those shares needed to satisfy the exercise of the Company’s outstanding warrants, preferred stock and options, these additional shares of Common Stock may be used by us for various purposes in the future without further stockholder approval, including, among other things:

• raising capital to fund our operations and to continue as a going concern;

• establishing strategic relationships with other companies;

• providing equity incentives to our employees, officers or directors; and

• expanding our business or product lines through the acquisition of other businesses or products.

While the Common Stock Reverse Stock Split will make additional shares of Common Stock available for the Company to use in connection with the foregoing, the primary purpose of the Common Stock Reverse Stock Split is to increase our stock price in order to regain and maintain compliance with the Minimum Bid Price Requirement. In addition,

14

the additional shares of Common Stock available for the Company to use in connection with the foregoing will also provide for a sufficient number of authorized shares of Common Stock available for any future issuance of Common Stock upon the exercise of the Company’s outstanding warrants, including, without limitation, the Warrants, which will be considered in determining the ratio of the Common Stock Reverse Stock Split.

Effect on Employee Plans, Options, Restricted Stock Awards and Convertible or Exchangeable Securities. Pursuant to the terms of the 2013 LTIP, the 2017 SIP and the 2023 SIP (collectively, the “Plans”), the Board or a committee thereof, as applicable, will adjust the number of shares of Common Stock available for future grant under the Plans, the number of shares of Common Stock underlying outstanding awards, the exercise price per share of outstanding stock options, and other terms of outstanding awards issued pursuant to the Plans to equitably reflect the effects of the Common Stock Reverse Stock Split. Based upon the Common Stock Reverse Stock Split ratio determined by the Board, proportionate adjustments are also generally required to be made to the per share exercise or conversion prices, as applicable, and the number of shares of Common Stock issuable upon the exercise or conversion, as applicable, of outstanding options, preferred stock and warrants, and any other convertible or exchangeable securities that may entitle the holders thereof to purchase, exchange for, or convert into, shares of Common Stock. This would result in approximately the same aggregate price being required to be paid under such options, preferred stock, warrants and other then outstanding convertible or exchangeable securities upon exercise or conversion, as applicable, and approximately the same value of shares of Common Stock being delivered upon such exercise, exchange or conversion, immediately following the Common Stock Reverse Stock Split as was the case immediately preceding the Common Stock Reverse Stock Split. The number of shares of Common Stock subject to restricted stock awards and restricted stock units will be similarly adjusted, subject to our treatment of fractional shares of Common Stock. The number of shares of Common Stock reserved for issuance pursuant to these securities and our Plans will be adjusted proportionately based upon the Common Stock Reverse Stock Split ratio determined by the Board, subject to our treatment of fractional shares of Common Stock.

Listing. Our shares of Common Stock currently trade on the Nasdaq Capital Market. The Common Stock Reverse Stock Split will directly affect the listing of our Common Stock on the Nasdaq Capital Market, and we believe that the Common Stock Reverse Stock Split could potentially increase our stock price, facilitating continued compliance with the Minimum Bid Price Requirement. Following the Common Stock Reverse Stock Split, we intend for our Common Stock to continue to be listed on the Nasdaq Capital Market under the symbol “LGMK”, subject to our ability to continue to comply with Nasdaq rules, although our Common Stock would have a new committee on uniform securities identification procedures (“CUSIP”) number, a number used to identify our Common Stock.