Q4 & FY 2018 Results Review February 7, 2019 Exhibit 99.2

Safe Harbor Statement and Disclosures All statements other than statements of historical fact contained in this presentation including statements regarding our competitive strengths; business strategy; future financial position or operating results; budgets; projections with respect to revenue, income, earnings (or loss) per share, capital expenditures, dividends, capital structure or other financial items; costs; and plans and objectives of management regarding operations and products, are forward-looking statements. These statements may include terminology such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “outlook”, “continue”, “remain”, “on track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “prospects”, “plan”, or similar terminology. Forward-looking statements are not guarantees of future performance. Rather, they are based on current views and assumptions and involve known and unknown risks, uncertainties and other factors, many of which are outside our control and are difficult to predict. If any of these risks and uncertainties materialize or other assumptions underlying any of the forward-looking statements prove to be incorrect, the actual results or developments may differ materially from any future results or developments expressed or implied by the forward-looking statements. Factors, risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements include, among others: the many interrelated factors that affect consumer confidence and worldwide demand for capital goods and capital goods-related products; general economic conditions in each of our markets; changes in government policies regarding banking, monetary and fiscal policy; legislation, particularly relating to capital goods-related issues such as agriculture, the environment, debt relief and subsidy program policies, trade and commerce and infrastructure development; government policies on international trade and investment, including sanctions, import quotas, capital controls and tariffs; actions of competitors in the various industries in which we compete; development and use of new technologies and technological difficulties; the interpretation of, or adoption of new, compliance requirements with respect to engine emissions, safety or other aspects of our products; production difficulties, including capacity and supply constraints and excess inventory levels; labor relations; interest rates and currency exchange rates; inflation and deflation; energy prices; prices for agricultural commodities; housing starts and other construction activity; our ability to obtain financing or to refinance existing debt; a decline in the price of used vehicles; the resolution of pending litigation and investigations on a wide range of topics, including dealer and supplier litigation, follow-on private litigation in various jurisdictions after the settlement of the EU antitrust investigation announced on July 19, 2016, intellectual property rights disputes, product warranty and defective product claims, and emissions and/or fuel economy regulatory and contractual issues; our pension plans and other post-employment obligations; political and civil unrest; volatility and deterioration of capital and financial markets, including possible effects of “Brexit”, terror attacks in Europe and elsewhere, and other similar risks and uncertainties and our success in managing the risks involved in the foregoing. Further information concerning factors, risks, and uncertainties that could materially affect the Company’s financial results is included in our annual report on Form 20-F for the year ended December 31, 2017, prepared in accordance with U.S. GAAP and in the Company’s EU Annual Report at December 31, 2017, prepared in accordance with EU-IFRS. Investors should refer to and consider the incorporated information on risks, factors, and uncertainties in addition to the information presented here. Investors should consider non-GAAP financial measures in addition to, and not as a substitute for, financial measures prepared in accordance with U.S. GAAP. Reconciliations of non-GAAP measures to the most directly comparable GAAP measure are presented in our earning releases, which are available in EDGAR on the SEC’s website at www.sec.gov and on our website at www.cnhindustrial.com. Forward-looking statements are based upon assumptions relating to the factors described in this presentation, which are sometimes based upon estimates and data received from third parties. Such estimates and data are often revised. Our actual results could differ materially from those anticipated in such forward-looking statements. Forward-looking statements speak only as of the date on which such statements are made, and we undertake no obligation to update or revise publicly our forward-looking statements. Further information concerning CNH Industrial and its businesses, including factors that potentially could materially affect CNH Industrial’s financial results, is included in CNH Industrial’s reports and filings with the U.S. Securities and Exchange Commission (“SEC”), the Autoriteit Financiële Markten (“AFM”) and Commissione Nazionale per le Società e la Borsa (“CONSOB”). All future written and oral forward-looking statements by CNH Industrial or persons acting on the behalf of CNH Industrial are expressly qualified in their entirety by the cautionary statements contained herein or referred to above.

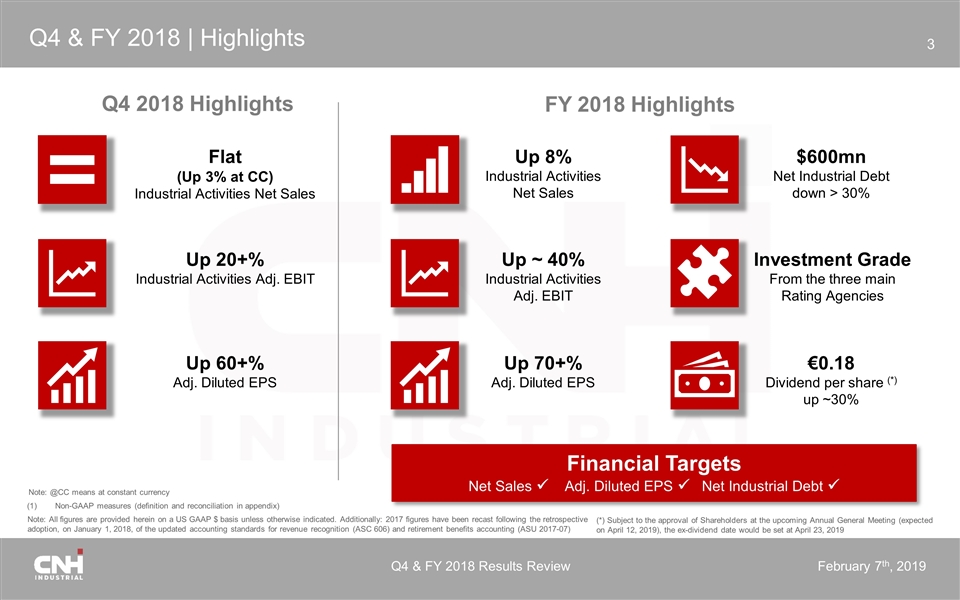

Q4 & FY 2018 | Highlights Note: All figures are provided herein on a US GAAP $ basis unless otherwise indicated. Additionally: 2017 figures have been recast following the retrospective adoption, on January 1, 2018, of the updated accounting standards for revenue recognition (ASC 606) and retirement benefits accounting (ASU 2017-07) Non-GAAP measures (definition and reconciliation in appendix) (*) Subject to the approval of Shareholders at the upcoming Annual General Meeting (expected on April 12, 2019), the ex-dividend date would be set at April 23, 2019 FY 2018 Highlights Q4 2018 Highlights Financial Targets Net Sales ü Adj. Diluted EPS ü Net Industrial Debt ü $600mn Net Industrial Debt down > 30% Flat (Up 3% at CC) Industrial Activities Net Sales Up 8% Industrial Activities Net Sales Up 70+% Adj. Diluted EPS €0.18 Dividend per share (*) up ~30% Up 60+% Adj. Diluted EPS Up ~ 40% Industrial Activities Adj. EBIT Investment Grade From the three main Rating Agencies Up 20+% Industrial Activities Adj. EBIT Note: @CC means at constant currency

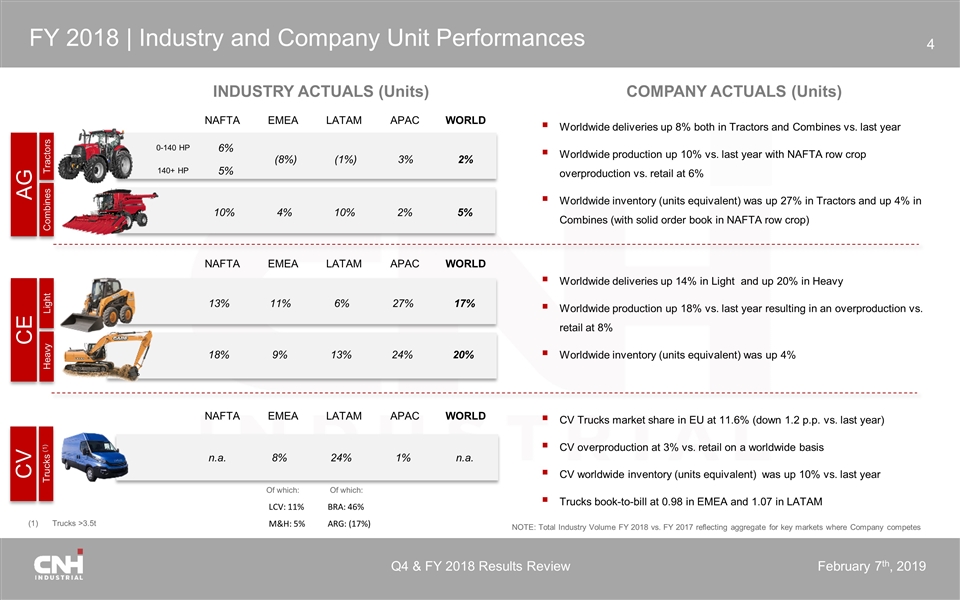

FY 2018 | Industry and Company Unit Performances Worldwide deliveries up 8% both in Tractors and Combines vs. last year Worldwide production up 10% vs. last year with NAFTA row crop overproduction vs. retail at 6% Worldwide inventory (units equivalent) was up 27% in Tractors and up 4% in Combines (with solid order book in NAFTA row crop) Worldwide deliveries up 14% in Light and up 20% in Heavy Worldwide production up 18% vs. last year resulting in an overproduction vs. retail at 8% Worldwide inventory (units equivalent) was up 4% CV Trucks market share in EU at 11.6% (down 1.2 p.p. vs. last year) CV overproduction at 3% vs. retail on a worldwide basis CV worldwide inventory (units equivalent) was up 10% vs. last year Trucks book-to-bill at 0.98 in EMEA and 1.07 in LATAM NOTE: Total Industry Volume FY 2018 vs. FY 2017 reflecting aggregate for key markets where Company competes AG Tractors Combines 0-140 HP 6% (8%) (1%) 3% 2% 140+ HP 5% CE Light Heavy 10% 4% 10% 2% 5% NAFTA EMEA LATAM APAC WORLD 18% 9% 13% 24% 20% 13% 11% 6% 27% 17% CV Trucks (1) n.a. 8% 24% 1% n.a. INDUSTRY ACTUALS (Units) NAFTA EMEA LATAM APAC WORLD NAFTA EMEA LATAM APAC WORLD COMPANY ACTUALS (Units) Trucks >3.5t Of which: Of which: LCV: 11% M&H: 5% BRA: 46% ARG: (17%)

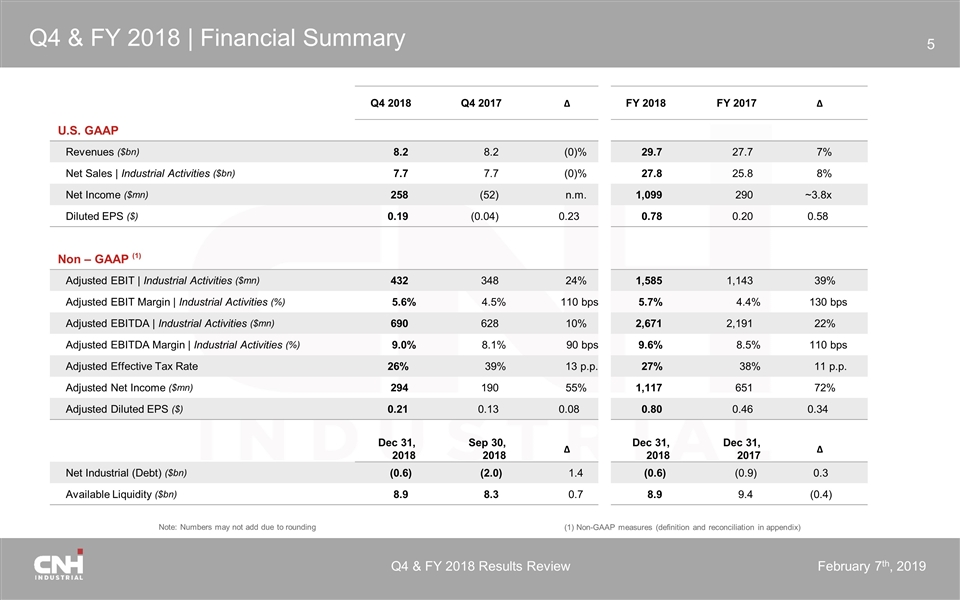

Q4 & FY 2018 | Financial Summary (1) Non-GAAP measures (definition and reconciliation in appendix) Q4 2018 Q4 2017 Δ FY 2018 FY 2017 Δ U.S. GAAP Revenues ($bn) 8.2 8.2 (0)% 29.7 27.7 7% Net Sales | Industrial Activities ($bn) 7.7 7.7 (0)% 27.8 25.8 8% Net Income ($mn) 258 (52) n.m. 1,099 290 ~3.8x Diluted EPS ($) 0.19 (0.04) 0.23 0.78 0.20 0.58 Non – GAAP (1) Adjusted EBIT | Industrial Activities ($mn) 432 348 24% 1,585 1,143 39% Adjusted EBIT Margin | Industrial Activities (%) 5.6% 4.5% 110 bps 5.7% 4.4% 130 bps Adjusted EBITDA | Industrial Activities ($mn) 690 628 10% 2,671 2,191 22% Adjusted EBITDA Margin | Industrial Activities (%) 9.0% 8.1% 90 bps 9.6% 8.5% 110 bps Adjusted Effective Tax Rate 26% 39% 13 p.p. 27% 38% 11 p.p. Adjusted Net Income ($mn) 294 190 55% 1,117 651 72% Adjusted Diluted EPS ($) 0.21 0.13 0.08 0.80 0.46 0.34 Dec 31, 2018 Sep 30, 2018 Δ Dec 31, 2018 Dec 31, 2017 Δ Net Industrial (Debt) ($bn) (0.6) (2.0) 1.4 (0.6) (0.9) 0.3 Available Liquidity ($bn) 8.9 8.3 0.7 8.9 9.4 (0.4) Note: Numbers may not add due to rounding

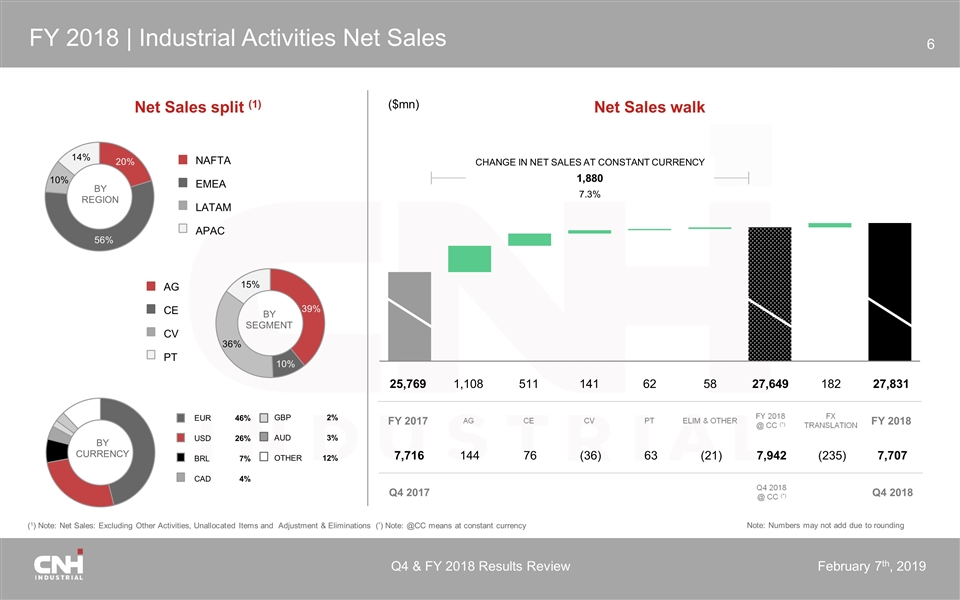

FY 2018 | Industrial Activities Net Sales Net Sales split (1) BY SEGMENT AG CE CV PT (1) Note: Net Sales: Excluding Other Activities, Unallocated Items and Adjustment & Eliminations BY CURRENCY EUR 46% USD 26% BRL 7% CAD 4% GBP 2% AUD 3% OTHER 12% Note: Numbers may not add due to rounding (*) Note: @CC means at constant currency ($mn) 25,769 1,108 511 141 62 58 27,649 182 27,831 FY 2017 AG CE CV PT ELIM & OTHER FY 2018 @ CC (*) FX TRANSLATION FY 2018 CHANGE IN NET SALES AT CONSTANT CURRENCY 1,880 7.3% Net Sales walk 7,716 144 76 (36) 63 (21) 7,942 (235) 7,707 Q4 2017 Q4 2018 @ CC (*) Q4 2018 BY REGION NAFTA EMEA LATAM APAC

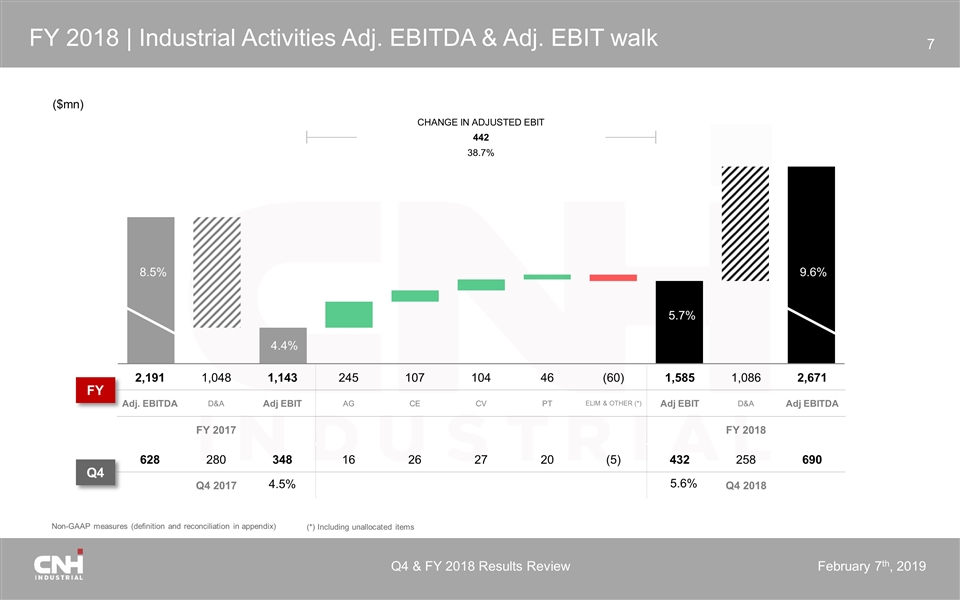

FY 2018 | Industrial Activities Adj. EBITDA & Adj. EBIT walk Non-GAAP measures (definition and reconciliation in appendix) 2,191 1,048 1,143 245 107 104 46 (60) 1,585 1,086 2,671 Adj. EBITDA D&A Adj EBIT AG CE CV PT ELIM & OTHER (*) Adj EBIT D&A Adj EBITDA FY 2017 FY 2018 CHANGE IN ADJUSTED EBIT 442 38.7% 8.5% 4.4% 5.7% 9.6% (*) Including unallocated items ($mn) 628 280 348 16 26 27 20 (5) 432 258 690 Q4 2017 Q4 2018 FY Q4 4.5% 5.6%

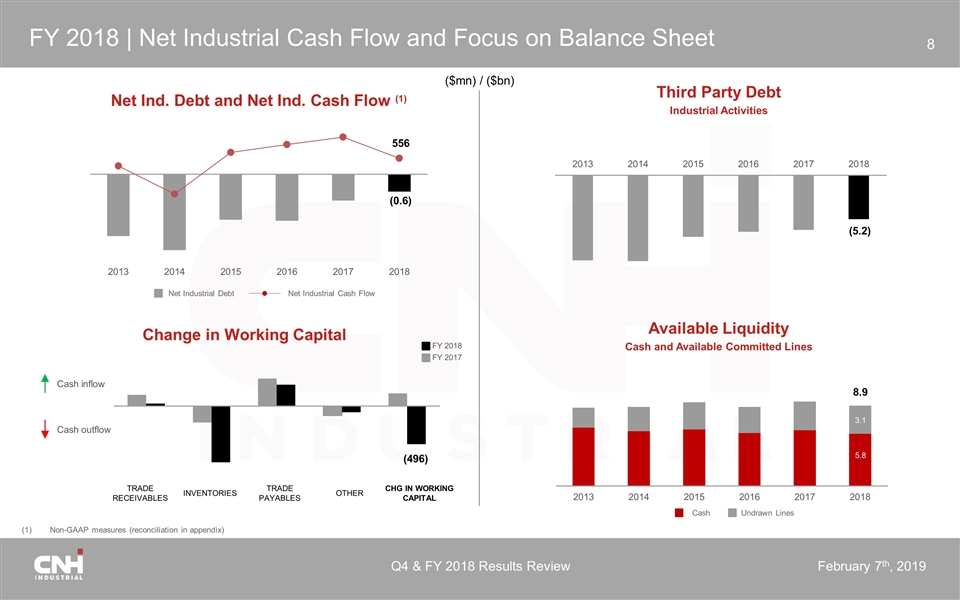

FY 2018 | Net Industrial Cash Flow and Focus on Balance Sheet Available Liquidity Cash and Available Committed Lines 3.1 (5.2) 8.9 Change in Working Capital Cash inflow Cash outflow TRADE RECEIVABLES INVENTORIES TRADE PAYABLES OTHER CHG IN WORKING CAPITAL (496) FY 2018 FY 2017 Third Party Debt Industrial Activities Non-GAAP measures (reconciliation in appendix) Net Ind. Debt and Net Ind. Cash Flow (1) (0.6) 556 Net Industrial Debt Net Industrial Cash Flow Cash Undrawn Lines 5.8 ($mn) / ($bn)

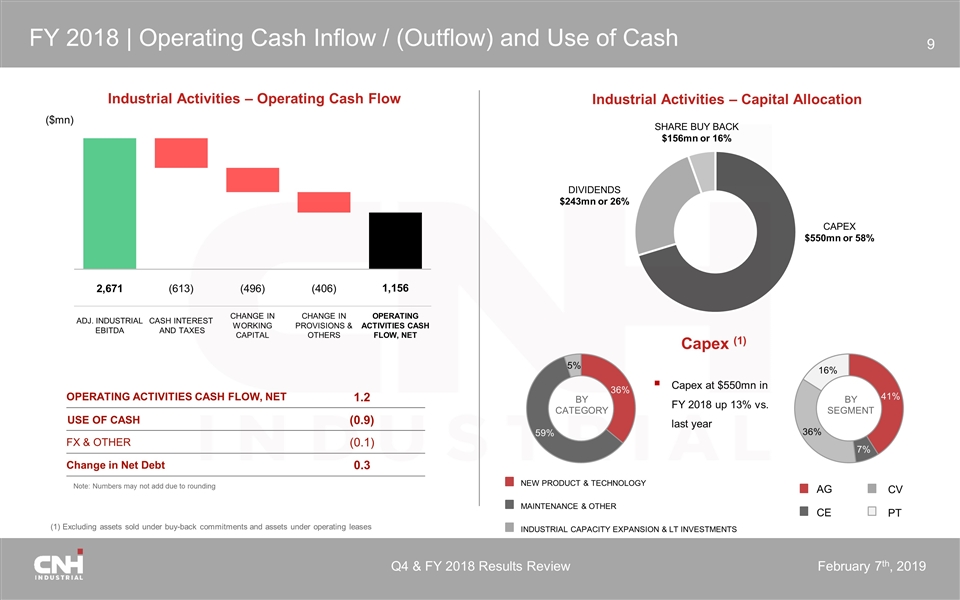

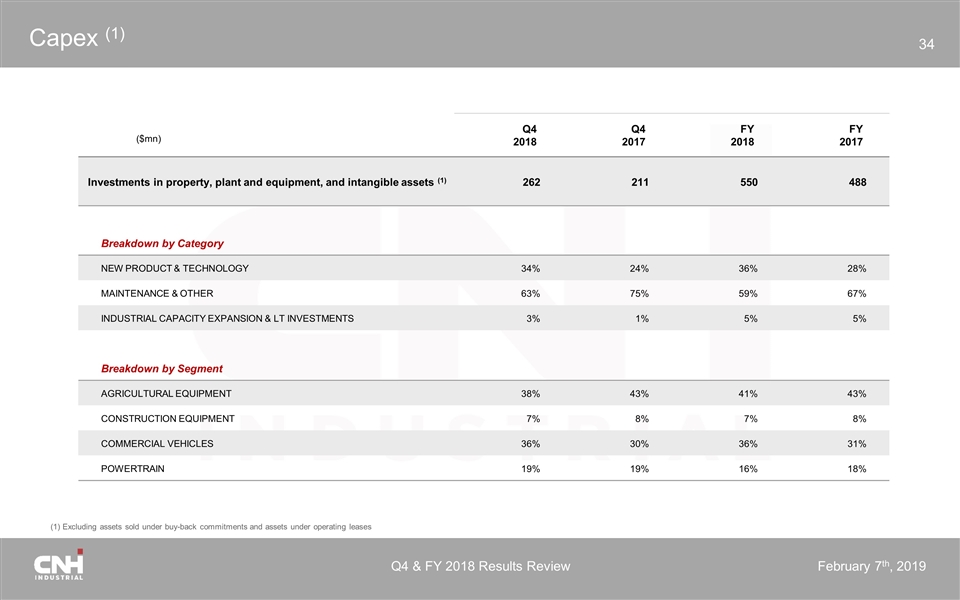

FY 2018 | Operating Cash Inflow / (Outflow) and Use of Cash Industrial Activities – Capital Allocation CAPEX $550mn or 58% DIVIDENDS $243mn or 26% SHARE BUY BACK $156mn or 16% Industrial Activities – Operating Cash Flow 2,671 (613) (496) (406) 1,156 ADJ. INDUSTRIAL EBITDA CASH INTEREST AND TAXES CHANGE IN WORKING CAPITAL CHANGE IN PROVISIONS & OTHERS OPERATING ACTIVITIES CASH FLOW, NET ($mn) Note: Numbers may not add due to rounding OPERATING ACTIVITIES CASH FLOW, NET 1.2 USE OF CASH (0.9) FX & OTHER (0.1) Change in Net Debt 0.3 Capex (1) BY CATEGORY BY SEGMENT NEW PRODUCT & TECHNOLOGY MAINTENANCE & OTHER INDUSTRIAL CAPACITY EXPANSION & LT INVESTMENTS AG CE CV PT Capex at $550mn in FY 2018 up 13% vs. last year (1) Excluding assets sold under buy-back commitments and assets under operating leases

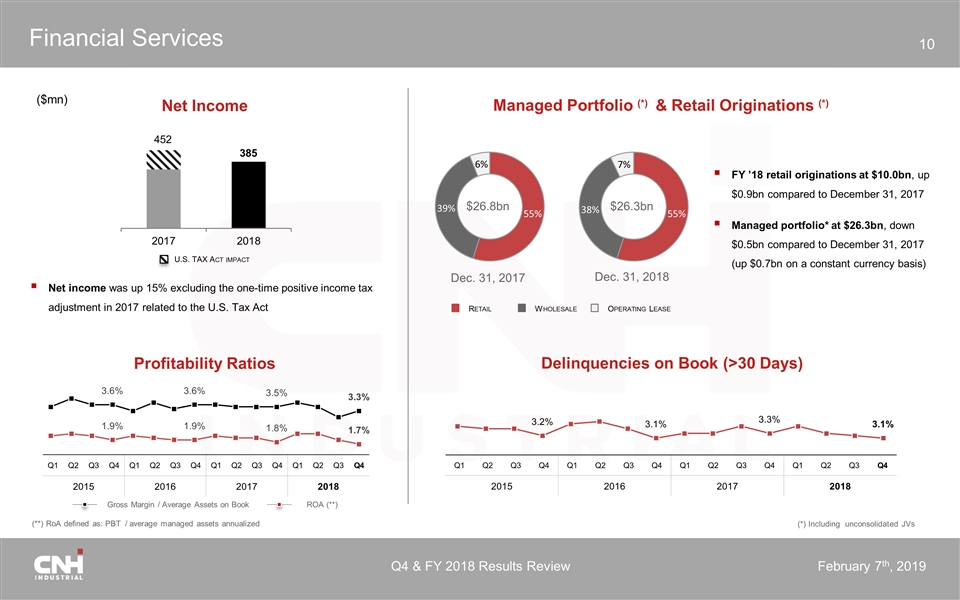

Financial Services (*) Including unconsolidated JVs Managed Portfolio (*) & Retail Originations (*) FY ’18 retail originations at $10.0bn, up $0.9bn compared to December 31, 2017 Managed portfolio* at $26.3bn, down $0.5bn compared to December 31, 2017 (up $0.7bn on a constant currency basis) $26.8bn $26.3bn Dec. 31, 2017 Dec. 31, 2018 Retail Wholesale Operating Lease Delinquencies on Book (>30 Days) (**) RoA defined as: PBT / average managed assets annualized Net Income ($mn) 452 385 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2015 2016 2017 2018 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 Q1 Q2 Q3 Q4 2015 2016 2017 2018 Profitability Ratios Gross Margin / Average Assets on Book ROA (**) U.S. TAX Act impact Net income was up 15% excluding the one-time positive income tax adjustment in 2017 related to the U.S. Tax Act

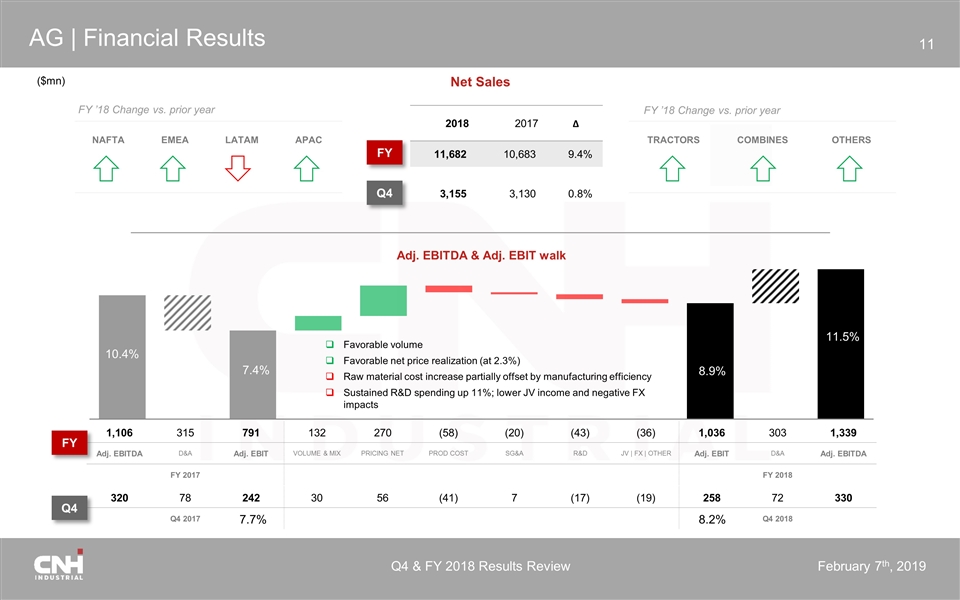

AG | Financial Results Adj. EBITDA & Adj. EBIT walk ($mn) NAFTA EMEA LATAM APAC TRACTORS COMBINES OTHERS FY ’18 Change vs. prior year 1,106 315 791 132 270 (58) (20) (43) (36) 1,036 303 1,339 Adj. EBITDA D&A Adj. EBIT VOLUME & MIX PRICING NET PROD COST SG&A R&D JV | FX | OTHER Adj. EBIT D&A Adj. EBITDA FY 2017 FY 2018 Net Sales 10.4% 7.4% 8.9% 11.5% Favorable volume Favorable net price realization (at 2.3%) Raw material cost increase partially offset by manufacturing efficiency Sustained R&D spending up 11%; lower JV income and negative FX impacts 320 78 242 30 56 (41) 7 (17) (19) 258 72 330 Q4 2017 Q4 2018 FY Q4 FY ’18 Change vs. prior year 2018 2017 Δ 11,682 10,683 9.4% 3,155 3,130 0.8% FY Q4 7.7% 8.2%

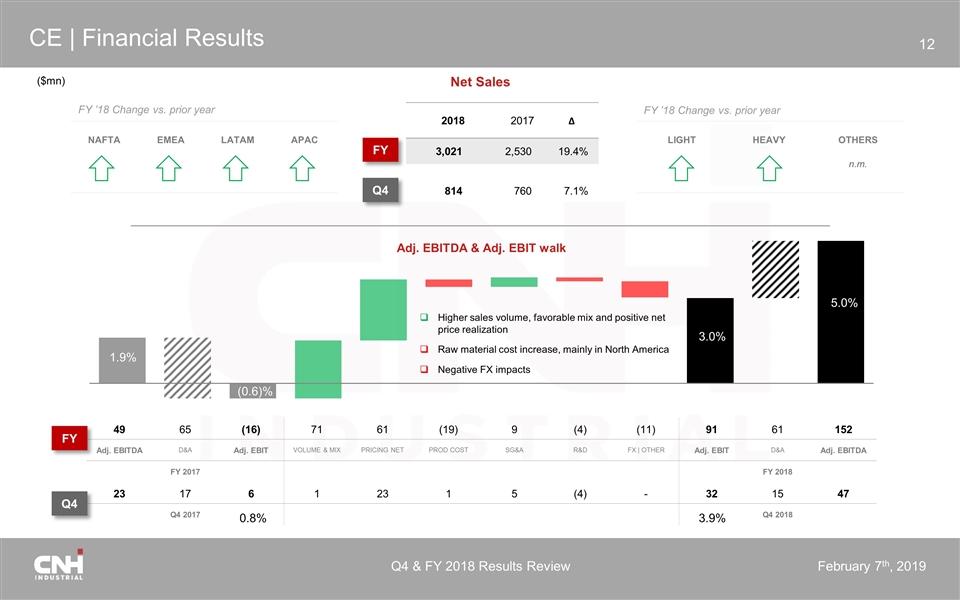

CE | Financial Results Adj. EBITDA & Adj. EBIT walk Net Sales ($mn) NAFTA EMEA LATAM APAC LIGHT HEAVY OTHERS n.m. 1.9% (0.6)% 3.0% 5.0% Higher sales volume, favorable mix and positive net price realization Raw material cost increase, mainly in North America Negative FX impacts 49 65 (16) 71 61 (19) 9 (4) (11) 91 61 152 Adj. EBITDA D&A Adj. EBIT VOLUME & MIX PRICING NET PROD COST SG&A R&D FX | OTHER Adj. EBIT D&A Adj. EBITDA FY 2017 FY 2018 23 17 6 1 23 1 5 (4) - 32 15 47 Q4 2017 Q4 2018 FY Q4 2018 2017 Δ 3,021 2,530 19.4% 814 760 7.1% FY Q4 FY ’18 Change vs. prior year FY ’18 Change vs. prior year 0.8% 3.9%

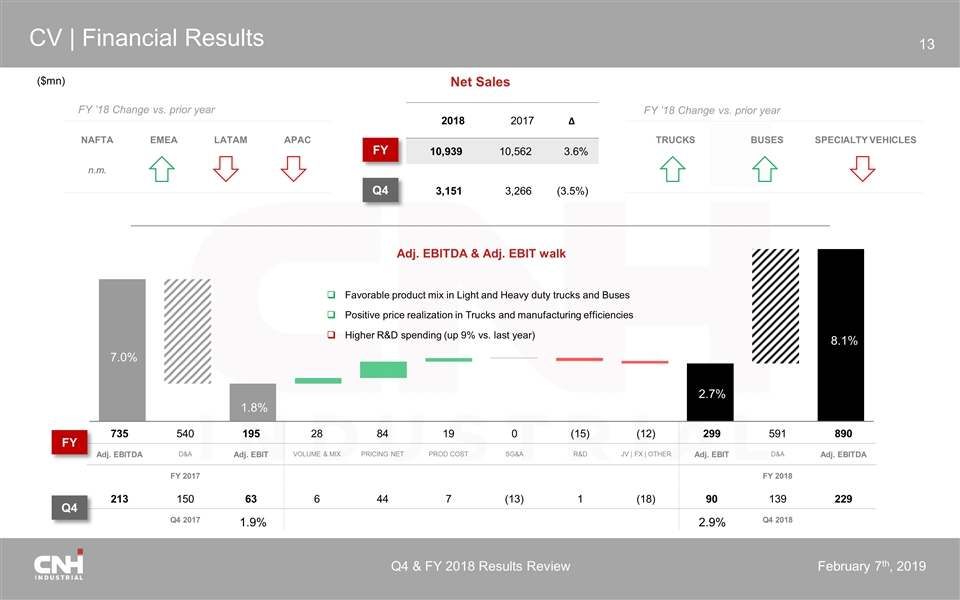

CV | Financial Results Adj. EBITDA & Adj. EBIT walk ($mn) NAFTA EMEA LATAM APAC n.m. TRUCKS BUSES SPECIALTY VEHICLES 7.0% 1.8% 2.7% 8.1% 735 540 195 28 84 19 0 (15) (12) 299 591 890 Adj. EBITDA D&A Adj. EBIT VOLUME & MIX PRICING NET PROD COST SG&A R&D JV | FX | OTHER Adj. EBIT D&A Adj. EBITDA FY 2017 FY 2018 Net Sales 213 150 63 6 44 7 (13) 1 (18) 90 139 229 Q4 2017 Q4 2018 Favorable product mix in Light and Heavy duty trucks and Buses Positive price realization in Trucks and manufacturing efficiencies Higher R&D spending (up 9% vs. last year) FY Q4 2018 2017 Δ 10,939 10,562 3.6% 3,151 3,266 (3.5%) FY Q4 FY ’18 Change vs. prior year FY ’18 Change vs. prior year 1.9% 2.9%

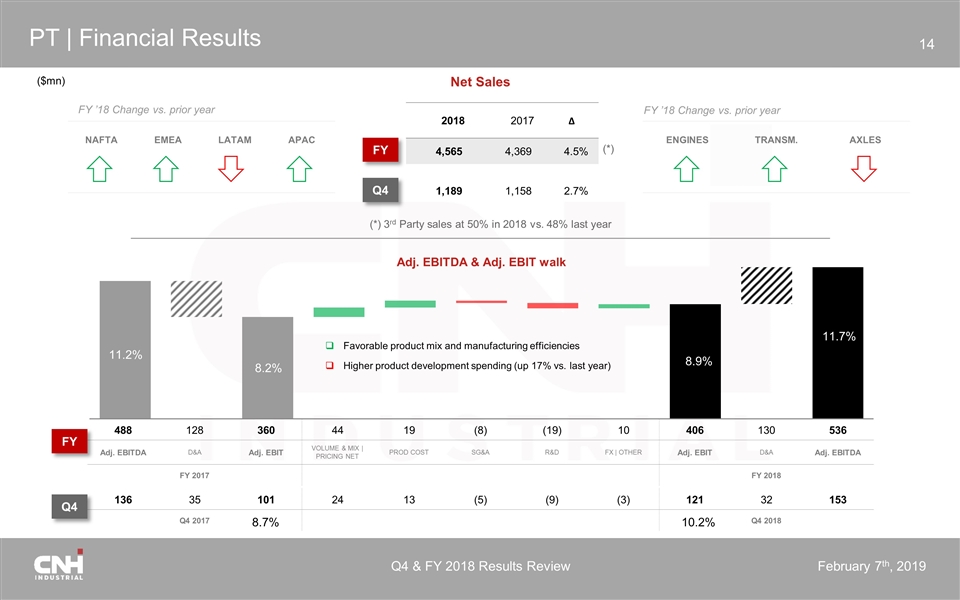

PT | Financial Results Adj. EBITDA & Adj. EBIT walk (*) NAFTA EMEA LATAM APAC ENGINES TRANSM. AXLES 488 128 360 44 19 (8) (19) 10 406 130 536 Adj. EBITDA D&A Adj. EBIT VOLUME & MIX | PRICING NET PROD COST SG&A R&D FX | OTHER Adj. EBIT D&A Adj. EBITDA FY 2017 FY 2018 11.2% 8.2% 8.9% 11.7% Favorable product mix and manufacturing efficiencies Higher product development spending (up 17% vs. last year) 136 35 101 24 13 (5) (9) (3) 121 32 153 Q4 2017 Q4 2018 FY Q4 Net Sales 2018 2017 Δ 4,565 4,369 4.5% 1,189 1,158 2.7% FY Q4 FY ’18 Change vs. prior year FY ’18 Change vs. prior year (*) 3rd Party sales at 50% in 2018 vs. 48% last year 8.7% 10.2% ($mn)

FY 2019E US GAAP Financial Targets and Market Outlook

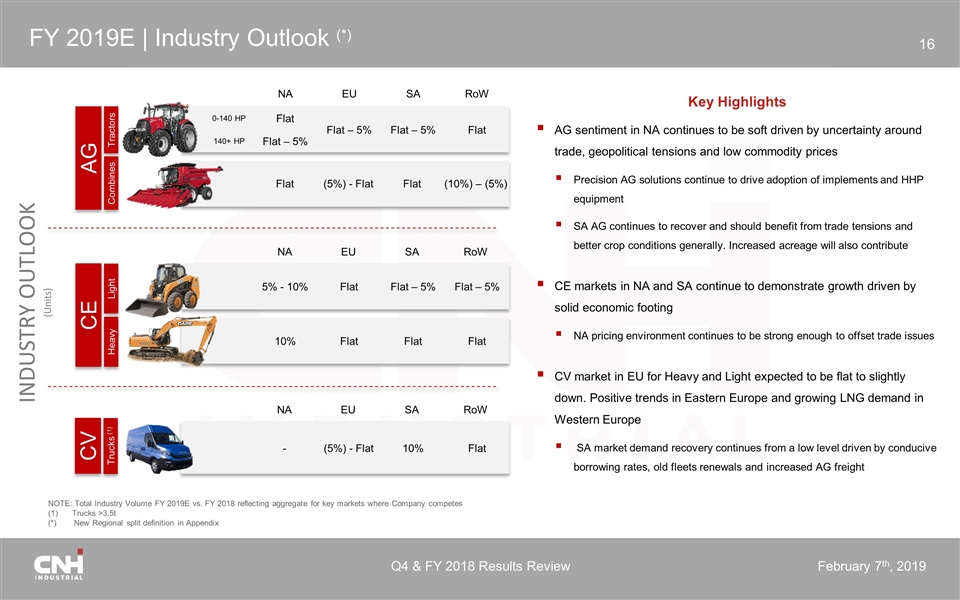

FY 2019E | Industry Outlook (*) NOTE: Total Industry Volume FY 2019E vs. FY 2018 reflecting aggregate for key markets where Company competes Trucks >3.5t (*) New Regional split definition in Appendix AG Tractors Combines 0-140 HP Flat Flat – 5% Flat – 5% Flat 140+ HP Flat – 5% CE Light Heavy Flat (5%) - Flat Flat (10%) – (5%) NA EU SA RoW 10% Flat Flat Flat NA EU SA RoW 5% - 10% Flat Flat – 5% Flat – 5% CV Trucks (1) NA EU SA RoW - (5%) - Flat 10% Flat INDUSTRY OUTLOOK (Units) Key Highlights AG sentiment in NA continues to be soft driven by uncertainty around trade, geopolitical tensions and low commodity prices Precision AG solutions continue to drive adoption of implements and HHP equipment SA AG continues to recover and should benefit from trade tensions and better crop conditions generally. Increased acreage will also contribute CE markets in NA and SA continue to demonstrate growth driven by solid economic footing NA pricing environment continues to be strong enough to offset trade issues CV market in EU for Heavy and Light expected to be flat to slightly down. Positive trends in Eastern Europe and growing LNG demand in Western Europe SA market demand recovery continues from a low level driven by conducive borrowing rates, old fleets renewals and increased AG freight

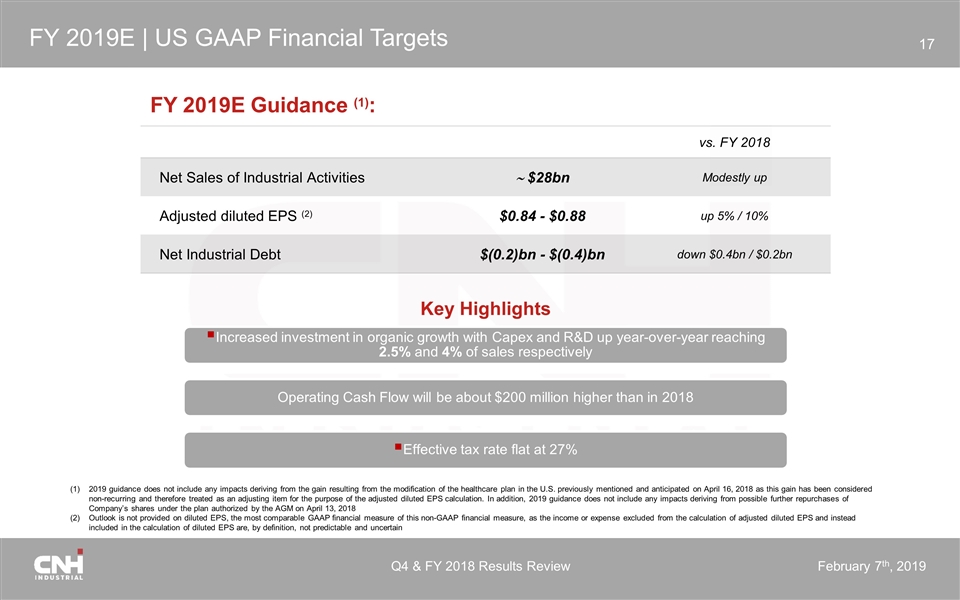

FY 2019E | US GAAP Financial Targets (1) 2019 guidance does not include any impacts deriving from the gain resulting from the modification of the healthcare plan in the U.S. previously mentioned and anticipated on April 16, 2018 as this gain has been considered non-recurring and therefore treated as an adjusting item for the purpose of the adjusted diluted EPS calculation. In addition, 2019 guidance does not include any impacts deriving from possible further repurchases of Company’s shares under the plan authorized by the AGM on April 13, 2018 (2)Outlook is not provided on diluted EPS, the most comparable GAAP financial measure of this non-GAAP financial measure, as the income or expense excluded from the calculation of adjusted diluted EPS and instead included in the calculation of diluted EPS are, by definition, not predictable and uncertain FY 2019E Guidance (1): vs. FY 2018 Net Sales of Industrial Activities ~ $28bn Modestly up Adjusted diluted EPS (2) $0.84 - $0.88 up 5% / 10% Net Industrial Debt $(0.2)bn - $(0.4)bn down $0.4bn / $0.2bn Key Highlights Increased investment in organic growth with Capex and R&D up year-over-year reaching 2.5% and 4% of sales respectively Operating Cash Flow will be about $200 million higher than in 2018 Effective tax rate flat at 27%

Closing Remarks

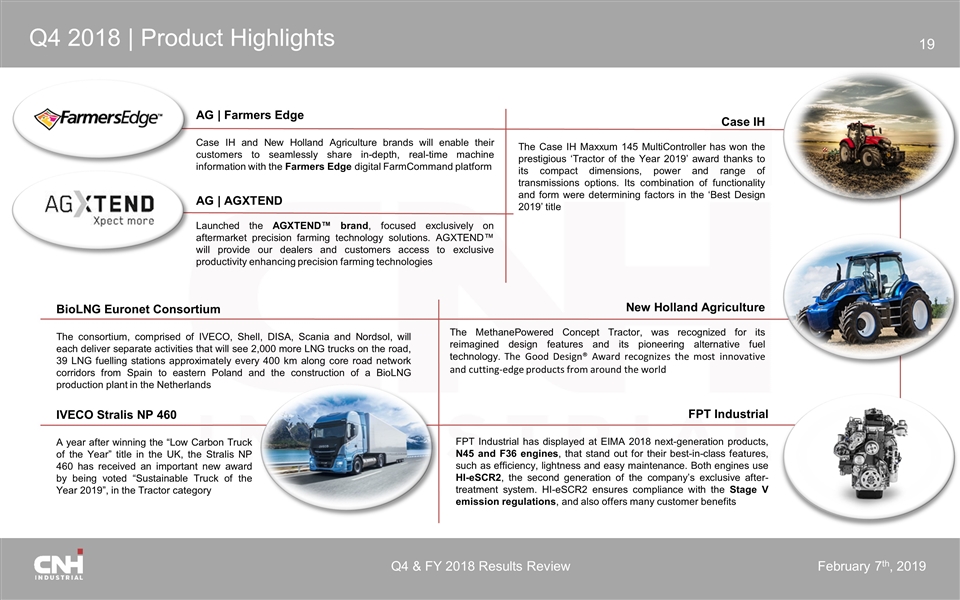

Q4 2018 | Product Highlights New Engine New Engine FPT Industrial FPT Industrial has displayed at EIMA 2018 next-generation products, N45 and F36 engines, that stand out for their best-in-class features, such as efficiency, lightness and easy maintenance. Both engines use HI-eSCR2, the second generation of the company’s exclusive after-treatment system. HI-eSCR2 ensures compliance with the Stage V emission regulations, and also offers many customer benefits New Holland Agriculture The MethanePowered Concept Tractor, was recognized for its reimagined design features and its pioneering alternative fuel technology. The Good Design® Award recognizes the most innovative and cutting-edge products from around the world Case IH The Case IH Maxxum 145 MultiController has won the prestigious ‘Tractor of the Year 2019’ award thanks to its compact dimensions, power and range of transmissions options. Its combination of functionality and form were determining factors in the ‘Best Design 2019’ title New Engine New Engine AG | Farmers Edge Case IH and New Holland Agriculture brands will enable their customers to seamlessly share in-depth, real-time machine information with the Farmers Edge digital FarmCommand platform IVECO Stralis NP 460 A year after winning the “Low Carbon Truck of the Year” title in the UK, the Stralis NP 460 has received an important new award by being voted “Sustainable Truck of the Year 2019”, in the Tractor category New Engine BioLNG Euronet Consortium The consortium, comprised of IVECO, Shell, DISA, Scania and Nordsol, will each deliver separate activities that will see 2,000 more LNG trucks on the road, 39 LNG fuelling stations approximately every 400 km along core road network corridors from Spain to eastern Poland and the construction of a BioLNG production plant in the Netherlands AG | AGXTEND Launched the AGXTEND™ brand, focused exclusively on aftermarket precision farming technology solutions. AGXTEND™ will provide our dealers and customers access to exclusive productivity enhancing precision farming technologies New Engine

FY 2019 | Main Themes, New Products and Upgrades Alternative Drivelines & Emissions Reductions Key new Commercial and Specialty Vehicle electric, CNG and LNG offerings Best in class advanced diesel solutions in all segments featuring improved TCO and lower emissions while meeting Stage V and Euro VI Step D requirements # 100+ new products and upgrades overall in 2019 Digitalization Next generation high horsepower tractor product line featuring advanced digital and connectivity including a new web portal New telematics platform for our Commercial Vehicle Segment in addition to enhancements in our Construction Equipment telematics solution Automation Automated combines, simplifying the farmers jobs while ensuring high productivity and grain quality as well as adding implement control on tillage products Increased SiteControl and FleetGrade machine control offerings for our Construction Equipment customers

Global Executive Committee (GEC) New organizational structure to accelerate global growth and profitability Enhanced Company organizational structure focusing on its five global operating segments (Agriculture, Commercial & Specialty Vehicles, Construction, Powertrain, and Financial Services) supported by Global Functions addressing key synergy and development areas Increased customer focus, fostering entrepreneurship and agility at segment level combined with greater leverage of global supply chain and innovation efforts Further expansion in digitalization, automation, electrification and servitization New members announced Mr. Gerrit Marx (President Commercial and Specialty Vehicles) has a strong automotive background, including commercial vehicles, having served for Daimler Trucks and Volkswagen in different world regions Mr. Andreas Weishaar (Chief Strategy, Talent, ICT and Digital Officer) has a rich background having served at AGCO Corporation and Welbilt Inc. in similar roles. Mr. Weishaar started his career at Arthur D. Little CHIEF EXECUTIVE OFFICER Hubertus Mühlhäuser OPERATING SEGMENTS Derek Neilson President, Agriculture Carl Gustaf Göransson President, Construction Oddone Incisa President, Financial Services Annalisa Stupenengo President, Powertrain Gerrit Marx President, Commercial and Specialty Vehicles FUNCTIONS Stefano Pampalone General Manager, Asia, Middle East and Africa Vilmar Fistarol General Manager, South America Tom Verbaeten Chief Supply Chain Officer Luc Billiet General Manager, Aftermarket Massimiliano Chiara Chief Financial Officer and Chief Sustainability Officer Andreas Weishaar Chief Strategy, Talent, ICT and Digital Officer Alan Berger Chief Technology Officer

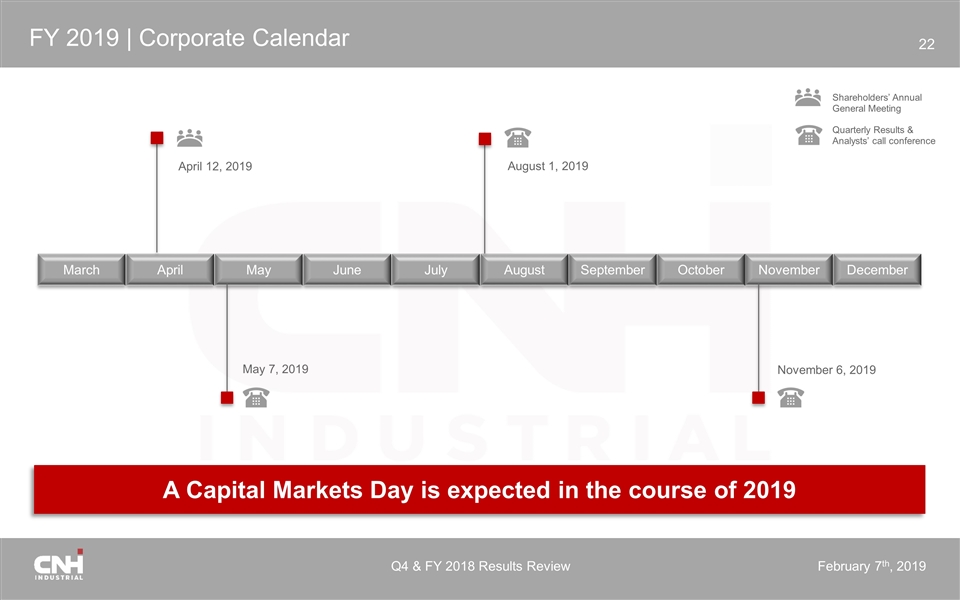

FY 2019 | Corporate Calendar March April May June July August September October November December A Capital Markets Day is expected in the course of 2019 Shareholders’ Annual General Meeting Quarterly Results & Analysts’ call conference April 12, 2019 August 1, 2019 May 7, 2019 November 6, 2019

CEO | Priorities IMPROVE PROFITABILITY WCM continuous improvement | 80/20 Implementation | Gas innovation premium | Reorganization and resizing | Continue turnaround in CV and CE CONCLUDE STRATEGIC BUSINESS PLAN Digitalization/Connectivity | Electrification | Automation and Autonomous Driving | Servitization MAINTAIN DILIGENCE IN OUR CAPITAL ALLOCATION Solid Balance Sheet | Increased investment in Organic Growth Initiatives | Inorganic Growth Opportunities | Dividend Policy | Shareholder friendly actions

Appendix

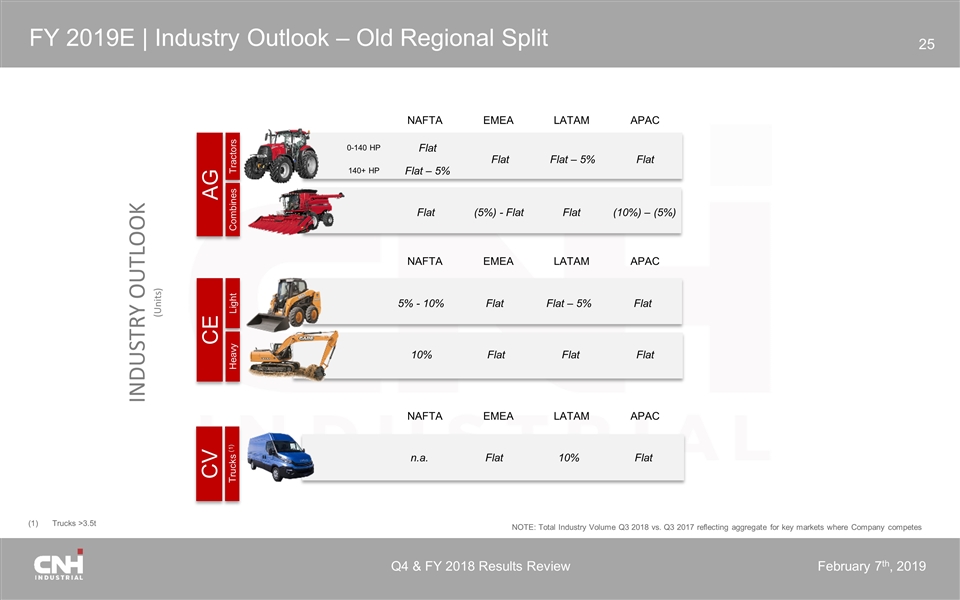

FY 2019E | Industry Outlook – Old Regional Split NOTE: Total Industry Volume Q3 2018 vs. Q3 2017 reflecting aggregate for key markets where Company competes AG Tractors Combines 0-140 HP Flat Flat Flat – 5% Flat 140+ HP Flat – 5% CE Light Heavy Flat (5%) - Flat Flat (10%) – (5%) NAFTA EMEA LATAM APAC 10% Flat Flat Flat 5% - 10% Flat Flat – 5% Flat CV Trucks (1) n.a. Flat 10% Flat Trucks >3.5t INDUSTRY OUTLOOK (Units) NAFTA EMEA LATAM APAC NAFTA EMEA LATAM APAC

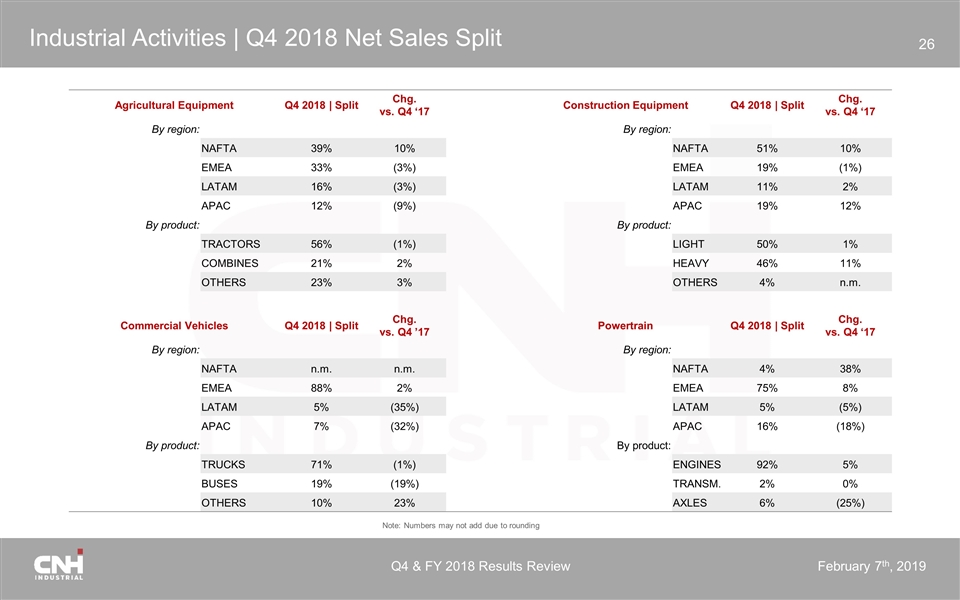

Industrial Activities | Q4 2018 Net Sales Split Agricultural Equipment Q4 2018 | Split Chg. vs. Q4 ‘17 Construction Equipment Q4 2018 | Split Chg. vs. Q4 ‘17 By region: By region: NAFTA 39% 10% NAFTA 51% 10% EMEA 33% (3%) EMEA 19% (1%) LATAM 16% (3%) LATAM 11% 2% APAC 12% (9%) APAC 19% 12% By product: By product: TRACTORS 56% (1%) LIGHT 50% 1% COMBINES 21% 2% HEAVY 46% 11% OTHERS 23% 3% OTHERS 4% n.m. Commercial Vehicles Q4 2018 | Split Chg. vs. Q4 ’17 Powertrain Q4 2018 | Split Chg. vs. Q4 ‘17 By region: By region: NAFTA n.m. n.m. NAFTA 4% 38% EMEA 88% 2% EMEA 75% 8% LATAM 5% (35%) LATAM 5% (5%) APAC 7% (32%) APAC 16% (18%) By product: By product: TRUCKS 71% (1%) ENGINES 92% 5% BUSES 19% (19%) TRANSM. 2% 0% OTHERS 10% 23% AXLES 6% (25%) Note: Numbers may not add due to rounding

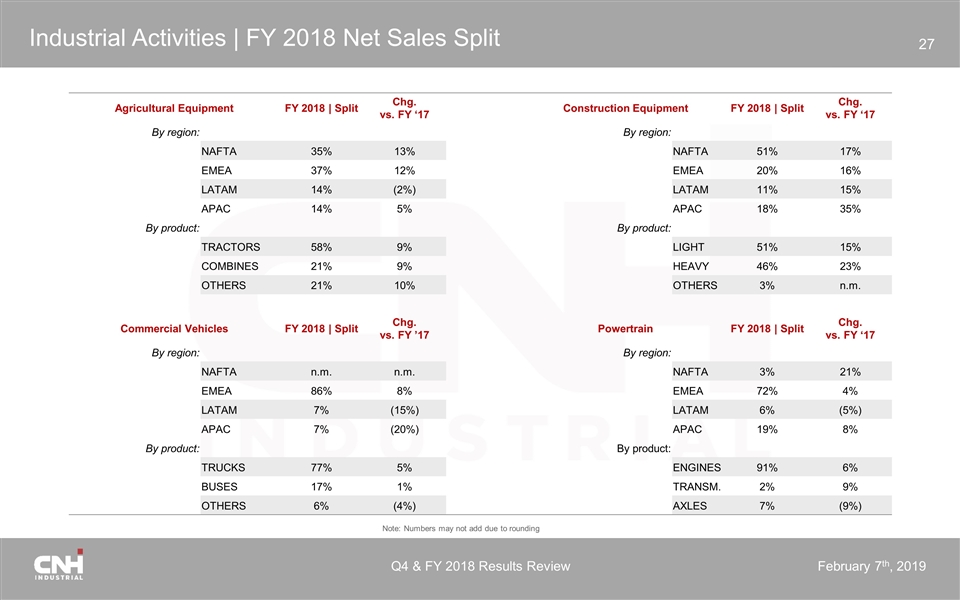

Industrial Activities | FY 2018 Net Sales Split Agricultural Equipment FY 2018 | Split Chg. vs. FY ‘17 Construction Equipment FY 2018 | Split Chg. vs. FY ‘17 By region: By region: NAFTA 35% 13% NAFTA 51% 17% EMEA 37% 12% EMEA 20% 16% LATAM 14% (2%) LATAM 11% 15% APAC 14% 5% APAC 18% 35% By product: By product: TRACTORS 58% 9% LIGHT 51% 15% COMBINES 21% 9% HEAVY 46% 23% OTHERS 21% 10% OTHERS 3% n.m. Commercial Vehicles FY 2018 | Split Chg. vs. FY ’17 Powertrain FY 2018 | Split Chg. vs. FY ‘17 By region: By region: NAFTA n.m. n.m. NAFTA 3% 21% EMEA 86% 8% EMEA 72% 4% LATAM 7% (15%) LATAM 6% (5%) APAC 7% (20%) APAC 19% 8% By product: By product: TRUCKS 77% 5% ENGINES 91% 6% BUSES 17% 1% TRANSM. 2% 9% OTHERS 6% (4%) AXLES 7% (9%) Note: Numbers may not add due to rounding

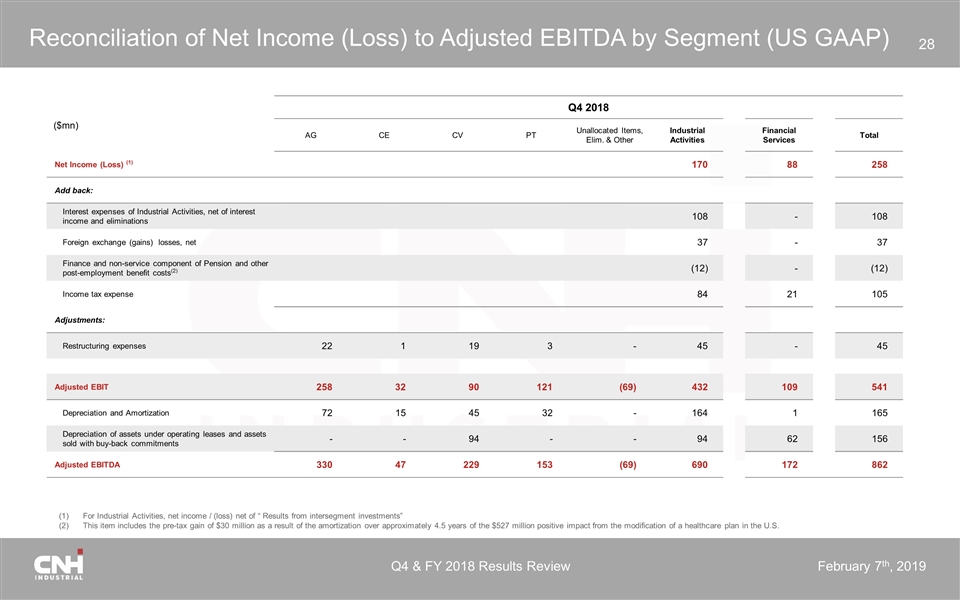

Reconciliation of Net Income (Loss) to Adjusted EBITDA by Segment (US GAAP) For Industrial Activities, net income / (loss) net of “ Results from intersegment investments” This item includes the pre-tax gain of $30 million as a result of the amortization over approximately 4.5 years of the $527 million positive impact from the modification of a healthcare plan in the U.S. Q4 2018 AG CE CV PT Unallocated Items, Elim. & Other Industrial Activities Financial Services Total Net Income (Loss) (1) 170 88 258 Add back: Interest expenses of Industrial Activities, net of interest income and eliminations 108 - 108 Foreign exchange (gains) losses, net 37 - 37 Finance and non-service component of Pension and other post-employment benefit costs(2) (12) - (12) Income tax expense 84 21 105 Adjustments: Restructuring expenses 22 1 19 3 - 45 - 45 Adjusted EBIT 258 32 90 121 (69) 432 109 541 Depreciation and Amortization 72 15 45 32 - 164 1 165 Depreciation of assets under operating leases and assets sold with buy-back commitments - - 94 - - 94 62 156 Adjusted EBITDA 330 47 229 153 (69) 690 172 862 ($mn)

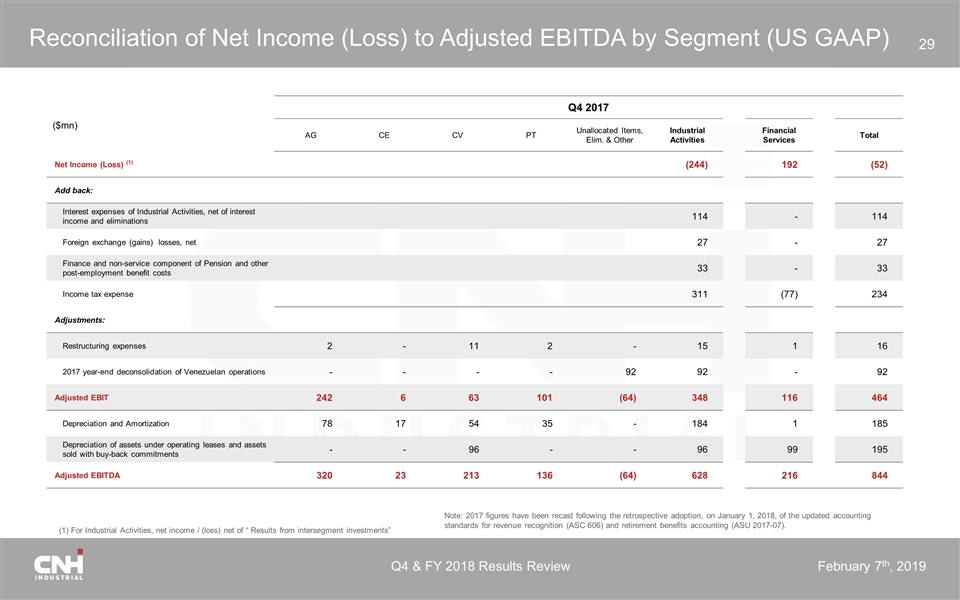

Reconciliation of Net Income (Loss) to Adjusted EBITDA by Segment (US GAAP) (1) For Industrial Activities, net income / (loss) net of “ Results from intersegment investments” ($mn) Q4 2017 AG CE CV PT Unallocated Items, Elim. & Other Industrial Activities Financial Services Total Net Income (Loss) (1) (244) 192 (52) Add back: Interest expenses of Industrial Activities, net of interest income and eliminations 114 - 114 Foreign exchange (gains) losses, net 27 - 27 Finance and non-service component of Pension and other post-employment benefit costs 33 - 33 Income tax expense 311 (77) 234 Adjustments: Restructuring expenses 2 - 11 2 - 15 1 16 2017 year-end deconsolidation of Venezuelan operations - - - - 92 92 - 92 Adjusted EBIT 242 6 63 101 (64) 348 116 464 Depreciation and Amortization 78 17 54 35 - 184 1 185 Depreciation of assets under operating leases and assets sold with buy-back commitments - - 96 - - 96 99 195 Adjusted EBITDA 320 23 213 136 (64) 628 216 844 Note: 2017 figures have been recast following the retrospective adoption, on January 1, 2018, of the updated accounting standards for revenue recognition (ASC 606) and retirement benefits accounting (ASU 2017-07).

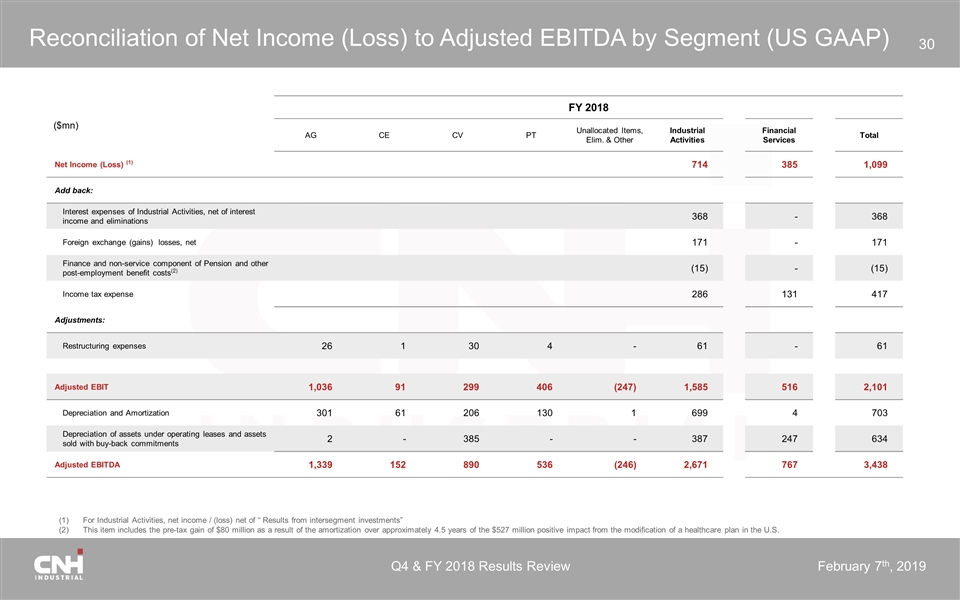

Reconciliation of Net Income (Loss) to Adjusted EBITDA by Segment (US GAAP) For Industrial Activities, net income / (loss) net of “ Results from intersegment investments” This item includes the pre-tax gain of $80 million as a result of the amortization over approximately 4.5 years of the $527 million positive impact from the modification of a healthcare plan in the U.S. FY 2018 AG CE CV PT Unallocated Items, Elim. & Other Industrial Activities Financial Services Total Net Income (Loss) (1) 714 385 1,099 Add back: Interest expenses of Industrial Activities, net of interest income and eliminations 368 - 368 Foreign exchange (gains) losses, net 171 - 171 Finance and non-service component of Pension and other post-employment benefit costs(2) (15) - (15) Income tax expense 286 131 417 Adjustments: Restructuring expenses 26 1 30 4 - 61 - 61 Adjusted EBIT 1,036 91 299 406 (247) 1,585 516 2,101 Depreciation and Amortization 301 61 206 130 1 699 4 703 Depreciation of assets under operating leases and assets sold with buy-back commitments 2 - 385 - - 387 247 634 Adjusted EBITDA 1,339 152 890 536 (246) 2,671 767 3,438 ($mn)

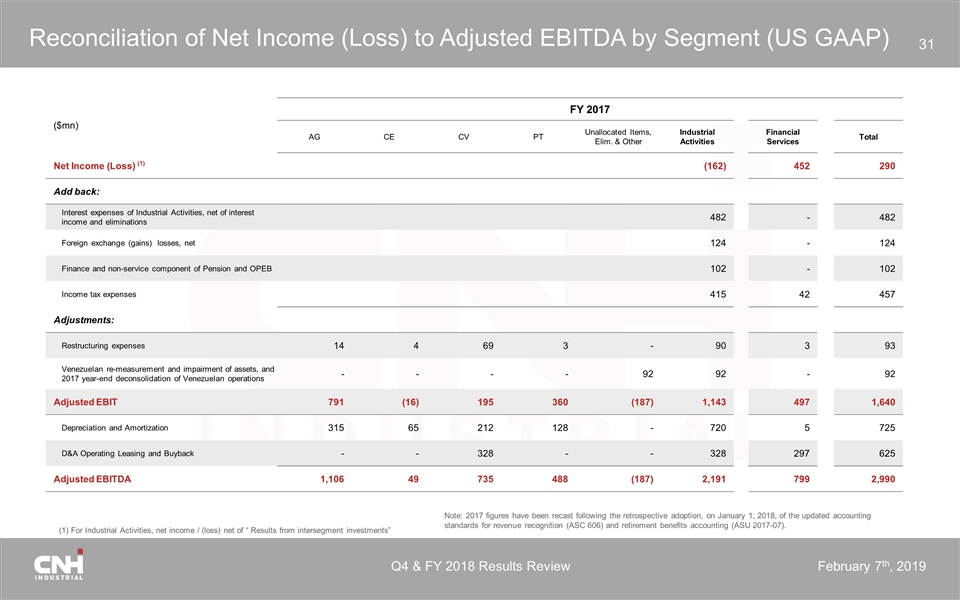

Reconciliation of Net Income (Loss) to Adjusted EBITDA by Segment (US GAAP) (1) For Industrial Activities, net income / (loss) net of “ Results from intersegment investments” FY 2017 AG CE CV PT Unallocated Items, Elim. & Other Industrial Activities Financial Services Total Net Income (Loss) (1) (162) 452 290 Add back: Interest expenses of Industrial Activities, net of interest income and eliminations 482 - 482 Foreign exchange (gains) losses, net 124 - 124 Finance and non-service component of Pension and OPEB 102 - 102 Income tax expenses 415 42 457 Adjustments: Restructuring expenses 14 4 69 3 - 90 3 93 Venezuelan re-measurement and impairment of assets, and 2017 year-end deconsolidation of Venezuelan operations - - - - 92 92 - 92 Adjusted EBIT 791 (16) 195 360 (187) 1,143 497 1,640 Depreciation and Amortization 315 65 212 128 - 720 5 725 D&A Operating Leasing and Buyback - - 328 - - 328 297 625 Adjusted EBITDA 1,106 49 735 488 (187) 2,191 799 2,990 Note: 2017 figures have been recast following the retrospective adoption, on January 1, 2018, of the updated accounting standards for revenue recognition (ASC 606) and retirement benefits accounting (ASU 2017-07). ($mn)

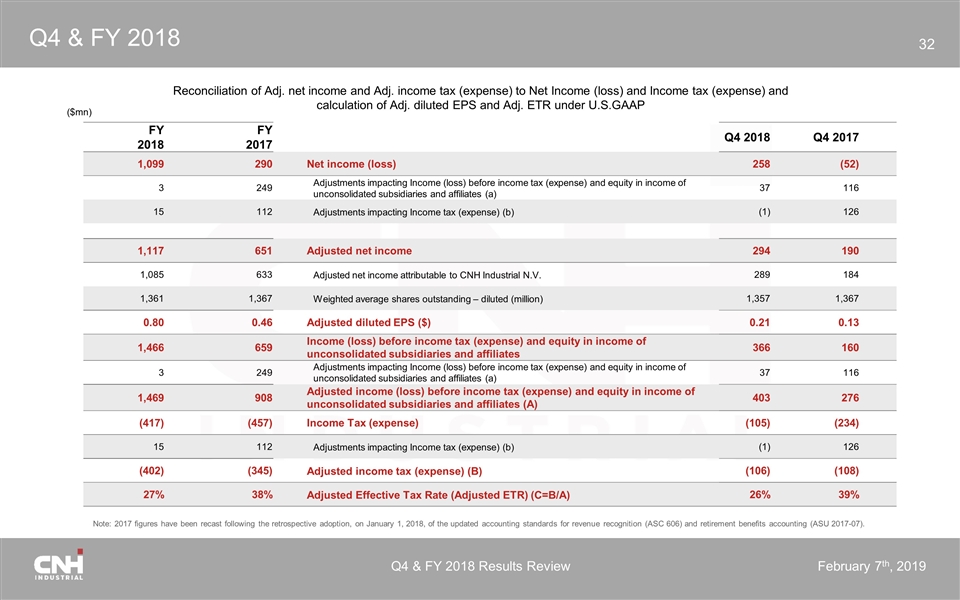

Q4 & FY 2018 Reconciliation of Adj. net income and Adj. income tax (expense) to Net Income (loss) and Income tax (expense) and calculation of Adj. diluted EPS and Adj. ETR under U.S.GAAP FY 2018 FY 2017 Q4 2018 Q4 2017 1,099 290 Net income (loss) 258 (52) 3 249 Adjustments impacting Income (loss) before income tax (expense) and equity in income of unconsolidated subsidiaries and affiliates (a) 37 116 15 112 Adjustments impacting Income tax (expense) (b) (1) 126 1,117 651 Adjusted net income 294 190 1,085 633 Adjusted net income attributable to CNH Industrial N.V. 289 184 1,361 1,367 Weighted average shares outstanding – diluted (million) 1,357 1,367 0.80 0.46 Adjusted diluted EPS ($) 0.21 0.13 1,466 659 Income (loss) before income tax (expense) and equity in income of unconsolidated subsidiaries and affiliates 366 160 3 249 Adjustments impacting Income (loss) before income tax (expense) and equity in income of unconsolidated subsidiaries and affiliates (a) 37 116 1,469 908 Adjusted income (loss) before income tax (expense) and equity in income of unconsolidated subsidiaries and affiliates (A) 403 276 (417) (457) Income Tax (expense) (105) (234) 15 112 Adjustments impacting Income tax (expense) (b) (1) 126 (402) (345) Adjusted income tax (expense) (B) (106) (108) 27% 38% Adjusted Effective Tax Rate (Adjusted ETR) (C=B/A) 26% 39% ($mn) Note: 2017 figures have been recast following the retrospective adoption, on January 1, 2018, of the updated accounting standards for revenue recognition (ASC 606) and retirement benefits accounting (ASU 2017-07).

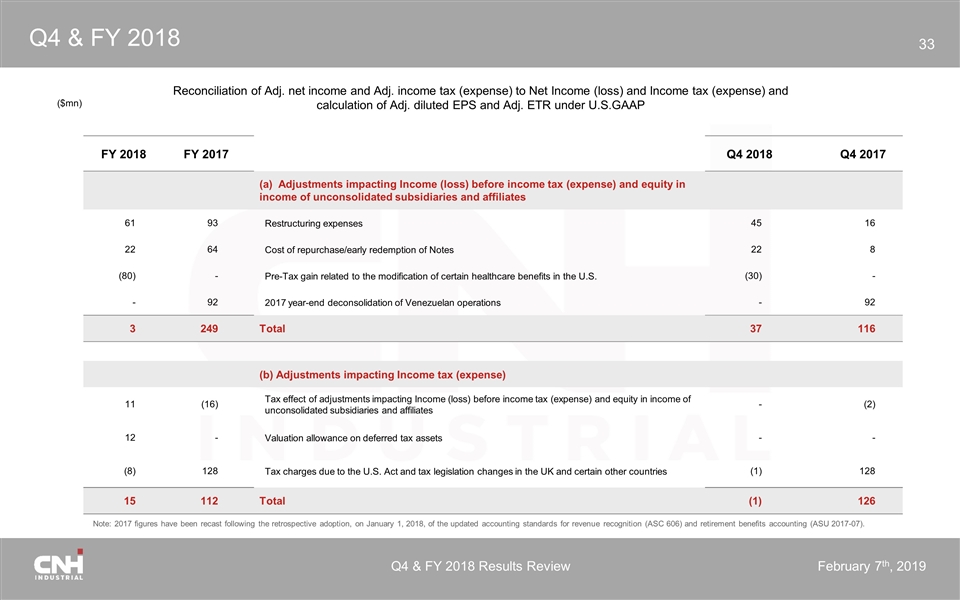

Q4 & FY 2018 FY 2018 FY 2017 Q4 2018 Q4 2017 (a) Adjustments impacting Income (loss) before income tax (expense) and equity in income of unconsolidated subsidiaries and affiliates 61 93 Restructuring expenses 45 16 22 64 Cost of repurchase/early redemption of Notes 22 8 (80) - Pre-Tax gain related to the modification of certain healthcare benefits in the U.S. (30) - - 92 2017 year-end deconsolidation of Venezuelan operations - 92 3 249 Total 37 116 (b) Adjustments impacting Income tax (expense) 11 (16) Tax effect of adjustments impacting Income (loss) before income tax (expense) and equity in income of unconsolidated subsidiaries and affiliates - (2) 12 - Valuation allowance on deferred tax assets - - (8) 128 Tax charges due to the U.S. Act and tax legislation changes in the UK and certain other countries (1) 128 15 112 Total (1) 126 ($mn) Note: 2017 figures have been recast following the retrospective adoption, on January 1, 2018, of the updated accounting standards for revenue recognition (ASC 606) and retirement benefits accounting (ASU 2017-07). Reconciliation of Adj. net income and Adj. income tax (expense) to Net Income (loss) and Income tax (expense) and calculation of Adj. diluted EPS and Adj. ETR under U.S.GAAP

Capex (1) (1) Excluding assets sold under buy-back commitments and assets under operating leases Q4 2018 Q4 2017 FY 2018 FY 2017 Investments in property, plant and equipment, and intangible assets (1) 262 211 550 488 Breakdown by Category NEW PRODUCT & TECHNOLOGY 34% 24% 36% 28% MAINTENANCE & OTHER 63% 75% 59% 67% INDUSTRIAL CAPACITY EXPANSION & LT INVESTMENTS 3% 1% 5% 5% Breakdown by Segment AGRICULTURAL EQUIPMENT 38% 43% 41% 43% CONSTRUCTION EQUIPMENT 7% 8% 7% 8% COMMERCIAL VEHICLES 36% 30% 36% 31% POWERTRAIN 19% 19% 16% 18% ($mn)

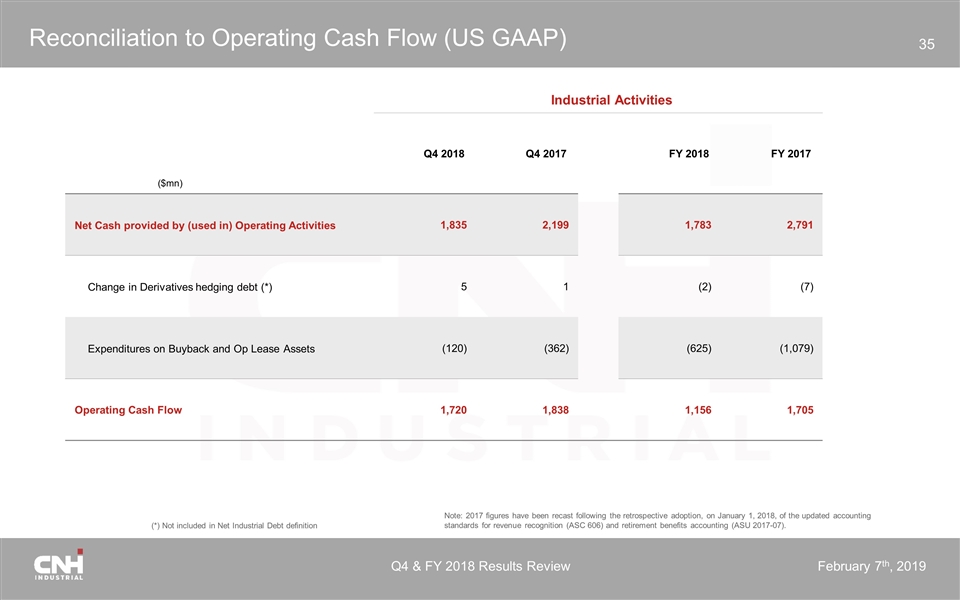

Reconciliation to Operating Cash Flow (US GAAP) (*) Not included in Net Industrial Debt definition Q4 2018 Q4 2017 FY 2018 FY 2017 Net Cash provided by (used in) Operating Activities 1,835 2,199 1,783 2,791 Change in Derivatives hedging debt (*) 5 1 (2) (7) Expenditures on Buyback and Op Lease Assets (120) (362) (625) (1,079) Operating Cash Flow 1,720 1,838 1,156 1,705 ($mn) Note: 2017 figures have been recast following the retrospective adoption, on January 1, 2018, of the updated accounting standards for revenue recognition (ASC 606) and retirement benefits accounting (ASU 2017-07). Industrial Activities

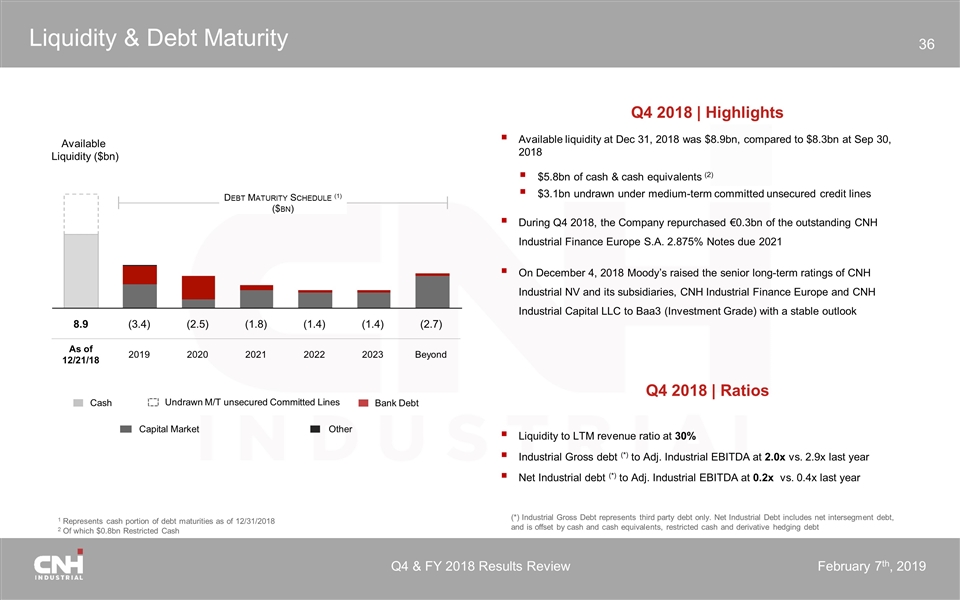

Liquidity & Debt Maturity 1 Represents cash portion of debt maturities as of 12/31/2018 2 Of which $0.8bn Restricted Cash Undrawn M/T unsecured Committed Lines Bank Debt Capital Market Cash Other Available Liquidity ($bn) Debt Maturity Schedule (1) ($bn) (*) Industrial Gross Debt represents third party debt only. Net Industrial Debt includes net intersegment debt, and is offset by cash and cash equivalents, restricted cash and derivative hedging debt 8.9 (3.4) (2.5) (1.8) (1.4) (1.4) (2.7) As of 12/21/18 2019 2020 2021 2022 2023 Beyond Available liquidity at Dec 31, 2018 was $8.9bn, compared to $8.3bn at Sep 30, 2018 $5.8bn of cash & cash equivalents (2) $3.1bn undrawn under medium-term committed unsecured credit lines During Q4 2018, the Company repurchased €0.3bn of the outstanding CNH Industrial Finance Europe S.A. 2.875% Notes due 2021 On December 4, 2018 Moody’s raised the senior long-term ratings of CNH Industrial NV and its subsidiaries, CNH Industrial Finance Europe and CNH Industrial Capital LLC to Baa3 (Investment Grade) with a stable outlook Liquidity to LTM revenue ratio at 30% Industrial Gross debt (*) to Adj. Industrial EBITDA at 2.0x vs. 2.9x last year Net Industrial debt (*) to Adj. Industrial EBITDA at 0.2x vs. 0.4x last year Q4 2018 | Highlights Q4 2018 | Ratios

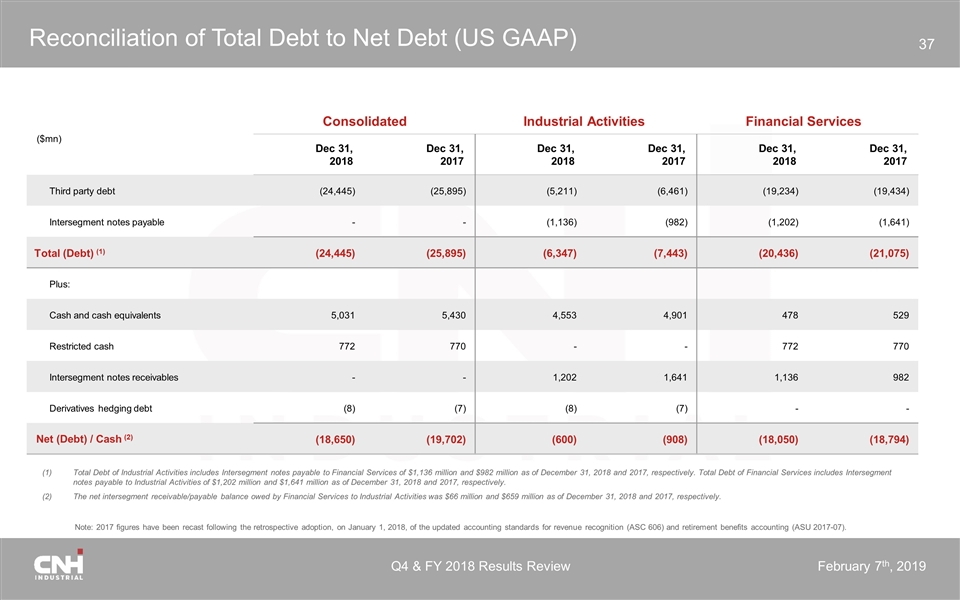

Reconciliation of Total Debt to Net Debt (US GAAP) Dec 31, 2018 Dec 31, 2017 Dec 31, 2018 Dec 31, 2017 Dec 31, 2018 Dec 31, 2017 Third party debt (24,445) (25,895) (5,211) (6,461) (19,234) (19,434) Intersegment notes payable - - (1,136) (982) (1,202) (1,641) Total (Debt) (1) (24,445) (25,895) (6,347) (7,443) (20,436) (21,075) Plus: Cash and cash equivalents 5,031 5,430 4,553 4,901 478 529 Restricted cash 772 770 - - 772 770 Intersegment notes receivables - - 1,202 1,641 1,136 982 Derivatives hedging debt (8) (7) (8) (7) - - Net (Debt) / Cash (2) (18,650) (19,702) (600) (908) (18,050) (18,794) Consolidated Industrial Activities Financial Services ($mn) (1) Total Debt of Industrial Activities includes Intersegment notes payable to Financial Services of $1,136 million and $982 million as of December 31, 2018 and 2017, respectively. Total Debt of Financial Services includes Intersegment notes payable to Industrial Activities of $1,202 million and $1,641 million as of December 31, 2018 and 2017, respectively. (2) The net intersegment receivable/payable balance owed by Financial Services to Industrial Activities was $66 million and $659 million as of December 31, 2018 and 2017, respectively. Note: 2017 figures have been recast following the retrospective adoption, on January 1, 2018, of the updated accounting standards for revenue recognition (ASC 606) and retirement benefits accounting (ASU 2017-07).

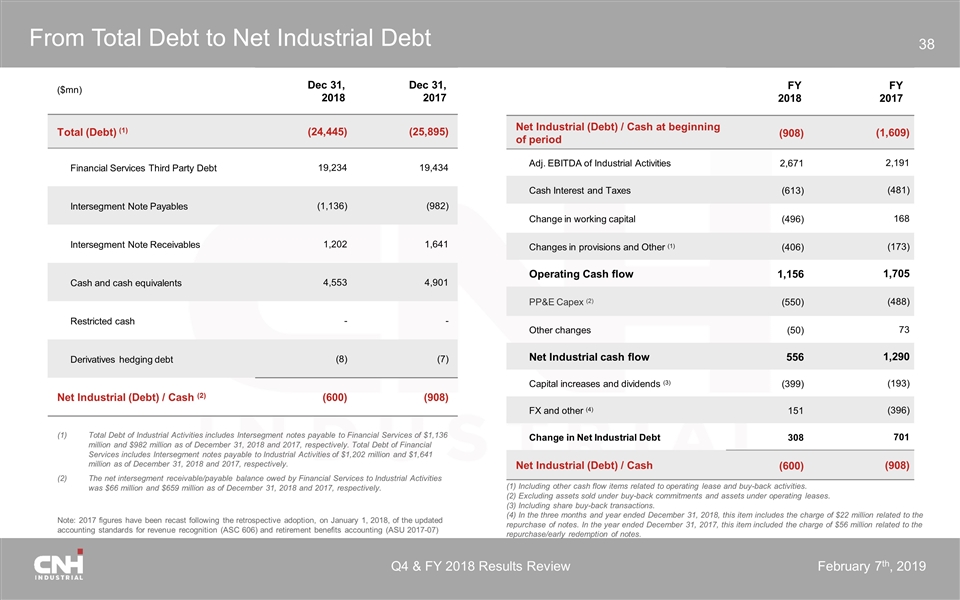

From Total Debt to Net Industrial Debt Dec 31, 2018 Dec 31, 2017 Total (Debt) (1) (24,445) (25,895) Financial Services Third Party Debt 19,234 19,434 Intersegment Note Payables (1,136) (982) Intersegment Note Receivables 1,202 1,641 Cash and cash equivalents 4,553 4,901 Restricted cash - - Derivatives hedging debt (8) (7) Net Industrial (Debt) / Cash (2) (600) (908) FY 2018 FY 2017 Net Industrial (Debt) / Cash at beginning of period (908) (1,609) Adj. EBITDA of Industrial Activities 2,671 2,191 Cash Interest and Taxes (613) (481) Change in working capital (496) 168 Changes in provisions and Other (1) (406) (173) Operating Cash flow 1,156 1,705 PP&E Capex (2) (550) (488) Other changes (50) 73 Net Industrial cash flow 556 1,290 Capital increases and dividends (3) (399) (193) FX and other (4) 151 (396) Change in Net Industrial Debt 308 701 Net Industrial (Debt) / Cash (600) (908) (1) Total Debt of Industrial Activities includes Intersegment notes payable to Financial Services of $1,136 million and $982 million as of December 31, 2018 and 2017, respectively. Total Debt of Financial Services includes Intersegment notes payable to Industrial Activities of $1,202 million and $1,641 million as of December 31, 2018 and 2017, respectively. (2) The net intersegment receivable/payable balance owed by Financial Services to Industrial Activities was $66 million and $659 million as of December 31, 2018 and 2017, respectively. ($mn) (1) Including other cash flow items related to operating lease and buy-back activities. (2) Excluding assets sold under buy-back commitments and assets under operating leases. (3) Including share buy-back transactions. (4) In the three months and year ended December 31, 2018, this item includes the charge of $22 million related to the repurchase of notes. In the year ended December 31, 2017, this item included the charge of $56 million related to the repurchase/early redemption of notes. Note: 2017 figures have been recast following the retrospective adoption, on January 1, 2018, of the updated accounting standards for revenue recognition (ASC 606) and retirement benefits accounting (ASU 2017-07)

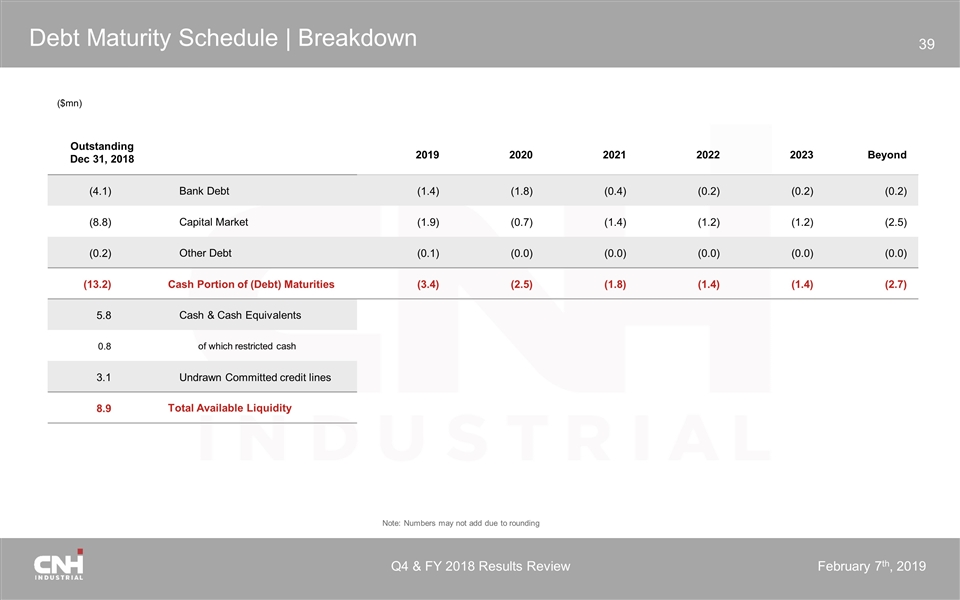

Debt Maturity Schedule | Breakdown Outstanding Dec 31, 2018 2019 2020 2021 2022 2023 Beyond (4.1) Bank Debt (1.4) (1.8) (0.4) (0.2) (0.2) (0.2) (8.8) Capital Market (1.9) (0.7) (1.4) (1.2) (1.2) (2.5) (0.2) Other Debt (0.1) (0.0) (0.0) (0.0) (0.0) (0.0) (13.2) Cash Portion of (Debt) Maturities (3.4) (2.5) (1.8) (1.4) (1.4) (2.7) 5.8 Cash & Cash Equivalents 0.8 of which restricted cash 3.1 Undrawn Committed credit lines 8.9 Total Available Liquidity Note: Numbers may not add due to rounding ($mn)

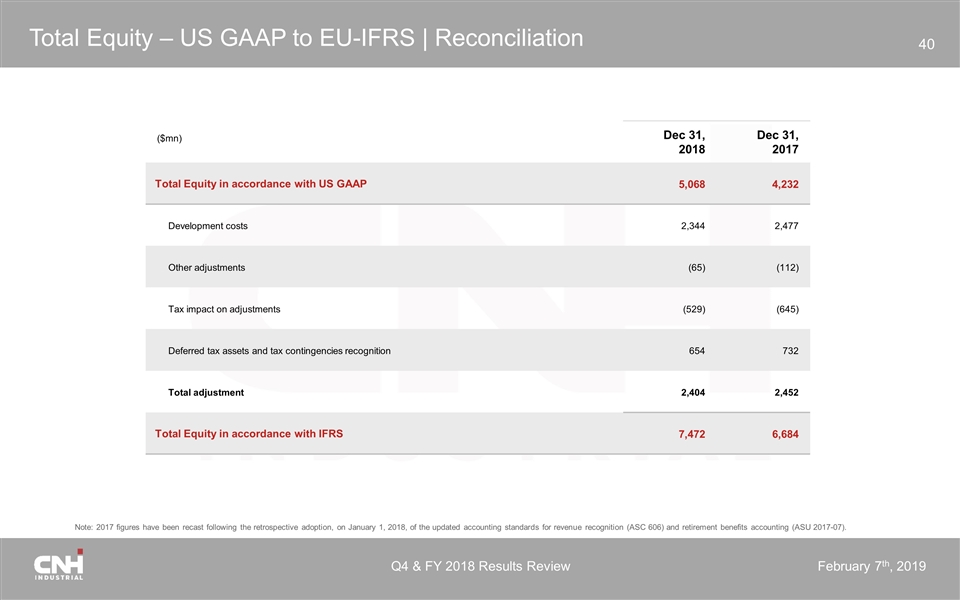

Total Equity – US GAAP to EU-IFRS | Reconciliation Note: 2017 figures have been recast following the retrospective adoption, on January 1, 2018, of the updated accounting standards for revenue recognition (ASC 606) and retirement benefits accounting (ASU 2017-07). Dec 31, 2018 Dec 31, 2017 Total Equity in accordance with US GAAP 5,068 4,232 Development costs 2,344 2,477 Other adjustments (65) (112) Tax impact on adjustments (529) (645) Deferred tax assets and tax contingencies recognition 654 732 Total adjustment 2,404 2,452 Total Equity in accordance with IFRS 7,472 6,684 ($mn)

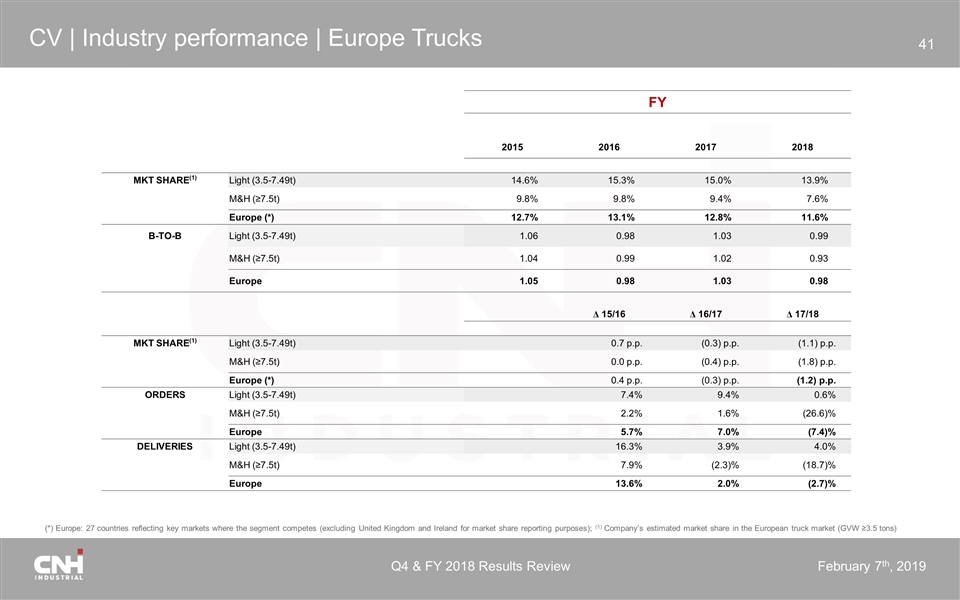

CV | Industry performance | Europe Trucks (*) Europe: 27 countries reflecting key markets where the segment competes (excluding United Kingdom and Ireland for market share reporting purposes); (1) Company’s estimated market share in the European truck market (GVW ≥3.5 tons) FY 2015 2016 2017 2018 MKT SHARE(1) Light (3.5-7.49t) 14.6% 15.3% 15.0% 13.9% M&H (≥7.5t) 9.8% 9.8% 9.4% 7.6% Europe (*) 12.7% 13.1% 12.8% 11.6% B-TO-B Light (3.5-7.49t) 1.06 0.98 1.03 0.99 M&H (≥7.5t) 1.04 0.99 1.02 0.93 Europe 1.05 0.98 1.03 0.98 Δ 15/16 Δ 16/17 Δ 17/18 MKT SHARE(1) Light (3.5-7.49t) 0.7 p.p. (0.3) p.p. (1.1) p.p. M&H (≥7.5t) 0.0 p.p. (0.4) p.p. (1.8) p.p. Europe (*) 0.4 p.p. (0.3) p.p. (1.2) p.p. ORDERS Light (3.5-7.49t) 7.4% 9.4% 0.6% M&H (≥7.5t) 2.2% 1.6% (26.6)% Europe 5.7% 7.0% (7.4)% DELIVERIES Light (3.5-7.49t) 16.3% 3.9% 4.0% M&H (≥7.5t) 7.9% (2.3)% (18.7)% Europe 13.6% 2.0% (2.7)%

Geographic Information Certain financial and market information in this presentation has been presented by geographic area. CNH Industrial defines its geographic areas as NAFTA: United States, Canada and Mexico; EMEA: member countries of the European Union, European Free Trade Association, Ukraine, Balkans, African continent, and Middle East (excluding Turkey); LATAM: Central and South America, and the Caribbean Islands; and APAC: Continental Asia (including Turkey and Russia), Oceania and member countries of the Commonwealth of Independent States (excluding Ukraine). Market Share / Market Position Data Certain industry and market share information in this report has been presented on a worldwide basis which includes all countries. In this presentation, management estimates of market share information are generally based on retail unit sales data in North America, on registrations of equipment in most of Europe, Brazil, and various APAC markets, and on retail and shipment unit data collected by a central information bureau appointed by equipment manufacturers associations, including the Association of Equipment Manufacturers’ in North America, the Committee for European Construction Equipment in Europe, the ANFAVEA in Brazil, the Japan Construction Equipment Manufacturers Association, and the Korea Construction Equipment Manufacturers Association, as well as on other shipment data collected by an independent service bureau Not all agricultural or construction equipment is registered, and registration data may thus underestimate, perhaps substantially, actual retail industry unit sales demand, particularly for local manufacturers in China, Southeast Asia, Eastern Europe, Russia, Turkey, Brazil, and any country where local shipments are not reported For Commercial Vehicles regions are defined as: Europe (the 27 countries where Commercial Vehicles competes, excluding United Kingdom and Ireland, for market share and total industry volume “TIV” reporting purpose); LATAM (Brazil, Argentina and Venezuela) and APAC (Russia, Turkey, South East Asia, Australia, New Zealand) In addition, there may be a period of time between the shipment, delivery, sale and/or registration of a unit, which must be estimated, in making any adjustments to the shipment, delivery, sale, or registration data to determine our estimates of retail unit data in any period

New Geographic Information Starting from Q1 2019 the composition of our regions part of the geographic information have been amended as follow: North America (formerly NAFTA): United States, Canada and Mexico; Europe (member countries of the European Union, European Free Trade Association, Ukraine, Balkans, formerly included in EMEA); South America (formerly LATAM): Central and South America, and the Caribbean Islands; and Rest of World (Continental Asia - including Turkey and Russia - Oceania and member countries of the Commonwealth of Independent States (excluding Ukraine) ; African continent, and Middle East, formerly included in APAC) Market Share / Market Position Data Certain industry and market share information in this report has been presented on a worldwide basis which includes all countries. In this presentation, management estimates of past market-share information are generally based on retail unit sales data in North America, on registrations of equipment in most of Europe, Brazil, and various APAC markets, and on retail and shipment unit data collected by a central information bureau appointed by equipment manufacturers associations, including the Association of Equipment Manufacturers’ in North America, the Committee for European Construction Equipment in Europe, the ANFAVEA in Brazil, the Japan Construction Equipment Manufacturers Association, and the Korea Construction Equipment Manufacturers Association, as well as on other shipment data collected by an independent service bureau Not all agricultural or construction equipment is registered, and registration data may thus underestimate, perhaps substantially, actual retail industry unit sales demand, particularly for local manufacturers in China, Southeast Asia, Eastern Europe, Russia, Turkey, Brazil, and any country where local shipments are not reported For Commercial Vehicles regions are defined as: Europe (the EU 27 countries where Commercial Vehicles competes, excluding United Kingdom and Ireland, for market share and total industry volume “TIV” reporting purpose); South America (Brazil, Argentina and Venezuela) and RoW (Russia, Turkey, South East Asia, Australia, New Zealand) In addition, there may be a period of time between the shipment, delivery, sale and/or registration of a unit, which must be estimated, in making any adjustments to the shipment, delivery, sale, or registration data to determine our estimates of retail unit data in any period

Non-GAAP Financial Measures CNH Industrial monitors its operations through the use of several non-GAAP financial measures. CNH Industrial’s management believes that these non-GAAP financial measures provide useful and relevant information regarding its results and allow management and investors to assess CNH Industrial’s and our segments’ operating trends, financial performance and financial position. Management uses these non-GAAP measures to identify operational trends, as well as make decisions regarding future spending, resource allocations and other operational decisions as they provide additional transparency with respect to our and our business segments’ core operations. These non-GAAP financial measures have no standardized meaning presented in U.S. GAAP or EU-IFRS and are unlikely to be comparable to other similarly titled measures used by other companies due to potential differences between the companies in calculations. As a result, the use of these non-GAAP measures has limitations and they should not be considered as substitutes for measures of financial performance and financial position as prepared in accordance with U.S. GAAP and/or EU-IFRS. CNH Industrial non-GAAP financial measures are defined as follows: Adjusted EBIT: is defined as net income (loss) before income taxes, interest expenses of Industrial Activities, net, restructuring expenses, the finance and non-service component of pension and other postemployment benefit costs, foreign exchange gains/(losses), and certain non-recurring items. In particular, non-recurring items are specifically disclosed items that management considers rare or discrete events that are infrequent in nature and not reflective of on-going operational activities. Adjusted EBITDA: is defined as Adjusted EBIT plus depreciation and amortization (including on assets sold under operating leases and assets sold under buy-back commitments). Adjusted Net Income (Loss): is defined as net income (loss), less restructuring charges and non-recurring items, after tax. Adjusted Diluted EPS: is computed by dividing Adjusted Net Income (loss) attributable to CNH Industrial N.V. by a weighted-average number of common shares outstanding during the period that takes into consideration potential common shares outstanding deriving from the CNH Industrial share-based payment awards, when inclusion is not anti-dilutive. When we provide guidance for adjusted diluted EPS, we do not provide guidance on an earnings per share basis because the GAAP measure will include potentially significant items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end. Adjusted Income Taxes:is defined as income taxes less the tax effect of restructuring expenses and non-recurring items and non-recurring tax charges or benefits. Adjusted Effective Tax Rate (Adjusted ETR): is computed by dividing a) adjusted income taxes by b) income (loss) before income taxes and equity in income of unconsolidated subsidiaries and affiliates, less restructuring expenses and non-recurring items. Net Debt and Net Debt of Industrial Activities (or Net Industrial Debt): Net Debt is defined as total debt less intersegment notes receivable, cash and cash equivalents, restricted cash and derivative hedging debt. CNH Industrial provides the reconciliation of Net Debt to Total Debt, which is the most directly comparable measure included in the consolidated balance sheets. Due to different sources of cash flows used for the repayment of the debt between Industrial Activities and Financial Services (by cash from operations for Industrial Activities and by collection of financing receivables for Financial Services), management separately evaluates the cash flow performance of Industrial Activities using Net Debt of Industrial Activities. Available Liquidity: is defined as cash and cash equivalents plus restricted cash and undrawn committed facilities. Change excl. FX or Constant Currency: CNH Industrial discusses the fluctuations in revenues on a constant currency basis by applying the prior year average exchange rates to current year’s revenues expressed in local currency in order to eliminate the impact of foreign exchange rate fluctuations. The tables attached to this presentation provide reconciliations of the non-GAAP measures used in this presentation to the most directly comparable GAAP measures.

Investor Relations Team e-mail: investor.relations@cnhind.com website: www.cnhindustrial.com Federico Donati – Head of Global Investor Relations ( +44 (207) 76 - 60386 ( +39 (011) 00 - 71929 Noah Weiss – Investor Relations North America ( +1 (630) 887 - 3745 Giovanni Somajni – Investor Relations Europe ( +44 (207) 76 - 60369