Q4 & FY 2022 RESULTS REVIEW February 2, 2023 Exhibit 99.2

Safe Harbor Statement and Disclosures All statements other than statements of historical fact contained in this presentation, including competitive strengths; business strategy; future financial position or operating results; budgets; projections with respect to revenue, income, earnings (or loss) per share, capital expenditures, dividends, liquidity, capital structure or other financial items; costs; and plans and objectives of management regarding operations and products, are forward-looking statements. Forward-looking statements also include statements regarding the future performance of CNH Industrial and its subsidiaries on a standalone basis. These statements may include terminology such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “outlook”, “continue”, “remain”, “on track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “prospects”, “plan”, or similar terminology. Forward-looking statements are not guarantees of future performance. Rather, they are based on current views and assumptions and involve known and unknown risks, uncertainties and other factors, many of which are outside our control and are difficult to predict. If any of these risks and uncertainties materialize (or they occur with a degree of severity that the Company is unable to predict) or other assumptions underlying any of the forward-looking statements prove to be incorrect, including any assumptions regarding strategic plans, the actual results or developments may differ materially from any future results or developments expressed or implied by the forward-looking statements. Factors, risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements include, among others: economic conditions in each of our markets, including the significant uncertainty caused by the war in the Ukraine; the duration and economic, operational and financial impacts of the global COVID-19 pandemic; production and supply chain disruptions, including industry capacity constraints, material availability, and global logistics delays and constraints; the many interrelated factors that affect consumer confidence and worldwide demand for capital goods and capital goods-related products, changes in government policies regarding banking, monetary and fiscal policy; legislation, particularly pertaining to capital goods-related issues such as agriculture, the environment, debt relief and subsidy program policies, trade and commerce and infrastructure development; government policies on international trade and investment, including sanctions, import quotas, capital controls and tariffs; volatility in international trade caused by the imposition of tariffs, sanctions, embargoes, and trade wars; actions of competitors in the various industries in which we compete; development and use of new technologies and technological difficulties; the interpretation of, or adoption of new, compliance requirements with respect to engine emissions, safety or other aspects of our products; labor relations; interest rates and currency exchange rates; inflation and deflation; energy prices; prices for agricultural commodities and material price increases; housing starts and other construction activity; our ability to obtain financing or to refinance existing debt; price pressure on new and used equipment; the resolution of pending litigation and investigations on a wide range of topics, including dealer and supplier litigation, intellectual property rights disputes, product warranty and defective product claims, and emissions and/or fuel economy regulatory and contractual issues; security breaches, cybersecurity attacks, technology failures, and other disruptions to the information technology infrastructure of CNH Industrial and its suppliers and dealers; security breaches with respect to our products; our pension plans and other post-employment obligations; political and civil unrest; volatility and deterioration of capital and financial markets, including pandemics, terrorist attacks in Europe and elsewhere; our ability to realize the anticipated benefits from our business initiatives as part of our strategic plan; our failure to realize, or a delay in realizing, all of the anticipated benefits of our acquisitions, joint ventures, strategic alliances or divestitures and other similar risks and uncertainties, and our success in managing the risks involved in the foregoing. Reconciliations of non-GAAP measures to the most directly comparable GAAP measure are included in this presentation, which is available on our website at www.cnhindustrial.com. Forward-looking statements are based upon assumptions relating to the factors described in this presentation, which are sometimes based upon estimates and data received from third parties. Such estimates and data are often revised. Actual results may differ materially from the forward-looking statements as a result of a number of risks and uncertainties, many of which are outside CNH Industrial’s control. CNH Industrial expressly disclaims any intention or obligation to provide, update or revise any forward-looking statements in this presentation to reflect any change in expectations or any change in events, conditions or circumstances on which these forward-looking statements are based. Further information concerning CNH Industrial, including factors that potentially could materially affect CNH Industrial’s financial results, is included in CNH Industrial’s reports and filings with the U.S. Securities and Exchange Commission (“SEC”), the Autoriteit Financiële Markten (“AFM”) and Commissione Nazionale per le Società e la Borsa (“CONSOB”). All future written and oral forward-looking statements by CNH Industrial or persons acting on the behalf of CNH Industrial are expressly qualified in their entirety by the cautionary statements contained herein or referred to above.

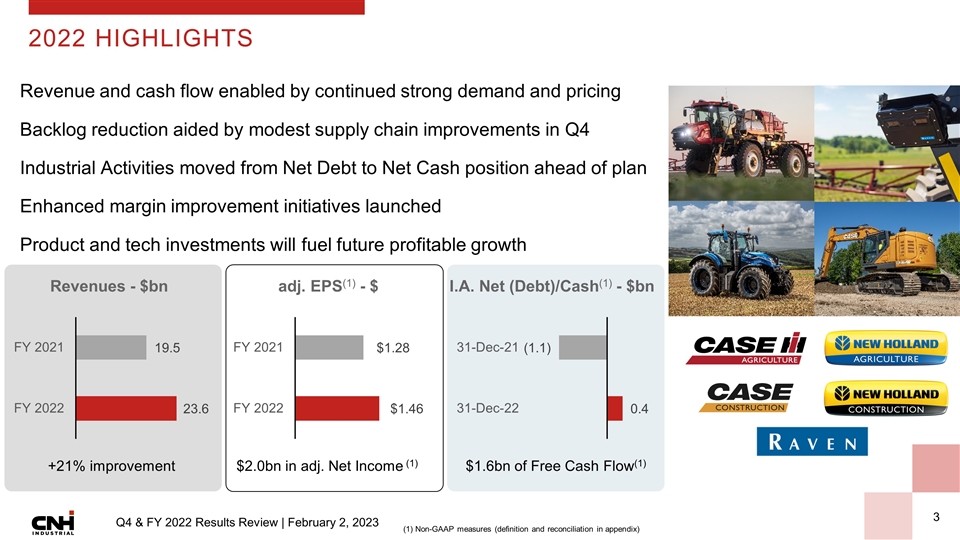

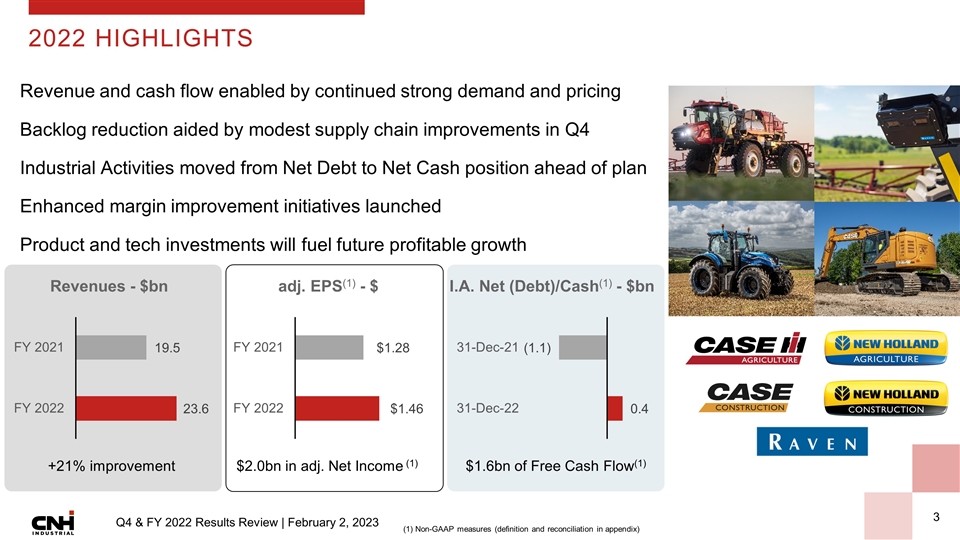

2022 HIGHLIGHTS Revenue and cash flow enabled by continued strong demand and pricing Backlog reduction aided by modest supply chain improvements in Q4 Industrial Activities moved from Net Debt to Net Cash position ahead of plan Enhanced margin improvement initiatives launched Product and tech investments will fuel future profitable growth (1) Non-GAAP measures (definition and reconciliation in appendix) Revenues - $bn adj. EPS(1) - $ I.A. Net (Debt)/Cash(1) - $bn +21% improvement $1.6bn of Free Cash Flow(1) $2.0bn in adj. Net Income (1)

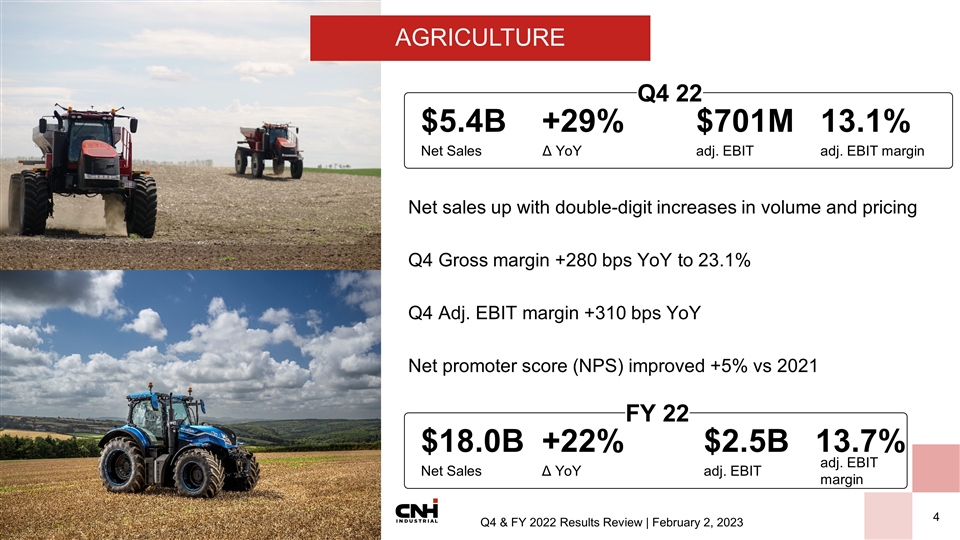

$701M adj. EBIT 13.1% adj. EBIT margin $5.4B Net Sales +29% Δ YoY Net sales up with double-digit increases in volume and pricing Q4 Gross margin +280 bps YoY to 23.1% Q4 Adj. EBIT margin +310 bps YoY Net promoter score (NPS) improved +5% vs 2021 AGRICULTURE Q4 22 $2.5B adj. EBIT 13.7% adj. EBIT margin $18.0B Net Sales +22% Δ YoY FY 22

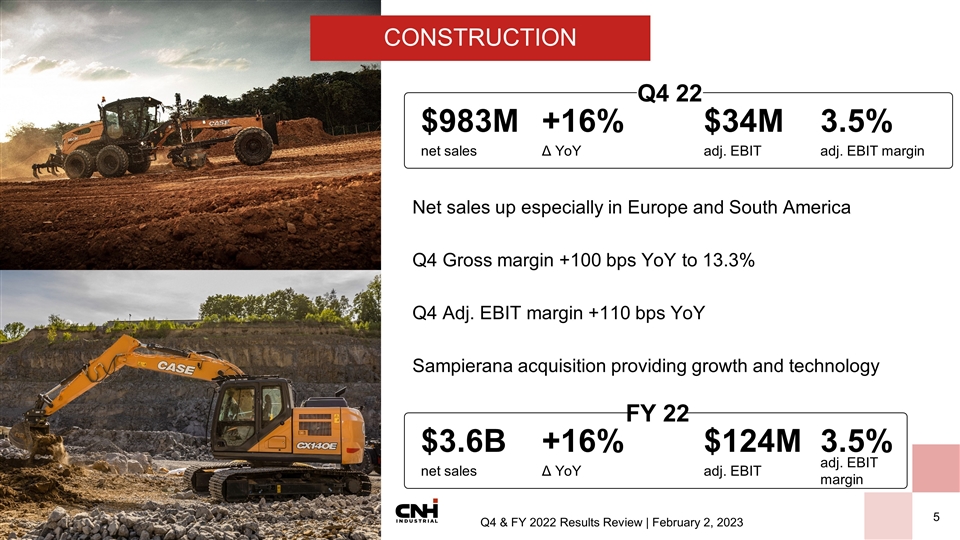

$34M adj. EBIT 3.5% adj. EBIT margin $983M net sales +16% Δ YoY CONSTRUCTION Q4 22 $124M adj. EBIT 3.5% adj. EBIT margin $3.6B net sales +16% Δ YoY FY 22 Net sales up especially in Europe and South America Q4 Gross margin +100 bps YoY to 13.3% Q4 Adj. EBIT margin +110 bps YoY Sampierana acquisition providing growth and technology

TECHNOLOGY HIGHLIGHTS Our first Tech Day showcased CNH Industrial’s technology and sustainability strengths New Holland introduces driverless T8 Tractor with Raven Autonomy™ Case IH Quadtrac AFS Connect™ awarded ‘Farm Machine 2023’ prize at SIMA Most recent investments

ADDING VALUE THROUGH SUSTAINABILITY The use by CNH Industrial of any MSCI ESG Research LLC or its affiliates (“MSCI”) data, and the use of MSCI logos, trademarks, service marks or index names herein, do not constitute a sponsorship, endorsement, recommendation, or promotion of CNH Industrial by MSCI. MSCI services and data are the property of MSCI or its information providers, and are provided ‘as-is’ and without warranty. MSCI names and logos are trademarks or service marks of MSCI. Key Recognitions Innovative Products Our Commitment Be the sustainability leader in Agriculture and Construction Be accountable for our sustainability performance Be the employer of choice in our industries New Holland T6.180 Methane Tractor New Holland E15X Electric Power Mini Excavator

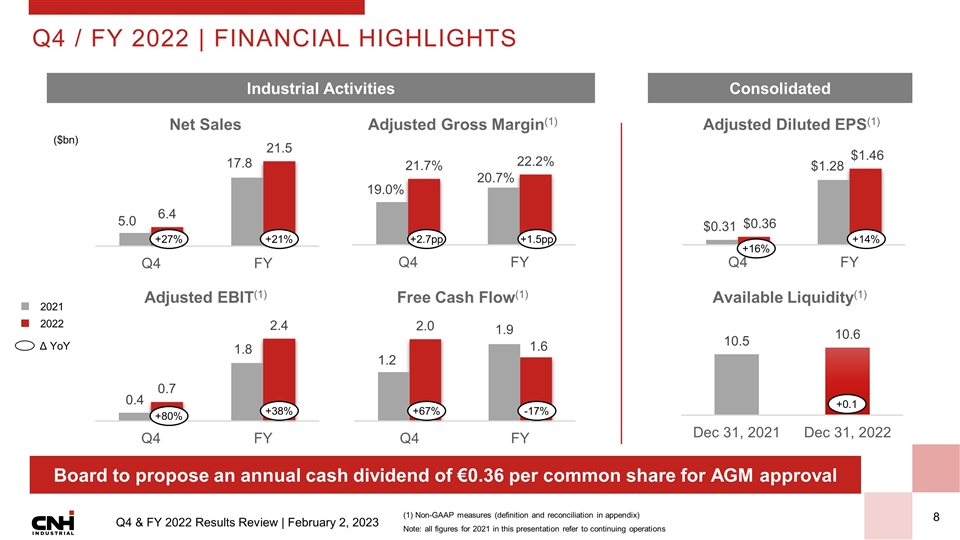

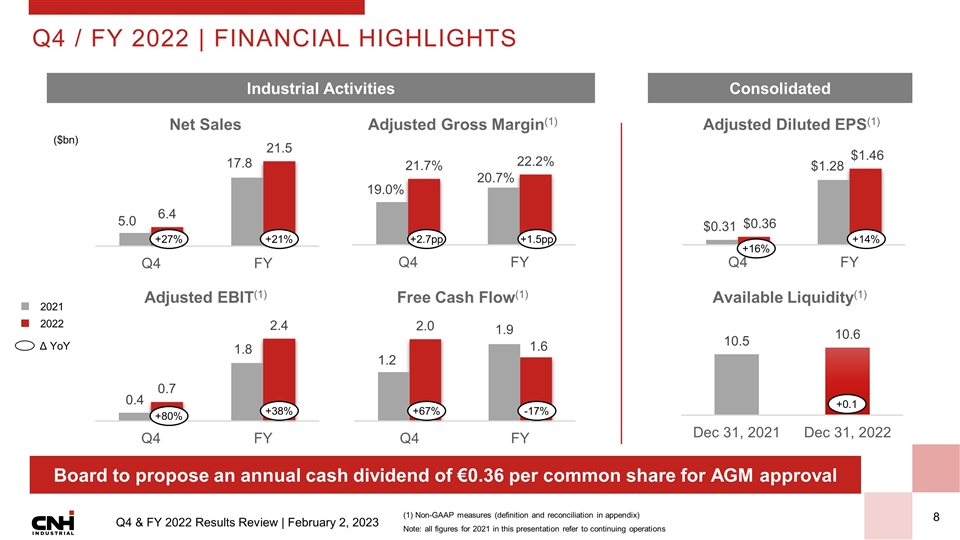

Q4 / FY 2022 | FINANCIAL HIGHLIGHTS (1) Non-GAAP measures (definition and reconciliation in appendix) Note: all figures for 2021 in this presentation refer to continuing operations Industrial Activities Consolidated Adjusted Diluted EPS(1) Available Liquidity(1) Adjusted Gross Margin(1) Free Cash Flow(1) Adjusted EBIT(1) Net Sales ($bn) 2021 2022 Δ YoY +27% +21% +2.7pp +1.5pp +80% +38% -17% +67% +14% +16% +0.1 Board to propose an annual cash dividend of €0.36 per common share for AGM approval

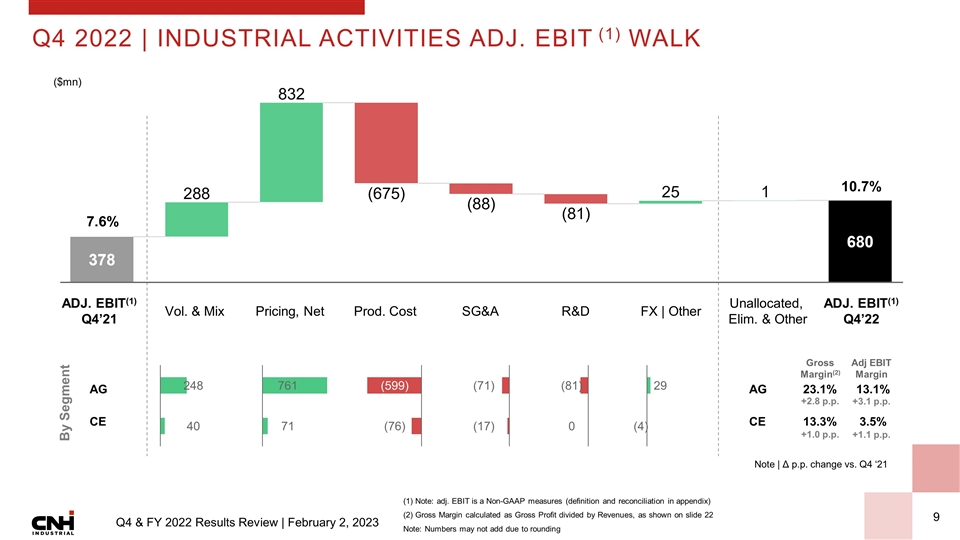

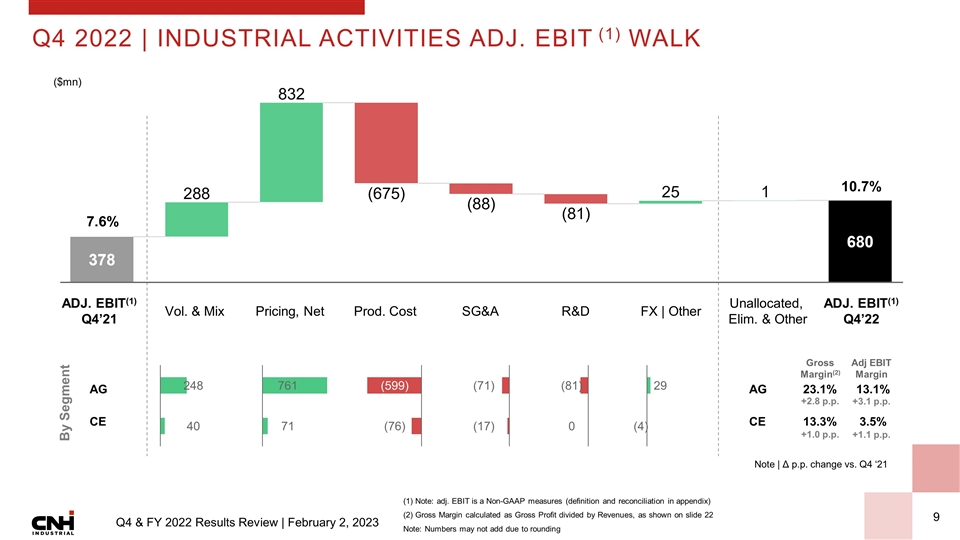

(1) Note: adj. EBIT is a Non-GAAP measures (definition and reconciliation in appendix) (2) Gross Margin calculated as Gross Profit divided by Revenues, as shown on slide 22 Note: Numbers may not add due to rounding Q4 2022 | INDUSTRIAL ACTIVITIES ADJ. EBIT (1) WALK AG CE 248 40 761 71 (599) (76) (71) (17) (81) 0 29 (4) AG 23.1% 13.1% CE 13.3% 3.5% Gross Margin(2) Adj EBIT Margin By Segment +2.8 p.p. +1.0 p.p. +3.1 p.p. +1.1 p.p. Note | Δ p.p. change vs. Q4 ‘21 ($mn) ADJ. EBIT(1) Q4’21 Vol. & Mix Pricing, Net Prod. Cost SG&A R&D FX | Other Unallocated, Elim. & Other ADJ. EBIT(1) Q4’22 10.7% 7.6%

Q4 / FY 2022 | FINANCIAL SERVICES (1) Including unconsolidated JVs (2) Return on Assets defined as: EBIT / average managed assets annualized ($mn) Delinquencies on Book (>30 Days) Profitability Ratios Managed Portfolio(*) & Retail Originations(*) Net Income Gross Margin / Average Assets on Book RoA(2) December 31, 2021 December 31, 2022 2020 2021 2022 2020 2021 2022 Retail Wholesale Operating Lease 27% 65% 8% 61% 33% 6% $20.2bn $23.8bn Q4’22 retail originations at $2.9bn, relatively flat YoY Managed portfolio(1) at $23.8bn, up $3.6bn YoY (up $4.0bn on a constant currency basis) 2021 2022 Δ YoY -3% -17%

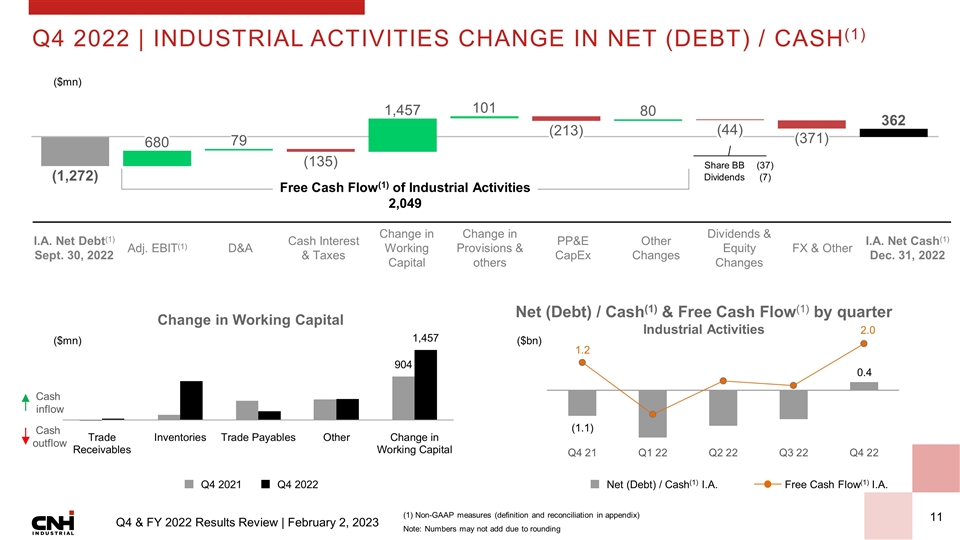

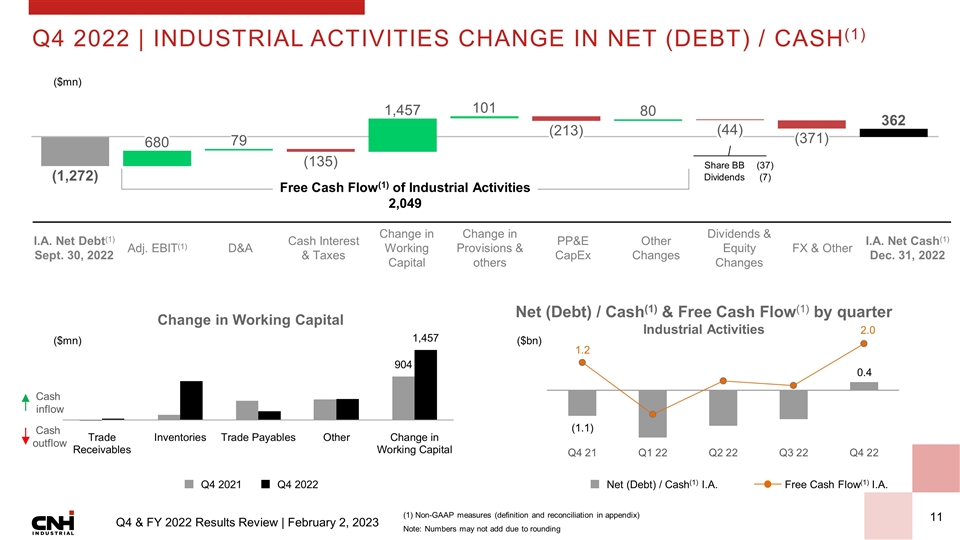

Q4 2022 | INDUSTRIAL ACTIVITIES CHANGE IN NET (DEBT) / CASH(1) (1) Non-GAAP measures (definition and reconciliation in appendix) Note: Numbers may not add due to rounding Q4 2021 Q4 2022 Net (Debt) / Cash(1) I.A. Free Cash Flow(1) I.A. ($mn) I.A. Net Debt(1) Sept. 30, 2022 Adj. EBIT(1) D&A Cash Interest & Taxes Change in Working Capital Change in Provisions & others PP&E CapEx Other Changes Dividends & Equity Changes FX & Other I.A. Net Cash(1) Dec. 31, 2022 Share BB (37) Dividends (7) Free Cash Flow(1) of Industrial Activities 2,049 ($mn) Change in Working Capital Cash inflow Cash outflow 2.0 0.4 ($bn) 1.2 (1.1) Net (Debt) / Cash(1) & Free Cash Flow(1) by quarter Industrial Activities

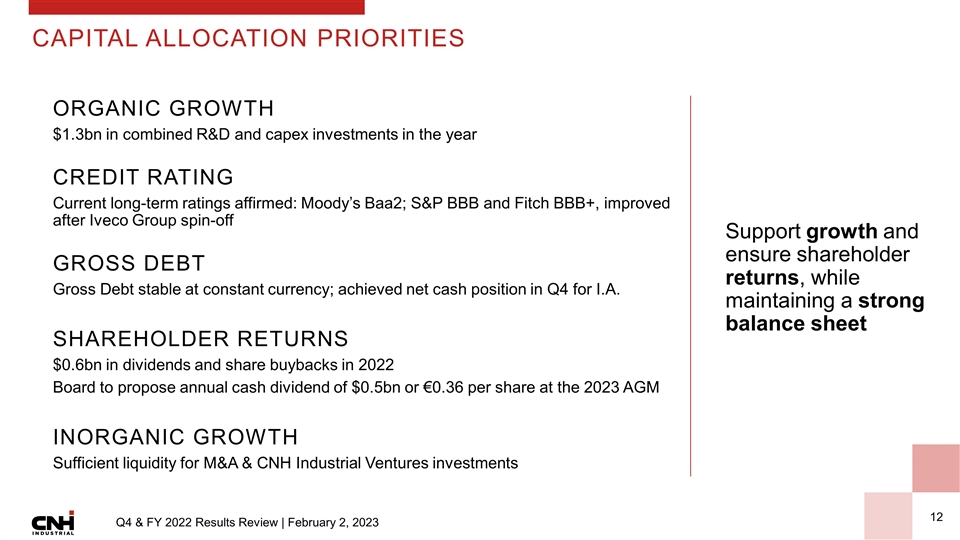

CAPITAL ALLOCATION PRIORITIES Support growth and ensure shareholder returns, while maintaining a strong balance sheet ORGANIC GROWTH $1.3bn in combined R&D and capex investments in the year CREDIT RATING Current long-term ratings affirmed: Moody’s Baa2; S&P BBB and Fitch BBB+, improved after Iveco Group spin-off GROSS DEBT Gross Debt stable at constant currency; achieved net cash position in Q4 for I.A. SHAREHOLDER RETURNS $0.6bn in dividends and share buybacks in 2022 Board to propose annual cash dividend of $0.5bn or €0.36 per share at the 2023 AGM INORGANIC GROWTH Sufficient liquidity for M&A & CNH Industrial Ventures investments

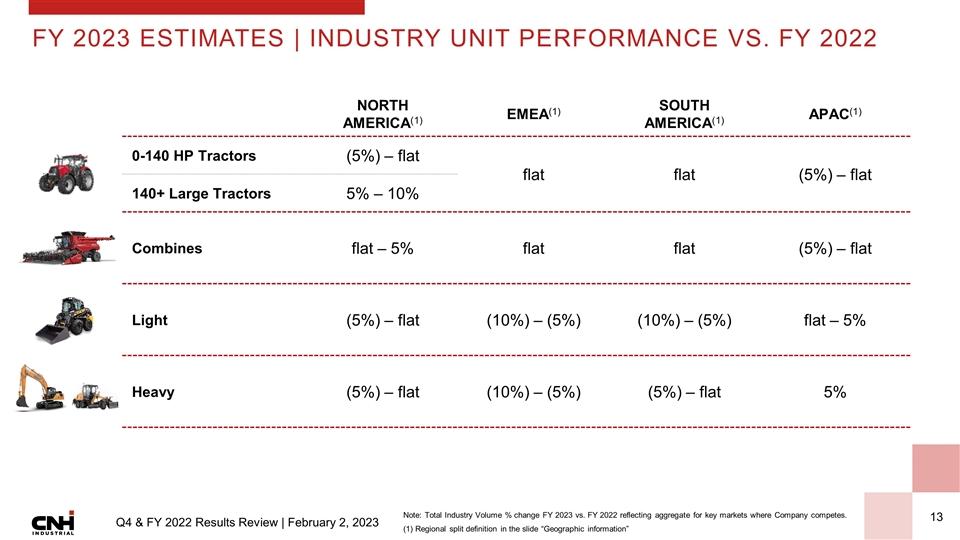

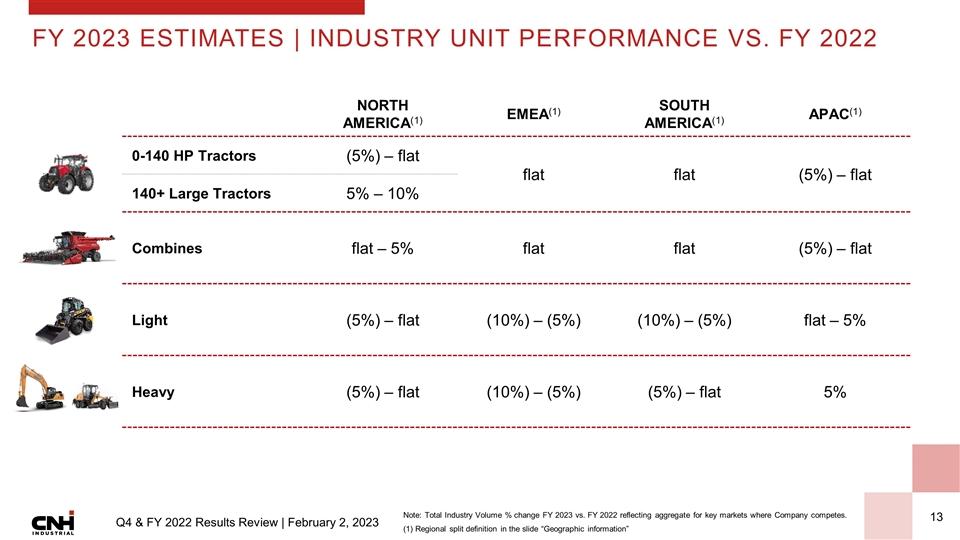

FY 2023 ESTIMATES | INDUSTRY UNIT PERFORMANCE VS. FY 2022 Note: Total Industry Volume % change FY 2023 vs. FY 2022 reflecting aggregate for key markets where Company competes. (1) Regional split definition in the slide “Geographic information” NORTH AMERICA(1) EMEA(1) SOUTH AMERICA(1) APAC(1) 0-140 HP Tractors (5%) – flat flat flat (5%) – flat 140+ Large Tractors 5% – 10% Combines flat – 5% flat flat (5%) – flat Light (5%) – flat (10%) – (5%) (10%) – (5%) flat – 5% Heavy (5%) – flat (10%) – (5%) (5%) – flat 5%

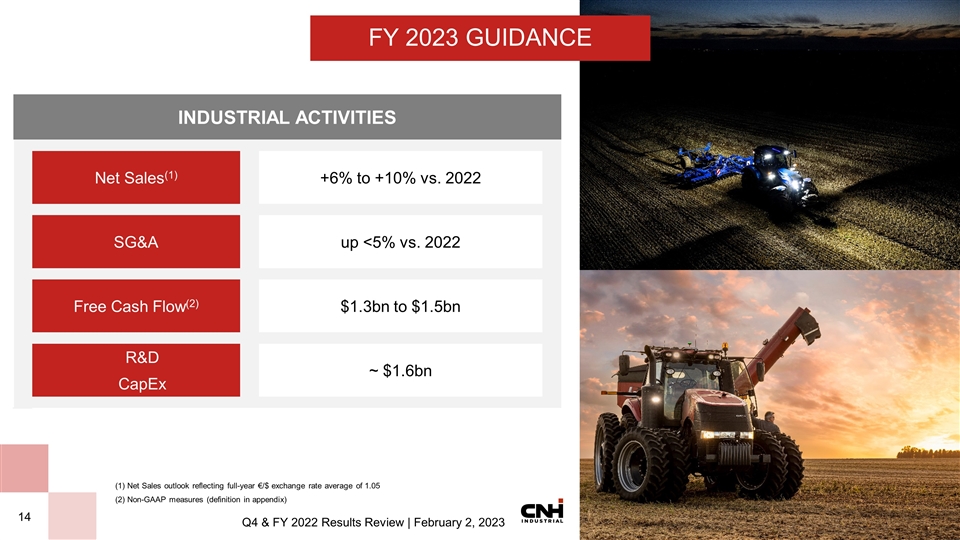

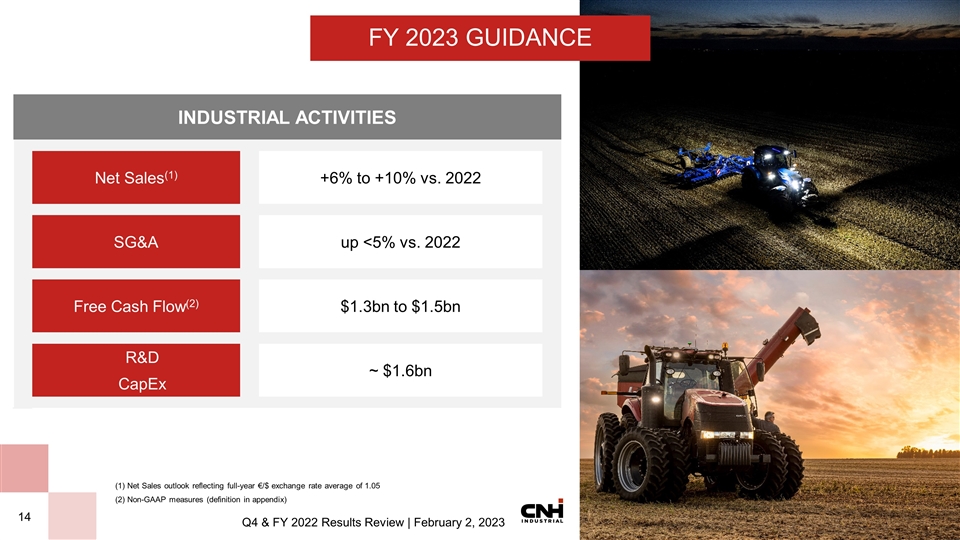

(1) Net Sales outlook reflecting full-year €/$ exchange rate average of 1.05 (2) Non-GAAP measures (definition in appendix) FY 2023 GUIDANCE INDUSTRIAL ACTIVITIES INDUSTRIAL ACTIVITIES Net Sales(1) +6% to +10% vs. 2022 SG&A up <5% vs. 2022 Free Cash Flow(2) $1.3bn to $1.5bn R&D ~ $1.6bn CapEx

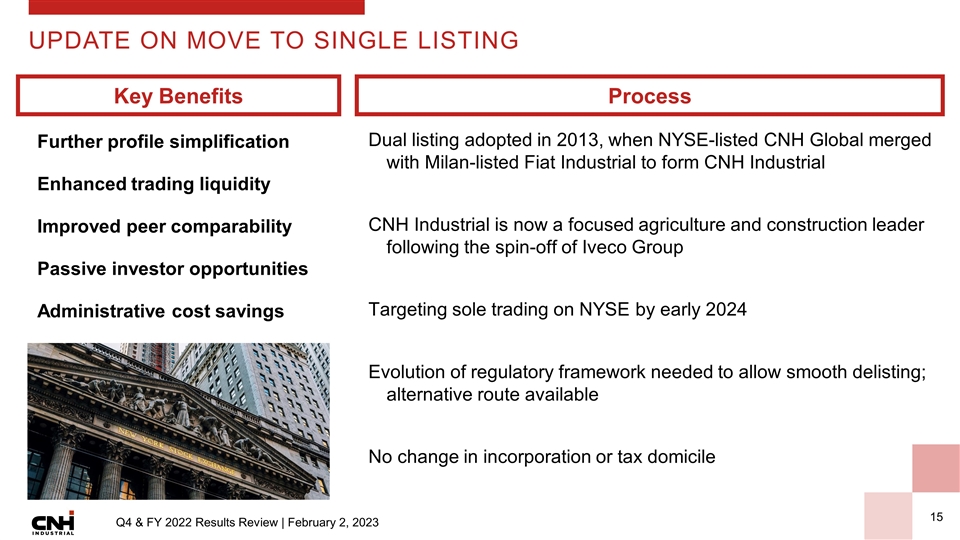

UPDATE ON MOVE TO SINGLE LISTING Dual listing adopted in 2013, when NYSE-listed CNH Global merged with Milan-listed Fiat Industrial to form CNH Industrial CNH Industrial is now a focused agriculture and construction leader following the spin-off of Iveco Group Targeting sole trading on NYSE by early 2024 Evolution of regulatory framework needed to allow smooth delisting; alternative route available No change in incorporation or tax domicile Further profile simplification Enhanced trading liquidity Improved peer comparability Passive investor opportunities Administrative cost savings Process Key Benefits

Strong orders & momentum; macro uncertainty remains Continued ramp-up of R&D & tech investments Raven impact accelerates Inflation & supply chain moderately improving Margin improvement programs yielding results 2023 PRIORITIES & OUTLOOK

APPENDIX

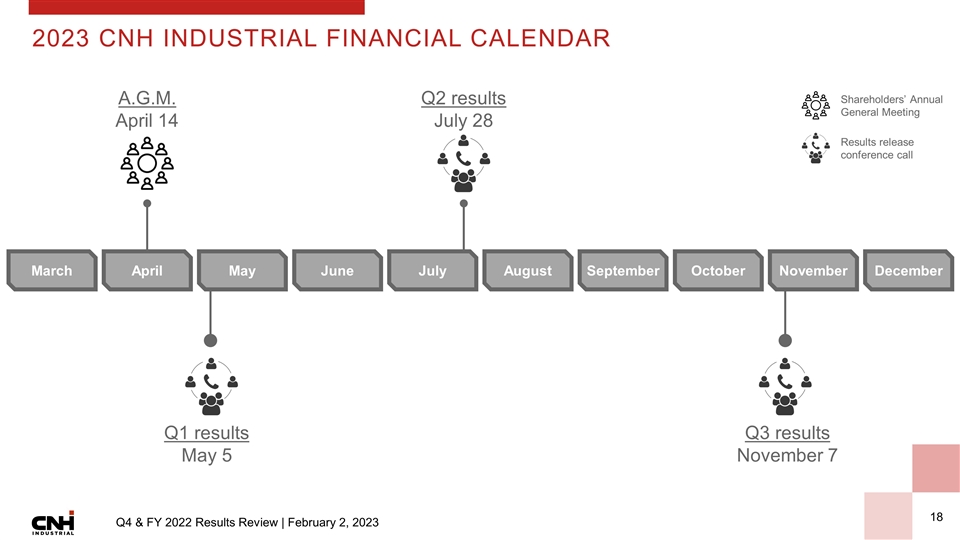

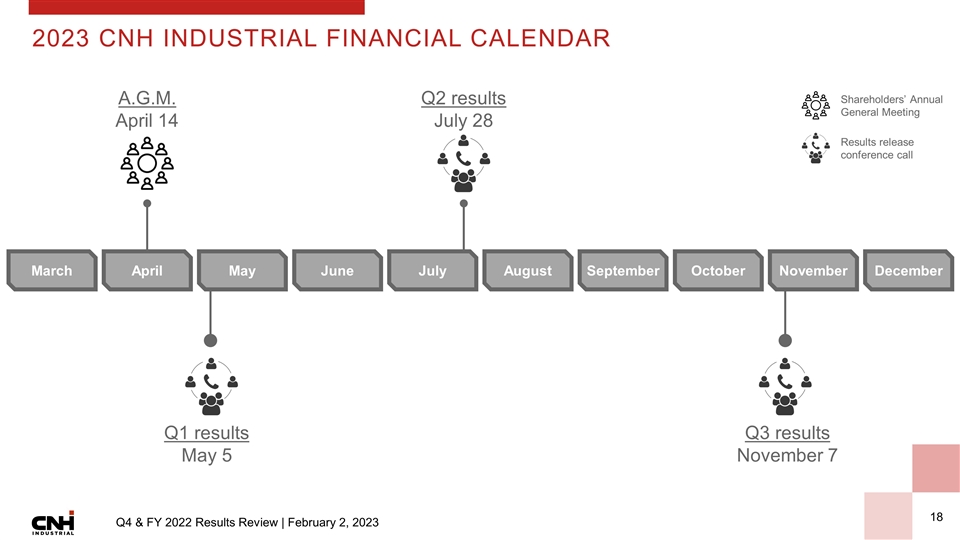

2023 CNH INDUSTRIAL FINANCIAL CALENDAR Shareholders’ Annual General Meeting Results release conference call Q1 results May 5 March April May June July August September October November December Q2 results July 28 A.G.M. April 14 Q3 results November 7

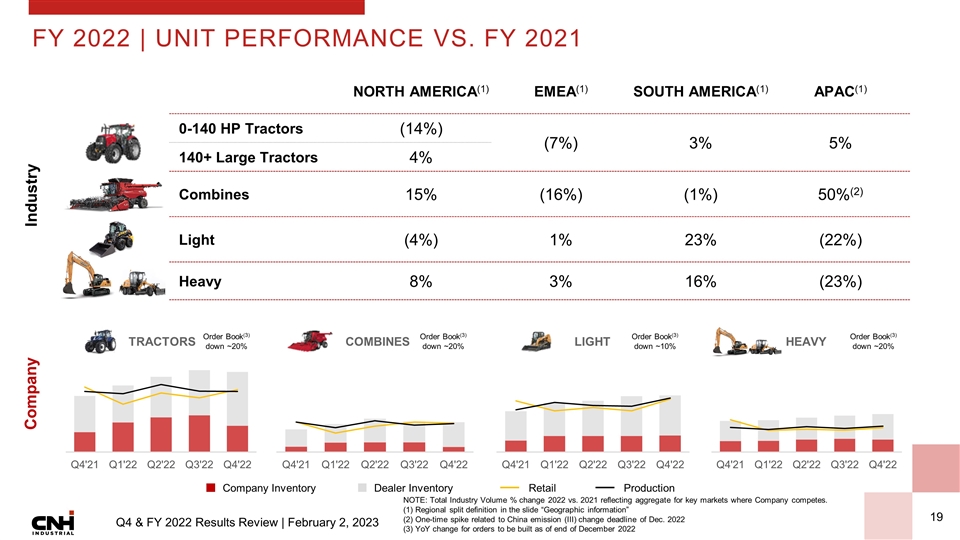

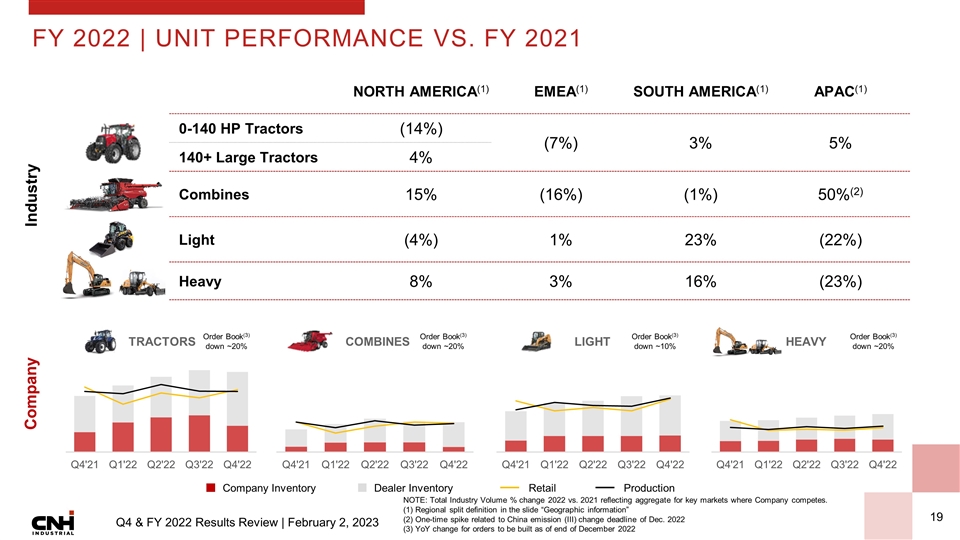

FY 2022 | UNIT PERFORMANCE VS. FY 2021 NOTE: Total Industry Volume % change 2022 vs. 2021 reflecting aggregate for key markets where Company competes. (1) Regional split definition in the slide “Geographic information” (2) One-time spike related to China emission (III) change deadline of Dec. 2022 (3) YoY change for orders to be built as of end of December 2022 NORTH AMERICA(1) EMEA(1) SOUTH AMERICA(1) APAC(1) 0-140 HP Tractors (14%) (7%) 3% 5% 140+ Large Tractors 4% Combines 15% (16%) (1%) 50%(2) Light (4%) 1% 23% (22%) Heavy 8% 3% 16% (23%) Industry Company TRACTORS COMBINES LIGHT Heavy Order Book(3) down ~20% Order Book(3) down ~20% Order Book(3) down ~10% Order Book(3) down ~20% Company Inventory Dealer Inventory Retail Production

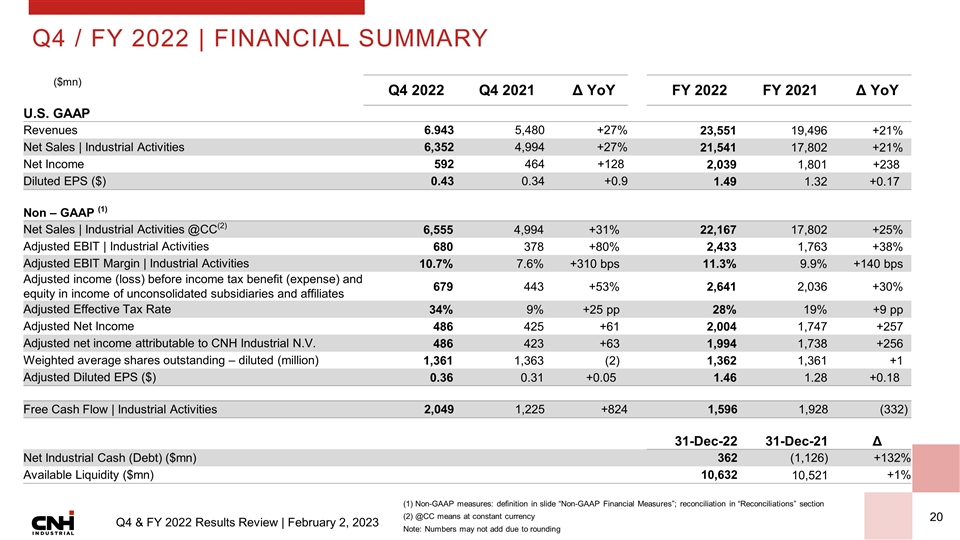

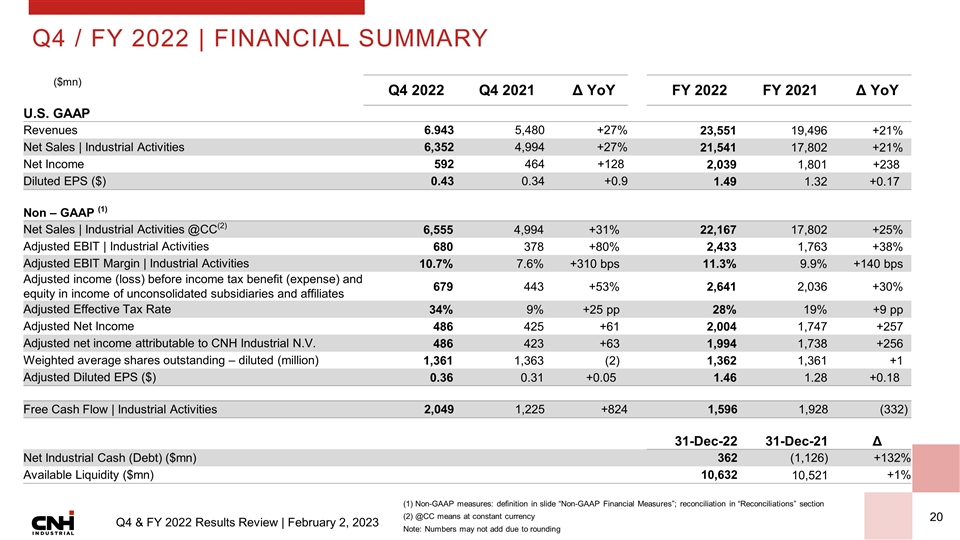

Q4 2022 Q4 2021 Δ YoY FY 2022 FY 2021 Δ YoY U.S. GAAP Revenues 6.943 5,480 +27% 23,551 19,496 +21% Net Sales | Industrial Activities 6,352 4,994 +27% 21,541 17,802 +21% Net Income 592 464 +128 2,039 1,801 +238 Diluted EPS ($) 0.43 0.34 +0.9 1.49 1.32 +0.17 Non – GAAP (1) Net Sales | Industrial Activities @CC(2) 6,555 4,994 +31% 22,167 17,802 +25% Adjusted EBIT | Industrial Activities 680 378 +80% 2,433 1,763 +38% Adjusted EBIT Margin | Industrial Activities 10.7% 7.6% +310 bps 11.3% 9.9% +140 bps Adjusted income (loss) before income tax benefit (expense) and equity in income of unconsolidated subsidiaries and affiliates 679 443 +53% 2,641 2,036 +30% Adjusted Effective Tax Rate 34% 9% +25 pp 28% 19% +9 pp Adjusted Net Income 486 425 +61 2,004 1,747 +257 Adjusted net income attributable to CNH Industrial N.V. 486 423 +63 1,994 1,738 +256 Weighted average shares outstanding – diluted (million) 1,361 1,363 (2) 1,362 1,361 +1 Adjusted Diluted EPS ($) 0.36 0.31 +0.05 1.46 1.28 +0.18 Free Cash Flow | Industrial Activities 2,049 1,225 +824 1,596 1,928 (332) 31-Dec-22 31-Dec-21 Δ Net Industrial Cash (Debt) ($mn) 362 (1,126) +132% Available Liquidity ($mn) 10,632 10,521 +1% Q4 / FY 2022 | Financial Summary (1) Non-GAAP measures: definition in slide “Non-GAAP Financial Measures”; reconciliation in “Reconciliations” section (2) @CC means at constant currency Note: Numbers may not add due to rounding ($mn)

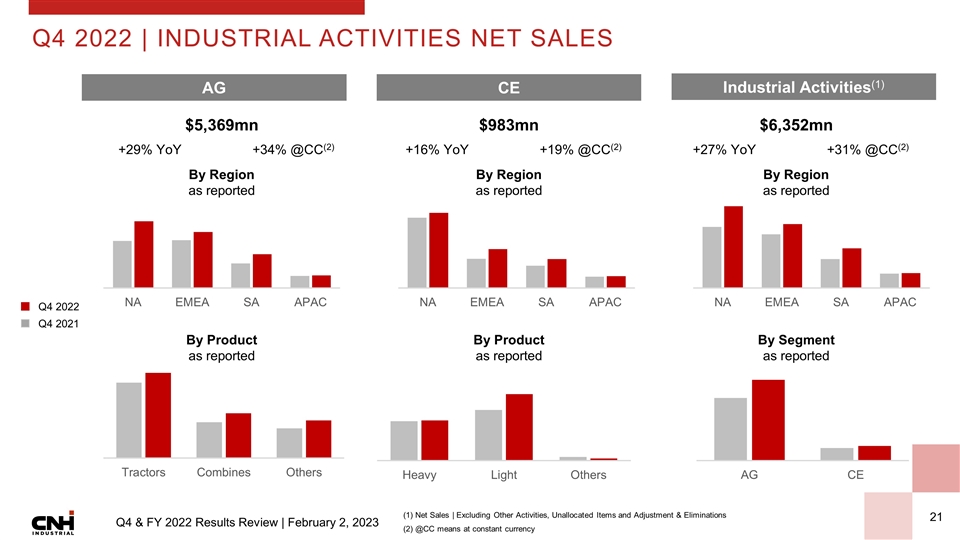

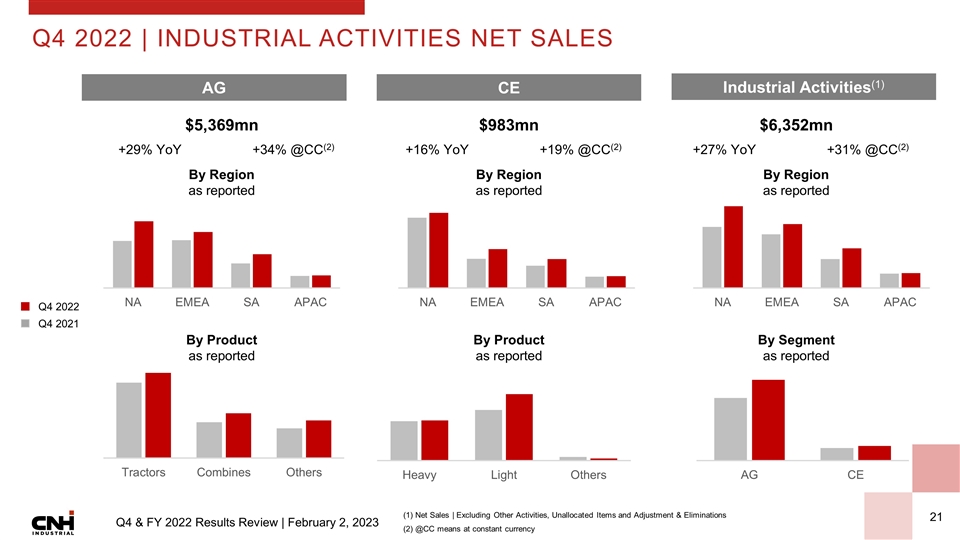

Q4 2022 | Industrial activities net sales (1) Net Sales | Excluding Other Activities, Unallocated Items and Adjustment & Eliminations (2) @CC means at constant currency AG CE Industrial Activities (1) $5,369mn $983mn $6,352mn +29% YoY +34% @CC(2) +16% YoY +19% @CC(2) +27% YoY +31% @CC(2) By Region as reported By Region as reported By Region as reported By Product as reported By Product as reported By Segment as reported Q4 2022 Q4 2021 AG Industrial Activities(1) CE

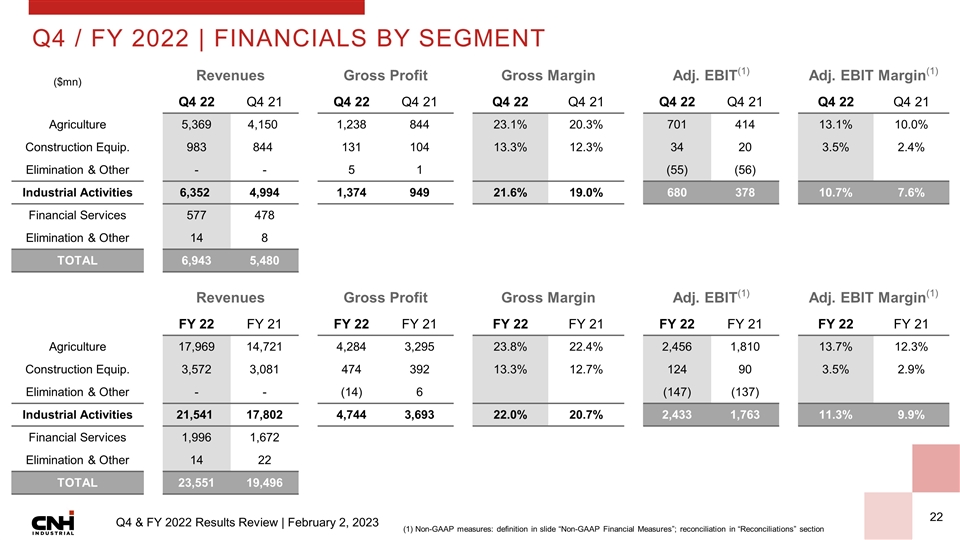

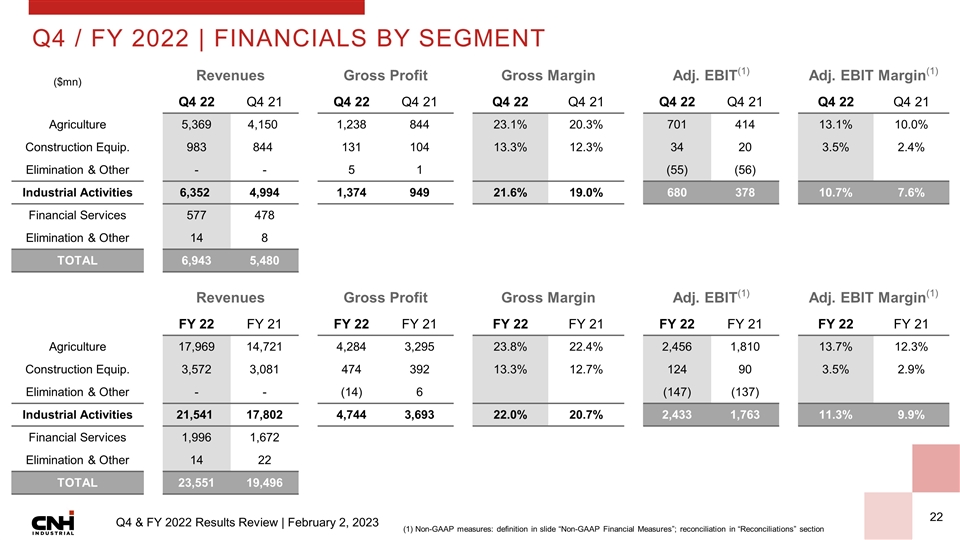

Q4 / FY 2022 | Financials by segment Revenues Gross Profit Gross Margin Adj. EBIT(1) Adj. EBIT Margin(1) Q4 22 Q4 21 Q4 22 Q4 21 Q4 22 Q4 21 Q4 22 Q4 21 Q4 22 Q4 21 Agriculture 5,369 4,150 1,238 844 23.1% 20.3% 701 414 13.1% 10.0% Construction Equip. 983 844 131 104 13.3% 12.3% 34 20 3.5% 2.4% Elimination & Other - - 5 1 (55) (56) Industrial Activities 6,352 4,994 1,374 949 21.6% 19.0% 680 378 10.7% 7.6% Financial Services 577 478 Elimination & Other 14 8 TOTAL 6,943 5,480 ($mn) (1) Non-GAAP measures: definition in slide “Non-GAAP Financial Measures”; reconciliation in “Reconciliations” section Revenues Gross Profit Gross Margin Adj. EBIT(1) Adj. EBIT Margin(1) FY 22 FY 21 FY 22 FY 21 FY 22 FY 21 FY 22 FY 21 FY 22 FY 21 Agriculture 17,969 14,721 4,284 3,295 23.8% 22.4% 2,456 1,810 13.7% 12.3% Construction Equip. 3,572 3,081 474 392 13.3% 12.7% 124 90 3.5% 2.9% Elimination & Other - - (14) 6 (147) (137) Industrial Activities 21,541 17,802 4,744 3,693 22.0% 20.7% 2,433 1,763 11.3% 9.9% Financial Services 1,996 1,672 Elimination & Other 14 22 TOTAL 23,551 19,496

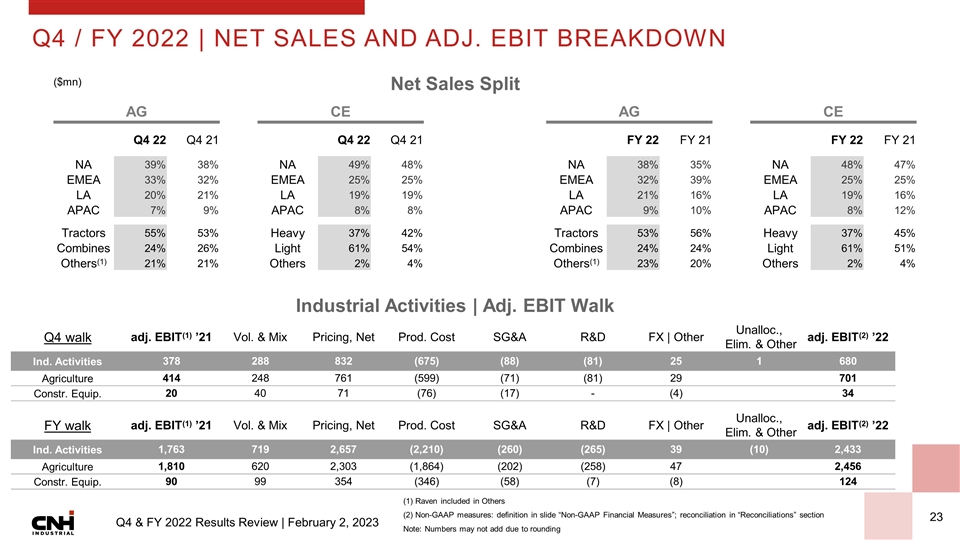

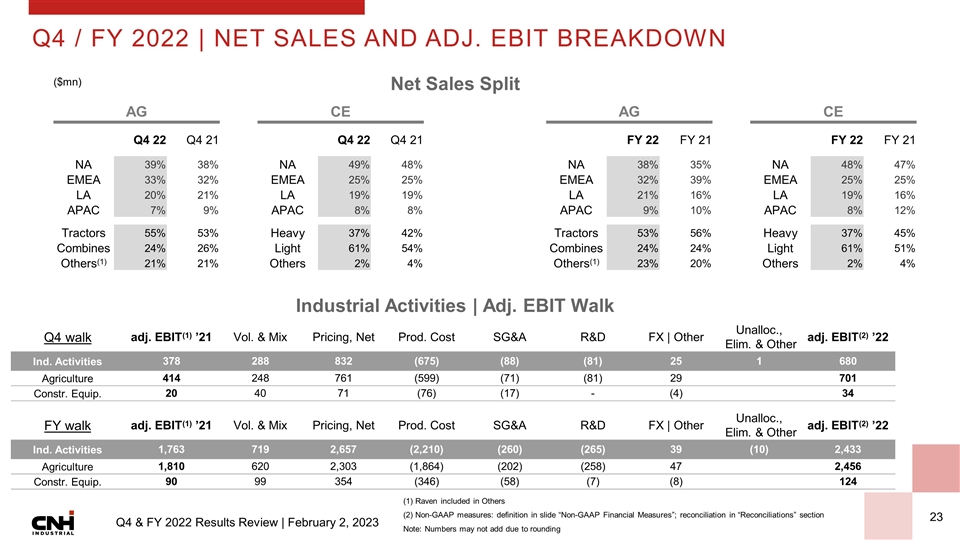

Q4 / FY 2022 | Net Sales and Adj. EBIT Breakdown (1) Raven included in Others (2) Non-GAAP measures: definition in slide “Non-GAAP Financial Measures”; reconciliation in “Reconciliations” section Note: Numbers may not add due to rounding Net Sales Split Industrial Activities | Adj. EBIT Walk AG CE Q4 22 Q4 21 Q4 22 Q4 21 NA 39% 38% NA 49% 48% EMEA 33% 32% EMEA 25% 25% LA 20% 21% LA 19% 19% APAC 7% 9% APAC 8% 8% Tractors 55% 53% Heavy 37% 42% Combines 24% 26% Light 61% 54% Others(1) 21% 21% Others 2% 4% Q4 walk adj. EBIT(1) ’21 Vol. & Mix Pricing, Net Prod. Cost SG&A R&D FX | Other Unalloc., Elim. & Other adj. EBIT(2) ’22 Ind. Activities 378 288 832 (675) (88) (81) 25 1 680 Agriculture 414 248 761 (599) (71) (81) 29 701 Constr. Equip. 20 40 71 (76) (17) - (4) 34 ($mn) AG CE FY 22 FY 21 FY 22 FY 21 NA 38% 35% NA 48% 47% EMEA 32% 39% EMEA 25% 25% LA 21% 16% LA 19% 16% APAC 9% 10% APAC 8% 12% Tractors 53% 56% Heavy 37% 45% Combines 24% 24% Light 61% 51% Others(1) 23% 20% Others 2% 4% FY walk adj. EBIT(1) ’21 Vol. & Mix Pricing, Net Prod. Cost SG&A R&D FX | Other Unalloc., Elim. & Other adj. EBIT(2) ’22 Ind. Activities 1,763 719 2,657 (2,210) (260) (265) 39 (10) 2,433 Agriculture 1,810 620 2,303 (1,864) (202) (258) 47 2,456 Constr. Equip. 90 99 354 (346) (58) (7) (8) 124

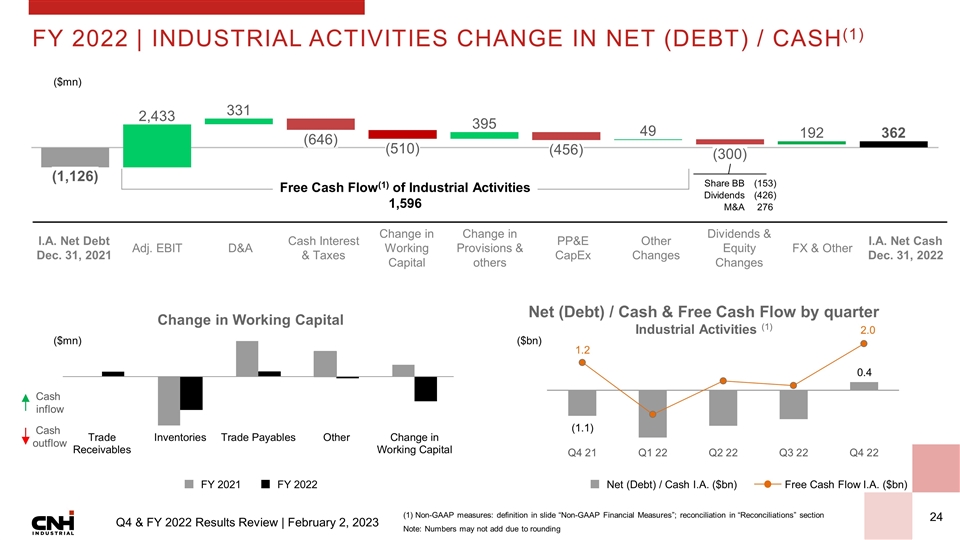

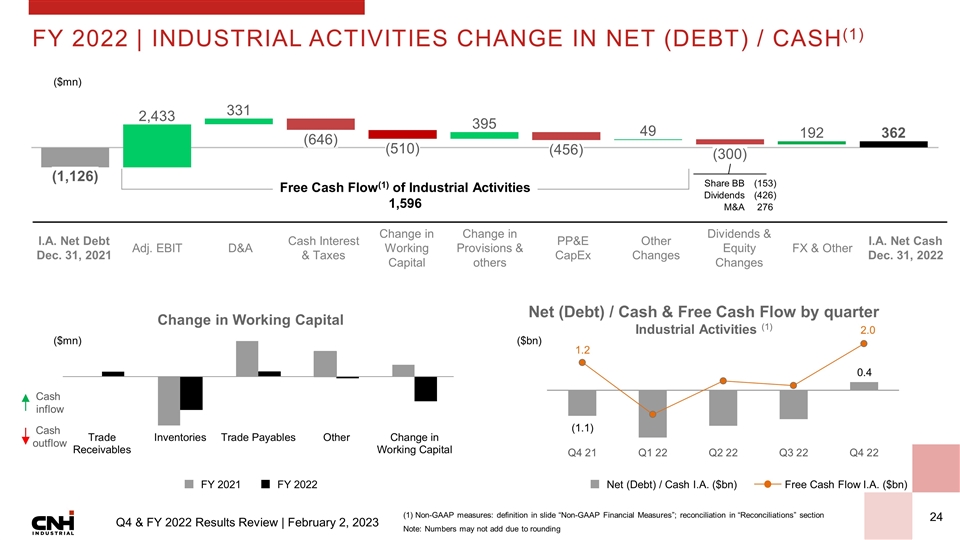

FY 2022 | INDUSTRIAL ACTIVITIES CHANGE IN NET (DEBT) / CASH(1) (1) Non-GAAP measures: definition in slide “Non-GAAP Financial Measures”; reconciliation in “Reconciliations” section Note: Numbers may not add due to rounding FY 2021 FY 2022 Net (Debt) / Cash I.A. ($bn) Free Cash Flow I.A. ($bn) ($mn) I.A. Net Debt Dec. 31, 2021 Adj. EBIT D&A Cash Interest & Taxes Change in Working Capital Change in Provisions & others PP&E CapEx Other Changes Dividends & Equity Changes FX & Other I.A. Net Cash Dec. 31, 2022 Share BB (153) Dividends (426) M&A 276 Free Cash Flow(1) of Industrial Activities 1,596 ($mn) Change in Working Capital Cash inflow Cash outflow 2.0 0.4 ($bn) 1.2 (1.1) Net (Debt) / Cash & Free Cash Flow by quarter Industrial Activities (1)

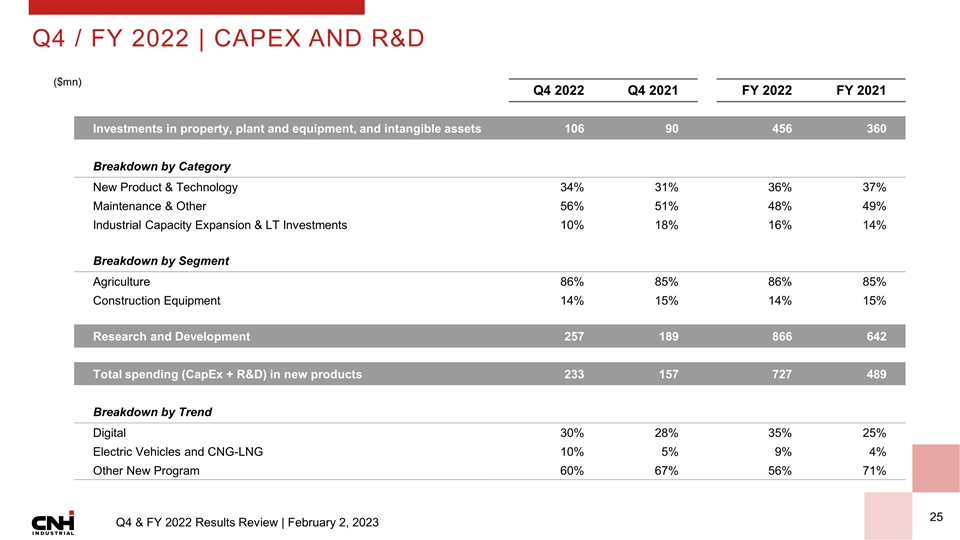

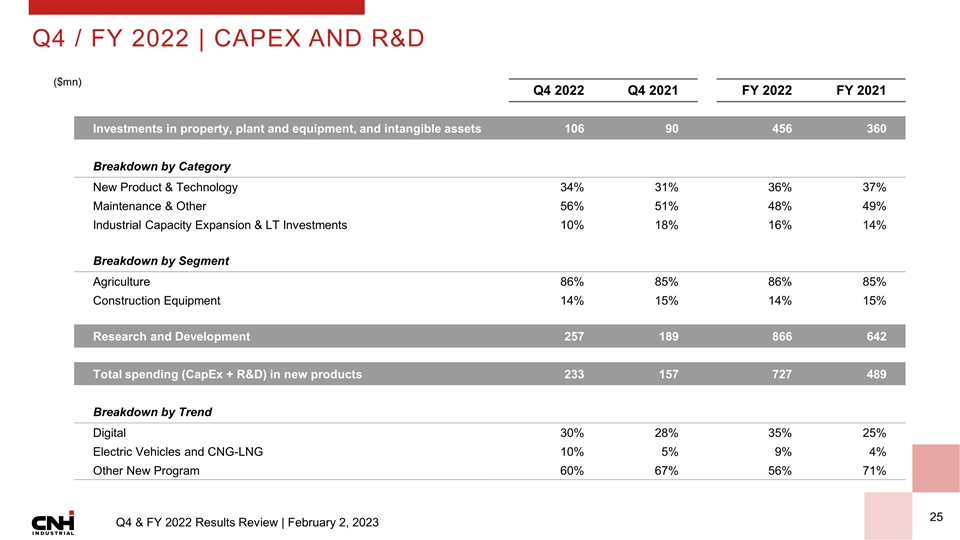

Q4 2022 Q4 2021 FY 2022 FY 2021 Investments in property, plant and equipment, and intangible assets 106 90 456 360 Breakdown by Category New Product & Technology 34% 31% 36% 37% Maintenance & Other 56% 51% 48% 49% Industrial Capacity Expansion & LT Investments 10% 18% 16% 14% Breakdown by Segment Agriculture 86% 85% 86% 85% Construction Equipment 14% 15% 14% 15% Research and Development 257 189 866 642 Total spending (CapEx + R&D) in new products 233 157 727 489 Breakdown by Trend Digital 30% 28% 35% 25% Electric Vehicles and CNG-LNG 10% 5% 9% 4% Other New Program 60% 67% 56% 71% ($mn) Q4 / FY 2022 | capex and r&d

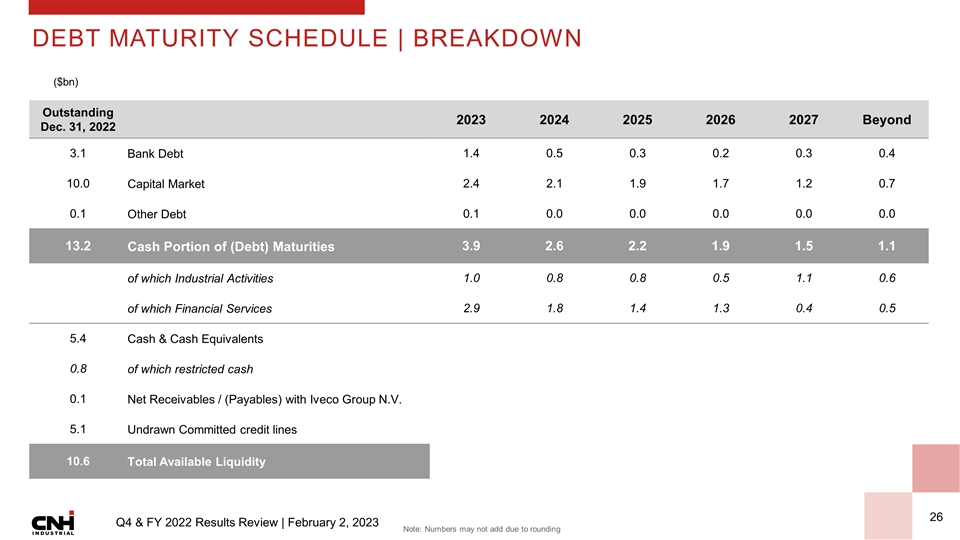

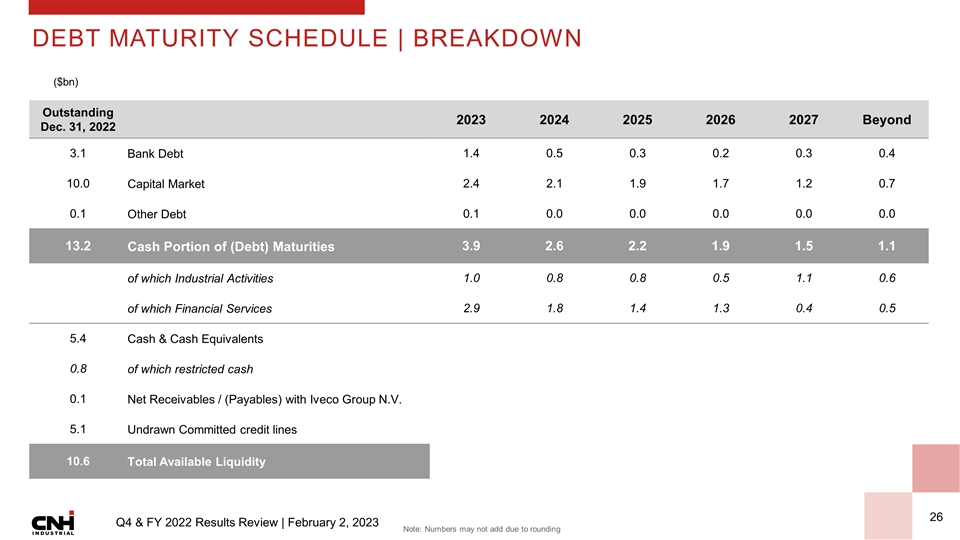

($bn) Outstanding Dec. 31, 2022 2023 2024 2025 2026 2027 Beyond 3.1 Bank Debt 1.4 0.5 0.3 0.2 0.3 0.4 10.0 Capital Market 2.4 2.1 1.9 1.7 1.2 0.7 0.1 Other Debt 0.1 0.0 0.0 0.0 0.0 0.0 13.2 Cash Portion of (Debt) Maturities 3.9 2.6 2.2 1.9 1.5 1.1 of which Industrial Activities 1.0 0.8 0.8 0.5 1.1 0.6 of which Financial Services 2.9 1.8 1.4 1.3 0.4 0.5 5.4 Cash & Cash Equivalents 0.8 of which restricted cash 0.1 Net Receivables / (Payables) with Iveco Group N.V. 5.1 Undrawn Committed credit lines 10.6 Total Available Liquidity Debt maturity schedule | breakdown Note: Numbers may not add due to rounding

Reconciliations

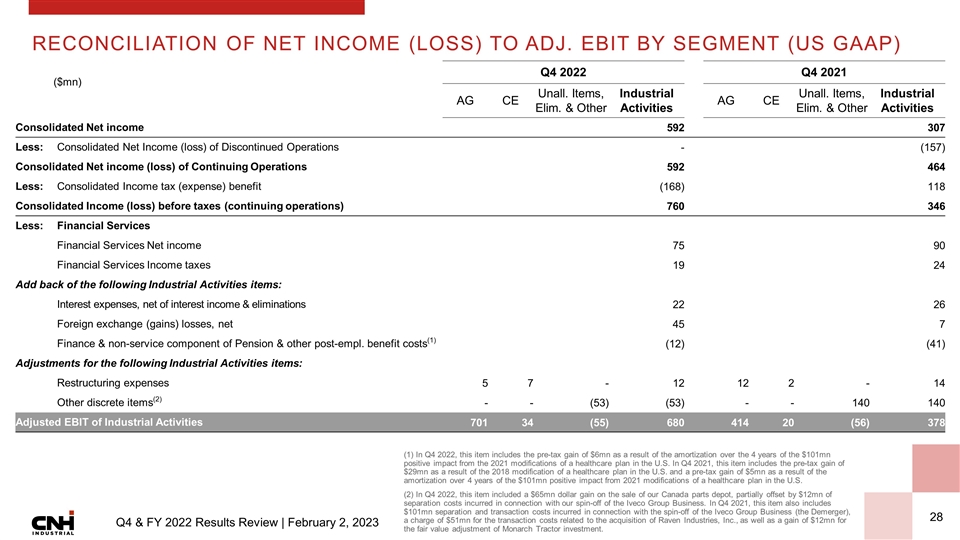

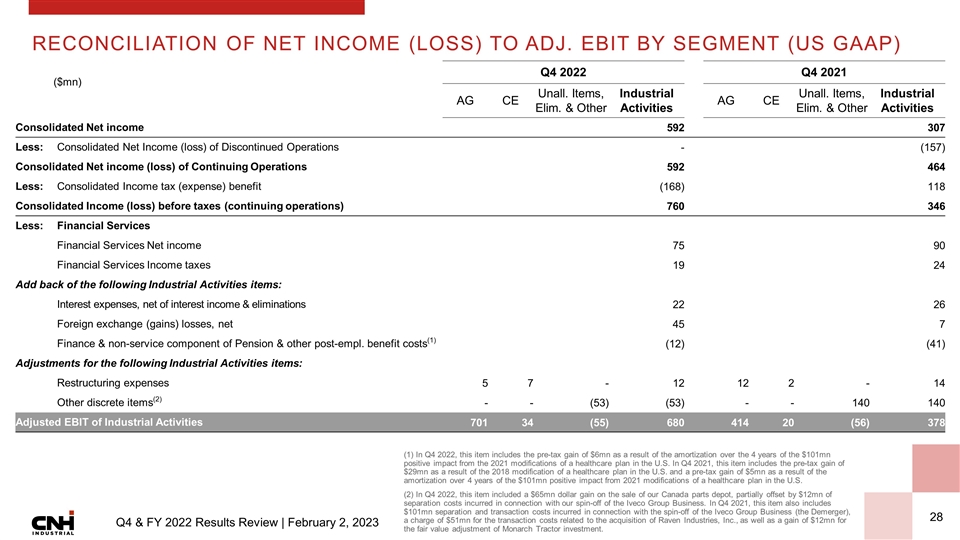

(1) In Q4 2022, this item includes the pre-tax gain of $6mn as a result of the amortization over the 4 years of the $101mn positive impact from the 2021 modifications of a healthcare plan in the U.S. In Q4 2021, this item includes the pre-tax gain of $29mn as a result of the 2018 modification of a healthcare plan in the U.S. and a pre-tax gain of $5mn as a result of the amortization over 4 years of the $101mn positive impact from 2021 modifications of a healthcare plan in the U.S. (2) In Q4 2022, this item included a $65mn dollar gain on the sale of our Canada parts depot, partially offset by $12mn of separation costs incurred in connection with our spin-off of the Iveco Group Business. In Q4 2021, this item also includes $101mn separation and transaction costs incurred in connection with the spin-off of the Iveco Group Business (the Demerger), a charge of $51mn for the transaction costs related to the acquisition of Raven Industries, Inc., as well as a gain of $12mn for the fair value adjustment of Monarch Tractor investment. ($mn) Reconciliation of Net Income (Loss) to Adj. EBIT by Segment (US GAAP) Q4 2022 Q4 2021 AG CE Unall. Items, Elim. & Other Industrial Activities AG CE Unall. Items, Elim. & Other Industrial Activities Consolidated Net income 592 307 Less: Consolidated Net Income (loss) of Discontinued Operations - (157) Consolidated Net income (loss) of Continuing Operations Consolidated Net income (loss) of Continuing Operations 592 464 Less: Consolidated Income tax (expense) benefit (168) 118 Consolidated Income (loss) before taxes (continuing operations) 760 346 Less: Financial Services Financial Services Net income 75 90 Financial Services Income taxes 19 24 Add back of the following Industrial Activities items: Interest expenses, net of interest income & eliminations 22 26 Foreign exchange (gains) losses, net 45 7 Finance & non-service component of Pension & other post-empl. benefit costs(1) (12) (41) Adjustments for the following Industrial Activities items: Restructuring expenses 5 7 - 12 12 2 - 14 Other discrete items(2) - - (53) (53) - - 140 140 Adjusted EBIT of Industrial Activities 701 34 (55) 680 414 20 (56) 378

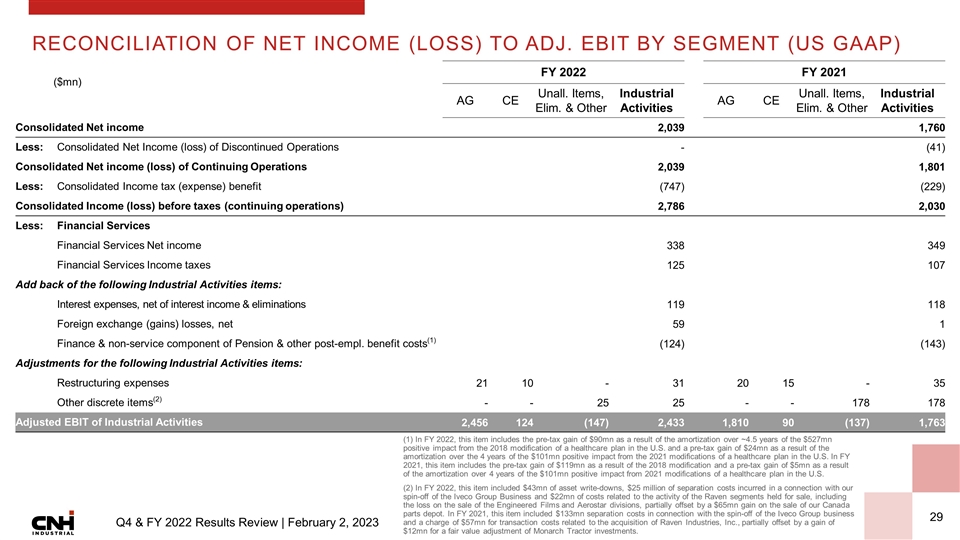

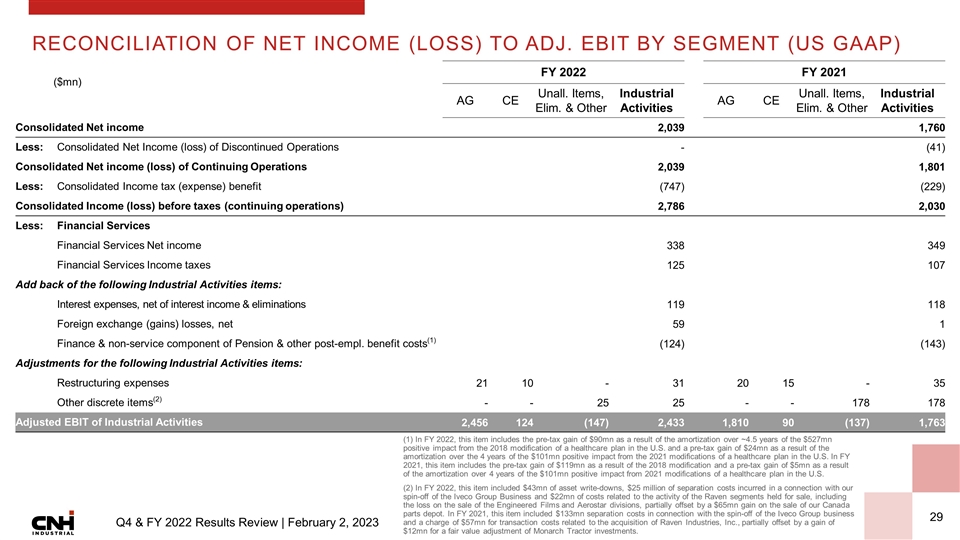

(1) In FY 2022, this item includes the pre-tax gain of $90mn as a result of the amortization over ~4.5 years of the $527mn positive impact from the 2018 modification of a healthcare plan in the U.S. and a pre-tax gain of $24mn as a result of the amortization over the 4 years of the $101mn positive impact from the 2021 modifications of a healthcare plan in the U.S. In FY 2021, this item includes the pre-tax gain of $119mn as a result of the 2018 modification and a pre-tax gain of $5mn as a result of the amortization over 4 years of the $101mn positive impact from 2021 modifications of a healthcare plan in the U.S. (2) In FY 2022, this item included $43mn of asset write-downs, $25 million of separation costs incurred in a connection with our spin-off of the Iveco Group Business and $22mn of costs related to the activity of the Raven segments held for sale, including the loss on the sale of the Engineered Films and Aerostar divisions, partially offset by a $65mn gain on the sale of our Canada parts depot. In FY 2021, this item included $133mn separation costs in connection with the spin-off of the Iveco Group business and a charge of $57mn for transaction costs related to the acquisition of Raven Industries, Inc., partially offset by a gain of $12mn for a fair value adjustment of Monarch Tractor investments. ($mn) FY 2022 FY 2021 AG CE Unall. Items, Elim. & Other Industrial Activities AG CE Unall. Items, Elim. & Other Industrial Activities Consolidated Net income 2,039 1,760 Less: Consolidated Net Income (loss) of Discontinued Operations - (41) Consolidated Net income (loss) of Continuing Operations Consolidated Net income (loss) of Continuing Operations 2,039 1,801 Less: Consolidated Income tax (expense) benefit (747) (229) Consolidated Income (loss) before taxes (continuing operations) 2,786 2,030 Less: Financial Services Financial Services Net income 338 349 Financial Services Income taxes 125 107 Add back of the following Industrial Activities items: Interest expenses, net of interest income & eliminations 119 118 Foreign exchange (gains) losses, net 59 1 Finance & non-service component of Pension & other post-empl. benefit costs(1) (124) (143) Adjustments for the following Industrial Activities items: Restructuring expenses 21 10 - 31 20 15 - 35 Other discrete items(2) - - 25 25 - - 178 178 Adjusted EBIT of Industrial Activities 2,456 124 (147) 2,433 1,810 90 (137) 1,763 Reconciliation of Net Income (Loss) to Adj. EBIT by Segment (US GAAP)

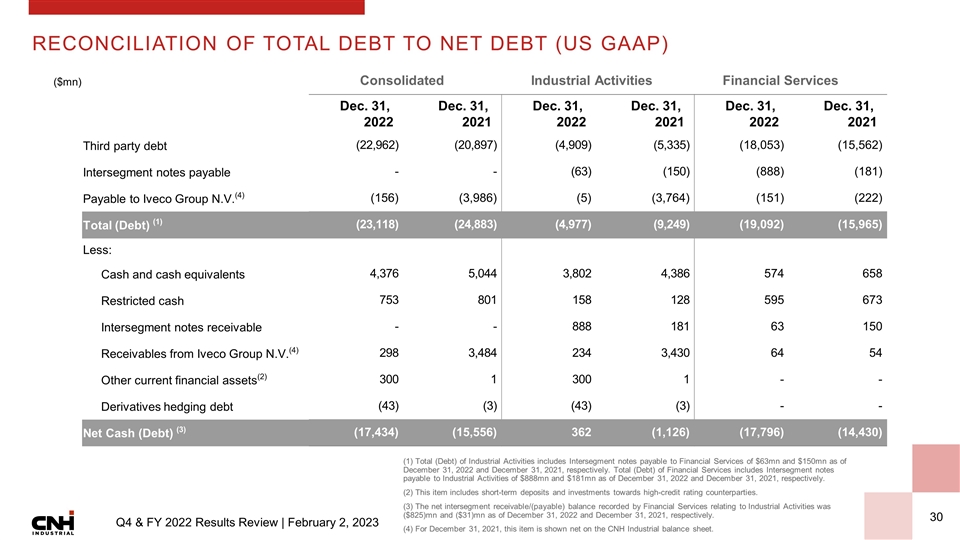

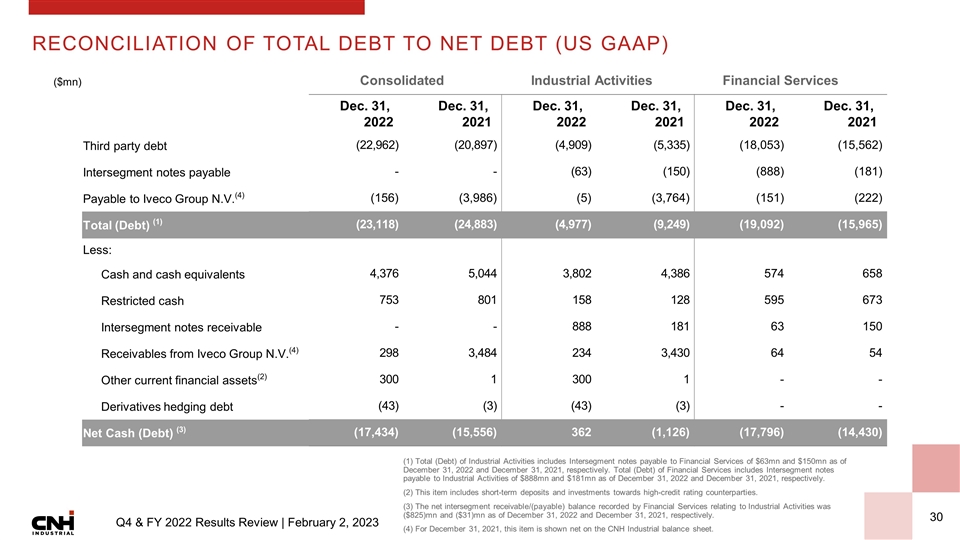

RECONCILIATION OF TOTAL DEBT TO NET DEBT (US GAAP) (1) Total (Debt) of Industrial Activities includes Intersegment notes payable to Financial Services of $63mn and $150mn as of December 31, 2022 and December 31, 2021, respectively. Total (Debt) of Financial Services includes Intersegment notes payable to Industrial Activities of $888mn and $181mn as of December 31, 2022 and December 31, 2021, respectively. (2) This item includes short-term deposits and investments towards high-credit rating counterparties. (3) The net intersegment receivable/(payable) balance recorded by Financial Services relating to Industrial Activities was ($825)mn and ($31)mn as of December 31, 2022 and December 31, 2021, respectively. (4) For December 31, 2021, this item is shown net on the CNH Industrial balance sheet. Consolidated Industrial Activities Financial Services Dec. 31, 2022 Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2021 Dec. 31, 2022 Dec. 31, 2021 Third party debt (22,962) (20,897) (4,909) (5,335) (18,053) (15,562) Intersegment notes payable - - (63) (150) (888) (181) Payable to Iveco Group N.V.(4) (156) (3,986) (5) (3,764) (151) (222) Total (Debt) (1) (23,118) (24,883) (4,977) (9,249) (19,092) (15,965) Less: Cash and cash equivalents 4,376 5,044 3,802 4,386 574 658 Restricted cash 753 801 158 128 595 673 Intersegment notes receivable - - 888 181 63 150 Receivables from Iveco Group N.V.(4) 298 3,484 234 3,430 64 54 Other current financial assets(2) 300 1 300 1 - - Derivatives hedging debt (43) (3) (43) (3) - - Net Cash (Debt) (3) (17,434) (15,556) 362 (1,126) (17,796) (14,430) ($mn)

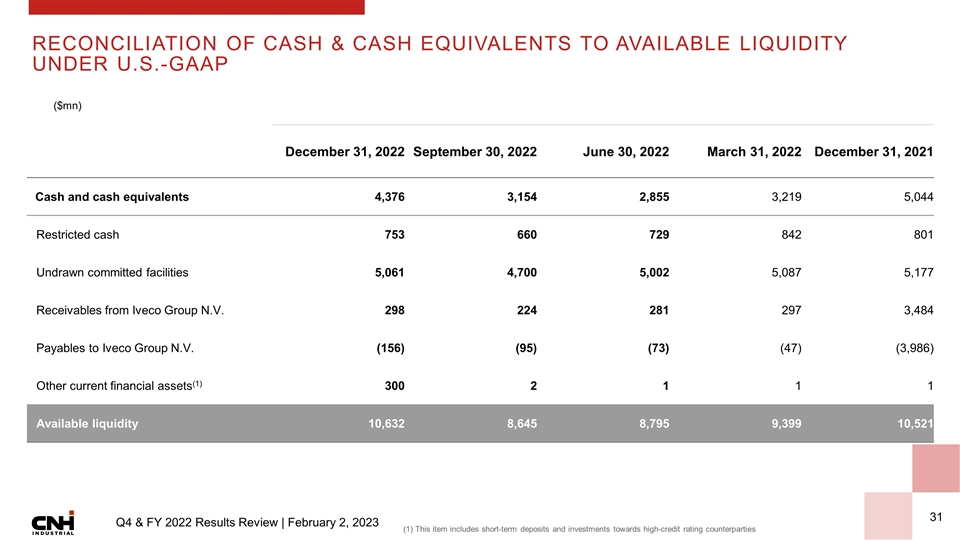

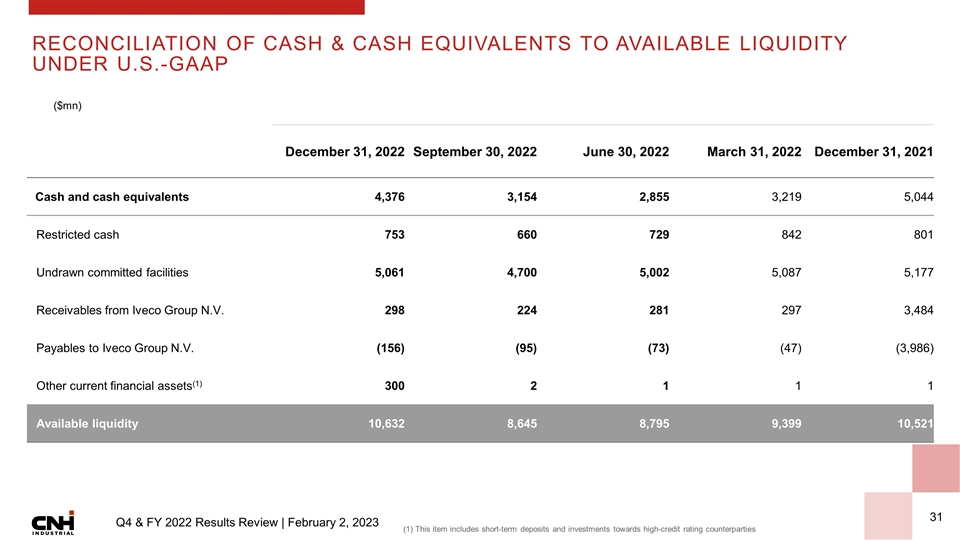

Reconciliation of Cash & cash equivalents to Available liquidity under U.S.-GAAP (1) This item includes short-term deposits and investments towards high-credit rating counterparties December 31, 2022 September 30, 2022 June 30, 2022 March 31, 2022 December 31, 2021 Cash and cash equivalents 4,376 3,154 2,855 3,219 5,044 Restricted cash 753 660 729 842 801 Undrawn committed facilities 5,061 4,700 5,002 5,087 5,177 Receivables from Iveco Group N.V. 298 224 281 297 3,484 Payables to Iveco Group N.V. (156) (95) (73) (47) (3,986) Other current financial assets(1) 300 2 1 1 1 Available liquidity 10,632 8,645 8,795 9,399 10,521 ($mn)

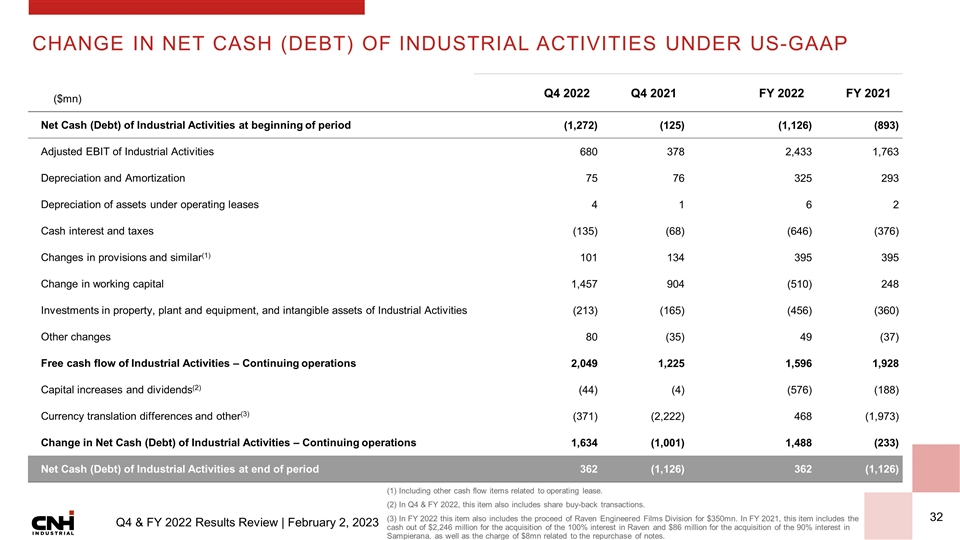

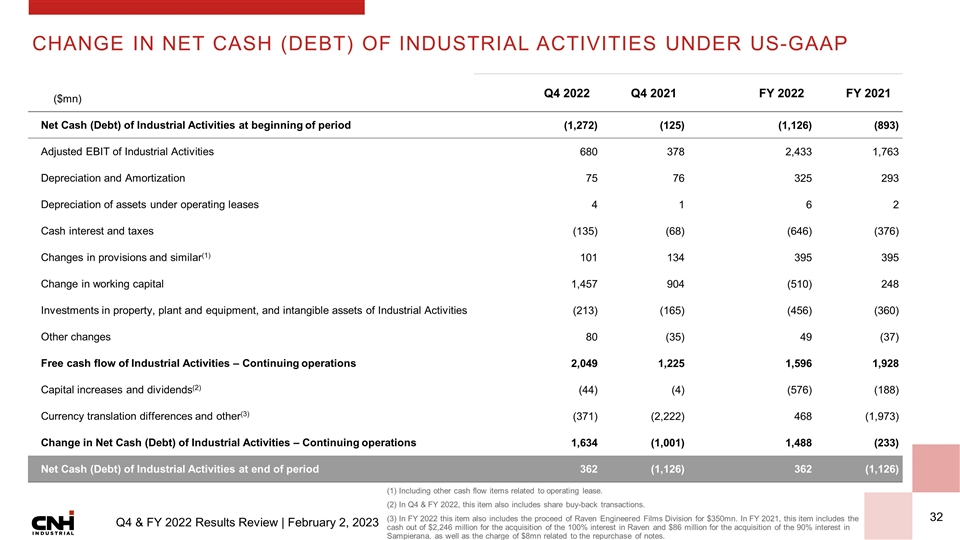

Q4 2022 Q4 2021 FY 2022 FY 2021 Net Cash (Debt) of Industrial Activities at beginning of period (1,272) (125) (1,126) (893) Adjusted EBIT of Industrial Activities 680 378 2,433 1,763 Depreciation and Amortization 75 76 325 293 Depreciation of assets under operating leases 4 1 6 2 Cash interest and taxes (135) (68) (646) (376) Changes in provisions and similar(1) 101 134 395 395 Change in working capital 1,457 904 (510) 248 Investments in property, plant and equipment, and intangible assets of Industrial Activities (213) (165) (456) (360) Other changes 80 (35) 49 (37) Free cash flow of Industrial Activities – Continuing operations 2,049 1,225 1,596 1,928 Capital increases and dividends(2) (44) (4) (576) (188) Currency translation differences and other(3) (371) (2,222) 468 (1,973) Change in Net Cash (Debt) of Industrial Activities – Continuing operations 1,634 (1,001) 1,488 (233) Net Cash (Debt) of Industrial Activities at end of period 362 (1,126) 362 (1,126) Change in Net Cash (Debt) of Industrial Activities under US-GAAP (1) Including other cash flow items related to operating lease. (2) In Q4 & FY 2022, this item also includes share buy-back transactions. (3) In FY 2022 this item also includes the proceed of Raven Engineered Films Division for $350mn. In FY 2021, this item includes the cash out of $2,246 million for the acquisition of the 100% interest in Raven and $86 million for the acquisition of the 90% interest in Sampierana, as well as the charge of $8mn related to the repurchase of notes. ($mn)

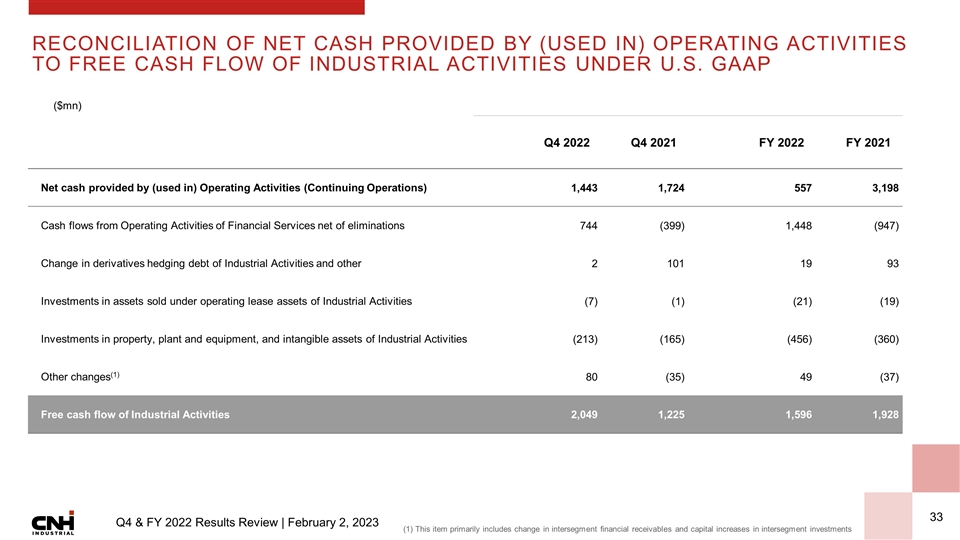

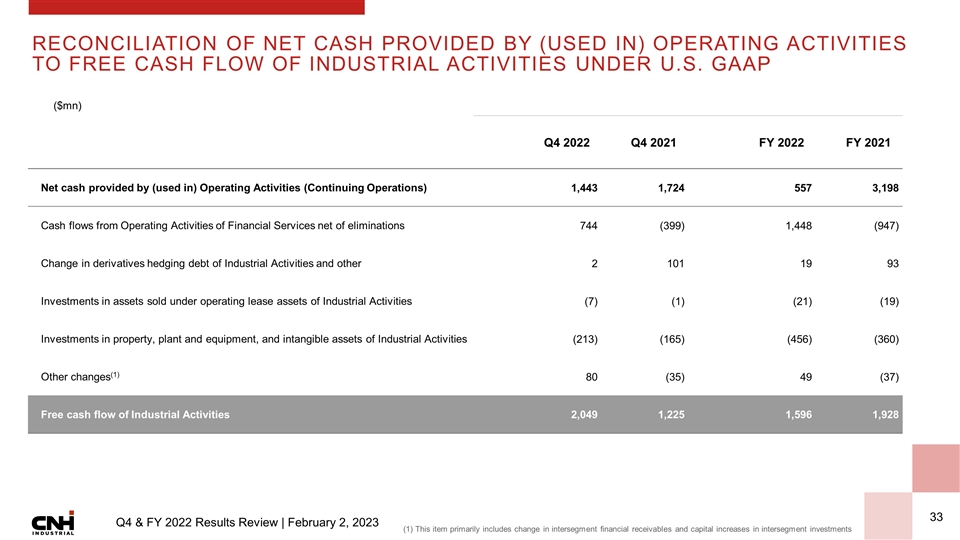

Q4 2022 Q4 2021 FY 2022 FY 2021 Net cash provided by (used in) Operating Activities (Continuing Operations) 1,443 1,724 557 3,198 Cash flows from Operating Activities of Financial Services net of eliminations 744 (399) 1,448 (947) Change in derivatives hedging debt of Industrial Activities and other 2 101 19 93 Investments in assets sold under operating lease assets of Industrial Activities (7) (1) (21) (19) Investments in property, plant and equipment, and intangible assets of Industrial Activities (213) (165) (456) (360) Other changes(1) 80 (35) 49 (37) Free cash flow of Industrial Activities 2,049 1,225 1,596 1,928 Reconciliation of Net cash provided by (used in) Operating Activities to Free cash flow of Industrial Activities under U.S. GAAP (1) This item primarily includes change in intersegment financial receivables and capital increases in intersegment investments ($mn)

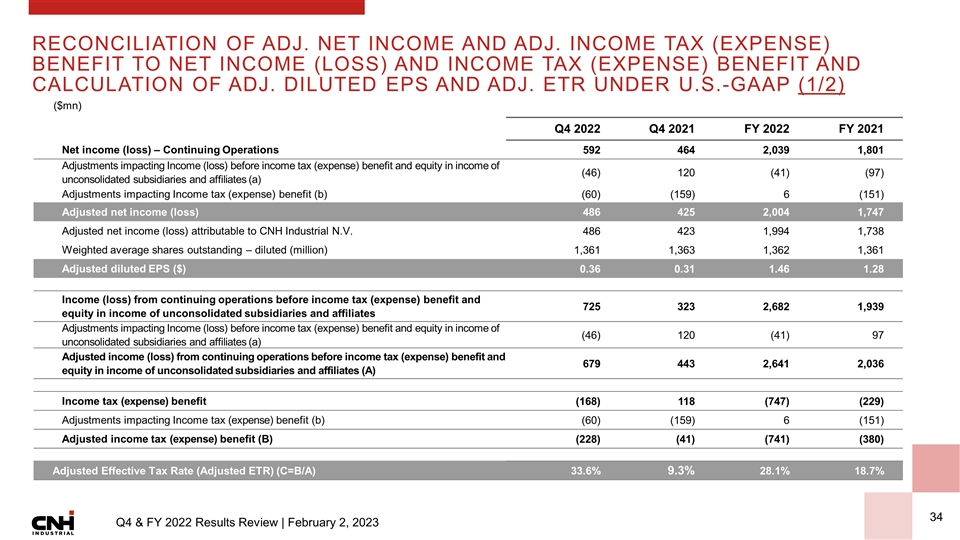

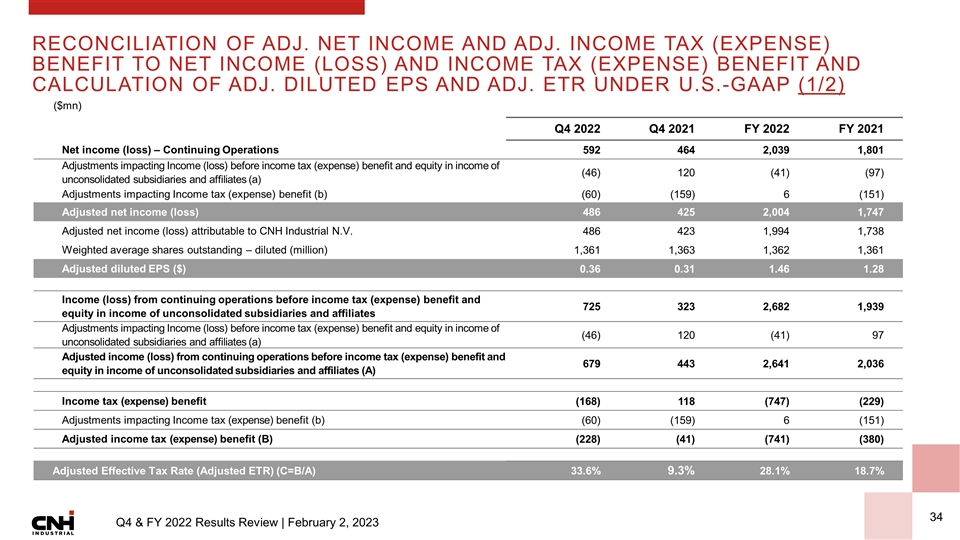

Q4 2022 Q4 2021 FY 2022 FY 2021 Net income (loss) – Continuing Operations 592 464 2,039 1,801 Adjustments impacting Income (loss) before income tax (expense) benefit and equity in income of unconsolidated subsidiaries and affiliates (a) (46) 120 (41) (97) Adjustments impacting Income tax (expense) benefit (b) (60) (159) 6 (151) Adjusted net income (loss) 486 425 2,004 1,747 Adjusted net income (loss) attributable to CNH Industrial N.V. 486 423 1,994 1,738 Weighted average shares outstanding – diluted (million) 1,361 1,363 1,362 1,361 Adjusted diluted EPS ($) 0.36 0.31 1.46 1.28 Income (loss) from continuing operations before income tax (expense) benefit and equity in income of unconsolidated subsidiaries and affiliates 725 323 2,682 1,939 Adjustments impacting Income (loss) before income tax (expense) benefit and equity in income of unconsolidated subsidiaries and affiliates (a) (46) 120 (41) 97 Adjusted income (loss) from continuing operations before income tax (expense) benefit and equity in income of unconsolidated subsidiaries and affiliates (A) 679 443 2,641 2,036 Income tax (expense) benefit (168) 118 (747) (229) Adjustments impacting Income tax (expense) benefit (b) (60) (159) 6 (151) Adjusted income tax (expense) benefit (B) (228) (41) (741) (380) Adjusted Effective Tax Rate (Adjusted ETR) (C=B/A) 33.6% 9.3% 28.1% 18.7% ($mn) Reconciliation of Adj. net income and Adj. income tax (expense) benefit to Net income (loss) and Income tax (expense) benefit and calculation of Adj. diluted EPS and Adj. ETR under U.S.-GAAP (1/2)

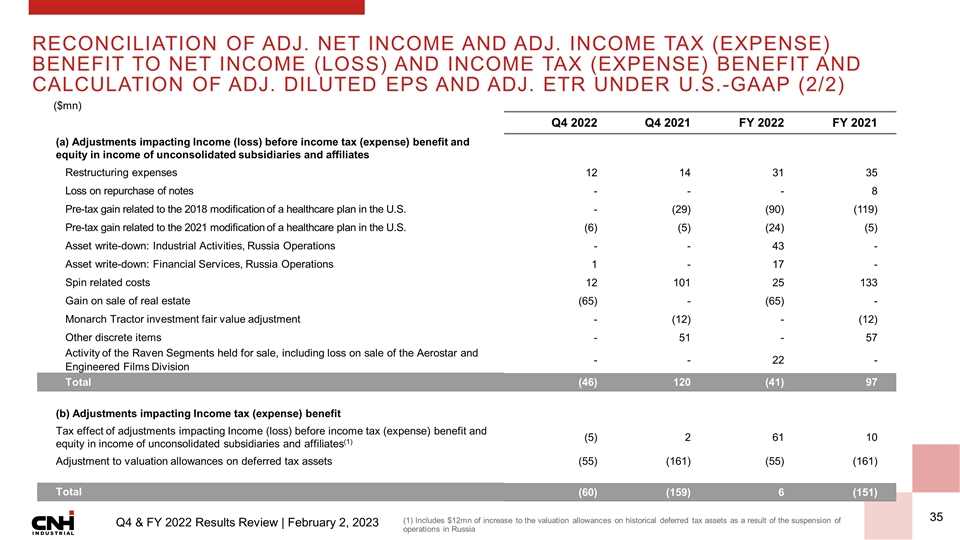

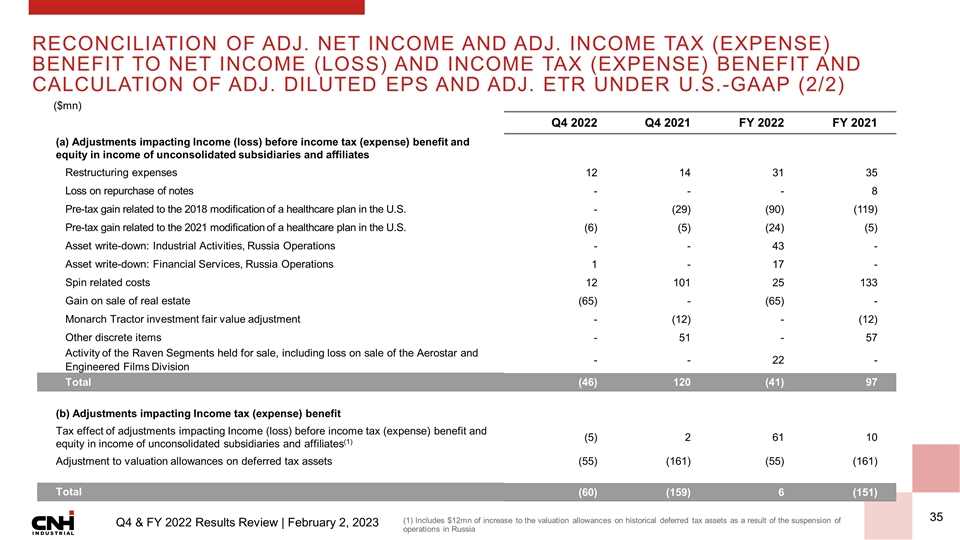

Q4 2022 Q4 2021 FY 2022 FY 2021 (a) Adjustments impacting Income (loss) before income tax (expense) benefit and equity in income of unconsolidated subsidiaries and affiliates Restructuring expenses 12 14 31 35 Loss on repurchase of notes - - - 8 Pre-tax gain related to the 2018 modification of a healthcare plan in the U.S. - (29) (90) (119) Pre-tax gain related to the 2021 modification of a healthcare plan in the U.S. (6) (5) (24) (5) Asset write-down: Industrial Activities, Russia Operations - - 43 - Asset write-down: Financial Services, Russia Operations 1 - 17 - Spin related costs 12 101 25 133 Gain on sale of real estate (65) - (65) - Monarch Tractor investment fair value adjustment - (12) - (12) Other discrete items - 51 - 57 Activity of the Raven Segments held for sale, including loss on sale of the Aerostar and Engineered Films Division - - 22 - Total (46) 120 (41) 97 (b) Adjustments impacting Income tax (expense) benefit Tax effect of adjustments impacting Income (loss) before income tax (expense) benefit and equity in income of unconsolidated subsidiaries and affiliates(1) (5) 2 61 10 Adjustment to valuation allowances on deferred tax assets (55) (161) (55) (161) Total (60) (159) 6 (151) ($mn) Reconciliation of Adj. net income and Adj. income tax (expense) benefit to Net income (loss) and Income tax (expense) benefit and calculation of Adj. diluted EPS and Adj. ETR under U.S.-GAAP (2/2) (1) Includes $12mn of increase to the valuation allowances on historical deferred tax assets as a result of the suspension of operations in Russia

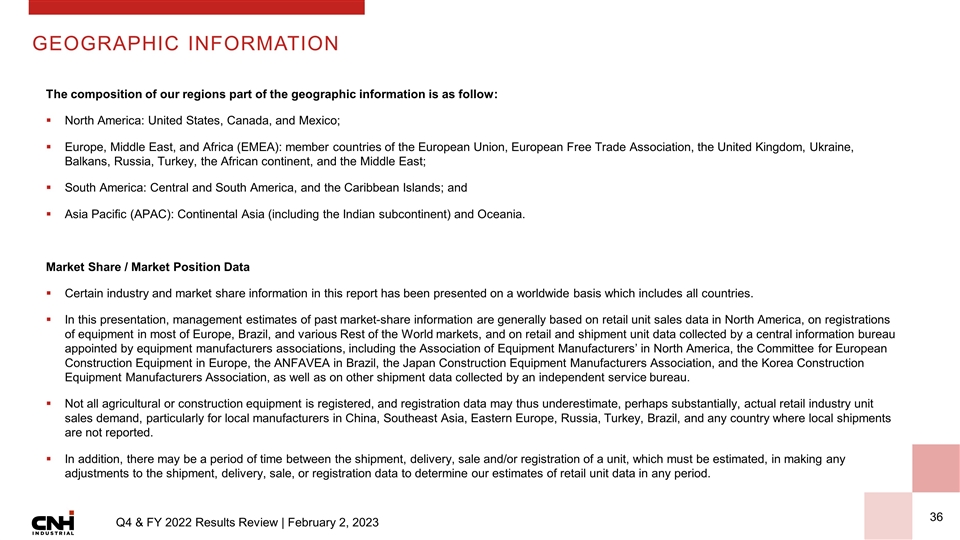

The composition of our regions part of the geographic information is as follow: North America: United States, Canada, and Mexico; Europe, Middle East, and Africa (EMEA): member countries of the European Union, European Free Trade Association, the United Kingdom, Ukraine, Balkans, Russia, Turkey, the African continent, and the Middle East; South America: Central and South America, and the Caribbean Islands; and Asia Pacific (APAC): Continental Asia (including the Indian subcontinent) and Oceania. Market Share / Market Position Data Certain industry and market share information in this report has been presented on a worldwide basis which includes all countries. In this presentation, management estimates of past market-share information are generally based on retail unit sales data in North America, on registrations of equipment in most of Europe, Brazil, and various Rest of the World markets, and on retail and shipment unit data collected by a central information bureau appointed by equipment manufacturers associations, including the Association of Equipment Manufacturers’ in North America, the Committee for European Construction Equipment in Europe, the ANFAVEA in Brazil, the Japan Construction Equipment Manufacturers Association, and the Korea Construction Equipment Manufacturers Association, as well as on other shipment data collected by an independent service bureau. Not all agricultural or construction equipment is registered, and registration data may thus underestimate, perhaps substantially, actual retail industry unit sales demand, particularly for local manufacturers in China, Southeast Asia, Eastern Europe, Russia, Turkey, Brazil, and any country where local shipments are not reported. In addition, there may be a period of time between the shipment, delivery, sale and/or registration of a unit, which must be estimated, in making any adjustments to the shipment, delivery, sale, or registration data to determine our estimates of retail unit data in any period. Geographic information

CNH Industrial monitors its operations through the use of several non-GAAP financial measures. CNH Industrial’s management believes that these non-GAAP financial measures provide useful and relevant information regarding its operating results and enhance the readers’ ability to assess CNH Industrial’s financial performance and financial position. Management uses these non-GAAP measures to identify operational trends, as well as make decisions regarding future spending, resource allocations and other operational decisions as they provide additional transparency with respect to our core operations. These non-GAAP financial measures have no standardized meaning under U.S. GAAP and are unlikely to be comparable to other similarly titled measures used by other companies and are not intended to be substitutes for measures of financial performance and financial position as prepared in accordance with U.S. GAAP. CNH Industrial’s non-GAAP financial measures are defined as follows: Adjusted EBIT of Industrial Activities is defined as net income (loss) before income taxes, Financial Services’ results, Industrial Activities’ interest expenses, net, foreign exchange gains/losses, finance and non-service component of pension and other post-employment benefit costs, restructuring expenses, and certain non-recurring items. In particular, non-recurring items are specifically disclosed items that management considers rare or discrete events that are infrequent in nature and not reflective of on-going operational activities. Adjusted EBIT Margin of Industrial Activities: is computed by dividing Adjusted EBIT of Industrial Activities by Net Sales of Industrial Activities. Adjusted Net Income (Loss): is defined as net income (loss), less restructuring charges and non-recurring items, after tax. Adjusted Diluted EPS: is computed by dividing Adjusted Net Income (loss) attributable to CNH Industrial N.V. by a weighted-average number of common shares outstanding during the period that takes into consideration potential common shares outstanding deriving from the CNH Industrial share-based payment awards, when inclusion is not anti-dilutive. When we provide guidance for adjusted diluted EPS, we do not provide guidance on a earnings per share basis because the GAAP measure will include potentially significant items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end. Adjusted Income Taxes: is defined as income taxes less the tax effect of restructuring expenses and non-recurring items, and non-recurring tax charges or benefits. Adjusted Effective Tax Rate (Adjusted ETR): is computed by dividing a) adjusted income taxes by b) income (loss) before income taxes and equity in income of unconsolidated subsidiaries and affiliates, less restructuring expenses and non-recurring items. Adjusted Gross Profit Margin of Industrial Activities: is computed by dividing Net sales less Cost of goods sold, as adjusted by non-recurring items, by Net sales. Net Cash (Debt) and Net Cash (Debt) of Industrial Activities: Net Cash (Debt) is defined as total debt less intersegment notes receivable, cash and cash equivalents, restricted cash, other current financial assets (primarily current securities, short-term deposits and investments towards high-credit rating counterparties) and derivative hedging debt. CNH Industrial provides the reconciliation of Net Cash (Debt) to Total (Debt), which is the most directly comparable measure included in the consolidated balance sheets. Due to different sources of cash flows used for the repayment of the debt between Industrial Activities and Financial Services (by cash from operations for Industrial Activities and by collection of financing receivables for Financial Services), management separately evaluates the cash flow performance of Industrial Activities using Net Cash (Debt) of Industrial Activities. Free Cash Flow of Industrial Activities (or Industrial Free Cash Flow): refers to Industrial Activities only, and is computed as consolidated cash flow from operating activities less: cash flow from operating activities of Financial Services; investments of Industrial Activities in assets sold under buy-back commitments, assets under operating leases, property, plant and equipment and intangible assets; change in derivatives hedging debt of Industrial Activities; as well as other changes and intersegment eliminations. For forecasted information, the Company is unable to provide a reconciliation of this measure without unreasonable effort due to the uncertainty and inherent difficulty of predicting the occurrence, the financial impact, and the periods in which the adjustments may be recognized. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results. Available Liquidity: is defined as cash and cash equivalents plus restricted cash, undrawn medium-term unsecured committed facilities, net receivables/payables with Iveco Group N.V. and other current financial assets (primarily current securities, short-term deposits and investments in instruments of high-credit rating counterparties). Change excl. FX or Constant Currency: CNH Industrial discusses the fluctuations in revenues on a constant currency basis by applying the prior year average exchange rates to current year’s revenues expressed in local currency in order to eliminate the impact of foreign exchange rate fluctuations. The tables attached to this press release provide reconciliations of the non-GAAP measures used in this press release to the most directly comparable GAAP measures. Non-GAAP Financial Measures

INVESTOR RELATIONS CONTACTS investor.relations@cnhind.com Jason Omerza +1 (630) 740 8079 | jason.omerza@cnhind.com Federico Pavesi +39 (345) 605 6218 | federico.pavesi@cnhind.com