Q3 2024 RESULTS REVIEW November 8, 2024 Exhibit 99.2

Q3 2024 results review | Nov 8, 20242 SAFE HARBOR STATEMENT AND DISCLOSURES All statements other than statements of historical fact contained in this presentation including competitive strengths; business strategy; future financial position or operating results; budgets; projections with respect to revenue, income, earnings (or loss) per share, capital expenditures, dividends, liquidity, capital structure or other financial items; costs; and plans and objectives of management regarding operations and products, are forward-looking statements. Forward-looking statements also include statements regarding the future performance of CNH and its subsidiaries on a standalone basis. These statements may include terminology such as “may”, “will”, “expect”, “could”, “should”, “intend”, “estimate”, “anticipate”, “believe”, “outlook”, “continue”, “remain”, “on track”, “design”, “target”, “objective”, “goal”, “forecast”, “projection”, “prospects”, “plan”, or similar terminology. Forward-looking statements are not guarantees of future performance. Rather, they are based on current views and assumptions and involve known and unknown risks, uncertainties and other factors, many of which are outside our control and are difficult to predict. If any of these risks and uncertainties materialize (or they occur with a degree of severity that the Company is unable to predict) or other assumptions underlying any of the forward-looking statements prove to be incorrect, including any assumptions regarding strategic plans, the actual results or developments may differ materially from any future results or developments expressed or implied by the forward-looking statements. Factors, risks and uncertainties that could cause actual results to differ materially from those contemplated by the forward-looking statements include, among others: economic conditions in each of our markets, including the significant uncertainty caused by geopolitical events; production and supply chain disruptions, including industry capacity constraints, material availability, and global logistics delays and constraints; the many interrelated factors that affect consumer confidence and worldwide demand for capital goods and capital goods-related products, changes in government policies regarding banking, monetary and fiscal policy; legislation, particularly pertaining to capital goods-related issues such as agriculture, the environment, debt relief and subsidy program policies, trade and commerce and infrastructure development; government policies on international trade and investment, including sanctions, import quotas, capital controls and tariffs; volatility in international trade caused by the imposition of tariffs, sanctions, embargoes, and trade wars; actions of competitors in the various industries in which we compete; development and use of new technologies and technological difficulties; the interpretation of, or adoption of new, compliance requirements with respect to engine emissions, safety or other aspects of our products; labor relations; interest rates and currency exchange rates; inflation and deflation; energy prices; prices for agricultural commodities and material price increases; housing starts and other construction activity; our ability to obtain financing or to refinance existing debt; price pressure on new and used equipment; the resolution of pending litigation and investigations on a wide range of topics, including dealer and supplier litigation, intellectual property rights disputes, product warranty and defective product claims, and emissions and/or fuel economy regulatory and contractual issues; security breaches, cybersecurity attacks, technology failures, and other disruptions to the information technology infrastructure of CNH and its suppliers and dealers; security breaches with respect to our products; our pension plans and other post-employment obligations; political and civil unrest; volatility and deterioration of capital and financial markets, including pandemics (such as the COVID-19 pandemic), terrorist attacks in Europe and elsewhere; the remediation of a material weakness; our ability to realize the anticipated benefits from our business initiatives as part of our strategic plan; including targeted restructuring actions to optimize our cost structure and improve the efficiency of our operations; our failure to realize, or a delay in realizing, all of the anticipated benefits of our acquisitions, joint ventures, strategic alliances or divestitures and other similar risks and uncertainties, and our success in managing the risks involved in the foregoing. Forward-looking statements are based upon assumptions relating to the factors described in this presentation, which are sometimes based upon estimates and data received from third parties. Such estimates and data are often revised. Actual results may differ materially from the forward-looking statements as a result of a number of risks and uncertainties, many of which are outside CNH’s control. CNH expressly disclaims any intention or obligation to provide, update or revise any forward-looking statements in this announcement to reflect any change in expectations or any change in events, conditions or circumstances on which these forward-looking statements are based. Further information concerning CNH, including factors that potentially could materially affect its financial results, is included in the Company’s reports and filings with the U.S. Securities and Exchange Commission ("SEC"). All future written and oral forward-looking statements by CNH or persons acting on the behalf of CNH are expressly qualified in their entirety by the cautionary statements contained herein or referred to above. Additional factors could cause actual results to differ from those expressed or implied by the forward-looking statements included in the Company’s filings with the SEC (including, but not limited to, the factors discussed in our 2023 Annual Report and subsequent quarterly reports). Reconciliations of non-GAAP measures to the most directly comparable GAAP measure are included in this presentation, which is available on our website at www.cnh.com.

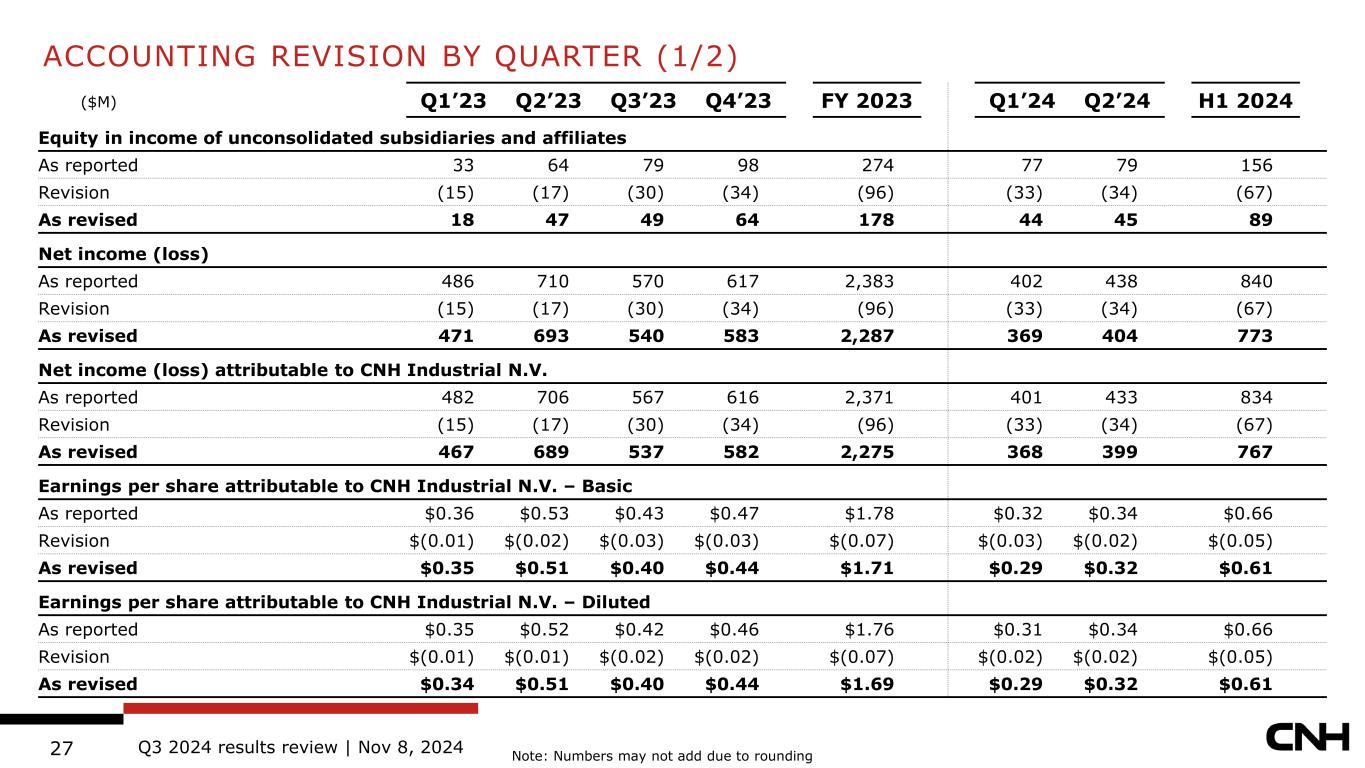

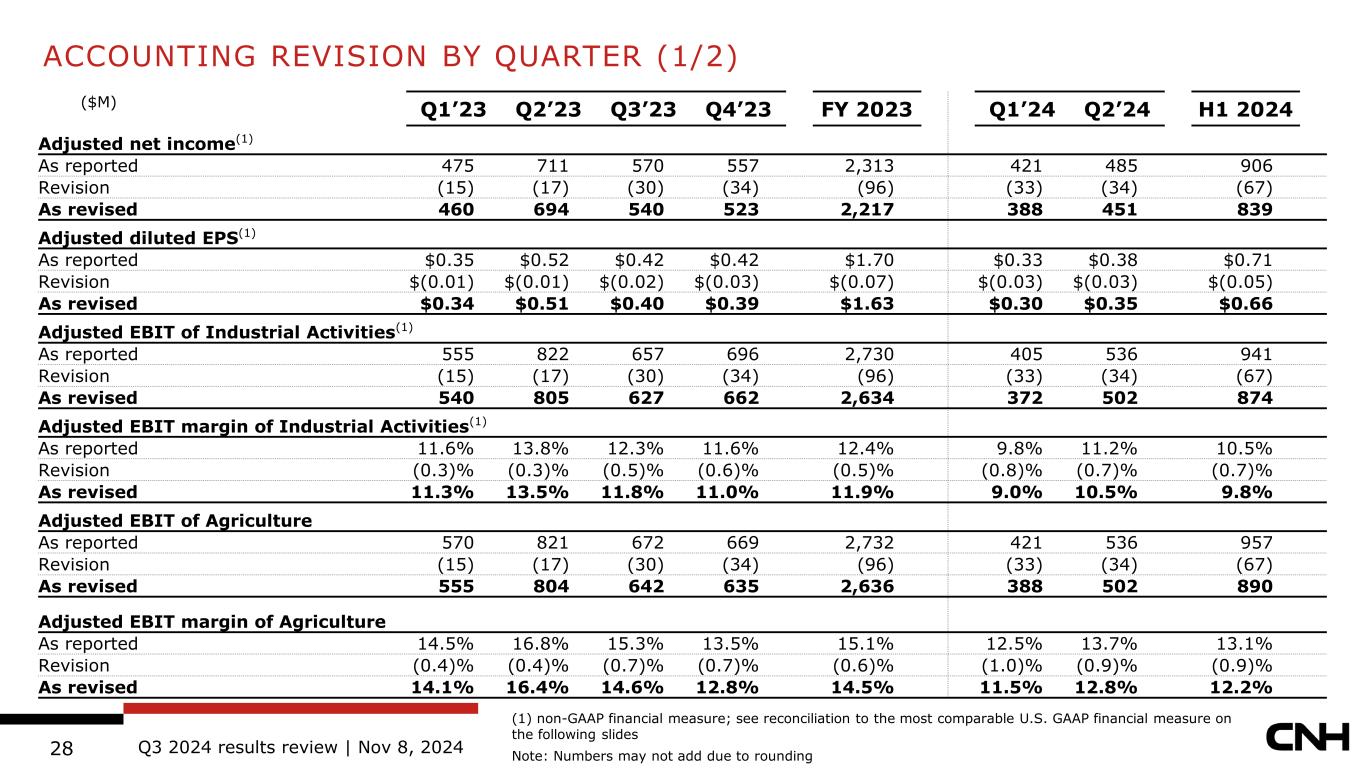

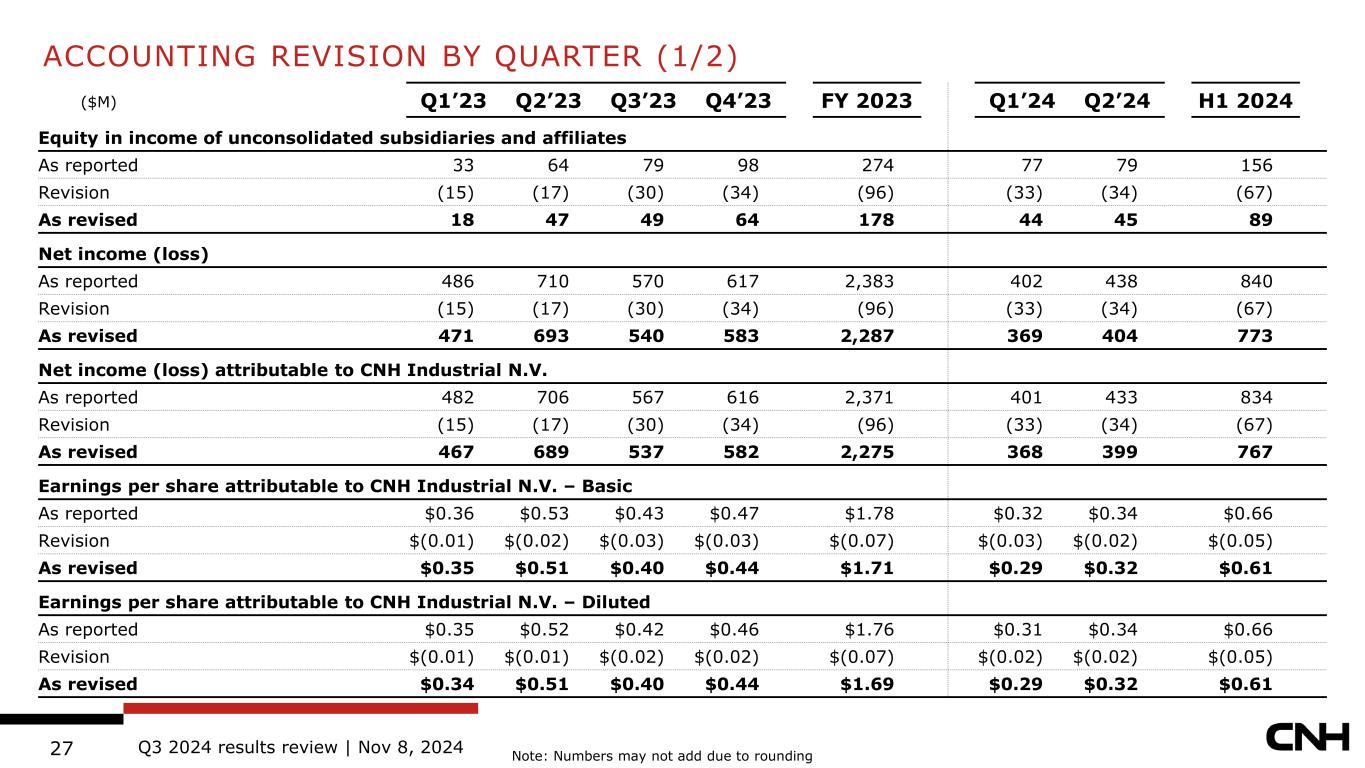

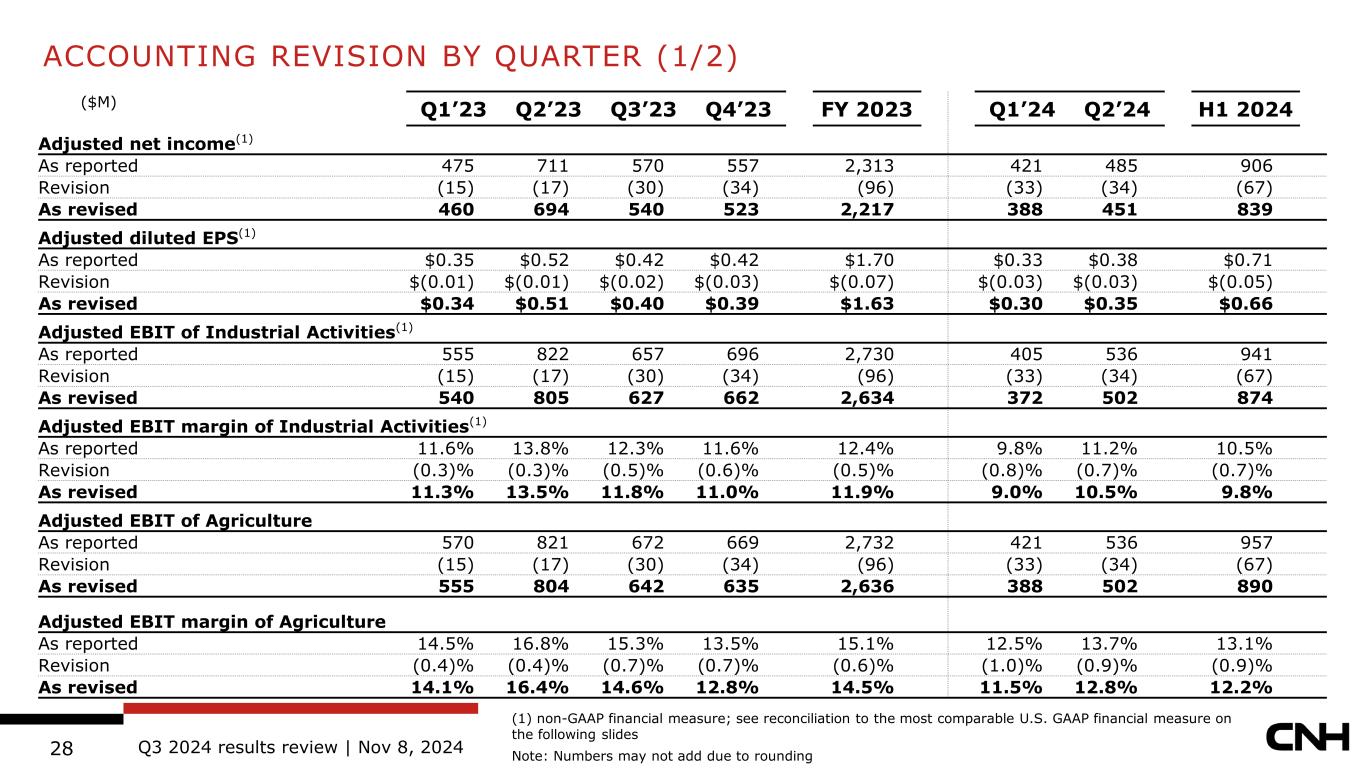

Q3 2024 results review | Nov 8, 20243 BASIS OF PRESENTATION Prior periods have been revised to reflect an immaterial correction to the financial statements CNH accounts for its 37.5% ownership of Türkiye-based TürkTraktör ve Ziraat Makineleri A.S. (TTRAK.IS) under the equity method TürkTraktör’s functional currency is the Turkish lira; the Turkish economy was deemed highly inflationary in 2022 CNH has determined that its translation from Turkish lira into US dollars under highly inflationary accounting resulted in an immaterial overstatement of CNH’s results CNH has revised its previously reported results for FY 2023 and for H1 2024; see appendix for details of the non-cash revision impacts As of Sept. 30, 2024, the market value CNH’s share of TürkTraktör was $775M, whereas the CNH book value after the revision was $150M

Q3 2024 results review | Nov 8, 20244 CEO OBSERVATIONS – MY FIRST QUARTER AT CNH MARKET DYNAMICS Farmer sentiment remains muted Low visibility on industry cycle Very slow retail pace; inventory levels decreasing but still above our target INDUSTRIAL CAPABILITIES Need more consistency in quality Cost efficient capacity utilization at low production rates Transforming our supply base through strategic sourcing and partnerships PRODUCT STRENGTH Outstanding product portfolio Impressive progress on tech Full product launch pipeline HUMAN CAPITAL Competent and passionate professionals across the organization Working together as one team looking forward to writing the next chapter

Q3 2024 results review | Nov 8, 20245 Q3 2024 | MAIN ACHIEVEMENTS Continued cost reduction momentum New leadership team working closer to business priorities Strategic Sourcing supplier convention FieldOps commercial launch

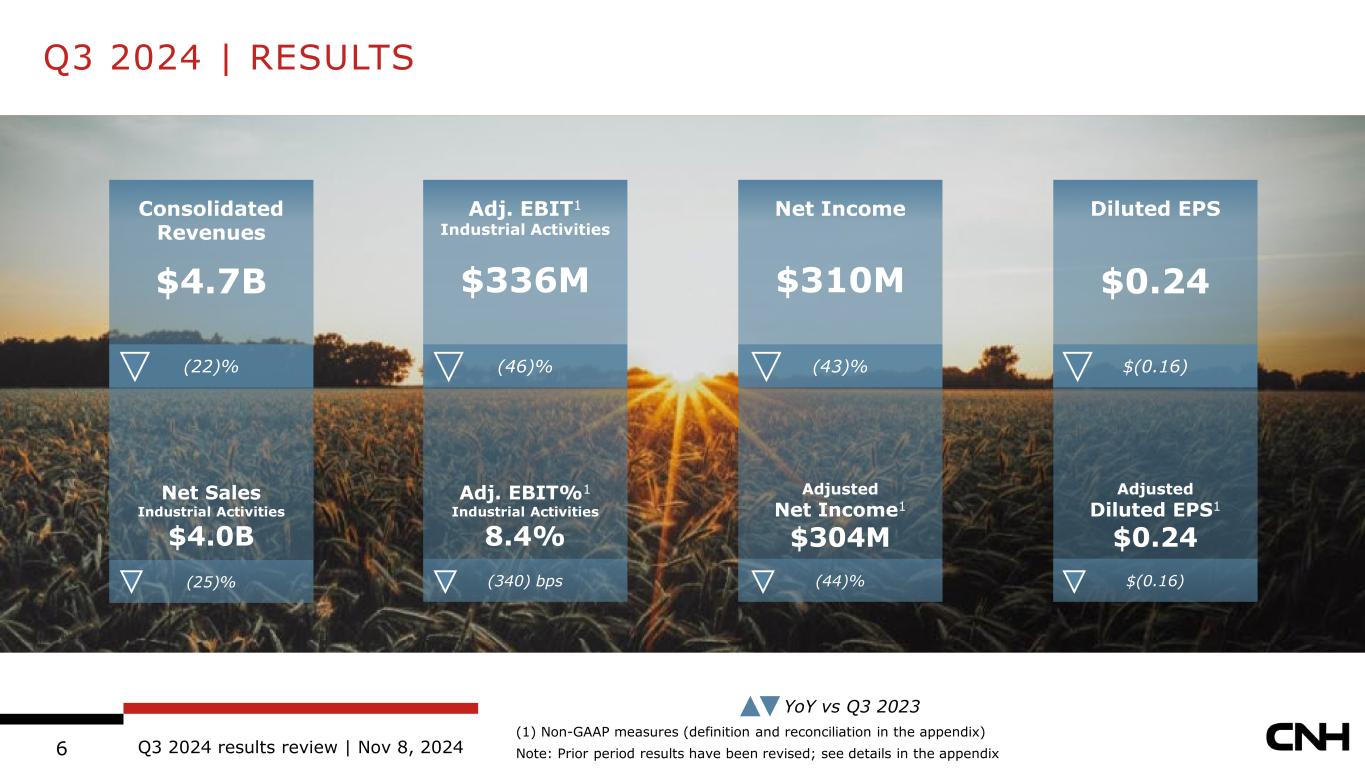

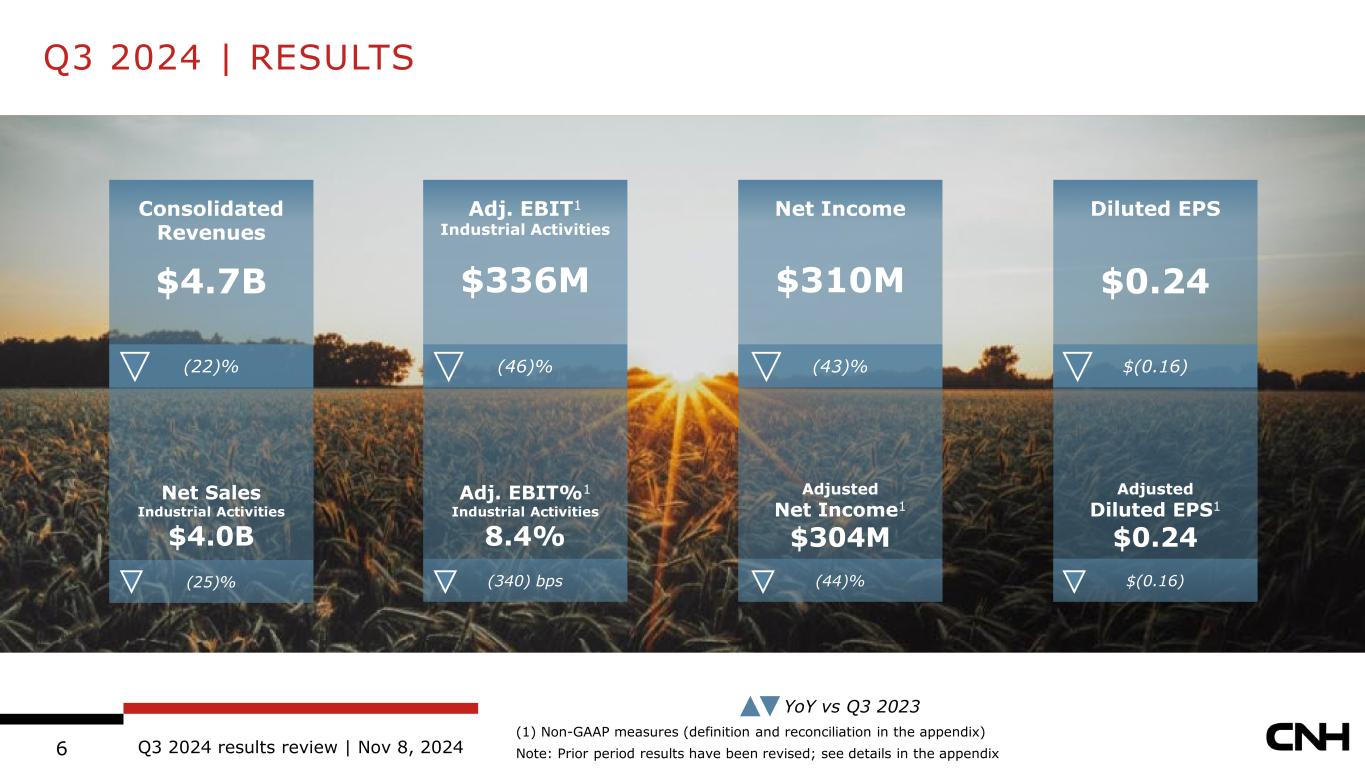

Q3 2024 results review | Nov 8, 20246 Q3 2024 | RESULTS (1) Non-GAAP measures (definition and reconciliation in the appendix) Note: Prior period results have been revised; see details in the appendix Consolidated Revenues $4.7B (22)% Adj. EBIT1 Industrial Activities $336M (46)% Net Income $310M (43)% Diluted EPS $0.24 $(0.16) Net Sales Industrial Activities $4.0B (25)% (340) bps (44)% $(0.16) Adj. EBIT%1 Industrial Activities 8.4% Adjusted Net Income1 $304M Adjusted Diluted EPS1 $0.24 YoY vs Q3 2023

7 Q3 2024 results review | Nov 8, 2024 Declining industry retail demand and sentiment Lower production levels to address demand weakness Limited progress on dealer inventory reductions Additional focus on product quality programs Q3 2024 | BUSINESS HIGHLIGHTS

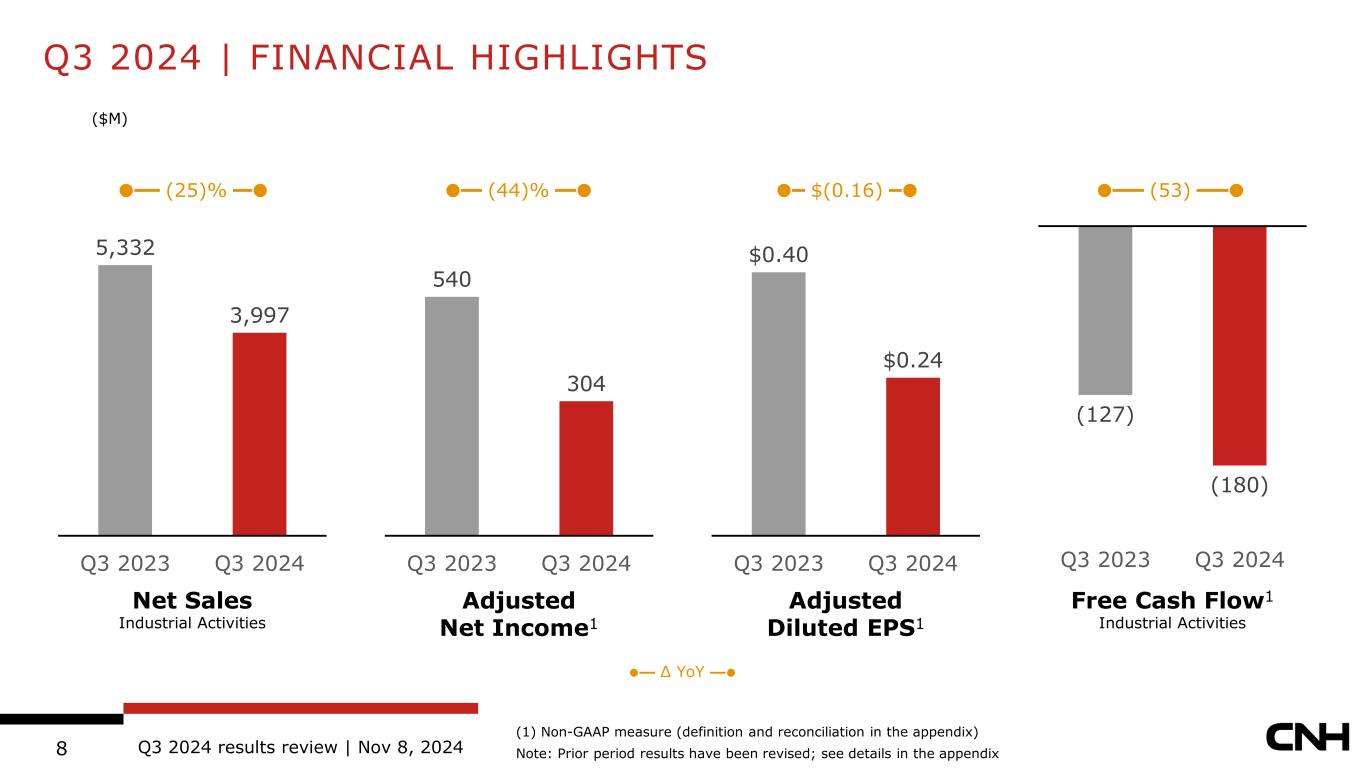

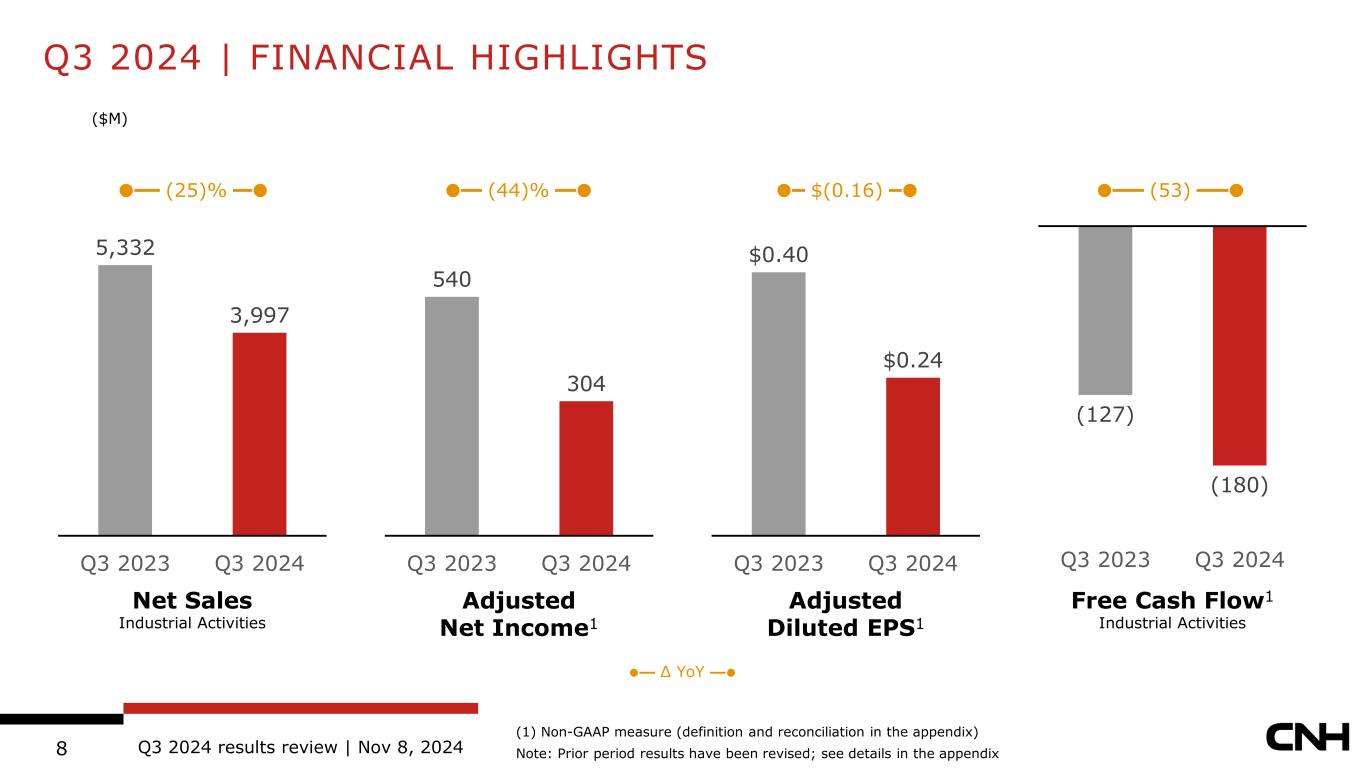

Q3 2024 results review | Nov 8, 20248 Q3 2024 | FINANCIAL HIGHLIGHTS (1) Non-GAAP measure (definition and reconciliation in the appendix) Note: Prior period results have been revised; see details in the appendix ($M) $0.40 $0.24 Q3 2023 Q3 2024 (127) (180) Q3 2023 Q3 2024 540 304 Q3 2023 Q3 2024 5,332 3,997 Q3 2023 Q3 2024 Net Sales Industrial Activities Free Cash Flow1 Industrial Activities Adjusted Diluted EPS1 Adjusted Net Income1 (25)% (44)% $(0.16) (53) Δ YoY

Q3 2024 results review | Nov 8, 20249 Q3 2024 | AGRICULTURE (1) Gross Margin calculated as Gross Profit divided by Net Sales, as shown in the appendix Note: Prior period results have been revised; see details in the appendix. Numbers may not add due to rounding. 4,384 3,310 Q3 2023 Q3 2024 Net Sales ($M) Gross Margin1 Adjusted EBIT (375) 62 46 40 (46)642 (33) 336 Q3 2023 Vol. & Mix Pricing, Net Prod. Cost SG&A R&D FX & Other Q3 2024 10.2% 14.6% (24)% (290) bps Δ YoY 25.6% 22.7% Q3 2023 Q3 2024

Q3 2024 results review | Nov 8, 202410 Q3 2024 | CONSTRUCTION (1) Gross Margin calculated as Gross Profit divided by Net Sales, as shown in the appendix Note: Numbers may not add due to rounding 948 687 Q3 2023 Q3 2024 Net Sales ($M) Gross Margin1 Adjusted EBIT (60) 37 13 3 (3)60 (10) 40 Q3 2023 Vol. & Mix Pricing, Net Prod. Cost SG&A R&D FX & Other Q3 2024 5.8% 6.3% (28)% +70 bps Δ YoY 15.9% 16.6% Q3 2023 Q3 2024

Q3 2024 results review | Nov 8, 202411 Q3 2024 | FINANCIAL SERVICES (1) Return on Assets defined as: EBIT / average managed assets annualized (2) Including unconsolidated JVs (3) At constant currency Q3 retail originations $2.8B, -$0.2B YoY Managed portfolio $29.0B, +$2.2B YoY (+$2.2B @ CC3) ($M) Managed Portfolio2 & Retail Originations2 Net Income Portfolio at Sept. 30, 2024 Retail Wholesale Operating Lease 62% 33% 5% 86 78 Q3 2023 Q3 2024 Delinquencies on Book (>30 Days) Profitability Ratios Gross Margin / Average Assets on Book RoA1 3.5% 3.0% 3.1% 2.2% 1.8% 1.3% 1.0% 2.0% 3.0% 4.0% Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 1.3% 1.6% 2.2% 1.0% 1.5% 2.0% 2.5% 3.0% Q3'22 Q4'22 Q1'23 Q2'23 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24

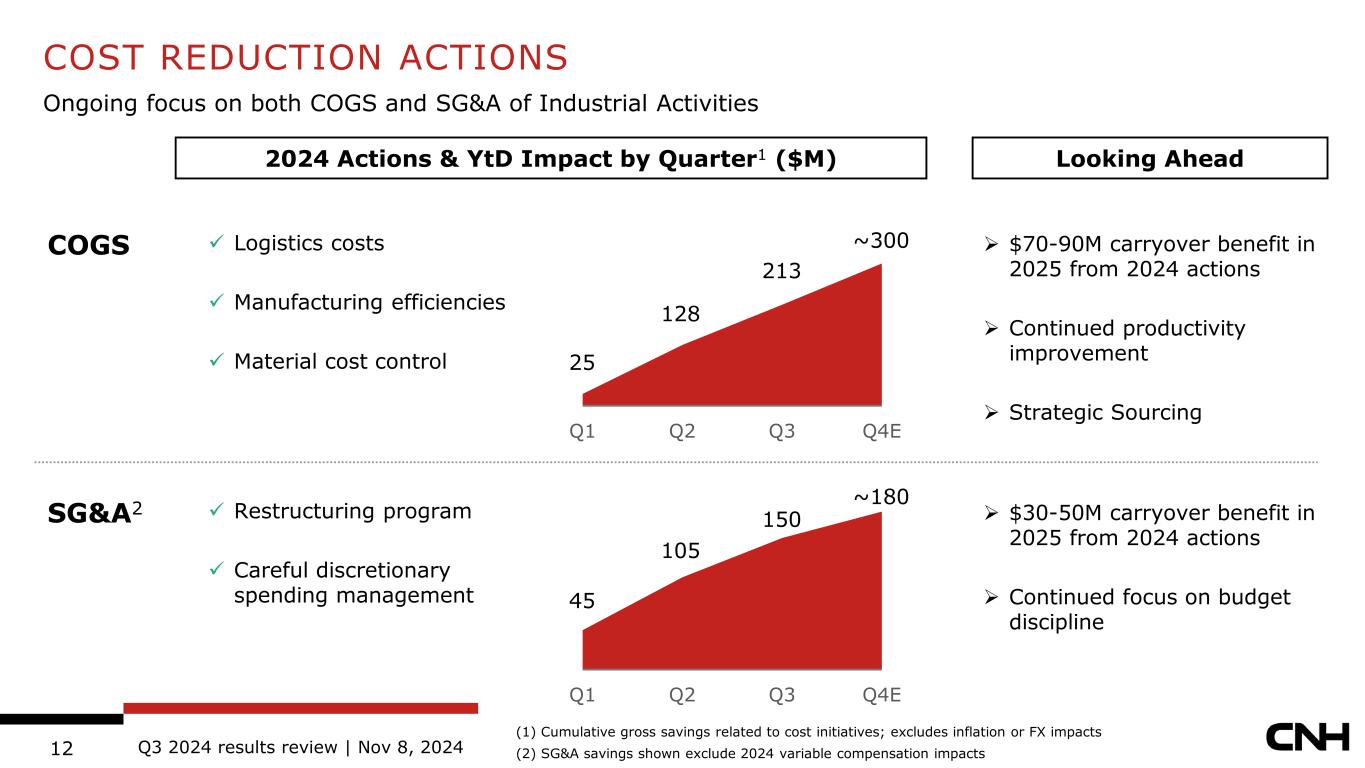

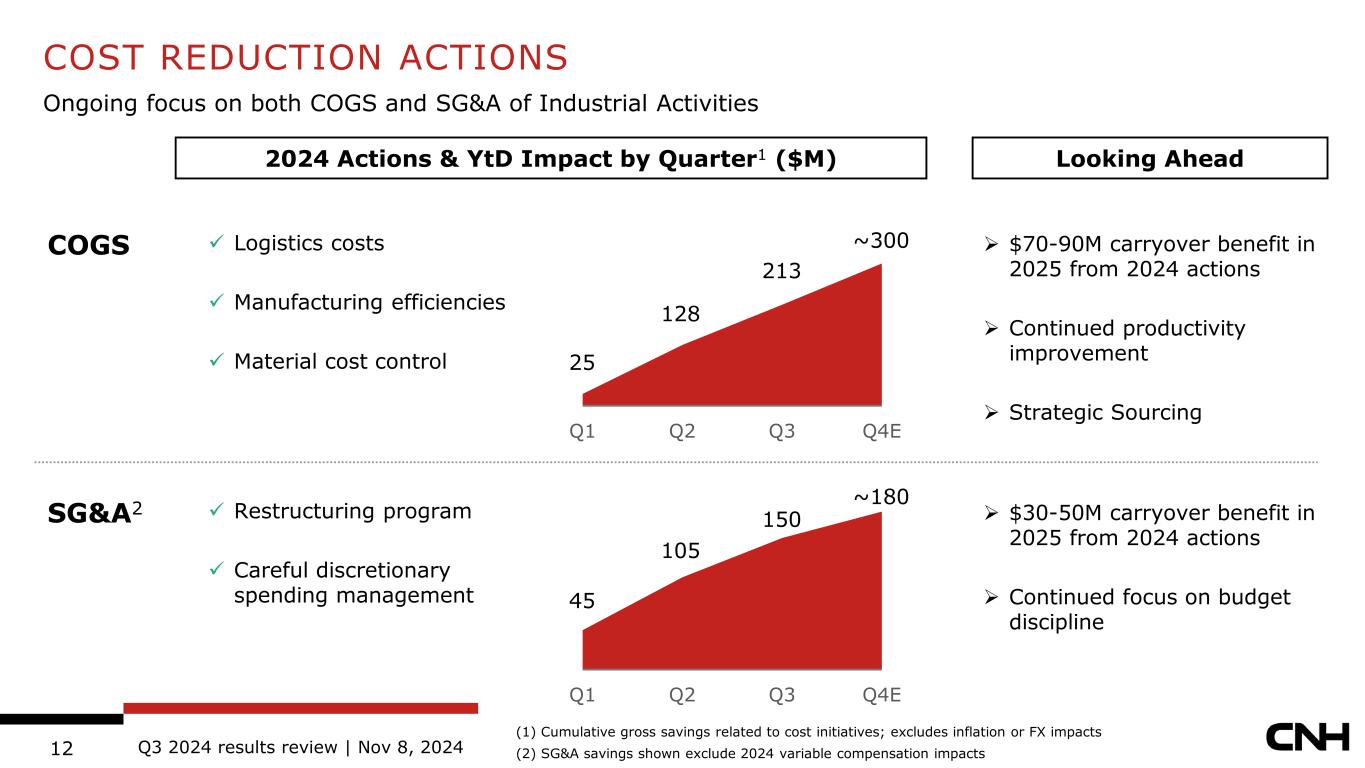

Q3 2024 results review | Nov 8, 202412 COST REDUCTION ACTIONS Ongoing focus on both COGS and SG&A of Industrial Activities COGS SG&A2 2024 Actions & YtD Impact by Quarter1 ($M) Logistics costs Manufacturing efficiencies Material cost control Restructuring program Careful discretionary spending management (1) Cumulative gross savings related to cost initiatives; excludes inflation or FX impacts (2) SG&A savings shown exclude 2024 variable compensation impacts Q1 Q2 Q3 Q4E 128 Q1 Q2 Q3 Q4E 105 ~300 ~180 25 45 Looking Ahead $70-90M carryover benefit in 2025 from 2024 actions Continued productivity improvement Strategic Sourcing $30-50M carryover benefit in 2025 from 2024 actions Continued focus on budget discipline 213 150

Q3 2024 results review | Nov 8, 202413 CAPITAL ALLOCATION PRIORITIES ORGANIC GROWTH Support future growth through operating cash flow reinvestments BALANCE SHEET & CREDIT RATING Sustain healthy liquidity levels and investment grade credit rating SHAREHOLDER RETURNS Maintain a dedicated and consistent dividend and share repurchase policy INORGANIC GROWTH Retain option for disciplined and well-structured M&A

Q3 2024 results review | Nov 8, 202414 2024 OUTLOOK – AGRICULTURE (1) Regional split definition in the appendix (2) Reflects full-year €/$ exchange rate average of 1.09 Note: Prior period results have been revised; see details in the appendix North America EMEA South America APAC LHP Tractors (15)% – (10)% (15)% – (10)% (15)% – (10)% (5)% – flat HHP Tractors (20)% – (15)% Combines (25)% – (20)% (35)% – (30)% (35)% – (30)% flat – 5% Total Industry Unit Performance1 CNH Agriculture – Main Assumptions 18.1 2023 A 2024 E (23)-(22)% YoY Net Sales2: $B & Δ% YoY 14.5%2023 A 2024 E Adj. EBIT Margin 10.5-11.5% Total Industry Volume % change FY 2024 vs. FY 2023 reflecting the aggregate for key markets where the Company competes.

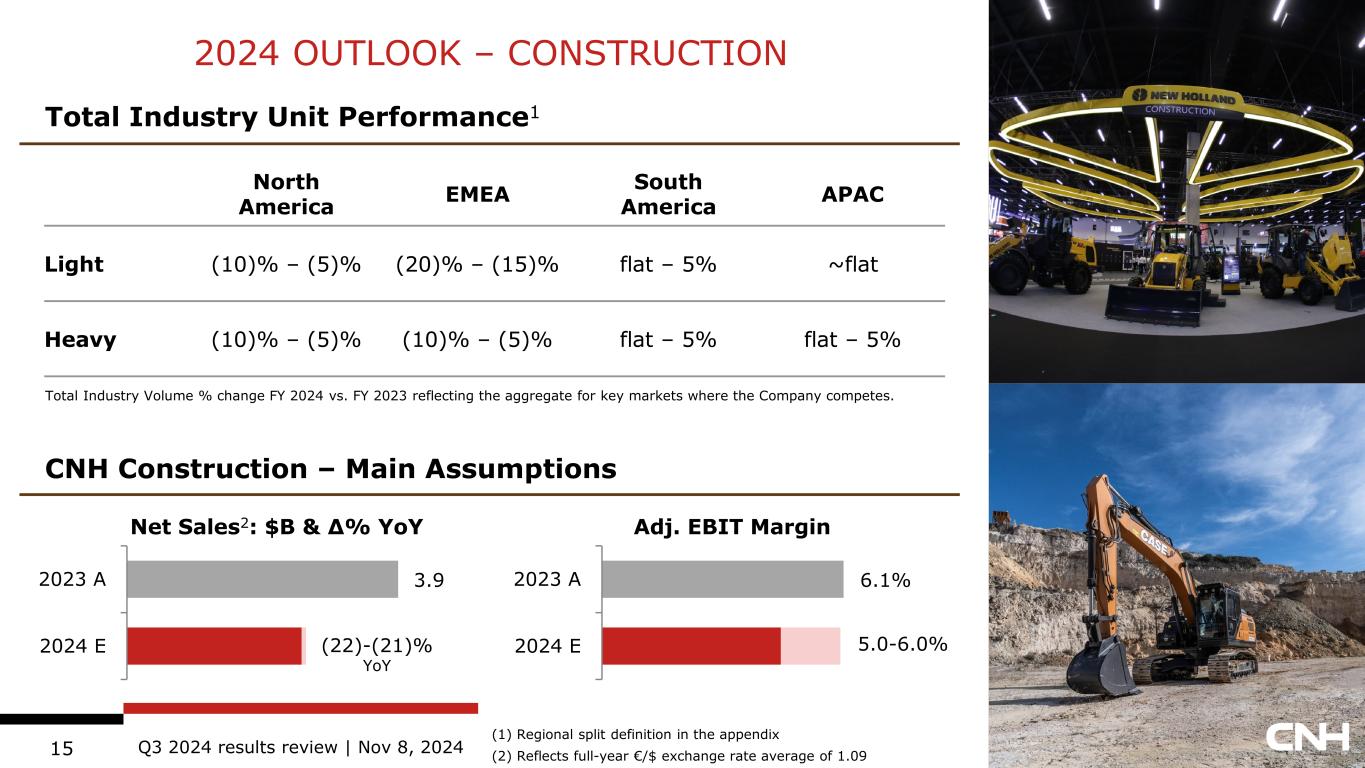

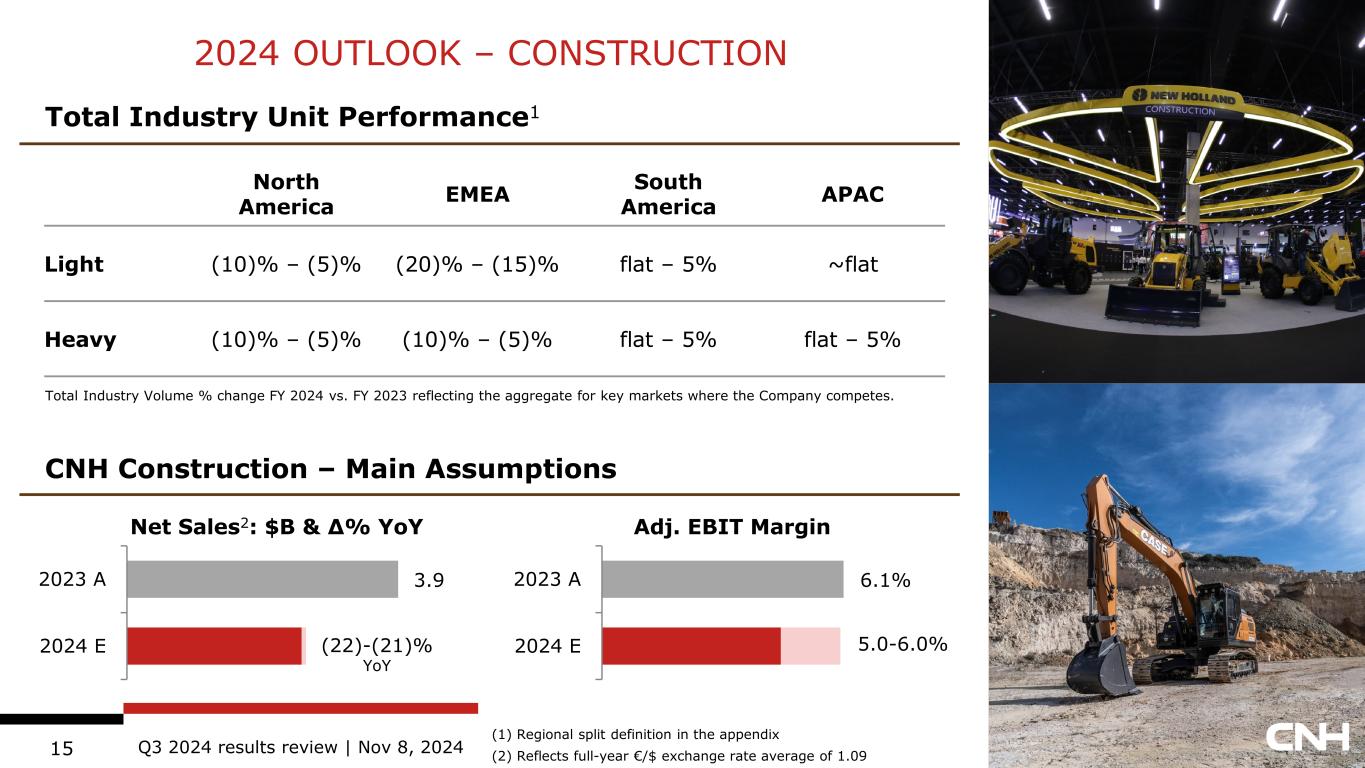

Q3 2024 results review | Nov 8, 202415 2024 OUTLOOK – CONSTRUCTION (1) Regional split definition in the appendix (2) Reflects full-year €/$ exchange rate average of 1.09 North America EMEA South America APAC Light (10)% – (5)% (20)% – (15)% flat – 5% ~flat Heavy (10)% – (5)% (10)% – (5)% flat – 5% flat – 5% Total Industry Unit Performance1 CNH Construction – Main Assumptions 3.9 2023 A 2024 E (22)-(21)% YoY 6.1%2023 A 2024 E Adj. EBIT Margin 5.0-6.0% Total Industry Volume % change FY 2024 vs. FY 2023 reflecting the aggregate for key markets where the Company competes. Net Sales2: $B & Δ% YoY

Q3 2024 results review | Nov 8, 202416 2024 OUTLOOK – FINANCIAL TARGETS (1) Reflects full-year €/$ exchange rate average of 1.09 (2) Non-GAAP measure (definition in the appendix) Note: Prior period results have been revised; see details in the appendix Industrial Activities previous current Net Sales1 (20)-(15)% YoY (23)-(22)% YoY Adj. EBIT margin2 10.0-11.0% 8.0-9.0% Free Cash Flow2 $700M-$900M ($300M)-($100M) Company previous current Adj. Diluted EPS2 $1.30-$1.40 $1.05-$1.15

Q3 2024 results review | Nov 8, 202417 Near Term Price-conscious reduction of channel inventory Taking orders for model year 2025 equipment Cost containment & further process streamlining Looking Ahead Monitor market indicators in a challenging industry environment Matching production to retail demand by H2 2025 Continued investments in key technologies Incremental Margin Opportunities Enhancing product quality through process improvements Strategic sourcing & supply chain transformation Manufacturing footprint & infrastructure realignment Save the date: Investor Day on May 8, 2025, at the NYSE PRIORITIES & OUTLOOK

APPENDIX

Q3 2024 results review | Nov 8, 202419 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q3'23 Q4'23 Q1'24 Q2'24 Q3'24Q3'23 Q4'23 Q1'24 Q2'24 Q3'24 Q3 2024 | UNIT PERFORMANCE VS. Q3 2023 (1) Regional split definition in the slide “Geographic information” Note: Total Industry Volume % YoY change reflecting the aggregate for key markets where the Company competes NORTH AMERICA1 EMEA1 SOUTH AMERICA1 APAC1 0-140 HP – Small Tractors (18)% (20)% (12)% 1% 140+ HP – Large Tractors (17)% Combines (29)% (50)% (32)% (33)% Light (7)% (20)% 9% (3)% Heavy (9)% (9)% 12% 9%To ta l I n d u st ry C o m p an y Tractors Combines Light Heavy Company Inventory Dealer Inventory Retail Production

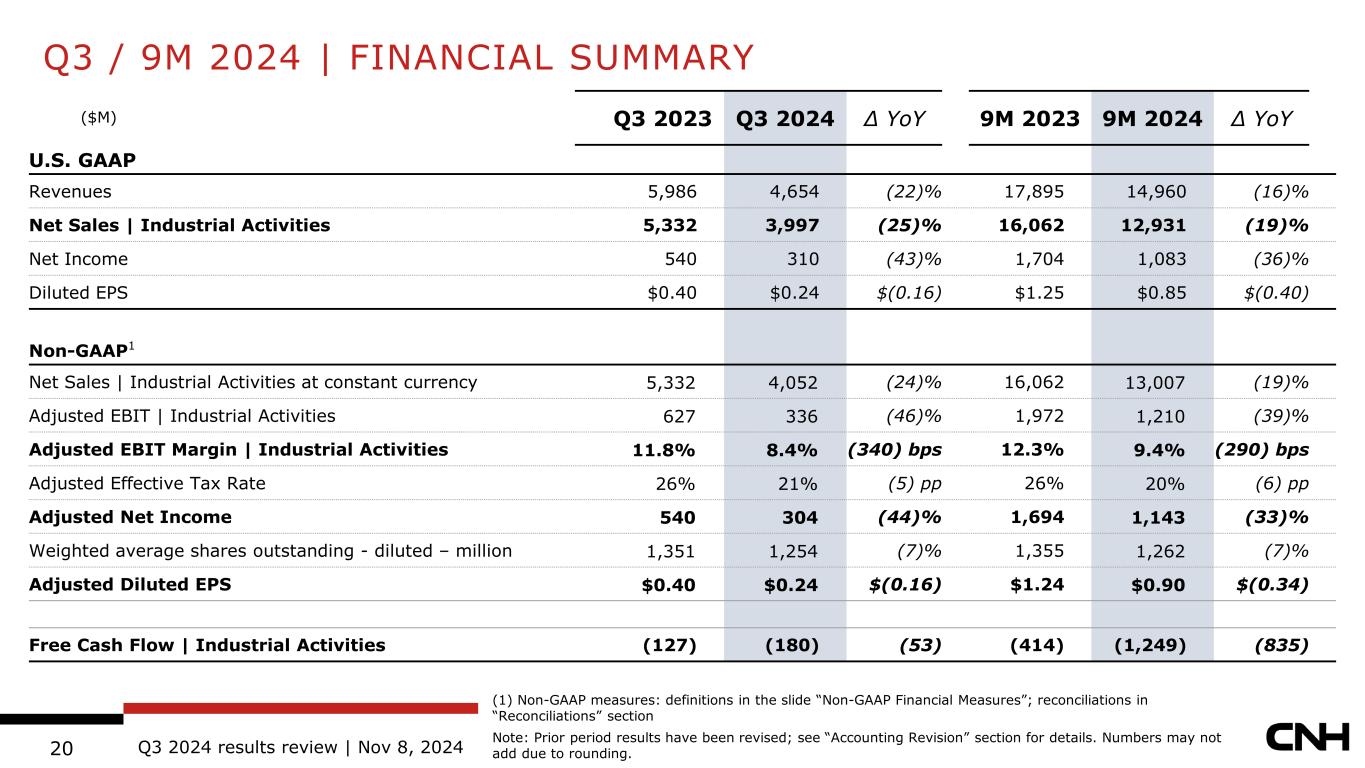

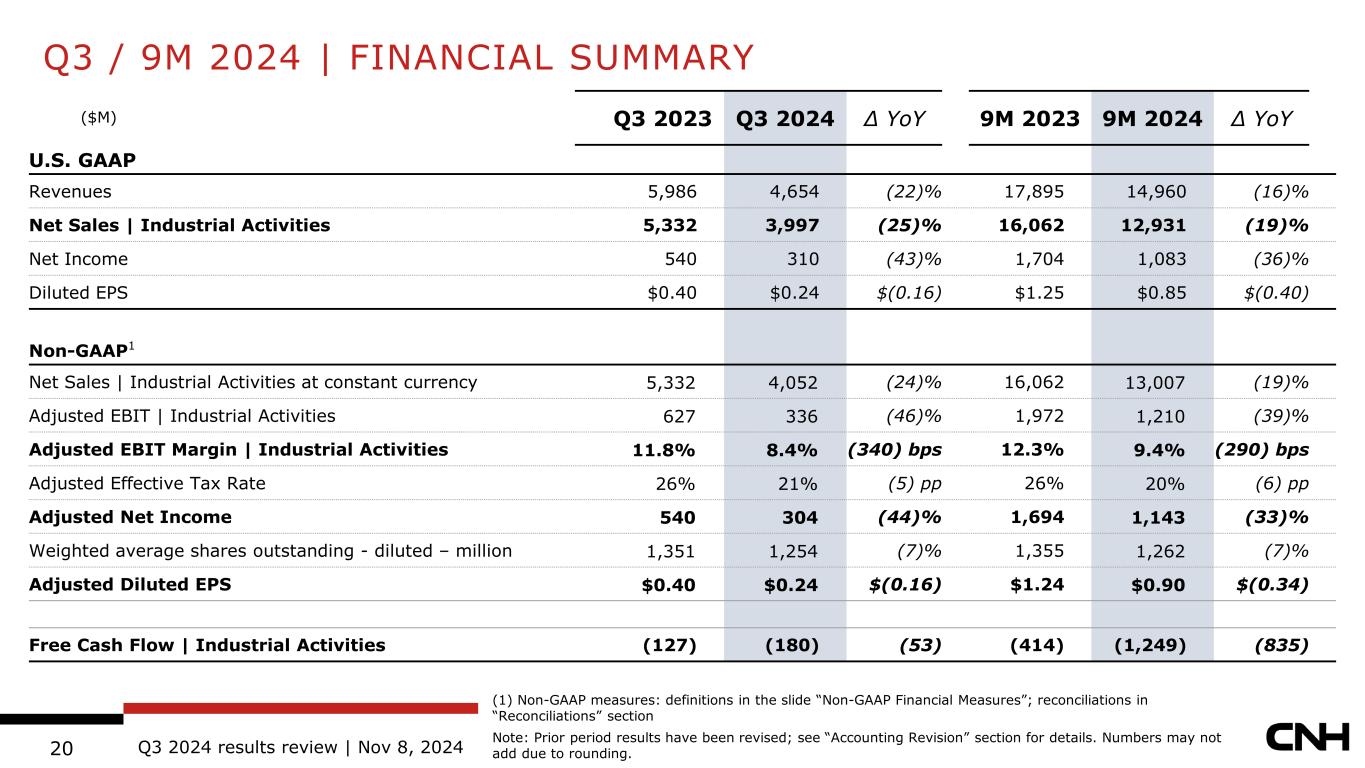

Q3 2024 results review | Nov 8, 202420 Q3 2023 Q3 2024 Δ YoY 9M 2023 9M 2024 Δ YoY U.S. GAAP Revenues 5,986 4,654 (22)% 17,895 14,960 (16)% Net Sales | Industrial Activities 5,332 3,997 (25)% 16,062 12,931 (19)% Net Income 540 310 (43)% 1,704 1,083 (36)% Diluted EPS $0.40 $0.24 $(0.16) $1.25 $0.85 $(0.40) Non-GAAP1 Net Sales | Industrial Activities at constant currency 5,332 4,052 (24)% 16,062 13,007 (19)% Adjusted EBIT | Industrial Activities 627 336 (46)% 1,972 1,210 (39)% Adjusted EBIT Margin | Industrial Activities 11.8% 8.4% (340) bps 12.3% 9.4% (290) bps Adjusted Effective Tax Rate 26% 21% (5) pp 26% 20% (6) pp Adjusted Net Income 540 304 (44)% 1,694 1,143 (33)% Weighted average shares outstanding - diluted – million 1,351 1,254 (7)% 1,355 1,262 (7)% Adjusted Diluted EPS $0.40 $0.24 $(0.16) $1.24 $0.90 $(0.34) Free Cash Flow | Industrial Activities (127) (180) (53) (414) (1,249) (835) Q3 / 9M 2024 | FINANCIAL SUMMARY (1) Non-GAAP measures: definitions in the slide “Non-GAAP Financial Measures”; reconciliations in “Reconciliations” section Note: Prior period results have been revised; see “Accounting Revision” section for details. Numbers may not add due to rounding. ($M)

Q3 2024 results review | Nov 8, 202421 Q3 2024 | INDUSTRIAL ACTIVITIES NET SALES (1) Net Sales | Excluding Other Activities, Unallocated Items and Adjustment & Eliminations (2) Δ YoY @CC means at constant currency Note: numbers may not add due to rounding Agriculture Construction Industrial Activities1 $3,310M $687M $3,997M (24)% YoY (24)% @CC2 (28)% YoY (26)% @CC2 (25)% YoY (24)% @CC2 By Region as reported By Region as reported By Region as reported 42% 27% 18% 13% 52% 22% 20% 6% 44% 26% 18% 12% 41% 27% 19% 13% 57% 21% 16% 6% 44% 26% 18% 11% By Product as reported By Product as reported By Segment as reported 63% 17% 20% 37% 62% 1% 83% 17% 56% 23% 21% 36% 62% 2% 82% 18% Q3 2023 Q3 2024 Agric. Constr. NA EMEA SA APAC Tractors Combines Others Heavy Light Others NA EMEA SA APAC NA EMEA SA APAC Q3 2024 mix Q3 2023 mix Q3 2024 mix Q3 2023 mix

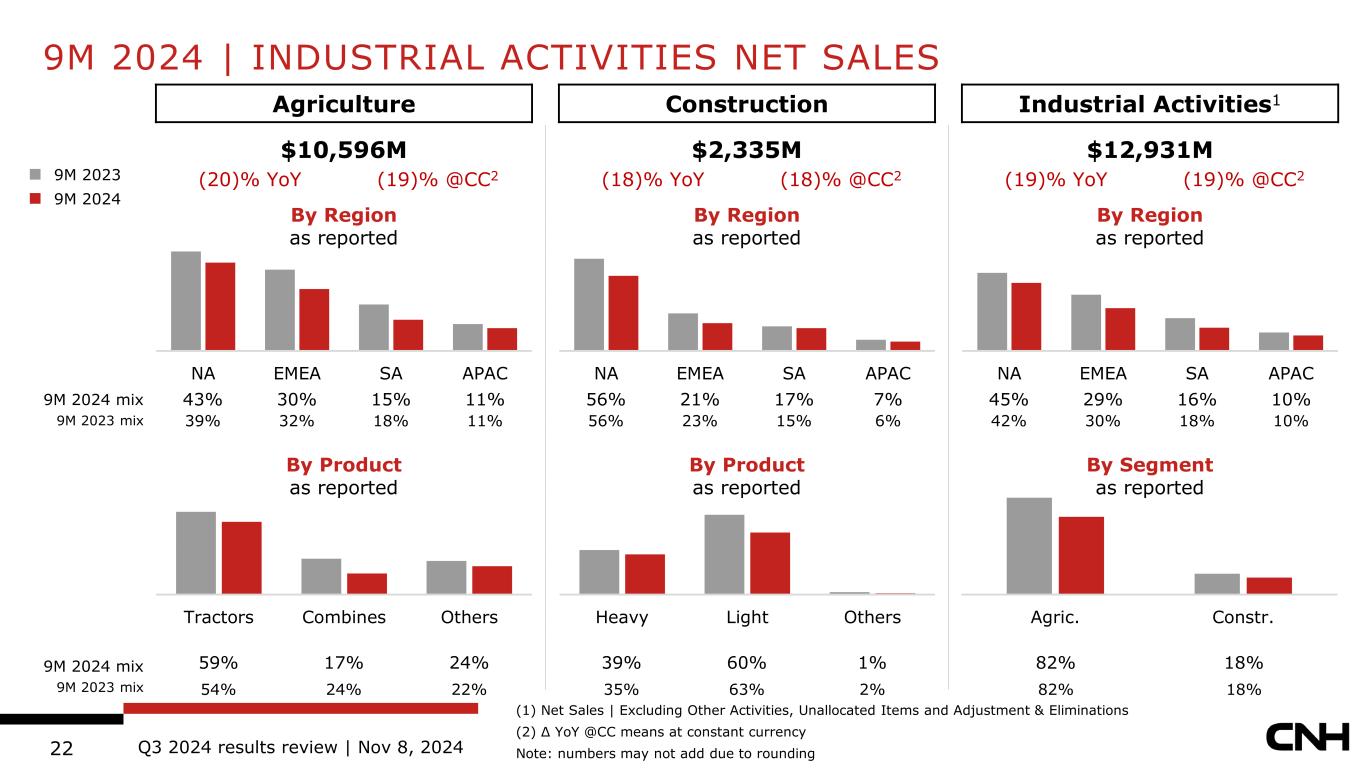

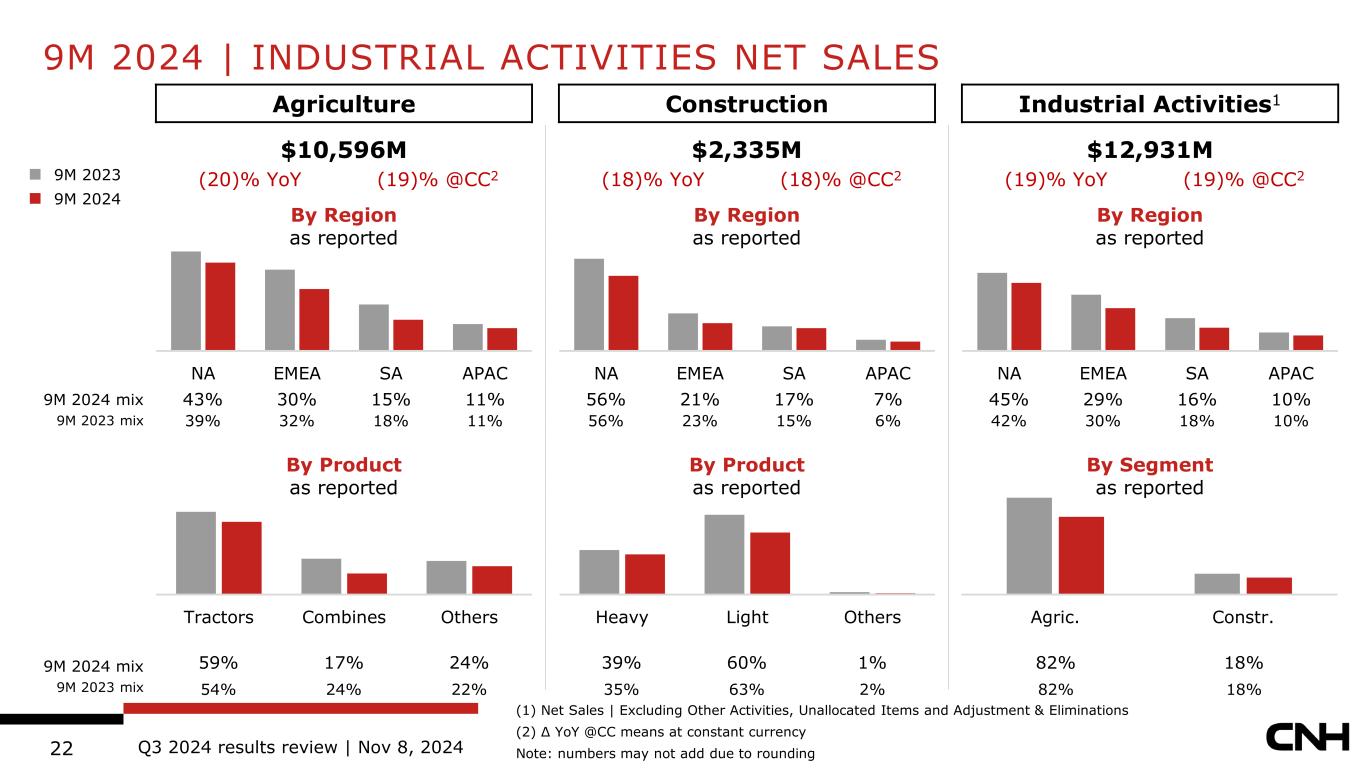

Q3 2024 results review | Nov 8, 202422 9M 2024 | INDUSTRIAL ACTIVITIES NET SALES (1) Net Sales | Excluding Other Activities, Unallocated Items and Adjustment & Eliminations (2) Δ YoY @CC means at constant currency Note: numbers may not add due to rounding Agriculture Construction Industrial Activities1 $10,596M $2,335M $12,931M (20)% YoY (19)% @CC2 (18)% YoY (18)% @CC2 (19)% YoY (19)% @CC2 By Region as reported By Region as reported By Region as reported 43% 30% 15% 11% 56% 21% 17% 7% 45% 29% 16% 10% 39% 32% 18% 11% 56% 23% 15% 6% 42% 30% 18% 10% By Product as reported By Product as reported By Segment as reported 59% 17% 24% 39% 60% 1% 82% 18% 54% 24% 22% 35% 63% 2% 82% 18% 9M 2023 9M 2024 Agric. Constr. NA EMEA SA APAC Tractors Combines Others Heavy Light Others NA EMEA SA APAC NA EMEA SA APAC 9M 2024 mix 9M 2023 mix 9M 2024 mix 9M 2023 mix

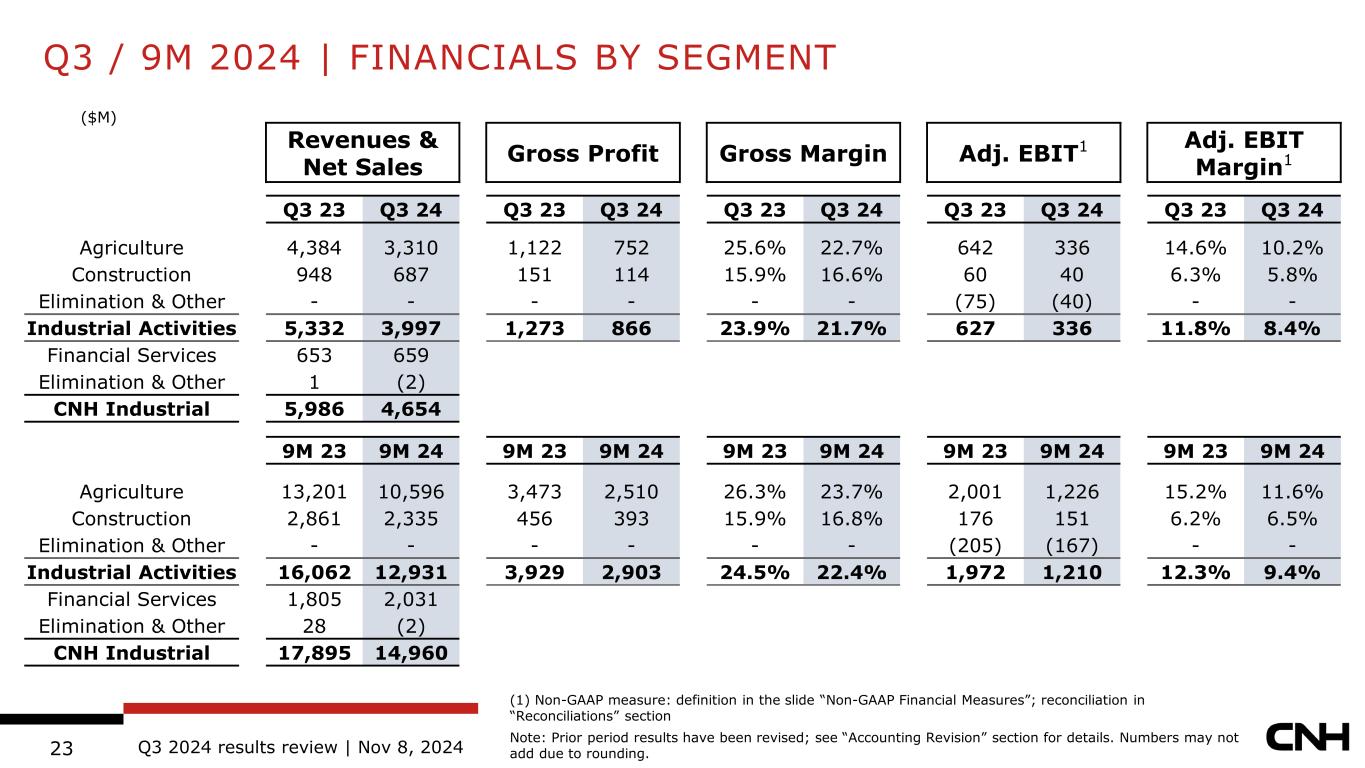

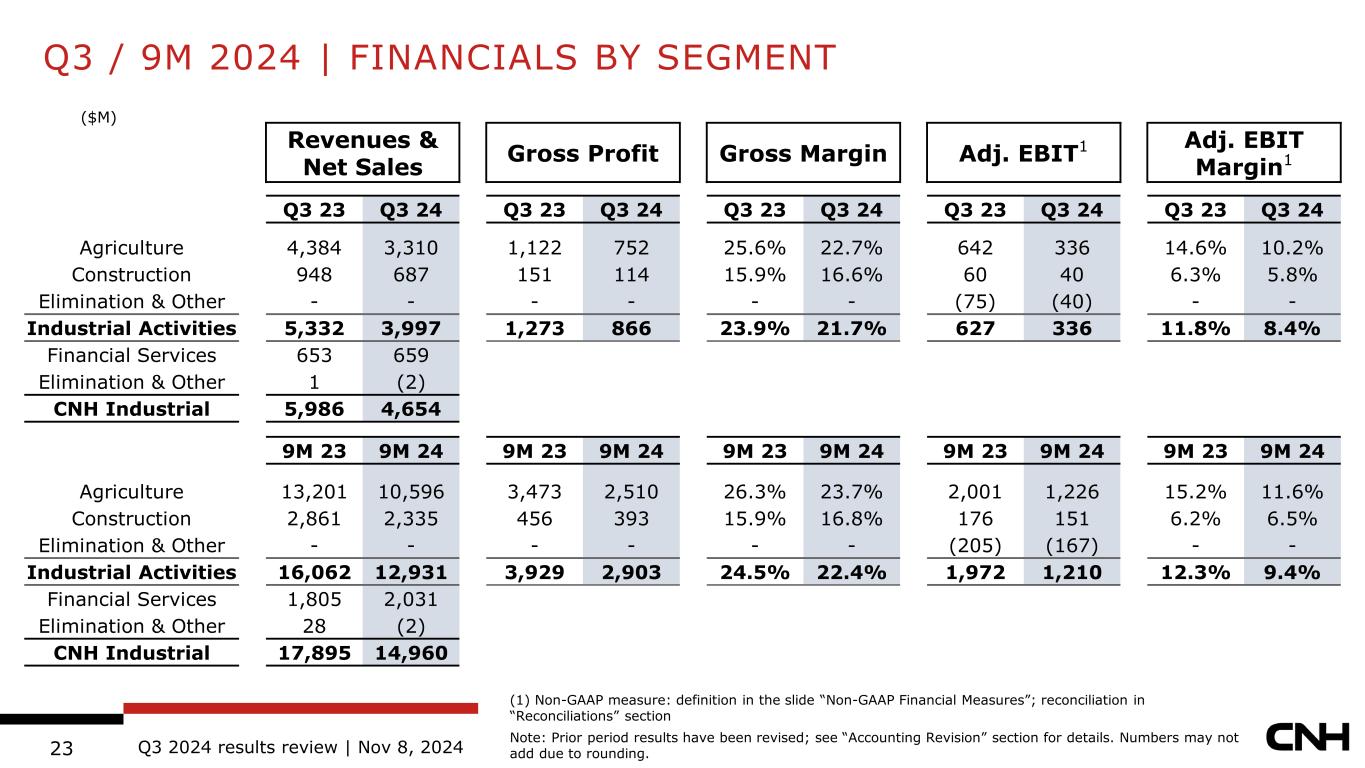

Q3 2024 results review | Nov 8, 202423 Q3 / 9M 2024 | FINANCIALS BY SEGMENT (1) Non-GAAP measure: definition in the slide “Non-GAAP Financial Measures”; reconciliation in “Reconciliations” section Note: Prior period results have been revised; see “Accounting Revision” section for details. Numbers may not add due to rounding. Revenues & Net Sales Gross Profit Gross Margin Adj. EBIT1 Adj. EBIT Margin1 Q3 23 Q3 24 Q3 23 Q3 24 Q3 23 Q3 24 Q3 23 Q3 24 Q3 23 Q3 24 Agriculture 4,384 3,310 1,122 752 25.6% 22.7% 642 336 14.6% 10.2% Construction 948 687 151 114 15.9% 16.6% 60 40 6.3% 5.8% Elimination & Other - - - - - - (75) (40) - - Industrial Activities 5,332 3,997 1,273 866 23.9% 21.7% 627 336 11.8% 8.4% Financial Services 653 659 Elimination & Other 1 (2) CNH Industrial 5,986 4,654 ($M) 9M 23 9M 24 9M 23 9M 24 9M 23 9M 24 9M 23 9M 24 9M 23 9M 24 Agriculture 13,201 10,596 3,473 2,510 26.3% 23.7% 2,001 1,226 15.2% 11.6% Construction 2,861 2,335 456 393 15.9% 16.8% 176 151 6.2% 6.5% Elimination & Other - - - - - - (205) (167) - - Industrial Activities 16,062 12,931 3,929 2,903 24.5% 22.4% 1,972 1,210 12.3% 9.4% Financial Services 1,805 2,031 Elimination & Other 28 (2) CNH Industrial 17,895 14,960

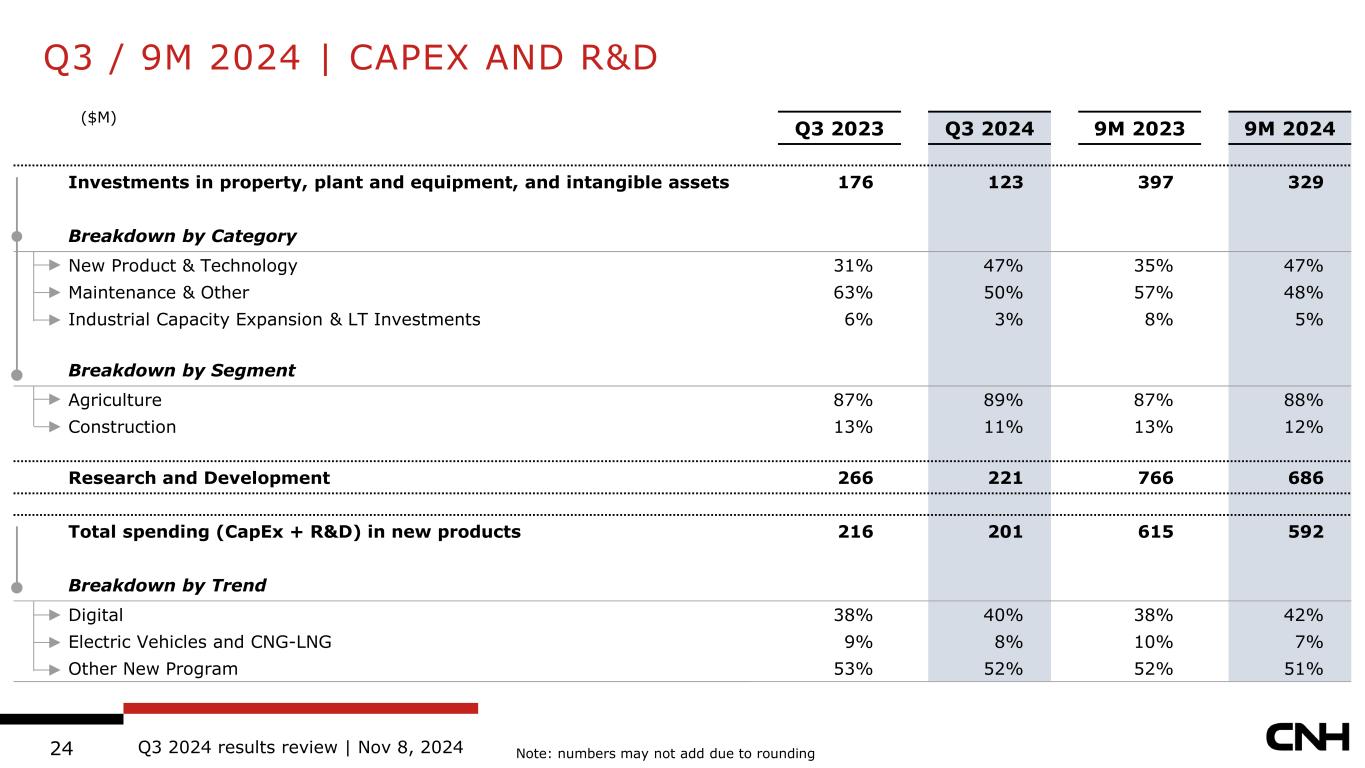

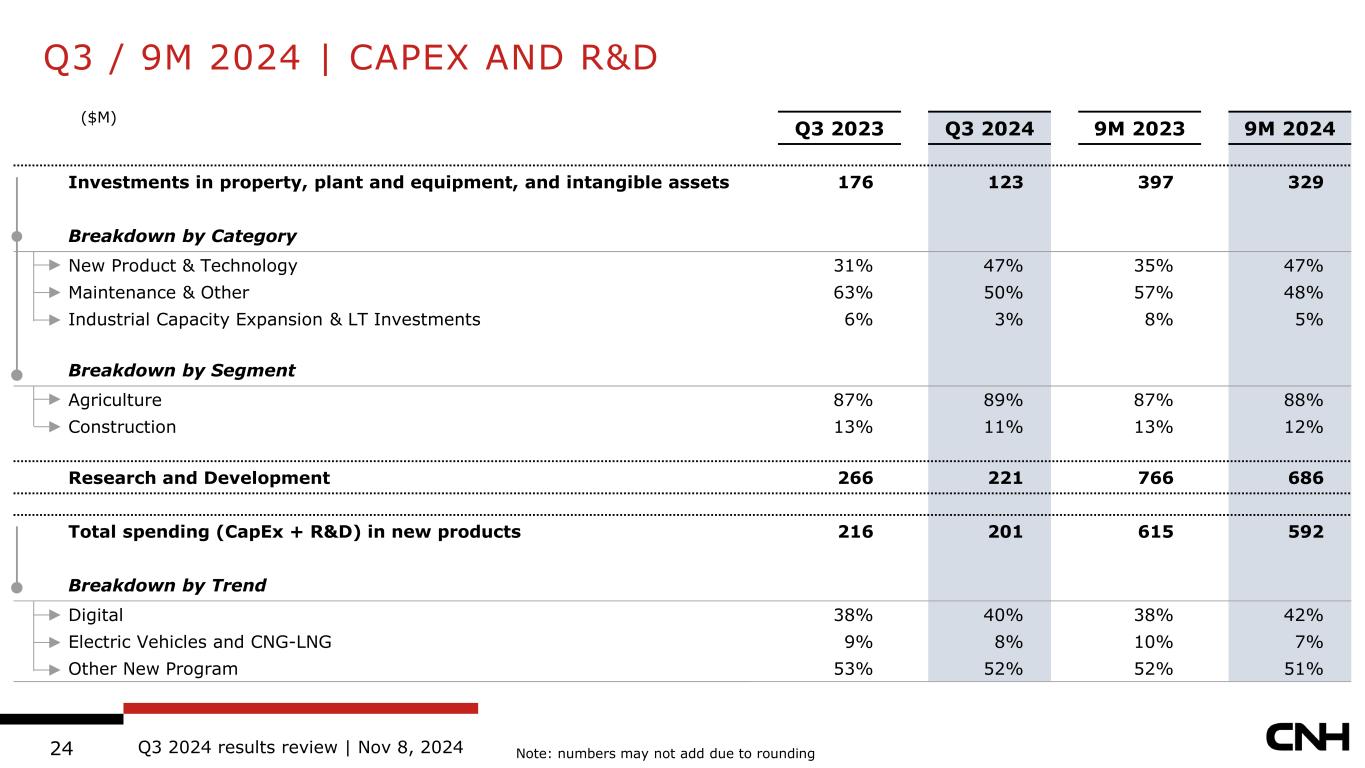

Q3 2024 results review | Nov 8, 202424 Q3 2023 Q3 2024 9M 2023 9M 2024 Investments in property, plant and equipment, and intangible assets 176 123 397 329 Breakdown by Category New Product & Technology 31% 47% 35% 47% Maintenance & Other 63% 50% 57% 48% Industrial Capacity Expansion & LT Investments 6% 3% 8% 5% Breakdown by Segment Agriculture 87% 89% 87% 88% Construction 13% 11% 13% 12% Research and Development 266 221 766 686 Total spending (CapEx + R&D) in new products 216 201 615 592 Breakdown by Trend Digital 38% 40% 38% 42% Electric Vehicles and CNG-LNG 9% 8% 10% 7% Other New Program 53% 52% 52% 51% ($M) Q3 / 9M 2024 | CAPEX AND R&D Note: numbers may not add due to rounding

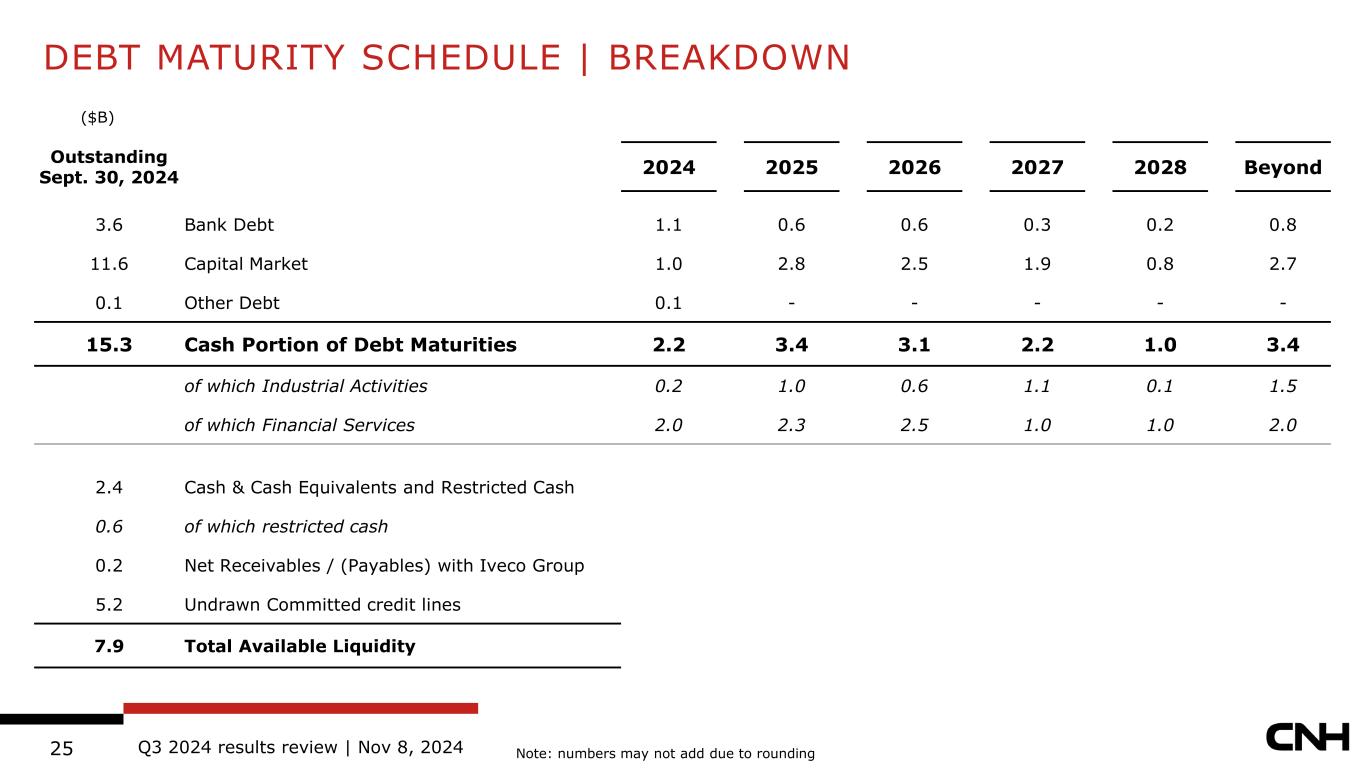

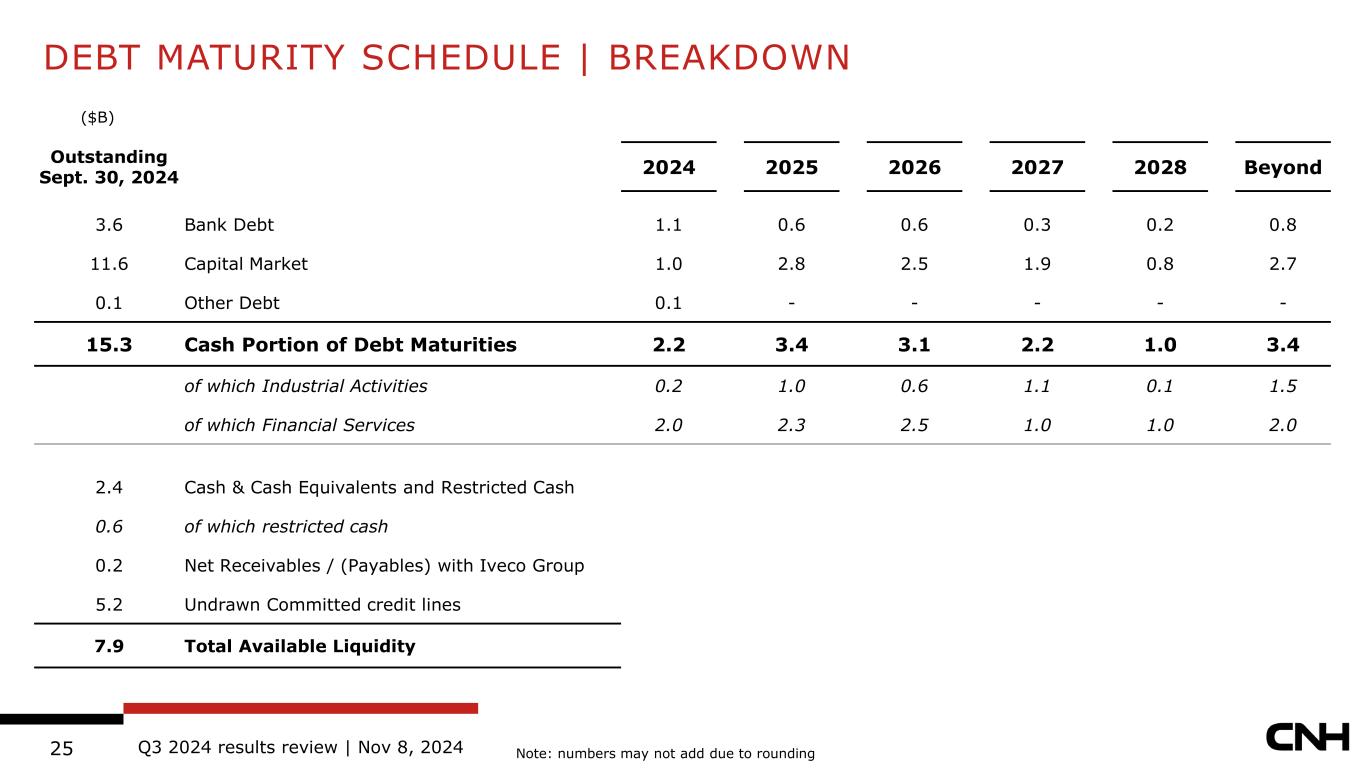

Q3 2024 results review | Nov 8, 202425 ($B) Outstanding Sept. 30, 2024 2024 2025 2026 2027 2028 Beyond 3.6 Bank Debt 1.1 0.6 0.6 0.3 0.2 0.8 11.6 Capital Market 1.0 2.8 2.5 1.9 0.8 2.7 0.1 Other Debt 0.1 - - - - - 15.3 Cash Portion of Debt Maturities 2.2 3.4 3.1 2.2 1.0 3.4 of which Industrial Activities 0.2 1.0 0.6 1.1 0.1 1.5 of which Financial Services 2.0 2.3 2.5 1.0 1.0 2.0 2.4 Cash & Cash Equivalents and Restricted Cash 0.6 of which restricted cash 0.2 Net Receivables / (Payables) with Iveco Group 5.2 Undrawn Committed credit lines 7.9 Total Available Liquidity DEBT MATURITY SCHEDULE | BREAKDOWN Note: numbers may not add due to rounding

ACCOUNTING REVISION

Q3 2024 results review | Nov 8, 202427 ACCOUNTING REVISION BY QUARTER (1/2) Note: Numbers may not add due to rounding Q1’23 Q2’23 Q3’23 Q4’23 FY 2023 Q1’24 Q2’24 H1 2024 Equity in income of unconsolidated subsidiaries and affiliates As reported 33 64 79 98 274 77 79 156 Revision (15) (17) (30) (34) (96) (33) (34) (67) As revised 18 47 49 64 178 44 45 89 Net income (loss) As reported 486 710 570 617 2,383 402 438 840 Revision (15) (17) (30) (34) (96) (33) (34) (67) As revised 471 693 540 583 2,287 369 404 773 Net income (loss) attributable to CNH Industrial N.V. As reported 482 706 567 616 2,371 401 433 834 Revision (15) (17) (30) (34) (96) (33) (34) (67) As revised 467 689 537 582 2,275 368 399 767 Earnings per share attributable to CNH Industrial N.V. – Basic As reported $0.36 $0.53 $0.43 $0.47 $1.78 $0.32 $0.34 $0.66 Revision $(0.01) $(0.02) $(0.03) $(0.03) $(0.07) $(0.03) $(0.02) $(0.05) As revised $0.35 $0.51 $0.40 $0.44 $1.71 $0.29 $0.32 $0.61 Earnings per share attributable to CNH Industrial N.V. – Diluted As reported $0.35 $0.52 $0.42 $0.46 $1.76 $0.31 $0.34 $0.66 Revision $(0.01) $(0.01) $(0.02) $(0.02) $(0.07) $(0.02) $(0.02) $(0.05) As revised $0.34 $0.51 $0.40 $0.44 $1.69 $0.29 $0.32 $0.61 ($M)

Q3 2024 results review | Nov 8, 202428 ACCOUNTING REVISION BY QUARTER (1/2) (1) non-GAAP financial measure; see reconciliation to the most comparable U.S. GAAP financial measure on the following slides Note: Numbers may not add due to rounding Q1’23 Q2’23 Q3’23 Q4’23 FY 2023 Q1’24 Q2’24 H1 2024 Adjusted net income(1) As reported 475 711 570 557 2,313 421 485 906 Revision (15) (17) (30) (34) (96) (33) (34) (67) As revised 460 694 540 523 2,217 388 451 839 Adjusted diluted EPS(1) As reported $0.35 $0.52 $0.42 $0.42 $1.70 $0.33 $0.38 $0.71 Revision $(0.01) $(0.01) $(0.02) $(0.03) $(0.07) $(0.03) $(0.03) $(0.05) As revised $0.34 $0.51 $0.40 $0.39 $1.63 $0.30 $0.35 $0.66 Adjusted EBIT of Industrial Activities(1) As reported 555 822 657 696 2,730 405 536 941 Revision (15) (17) (30) (34) (96) (33) (34) (67) As revised 540 805 627 662 2,634 372 502 874 Adjusted EBIT margin of Industrial Activities(1) As reported 11.6% 13.8% 12.3% 11.6% 12.4% 9.8% 11.2% 10.5% Revision (0.3)% (0.3)% (0.5)% (0.6)% (0.5)% (0.8)% (0.7)% (0.7)% As revised 11.3% 13.5% 11.8% 11.0% 11.9% 9.0% 10.5% 9.8% Adjusted EBIT of Agriculture As reported 570 821 672 669 2,732 421 536 957 Revision (15) (17) (30) (34) (96) (33) (34) (67) As revised 555 804 642 635 2,636 388 502 890 Adjusted EBIT margin of Agriculture As reported 14.5% 16.8% 15.3% 13.5% 15.1% 12.5% 13.7% 13.1% Revision (0.4)% (0.4)% (0.7)% (0.7)% (0.6)% (1.0)% (0.9)% (0.9)% As revised 14.1% 16.4% 14.6% 12.8% 14.5% 11.5% 12.8% 12.2% ($M)

Q3 2024 results review | Nov 8, 202429 RECONCILIATION OF ADJ. EBIT FOR INDUSTRIAL ACTIVITIES TO NET INCOME Note: Numbers may not add due to rounding Q1’23 Q2’23 Q3’23 Q4’23 FY 2023 Q1’24 Q2’24 H1 2024 Net Income (loss) - as reported 486 710 570 617 2,383 402 438 840 Revision impacts (15) (17) (30) (34) (96) (33) (34) (67) Net income (loss) - as revised 471 693 540 583 2,287 369 404 773 Less: Consolidated income tax expense (173) (192) (171) (58) (594) (77) (95) (172) Consolidated income before taxes 644 885 711 641 2,881 446 499 945 Less: Financial Services Financial Services Net Income 78 94 86 113 371 118 91 209 Financial Services Income Taxes 29 26 34 47 136 19 23 42 Add back of the following I. A. items Interest expense of I.A., net of Interest income and eliminations 4 22 10 40 76 32 46 78 Foreign exch. (gains) losses, net of I.A. 6 - 21 78 105 - 4 4 Finance and non-service comp. of pension & other post-empl. benefit costs of I.A. (1) (1) - 6 4 1 1 2 Adjustments for the following I.A. items Restructuring expenses 1 2 5 57 65 30 51 81 Other discrete items (7) 17 - - 10 - 15 15 Total Adjusted EBIT of Ind. Actitivities 540 805 627 662 2,634 372 502 874 ($M)

Q3 2024 results review | Nov 8, 202430 RECONCILIATION OF ADJUSTED NET INCOME TO NET INCOME AND CALCULATION OF THE RECASTED ADJUSTED DILUTIVE EPS Note: Numbers may not add due to rounding Q1’23 Q2’23 Q3’23 Q4’23 FY 2023 Q1’24 Q2’24 H1 2024 Net Income (loss) - as reported 486 710 570 617 2,383 402 438 840 Revision impacts (15) (17) (30) (34) (96) (33) (34) (67) Net income (loss) - as revised 471 693 540 583 2,287 369 404 773 Adjustments impacting Income (loss) before income tax (expense) benefit and equity in income of unconsolidated subsidiaries and affiliates (12) 13 (1) 53 53 25 60 85 Adjustments impacting Income tax (expense) benefit 1 (12) 1 (113) (123) (6) (13) (19) Adjusted net income (loss) 460 694 540 523 2,217 388 451 839 Adjusted net income (loss) attributable to CNH Industrial N.V. - as reported 471 707 567 556 2,301 420 480 900 Adjustment (15) (17) (30) (34) (96) (33) (34) (67) Adjusted net income (loss) attributable to CNH Industrial N.V. - as recast 456 690 537 522 2,205 387 446 833 Weighted average shares outstanding - diluted (million) 1,359 1,355 1,351 1,334 1,350 1,274 1,260 1,267 Adjusted diluted EPS $0.34 $0.51 $0.40 $0.39 $1.63 $0.30 $0.35 $0.66 ($M)

RECONCILIATIONS

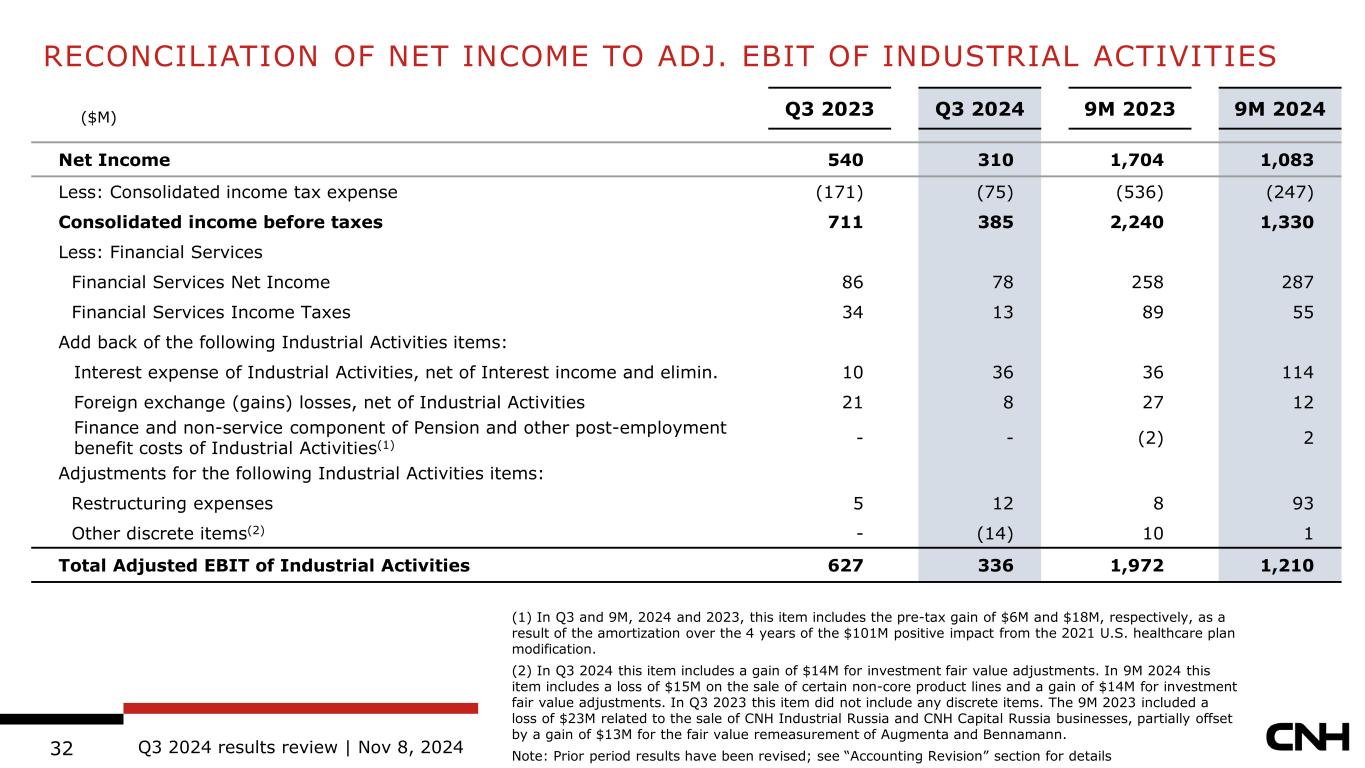

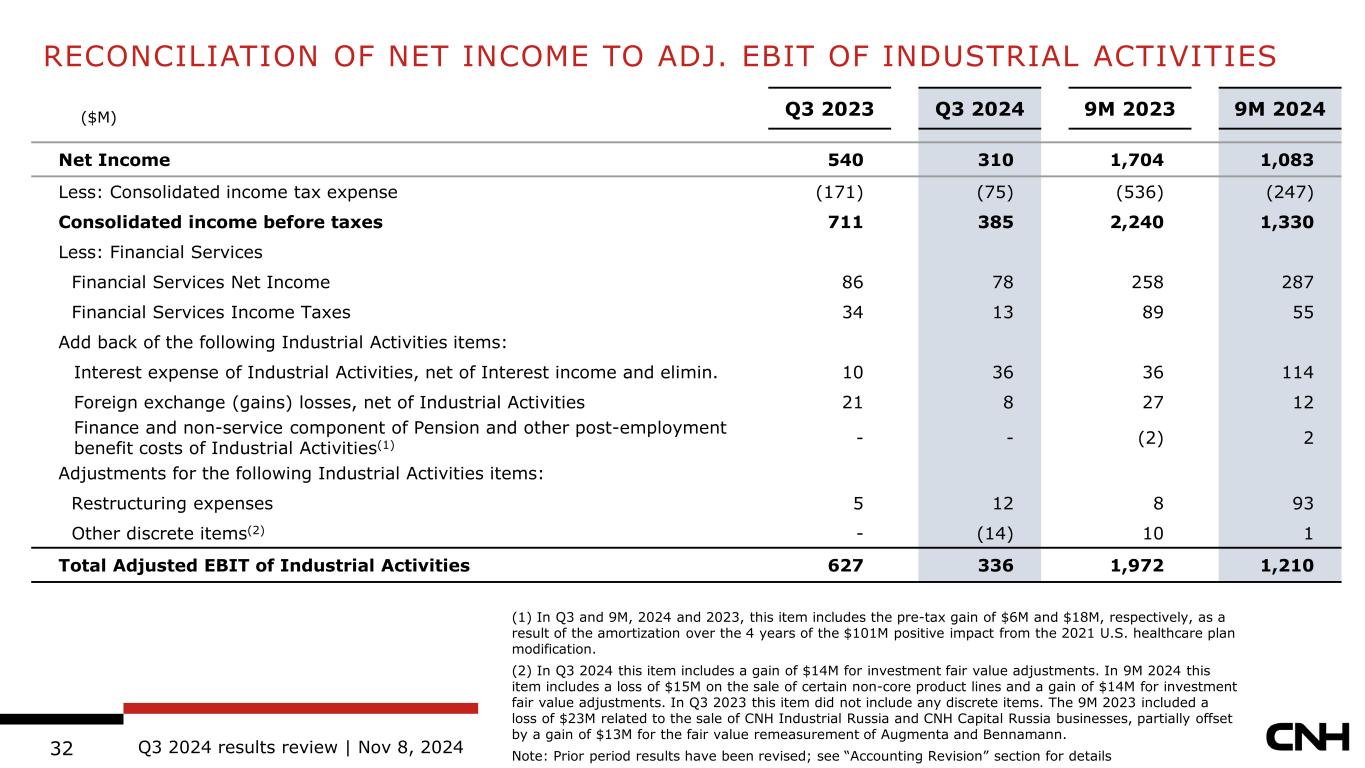

Q3 2024 results review | Nov 8, 202432 Q3 2023 Q3 2024 9M 2023 9M 2024 Net Income 540 310 1,704 1,083 Less: Consolidated income tax expense (171) (75) (536) (247) Consolidated income before taxes 711 385 2,240 1,330 Less: Financial Services Financial Services Net Income 86 78 258 287 Financial Services Income Taxes 34 13 89 55 Add back of the following Industrial Activities items: Interest expense of Industrial Activities, net of Interest income and elimin. 10 36 36 114 Foreign exchange (gains) losses, net of Industrial Activities 21 8 27 12 Finance and non-service component of Pension and other post-employment benefit costs of Industrial Activities(1) - - (2) 2 Adjustments for the following Industrial Activities items: Restructuring expenses 5 12 8 93 Other discrete items(2) - (14) 10 1 Total Adjusted EBIT of Industrial Activities 627 336 1,972 1,210 RECONCILIATION OF NET INCOME TO ADJ. EBIT OF INDUSTRIAL ACTIVITIES (1) In Q3 and 9M, 2024 and 2023, this item includes the pre-tax gain of $6M and $18M, respectively, as a result of the amortization over the 4 years of the $101M positive impact from the 2021 U.S. healthcare plan modification. (2) In Q3 2024 this item includes a gain of $14M for investment fair value adjustments. In 9M 2024 this item includes a loss of $15M on the sale of certain non-core product lines and a gain of $14M for investment fair value adjustments. In Q3 2023 this item did not include any discrete items. The 9M 2023 included a loss of $23M related to the sale of CNH Industrial Russia and CNH Capital Russia businesses, partially offset by a gain of $13M for the fair value remeasurement of Augmenta and Bennamann. Note: Prior period results have been revised; see “Accounting Revision” section for details ($M)

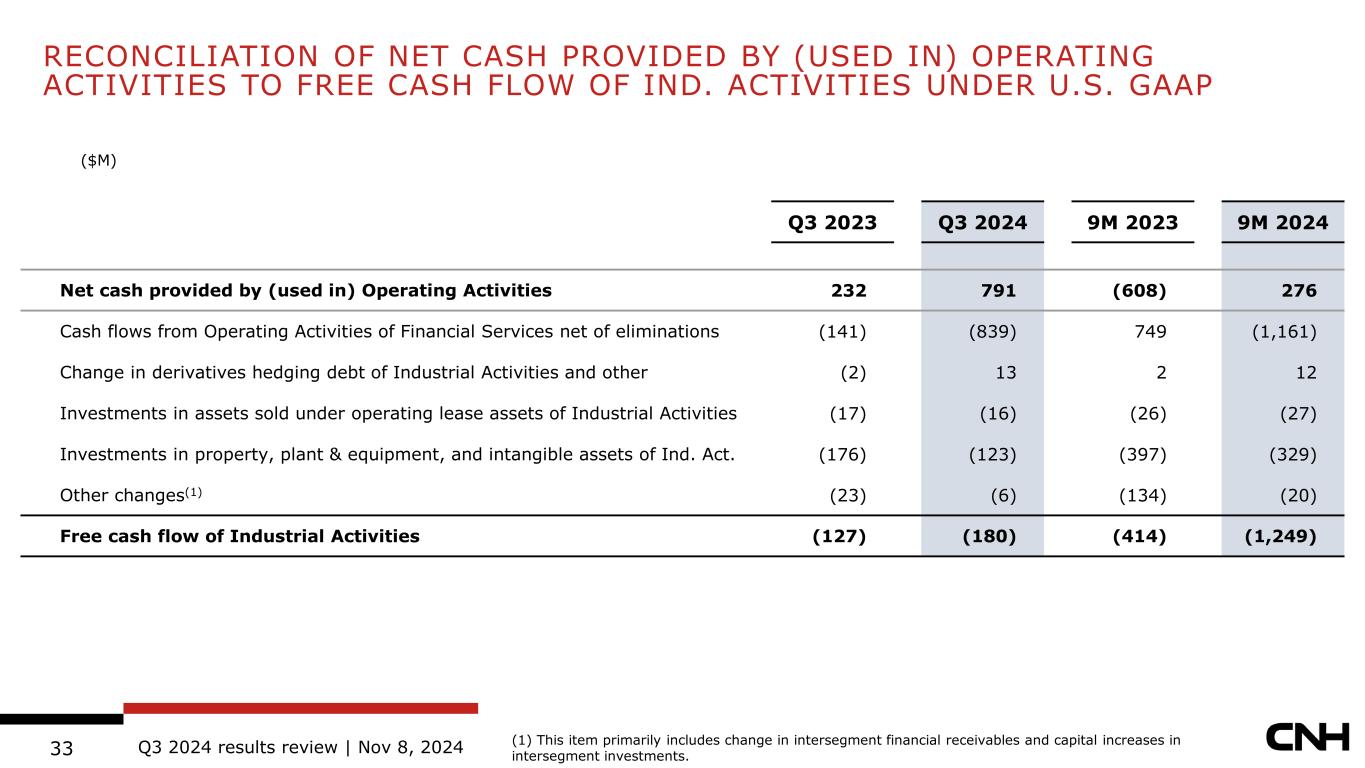

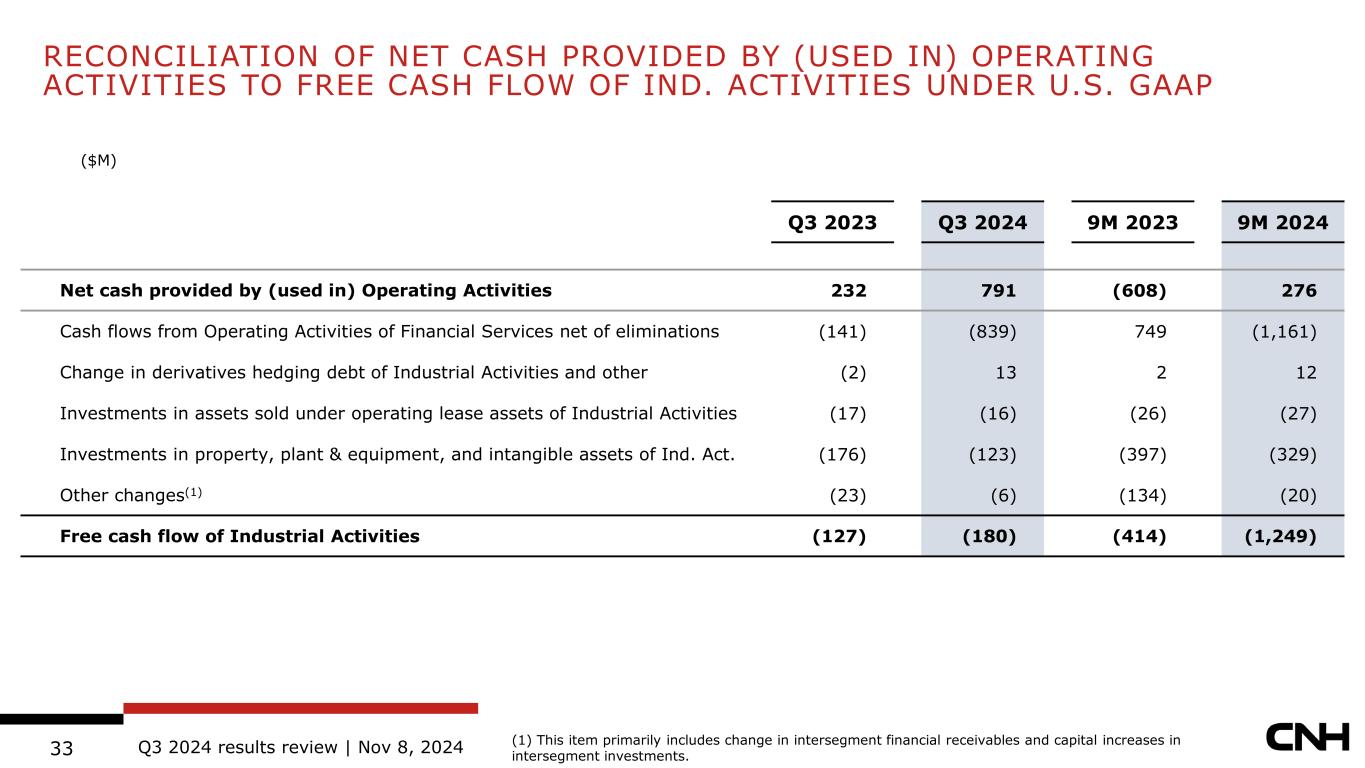

Q3 2024 results review | Nov 8, 202433 Q3 2023 Q3 2024 9M 2023 9M 2024 Net cash provided by (used in) Operating Activities 232 791 (608) 276 Cash flows from Operating Activities of Financial Services net of eliminations (141) (839) 749 (1,161) Change in derivatives hedging debt of Industrial Activities and other (2) 13 2 12 Investments in assets sold under operating lease assets of Industrial Activities (17) (16) (26) (27) Investments in property, plant & equipment, and intangible assets of Ind. Act. (176) (123) (397) (329) Other changes(1) (23) (6) (134) (20) Free cash flow of Industrial Activities (127) (180) (414) (1,249) RECONCILIATION OF NET CASH PROVIDED BY (USED IN) OPERATING ACTIVITIES TO FREE CASH FLOW OF IND. ACTIVITIES UNDER U.S. GAAP (1) This item primarily includes change in intersegment financial receivables and capital increases in intersegment investments. ($M)

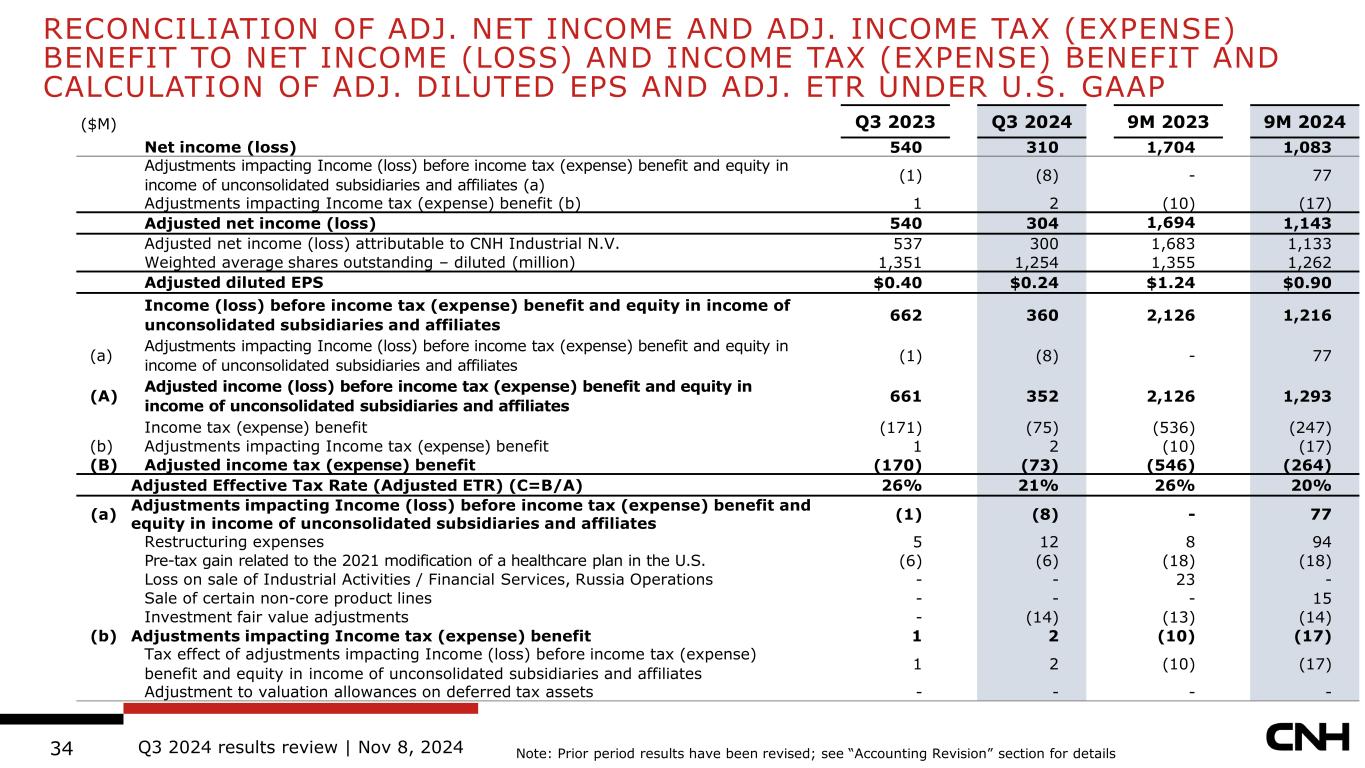

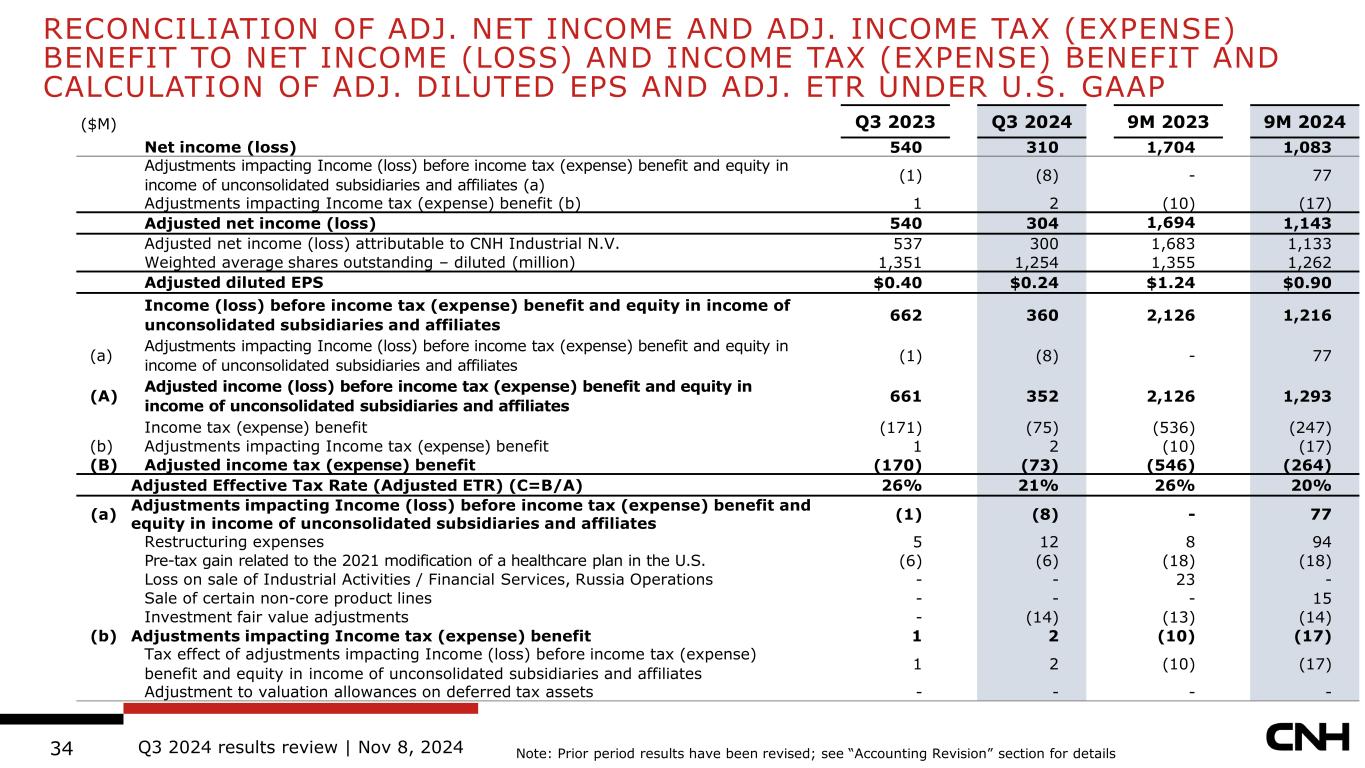

Q3 2024 results review | Nov 8, 202434 Q3 2023 Q3 2024 9M 2023 9M 2024 Net income (loss) 540 310 1,704 1,083 Adjustments impacting Income (loss) before income tax (expense) benefit and equity in income of unconsolidated subsidiaries and affiliates (a) (1) (8) - 77 Adjustments impacting Income tax (expense) benefit (b) 1 2 (10) (17) Adjusted net income (loss) 540 304 1,694 1,143 Adjusted net income (loss) attributable to CNH Industrial N.V. 537 300 1,683 1,133 Weighted average shares outstanding – diluted (million) 1,351 1,254 1,355 1,262 Adjusted diluted EPS $0.40 $0.24 $1.24 $0.90 Income (loss) before income tax (expense) benefit and equity in income of unconsolidated subsidiaries and affiliates 662 360 2,126 1,216 (a) Adjustments impacting Income (loss) before income tax (expense) benefit and equity in income of unconsolidated subsidiaries and affiliates (1) (8) - 77 (A) Adjusted income (loss) before income tax (expense) benefit and equity in income of unconsolidated subsidiaries and affiliates 661 352 2,126 1,293 Income tax (expense) benefit (171) (75) (536) (247) (b) Adjustments impacting Income tax (expense) benefit 1 2 (10) (17) (B) Adjusted income tax (expense) benefit (170) (73) (546) (264) Adjusted Effective Tax Rate (Adjusted ETR) (C=B/A) 26% 21% 26% 20% (a) Adjustments impacting Income (loss) before income tax (expense) benefit and equity in income of unconsolidated subsidiaries and affiliates (1) (8) - 77 Restructuring expenses 5 12 8 94 Pre-tax gain related to the 2021 modification of a healthcare plan in the U.S. (6) (6) (18) (18) Loss on sale of Industrial Activities / Financial Services, Russia Operations - - 23 - Sale of certain non-core product lines - - - 15 Investment fair value adjustments - (14) (13) (14) (b) Adjustments impacting Income tax (expense) benefit 1 2 (10) (17) Tax effect of adjustments impacting Income (loss) before income tax (expense) benefit and equity in income of unconsolidated subsidiaries and affiliates 1 2 (10) (17) Adjustment to valuation allowances on deferred tax assets - - - - ($M) RECONCILIATION OF ADJ. NET INCOME AND ADJ. INCOME TAX (EXPENSE) BENEFIT TO NET INCOME (LOSS) AND INCOME TAX (EXPENSE) BENEFIT AND CALCULATION OF ADJ. DILUTED EPS AND ADJ. ETR UNDER U.S. GAAP Note: Prior period results have been revised; see “Accounting Revision” section for details

Q3 2024 results review | Nov 8, 202435 The composition of our regions part of the geographic information is as follows: North America: United States, Canada, and Mexico Europe, Middle East, and Africa (EMEA): member countries of the European Union, European Free Trade Association, the United Kingdom, Ukraine, Balkans, Russia, Türkiye, Uzbekistan, Pakistan, the African continent, and the Middle East South America: Central and South America, and the Caribbean Islands Asia Pacific (APAC): Continental Asia (including the Indian subcontinent), Indonesia and Oceania Industry Data In this presentation, industry information is generally based on retail unit sales data in North America, on registrations of equipment in most of Europe, Brazil, and various Rest of the World markets, and on retail and shipment unit data collected by a central information bureau appointed by equipment manufacturers associations, including the Association of Equipment Manufacturers’ in North America, the Committee for European Construction Equipment in Europe, the ANFAVEA in Brazil, the Japan Construction Equipment Manufacturers Association, and the Korea Construction Equipment Manufacturers Association, as well as on other shipment data collected by an independent service bureau. Not all Agricultural or Construction equipment is registered, and registration data may thus underestimate, perhaps substantially, actual retail industry unit sales demand, particularly for local manufacturers in China, Southeast Asia, Eastern Europe, Russia, Turkey, Brazil, and any country where local shipments are not reported. In addition, there may be a period of time between the shipment, delivery, sale and/or registration of a unit, which must be estimated, in making any adjustments to the shipment, delivery, sale, or registration data to determine our estimates of retail unit data in any period. GEOGRAPHIC INFORMATION

Q3 2024 results review | Nov 8, 202436 CNH monitors its operations through the use of several non-GAAP financial measures. CNH’s management believes that these non-GAAP financial measures provide useful and relevant information regarding its operating results and enhance the readers’ ability to assess CNH’s financial performance and financial position. Management uses these non-GAAP measures to identify operational trends, as well as make decisions regarding future spending, resource allocations and other operational decisions as they provide additional transparency with respect to our core operations. These non-GAAP financial measures have no standardized meaning under U.S. GAAP and are unlikely to be comparable to other similarly titled measures used by other companies and are not intended to be substitutes for measures of financial performance and financial position as prepared in accordance with U.S. GAAP. CNH’s non-GAAP financial measures used in this presentation are defined as follows: Adjusted EBIT of Industrial Activities is defined as net income (loss) before income taxes, Financial Services’ results, Industrial Activities’ interest expenses, net, foreign exchange gains/losses, finance and non-service component of pension and other post-employment benefit costs, restructuring expenses, and certain non- recurring items. In particular, non-recurring items are specifically disclosed items that management considers rare or discrete events that are infrequent in nature and not reflective of on-going operational activities. Adjusted EBIT Margin of Industrial Activities is computed by dividing Adjusted EBIT of Industrial Activities by Net Sales of Industrial Activities. Adjusted Net Income (Loss) is defined as net income (loss), less restructuring charges and non-recurring items, after tax. Adjusted Diluted EPS is computed by dividing Adjusted Net Income (loss) attributable to CNH Industrial N.V. by a weighted-average number of common shares outstanding during the period that takes into consideration potential common shares outstanding deriving from the CNH share-based payment awards, when inclusion is not anti-dilutive. When we provide guidance for adjusted diluted EPS, we do not provide guidance on an earnings per share basis because the GAAP measure will include potentially significant items that have not yet occurred and are difficult to predict with reasonable certainty prior to year-end. Adjusted Income Tax (Expense) Benefit is defined as income taxes less the tax effect of restructuring expenses and non-recurring items, and non-recurring tax charges or benefits. Adjusted Effective Tax Rate (Adjusted ETR) is computed by dividing a) adjusted income taxes by b) income (loss) before income taxes and equity in income of unconsolidated subsidiaries and affiliates, less restructuring expenses and non-recurring items. Free Cash Flow of Industrial Activities (or Industrial Free Cash Flow) refers to Industrial Activities only and is computed as consolidated cash flow from operating activities less: cash flow from operating activities of Financial Services; investments of Industrial Activities in assets sold under operating leases, property, plant and equipment and intangible assets; change in derivatives hedging debt of Industrial Activities; as well as other changes and intersegment eliminations. For forecasted information, the Company is unable to provide a reconciliation of this measure without unreasonable effort due to the uncertainty and inherent difficulty of predicting the occurrence, the financial impact, and the periods in which the adjustments may be recognized. For the same reasons, the Company is unable to address the probable significance of the unavailable information, which could be material to future results. Change excluding FX or Constant Currency refers to the fluctuations in revenues on a constant currency basis by applying the prior year average exchange rates to current year’s revenues expressed in local currency in order to eliminate the impact of foreign exchange rate fluctuations. NON-GAAP FINANCIAL MEASURES

INVESTOR RELATIONS CONTACTS investor.relations@cnh.com Jason Omerza +1 (630) 740 8079 | jason.omerza@cnh.com Federico Pavesi +39 (345) 605 6218 | federico.pavesi@cnh.com www.cnh.com