EXHIBIT 99.1

1 June 2017

2 FORWARD - LOOKING STATEMENTS Statements in this presentation and oral statements made from time to time by representatives of Hemisphere Media Group, Inc. or its affiliates (the “Company ”) may contain certain statements about the Company and its consolidated subsidiaries, joint ventures and other investments that are "forward - looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. These include, but are not limited to, statements relating to the Company’s future financial and operatin g r esults (including growth and earnings), plans, objectives, expectations and intentions and other statements that are not historical facts. These statements are based on the current exp ect ations of the management of the Company and are subject to uncertainty and changes in circumstance, which may cause actual results to differ materially from those expressed or implied in such forward - looking statements. Without limitation, any statements preceded or followed by or that include the words "targets," "plans," "believes," "expects," "intends," "will," "l ike ly," "may," "anticipates," "estimates," "projects," "should," "would," "expect," "positioned," "strategy," "future," or words, phrases or terms of similar substance or the negative thereof, are fo rwa rd - looking statements. In addition, these statements are based on a number of assumptions that are subject to change. Factors that could cause actual results to differ materially from those exp res sed or implied by the forward - looking statements are discussed under the headings "Risk Factors" and "Forward - Looking Statements" in the Company’s most recent Annual Report on Form 10 - K, file d with the Securities and Exchange Commission ("SEC"), as they may be updated in any future reports filed with the SEC. If one or more of these factors materialize, or if any underlyi ng assumptions prove incorrect, the Company’s actual results, performance, or achievements may vary materially from any future results, performance or achievements expressed or implied by th ese forward - looking statements. Forward - looking statements included herein are made as of the date hereof, and the Company undertakes no obligation to update publicly such statements t o r eflect subsequent events or circumstances. DISCLAIMER The information contained in this presentation is being provided for your convenience and information only. Our Annual Report s on Form 10 - K, Quarterly Reports on Form 10 - Q, Current Reports on Form 8 - K and amendments to reports filed pursuant to Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amen ded (the "Exchange Act") are made available free of charge on or through our website at www.hemispheretv.com as soon as reasonably practicable after such reports are filed with, or fu rni shed to, the SEC. The information on our website is not, and shall not be deemed to be, or incorporated into any other filings we make with the SEC. You may read and copy any materials we file wi th the SEC at the SEC’s Public Reference Room at 100 F Street, NE, Washington, DC 20549. You may obtain information on the operation of the Public Reference Room by calling the Com mis sion at 1 - 800 - SEC - 0330. The SEC also maintains a website that contains our reports, proxy statements and other information at www.sec.gov. The Company assumes no duty to update or r evi sed the information contained in this presentation and the information presented herein is historical and may not be updated for recent events. You may not reproduce the information i n t his presentation. TRADEMARKS This document may contain registered and unregistered trademarks, service marks and copyrights of the Company’s joint venture s and television networks, Cinelatino, WAPA America, WAPA, Pasiones, Centroamerica TV and Television Dominicana and their affiliates, as well as trademarks, service marks and copyright s o f third parties. All brand names, trademarks, service marks and copyrights appearing in this document are the property of their respective holders. RECONCILIATION OF GAAP TO NON - GAAP FINANCIAL MEASURES In addition to financial information presented in accordance with U.S. GAAP, the Company has presented the non - GAAP financial m easure Adjusted EBITDA. Management uses this measure to assess the operating results and performance of the business, perform analytical comparisons and identify strategies to impro ve performance. The Company believes Adjusted EBITDA is relevant to investors because it allows them to analyze the operating performance of each business using the same metrics use d b y management. When presenting Adjusted EBITDA, the Company’s management adds back (deducts) from net income, if any, depreciation expense, amortization of intangibles, loss on dis position of assets, loss on extinguishment of debt, transaction and non - recurring expenses, income tax expense, interest and other expense, and stock - based compensation. The Company believes that this non - GAAP presentation is important to investors’ understanding of our businesses. A reconciliation of this measure to GAAP can be found in the slide entitled, “Adjusted EBITD A R econciliation” on page 28 of this presentation.

3 U.S. Cable Networks Latin America Cable Networks Broadcast TV Networks Digital/OTT Hemisphere Media: A Dynamic Portfolio Content Creation and Distribution 3

4 Investment Highlights Content that appeals to the highly attractive and fast - growing U.S. Hispanic and Latin American markets Large and fast growing target market; untapped subscriber and distribution opportunity Unique and compelling proprietary content with strong monetization potential Stable revenue, including contractual subscriber and retransmission fees; Strong earnings and cash flow margins; attractive free cash flow generation Leading market position with limited direct competition; scalable business model Long - term growth through organic growth and further M&A Experienced and proven management team OTT 4

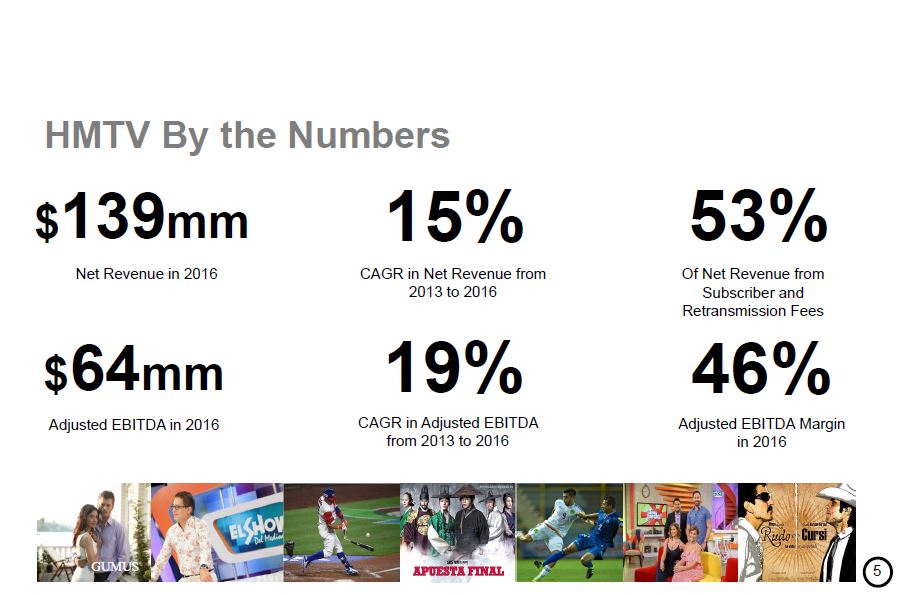

5 GUMUS 15% CAGR in Net Revenue from 2013 to 2016 19% CAGR in Adjusted EBITDA from 2013 to 2016 46% Adjusted EBITDA Margin in 2016 $ 139 mm Net Revenue in 2016 HMTV By the Numbers $ 64 mm Adjusted EBITDA in 2016 53% Of Net Revenue from Subscriber and Retransmission Fees 5

6 U.S. Hispanic Market Opportunity 4.2x U.S. Hispanic population growth vs. general population growth 95% of Latinos state that it’s important for future generations of U.S. Hispanics to speak Spanish Source: U.S. Census, Pew Hispanic . 24.6 37.5 2000 2015 U.S. Spanish Speakers (in millions) 6

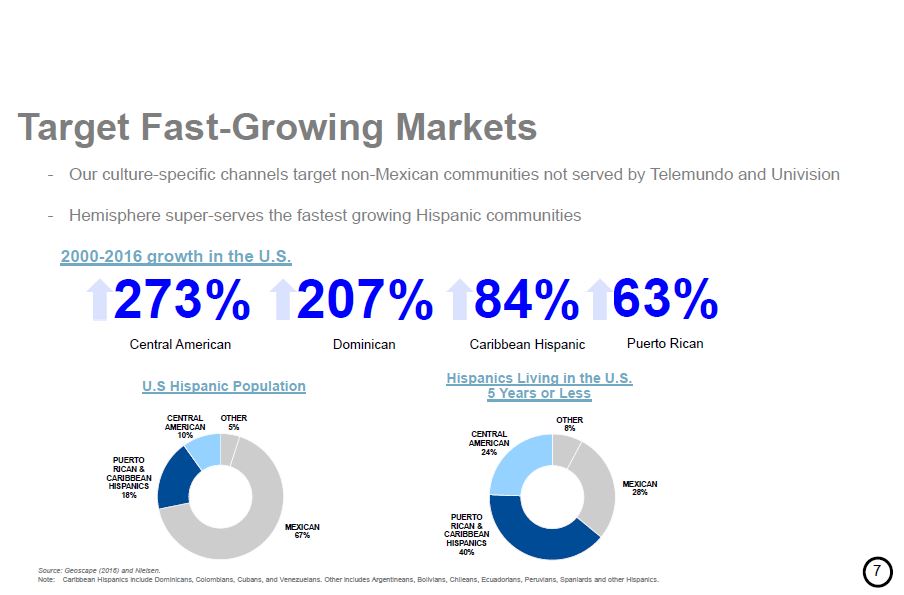

7 Target Fast - Growing Markets 2000 - 2016 growth in the U.S. 273% Central American 207% Dominican 84% Caribbean Hispanic 63% Puerto Rican Source: Geoscape (2016) and Nielsen. Note: Caribbean Hispanics include Dominicans, Colombians, Cubans, and Venezuelans. Other includes Argentineans, Bolivians, Chileans, Ecuadorians, Peruvians, Spaniards and other Hispanics. OTHER 8% MEXICAN 28% PUERTO RICAN & CARIBBEAN HISPANICS 40% CENTRAL AMERICAN 24% Hispanics Living in the U.S. 5 Years or Less - Our culture - specific channels target non - Mexican communities not served by Telemundo and Univision - Hemisphere super - serves the fastest growing Hispanic communities OTHER 5% MEXICAN 67% PUERTO RICAN & CARIBBEAN HISPANICS 18% CENTRAL AMERICAN 10% U.S Hispanic Population 7

8 15.6 mm 7.3 mm 12.2 mm 4.9 mm Hispanic TV Households Untapped Opportunity Hispanic Package Subs Hemisphere cable networks are carried on Hispanic programming packages U.S. Hispanic Market Opportunity Source: Hispanic TV HH’s and pay - TV subscribers are from Nielsen Universe estimates for 2017, Hispanic package subscribers are based on management estimates. 2017 Subscriber Growth Growing Hispanic Population Increased Pay - TV Penetration 34% Growth (2007 - 2017) Hispanic Pay - TV Subs 39% Growth (2007 - 2017) 68% Growth (2007 - 2017) 8

9 11% 23% 6% 13% 0% 5% 10% 15% 20% 25% 2007 2016 $204 $520 $705 2009 2016 2019 U.S. Hispanic Cable Advertising Fast - Growing U.S. Hispanic Cable Advertising Market 11% Projected CAGR of U.S. Hispanic cable advertising from 2016 to 2019 (a) 58% of Spanish dominant Hispanics believe brands that reach out in Spanish demonstrate they value the Hispanic community (b) (a) SNL Kagan (b) Source: “Facebook IQ” study conducted by Latinum Network, October, 2016. 86% of U.S. Hispanics believe the Spanish language helps them remain connected to their culture (b) Opportunity gap Similar gap as U.S. general market cable 25 years ago Spanish - language cable viewing as a % of total Spanish - language TV viewing U.S. Hispanic cable advertising as a % of total U.S. Hispanic TV advertising Comparison of Hispanic Cable Advertising to Viewing Share 9

10 5.0% 3.3% 5.6% 2.4% 8.6% - 1.6% Unique and Superior Growth Paradigm – U.S. U.S. Subscriber Growth: 2016 Overall U.S. Pay - TV 2016 Launches 10

11 Broadcast TV in Latin America is Very Attractive Source: Ibope and Nielsen (2016). Broadcast television in Latin America dominates television viewing in primetime 55% Share of overall viewing to 2 major broadcast networks Colombia 69% Share of overall viewing to 3 major broadcast networks Puerto Rico 27% Share of overall viewing to 4 major broadcast networks U.S . VS. 11

12 Rapid Growth in Pay - TV Subscribers in Latin America Source: Kagan (2017). 37 53 69 2012 2016 2021 Latin America Pay - TV Subscribers 41% 55% 63% 2012 2016 2021 Latin America Pay - TV Penetration 12

13 Tremendous Growth Opportunity – LatAm 30% 30% Latin America Subscriber Growth: 2016 +28% Projected Growth in Latin American pay - TV subscribers 2016 - 2021 (a) 30% Pay - TV penetration of Hemisphere’s LatAm channels 2016 Launches (a) Kagan ( 2017). 13

14 ORGANIC Strategic M&A Multiple Avenues for Growth MACROECONOMIC Growth in U.S. Hispanic population driving Hispanic pay - TV HHs and Hispanic programming package subscribers Growing Hispanic cable advertising market in the U.S. Growth in Latin America pay - TV subscribers Retransmission fees continue to rise in the U.S. – LatAm expected to follow U.S. trend Complement organic growth through strategic acquisitions such as: Latin America broadcast and cable TV networks U.S. Spanish language cable networks Production companies Content libraries Digital assets Continued retransmission revenue growth and increases in subscriber revenue through organic sub growth, new launches and fee increases Advertising sales increases through continued improved ratings performance Latin American subscriber growth through launches in new markets and on additional systems Content monetization through various platforms 14

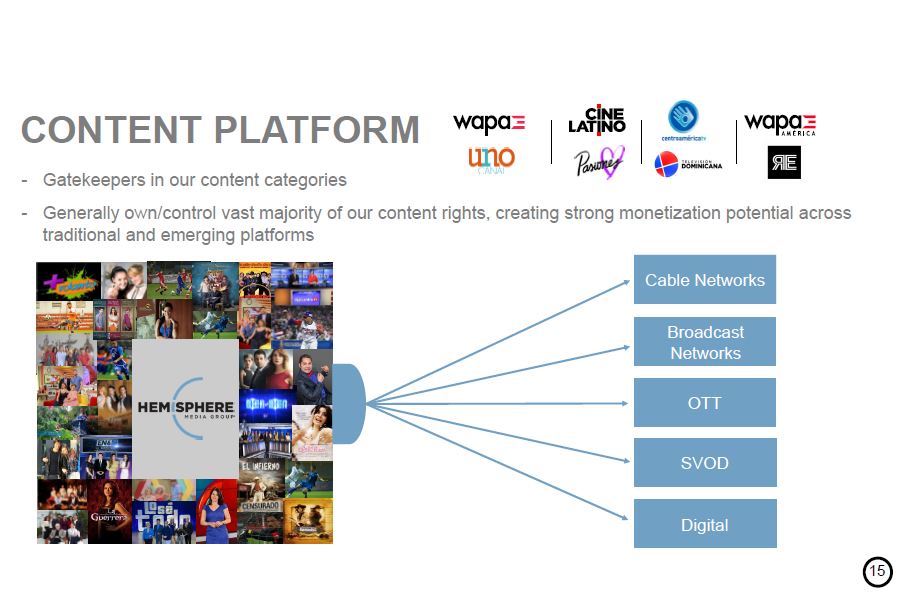

15 CONTENT PLATFORM - Gatekeepers in our content categories - Generally own/control vast majority of our content rights, creating strong monetization potential across traditional and emerging platforms Cable Networks Broadcast Networks OTT SVOD Digital 15

16 17.2 Primetime household rating – higher than the four major TV Networks in the U.S. combined 70+ Hours of top rated news and entertainment programming produced each week 33% Share of primetime audience #1 Rated TV network in Puerto Rico for last 8 years 4.5 4.5 3.4 2.6 17.2 15.0 Fox ABC NBC CBS "Big 4" WAPA’s Primetime Ratings Are Higher than the Four Major TV Networks in the U.S. Combined (b) Source: Nielsen (a) Represents 2016 total household figures, Mon - Sun 6:00 - 11:30pm. (b) Represents 2016 household ratings, Mon - Sun 6:00 - 11:30pm for WAPA and M - Fri 8:00 - 11:00pm for U.S. networks. 17.2 14.4 4.7 WAPA Telemundo Univision Primetime Ratings (a) 16

17 Clear Ratings Leader & Highest TV Broadcasting Ad Market Share • Grew from #3 - rated network to #1 in only 2 years o Significantly grew and improved local news and local entertainment production o Introduced U.S. series and blockbuster movies to Puerto Rico, dubbed in Spanish o Rebranded station as "WAPA" and dramatically expanded promotional efforts • #1 - rated television network in Puerto Rico for eight consecutive years • Receives retransmission fees from all distributors • WAPA’s recent contract renewals have yielded significant retransmission fee increases • 100% margin dollars • Significant room for continued growth, given WAPA's dominant ratings WAPA Case Study • Leveraged WAPA’s local news and entertainment programming to grow WAPA America’s distribution to 5 million subscribers from 1 million subscribers • Repurpose all original programming from WAPA at virtually zero cost • High margin business Robust & Growing Retransmission Revenue Development & Growth of a U.S. Cable Network 17

18 Access to one of Latin America’s most robust and stable economies with an attractive television advertising market RARE OPPORTUNITY One of only three national broadcast TV networks – unusually low number of broadcast competitors for a market of this size SCARCE ASSET Leverage management’s broadcast television expertise to create a compelling, differentiated programming option in Colombia, as proven in Puerto Rico PROVEN PLAYBOOK 40% (a) Ownership in a 10 year renewable broadcast TV concession for Canal Uno in Colombia Partnership with leading Colombian news and scripted content producers Opportunity to produce content, which can be repurposed on HMTV’s channels and syndicated internationally PRODUCTION HUB (a) Subject to regulatory approval from ANTV. 18

19 Significant Opportunity COST Concession cost of approximately $35 million payable over two years (c) AUDIENCE SHARE Win audience share from top two Colombian national broadcasters, which on a combined basis have a 98% share of the national broadcast TV audience STRONG MARGIN PROFILE Manage the business at typical broadcast margins 49mm Second largest population in Latin America (b) $400mm Approximate Colombian Addressable Television Advertising Market (a) ; Third largest Latin American ad market (b) (a) Source: Asomedios . (b) Excluding Brazil. (c) Exchange rate as of announcement, 11/30/2016. 19

20 #1 - Nielsen Rated U.S. Hispanic Cable Movie Network Ratings Leader #1 - Nielsen rated U.S. Hispanic cable movie network; #2 - Nielsen rated Spanish - language cable television network in the U.S. overall (a) Strength in LatAm 30% Growth in Latin America subscribers in 2016 Distributed to only 30% of all pay - TV subscribers throughout Latin America (excluding Brazil) 4.6 million U.S. subscribers – largest subscriber base of any Spanish - language cable movie network High Quality Content Exclusive rights to over 600 titles, including the vast majority of highest - grossing Spanish - language films released in last 5 years. Produces 5 – 10 original movies per year Strong Ad Model Transition to advertising on the channel’s U.S. feed provides another lever of revenue growth over time 20 (a) Based on coverage ratings.

21 Only U.S. cable network to offer global telenovela blockbusters Capitalizing on the most popular Hispanic programming genre Currently distributed to only 25% of total pay - TV subscribers throughout Latin America (ex. Brazil) Significant Growth Opportunity 4.6mm subscribers in the U.S 13.5mm subscribers in Latin America Solid Subscriber Base Featuring the top rated novelas from Latin America, Turkey, Korea and the biggest producers including Televisa , Sony, Globo , Caracol and Telemundo Strong Supply of Content 30% growth in 2016 Significant Subscriber Growth 21

22 The Content Platform for Puerto Ricans and Caribbean Hispanics Living in the U.S. Distributed by all major operators on Hispanic programming packages nationally and on the digital basic package in Orlando and Tampa NATIONWIDE DISTRIBUTION Spanish - Language Cable Network M - F, 5 - 7PM (a) #1 - Rated Puerto Rican and Caribbean Hispanics as a whole represent 18% of the U.S. Hispanic Population – in select markets they are the largest population group GROWING TARGET POPULATION (a) Nielsen – TVHH rating M - F 5PM - 7PM (2016). 5.3mm U.S. Subs Leverages news and entertainment programming produced by WAPA Only nightly newscast from Puerto Rico created for U.S. Hispanics, supplemented by acquired live sports and telenovelas 70+ HRS WEEKLY PROGRAMMING 22

23 Leading network targeting 6 million Central Americans living in the U.S. Central Americans Represent the 3 rd Largest U.S. Hispanic Population Group Programming from leading broadcasters throughout Central America Distributed to 4.1million subscribers in the U.S. Exclusive U.S. Soccer Rights from best professional leagues in the region Central Americans – fastest growing U.S. Hispanic group 18 Noticiero Guatevisión Noticiero Guatevisión Population in U.S. grew by 273% from 2000 - 2016 – the fastest growing segment of the U.S. Hispanic population 23

24 Focus on Fast Growing Dominican Population in the U.S. 2.4 million Dominicans living in the U.S. 4 th largest U.S. Hispanic population 3 rd fastest growing segment of the U.S. Hispanic population – 207% from 2000 - 2016 Large Addressable Market 3.3 million U.S. subscribers Solid Subscriber Base Programming from leading Dominican content producers Strong program offering 24

25 OTT PARTNERSHIP - One - of - a - kind cross - platform Spanish - language digital subscription service - Exclusive and differentiated premium content positions service to be dominant player in Spanish Digital/OTT space - Able to reach an audience not currently subscribing to Spanish - language pay - TV package *OTT Service set to launch in 2017 STARZ TECHNOLOGY PLATFORM UNIVISION MARKETING AND DISTRIBUTION ACCESS TELEVISA’S THEATRICAL RELEASES HEMISPHERE MOVIE LIBRARY LIONSGATE MOVIE LIBRARY AND NEW RELEASES 25

26 $38 $50 $58 $64 2013 2014 2015 2016 Adjusted EBITDA (a) ($ in mm) $92 $112 $130 $139 2013 2014 2015 2016 Net Revenue ($ in mm) Strong Financial Performance 46.4% 44.8% 44.7% 41.3% % margin 15% CAGR 19% CAGR (a) See slide # 28 for Adjusted EBITDA reconciliation. 26

27 APPENDIX

28 ($ in ‘000s) 2013 2014 2015 2016 Net (loss) income ($5,474) $10,557 $13,739 $18,000 Add: Income tax expense 3,951 2,429 9,042 10,372 Interest and other expense, net 8,243 11,925 12,086 11,651 Loss on disposition of assets 199 70 33 6 Loss on extinguishment of debt 1,649 1,116 - - Depreciation and amortization 10,344 16,552 17,218 16,608 Stock - based compensation 7,192 5,920 5,575 4,691 Transaction and non - recurring expenses (a) 11,968 1,455 446 2,993 Adjusted EBITDA $38,072 $50,024 $58,139 $64,321 Note: Financial data presented for all years and quarters reflect combined operating results of WAPA and Cinelatino. 2014 inc lud es nine months of operating results from cable networks acquired on April 1, 2014. Results from acquired cable networks and pro forma corporate cost (including public company costs) are excluded from 2013. For more information, p lea se see our Registration Statement on form S - 4 filed January 25, 2013, as amended, our quarterly reports on Form 10 - Q , our annual report on Form 10 - K. (a) Includes transaction fees related to the initial public offering and the acquisition of Pasiones, Television Dominicana and Centroamerica TV , a $3.8mm charge to terminate a services agreement, and other non - recurring expenses. Adjusted EBITDA Reconciliation (a) 28 (a)

29 Contact Investor Relations PHONE Erica Bartsch: 212.446.1875 EMAIL ebartsch@sloanepr.com WEBSITE Hemispheretv.com