Exhibit 99.2

Corporate Presentation January 2025 PRO F ITABLE GROWTH THROUGH SPECIALTY PLASMA THERAPIES NASDAQ: KMDA; TASE: KMDA.TA

FORWARD - LOOKING STATEMENT This presentation is not intended to provide investment or medical advice . It should be noted that some products under development described herein have not been found safe or effective by any regulatory agency and are not approved for any use outside of clinical trials . This presentation contains forward - looking statements, which express the current beliefs and expectations of Kamada’s management . Such statements include 2024 and 2025 financial guidance ; 5 - year growth strategy and plans for double digit growth ; progression of inhaled AAT clinical study, its advantages and potential market size, results of the discussions with the FDA, excepted reduction in sample size and plans to conduct an interim futility analysis by the end of 2025 ; success in being a pioneer in areas of limited treatment alternatives ; expansion to new markets, mainly MENA region ; growth prospects, product introductions and revenue projections for KEDRAB, CYTOGAM, Israeli distribution business segment and U . S . plasma segment ; success in identifying and integrating M&A targets for growth . These statements involve a number of known and unknown risks and uncertainties that could cause Kamada's future results, performance or achievements to differ significantly from the projected results, performances or achievements expressed or implied by such forward - looking statements . Important factors that could cause or contribute to such differences include, but are not limited to, risks relating to Kamada's ability to successfully develop and commercialize its products and product candidates, progress and results of any clinical trials, introduction of competing products, continued market acceptance of Kamada’s commercial products portfolio, impact of geo - political environment in the middle east, impact of any changes in regulation and legislation that could affect the pharmaceutical industry, difficulty in predicting, obtaining or maintaining U . S . Food and Drug Administration, European Medicines Agency and other regulatory authority approvals, restrains related to third parties’ IP rights and changes in the health policies and structures of various countries, success of M&A strategies, environmental risks, changes in the worldwide pharmaceutical industry and other factors that are discussed under the heading “Risk Factors” of Kamada’s 2023 Annual Report on Form 20 - F (filed on March 6 , 2024 ), as well as in Kamada’s recent Forms 6 - K filed with the U . S . Securities and Exchange Commission . This presentation includes certain non - IFRS financial information, which is not intended to be considered in isolation or as a substitute for, or superior to, the financial information prepared and presented in accordance with IFRS . The non - IFRS financial measures may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies . In accordance with the requirements of the SEC regulations, a reconciliation of these non - IFRS financial measures to the comparable IFRS measures is included in an appendix to this presentation . Management uses these non - IFRS financial measures for financial and operational decision - making and as a means to evaluate period - to - period comparisons . Management believes that these non - IFRS financial measures provide meaningful supplemental information regarding Kamada’s performance and liquidity . Forward - looking statements speak only as of the date they are made, and Kamada undertakes no obligation to update any forward - looking statement to reflect the impact of circumstances or events that arise after the date the forward - looking statement was made, except as required by applicable law . 2

KEDRAB® CYTOGAM ® HEPGAM B® VARIZIG® WINRHO® GLASSIA® KAMADA - A GLOBAL BIOPHARMACEUTICAL COMPANY 6 FDA - Approved Products 15 % CAGR (from 2021) $ 178 - 182M 1 2025 Revenues Guidance $ 38 - 42M 1 2025 Adj. EBIDTA Guidance 4 Pillars of Growth A LEADER IN SPECIALTY PLASMA THERAPIES, WITH A PORTFOLIO OF MARKETED PRODUCTS INDICATED FOR RARE AND SERIOUS CONDITIONS $ 78.0 M Unaudited Cash (Dec 31 , 2024 ) 3 Organic Growth M&A Transactions Inhaled AAT Pivotal Study Plasma Collection Centers 1. Expects to Achieve 2024 Guidance of $ 158 - 162 Million in Revenue and $ 32 - 35 Million of Adjusted EBITDA

Multi - scale Innovative Agile WHAT MAKES US UNIQUE First to develop an FDA - approved liquid - ready - to - use IV AAT therapy First to advance an Inhaled AAT therapy to a pivotal phase III study First to demonstrate safety and efficacy of anti - Rabies IgG in pediatric population First to treat COVID patients with a plasma derived anti - COVID IgG Vertically Integrated At Kamada, we believe that each life is unique, which is why we have developed an innovative technology for production of life - saving plasma - derived therapeutics, and we are working with creativity, agility and passion to be pioneers in areas of limited treatment alternatives 4

GLOBAL COMMERCIAL FOOTPRINT United States El Salvador Brazil Nigeria India South Korea Russia Israel Chile Thailand Sri Lanka Australia South Africa Uruguay Argentina Paraguay Colombia Canada Hong Kong Saudi Arabia Kuwait Qatar Bahrain UAE Egypt Philippines Jordan Iraq Netherlands Montenegro Albania Turkey Costa Rica New Zeeland Ukraine Poland Bosnia Expanding to new markets, mainly in the MENA region Commercial operations in the US with seasoned staff, experienced in specialty plasma products Focused on products' life cycle management, commercialization and business Ɗ development activities STRONG DISTRIBUTION NETWORK IN OVER 30 COUNTRIES 5 Switzerland Serbia Romania

6 EXPERIENCED LEADERSHIP Amir London CEO Hanni Neheman VP Marketing & Sales Liron Reshef VP Human Resources Shavit Beladev VP Kamada Ɗ Plasma Chaime Orlev CFO Jon Knight VP U.S Commercial Yael Brenner VP Quality Boris Gorelik VP Business Development & Strategic Programs Nir Livneh VP Legal, General Counsel & Corporate Secretary Eran Nir COO Orit Pinchuk VP Regulatory Affairs & PVG WITH PROVEN TRACK RECORD

DELIVERING ON OUR COMMITMENTS 7

6 18 24 32 - 35 38 - 42 2021 2022 2023 2024 2025 104 129 143 158 – 162 178 - 182 2021 2022 2023 2024 2025 ADJUSTED EBITDA US$M 61 % CAGR 2024 and 2025 represents annual guidance 2024 and 2025 represents annual guidance ANNUAL DOUBLE - DIGIT GROWTH TRAJECTORY REVENUES US$M 15 % CAGR 9 M $ 122 M ( 76 %) 8 9 M $ 25 M ( 76 %) Increase overall cash position during 2024 by approximately $ 22 M

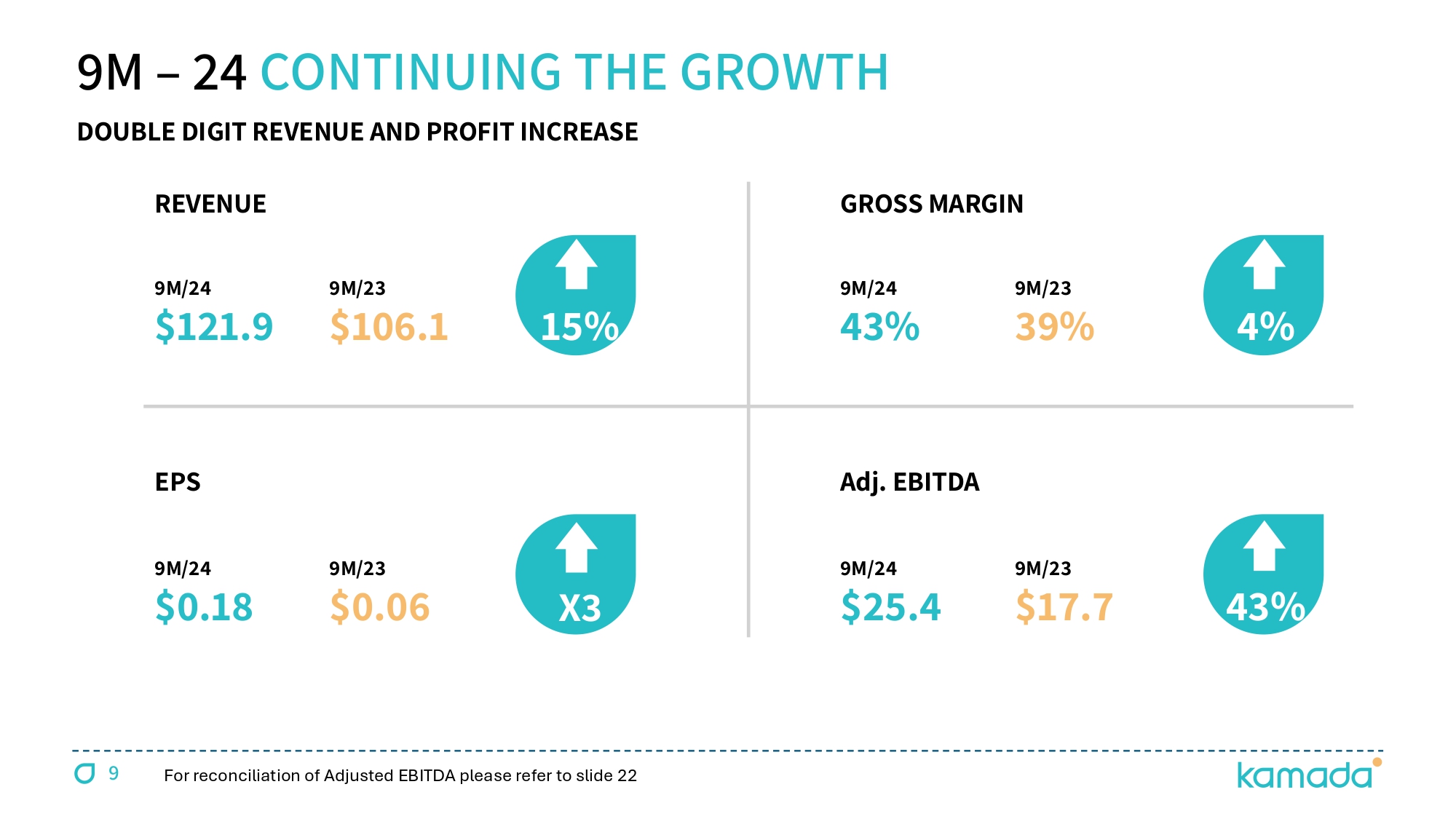

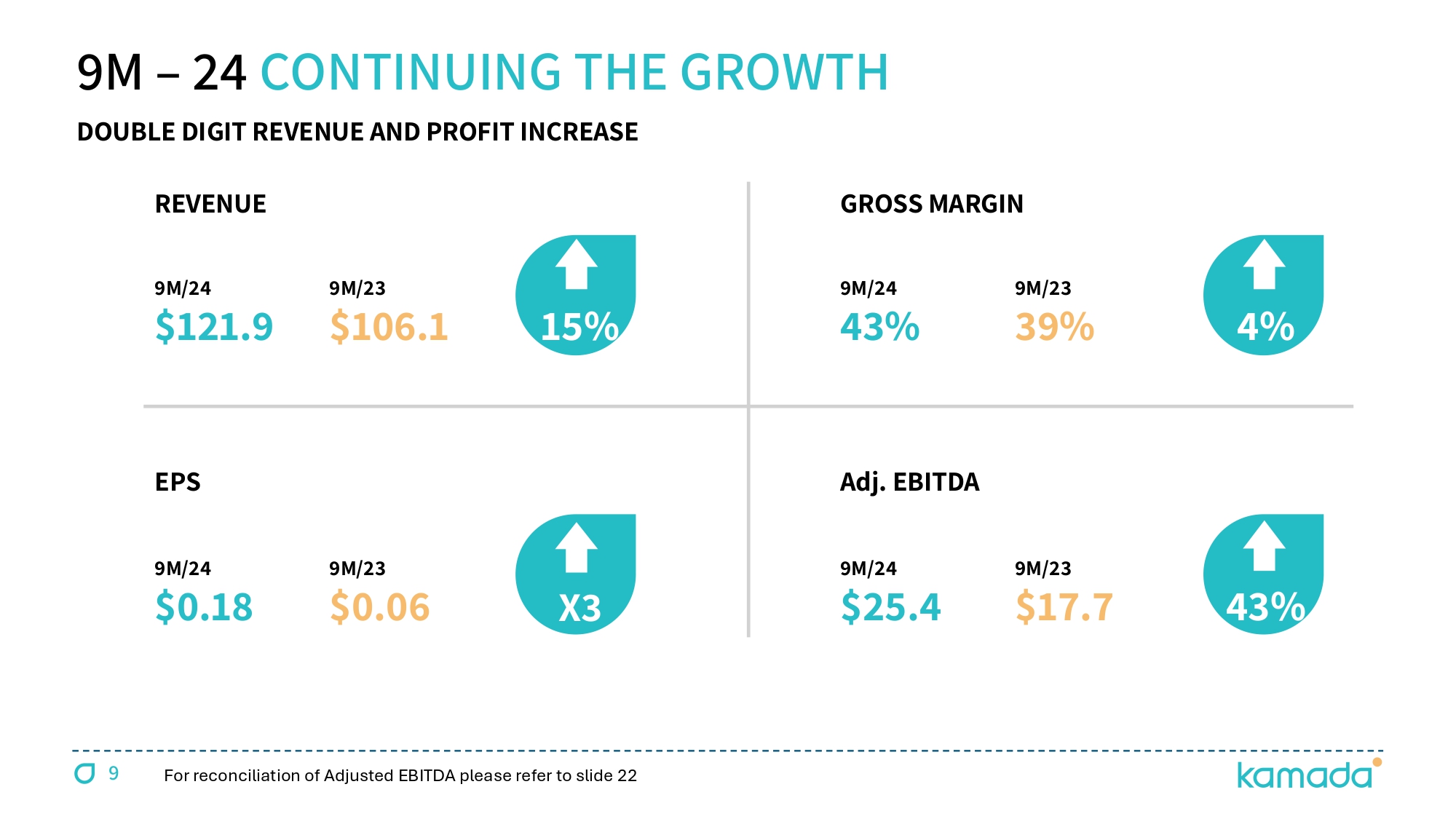

GROSS MARGIN REVENUE 4% 9M/23 39% 9 M/ 24 43 % 15% 9M/23 $106.1 9 M/ 24 $ 121.9 Adj. EBITDA EPS 43% 9M/23 $17.7 9 M/ 24 $ 25.4 X3 9M/23 $0.06 9M/24 $0.18 9 M – 24 CONTINUING THE GROWTH DOUBLE DIGIT REVENUE AND PROFIT INCREASE 9 For reconciliation of Adjusted EBITDA please refer to slide 22

KAMADA ’ S ROADMAP FOR ANNUAL DOUBLE - DIGIT GROWTH 10 Organic Growth Portfolio of 6 FDA - approved products; Over 30 territories M&A Transactions Support growth through M&A transactions Plasma Collection Centers $ 8 M - $ 10 M of expected annual revenues from each new center at peak capacity Inhaled AAT Phase III pivotal clinical study, targeting a market of over $ 2 B

5 YEARS GROWTH JOURNEY 2025 & Beyond ĎČĎđ M&A 2026 - 2028 Plasma Collection ĎČĎĕ ū ĎČĎĔ Inhaled AAT O rganic Ɗ Growth 11

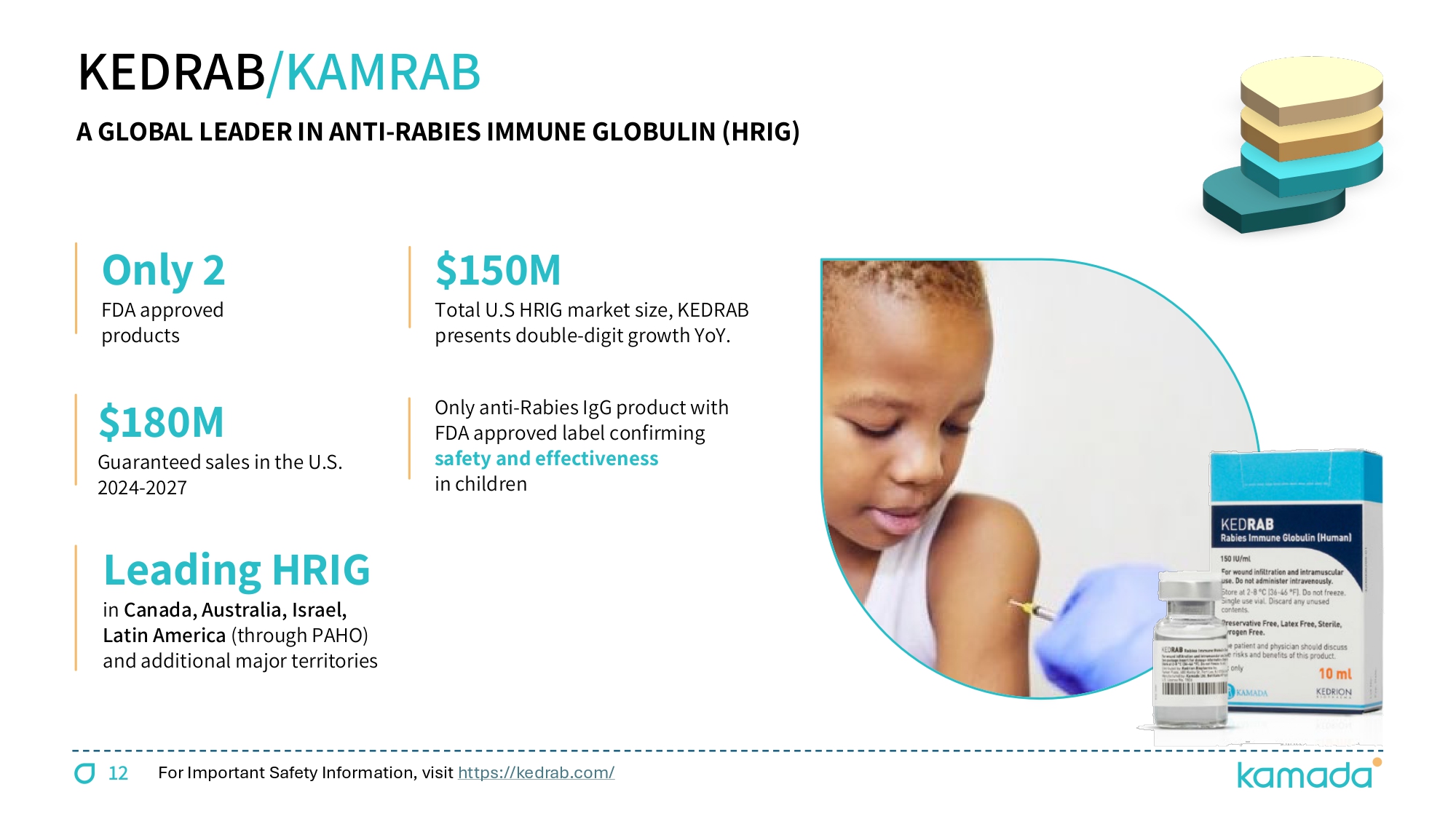

$ 150 M Total U.S HRIG market size, KEDRAB presents double - digit growth YoY. Only anti - Rabies IgG product with FDA approved label confirming safety and effectiveness in children KEDRAB /KAMRAB $ 180 M Guaranteed sales in the U.S. 2024 - 2027 Only 2 FDA approved products Leading HRIG in Canada, Australia, Israel, Latin America (through PAHO) and additional major territories A GLOBAL LEADER IN ANTI - RABIES IMMUNE GLOBULIN (HRIG) For Important Safety Information, visit https://kedrab.com/ 12

CYTOGAM is the only plasma - derived IgG approved in the U.S. and Canada for prophylaxis of CMV disease after Solid Organ Transplantation. CMV is the leading cause for organ rejection post - transplant CYTOGAM ĎČĎď - 2024 Product re - launch, working with U.S. KOLs to generate new clinical and medical data ĕƱ Annual Increase in US Organ Transplants ( 2023 ) Ŀ $ 17 M 2023 Revenues CMV IMMUNE GLOBULIN Growth Continued growth expected in the U.S. and Canada markets 13 For Important Safety Information, visit https://cytogam.com/ ; *Source: https://optn.transplant.hrsa.gov/

DISTRIBUTION SEGMENT GROWTH More than 25 products exclusively licensed from leading international pharmaceutical companies, marketed in the Israeli market EXCLUSIVE DISTRIBUTOR IN ISRAEL FOR LEADING BIOPHARMACEUTICAL COMPANIES Key areas : plasma - derived, respiratory, rare diseases, infectious diseases, biosimilar portfolio of 11 product candidates, mainly from Alvotech First biosimilar was launched in Q 1 - 2024 and second product expected to be launched by Q 1 - 2025 The other Biosimilar products are expected to be launched through 2028 , upon receipt of regulatory approval Biosimilar portfolio represents the main growth driver with estimated peak annual sales of $ 30 - 34 M 14

15 M&A TRANSACTIONS AIMING TO SECURE NEW BUSINESS DEVELOPMENT AND M&A TRANSACTIONS DURING 2025 ; LEVERAGING OVERALL FINANCIAL STRENGTH AND COMMERCIAL INFRASTRUCTURE Exploring strategic business development opportunities to identify potential acquisition or in - licensing to accelerate long - term growth Focusing on products synergistic to our existing commercial and/or production activities Strong financial position, commercial infrastructure and proven successful M&A capabilities

16 KAMADA PLASMA EXPANDING VERTICAL INTEGRATION & REVENUE GROWTH Collecting hyper - immune plasma for our specialty IgG products and normal source plasma (NSP) to support revenue growth Recently opened a new plasma collection center in Houston, Texas ; planning to open another center in San Antonio, Texas (by the end of Q 1 - 25 ) At full collection capacity, each of the Houston and San Antonio centers is expected to generate $ 8 M to $ 10 M of revenues from sales of NSP

$ 2 Billion A substantial market opportunity ( 2028 ) č Based on expected changes to the statistical analysis plan, intend to reduce the study sample size to approximately 180 patients, and conduct an interim futility analysis by the end of 2025 FDA recently reconfirmed overall study design, endorsed positive safety data to date, and confirmed its agreement with our proposed P - value of 0.1 in evaluating the trial ’ s efficacy primary endpoint INHALED AAT PHASE 3 PIVOTAL STUDY InnovAATe - a global, double - blind, randomized, placebo - controlled pivotal Phase 3 clinical trial testing the safety and efficacy of inhaled AAT in patients with AATD. Study design meets FDA and EMA ’ s requirements 1. Source: CantorFizgerald, JAN 11 2024 17

INHALED AAT PHASE 3 PIVOTAL STUDY Non - Invasive, at - home treatment. Expected better ease of use and quality of life for AATD patients than current IV SOC Most effective mode of treatment for delivering therapeutic quantities of AAT directly into the airways Studied in more than 200 individuals to date, with an established safety profile Only 1/8th of the IV AAT dosing, more cost - effective; favorable market access landscape STUDY D ESIGN EXPECTED ADVANTAGES Ɗ čŃč randomization; 9 active sites; ~ 50 % of patients enrolled to date; Open Label Extension (OLE) initiated Mid 2024 Inhaled AAT ĔČ mg Ɗ once Ɗ daily o r Ɗ placebo, Ɗ during Ɗ two Ɗ years of Ɗ treatment Primary Ɗ Endpoint: Lung Ɗ function - FEV č Secondary Ɗ Endpoints Ń Lung Ɗ density - CT Ɗ densitometry Ɗ and Ɗ other Ɗ disease Ɗ severity Ɗ parameters 18 POTENTIAL TRANSFORMATIVE TREATMENT IN AATD - RELATED LUNG DISEASE

KEDRAB® CYTOGAM® HEPGAM B® VARIZIG® WINRHO® GLASSIA® KAMADA - A GLOBAL BIOPHARMACEUTICAL COMPANY 6 FDA - Approved Products 15 % CAGR (from 2021) $ 178 - 182 M 1 2025 Revenues Guidance $ 38 - 42 M 1 2025 Adj. EBIDTA Guidance 4 Pillars of Growth DELIVERING ON OUR COMMITMENTS $ 78.0 M Unaudited Cash (Dec 31 , 2024 ) 19 Organic Growth M&A Transactions Inhaled AAT Pivotal Study Plasma Collection Centers 1. Expects to Achieve 2024 Guidance of $ 158 - 162 Million in Revenue and $ 32 - 35 Million of Adjusted EBITDA

THANK YOU www.kamada.com NASDAQ: KMDA; TASE: KMDA.TA

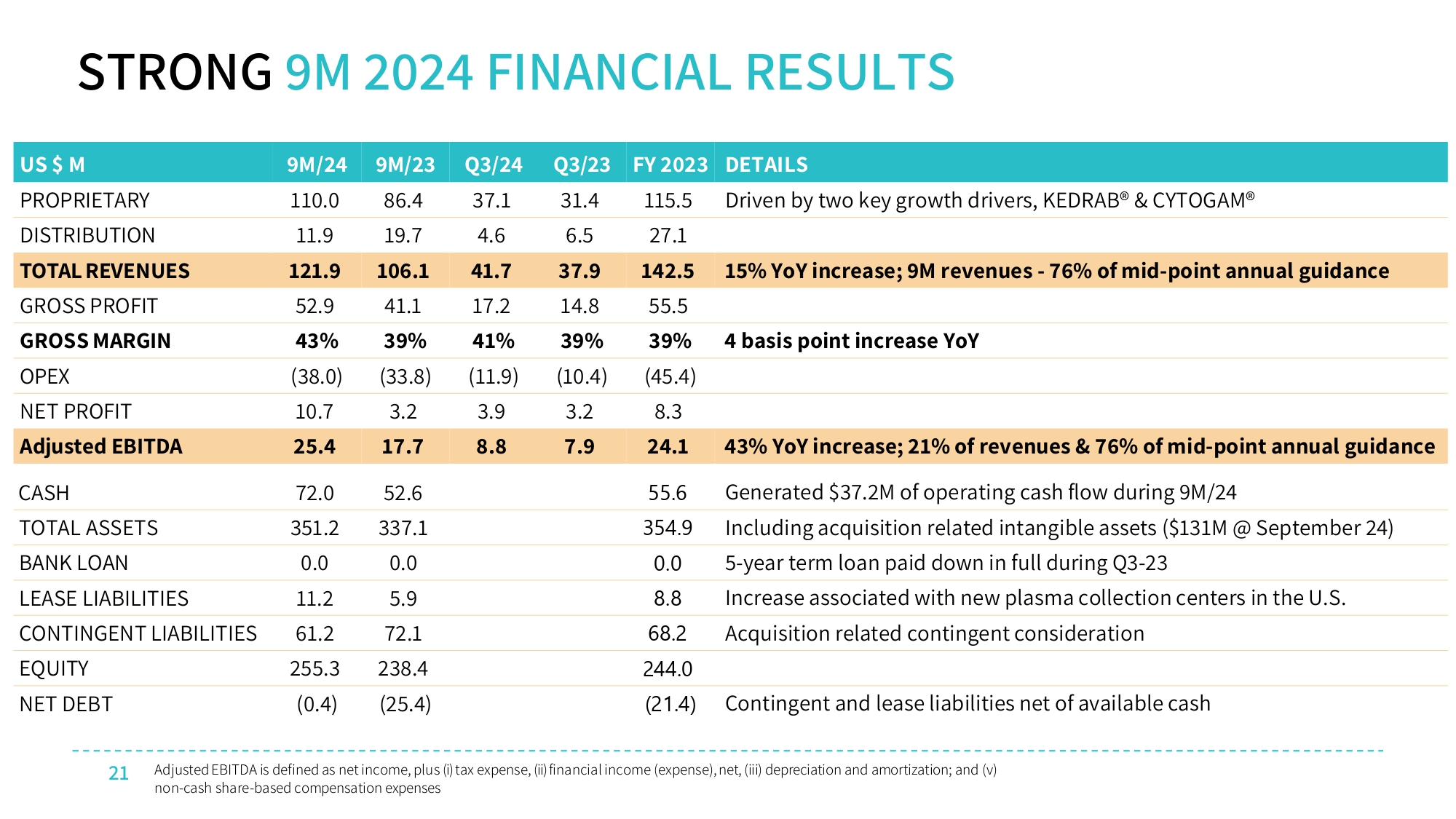

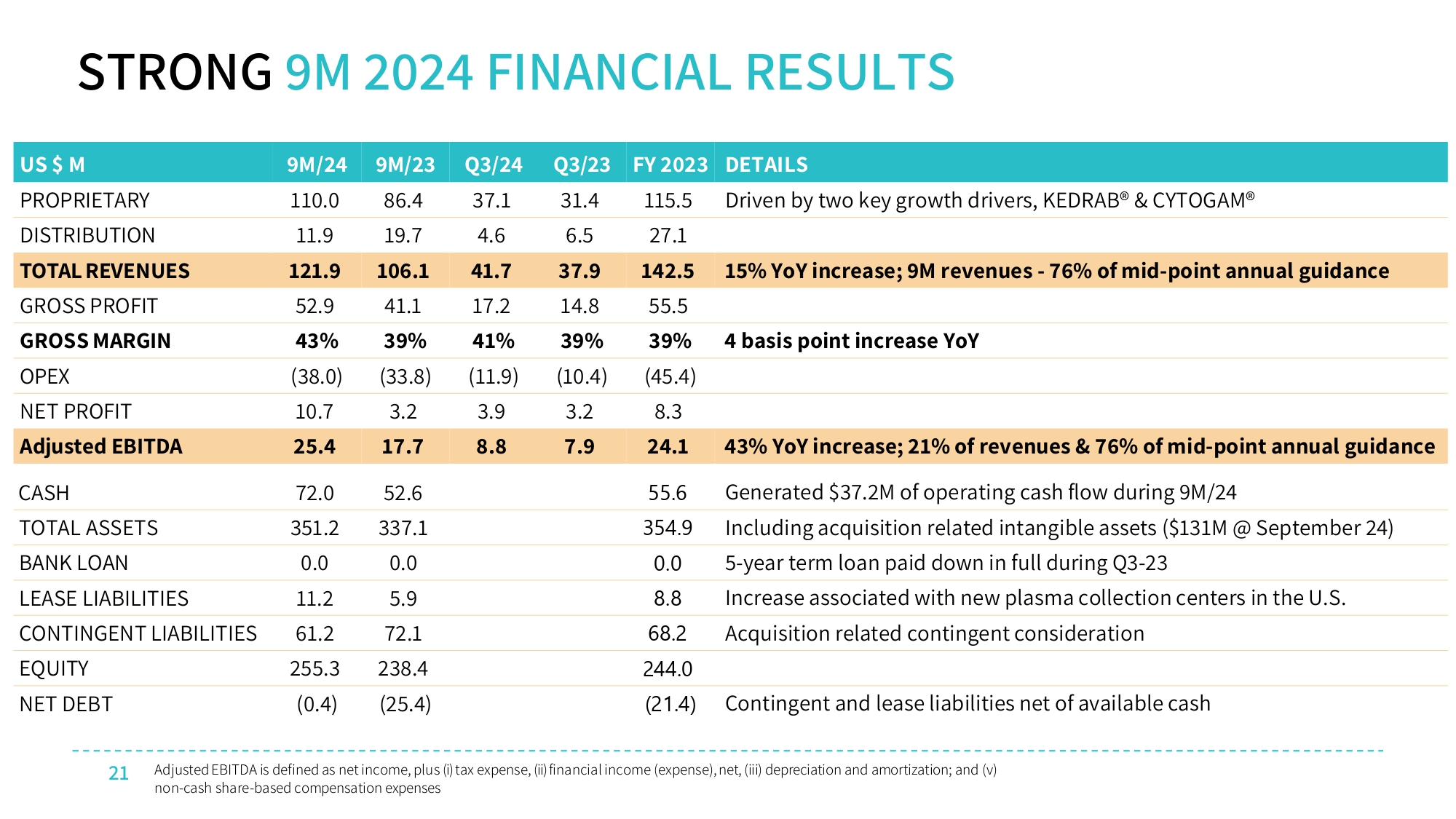

21 DETAILS FY 2023 Q3/23 Q3/24 9M/23 9 M/ 24 US $ M Driven by two key growth drivers, KEDRAB® & CYTOGAM® 115.5 31.4 37.1 86.4 110.0 PROPRIETARY 27.1 6.5 4.6 19.7 11.9 DISTRIBUTION 15% YoY increase; 9M revenues - 76% of mid - point annual guidance 142.5 37.9 41.7 106.1 121.9 TOTAL REVENUES 55.5 14.8 17.2 41.1 52.9 GROSS PROFIT 4 basis point increase YoY 39 % 39 % 41 % 39 % 43 % GROSS MARGIN ( 45.4 ) ( 10.4 ) ( 11.9 ) ( 33.8 ) ( 38.0 ) OPEX 8.3 3.2 3.9 3.2 10.7 NET PROFIT 43% YoY increase; 21% of revenues & 76% of mid - point annual guidance 24.1 7.9 8.8 17.7 25.4 Adjusted EBITDA Generated $37.2M of operating cash flow during 9M/24 55.6 52.6 72.0 CASH Including acquisition related intangible assets ($131M @ September 24) 354.9 337.1 351.2 TOTAL ASSETS 5 - year term loan paid down in full during Q3 - 23 0.0 0.0 0.0 BANK LOAN Increase associated with new plasma collection centers in the U.S. 8.8 5.9 11.2 LEASE LIABILITIES Acquisition related contingent consideration 68.2 72.1 61.2 CONTINGENT LIABILITIES 244.0 238.4 255.3 EQUITY Contingent and lease liabilities net of available cash ( 21.4 ) ( 25.4 ) ( 0.4 ) NET DEBT Adjusted EBITDA is defined as net income, plus ( i ) tax expense, (ii) financial income (expense), net, (iii) depreciation and amortization ; and (v) non - cash share - based compensation expenses STRONG 9 M 2024 FINANCIAL RESULTS

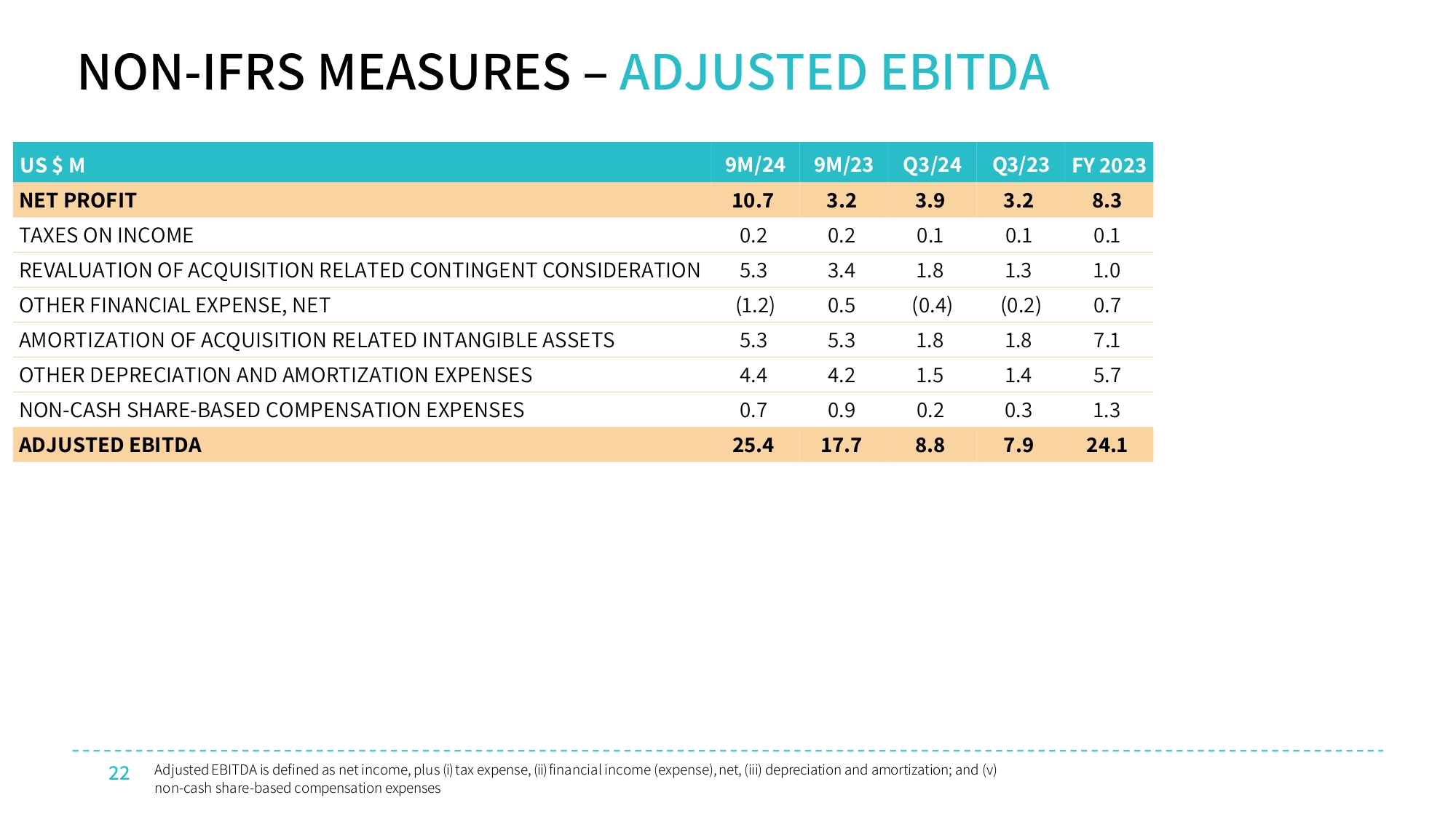

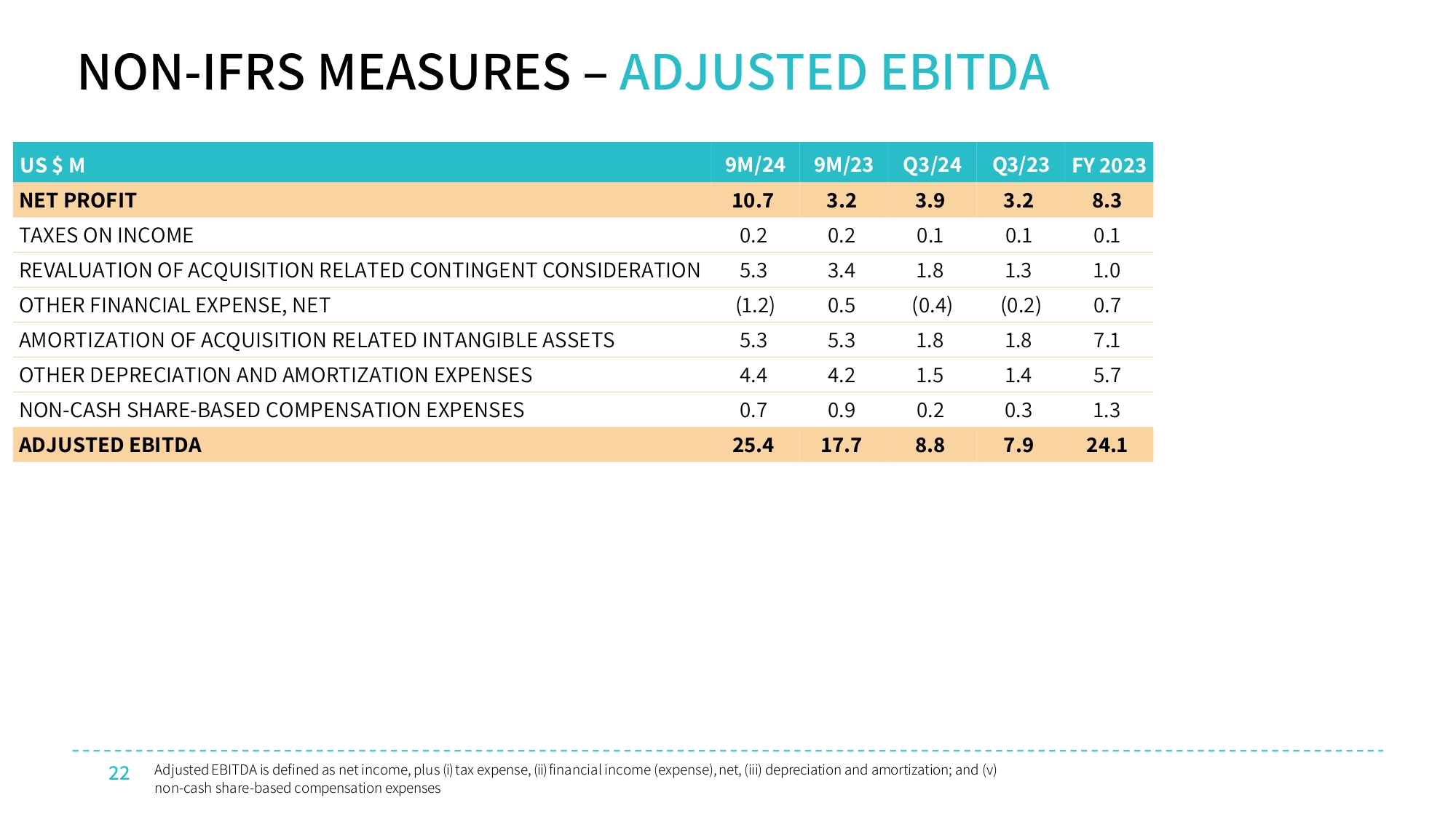

22 NON - IFRS MEASURES – ADJUSTED EBITDA FY 2023 Q 3 / 23 Q 3 / 24 9 M/ 23 9 M/ 24 US $ M 8.3 3.2 3.9 3.2 10.7 NET PROFIT 0.1 0.1 0.1 0.2 0.2 TAXES ON INCOME 1.0 1.3 1.8 3.4 5.3 REVALUATION OF ACQUISITION RELATED CONTINGENT CONSIDERATION 0.7 ( 0.2 ) ( 0.4 ) 0.5 ( 1.2 ) OTHER FINANCIAL EXPENSE, NET 7.1 1.8 1.8 5.3 5.3 AMORTIZATION OF ACQUISITION RELATED INTANGIBLE ASSETS 5.7 1.4 1.5 4.2 4.4 OTHER DEPRECIATION AND AMORTIZATION EXPENSES 1.3 0.3 0.2 0.9 0.7 NON - CASH SHARE - BASED COMPENSATION EXPENSES 24.1 7.9 8.8 17.7 25.4 ADJUSTED EBITDA Adjusted EBITDA is defined as net income, plus ( i ) tax expense, (ii) financial income (expense), net, (iii) depreciation and amortization ; and (v) non - cash share - based compensation expenses

23 6 FDA - APPROVED SPECIALTY PLASMA PRODUCTS KEDRAB® [Rabies Immune Globulin (Human)] Post exposure prophylaxis of rabies infection CYTOGAM® [Cytomegalovirus Immune Globulin (Human)] Prophylaxis of CMV disease associated with transplants HEPGAM B® [Hepatitis B Immune Globulin (Human)] Prevention of HBV recurrence following liver transplants VARIZIG® [Varicella Zoster Immune Globulin (Human)] Post - exposure prophylaxis of varicella in high - risk patients WINRHO® [Rho(D) Immune Globulin (Human)] Treatment of ITP & suppression of Rh isoimmunization (HDN) KEY FOCUS ON TRANSPLANTS & RARE CONDITIONS For Important Safety Information, visit www.Kamada.com GLASSIA® [Alpha 1 - Proteinase Inhibitor (Human)] Augmentation therapy for Alpha - 1 Antitrypsin Deficiency (AATD)

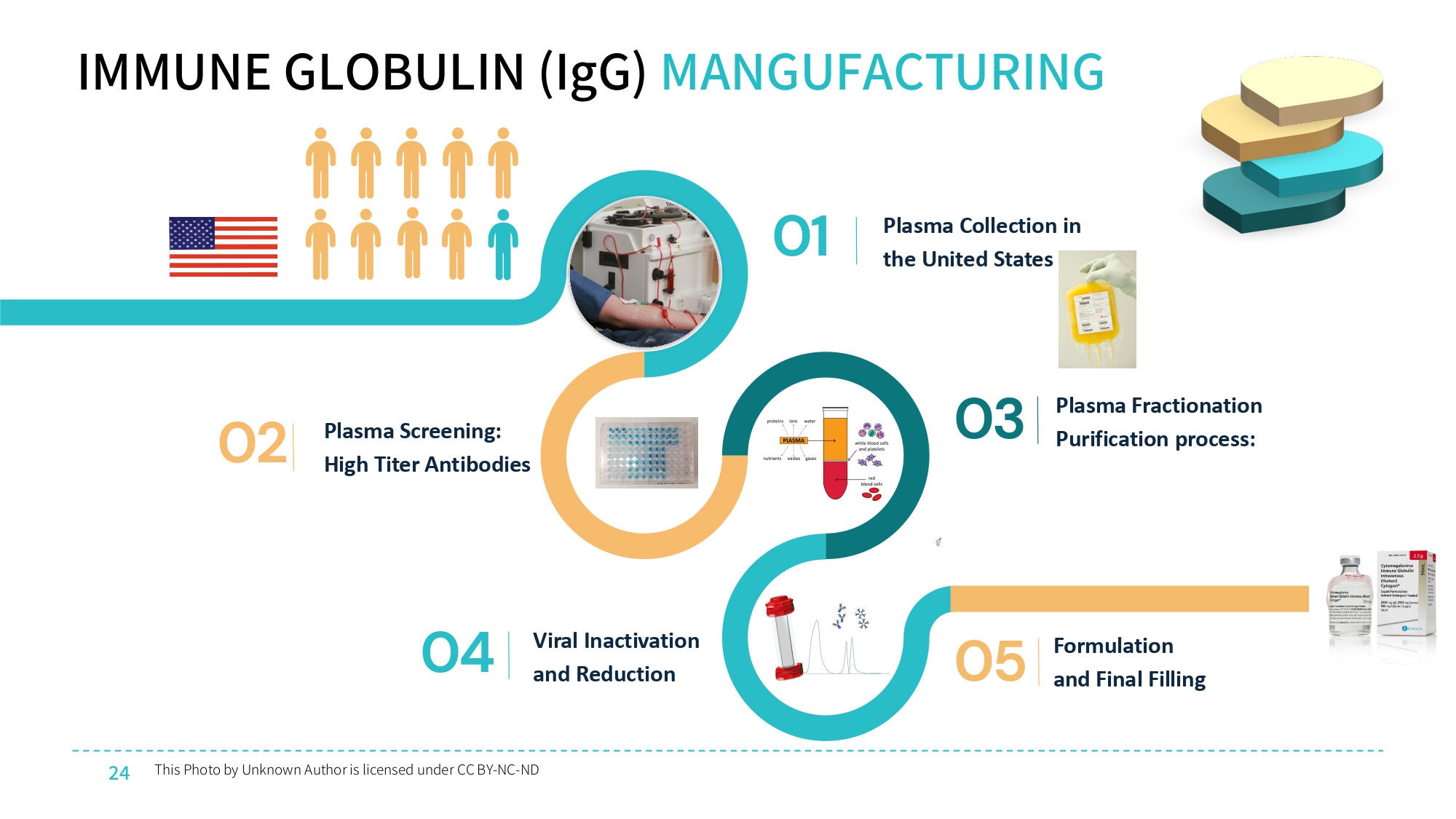

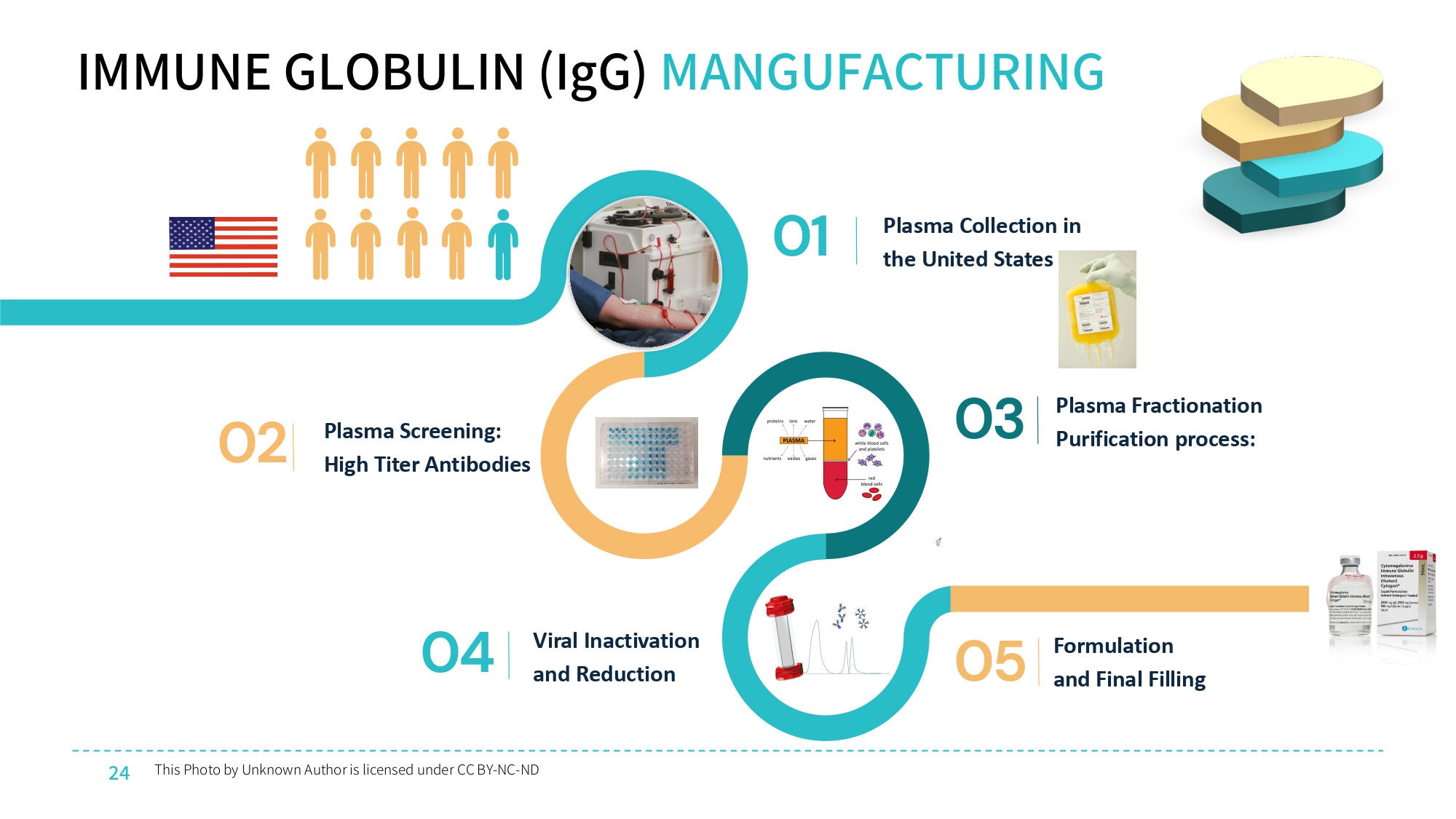

24 This Photo by Unknown Author is licensed under CC BY - NC - ND IMMUNE GLOBULIN (IgG) MANGUFACTURING 02 Plasma Screening: High Titer Antibodies 03 Plasma Fractionation Purification process: 01 Plasma Collection in the United States 04 Viral Inactivation and Reduction 05 Formulation and Final Filling