As filed with the Securities and Exchange Commission on July 2, 2013

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form S-11

FOR REGISTRATION UNDER

THE SECURITIES ACT OF 1933

OF SECURITIES OF CERTAIN REAL ESTATE COMPANIES

ELLINGTON HOUSING INC.

(Exact name of registrant as specified in its governing instruments)

Ellington Housing Inc.

53 Forest Avenue

Old Greenwich, CT 06870

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Leo Huang

Chief Executive Officer

Ellington Housing Inc.

53 Forest Avenue

Old Greenwich, CT 06870

(203) 698-1200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

| | |

Daniel M. LeBey, Esq. Mark W. Wickersham, Esq. Hunton & Williams LLP Riverfront Plaza, East Tower 951 East Byrd Street Richmond, Virginia 23219 (804) 788-8200 (804) 788-8218 (Telecopy) | | Paul Tropp, Esq. Fried, Frank, Harris, Shriver & Jacobson LLP One New York Plaza New York, New York 10004 (212) 859-8000 (212) 859-4000 (Telecopy) |

Approximate date of commencement of proposed sale to public: As soon as practicable after the registration statement becomes effective.

If any of the Securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act, check the following box: ¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration number of the earlier effective registration statement for the same offering. ¨

If delivery of the prospectus is expected to be made pursuant to Rule 434, please check the following box. ¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

| | | | | | |

| Large accelerated filer | | ¨ | | Accelerated filer | | ¨ |

| | | |

| Non-accelerated filer | | x (Do not check if a smaller reporting company) | | Smaller reporting company | | ¨ |

CALCULATION OF REGISTRATION FEE

| | | | |

|

Title of Securities to be Registered | | Proposed

Maximum

Aggregate

Offering Price(1)(2) | | Amount of

Registration Fee(1) |

Common Stock, $0.01 par value per share | | $100,000,000 | | $13,640 |

|

|

| (1) | Estimated solely for the purpose of calculating the registration fee pursuant to Rule 457(o) of the Securities Act of 1933, as amended. |

| (2) | Includes shares offered by selling stockholders and shares that the underwriters have the option to purchase to cover over-allotments, if any. |

The Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any state where the offer or sale thereof is not permitted.

PROSPECTUS (Subject to Completion)

July 2, 2013

Shares

Common Stock

This is the initial public offering of Ellington Housing Inc., an externally managed Maryland corporation that invests in and manages single-family and multi-family residential real estate assets in the United States. Our primary focus is on the selection, acquisition, renovation, leasing and management as rental homes of single-family homes, and the selection and acquisition of single-family residential mortgage loans and small-balance multi-family residential loans, which are loans that have an unpaid principal balance of $25 million or less and are secured by multi-family residential properties. We are externally managed by Ellington REIT Management LLC, an affiliate of Ellington Management Group, L.L.C.

We are offering shares of our common stock, $0.01 par value per share, and the selling stockholders named in this prospectus are offering shares of our common stock. We will not receive any proceeds from the sale of our common stock by the selling stockholders.

We intend to elect and qualify to be taxed as a real estate investment trust for U.S. federal income tax purposes, or REIT, commencing with our taxable year ending December 31, 2013. To assist us in complying with certain U.S. federal income tax requirements applicable to REITs, our charter generally limits beneficial and constructive ownership by any person to no more than 9.8% in value or in number of shares, whichever is more restrictive, of the outstanding shares of any class or series of our capital stock. In addition, our charter contains various other restrictions on the ownership and transfer of our common stock. See “Description of Capital Stock — Restrictions on Ownership and Transfer” for a description of the ownership and transfer restrictions applicable to our common stock.

Prior to this offering, there has been no public market for our common stock. The initial public offering price of our common stock is expected to be between $ and $ per share. We intend to apply to list our common stock on the New York Stock Exchange, or the NYSE, under the symbol “ .”

We are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and, therefore, we will be subject to reduced public company reporting requirements.

Investing in our common stock involves risks. See “Risk Factors” beginning on page 23.

| | | | | | | | | | | | | | | | |

| | | Initial

Public

Offering

Price | | | Underwriting

Discounts and

Commissions(1) | | | Proceeds,

before

Expenses, to Us | | | Proceeds,

before

Expenses, to

Selling

Stockholders | |

Per Share | | $ | | | | $ | | | | $ | | | | $ | | |

Total | | $ | | | | $ | | | | $ | | | | $ | | |

| (1) | See “Underwriting” for a description of the underwriters’ compensation. |

We have granted the underwriters an option to purchase up to an additional shares of our common stock from us, at the initial public offering price, less underwriting discounts and commissions, within 30 days after the date of this prospectus to cover over-allotments, if any.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the shares of our common stock on , 2013.

| | |

| |

| Deutsche Bank Securities | | Credit Suisse |

The date of this prospectus is , 2013

TABLE OF CONTENTS

Through and including , 2013 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, regardless of whether they are participating in this offering, may be required to deliver a prospectus. This is in addition to a dealer’s obligation to deliver a prospectus when acting as an underwriter and with respect to unsold allotments or subscriptions.

You should rely only on the information contained in this prospectus or in any free writing prospectus prepared by us. We, the selling stockholders and the underwriters have not authorized anyone to provide you with different information. If anyone provides you with different or inconsistent information, you should not rely on it. We, the selling stockholders and the underwriters are not making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus and any free writing prospectus prepared by us is accurate only as of the respective dates of such documents or as of the date or dates which are specified therein. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates.

Certain Terms Used in This Prospectus

Except where the context suggests otherwise, we define certain terms in this prospectus as follows:

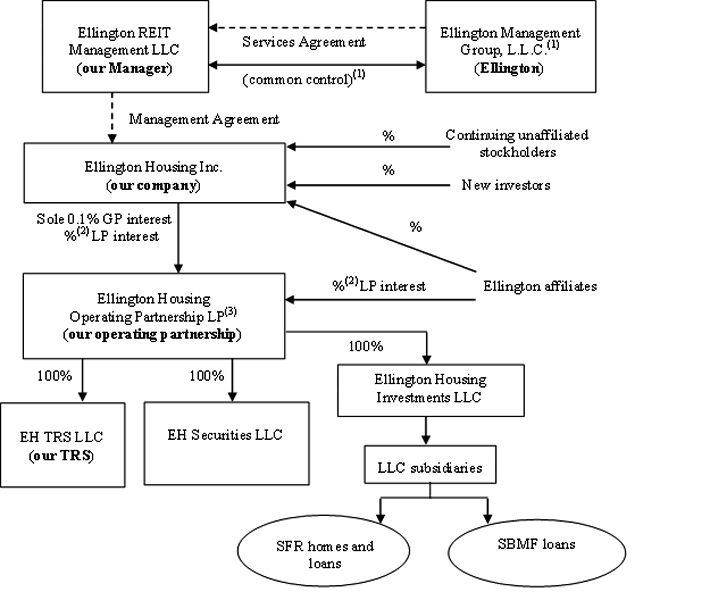

“We,” “our,” “us” and “our company” refer to Ellington Housing Inc., a Maryland corporation, together with its consolidated subsidiaries, including: (1) Ellington Housing Operating Partnership LP, a Delaware limited partnership, or our operating partnership; (2) Ellington Housing Investments LLC, a Delaware limited liability company that is a wholly owned subsidiary of our operating partnership; (3) EH TRS LLC, a Delaware limited liability company, or our TRS, that is a wholly owned subsidiary of our operating partnership that we have elected to treat as a taxable REIT subsidiary; and (4) EH Securities LLC, a Delaware limited liability company that is a wholly owned subsidiary of our operating partnership. When we refer to our investment history and experience, “we,” “our,” “us” and “our company” include our predecessor entities.

“Agency RMBS” means government agency RMBS, which are mortgage pass-through certificates backed by pools of residential mortgage loans issued or guaranteed by Ginnie Mae, Fannie Mae or Freddie Mac.

“Ellington” refers to Ellington Management Group, L.L.C.

“CMBS” means commercial mortgage-backed securities.

“Cost basis” of a home represents the purchase price of such home plus broker commissions, if applicable, closing costs, restoration costs incurred to prepare the home for rent and other capitalized costs.

Our “Manager” refers to Ellington REIT Management LLC, our external manager, which is an affiliate of Ellington.

“Non-Agency RMBS” means residential mortgage-backed securities that are not Agency RMBS, whether investment grade (AAA through BBB rated) or non-investment grade (BB rated through unrated) classes.

Our “predecessor entities” are Elizon Housing 2012-A1 LLC, Elizon Housing II LLC and Elizon Residential Phoenix I LLC.

“REO sales” are sales of real estate by holders of mortgage loans who became owners of the real estate (i.e., “real estate owned,” or REO) securing mortgage loans, such as through foreclosure.

“SBMF” means small balance multi-family residential. When we refer to “SBMF loans,” we mean commercial mortgage loans that have an unpaid principal balance of $25 million or less and that are secured by multi-family residential properties.

“SFR” means single-family residential. When we refer to “SFR properties,” we mean single-family residential properties that we operate or intend to operate as rental properties. When we refer to “SFR loans,” we mean mortgage loans secured by single-family residential properties.

“Short sales” are sales of real estate in which the proceeds from the sale are less than (i.e., “short” of) the outstanding balance of the debt secured by the property; however, the lien holder agrees to release the lien, based on the tacit agreement by the borrower to surrender possession without contest.

“TBA” means a forward-settling Agency RMBS where the pool is “to-be-announced.” In a TBA, a buyer will agree to purchase, for future delivery, Agency RMBS with certain principal and interest terms and certain types of underlying collateral, but the particular Agency RMBS to be delivered is not identified until shortly before the settlement date of the TBA.

Market, Industry and Other Data

We have obtained certain market and industry data from publicly available industry publications. These sources generally state that the information they provide has been derived from sources believed to be reliable, but that the accuracy and completeness of the information are not guaranteed. We believe that these data sources are generally reliable, but we have not independently verified this information.

PROSPECTUS SUMMARY

This prospectus summary highlights some of the information contained elsewhere in this prospectus. Because it is a summary, it does not contain all of the information you should consider before investing in our common stock. You should read the entire prospectus carefully, including the information set forth under the caption “Risk Factors,” as well as the financial statements and related notes included elsewhere in this prospectus. Unless indicated otherwise, the information in this prospectus assumes (1) the shares of our common stock to be sold in this offering will be sold at an initial public offering price of $ per share, which is the mid-point of the price range set forth on the front cover page of this prospectus, and (2) no exercise of the over-allotment option described on the front cover page of this prospectus.

Our Company

Ellington Housing Inc. is a Maryland corporation that acquires, owns, leases and manages single-family and multi-family residential real estate assets in selected markets in the United States. We are externally managed and advised by Ellington REIT Management LLC, or our Manager, which is an affiliate of Ellington Management Group, L.L.C., or Ellington. Ellington is an investment management firm and registered investment adviser with an 18-year history of analyzing and investing in a broad range of primarily residential mortgage-backed securities and related derivatives.

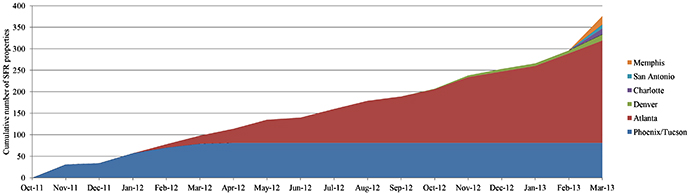

In November 2011, Ellington began to acquire residential properties in selected markets in the United States to manage as rental properties. Ellington believed such assets would benefit from a recovery in the residential housing market in terms of both price appreciation and an increase in demand for rental properties given the continued shift away from homeownership. Using its own capital, Ellington selectively acquired assets in markets Ellington believed offered high return potential and also built the operating platform necessary to renovate, lease and manage such assets. We were formed to expand upon Ellington’s vision, strategy and platform and were capitalized through a contribution by affiliates of Ellington of approximately $24 million of properties, cash and other assets and a series of private placements of our common stock in which we raised approximately $116 million for a total of approximately $140 million of equity in the first quarter of 2013.

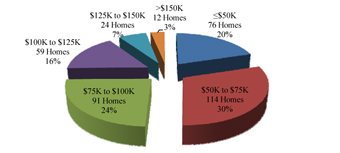

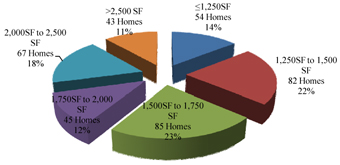

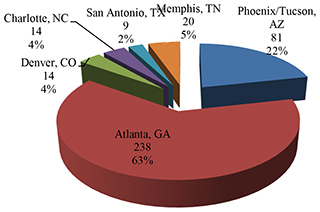

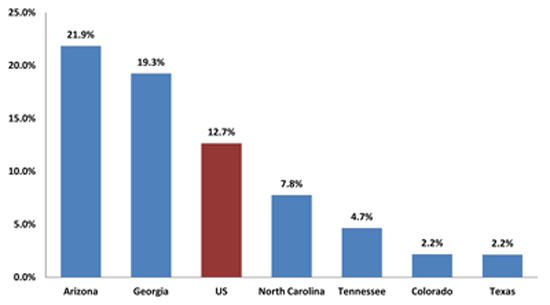

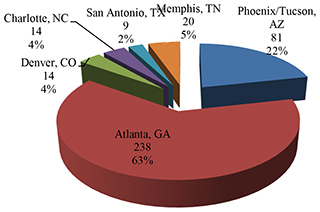

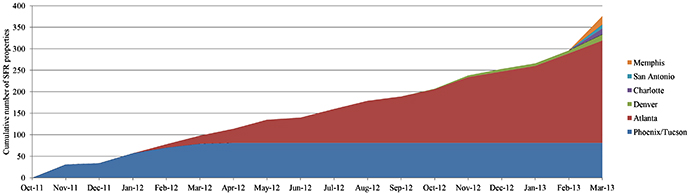

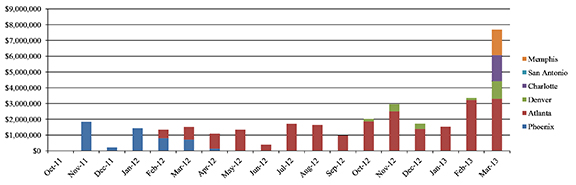

Our objective is to provide attractive risk-adjusted returns to our investors through a combination of dividends and capital appreciation. We intend to achieve this objective primarily through investments in, and active management of, a portfolio of (i) single-family homes and loans, which we refer to as our single-family residential, or SFR, strategy and (ii) multi-family residential loans and properties, which we refer to as our small balance multi-family, or SBMF, strategy. While we expect our SFR strategy will be geographically targeted, our SBMF strategy may be geographically dispersed. Our current target markets for our SFR strategy are the metropolitan statistical areas, or MSAs, of Atlanta, Georgia; Charlotte, North Carolina; Denver, Colorado; Memphis, Tennessee; Phoenix/Tucson, Arizona; and San Antonio, Texas. As of March 31, 2013, our portfolio consisted of 376 SFR properties across our target markets, with an aggregate cost basis of $33.7 million, together with $8.3 million of SBMF loans. As of June 15, 2013, our portfolio consisted of 707 SFR properties across our target markets, with an aggregate cost basis of $72.9 million, together with $15.6 million of SBMF loans. We continue to acquire homes in each of our current target markets other than Phoenix/Tucson, Arizona, where we have not purchased a home since April 2012. On June 28, 2013, we acquired a multi-family property valued at approximately $4.1 million pursuant to the conversion of one of our SBMF loans via a deed-in-lieu-of-foreclosure agreement.

The members of our management team include: Michael Vranos, founder and Chief Executive Officer of Ellington, who serves as our Co-Chief Investment Officer and is a member of our Board of Directors; Leo Huang, a Senior Portfolio Manager of Ellington, who serves as our President and Chief Executive Officer and is a member of our Board of Directors; Jared Samet, a Managing Director of Ellington, who serves as our Executive Vice President, Head of Acquisitions; JR Herlihy, a Director of Ellington, who serves as our Co-Chief Investment Officer; Howard Barash, who serves as our Chief Financial Officer; Daniel Margolis, General Counsel of Ellington, who serves as our General Counsel; and Sara Walden Brown, Associate General Counsel of Ellington, who serves as our Secretary. Each of these individuals is also an officer of our Manager.

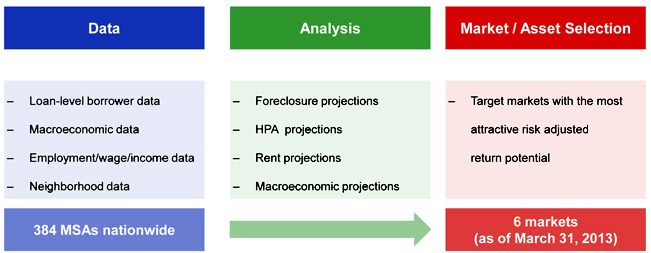

Over 18 years, Ellington has built extensive proprietary models for analyzing mortgage loans; among other things, these models estimate the future probabilities that such mortgage loans will remain current or default. Ellington’s proprietary integrated analytics program is managed by a team of 11 dedicated professionals led by John Geanakoplos, the James Tobin Professor of Economics at Yale and Head of Research at Ellington. Ellington collects

1

and maintains payment records and consumer credit data covering over 35 million active residential loans across 40,000 ZIP codes, representing approximately 70% of total U.S. SFR loans. Ellington also collects a range of macroeconomic and microeconomic data on, among other things, housing starts, home sales, distressed sale prices and volume, unemployment, demographics and income. Ellington’s models are designed to assist Ellington in maintaining up-to-date information regarding foreclosure activity and credit conditions at a local level.

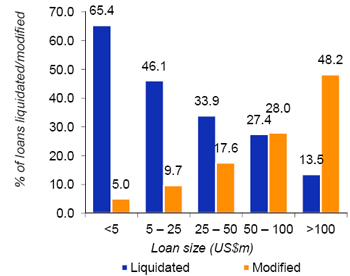

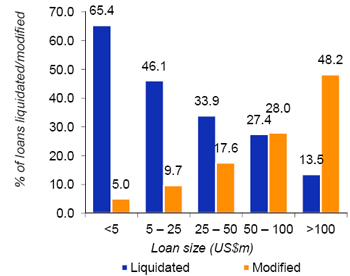

Ellington has extensive expertise in actively managing and rehabilitating residential and commercial real estate and residential mortgage loans, having overseen the management of approximately 1,000 SFR properties (either through direct acquisition or REO) since 2009. Ellington also has extensive expertise in acquiring and resolving distressed SBMF loans, having acquired 133 mostly non-performing small-balance commercial loans with an aggregate unpaid balance of approximately $224 million since June 2010. Approximately 88% of the small-balance loans acquired were secured by either multi-family residential properties or mixed-use properties with multi-family residential components and were acquired from more than a dozen sellers.

We were organized as a Maryland corporation in September 2012 and intend to elect and qualify to be taxed as a REIT commencing with our taxable year ending December 31, 2013. We generally will not be subject to U.S. federal income tax on our REIT taxable income to the extent that we annually distribute all of our REIT taxable income to stockholders and qualify as a REIT. We also intend to conduct our operations so that neither we nor any of our subsidiaries are required to register as an investment company under the Investment Company Act of 1940, as amended, or the Investment Company Act.

Our Strategy

We see significant opportunities in both the SFR and multi-family residential sectors of the housing market. We believe that distress in the financial markets has created significant dislocation between price and intrinsic value in certain residential housing markets and that attractive investment opportunities will be available for many years.

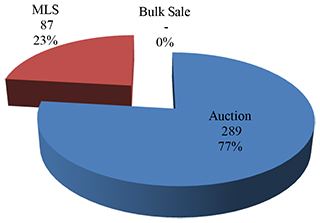

Our strategy in the SFR sector consists of acquiring individual SFR properties or small portfolios of SFR properties in targeted markets that can be operated as investment properties for rental. We acquire properties directly through foreclosure sales, short sales, negotiated purchases and auctions, and we also intend to acquire sub-performing and non-performing SFR loans, which may be geographically diversified, with a view towards acquiring the underlying properties through foreclosure. We target markets that we believe offer the potential for home price appreciation, or HPA, as well as attractive rental yields. We believe Ellington is well positioned, given its analytical tools and housing price modeling expertise, to identify markets with high HPA and risk-adjusted return potential. We generally seek to acquire quality SFR properties at attractive prices that can generate both attractive rental yields and price appreciation instead of seeking solely assets with the lowest prices. We intend to avoid acquiring SFR properties when the purchase price will result in an unattractive rental yield, and we also intend to avoid SFR properties that we believe will be too costly to renovate, for example, as a result of excessive age and wear. While we believe in the diversification benefits of being in several markets, we expect that the housing recovery will continue to be uneven throughout the United States, and, as a result, we do not expect to maintain a national presence for our SFR strategy. Rather, for our SFR strategy, we will focus on markets that we project to outperform the national average on a risk-adjusted return basis. As the housing market undergoes regional ebbs and flows over time, we anticipate that the regional markets on which we focus may also vary over time. We have developed relationships with experienced local property operators in our current markets, and expect to do the same in future markets we may target. We may acquire SFR properties either directly or by foreclosing on sub-performing and non-performing SFR loans that we may acquire. The purchase of SFR properties through foreclosures on distressed loans that we have acquired diversifies our acquisition channels and may, in certain situations, be more attractive than other channels. We believe Ellington has the necessary prior experience, infrastructure, and analytical capabilities to evaluate and access these various acquisition channels in order to effectively implement our SFR strategy.

Our strategy in the multi-family sector consists of acquiring performing, sub-performing and non-performing SBMF loans, which we define as commercial mortgage loans that have unpaid principal balances of $25 million or less and that are secured by multi-family residential properties. With Ellington’s sourcing capabilities and its proven ability to work out loans (including taking ownership of and managing the underlying real estate), in each case if appropriate, in a timely and efficient manner, we believe that investing in sub-performing and non-performing

2

SBMF loans is currently the most attractive and cost-effective way to invest in the multi-family real estate market. We expect that our SBMF strategy will in many cases include obtaining discounted payoffs (or foreclosing into ownership of the underlying property) of SBMF loans that we have acquired at significant discounts, as well as selectively acquiring multi-family and mixed-use housing properties and opportunistically originating loans to recapitalize multi-family residential properties underlying SBMF loans. Unlike our SFR strategy, our SBMF strategy may be geographically dispersed.

We use Ellington’s analytics to carefully select each MSA in which we choose to invest. We closely monitor our MSAs and, thanks to our outsourced property management model and resulting variable cost structure, we are able to scale up or cease further incremental investment quickly in any given MSA. As a result, our individual investment decisions can be driven by the merits of each investment, as informed by our data and analytics rather than by the need to maintain volume thresholds or concerns of locally deployed infrastructure.

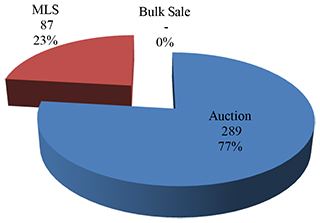

Our Portfolio

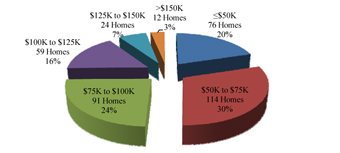

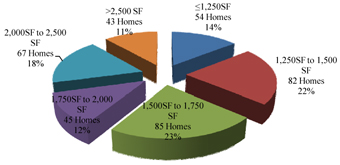

As of March 31, 2013, our SFR portfolio consisted of 376 SFR properties with an aggregate cost basis of $33.7 million. We acquired this portfolio without the use of debt financing. A summary of our SFR portfolio as of March 31, 2013 is as follows:

SFR Portfolio Summary Statistics

As of March 31, 2013

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | Leased Homes | |

MSA / Metro Division | | Number

of

Homes | | | Average

Purchase

Price per

Home(1) | | | Average

Capital

Expenditures

Per Home(2) | | | Average

Investment

Per Home(3) | | | Aggregate

Investment | | | Percent

Leased | | | Average

Age

(years) | | | Average

Size

(square

feet) | | | Average

Monthly

Rent Per

Leased

Home(4) | | | Annual

Average Rent

per Leased

Home as a

Percentage of

Average

Investment Per

Leased Home | |

Atlanta, GA | | | 238 | | | $ | 81,846 | | | $ | 11,264 | | | $ | 93,109 | | | $ | 22,160,045 | | | | 61 | % | | | 13.9 | | | | 1,909 | | | $ | 1,046 | | | | 14.6 | % |

Phoenix/Tucson, AZ | | | 81 | | | | 53,883 | | | | 9,650 | | | | 63,532 | | | | 5,146,099 | | | | 89 | % | | | 30.8 | | | | 1,363 | | | | 815 | | | | 15.2 | % |

Denver, CO | | | 14 | | | | 145,071 | | | | 10,684 | | | | 155,755 | | | | 2,180,571 | | | | 50 | % | | | 48.9 | | | | 1,584 | | | | 1,268 | | | | 10.1 | % |

Charlotte, NC | | | 14 | | | | 114,436 | | | | 3,342 | | | | 117,778 | | | | 1,648,891 | | | | — | | | | 15.9 | | | | 1,617 | | | | — | | | | — | |

Memphis, TN | | | 20 | | | | 79,146 | | | | 1,622 | | | | 80,768 | | | | 1,615,366 | | | | — | | | | 29.3 | | | | 1,809 | | | | — | | | | — | |

San Antonio, TX | | | 9 | | | | 106,455 | | | | 1,806 | | | | 108,262 | | | | 974,354 | | | | — | | | | 20.1 | | | | 1,827 | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Total / Weighted Average | | | 376 | | | $ | 79,835 | | | $ | 9,860 | | | $ | 89,695 | | | $ | 33,725,326 | | | | 59 | % | | | 19.9 | | | | 1,761 | | | $ | 978 | | | | 14.5 | % |

| (1) | Does not include acquisition costs (defined below). |

| (2) | Represents average actual acquisition costs of $2,111 per home to date and average actual capital expenditures of $7,750 per home to date and does not include additional expected or future capital expenditures. Capital expenditures include actual upfront renovation costs for vacant homes purchased and homes purchased with in-place tenants where an initial renovation was not performed. We estimate total upfront renovation costs will be approximately $13,000 per home. Acquisition costs include (as applicable) acquisition fees, due diligence costs, filing fees, broker commissions, insurance premiums until the property is leased, closing costs, legal and eviction costs, past due HOA and property taxes and boarding fees. |

| (3) | Equals the sum of average purchase price per home and average capital expenditures per home. |

| (4) | Represents average monthly in-place rent before any rent concessions on the 223 homes leased as of March 31, 2013. We have offered and may continue to offer limited periods of free rent as a leasing incentive to potential residents. Of the 223 homes leased as of March 31, 2013, four tenants were offered rent concessions of free rent for a partial month to one month totaling $2,265, or 0.1% of annualized gross rental income on these homes. |

As of March 31, 2013, our SFR portfolio was primarily concentrated in the MSAs of Atlanta, Georgia and Phoenix/Tucson, Arizona, which are the first two markets that Ellington originally identified as having attractive return potential, and it also included properties in the MSAs of Charlotte, North Carolina; Denver, Colorado; Memphis, Tennessee; and San Antonio, Texas. We use Ellington’s projections of HPA and foreclosure rates as well as a wide variety of demographic, demand, supply, valuation, legal, and structural criteria to select our target markets and properties. As of March 31, 2013, we owned a portfolio of 376 homes. Of these homes, 211 were vacant at the time of acquisition and 165 were occupied at the time of acquisition. Of the 165 homes that were occupied upon acquisition, 21 had in-place leases upon acquisition, 25 prior owners were converted to a lease and 119 were vacated immediately following the acquisition.

As of March 31, 2013, our SBMF portfolio consisted of four first-lien mortgage loans with an aggregate unpaid principal balance of $9.8 million, a combined investment amount of $8.3 million, an estimated loan-to-value ratio of 77% (ranging from 58% to 87%) and backed by multi-family residential properties containing a total of 358 residential units. The portfolio included three loans on multi-family residential properties located in Las Vegas, Nevada that are in technical default, but are still paying current principal and interest, and one non-performing SBMF loan in Pensacola, Florida. Our strategy with respect to the three loans located in Las Vegas, Nevada is to attempt to negotiate discounted payoffs with the borrowers but we have not initiated discussions with the borrowers regarding such resolution and any such resolution may take time to implement, if at all. On June 28, 2013, we acquired the property collateralizing the loan in Pensacola, Florida pursuant to a conversion via a deed-in-lieu of foreclosure agreement.

3

Our Competitive Strengths

Access to Established Asset Manager with Extensive Infrastructure. We expect to benefit substantially from our relationship with our Manager and Ellington. Ellington has more than 120 employees and over 18 years of investment experience. We believe this relationship will provide us with insights into attractive opportunities and access to market information. We will also benefit from Ellington’s finance, accounting, operational, legal, compliance and administrative resources. We believe Ellington’s experience with, and resources used in, managing Ellington Financial LLC (NYSE: EFC), or EFC, and Ellington Residential Mortgage REIT (NYSE: EARN), or EARN, both public companies, will benefit us.

Leading and Experienced Management Team. We believe that the extensive experience of our officers and the officers and employees of Ellington and our Manager provides us with significant management expertise across our targeted asset classes. As of March 31, 2013, 45 Ellington employees were fully or partially dedicated to our strategies. Our senior management team includes Michael W. Vranos, founder and Chief Executive Officer of Ellington and the former head of RMBS trading and origination at Kidder Peabody, and Leo Huang who has over 16 years of experience in commercial real estate lending and securitizations including as Managing Director and Head of Real Estate Fixed Income at Starwood Capital Group and Managing Director and co-head of the commercial real estate lending and securitization business at Goldman, Sachs & Co.

Access to Ellington’s Proprietary Database and Analytics. We expect to benefit from Ellington’s proprietary analytical models, research, analytics and databases. Ellington maintains an extensive loan-level database that allows it to perform in-depth analysis. Ellington’s mortgage analytics will permit us to perform granular analysis including developing projections for forecasting foreclosures and HPA. We believe that access to Ellington’s proprietary models and modeling capabilities provides us with a substantial competitive advantage over many other market participants.

Focus on Risk-Adjusted Returns for Our Assets. Our business philosophy is to identify and target residential housing markets that we believe offer the potential for high risk-adjusted returns. Our focus is on maximizing returns for our stockholders rather than maximizing the size of our portfolio. This philosophy drives our organization to evaluate the relative merits of various means to enhance risk-adjusted returns such as: opening up a new market with less competition, as opposed to optimizing property management in an overly competitive current market; considering whether there is better opportunity in single-family as opposed to multi-family residential properties or vice versa; focusing on optimizing rental yield as opposed to housing price appreciation upside or vice versa; or purchasing distressed properties directly as opposed to purchasing distressed loans secured by such properties or vice versa.

Balanced and Diverse Approach to Residential Asset Ownership.Our portfolio is composed of both SFR and multi-family residential assets. By having the flexibility to own a property directly or to own the mortgage that it secures, we enhance our ability to benefit from the opportunities being generated by the growing strength of residential rentals. Also, since we are pursuing both an SFR strategy and an SBMF strategy, we can benefit regardless of whether potential renters choose single-family or multi-family options when making their living arrangements. The scope of our investment strategy provides for a sizeable supply of our target assets and should permit us to exploit inefficiencies between the different forms of rental housing in different markets.

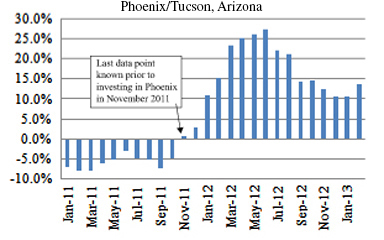

Nimble Market Entry and Exit. We believe our data-driven approach and our ability to identify attractive target markets, develop operating relationships with experienced local real estate service providers, understand each region’s legal and regulatory framework, source quality assets at attractive prices and manage the process from renovation, tenant selection and ongoing property management, enable us to effectively deploy capital. Our strategy of outsourcing the operation of our properties to experienced local property managers and other service providers in the markets where we own properties, as opposed to making large investments in personnel and operating infrastructure in these markets, allows us to capture upfront the operational efficiencies/economies of scale that the local property manager may have already achieved. This gives us the flexibility to be selective in our acquisitions (or to cease acquisition activity quickly if we determine that the risk-adjusted return potential for new acquisitions in a particular market is unattractive), since we do not need substantial scale in each of our markets to achieve attractive returns. Ellington identified Phoenix/Tucson, Arizona as a target market in November 2011 and had purchased 81 SFR properties there by April 2012, before that market’s significant increase in single-family housing

4

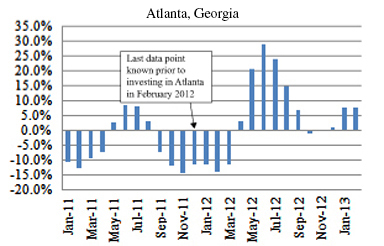

investment activity and corresponding HPA. In February 2012, Ellington began investing in the Atlanta, Georgia MSA, where we had acquired 238 homes as of March 31, 2013, and subsequently acquired SFR properties in the MSAs of Charlotte, North Carolina; Denver, Colorado; Memphis, Tennessee; and San Antonio, Texas, where we had acquired of 57 SFR properties in total as of March 31, 2013. We believe our current portfolio is an attractive portfolio with potential for HPA and which we expect to generate attractive rental yields.

Attractive Existing Portfolio. As of June 15, 2013, we owned a portfolio of 707 SFR properties. Our average cost basis per home, inclusive of acquisition and actual upfront renovation costs, was approximately $103,000.

Alignment of Our Stockholders’, Our Manager’s and Ellington’s Interests. In connection with our formation transactions and equity private placements in the first quarter of 2013, affiliates of Ellington contributed to us all of their ownership interests in three entities that, as of the closing date of these transactions, January 31, 2013, collectively owned a portfolio of 266 SFR properties located in the MSAs of Atlanta, Georgia; Denver, Colorado; and Phoenix/Tucson, Arizona, with an aggregate undepreciated cost basis of $20.6 million, plus $3.7 million in cash and other short-term assets and liabilities, and had contracts to purchase 36 additional SFR properties with an estimated cost basis of $3.6 million. In exchange for this contribution, the contributors received 1,215,189 common units of limited partnership in our operating partnership, or OP units, valued at $20.00 per unit. Ellington, together with its affiliates, its principals (including family trusts established by its principals) and entities in which 100% of the interests are beneficially owned by the foregoing, or our Manager Group, purchased over $8.5 million in shares of our common stock in the two private placements in addition to shares of our common stock and OP units that they received as part of the formation transactions. Our Manager Group currently owns 1,006,949 shares of our common stock, 608,737 OP units and 206,069 long-term incentive plan units in our operating partnership, or LTIP units. In addition, our management agreement with Ellington includes incentive compensation that is designed to further align Ellington’s interests with those of our stockholders. At least 20% of any incentive fee earned by our Manager will be payable in shares of our common stock or common stock equivalents, subject to the 9.8% ownership limit in our charter, which may be waived by our Board of Directors. We believe that the ownership of our common stock, OP units and LTIP units by our Manager and its affiliates further aligns our Manager’s interests with our stockholders’ interests.

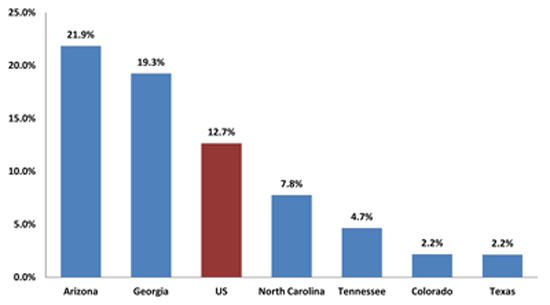

Market Opportunity

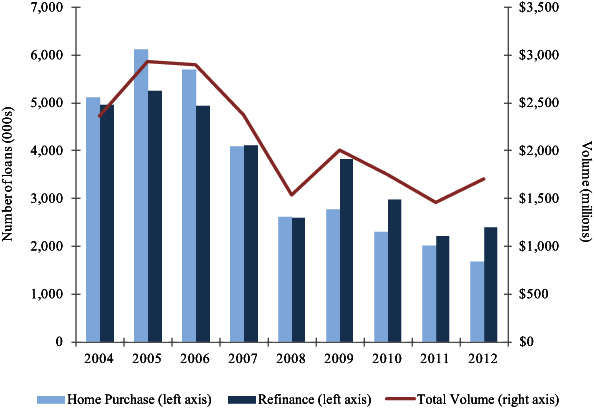

We believe the current market offers an opportunity to earn attractive risk-adjusted returns, on both a capital-appreciation and current-income basis, by acquiring title and renting or resolving loans on SFR and multi-family residential properties and capitalizing on the ongoing trend toward renting, rather than owning, homes. The current market environment of increasing demand for rental housing, depressed housing prices, structural changes to the economy and employment and financial distress of many homeowners presents a significant opportunity for those with access to capital and experience. In particular, we believe that the general lack of purchase financing available to homeowners, high down-payment requirements and restrictive underwriting standards are forcing many potential homeowners to rent rather than buy. In both the single-family and multi-family sectors, the number of potential renters has increased substantially over the last several years, the supply of new construction has been limited to date, the prices of properties and the mortgages secured by properties have fallen from their highs and the ability of owners to remain current on, or to refinance, their financial obligations remains constrained.

Opportunity of Significant Scale. Residential housing in the United States is one of the largest asset classes in the world. Of this asset class, we believe that approximately 18.3 million homes, or 14% of all housing stock, comprise the potential available market for SFR rentership. We believe the homeownership rate is expected to continue to decline as tight mortgage credit, higher down-payment requirements and unemployment rates continuing above the long-term average constrain the pool of eligible home-buyers. This trend, combined with positive underlying demographic trends of population and household formation growth and a limited supply of new construction over the last several years, provides investors an opportunity to participate in the SFR rental market and the recovery of the U.S. housing market at what we believe is an attractive entry point in the housing cycle.

Historically Attractive Valuation. Given the price declines in the housing market, we believe that SFR properties are one of the least expensive asset classes available on both an absolute and relative basis, providing attractive risk-adjusted returns from both rental yields and asset appreciation as home prices begin to recover from

5

financial crisis lows. Home affordability measures are at record highs and home price-to-income ratios in some states are more than 10% below pre-housing-peak averages. Prices have begun to rise in most major metropolitan markets, and we believe confidence in homes as an investment is similarly on the rise. We believe that in the current market SFR properties can provide equity-like upside, some protection against future inflation and superior current yields compared to other asset classes.

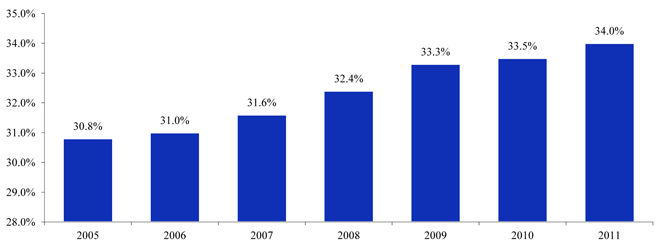

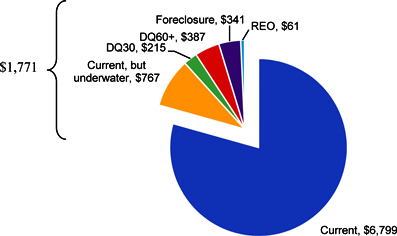

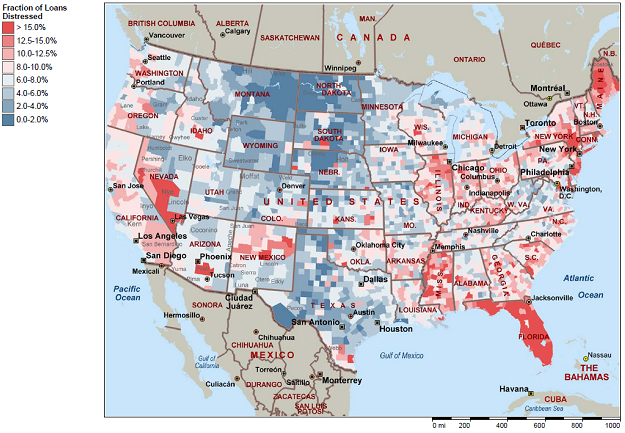

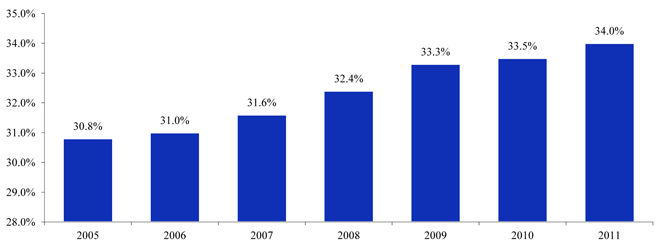

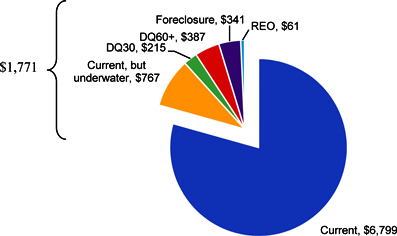

Severe Supply and Demand Imbalance. We believe a significant imbalance exists between the supply and demand for single-family and multi-family residential rental housing. In the aftermath of the well-documented housing crisis, we believe that secular declines in the U.S. homeownership rate and recovering household formation rates are increasing rental demand for both SFR and multi-family residential housing. The national homeownership rate rose steadily, fueled in part by easy access to credit and more lenient underwriting standards, and peaked at 69.2% in the fourth quarter of 2004; it has since retracted to 65.0% as of the first quarter of 2013, the lowest level since 1997, after widespread foreclosures and slower growth in household formations. According to LPS Applied Analytics, the total shadow inventory of homes (homes whose mortgages are delinquent for more than 60 days, or DQ60+, in foreclosure or REO) was 3.6 million households as of May 2013. Excluding these households, the national homeownership rate is only 61.9%, resulting in what we believe is and will continue to be a large need for rental housing.

According to Moody’s Analytics, the current level of housing starts has rebounded to a seasonally adjusted annual rate, or SAAR, of 1.0 million as of March 31, 2013 from trough 2009-2010 levels, but it is still 33% below the 25-year average SAAR of 1.56 million before 2007. We believe this level of housing starts is not keeping pace with projected household and continued population growth. Therefore, we believe that the lack of adequate new supply coupled with increasing household formations will lead to more demand for rental units and a supportive environment for home prices.

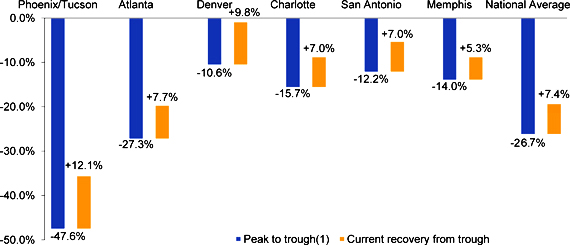

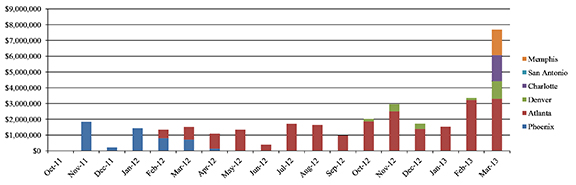

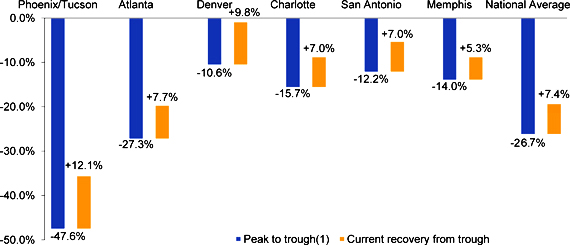

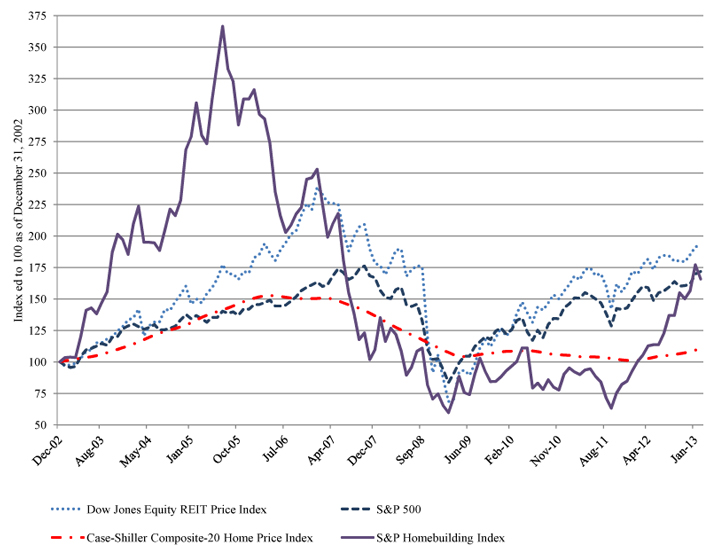

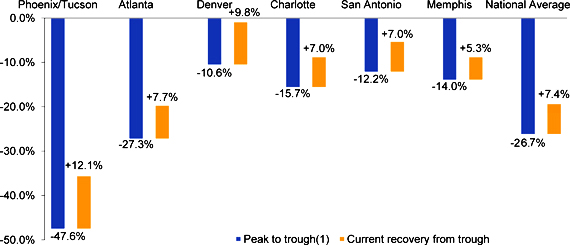

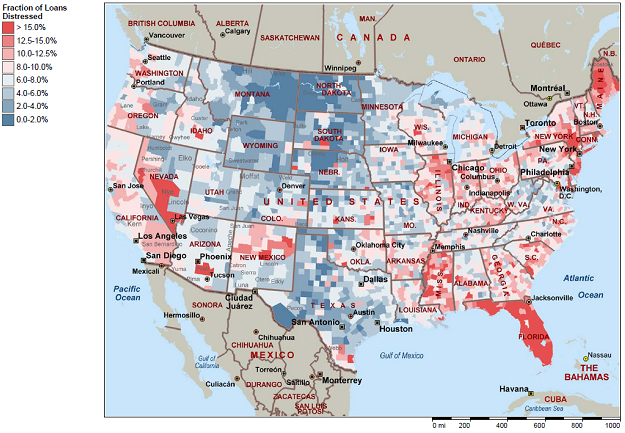

We believe that a significant contributing factor to the slow recovery of home prices nationally has been the large overall pipeline of distressed properties available for sale. While we expect the recovery to remain slow on the whole, we have witnessed that once the majority of the distressed properties have been resolved in an MSA, the market for SFR properties experiences significant HPA. We are already seeing evidence of this in certain markets such as the Phoenix/Tucson, Arizona MSA that are in the later stages of shadow-inventory resolution. While home prices in certain markets have begun to recover rapidly, as shown in the chart below, prices are still significantly below their peaks in most areas.

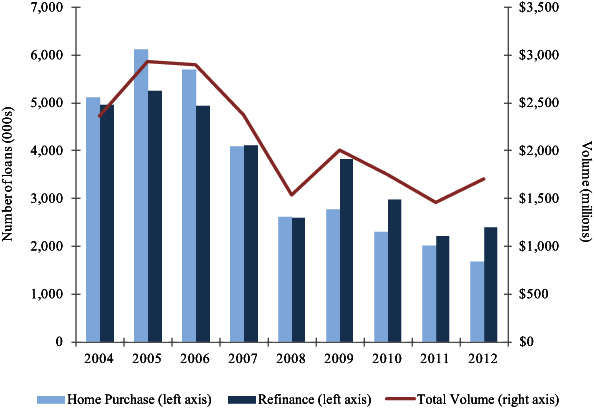

Changes in CoreLogic Distressed Excluded Home Price Index

Source: CoreLogic, February 2013.

| (1) | Peaks occurred in each MSA as follows: Atlanta — July 2007, Charlotte — June 2007, Denver — July 2007, Memphis — July 2007, Phoenix/Tucson — June 2006, San Antonio — August 2007, and National Average — April 2006. |

Troughs occurred in February 2012 for all markets shown except Atlanta (March 2012) and Phoenix/Tucson (October 2011).

6

Our Manager and Ellington

Ellington is a privately held investment advisor registered with the Securities and Exchange Commission, or the SEC. As of May 31, 2013, Ellington employed over 120 employees and had net assets under management of approximately $5.6 billion, including management of EFC, a publicly traded specialty finance company focusing on non-agency mortgage related assets with an estimated net asset value as of May 31, 2013 of approximately $638 million, and EARN, an Agency RMBS-focused mortgage REIT that completed its initial public offering in May 2013 and had an estimated net asset value as of May 31, 2013 of approximately $177 million.

Our Manager was established by Ellington on October 9, 2012 to build a large-scale platform to acquire, lease and manage a portfolio of SFR and multi-family residential properties and to acquire loans on single-family and multi-family residential properties. Ellington has established portfolio management resources for each of our target asset classes and infrastructure to support those resources. Through our Manager, we benefit from Ellington’s highly analytical investment processes, deep institutional knowledge across all aspects of residential real estate assets, broad-based deal flow, established relationships in the financial community, systems, surveillance, risk management, compliance, accounting, tax and public company infrastructure.

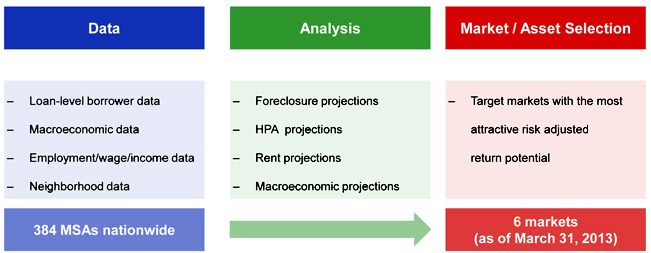

Ellington’s analytic approach to the investment process for our target markets involves the collection and processing of substantial amounts of data regarding historical performance of single-family home loans and securities backed by those loans and associated derivatives and market transactions. Ellington analyzes this data to identify possible trends and develops financial models used to support the investment and risk management process. Of particular relevance to us are Ellington’s proprietary databases that enable analysis of the ratio of equity value (through analysis of current market conditions) to mortgage debt and analysis of borrowers’ propensity to default or prepay, which, when examined in conjunction with other economic and demographic data such as household formation, population, job creation and unemployment rate, provides insights into emerging trends in local real estate markets. We believe this experience and analytical expertise will provide us with a competitive advantage in identifying markets with the potential for attractive risk-adjusted returns and acquisition opportunities within those markets.

Our Manager provides the following services to us using its own resources and internal resources of Ellington:

| | • | | research, analytics and economic projections of the U.S. housing and mortgage markets; |

| | • | | sourcing potential acquisitions for SFR and SBMF opportunities; |

| | • | | determining target markets, neighborhoods and home profiles; |

| | • | | underwriting of each potential acquisition, including defining assumptions, determining bidding prices and calculating projected net rental yields and total returns asset-by-asset; |

| | • | | overseeing the due diligence process on each potential acquisition, including negotiating applicable agreements and reviewing title commitments, HOA documents and closing statements; |

| | • | | binding insurance for acquired assets, |

| | • | | maintaining discretion over key investment decisions (e.g., bid amounts and strategy, rent levels and marketing strategy, and renovation budgets); |

| | • | | actively overseeing operations, including renovation process, leasing and ongoing property management; |

| | • | | maintaining cash control procedures and regular internal checks; |

| | • | | developing and maintaining proprietary software systems to facilitate the acquisition process and tracking of operations; |

| | • | | accounting and financial reporting; and |

| | • | | legal, compliance and human resources. |

See “Our Manager and the Management Agreement — The Management Agreement” for a complete list of services provided by our Manager pursuant to the Management Agreement.

We may engage third parties to assist us in sourcing, managing, maintaining and renovating and/or disposing of our SFR investments. Such third parties will generally provide local market knowledge regarding our target markets or prospective target markets, prepare auction drive reports, conduct title searches, coordinate bidding logistics based on specific instructions, input MLS data on listings, conduct home inspections, prepare title work and provide property management, leasing, renovation and maintenance services.

Recent Developments

SFR Property Investment Activity. As of June 15, 2013, we owned a portfolio of 707 SFR properties with a cost basis of $72.9 million. For the period from April 1, 2013 through June 15, 2013, we acquired 331 SFR properties for an aggregate purchase price of $36.7 million. The 331 homes we acquired during this period are located in the following MSAs:

| | | | |

Atlanta, Georgia | | | 28 | |

Charlotte, North Carolina | | | 96 | |

Denver, Colorado | | | 30 | |

Memphis, Tennessee | | | 111 | |

San Antonio, Texas | | | 66 | |

Additionally, as of June 15, 2013, we had agreed to purchase an additional 55 SFR properties in separate transactions for an aggregate purchase price of $6.5 million. The number and location of these 55 homes were as follows: Charlotte, North Carolina (16), Atlanta, Georgia (20), Denver, Colorado (5), San Antonia, Texas (13) and Memphis, Tennessee (1). The aggregate purchase price of the recently acquired and recently contracted SFR properties is $43.2 million.

SBMF Loan Investment Activity. As of June 15, 2013, we owned $15.6 million of SBMF loans. For the period from April 1, 2013 through June 15, 2013, we acquired three SBMF loans in Florida and one SBMF loan in Arizona for an aggregate purchase price of $7.3 million. On June 28, 2013, we acquired a multi-family property valued at approximately $4.1 million pursuant to the conversion of one of our SBMF loans via a deed-in-lieu-of-foreclosure agreement.

Our Formation Transactions and Organizational Structure

We were incorporated in Maryland in September 2012. Our operating partnership, Ellington Housing Operating Partnership LP, was formed as a Delaware limited partnership in September 2012. We are the sole general partner of our operating partnership.

7

In January 2013, we completed a series of transactions that included a private placement of shares of our common stock and OP units, the closing of a series of contribution transactions pursuant to which we acquired our initial portfolio of SFR properties, and the purchase by our contributors of additional OP units and shares of common stock using the proceeds of cash distributions received from the contributed entities. In these transactions, we:

| | • | | sold a total of 4,504,765 shares of common stock for a price of $20.00 per share, raising an aggregate of approximately $90 million of net proceeds in private placements that closed on January 18, 2013 and January 31, 2013; |

| | • | | completed certain formation transactions through which we acquired the ownership interests of certain Ellington affiliates in three entities that, as of the closing date on January 31, 2013, collectively owned 266 SFR properties with an acquisition cost of $20.6 million, plus $3.7 million in cash and other short-term assets and liabilities, and had 36 pending SFR property purchases with an estimated cost basis of $3.6 million; and |

| | • | | issued 1,215,189 OP units, valued at $20.00 per unit to the contributors in exchange for the contribution to us of these interests in the formation transactions. |

The contributors subsequently converted 606,452 OP units into shares of our common stock.

On March 18, 2013, we completed a follow-on private placement of common stock in which we sold an additional 1,274,035 shares of our common stock for a price of $20.15 per share, raising $25.7 million of net proceeds.

Our Manager Group purchased over $8.5 million in shares of our common stock in the two private placements in addition to shares of common stock and OP units that they received as part of the formation transactions. Our Manager Group currently owns 1,006,949 shares of our common stock, 608,737 OP units and 206,069 LTIP units.

8

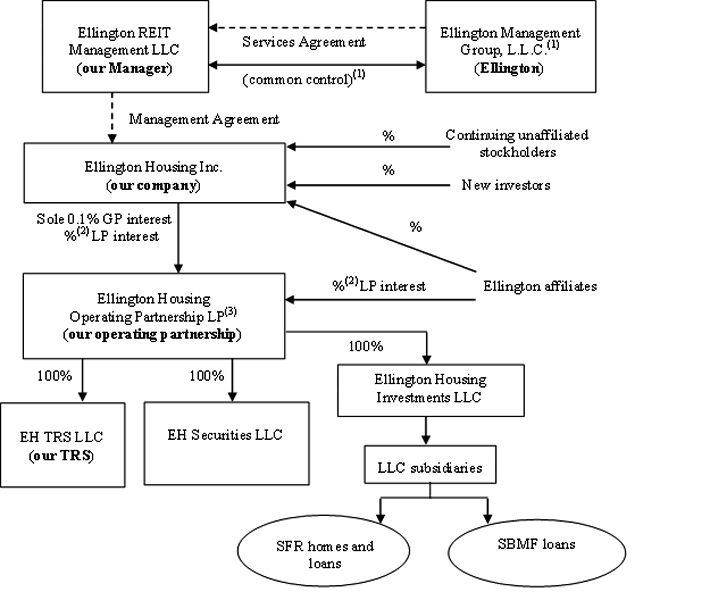

The following chart illustrates our expected organizational structure immediately following completion of this offering:

| (1) | EMG Holdings, L.P., or EMG Holdings, is a holding company that owns interests in our Manager, Ellington and other Ellington affiliates. VC Investments L.L.C., or VC Investments, is the general partner of EMG Holdings and is also the managing member of our Manager and of Ellington, and as such controls each of these three entities. The limited partners of EMG Holdings include Mr. Vranos and certain other Ellington principals. Mr. Vranos beneficially owns a controlling interest in VC Investments. Upon completion of this offering under the assumptions in footnote 2 below, affiliates of Ellington will hold an approximately % limited partner interest in our operating partnership. |

| (2) | Assumes a total of shares of our common stock are sold in this offering. Excludes an aggregate of 209,819 LTIP units granted to our Manager and our independent directors pursuant to our 2013 equity incentive plans. |

| (3) | Ellington Housing Operating Partnership LP is our operating partnership. We hold all of our assets and conduct all of our operations primarily through our operating partnership and its subsidiaries. |

Our Management Agreement

In January 2013, we entered into a management agreement with our Manager pursuant to which our Manager is required to manage our business affairs in conformity with policies and investment guidelines that are approved by our Board of Directors, including a majority of our independent directors, and monitored by our Board of Directors. Our Manager is subject to the direction and oversight of our Board of Directors. Our Manager is responsible for, among other things:

| | • | | the identification, selection, purchase and sale of our portfolio investments; |

9

| | • | | our financing and risk management activities; |

| | • | | providing us with investment advisory services; and |

| | • | | providing us with a management team and appropriate personnel. |

In addition, our Manager is responsible for our day-to-day operations and performs (or causes to be performed) such services and activities relating to our assets and operations as may be necessary or appropriate.

The initial term of the management agreement will expire on January 31, 2016 and will be automatically renewed for a one-year term on such date and on each anniversary of such date thereafter unless terminated as described below. Our independent directors will review our Manager’s performance periodically and, following the initial term, upon the affirmative vote of at least two-thirds of our independent directors or the affirmative vote of the holders of a majority our common stock, the management agreement may be terminated based upon:

| | • | | unsatisfactory performance that is materially detrimental to us; or |

| | • | | a determination by our independent directors that the management fee payable to our Manager is not fair, subject to our Manager’s right to prevent such a compensation termination by accepting a reduction of management fees. |

We will provide our Manager 180 days prior notice of any such termination. Upon such termination, our Manager will be paid a termination fee in the amount described in the table below. Following the initial term or any renewal term, we may elect not to renew the management agreement for any reason by providing our Manager with at least 180 days, but not more than 270 days, written notice; however, if we elect not to renew the term of the management agreement, we will be required to pay the termination fee to our Manager.

We may also terminate the management agreement without payment of the termination fee with 30 days prior written notice to our Manager for cause, as defined in the management agreement. Our Manager may terminate the management agreement, without payment of the termination fee, in the event we become regulated as an investment company under the Investment Company Act, or if our Manager declines to renew the management agreement for any reason by providing us with at least 180 days, but not more than 270 days, written notice. Our Manager may also terminate the management agreement upon 60 days written notice if we default in the performance of any material term of the management agreement and the default continues for a period of 30 days after written notice to us, whereupon we would be required to pay our Manager the termination fee described below.

The following table summarizes the fees and expense reimbursements that we are required to pay our Manager.

| | |

Type | | Description |

| Base management fee | | We are required to pay our Manager a base management fee equal to 1.50% per annum of our stockholders’ equity, payable quarterly in arrears in cash, with stockholders’ equity being calculated in accordance with accounting principles generally accepted in the United States, or GAAP, as of the end of each fiscal quarter (before deduction of the base management fee and the incentive fee with respect to such fiscal quarter). Stockholders’ equity will be adjusted to exclude one-time events pursuant to changes in GAAP, as well as non-cash charges after discussions between our Manager and our independent directors and approval by a majority of our independent directors in the case of non-cash charges. |

10

| | |

Type | | Description |

| Incentive compensation | | Beginning with the end of the second fiscal quarter of 2014, we will be required to pay our Manager an incentive fee with respect to each fiscal quarter (or part thereof that the management agreement is in effect), payable quarterly in arrears. The incentive fee will be an amount, not less than zero, equal to the difference between (1) the product of (x) 20% and (y) the difference between (i) our Core Earnings (as defined below) for the previous four fiscal quarters, and (ii) the product of (A) the weighted-average issue price per share of our common stock of all of our private and public offerings of common stock (other than issuances to Ellington and its affiliates that are not part of a broader offering of common stock to third-party investors) (where each such offering is weighted by both the number of shares issued in such offering and the number of days that such issued shares were outstanding during such four fiscal quarter period) multiplied by the weighted-average number of shares of our common stock outstanding in the previous four fiscal quarters, and (B) 8%, and (2) the sum of any incentive fee paid to our Manager with respect to the first three fiscal quarters of such previous four fiscal quarters. No incentive fee will be payable with respect to any fiscal quarter unless Core Earnings for the 12 most-recently completed fiscal quarters (or part thereof prior to the completion of 12 fiscal quarters following the completion of this offering) is greater than zero. |

| |

| | Core Earnings is a non-GAAP measure and is defined as our GAAP net income (loss) excluding non-cash equity compensation expense, the incentive fee, real estate-related depreciation and amortization, any unrealized gains, losses or other non-cash items recorded in net income for the period, regardless of whether such items are included in other comprehensive income or loss, or in net income. The amount will be adjusted to exclude one-time events pursuant to changes in GAAP and certain other non-cash charges after discussions between our Manager and our independent directors and after approval by a majority of our independent directors. See “Our Manager and the Management Agreement” for a hypothetical example of the calculation of the incentive fee. |

| |

| Partial payment of incentive fee in shares of our common stock or LTIP units | | At least 20% of each quarterly installment of the incentive fee will be payable in shares of our common stock or, at our Manager’s option, LTIP units in our operating partnership, or LTIP units, so long as the ownership of such additional number of shares by our Manager would not violate the 9.8% stock ownership limit set forth in our charter, after giving effect to any waiver from such limit that our Board of Directors may grant to our Manager in the future. The remainder of the incentive fee will be payable in cash. |

| |

| | The number of shares or LTIP units to be issued to our Manager will be equal to the dollar amount of the portion of the quarterly installment of the incentive fee payable in shares divided by the greater of the average of the closing prices of our common stock on the NYSE, for the five trading days prior to the date on which such quarterly installment is paid and the most recent stated book value per share of our common stock. |

11

| | |

Type | | Description |

| Expense reimbursement | | We are required to reimburse our Manager for operating and other expenses related to us that are incurred by our Manager, including expenses relating to legal, regulatory, tax, accounting, consulting, auditing, administrative, due diligence, property management and oversight and other services. Our reimbursement obligation is not subject to any dollar limitation. Expenses are required to be reimbursed in cash on a monthly basis. We do not reimburse our Manager for the salaries and other compensation of its personnel; provided, however, we are required to reimburse our Manager for the costs of the wages, salaries and benefits incurred by our Manager if our Manager elects to provide us with a dedicated Chief Financial Officer, Chief Operating Officer, Controller, in-house legal counsel, property managers and/or property management oversight professionals (or a pro rata portion of the costs of the wages, salaries and benefits incurred by our Manager with respect to such personnel, if our Manager elects to provide a partially dedicated Chief Financial Officer, Chief Operating Officer, Controller, in-house legal counsel, property managers and/or property management oversight professionals, based on the percentage of their working time and efforts spent on matters related to our company). The amount of any wages, salaries and benefits paid or reimbursed with respect to any dedicated or partially dedicated personnel that our Manager elects to provide to us will be subject to the approval of the compensation committee of our Board of Directors. |

| |

| Termination fee | | As described above, in the case of certain terminations and non-renewals of the management agreement, we will be required to pay our Manager a termination fee equal to the sum of (a) three times the sum of (i) the average annual base management fee and (ii) the average annual incentive compensation, in either case paid or payable to our Manager during the previous eight fiscal quarters ending on the last day of the latest fiscal quarter completed prior to the effective date of termination or non-renewal, or the final quarter, and (b) the difference between the final quarter adjusted incentive fee and any incentive fee actually paid with respect to the final quarter; provided, however, if eight fiscal quarters have not elapsed under the management agreement as of the last day of the final quarter, the average annual base management fee and the average annual incentive compensation paid or payable to our Manager for the second partial four fiscal quarter period shall be annualized when calculating the termination fee. For purposes of calculating the termination fee payable to our Manager, the final quarter adjusted incentive fee means the hypothetical incentive fee that would have been payable to our Manager with respect to the final quarter had Core Earnings included net unrealized gains and losses with respect to our assets. Net unrealized gains and losses for the final quarter will be calculated based on the fair market value of our assets as of the last day of the final quarter. We will have the right to defer paying all or a portion of the difference between the final quarter adjusted incentive fee and any incentive fee actually paid by us to our Manager with respect to the final quarter for a period of up to one year after the effective date of the termination or non-renewal; provided that any portion of the fee that has not been paid in cash within 90 days after the effective date of the termination or non-renewal will be made in the form of a one-year note that will bear interest from and after the 90th day following the effective date of the termination or non-renewal at an annual rate equal to the Wall Street Journal prime rate plus 5% until the amount has been paid in full. |

12

| | |

Type | | Description |

| Equity incentive plans | | Our equity incentive plans include provisions for grants of restricted common stock and other equity based awards to our officers and directors, our Manager and any officers or other personnel of our Manager or its affiliates who provide services to us. We have granted an aggregate of 209,819 LTIP units to our Manager and our independent directors. The grants to our Manager do not vest until both (i) our common stock has been listed on a national securities exchange and (ii) for any four full consecutive calendar quarters following the closing of our initial private placement, our Core Earnings for any such four-quarter period exceeds an 8% performance hurdle rate. The grants to our independent directors will vest at our 2013 annual meeting of stockholders. The LTIP unitholders are entitled to receive distributions with respect to these equity grants, whether or not vested, at the same time as distributions are paid to our common stockholders. Our Manager may allocate the LTIP units it received or receives in the future to our officers and other key employees of our Manager and its affiliates. |

See “Our Manager and the Management Agreement — The Management Agreement” for a detailed description of the terms of the Management Agreement.

Services Agreement

Upon completion of our initial private placement, our Manager entered into a services agreement with Ellington, pursuant to which Ellington provides to our Manager the personnel, services and resources as needed by our Manager to enable our Manager to carry out its obligations and responsibilities under the management agreement. We are a named third-party beneficiary under the services agreement and, as a result, will have, as a non-exclusive remedy, a direct right of action against Ellington in the event of any breach by our Manager of any of its duties, obligations or agreements under the management agreement that arise out of or result from any breach by Ellington of its obligations under the services agreement. The services agreement will terminate upon the termination of the management agreement. Pursuant to the services agreement, our Manager pays fees to Ellington, in connection with the services provided, in an amount equal to 50% of all fees paid or payable to our Manager pursuant to the management agreement and any termination fees received by our Manager upon termination of the management agreement.

Our Manager and Ellington are under common ownership and control. As a result, all management fee and incentive compensation earned by our Manager and all service agreement fees earned by Ellington accrue to the common benefit of the owners of our Manager and Ellington, namely EMG Holdings and VC Investments.

Conflicts of Interest; Equitable Allocation of Opportunities

Ellington expects to manage in the future non-permanent capital vehicles that have strategies that are similar to, or that overlap with, our strategy. However, Ellington and our Manager have agreed that for so long as the management agreement between us and our Manager is in effect, none of Ellington, our Manager or any of their affiliates will sponsor or manage any permanent capital vehicle that invests primarily in (i) SFR properties or (ii) SBMF loans. Ellington will make available to our Manager all opportunities to acquire assets that it determines, in its reasonable and good faith judgment, based on our objectives, policies and strategies, and other relevant factors, to be appropriate for us in accordance with Ellington’s written investment allocation policy, subject to the exception that we might not participate in each such opportunity, but will on an overall basis equitably participate with Ellington’s other accounts in all such opportunities. Ellington’s investment and risk management committee and its compliance committee (headed by its chief compliance officer) are responsible for monitoring the administration of, and facilitating compliance with, Ellington’s investment allocation policy.

In the event that Ellington is unable to buy as many of our target assets as will be required to satisfy the needs of all of Ellington’s accounts at that time, Ellington’s investment allocation policies and procedures typically allocate such assets to multiple accounts in proportion to their needs and available capital. Ellington may at times

13

allocate opportunities on a preferential basis to accounts that are in a “start-up” or “ramp-up” phase. The policies permit departure from such proportional allocation under certain circumstances, for example when such allocation would result in an inefficiently small amount of the security being purchased for an account or for assets that cannot be easily divided among accounts, including SBMF and SFR, our target asset classes. Such assets may be allocated on a rotational or otherwise equitable basis. In that case, the policies allow for a protocol of allocating assets so that, on an overall basis, each account is treated equitably. A departure from these policies would be permitted to allow us to maintain our exclusion from regulation as an investment company under the Investment Company Act, or to maintain compliance with other applicable regulations, guidelines or restrictions.

Other policies of Ellington that our Manager applies to the management of our company include controls for cross transactions (transactions between Ellington-managed accounts), principal transactions (transactions between Ellington and an Ellington-managed account), investments in other Ellington accounts and split price executions. See “Our Business and Investments — Conflicts of Interest; Equitable Allocation of Opportunities” for a more detailed description of these types of transactions and the policies of Ellington and our Manager that govern these types of transactions.

Our executive officers and the officers of our Manager are also officers and employees of Ellington and, with the exception of those officers that may be fully dedicated to us, we compete with other Ellington accounts for access to these individuals.

The management agreement with our Manager does not restrict the ability of its officers and employees from engaging in other business ventures of any nature, whether or not such ventures are competitive with our business.

Our Tax Status

We will elect and intend to be taxed as a REIT commencing with our taxable year ending December 31, 2013. Our qualification as a REIT, and maintenance of such qualification, will depend upon our ability to meet, on a continuing basis, various complex requirements under the Internal Revenue Code of 1986, as amended, or the Code, relating to, among other things, the sources of our gross income, the composition and values of our assets, our distributions to our stockholders and the concentration of ownership of our capital stock. We believe that we have been organized and have operated in conformity with the requirements for qualification and taxation as a REIT, and we intend to continue to operate in a manner that will enable us to meet the requirements for qualification and taxation as a REIT. In connection with this offering of our common stock, we will receive an opinion from Hunton & Williams LLP to the effect that we have been organized and have operated in conformity with the requirements for qualification and taxation as a REIT, and that our current and proposed method of operation will enable us to continue to meet the requirements for qualification and taxation as a REIT.

As a REIT, we generally will not be subject to U.S. federal income tax on the REIT taxable income that we currently distribute to our stockholders, but taxable income generated by our TRS and any other taxable REIT subsidiary that we may form or acquire will be subject to U.S. federal, state and local income tax. Under the Code, REITs are subject to numerous organizational and operational requirements, including a requirement that they distribute annually at least 90% of their REIT taxable income to their stockholders. If we failed to qualify as a REIT in any taxable year and did not qualify for certain statutory relief provisions, our income would be subject to U.S. federal income tax, and we would likely be precluded from qualifying for treatment as a REIT until the fifth calendar year following the year in which we failed to qualify. Even if we qualify as a REIT, we may still be subject to certain U.S. federal, state and local taxes on our income and assets and to U.S. federal income and excise taxes on our undistributed income.

Our Distribution Policy

To qualify as a REIT, we must distribute annually to our stockholders an amount at least equal to 90% of our REIT taxable income, determined without regard to the deduction for dividends paid and excluding any net capital gain. We currently expect to distribute substantially all of our REIT taxable income to our stockholders. We will be subject to income tax on our taxable income that is not distributed and to an excise tax to the extent that certain percentages of our taxable income are not distributed by specified dates. See “Material U.S. Federal Income Tax Considerations.” Income as computed for purposes of

14

the foregoing tax rules will not necessarily correspond to our income as determined for financial reporting purposes. Our cash available for distribution may be less than the amount required to meet the distribution requirements for REITs under the Code, and we may be required to borrow money, sell assets or make taxable distributions of our capital stock or debt securities to satisfy the distribution requirements. Additionally, we may pay future distributions from the proceeds from this offering or other securities offerings and thus all or a portion of such distributions may constitute a return of capital for U.S. federal income tax purposes.

The timing and frequency of distributions authorized by our Board of Directors and declared by us will be based upon a variety of factors deemed relevant by our Board of Directors, including restrictions under applicable law, capital requirements of our company and the REIT requirements of the Code. Distributions to our stockholders generally will be taxable to our stockholders as ordinary income, although a portion of such distributions may be designated by us as long-term capital gain or qualified dividend income or may constitute a return of capital. We will furnish annually to each of our stockholders a statement setting forth distributions paid during the preceding year and their U.S. federal income tax treatment. For a discussion of the U.S. federal income tax treatment of our distributions, see “Material U.S. Federal Income Tax Considerations.”

Summary Risk Factors

An investment in our common stock is subject to significant risks. Listed below are some of the most significant risks relating to an investment in our common stock.

| | • | | We are a recently organized corporation with a limited operating history and we may not be able to successfully operate our business or generate sufficient operating cash flows to make or sustain distributions to our stockholders. |

| | • | | We are an early entrant in an emerging industry, and the long-term viability of our investment strategy on an institutional scale is unproven. |

| | • | | We have many competitors and expect to encounter significant competition for acquisitions of our target assets and for quality tenants. |

| | • | | We have not identified specific acquisitions or other uses for the net proceeds from this offering. Therefore, you will be unable to evaluate the allocation of the net proceeds from this offering or the economic merits of our investments prior to making your investment decision to purchase our common stock. |

| | • | | Our investments will be concentrated in the SFR and multi-family residential real estate sectors, which could expose us to downturns in either of those sectors, and our business would be adversely affected by an economic downturn or other event impacting either of those sectors. |

| | • | | Our portfolio consists of properties that are geographically concentrated and any adverse developments in local economic conditions, the demand for single-family and multi-family rental homes in these markets or natural disasters may negatively affect our operating results. |

| | • | | We may acquire residential mortgage loans that are, or may become, sub-performing or non-performing loans, which would increase our risk of loss. |

| | • | | Residential mortgage loan modification and refinance programs, future legislative action, and other actions and changes may materially and adversely affect the supply of, value of, and the returns on, sub-performing and non-performing loans and other available properties that meet our investment criteria. |

| | • | | We rely on local, third-party service providers, and the level and consistency of the service we receive from, and our access to, these service providers cannot be guaranteed. |

15

| | • | | We rely on analytical models and other data to analyze potential asset acquisition and disposition opportunities and to manage our portfolio. Such models and other data may be incorrect, misleading or incomplete, which could cause us to purchase assets that do not meet our expectations or to make asset management decisions that are not in line with our strategy. |