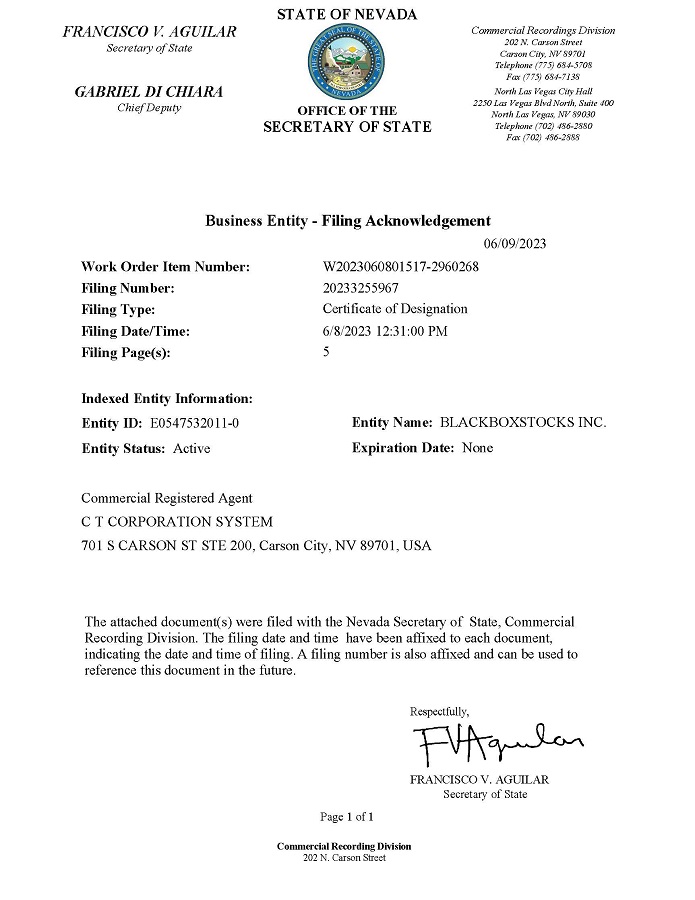

Exhibit 3.1

Annex A

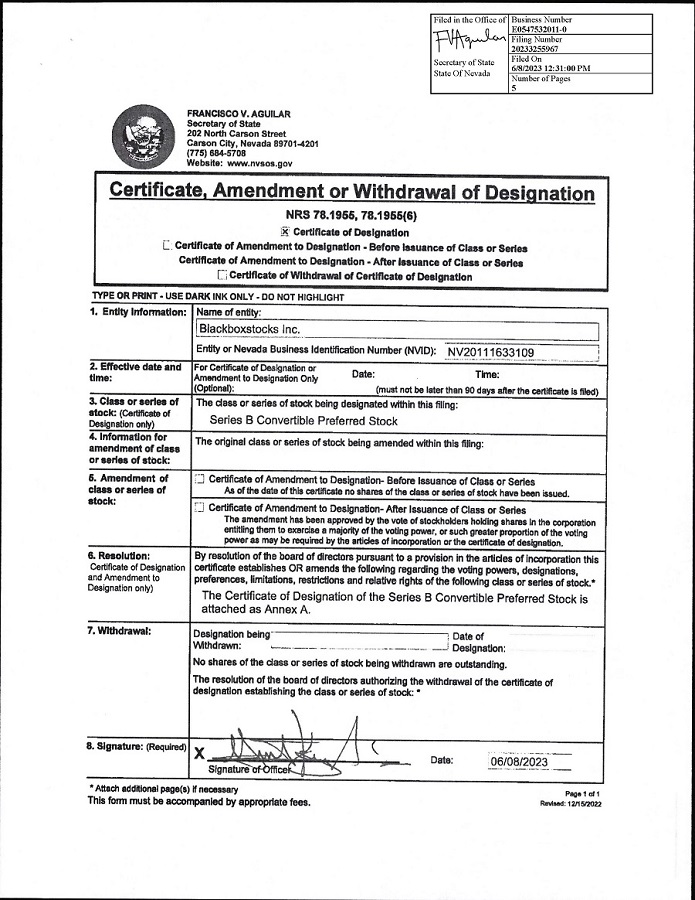

Certificate of Designation of

Series B Convertible Preferred Stock of

Blackboxstocks Inc.

Pursuant to Section 78.1955 of the

Nevada Revised Statutes

Blackboxstocks Inc., a Nevada corporation (the "Corporation"), does hereby certify that, pursuant to the authority contained in its Articles of Incorporation (“Articles”), as amended, and in accordance with the provisions of Section 78.1955 of the Nevada Revised Statutes (the “NRS”), the Corporation's Board of Directors has duly adopted the following resolutions creating a series of Preferred Stock designated as Series B Convertible Preferred Stock:

RESOLVED, that the Corporation hereby designates and creates a series of the authorized Preferred Shares of the Corporation, designated as Series B Convertible Preferred Stock, as follows:

FIRST: that, of the 10,000,000 Preferred Shares, having a par value of one-tenth of a cent ($0.001) per share ("Preferred Stock") authorized to be issued by the Corporation, 2,400,000 shares are hereby designated as "Series B Convertible Preferred Stock." The rights, preferences and limitations granted to and imposed upon the Series B Convertible Preferred Stock are as set forth below:

Section 1. Definitions. For the purposes hereof, the following terms shall have the following meanings:

“Common Stock” means the Corporation’s common stock, par value $0.001 per share.

“Conversion” shall have the meaning set forth in Section 6.

“Conversion Date” shall have the meaning set forth in Section 6(a).

“Conversion Period Commencement Date” means June 1, 2024.

“Conversion Shares” means, collectively, the shares of Common Stock issuable upon conversion of the shares of the Series B Preferred Stock in accordance with the terms hereof.

“Exchange Agreement” means the Securities Exchange Agreement, dated as of June 9, 2023, between the Corporation and Evtec Group Limited, as amended, modified or supplemented from time to time in accordance with its terms.

“Information Statement” means the information statement to be filed by the Corporation pursuant to the Exchange Agreement in order to inform stockholders of the Stockholder Approval.

“Notice of Conversion” shall have the meaning set forth in Section 6(a).

“Original Issue Date” means the date of the first issuance of any shares of the Series B Preferred Stock under the terms of the Exchange Agreement.

“Series B Preferred Stock” means the Corporation’s Series B Convertible Preferred Stock, par value $0.001 per share.

“Stockholder Approval” means such approval as may be required by the applicable rules and regulations of the Nasdaq Stock Market (or any successor entity) from the stockholders of the Corporation with respect to the transactions contemplated by the Exchange Agreement, including the issuance of all of the Conversion Shares in excess of 20% of the issued and outstanding Common Stock on the Original Issue Date.

Section 2. Designation and Amount. 2,400,000 shares of Preferred Stock of the Corporation are hereby designated as "Series B Convertible Preferred Stock."

Section 3. No Dividends. No dividends shall be paid or payable on the Series B Preferred Stock.

Section 4. Voting Rights. Except as required by law, or the Bylaws of the Company, holders of Series B Preferred Stock shall have no voting rights. However, for as long as any shares of Series B Preferred Stock are outstanding, the Corporation shall not, without the affirmative vote of the holders of a majority of the then outstanding shares of the Series B Preferred Stock, (i) alter or change adversely the powers, preferences or rights given to the Series B Preferred Stock or alter or amend this Certificate of Designation, (ii) amend its articles of incorporation or other charter documents in any manner that adversely affects any rights of the holders of Series B Preferred Stock, or (iii) enter into any agreement with respect to any of the foregoing.

Section 5. Liquidation. Upon any liquidation, dissolution or winding-up of the Corporation, whether voluntary or involuntary (a “Liquidation”), the entire remaining assets and funds of the Corporation legally available for distribution, if any, shall be distributed among the holders of Common Stock and the Series B Preferred Stock in proportion to the shares of Common Stock then held by them and the shares of Common Stock which they then have the right to acquire upon conversion of the shares of Series B Preferred Stock then held by them.

Section 6. Conversion. Holders of Series B Preferred Stock shall have the following rights with respect to the conversion (“Conversion”) of the Series B Preferred Stock into shares of Common Stock:

(a) Conversions at Option of Holder. Subject to and in compliance with the provisions of this Section 4, upon the latest date of (i) the Conversion Period Commencement Date, (ii) the date upon which the Corporation has received Stockholder Approval with respect to the issuance of all of the Conversion Shares in excess of 20% of the issued and outstanding Common Stock on the Original Issue Date, as provided in the Information Statement, each share of Series B Preferred Stock may, at the option of the holder, be converted into one (1) fully paid and non-assessable share of Common Stock, upon notice (a “Notice of Conversion”) to the Corporation. The holders shall effect conversions by providing the Corporation with a Notice of Conversion that shall specify the number of shares of Series B Preferred Stock to be converted, the number of shares of Series B Preferred Stock owned prior to the conversion at issue, the number of shares of Series B Preferred Stock owned subsequent to the conversion at issue and the date on which such conversion is to be effected, which date may not be prior to the date the holder delivers such Notice of Conversion to the Corporation (the “Conversion Date”). If no Conversion Date is specified in a Notice of Conversion, the Conversion Date shall be the date that such Notice of Conversion to the Corporation is deemed delivered hereunder. To effect conversions, as the case may be, of shares of Series B Preferred Stock, a holder shall not be required to surrender the certificate(s) representing such shares of Series B Preferred Stock to the Corporation unless all of the shares of Series B Preferred Stock represented thereby are so converted, in which case the holder shall deliver the certificate representing such shares of Series B Preferred Stock promptly following the Conversion Date at issue.

(b) Conversion Limits. Notwithstanding anything to the contrary herein, the holder of Series B Preferred Stock may not effectuate any Conversion and the Company may not issue any shares of Common Stock in connection therewith that would trigger any Nasdaq requirement to obtain Stockholder Approval prior to a Conversion or any issuance of shares of Common Stock in connection therewith that would be in excess of that number of shares of Common Stock equivalent to 19.99% of the number of shares of Common Stock as of the date hereof (the “Nasdaq Threshold”); provided, however, that the holder may effectuate any Conversion and the Company shall be obligated to issue shares of Common Stock in connection therewith that would not trigger such a requirement. This restriction shall be of no further force or effect upon Stockholder Approval obtained in compliance with Nasdaq's stockholder voting requirements. Notwithstanding anything to the contrary contained herein, in the event that Stockholder Approval is obtained by consent or authorization of the Corporation’s stockholders, the holder may not effectuate any Conversion and the Corporation shall not issue any shares of Common Stock in connection therewith in excess of the Nasdaq Threshold until an Information Statement has been filed with respect to such Stockholder Approval and the requisite time period has elapsed after the Information Statement has been sent or made available to the Corporation’s stockholders for the Stockholder Approval to become effective for Conversions in excess of the Nasdaq Threshold.

(c) Mechanics of Conversion.

(i) Delivery of Certificate Upon Conversion. Not later than three Trading Days after each Conversion Date (the “Share Delivery Date”), the Corporation shall deliver or cause to be delivered to the holder a certificate or certificates representing the number of shares of Common Stock being acquired upon the conversion of shares of Series B Preferred Stock. “Trading Day” shall mean a day in which the Common Stock is traded on a Trading Market. “Trading Market” means the following markets or exchanges on which the Common Stock is listed or quoted for trading on the date in question: the Nasdaq Capital Market, the Nasdaq Global Market, the Nasdaq Global Select Market, the American Stock Exchange, the New York Stock Exchange, the OTC Bulletin Board or the Pink Sheets, LLC.

(ii) Fractional Shares. Upon a conversion hereunder, the Corporation shall not be required to issue stock certificates representing fractions of shares of the Common Stock, but may if otherwise permitted, make a cash payment in respect of any final fraction of a share. If the Corporation elects not, or is unable, to make such a cash payment, the holder shall be entitled to receive, in lieu of the final fraction of a share, one whole share of Common Stock.

(iii) Adjustment for Reclassification, Exchange and Substitution. If at any time or from time to time after the Common Stock issuable upon the Conversion of the Series B Preferred Stock is changed into the same or a different number of shares of any class or classes of stock, whether by recapitalization, reclassification, reverse split or otherwise, each holder of Series B Preferred Stock shall have the right, but not the obligation, thereafter to convert such stock into the kind and amount of stock and other securities and property receivable upon such recapitalization, reclassification, reverse split or other change by holders of the maximum number of shares of Common Stock into which such shares of Series B Preferred Stock could have been converted immediately prior to such recapitalization, reclassification or change, all subject to further adjustment as provided herein or with respect to such other securities of property by the terms thereof.

(iv) Reorganizations, Mergers, Consolidations or Sales of Assets. If at any time or from time to time after the date of issuance of the Series B Preferred Stock, there is a capital reorganization of the Common Stock (other than a transaction provided for elsewhere in this Section 6), as a part of such capital reorganization, provision shall be made so that the holders of the Series B Preferred Stock shall thereafter be entitled to receive upon conversion of the Series B Preferred Stock the number of shares of stock or other securities or property of the Corporation to which a holder of the number of shares of Common Stock deliverable upon conversion would have been entitled on such capital reorganization, subject to adjustment in respect of such stock or securities by the terms thereof.

Section 7. Reacquired Shares. Any shares of Series B Preferred Stock purchased or otherwise acquired by the Corporation in any manner whatsoever shall be retired and cancelled promptly after the acquisition thereof. All such shares shall upon their cancellation become authorized but unissued shares of Preferred Stock and may be reissued as part of a new series of preferred stock to be created by resolution or resolutions of the Board of Directors, subject to the conditions and restrictions on issuance set forth herein.

SECOND: That such determination of the designation, rights, preferences and limitations relating to the Series B Preferred Stock, was duly made by the Board of Directors pursuant to the provisions of the Articles of the Corporation, and in accordance with the provisions of NRS 78.1955.

IN WITNESS WHEREOF, the Corporation has caused this Designation to be duly executed to be effective June 8, 2023.

| Blackboxstocks Inc. | |

| | | |

| | | |

| By: | /s/ Gust Kepler | |

| | Gust Kepler | |

| | President and Chief Executive Officer | |