- SILA Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Sila Realty Trust (SILA) 424B3Prospectus supplement

Filed: 24 Jul 14, 12:00am

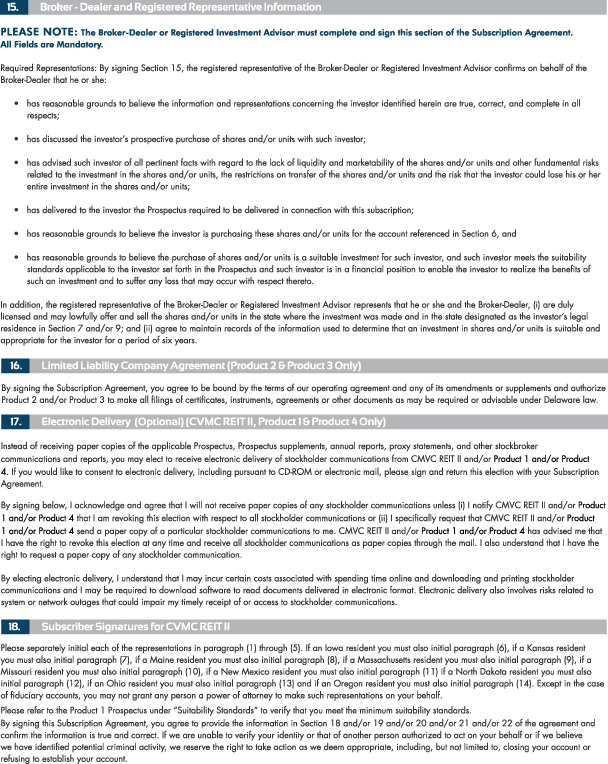

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-191706

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

SUPPLEMENT NO. 2 DATED JULY 24, 2014

TO THE PROSPECTUS DATED JUNE 27, 2014

This document supplements, and should be read in conjunction with, the prospectus of Carter Validus Mission Critical REIT II, Inc. (the “Company”), dated June 27, 2014 and Supplement No. 1, dated July 7, 2014. Unless otherwise defined in this prospectus supplement, capitalized terms used in this prospectus supplement shall have the same meanings as set forth in the prospectus.

The purpose of this prospectus supplement is to describe the following:

| (1) | the status of the offering of shares of common stock of the Company; |

| (2) | the declaration of distributions to our stockholders; |

| (3) | clarification related to management compensation regarding disposition and property management fees; |

| (4) | clarification related to investor suitability standards regarding Pennsylvania requirements; |

| (5) | clarification relating to ability of the board of directors to revise our investment objectives and strategies; and |

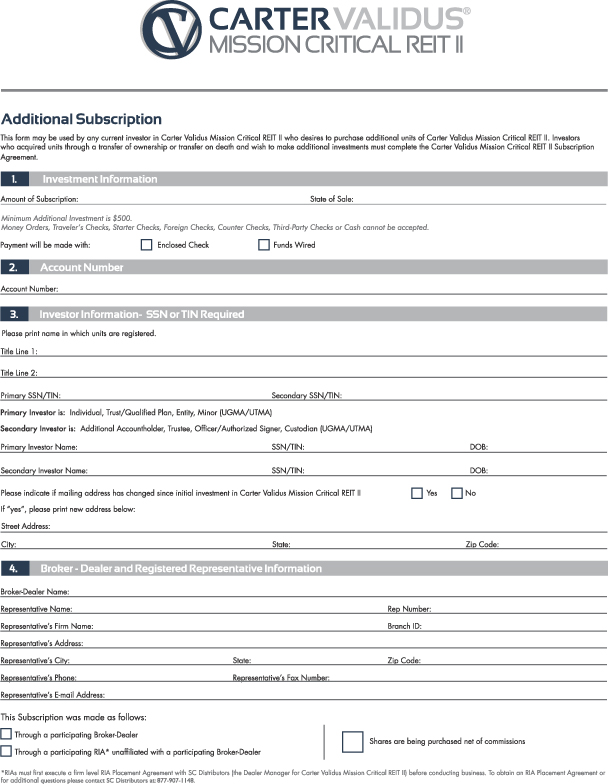

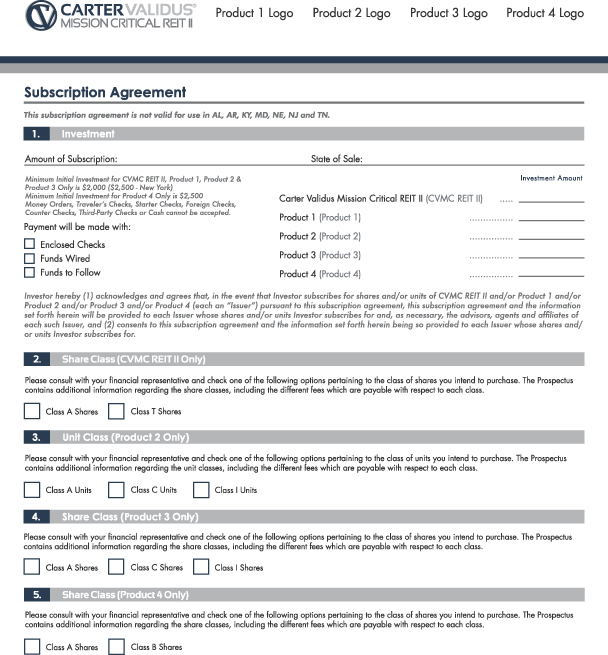

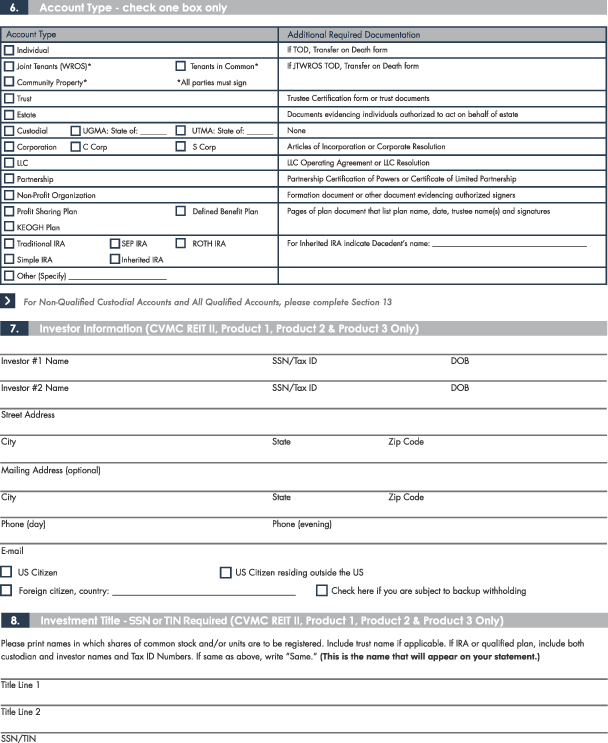

| (6) | revised forms of subscription agreements. |

Status of Our Public Offering

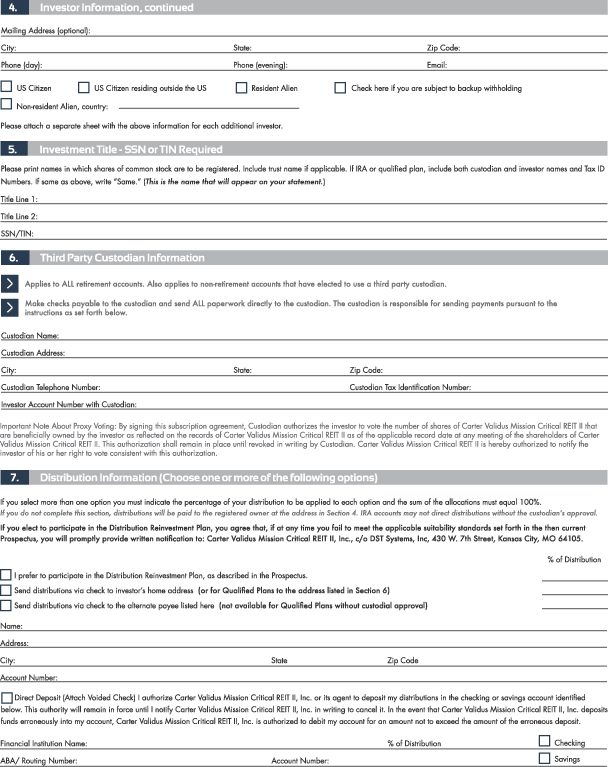

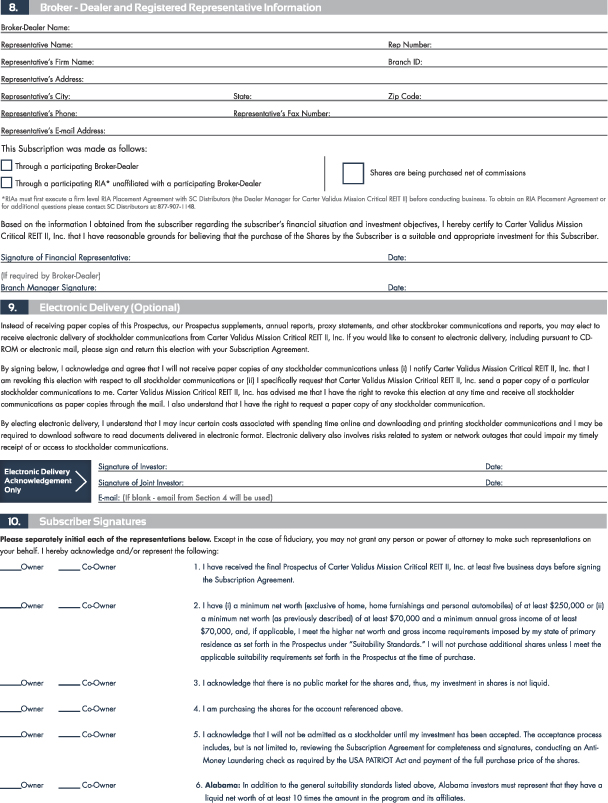

We commenced our initial public offering of $2,350,000,000 of shares of our common stock, consisting of up to $2,250,000,000 of shares in our primary offering and up to $100,000,000 of shares pursuant to our distribution reinvestment plan, on May 29, 2014. We are publicly offering two classes of shares of common stock, Class A shares and Class T shares, in any combination with a dollar value up to the maximum offering amount. As of July 24, 2014, we had accepted investors’ subscriptions for and issued approximately 218,333 shares of Class A common stock in the offering, resulting in receipt of gross proceeds of approximately $2,050,000. In addition, we have special escrow requirements for subscriptions from residents of Pennsylvania and Washington, the conditions of which, to date, have not been satisfied. As of July 24, 2014, we had approximately $2,247,950,000 in Class A shares and Class T shares of common stock remaining in our primary offering.

Declaration of Distributions

The following information should be read in conjunction with the discussion contained in the “Prospectus Summary – Distribution Policy” section on page 14 of the prospectus and the “Description of Securities – Distribution Policy and Distributions” section on page 157 of the prospectus:

On July 16, 2014, the board of directors of the Company approved and authorized a daily distribution to the Company’s stockholders of record as of the close of business on each day of the period commencing on the closing date of its first property acquisition and ending on August 31, 2014. The distributions will be calculated based on 365 days in the calendar year and will be equal to $0.001753425 per share of Class A and Class T common stock. The distributions for each record date in July 2014 and August 2014 would be paid in August 2014 and September 2014, respectively. The distributions will be payable to stockholders from legally available funds therefor.

Management Compensation

The following information replaces in its entirety the discussion related to property management and leasing fees contained in the “Prospectus Summary – Compensation to Our Adviser and its Affiliates” section beginning on page 17 of the prospectus and the “Management Compensation” section beginning on page 88 of the prospectus:

Property Management and Leasing Fees – Carter Validus Real Estate Management Services II, LLC | In connection with the rental, leasing, operation and management of our properties, we will pay our property manager and its affiliates aggregate fees equal to 3.0% of gross revenues from the properties managed. We also will reimburse the property manager and its affiliates for property-level expenses that any of them pay or incur on our behalf, including salaries, bonuses and benefits of persons employed by the property manager and its affiliates except for the salaries, bonuses and benefits of persons who also serve as one of our executive officers. Our property manager and its affiliates may subcontract the performance of their duties to third parties and pay all or a portion of the property management fee to the third parties with whom they contract for these services. If we contract directly with third parties for such services, we will pay them customary market fees and will pay Carter Validus Real Estate Management Services II, LLC an oversight fee equal to 1.0% of the gross revenues of the property managed. In no event will we pay our property manager or any affiliate both a property management fee and an oversight fee with respect to any particular property. | Not determinable at this time. Because the fee is based on a fixed percentage of gross revenue and/or market rates, there is no maximum dollar amount of this fee. |

The following information replaces in its entirety the discussion related to disposition fees contained in the “Prospectus Summary – Compensation to Our Adviser and its Affiliates” section beginning on page 17 of the prospectus:

Disposition Fees – Carter Validus Advisors II, LLC | If our advisor or its affiliates provides a substantial amount of services (as determined by a majority of our independent directors) in connection with the sale of properties, we will pay our advisor a disposition fee, up to the lesser of 1.0% of the contract sales price and one-half of the total brokerage commission paid if a third party broker is also involved; provided, however, that in no event may the disposition fees paid to our advisor, its affiliates and unaffiliated third parties exceed the lesser of 6.0% of the contract sales price and a reasonable, customary and competitive real estate commission in light of the size, type and location of the property. | Not determinable at this time. Because the disposition fees are based on a fixed percentage of the contract price for a sold property, there is no maximum dollar amount of these commissions. |

The following information replaces in its entirety the second full paragraph on page 83 of the prospectus contained in the “Management – The Advisory Agreement” section of the prospectus:

If our advisor or its affiliates provides a substantial amount of services (as determined by a majority of our independent directors) in connection with the sale of properties, we will pay our advisor or its affiliate a disposition fee paid on the sale of property, up to the lesser of 1.0% of the contract sales price and one-half of the total brokerage commission paid if a third party broker is also involved.

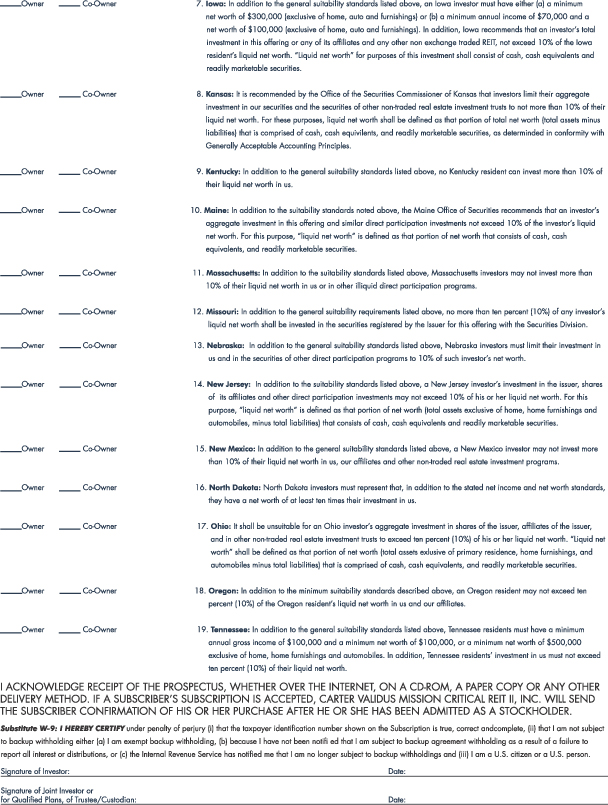

Investor Suitability Standards

The following information replaces in its entirety the investor suitability standard for Pennsylvania found on page ii of the prospectus to clarify that the proceeds from Pennsylvania investors will not be released until we have an aggregate of $112,500,000 in subscriptions from this offering:

Pennsylvania.Because the minimum closing amount is less than $225,000,000, you are cautioned to carefully evaluate the program’s ability to fully accomplish its stated objectives and inquire as to the current dollar volume of the program subscriptions. We will not release any proceeds received from Pennsylvania investors from escrow until we have an aggregate of $112,500,000 in subscriptions. See the section entitled “Special Notice to Pennsylvania Investors” on page 184 of this prospectus.

Risk Factors

The following information replaces in its entirety the risk factor on page 38 of the prospectus entitled “Our board of directors may change our investment policies without stockholder approval, which could alter the nature of your investments.”:

Our board of directors may change our investment objectives and strategies without stockholder approval, which could alter the nature of your investments.

Our charter requires that our independent directors review our investment policies at least annually to determine that the policies we are following are in the best interest of the stockholders. These policies may change over time. The methods of implementing our investment policies also may vary, as new real estate development trends emerge and new investment techniques are developed. Except to the extent that policies and investment limitations are included in our charter, our investment objectives and strategies, the methods for their implementation, and our other objectives, policies and procedures may be altered by our board of directors without the approval of our stockholders. As a result, the nature of your investment could change without your consent.

Management

The following information replaces in its entirety the fourth full paragraph on page 71 of the prospectus contained in the “Management – General” section of the prospectus:

In general, a majority of our independent directors are required to approve matters relating to minimum capital, duties of our directors, the advisory agreement, liability and indemnification of our directors, advisor and affiliates, advisor and affiliate fees, compensation and expenses, investment objectives and strategies, leverage and borrowing policies, meetings of stockholders, stockholders’ election of directors, and our distribution reinvestment plan.

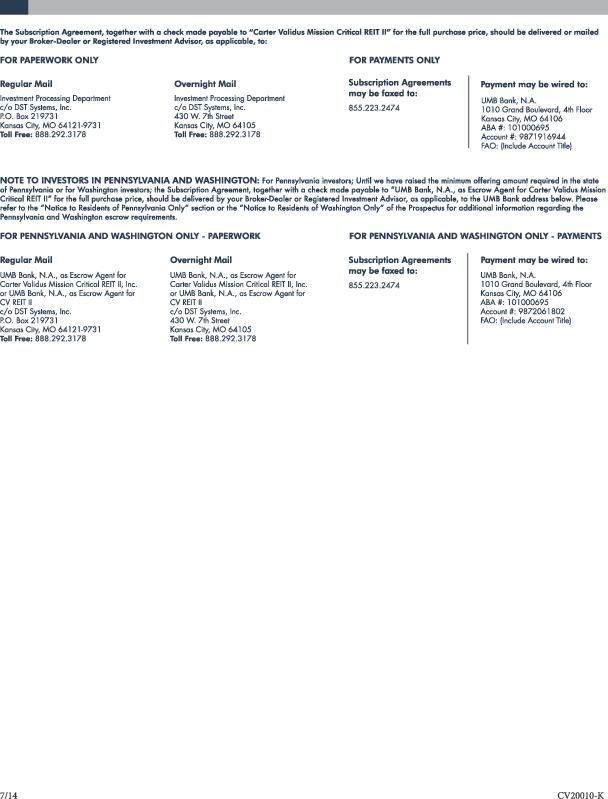

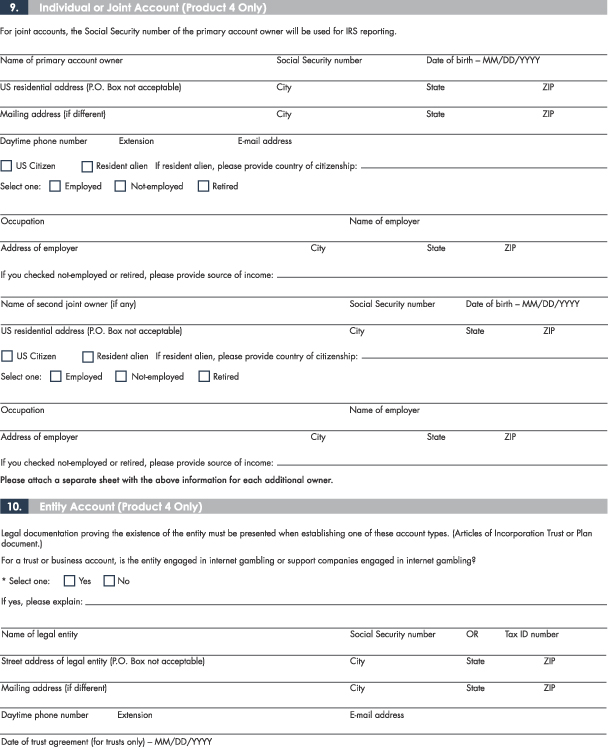

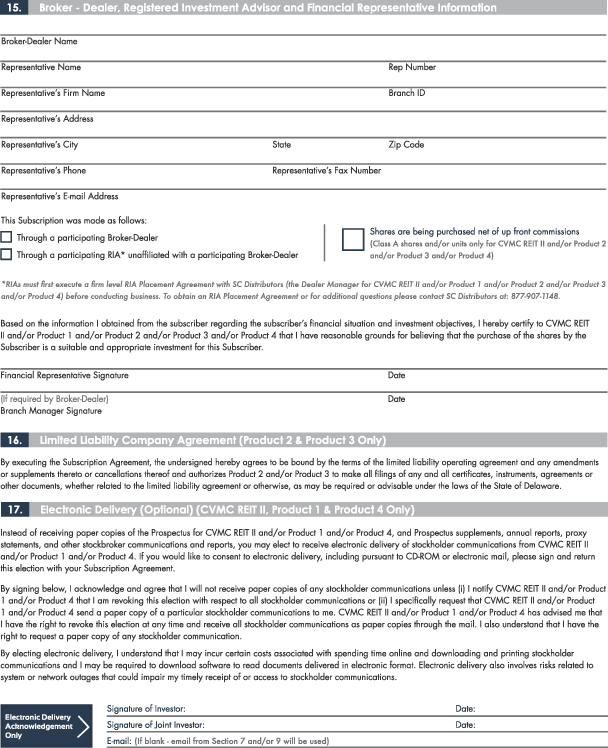

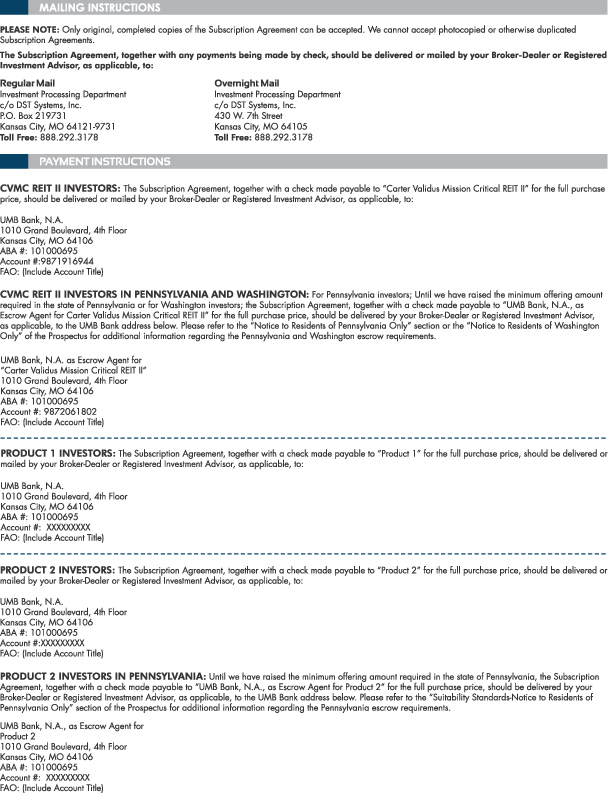

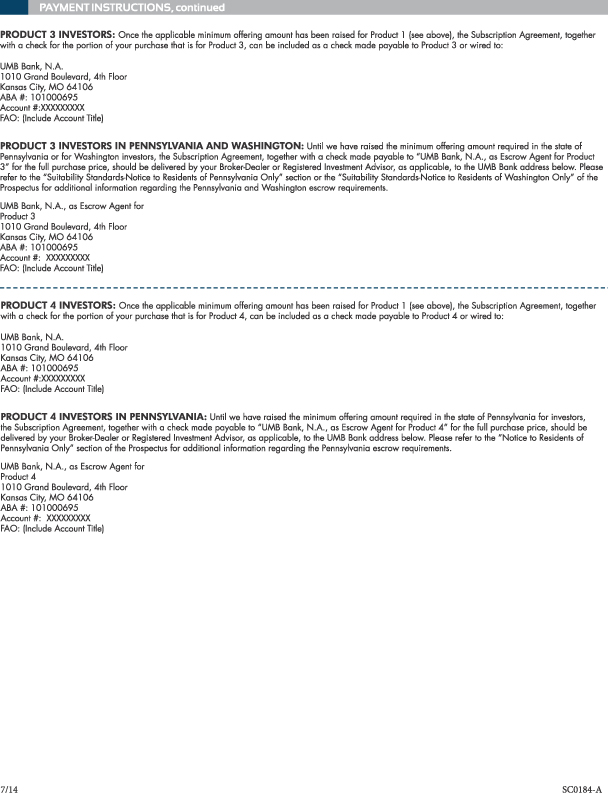

B-1

B-2

B-3

B-4

B-5

B-6

B-7

B-8

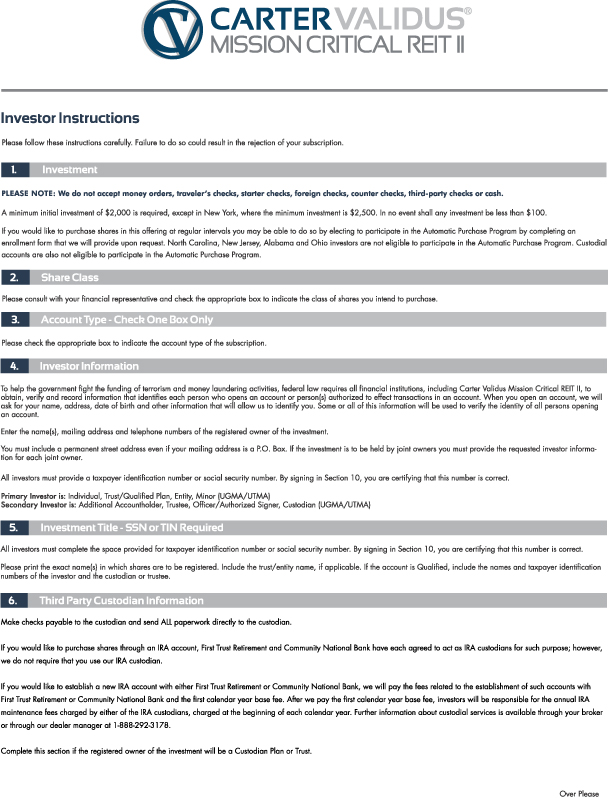

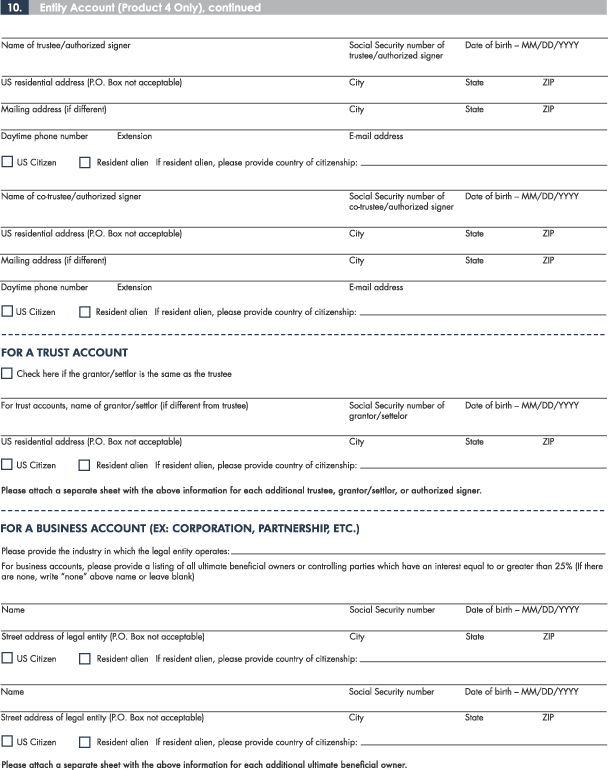

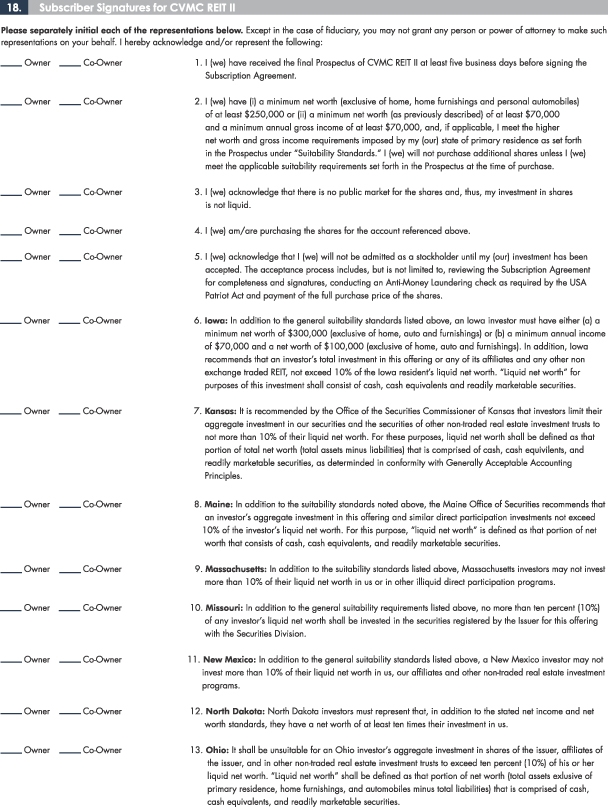

C-1

C-2

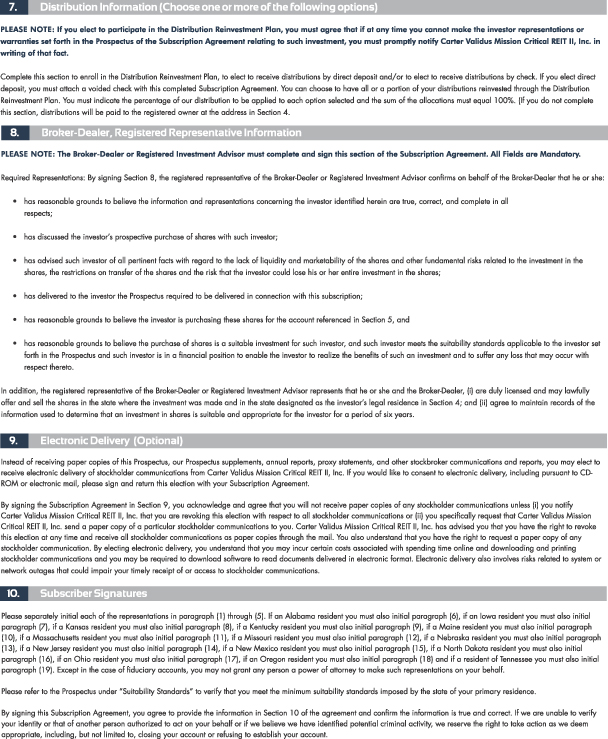

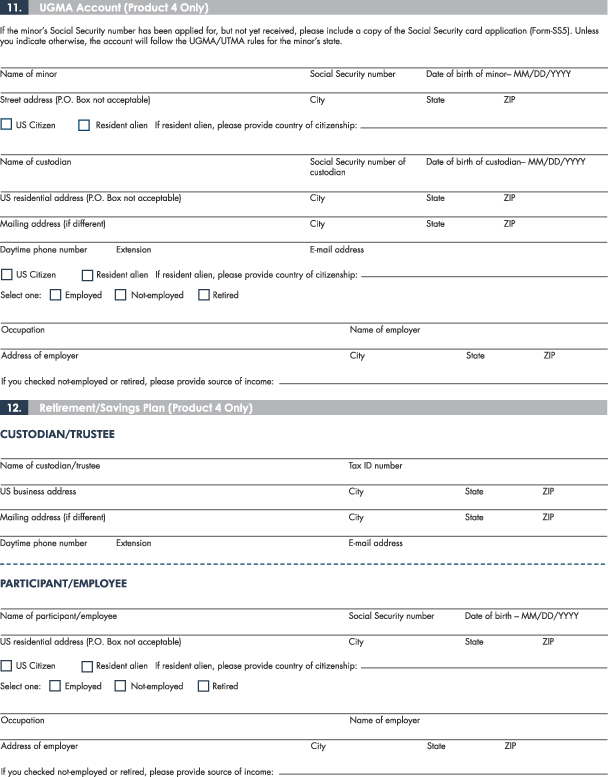

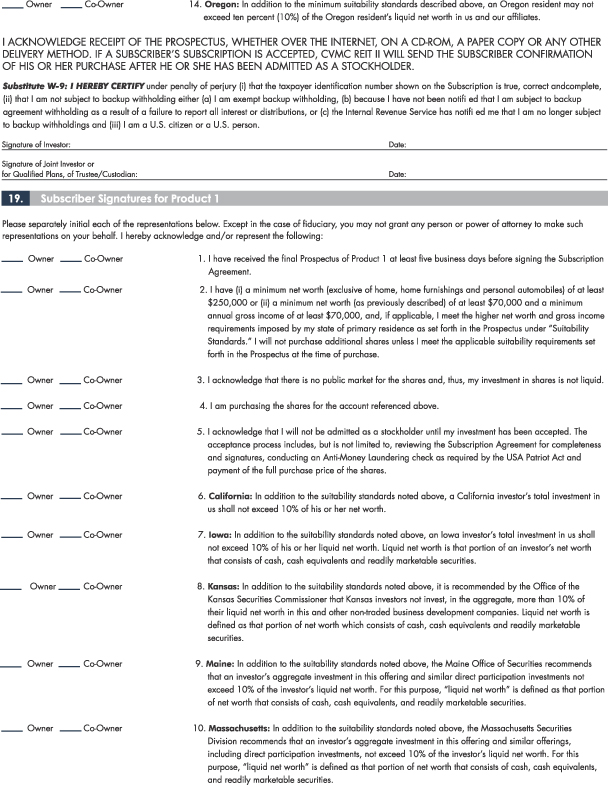

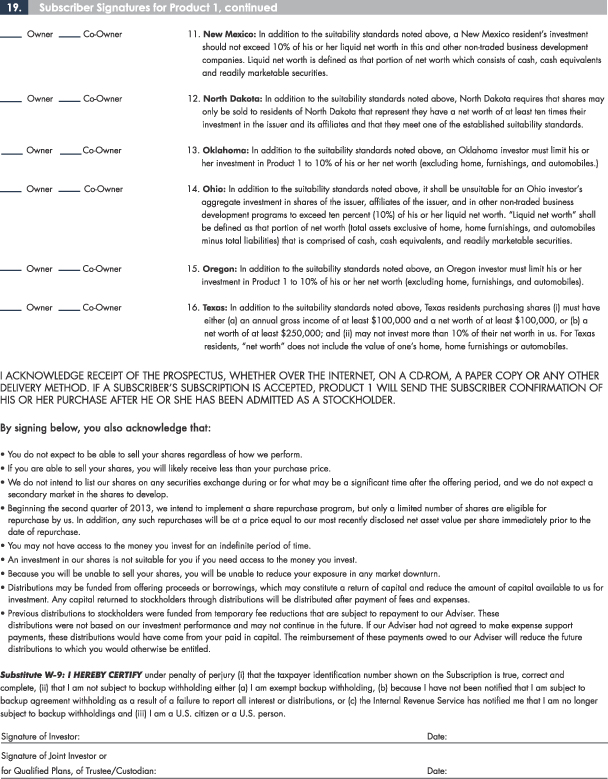

E-1

E-2

E-3

E-4

E-5

E-6

E-7

E-8

E-9

E-10

E-11

E-12

E-13

E-14

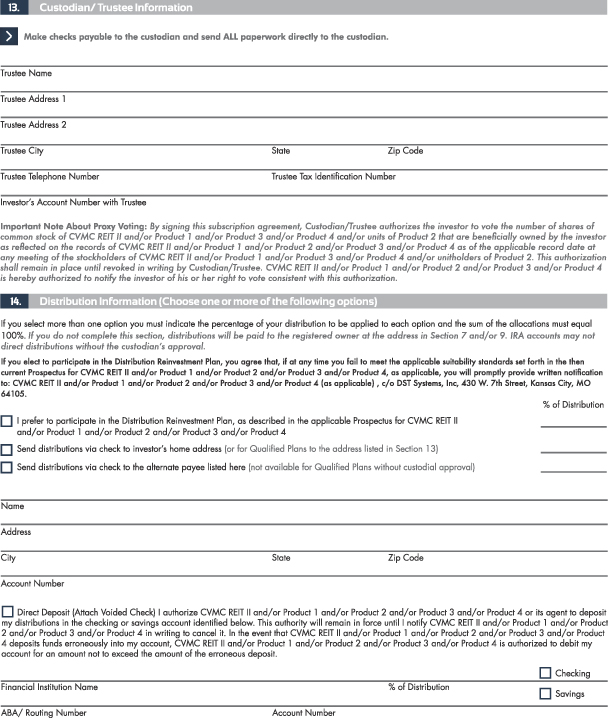

E-15

E-16

E-17

E-18

E-19

E-20

E-21

E-22