- SILA Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Sila Realty Trust (SILA) 424B3Prospectus supplement

Filed: 8 Jan 15, 12:00am

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-191706

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

SUPPLEMENT NO. 10 DATED JANUARY 8, 2015

TO THE PROSPECTUS DATED JUNE 27, 2014

This document supplements, and should be read in conjunction with, the prospectus of Carter Validus Mission Critical REIT II, Inc., dated June 27, 2014, Supplement No. 6, dated October 30, 2014, which superseded and replaced all previous supplements to the prospectus, Supplement No. 7, dated November 12, 2014, Supplement No. 8, dated November 19, 2014, and Supplement No. 9, dated December 23, 2014. Unless otherwise defined in this prospectus supplement, capitalized terms used in this prospectus supplement shall have the same meanings as set forth in the prospectus.

The purpose of this prospectus supplement is to describe the following:

| (1) | the status of our initial public offering of shares of common stock; |

| (2) | the completion of our acquisition of the New England Sinai Medical Center; |

| (3) | the completion of our acquisition of the Baylor Surgical Hospital at Fort Worth; |

| (4) | the completion of our acquisition of the Baylor Surgical Hospital Integrated Medical Facility; and |

| (5) | revised forms of subscription agreements. |

Status of Our Public Offering

We commenced our initial public offering of $2,350,000,000 of shares of our common stock (the “Offering”), consisting of up to $2,250,000,000 of shares in our primary offering and up to $100,000,000 of shares pursuant to our distribution reinvestment plan, on May 29, 2014. We are publicly offering two classes of shares of common stock, Class A shares and Class T shares, in any combination with a dollar value up to the maximum offering amount. As of January 7, 2015, we had accepted investors’ subscriptions for and issued approximately 7,624,000 shares of Class A common stock in the Offering, resulting in receipt of gross proceeds of approximately $75,576,000. In addition, we have special escrow requirements for subscriptions from residents of Pennsylvania, the conditions of which, to date, have not been satisfied. As of January 7, 2015, we had approximately $2,274,424,000 in Class A shares and Class T shares of common stock remaining in our Offering.

Acquisition of the New England Sinai Medical Center, the Baylor Surgical Hospital at Fort Worth and the Baylor Surgical Hospital Integrated Medical Facility

The following information should be read in conjunction with the discussion contained in the “Prospectus Summary—Our Investment Objectives” section on page 8 of the prospectus and the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section beginning on page 117 of the prospectus:

On December 23, 2014, we, through a wholly-owned subsidiary of our operating partnership, Carter Validus Operating Partnership II, LP (“CVOP II”), acquired 100% of the fee simple interest in a 180,744 rentable square foot medical facility property (the “New England Sinai Medical Center”), located in the Boston-Cambridge-Quincy, Massachusetts metropolitan area, for a purchase price of $23,398,100, plus closing costs. The seller, New England Sinai Hospital, A Steward Family Hospital, Inc. (“Sinai”), is not affiliated with us, our advisor or our respective affiliates. We funded the purchase of the New England Sinai Medical Center using net proceeds from the Offering. In connection with the acquisition, we paid an acquisition fee of $526,400, which is the sum of 2% of the purchase price of the property and 2% of estimated future capital improvements of approximately $2,922,000, to our advisor.

On December 31, 2014, we, through a wholly-owned subsidiary of CVOP II, acquired 100% of the fee simple interest in a 83,464 rentable square foot medical facility property (the “Baylor Surgical Hospital at Fort Worth”), located in the Dallas/Fort Worth, Texas metropolitan area, for a purchase price of $48,210,548, plus closing costs. The seller, Fort Worth Hospital Real Estate, LP, is not affiliated with us, our advisor, or our respective affiliates. We funded the purchase of the Baylor Surgical Hospital at Fort Worth using net proceeds from the Offering and the KeyBank Credit Facility (as defined below). In connection with the acquisition, we paid an acquisition fee of $964,211, or 2% of the purchase price, to our advisor.

On December 31, 2014, we, through a wholly-owned subsidiary of CVOP II, acquired 100% of the fee simple interest in a 8,268 rentable square foot medical facility property (the “Baylor Surgical Hospital Integrated Medical Facility”), located in the Dallas/Fort Worth, Texas metropolitan area, for a purchase price of $2,340,000, plus closing costs. The seller, 1800 Park Place Partners, LLC, is not affiliated with us, our advisor, or our respective affiliates. We funded the purchase of the Baylor Surgical Hospital Integrated Medical Facility using net proceeds from the Offering. In connection with the acquisition, we paid an acquisition fee of $46,800, or 2% of the purchase price, to our advisor.

Description of the Properties

The New England Sinai Medical Center consists of two buildings, which were constructed in 1967 and 1973, respectively. On December 23, 2014, we entered into a lease agreement with Sinai. Sinai is the sole tenant of the New England Sinai Medical Center.

The Baylor Surgical Hospital at Fort Worth was constructed in 2014. As of December 31, 2014, the Baylor Surgical Hospital at Fort Worth was 100% leased to Fort Worth Surgicare Partners, Ltd., (“Fort Worth Surgicare”). Fort Worth Surgicare is the sole tenant of the Baylor Surgical Hospital at Fort Worth.

The Baylor Surgical Hospital Integrated Medical Facility was constructed in 2014. As of December 31, 2014, the Baylor Surgical Hospital Integrated Medical Facility was leased to two tenants: Fort Worth Surgicare and THVG Bariatric, LLC.

In evaluating the New England Sinai Medical Center, the Baylor Surgical Hospital at Fort Worth and the Baylor Surgical Hospital Integrated Medical Facility as potential acquisitions and determining the appropriate amount of consideration to be paid for such acquisitions, a variety of factors were considered, including the property condition and environmental reports, physical condition and curb appeal, age, location, including visibility and access, tenant creditworthiness, the operators of the facilities, lease terms, including rent, rent increases, length of lease term, specific tenant and landlord responsibilities, renewal options, expansion, termination, purchase options, exclusive and permitted use provisions, assignment, sublease and co-tenancy provisions, local market conditions, demographics and population growth patterns, neighboring properties, the potential for new property construction in the area and whether there were any anticipated required capital improvements.

The following table summarizes the acquisitions of the New England Sinai Medical Center, the Baylor Surgical Hospital at Fort Worth and the Baylor Surgical Hospital Integrated Medical Facility:

Property Description | Date Acquired | Year Built | Purchase Price | Fees Paid to Sponsor(1) | Initial Yield(2) | Average Yield(3) | Physical Occupancy | |||||||||||||||||||||

New England Sinai Medical Center | 12/23/2014 | 1967/1973 | $ | 23,398,100 | $ | 526,400 | 8.50 | % | 10.16 | % | 100.00 | % | ||||||||||||||||

Baylor Surgical Hospital at Fort Worth | 12/31/2014 | 2014 | $ | 48,210,548 | $ | 964,211 | 6.73 | % | 8.00 | % | 100.00 | % | ||||||||||||||||

Baylor Surgical Hospital Integrated Medical Facility | 12/31/2014 | 2014 | $ | 2,340,000 | $ | 46,800 | 6.93 | % | 7.80 | % | 87.31 | % | ||||||||||||||||

| (1) | Fees paid to the sponsor include payments made to an affiliate of our advisor for acquisition fees in connection with the property acquisition. It does not include fees paid to any property manager, including our affiliated property manager. For more detailed information on fees paid to our advisor or its affiliates, see the section captioned “Management Compensation” beginning on page 88 of the prospectus. |

| (2) | Initial yield is calculated as the current annualized rental income for the in-place lease at the property divided by the property purchase price adjusted for certain seller credits, exclusive of acquisition costs and |

2

| fees paid to our advisor or its affiliates. The property is subject to a long-term net lease. Accordingly, our management believes that current annualized rental income is a more appropriate figure from which to calculate initial yield than net operating income. |

| (3) | Average yield is calculated as the average annual rental income, adjusted for any rent incentives, for the in-place lease over the non-cancellable lease term at the property divided by the property purchase price adjusted for certain seller credits, exclusive of acquisition costs and fees paid to our advisor or its affiliates. The property is subject to a long-term net lease. Accordingly, our management believes that average annual rental income is a more appropriate figure from which to calculate average yield than net operating income. |

We believe the New England Sinai Medical Center, the Baylor Surgical Hospital at Fort Worth and the Baylor Surgical Hospital Integrated Medical Facility are suitable for their present and intended purposes as medical facilities and adequately covered by insurance.

The New England Sinai Medical Center is located in the Boston-Cambridge-Quincy, Massachusetts metropolitan area, and as such may compete with other medical facilities for tenants if the current tenant lease is not renewed.

The Baylor Surgical Hospital at Fort Worth is located in the Dallas/Fort Worth, Texas metropolitan area, and as such may compete with other medical facilities for tenants if the current tenant lease is not renewed.

The Baylor Surgical Hospital Integrated Medical Facility is located in the Dallas/Fort Worth, Texas metropolitan area, and as such may compete with other medical facilities for tenants if the current tenant lease is not renewed.

We will pay an affiliate of our advisor a property management and leasing fee of 3% of the gross monthly revenues derived from the operations of the New England Sinai Medical Center, the Baylor Surgical Hospital at Fort Worth and the Baylor Surgical Hospital Integrated Medical Facility. Among other things, the property manager will have the authority to negotiate and enter into leases for the New England Sinai Medical Center, the Baylor Surgical Hospital at Fort Worth and the Baylor Surgical Hospital Integrated Medical Facility on our behalf, to incur costs and expenses, to pay property operating costs and expenses from property cash flow or reserves and to require that we provide sufficient funds for the payment of operating expenses. Our other affiliates may receive additional fees or compensation as a result of the acquisition of the New England Sinai Medical Center, the Baylor Surgical Hospital at Fort Worth and the Baylor Surgical Hospital Integrated Medical Facility in accordance with the compensation provisions described in the prospectus.

Tenant Lease Terms

The following information should be read in conjunction with the discussion contained in the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section on page 117 of the prospectus:

The following table shows, as of each property’s respective acquisition date, the principal provisions of the lease terms for the sole tenants of the New England Sinai Medical Center and the Baylor Surgical Hospital at Fort Worth and the two tenants of the Baylor Surgical Hospital Integrated Medical Facility:

Tenant | Renewal Options(1) | Current Annual Base Rent | Base Rent Per Square Foot | Lease Expiration | ||||||||||||

Sinai(2) | 2/10 yr | $ | 1,988,184 | (4) | $ | 11.00 | 12/22/2029 | |||||||||

Fort Worth Surgicare(3) | 4/5 yr | $ | 3,244,590 | (5) | $ | 38.88 | 10/31/2031 | |||||||||

Fort Worth Surgicare(3) | 2/5 yr | $ | 88,881 | (6) | $ | 21.50 | 09/30/2019 | |||||||||

THVG Bariatric, LLC(3) | 2/5 yr | $ | 73,269 | (4) | $ | 23.75 | 04/30/2022 | |||||||||

| (1) | Represents option renewal period/term of each option. |

3

| (2) | All of the operations and the principal nature of business of the tenant are healthcare related. The tenant entered into a net lease pursuant to which the tenant is required to pay all operating expenses. We are responsible for roof, structural components of the building and the heating, ventilation and air conditioning system. |

| (3) | All of the operations and the principal nature of business of the tenant are healthcare related. The tenant entered into a net lease pursuant to which the tenant is required to pay all operating expenses and capital expenditures. |

| (4) | The annual base rent under the lease increases each year by 2.5% of then-current annual base rent. |

| (5) | The annual base rent under the lease increases each year by 2.0% of then-current annual base rent. |

| (6) | The annual base rent under the lease has no rent escalation. |

Depreciable Tax Basis

For 2014, the real estate taxes on the New England Sinai Medical Center were approximately $310,094. For federal income tax purposes, we estimate that the depreciable tax basis in the New England Sinai Medical Center will be approximately $21,058,290.

For 2014, the real estate taxes on the Baylor Surgical Hospital at Fort Worth and the Baylor Surgical Hospital Integrated Medical Facility were approximately $9,454. For federal income tax purposes, we estimate that the depreciable tax bases in the Baylor Surgical Hospital at Fort Worth and the Baylor Surgical Hospital Integrated Medical Facility will be approximately $43,389,493 and $2,106,000, respectively.

For federal income tax purposes, we depreciate personal property and buildings based upon an estimated useful life of 7 and 39 years, respectively.

Line of Credit Facility

The following information supplements and should be read in conjunction with the discussion contained in the “Investment Objectives, Strategy and Policies” section beginning on page 104 of the prospectus:

On December 17, 2014, CVOP II and certain of our subsidiaries amended certain agreements related to our credit facility (the “KeyBank Credit Facility”) to increase the maximum commitments available under the KeyBank Credit Facility from $35,000,000 to an aggregate of up to $180,000,000, consisting of a revolving line of credit with a maturity date of December 17, 2017, subject to CVOP II’s right for two, 12-month extension periods (the “KeyBank Credit Facility Amendment”). Subject to certain conditions, the KeyBank Credit Facility can be increased to $400,000,000. The following table presents information on the properties in which CVOP II has pledged its security interests that serve as collateral for the KeyBank Credit Facility since December 23, 2014:

Entity(1) | Property(2) | Date Added | Pool Availability(3) | |||||||

HCII-150 York Street, LLC | New England Sinai Medical Center | December 23, 2014 | $ | 14,040,000 | ||||||

HCII-1800 Park Place Avenue, LLC | Baylor Surgical Hospital at Fort Worth | December 31, 2014 | $ | 26,097,166 | ||||||

HCII-1800 Park Place Avenue, LLC | Baylor Surgical Hospital Integrated Medical Facility |

| December 31, 2014 |

| $ | 1,288,359 | ||||

Total | $ | 41,425,525 | ||||||||

|

| |||||||||

| (1) | CVOP II has assigned its rights under a property management agreement and advisory agreement of the entity as additional collateral to secure the KeyBank Line of Credit. |

4

| (2) | CVOP II has pledged a security interest in the property that serves as collateral for the KeyBank Credit Facility pursuant to the terms of the KeyBank Credit Facility Amendment. |

| (3) | The actual amount of credit available under the KeyBank Credit Facility is a function of certain loan-to-cost, loan-to-value and debt service coverage ratios contained in the KeyBank Credit Facility Amendment. |

As of the date of this prospectus supplement, CVOP II had drawn $37,500,000 under the KeyBank Credit Facility and had a remaining aggregate pool availability of $14,438,273.

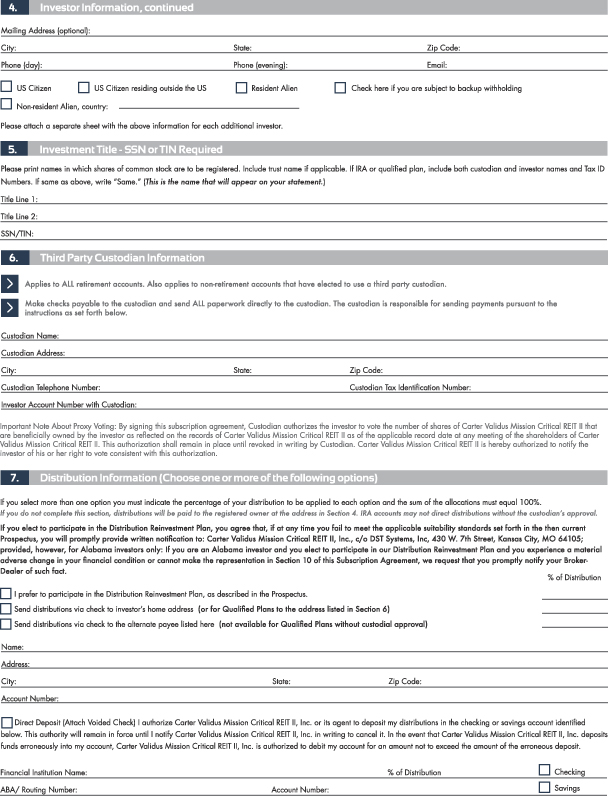

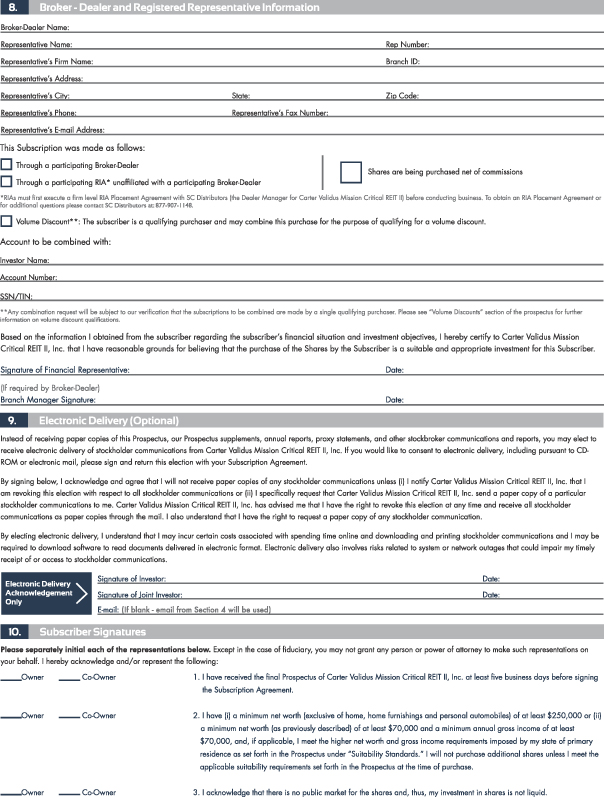

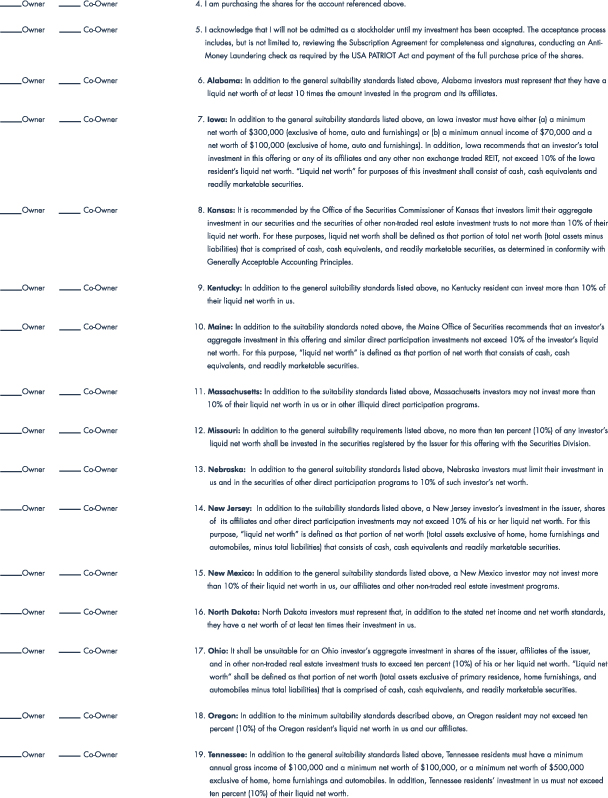

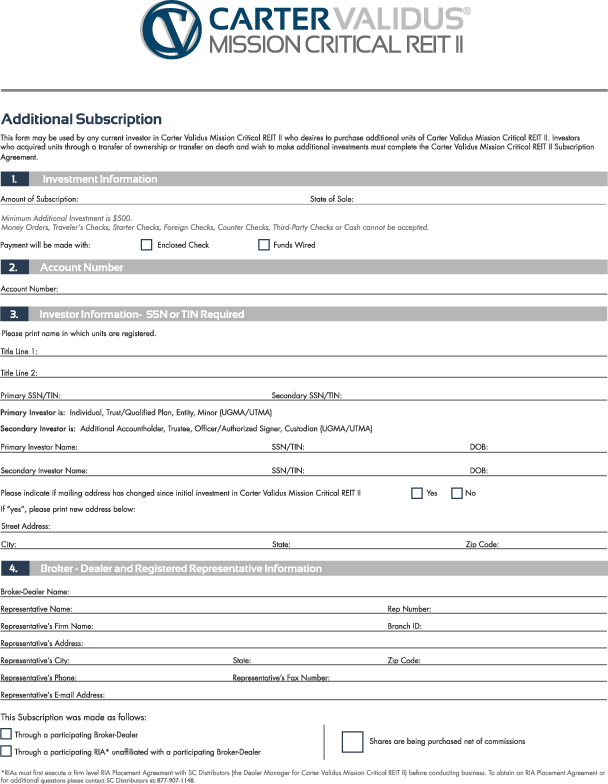

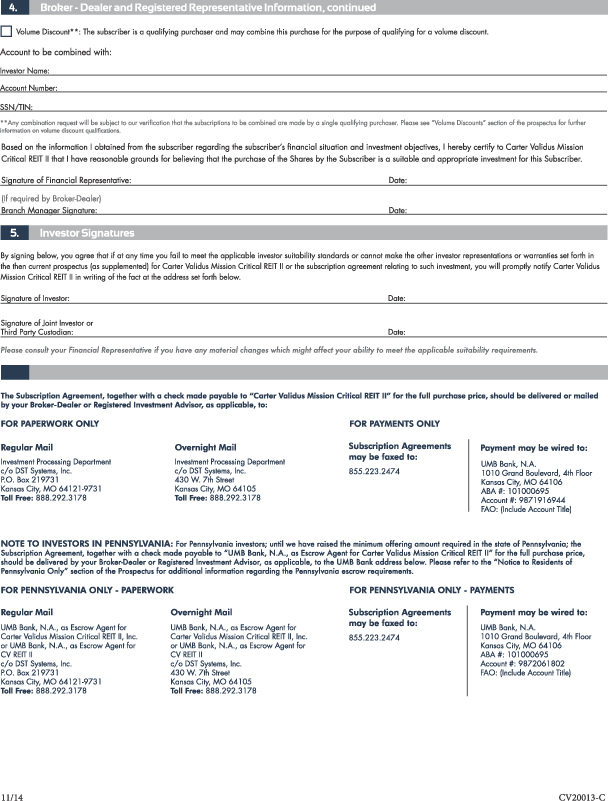

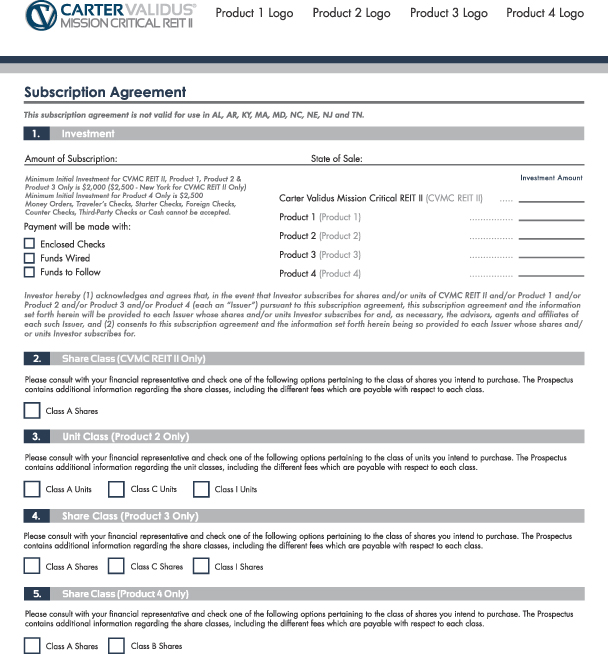

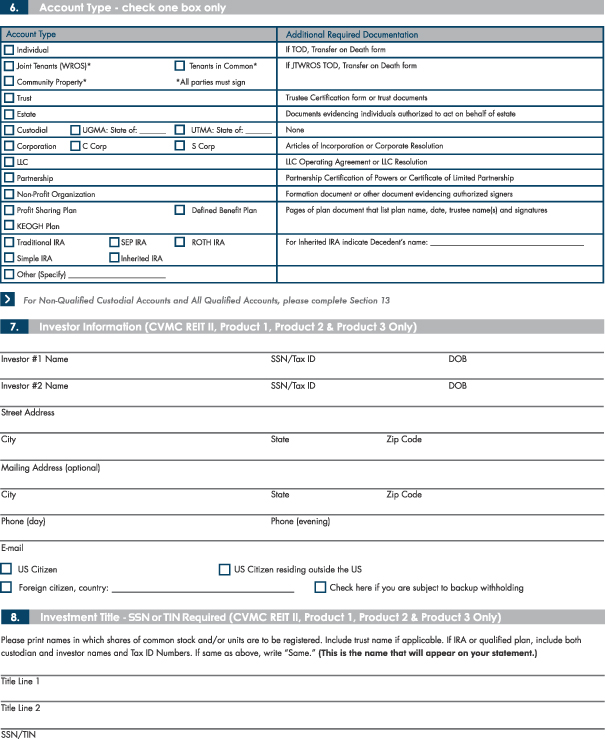

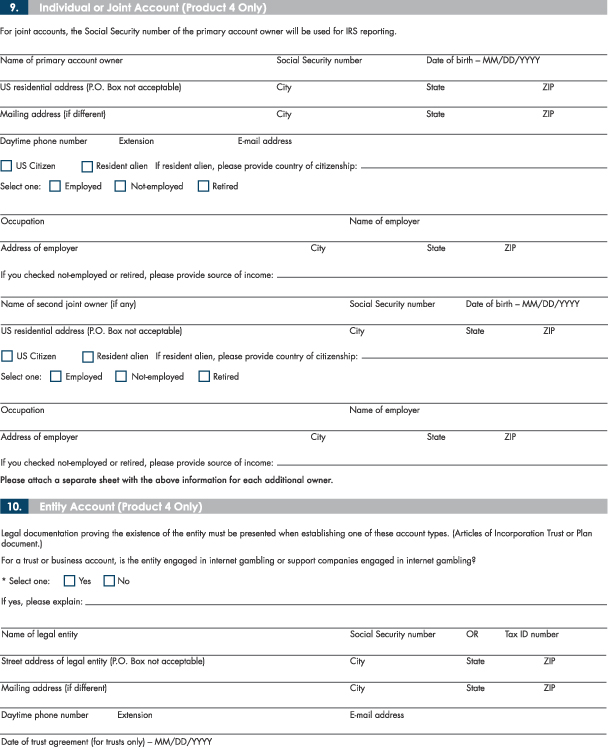

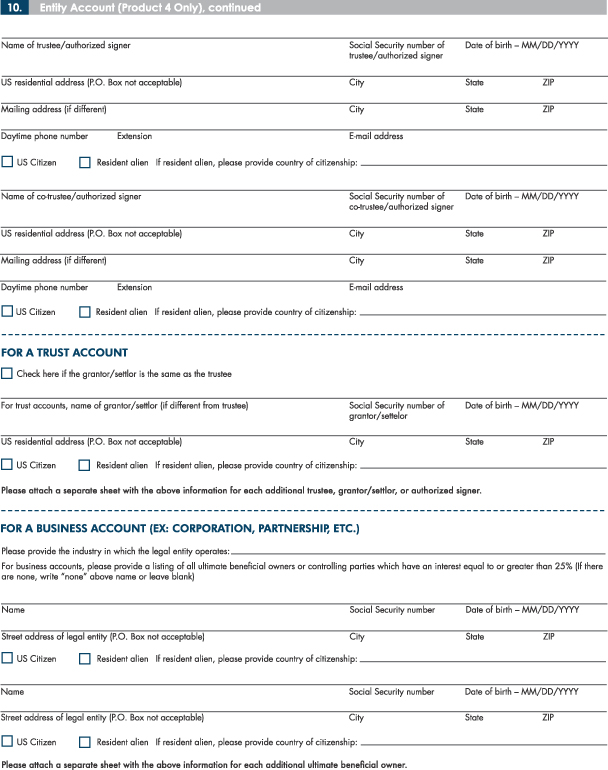

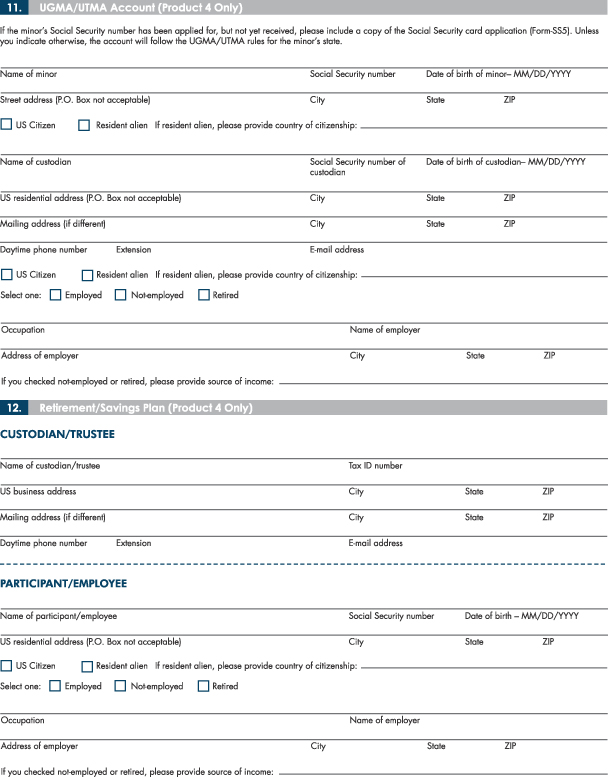

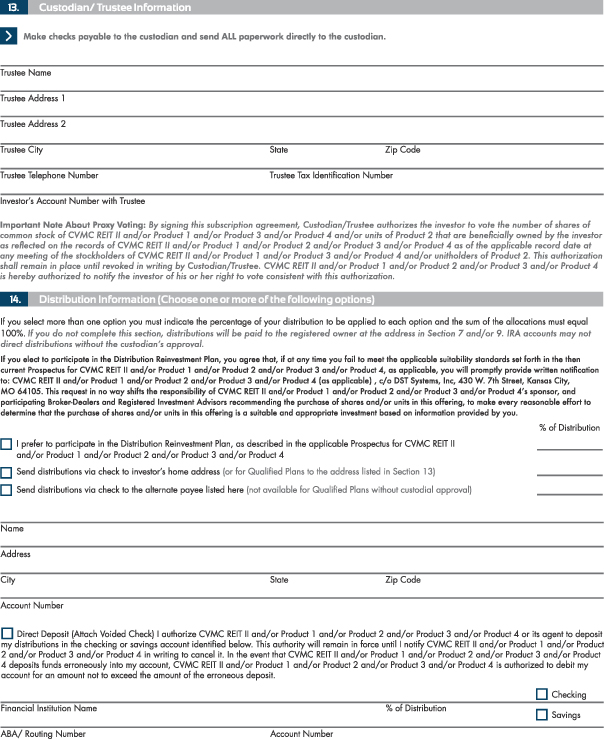

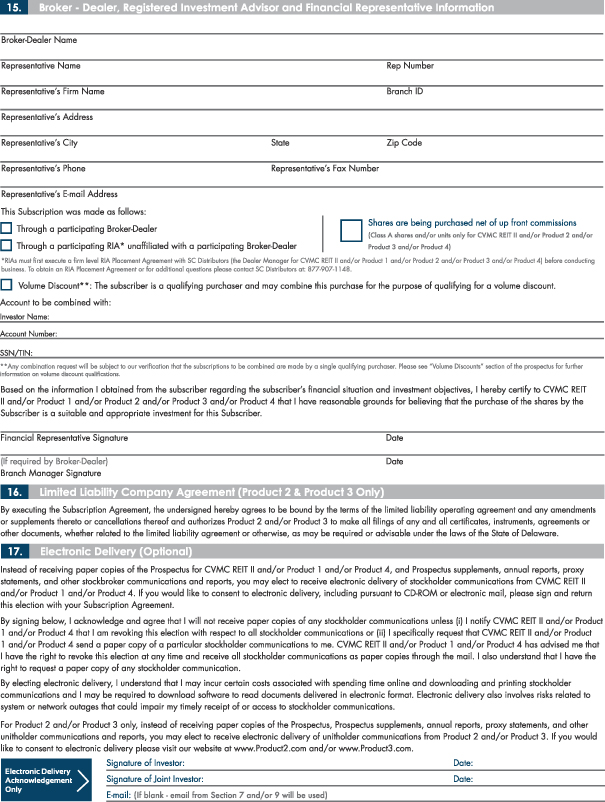

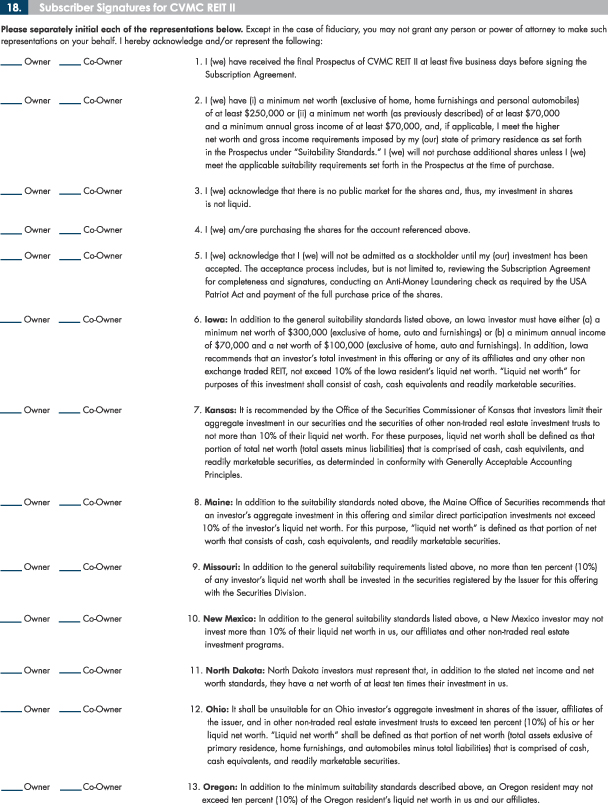

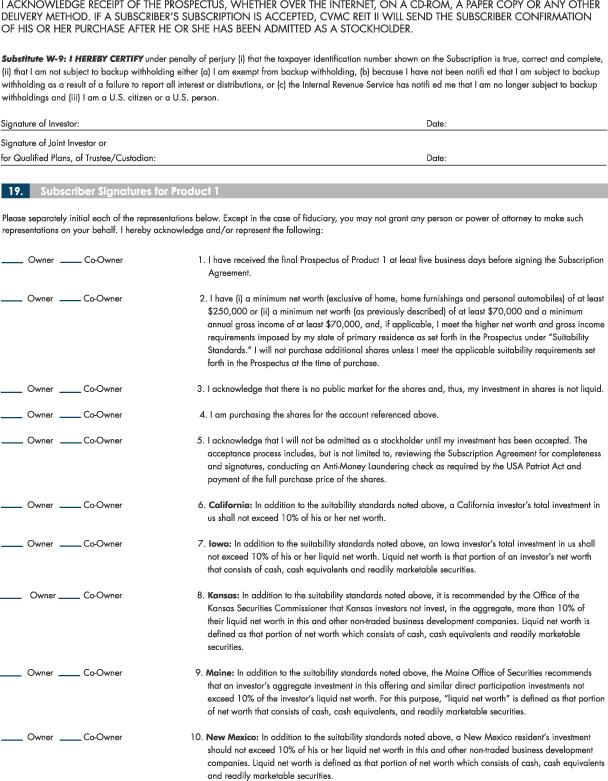

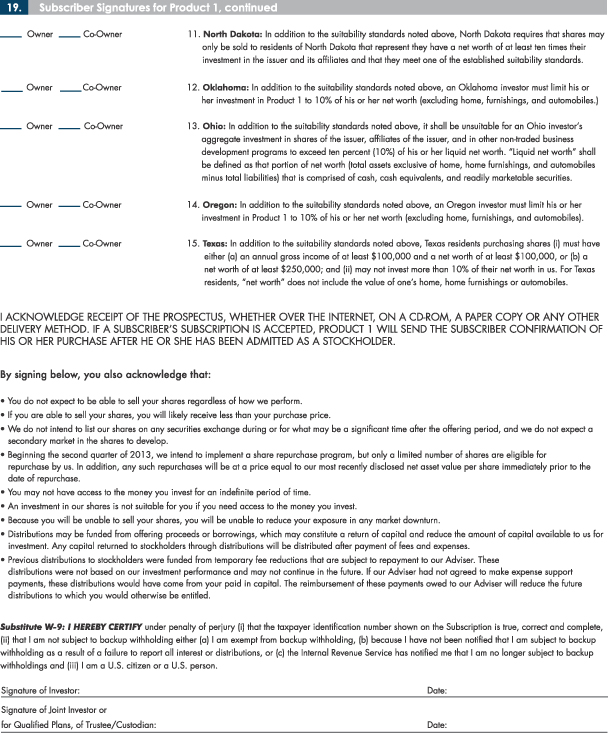

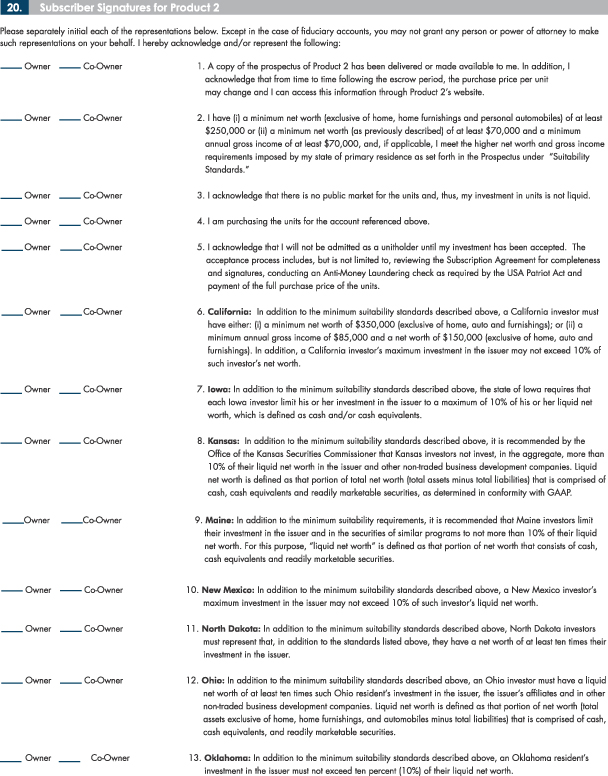

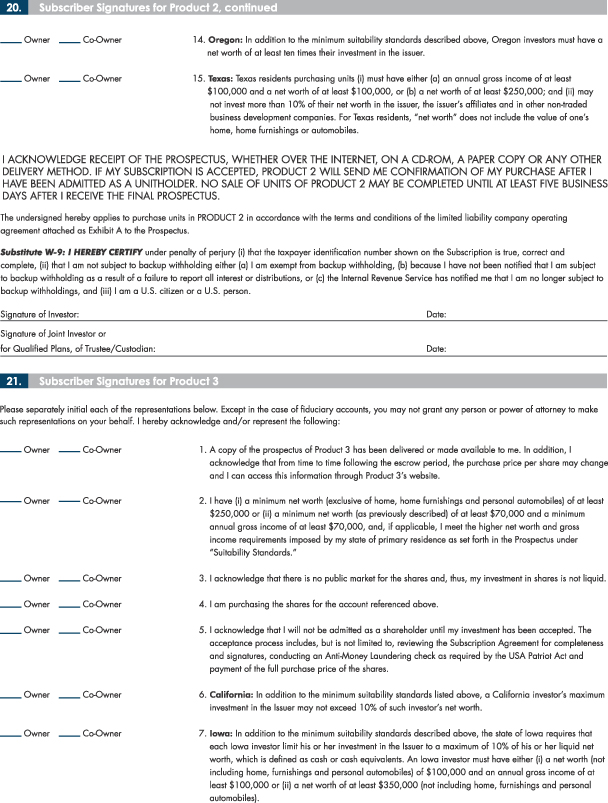

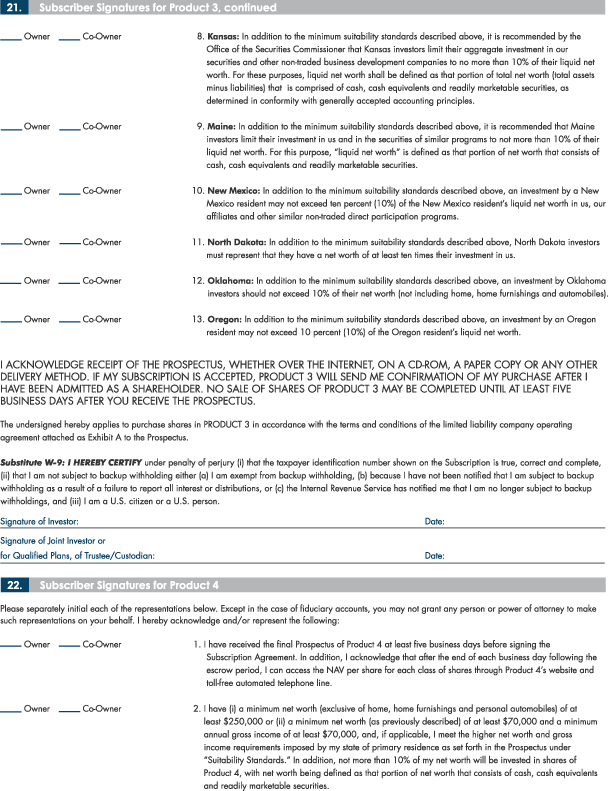

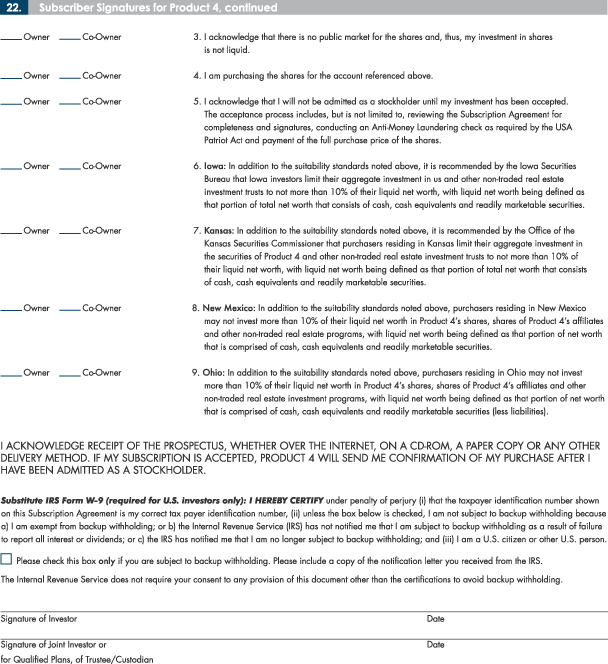

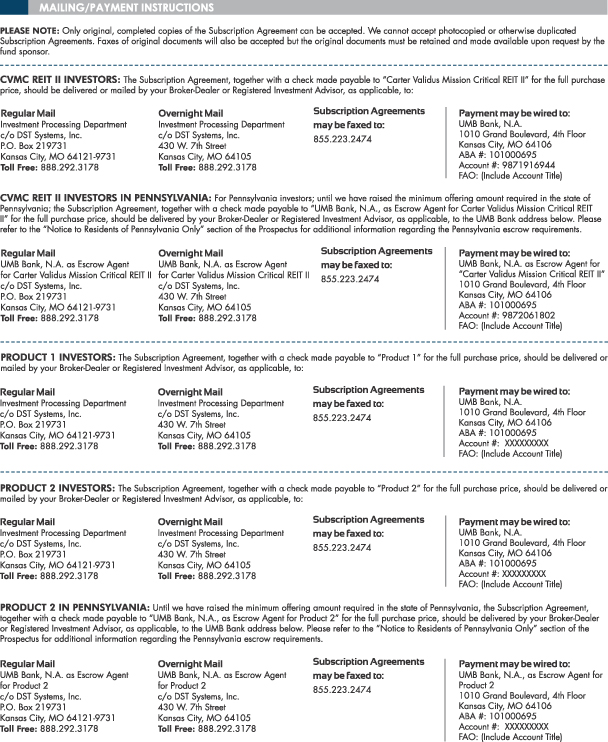

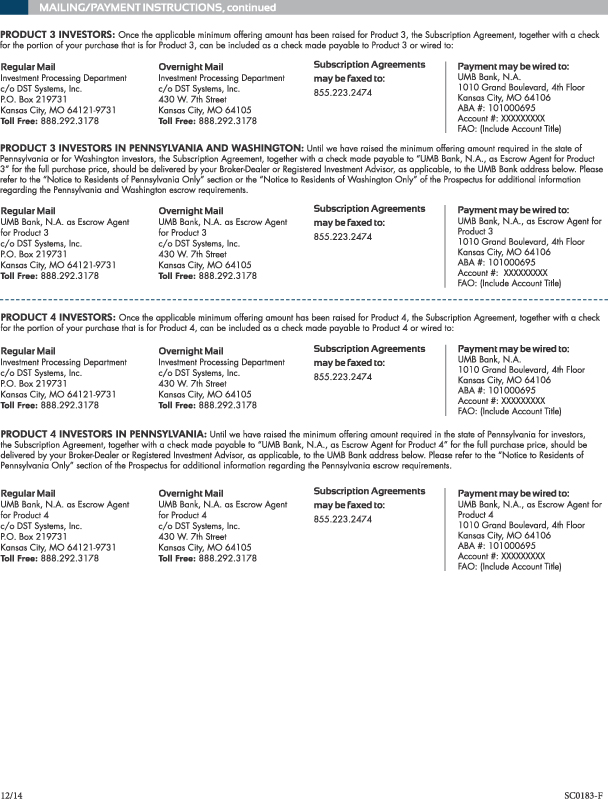

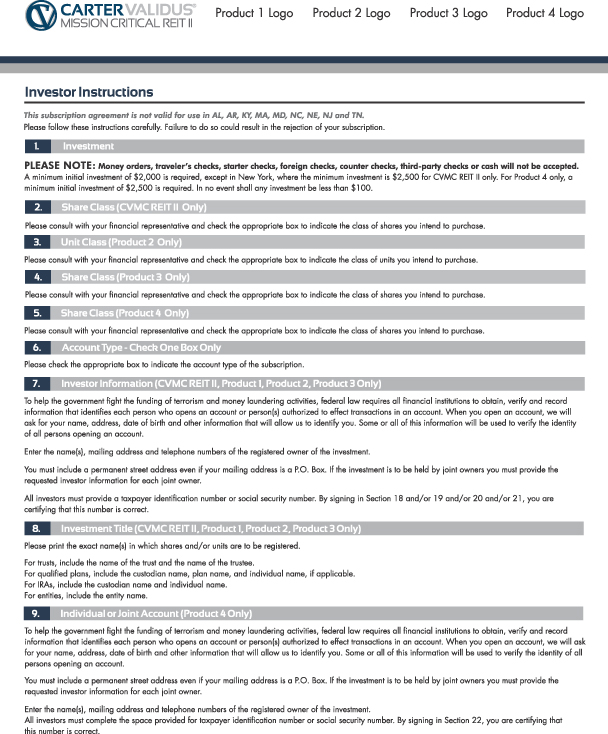

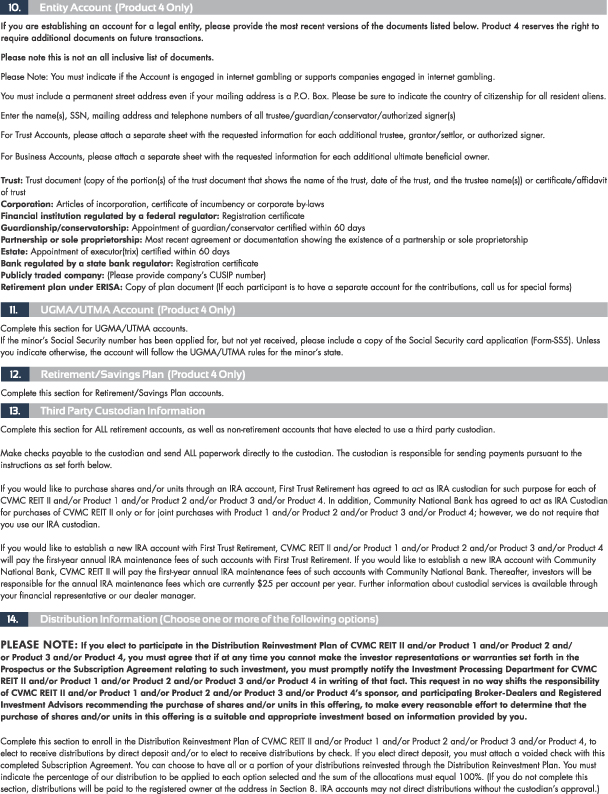

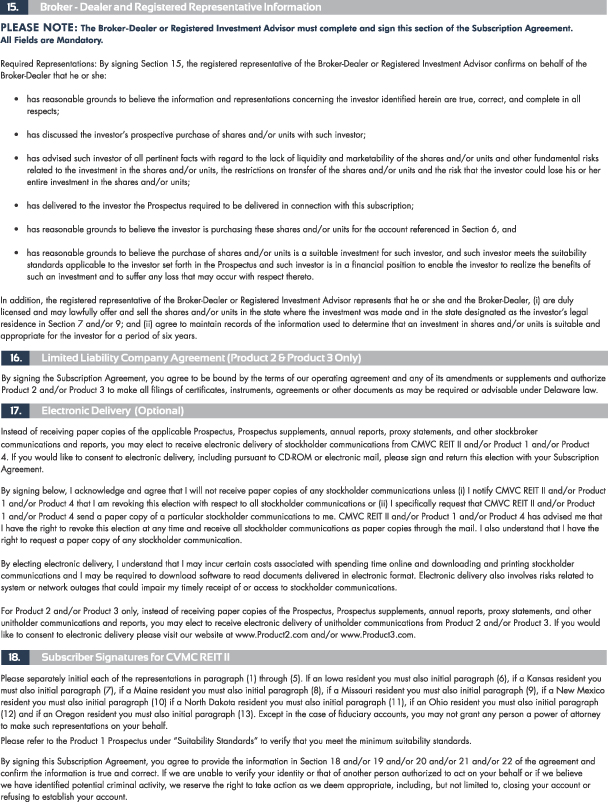

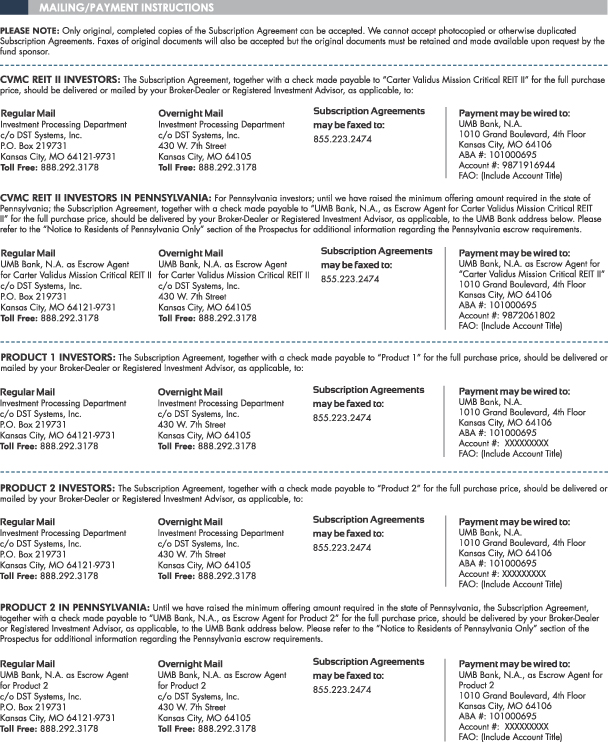

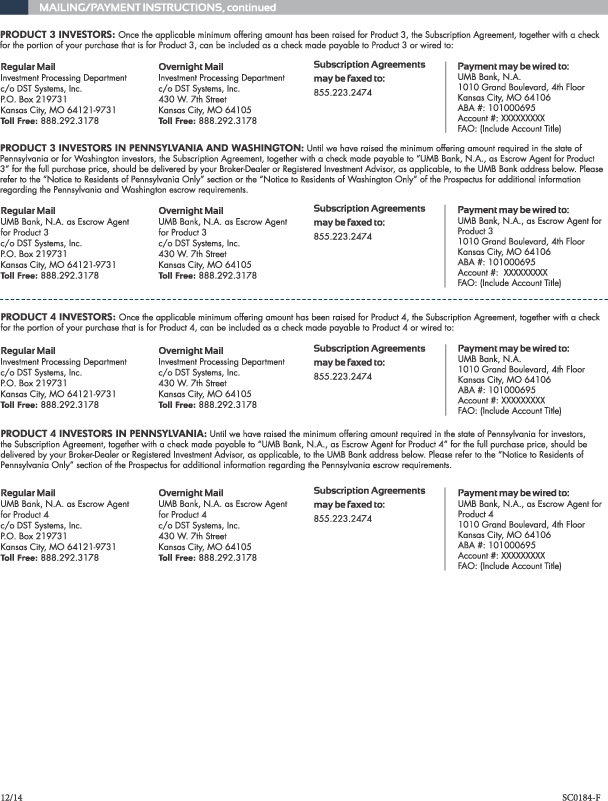

Revised Forms of Subscription Agreements

Revised forms of our Subscription Agreement, Additional Subscription Agreement and Multi-Product Subscription Agreement are attached as Appendices B, C and G, respectively, and supersede and replace Appendices B, C and G included in our prospectus.

5

B-1

B-2

B-3

B-4

B-5

B-6

B-7

B-8

C-1

C-2

G-1

G-2

G-3

G-4

G-5

G-6

G-7

G-8

G-9

G-10

G-11

G-12

G-13

G-14

G-15

G-16

G-17

G-18

G-19

G-20

G-21

G-22