- SILA Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

424B3 Filing

Sila Realty Trust (SILA) 424B3Prospectus supplement

Filed: 3 Jun 15, 12:00am

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-191706

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

SUPPLEMENT NO. 2 DATED JUNE 3, 2015

TO THE PROSPECTUS DATED APRIL 29, 2015

This document supplements, and should be read in conjunction with, the prospectus of Carter Validus Mission Critical REIT II, Inc. (the “Company”), dated April 29, 2015 and Supplement No. 1, dated May 14, 2015. Unless otherwise defined in this prospectus supplement, capitalized terms used in this prospectus supplement shall have the same meanings as set forth in the prospectus.

The purpose of this prospectus supplement is to describe the following:

| (1) | the status of the offering of shares of common stock of the Company; |

| (2) | a recent real property acquisition; and |

| (3) | revised forms of subscription agreements. |

Status of Our Public Offering

We commenced our initial public offering of $2,350,000,000 of shares of our common stock (the “Offering”), consisting of up to $2,250,000,000 of shares in our primary offering and up to $100,000,000 of shares pursuant to our distribution reinvestment plan, on May 29, 2014. We are publicly offering two classes of shares of common stock, Class A shares and Class T shares, in any combination with a dollar value up to the maximum offering amount. As of June 2, 2015, we had accepted investors’ subscriptions for and issued approximately 26,308,000 shares of Class A common stock in the Offering, resulting in receipt of gross proceeds of approximately $261,429,000. As of June 2, 2015, we had approximately $2,088,571,000 in Class A shares and Class T shares of common stock remaining in our Offering.

Recent Real Property Acquisition

The following information replaces in its entirety the first sentence of the fourth full paragraph on page 16 of the “Prospectus Summary—Description of Real Estate Investments” section of the prospectus and the first sentence of the fourth full paragraph on page 129 of the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

In addition, as of June 3, 2015, we purchased, since inception, seven other properties for an aggregate purchase price of $35,367,640, plus closing costs, with a weighted average consolidated initial yield of 7.55%, a weighted average consolidated average yield of 8.21% and a consolidated annual base rent at acquisition of $2,671,992.

The following information supplements, and should be read in conjunction with, the table beginning on page 16 contained in the “Prospectus Summary—Description of Real Estate Investments” section of the prospectus and the table beginning on page 129 contained in the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

Property Description * | Major | Location (3) | Date Acquired | Purchase Price | Property Taxes | Fees Paid to Sponsor (1) | Total Rentable Square Feet | % of Total Rentable Square Feet Leased | Lease Expiration | |||||||||||||||||||||||||

Clarion IMF | The Primary Health Network (5) | Clarion, PA | 06/01/2015 | $ | 6,920,000 | (4 | ) | $ | 138,400 | 33,000 | 100.0 | % | 10/31/2027 | |||||||||||||||||||||

| (1) | Fees paid to the sponsor include payments made to an affiliate of our advisor for acquisition fees in connection with the property acquisition. It does not include fees paid to any property manager, including our affiliated property manager. For more detailed information on fees paid to our advisor or its affiliates, see the section captioned “Management Compensation” beginning on page 96 of the prospectus. |

| (2) | Major tenants include those tenants who occupy greater than 10% of the rentable square feet of their respective property. We believe this tenant is creditworthy. |

| (3) | Our property is located in the metropolitan area of its city and as such may compete with other facilities for tenants if the current lease is not renewed. |

| (4) | The property qualified and was approved for property tax abatement in 2014. |

| (5) | The tenant is not a rated entity. |

| * | We believe the property is suitable for its present and intended purpose and is adequately covered by insurance. |

KeyBank Credit Facility

The following information supplements, and should be read in conjunction with, the discussion contained in the “Investment Objectives, Strategy and Policies—Entry into a Credit Facility” section beginning on page 131 of the prospectus:

The following table presents information on the property in which CVOP II has pledged its security interests that serve as collateral for the KeyBank Credit Facility since April 29, 2015:

Property (1) | Date Added | Pool Availability (2) | ||||||

Clarion IMF | 06/01/2015 | $ | 3,981,564 | |||||

| (1) | CVOP II has pledged a security interest in the property that serves as collateral for the KeyBank Credit Facility pursuant to the terms of the KeyBank Credit Facility Amendment. |

| (2) | The actual amount of credit available under the KeyBank Credit Facility is a function of certain loan-to-cost, loan-to-value and debt service coverage ratios contained in the KeyBank Credit Facility Amendment. |

As of the date of this prospectus supplement, the aggregate pool availability was $74,688,801 and there was no outstanding balance under the KeyBank Credit Facility.

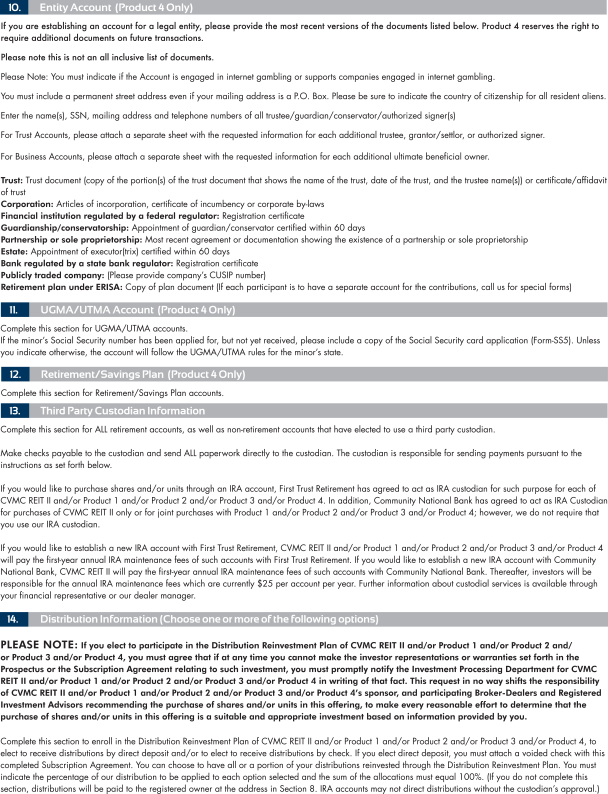

Revised Forms of Subscription Agreements

Revised forms of our Subscription Agreement, Additional Subscription Agreement and Multi-Product Subscription Agreement are attached as Appendices B, C and F, respectively, and supersede and replace Appendices B, C and F included in our prospectus.

2

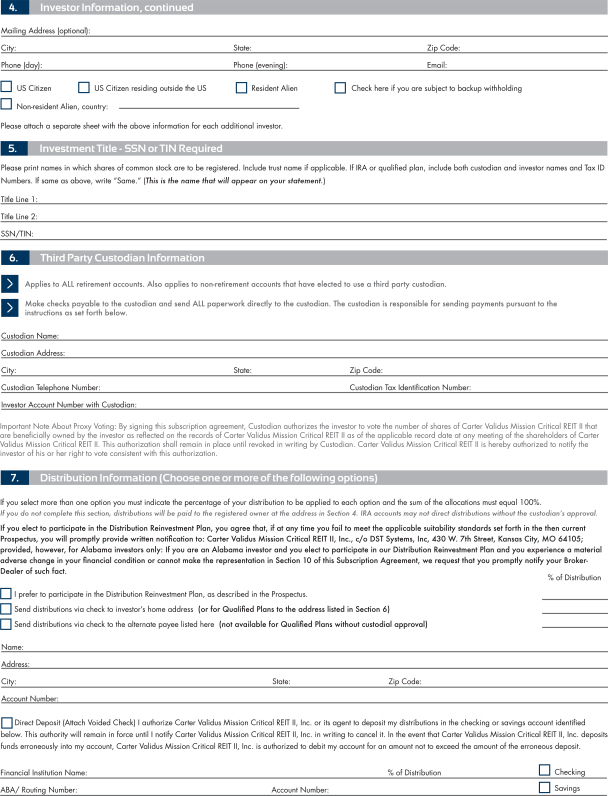

CARTER VALIDUS® MISSION CRITICAL REIT II Subscription Agreement 1. Investment Amount of Subscription: State of Sale: Minimum Initial Investment is $2,000 ($2,500 - New York) Money Orders, Traveler’s Checks, Starter Checks, Foreign Checks, Counter Checks, Third-Party Checks or Cash cannot be accepted. Payment will be made with: Enclosed Check Funds Wired Funds to Follow Please consult with your financial representative and check one of the following options pertaining to the class of shares you intend to purchase. The Prospectus contains additional information regarding the share classes, including the different fees which are payable with respect to each class. Share Class Required Class A Shares 3. Account Type - Check One Box Only Account Type Additional Required Documentation Individual If TOD, Transfer on Death form Joint Tenants (WROS)* Tenants in Common* Community Property* *All parties must sign If JTWROS TOD, Transfer on Death form Trust Trustee Certification form or trust documents Estate Documents evidencing individuals authorized to act on behalf of estate Custodial UGMA: State of: UTMA: State of: None Corporation C Corp S Corp Articles of Incorporation or Corporate Resolution LLC LLC Operating Agreement or LLC Resolution Partnership Partnership Certification of Powers or Certificate of Limited Partnership Non-Profit Organization Formation document or other document evidencing authorized signers Profit Sharing Plan Defined Benefit Plan KEOGH Plan Pages of plan document that list plan name, date, trustee name(s) and signatures Traditional IRA SEP IRA ROTH IRA Simple IRA Inherited IRA For Inherited IRA indicate Decedent’s name: Other (Specify) For Non-Qualified Custodial Accounts and All Qualified Accounts, please complete Section 6 4. Investor Information Primary Investor is: Individual, Trust/Qualified Plan, Entity, Minor (UGMA/UTMA) Secondary Investor is: Additional Account holder, Trustee, Officer/Authorized Signer, Custodian (UGMA/UTMA) Primary Investor Name: SSN/TIN: DOB: Secondary Investor Name: SSN/TIN: DOB: Street Address: City: State: Zip Code:

B-1

4. Investor Information, continued Mailing Address (optional): City: State: Zip Code: Phone (day): Phone (evening): Email: US Citizen US Citizen residing outside the US Resident Alien Check here if you are subject to backup withholding Non-resident Alien, country: Please attach a separate sheet with the above information for each additional investor. 5. Investment Title—SSN or TIN Required Please print names in which shares of common stock are to be registered. Include trust name if applicable. If IRA or qualified plan, include both custodian and investor names and Tax ID Numbers. If same as above, write “Same.” (This is the name that will appear on your statement.) Title Line 1: Title Line 2: SSN/TIN: 6. Third Party Custodian Information Applies to ALL retirement accounts. Also applies to non-retirement accounts that have elected to use a third party custodian. Make checks payable to the custodian and send ALL paperwork directly to the custodian. The custodian is responsible for sending payments pursuant to the instructions as set forth below. Custodian Name: Custodian Address: City: State: Zip Code: Custodian Telephone Number: Custodian Tax Identification Number: Investor Account Number with Custodian: Important Note About Proxy Voting: By signing this subscription agreement, Custodian authorizes the investor to vote the number of shares of Carter Validus Mission Critical REIT II that are beneficially owned by the investor as reflected on the records of Carter Validus Mission Critical REIT II as of the applicable record date at any meeting of the shareholders of Carter Validus Mission Critical REIT II. This authorization shall remain in place until revoked in writing by Custodian. Carter Validus Mission Critical REIT II is hereby authorized to notify the investor of his or her right to vote consistent with this authorization. 7. Distribution Information (Choose one or more of the following options) If you select more than one option you must indicate the percentage of your distribution to be applied to each option and the sum of the allocations must equal 100%. If you do not complete this section, distributions will be paid to the registered owner at the address in Section 4. IRA accounts may not direct distributions without the custodian’s approval. If you elect to participate in the Distribution Reinvestment Plan, you agree that, if at any time you fail to meet the applicable suitability standards set forth in the then current Prospectus, you will promptly provide written notification to: Carter Validus Mission Critical REIT II, Inc., c/o DST Systems, Inc, 430 W. 7th Street, Kansas City, MO 64105; provided, however, for Alabama investors only: If you are an Alabama investor and you elect to participate in our Distribution Reinvestment Plan and you experience a material adverse change in your financial condition or cannot make the representation in Section 10 of this Subscription Agreement, we request that you promptly notify your Broker- Dealer of such fact. % of Distribution I prefer to participate in the Distribution Reinvestment Plan, as described in the Prospectus. Send distributions via check to investor’s home address (or for Qualified Plans to the address listed in Section 6) Send distributions via check to the alternate payee listed here (not available for Qualified Plans without custodial approval) Name: Address: City: State: Zip Code: Account Number: Direct Deposit (Attach Voided Check) I authorize Carter Validus Mission Critical REIT II, Inc. or its agent to deposit my distributions in the checking or savings account identified below. This authority will remain in force until I notify Carter Validus Mission Critical REIT II, Inc. in writing to cancel it. In the event that Carter Validus Mission Critical REIT II, Inc. deposits funds erroneously into my account, Carter Validus Mission Critical REIT II, Inc. is authorized to debit my account for an amount not to exceed the amount of the erroneous deposit. Financial Institution Name:% of Distribution ABA/ Routing Number: Account Number: Checking Savings

B-2

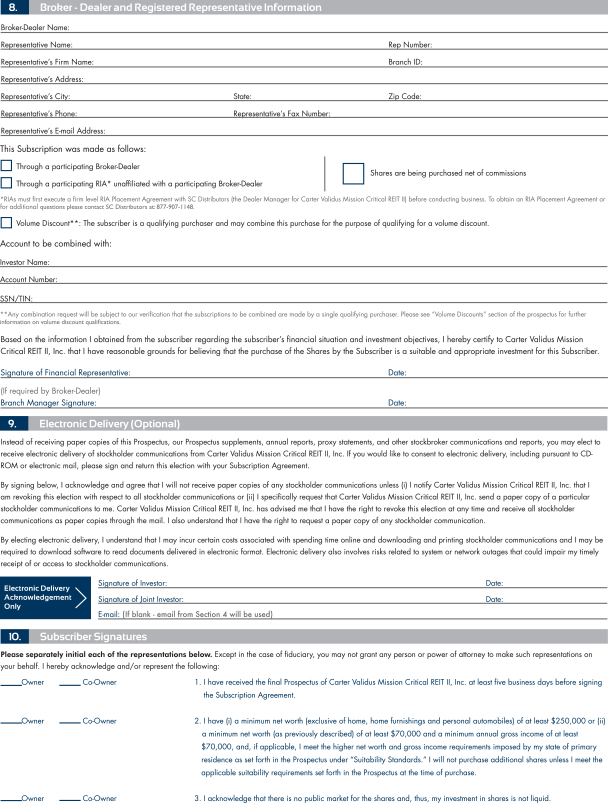

8. Broker—Dealer and Registered Representative Information Broker-Dealer Name: Representative Name: Rep Number: Representative’s Firm Name: Branch ID: Representative’s Address: Representative’s City: State: Zip Code: Representative’s Phone: Representative’s Fax Number: Representative’s E-mail Address: This Subscription was made as follows: Through a participating Broker-Dealer Through a participating RIA* unaffiliated with a participating Broker-Dealer Shares are being purchased net of commissions *RIAs must first execute a firm level RIA Placement Agreement with SC Distributors (the Dealer Manager for Carter Validus Mission Critical REIT II) before conducting business. To obtain an RIA Placement Agreement or for additional questions please contact SC Distributors at: 877-907-1148. Volume Discount**: The subscriber is a qualifying purchaser and may combine this purchase for the purpose of qualifying for a volume discount. Account to be combined with: Investor Name: Account Number: SSN/TIN: **Any combination request will be subject to our verification that the subscriptions to be combined are made by a single qualifying purchaser. Please see “Volume Discounts” section of the prospectus for further information on volume discount qualifications. Based on the information I obtained from the subscriber regarding the subscriber’s financial situation and investment objectives, I hereby certify to Carter Validus Mission Critical REIT II, Inc. that I have reasonable grounds for believing that the purchase of the Shares by the Subscriber is a suitable and appropriate investment for this Subscriber. Signature of Financial Representative: Date: (If required by Broker-Dealer) Branch Manager Signature: Date: 9. Electronic Delivery (Optional) Instead of receiving paper copies of this Prospectus, our Prospectus supplements, annual reports, proxy statements, and other stockbroker communications and reports, you may elect to receive electronic delivery of stockholder communications from Carter Validus Mission Critical REIT II, Inc. If you would like to consent to electronic delivery, including pursuant to CD-ROM or electronic mail, please sign and return this election with your Subscription Agreement. By signing below, I acknowledge and agree that I will not receive paper copies of any stockholder communications unless (i) I notify Carter Validus Mission Critical REIT II, Inc. that I am revoking this election with respect to all stockholder communications or (ii) I specifically request that Carter Validus Mission Critical REIT II, Inc. send a paper copy of a particular stockholder communications to me. Carter Validus Mission Critical REIT II, Inc. has advised me that I have the right to revoke this election at any time and receive all stockholder communications as paper copies through the mail. I also understand that I have the right to request a paper copy of any stockholder communication. By electing electronic delivery, I understand that I may incur certain costs associated with spending time online and downloading and printing stockholder communications and I may be required to download software to read documents delivered in electronic format. Electronic delivery also involves risks related to system or network outages that could impair my timely receipt of or access to stockholder communications. Electronic Delivery Acknowledgement Only Signature of Investor: Date: Signature of Joint Investor: Date: E-mail: (If blank — email from Section 4 will be used) 10. Subscriber Signatures Please separately initial each of the representations below. Except in the case of fiduciary, you may not grant any person or power of attorney to make such representations on your behalf. I hereby acknowledge and/or represent the following: Owner Co-Owner 1. I have received the final Prospectus of Carter Validus Mission Critical REIT II, Inc. at least five business days before signing the Subscription Agreement. Owner Co-Owner 2. I have (i) a minimum net worth (exclusive of home, home furnishings and personal automobiles) of at least $250,000 or (ii) a minimum net worth (as previously described) of at least $70,000 and a minimum annual gross income of at least $70,000, and, if applicable, I meet the higher net worth and gross income requirements imposed by my state of primary residence as set forth in the Prospectus under “Suitability Standards.” I will not purchase additional shares unless I meet the applicable suitability requirements set forth in the Prospectus at the time of purchase. Owner Co-Owner 3. I acknowledge that there is no public market for the shares and, thus, my investment in shares is not liquid.

B-3

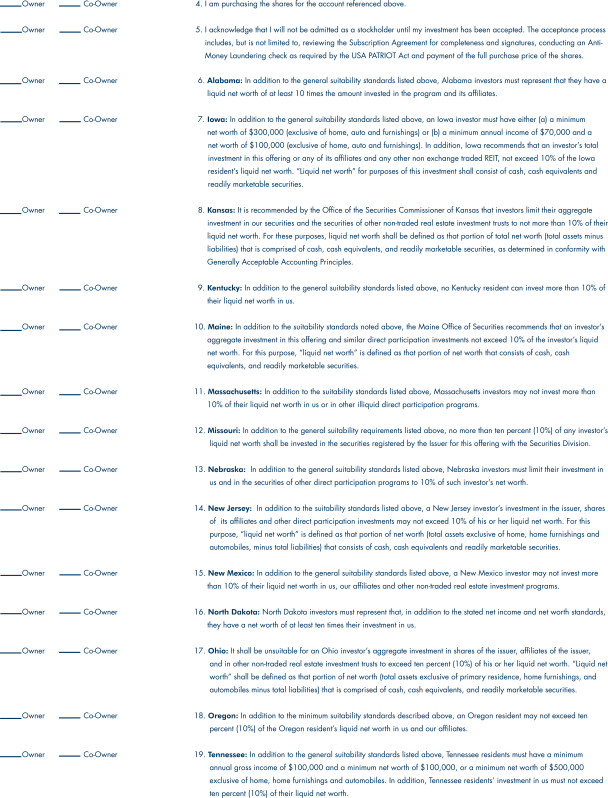

Owner Co-Owner 4. I am purchasing the shares for the account referenced above. Owner Co-Owner 5. I acknowledge that I will not be admitted as a stockholder until my investment has been accepted. The acceptance process includes, but is not limited to, reviewing the Subscription Agreement for completeness and signatures, conducting an Anti-Money Laundering check as required by the USA PATRIOT Act and payment of the full purchase price of the shares. Owner Co-Owner 6. Alabama: In addition to the general suitability standards listed above, Alabama investors must represent that they have a liquid net worth of at least 10 times the amount invested in the program and its affiliates. Owner Co-Owner 7. Iowa: In addition to the general suitability standards listed above, an Iowa investor must have either (a) a minimum net worth of $300,000 (exclusive of home, auto and furnishings) or (b) a minimum annual income of $70,000 and a net worth of $100,000 (exclusive of home, auto and furnishings). In addition, Iowa recommends that an investor’s total investment in this offering or any of its affiliates and any other non exchange traded REIT, not exceed 10% of the Iowa resident’s liquid net worth. “Liquid net worth” for purposes of this investment shall consist of cash, cash equivalents and readily marketable securities. Owner Co-Owner 8. Kansas: It is recommended by the Office of the Securities Commissioner of Kansas that investors limit their aggregate investment in our securities and the securities of other non-traded real estate investment trusts to not more than 10% of their liquid net worth. For these purposes, liquid net worth shall be defined as that portion of total net worth (total assets minus liabilities) that is comprised of cash, cash equivalents, and readily marketable securities, as determined in conformity with Generally Acceptable Accounting Principles. Owner Co-Owner 9. Kentucky: In addition to the general suitability standards listed above, no Kentucky resident can invest more than 10% of their liquid net worth in us. Owner Co-Owner 10. Maine: In addition to the suitability standards noted above, the Maine Office of Securities recommends that an investor’s aggregate investment in this offering and similar direct participation investments not exceed 10% of the investor’s liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents, and readily marketable securities. Owner Co-Owner 11. Massachusetts: In addition to the suitability standards listed above, Massachusetts investors may not invest more than 10% of their liquid net worth in us or in other illiquid direct participation programs. Owner Co-Owner 12. Missouri: In addition to the general suitability requirements listed above, no more than ten percent (10%) of any investor’s liquid net worth shall be invested in the securities registered by the Issuer for this offering with the Securities Division. Owner Co-Owner 13. Nebraska: In addition to the general suitability standards listed above, Nebraska investors must limit their investment in us and in the securities of other direct participation programs to 10% of such investor’s net worth. Owner Co-Owner 14. New Jersey: In addition to the suitability standards listed above, a New Jersey investor’s investment in the issuer, shares of its affiliates and other direct participation investments may not exceed 10% of his or her liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth (total assets exclusive of home, home furnishings and automobiles, minus total liabilities) that consists of cash, cash equivalents and readily marketable securities. Owner Co-Owner 15. New Mexico: In addition to the general suitability standards listed above, a New Mexico investor may not invest more than 10% of their liquid net worth in us, our affiliates and other non-traded real estate investment programs. Owner Co-Owner 16. North Dakota: North Dakota investors must represent that, in addition to the stated net income and net worth standards, they have a net worth of at least ten times their investment in us. Owner Co-Owner 17. Ohio: It shall be unsuitable for an Ohio investor’s aggregate investment in shares of the issuer, affiliates of the issuer, and in other non-traded real estate investment trusts to exceed ten percent (10%) of his or her liquid net worth. “Liquid net worth” shall be defined as that portion of net worth (total assets exclusive of primary residence, home furnishings, and automobiles minus total liabilities) that is comprised of cash, cash equivalents, and readily marketable securities. Owner Co-Owner 18. Oregon: In addition to the minimum suitability standards described above, an Oregon resident may not exceed ten percent (10%) of the Oregon resident’s liquid net worth in us and our affiliates. Owner Co-Owner 19. Tennessee: In addition to the general suitability standards listed above, Tennessee residents must have a minimum annual gross income of $100,000 and a minimum net worth of $100,000, or a minimum net worth of $500,000 exclusive of home, home furnishings and automobiles. In addition, Tennessee residents’ investment in us must not exceed ten percent (10%) of their liquid net worth.

B-4

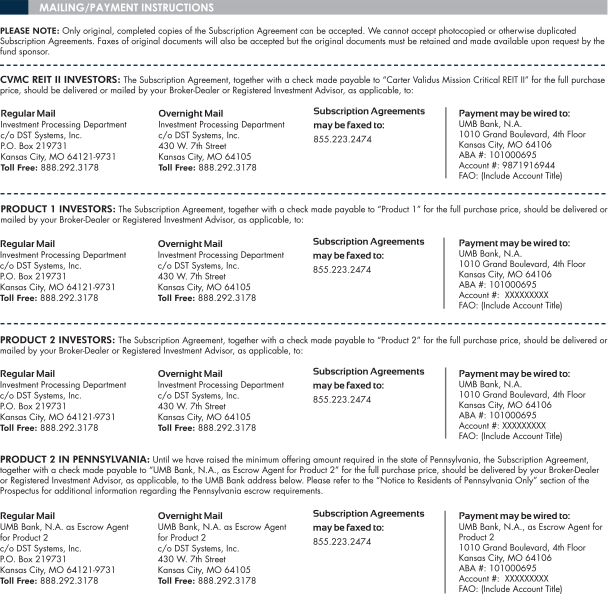

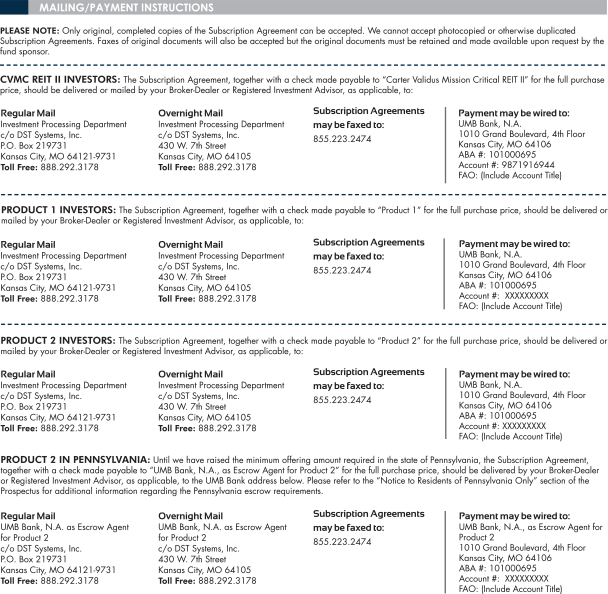

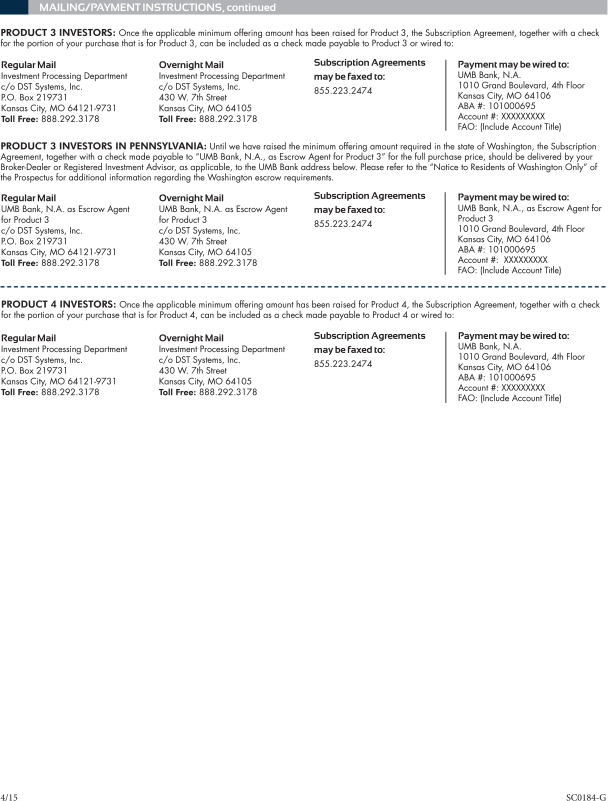

I ACKNOWLEDGE RECEIPT OF THE PROSPECTUS, WHETHER OVER THE INTERNET, ON A CD-ROM, A PAPER COPY OR ANY OTHER DELIVERY METHOD. IF A SUBSCRIBER’S SUBSCRIPTION IS ACCEPTED, CARTER VALIDUS MISSION CRITICAL REIT II, INC. WILL SEND THE SUBSCRIBER CONFIRMATION OF HIS OR HER PURCHASE AFTER HE OR SHE HAS BEEN ADMITTED AS A STOCKHOLDER. Substitute W-9: I HEREBY CERTIFY under penalty of perjury (i) that the taxpayer identification number shown on the Subscription is true, correct and complete, (ii) that I am not subject to backup withholding either (a) I am exempt from backup withholding, (b) because I have not been notified that I am subject to backup agreement withholding as a result of a failure to report all interest or distributions, or (c) the Internal Revenue Service has notified me that I am no longer subject to backup withholdings and (iii) I am a U.S. citizen or a U.S. person. Signature of Investor: Date: Signature of Joint Investor or for Qualified Plans, of Trustee/Custodian: Date: The Subscription Agreement, together with a check made payable to “Carter Validus Mission Critical REIT II” for the full purchase price, should be delivered or mailed by your Broker-Dealer or Registered Investment Advisor, as applicable, to: FOR PAPERWORK ONLY FOR PAYMENTS ONLY Regular Mail Overnight Mail Subscription Agreements may be faxed to: Payment may be wired to: Investment Processing Department c/o DST Systems, Inc. P.O. Box 219731 Kansas City, MO 64121-9731 Toll Free: 888.292.3178 Investment Processing Department c/o DST Systems, Inc. 430 W. 7th Street Kansas City, MO 64105 Toll Free: 888.292.3178 855.223.2474 UMB Bank, N.A. 1010 Grand Boulevard, 4th Floor Kansas City, MO 64106 ABA #: 101000695 Account #: 9871916944 FAO: (Include Account Title) 4/15 CV20010-P

B-5

CARTER VALIDUS® MISSION CRITICAL REIT II Investor Instructions Please follow these instructions carefully. Failure to do so could result in the rejection of your subscription. 1. Investment PLEASE NOTE: We do not accept money orders, traveler ’s checks, starter checks, foreign checks, counter checks, third-party checks or cash. A minimum initial investment of $2,000 is required, except in New York, where the minimum investment is $2,500. In no event shall any investment be less than $100. If you would like to purchase shares in this offering at regular intervals you may be able to do so by electing to participate in the Automatic Purchase Program by completing an enrollment form that we will provide upon request. North Carolina, New Jersey, Alabama and Ohio investors are not eligible to participate in the Automatic Purchase Program. Custodial accounts are also not eligible to participate in the Automatic Purchase Program. 2. Share Class Please consult with your financial representative and check the appropriate box to indicate the class of shares you intend to purchase. 3. Account Type—Check One Box Only Please check the appropriate box to indicate the account type of the subscription. 4. Investor Information To help the government fight the funding of terrorism and money laundering activities, federal law requires all financial institutions, including Carter Validus Mission Critical REIT II, to obtain, verify and record information that identifies each person who opens an account or person(s) authorized to effect transactions in an account. When you open an account, we will ask for your name, address, date of birth and other information that will allow us to identify you. Some or all of this information will be used to verify the identity of all persons opening an account. Enter the name(s), mailing address and telephone numbers of the registered owner of the investment. You must include a permanent street address even if your mailing address is a P.O. Box. If the investment is to be held by joint owners you must provide the requested investor information for each joint owner. All investors must provide a taxpayer identification number or social security number. By signing in Section 10, you are certifying that this number is correct. Primary Investor is: Individual, Trust/Qualified Plan, Entity, Minor (UGMA/UTMA) Secondary Investor is: Additional Accountholder, Trustee, Officer/Authorized Signer, Custodian (UGMA/UTMA) 5. Investment Title—SSN or TIN Required All investors must complete the space provided for taxpayer identification number or social security number. By signing in Section 10, you are certifying that this number is correct. Please print the exact name(s) in which shares are to be registered. Include the trust/entity name, if applicable. If the account is Qualified, include the names and taxpayer identification numbers of the investor and the custodian or trustee. 6. Third Party Custodian Information Make checks payable to the custodian and send ALL paperwork directly to the custodian. If you would like to purchase shares through an IRA account, First Trust Retirement and Community National Bank have each agreed to act as IRA custodians for such purpose; however, we do not require that you use our IRA custodian. If you would like to establish a new IRA account with either First Trust Retirement or Community National Bank, we will pay the fees related to the establishment of such accounts with First Trust Retirement or Community National Bank and the first calendar year base fee. After we pay the first calendar year base fee, investors will be responsible for the annual IRA maintenance fees charged by either of the IRA custodians, charged at the beginning of each calendar year. Further information about custodial services is available through your broker or through our dealer manager at 1-888-292-3178.

Complete this section if the registered owner of the investment will be a Custodian Plan or Trust.

Over Please

B-6

7. Distribution Information (Choose one or more of the following options) PLEASE NOTE: If you elect to participate in the Distribution Reinvestment Plan, you must agree that if at any time you cannot make the investor representations or warranties set forth in the Prospectus of the Subscription Agreement relating to such investment, you must promptly notify Carter Validus Mission Critical REIT II, Inc. in writing of that fact; provided, however, for Alabama investors only: If you are an Alabama investor and you elect to participate in our Distribution Reinvestment Plan and you experience a material adverse change in your financial condition or cannot make the representation in Section 10 of this Subscription Agreement, we request that you promptly notify your Broker-Dealer of such fact. Complete this section to enroll in the Distribution Reinvestment Plan, to elect to receive distributions by direct deposit and/or to elect to receive distributions by check. If you elect direct deposit, you must attach a voided check with this completed Subscription Agreement. You can choose to have all or a portion of your distributions reinvested through the Distribution Reinvestment Plan. You must indicate the percentage of our distribution to be applied to each option selected and the sum of the allocations must equal 100%. (If you do not complete this section, distributions will be paid to the registered owner at the address in Section 4. IRA accounts may not direct distributions without the custodian’s approval.) 8. Broker-Dealer, Registered Representative Information PLEASE NOTE: The Broker-Dealer or Registered Investment Advisor must complete and sign this section of the Subscription Agreement. All Fields are Mandatory. Required Representations: By signing Section 8, the registered representative of the Broker-Dealer or Registered Investment Advisor confirms on behalf of the Broker-Dealer that he or she: has reasonable grounds to believe the information and representations concerning the investor identified herein are true, correct, and complete in all respects; has discussed the investor’s prospective purchase of shares with such investor; has advised such investor of all pertinent facts with regard to the lack of liquidity and marketability of the shares and other fundamental risks related to the investment in the shares, the restrictions on transfer of the shares and the risk that the investor could lose his or her entire investment in the shares; has delivered to the investor the Prospectus required to be delivered in connection with this subscription; has reasonable grounds to believe the investor is purchasing these shares for the account referenced in Section 5, and has reasonable grounds to believe the purchase of shares is a suitable investment for such investor, and such investor meets the suitability standards applicable to the investor set forth in the Prospectus and such investor is in a financial position to enable the investor to realize the benefits of such an investment and to suffer any loss that may occur with respect thereto. In addition, the registered representative of the Broker-Dealer or Registered Investment Advisor represents that he or she and the Broker-Dealer, (i) are duly licensed and may lawfully offer and sell the shares in the state where the investment was made and in the state designated as the investor’s legal residence in Section 4; and (ii) agree to maintain records of the information used to determine that an investment in shares is suitable and appropriate for the investor for a period of six years. 9. Electronic Delivery (Optional) Instead of receiving paper copies of this Prospectus, our Prospectus supplements, annual reports, proxy statements, and other stockbroker communications and reports, you may elect to receive electronic delivery of stockholder communications from Carter Validus Mission Critical REIT II, Inc. If you would like to consent to electronic delivery, including pursuant to CD- ROM or electronic mail, please sign and return this election with your Subscription Agreement. By signing the Subscription Agreement in Section 9, you acknowledge and agree that you will not receive paper copies of any stockholder communications unless (i) you notify Carter Validus Mission Critical REIT II, Inc. that you are revoking this election with respect to all stockholder communications or (ii) you specifically request that Carter Validus Mission Critical REIT II, Inc. send a paper copy of a particular stockholder communications to you. Carter Validus Mission Critical REIT II, Inc. has advised you that you have the right to revoke this election at any time and receive all stockholder communications as paper copies through the mail. You also understand that you have the right to request a paper copy of any stockholder communication. By electing electronic delivery, you understand that you may incur certain costs associated with spending time online and downloading and printing stockholder communications and you may be required to download software to read documents delivered in electronic format. Electronic delivery also involves risks related to system or network outages that could impair your timely receipt of or access to stockholder communications. 10. Subscriber Signatures Please separately initial each of the representations in paragraph (1) through (5). If an Alabama resident you must also initial paragraph (6), if an Iowa resident you must also initial paragraph (7), if a Kansas resident you must also initial paragraph (8), if a Kentucky resident you must also initial paragraph (9), if a Maine resident you must also initial paragraph (10), if a Massachusetts resident you must also initial paragraph (11), if a Missouri resident you must also initial paragraph (12), if a Nebraska resident you must also initial paragraph (13), if a New Jersey resident you must also initial paragraph (14), if a New Mexico resident you must also initial paragraph (15), if a North Dakota resident you must also initial paragraph (16), if an Ohio resident you must also initial paragraph (17), if an Oregon resident you must also initial paragraph (18) and if a resident of Tennessee you must also initial paragraph (19). Except in the case of fiduciary accounts, you may not grant any person a power of attorney to make such representations on your behalf. Please refer to the Prospectus under “Suitability Standards” to verify that you meet the minimum suitability standards imposed by the state of your primary residence. By signing this Subscription Agreement, you agree to provide the information in Section 10 of the agreement and confirm the information is true and correct. If we are unable to verify your identity or that of another person authorized to act on your behalf or if we believe we have identified potential criminal activity, we reserve the right to take action as we deem appropriate, including, but not limited to, closing your account or refusing to establish your account.

B-7

The Subscription Agreement, together with a check made payable to “Carter Validus Mission Critical REIT II” for the full purchase price, should be delivered or mailed by your Broker-Dealer or Registered Investment Advisor, as applicable, to: FOR PAPERWORK ONLY FOR PAYMENTS ONLY Regular Mail Overnight Mail Subscription Agreements may be faxed to: Payment may be wired to: Investment Processing Department c/o DST Systems, Inc. P.O. Box 219731 Kansas City, MO 64121-9731 Toll Free: 888.292.3178 Investment Processing Department c/o DST Systems, Inc. 430 W. 7th Street Kansas City, MO 64105 Toll Free: 888.292.3178 855.223.2474 UMB Bank, N.A. 1010 Grand Boulevard, 4th Floor Kansas City, MO 64106 ABA #: 101000695 Account #: 9871916944 FAO: (Include Account Title) 4/15 CV20011-J

B-8

Additional Subscription This form may be used by any current investor in Carter Validus Mission Critical REIT II who desires to purchase additional units of Carter Validus Mission Critical REIT II. Investors who acquired units through a transfer of ownership or transfer on death and wish to make additional investments must complete the Carter Validus Mission Critical REIT II Subscription Agreement. 1. Investment Information Amount of Subscription: State of Sale: Minimum Additional Investment is $500. Money Orders, Traveler’s Checks, Starter Checks, Foreign Checks, Counter Checks, Third-Party Checks or Cash cannot be accepted. Payment will be made with: Enclosed Check Funds Wired 2. Account Number Account Number: 3. Investor Information- SSN or TIN Required Please print name in which units are registered. Title Line 1: Title Line 2: Primary SSN/TIN: Secondary SSN/TIN: Primary Investor is: Individual, Trust/Qualified Plan, Entity, Minor (UGMA/UTMA) Secondary Investor is: Additional Accountholder, Trustee, Officer/Authorized Signer, Custodian (UGMA/UTMA) Primary Investor Name: SSN/TIN: DOB: Secondary Investor Name: SSN/TIN: DOB: Please indicate if mailing address has changed since initial investment in Carter Validus Mission Critical REIT II Yes No If “yes”, please print new address below: Street Address: City: State: Zip Code: 4. Broker - Dealer and Registered Representative Information Broker-Dealer Name: Representative Name: Rep Number: Representative’s Firm Name: Branch ID: Representative’s Address: Representative’s City: State: Zip Code: Representative’s Phone: Representative’s Fax Number: Representative’s E-mail Address: This Subscription was made as follows: Through a participating Broker-Dealer Shares are being purchased net of commissions Through a participating RIA* unaffiliated with a participating Broker-Dealer *RIAs must first execute a firm level RIA Placement Agreement with SC Distributors (the Dealer Manager for Carter Validus Mission Critical REIT II) before conducting business. To obtain an RIA Placement Agreement or for additional questions please contact SC Distributors at: 877-907-1148.

C-1

Volume Discount**: The subscriber is a qualifying purchaser and may combine this purchase for the purpose of qualifying for a volume discount. Account to be combined with: Investor Name: Account Number: SSN/TIN: **Any combination request will be subject to our verification that the subscriptions to be combined are made by a single qualifying purchaser. Please see “Volume Discounts” section of the prospectus for further information on volume discount qualifications. Based on the information I obtained from the subscriber regarding the subscriber’s financial situation and investment objectives, I hereby certify to Carter Validus Mission Critical REIT II that I have reasonable grounds for believing that the purchase of the Shares by the Subscriber is a suitable and appropriate investment for this Subscriber. Signature of Financial Representative: Date: (If required by Broker-Dealer) Branch Manager Signature: Date: 5. Investor Signatures By signing below, you agree that if at any time you fail to meet the applicable investor suitability standards or cannot make the other investor representations or warranties set forth in the then current prospectus (as supplemented) for Carter Validus Mission Critical REIT II or the subscription agreement relating to such investment, you will promptly notify Carter Validus Mission Critical REIT II in writing of the fact at the address set forth below. Signature of Investor: Date: Signature of Joint Investor or Third Party Custodian: Date: Please consult your Financial Representative if you have any material changes which might affect your ability to meet the applicable suitability requirements. The Subscription Agreement, together with a check made payable to “Carter Validus Mission Critical REIT II” for the full purchase price, should be delivered or mailed by your Broker-Dealer or Registered Investment Advisor, as applicable, to: FOR PAPERWORK ONLY Regular Mail Investment Processing Department c/o DST Systems, Inc. P.O. Box 219731 Kansas City, MO 64121-9731 Toll Free: 888.292.3178 Overnight Mail Investment Processing Department c/o DST Systems, Inc. 430 W. 7th Street Kansas City, MO 64105 Toll Free: 888.292.3178 FOR PAYMENTS ONLY Subscription Agreements may be faxed to: 855.223.2474 Payment may be wired to: UMB Bank, N.A. 1010 Grand Boulevard, 4th Floor Kansas City, MO 64106 ABA #: 101000695 Account #: 9871916944 FAO: (Include Account Title)

C-2

CARTER VALIDUS® MISSION CRITICAL REIT II Subscription Agreement Product 1 Logo Product 2 Logo Product 3 Logo Product 4 Logo This subscription agreement is not valid for use in AL, AR, KY, MA, MD, NC, NE, NJ and TN. 1. Investment Amount of Subscription: State of Sale: Minimum Initial Investment for CVMC REIT II, Product 1, Product 2 & Product 3 Only is $2,000 ($2,500 -New York for CVMC REIT II Only) Minimum Initial Investment for Product 4 Only is $2,500 Money Orders, Traveler’s Checks, Starter Checks, Foreign Checks, Counter Checks, Third-Party Checks or Cash cannot be accepted. Payment will be made with: Enclosed Checks Funds Wired Funds to Follow Investment Amount Carter Validus Mission Critical REIT II (CVMC REIT II) Product 1 (Product 1) Product 2 (Product 2) Product 3 (Product 3) Product 4 (Product 4) Investor hereby (1) acknowledges and agrees that, in the event that Investor subscribes for shares and/or units of CVMC REIT II and/or Product 1 and/or Product 2 and/or Product 3 and/or Product 4 (each an “Issuer”) pursuant to this subscription agreement, this subscription agreement and the information set forth herein will be provided to each Issuer whose shares and/or units Investor subscribes for and, as necessary, the advisors, agents and affiliates of each such Issuer, and (2) consents to this subscription agreement and the information set forth herein being so provided to each Issuer whose shares and/or units Investor subscribes for. 2. Share Class (CVMC REIT II Only) Please consult with your financial representative and check one of the following options pertaining to the class of shares you intend to purchase. The Prospectus contains additional information regarding the share classes, including the different fees which are payable with respect to each class. Class A Shares 3. Unit Class (Product 2 Only) Please consult with your financial representative and check one of the following options pertaining to the class of units you intend to purchase. The Prospectus contains additional information regarding the unit classes, including the different fees which are payable with respect to each class. Class A Units Class C Units Class I Units 4. Share Class (Product 3 Only) Please consult with your financial representative and check one of the following options pertaining to the class of shares you intend to purchase. The Prospectus contains additional information regarding the share classes, including the different fees which are payable with respect to each class. Class A Shares Class C Shares Class I Shares 5. Share Class (Product 4 Only) Please consult with your financial representative and check one of the following options pertaining to the class of shares you intend to purchase. The Prospectus contains additional information regarding the share classes, including the different fees which are payable with respect to each class. Class A Shares Class B Shares

F-1

6. Account Type - check one box only Account Type Additional Required Documentation Individual If TOD, Transfer on Death form Joint Tenants (WROS)* Tenants in Common* Community Property* *All parties must sign If JTWROS TOD, Transfer on Death form Trust Trustee Certification form or trust documents Estate Documents evidencing individuals authorized to act on behalf of estate Custodial UGMA: State of: UTMA: State of: None Corporation C Corp S Corp Articles of Incorporation or Corporate Resolution LLC LLC Operating Agreement or LLC Resolution Partnership Partnership Certification of Powers or Certificate of Limited Partnership Non-Profit Organization Formation document or other document evidencing authorized signers Profit Sharing Plan Defined Benefit Plan KEOGH Plan Pages of plan document that list plan name, date, trustee name(s) and signatures Traditional IRA SEP IRA ROTHIRA Simple IRA Inherited IRA For Inherited IRA indicate Decedent’s name: Other (Specify) For Non-Qualified Custodial Accounts and All Qualified Accounts, please complete Section 13 7. Investor Information (CVMC REIT II, Product 1, Product 2 & Product 3 Only) Investor #1 Name SSN/Tax ID DOB Investor #2 Name SSN/Tax ID DOB Street Address City State Zip Code Mailing Address (optional) City State Zip Code Phone (day) Phone (evening) E-mail US Citizen US Citizen residing outside the US Foreign citizen, country: Check here if you are subject to backup withholding 8. Investment Title - SSN or TIN Required (CVMC REIT II, Product 1, Product 2 & Product 3 Only) Please print names in which shares of common stock and/or units are to be registered. Include trust name if applicable. If IRA or qualified plan, include both custodian and investor names and Tax ID Numbers. If same as above, write “Same.” (This is the name that will appear on your statement.) Title Line 1 Title Line 2 SSN/TIN

F-2

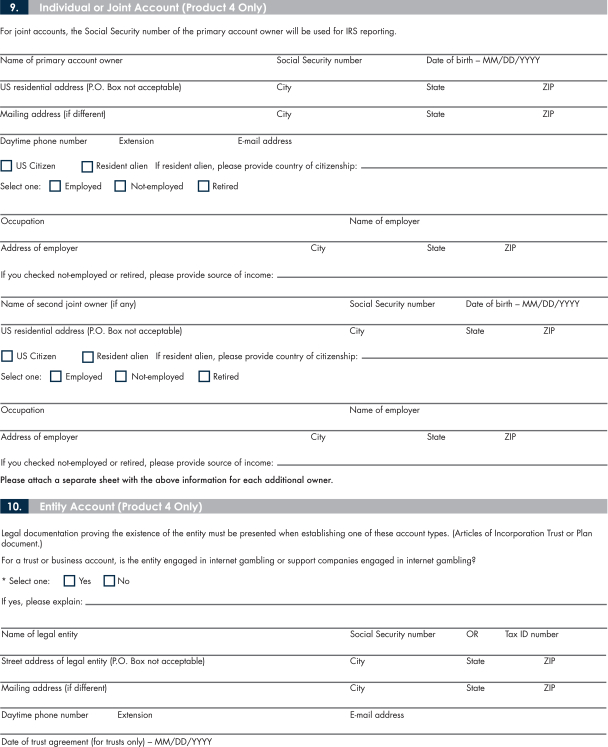

9. Individual or Joint Account (Product 4 Only) For joint accounts, the Social Security number of the primary account owner will be used for IRS reporting. Name of primary account owner Social Security number Date of birth – MM/DD/YYYY US residential address (P.O. Box not acceptable) City State ZIP Mailing address (if different) City State ZIP Daytime phone number Extension E-mail address US Citizen Resident alien If resident alien, please provide country of citizenship: Select one: Employed Not-employed Retired Occupation Name of employer Address of employer City State ZIP If you checked not-employed or retired, please provide source of income: Name of second joint owner (if any) Social Security number Date of birth – MM/DD/YYYY US residential address (P.O. Box not acceptable) City State ZIP US Citizen Resident alien If resident alien, please provide country of citizenship: Select one: Employed Not-employed Retired Occupation Name of employer Address of employer City State ZIP If you checked not-employed or retired, please provide source of income: Please attach a separate sheet with the above information for each additional owner. 10. Entity Account (Product 4 Only) Legal documentation proving the existence of the entity must be presented when establishing one of these account types. (Articles of Incorporation Trust or Plan document.) For a trust or business account, is the entity engaged in internet gambling or support companies engaged in internet gambling? * Select one: Yes No If yes, please explain: Name of legal entity Social Security number OR Tax ID number Street address of legal entity (P.O. Box not acceptable) City State ZIP Mailing address (if different) City State ZIP Daytime phone number Extension E-mail address Date of trust agreement (for trusts only) – MM/DD/YYYY

F-3

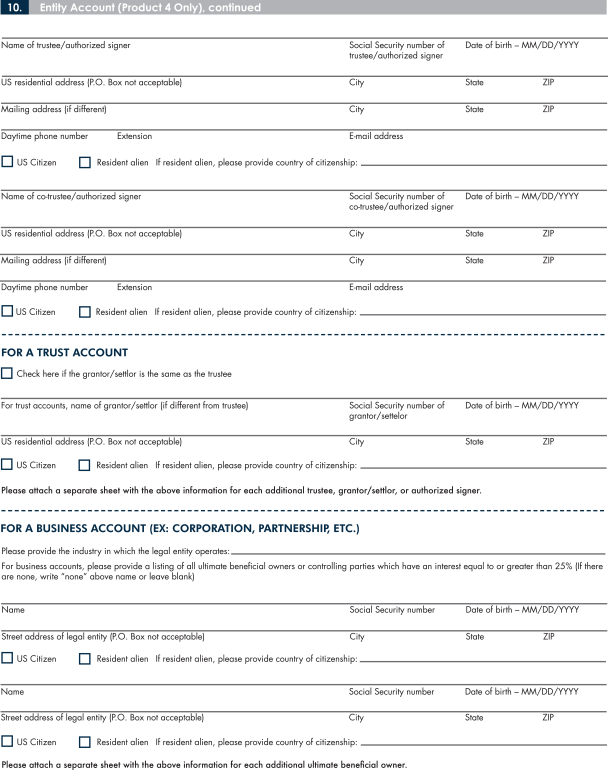

10. Entity Account (Product 4 Only), continued Name of trustee/authorized signer Social Security number of Date of birth – MM/DD/YYYY trustee/authorized signer US residential address (P.O. Box not acceptable) City State ZIP Mailing address (if different) City State ZIP Daytime phone number Extension E-mail address US Citizen Resident alien If resident alien, please provide country of citizenship: Name of co-trustee/authorized signer Social Security number of Date of birth – MM/DD/YYYY co-trustee/authorized signer US residential address (P.O. Box not acceptable) City State ZIP Mailing address (if different) City State ZIP Daytime phone number Extension E-mail address US Citizen Resident alien If resident alien, please provide country of citizenship: FOR A TRUST ACCOUNT Check here if the grantor/settlor is the same as the trustee For trust accounts, name of grantor/settlor (if different from trustee) Social Security number of Date of birth – MM/DD/YYYY grantor/settelor US residential address (P.O. Box not acceptable) City State ZIP US Citizen Resident alien If resident alien, please provide country of citizenship: Please attach a separate sheet with the above information for each additional trustee, grantor/settlor, or authorized signer. FOR A BUSINESS ACCOUNT (EX: CORPORATION, PARTNERSHIP, ETC.) Please provide the industry in which the legal entity operates: For business accounts, please provide a listing of all ultimate beneficial owners or controlling parties which have an interest equal to or greater than 25% (If there are none, write “none” above name or leave blank) Name Social Security number Date of birth – MM/DD/YYYY Street address of legal entity (P.O. Box not acceptable) City State ZIP US Citizen Resident alien If resident alien, please provide country of citizenship: Name Social Security number Date of birth – MM/DD/YYYY Street address of legal entity (P.O. Box not acceptable) City State ZIP US Citizen Resident alien If resident alien, please provide country of citizenship: Please attach a separate sheet with the above information for each additional ultimate beneficial owner.

F-4

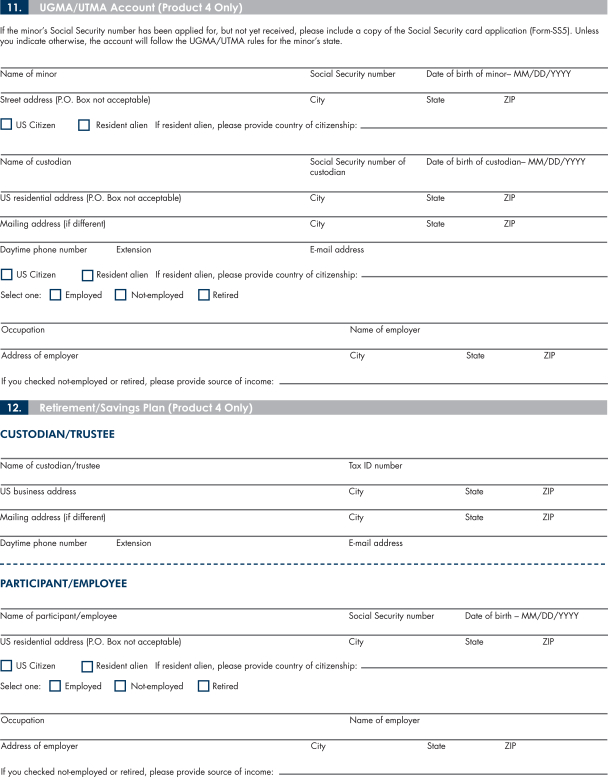

11. UGMA/UTMA Account (Product 4 Only) If the minor’s Social Security number has been applied for, but not yet received, please include a copy of the Social Security card application (Form-SS5). Unless you indicate otherwise, the account will follow the UGMA/UTMA rules for the minor’s state. Name of minor Social Security number Date of birth of minor– MM/DD/YYYY Street address (P.O. Box not acceptable) City State ZIP US Citizen Resident alien If resident alien, please provide country of citizenship: Name of custodian Social Security number of custodian Date of birth of custodian– MM/DD/YYYY US residential address (P.O. Box not acceptable) City State ZIP Mailing address (if different) City State ZIP Daytime phone number Extension E-mail address US Citizen Resident alien If resident alien, please provide country of citizenship: Select one: Employed Not-employed Retired Occupation Name of employer Address of employer City State ZIP If you checked not-employed or retired, please provide source of income: 12. Retirement/Savings Plan (Product 4 Only) CUSTODIAN/TRUSTEE Name of custodian/trustee Tax ID number US business address City State ZIP Mailing address (if different) City State ZIP Daytime phone number Extension E-mail address PARTICIPANT/EMPLOYEE Name of participant/employee Social Security number Date of birth – MM/DD/YYYY US residential address (P.O. Box not acceptable) City State ZIP US Citizen Resident alien If resident alien, please provide country of citizenship: Select one: Employed Not-employed Retired Occupation Name of employer Address of employer City State ZIP If you checked not-employed or retired, please provide source of income:

F-5

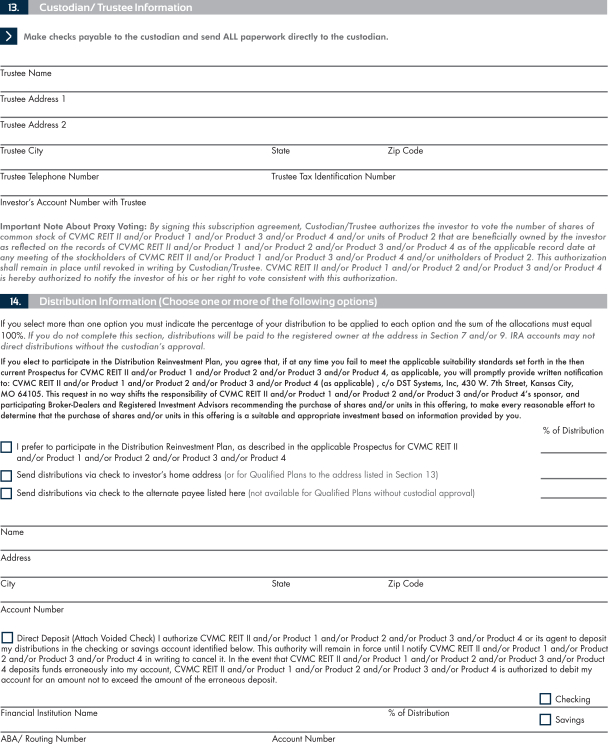

13. Custodian/ Trustee Information Make checks payable to the custodian and send ALL paperwork directly to the custodian. Trustee Name Trustee Address 1 Trustee Address 2 Trustee City State Zip Code Trustee Telephone Number Trustee Tax Identification Number Investor’s Account Number with Trustee Important Note About Proxy Voting: By signing this subscription agreement, Custodian/Trustee authorizes the investor to vote the number of shares of common stock of CVMC REIT II and/or Product 1 and/or Product 3 and/or Product 4 and/or units of Product 2 that are beneficially owned by the investor as reflected on the records of CVMC REIT II and/or Product 1 and/or Product 2 and/or Product 3 and/or Product 4 as of the applicable record date at any meeting of the stockholders of CVMC REIT II and/or Product 1 and/or Product 3 and/or Product 4 and/or unitholders of Product 2. This authorization shall remain in place until revoked in writing by Custodian/Trustee. CVMC REIT II and/or Product 1 and/or Product 2 and/or Product 3 and/or Product 4 is hereby authorized to notify the investor of his or her right to vote consistent with this authorization. 14. Distribution Information (Choose one or more of the following options) If you select more than one option you must indicate the percentage of your distribution to be applied to each option and the sum of the allocations must equal 100%. If you do not complete this section, distributions will be paid to the registered owner at the address in Section 7 and/or 9. IRA accounts may not direct distributions without the custodian’s approval. If you elect to participate in the Distribution Reinvestment Plan, you agree that, if at any time you fail to meet the applicable suitability standards set forth in the then current Prospectus for CVMC REIT II and/or Product 1 and/or Product 2 and/or Product 3 and/or Product 4, as applicable, you will promptly provide written notification to: CVMC REIT II and/or Product 1 and/or Product 2 and/or Product 3 and/or Product 4 (as applicable) , c/o DST Systems, Inc, 430 W. 7th Street, Kansas City, MO 64105. This request in no way shifts the responsibility of CVMC REIT II and/or Product 1 and/or Product 2 and/or Product 3 and/or Product 4’s sponsor, and participating Broker-Dealers and Registered Investment Advisors recommending the purchase of shares and/or units in this offering, to make every reasonable effort to determine that the purchase of shares and/or units in this offering is a suitable and appropriate investment based on information provided by you. I prefer to participate in the Distribution Reinvestment Plan, as described in the applicable Prospectus for CVMC REIT II and/or Product 1 and/or Product 2 and/or Product 3 and/or Product 4 Send distributions via check to investor’s home address (or for Qualified Plans to the address listed in Section 13) Send distributions via check to the alternate payee listed here (not available for Qualified Plans without custodial approval) % of Distribution Name Address City State Zip Code Account Number Direct Deposit (Attach Voided Check) I authorize CVMC REIT II and/or Product 1 and/or Product 2 and/or Product 3 and/or Product 4 or its agent to deposit my distributions in the checking or savings account identified below. This authority will remain in force until I notify CVMC REIT II and/or Product 1 and/or Product 2 and/or Product 3 and/or Product 4 in writing to cancel it. In the event that CVMC REIT II and/or Product 1 and/or Product 2 and/or Product 3 and/or Product 4 deposits funds erroneously into my account, CVMC REIT II and/or Product 1 and/or Product 2 and/or Product 3 and/or Product 4 is authorized to debit my account for an amount not to exceed the amount of the erroneous deposit. Financial Institution Name% of Distribution ABA/ Routing Number Account Number Checking Savings

F-6

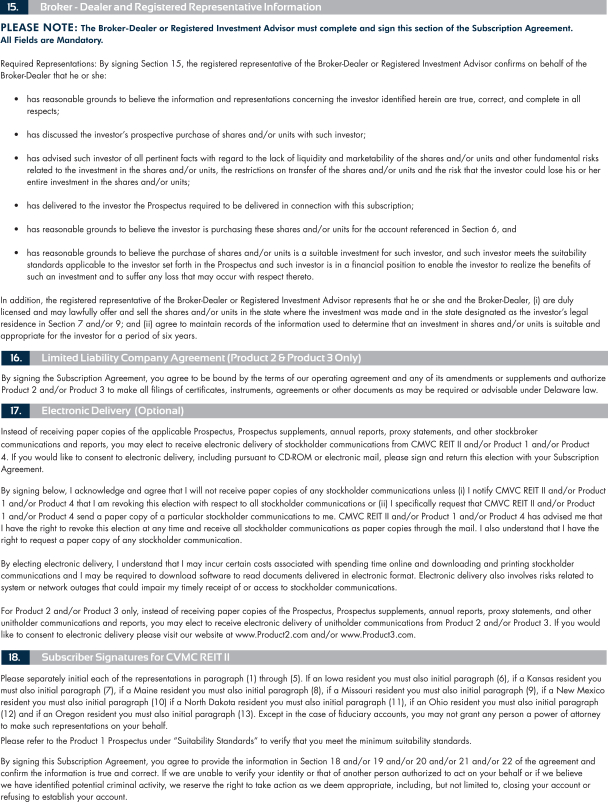

15. Broker—Dealer, Registered Investment Advisor and Financial Representative Information Broker-Dealer Name Representative Name Rep Number Representative’s Firm Name Branch ID Representative’s Address Representative’s City State Zip Code Representative’s Phone Representative’s Fax Number Representative’s E-mail Address This Subscription was made as follows: Through a participating Broker-Dealer Through a participating RIA* unaffiliated with a participating Broker-Dealer Shares are being purchased net of up front commissions (Class A shares and/or units only for CVMC REIT II and/or Product 2 and/or Product 3 and/or Product 4) *RIAs must first execute a firm level RIA Placement Agreement with SC Distributors (the Dealer Manager for CVMC REIT II and/or Product 1 and/or Product 2 and/or Product 3 and/or Product 4) before conducting business. To obtain an RIA Placement Agreement or for additional questions please contact SC Distributors at: 877-907-1148. Volume Discount**: The subscriber is a qualifying purchaser and may combine this purchase for the purpose of qualifying for a volume discount. Account to be combined with: Investor Name: Account Number: SSN/TIN: **Any combination request will be subject to our verification that the subscriptions to be combined are made by a single qualifying purchaser. Please see “Volume Discounts” section of the prospectus for further information on volume discount qualifications. Based on the information I obtained from the subscriber regarding the subscriber’s financial situation and investment objectives, I hereby certify to CVMC REIT II and/or Product 1 and/or Product 2 and/or Product 3 and/or Product 4 that I have reasonable grounds for believing that the purchase of the shares by the Subscriber is a suitable and appropriate investment for this Subscriber. Financial Representative Signature Date (If required by Broker-Dealer) Date Branch Manager Signature 16. Limited Liability Company Agreement (Product 2 & Product 3 Only) By executing the Subscription Agreement, the undersigned hereby agrees to be bound by the terms of the limited liability operating agreement and any amendments or supplements thereto or cancellations thereof and authorizes Product 2 and/or Product 3 to make all filings of any and all certificates, instruments, agreements or other documents, whether related to the limited liability agreement or otherwise, as may be required or advisable under the laws of the State of Delaware. 17. Electronic Delivery (Optional) Instead of receiving paper copies of the Prospectus for CVMC REIT II and/or Product 1 and/or Product 4, and Prospectus supplements, annual reports, proxy statements, and other stockbroker communications and reports, you may elect to receive electronic delivery of stockholder communications from CVMC REIT II and/or Product 1 and/or Product 4. If you would like to consent to electronic delivery, including pursuant to CD-ROM or electronic mail, please sign and return this election with your Subscription Agreement. By signing below, I acknowledge and agree that I will not receive paper copies of any stockholder communications unless (i) I notify CVMC REIT II and/or Product 1 and/or Product 4 that I am revoking this election with respect to all stockholder communications or (ii) I specifically request that CVMC REIT II and/or Product 1 and/or Product 4 send a paper copy of a particular stockholder communications to me. CVMC REIT II and/or Product 1 and/or Product 4 has advised me that I have the right to revoke this election at any time and receive all stockholder communications as paper copies through the mail. I also understand that I have the right to request a paper copy of any stockholder communication. By electing electronic delivery, I understand that I may incur certain costs associated with spending time online and downloading and printing stockholder communications and I may be required to download software to read documents delivered in electronic format. Electronic delivery also involves risks related to system or network outages that could impair my timely receipt of or access to stockholder communications. For Product 2 and/or Product 3 only, instead of receiving paper copies of the Prospectus, Prospectus supplements, annual reports, proxy statements, and other unitholder communications and reports, you may elect to receive electronic delivery of unitholder communications from Product 2 and/or Product 3. If you would like to consent to electronic delivery please visit our website at www.Product2.com and/or www.Product3.com. Signature of Investor: Date: Electronic Delivery Acknowledgement Only Signature of Joint Investor: Date: E-mail: (If blank - email from Section 7 and/or 9 will be used)

F-7

| 18. | Subscriber Signatures for CVMC REIT II Please separately initial each of the representations below. Except in the case of fiduciary, you may not grant any person or power of attorney to make such representations on your behalf. I hereby acknowledge and/or represent the following: Owner Co-Owner 1. I (we) have received the final Prospectus of CVMC REIT II at least five business days before signing the Subscription Agreement. Owner Co-Owner 2. I (we) have (i) a minimum net worth (exclusive of home, home furnishings and personal automobiles) of at least $250,000 or (ii) a minimum net worth (as previously described) of at least $70,000 and a minimum annual gross income of at least $70,000, and, if applicable, I meet the higher net worth and gross income requirements imposed by my (our) state of primary residence as set forth in the Prospectus under “Suitability Standards.” I (we) will not purchase additional shares unless I (we) meet the applicable suitability requirements set forth in the Prospectus at the time of purchase. Owner Co-Owner 3. I (we) acknowledge that there is no public market for the shares and, thus, my investment in shares is not liquid. Owner Co-Owner 4. I (we) am/are purchasing the shares for the account referenced above. Owner Co-Owner 5. I (we) acknowledge that I (we) will not be admitted as a stockholder until my (our) investment has been accepted. The acceptance process includes, but is not limited to, reviewing the Subscription Agreement for completeness and signatures, conducting an Anti-Money Laundering check as required by the USA Patriot Act and payment of the full purchase price of the shares. Owner Co-Owner 6. Iowa: In addition to the general suitability standards listed above, an Iowa investor must have either (a) a minimum net worth of $300,000 (exclusive of home, auto and furnishings) or (b) a minimum annual income of $70,000 and a net worth of $100,000 (exclusive of home, auto and furnishings). In addition, Iowa recommends that an investor’s total investment in this offering or any of its affiliates and any other non exchange traded REIT, not exceed 10% of the Iowa resident’s liquid net worth. “Liquid net worth” for purposes of this investment shall consist of cash, cash equivalents and readily marketable securities. Owner Co-Owner 7. Kansas: It is recommended by the Office of the Securities Commissioner of Kansas that investors limit their aggregate investment in our securities and the securities of other non-traded real estate investment trusts to not more than 10% of their liquid net worth. For these purposes, liquid net worth shall be defined as that portion of total net worth (total assets minus liabilities) that is comprised of cash, cash equivilents, and readily marketable securities, as determinded in conformity with Generally Acceptable Accounting Principles. Owner Co-Owner 8. Maine: In addition to the suitability standards noted above, the Maine Office of Securities recommends that an investor’s aggregate investment in this offering and similar direct participation investments not exceed 10% of the investor’s liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents, and readily marketable securities. Owner Co-Owner 9. Missouri: In addition to the general suitability requirements listed above, no more than ten percent (10%) of any investor’s liquid net worth shall be invested in the securities registered by the Issuer for this offering with the Securities Division. Owner Co-Owner 10. New Mexico: In addition to the general suitability standards listed above, a New Mexico investor may not invest more than 10% of their liquid net worth in us, our affiliates and other non-traded real estate investment programs. Owner Co-Owner 11. North Dakota: North Dakota investors must represent that, in addition to the stated net income and net worth standards, they have a net worth of at least ten times their investment in us. Owner Co-Owner 12. Ohio: It shall be unsuitable for an Ohio investor’s aggregate investment in shares of the issuer, affiliates of the issuer, and in other non-traded real estate investment trusts to exceed ten percent (10%) of his or her liquid net worth. “Liquid net worth” shall be defined as that portion of net worth (total assets exlusive of primary residence, home furnishings, and automobiles minus total liabilities) that is comprised of cash, cash equivalents, and readily marketable securities. Owner Co-Owner 13. Oregon: In addition to the minimum suitability standards described above, an Oregon resident may not exceed ten percent (10%) of the Oregon resident’s liquid net worth in us and our affiliates. |

F-8

I ACKNOWLEDGE RECEIPT OF THE PROSPECTUS, WHETHER OVER THE INTERNET, ON A CD-ROM, A PAPER COPY OR ANY OTHER DELIVERY METHOD. IF A SUBSCRIBER’S SUBSCRIPTION IS ACCEPTED, CVMC REIT II WILL SEND THE SUBSCRIBER CONFIRMATION OF HIS OR HER PURCHASE AFTER HE OR SHE HAS BEEN ADMITTED AS A STOCKHOLDER. Substitute W-9: I HEREBY CERTIFY under penalty of perjury (i) that the taxpayer identification number shown on the Subscription is true, correct and complete, (ii) that I am not subject to backup withholding either (a) I am exempt from backup withholding, (b) because I have not been notified that I am subject to backup withholding as a result of a failure to report all interest or distributions, or (c) the Internal Revenue Service has notified me that I am no longer subject to backup withholdings and (iii) I am a U.S. citizen or a U.S. person. Signature of Investor: Date: Signature of Joint Investor or for Qualified Plans, of Trustee/Custodian: Date: 19. Subscriber Signatures for Product 1 Please separately initial each of the representations below. Except in the case of fiduciary, you may not grant any person or power of attorney to make such representations on your behalf. I hereby acknowledge and/or represent the following: Owner Co-Owner 1. I have received the final Prospectus of Product 1 at least five business days before signing the Subscription Agreement. Owner Co-Owner 2. I have (i) a minimum net worth (exclusive of home, home furnishings and personal automobiles) of at least $250,000 or (ii) a minimum net worth (as previously described) of at least $70,000 and a minimum annual gross income of at least $70,000, and, if applicable, I meet the higher net worth and gross income requirements imposed by my state of primary residence as set forth in the Prospectus under “Suitability Standards.” I will not purchase additional shares unless I meet the applicable suitability requirements set forth in the Prospectus at the time of purchase. Owner Co-Owner 3. I acknowledge that there is no public market for the shares and, thus, my investment in shares is not liquid. Owner Co-Owner 4. I am purchasing the shares for the account referenced above. Owner Co-Owner 5. I acknowledge that I will not be admitted as a stockholder until my investment has been accepted. The acceptance process includes, but is not limited to, reviewing the Subscription Agreement for completeness and signatures, conducting an Anti-Money Laundering check as required by the USA Patriot Act and payment of the full purchase price of the shares. Owner Co-Owner 6. California: In addition to the suitability standards noted above, a California investor’s total investment in us shall not exceed 10% of his or her net worth. Owner Co-Owner 7. Iowa: In addition to the suitability standards noted above, an Iowa investor’s total investment in us shall not exceed 10% of his or her liquid net worth. Liquid net worth is that portion of an investor’s net worth that consists of cash, cash equivalents and readily marketable securities. Owner Co-Owner 8. Kansas: In addition to the suitability standards noted above, it is recommended by the Office of the Kansas Securities Commissioner that Kansas investors not invest, in the aggregate, more than 10% of their liquid net worth in this and other non-traded business development companies. Liquid net worth is defined as that portion of net worth which consists of cash, cash equivalents and readily marketable securities. Owner Co-Owner 9. Maine: In addition to the suitability standards noted above, the Maine Office of Securities recommends that an investor’s aggregate investment in this offering and similar direct participation investments not exceed 10% of the investor’s liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents, and readily marketable securities. Owner Co-Owner 10. New Mexico: In addition to the suitability standards noted above, a New Mexico resident’s investment should not exceed 10% of his or her liquid net worth in this and other non-traded business development companies. Liquid net worth is defined as that portion of net worth which consists of cash, cash equivalents and readily marketable securities.

F-9

19. Subscriber Signatures for Product 1, continued Owner Co-Owner 11. North Dakota: In addition to the suitability standards noted above, North Dakota requires that shares may only be sold to residents of North Dakota that represent they have a net worth of at least ten times their investment in the issuer and its affiliates and that they meet one of the established suitability standards. Owner Co-Owner 12. Oklahoma: In addition to the suitability standards noted above, an Oklahoma investor must limit his or her investment in Product 1 to 10% of his or her net worth (excluding home, furnishings, and automobiles.) Owner Co-Owner 13. Ohio: In addition to the suitability standards noted above, it shall be unsuitable for an Ohio investor’s aggregate investment in shares of the issuer, affiliates of the issuer, and in other non-traded business development programs to exceed ten percent (10%) of his or her liquid net worth. “Liquid net worth” shall be defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles minus total liabilities) that is comprised of cash, cash equivalents, and readily marketable securities. Owner Co-Owner 14. Oregon: In addition to the suitability standards noted above, an Oregon investor must limit his or her investment in Product 1 to 10% of his or her net worth (excluding home, furnishings, and automobiles). Owner Co-Owner 15. Texas: In addition to the suitability standards noted above, Texas residents purchasing shares (i) must have either (a) an annual gross income of at least $100,000 and a net worth of at least $100,000, or (b) a net worth of at least $250,000; and (ii) may not invest more than 10% of their net worth in us. For Texas residents, “net worth” does not include the value of one’s home, home furnishings or automobiles. I ACKNOWLEDGE RECEIPT OF THE PROSPECTUS, WHETHER OVER THE INTERNET, ON A CD-ROM, A PAPER COPY OR ANY OTHER DELIVERY METHOD. IF A SUBSCRIBER’S SUBSCRIPTION IS ACCEPTED, PRODUCT 1 WILL SEND THE SUBSCRIBER CONFIRMATION OF HIS OR HER PURCHASE AFTER HE OR SHE HAS BEEN ADMITTED AS A STOCKHOLDER. By signing below, you also acknowledge that: You do not expect to be able to sell your shares regardless of how we perform. If you are able to sell your shares, you will likely receive less than your purchase price. We do not intend to list our shares on any securities exchange during or for what may be a significant time after the offering period, and we do not expect a secondary market in the shares to develop. Beginning the second quarter of 2013, we intend to implement a share repurchase program, but only a limited number of shares are eligible for repurchase by us. In addition, any such repurchases will be at a price equal to our most recently disclosed net asset value per share immediately prior to the date of repurchase. You may not have access to the money you invest for an indefinite period of time. An investment in our shares is not suitable for you if you need access to the money you invest. Because you will be unable to sell your shares, you will be unable to reduce your exposure in any market downturn. Distributions may be funded from offering proceeds or borrowings, which may constitute a return of capital and reduce the amount of capital available to us for investment. Any capital returned to stockholders through distributions will be distributed after payment of fees and expenses. Previous distributions to stockholders were funded from temporary fee reductions that are subject to repayment to our Adviser. These distributions were not based on our investment performance and may not continue in the future. If our Adviser had not agreed to make expense support payments, these distributions would have come from your paid in capital. The reimbursement of these payments owed to our Adviser will reduce the future distributions to which you would otherwise be entitled. Substitute W-9: I HEREBY CERTIFY under penalty of perjury (i) that the taxpayer identification number shown on the Subscription is true, correct and complete, (ii) that I am not subject to backup withholding either (a) I am exempt from backup withholding, (b) because I have not been notified that I am subject to backup withholding as a result of a failure to report all interest or distributions, or (c) the Internal Revenue Service has notified me that I am no longer subject to backup withholdings and (iii) I am a U.S. citizen or a U.S. person. Signature of Investor: Date: Signature of Joint Investor or for Qualified Plans, of Trustee/Custodian: Date:

F-10

v20. Subscriber Signatures for Product 2 Please separately initial each of the representations below. Except in the case of fiduciary accounts, you may not grant any person or power of attorney to make such representations on your behalf. I hereby acknowledge and/or represent the following: Owner Co-Owner 1. A copy of the prospectus of Product 2 has been delivered or made available to me. In addition, I acknowledge that from time to time following the escrow period, the purchase price per unit may change and I can access this information through Product 2’s website. Owner Co-Owner 2. I have (i) a minimum net worth (exclusive of home, home furnishings and personal automobiles) of at least $250,000 or (ii) a minimum net worth (as previously described) of at least $70,000 and a minimum annual gross income of at least $70,000, and, if applicable, I meet the higher net worth and gross income requirements imposed by my state of primary residence as set forth in the Prospectus under “Suitability Standards.” Owner Co-Owner 3. I acknowledge that there is no public market for the units and, thus, my investment in units is not liquid. Owner Co-Owner 4. I am purchasing the units for the account referenced above. Owner Co-Owner 5. I acknowledge that I will not be admitted as a unitholder until my investment has been accepted. The acceptance process includes, but is not limited to, reviewing the Subscription Agreement for completeness and signatures, conducting an Anti-Money Laundering check as required by the USA Patriot Act and payment of the full purchase price of the units. Owner Co-Owner 6. California: In addition to the minimum suitability standards described above, a California investor must have either: (i) a minimum net worth of $350,000 (exclusive of home, auto and furnishings); or (ii) a minimum annual gross income of $85,000 and a net worth of $150,000 (exclusive of home, auto and furnishings). In addition, a California investor’s maximum investment in the issuer may not exceed 10% of such investor’s net worth. Owner Co-Owner 7. Iowa: In addition to the minimum suitability standards described above, the state of Iowa requires that each Iowa investor limit his or her investment in the issuer to a maximum of 10% of his or her liquid net worth, which is defined as cash and/or cash equivalents. Owner Co-Owner 8. Kansas: In addition to the minimum suitability standards described above, it is recommended by the Office of the Kansas Securities Commissioner that Kansas investors not invest, in the aggregate, more than 10% of their liquid net worth in the issuer and other non-traded business development companies. Liquid net worth is defined as that portion of total net worth (total assets minus total liabilities) that is comprised of cash, cash equivalents and readily marketable securities, as determined in conformity with GAAP. Owner Co-Owner 9. Maine: In addition to the minimum suitability requirements, it is recommended that Maine investors limit their investment in the issuer and in the securities of similar programs to not more than 10% of their liquid net worth. For this purpose, “liquid net worth” is defined as that portion of net worth that consists of cash, cash equivalents and readily marketable securities. Owner Co-Owner 10. New Mexico: In addition to the minimum suitability standards described above, a New Mexico investor’s maximum investment in the issuer may not exceed 10% of such investor’s liquid net worth. Owner Co-Owner 11. North Dakota: In addition to the minimum suitability standards described above, North Dakota investors must represent that, in addition to the standards listed above, they have a net worth of at least ten times their investment in the issuer. Owner Co-Owner 12. Ohio: In addition to the minimum suitability standards described above, an Ohio investor must have a liquid net worth of at least ten times such Ohio resident’s investment in the issuer, the issuer’s affiliates and in other non-traded business development companies. Liquid net worth is defined as that portion of net worth (total assets exclusive of home, home furnishings, and automobiles minus total liabilities) that is comprised of cash, cash equivalents, and readily marketable securities. Owner Co-Owner 13. Oklahoma: In addition to the minimum suitability standards described above, an Oklahoma resident’s investment in the issuer must not exceed ten percent (10%) of their liquid net worth.

F-11