Filed Pursuant to Rule 424(b)(3)

Registration No. 333-217579

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

SUPPLEMENT NO. 2 DATED JANUARY 16, 2018

TO THE PROSPECTUS DATED NOVEMBER 27, 2017

This document supplements, and should be read in conjunction with, the prospectus of Carter Validus Mission Critical REIT II, Inc., dated November 27, 2017. Unless otherwise defined in this prospectus supplement, capitalized terms used in this prospectus supplement shall have the same meanings as set forth in the prospectus.

The purpose of this prospectus supplement is to describe the following:

| |

| (1) | the status of our follow-on offering of common stock (the "Offering"); |

| |

| (2) | recent individually immaterial real property acquisitions; |

| |

| (3) | updates regarding our credit facility; and |

| |

| (4) | a revised form of our subscription agreement. |

Status of the Offering

On November 27, 2017, our follow-on offering of up to $1,000,000,000 in shares of common stock was declared effective by the SEC (the "Offering"). As of January 16, 2018, we are offering shares of Class A common stock, Class I common stock and Class T common stock in the Offering. As of January 12, 2018, we had accepted investors' subscriptions for and issued approximately 974,000 shares of Class A common stock, 660,000 shares of Class I common stock and 608,000 shares of Class T common stock in the Offering, resulting in receipt of gross proceeds of $9,445,000, $6,063,000 and $5,781,000, respectively, for total gross proceeds raised of $21,289,000. As of January 12, 2018, we had approximately $978,711,000 in Class A shares, Class I shares and Class T shares of common stock remaining in the Offering.

Description of Real Estate Investments

The following information replaces in its entirety the second full paragraph on page 14 of the “Prospectus Summary—Description of Real Estate Investments” section of the prospectus and on page 109 of the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

As of January 16, 2018, on a portfolio level, we, through wholly-owned subsidiaries of our operating partnership, owned a combination of the fee simple interest and leasehold interest in 70 properties located in various states, consisting of approximately 5,190,000 gross rentable square feet of commercial space. As of January 16, 2018, our properties that are subject to net leases have a consolidated weighted average yield of 7.89%. As of January 16, 2018, our leases have average annual rent escalations of 2.11%.

Individually Immaterial Real Property Acquisitions

The following information replaces in its entirety the first sentence of the first full paragraph on page 110 of the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

As of January 16, 2018, we purchased, since inception, 69 individually immaterial properties for an aggregate contract purchase price of approximately $1,420,531,000 plus closing costs, with total annualized base rent at acquisition of approximately $99,637,000.

The following table supplements, and should be read in conjunction with, the table beginning on page 111 contained in the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

The following tables summarizes the three individually immaterial properties acquired since November 27, 2017 in order of acquisition date:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Description | | Location | | MSA/µSA (1) | | Date Acquired | | Contract Purchase Price (2) | | Property Taxes (3) | | Fees Paid to Advisor (4) | | Major Tenants (5) | | Total Rentable Square Feet | | % of Total Rentable Square Feet Leased to Major Tenants | | % of Total Rentable Square Feet Leased | | Lease Expiration for Major Tenants |

| Saginaw Healthcare Facility | | Saginaw, MI | | Saginaw, MI | | 12/21/2017 | | $ | 18,000,000 |

| | $ | 183,211 |

| | $ | 360,000 |

| | Michigan Cardiovascular Institute, P.C. | | 87,843 | | 100.00% | | 100.00% | | 12/31/2028 |

| Elgin Data Center | | Elgin, IL | | Chicago-Naperville-Elgin, IL-IN-WI | | 12/22/2017 | | $ | 8,290,000 |

| | $ | 118,210 |

| | $ | 165,800 |

| | T-Mobile Central, LLC | | 65,745 | | 71.52% | | 84.45% | | 09/30/2024 |

| | | | | | | | Corporate America Family Credit Union | | | 12.93% | | | 12/31/2019 |

| Oklahoma City Data Center | | Oklahoma City, OK | | Oklahoma City, OK | | 12/27/2017 | | $ | 46,959,892 |

| | $ | 51,548 |

| | $ | 939,198 |

| | Tierpoint, LLC | | 92,456 | | 100.00% | | 100.00% | | 12/31/2032 |

| |

| (1) | Our properties are located in the MSAs of their respective cities and as such may compete with other facilities for tenants if the current leases are not renewed. |

| |

| (2) | Contract purchase price excludes acquisition fees and costs. |

| |

| (3) | Represents real estate taxes for 2016. |

| |

| (4) | Fees paid to our advisor include payments for acquisition fees in connection with the property acquisition. It does not include fees paid to any property manager, including our affiliated property manager. For more detailed information on fees paid to our advisor or its affiliates, see the section captioned "Management Compensation" beginning on page 84 of the prospectus. |

| |

| (5) | Major tenants include those tenants who occupy greater than 10% of the rentable square feet of their respective property. We believe each of these tenants is creditworthy. |

Credit Facility

The following information supplements, and should be read in conjunction with, the table on page 120 contained in the “Investment Objectives, Strategy and Policies—Entry into a Credit Facility” section of the prospectus:

The following table summarizes the property added to the pool availability under our credit facility since November 27, 2017:

|

| | | | | | |

| Property | | Date Added | | Pool Availability |

| Saginaw Healthcare Facility | | 12/21/2017 | | $ | 9,900,000 |

|

CVOP II has pledged a security interest in the properties that serve as collateral for the KeyBank Credit Facility pursuant to the terms of the KeyBank Credit Facility Amendment.

As of January 16, 2018, CVOP II had a total pool availability under the KeyBank Credit Facility of $397,842,000 and an aggregate outstanding principal balance of $220,000,000. As of January 16, 2018, $177,842,000 remained available to be drawn on the KeyBank Credit Facility.

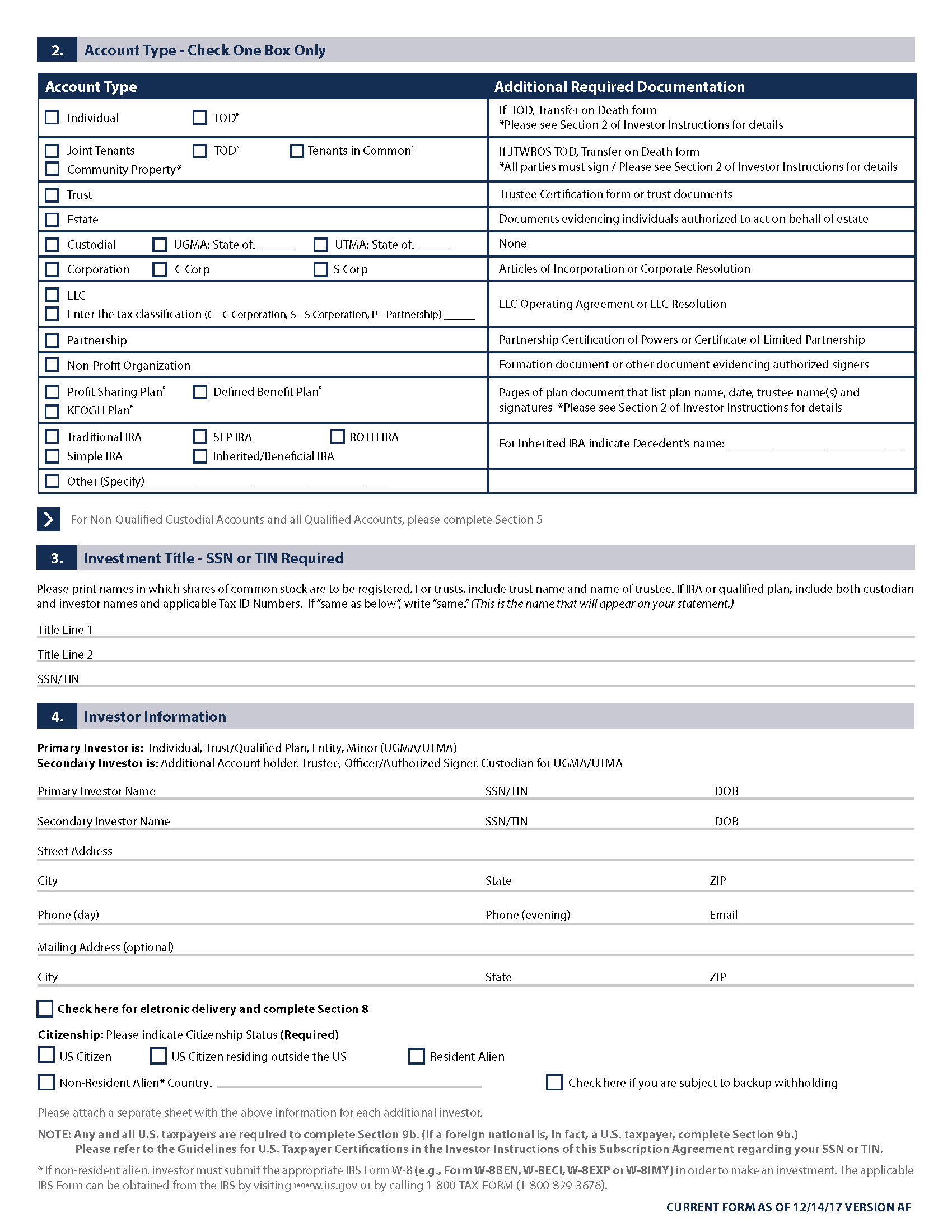

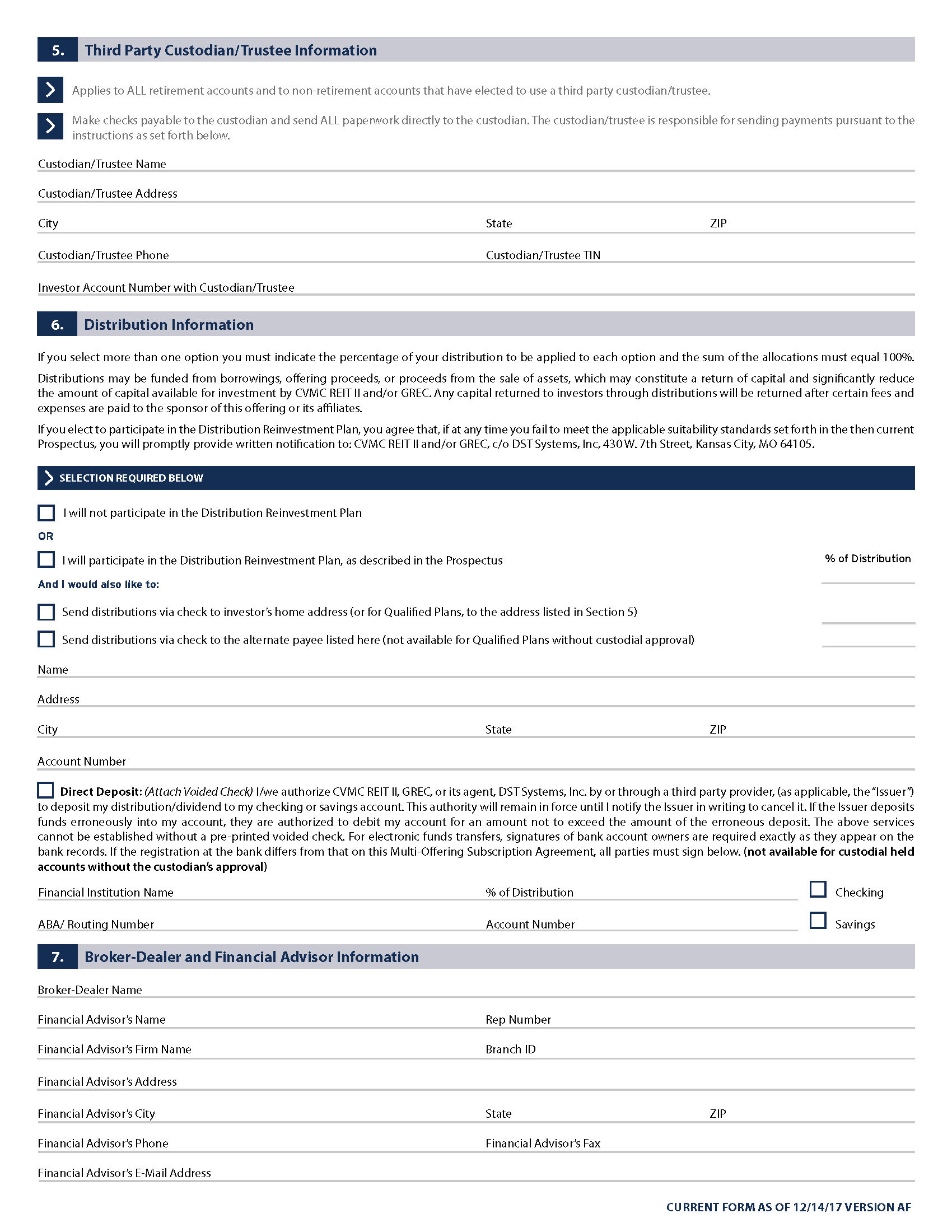

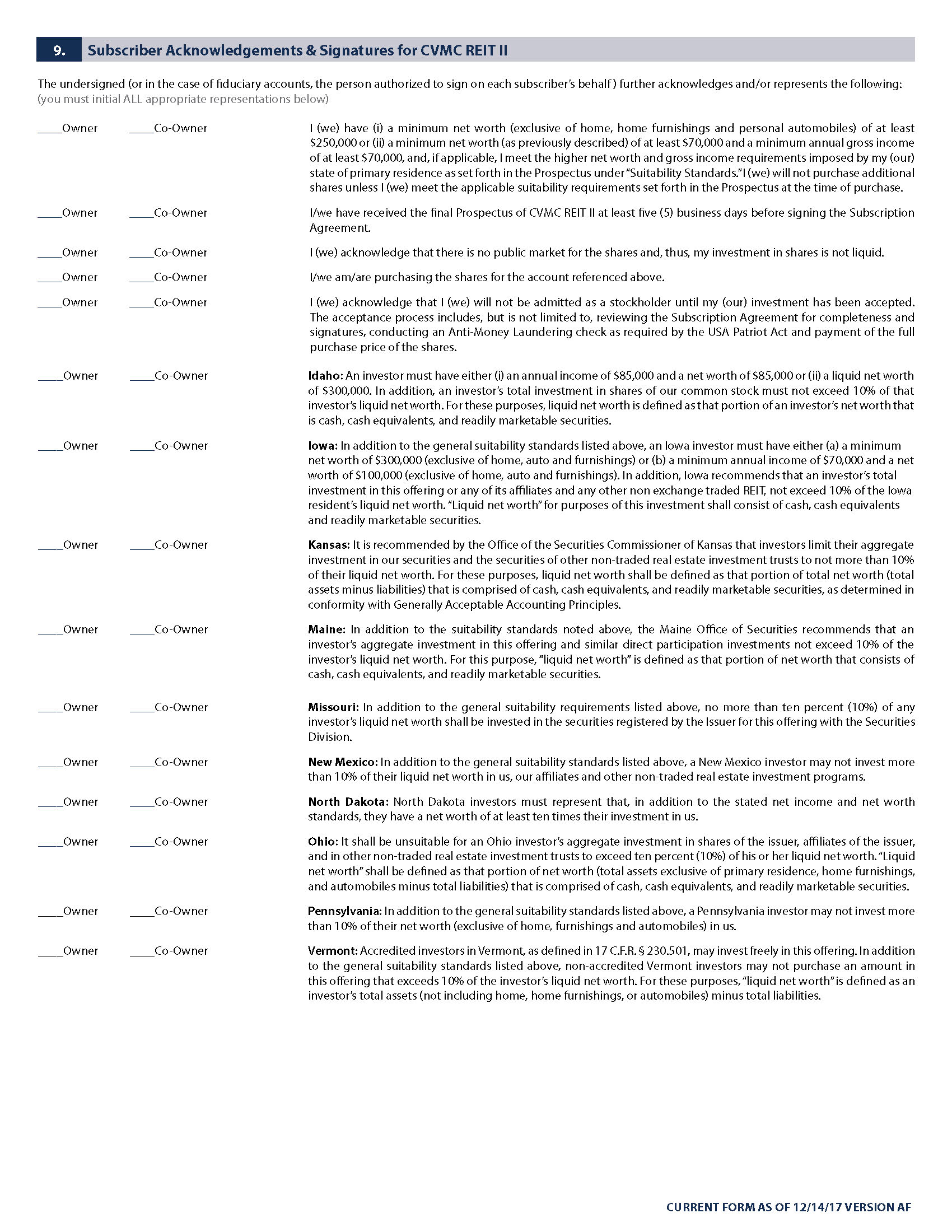

Revised Form of Subscription Agreement

A revised form of our Multi-Product Subscription Agreement is attached as Appendix F and supersedes and replaces Appendix F in the prospectus.