Filed Pursuant to Rule 424(b)(3)

Registration No. 333-217579

CARTER VALIDUS MISSION CRITICAL REIT II, INC.

SUPPLEMENT NO. 8 DATED APRIL 10, 2018

TO THE PROSPECTUS DATED NOVEMBER 27, 2017

This document supplements, and should be read in conjunction with, the prospectus of Carter Validus Mission Critical REIT II, Inc., dated November 27, 2017, Supplement No. 2 dated January 16, 2018, Supplement No. 3 dated January 29, 2018, Supplement No. 4 dated February 21, 2018, Supplement No. 5 dated February 22, 2018, Supplement No. 6 dated March 9, 2018 and Supplement No. 7 dated March 26, 2018. Unless otherwise defined in this prospectus supplement, capitalized terms used in this prospectus supplement shall have the same meanings as set forth in the prospectus.

The purpose of this prospectus supplement is to describe the following:

| |

| (1) | the status of our follow-on offering of common stock (the "Offering"); |

| |

| (2) | recent individually immaterial real property acquisitions; |

| |

| (3) | updates regarding our credit facility; |

| |

| (4) | updates to our organizational structure; |

| |

| (5) | updates to our management; and |

| |

| (6) | updates to the "Risk Factors" section of our prospectus. |

Status of the Offering

On November 27, 2017, our follow-on offering of up to $1,000,000,000 in shares of common stock was declared effective by the SEC (the "Offering"). As of April 10, 2018, we are offering shares of Class A common stock, Class I common stock and Class T2 common stock in the Offering. As of April 6, 2018, we had accepted investors' subscriptions for and issued approximately 1,492,000 shares of Class A common stock, 2,053,000 shares of Class I common stock, 1,306,000 shares of Class T common stock and 177,000 shares of Class T2 common stock in the Offering, resulting in receipt of gross proceeds of $15,208,000, $18,876,000, $12,714,000 and $1,723,000, respectively, for total gross proceeds raised of $48,521,000. As of April 6, 2018, we had approximately $951,479,000 in Class A shares, Class I shares and Class T2 shares of common stock remaining in the Offering. We commenced offering shares of Class T2 common stock in this Offering at a price of $9.714 per share on March 15, 2018. We ceased offering shares of Class T common stock in this Offering on the close of business of March 14, 2018. We will continue to offer shares of Class T common stock pursuant to our DRIP Registration Statement on Form S-3.

Description of Real Estate Investments

The following information replaces in its entirety the second full paragraph on page 14 of the “Prospectus Summary—Description of Real Estate Investments” section of the prospectus and on page 109 of the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

As of April 10, 2018, on a portfolio level, we, through wholly-owned subsidiaries of our operating partnership, owned a combination of the fee simple interest and leasehold interest in 72 properties located in various states, consisting of approximately 5,323,000 gross rentable square feet of commercial space. As of April 10, 2018, our properties that are subject to net leases have a consolidated weighted average yield of 7.91%. As of April 10, 2018, our leases have average annual rent escalations of 2.15%.

Individually Immaterial Real Property Acquisitions

The following information replaces in its entirety the first sentence of the first full paragraph on page 110 of the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

As of April 10, 2018, we purchased, since inception, 71 individually immaterial properties for an aggregate contract purchase price of approximately $1,471,491,000 plus closing costs, with total annualized base rent at acquisition of approximately $105,924,000.

The following table supplements, and should be read in conjunction with, the table beginning on page 111 contained in the “Investment Objectives, Strategy and Policies—Description of Real Estate Investments” section of the prospectus:

The following table summarizes the two individually immaterial properties acquired since January 16, 2018 in order of acquisition date:

|

| | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Description | | Location | | MSA/µSA (1) | | Date Acquired | | Contract Purchase Price (2) | | Property Taxes (3) | | Fees Paid to Advisor (4) | | Major Tenants (5) | | Total Rentable Square Feet | | % of Total Rentable Square Feet Leased to Major Tenants | | % of Total Rentable Square Feet Leased | | Lease Expiration for Major Tenants |

| Rancho Cordova Data Center I | | Rancho Cordova, CA | | Sacramento–Roseville–Arden-Arcade, CA | | 03/14/2018 | | $ | 36,800,000 |

| | $ | 247,308 |

| | $ | 736,000 |

| | Sungard Availability Services, LP | | 69,048 | | 100.00% | | 100.00% | | 12/31/2025 |

| Rancho Cordova Data Center II | | Rancho Cordova, CA | | Sacramento–Roseville–Arden-Arcade, CA

| | 03/14/2018 | | $ | 14,160,000 |

| | $ | 170,760 |

| | $ | 283,200 |

| | Pacific Gas and Electric Company | | 63,791 | | 41.15% | | 62.01% | | 06/30/2024 |

| | | | | | | | Sprint Communications Company, LP | | | 20.86% | | | 09/30/2019 |

| |

| (1) | Our properties are located in the MSAs of their respective cities and as such may compete with other facilities for tenants if the current leases are not renewed. |

| |

| (2) | Contract purchase price excludes acquisition fees and costs. |

| |

| (3) | Represents real estate taxes for 2017. |

| |

| (4) | Fees paid to our advisor include payments for acquisition fees in connection with the property acquisition. It does not include fees paid to any property manager, including our affiliated property manager. For more detailed information on fees paid to our advisor or its affiliates, see the section captioned "Management Compensation" beginning on page 84 of the prospectus. |

| |

| (5) | Major tenants include those tenants who occupy greater than 10% of the rentable square feet of their respective property. We believe each of these tenants is creditworthy. |

Credit Facility

The following information supplements, and should be read in conjunction with, the table on page 120 contained in the “Investment Objectives, Strategy and Policies—Entry into a Credit Facility” section of the prospectus:

The following table summarizes the properties in which CVOP II has pledged a security interest since January 16, 2018 that serve as collateral for the KeyBank Credit Facility:

|

| | | | | | |

| Property | | Date Added | | Pool Availability |

| Rancho Cordova Data Center I | | 03/14/2018 | | $ | 20,240,000 |

|

| Rancho Cordova Data Center II | | 03/14/2018 | | $ | 7,788,000 |

|

| Oklahoma City Data Center | | 04/05/2018 | | $ | 25,828,000 |

|

The following information supersedes and replaces the second full paragraph on page 121 of the "Investment Objectives, Strategy and Policies - Entry into a Credit Facility" section of the prospectus:

As of April 10, 2018, CVOP II had total pool availability under the KeyBank Credit Facility of $453,199,000, however, the maximum commitment thereunder was $425,000,000. As of April 10, 2018, the aggregate outstanding principal balance under the KeyBank Credit Facility was $250,000,000 and a total of $175,000,000 remained available to be drawn.

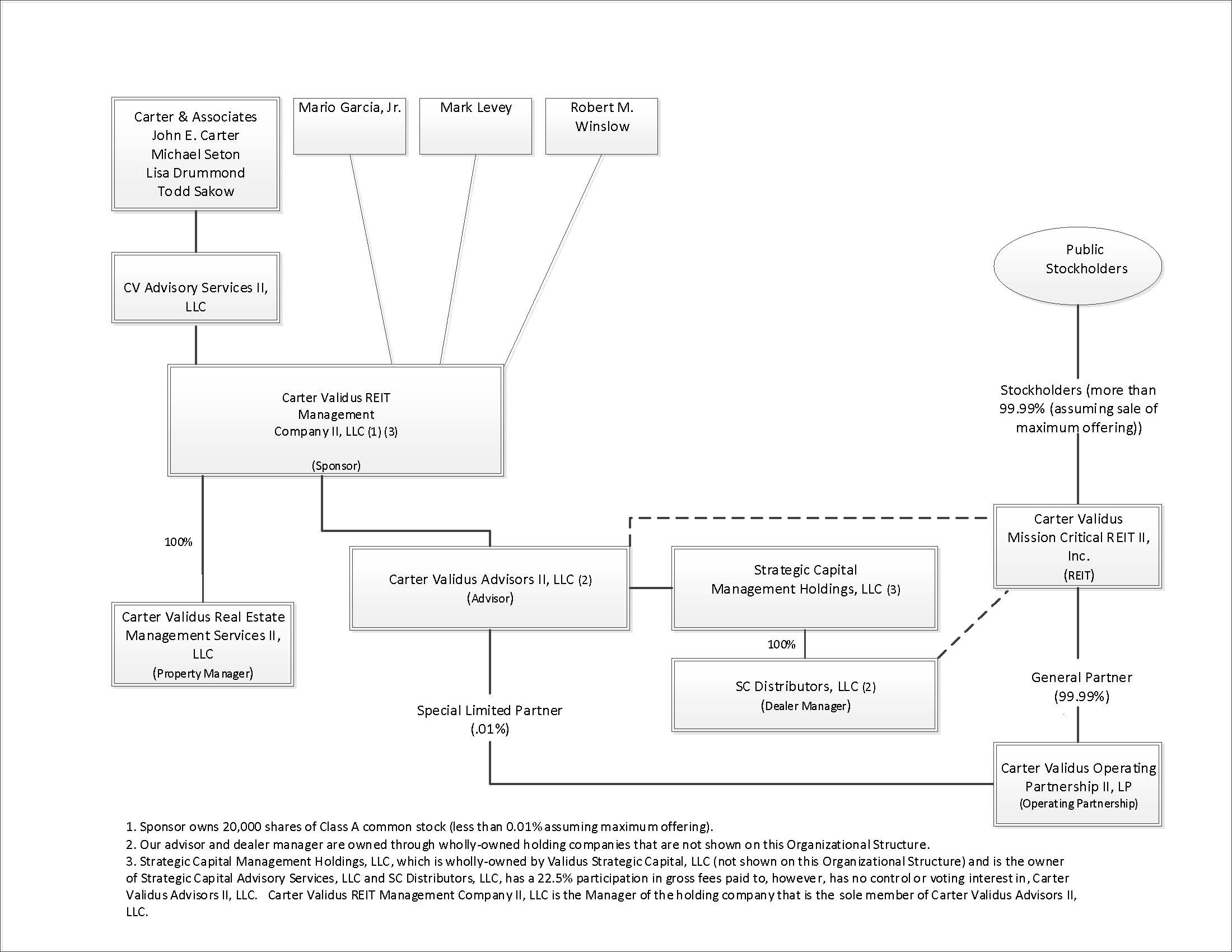

Organizational Structure

The following chart supersedes and replaces the organizational structure chart on page 18 of the prospectus in the “Prospectus Summary” section of the prospectus:

Management

Effective as of April 10, 2018, John E. Carter resigned as our Chief Executive Officer and as Co-Chief Executive officer of the Advisor. Mr. Carter will continue to serve as the Chairman of our board of directors. Mr. Carter will remain with the Advisor as the Executive Chairman, where he will advise the Company upon the request of the Chief Executive Officer. Also effective April 10, 2018, Michael A. Seton serves as our Chief Executive Officer and President and as Chief Executive Officer of the Advisor. Therefore, all references to Messrs. Carter and Seton in the prospectus are hereby supplemented with the aforementioned information, to the extent the content requires.

The following table supersedes and replaces the table of our executive officers and directors beginning on page 71 of the prospectus in the “Management - Executive Officers and Directors” section of the prospectus:

|

| | | | |

| Name | | Age | | Position(s) |

| Michael A. Seton | | 45 | | Chief Executive Officer and President |

| Todd M. Sakow | | 46 | | Chief Financial Officer and Treasurer |

| Lisa A. Drummond | | 54 | | Chief Operating Officer and Secretary |

| John E. Carter | | 58 | | Chairman of the Board |

| Robert M. Winslow | | 68 | | Director |

| Randall Greene | | 68 | | Independent Director |

| Jonathan Kuchin | | 66 | | Independent Director |

| Ronald Rayevich | | 75 | | Independent Director |

The following table supersedes and replaces the table of the officers and key personnel of our advisor beginning on page 77 of the prospectus in the “Management - Executive Officers and Directors” section of the prospectus:

|

| | | | |

| Name | | Age | | Position(s) |

| Michael A. Seton | | 45 | | Chief Executive Officer, President and Member of Investment Committee |

| Todd M. Sakow | | 46 | | Chief Financial Officer and Treasurer |

| Lisa A. Drummond | | 54 | | Chief Operating Officer and Secretary |

| Alex Stacy | | 41 | | Chief Acquisitions Officer, Healthcare |

| Robert M. Winslow | | 68 | | Executive Vice President of Construction, Development and Special Projects and Member of Investment Committee |

| James MacQueen | | 56 | | Senior Vice President of Asset Management |

| Kay C. Neely | | 41 | | Senior Vice President of Accounting |

| Jamie Yoakum | | 46 | | Senior Vice President of Accounting |

| Mario Garcia, Jr. | | 47 | | Member of Investment Committee |

| Robert Peterson | | 66 | | Member of Investment Committee |

| Mark Levey | | 55 | | Member of Investment Committee |

| John E. Carter | | 58 | | Executive Chairman |

John Carter’s biographical information on page 71 of the prospectus is hereby superseded and replaced with the following information:

John E. Carter has served as the Chairman of our board of directors since January 2013. Mr. Carter served as our Chief Executive Officer from December 2009 to April 2018. Mr. Carter also served as the Chairman of the board of directors of Carter Validus Mission Critical REIT, Inc. since December 2009 and Chief Executive Officer of Carter Validus Mission Critical REIT, Inc. from December 2009 to April 2018. Mr. Carter also served as our President from January 2013 to March 2015 and served as President of Carter Validus Mission Critical REIT, Inc. from December 2009 to March 2015. He also has served as Co-Chief Executive Officer of Carter Validus Advisors II, LLC from August 2015 to April 2018, and a member of the Investment Committee of Carter Validus Advisors II, LLC and Chief Executive Officer of Carter Validus Real Estate Management Services II, LLC since January 2013. Mr. Carter served as Co-Chief Executive Officer of our sponsor, Carter Validus REIT Management Company II, LLC, from July 2015 to April 2018. Mr. Carter also served as the Chief Executive Officer of Carter Validus REIT Management Company II, LLC from January 2013 to July 2015. Mr. Carter also served as Chief Executive Officer of Carter Validus Advisors II, LLC from January 2013 to August 2015. He has served as Co-Chief Executive Officer of Carter/Validus Advisors, LLC from August 2015 to April 2018, a member of the Investment Management

Committee of Carter/Validus Advisors, LLC and Chief Executive Officer of Carter Validus Real Estate Management Services, LLC since December 2009 and served as Co-Chief Executive Officer of Carter/Validus REIT Investment Management Company from July 2015 to April 2018. Mr. Carter also served on the Board of Managers for Validus/Strategic Capital Partners, LLC (now Strategic Capital Management Holdings, LLC) from November 2010 to August 2014. Mr. Carter has more than 33 years of real estate experience in all aspects of leasing, asset management, acquisitions, finance, investment and corporate advisory services. Mr. Carter served as Vice Chairman and a principal of Carter & Associates, L.L.C., or Carter & Associates, one of the principals of our sponsor, from January 2000 to June 2016. Mr. Carter has served in such capacities since he merged his company, Newport Partners, LLC, or Newport Partners, to Carter & Associates in January 2000. Mr. Carter founded Newport Partners in November 1989 and grew the company into a full-service real estate firm with approximately 63 associates throughout Florida. Prior to November 1989, Mr. Carter worked for two years at Trammel Crow Company. In the early 1980s, he spent five years at Citicorp where he focused primarily on tax shelter, Industrial Revenue Bonds (IRBs) and other real estate financing transactions. He also was a founding board member of GulfShore Bank, a community bank located in Tampa, Florida, serving on the Board from August 2007 until April 2017. Mr. Carter obtained a Bachelor’s degree in Economics with a minor in Mathematics from St. Lawrence University in Canton, New York in 1982 and a Masters in Business Administration from Harvard University in Cambridge, Massachusetts in 1989. Mr. Carter was selected to serve as a director because he was the Company’s Chief Executive Officer and has significant real estate experience in various areas. He has expansive knowledge of the real estate industry and has relationships with chief executives and other senior management at numerous real estate companies. Mr. Carter brings a unique and valuable perspective to our board of directors.

Michael A. Seton’s biographical information on page 73 of the prospectus is hereby superseded and replaced with the following information:

Michael A. Seton has served as our Chief Executive Officer since April 2018 and as our President since March 2015. He also has served as the Chief Executive Officer of Carter Validus Mission Critical REIT, Inc. since April 2018 and as the President of Carter Validus Mission Critical REIT, Inc. since March 2015. He also serves as Chief Executive Officer of Carter Validus Advisors II, LLC, served as Co-Chief Executive Officer from August 2015 to April 2018, and has served as the President and a member of the Investment Committee of Carter Validus Advisors II, LLC, the President of our sponsor, Carter Validus REIT Management Company II, LLC, since January 2013, as Chief Executive Officer of Carter Validus REIT Management Company II, LLC since April 2018 and served the Co-Chief Executive Officer of Carter Validus REIT Management Company II, LLC from July 2015 to April 2018. Mr. Seton has also served as the Chief Executive Officer of Carter/Validus Advisors, LLC since April 2018, served as the Co-Chief Executive Officer of Carter/Validus Advisors, LLC from August 2015 to April 2018, has served as the President of Carter/Validus Advisors, LLC and the President of Carter/Validus REIT Investment Management Company, LLC since December 2009, has served as the Chief Executive Officer of Carter/Validus REIT Investment Management Company since April 2018 and served as Co-Chief Executive Officer of Carter/Validus REIT Investment Management Company from July 2015 to April 2018. Mr. Seton has more than 20 years of real estate investment and finance experience. From December 1996 until June 2009, Mr. Seton worked for Eurohypo AG (including its predecessor organizations) in New York, New York. At Eurohypo AG, Mr. Seton was a Managing Director and Division Head in the Originations Group, leading a team of 12 professionals in the origination, structuring, documenting, closing and syndication of real estate financings for private developers and owners, REITs, and real estate operating companies. Real estate finance transactions in which Mr. Seton was involved included both on and off-balance sheet executions, including senior debt and mezzanine financings. Mr. Seton has been directly involved in over $35 billion in acquisitions and financings during his real estate career. Mr. Seton obtained a Bachelor of Science in Economics from Vanderbilt University in Nashville, Tennessee in 1994.

Risk Factors

The following risk factor supersedes and replaces in its entirety the second risk factor contained in the "Risk Factors - Employee Benefit Plan, IRA, and Other Tax-Exempt Investor Risks" section beginning on page 54 of the prospectus:

The U.S. Department of Labor has issued a final regulation revising the definition of “fiduciary” and the scope of “investment advice” under ERISA, which may have a negative impact on our ability to raise capital.

On April 8, 2016, the U.S. Department of Labor issued a final regulation that substantially expands the range of activities that would be considered to be fiduciary investment advice under ERISA and the Internal Revenue Code, which may make it more difficult to qualify for a prohibited transaction exemption. This new regulation could have negative implications on our ability to raise capital from potential investors, including those investing through IRAs or other arrangements. Prior to the issuance of the new regulation, ERISA and the Internal Revenue Code broadly defined fiduciaries to include persons who give investment advice for a fee, regardless of whether that fee is paid directly by the customer or by a third party. However, prior law required that advice must be given on a “regular basis” before a fiduciary standard would apply, and that a mutual agreement or understanding between the customer and the adviser that the advice would serve as a primary basis for the investment decision would also be required. Under the new regulation, a person is a fiduciary if the person receives

compensation for providing advice (a "recommendation” or “communication that would reasonably be viewed as a suggestion that the recipient engage in or refrain from taking a particular course of action”) with the understanding it is based on the particular needs of the person being advised or that it is directed to a specific plan sponsor, plan participant, or IRA owner. Such decisions can include, but are not limited to, what assets to purchase or sell and (unlike under prior law) whether to rollover from an employment-based plan to an IRA. The fiduciary can be a broker, registered investment adviser or other type of adviser, some of which are subject to federal securities laws and some of which are not. The final regulation and the related exemptions were expected to become applicable for investment transactions on and after April 10, 2017. However, on February 3, 2017, the President asked for additional review of this regulation. In response, on March 2, 2017, the U.S. Department of Labor published a notice seeking public comments on, among other things, a proposal to adopt a 60-day delay of the April 10 applicability date of the final regulation. On April 7, 2017, the U.S. Department of Labor published a final rule extending the applicability date of the final regulation to June 9, 2017. However, certain requirements and exemptions under the regulation are implemented through a phased-in approach, and on November 27, 2017, the U.S. Department of Labor further delayed the implementation of certain requirements and exemptions. Therefore, certain requirements and exemptions will not take effect until July 1, 2019.

On March 15, 2018, the U.S. Court of Appeals for the Fifth Circuit issued a decision vacating the final regulation in its entirety, including the expanded definition of “investment advice fiduciary” and the associated exemptions. It is unclear what impact this decision will have on the final regulation - the U.S. Department of Labor could, among other things, ask for a rehearing en banc to the full Fifth Circuit, seek review by the U.S. Supreme Court, or further revise or withdraw the final regulation. In response to the Fifth Circuit’s decision, a U.S. Department of Labor spokesperson has informally indicated that the U.S. Department of Labor will not enforce the final regulation at this time pending further review. If the U.S. Department of Labor does not seek a rehearing, the Fifth Circuit is expected to enter a mandate vacating the final regulation on May 7, 2018.

The final regulation and the accompanying exemptions are complex and may be subject to further revision or withdrawal. Plan fiduciaries and the beneficial owners of IRAs are urged to consult with their own advisors regarding the impact of the final regulation on purchasing and holding shares of common stock in the Company. The final regulation could have negative implications on our ability to raise capital from potential investors, including those investing through IRAs.