EXHIBIT 99.2

Q3 | 2024 This presentation contains certain financial information not derived in accordance with the United States generally accepted accounting principles (GAAP). These items include, but are not limited to, earnings before interest, income taxes, depreciation and amortization (EBITDA), EBITDA for real estate (EBITDAre), earnings before interest, income taxes, depreciation, amortization, rent and management fees (EBITDARM), funds from operations (FFO), core funds from operations (Core FFO), adjusted funds from operations (AFFO), liquidity, net debt, net operating income (NOI), cash NOI, and same store cash NOI, as well as ratios derived from the foregoing. These measures (and the methodologies used to derive them) may not be comparable to those used by other companies. Refer to the glossary for a detailed explanation of these terms and reconciliations to the most directly comparable GAAP measures, as well as others appearing in the supplement. Management considers each item an important supplemental measure of operating and financial performance and believes they are frequently used by interested parties in the evaluation of real estate investment trusts. These measures should not be considered as alternatives, or superior measures, to net income or loss as an indicator of the Company's performance and should be considered only as a supplement to net income or loss and cash flows from operating, investing or financing activities as measures of profitability and/or liquidity, computed in accordance with GAAP. Certain statements contained herein, other than historical fact, may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the safe harbor provided by the same. These statements are based on management’s current expectations and beliefs and are subject to a number of trends and uncertainties. No forward-looking statement is intended to, nor shall it, serve as a guarantee of future performance. You can identify the forward-looking statements by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will” and other similar terms and phrases, including references to expected lease expiration and annualized base rent trends and extensions of the Company's term loan and revolving line of credit. Forward-looking statements are subject to various risks and uncertainties and factors that could cause actual results to differ materially from the expectations of Sila Realty Trust, Inc. (the "Company"), and investors should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond the Company’s control and could materially affect the Company’s results of operations, financial condition, cash flows, performance or future achievements or events, including those described under the section entitled Part I, Item 1A. “Risk Factors” of the Company's 2023 Annual Report on Form 10-K, as filed with the SEC on March 6, 2024, and the risk factors described under section Item 1A. "Risk Factors" of Part II of our Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, as filed with the SEC on August 7, 2024. The Company undertakes no obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Forward Looking Statements Non-GAAP Measures Unaudited Financial Information Disclosures All quarterly information presented in this supplement is unaudited and should be read in conjunction with the Company’s audited consolidated financial statements (and the notes thereto) included in the Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on March 6, 2024. All per share data has been retroactively adjusted to reflect the Company's one-for-four reverse stock split, or Reverse Stock Split, of each issued and outstanding share of each class of common stock, which occurred on May 1, 2024. See the glossary for a description of the Company's non-GAAP financial and operating metrics.

Q3 | 2024 Section Page Corporate Address 1001 Water Street Suite 800 Tampa, FL 33602 Transfer Agent By Regular Mail: Computershare P.O. Box 43007 Providence, RI 02940-3007 By Overnight Delivery: Computershare 150 Royall Street, Suite 101 Canton, MA 02021 Contact Information Investor Support 833-404-4107 Miles Callahan, Senior Vice President of Capital Markets and Investor Relations IR@silarealtytrust.com www.silarealtytrust.com Quarterly Financial Summary ..................................................................... 3 Financial Statistics and Ratios ................................................................... 4 Condensed Consolidated Balance Sheets ............................................. 5 Condensed Consolidated Statements of Net Income ......................... 6 Reconciliations of Non-GAAP Measures - FFO, Core FFO, and AFFO ................................................................................................................. 7 Reconciliations of Non-GAAP Measures - EBITDA and EBITDAre ... 8 Reconciliations of Non-GAAP Measures - Net Operating Income (NOI) ................................................................................................................. 9 Same Store Cash NOI and Leasing Trends ............................................ 10 Debt .................................................................................................................. 11 Acquisitions and Dispositions .................................................................... 12 Property Map .................................................................................................. 13 Real Estate Diversification .......................................................................... 14 Portfolio ........................................................................................................... 17 Glossary ........................................................................................................... 21 Supplemental Information as of September 30, 2024 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

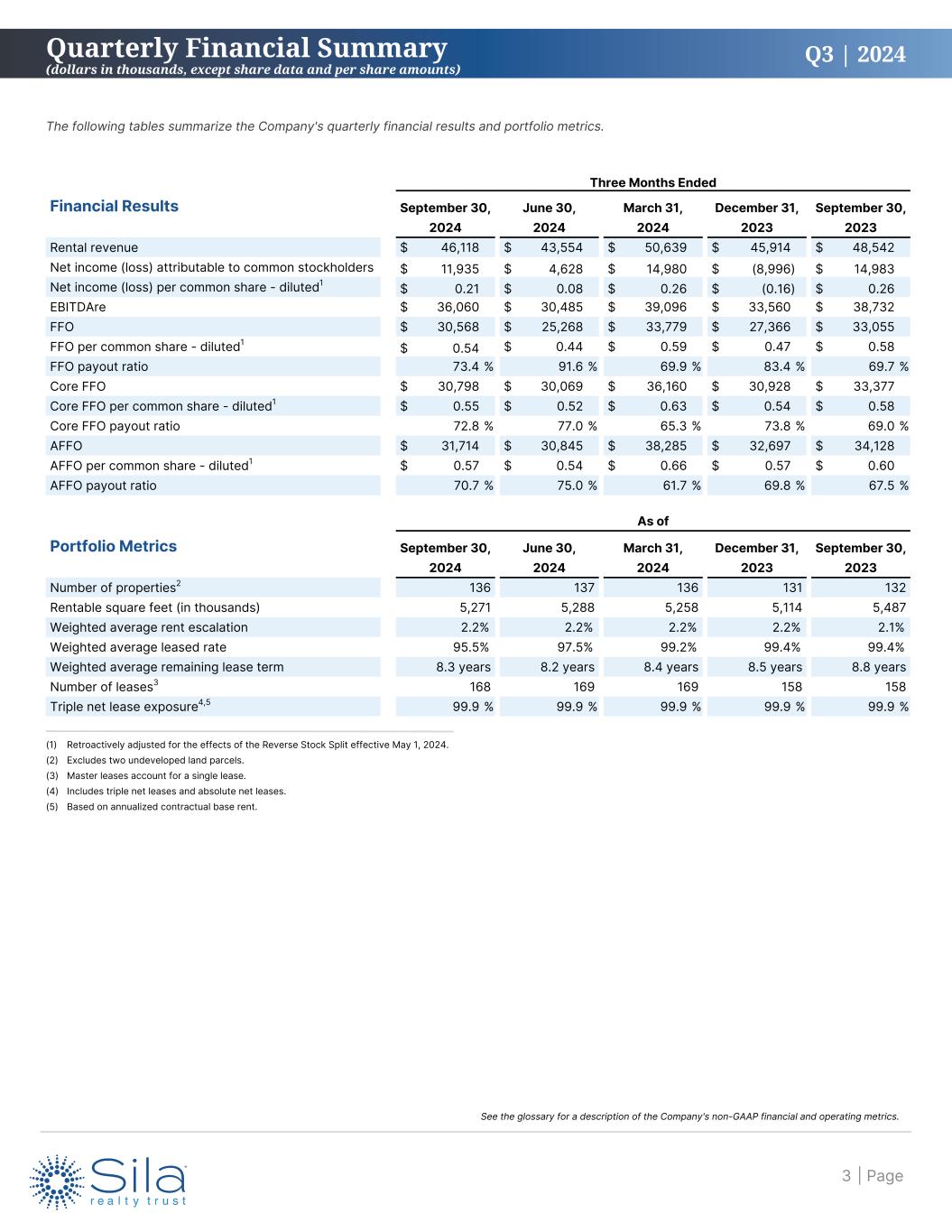

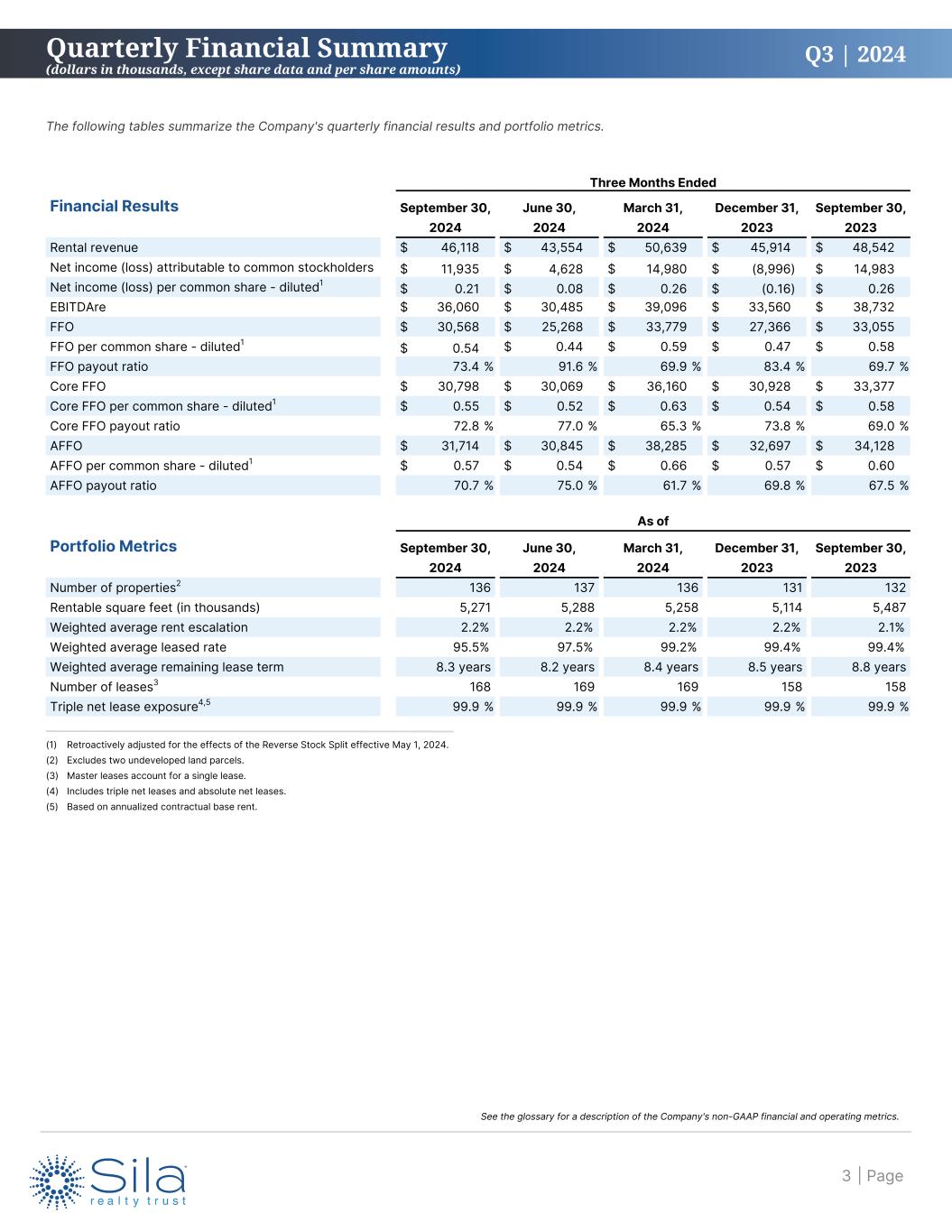

Q3 | 2024 Three Months Ended Financial Results September 30, June 30, March 31, December 31, September 30, 2024 2024 2024 2023 2023 Rental revenue $ 46,118 $ 43,554 $ 50,639 $ 45,914 $ 48,542 Net income (loss) attributable to common stockholders $ 11,935 $ 4,628 $ 14,980 $ (8,996) $ 14,983 Net income (loss) per common share - diluted1 $ 0.21 $ 0.08 $ 0.26 $ (0.16) $ 0.26 EBITDAre $ 36,060 $ 30,485 $ 39,096 $ 33,560 $ 38,732 FFO $ 30,568 $ 25,268 $ 33,779 $ 27,366 $ 33,055 FFO per common share - diluted1 $ 0.54 $ 0.44 $ 0.59 $ 0.47 $ 0.58 FFO payout ratio 73.4 % 91.6 % 69.9 % 83.4 % 69.7 % Core FFO $ 30,798 $ 30,069 $ 36,160 $ 30,928 $ 33,377 Core FFO per common share - diluted1 $ 0.55 $ 0.52 $ 0.63 $ 0.54 $ 0.58 Core FFO payout ratio 72.8 % 77.0 % 65.3 % 73.8 % 69.0 % AFFO $ 31,714 $ 30,845 $ 38,285 $ 32,697 $ 34,128 AFFO per common share - diluted1 $ 0.57 $ 0.54 $ 0.66 $ 0.57 $ 0.60 AFFO payout ratio 70.7 % 75.0 % 61.7 % 69.8 % 67.5 % As of Portfolio Metrics September 30, June 30, March 31, December 31, September 30, 2024 2024 2024 2023 2023 Number of properties2 136 137 136 131 132 Rentable square feet (in thousands) 5,271 5,288 5,258 5,114 5,487 Weighted average rent escalation 2.2% 2.2% 2.2% 2.2% 2.1% Weighted average leased rate 95.5% 97.5% 99.2% 99.4% 99.4% Weighted average remaining lease term 8.3 years 8.2 years 8.4 years 8.5 years 8.8 years Number of leases3 168 169 169 158 158 Triple net lease exposure4,5 99.9 % 99.9 % 99.9 % 99.9 % 99.9 % The following tables summarize the Company's quarterly financial results and portfolio metrics. | Page (1) Retroactively adjusted for the effects of the Reverse Stock Split effective May 1, 2024. (2) Excludes two undeveloped land parcels. (3) Master leases account for a single lease. (4) Includes triple net leases and absolute net leases. (5) Based on annualized contractual base rent. Quarterly Financial Summary (dollars in thousands, except share data and per share amounts) 3 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

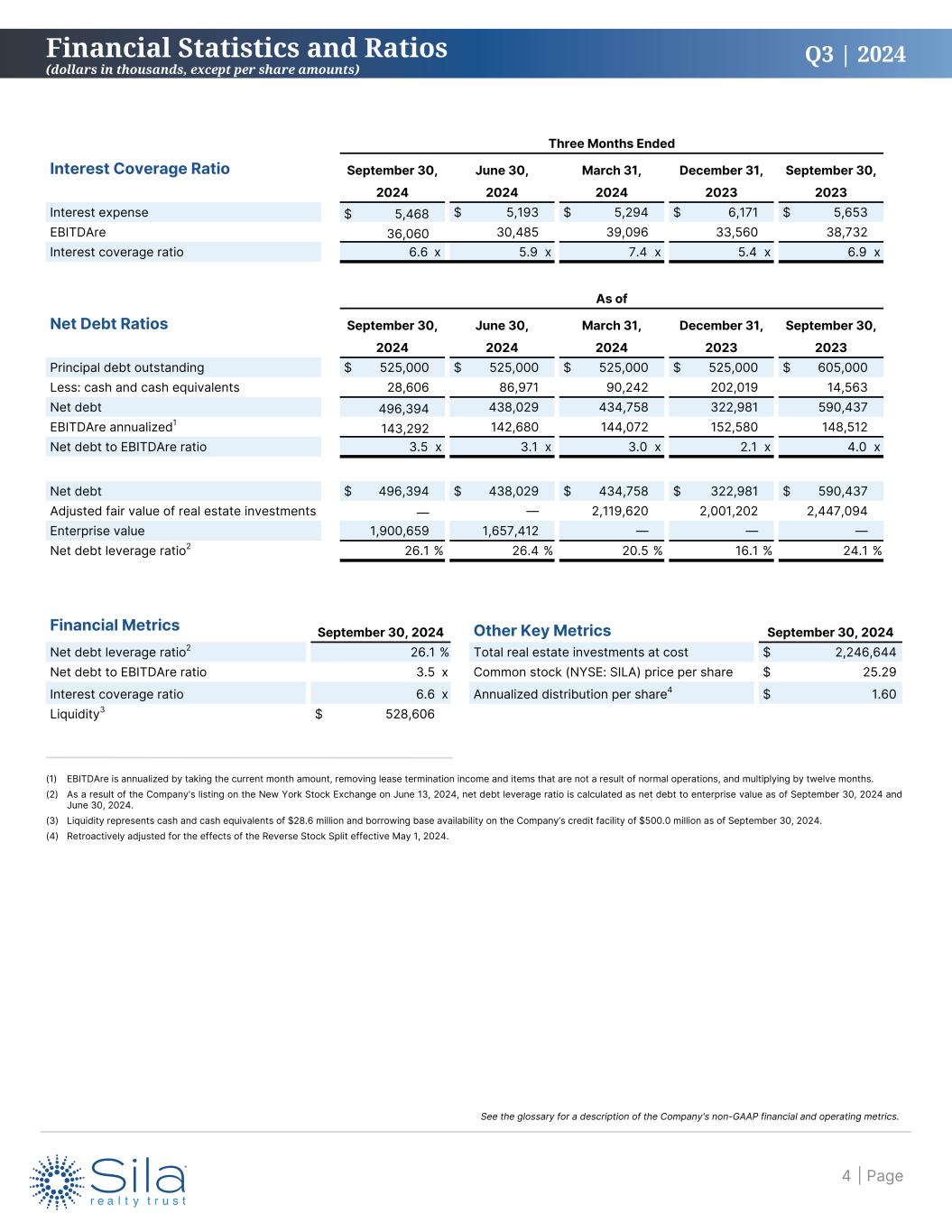

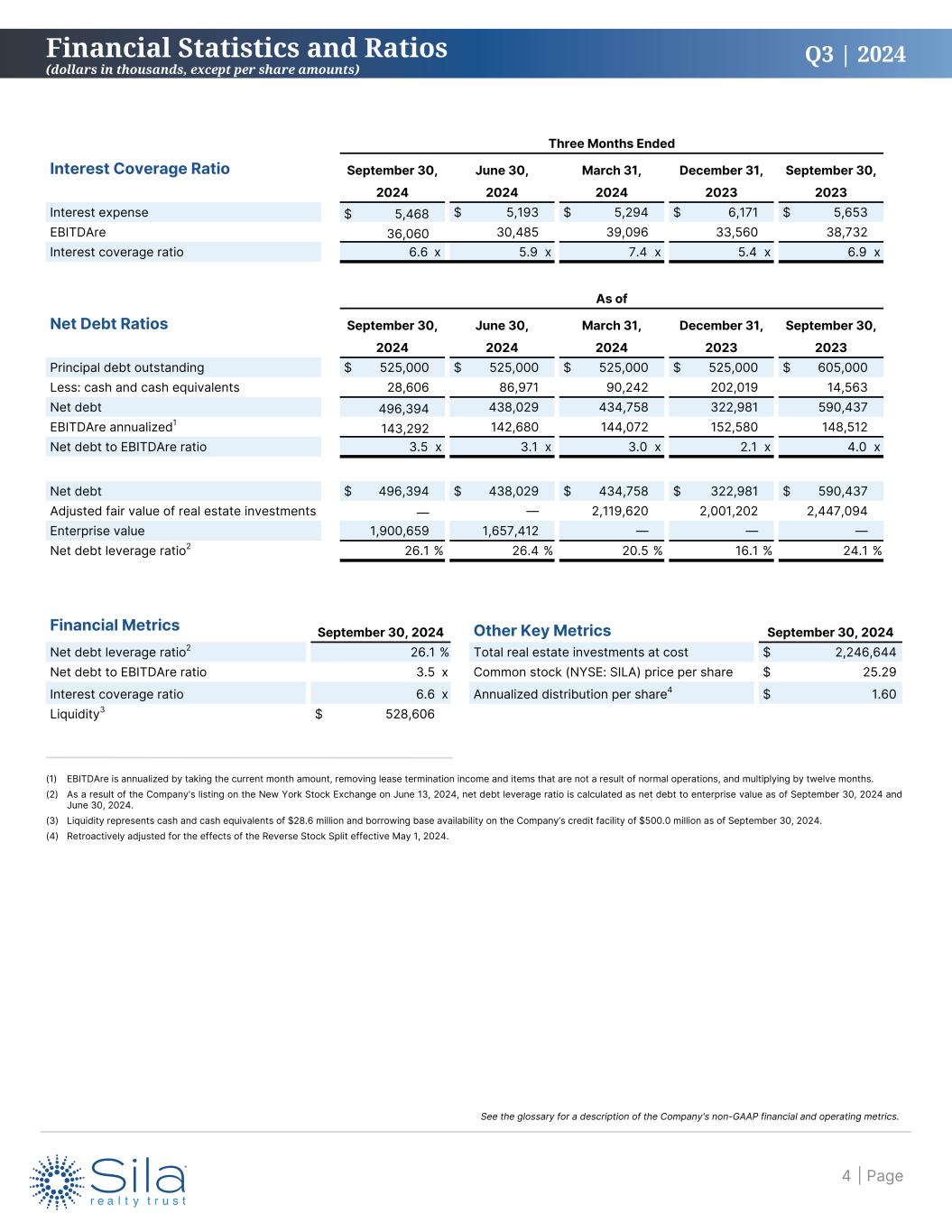

Q3 | 2024 Three Months Ended Interest Coverage Ratio September 30, June 30, March 31, December 31, September 30, 2024 2024 2024 2023 2023 Interest expense $ 5,468 $ 5,193 $ 5,294 $ 6,171 $ 5,653 EBITDAre 36,060 30,485 39,096 33,560 38,732 Interest coverage ratio 6.6 x 5.9 x 7.4 x 5.4 x 6.9 x As of Net Debt Ratios September 30, June 30, March 31, December 31, September 30, 2024 2024 2024 2023 2023 Principal debt outstanding $ 525,000 $ 525,000 $ 525,000 $ 525,000 $ 605,000 Less: cash and cash equivalents 28,606 86,971 90,242 202,019 14,563 Net debt 496,394 438,029 434,758 322,981 590,437 EBITDAre annualized1 143,292 142,680 144,072 152,580 148,512 Net debt to EBITDAre ratio 3.5 x 3.1 x 3.0 x 2.1 x 4.0 x Net debt $ 496,394 $ 438,029 $ 434,758 $ 322,981 $ 590,437 Adjusted fair value of real estate investments — — 2,119,620 2,001,202 2,447,094 Enterprise value 1,900,659 1,657,412 — — — Net debt leverage ratio2 26.1 % 26.4 % 20.5 % 16.1 % 24.1 % Financial Metrics September 30, 2024 Other Key Metrics September 30, 2024 Net debt leverage ratio2 26.1 % Total real estate investments at cost $ 2,246,644 Net debt to EBITDAre ratio 3.5 x Common stock (NYSE: SILA) price per share $ 25.29 Interest coverage ratio 6.6 x Annualized distribution per share4 $ 1.60 Liquidity3 $ 528,606 (1) EBITDAre is annualized by taking the current month amount, removing lease termination income and items that are not a result of normal operations, and multiplying by twelve months. (2) As a result of the Company's listing on the New York Stock Exchange on June 13, 2024, net debt leverage ratio is calculated as net debt to enterprise value as of September 30, 2024 and June 30, 2024. (3) Liquidity represents cash and cash equivalents of $28.6 million and borrowing base availability on the Company’s credit facility of $500.0 million as of September 30, 2024. (4) Retroactively adjusted for the effects of the Reverse Stock Split effective May 1, 2024. Financial Statistics and Ratios (dollars in thousands, except per share amounts) | Page4 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

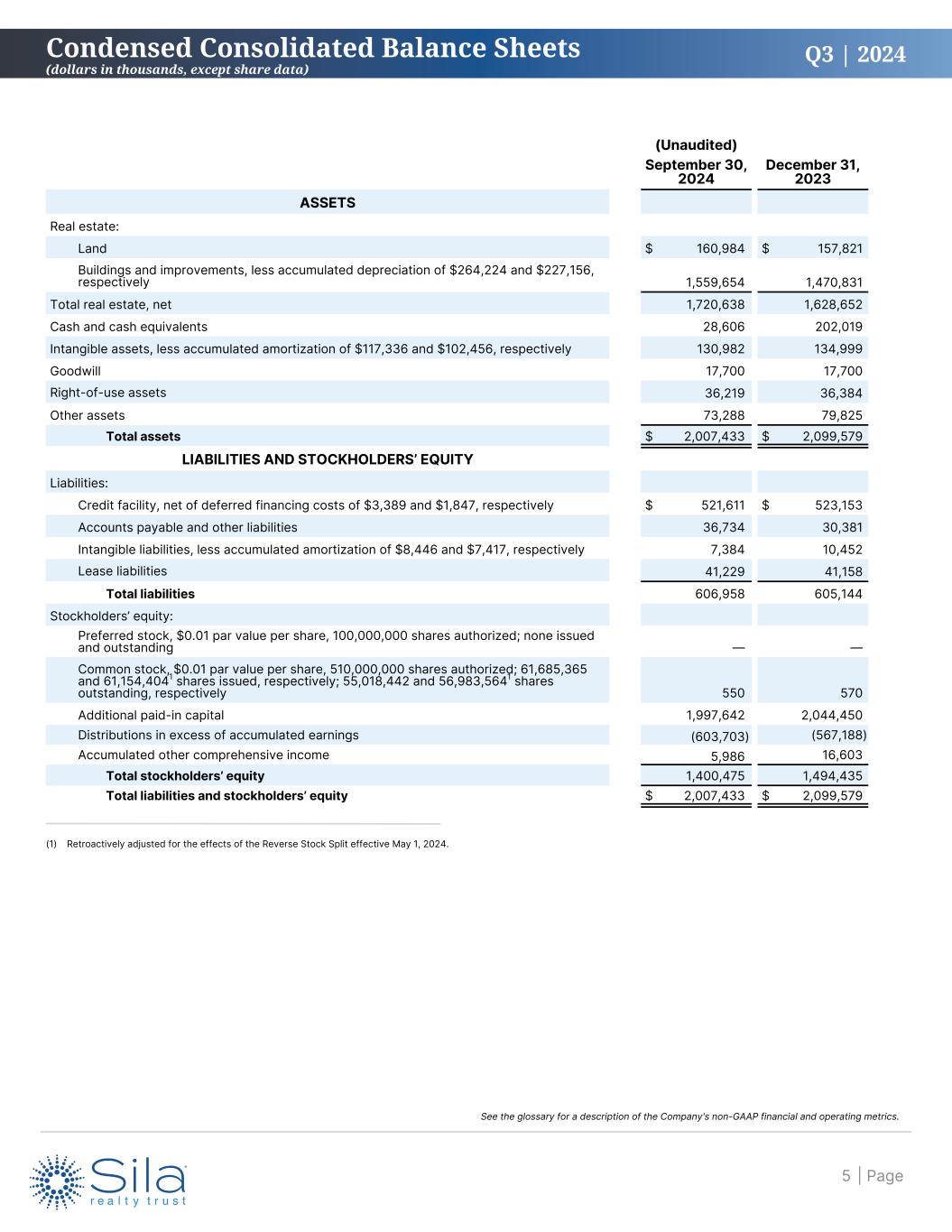

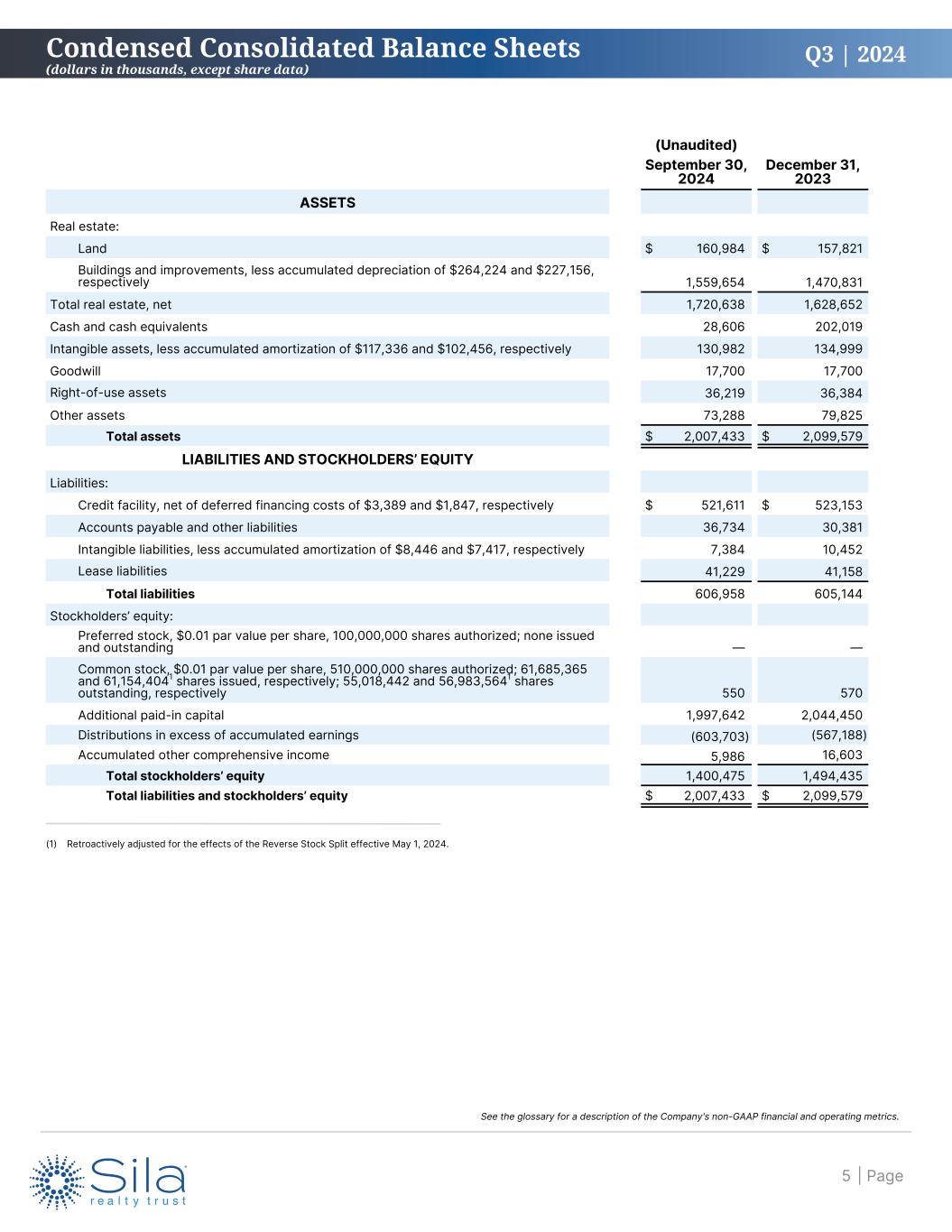

Q3 | 2024 (Unaudited) September 30, 2024 December 31, 2023 ASSETS Real estate: Land $ 160,984 $ 157,821 Buildings and improvements, less accumulated depreciation of $264,224 and $227,156, respectively 1,559,654 1,470,831 Total real estate, net 1,720,638 1,628,652 Cash and cash equivalents 28,606 202,019 Intangible assets, less accumulated amortization of $117,336 and $102,456, respectively 130,982 134,999 Goodwill 17,700 17,700 Right-of-use assets 36,219 36,384 Other assets 73,288 79,825 Total assets $ 2,007,433 $ 2,099,579 LIABILITIES AND STOCKHOLDERS’ EQUITY Liabilities: Credit facility, net of deferred financing costs of $3,389 and $1,847, respectively $ 521,611 $ 523,153 Accounts payable and other liabilities 36,734 30,381 Intangible liabilities, less accumulated amortization of $8,446 and $7,417, respectively 7,384 10,452 Lease liabilities 41,229 41,158 Total liabilities 606,958 605,144 Stockholders’ equity: Preferred stock, $0.01 par value per share, 100,000,000 shares authorized; none issued and outstanding — — Common stock, $0.01 par value per share, 510,000,000 shares authorized; 61,685,365 and 61,154,4041 shares issued, respectively; 55,018,442 and 56,983,5641 shares outstanding, respectively 550 570 Additional paid-in capital 1,997,642 2,044,450 Distributions in excess of accumulated earnings (603,703) (567,188) Accumulated other comprehensive income 5,986 16,603 Total stockholders’ equity 1,400,475 1,494,435 Total liabilities and stockholders’ equity $ 2,007,433 $ 2,099,579 Condensed Consolidated Balance Sheets (dollars in thousands, except share data) (1) Retroactively adjusted for the effects of the Reverse Stock Split effective May 1, 2024. | Page5 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

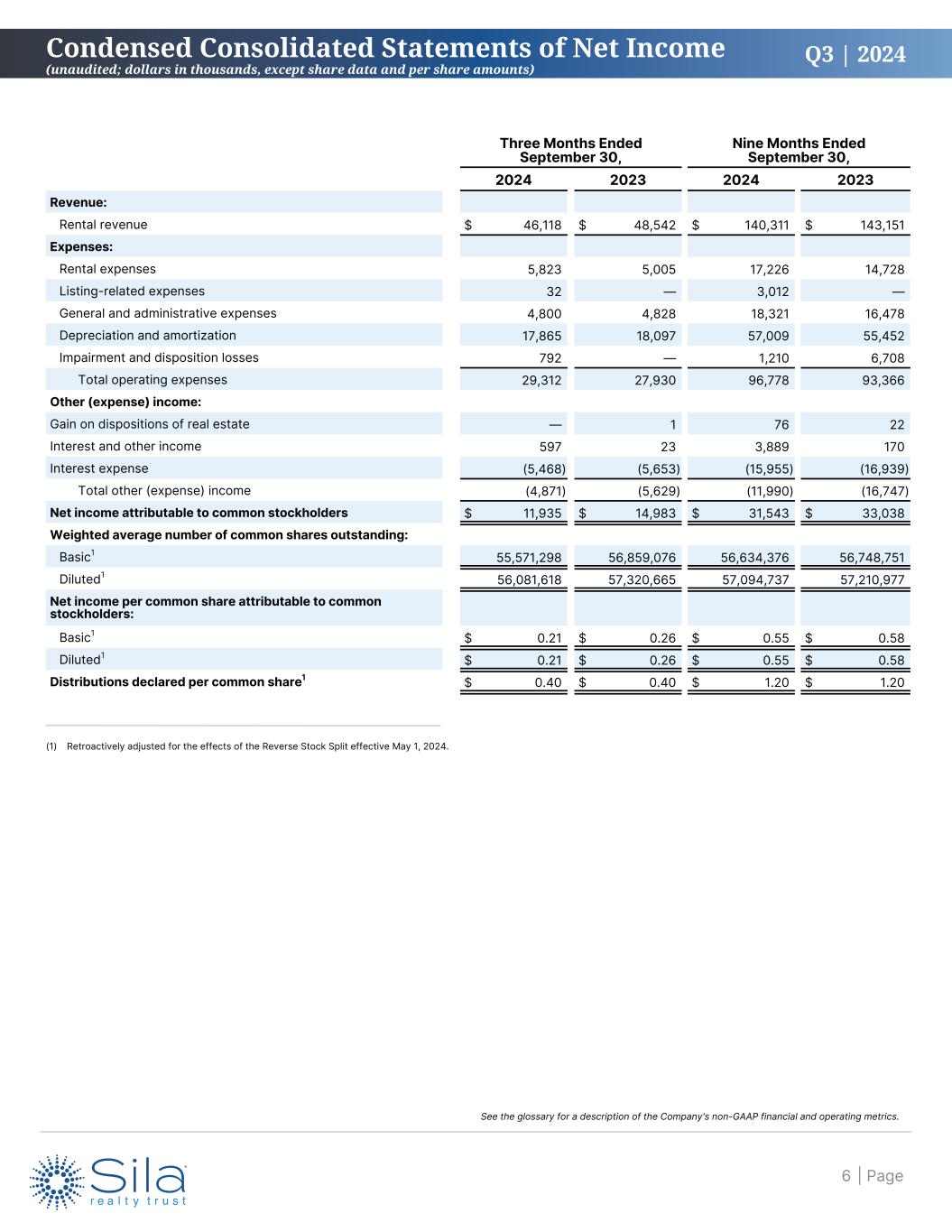

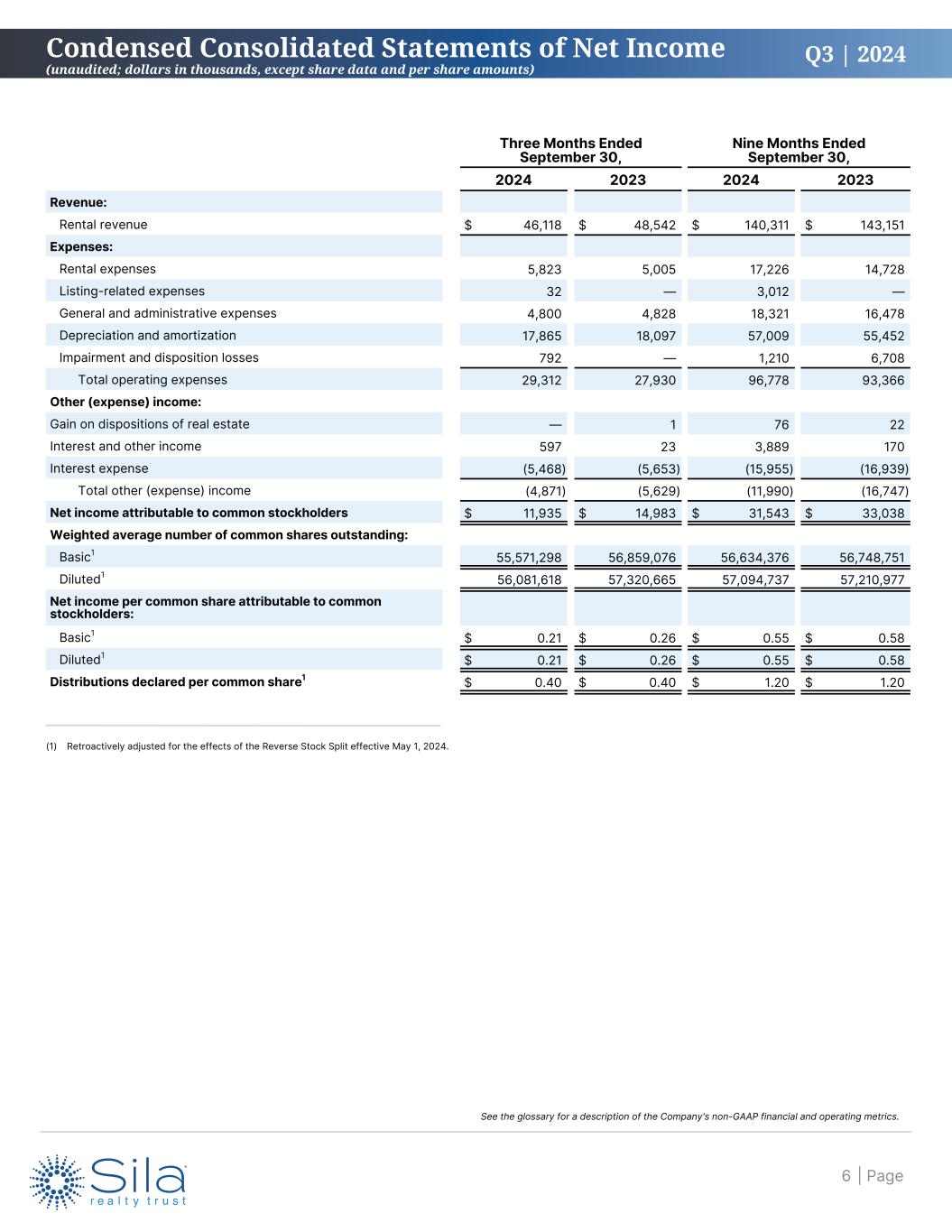

Q3 | 2024 Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Revenue: Rental revenue $ 46,118 $ 48,542 $ 140,311 $ 143,151 Expenses: Rental expenses 5,823 5,005 17,226 14,728 Listing-related expenses 32 — 3,012 — General and administrative expenses 4,800 4,828 18,321 16,478 Depreciation and amortization 17,865 18,097 57,009 55,452 Impairment and disposition losses 792 — 1,210 6,708 Total operating expenses 29,312 27,930 96,778 93,366 Other (expense) income: Gain on dispositions of real estate — 1 76 22 Interest and other income 597 23 3,889 170 Interest expense (5,468) (5,653) (15,955) (16,939) Total other (expense) income (4,871) (5,629) (11,990) (16,747) Net income attributable to common stockholders $ 11,935 $ 14,983 $ 31,543 $ 33,038 Weighted average number of common shares outstanding: Basic1 55,571,298 56,859,076 56,634,376 56,748,751 Diluted1 56,081,618 57,320,665 57,094,737 57,210,977 Net income per common share attributable to common stockholders: Basic1 $ 0.21 $ 0.26 $ 0.55 $ 0.58 Diluted1 $ 0.21 $ 0.26 $ 0.55 $ 0.58 Distributions declared per common share1 $ 0.40 $ 0.40 $ 1.20 $ 1.20 Condensed Consolidated Statements of Net Income (unaudited; dollars in thousands, except share data and per share amounts) (1) Retroactively adjusted for the effects of the Reverse Stock Split effective May 1, 2024. | Page6 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

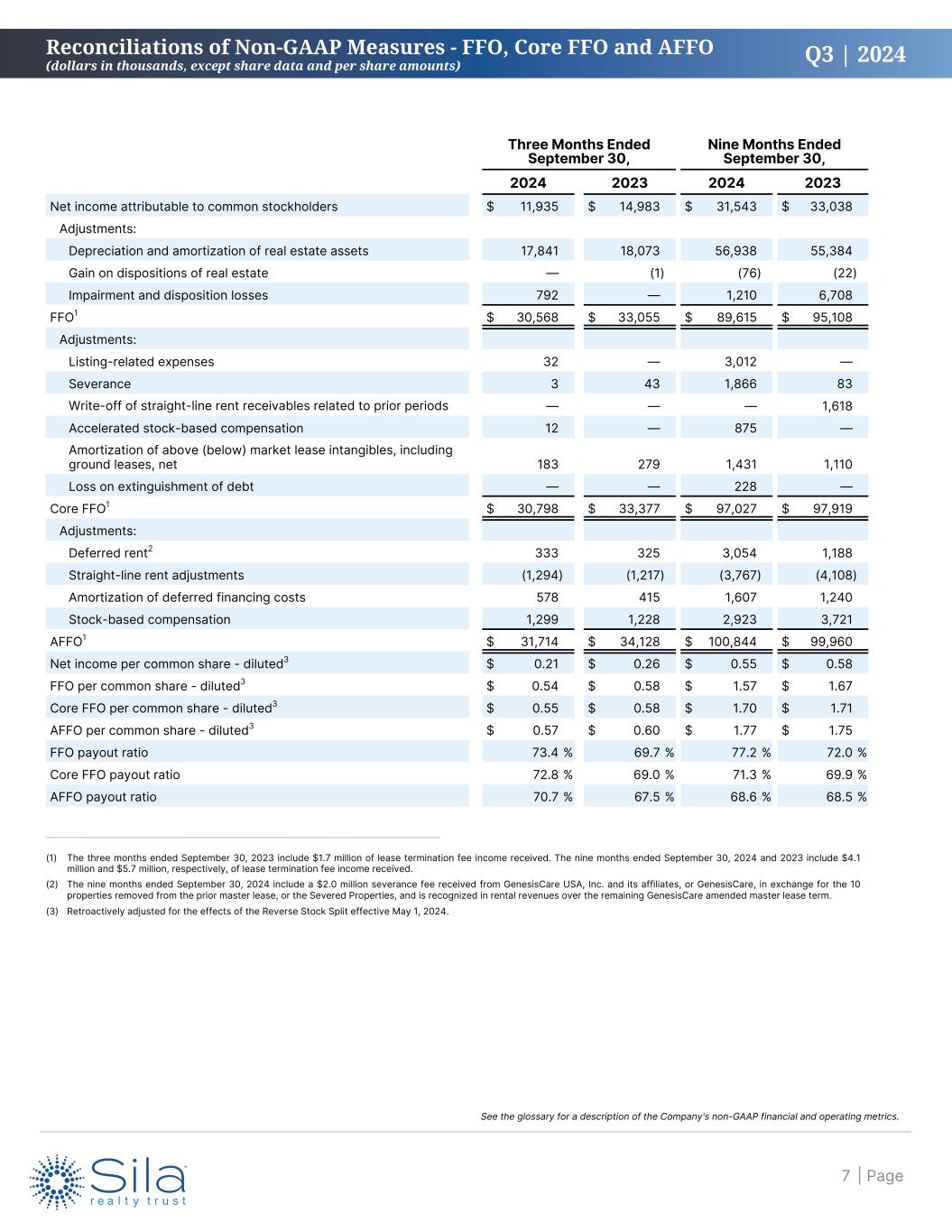

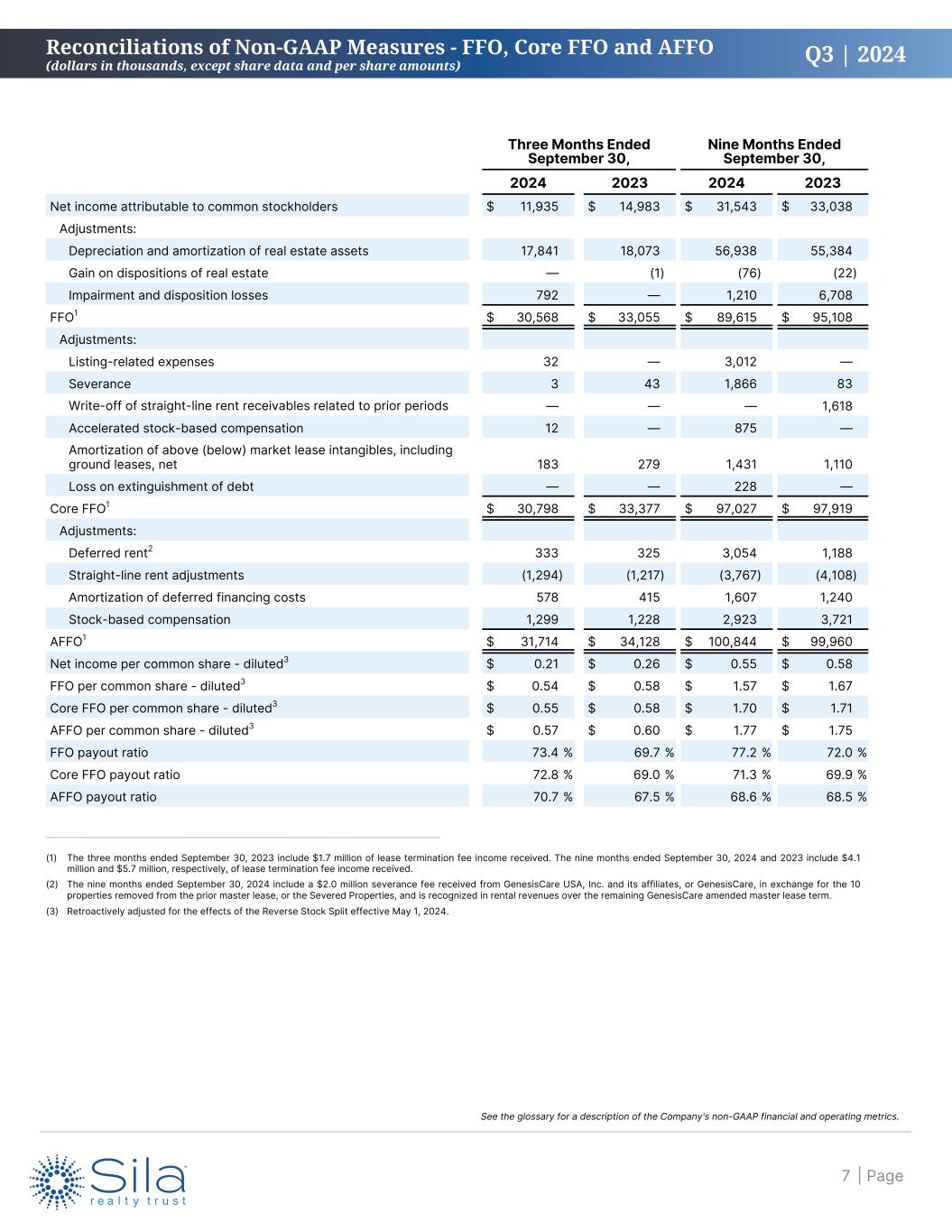

Q3 | 2024 Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Net income attributable to common stockholders $ 11,935 $ 14,983 $ 31,543 $ 33,038 Adjustments: Depreciation and amortization of real estate assets 17,841 18,073 56,938 55,384 Gain on dispositions of real estate — (1) (76) (22) Impairment and disposition losses 792 — 1,210 6,708 FFO1 $ 30,568 $ 33,055 $ 89,615 $ 95,108 Adjustments: Listing-related expenses 32 — 3,012 — Severance 3 43 1,866 83 Write-off of straight-line rent receivables related to prior periods — — — 1,618 Accelerated stock-based compensation 12 — 875 — Amortization of above (below) market lease intangibles, including ground leases, net 183 279 1,431 1,110 Loss on extinguishment of debt — — 228 — Core FFO1 $ 30,798 $ 33,377 $ 97,027 $ 97,919 Adjustments: Deferred rent2 333 325 3,054 1,188 Straight-line rent adjustments (1,294) (1,217) (3,767) (4,108) Amortization of deferred financing costs 578 415 1,607 1,240 Stock-based compensation 1,299 1,228 2,923 3,721 AFFO1 $ 31,714 $ 34,128 $ 100,844 $ 99,960 Net income per common share - diluted3 $ 0.21 $ 0.26 $ 0.55 $ 0.58 FFO per common share - diluted3 $ 0.54 $ 0.58 $ 1.57 $ 1.67 Core FFO per common share - diluted3 $ 0.55 $ 0.58 $ 1.70 $ 1.71 AFFO per common share - diluted3 $ 0.57 $ 0.60 $ 1.77 $ 1.75 FFO payout ratio 73.4 % 69.7 % 77.2 % 72.0 % Core FFO payout ratio 72.8 % 69.0 % 71.3 % 69.9 % AFFO payout ratio 70.7 % 67.5 % 68.6 % 68.5 % Reconciliations of Non-GAAP Measures - FFO, Core FFO and AFFO (dollars in thousands, except share data and per share amounts) (1) The three months ended September 30, 2023 include $1.7 million of lease termination fee income received. The nine months ended September 30, 2024 and 2023 include $4.1 million and $5.7 million, respectively, of lease termination fee income received. (2) The nine months ended September 30, 2024 include a $2.0 million severance fee received from GenesisCare USA, Inc. and its affiliates, or GenesisCare, in exchange for the 10 properties removed from the prior master lease, or the Severed Properties, and is recognized in rental revenues over the remaining GenesisCare amended master lease term. (3) Retroactively adjusted for the effects of the Reverse Stock Split effective May 1, 2024. | Page7 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

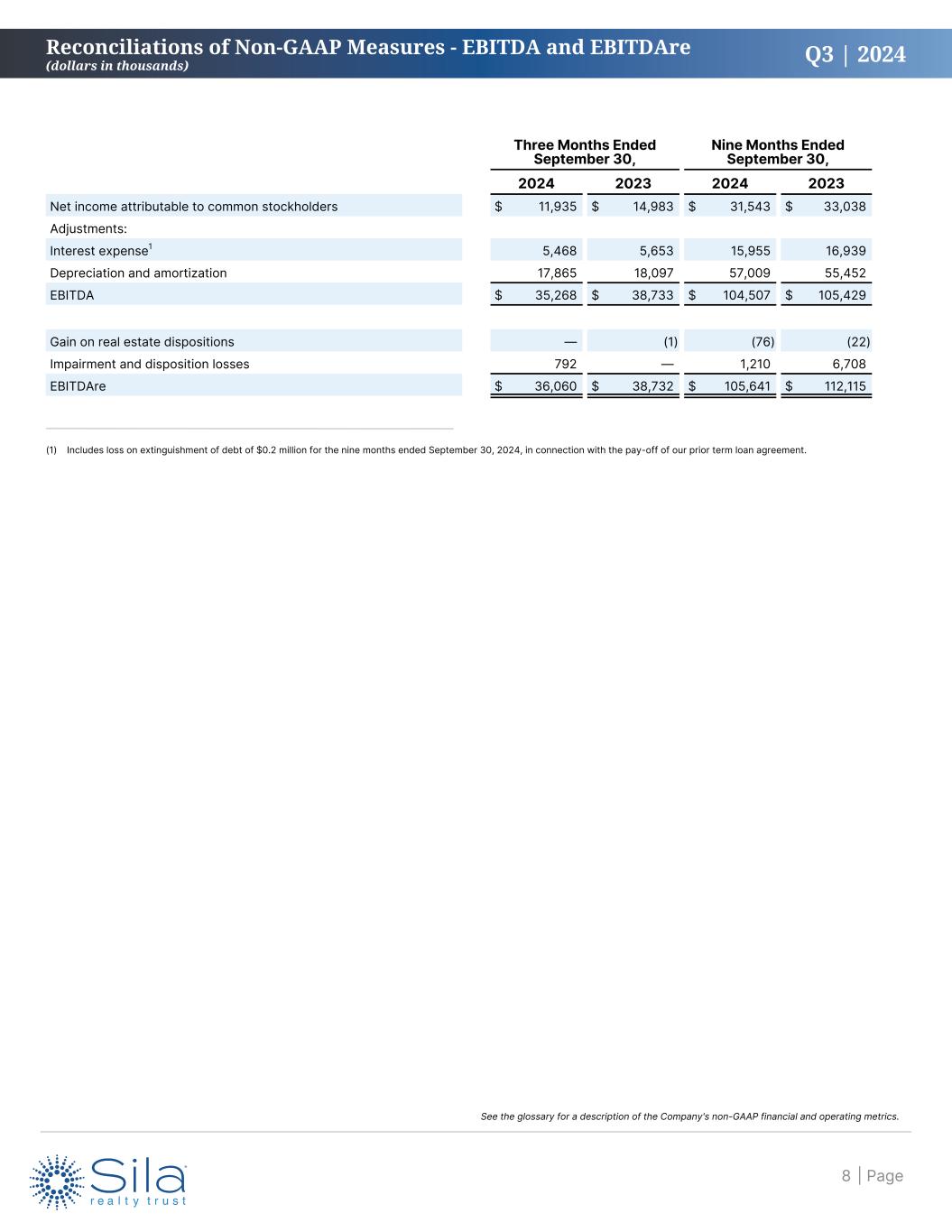

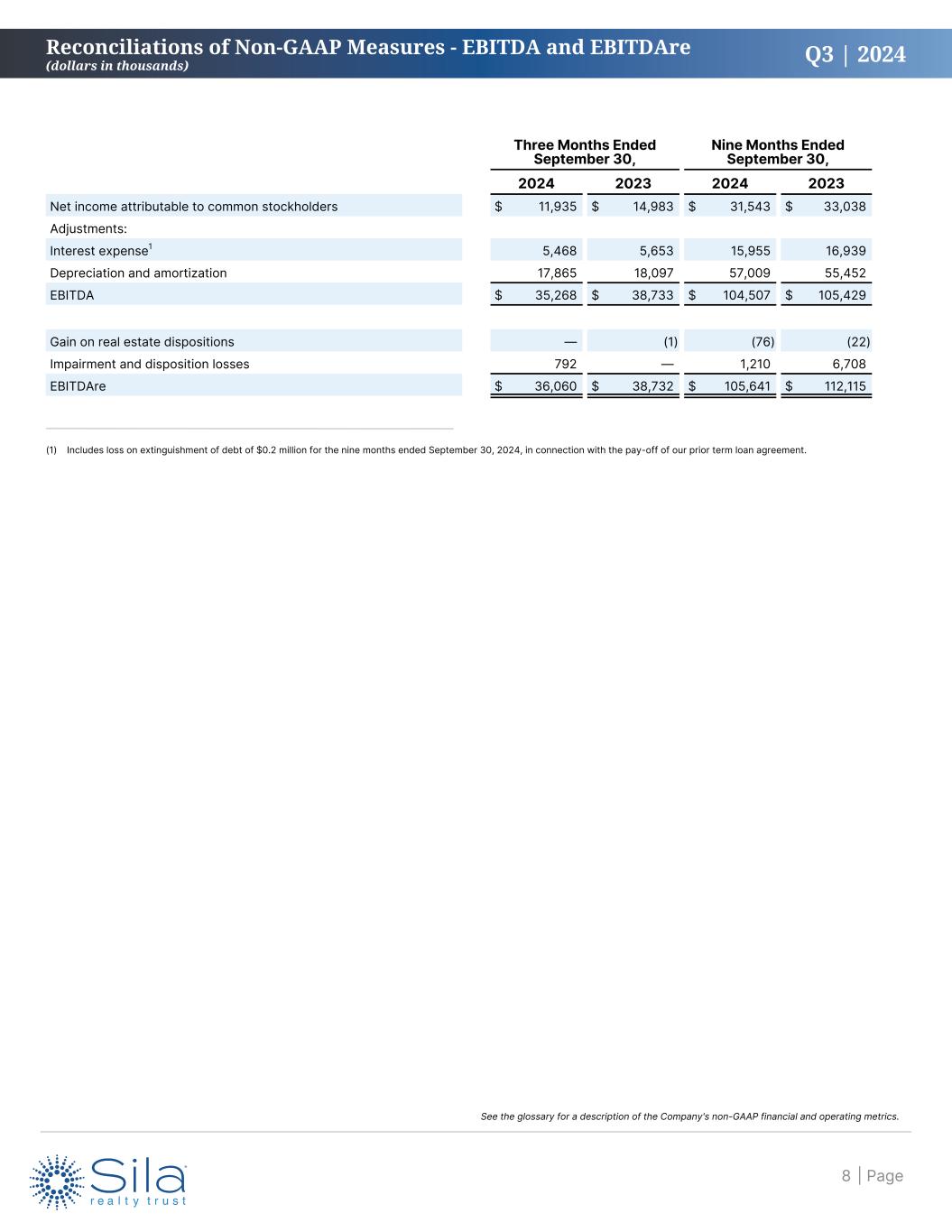

Q3 | 2024 Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Net income attributable to common stockholders $ 11,935 $ 14,983 $ 31,543 $ 33,038 Adjustments: Interest expense1 5,468 5,653 15,955 16,939 Depreciation and amortization 17,865 18,097 57,009 55,452 EBITDA $ 35,268 $ 38,733 $ 104,507 $ 105,429 Gain on real estate dispositions — (1) (76) (22) Impairment and disposition losses 792 — 1,210 6,708 EBITDAre $ 36,060 $ 38,732 $ 105,641 $ 112,115 Reconciliations of Non-GAAP Measures - EBITDA and EBITDAre (dollars in thousands) (1) Includes loss on extinguishment of debt of $0.2 million for the nine months ended September 30, 2024, in connection with the pay-off of our prior term loan agreement. | Page8 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

Q3 | 2024 Three Months Ended September 30, Nine Months Ended September 30, 2024 2023 2024 2023 Rental revenue $ 46,118 $ 48,542 $ 140,311 $ 143,151 Rental expenses (5,823) (5,005) (17,226) (14,728) Net operating income $ 40,295 $ 43,537 $ 123,085 $ 128,423 Adjustments: Straight-line rent adjustments, net of write-offs (1,294) (1,217) (3,767) (2,490) Amortization of above (below) market lease intangibles, including ground leases, net 183 279 1,431 1,110 Internal property management fee 1,295 1,237 3,827 3,918 Deferred rent1 333 325 3,054 1,188 Cash NOI1,2 $ 40,812 $ 44,161 $ 127,630 $ 132,149 Cash NOI margin3 88.5 % 91.0 % 91.0 % 92.3 % Cash NOI yield4 7.3 % 7.2 % 7.7 % 7.3 % (1) The nine months ended September 30, 2024 include a $2.0 million severance fee received from GenesisCare in exchange for the Severed Properties, and will be recognized in rental revenues over the remaining GenesisCare amended master lease term. (2) The three months ended September 30, 2023 include $1.7 million of lease termination fee income received. The nine months ended September 30, 2024 and 2023 include $4.1 million and $5.7 million, respectively, of lease termination fee income received. (3) Calculated by dividing Cash NOI by rental revenue. (4) Calculated by dividing the annualized Cash NOI for the three months ended September 30, 2024 and 2023, respectively, (determined by multiplying actual Cash NOI, excluding lease termination income by four quarters, then adding lease termination income collected for the quarter) by the weighted average total real estate investments at cost. Calculated by dividing the annualized Cash NOI for the nine months ended September 30, 2024 and 2023, respectively, (determined by dividing actual Cash NOI, excluding lease termination income by three, then multiplying by four quarters, then adding lease termination income collected for the three quarters) by the weighted average total real estate investments at cost. Reconciliations of Non-GAAP Measures - Net Operating Income (NOI) (dollars in thousands) | Page9 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

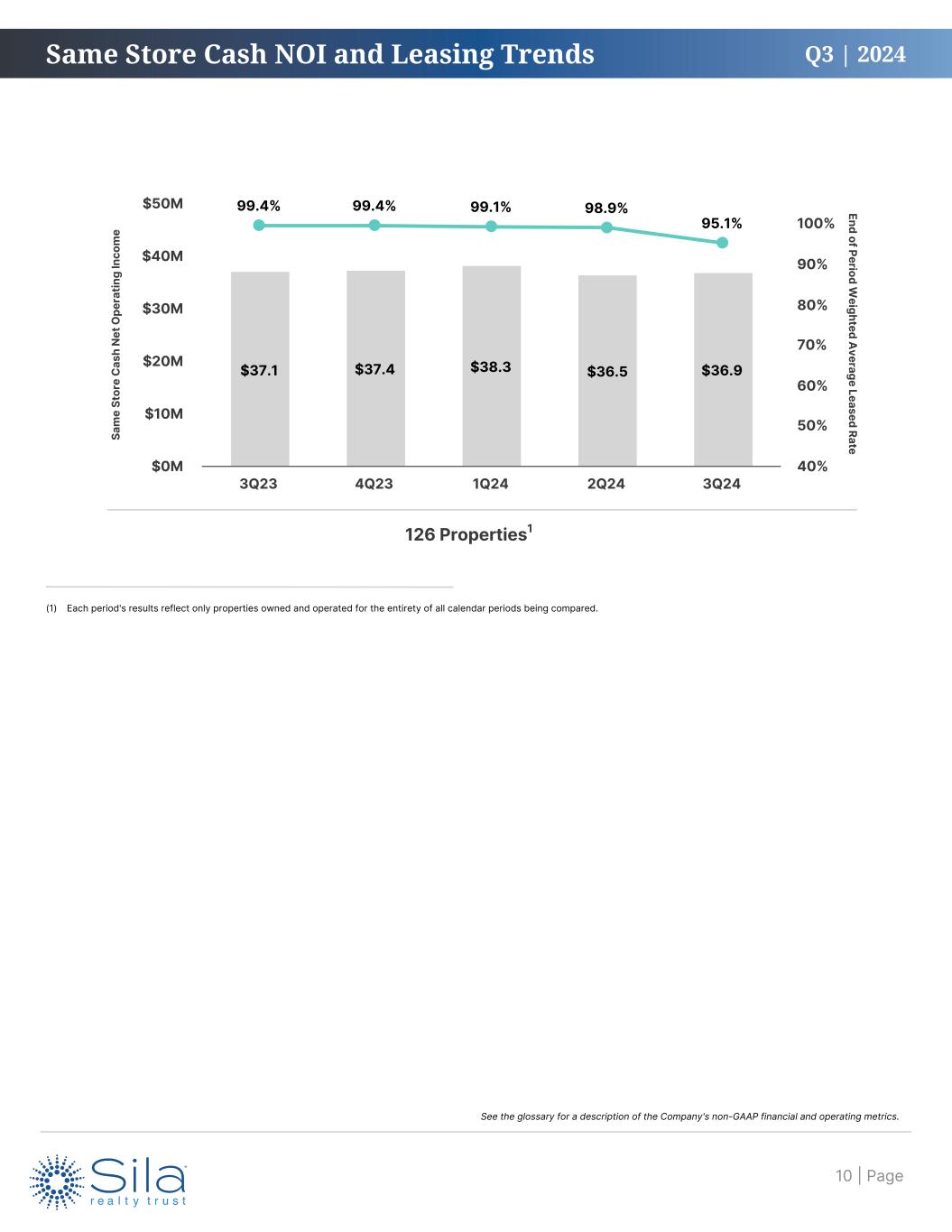

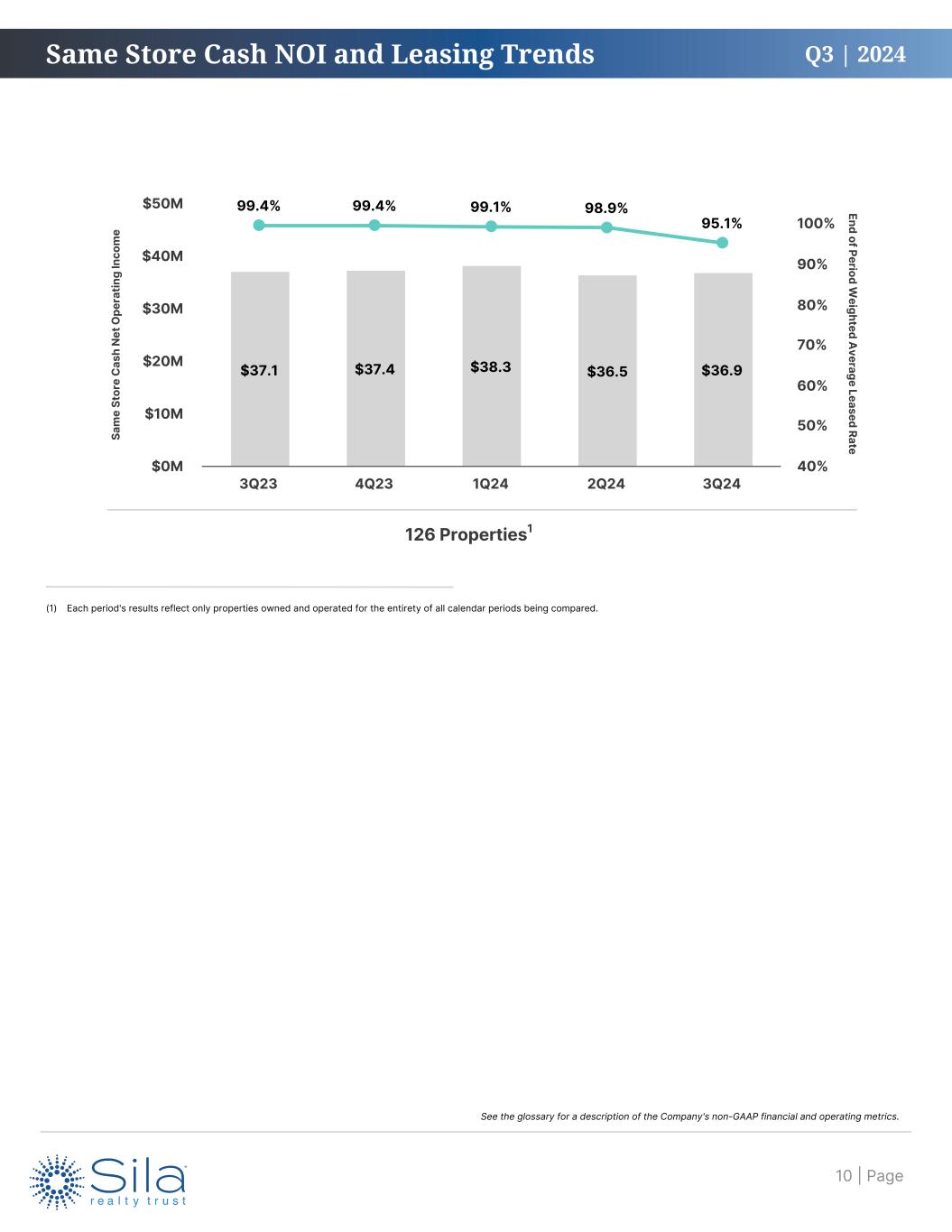

Q3 | 2024 126 Properties1 (1) Each period's results reflect only properties owned and operated for the entirety of all calendar periods being compared. Sa m e St or e C as h N et O pe ra tin g In co m e End of Period W eighted A verage Leased Rate $37.1 $37.4 $38.3 $36.5 $36.9 99.4% 99.4% 99.1% 98.9% 95.1% 3Q23 4Q23 1Q24 2Q24 3Q24 $0M $10M $20M $30M $40M $50M 40% 50% 60% 70% 80% 90% 100% Same Store Cash NOI and Leasing Trends | Page10 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

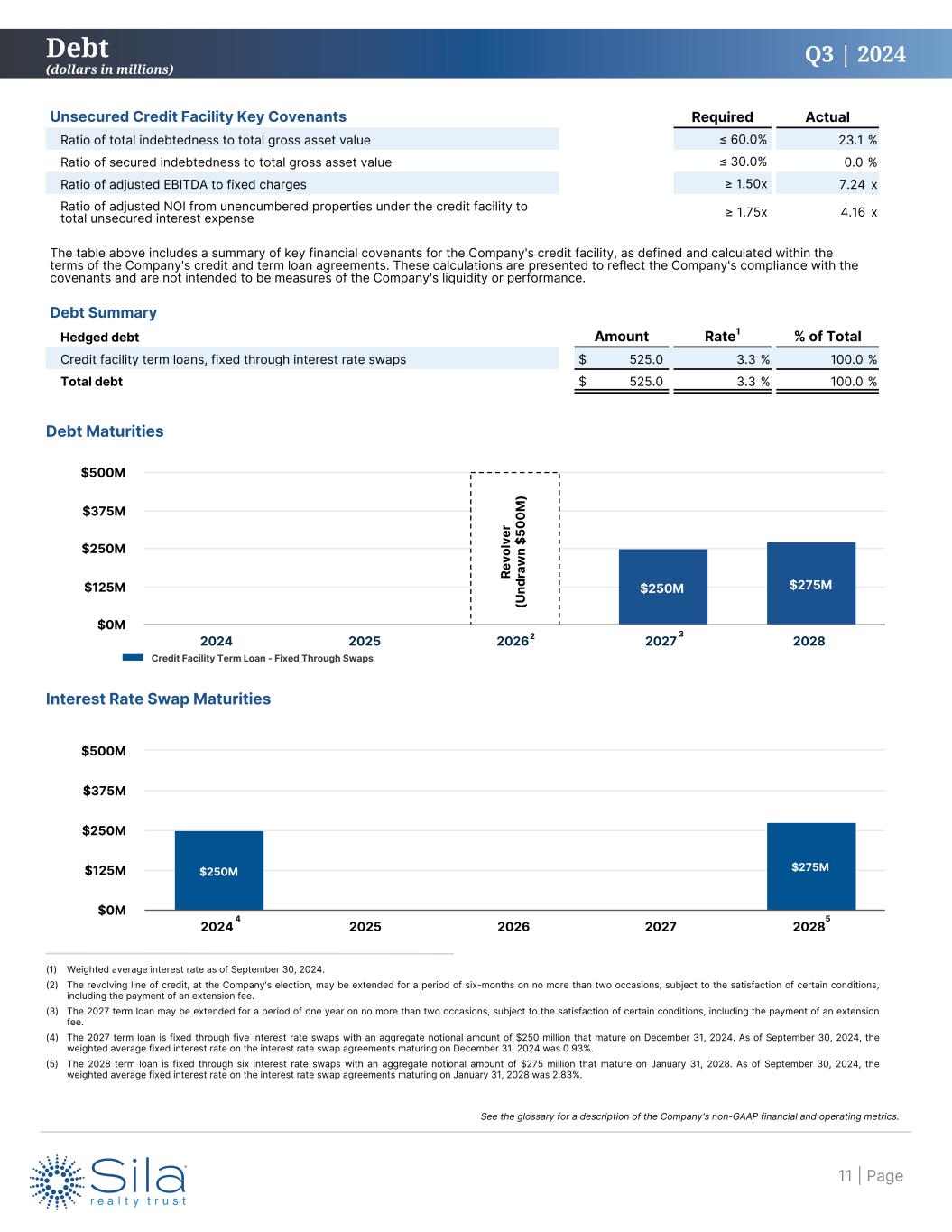

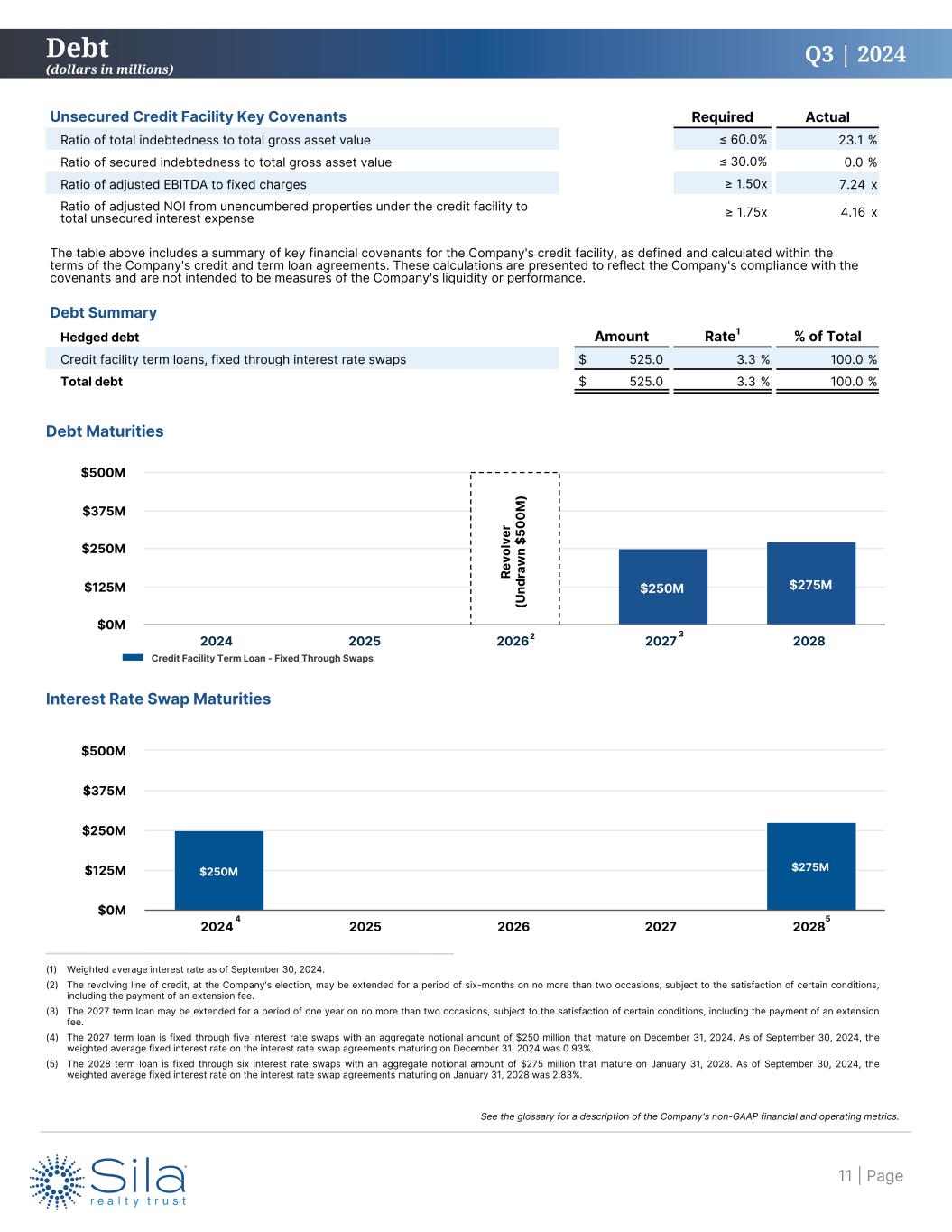

Q3 | 2024 $250M $275M 2024 2025 2026 2027 2028 $0M $125M $250M $375M $500M Unsecured Credit Facility Key Covenants Required Actual Ratio of total indebtedness to total gross asset value ≤ 60.0% 23.1 % Ratio of secured indebtedness to total gross asset value ≤ 30.0% 0.0 % Ratio of adjusted EBITDA to fixed charges ≥ 1.50x 7.24 x Ratio of adjusted NOI from unencumbered properties under the credit facility to total unsecured interest expense ≥ 1.75x 4.16 x The table above includes a summary of key financial covenants for the Company's credit facility, as defined and calculated within the terms of the Company's credit and term loan agreements. These calculations are presented to reflect the Company's compliance with the covenants and are not intended to be measures of the Company's liquidity or performance. Debt Summary Hedged debt Amount Rate1 % of Total Credit facility term loans, fixed through interest rate swaps $ 525.0 3.3 % 100.0 % Total debt $ 525.0 3.3 % 100.0 % Debt Maturities (1) Weighted average interest rate as of September 30, 2024. (2) The revolving line of credit, at the Company's election, may be extended for a period of six-months on no more than two occasions, subject to the satisfaction of certain conditions, including the payment of an extension fee. (3) The 2027 term loan may be extended for a period of one year on no more than two occasions, subject to the satisfaction of certain conditions, including the payment of an extension fee. (4) The 2027 term loan is fixed through five interest rate swaps with an aggregate notional amount of $250 million that mature on December 31, 2024. As of September 30, 2024, the weighted average fixed interest rate on the interest rate swap agreements maturing on December 31, 2024 was 0.93%. (5) The 2028 term loan is fixed through six interest rate swaps with an aggregate notional amount of $275 million that mature on January 31, 2028. As of September 30, 2024, the weighted average fixed interest rate on the interest rate swap agreements maturing on January 31, 2028 was 2.83%. Credit Facility Term Loan - Fixed Through Swaps 2 3 Debt (dollars in millions) Re vo lv er (U nd ra w n $5 00 M ) Interest Rate Swap Maturities $250M $275M 2024 2025 2026 2027 2028 $0M $125M $250M $375M $500M 4 5 | Page11 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

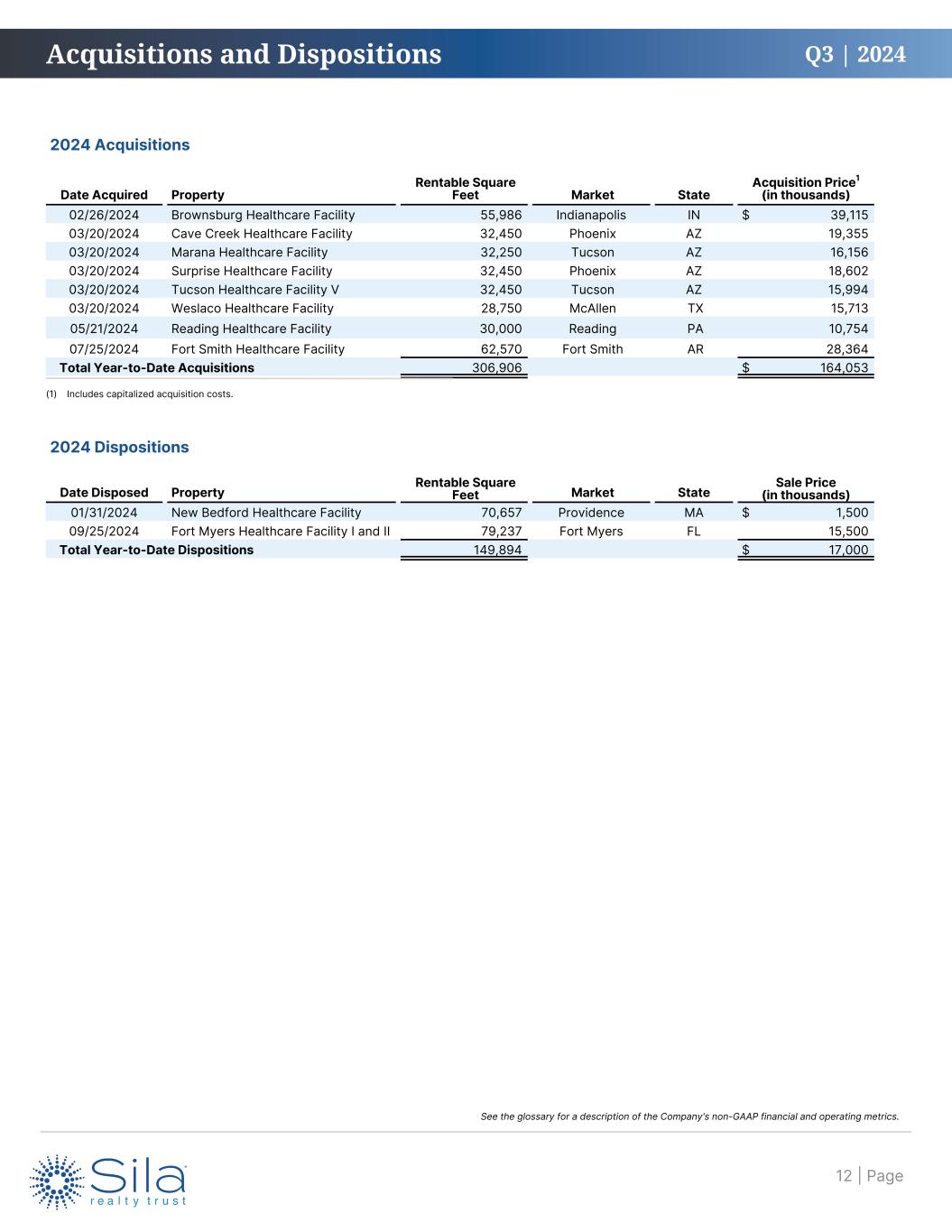

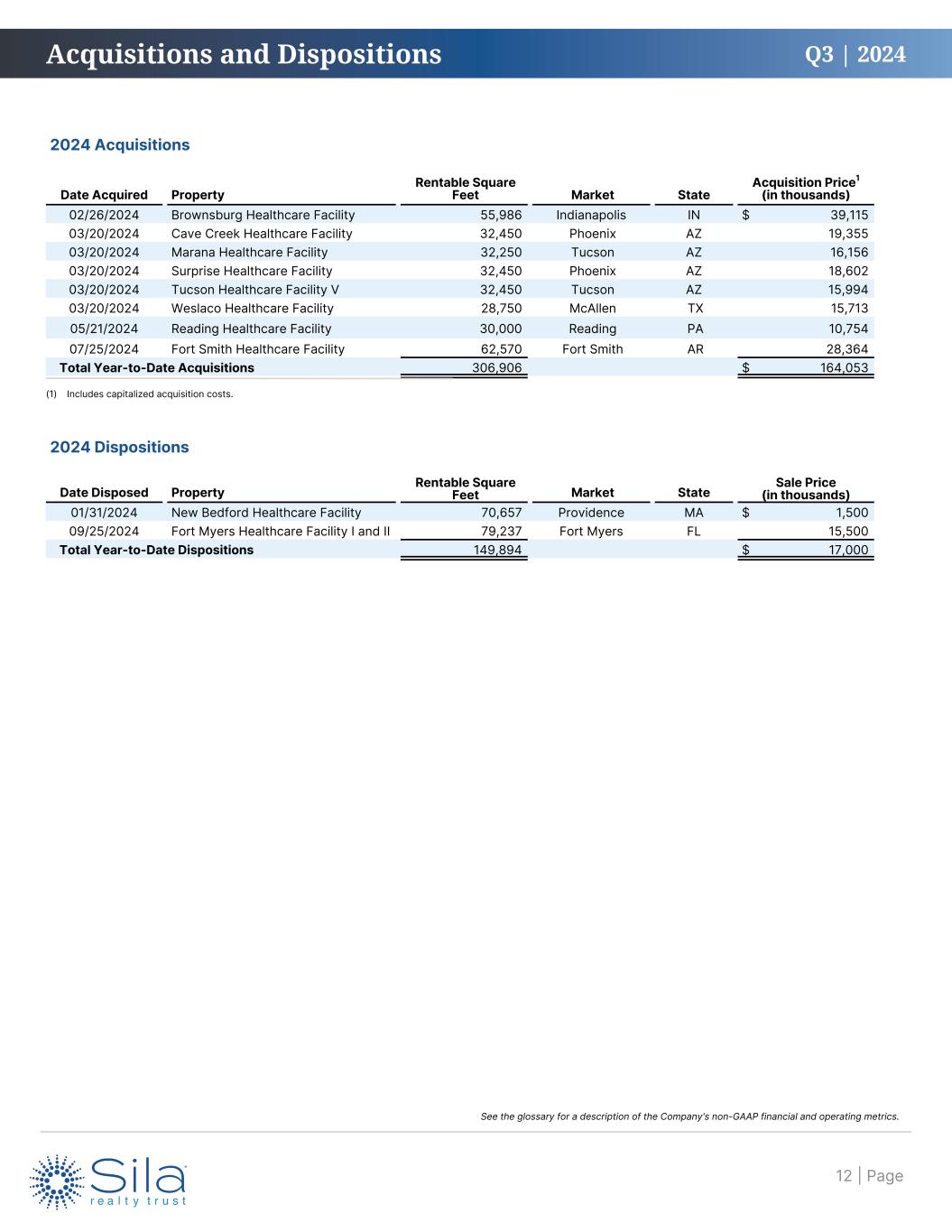

Q3 | 2024 2024 Acquisitions Date Acquired Property Rentable Square Feet Market State Acquisition Price1 (in thousands) 02/26/2024 Brownsburg Healthcare Facility 55,986 Indianapolis IN $ 39,115 03/20/2024 Cave Creek Healthcare Facility 32,450 Phoenix AZ 19,355 03/20/2024 Marana Healthcare Facility 32,250 Tucson AZ 16,156 03/20/2024 Surprise Healthcare Facility 32,450 Phoenix AZ 18,602 03/20/2024 Tucson Healthcare Facility V 32,450 Tucson AZ 15,994 03/20/2024 Weslaco Healthcare Facility 28,750 McAllen TX 15,713 05/21/2024 Reading Healthcare Facility 30,000 Reading PA 10,754 07/25/2024 Fort Smith Healthcare Facility 62,570 Fort Smith AR 28,364 Total Year-to-Date Acquisitions 306,906 $ 164,053 2024 Dispositions Date Disposed Property Rentable Square Feet Market State Sale Price (in thousands) 01/31/2024 New Bedford Healthcare Facility 70,657 Providence MA $ 1,500 09/25/2024 Fort Myers Healthcare Facility I and II 79,237 Fort Myers FL 15,500 Total Year-to-Date Dispositions 149,894 $ 17,000 Acquisitions and Dispositions (1) Includes capitalized acquisition costs. | Page12 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

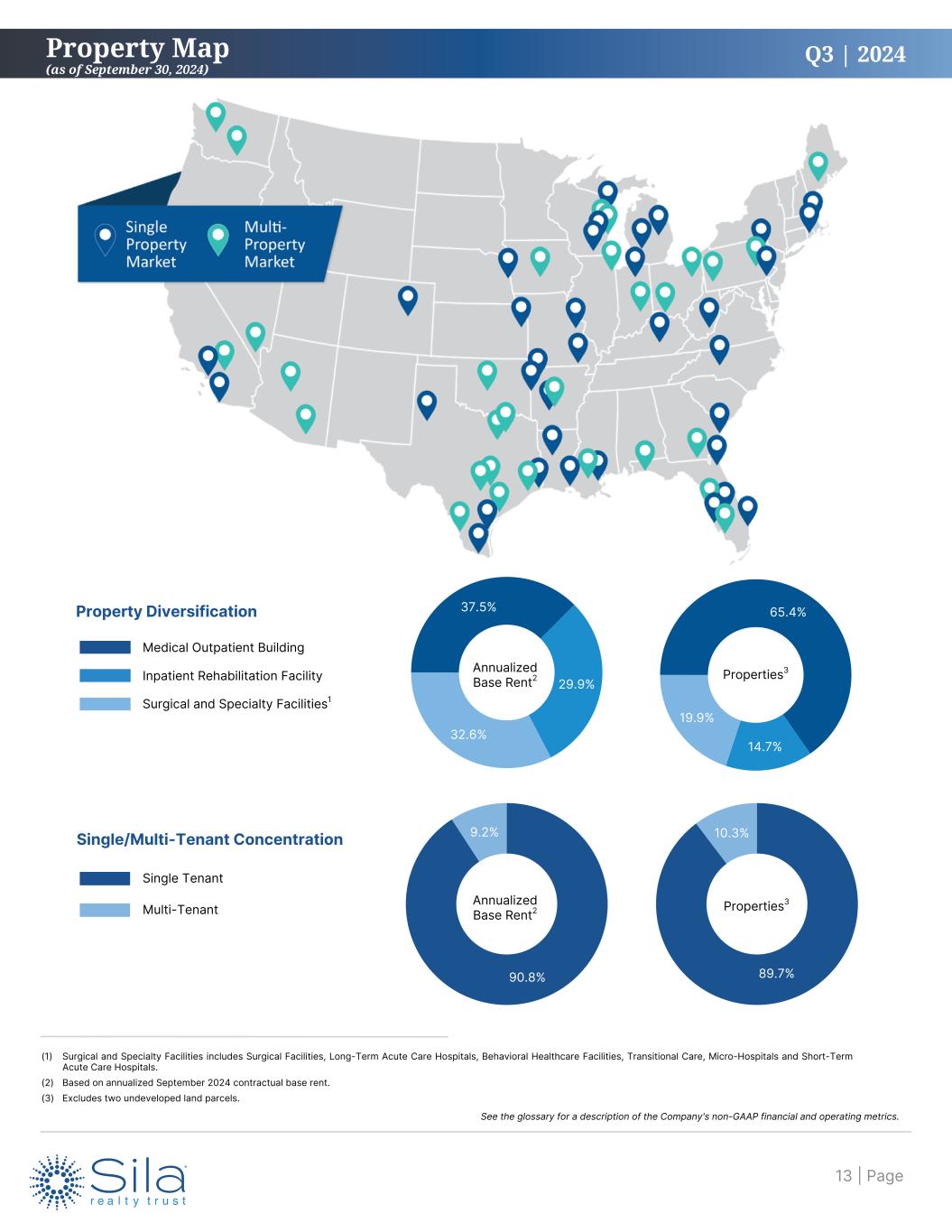

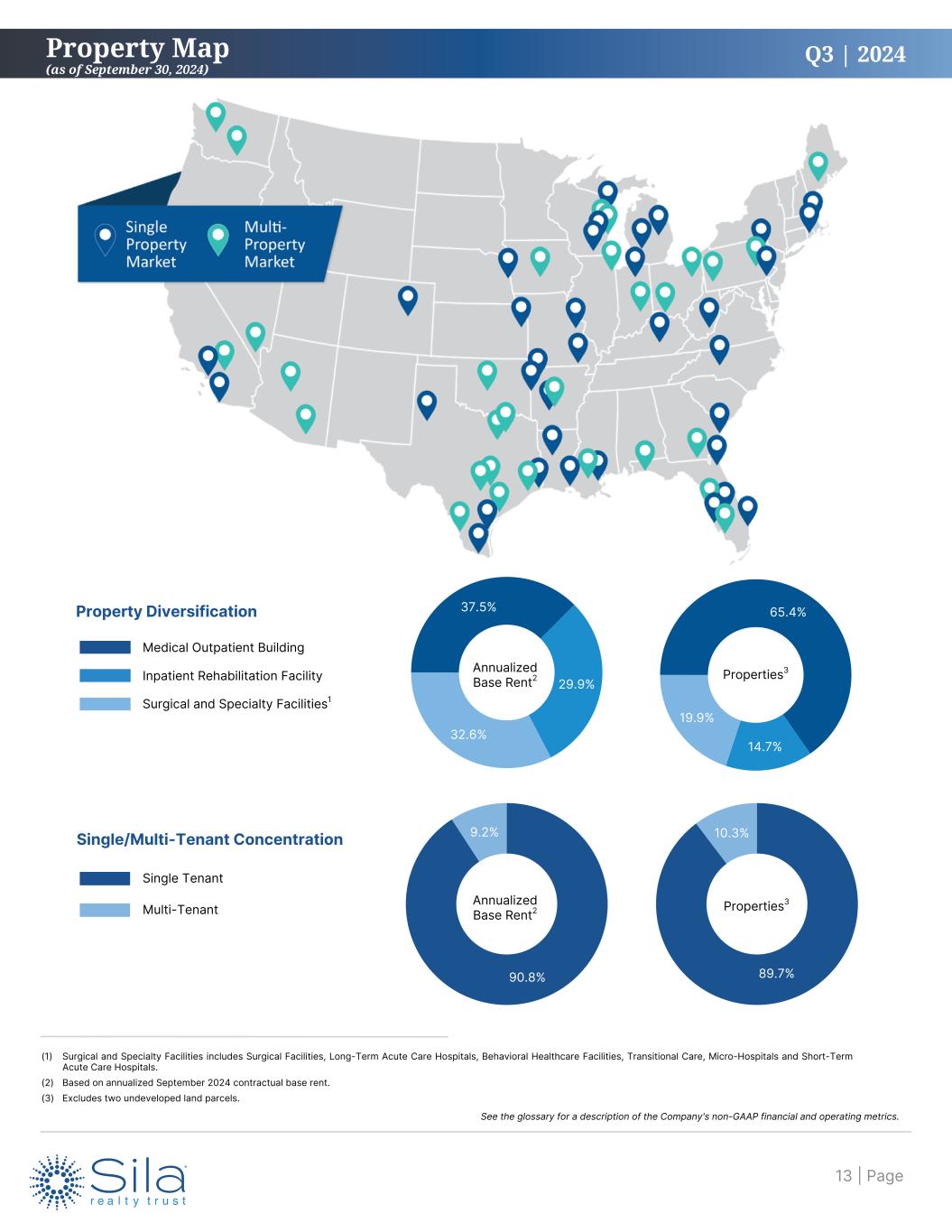

Q3 | 2024 (1) Surgical and Specialty Facilities includes Surgical Facilities, Long-Term Acute Care Hospitals, Behavioral Healthcare Facilities, Transitional Care, Micro-Hospitals and Short-Term Acute Care Hospitals. (2) Based on annualized September 2024 contractual base rent. (3) Excludes two undeveloped land parcels. Property Map (as of September 30, 2024) 37.5% 29.9% 32.6% Property Diversification Medical Outpatient Building Inpatient Rehabilitation Facility Surgical and Specialty Facilities1 65.4% 14.7% 19.9% Properties3Annualized Base Rent2 89.7% 10.3% 90.8% 9.2% Annualized Base Rent2 Properties3 Single/Multi-Tenant Concentration Single Tenant Multi-Tenant | Page13 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

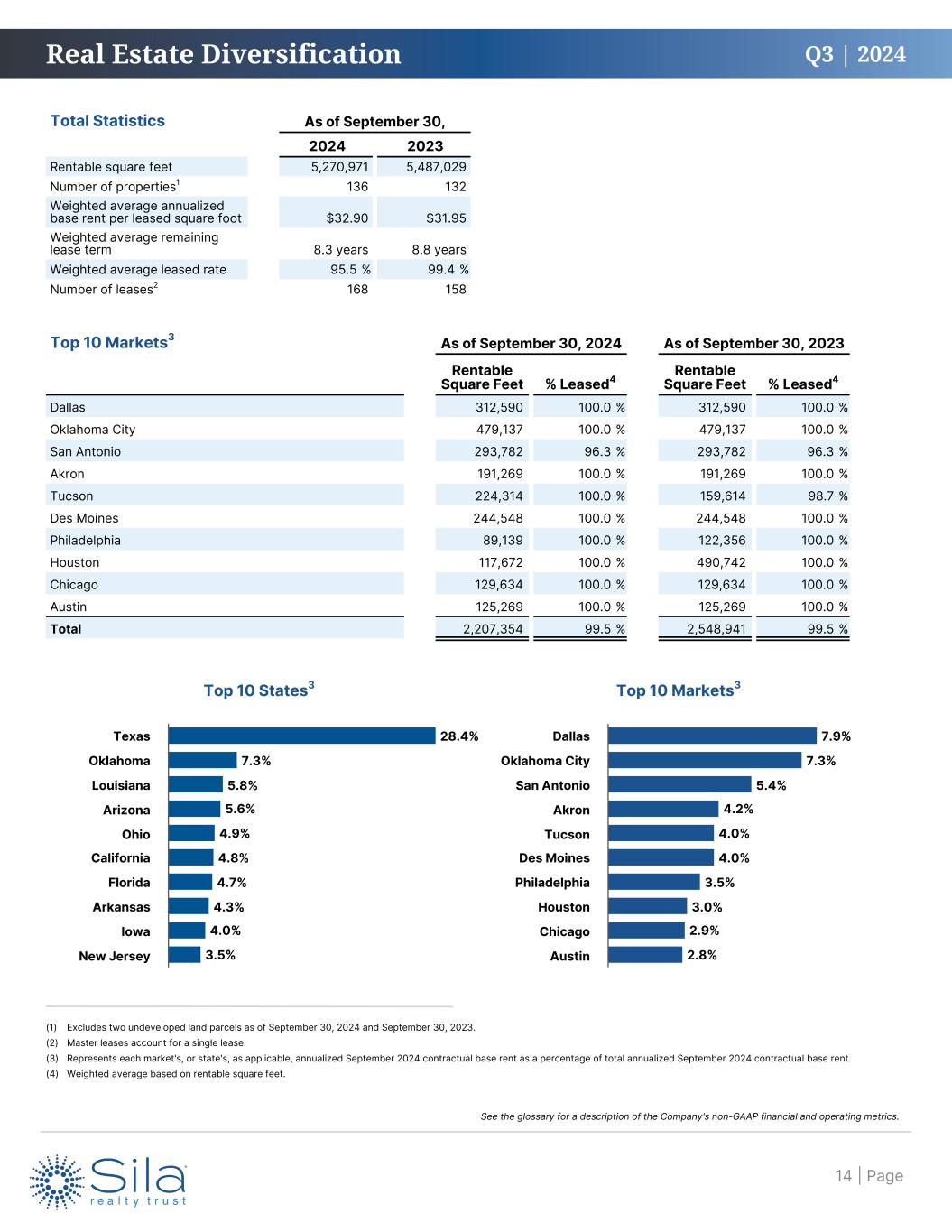

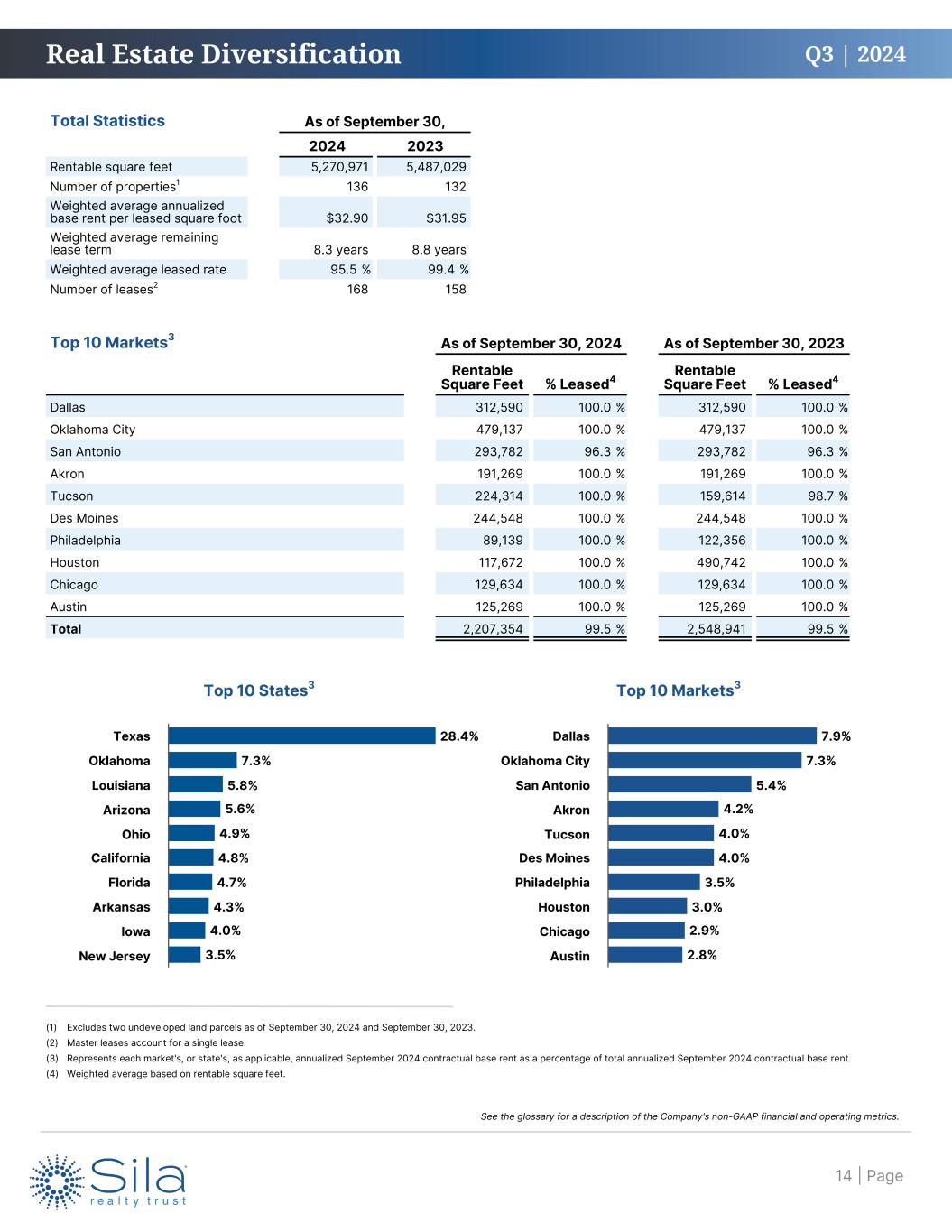

Q3 | 2024 7.9% 7.3% 5.4% 4.2% 4.0% 4.0% 3.5% 3.0% 2.9% 2.8% Dallas Oklahoma City San Antonio Akron Tucson Des Moines Philadelphia Houston Chicago Austin Total Statistics As of September 30, 2024 2023 Rentable square feet 5,270,971 5,487,029 Number of properties1 136 132 Weighted average annualized base rent per leased square foot $32.90 $31.95 Weighted average remaining lease term 8.3 years 8.8 years Weighted average leased rate 95.5 % 99.4 % Number of leases2 168 158 Top 10 Markets3 As of September 30, 2024 As of September 30, 2023 Rentable Square Feet % Leased4 Rentable Square Feet % Leased4 Dallas 312,590 100.0 % 312,590 100.0 % Oklahoma City 479,137 100.0 % 479,137 100.0 % San Antonio 293,782 96.3 % 293,782 96.3 % Akron 191,269 100.0 % 191,269 100.0 % Tucson 224,314 100.0 % 159,614 98.7 % Des Moines 244,548 100.0 % 244,548 100.0 % Philadelphia 89,139 100.0 % 122,356 100.0 % Houston 117,672 100.0 % 490,742 100.0 % Chicago 129,634 100.0 % 129,634 100.0 % Austin 125,269 100.0 % 125,269 100.0 % Total 2,207,354 99.5 % 2,548,941 99.5 % Top 10 Markets3 (1) Excludes two undeveloped land parcels as of September 30, 2024 and September 30, 2023. (2) Master leases account for a single lease. (3) Represents each market's, or state's, as applicable, annualized September 2024 contractual base rent as a percentage of total annualized September 2024 contractual base rent. (4) Weighted average based on rentable square feet. Real Estate Diversification 28.4% 7.3% 5.8% 5.6% 4.9% 4.8% 4.7% 4.3% 4.0% 3.5% Texas Oklahoma Louisiana Arizona Ohio California Florida Arkansas Iowa New Jersey Top 10 States3 | Page14 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

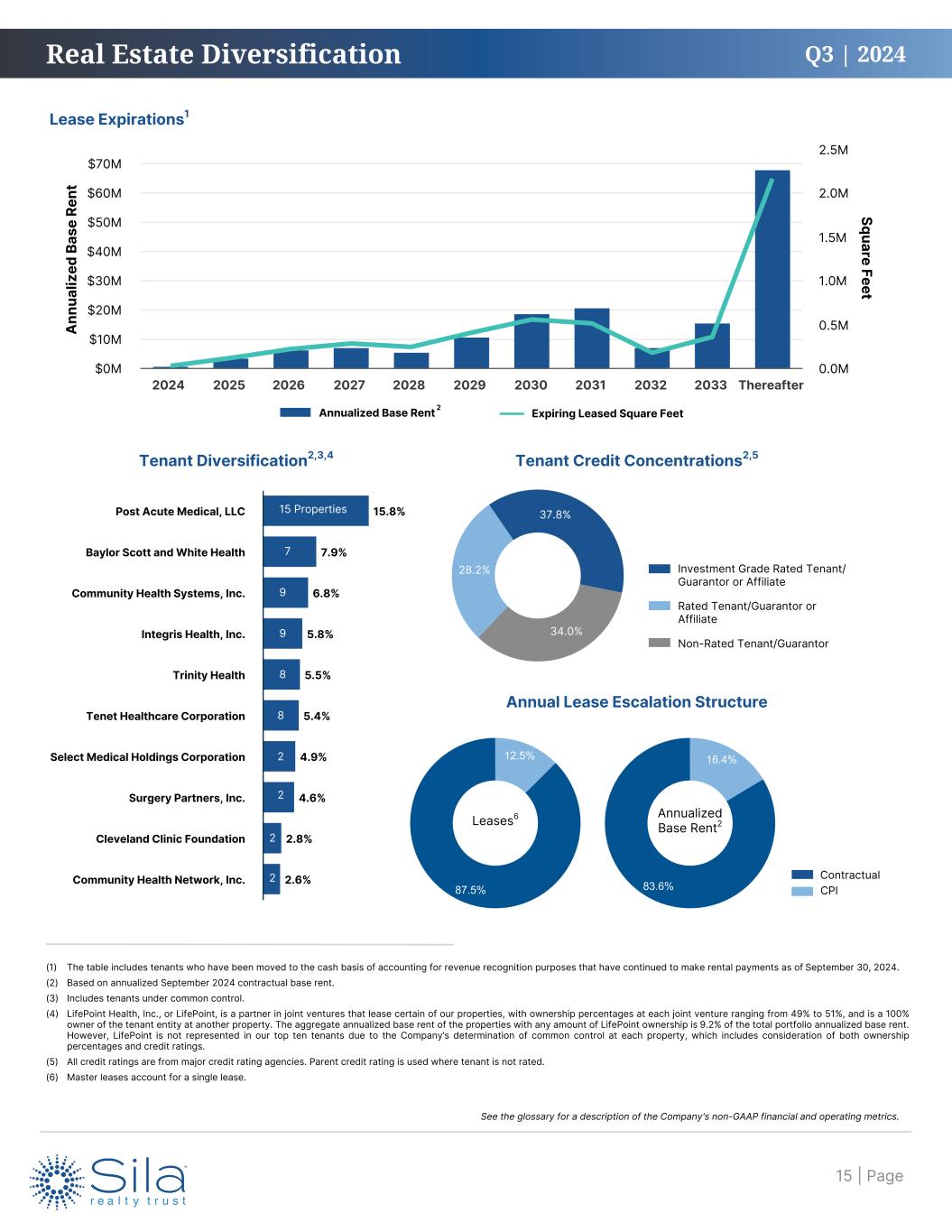

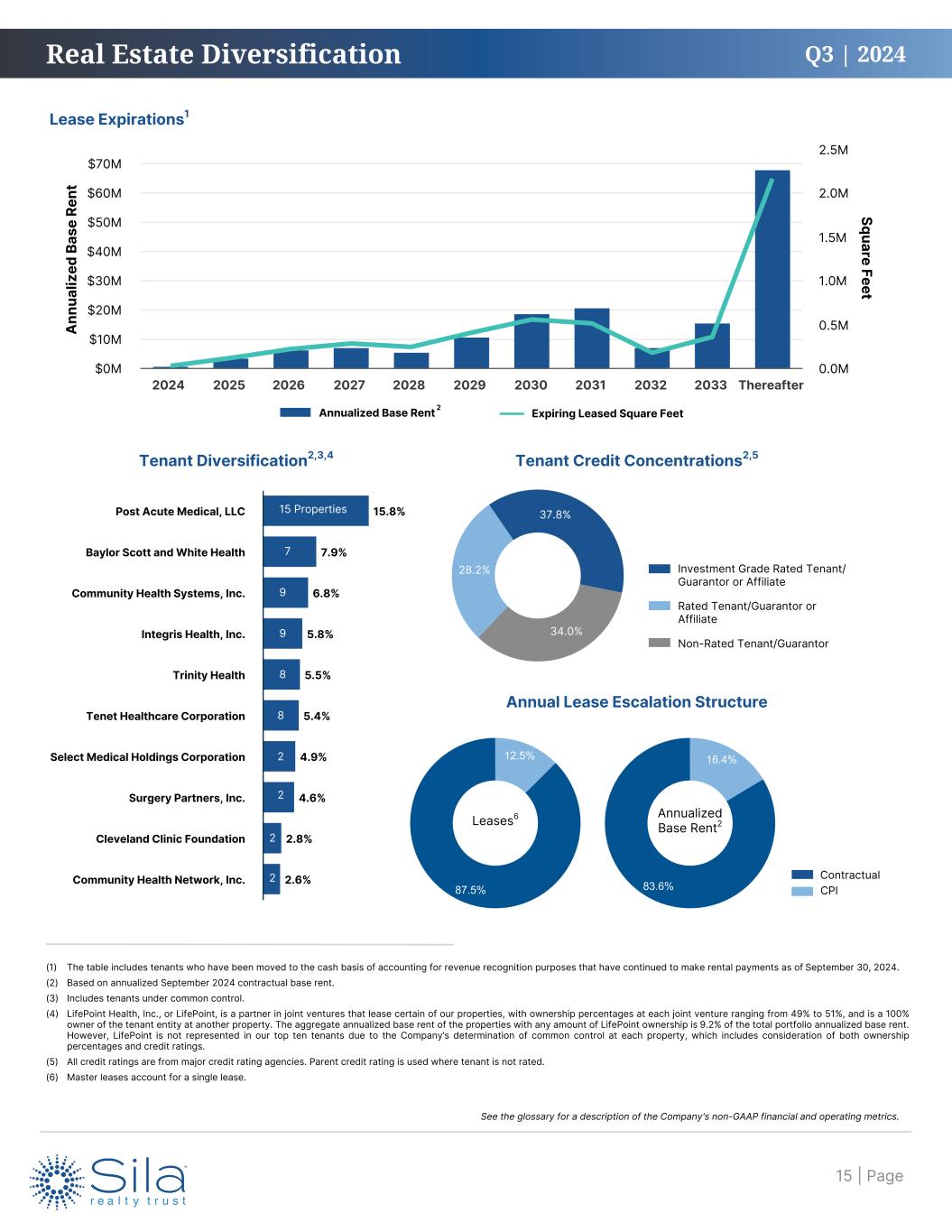

Q3 | 2024 15.8% 7.9% 6.8% 5.8% 5.5% 5.4% 4.9% 4.6% 2.8% 2.6% Post Acute Medical, LLC Baylor Scott and White Health Community Health Systems, Inc. Integris Health, Inc. Trinity Health Tenet Healthcare Corporation Select Medical Holdings Corporation Surgery Partners, Inc. Cleveland Clinic Foundation Community Health Network, Inc. 28.2% 37.8% 34.0% A nn ua liz ed B as e Re nt Square Feet 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 Thereafter $0M $10M $20M $30M $40M $50M $60M $70M 0.0M 0.5M 1.0M 1.5M 2.0M 2.5M Tenant Diversification2,3,4 Lease Expirations1 (1) The table includes tenants who have been moved to the cash basis of accounting for revenue recognition purposes that have continued to make rental payments as of September 30, 2024. (2) Based on annualized September 2024 contractual base rent. (3) Includes tenants under common control. (4) LifePoint Health, Inc., or LifePoint, is a partner in joint ventures that lease certain of our properties, with ownership percentages at each joint venture ranging from 49% to 51%, and is a 100% owner of the tenant entity at another property. The aggregate annualized base rent of the properties with any amount of LifePoint ownership is 9.2% of the total portfolio annualized base rent. However, LifePoint is not represented in our top ten tenants due to the Company’s determination of common control at each property, which includes consideration of both ownership percentages and credit ratings. (5) All credit ratings are from major credit rating agencies. Parent credit rating is used where tenant is not rated. (6) Master leases account for a single lease. Annualized Base Rent Expiring Leased Square Feet Tenant Credit Concentrations2,5 Investment Grade Rated Tenant/ Guarantor or Affiliate Rated Tenant/Guarantor or Affiliate Non-Rated Tenant/Guarantor 2 Real Estate Diversification Annual Lease Escalation Structure 12.5% 87.5% Contractual CPI Leases6 16.4% 83.6% Annualized Base Rent2 15 Properties 7 9 9 8 8 2 2 2 2 | Page15 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

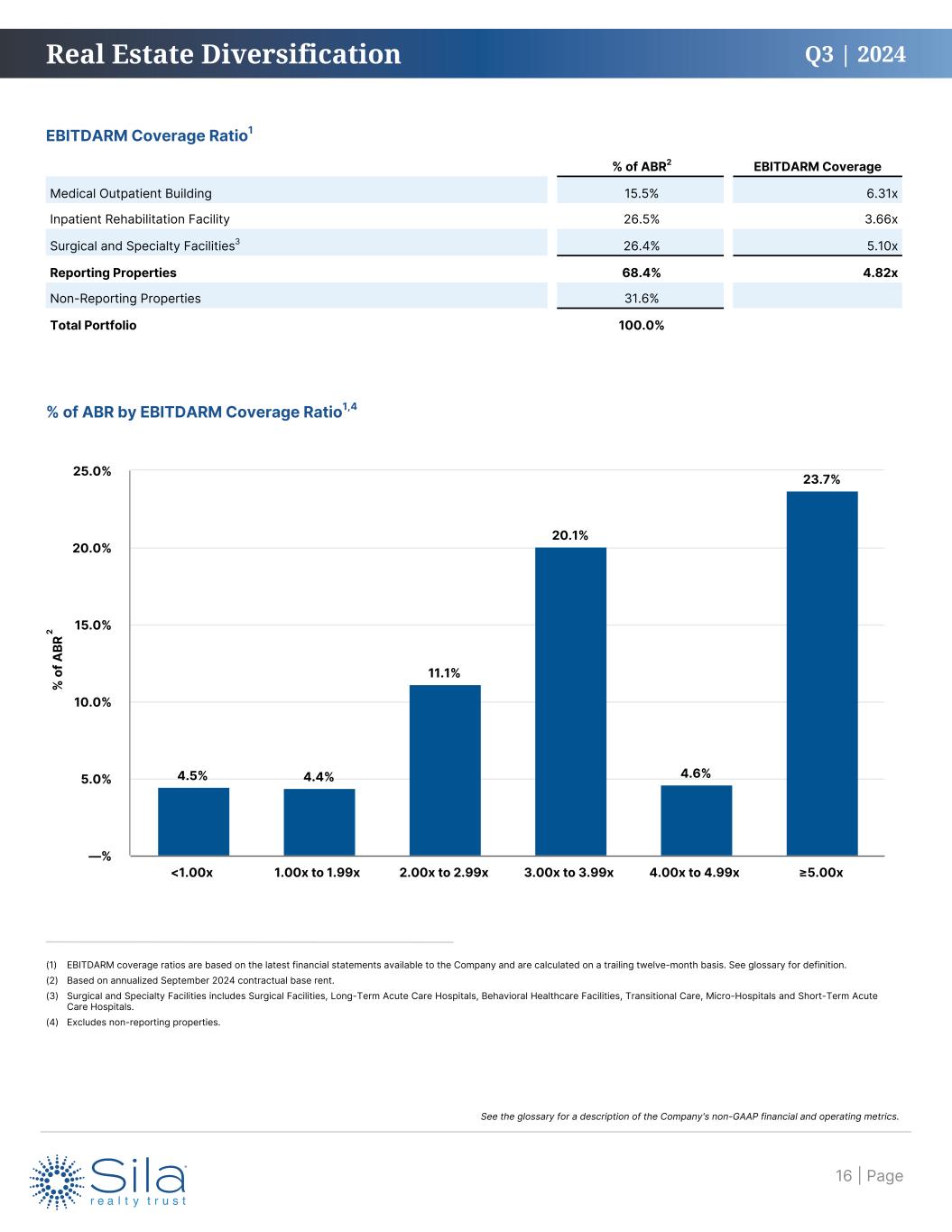

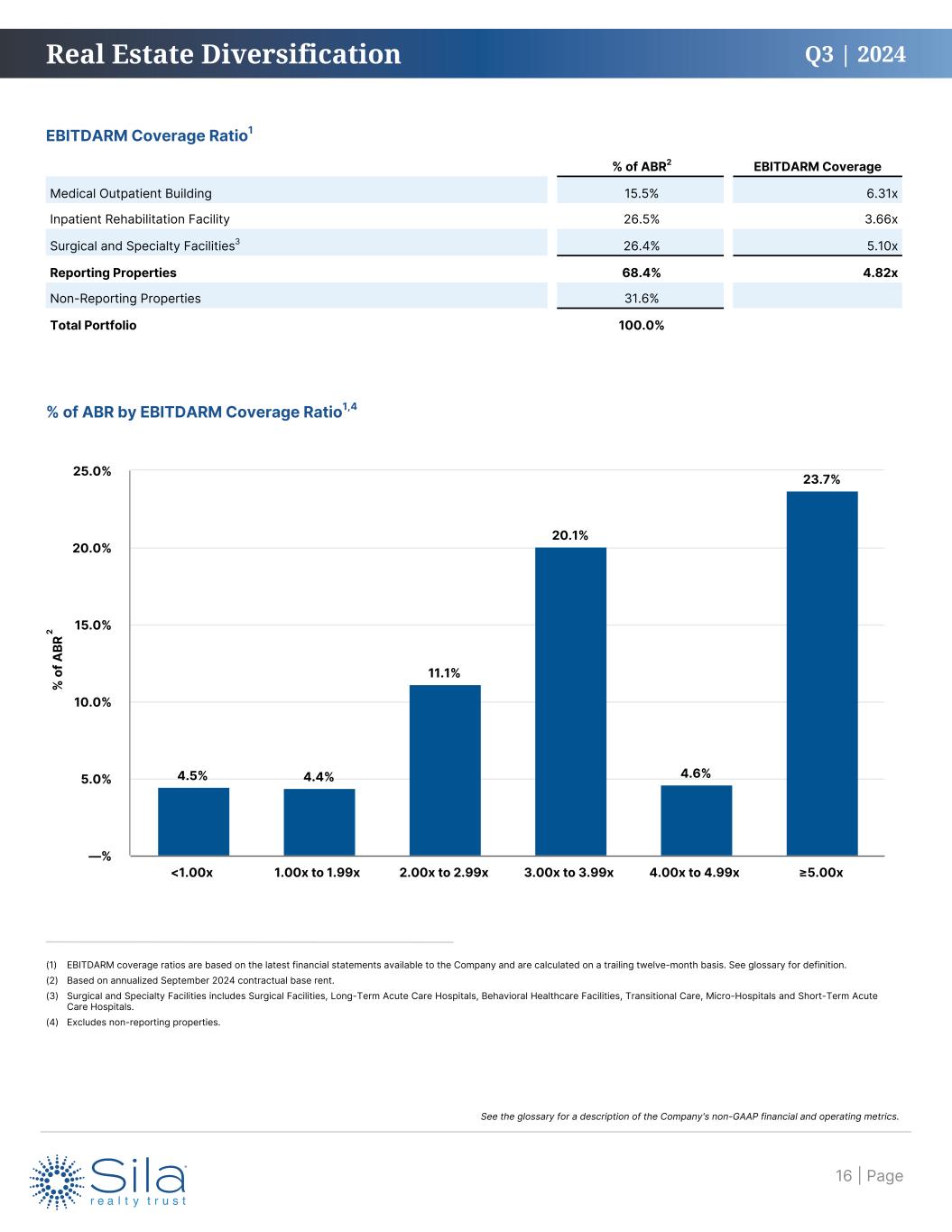

Q3 | 2024 % of ABR2 EBITDARM Coverage Medical Outpatient Building 15.5% 6.31x Inpatient Rehabilitation Facility 26.5% 3.66x Surgical and Specialty Facilities3 26.4% 5.10x Reporting Properties 68.4% 4.82x Non-Reporting Properties 31.6% Total Portfolio 100.0% EBITDARM Coverage Ratio1 Real Estate Diversification (1) EBITDARM coverage ratios are based on the latest financial statements available to the Company and are calculated on a trailing twelve-month basis. See glossary for definition. (2) Based on annualized September 2024 contractual base rent. (3) Surgical and Specialty Facilities includes Surgical Facilities, Long-Term Acute Care Hospitals, Behavioral Healthcare Facilities, Transitional Care, Micro-Hospitals and Short-Term Acute Care Hospitals. (4) Excludes non-reporting properties. % o f A BR 4.5% 4.4% 11.1% 20.1% 4.6% 23.7% <1.00x 1.00x to 1.99x 2.00x to 2.99x 3.00x to 3.99x 4.00x to 4.99x ≥5.00x —% 5.0% 10.0% 15.0% 20.0% 25.0% % of ABR by EBITDARM Coverage Ratio1,4 | Page16 See the glossary for a description of the Company's non-GAAP financial and operating metrics. 2

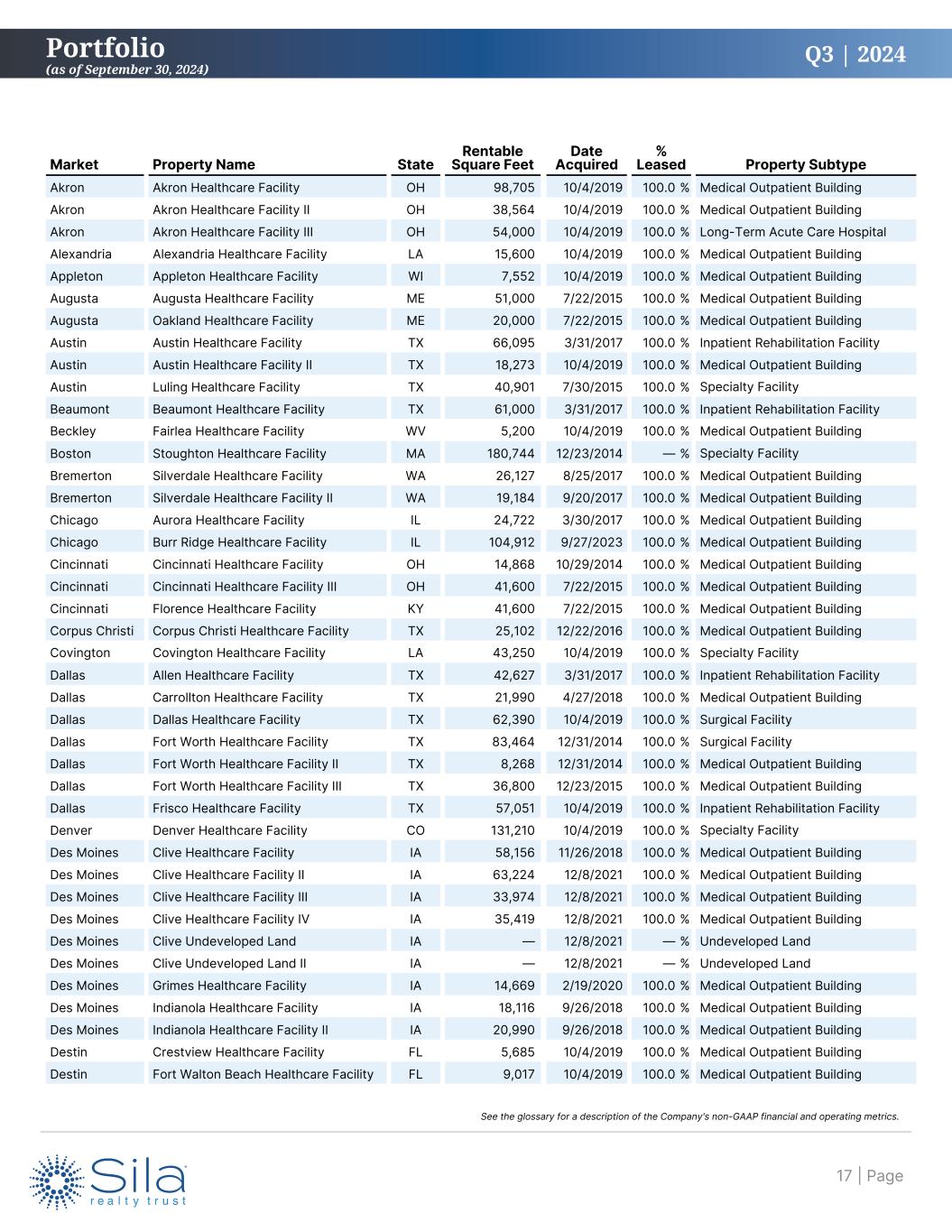

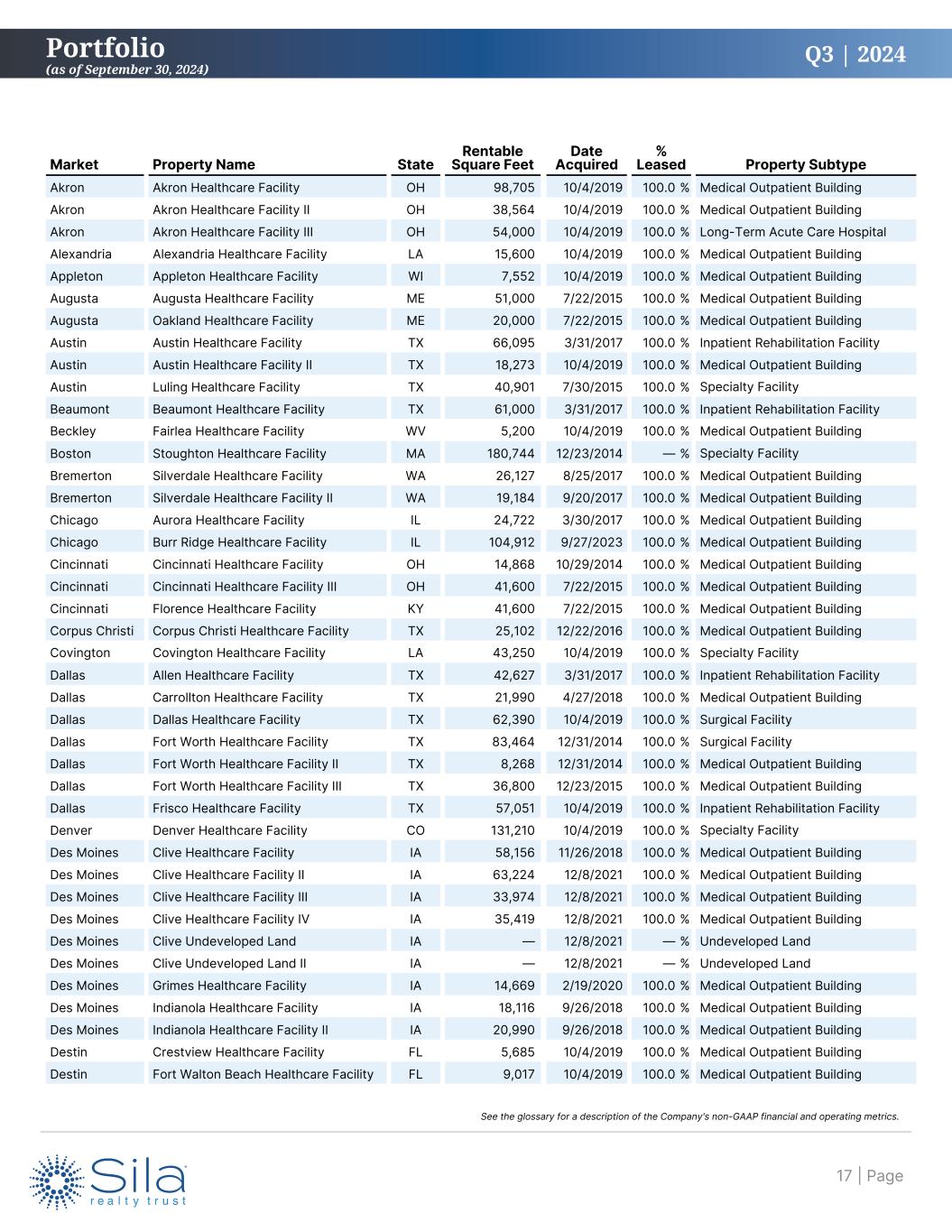

Q3 | 2024 Market Property Name State Rentable Square Feet Date Acquired % Leased Property Subtype Akron Akron Healthcare Facility OH 98,705 10/4/2019 100.0 % Medical Outpatient Building Akron Akron Healthcare Facility II OH 38,564 10/4/2019 100.0 % Medical Outpatient Building Akron Akron Healthcare Facility III OH 54,000 10/4/2019 100.0 % Long-Term Acute Care Hospital Alexandria Alexandria Healthcare Facility LA 15,600 10/4/2019 100.0 % Medical Outpatient Building Appleton Appleton Healthcare Facility WI 7,552 10/4/2019 100.0 % Medical Outpatient Building Augusta Augusta Healthcare Facility ME 51,000 7/22/2015 100.0 % Medical Outpatient Building Augusta Oakland Healthcare Facility ME 20,000 7/22/2015 100.0 % Medical Outpatient Building Austin Austin Healthcare Facility TX 66,095 3/31/2017 100.0 % Inpatient Rehabilitation Facility Austin Austin Healthcare Facility II TX 18,273 10/4/2019 100.0 % Medical Outpatient Building Austin Luling Healthcare Facility TX 40,901 7/30/2015 100.0 % Specialty Facility Beaumont Beaumont Healthcare Facility TX 61,000 3/31/2017 100.0 % Inpatient Rehabilitation Facility Beckley Fairlea Healthcare Facility WV 5,200 10/4/2019 100.0 % Medical Outpatient Building Boston Stoughton Healthcare Facility MA 180,744 12/23/2014 — % Specialty Facility Bremerton Silverdale Healthcare Facility WA 26,127 8/25/2017 100.0 % Medical Outpatient Building Bremerton Silverdale Healthcare Facility II WA 19,184 9/20/2017 100.0 % Medical Outpatient Building Chicago Aurora Healthcare Facility IL 24,722 3/30/2017 100.0 % Medical Outpatient Building Chicago Burr Ridge Healthcare Facility IL 104,912 9/27/2023 100.0 % Medical Outpatient Building Cincinnati Cincinnati Healthcare Facility OH 14,868 10/29/2014 100.0 % Medical Outpatient Building Cincinnati Cincinnati Healthcare Facility III OH 41,600 7/22/2015 100.0 % Medical Outpatient Building Cincinnati Florence Healthcare Facility KY 41,600 7/22/2015 100.0 % Medical Outpatient Building Corpus Christi Corpus Christi Healthcare Facility TX 25,102 12/22/2016 100.0 % Medical Outpatient Building Covington Covington Healthcare Facility LA 43,250 10/4/2019 100.0 % Specialty Facility Dallas Allen Healthcare Facility TX 42,627 3/31/2017 100.0 % Inpatient Rehabilitation Facility Dallas Carrollton Healthcare Facility TX 21,990 4/27/2018 100.0 % Medical Outpatient Building Dallas Dallas Healthcare Facility TX 62,390 10/4/2019 100.0 % Surgical Facility Dallas Fort Worth Healthcare Facility TX 83,464 12/31/2014 100.0 % Surgical Facility Dallas Fort Worth Healthcare Facility II TX 8,268 12/31/2014 100.0 % Medical Outpatient Building Dallas Fort Worth Healthcare Facility III TX 36,800 12/23/2015 100.0 % Medical Outpatient Building Dallas Frisco Healthcare Facility TX 57,051 10/4/2019 100.0 % Inpatient Rehabilitation Facility Denver Denver Healthcare Facility CO 131,210 10/4/2019 100.0 % Specialty Facility Des Moines Clive Healthcare Facility IA 58,156 11/26/2018 100.0 % Medical Outpatient Building Des Moines Clive Healthcare Facility II IA 63,224 12/8/2021 100.0 % Medical Outpatient Building Des Moines Clive Healthcare Facility III IA 33,974 12/8/2021 100.0 % Medical Outpatient Building Des Moines Clive Healthcare Facility IV IA 35,419 12/8/2021 100.0 % Medical Outpatient Building Des Moines Clive Undeveloped Land IA — 12/8/2021 — % Undeveloped Land Des Moines Clive Undeveloped Land II IA — 12/8/2021 — % Undeveloped Land Des Moines Grimes Healthcare Facility IA 14,669 2/19/2020 100.0 % Medical Outpatient Building Des Moines Indianola Healthcare Facility IA 18,116 9/26/2018 100.0 % Medical Outpatient Building Des Moines Indianola Healthcare Facility II IA 20,990 9/26/2018 100.0 % Medical Outpatient Building Destin Crestview Healthcare Facility FL 5,685 10/4/2019 100.0 % Medical Outpatient Building Destin Fort Walton Beach Healthcare Facility FL 9,017 10/4/2019 100.0 % Medical Outpatient Building Portfolio (as of September 30, 2024) | Page17 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

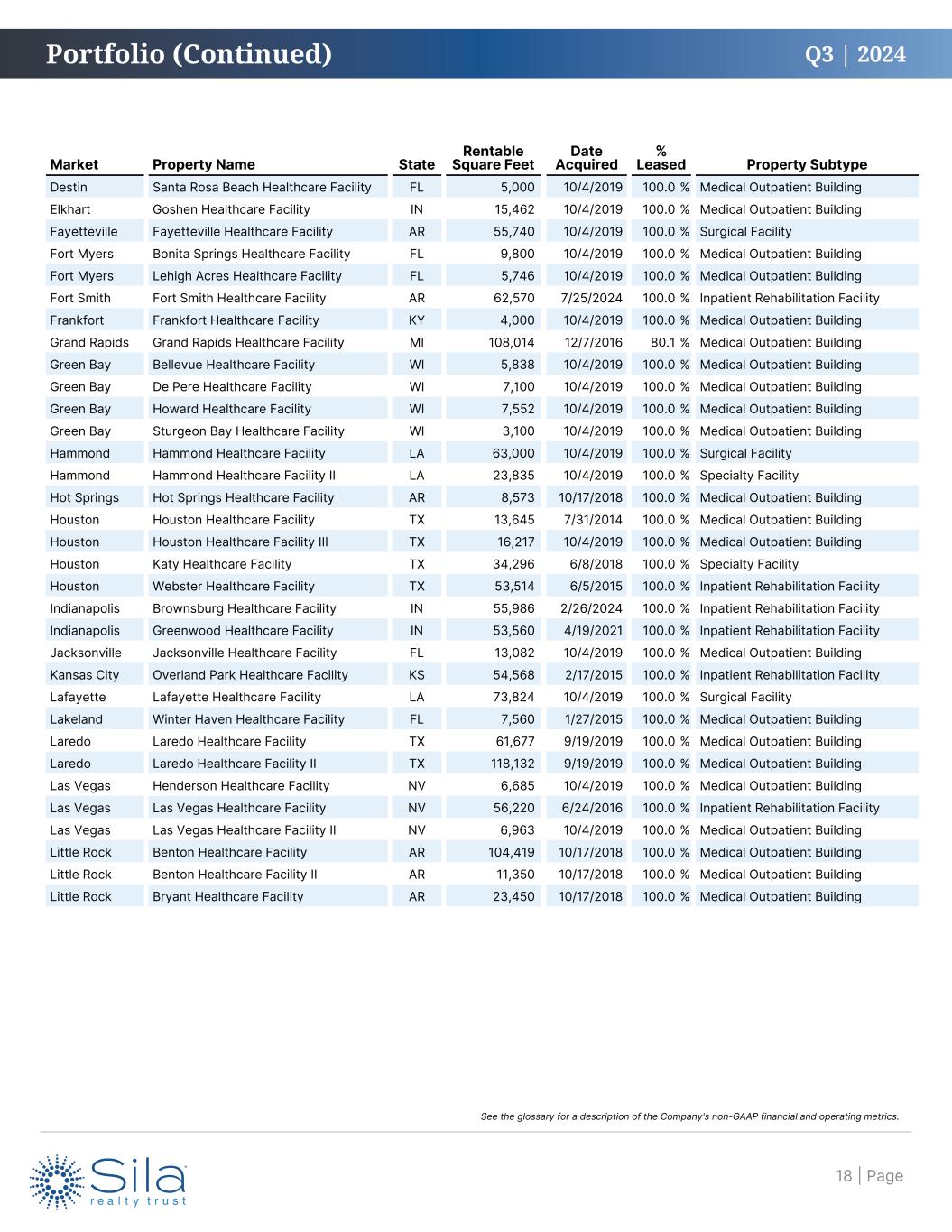

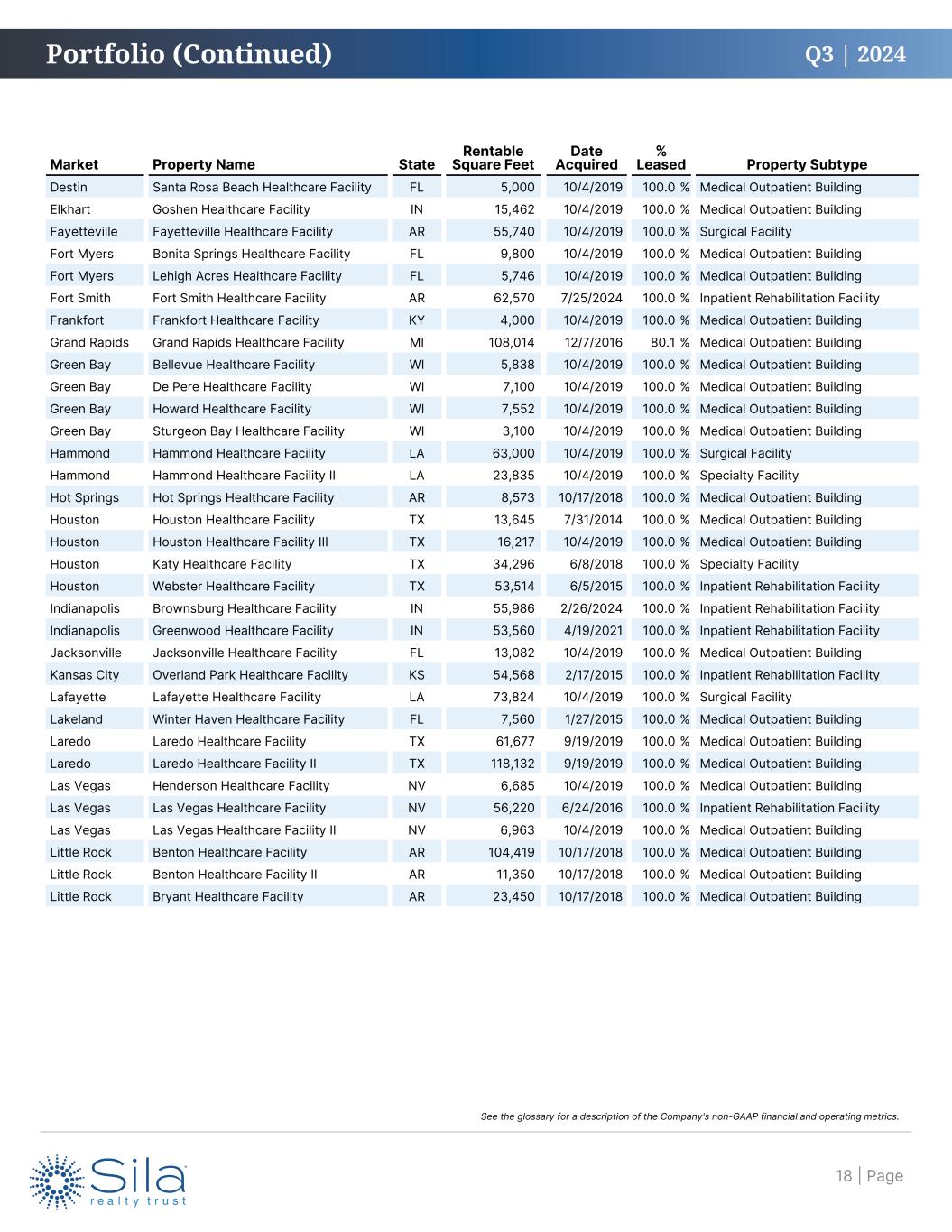

Q3 | 2024 Market Property Name State Rentable Square Feet Date Acquired % Leased Property Subtype Destin Santa Rosa Beach Healthcare Facility FL 5,000 10/4/2019 100.0 % Medical Outpatient Building Elkhart Goshen Healthcare Facility IN 15,462 10/4/2019 100.0 % Medical Outpatient Building Fayetteville Fayetteville Healthcare Facility AR 55,740 10/4/2019 100.0 % Surgical Facility Fort Myers Bonita Springs Healthcare Facility FL 9,800 10/4/2019 100.0 % Medical Outpatient Building Fort Myers Lehigh Acres Healthcare Facility FL 5,746 10/4/2019 100.0 % Medical Outpatient Building Fort Smith Fort Smith Healthcare Facility AR 62,570 7/25/2024 100.0 % Inpatient Rehabilitation Facility Frankfort Frankfort Healthcare Facility KY 4,000 10/4/2019 100.0 % Medical Outpatient Building Grand Rapids Grand Rapids Healthcare Facility MI 108,014 12/7/2016 80.1 % Medical Outpatient Building Green Bay Bellevue Healthcare Facility WI 5,838 10/4/2019 100.0 % Medical Outpatient Building Green Bay De Pere Healthcare Facility WI 7,100 10/4/2019 100.0 % Medical Outpatient Building Green Bay Howard Healthcare Facility WI 7,552 10/4/2019 100.0 % Medical Outpatient Building Green Bay Sturgeon Bay Healthcare Facility WI 3,100 10/4/2019 100.0 % Medical Outpatient Building Hammond Hammond Healthcare Facility LA 63,000 10/4/2019 100.0 % Surgical Facility Hammond Hammond Healthcare Facility II LA 23,835 10/4/2019 100.0 % Specialty Facility Hot Springs Hot Springs Healthcare Facility AR 8,573 10/17/2018 100.0 % Medical Outpatient Building Houston Houston Healthcare Facility TX 13,645 7/31/2014 100.0 % Medical Outpatient Building Houston Houston Healthcare Facility III TX 16,217 10/4/2019 100.0 % Medical Outpatient Building Houston Katy Healthcare Facility TX 34,296 6/8/2018 100.0 % Specialty Facility Houston Webster Healthcare Facility TX 53,514 6/5/2015 100.0 % Inpatient Rehabilitation Facility Indianapolis Brownsburg Healthcare Facility IN 55,986 2/26/2024 100.0 % Inpatient Rehabilitation Facility Indianapolis Greenwood Healthcare Facility IN 53,560 4/19/2021 100.0 % Inpatient Rehabilitation Facility Jacksonville Jacksonville Healthcare Facility FL 13,082 10/4/2019 100.0 % Medical Outpatient Building Kansas City Overland Park Healthcare Facility KS 54,568 2/17/2015 100.0 % Inpatient Rehabilitation Facility Lafayette Lafayette Healthcare Facility LA 73,824 10/4/2019 100.0 % Surgical Facility Lakeland Winter Haven Healthcare Facility FL 7,560 1/27/2015 100.0 % Medical Outpatient Building Laredo Laredo Healthcare Facility TX 61,677 9/19/2019 100.0 % Medical Outpatient Building Laredo Laredo Healthcare Facility II TX 118,132 9/19/2019 100.0 % Medical Outpatient Building Las Vegas Henderson Healthcare Facility NV 6,685 10/4/2019 100.0 % Medical Outpatient Building Las Vegas Las Vegas Healthcare Facility NV 56,220 6/24/2016 100.0 % Inpatient Rehabilitation Facility Las Vegas Las Vegas Healthcare Facility II NV 6,963 10/4/2019 100.0 % Medical Outpatient Building Little Rock Benton Healthcare Facility AR 104,419 10/17/2018 100.0 % Medical Outpatient Building Little Rock Benton Healthcare Facility II AR 11,350 10/17/2018 100.0 % Medical Outpatient Building Little Rock Bryant Healthcare Facility AR 23,450 10/17/2018 100.0 % Medical Outpatient Building Portfolio (Continued) | Page18 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

Q3 | 2024 Market Property Name State Rentable Square Feet Date Acquired % Leased Property Subtype Little Rock Bryant Healthcare Facility II AR 16,425 8/16/2019 100.0 % Medical Outpatient Building Los Angeles El Segundo Healthcare Facility CA 12,163 10/4/2019 — % Medical Outpatient Building Lubbock Lubbock Healthcare Facility TX 102,143 10/4/2019 100.0 % Surgical Facility Manitowoc Manitowoc Healthcare Facility WI 7,987 10/4/2019 100.0 % Medical Outpatient Building Manitowoc Manitowoc Healthcare Facility II WI 36,090 10/4/2019 100.0 % Medical Outpatient Building Marinette Marinette Healthcare Facility WI 4,178 10/4/2019 100.0 % Medical Outpatient Building Miami West Palm Beach Healthcare Facility FL 25,150 6/15/2023 100.0 % Medical Outpatient Building McAllen Weslaco Healthcare Facility TX 28,750 3/20/2024 100.0 % Specialty Facility Oklahoma City Edmond Healthcare Facility OK 17,700 1/20/2016 100.0 % Medical Outpatient Building Oklahoma City Newcastle Healthcare Facility OK 7,424 2/3/2016 100.0 % Medical Outpatient Building Oklahoma City Oklahoma City Healthcare Facility OK 94,076 12/29/2015 100.0 % Specialty Facility Oklahoma City Oklahoma City Healthcare Facility II OK 41,394 12/29/2015 100.0 % Medical Outpatient Building Oklahoma City Oklahoma City Healthcare Facility III OK 5,000 1/27/2016 100.0 % Medical Outpatient Building Oklahoma City Oklahoma City Healthcare Facility IV OK 8,762 1/27/2016 100.0 % Medical Outpatient Building Oklahoma City Oklahoma City Healthcare Facility V OK 43,676 2/11/2016 100.0 % Medical Outpatient Building Oklahoma City Oklahoma City Healthcare Facility VI OK 14,676 3/7/2016 100.0 % Medical Outpatient Building Oklahoma City Oklahoma City Healthcare Facility VII OK 102,978 6/22/2016 100.0 % Surgical Facility Oklahoma City Oklahoma City Healthcare Facility VIII OK 62,857 6/30/2016 100.0 % Surgical Facility Oklahoma City Oklahoma City Healthcare Facility IX OK 34,970 10/4/2019 100.0 % Medical Outpatient Building Oklahoma City Yukon Healthcare Facility OK 45,624 3/10/2022 100.0 % Medical Outpatient Building Omaha Omaha Healthcare Facility NE 40,402 10/14/2015 100.0 % Specialty Facility Oshkosh Oshkosh Healthcare Facility WI 8,717 10/4/2019 100.0 % Medical Outpatient Building Philadelphia Marlton Healthcare Facility NJ 89,139 11/1/2016 100.0 % Inpatient Rehabilitation Facility Phoenix Cave Creek Healthcare Facility AZ 32,450 3/20/2024 100.0 % Specialty Facility Phoenix Surprise Healthcare Facility AZ 32,450 3/20/2024 100.0 % Specialty Facility Pittsburgh Clarion Healthcare Facility PA 33,000 6/1/2015 100.0 % Medical Outpatient Building Pittsburgh Pleasant Hills Healthcare Facility PA 33,712 5/12/2022 100.0 % Medical Outpatient Building Poplar Bluff Poplar Bluff Healthcare Facility MO 71,519 9/19/2019 100.0 % Medical Outpatient Building Prosser Prosser Healthcare Facility I WA 6,000 5/20/2022 100.0 % Medical Outpatient Building Prosser Prosser Healthcare Facility II WA 9,230 5/20/2022 100.0 % Medical Outpatient Building Prosser Prosser Healthcare Facility III WA 5,400 5/20/2022 100.0 % Medical Outpatient Building Providence North Smithfield Healthcare Facility RI 92,944 10/4/2019 100.0 % Inpatient Rehabilitation Facility Reading Wyomissing Healthcare Facility PA 33,217 7/24/2015 100.0 % Surgical Facility Reading Reading Healthcare Facility PA 30,000 5/21/2024 100.0 % Medical Outpatient Building Riverside Palm Desert Healthcare Facility CA 6,963 10/4/2019 100.0 % Medical Outpatient Building Riverside Rancho Mirage Healthcare Facility CA 47,008 3/1/2016 100.0 % Inpatient Rehabilitation Facility Riverside Rancho Mirage Healthcare Facility II CA 7,432 10/4/2019 100.0 % Medical Outpatient Building Riverside Yucca Valley Healthcare Facility CA 12,240 10/4/2019 — % Medical Outpatient Building Saginaw Saginaw Healthcare Facility MI 87,843 12/21/2017 100.0 % Medical Outpatient Building Portfolio (Continued) | Page19 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

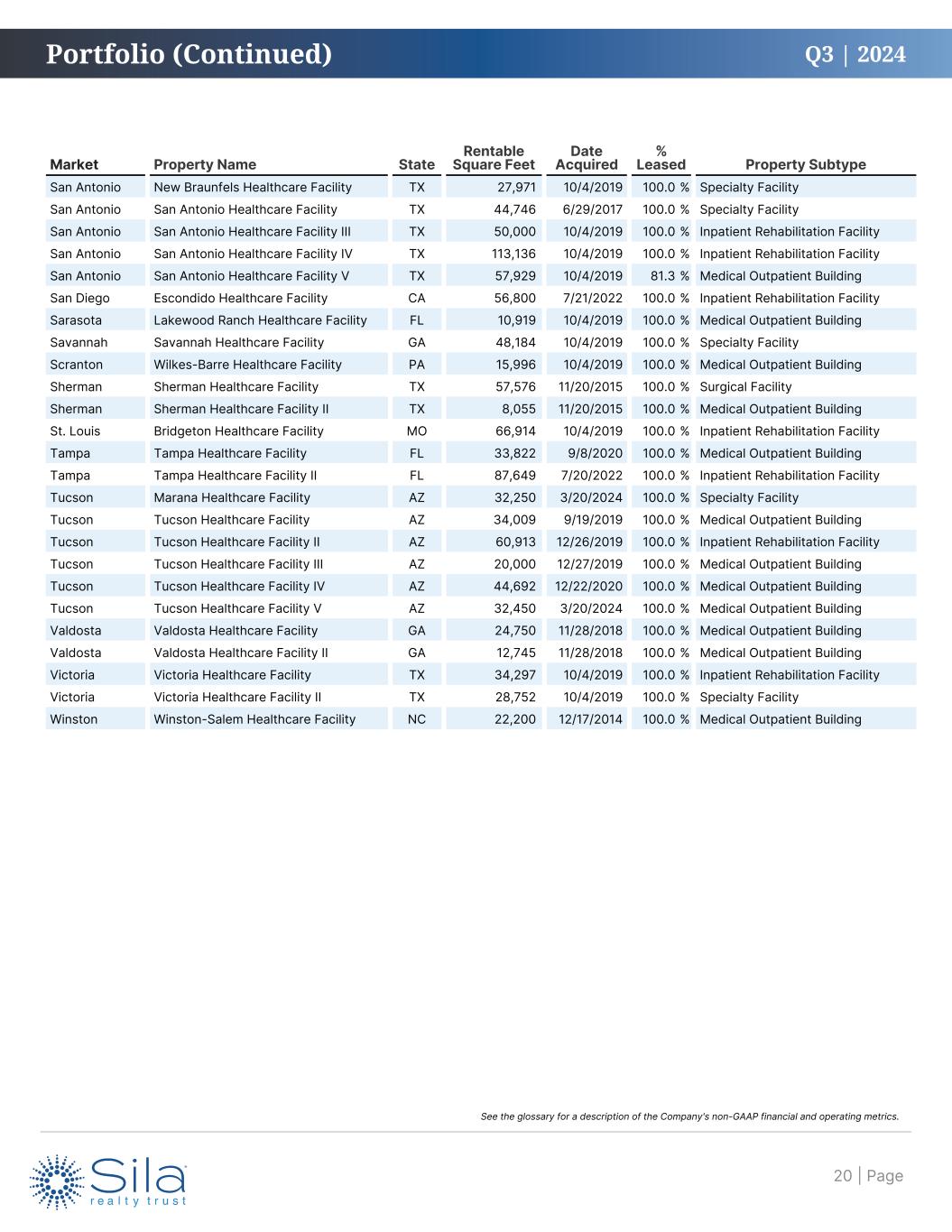

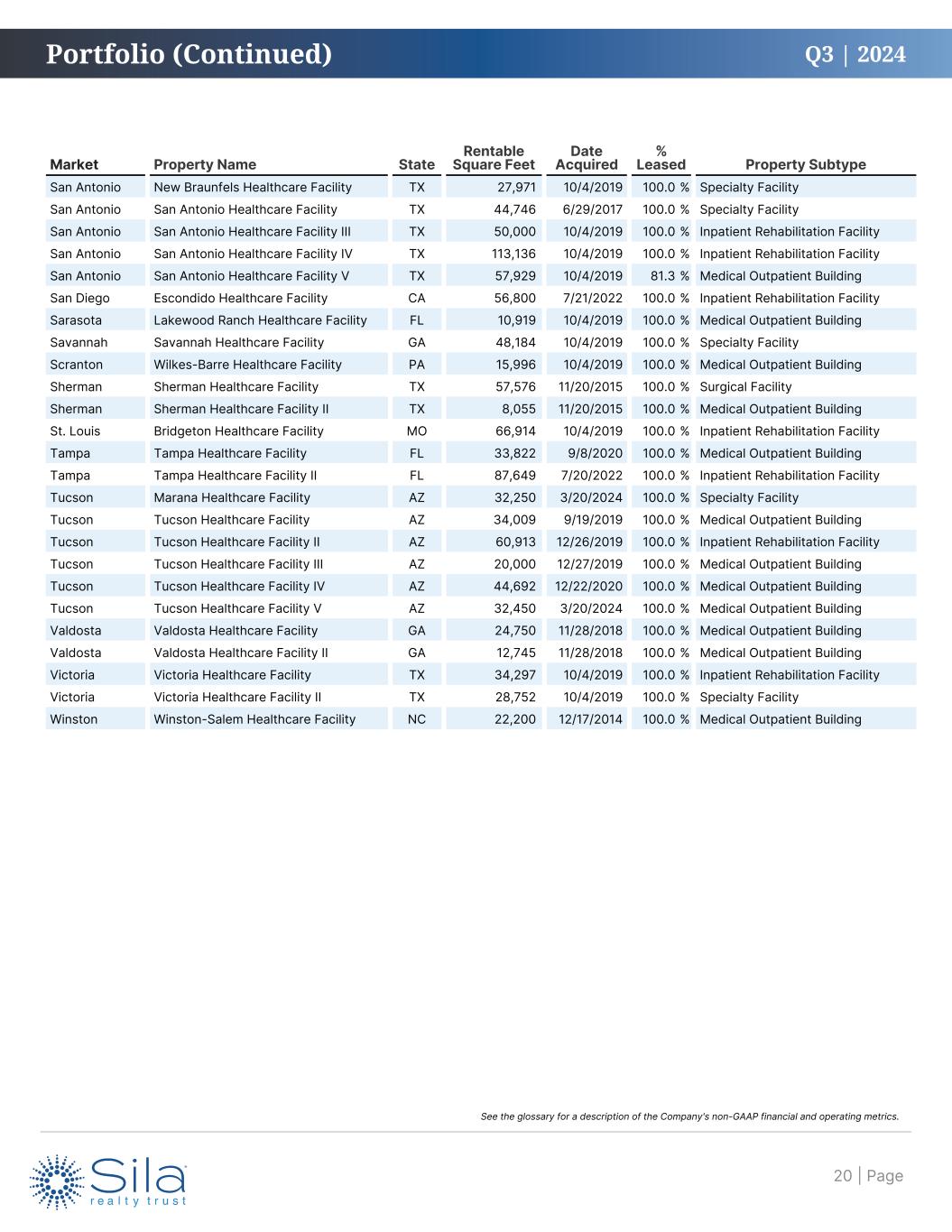

Q3 | 2024 Market Property Name State Rentable Square Feet Date Acquired % Leased Property Subtype San Antonio New Braunfels Healthcare Facility TX 27,971 10/4/2019 100.0 % Specialty Facility San Antonio San Antonio Healthcare Facility TX 44,746 6/29/2017 100.0 % Specialty Facility San Antonio San Antonio Healthcare Facility III TX 50,000 10/4/2019 100.0 % Inpatient Rehabilitation Facility San Antonio San Antonio Healthcare Facility IV TX 113,136 10/4/2019 100.0 % Inpatient Rehabilitation Facility San Antonio San Antonio Healthcare Facility V TX 57,929 10/4/2019 81.3 % Medical Outpatient Building San Diego Escondido Healthcare Facility CA 56,800 7/21/2022 100.0 % Inpatient Rehabilitation Facility Sarasota Lakewood Ranch Healthcare Facility FL 10,919 10/4/2019 100.0 % Medical Outpatient Building Savannah Savannah Healthcare Facility GA 48,184 10/4/2019 100.0 % Specialty Facility Scranton Wilkes-Barre Healthcare Facility PA 15,996 10/4/2019 100.0 % Medical Outpatient Building Sherman Sherman Healthcare Facility TX 57,576 11/20/2015 100.0 % Surgical Facility Sherman Sherman Healthcare Facility II TX 8,055 11/20/2015 100.0 % Medical Outpatient Building St. Louis Bridgeton Healthcare Facility MO 66,914 10/4/2019 100.0 % Inpatient Rehabilitation Facility Tampa Tampa Healthcare Facility FL 33,822 9/8/2020 100.0 % Medical Outpatient Building Tampa Tampa Healthcare Facility II FL 87,649 7/20/2022 100.0 % Inpatient Rehabilitation Facility Tucson Marana Healthcare Facility AZ 32,250 3/20/2024 100.0 % Specialty Facility Tucson Tucson Healthcare Facility AZ 34,009 9/19/2019 100.0 % Medical Outpatient Building Tucson Tucson Healthcare Facility II AZ 60,913 12/26/2019 100.0 % Inpatient Rehabilitation Facility Tucson Tucson Healthcare Facility III AZ 20,000 12/27/2019 100.0 % Medical Outpatient Building Tucson Tucson Healthcare Facility IV AZ 44,692 12/22/2020 100.0 % Medical Outpatient Building Tucson Tucson Healthcare Facility V AZ 32,450 3/20/2024 100.0 % Medical Outpatient Building Valdosta Valdosta Healthcare Facility GA 24,750 11/28/2018 100.0 % Medical Outpatient Building Valdosta Valdosta Healthcare Facility II GA 12,745 11/28/2018 100.0 % Medical Outpatient Building Victoria Victoria Healthcare Facility TX 34,297 10/4/2019 100.0 % Inpatient Rehabilitation Facility Victoria Victoria Healthcare Facility II TX 28,752 10/4/2019 100.0 % Specialty Facility Winston Winston-Salem Healthcare Facility NC 22,200 12/17/2014 100.0 % Medical Outpatient Building Portfolio (Continued) | Page20 See the glossary for a description of the Company's non-GAAP financial and operating metrics.

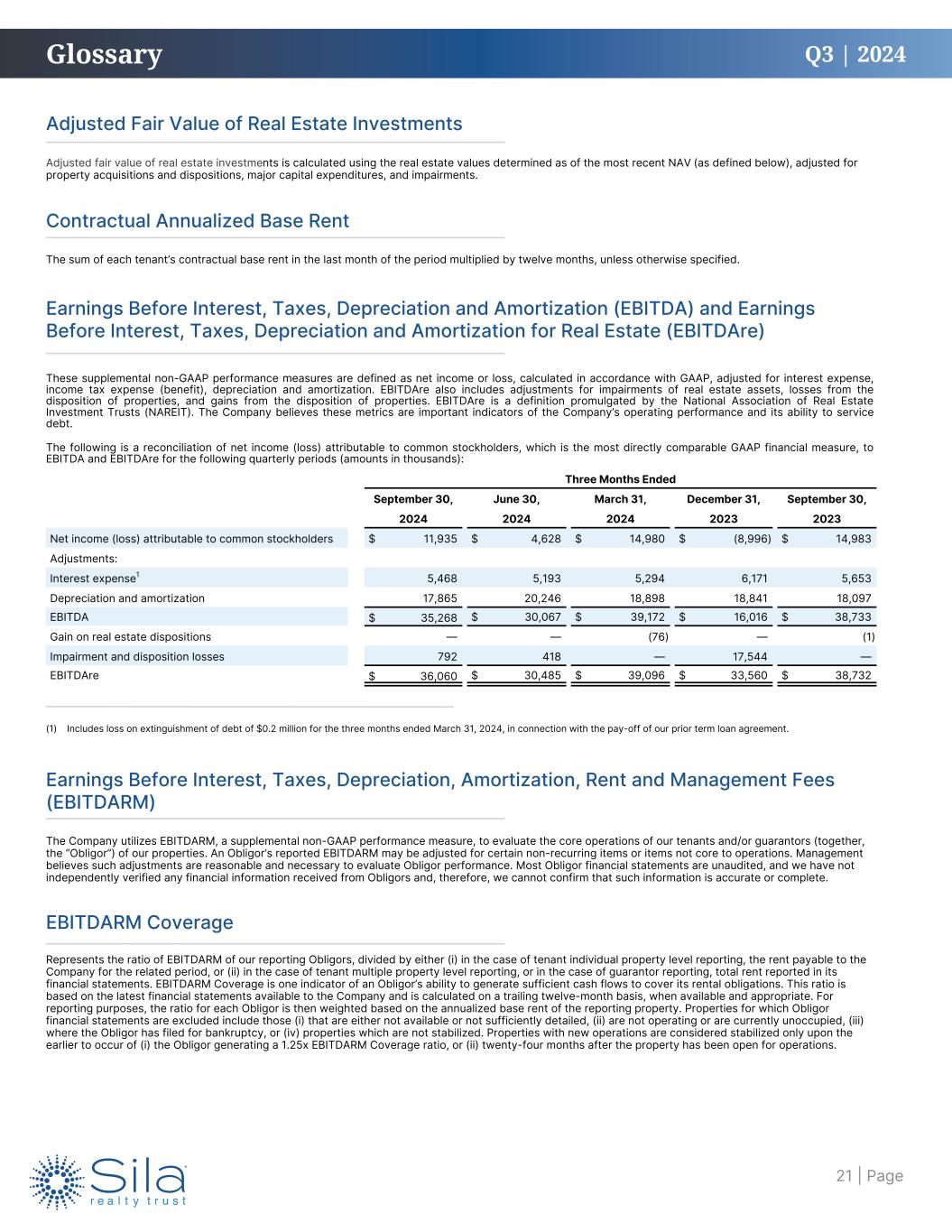

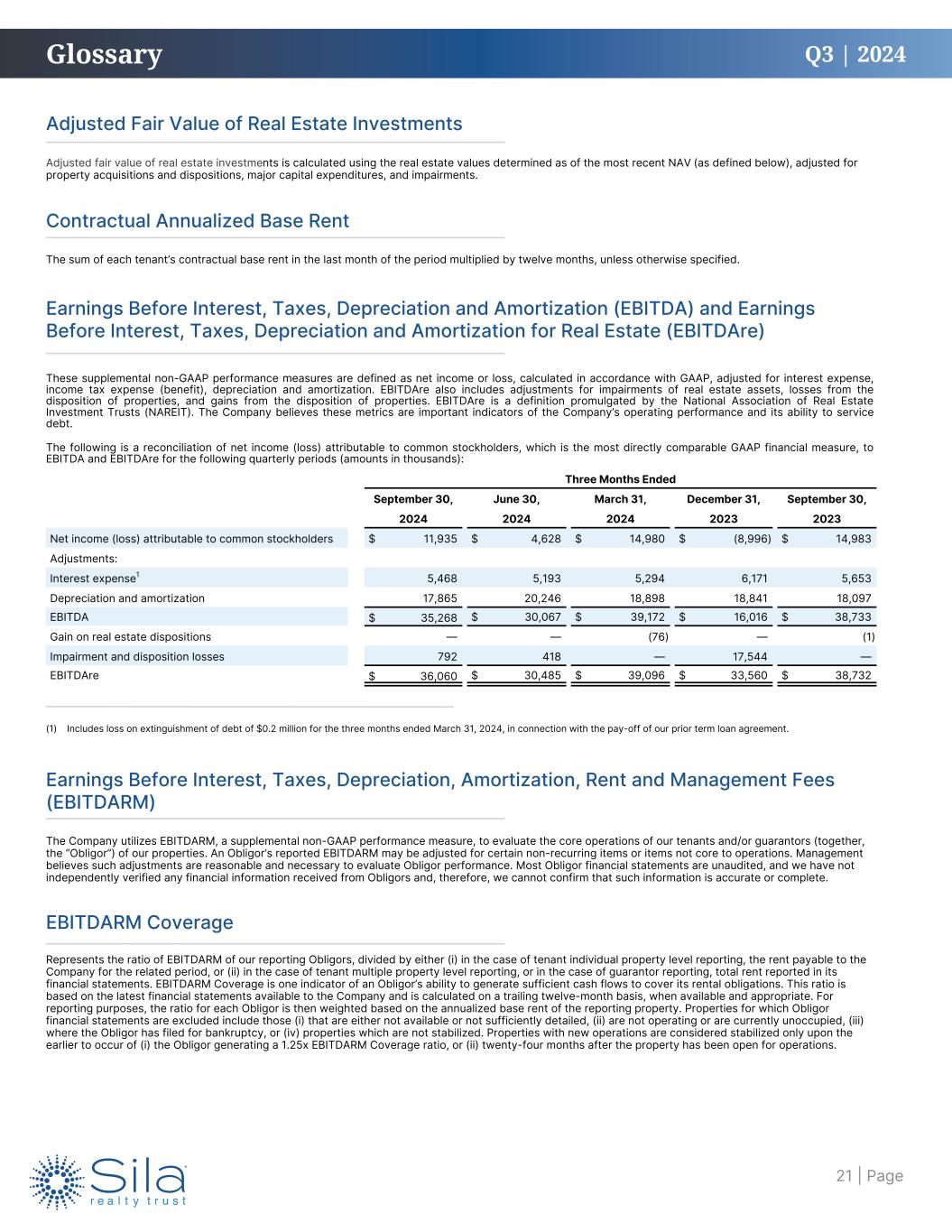

Q3 | 2024 Contractual Annualized Base Rent The sum of each tenant’s contractual base rent in the last month of the period multiplied by twelve months, unless otherwise specified. Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and Earnings Before Interest, Taxes, Depreciation and Amortization for Real Estate (EBITDAre) These supplemental non-GAAP performance measures are defined as net income or loss, calculated in accordance with GAAP, adjusted for interest expense, income tax expense (benefit), depreciation and amortization. EBITDAre also includes adjustments for impairments of real estate assets, losses from the disposition of properties, and gains from the disposition of properties. EBITDAre is a definition promulgated by the National Association of Real Estate Investment Trusts (NAREIT). The Company believes these metrics are important indicators of the Company’s operating performance and its ability to service debt. The following is a reconciliation of net income (loss) attributable to common stockholders, which is the most directly comparable GAAP financial measure, to EBITDA and EBITDAre for the following quarterly periods (amounts in thousands): Adjusted Fair Value of Real Estate Investments Adjusted fair value of real estate investments is calculated using the real estate values determined as of the most recent NAV (as defined below), adjusted for property acquisitions and dispositions, major capital expenditures, and impairments. Three Months Ended September 30, June 30, March 31, December 31, September 30, 2024 2024 2024 2023 2023 Net income (loss) attributable to common stockholders $ 11,935 $ 4,628 $ 14,980 $ (8,996) $ 14,983 Adjustments: Interest expense1 5,468 5,193 5,294 6,171 5,653 Depreciation and amortization 17,865 20,246 18,898 18,841 18,097 EBITDA $ 35,268 $ 30,067 $ 39,172 $ 16,016 $ 38,733 Gain on real estate dispositions — — (76) — (1) Impairment and disposition losses 792 418 — 17,544 — EBITDAre $ 36,060 $ 30,485 $ 39,096 $ 33,560 $ 38,732 Glossary Earnings Before Interest, Taxes, Depreciation, Amortization, Rent and Management Fees (EBITDARM) EBITDARM Coverage The Company utilizes EBITDARM, a supplemental non-GAAP performance measure, to evaluate the core operations of our tenants and/or guarantors (together, the “Obligor”) of our properties. An Obligor’s reported EBITDARM may be adjusted for certain non-recurring items or items not core to operations. Management believes such adjustments are reasonable and necessary to evaluate Obligor performance. Most Obligor financial statements are unaudited, and we have not independently verified any financial information received from Obligors and, therefore, we cannot confirm that such information is accurate or complete. Represents the ratio of EBITDARM of our reporting Obligors, divided by either (i) in the case of tenant individual property level reporting, the rent payable to the Company for the related period, or (ii) in the case of tenant multiple property level reporting, or in the case of guarantor reporting, total rent reported in its financial statements. EBITDARM Coverage is one indicator of an Obligor’s ability to generate sufficient cash flows to cover its rental obligations. This ratio is based on the latest financial statements available to the Company and is calculated on a trailing twelve-month basis, when available and appropriate. For reporting purposes, the ratio for each Obligor is then weighted based on the annualized base rent of the reporting property. Properties for which Obligor financial statements are excluded include those (i) that are either not available or not sufficiently detailed, (ii) are not operating or are currently unoccupied, (iii) where the Obligor has filed for bankruptcy, or (iv) properties which are not stabilized. Properties with new operations are considered stabilized only upon the earlier to occur of (i) the Obligor generating a 1.25x EBITDARM Coverage ratio, or (ii) twenty-four months after the property has been open for operations. (1) Includes loss on extinguishment of debt of $0.2 million for the three months ended March 31, 2024, in connection with the pay-off of our prior term loan agreement. | Page21

Q3 | 2024 Three Months Ended September 30, June 30, March 31, December 31, September 30, 2024 2024 2024 2023 2023 Net income (loss) attributable to common stockholders $ 11,935 $ 4,628 $ 14,980 $ (8,996) $ 14,983 Adjustments: Depreciation and amortization of real estate assets 17,841 20,222 18,875 18,818 18,073 Gain on dispositions of real estate — — (76) — (1) Impairment and disposition losses 792 418 — 17,544 — FFO1 $ 30,568 $ 25,268 $ 33,779 $ 27,366 $ 33,055 Adjustments: Listing-related expenses 32 2,924 56 — — Severance 3 — 1,863 1,318 43 Write-off of straight-line rent receivables related to prior periods — — — 1,650 — Accelerated stock-based compensation 12 — 863 318 — Amortization of above (below) market lease intangibles, including ground leases, net 183 1,877 (629) 276 279 Loss on extinguishment of debt — — 228 — — Core FFO1 $ 30,798 $ 30,069 $ 36,160 $ 30,928 $ 33,377 Adjustments: Deferred rent2 333 333 2,388 456 325 Straight-line rent adjustments (1,294) (1,297) (1,176) (1,357) (1,217) Amortization of deferred financing costs 578 577 452 425 415 Stock-based compensation 1,299 1,163 461 2,245 1,228 AFFO1 $ 31,714 $ 30,845 $ 38,285 $ 32,697 $ 34,128 The following is a reconciliation of net income (loss) attributable to common stockholders, which is the most directly comparable GAAP financial measure, to FFO, Core FFO and AFFO for the following quarterly periods (amounts in thousands): Funds From Operations (FFO), Core Funds From Operations, and Adjusted Funds From Operations (AFFO) FFO, a non-GAAP financial measure, is calculated consistent with NAREIT’s definition, as net income (loss) (calculated in accordance with GAAP), excluding gains from sales of real estate assets, impairment of real estate assets and disposition losses from sales of real estate assets, plus depreciation and amortization of real estate assets, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect FFO on the same basis. To date, the Company does not have any investments in unconsolidated partnerships or joint ventures. The Company believes FFO provides a useful understanding of our performance to investors and to our management, and when compared to year over year, FFO reflects the impact on our operations from trends in occupancy. It should be noted, however, that other REITs may not define FFO in accordance with the current NAREIT definition or may interpret the current NAREIT definition differently than the Company does, making comparisons less meaningful. The Company believes Core FFO, a non-GAAP financial measure, is a supplemental financial performance measure that provides investors with additional information to understand the Company's sustainable performance. The Company calculates Core FFO by adjusting FFO to remove the effect of certain GAAP non-cash income and expense items, unusual and infrequent items that are not expected to impact its operating performance on an ongoing basis, items that affect comparability to prior periods and/or items that are not related to its core real estate operations. Excluded items include listing-related expenses, severance, write-off of straight-line rent receivables related to prior periods, accelerated stock-based compensation, amortization of above- and below-market lease intangibles (including ground leases) and loss on extinguishment of debt. Other REITs may use different methodologies for calculating Core FFO and, accordingly, the Company’s Core FFO may not be comparable to other REITs. The Company believes AFFO, a non-GAAP financial measure, is a supplemental financial performance measure that provides investors appropriate supplemental information to evaluate the ongoing operations of the Company. AFFO is a metric used by management to evaluate the Company's dividend policy. The Company calculates AFFO by further adjusting Core FFO for the following items: deferred rent, current period straight-line rent adjustments, amortization of deferred financing costs and stock-based compensation. Other REITs may use different methodologies for calculating AFFO and, accordingly, the Company’s AFFO may not be comparable to other REITs. FFO, Core FFO and AFFO should not be considered to be more relevant or accurate than the GAAP methodology in calculating net income (loss) or in its applicability in evaluating the Company's operational performance. The method used to evaluate the value and performance of real estate under GAAP should be considered a more relevant measure of operating performance and more prominent than the non-GAAP FFO, Core FFO and AFFO measures and the adjustments to GAAP in calculating FFO, Core FFO and AFFO. Glossary Enterprise Value Enterprise value represents market capitalization plus net debt. (1) The three months ended March 31, 2024 include $4.1 million of lease termination fee income received. The three months ended September 30, 2023 include $1.7 million of lease termination fee income received. (2) The three months ended March 31, 2024 include a $2.0 million severance fee received from GenesisCare in exchange for the Severed Properties, and will be recognized in rental revenues over the remaining GenesisCare amended master lease term. | Page22

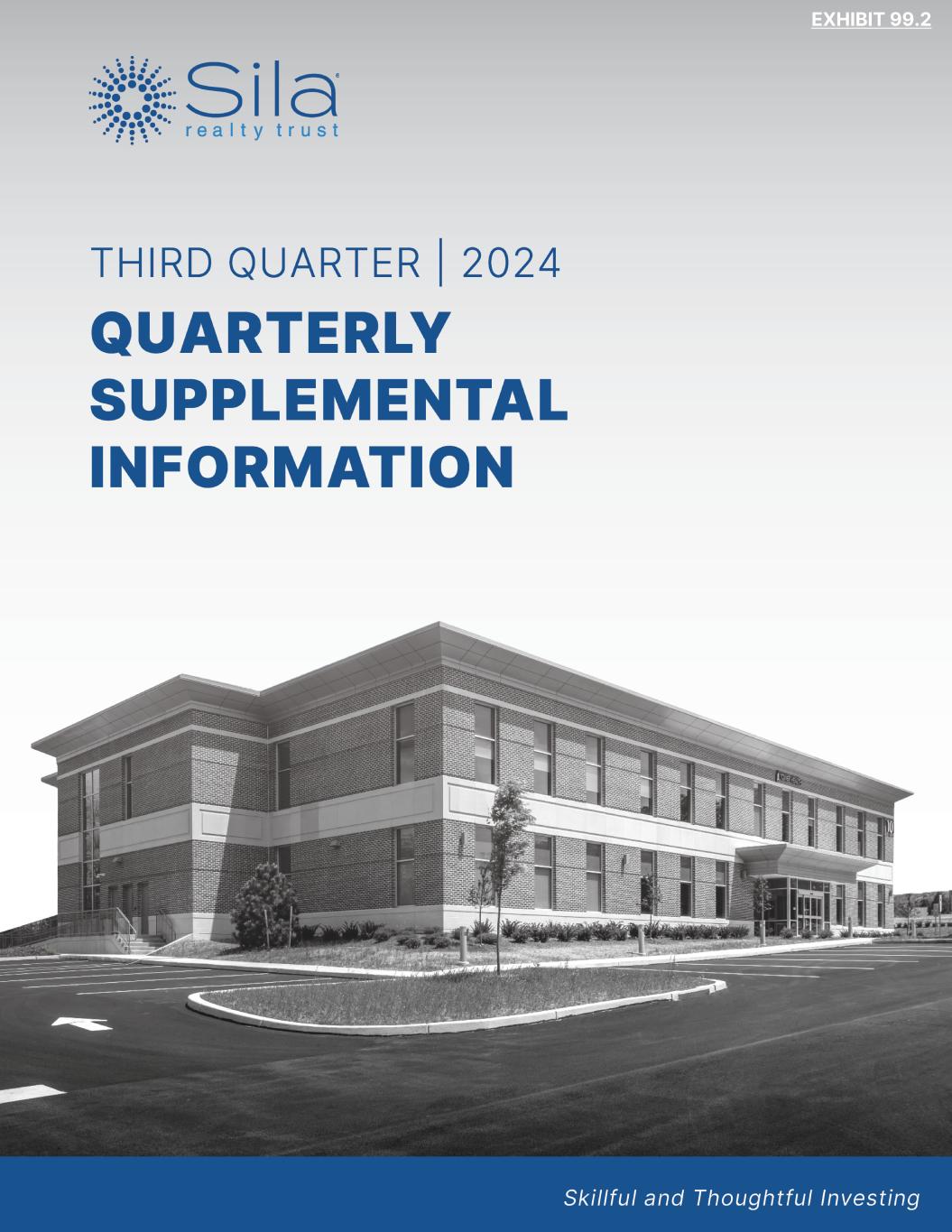

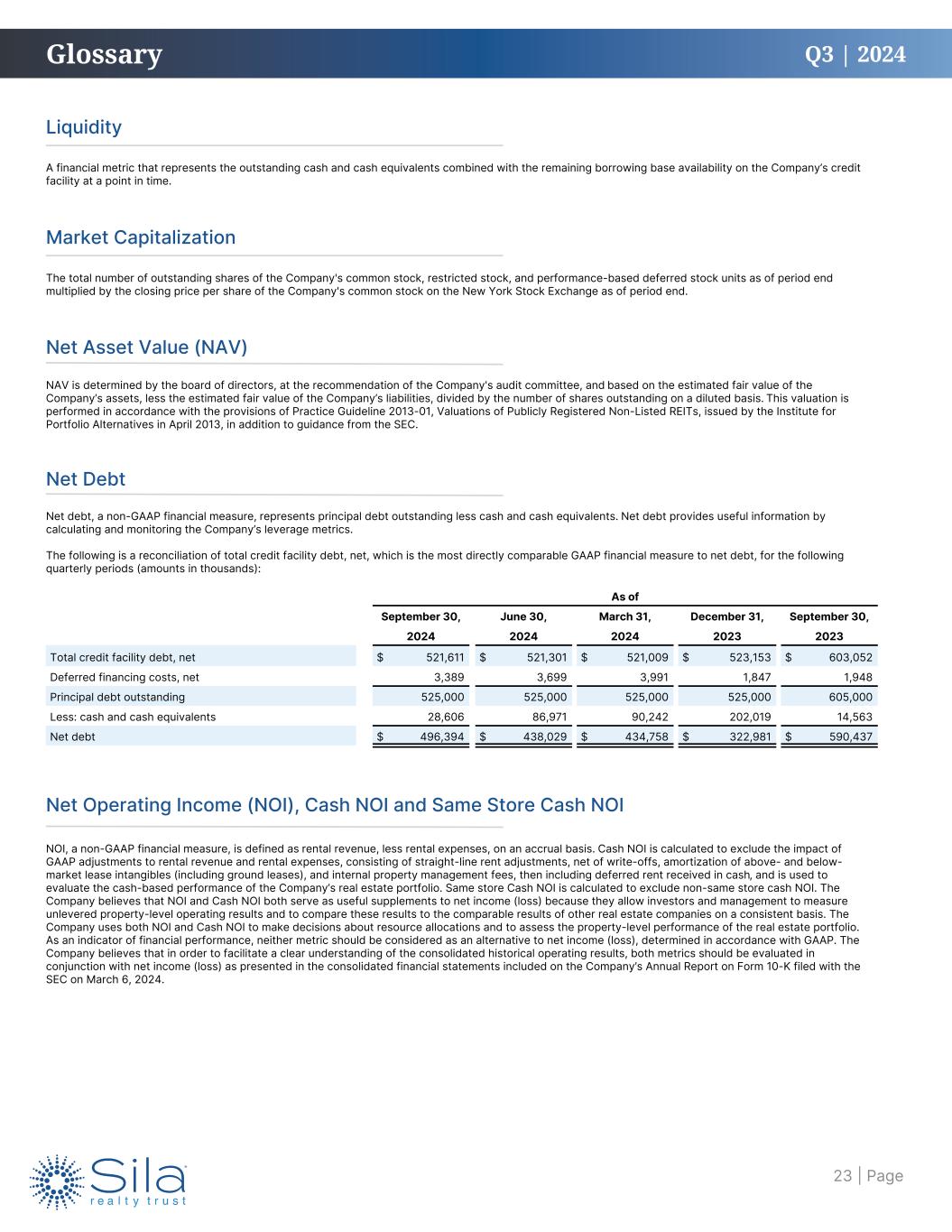

Q3 | 2024 Net Debt Net debt, a non-GAAP financial measure, represents principal debt outstanding less cash and cash equivalents. Net debt provides useful information by calculating and monitoring the Company’s leverage metrics. The following is a reconciliation of total credit facility debt, net, which is the most directly comparable GAAP financial measure to net debt, for the following quarterly periods (amounts in thousands): As of September 30, June 30, March 31, December 31, September 30, 2024 2024 2024 2023 2023 Total credit facility debt, net $ 521,611 $ 521,301 $ 521,009 $ 523,153 $ 603,052 Deferred financing costs, net 3,389 3,699 3,991 1,847 1,948 Principal debt outstanding 525,000 525,000 525,000 525,000 605,000 Less: cash and cash equivalents 28,606 86,971 90,242 202,019 14,563 Net debt $ 496,394 $ 438,029 $ 434,758 $ 322,981 $ 590,437 Net Asset Value (NAV) NAV is determined by the board of directors, at the recommendation of the Company's audit committee, and based on the estimated fair value of the Company’s assets, less the estimated fair value of the Company’s liabilities, divided by the number of shares outstanding on a diluted basis. This valuation is performed in accordance with the provisions of Practice Guideline 2013-01, Valuations of Publicly Registered Non-Listed REITs, issued by the Institute for Portfolio Alternatives in April 2013, in addition to guidance from the SEC. Liquidity A financial metric that represents the outstanding cash and cash equivalents combined with the remaining borrowing base availability on the Company’s credit facility at a point in time. Glossary Net Operating Income (NOI), Cash NOI and Same Store Cash NOI NOI, a non-GAAP financial measure, is defined as rental revenue, less rental expenses, on an accrual basis. Cash NOI is calculated to exclude the impact of GAAP adjustments to rental revenue and rental expenses, consisting of straight-line rent adjustments, net of write-offs, amortization of above- and below- market lease intangibles (including ground leases), and internal property management fees, then including deferred rent received in cash, and is used to evaluate the cash-based performance of the Company’s real estate portfolio. Same store Cash NOI is calculated to exclude non-same store cash NOI. The Company believes that NOI and Cash NOI both serve as useful supplements to net income (loss) because they allow investors and management to measure unlevered property-level operating results and to compare these results to the comparable results of other real estate companies on a consistent basis. The Company uses both NOI and Cash NOI to make decisions about resource allocations and to assess the property-level performance of the real estate portfolio. As an indicator of financial performance, neither metric should be considered as an alternative to net income (loss), determined in accordance with GAAP. The Company believes that in order to facilitate a clear understanding of the consolidated historical operating results, both metrics should be evaluated in conjunction with net income (loss) as presented in the consolidated financial statements included on the Company’s Annual Report on Form 10-K filed with the SEC on March 6, 2024. Market Capitalization The total number of outstanding shares of the Company's common stock, restricted stock, and performance-based deferred stock units as of period end multiplied by the closing price per share of the Company's common stock on the New York Stock Exchange as of period end. | Page23

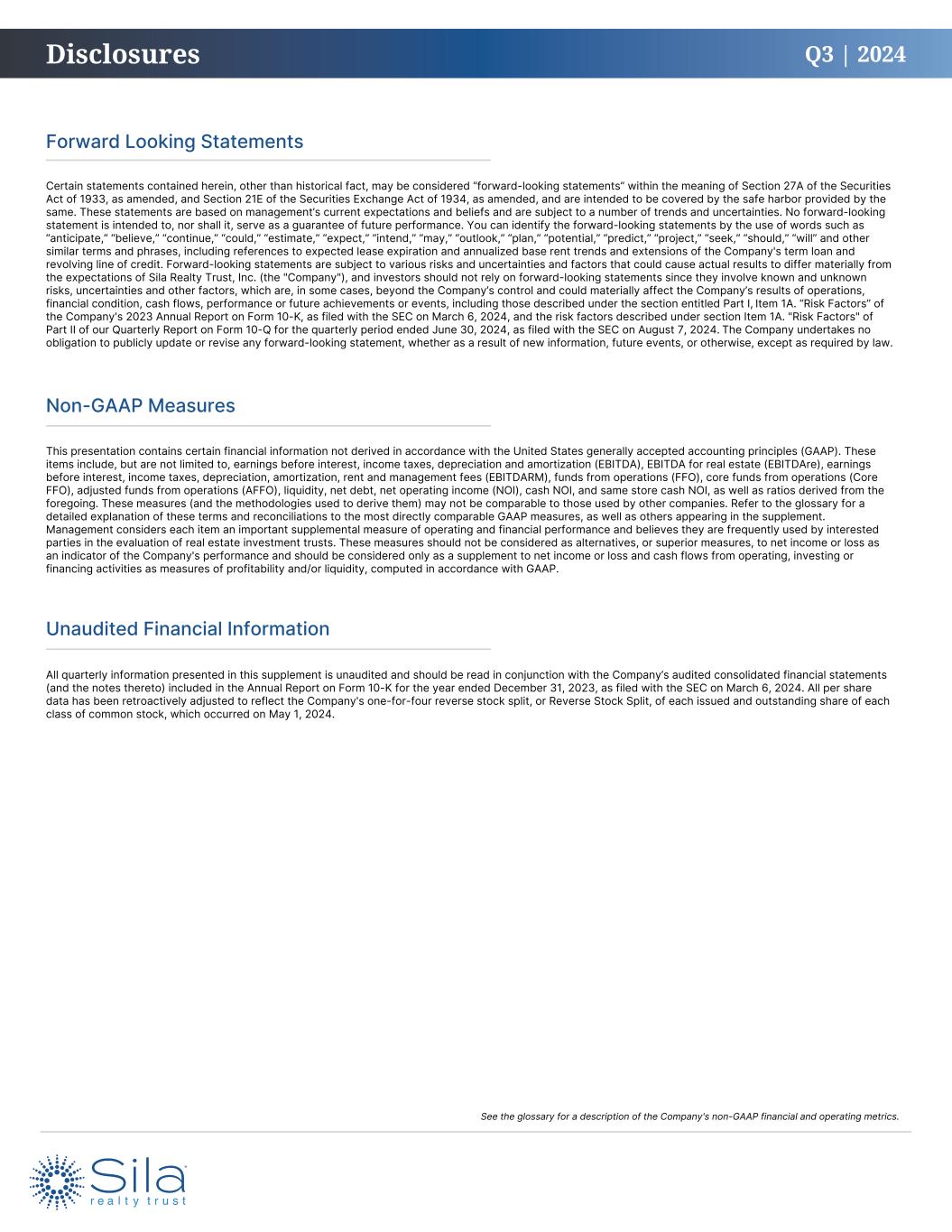

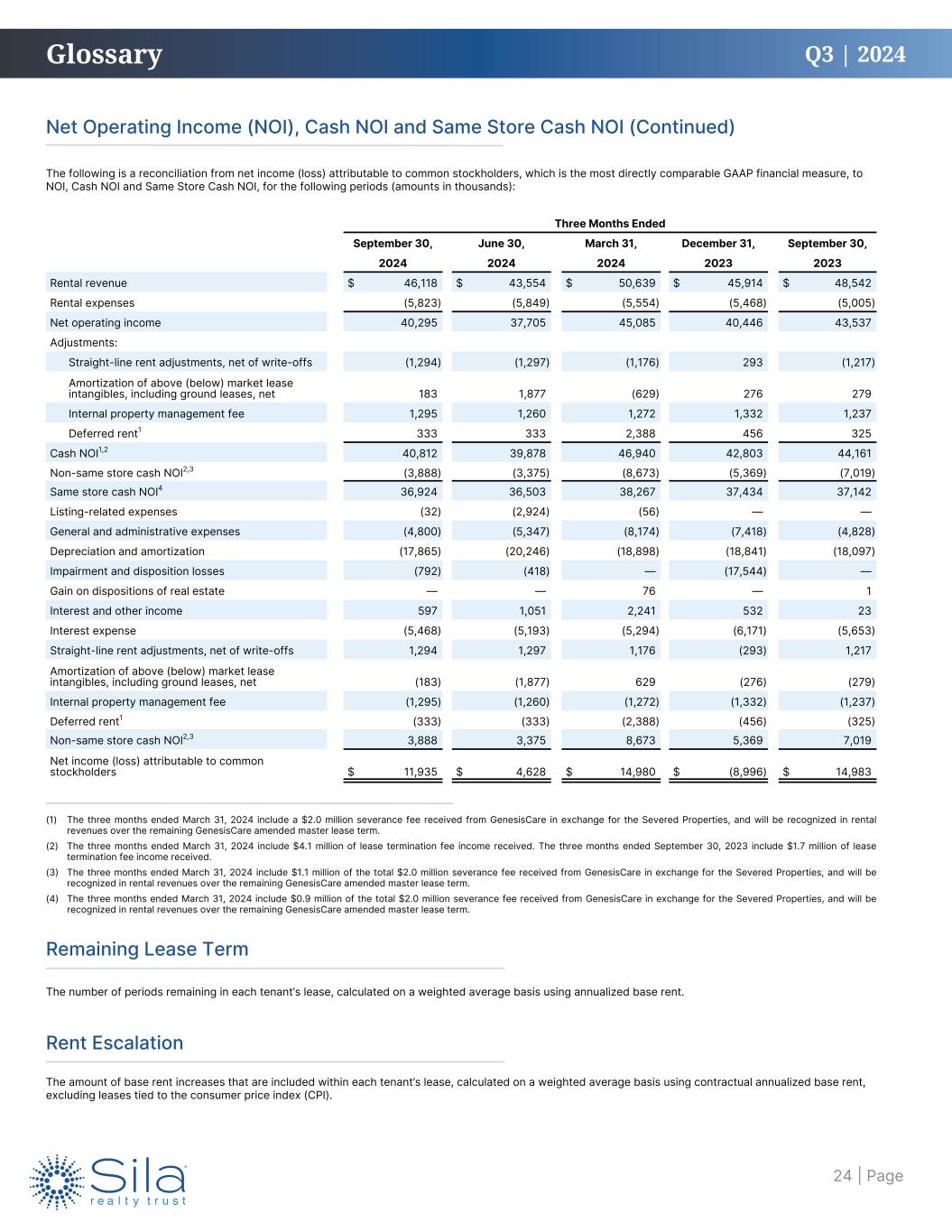

Q3 | 2024 The following is a reconciliation from net income (loss) attributable to common stockholders, which is the most directly comparable GAAP financial measure, to NOI, Cash NOI and Same Store Cash NOI, for the following periods (amounts in thousands): Net Operating Income (NOI), Cash NOI and Same Store Cash NOI (Continued) Three Months Ended September 30, June 30, March 31, December 31, September 30, 2024 2024 2024 2023 2023 Rental revenue $ 46,118 $ 43,554 $ 50,639 $ 45,914 $ 48,542 Rental expenses (5,823) (5,849) (5,554) (5,468) (5,005) Net operating income 40,295 37,705 45,085 40,446 43,537 Adjustments: Straight-line rent adjustments, net of write-offs (1,294) (1,297) (1,176) 293 (1,217) Amortization of above (below) market lease intangibles, including ground leases, net 183 1,877 (629) 276 279 Internal property management fee 1,295 1,260 1,272 1,332 1,237 Deferred rent1 333 333 2,388 456 325 Cash NOI1,2 40,812 39,878 46,940 42,803 44,161 Non-same store cash NOI2,3 (3,888) (3,375) (8,673) (5,369) (7,019) Same store cash NOI4 36,924 36,503 38,267 37,434 37,142 Listing-related expenses (32) (2,924) (56) — — General and administrative expenses (4,800) (5,347) (8,174) (7,418) (4,828) Depreciation and amortization (17,865) (20,246) (18,898) (18,841) (18,097) Impairment and disposition losses (792) (418) — (17,544) — Gain on dispositions of real estate — — 76 — 1 Interest and other income 597 1,051 2,241 532 23 Interest expense (5,468) (5,193) (5,294) (6,171) (5,653) Straight-line rent adjustments, net of write-offs 1,294 1,297 1,176 (293) 1,217 Amortization of above (below) market lease intangibles, including ground leases, net (183) (1,877) 629 (276) (279) Internal property management fee (1,295) (1,260) (1,272) (1,332) (1,237) Deferred rent1 (333) (333) (2,388) (456) (325) Non-same store cash NOI2,3 3,888 3,375 8,673 5,369 7,019 Net income (loss) attributable to common stockholders $ 11,935 $ 4,628 $ 14,980 $ (8,996) $ 14,983 Glossary Remaining Lease Term The number of periods remaining in each tenant’s lease, calculated on a weighted average basis using annualized base rent. Rent Escalation The amount of base rent increases that are included within each tenant’s lease, calculated on a weighted average basis using contractual annualized base rent, excluding leases tied to the consumer price index (CPI). (1) The three months ended March 31, 2024 include a $2.0 million severance fee received from GenesisCare in exchange for the Severed Properties, and will be recognized in rental revenues over the remaining GenesisCare amended master lease term. (2) The three months ended March 31, 2024 include $4.1 million of lease termination fee income received. The three months ended September 30, 2023 include $1.7 million of lease termination fee income received. (3) The three months ended March 31, 2024 include $1.1 million of the total $2.0 million severance fee received from GenesisCare in exchange for the Severed Properties, and will be recognized in rental revenues over the remaining GenesisCare amended master lease term. (4) The three months ended March 31, 2024 include $0.9 million of the total $2.0 million severance fee received from GenesisCare in exchange for the Severed Properties, and will be recognized in rental revenues over the remaining GenesisCare amended master lease term. | Page24

Q3 | 2024 Total Real Estate Investments at Cost Represents the contractual purchase price of real estate properties acquired, including capitalized acquisition costs, and capital expenditures incurred since acquisition, reduced by the cost basis of properties sold. Same Store Properties Operating properties that were owned and operated for the entirety of all calendar periods being compared, excluding properties under development, re- development, or classified as held for sale. To evaluate properties on a comparable basis, management analyzes metrics of same store properties in order to assess the core operations of the portfolio. By evaluating same store properties, management is able to monitor the operations of the Company's existing properties for comparable periods to measure the performance of the current portfolio and the effects of new acquisitions and dispositions on net income (loss). Glossary | Page25