Nareit REITworld Company Presentation November 2024 Skillful and Thoughtful Investing

Disclosures Forward Looking Statements Certain statements contained herein, other than historical fact, may be considered “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and are intended to be covered by the safe harbor provided by the same. These statements, including those regarding our near term and future growth, optimization of our portfolio, healthcare and population trends, expected growth in healthcare expenditures and healthcare demand, and insulation from adverse and unpredictable market dislocation, are based on management’s current expectations and beliefs and are subject to a number of trends and uncertainties. No forward-looking statement is intended to, nor shall it, serve as a guarantee of future performance. You can identify the forward-looking statements by the use of words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “may,” “outlook,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “will” and other similar terms and phrases. Forward-looking statements are subject to various risks and uncertainties and factors that could cause actual results to differ materially from the Company’s expectations, and investors should not rely on forward-looking statements since they involve known and unknown risks, uncertainties and other factors, which are, in some cases, beyond the Company’s control and could materially affect the Company’s results of operations, financial condition, cash flows, performance or future achievements or events, including those described under the section titled Part I, Item 1A. “Risk Factors” of the Company's 2023 Annual Report on Form 10-K, and those described under the section entitled Item 1A. "Risk Factors" of Part II of the Company's Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2024, copies of which are available at www.sec.gov. The company undertakes no obligation to publicly update or revise any forward- looking statement, whether as a result of new information, future events, or otherwise, except as required by law. Non-GAAP Measures This presentation contains certain financial information not derived in accordance with the United States generally accepted accounting principles (GAAP). These items include, but are not limited to, earnings before interest, income taxes, depreciation and amortization (EBITDA), EBITDA for real estate (EBITDAre), earnings before interest, taxes, depreciation, amortization, rent, and management fees (EBITDARM), funds from operations (FFO), core funds from operations (Core FFO), adjusted funds from operations (AFFO), liquidity, net debt, net operating income (NOI), cash NOI, and same store cash NOI, as well as ratios derived from the foregoing. These measures (and the methodologies used to derive them) may not be comparable to those used by other companies. Refer to the appendix for a detailed explanation of these terms and the reconciliations to the most directly comparable GAAP measures, as well as others appearing in this presentation. Management considers each item an important supplemental measure of operating and financial performance and believes they are frequently used by interested parties in the evaluation of real estate investment trusts. These measures should not be considered as alternatives, or superior measures, to net income or loss as an indicator of the Company's performance and should be considered only as a supplement to net income or loss and cash flows from operating, investing or financing activities as measures of profitability and/or liquidity, computed in accordance with GAAP. Unaudited Financial Information All quarterly information presented in this presentation is unaudited and should be read in conjunction with the Company’s audited consolidated financial statements (and the notes thereto) included in the Annual Report on Form 10-K for the year ended December 31, 2023, as filed with the SEC on March 6, 2024. 2

Sila Realty Trust is a net lease REIT focused on institutional quality healthcare properties along the continuum of care. We believe Sila offers REIT investors the best of both worlds - participation in the large and defensive healthcare sector while receiving the benefits of a triple net lease structure, including longer lease terms and an appropriately conservative financial profile.” Michael A. Seton President and Chief Executive Officer Sila Realty Trust, Inc. 3

Introductions 4 Michael A. Seton President and Chief Executive Officer Founder and Board Member Kay C. Neely Executive Vice President and Chief Financial Officer Christopher K. Flouhouse Executive Vice President and Chief Investment Officer Miles F. Callahan Senior Vice President Capital Markets and Investor Relations

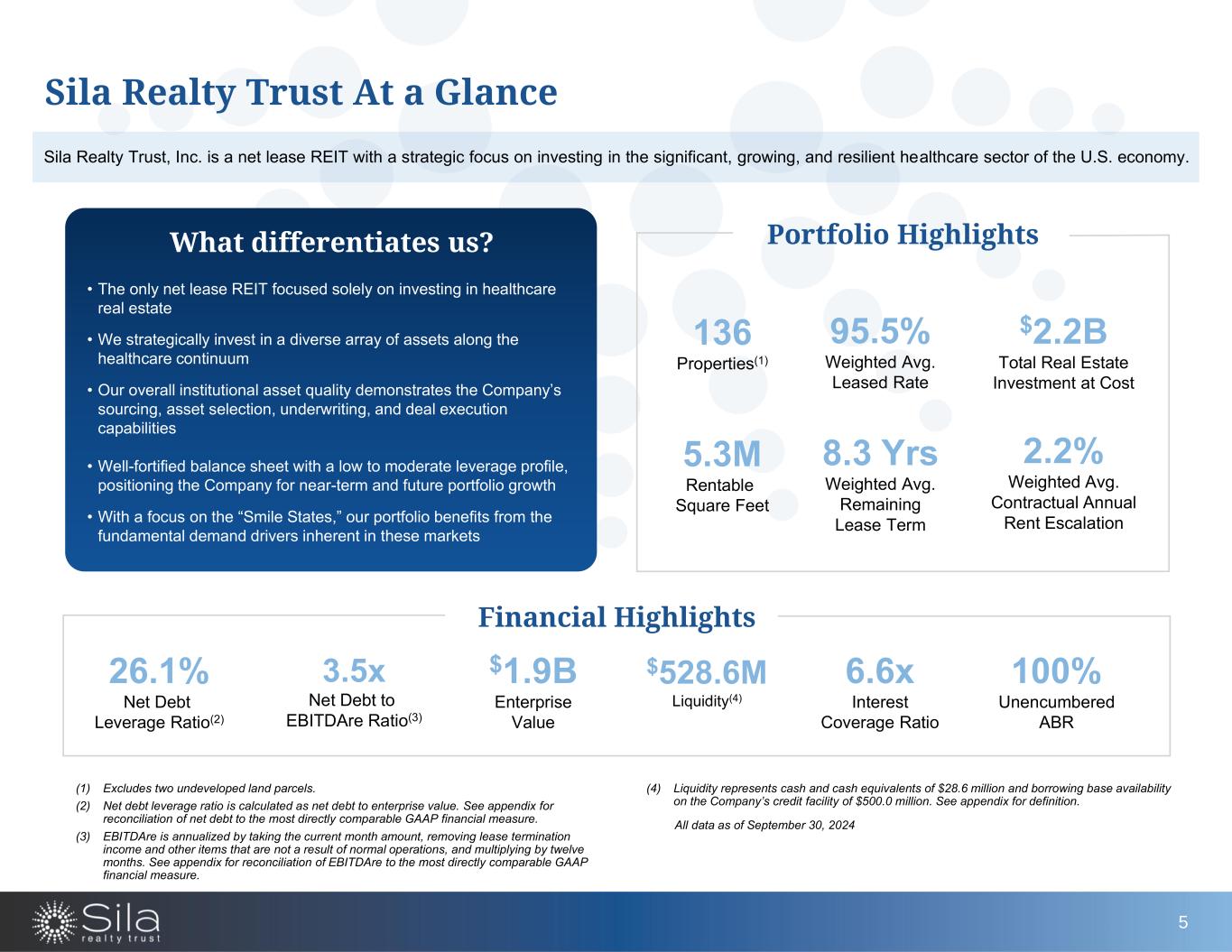

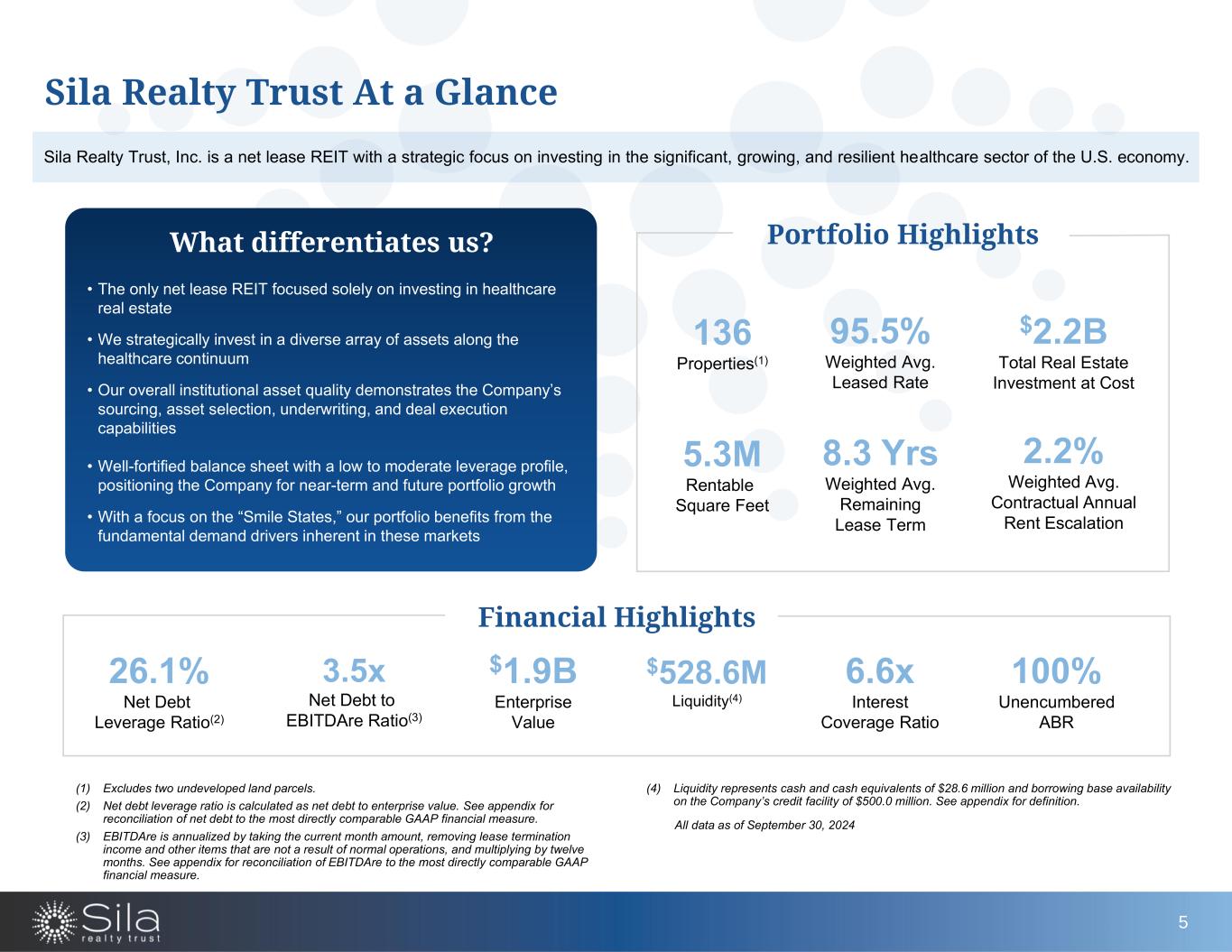

Portfolio Highlights Financial Highlights 26.1% Net Debt Leverage Ratio(2) 3.5x Net Debt to EBITDAre Ratio(3) $528.6M Liquidity(4) Sila Realty Trust At a Glance Sila Realty Trust, Inc. is a net lease REIT with a strategic focus on investing in the significant, growing, and resilient healthcare sector of the U.S. economy. (1) Excludes two undeveloped land parcels. (2) Net debt leverage ratio is calculated as net debt to enterprise value. See appendix for reconciliation of net debt to the most directly comparable GAAP financial measure. (3) EBITDAre is annualized by taking the current month amount, removing lease termination income and other items that are not a result of normal operations, and multiplying by twelve months. See appendix for reconciliation of EBITDAre to the most directly comparable GAAP financial measure. (4) Liquidity represents cash and cash equivalents of $28.6 million and borrowing base availability on the Company’s credit facility of $500.0 million. See appendix for definition. All data as of September 30, 2024 100% Unencumbered ABR 6.6x Interest Coverage Ratio • The only net lease REIT focused solely on investing in healthcare real estate • We strategically invest in a diverse array of assets along the healthcare continuum • Our overall institutional asset quality demonstrates the Company’s sourcing, asset selection, underwriting, and deal execution capabilities • Well-fortified balance sheet with a low to moderate leverage profile, positioning the Company for near-term and future portfolio growth • With a focus on the “Smile States,” our portfolio benefits from the fundamental demand drivers inherent in these markets What differentiates us? 8.3 Yrs Weighted Avg. Remaining Lease Term 95.5% Weighted Avg. Leased Rate 2.2% Weighted Avg. Contractual Annual Rent Escalation $2.2B Total Real Estate Investment at Cost 5.3M Rentable Square Feet 136 Properties(1) 5 $1.9B Enterprise Value

Pure-Play in High Quality Healthcare Assets NYSE Listing Day | June 13, 2024

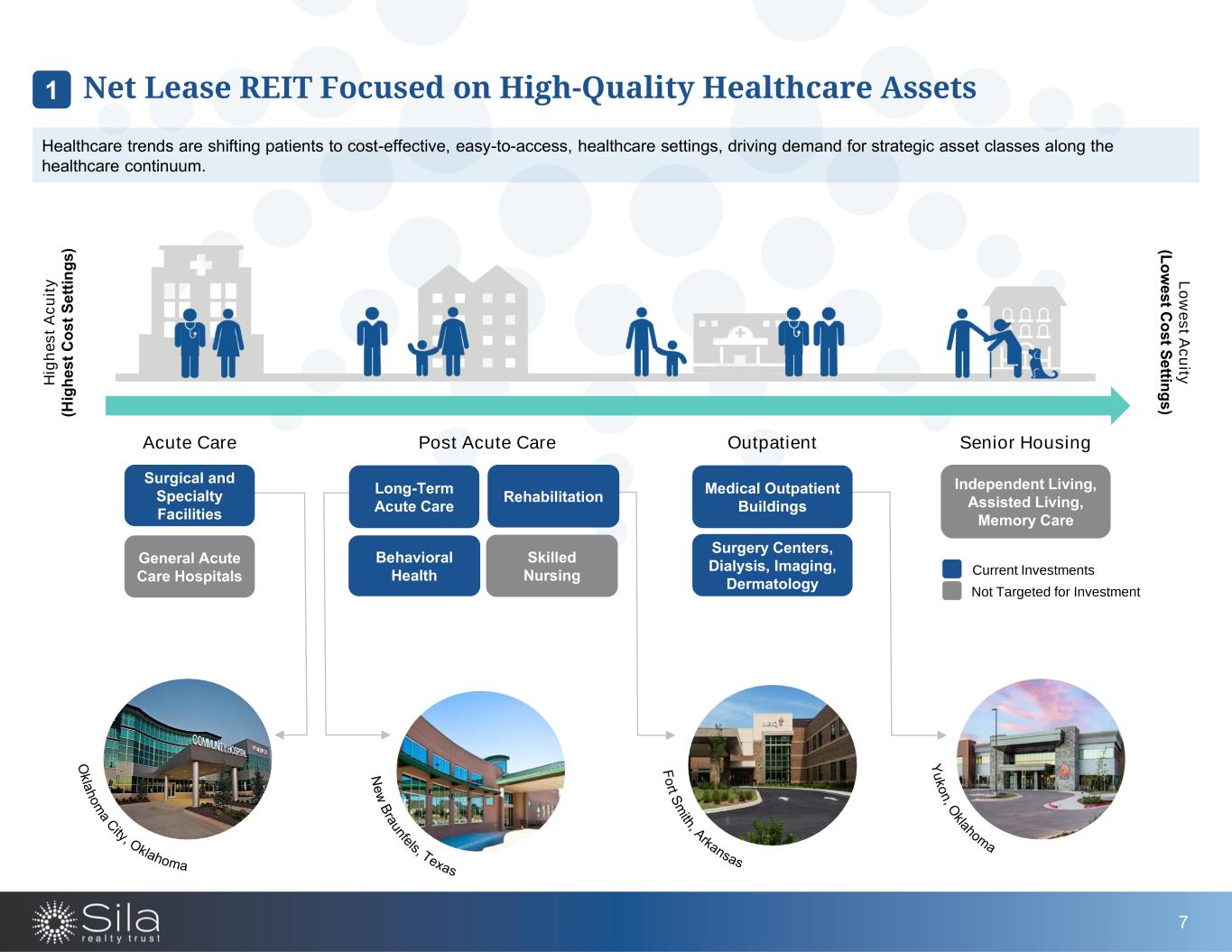

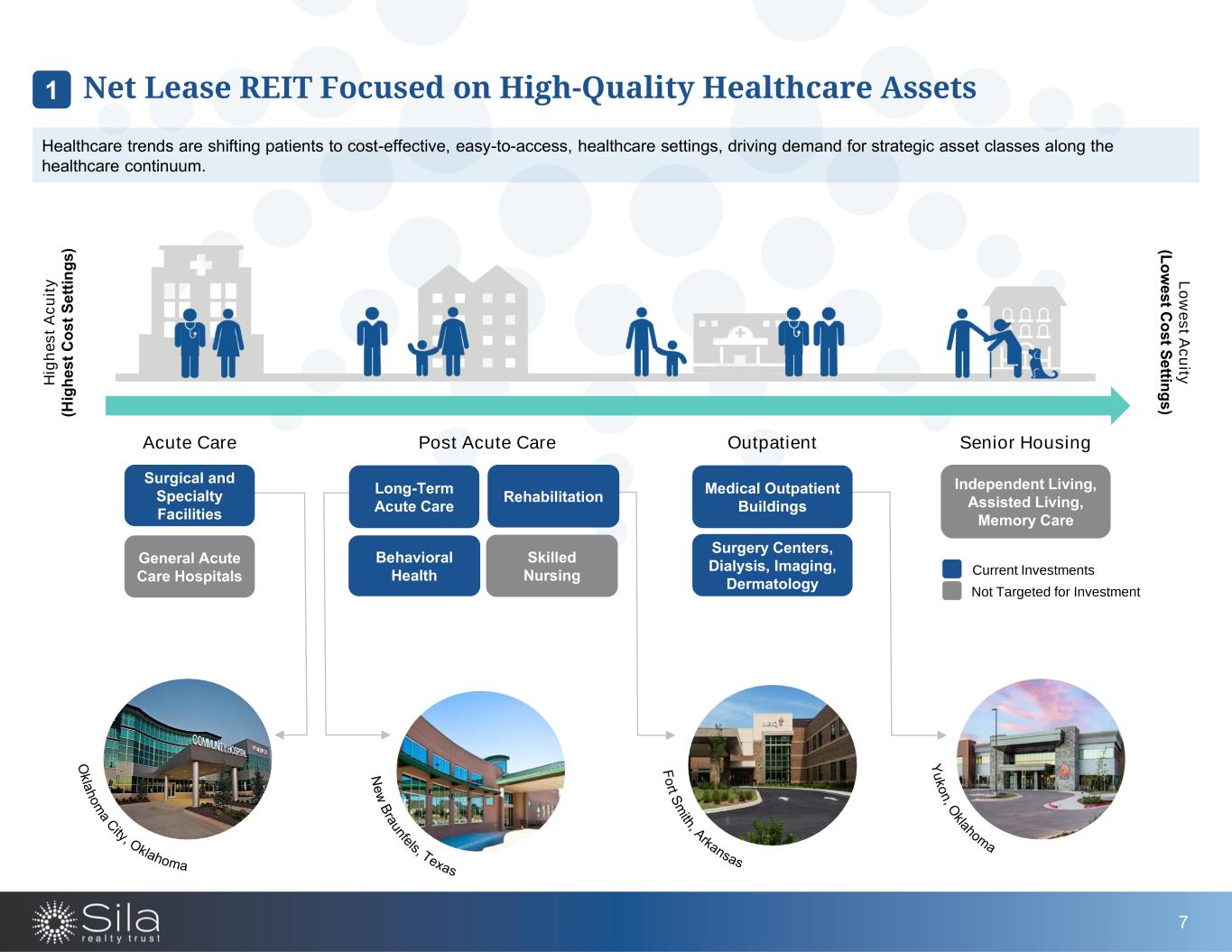

Healthcare trends are shifting patients to cost-effective, easy-to-access, healthcare settings, driving demand for strategic asset classes along the healthcare continuum. H ig h e s t A c u it y (H ig h e s t C o s t S e tt in g s ) L o w e s t A c u ity (L o w e s t C o s t S e ttin g s ) Acute Care Outpatient Senior Housing Surgery Centers, Dialysis, Imaging, Dermatology Independent Living, Assisted Living, Memory Care General Acute Care Hospitals Net Lease REIT Focused on High-Quality Healthcare Assets1 7 Post Acute Care Behavioral Health Skilled Nursing Surgical and Specialty Facilities O k la h o m a C ity, Oklahoma F o rt S m ith, A rkansas N e w B ra unfels, Texas Y u k o n , O klahom a Long-Term Acute Care Rehabilitation Medical Outpatient Buildings Current Investments Not Targeted for Investment

Large Growing Market in a Defensible Sector1 Capitalizing on favorable macro tailwinds driving demand for healthcare settings that are cost efficient while delivering personalized quality of care. (1) U.S. Census Bureau (2) Peterson-KFF analysis of 2021 Medical Expenditure Panel Survey (3) Center for Medicaid and Medicare Services Share of Population Share of Spending By 2030, all baby boomers will be 65+. This will expand the size of the older population so that one in every five Americans is projected to be retirement age.(1) The nation’s 65+ population is projected to increase in size in the coming decades, from 57.8 million in 2020 to 88.8 million people in 2060. As a result, the share of people in this age group will grow from 15% in 2020 to approximately 25% of the population in 2060.(1) People age 65+, on average, spend more on healthcare than any other age group.(2) Utilization of healthcare increases with age, driving growing demand for healthcare services. From 2022-2031, average growth in healthcare expenditures is expected to outpace GDP growth, resulting in an increase in health spending share of GDP from 18.3% to 19.6%.(3) 23% 9% 21% 12% 13% 10% 12% 14% 13% 19% 18% 36% Share of Population Share of Spending 65+ 55-64 45-54 35-44 19-34 0-18 3.1 4.9 9.0 16.2 25.5 35.0 57.8 78.3 88.8 1900 1920 1940 1960 1980 2000 2020 2040 2060 (numbers in millions)(1) Number of Persons 65+ Population vs Spending(2) 8

Proven Track Record of Value Creation Reading Healthcare Facility, Pennsylvania

• On-campus or off-campus facilities in retail-type locations • Strong visibility and access with ample parking • High growth areas near population clusters that are convenient to patients/customers • Near and convenient to the tenant’s patient referral sources • Large patient catchment areas • Class A, recent construction or newly renovated properties, purpose built for healthcare services • Single or multi-tenant facilities with strong anchor tenants • Specialized facilities with substantial tenant buildout • Long-weighted average lease terms with annual rent escalations • Market leading providers with dominant market share • Strong financial foundation with high rent coverage ratios or other credit enhancements • Hospital or health system affiliations • Providers with demonstrated experience at adapting to the rapidly changing healthcare sector • Diverse payor mix Robust In-House Management 18 Acquisition, Asset & Property Management Team Members 51 Total Employees 5.3M Square Feet of Real Estate Managed Reliable TenantsStrategic LocationsHigh Quality Facilities 65 Markets Managed Across the U.S. Employee data as of November 6, 2024. Market and square feet data as September 30, 2024. 3 Member Dedicated Credit Team Our in-depth, well-disciplined underwriting strategy, executed by a seasoned team of in-house professionals, allows the Company to source accretive opportunities that are critical to the business operations of our tenants and the communities they serve. Asset Strategy and Platform Positioned for Growth2 10

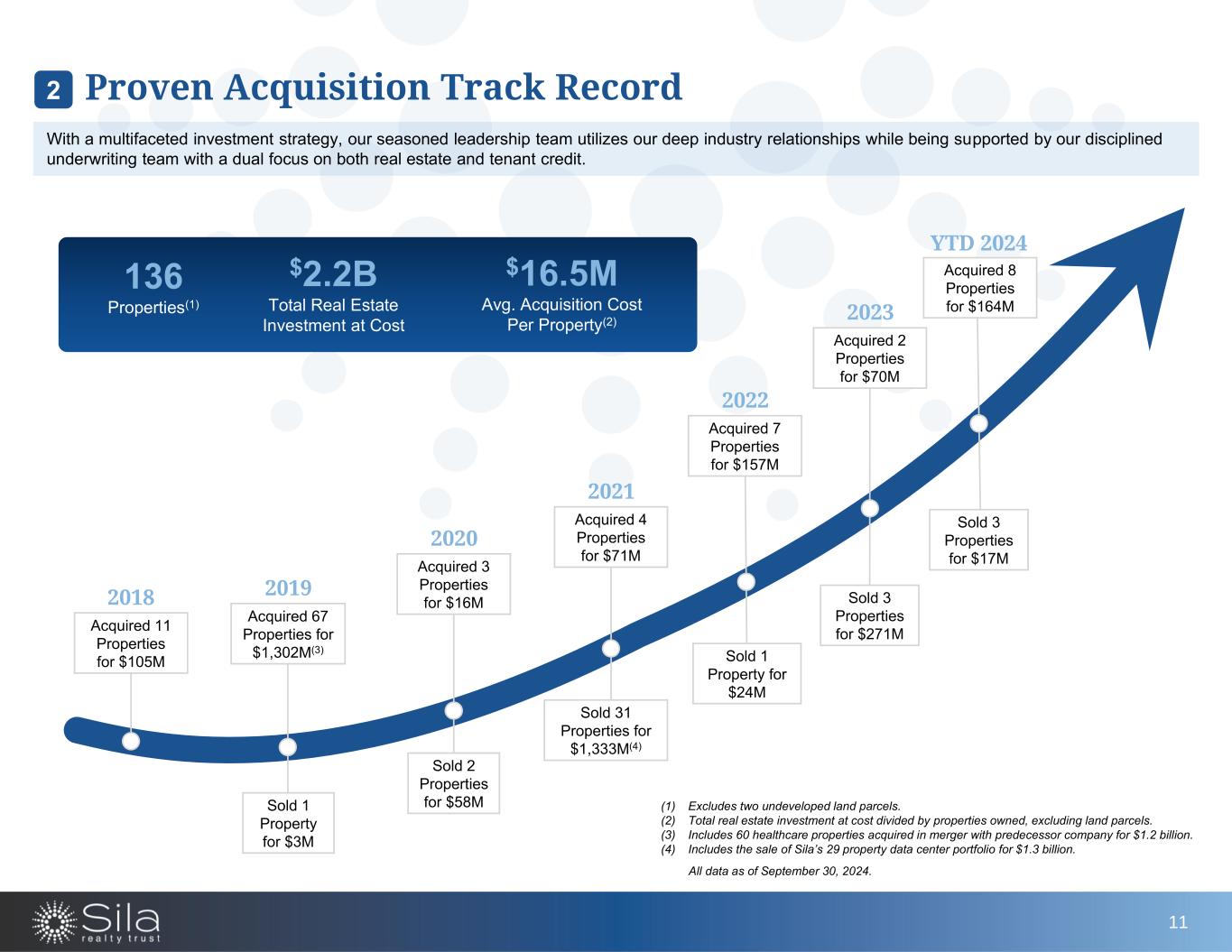

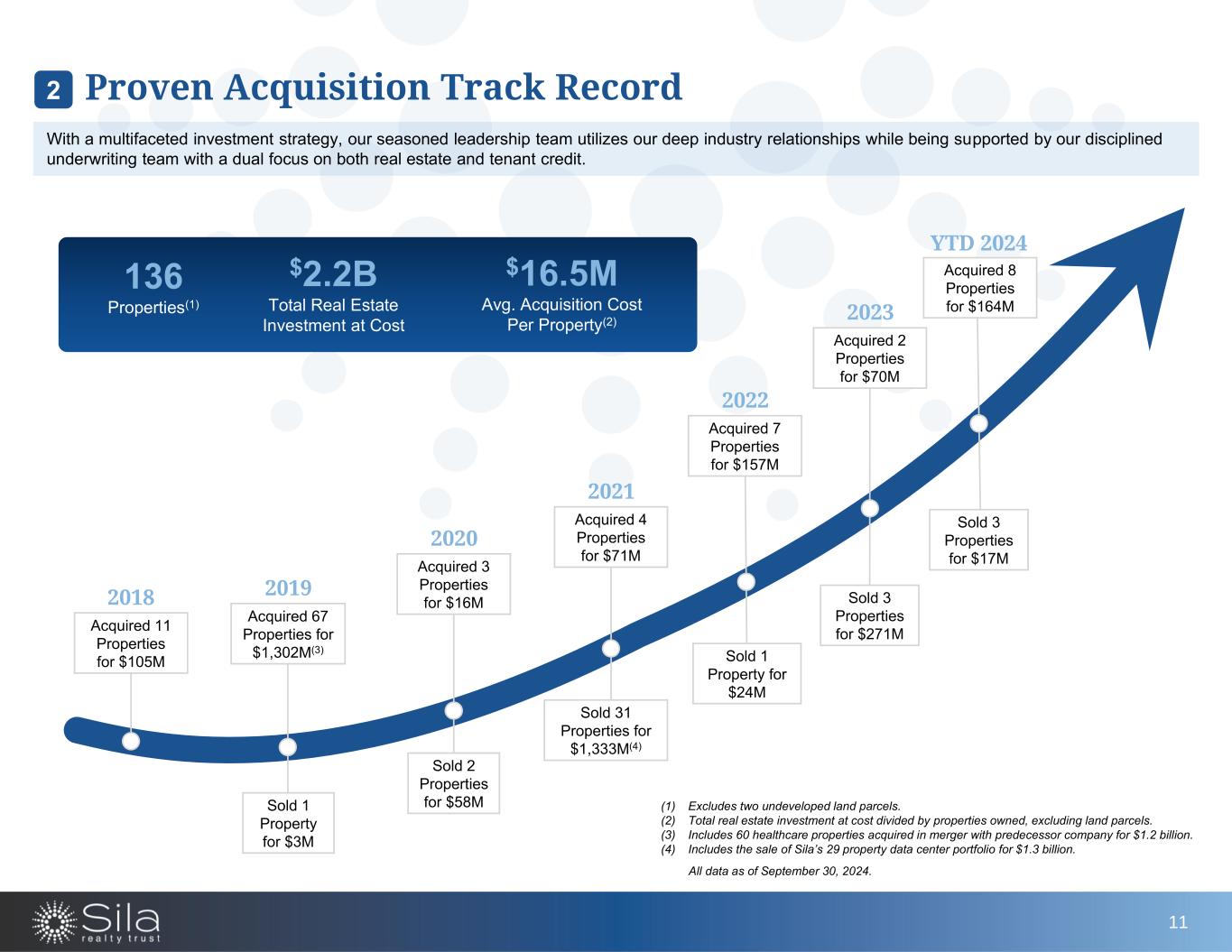

Acquired 11 Properties for $105M 2018 Acquired 67 Properties for $1,302M(3) 2019 Acquired 3 Properties for $16M 2020 Acquired 4 Properties for $71M 2021 Acquired 7 Properties for $157M 2022 Acquired 2 Properties for $70M 2023 Acquired 8 Properties for $164M YTD 2024 Sold 1 Property for $3M Sold 2 Properties for $58M Sold 31 Properties for $1,333M(4) Sold 1 Property for $24M Sold 3 Properties for $271M $2.2B Total Real Estate Investment at Cost $16.5M Avg. Acquisition Cost Per Property(2) 136 Properties(1) With a multifaceted investment strategy, our seasoned leadership team utilizes our deep industry relationships while being supported by our disciplined underwriting team with a dual focus on both real estate and tenant credit. (1) Excludes two undeveloped land parcels. (2) Total real estate investment at cost divided by properties owned, excluding land parcels. (3) Includes 60 healthcare properties acquired in merger with predecessor company for $1.2 billion. (4) Includes the sale of Sila’s 29 property data center portfolio for $1.3 billion. All data as of September 30, 2024. Sold 3 Properties for $17M Proven Acquisition Track Record2 11

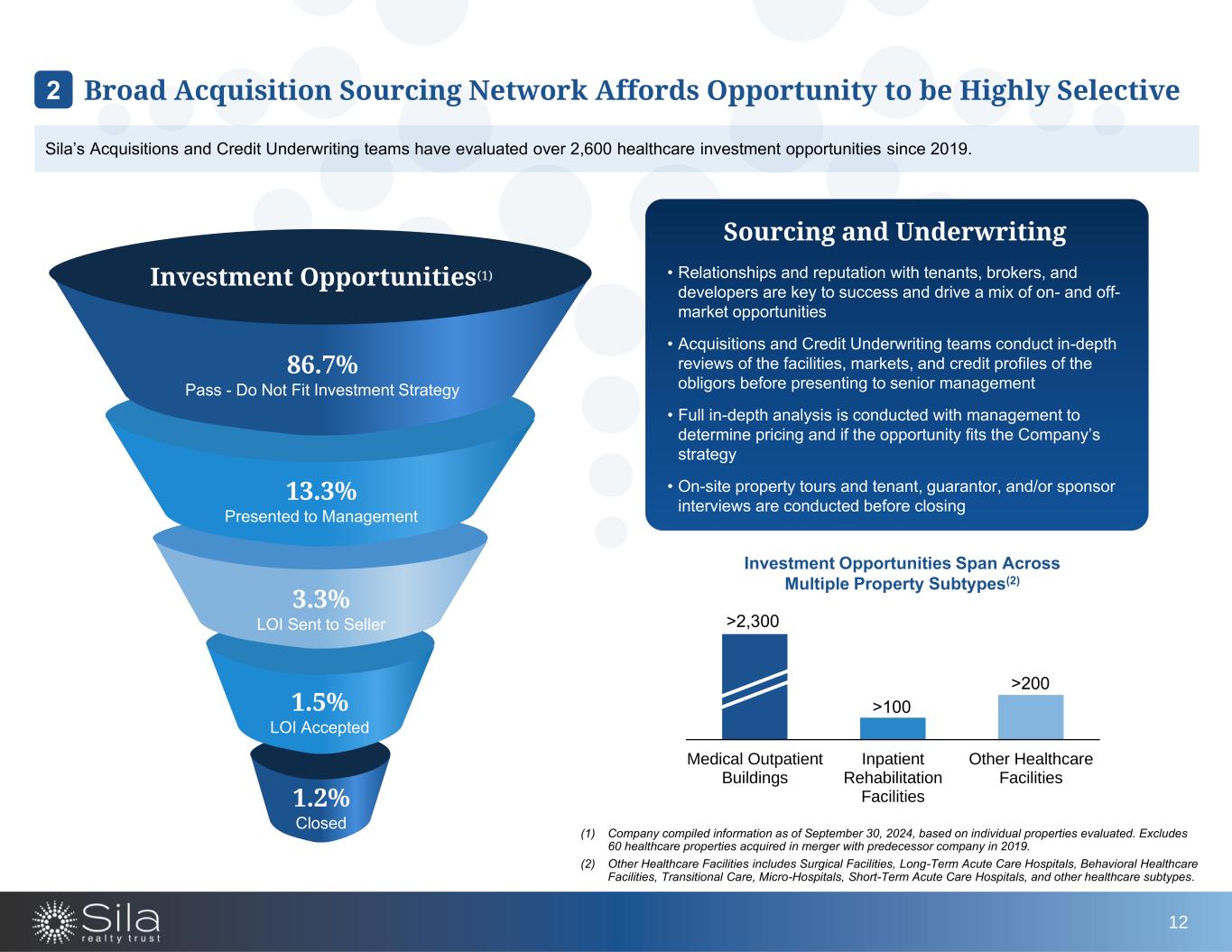

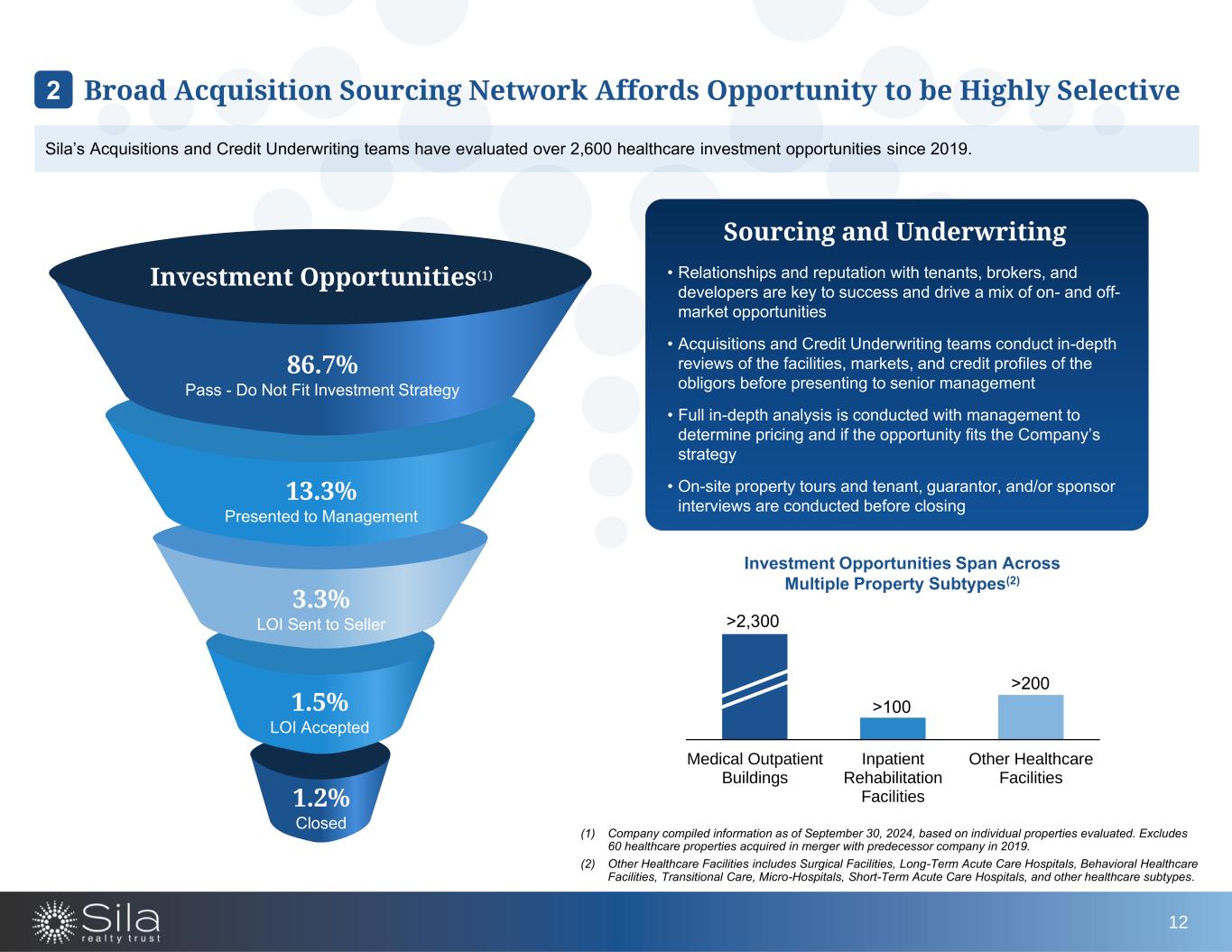

Broad Acquisition Sourcing Network Affords Opportunity to be Highly Selective 86.7% Pass - Do Not Fit Investment Strategy 13.3% Presented to Management 3.3% LOI Sent to Seller 1.5% LOI Accepted 1.2% Closed Medical Outpatient Buildings Inpatient Rehabilitation Facilities Other Healthcare Facilities Investment Opportunities Span Across Multiple Property Subtypes(2) >2,300 >100 >200 • Relationships and reputation with tenants, brokers, and developers are key to success and drive a mix of on- and off- market opportunities • Acquisitions and Credit Underwriting teams conduct in-depth reviews of the facilities, markets, and credit profiles of the obligors before presenting to senior management • Full in-depth analysis is conducted with management to determine pricing and if the opportunity fits the Company’s strategy • On-site property tours and tenant, guarantor, and/or sponsor interviews are conducted before closing Sourcing and Underwriting (1) Company compiled information as of September 30, 2024, based on individual properties evaluated. Excludes 60 healthcare properties acquired in merger with predecessor company in 2019. (2) Other Healthcare Facilities includes Surgical Facilities, Long-Term Acute Care Hospitals, Behavioral Healthcare Facilities, Transitional Care, Micro-Hospitals, Short-Term Acute Care Hospitals, and other healthcare subtypes. 12 Investment Opportunities(1) 2 Sila’s Acquisitions and Credit Underwriting teams have evaluated over 2,600 healthcare investment opportunities since 2019.

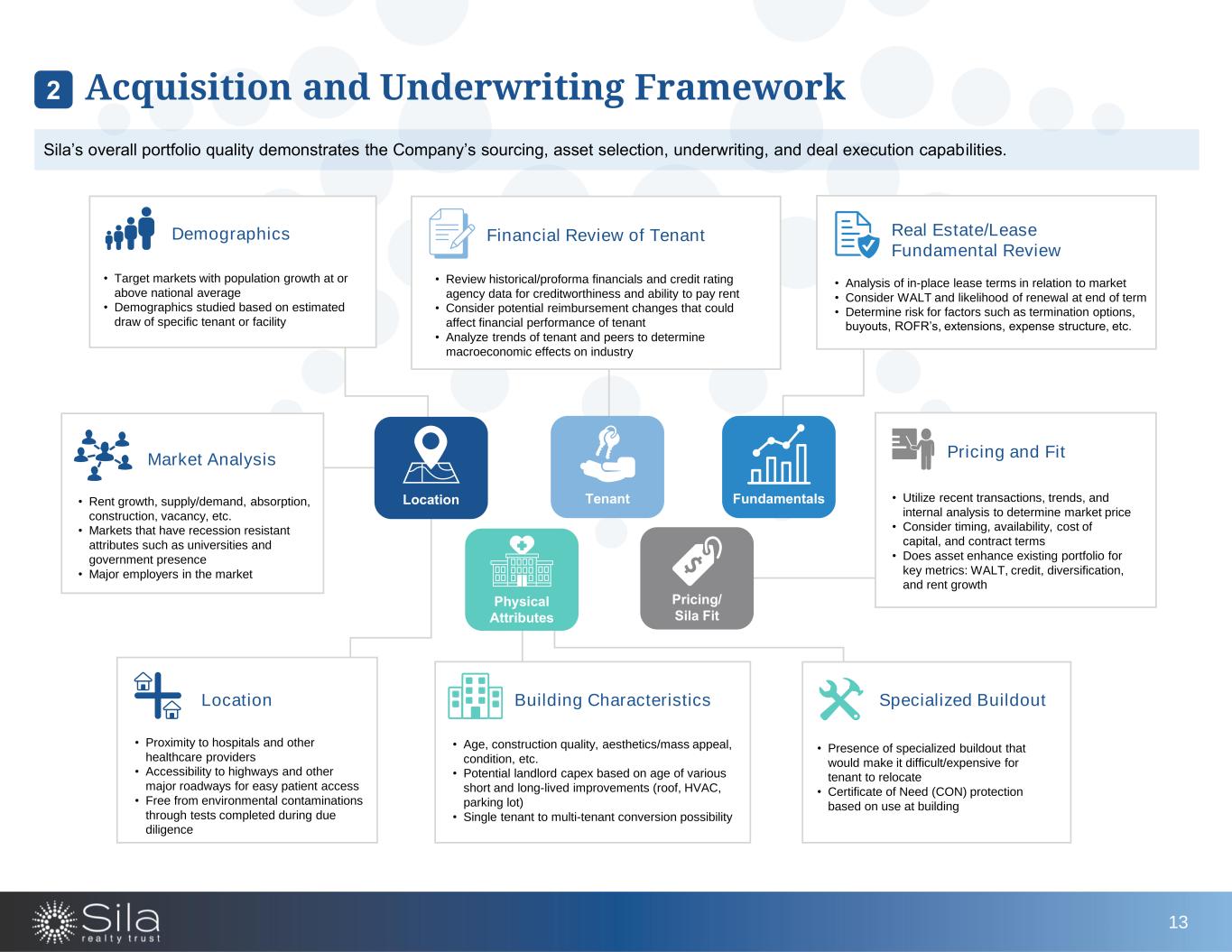

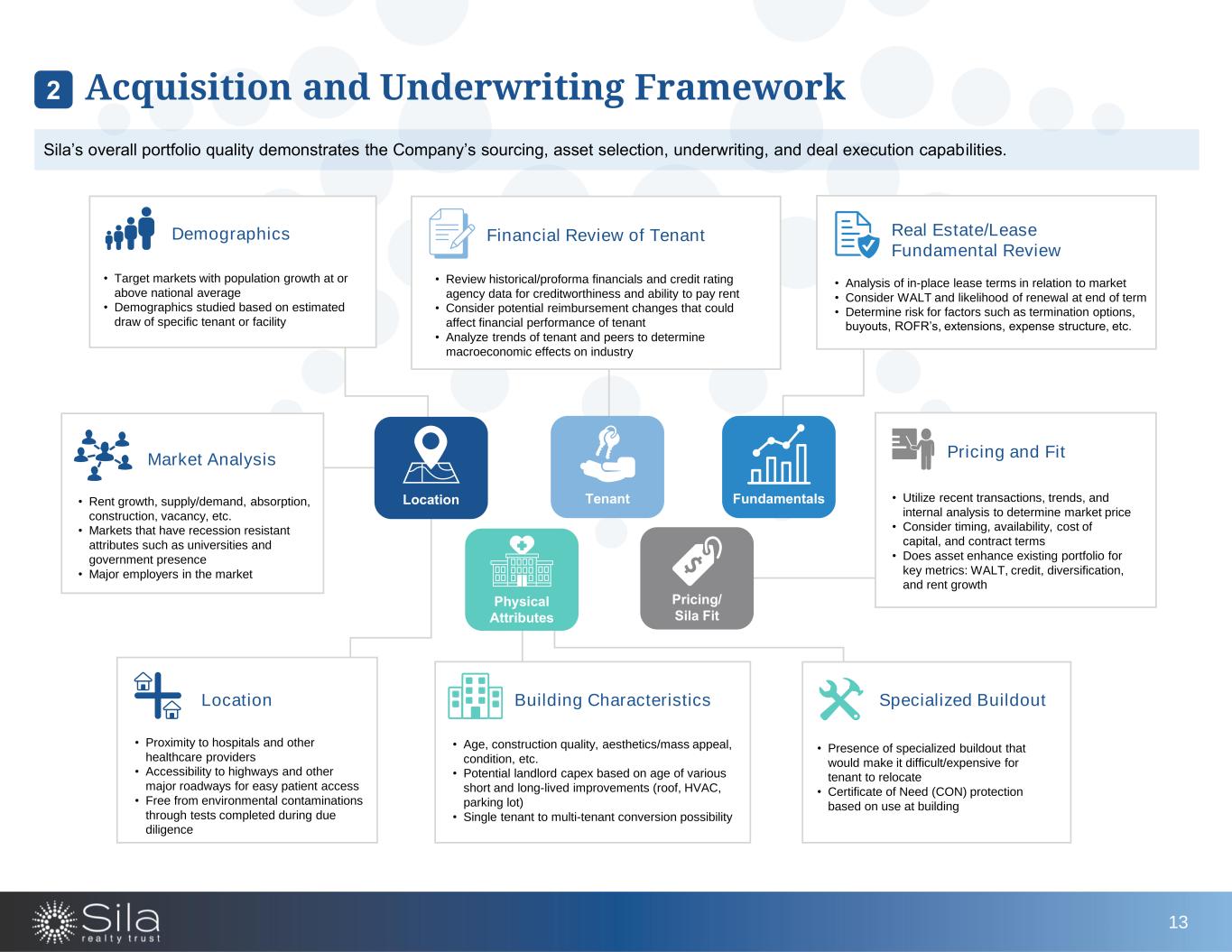

• Rent growth, supply/demand, absorption, construction, vacancy, etc. • Markets that have recession resistant attributes such as universities and government presence • Major employers in the market Market Analysis • Target markets with population growth at or above national average • Demographics studied based on estimated draw of specific tenant or facility Demographics Location • Proximity to hospitals and other healthcare providers • Accessibility to highways and other major roadways for easy patient access • Free from environmental contaminations through tests completed during due diligence Location • Review historical/proforma financials and credit rating agency data for creditworthiness and ability to pay rent • Consider potential reimbursement changes that could affect financial performance of tenant • Analyze trends of tenant and peers to determine macroeconomic effects on industry Financial Review of Tenant Tenant • Age, construction quality, aesthetics/mass appeal, condition, etc. • Potential landlord capex based on age of various short and long-lived improvements (roof, HVAC, parking lot) • Single tenant to multi-tenant conversion possibility Building Characteristics • Analysis of in-place lease terms in relation to market • Consider WALT and likelihood of renewal at end of term • Determine risk for factors such as termination options, buyouts, ROFR’s, extensions, expense structure, etc. Fundamentals Real Estate/Lease Fundamental Review • Utilize recent transactions, trends, and internal analysis to determine market price • Consider timing, availability, cost of capital, and contract terms • Does asset enhance existing portfolio for key metrics: WALT, credit, diversification, and rent growth Pricing/ Sila Fit Pricing and Fit Physical Attributes • Presence of specialized buildout that would make it difficult/expensive for tenant to relocate • Certificate of Need (CON) protection based on use at building Specialized Buildout Sila’s overall portfolio quality demonstrates the Company’s sourcing, asset selection, underwriting, and deal execution capabilities. Acquisition and Underwriting Framework2 13

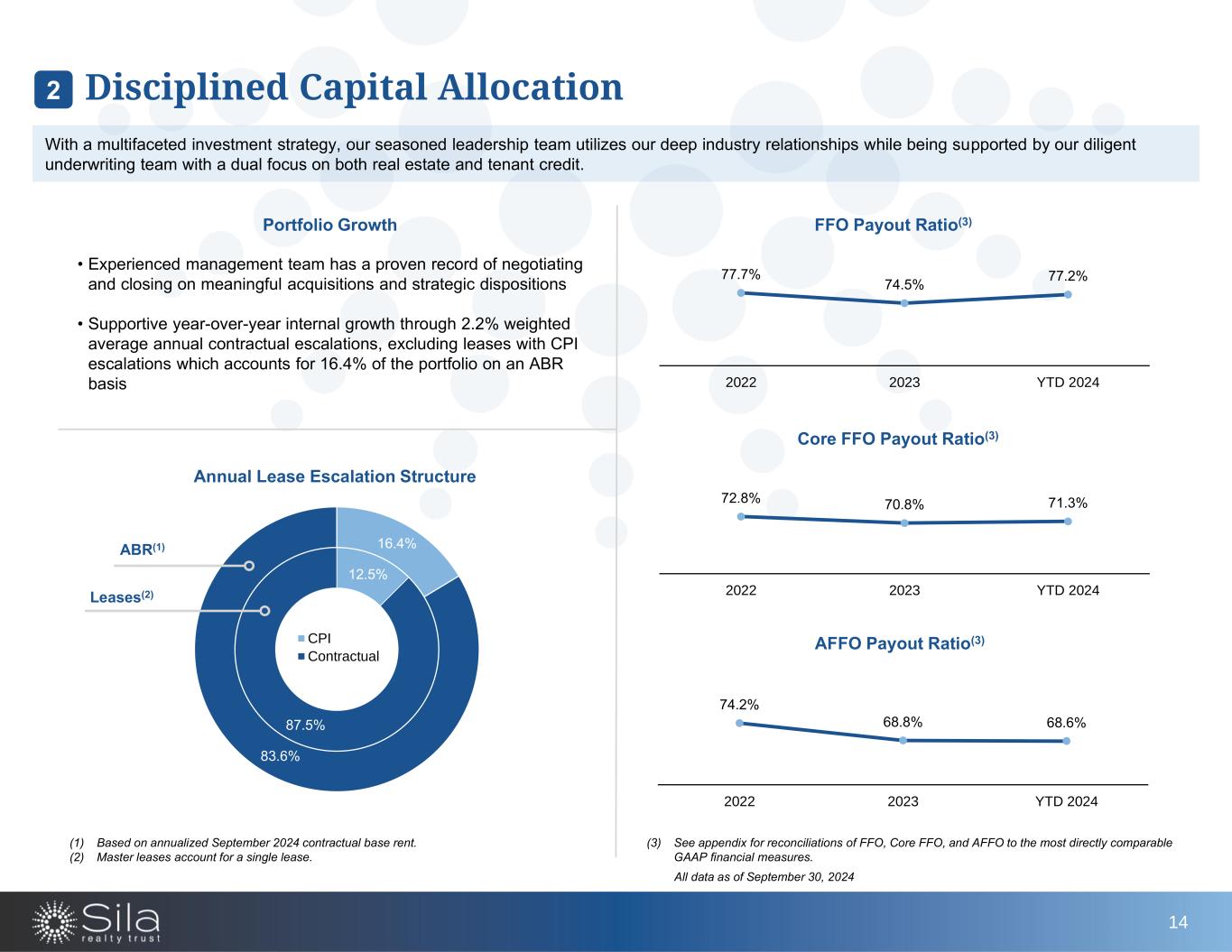

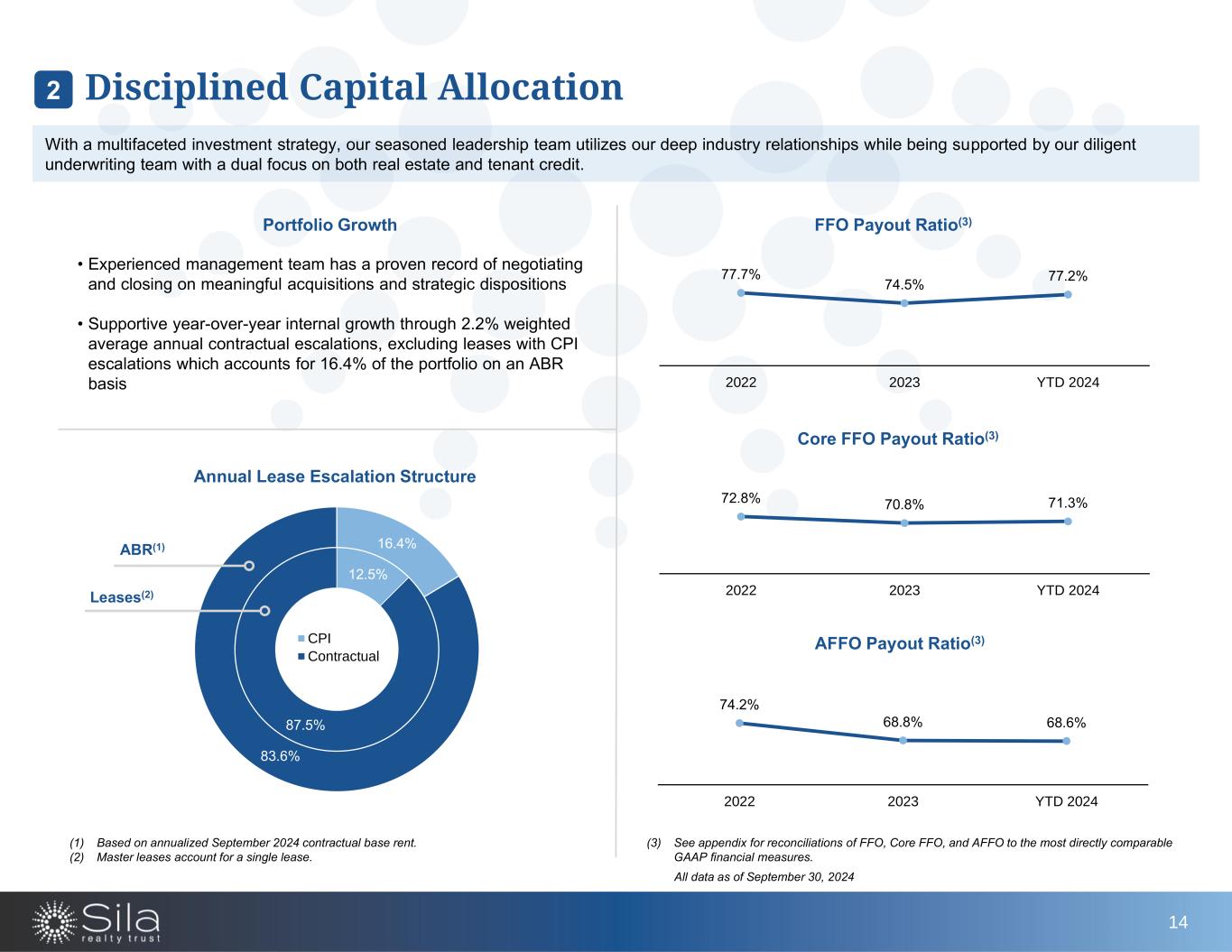

Annual Lease Escalation Structure 12.5% 87.5% 16.4% 83.6% CPI Contractual ABR(1) Leases(2) • Experienced management team has a proven record of negotiating and closing on meaningful acquisitions and strategic dispositions • Supportive year-over-year internal growth through 2.2% weighted average annual contractual escalations, excluding leases with CPI escalations which accounts for 16.4% of the portfolio on an ABR basis Portfolio Growth With a multifaceted investment strategy, our seasoned leadership team utilizes our deep industry relationships while being supported by our diligent underwriting team with a dual focus on both real estate and tenant credit. 72.8% 70.8% 71.3% 2022 2023 YTD 2024 Core FFO Payout Ratio(3) (1) Based on annualized September 2024 contractual base rent. (2) Master leases account for a single lease. (3) See appendix for reconciliations of FFO, Core FFO, and AFFO to the most directly comparable GAAP financial measures. All data as of September 30, 2024 AFFO Payout Ratio(3) 74.2% 68.8% 68.6% 2022 2023 YTD 2024 FFO Payout Ratio(3) 77.7% 74.5% 77.2% 2022 2023 YTD 2024 Disciplined Capital Allocation 2 14

Robust Portfolio Delivers Strong Operating Metrics NYSE Listing Day | June 13, 2024

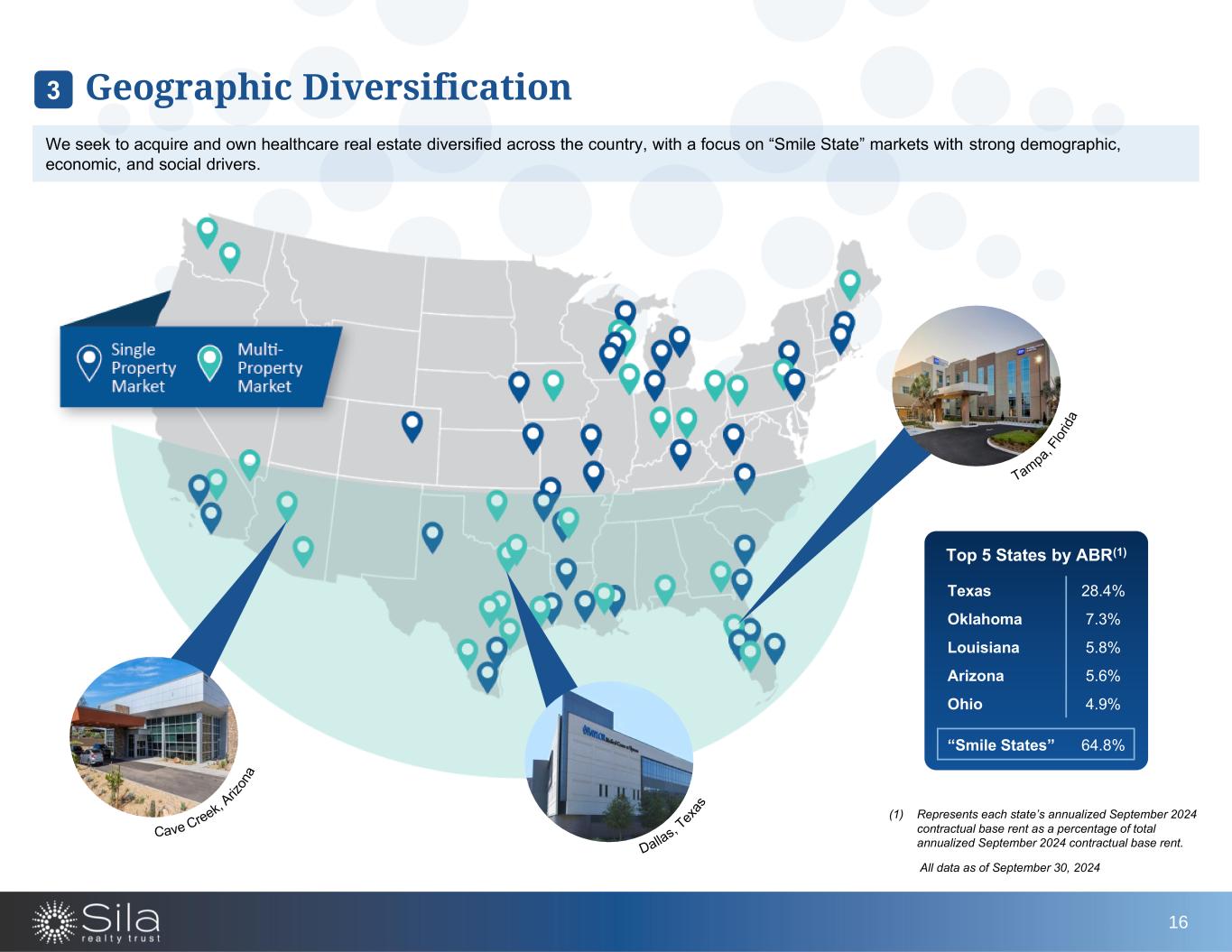

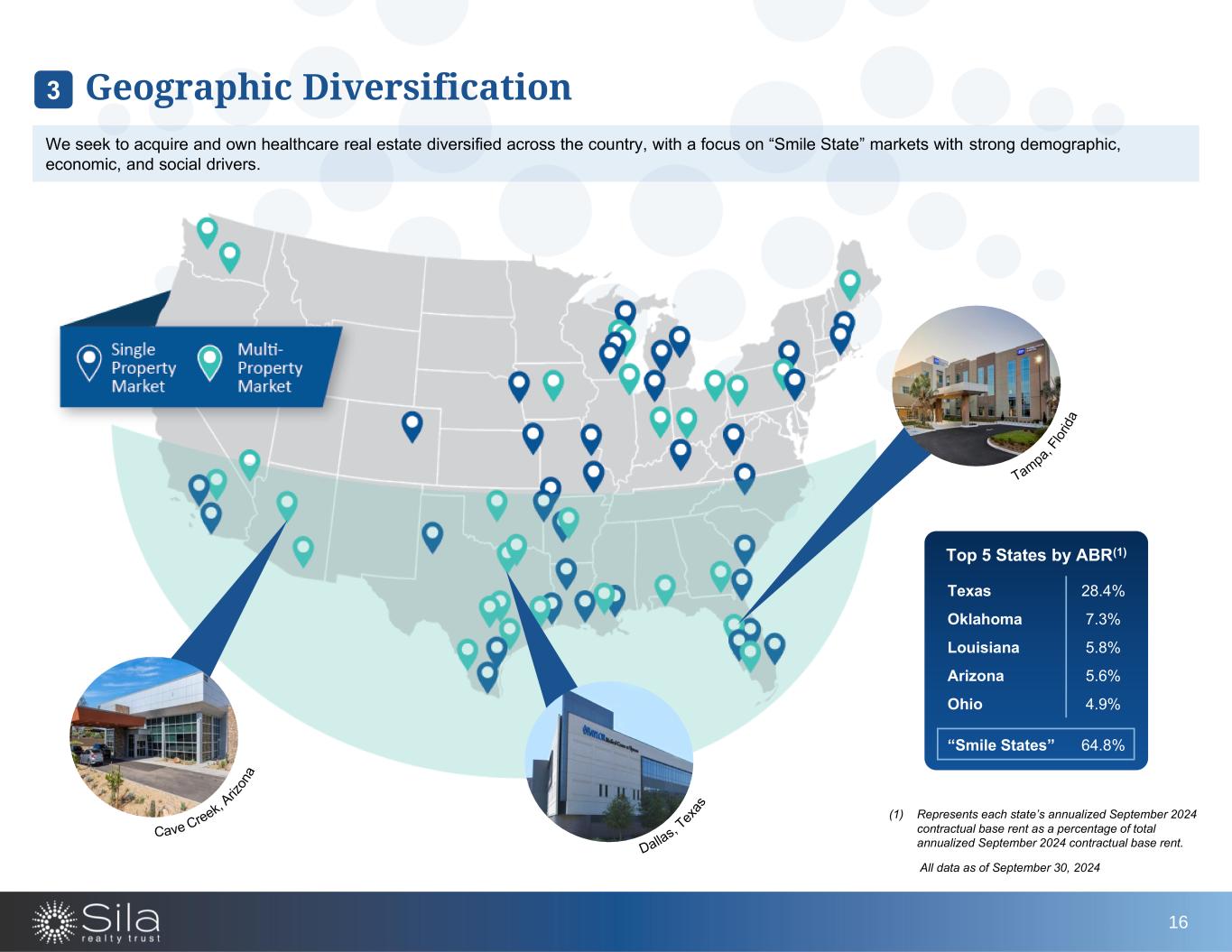

We seek to acquire and own healthcare real estate diversified across the country, with a focus on “Smile State” markets with strong demographic, economic, and social drivers. (1) Represents each state’s annualized September 2024 contractual base rent as a percentage of total annualized September 2024 contractual base rent. All data as of September 30, 2024 Cave Creek, Ariz on a Tam pa, F lo ri d a Dalla s, Tex as Top 5 States by ABR(1) Texas 28.4% Oklahoma 7.3% Louisiana 5.8% Arizona 5.6% Ohio 4.9% “Smile States” 64.8% Geographic Diversification3 16

Market leading healthcare providers across the country put their trust in our facilities to provide the highest quality healthcare settings. Sponsor Strength and Recognition3 17 Logos represent top 10 tenant diversification

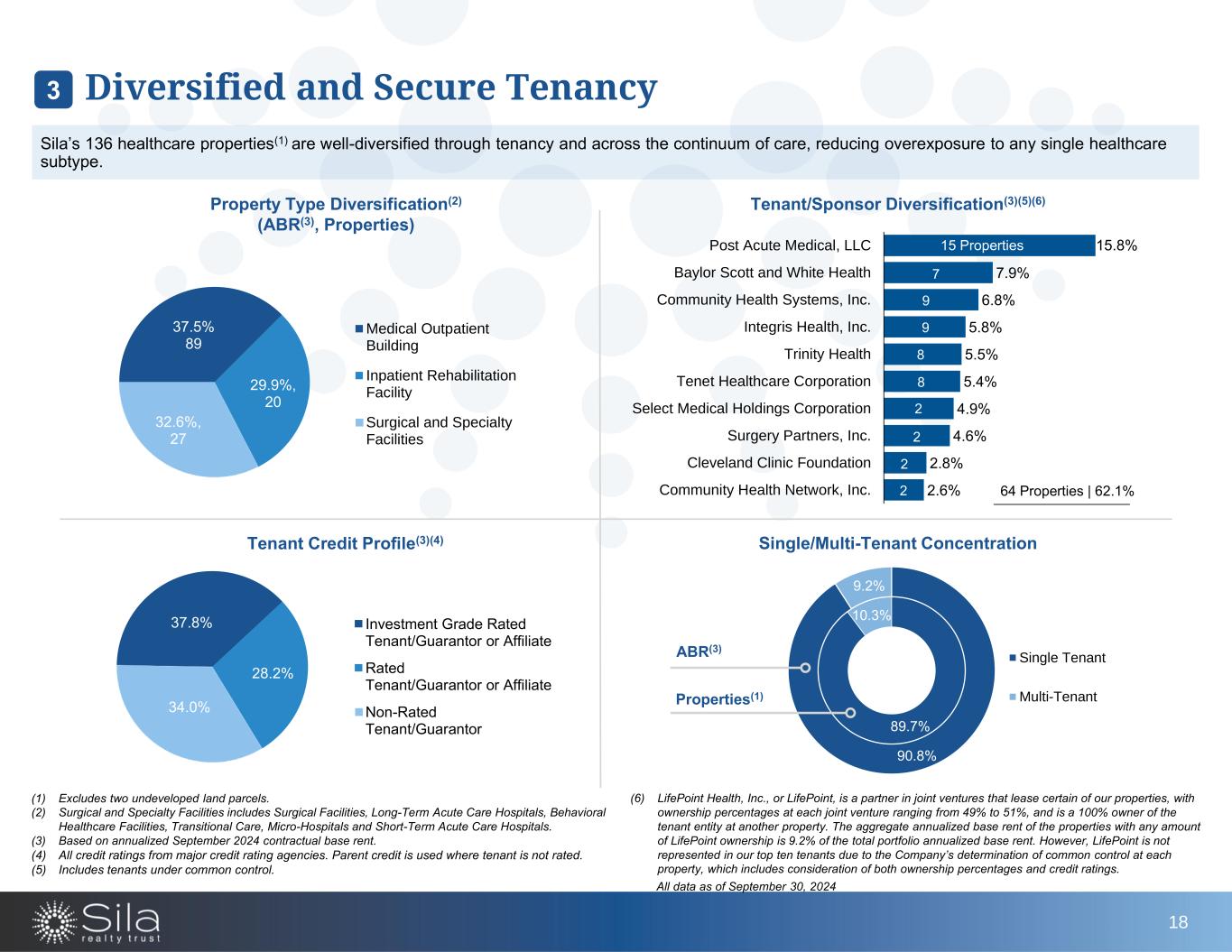

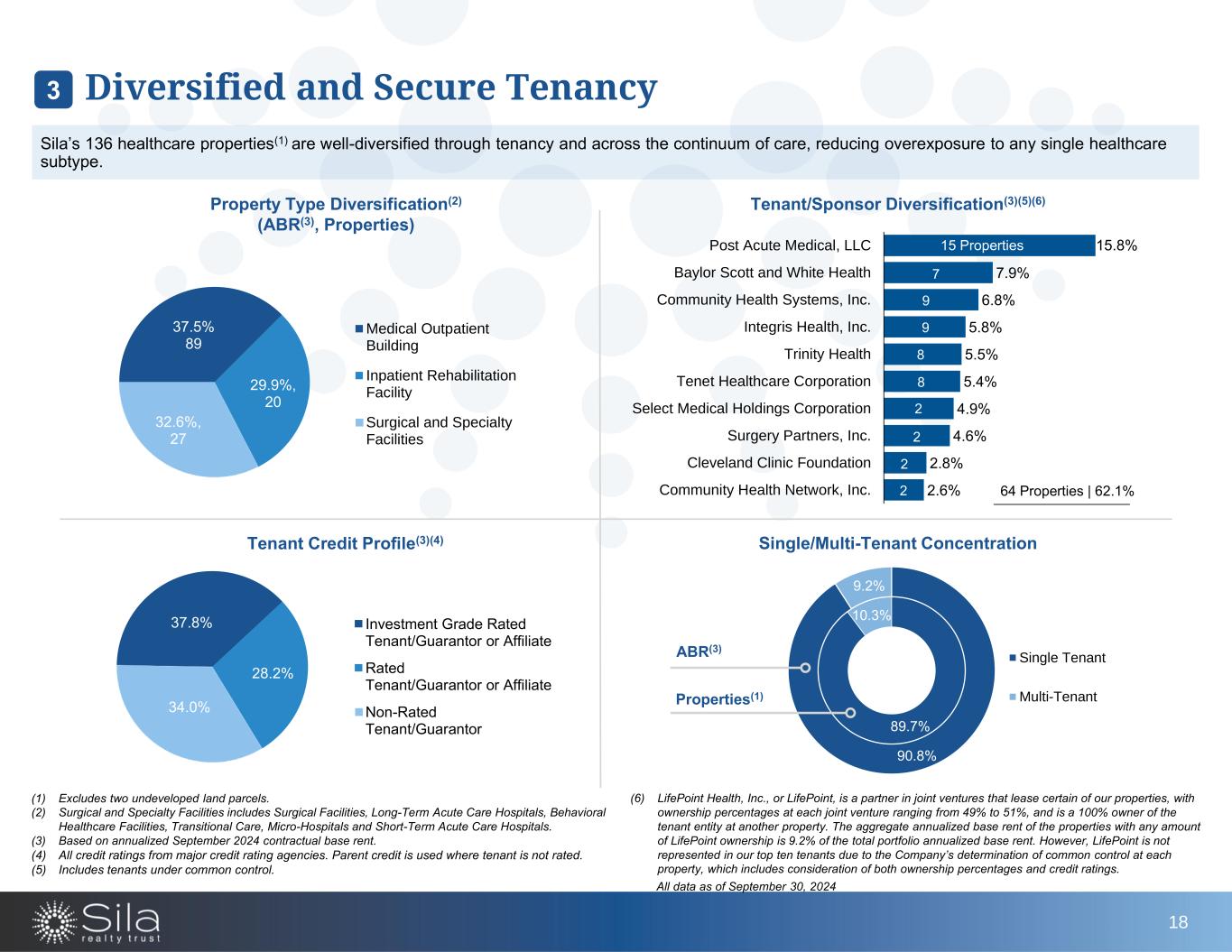

Property Type Diversification(2) (ABR(3), Properties) 37.5% 89 29.9%, 20 32.6%, 27 Medical Outpatient Building Inpatient Rehabilitation Facility Surgical and Specialty Facilities Tenant/Sponsor Diversification(3)(5)(6) 37.8% 28.2% 34.0% Investment Grade Rated Tenant/Guarantor or Affiliate Rated Tenant/Guarantor or Affiliate Non-Rated Tenant/Guarantor (1) Excludes two undeveloped land parcels. (2) Surgical and Specialty Facilities includes Surgical Facilities, Long-Term Acute Care Hospitals, Behavioral Healthcare Facilities, Transitional Care, Micro-Hospitals and Short-Term Acute Care Hospitals. (3) Based on annualized September 2024 contractual base rent. (4) All credit ratings from major credit rating agencies. Parent credit is used where tenant is not rated. (5) Includes tenants under common control. (6) LifePoint Health, Inc., or LifePoint, is a partner in joint ventures that lease certain of our properties, with ownership percentages at each joint venture ranging from 49% to 51%, and is a 100% owner of the tenant entity at another property. The aggregate annualized base rent of the properties with any amount of LifePoint ownership is 9.2% of the total portfolio annualized base rent. However, LifePoint is not represented in our top ten tenants due to the Company’s determination of common control at each property, which includes consideration of both ownership percentages and credit ratings. 2.6% 2.8% 4.6% 4.9% 5.4% 5.5% 5.8% 6.8% 7.9% 15.8% Community Health Network, Inc. Cleveland Clinic Foundation Surgery Partners, Inc. Select Medical Holdings Corporation Tenet Healthcare Corporation Trinity Health Integris Health, Inc. Community Health Systems, Inc. Baylor Scott and White Health Post Acute Medical, LLC 15 Properties 7 9 9 8 8 2 2 2 2 Sila’s 136 healthcare properties(1) are well-diversified through tenancy and across the continuum of care, reducing overexposure to any single healthcare subtype. Tenant Credit Profile(3)(4) Diversified and Secure Tenancy3 18 64 Properties | 62.1% Single/Multi-Tenant Concentration 89.7% 10.3% 90.8% 9.2% Single Tenant Multi-Tenant ABR(3) Properties(1) All data as of September 30, 2024

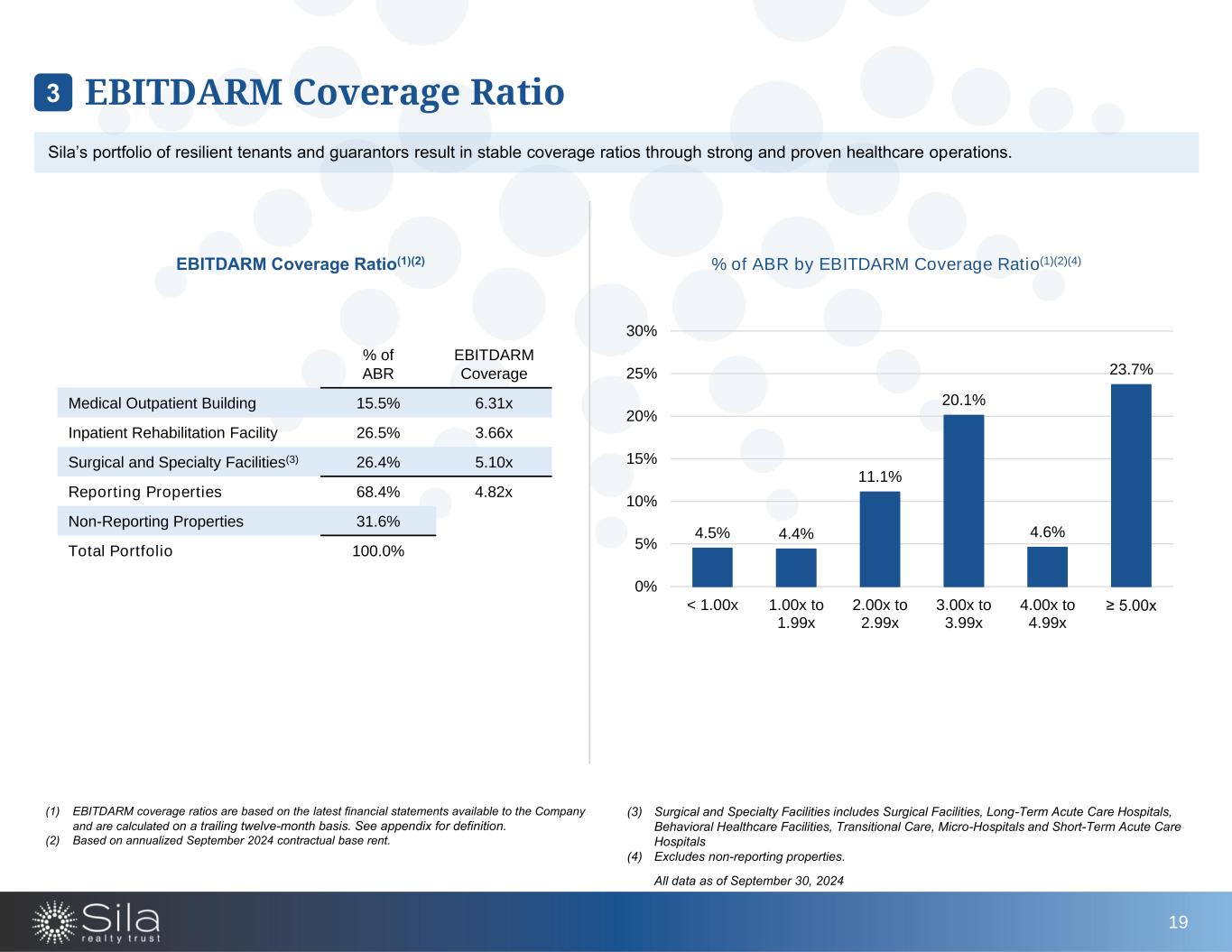

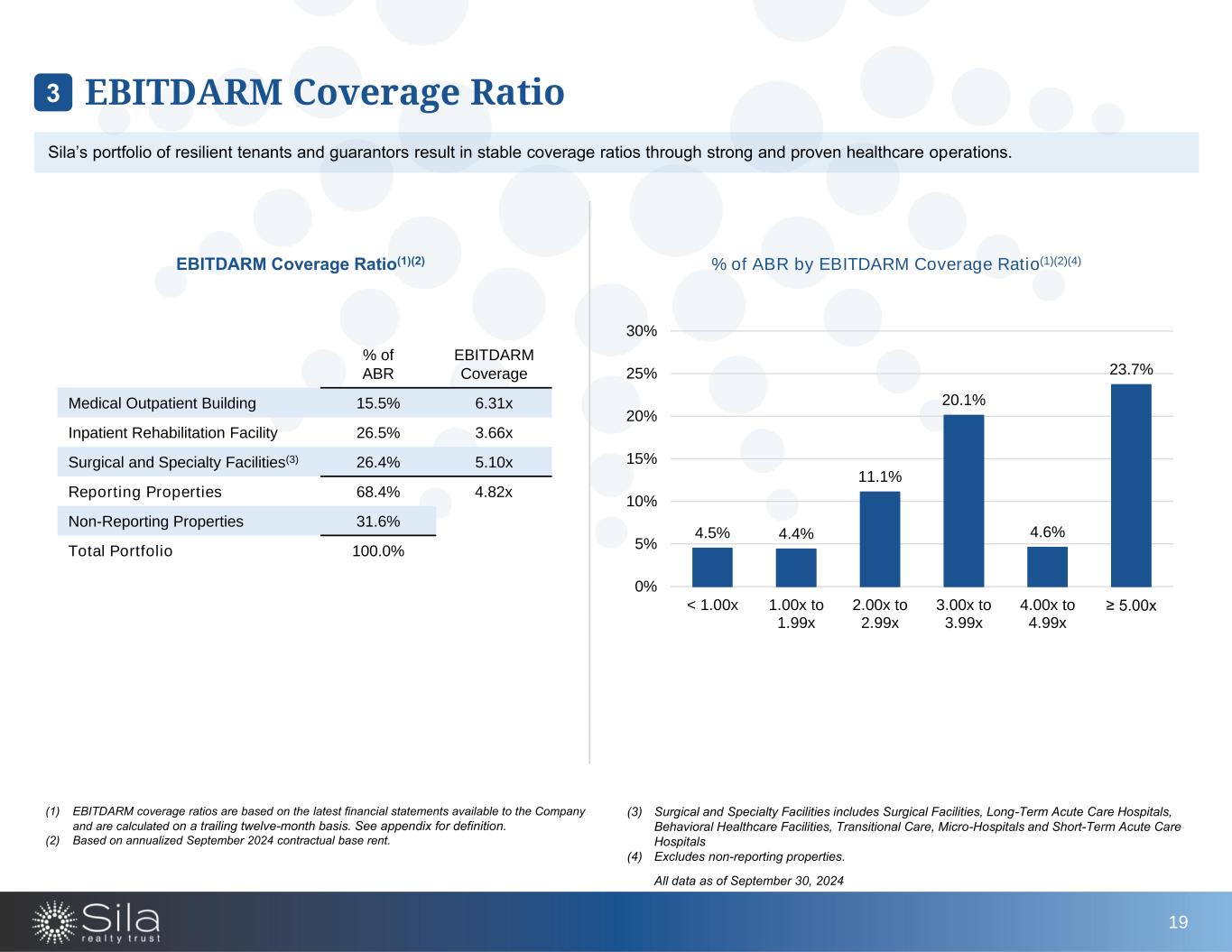

Sila’s portfolio of resilient tenants and guarantors result in stable coverage ratios through strong and proven healthcare operations. EBITDARM Coverage Ratio3 EBITDARM Coverage Ratio(1)(2) % of ABR by EBITDARM Coverage Ratio(1)(2)(4) 19 % of ABR EBITDARM Coverage Medical Outpatient Building 15.5% 6.31x Inpatient Rehabilitation Facility 26.5% 3.66x Surgical and Specialty Facilities(3) 26.4% 5.10x Reporting Properties 68.4% 4.82x Non-Reporting Properties 31.6% Total Portfolio 100.0% (1) EBITDARM coverage ratios are based on the latest financial statements available to the Company and are calculated on a trailing twelve-month basis. See appendix for definition. (2) Based on annualized September 2024 contractual base rent. (3) Surgical and Specialty Facilities includes Surgical Facilities, Long-Term Acute Care Hospitals, Behavioral Healthcare Facilities, Transitional Care, Micro-Hospitals and Short-Term Acute Care Hospitals (4) Excludes non-reporting properties. All data as of September 30, 2024 4.5% 4.4% 11.1% 20.1% 4.6% 23.7% 0% 5% 10% 15% 20% 25% 30% < 1.00x 1.00x to 1.99x 2.00x to 2.99x 3.00x to 3.99x 4.00x to 4.99x ≥ 5.00x

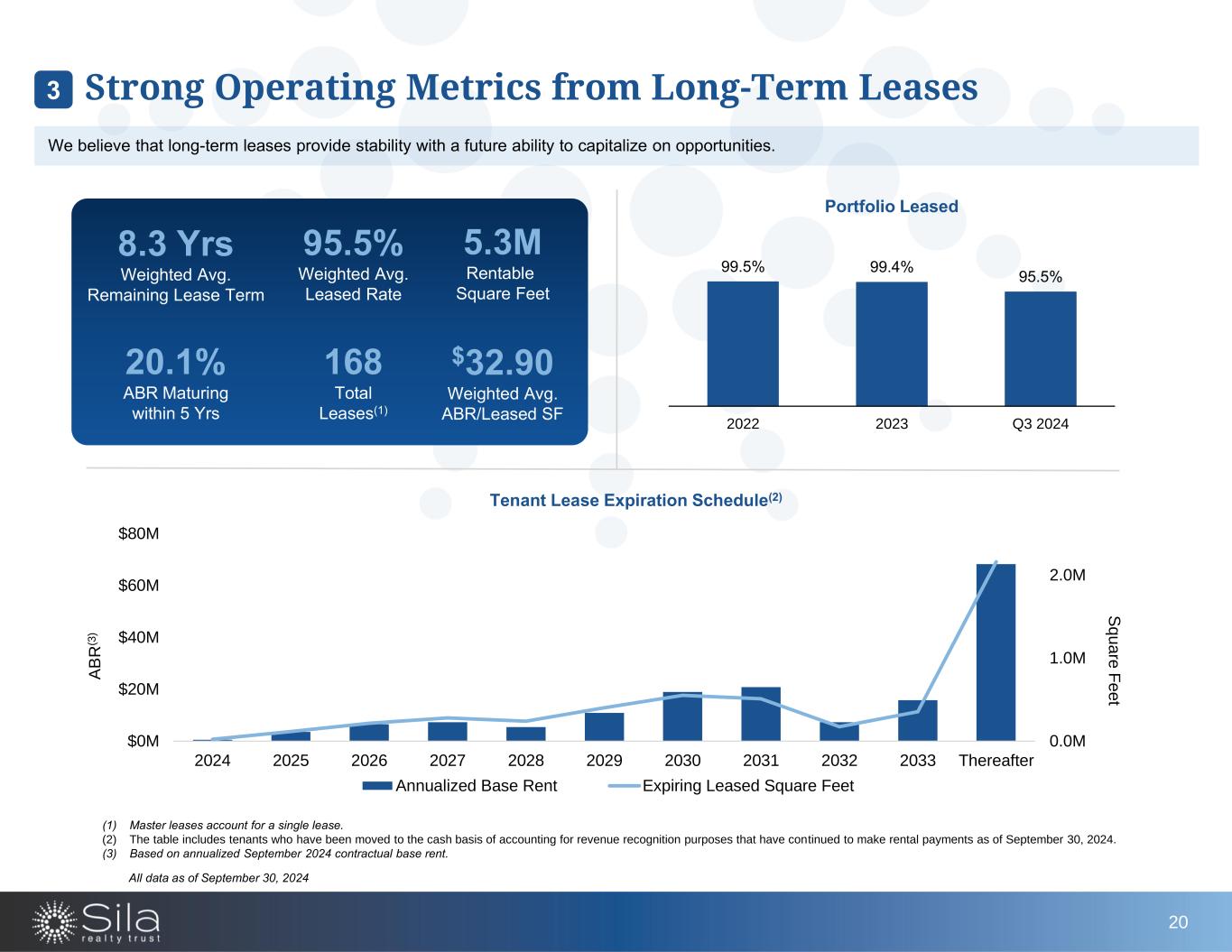

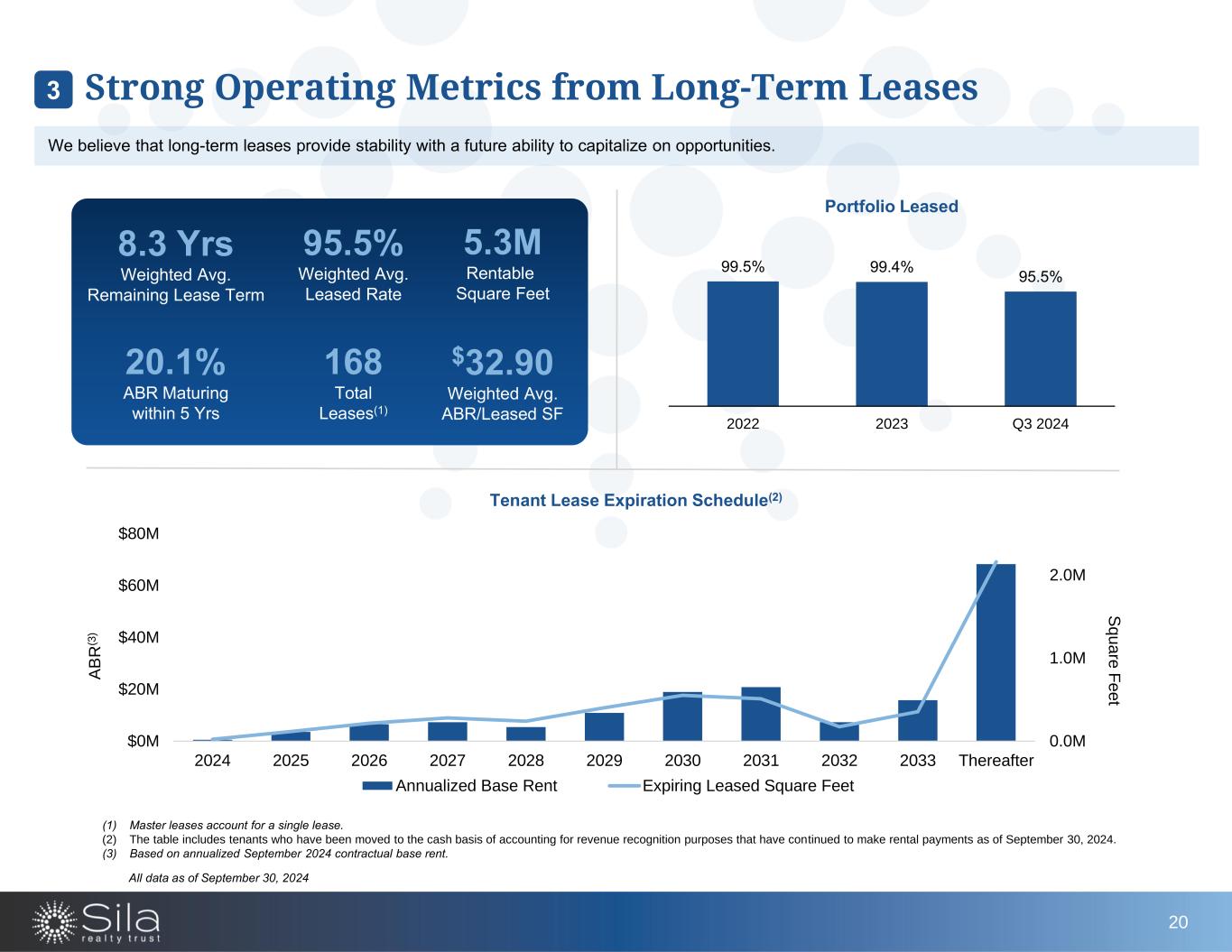

Tenant Lease Expiration Schedule(2) (1) Master leases account for a single lease. (2) The table includes tenants who have been moved to the cash basis of accounting for revenue recognition purposes that have continued to make rental payments as of September 30, 2024. (3) Based on annualized September 2024 contractual base rent. We believe that long-term leases provide stability with a future ability to capitalize on opportunities. 99.5% 99.4% 95.5% 2022 2023 Q3 2024 Portfolio Leased 20.1% ABR Maturing within 5 Yrs 8.3 Yrs Weighted Avg. Remaining Lease Term 168 Total Leases(1) 95.5% Weighted Avg. Leased Rate All data as of September 30, 2024 5.3M Rentable Square Feet $32.90 Weighted Avg. ABR/Leased SF Strong Operating Metrics from Long-Term Leases3 20 0.0M 1.0M 2.0M $0M $20M $40M $60M $80M 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 Thereafter S q u a re F e e t A B R (3 ) Annualized Base Rent Expiring Leased Square Feet

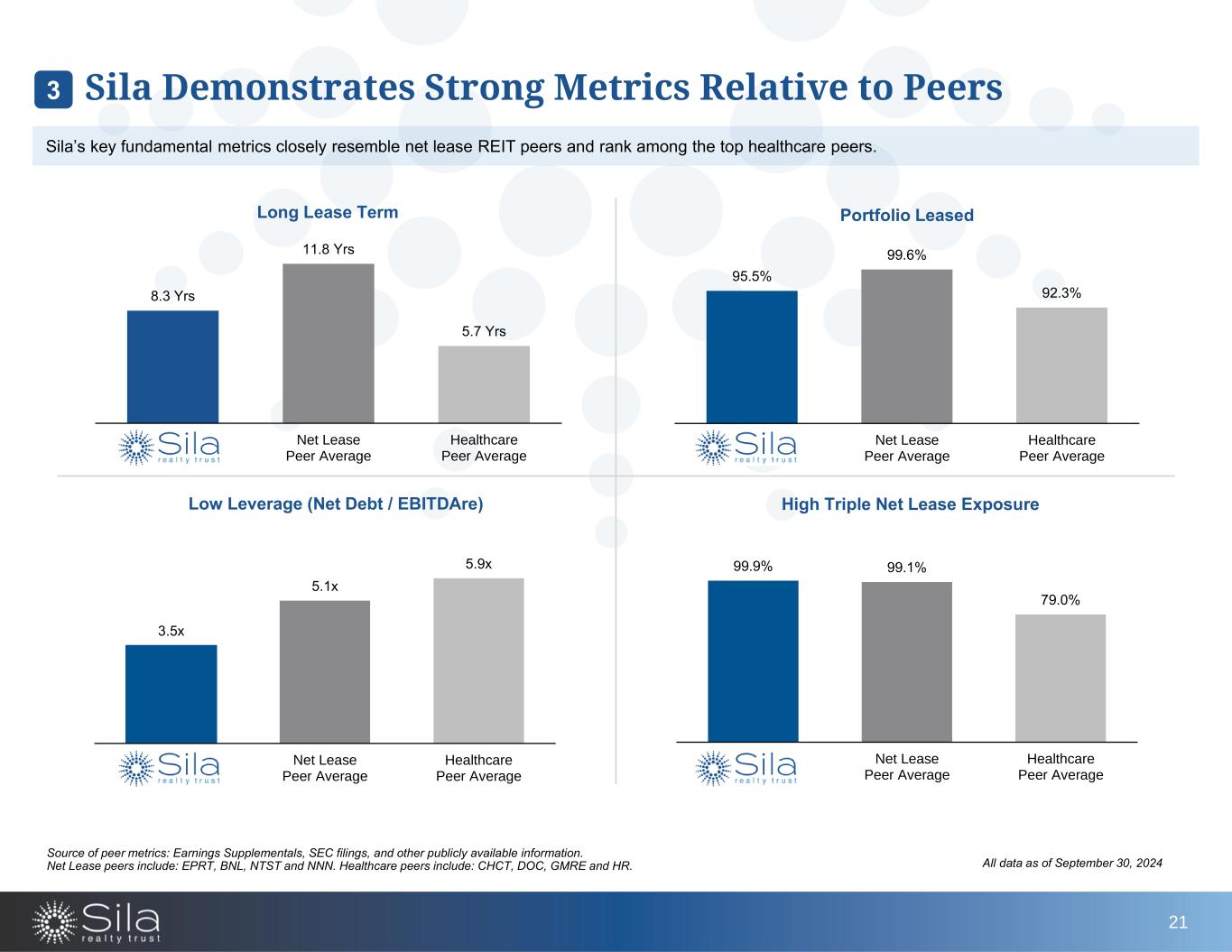

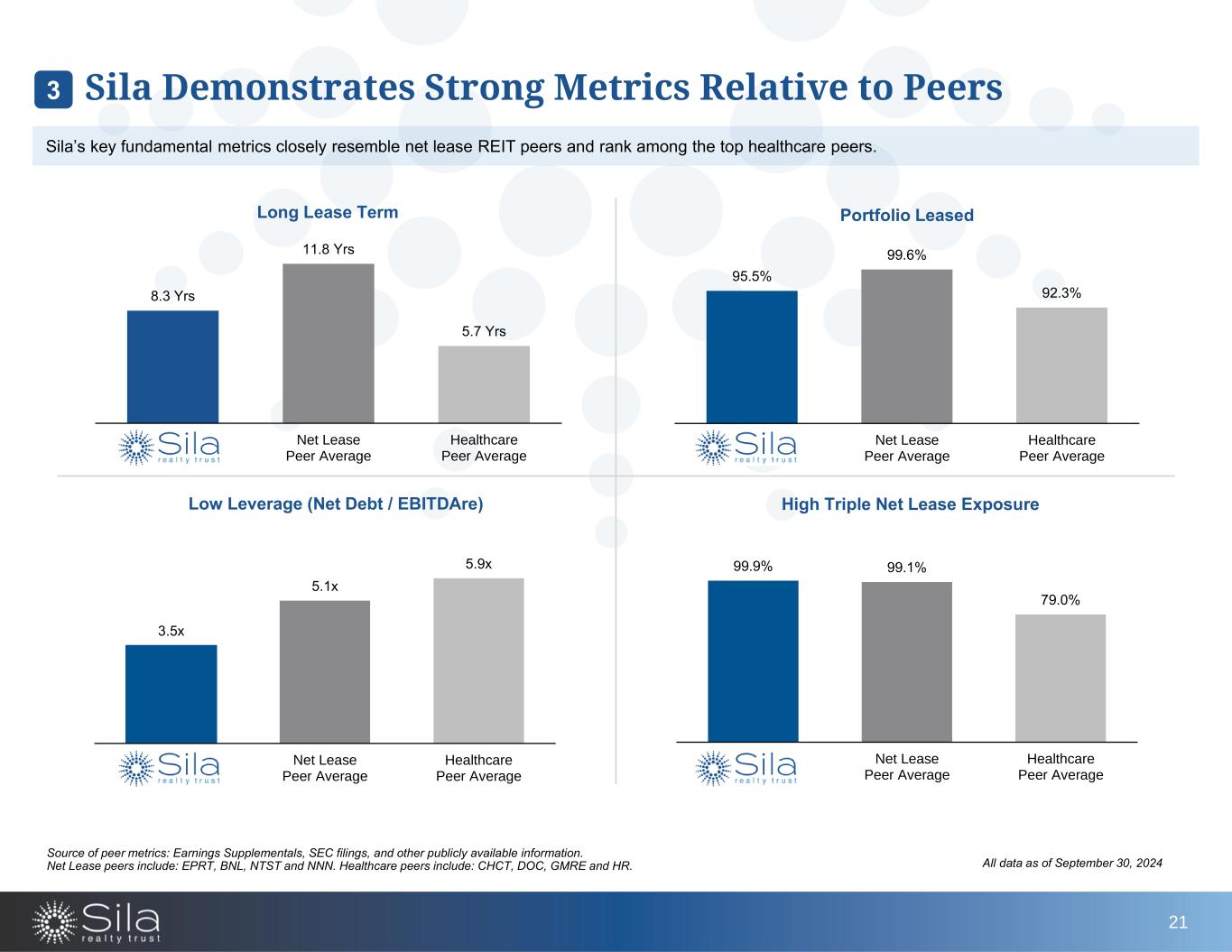

8.3 Yrs 11.8 Yrs 5.7 Yrs SILA Net Lease Peer Average Healthcare Peer Average Long Lease Term 95.5% 99.6% 92.3% SILA Net Lease Peer Average Healthcare Peer Average Portfolio Leased 3.5x 5.1x 5.9x SILA Net Lease Peer Average Healthcare Peer Average Low Leverage (Net Debt / EBITDAre) 99.9% 99.1% 79.0% SILA Net Lease Peer Average Healthcare Peer Average High Triple Net Lease Exposure Sila’s key fundamental metrics closely resemble net lease REIT peers and rank among the top healthcare peers. Source of peer metrics: Earnings Supplementals, SEC filings, and other publicly available information. Net Lease peers include: EPRT, BNL, NTST and NNN. Healthcare peers include: CHCT, DOC, GMRE and HR. All data as of September 30, 2024 Sila Demonstrates Strong Metrics Relative to Peers3 21

Fortified Balance Sheet to Fund Future Growth Fort Smith Healthcare Facility, Arkansas

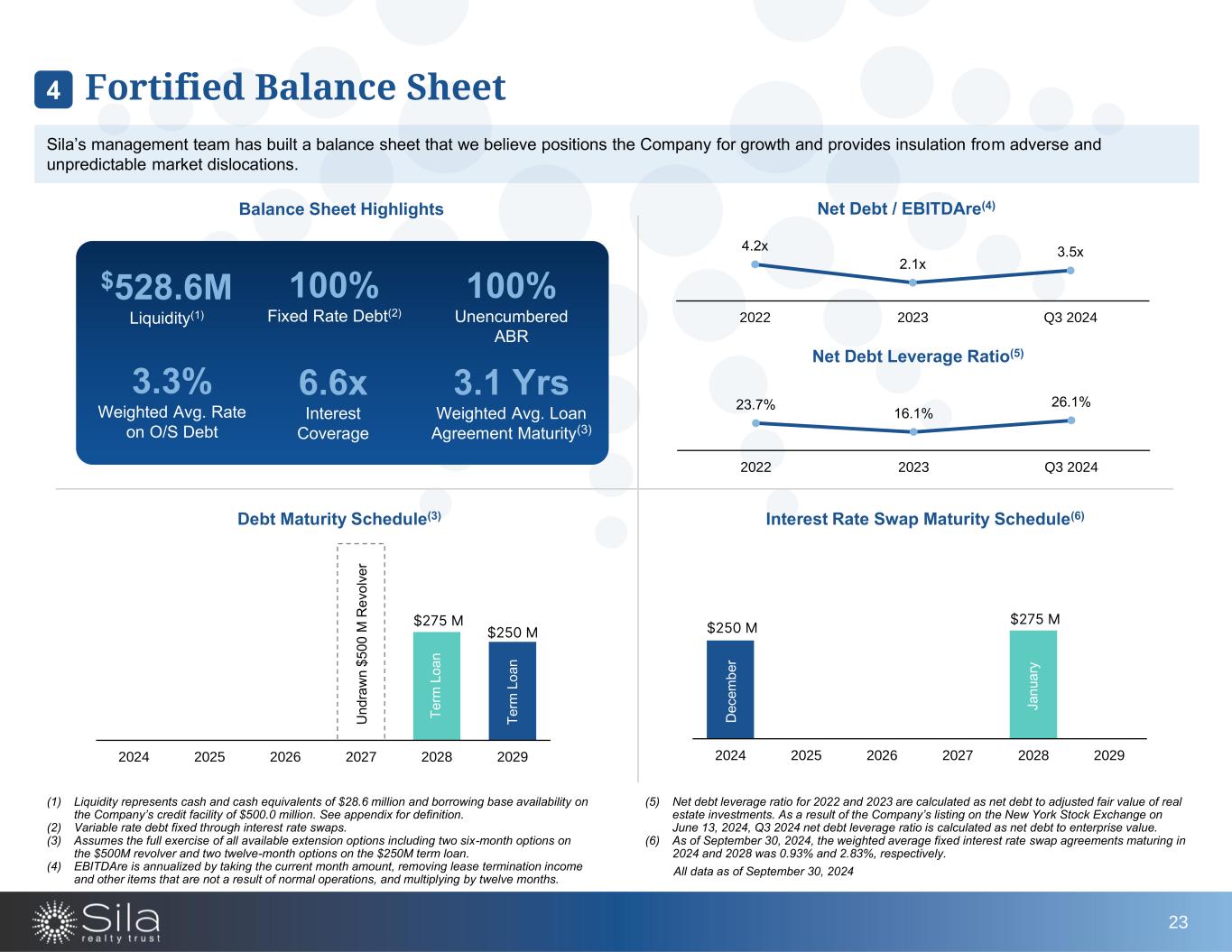

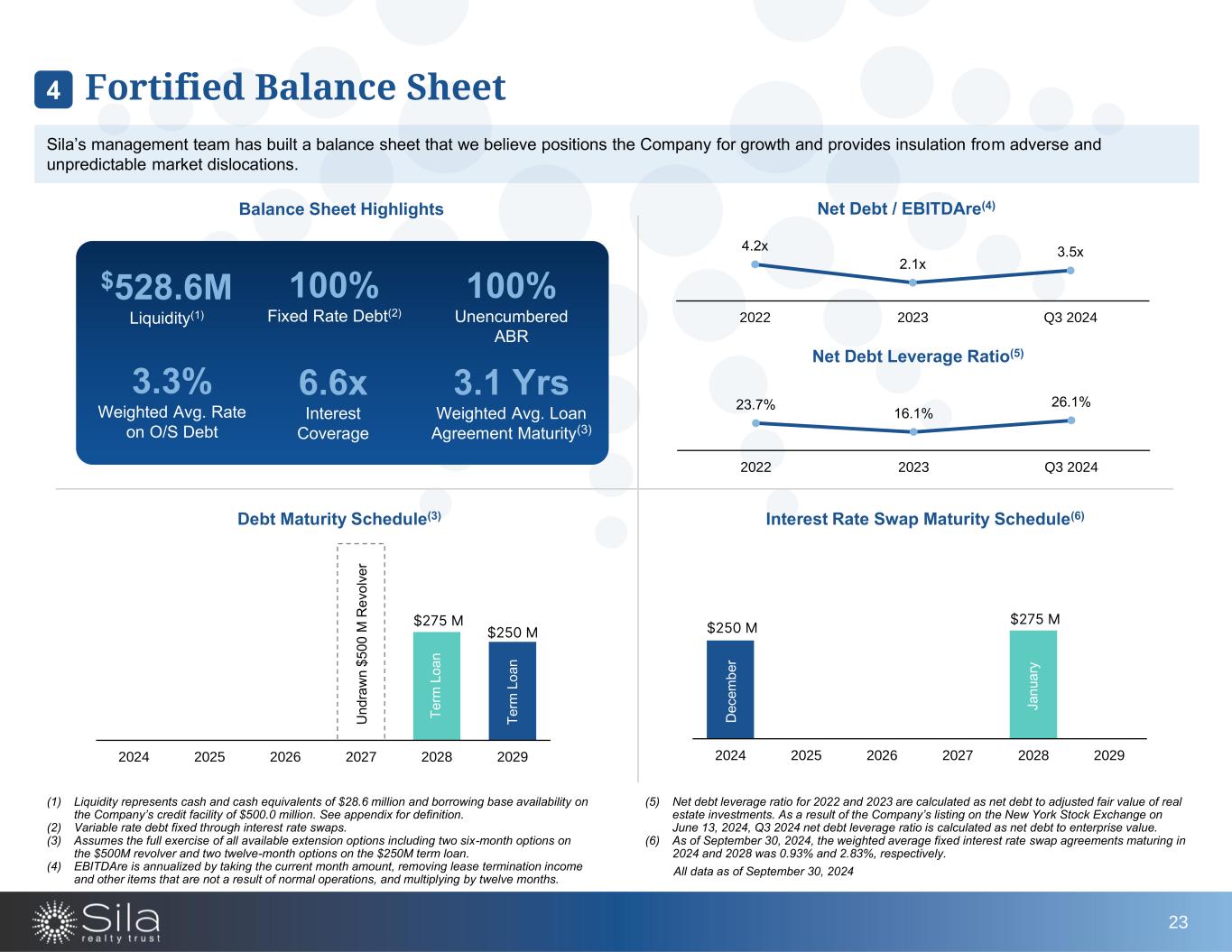

Sila’s management team has built a balance sheet that we believe positions the Company for growth and provides insulation from adverse and unpredictable market dislocations. Debt Maturity Schedule(3) $275 M $250 M 2024 2025 2026 2027 2028 2029 T e rm L o a n U n d ra w n $ 5 0 0 M R e v o lv e r Balance Sheet Highlights (1) Liquidity represents cash and cash equivalents of $28.6 million and borrowing base availability on the Company’s credit facility of $500.0 million. See appendix for definition. (2) Variable rate debt fixed through interest rate swaps. (3) Assumes the full exercise of all available extension options including two six-month options on the $500M revolver and two twelve-month options on the $250M term loan. (4) EBITDAre is annualized by taking the current month amount, removing lease termination income and other items that are not a result of normal operations, and multiplying by twelve months. (5) Net debt leverage ratio for 2022 and 2023 are calculated as net debt to adjusted fair value of real estate investments. As a result of the Company’s listing on the New York Stock Exchange on June 13, 2024, Q3 2024 net debt leverage ratio is calculated as net debt to enterprise value. (6) As of September 30, 2024, the weighted average fixed interest rate swap agreements maturing in 2024 and 2028 was 0.93% and 2.83%, respectively. All data as of September 30, 2024 T e rm L o a n 4.2x 2.1x 3.5x 2022 2023 Q3 2024 Net Debt / EBITDAre(4) 23.7% 16.1% 26.1% 2022 2023 Q3 2024 Net Debt Leverage Ratio(5) 3.3% Weighted Avg. Rate on O/S Debt $528.6M Liquidity(1) 100% Fixed Rate Debt(2) 6.6x Interest Coverage 100% Unencumbered ABR 3.1 Yrs Weighted Avg. Loan Agreement Maturity(3) Fortified Balance Sheet4 23 $250 M $275 M 2024 2025 2026 2027 2028 2029 Interest Rate Swap Maturity Schedule(6) D e c e m b e r J a n u a ry

Sila has an opportunistic ability to continue optimizing our portfolio composition on top of already possessing a curated and sizable assortment of high- quality and diversified healthcare net lease assets as demonstrated by our 2024 investments. Fort Smith Healthcare Facility Fort Smith, Arkansas • $28.3 million contract purchase price • Acquired July 2024 • ~62,500 SF inpatient rehabilitation facility • 100% leased to Mercy Rehabilitation Hospital • Two-story, 50-bed facility built in 2021 • Tenant is a joint venture between Mercy Hospital Fort Smith, an affiliate of Mercy Health of Missouri, a large integrated healthcare system with over 5,000 staffed beds and 2,400 physicians, and Lifepoint Health, a leading national healthcare provider with 60 community hospitals and more than 60 rehabilitation behavioral health facilities In p a ti e n t R e h a b il it a ti o n F a c il it y Mezzanine Loans for Developments in Lynchburg, Virginia • Two mezzanine loans for the development of an inpatient rehabilitation facility and behavioral healthcare facility, with loan amounts of $12.5 million and $5.0 million, respectively • Loans closed November 2024 • Loans include purchase options for Sila for each property upon completion of construction • ~62,500 SF inpatient rehabilitation facility and ~60,400 SF behavioral healthcare facility • 100% pre-leased to a joint venture of leading healthcare operators/systems • Being constructed by a leading national healthcare developer and general contractor M e z z a n in e L o a n s Select Transactions Demonstrating Investment Strategy4 24 Reading Healthcare Facility Reading, Pennsylvania • $10.5 million contract purchase price • Acquired May 2024 • ~30,000 SF medical outpatient building • 100% leased to Reading Behavioral Healthcare • Two-story building on campus of 144-bed Tower Behavioral Health facility • Tenant is joint venture between Acadia Healthcare, the largest provide of behavioral healthcare services in the U.S., and Tower Health, a not-for-profit regional healthcare system with leading-edge services in three acute care hospitals, a surgical hospital, and a children's hospital M e d ic a l O u tp a ti e n t B u il d in g

Experienced Leadership Team NYSE Listing Day | June 13, 2024

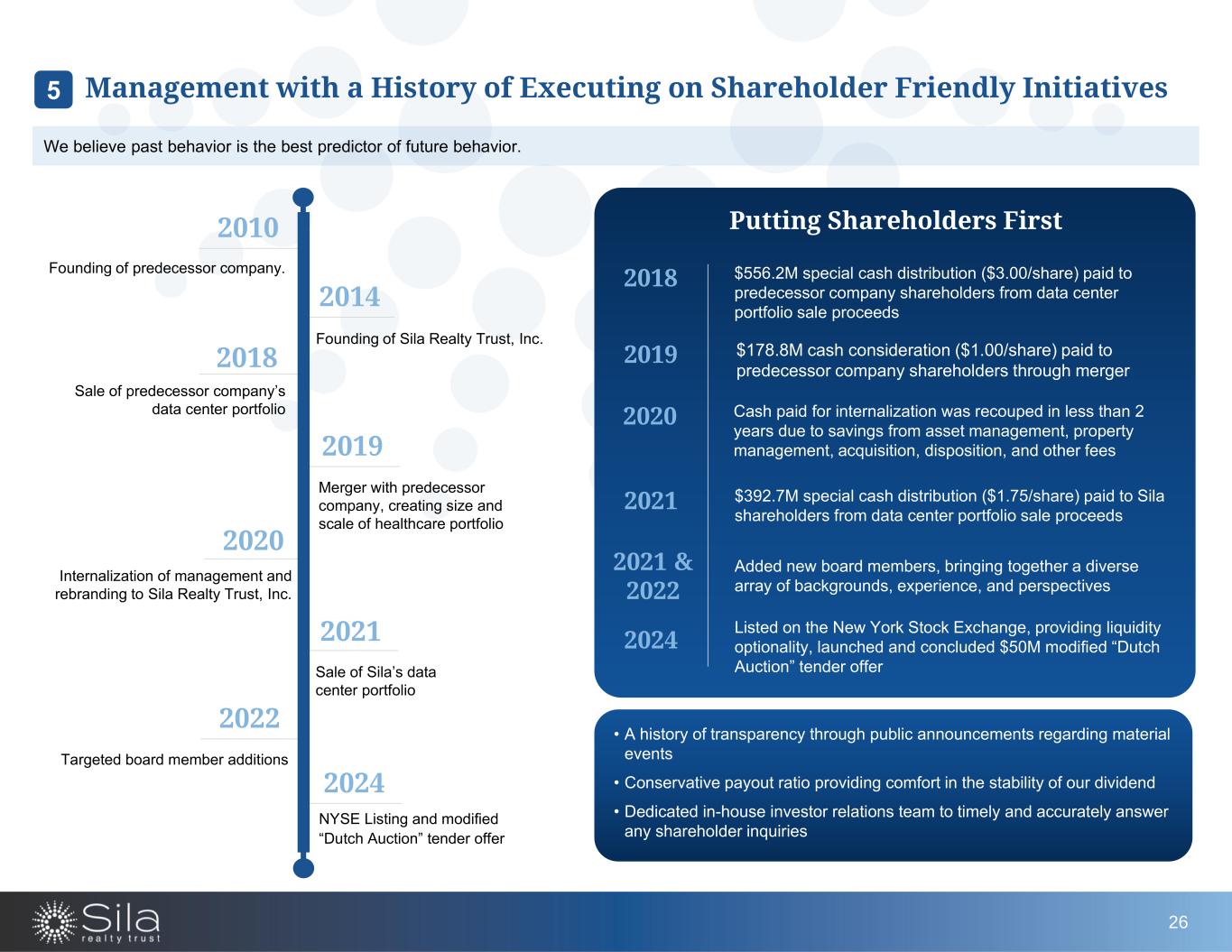

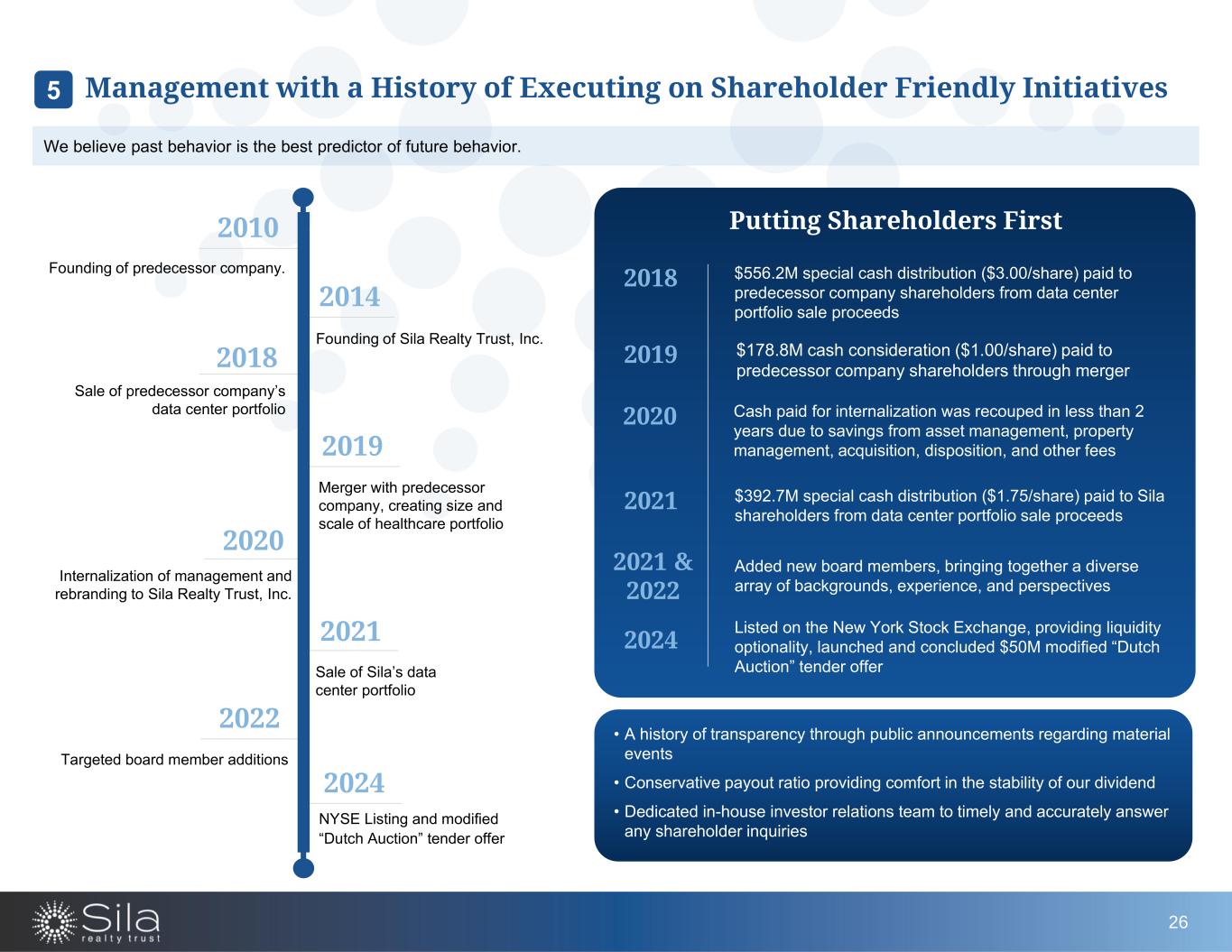

Founding of Sila Realty Trust, Inc. 2014 Founding of predecessor company. 2010 Sale of predecessor company’s data center portfolio 2018 Merger with predecessor company, creating size and scale of healthcare portfolio 2019 Internalization of management and rebranding to Sila Realty Trust, Inc. 2020 Sale of Sila’s data center portfolio 2021 Targeted board member additions 2022 Putting Shareholders First • A history of transparency through public announcements regarding material events • Conservative payout ratio providing comfort in the stability of our dividend • Dedicated in-house investor relations team to timely and accurately answer any shareholder inquiries $556.2M special cash distribution ($3.00/share) paid to predecessor company shareholders from data center portfolio sale proceeds 2018 2019 $178.8M cash consideration ($1.00/share) paid to predecessor company shareholders through merger 2020 Cash paid for internalization was recouped in less than 2 years due to savings from asset management, property management, acquisition, disposition, and other fees $392.7M special cash distribution ($1.75/share) paid to Sila shareholders from data center portfolio sale proceeds 2021 Added new board members, bringing together a diverse array of backgrounds, experience, and perspectives 2021 & 2022 Management with a History of Executing on Shareholder Friendly Initiatives5 26 We believe past behavior is the best predictor of future behavior. NYSE Listing and modified “Dutch Auction” tender offer 2024 Listed on the New York Stock Exchange, providing liquidity optionality, launched and concluded $50M modified “Dutch Auction” tender offer 2024

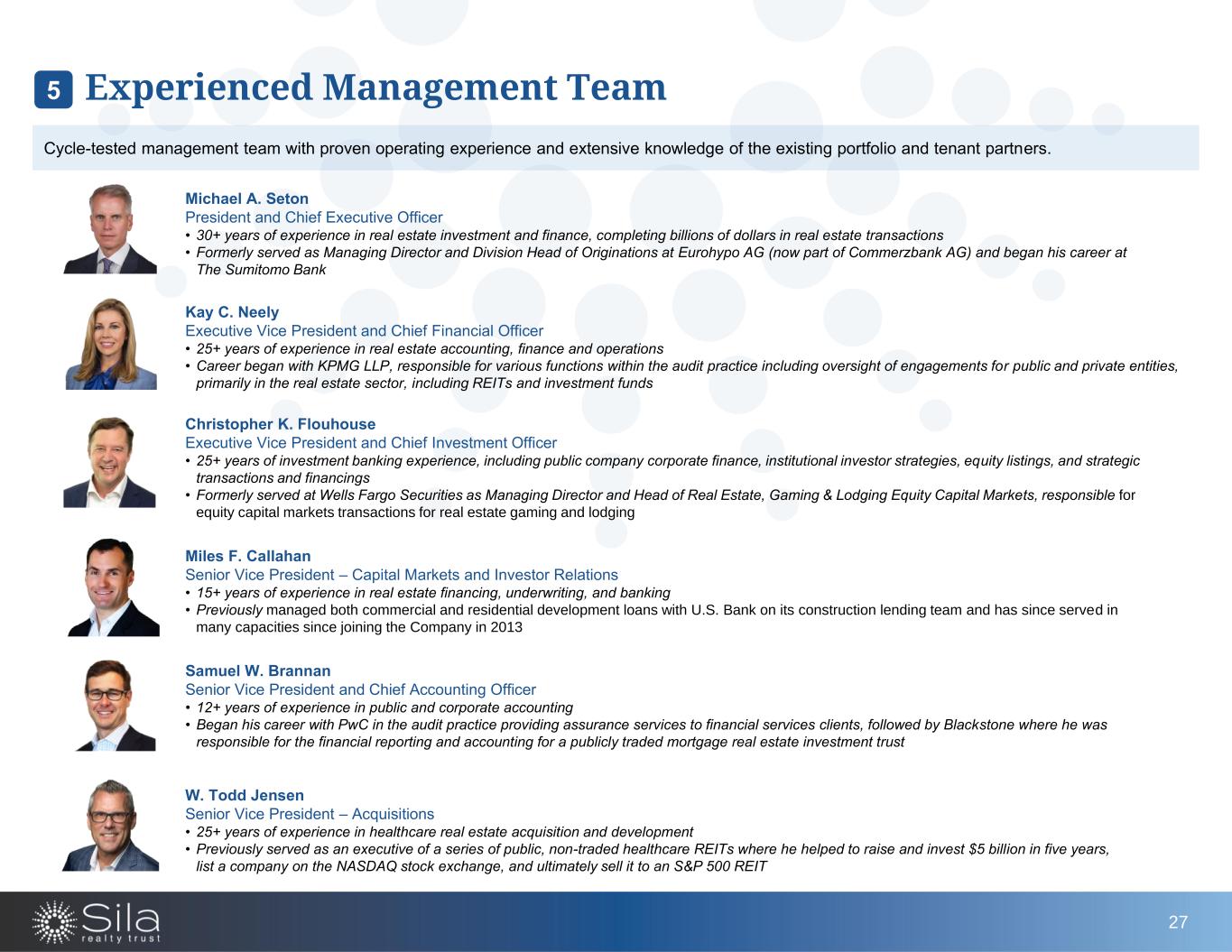

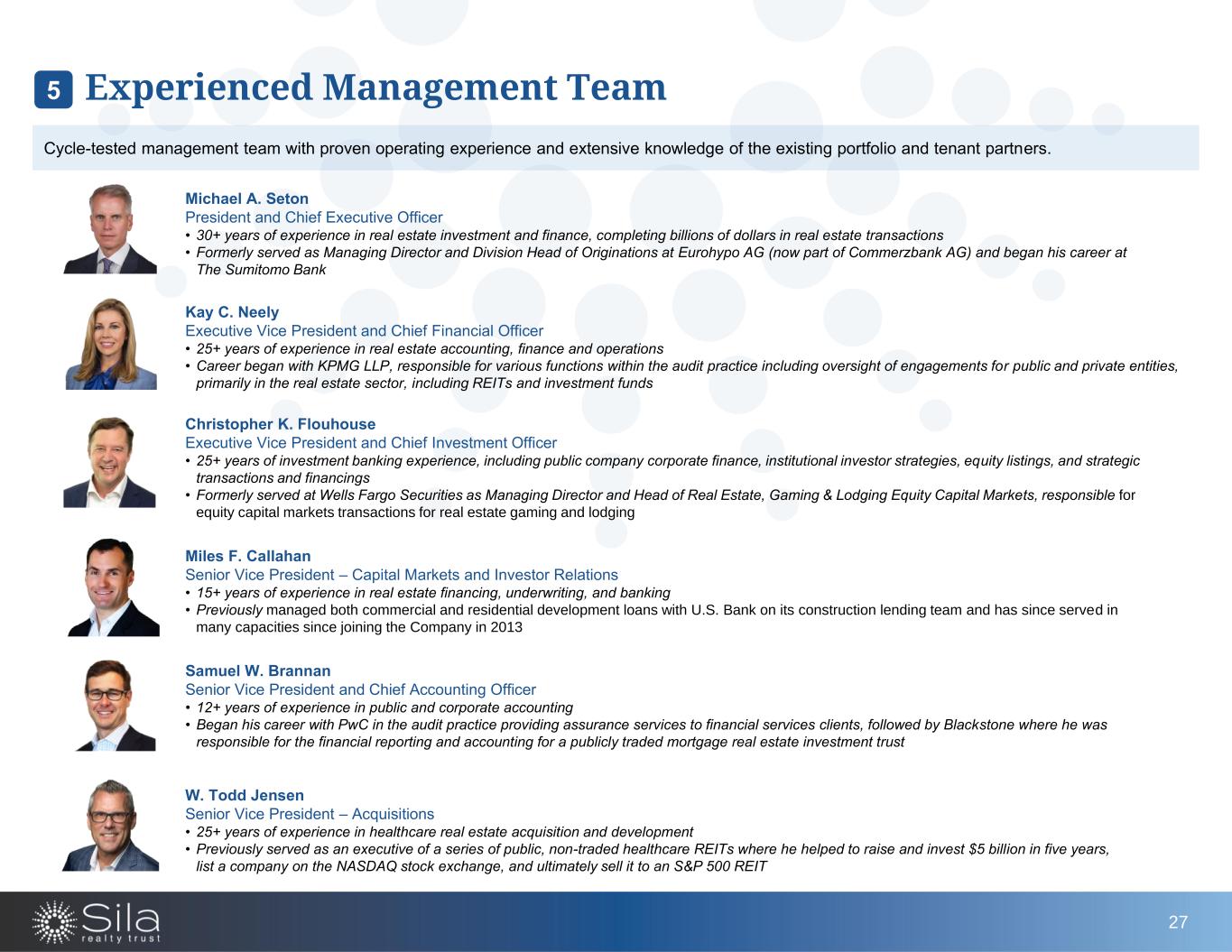

Cycle-tested management team with proven operating experience and extensive knowledge of the existing portfolio and tenant partners. Experienced Management Team5 27 Michael A. Seton President and Chief Executive Officer • 30+ years of experience in real estate investment and finance, completing billions of dollars in real estate transactions • Formerly served as Managing Director and Division Head of Originations at Eurohypo AG (now part of Commerzbank AG) and began his career at The Sumitomo Bank Kay C. Neely Executive Vice President and Chief Financial Officer • 25+ years of experience in real estate accounting, finance and operations • Career began with KPMG LLP, responsible for various functions within the audit practice including oversight of engagements for public and private entities, primarily in the real estate sector, including REITs and investment funds Christopher K. Flouhouse Executive Vice President and Chief Investment Officer • 25+ years of investment banking experience, including public company corporate finance, institutional investor strategies, equity listings, and strategic transactions and financings • Formerly served at Wells Fargo Securities as Managing Director and Head of Real Estate, Gaming & Lodging Equity Capital Markets, responsible for equity capital markets transactions for real estate gaming and lodging Samuel W. Brannan Senior Vice President and Chief Accounting Officer • 12+ years of experience in public and corporate accounting • Began his career with PwC in the audit practice providing assurance services to financial services clients, followed by Blackstone where he was responsible for the financial reporting and accounting for a publicly traded mortgage real estate investment trust W. Todd Jensen Senior Vice President – Acquisitions • 25+ years of experience in healthcare real estate acquisition and development • Previously served as an executive of a series of public, non-traded healthcare REITs where he helped to raise and invest $5 billion in five years, list a company on the NASDAQ stock exchange, and ultimately sell it to an S&P 500 REIT Miles F. Callahan Senior Vice President – Capital Markets and Investor Relations • 15+ years of experience in real estate financing, underwriting, and banking • Previously managed both commercial and residential development loans with U.S. Bank on its construction lending team and has since served in many capacities since joining the Company in 2013

Our Board of Directors brings industry insights, strong business expertise and diverse perspectives to Sila. * Denotes Independent Director Jonathan Kuchin, Chairman of the Board* Member of Audit Committee • Formerly Tax Partner at PWC - Focused on public and private REITS, SEC reporting for public REITS and income tax accounting • Prior experience includes accounting for IPOs, public financings, mergers and acquisitions Michael A. Seton, Director President and Chief Executive Officer of Sila Realty Trust, Inc. • Led Sila Realty Trust, Inc. and its predecessors since their founding • Previously served as Managing Director and Division Head at Eurohypo AG, now part of Commerzbank AG, leading in the origination, structuring, closing, and syndication of real estate findings for private developers, real estate companies, and trusts Z. Jamie Behar, Director* Audit Committee Chair and Member of Nominating & Corporate Governance Committee • Board member for Armour Residential REIT, Shurgard Self Storage, and Benefit Street Partners Multifamily Trust • Former board member of Sunstone Hotel Investors, Forest City Realty Trust, Gramercy Property Trust, and Broadstone Real Estate Access Fund • Formerly Managing Director for GM Investment Management Corp, previously serving as Portfolio Manager and responsible for the management of approximately $12 Billion of primarily private and publicly traded real estate Adrienne Kirby, Director* Compensation Committee Chair and Member of Nominating & Corporate Governance Committee • Board member of Greenway Health, TigerConnect, and Doctivity Health • Formerly Executive Chairman and CEO of Cooper University Health Care where she led the implementation and transformation from a safety net hospital to a regional academic tertiary care center and medical school Verett Mims, Director* Member of Audit Committee and Compensation Committee • Board member of Sunstone Hotel Investors and the Steppenwolf Theatre of Chicago • CFO at Blum Capital Partners, LP, responsible for Financial, Operations, Compliance, and Tax functions of the firm • Previously Assistant Treasurer at The Boeing Company where she oversaw their Global Treasury and International Finance Operations Roger Pratt, Director* Nominating & Corporate Governance Committee Chair and Member of Compensation Committee • Formerly Managing Director for Prudential Real Estate Investors where he oversaw the global management of over $50 Billion in gross assets • Also serves on the Wood Center Real Estate Studies Advisory Board at the University of NC, the Board of Directors of the Schumann Fund for NJ, and the Board of Directors of The George Washington University Museum and The Textile Museum in Washington, D.C. Robust Corporate Governance Led by Experienced Board of Directors 5 28

✓ Experienced Board of Directors, Audit Committee, Compensation Committee, and Nominating and Corporate Governance Committee ✓ Majority independent Board of Directors (83%), who bring a diverse array of backgrounds, experience, and perspectives ✓ 10+ years as an SEC registrant (since inception) Board Composition ✓ Non-staggered annual elections of Board of Directors ✓ Committee Charters (available on website) ✓ Code of Business Conduct and Ethics (available on website) Board Procedures ✓ Insider trading and minimum stock ownership policies ✓ Annual certifications and adherence to Company policies ✓ Whistleblower policy in place ✓ Clawback Policy for executive officers Board Policies Commitment to Corporate Governance5 29

Commitment to Corporate Responsibility Tree Planting Volunteer Event | April 24, 2024

Sila believes in maintaining a healthy, prosperous, and sustainable work environment through stewardship of the environment, the community, the employees, and strong corporate governance practices. • Sila seeks to own healthcare properties that are important to the communities they serve • Sila promotes community involvement with monetary contributions and charitable efforts, with 100.5 hours volunteered thus far in 2024 • All employees complete annual training to prevent harassment and discrimination • Our compensation and benefits program is designed to attract and retain talented personnel • We strive to create and maintain an inclusive work environment that values the uniqueness of each individual • Implemented green leasing initiative with standardized lease forms for tenants in our healthcare portfolio • Planted over 60 native trees and shrubs for a corporate volunteer event • Reduced corporate office footprint by 57% and implemented hybrid work schedule • New corporate office is in the world’s first WELL pre-certified community, designed to connect occupants with nature, and support the health and well-being of tenants and the wider community EnvironmentalSocial • Diversity in board makeup: 5 independent members • Annual election of board members by stockholders • Annually, all employees and the board must attest to the code of conduct and information systems policies • All employees and the board complete ongoing monthly and quarterly cybersecurity training, respectively Governance Corporate Office Certifications Philanthropic Initiatives Responsibility and Philanthropy 6 31

Appendix Marana Healthcare Facility, Arizona

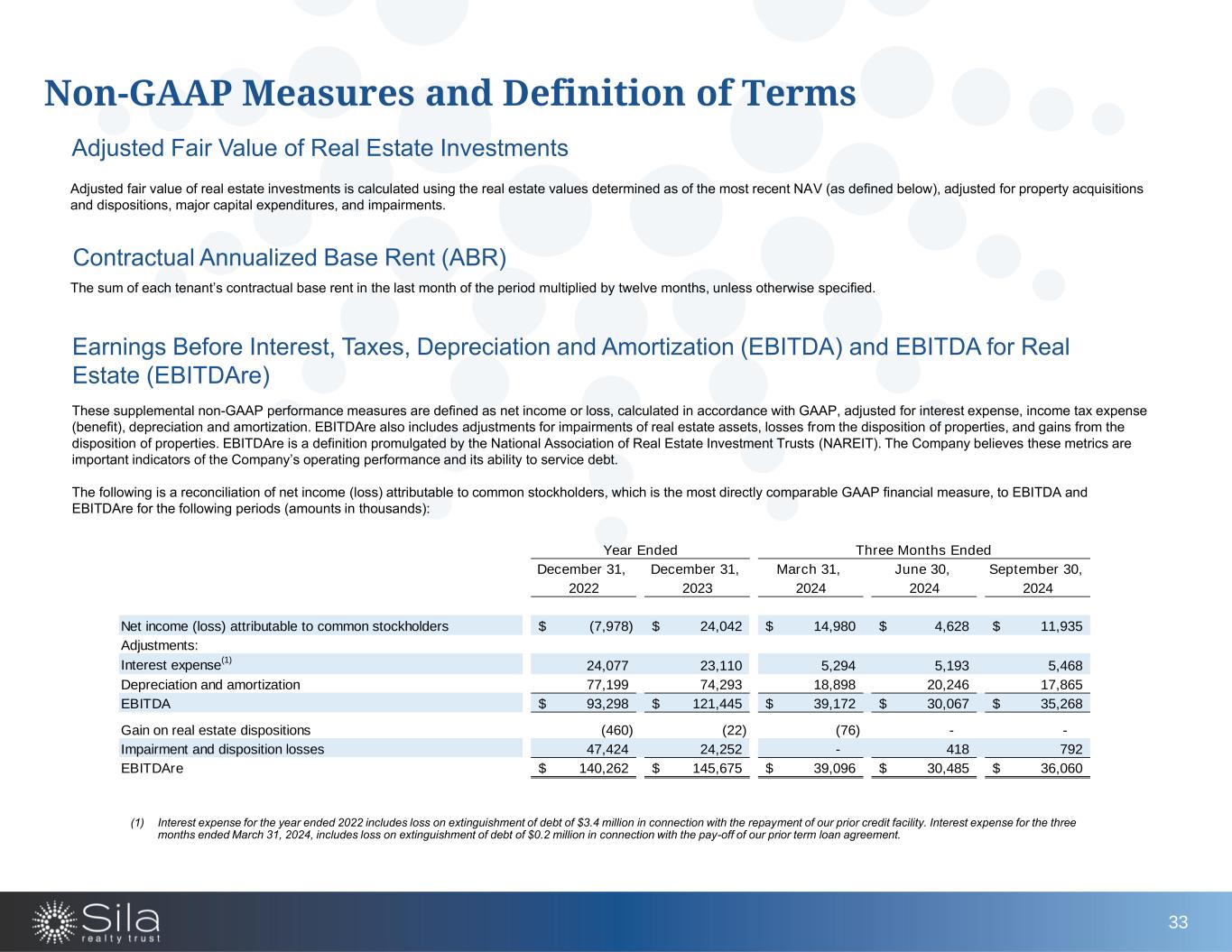

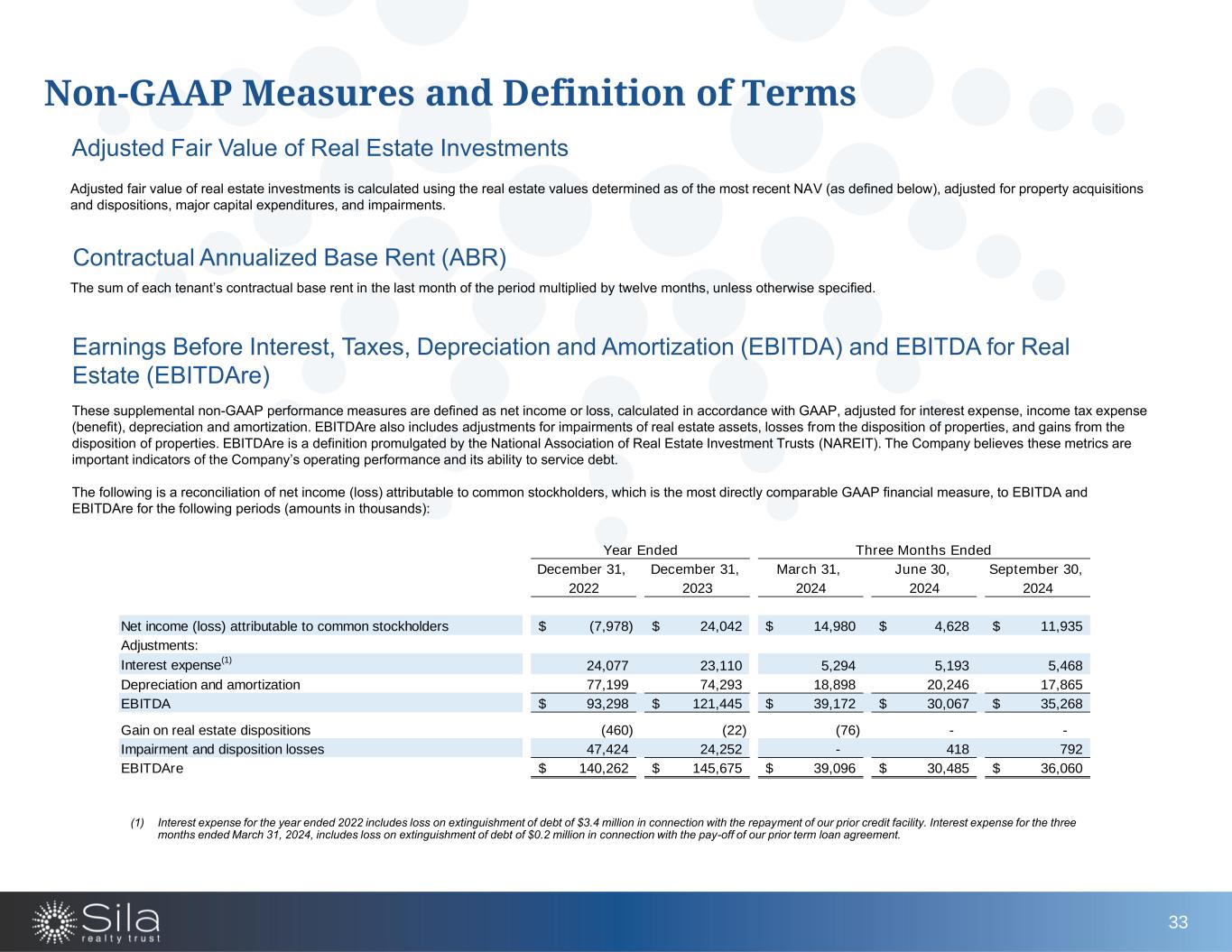

Non-GAAP Measures and Definition of Terms Adjusted Fair Value of Real Estate Investments Adjusted fair value of real estate investments is calculated using the real estate values determined as of the most recent NAV (as defined below), adjusted for property acquisitions and dispositions, major capital expenditures, and impairments. Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) and EBITDA for Real Estate (EBITDAre) These supplemental non-GAAP performance measures are defined as net income or loss, calculated in accordance with GAAP, adjusted for interest expense, income tax expense (benefit), depreciation and amortization. EBITDAre also includes adjustments for impairments of real estate assets, losses from the disposition of properties, and gains from the disposition of properties. EBITDAre is a definition promulgated by the National Association of Real Estate Investment Trusts (NAREIT). The Company believes these metrics are important indicators of the Company’s operating performance and its ability to service debt. The following is a reconciliation of net income (loss) attributable to common stockholders, which is the most directly comparable GAAP financial measure, to EBITDA and EBITDAre for the following periods (amounts in thousands): (1) Interest expense for the year ended 2022 includes loss on extinguishment of debt of $3.4 million in connection with the repayment of our prior credit facility. Interest expense for the three months ended March 31, 2024, includes loss on extinguishment of debt of $0.2 million in connection with the pay-off of our prior term loan agreement. Contractual Annualized Base Rent (ABR) The sum of each tenant’s contractual base rent in the last month of the period multiplied by twelve months, unless otherwise specified. December 31, December 31, March 31, June 30, September 30, 2022 2023 2024 2024 2024 Net income (loss) attributable to common stockholders (7,978)$ 24,042$ 14,980$ 4,628$ 11,935$ Adjustments: Interest expense (1) 24,077 23,110 5,294 5,193 5,468 Depreciation and amortization 77,199 74,293 18,898 20,246 17,865 EBITDA 93,298$ 121,445$ 39,172$ 30,067$ 35,268$ Gain on real estate dispositions (460) (22) (76) - - Impairment and disposition losses 47,424 24,252 - 418 792 EBITDAre 140,262$ 145,675$ 39,096$ 30,485$ 36,060$ Year Ended Three Months Ended 33

Non-GAAP Measures and Definition of Terms Earnings Before Interest, Taxes, Depreciation, Amortization, Rent and Management Fees (EBITDARM) The Company utilizes EBITDARM, a supplemental non-GAAP performance measure, to evaluate the core operations of our tenants and/or guarantors (together, the “Obligor”) of our properties. An Obligor’s reported EBITDARM may be adjusted for certain non-recurring items or items not core to operations. Management believes such adjustments are reasonable and necessary to evaluate Obligor performance. Most Obligor financial statements are unaudited, and we have not independently verified any financial information received from Obligors and, therefore, we cannot confirm that such information is accurate or complete. EBITDARM Coverage Represents the ratio of EBITDARM of our reporting Obligors, divided by either (i) in the case of tenant individual property level reporting, the rent payable to the Company for the related period, or (ii) in the case of tenant multiple property level reporting, or in the case of guarantor reporting, total rent reported in its financial statements. EBITDARM Coverage is one indicator of an Obligor’s ability to generate sufficient cash flows to cover its rental obligations. This ratio is based on the latest financial statements available to the Company and is calculated on a trailing twelve-month basis, when available and appropriate. For reporting purposes, the ratio for each Obligor is then weighted based on the annualized base rent of the reporting property. Properties for which Obligor financial statements are excluded include those (i) that are either not available or not sufficiently detailed, (ii) are not operating or are currently unoccupied, (iii) where the Obligor has filed for bankruptcy, or (iv) properties which are not stabilized. Properties with new operations are considered stabilized only upon the earlier to occur of (i) the Obligor generating a 1.25x EBITDARM Coverage ratio, or (ii) twenty-four months after the property has been open for operations. 34

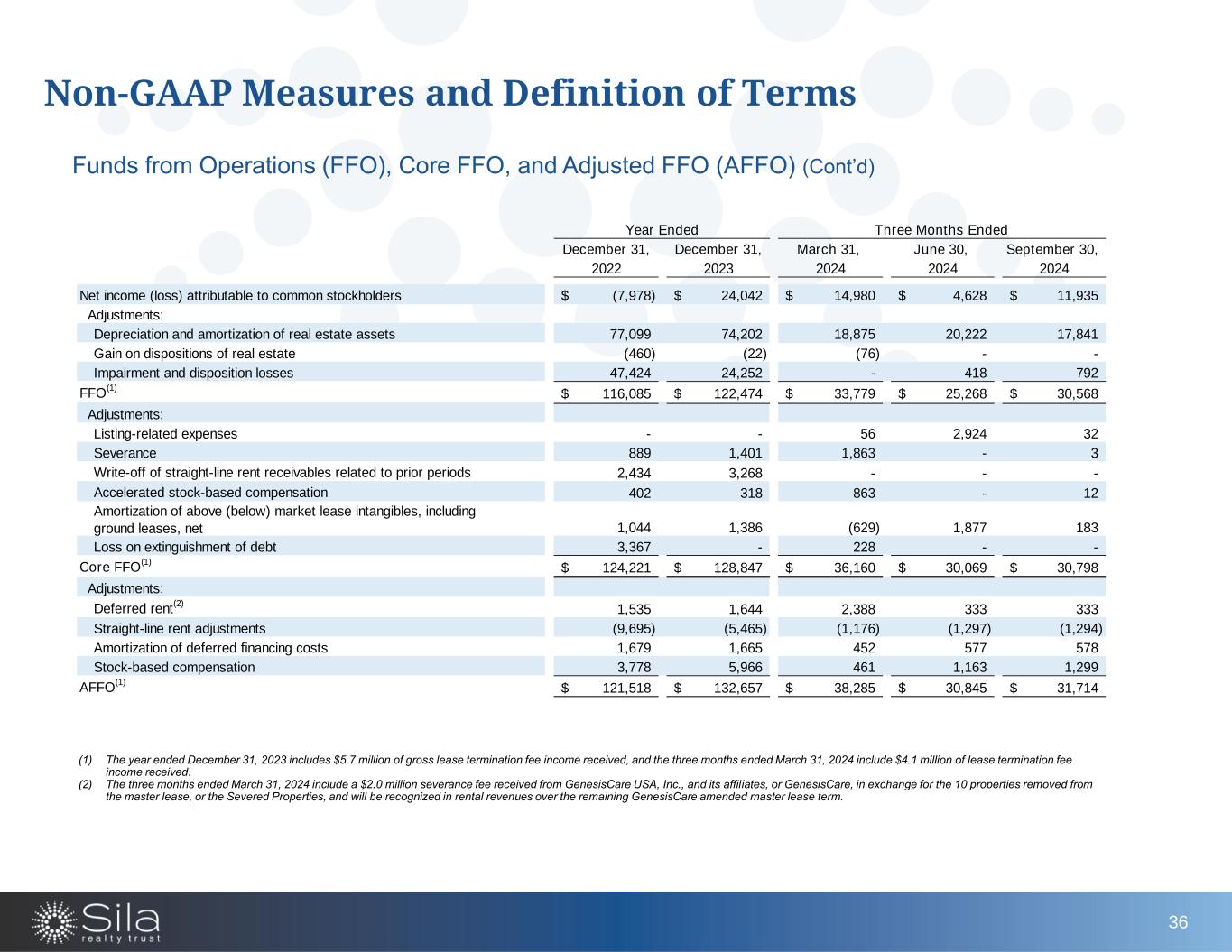

Non-GAAP Measures and Definition of Terms Funds from Operations (FFO), Core FFO, and Adjusted FFO (AFFO) FFO, a non-GAAP financial measure, is calculated consistent with NAREIT’s definition, as net income (loss) (calculated in accordance with GAAP), excluding gains from sales of real estate assets, impairment of real estate assets and disposition losses from sales of real estate assets, plus depreciation and amortization of real estate assets, and after adjustments for unconsolidated partnerships and joint ventures. Adjustments for unconsolidated partnerships and joint ventures will be calculated to reflect FFO on the same basis. To date, the Company does not have any investments in unconsolidated partnerships or joint ventures. The Company believes FFO provides a useful understanding of our performance to investors and to our management, and when compared to year over year, FFO reflects the impact on our operations from trends in occupancy. It should be noted, however, that other REITs may not define FFO in accordance with the current NAREIT definition or may interpret the current NAREIT definition differently than the Company does, making comparisons less meaningful. The Company believes Core FFO, a non-GAAP financial measure, is a supplemental financial performance measure that provides investors with additional information to understand the Company’s sustainable performance. The Company calculates Core FFO by adjusting FFO to remove the effect of certain GAAP non-cash income and expense items, unusual and infrequent items that are not expected to impact its operating performance on an ongoing basis, items that affect comparability to prior periods and/or items that are not related to its core real estate operations. Excluded items include listing-related expenses, severance, write-off of straight-line rent receivables related to prior periods, accelerated stock-based compensation, amortization of above- and below-market lease intangibles (including ground leases) and loss on extinguishment of debt. Other REITs may use different methodologies for calculating Core FFO and, accordingly, the Company’s Core FFO may not be comparable to other REITs. The Company believes AFFO, a non-GAAP financial measure, is a supplemental financial performance measure that provides investors appropriate supplemental information to evaluate the ongoing operations of the Company. AFFO is a metric used by management to evaluate the Company's dividend policy. The Company calculates AFFO by further adjusting Core FFO for the following items: deferred rent, current period straight-line rent adjustments, amortization of deferred financing costs and stock-based compensation. Other REITs may use different methodologies for calculating AFFO and, accordingly, the Company’s AFFO may not be comparable to other REITs. FFO, Core FFO and AFFO should not be considered to be more relevant or accurate than the GAAP methodology in calculating net income (loss) or in its applicability in evaluating the Company’s operational performance. The method used to evaluate the value and performance of real estate under GAAP should be considered a more relevant measure of operating performance and more prominent than the non-GAAP FFO, Core FFO and AFFO measures and the adjustments to GAAP in calculating FFO, Core FFO and AFFO. The following is a reconciliation of net income (loss) attributable to common stockholders, which is the most directly comparable GAAP financial measure, to FFO, Core FFO and AFFO for the following periods (amounts in thousands): 35 Enterprise Value Enterprise value represents market capitalization plus net debt.

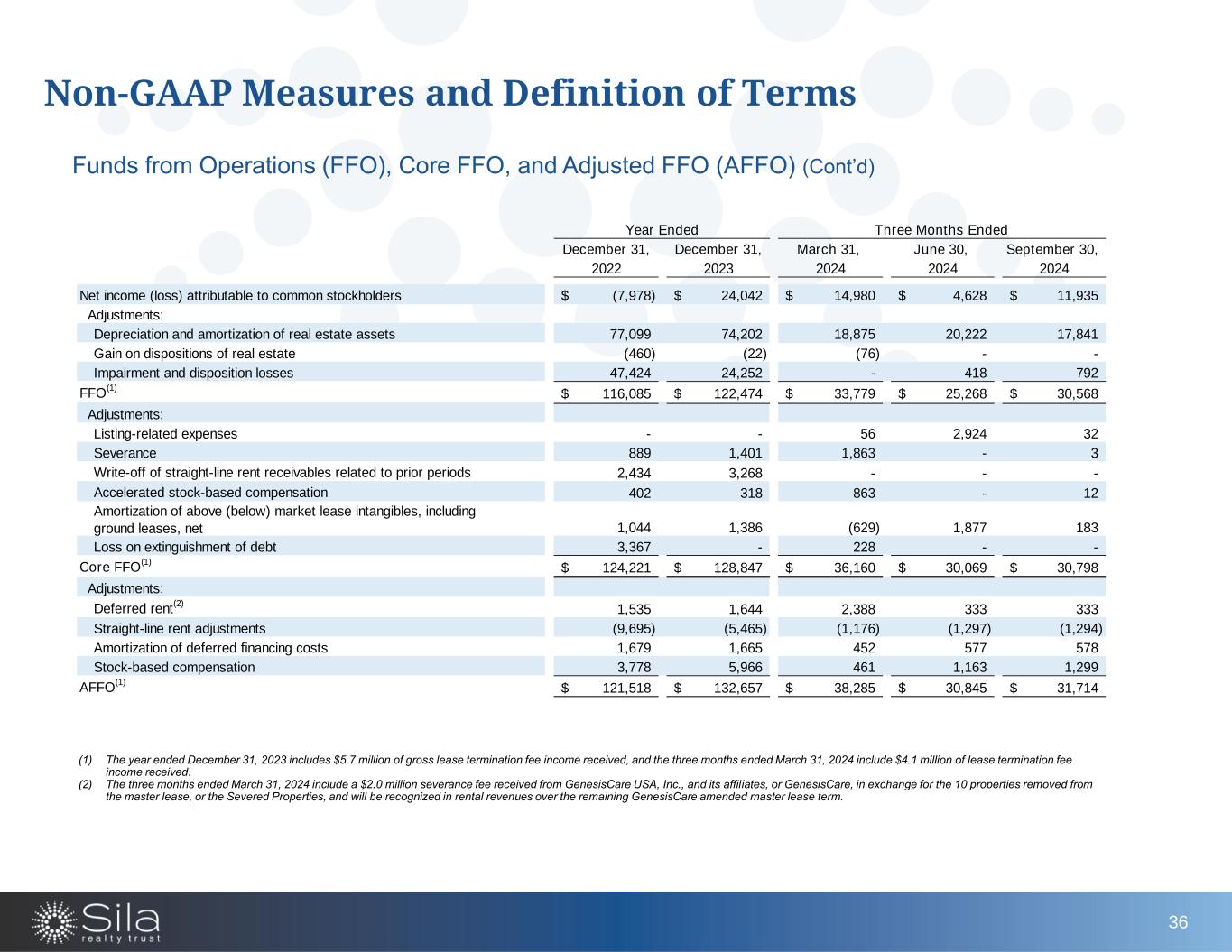

Non-GAAP Measures and Definition of Terms Funds from Operations (FFO), Core FFO, and Adjusted FFO (AFFO) (Cont’d) December 31, December 31, March 31, June 30, September 30, 2022 2023 2024 2024 2024 Net income (loss) attributable to common stockholders (7,978)$ 24,042$ 14,980$ 4,628$ 11,935$ Adjustments: Depreciation and amortization of real estate assets 77,099 74,202 18,875 20,222 17,841 Gain on dispositions of real estate (460) (22) (76) - - Impairment and disposition losses 47,424 24,252 - 418 792 FFO (1) 116,085$ 122,474$ 33,779$ 25,268$ 30,568$ Adjustments: Listing-related expenses - - 56 2,924 32 Severance 889 1,401 1,863 - 3 Write-off of straight-line rent receivables related to prior periods 2,434 3,268 - - - Accelerated stock-based compensation 402 318 863 - 12 Amortization of above (below) market lease intangibles, including ground leases, net 1,044 1,386 (629) 1,877 183 Loss on extinguishment of debt 3,367 - 228 - - Core FFO (1) 124,221$ 128,847$ 36,160$ 30,069$ 30,798$ Adjustments: Deferred rent (2) 1,535 1,644 2,388 333 333 Straight-line rent adjustments (9,695) (5,465) (1,176) (1,297) (1,294) Amortization of deferred financing costs 1,679 1,665 452 577 578 Stock-based compensation 3,778 5,966 461 1,163 1,299 AFFO (1) 121,518$ 132,657$ 38,285$ 30,845$ 31,714$ Year Ended Three Months Ended (1) The year ended December 31, 2023 includes $5.7 million of gross lease termination fee income received, and the three months ended March 31, 2024 include $4.1 million of lease termination fee income received. (2) The three months ended March 31, 2024 include a $2.0 million severance fee received from GenesisCare USA, Inc., and its affiliates, or GenesisCare, in exchange for the 10 properties removed from the master lease, or the Severed Properties, and will be recognized in rental revenues over the remaining GenesisCare amended master lease term. 36

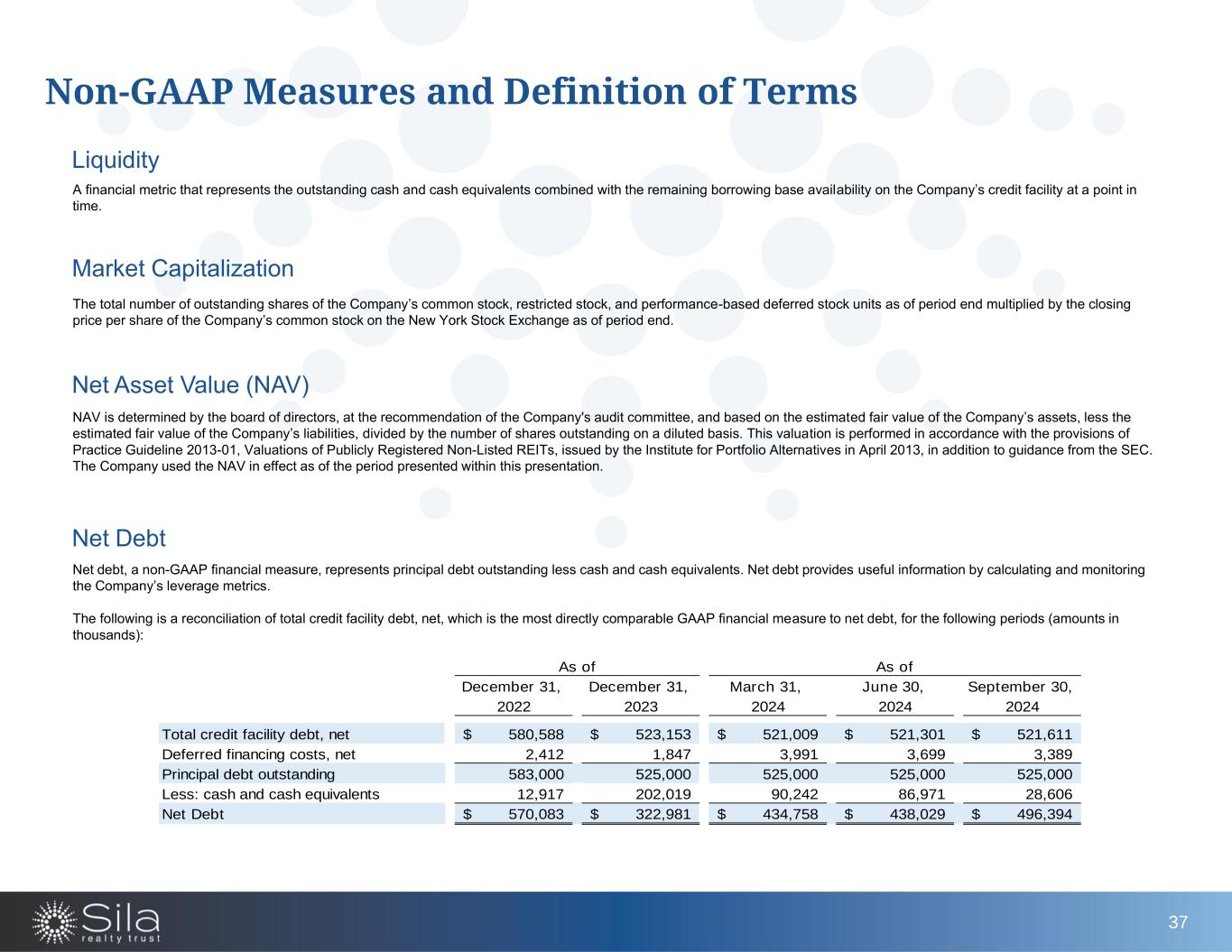

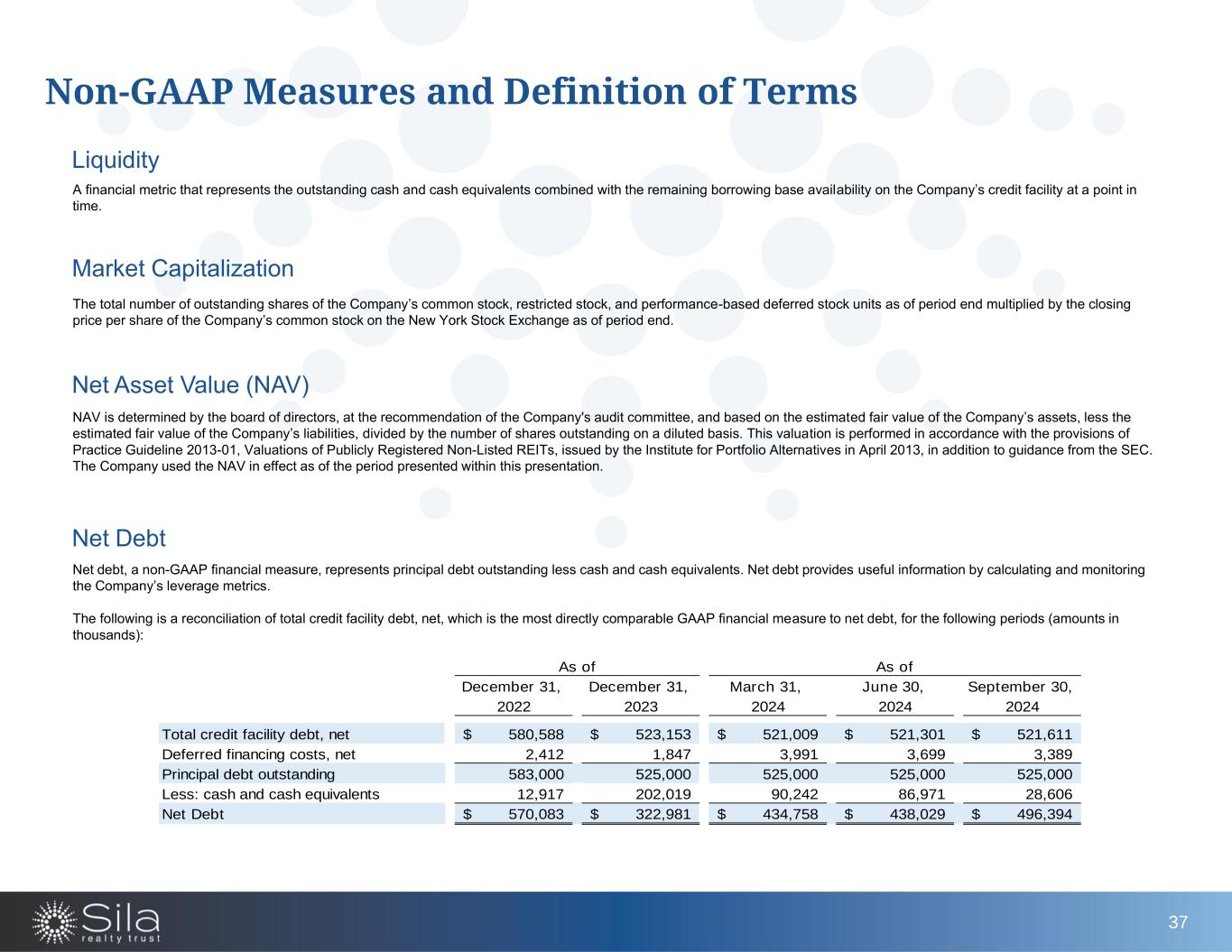

Liquidity A financial metric that represents the outstanding cash and cash equivalents combined with the remaining borrowing base availability on the Company’s credit facility at a point in time. Net Debt Net debt, a non-GAAP financial measure, represents principal debt outstanding less cash and cash equivalents. Net debt provides useful information by calculating and monitoring the Company’s leverage metrics. The following is a reconciliation of total credit facility debt, net, which is the most directly comparable GAAP financial measure to net debt, for the following periods (amounts in thousands): Non-GAAP Measures and Definition of Terms Net Asset Value (NAV) NAV is determined by the board of directors, at the recommendation of the Company's audit committee, and based on the estimated fair value of the Company’s assets, less the estimated fair value of the Company’s liabilities, divided by the number of shares outstanding on a diluted basis. This valuation is performed in accordance with the provisions of Practice Guideline 2013-01, Valuations of Publicly Registered Non-Listed REITs, issued by the Institute for Portfolio Alternatives in April 2013, in addition to guidance from the SEC. The Company used the NAV in effect as of the period presented within this presentation. December 31, December 31, March 31, June 30, September 30, 2022 2023 2024 2024 2024 Total credit facility debt, net 580,588$ 523,153$ 521,009$ 521,301$ 521,611$ Deferred financing costs, net 2,412 1,847 3,991 3,699 3,389 Principal debt outstanding 583,000 525,000 525,000 525,000 525,000 Less: cash and cash equivalents 12,917 202,019 90,242 86,971 28,606 Net Debt 570,083$ 322,981$ 434,758$ 438,029$ 496,394$ As of As of 37 Market Capitalization The total number of outstanding shares of the Company’s common stock, restricted stock, and performance-based deferred stock units as of period end multiplied by the closing price per share of the Company’s common stock on the New York Stock Exchange as of period end.

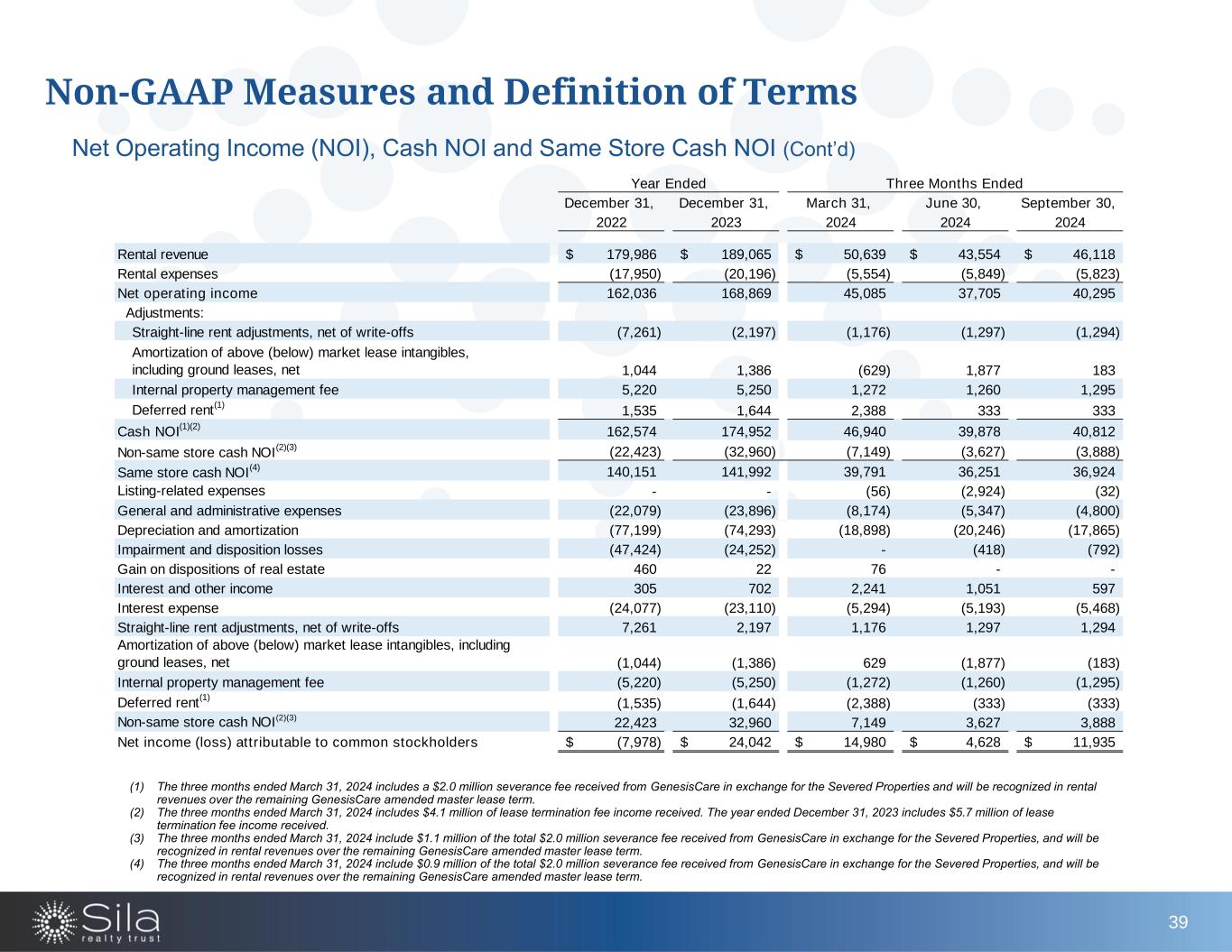

Net Operating Income (NOI), Cash NOI and Same Store Cash NOI NOI, a non-GAAP financial measure, is defined as rental revenue, less rental expenses, on an accrual basis. Cash NOI is calculated to exclude the impact of GAAP adjustments to rental revenue and rental expenses, consisting of straight-line rent adjustments, net of write-offs, amortization of above- and below-market lease intangibles (including ground leases), and internal property management fees, then including deferred rent received in cash, and is used to evaluate the cash-based performance of the Company’s real estate portfolio. Same store Cash NOI is calculated to exclude non-same store cash NOI. The Company believes that NOI and Cash NOI both serve as useful supplements to net income (loss) because they allow investors and management to measure unlevered property-level operating results and to compare these results to the comparable results of other real estate companies on a consistent basis. The Company uses both NOI and Cash NOI to make decisions about resource allocations and to assess the property-level performance of the real estate portfolio. As an indicator of financial performance, neither metric should be considered as an alternative to net income (loss), determined in accordance with GAAP. The Company believes that in order to facilitate a clear understanding of the consolidated historical operating results, both metrics should be evaluated in conjunction with net income (loss) as presented in the consolidated financial statements included on the Company’s Annual Report on Form 10-K filed with the SEC on March 6, 2024. The following is a reconciliation from net income (loss) attributable to common stockholders, which is the most directly comparable GAAP financial measure, to NOI, Cash NOI and Same Store Cash NOI, for the following periods (amounts in thousands): Non-GAAP Measures and Definition of Terms 38

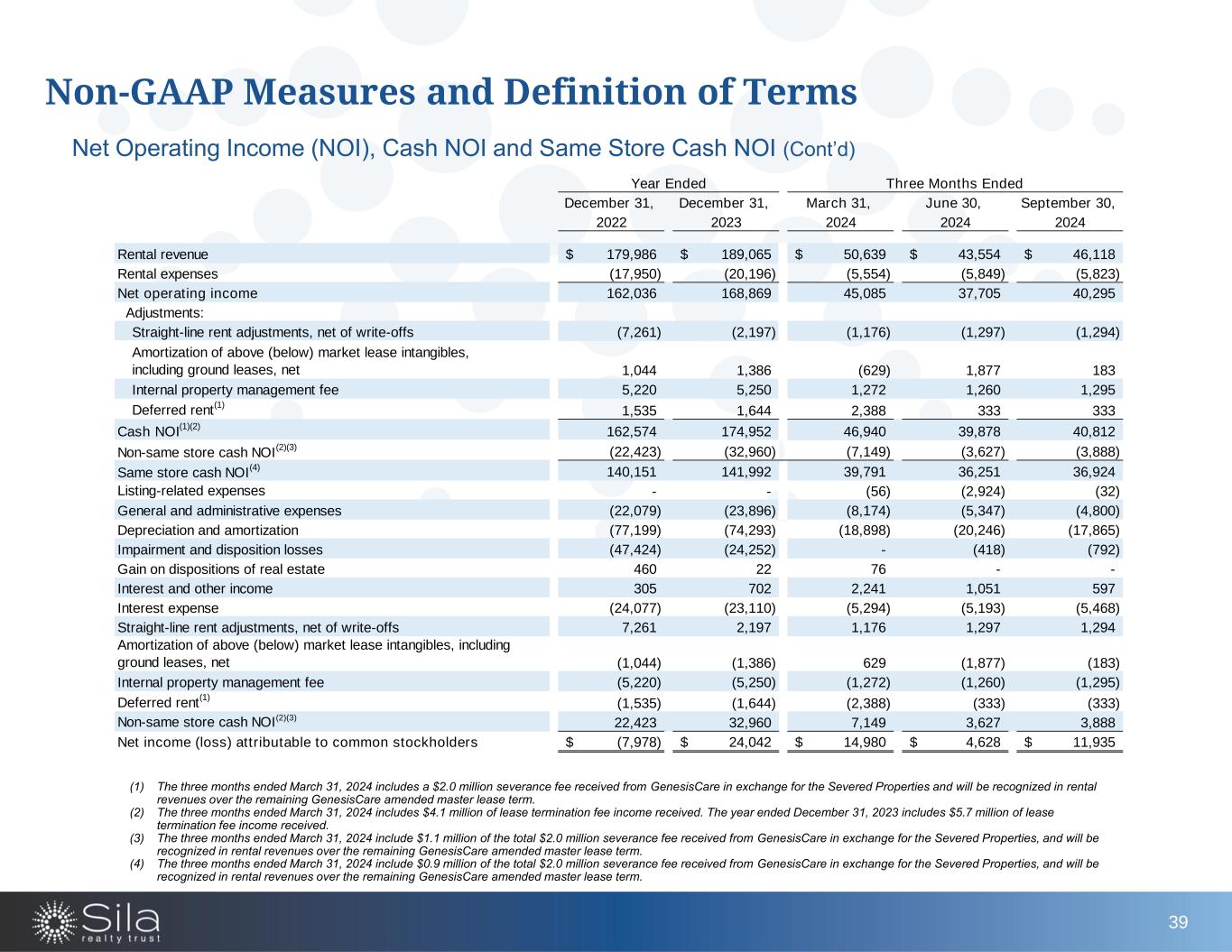

December 31, December 31, March 31, June 30, September 30, 2022 2023 2024 2024 2024 Rental revenue 179,986$ 189,065$ 50,639$ 43,554$ 46,118$ Rental expenses (17,950) (20,196) (5,554) (5,849) (5,823) Net operating income 162,036 168,869 45,085 37,705 40,295 Adjustments: Straight-line rent adjustments, net of write-offs (7,261) (2,197) (1,176) (1,297) (1,294) Amortization of above (below) market lease intangibles, including ground leases, net 1,044 1,386 (629) 1,877 183 Internal property management fee 5,220 5,250 1,272 1,260 1,295 Deferred rent (1) 1,535 1,644 2,388 333 333 Cash NOI (1)(2) 162,574 174,952 46,940 39,878 40,812 Non-same store cash NOI (2)(3) (22,423) (32,960) (7,149) (3,627) (3,888) Same store cash NOI (4) 140,151 141,992 39,791 36,251 36,924 Listing-related expenses - - (56) (2,924) (32) General and administrative expenses (22,079) (23,896) (8,174) (5,347) (4,800) Depreciation and amortization (77,199) (74,293) (18,898) (20,246) (17,865) Impairment and disposition losses (47,424) (24,252) - (418) (792) Gain on dispositions of real estate 460 22 76 - - Interest and other income 305 702 2,241 1,051 597 Interest expense (24,077) (23,110) (5,294) (5,193) (5,468) Straight-line rent adjustments, net of write-offs 7,261 2,197 1,176 1,297 1,294 Amortization of above (below) market lease intangibles, including ground leases, net (1,044) (1,386) 629 (1,877) (183) Internal property management fee (5,220) (5,250) (1,272) (1,260) (1,295) Deferred rent (1) (1,535) (1,644) (2,388) (333) (333) Non-same store cash NOI(2)(3) 22,423 32,960 7,149 3,627 3,888 Net income (loss) attributable to common stockholders (7,978)$ 24,042$ 14,980$ 4,628$ 11,935$ Year Ended Three Months Ended (1) The three months ended March 31, 2024 includes a $2.0 million severance fee received from GenesisCare in exchange for the Severed Properties and will be recognized in rental revenues over the remaining GenesisCare amended master lease term. (2) The three months ended March 31, 2024 includes $4.1 million of lease termination fee income received. The year ended December 31, 2023 includes $5.7 million of lease termination fee income received. (3) The three months ended March 31, 2024 include $1.1 million of the total $2.0 million severance fee received from GenesisCare in exchange for the Severed Properties, and will be recognized in rental revenues over the remaining GenesisCare amended master lease term. (4) The three months ended March 31, 2024 include $0.9 million of the total $2.0 million severance fee received from GenesisCare in exchange for the Severed Properties, and will be recognized in rental revenues over the remaining GenesisCare amended master lease term. 39 Net Operating Income (NOI), Cash NOI and Same Store Cash NOI (Cont’d) Non-GAAP Measures and Definition of Terms

Non-GAAP Measures and Definition of Terms 40 Remaining Lease Term The number of periods remaining in each tenant’s lease, calculated on a weighted average basis using annualized base rent. Rent Escalation The amount of base rent increases that are included within each tenant’s lease, calculated on a weighted average basis using contractual annualized base rent, excluding leases tied to the consumer price index (CPI). Same Store Properties Operating properties that were owned and operated for the entirety of all calendar periods being compared, excluding properties under development, redevelopment, or classified as held for sale. To evaluate properties on a comparable basis, management analyzes metrics of same store properties in order to assess the core operations of the portfolio. By evaluating same store properties, management is able to monitor the operations of the Company's existing properties for comparable periods to measure the performance of the current portfolio and the effects of new acquisitions and dispositions on net income (loss). Total Real Estate Investments at Cost Represents the contractual purchase price of real estate properties acquired, including capitalized acquisition costs, and capital expenditures incurred since acquisition, reduced by the cost basis of properties sold.

Contact Information Corporate Address www.SilaRealtyTrust.com 1001 Water Street Suite 800 Tampa, FL 33602 Miles Callahan Senior Vice President, Capital Markets & Investor Relations IR@silarealtytrust.com