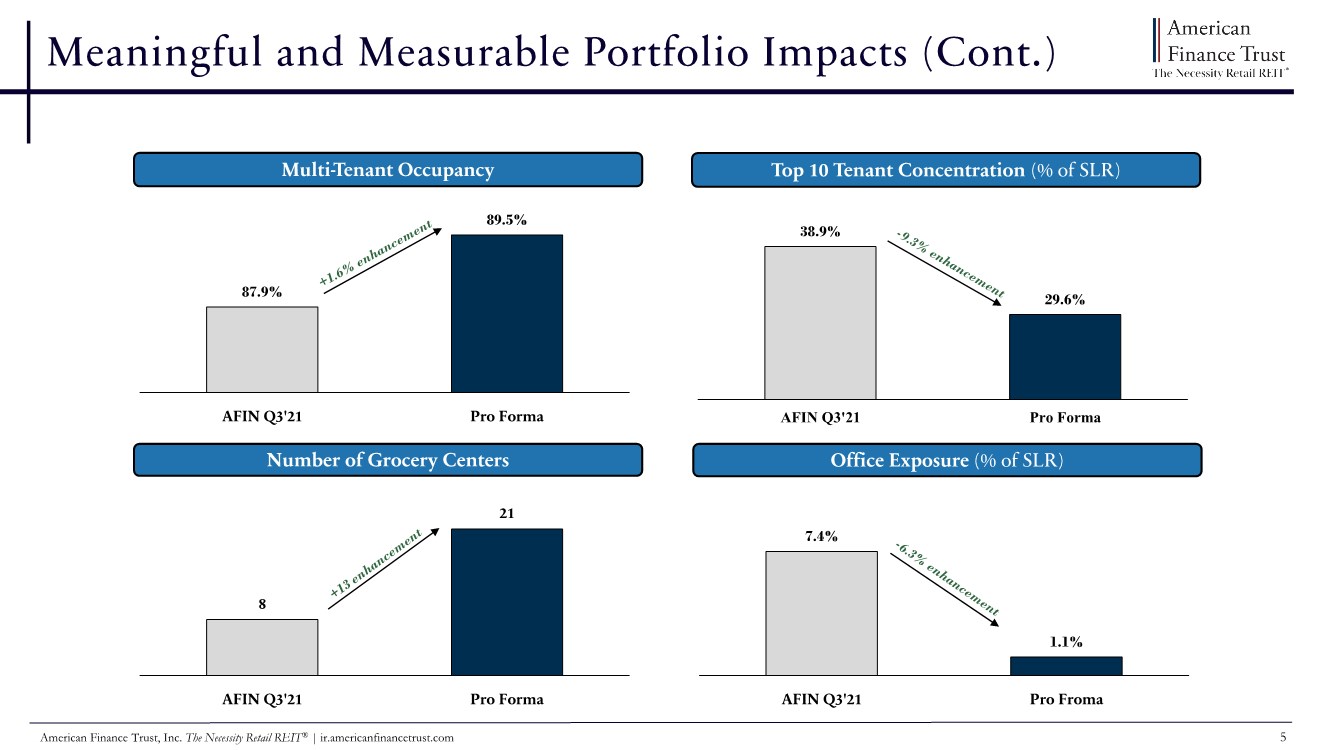

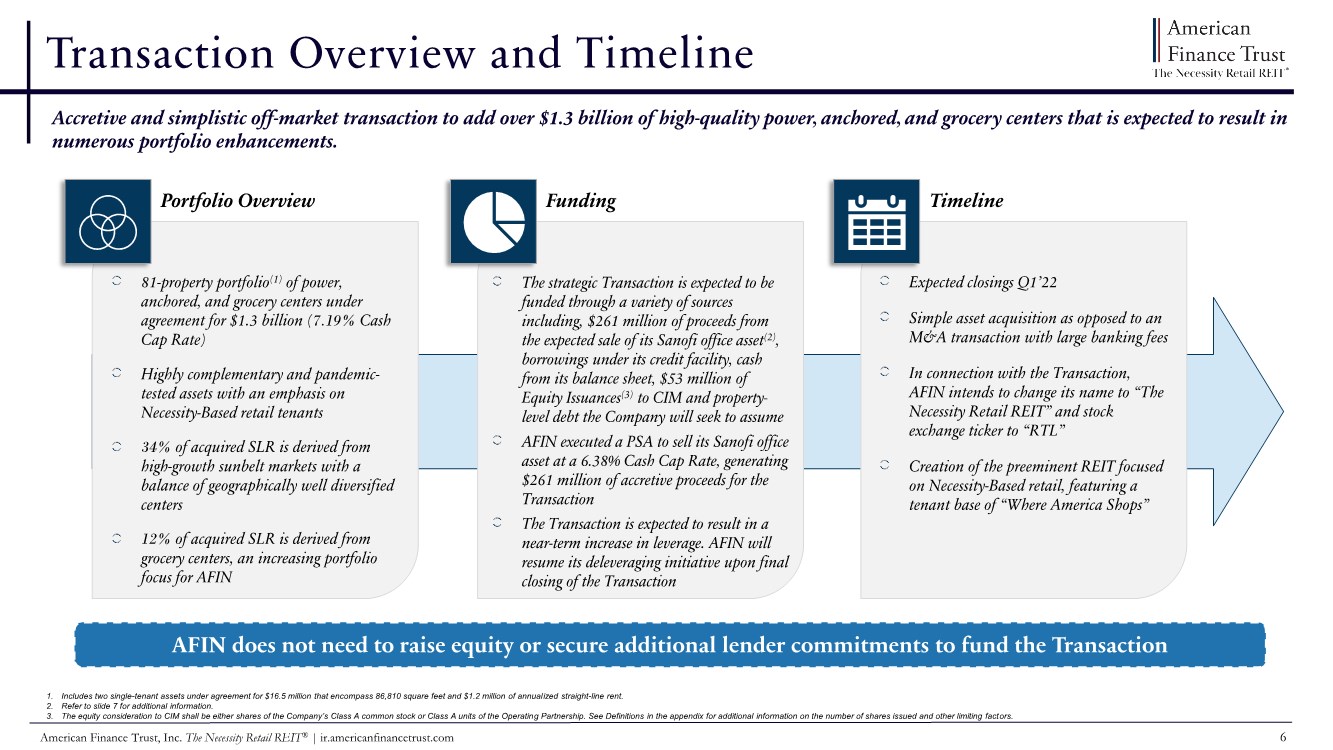

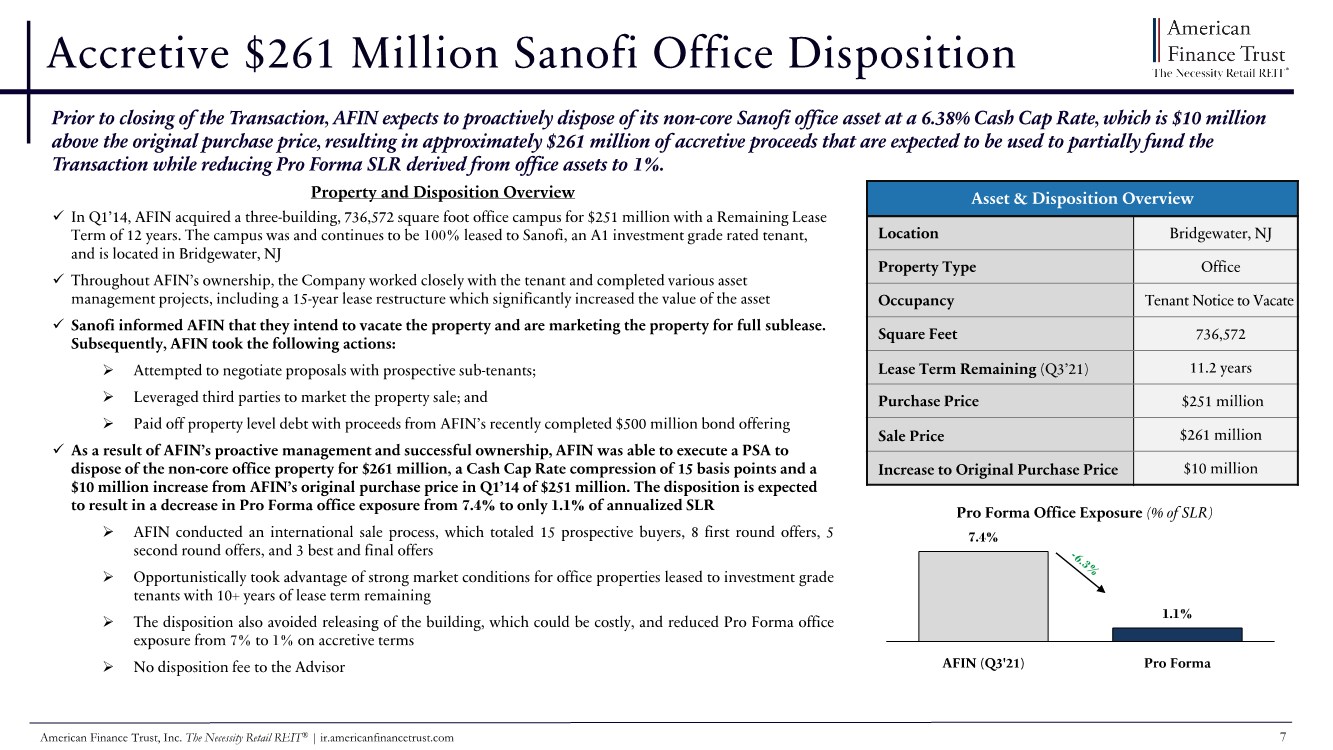

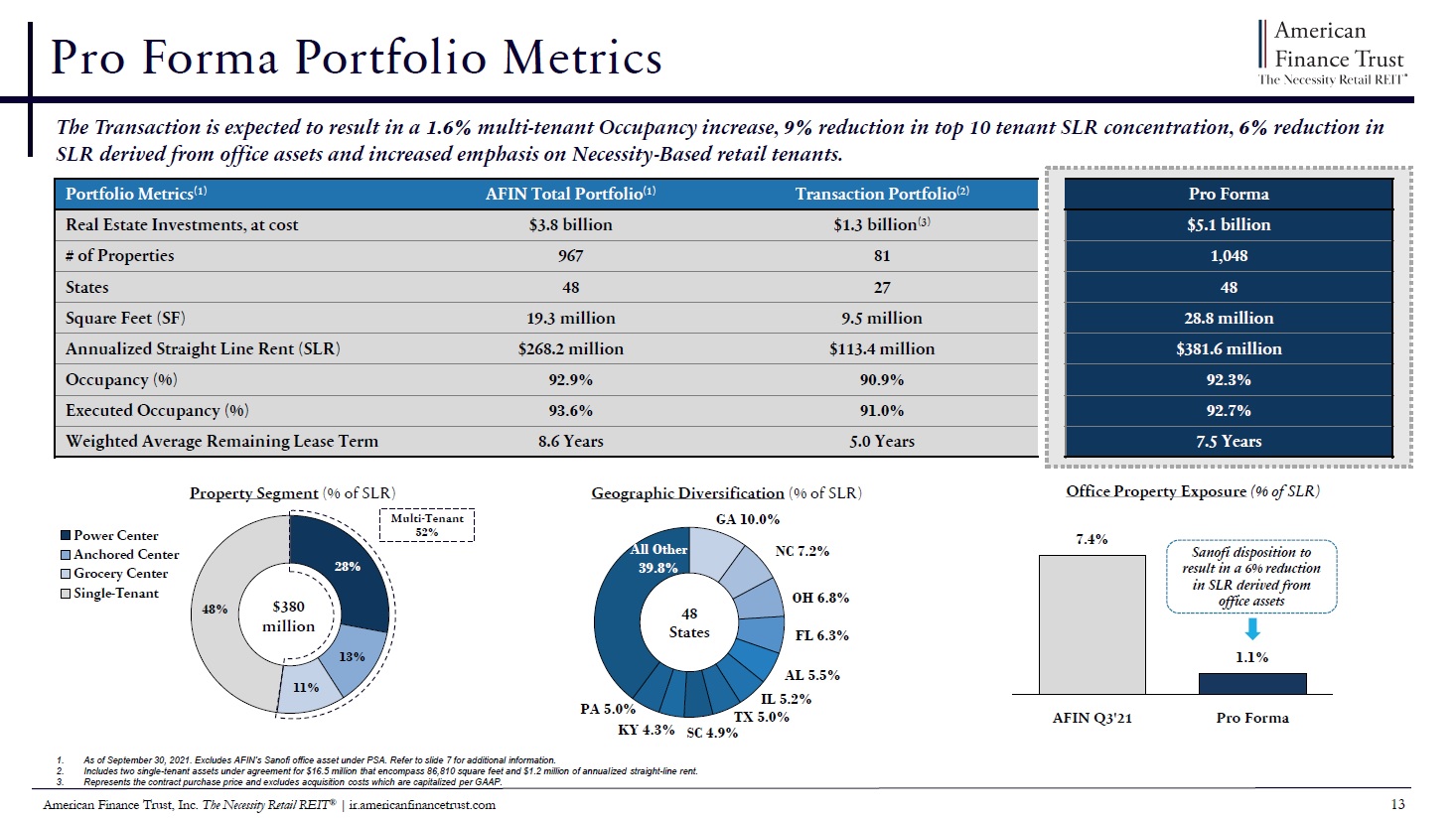

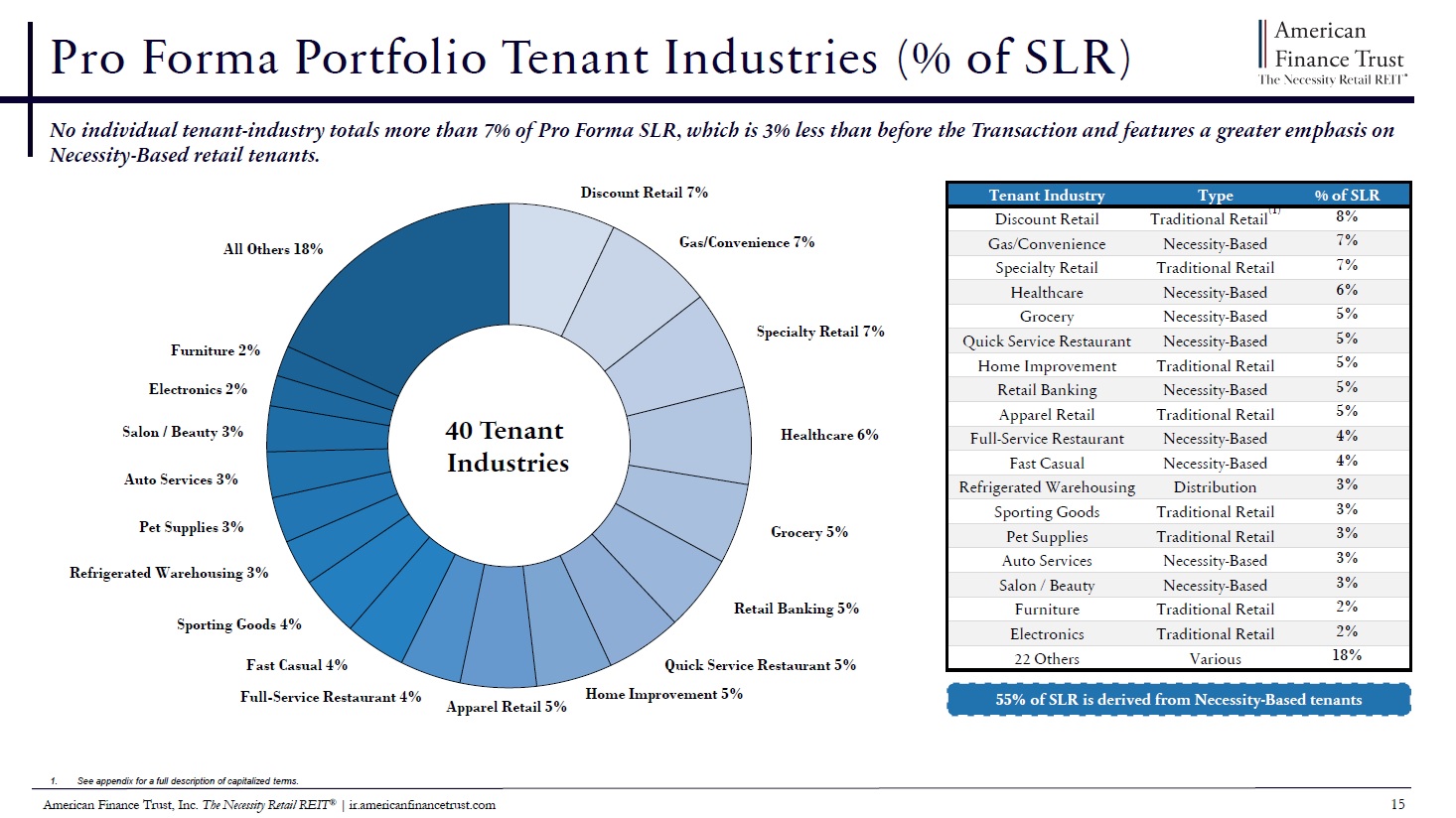

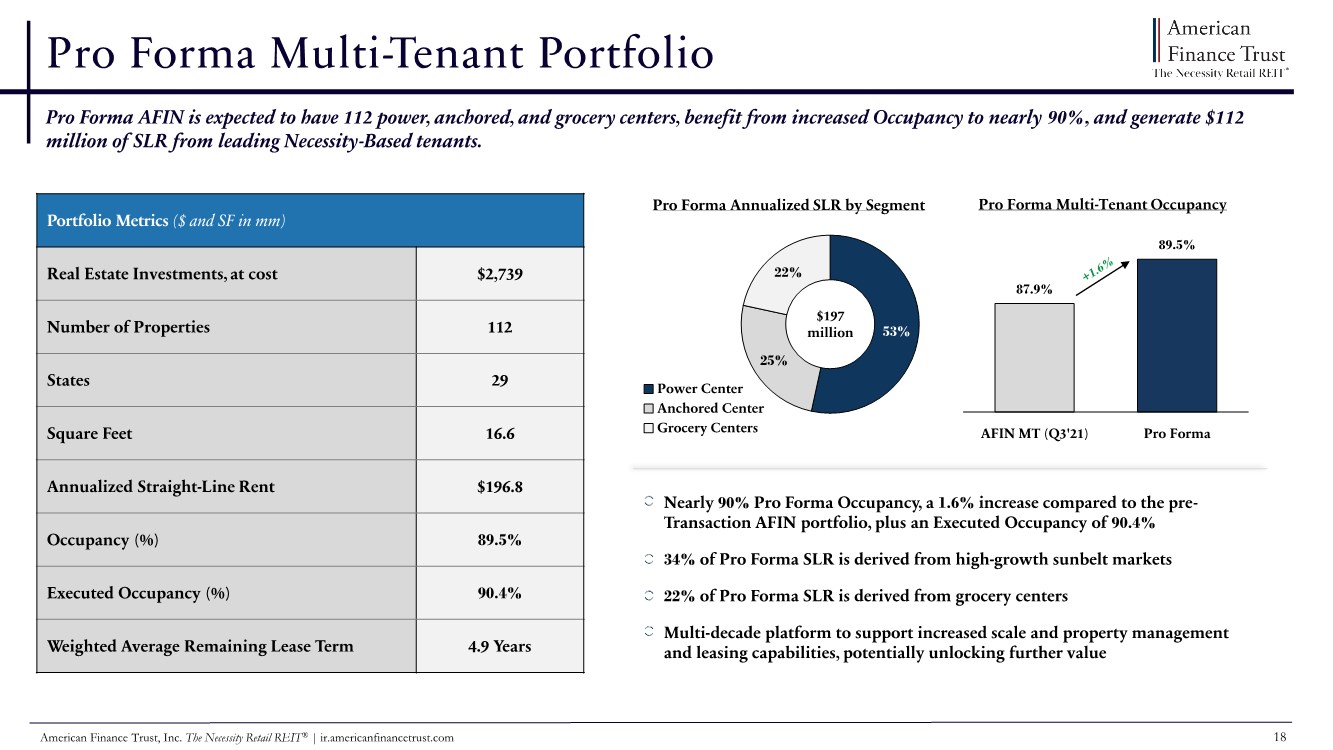

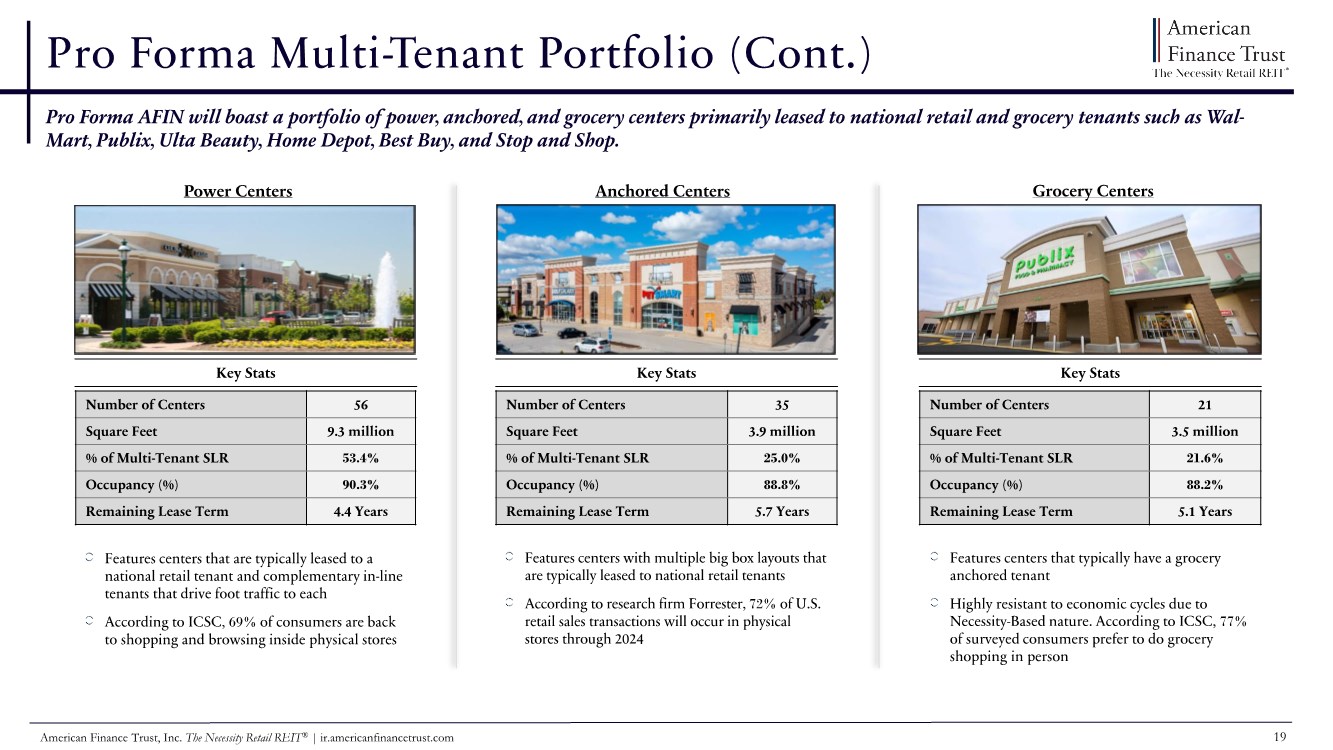

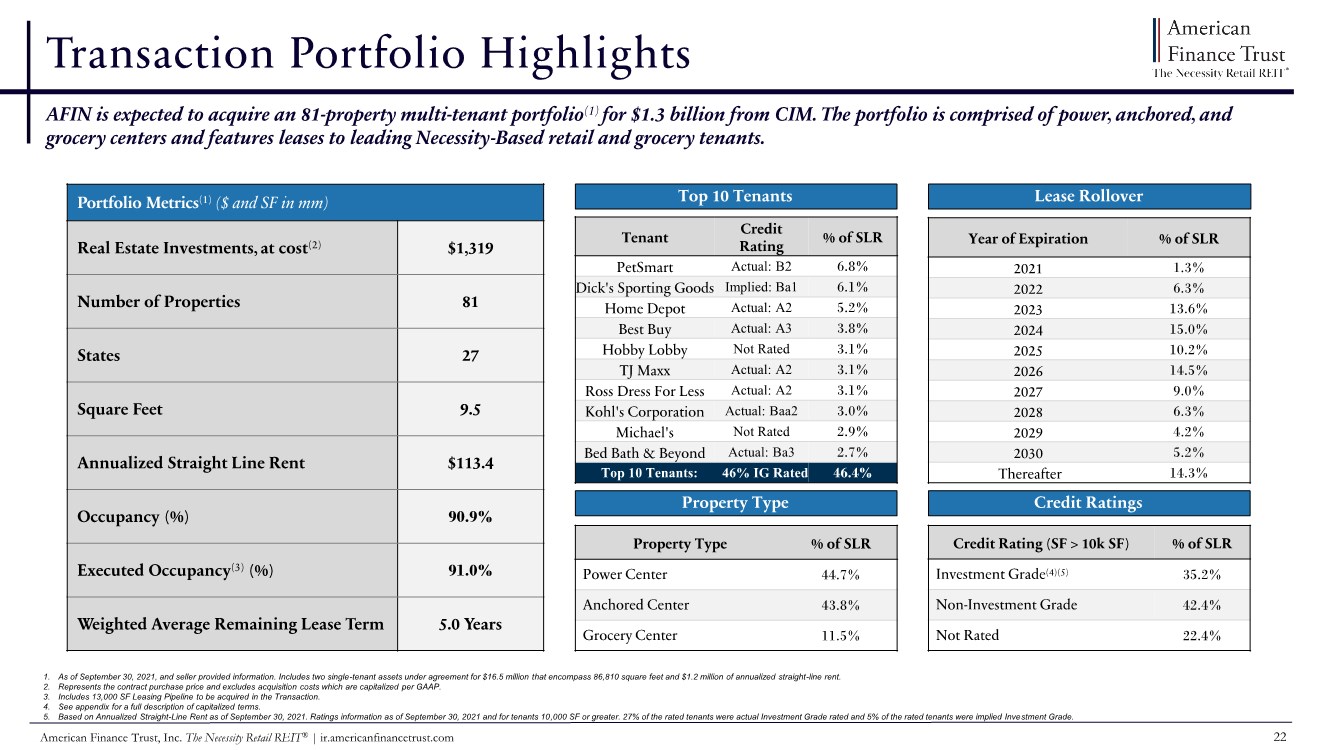

| 23 American Finance Trust, Inc. The Necessity Retail REIT® | ir.americanfinancetrust.com Definitions AFFO: In calculating AFFO, we start with FFO, then we exclude certain income or expense items from AFFO that we consider to be more reflective of investing activities, such as non-cash income and expense items and the income and expense effects of other activities that are not a fundamental attribute of our day to day operating business plan, such as amounts related to litigation arising out of the merger with American Realty Capital-Retail Centers of America, Inc. in February 2017 (the “Merger”). These amounts include legal costs incurred as a result of the litigation, portions of which have been and may in the future be reimbursed under insurance policies maintained by us. Insurance reimbursements are deducted from AFFO in the period of reimbursement. We believe that excluding the litigation costs and subsequent insurance reimbursements related to litigation arising out of the Merger helps to provide a better understanding of the operating performance of our business. Other income and expense items also include early extinguishment of debt and unrealized gains and losses, which may not ultimately be realized, such as gains or losses on derivative instruments and gains and losses on investments. In addition, by excluding non-cash income and expense items such as amortization of above-market and below-market leases intangibles, amortization of deferred financing costs, straight-line rent, and share-based compensation related to restricted shares and the 2018 OPP from AFFO, we believe we provide useful information regarding those income and expense items which have a direct impact on our ongoing operating performance. By providing AFFO, we believe we are presenting useful information that can be used to, among other things, assess our performance without the impact of transactions or other items that are not related to of our portfolio of properties. AFFO presented by us may not be comparable to AFFO reported by other REITs that define AFFO differently. Please refer to our Form 10-Q as of and for the period ended September 30, 2021 for further details on our calculation of AFFO. Annualized Straight-Line Rent: Straight-line rent which is annualized and calculated using most recent available lease terms as of the period end indicated. Cash Cap Rate: For acquisitions, cash cap rate is a rate of return on a real estate investment property based on the expected, annualized cash rental income during the first year of ownership that the property will generate under its existing lease or leases. For dispositions, cash cap rate is a rate of return based on the annualized cash rental income of the property to be sold. For acquisitions, cash cap rate is calculated by dividing this annualized cash rental income the property will generate (before debt service and depreciation and after fixed costs and variable costs) by the purchase price of the property, excluding acquisition costs. For dispositions, cash cap rate is calculated by dividing the annualized cash rental income by the contract sales price for the property, excluding acquisition costs Weighted average cash cap rates are based on square feet unless otherwise indicated. Cash NOI: We define Cash NOI as NOI excluding amortization of above/below market lease intangibles and straight-line adjustments that are included in GAAP lease revenues. Equity Issuances: As used herein, Equity Issuances represents $53 million of equity consideration to certain subsidiaries of CIM Real Estate Finance Trust, Inc.(“CIM”) in connection to the Transaction. The equity consideration shall be either shares of the Company’s Class A common stock or Class A units in the Operating Partnership. The number of shares or units to be issued at the applicable closing (limited to 4.9% of the Company’s outstanding Class A common stock at the time) will be based on the value of the shares or units that may be issued at closing divided by the per share volume weighted average price of the Company’s Class A Common Stock measured over a five consecutive trading day period immediately preceding (but not including) the date on which the written notice indicating CIM’s election is delivered to the Operating Partnership (such price to be limited by a 7.5% collar in either direction from the per share volume weighted average price of the Company’s Class A Common Stock measured over the ten consecutive trading day period immediately preceding (but not including) the effective date of the PSA). Further, the amount of the Company’s Class A common stock or Operating Partnership Units as applicable that the Partnership may issue at the first closing will not exceed approximately $27 million in value with the remainder to be issued in a form to be determined at the second closing. Refer to the Company’s Current Report on Form 8-K filed with the SEC on December 20, 2021 for additional information. Executed Occupancy: Includes Occupancy as defined below as of a particular date as well as all leases fully executed by both parties as of the same date where the tenant has yet to take possession as of such date. For Q3’21 and as of November 1, 2021, there are 15 additional leases executed where rent commences over time between the fourth quarter of 2021 and the first quarter of 2022 totaling approximately 122,000 square feet. For Q4’20 and as of January 31, 2021, there were four additional leases executed where rent commences over time between the first quarter of 2021 and the third quarter of 2021 totaling approximately 34,000 square feet. FFO: We define FFO, a non-GAAP measure, consistent with the standards established over time by the Board of Governors of NAREIT, as restated in a White Paper and approved by the Board of Governors of NAREIT effective in December 2018 (the "White Paper"). The White Paper defines FFO as net income or loss computed in accordance with GAAP excluding depreciation and amortization related to real estate, gains and losses from sales of certain real estate assets, gain and losses from change in control and impairment write-downs of certain real estate assets and investments in entities when the impairment is directly attributable to decreases in the value of depreciable real estate held by the entity. Adjustments for unconsolidated partnerships and joint ventures are calculated to exclude the proportionate share of the non-controlling interest to arrive at FFO attributable to stockholders. Our FFO calculation complies with NAREIT's definition. Please refer to our Form 10-Q as of and for the period ended September 30, 2021 for further details on our calculation of FFO. Investment Grade: As used herein, Investment Grade includes both actual investment grade ratings of the tenant or guarantor, if available, or implied investment grade. Implied investment grade may include actual ratings of tenant parent, guarantor parent (regardless of whether or not the parent has guaranteed the tenant’s obligation under the lease) or by using a proprietary Moody’s analytical tool, which generates an implied rating by measuring a company’s probability of default. The term “parent" for these purposes includes any entity, including any governmental entity, owning more than 50% of the voting stock in a tenant. Ratings information is as of September 30, 2021 and based on Annualized Straight-Line Rent. Leasing Pipeline: For AFIN, Leasing Pipeline for Q3’21 includes (i) all leases fully executed by both parties as of November 1, 2021, but after September 30, 2021 and (ii) all leases under negotiation with an executed LOI by both parties as of November 1, 2021. This represents six LOIs totaling approximately 19,000 square feet. No lease terminations occurred during this period. For the Transaction and Q3’21, includes a 13,000 SF Leasing Pipeline acquired in the Transaction. For AFIN and Q4’20 includes (i) all leases fully executed by both parties as of January 31, 2021, but after December 31, 2020 and (ii) all leases under negotiation with an executed LOI by both parties as of January 31, 2021. This represents six new leases totaling approximately 220,000 square feet, net of one lease termination for 5,000 square feet during this period. There can be no assurance that LOIs will lead to definitive leases that will commence on their current terms, or at all. Leasing pipeline should not be considered an indication of future performance. LOI: Means a non-binding letter of intent. Necessity-Based: We define Necessity-Based as properties that are leased to tenants that operate in what we believe to be service-based or essential industries such as auto services, distribution, financial services, gas/convenience, grocery. healthcare, and quick service restaurants, among others. NOI: Defined as a non-GAAP financial measure used by us to evaluate the operating performance of our real estate. NOI is equal to total revenues, excluding contingent purchase price consideration, less property operating and maintenance expense. NOI excludes all other items of expense and income included in the financial statements in calculating net (loss). Occupancy: Represents percentage of square footage of which the tenant has taken possession of divided by the respective total rentable square feet as of the date or period end indicated. Pro Forma: As used herein, Pro Forma represents the combined AFIN and 81 property multi-tenant portfolio, including the two single-tenant assets under agreement for $16.5 million that encompass 86,810 square feet and $1.2 million of annualized straight-line rent, under PSA with CIM Real Estate Finance Trust, Inc. as of September 30, 2021, excluding AFIN’s Sanofi office asset under PSA. Refer to slide 7 for additional information on the Sanofi office asset disposition. PSA: Means a definitive purchase and sale agreement entered into with certain subsidiaries of CIM Real Estate Finance Trust, Inc.(“CIM”). Remaining Lease Term: Represents the outstanding tenant lease term. Weighted based on Annualized Straight-Line Rent as of the date or period end indicated. Traditional Retail: AFIN definition of Traditional Retail includes retail properties leased to tenants in the auto retail, department store, discount retail, electronics, furniture, home improvement, home furnishing, specialty retail, and sporting good sectors. |