Exhibit 99.1

A Public Non - Traded Real Estate Investment Trust* SunTrust Leasing Update May 2016 1

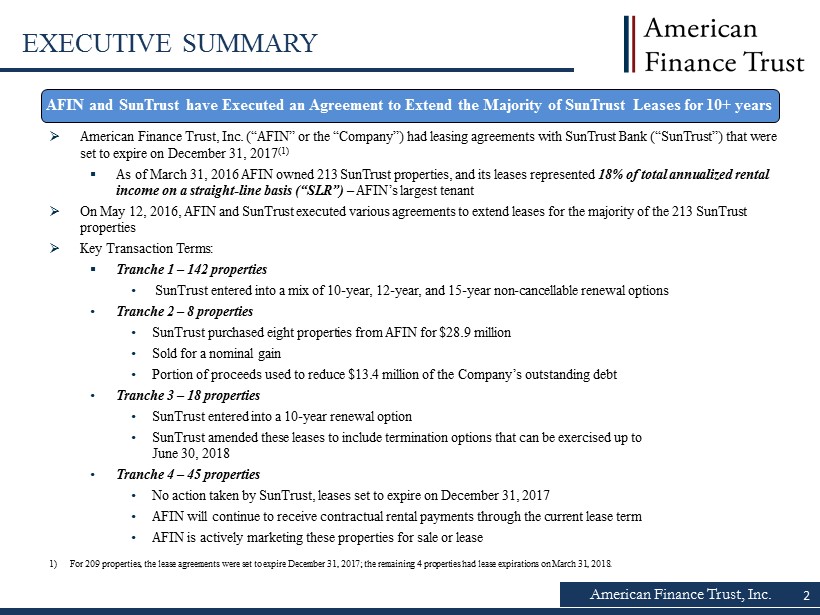

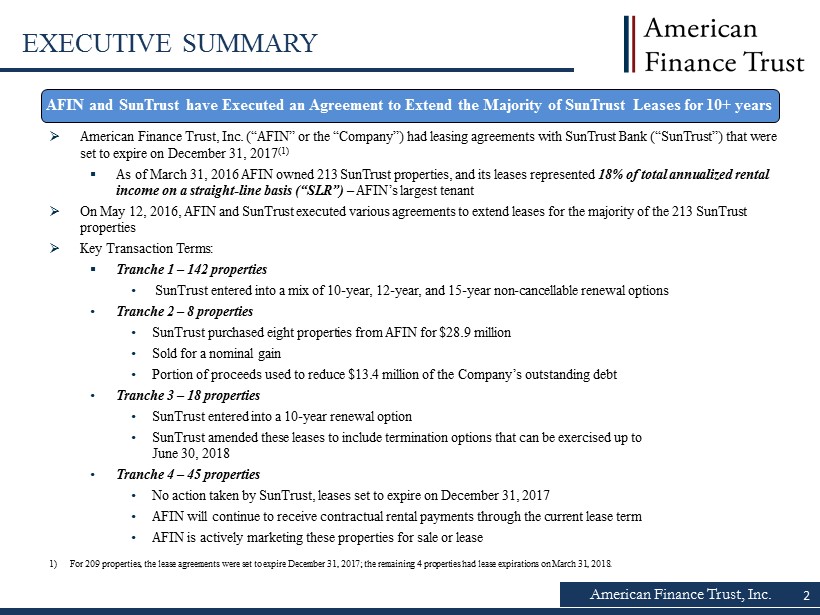

American Finance Trust, Inc. 2 EXECUTIVE SUMMARY 1) For 209 properties, the lease agreements were set to expire December 31, 2017; the remaining 4 properties had lease expirations on March 31, 2018 . » American Finance Trust, Inc. (“AFIN ” or the “Company”) had leasing agreements with SunTrust Bank (“SunTrust”) that were set to expire on December 31, 2017 (1) ▪ As of March 31, 2016 AFIN owned 213 SunTrust properties, and its leases represented 18% of total annualized rental income on a straight - line basis (“SLR”) – AFIN’s largest tenant » On May 12, 2016, AFIN and SunTrust executed various agreements to extend leases for the majority of the 213 SunTrust properties » Key Transaction Terms: ▪ Tranche 1 – 142 properties • SunTrust entered into a mix of 10 - year, 12 - year, and 15 - year non - cancellable renewal options • Tranche 2 – 8 properties • SunTrust purchased eight properties from AFIN for $28.9 million • Sold for a nominal gain • Portion of proceeds used to reduce $13.4 million of the Company’s outstanding debt • Tranche 3 – 18 properties • SunTrust entered into a 10 - year renewal option • SunTrust amended these leases to include termination options that can be exercised up to June 30, 2018 • Tranche 4 – 45 properties • No action taken by SunTrust, leases set to expire on December 31, 2017 • AFIN will continue to receive contractual rental payments through the current lease term • AFIN is actively marketing these properties for sale or lease AFIN and SunTrust have Executed an Agreement to Extend the Majority of SunTrust Leases for 10+ years

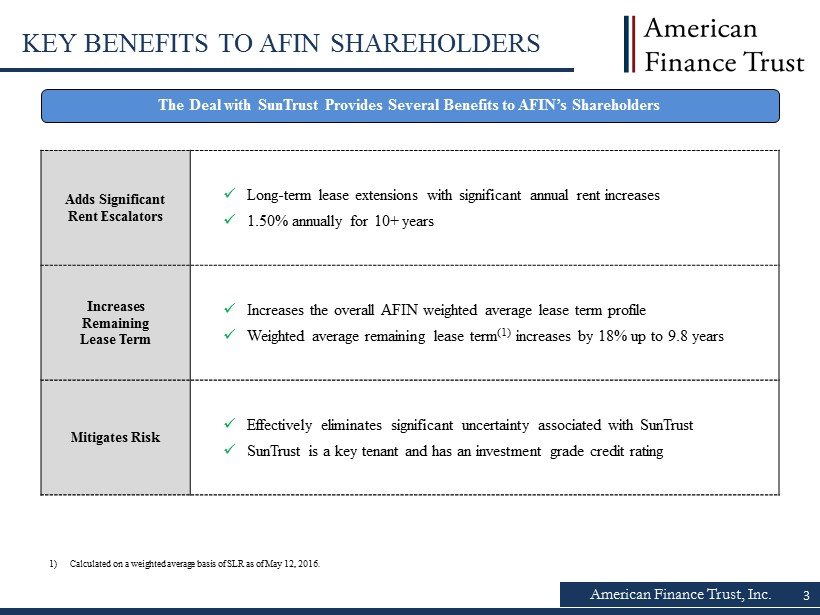

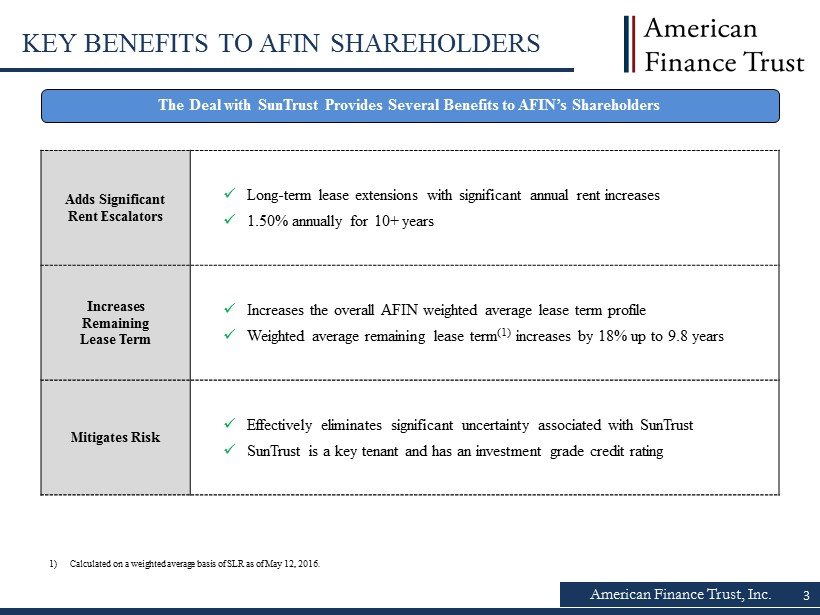

American Finance Trust, Inc. 3 KEY BENEFITS TO AFIN SHAREHOLDERS The Deal with SunTrust Provides Several Benefits to AFIN’s Shareholders Adds Significant Rent Escalators x Long - term lease extensions with significant annual rent increases x 1.50% annually for 10+ years Increases Remaining Lease Term x Increases the overall AFIN weighted average lease term profile x Weighted average remaining lease term (1) increases by 18% up to 9.8 years Mitigates Risk x Effectively eliminates significant uncertainty associated with SunTrust x SunTrust is a key tenant and has an investment grade credit rating 1) Calculated on a weighted average basis of SLR as of May 12, 2016.

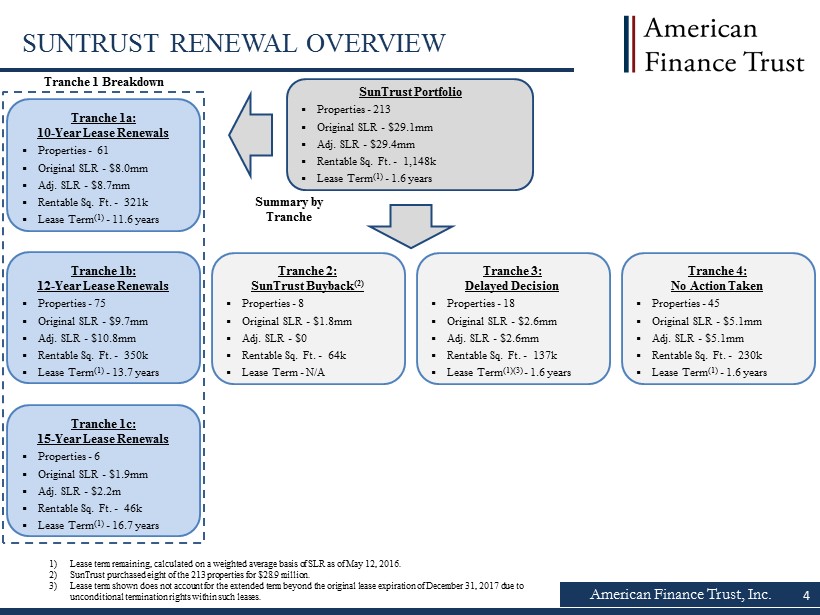

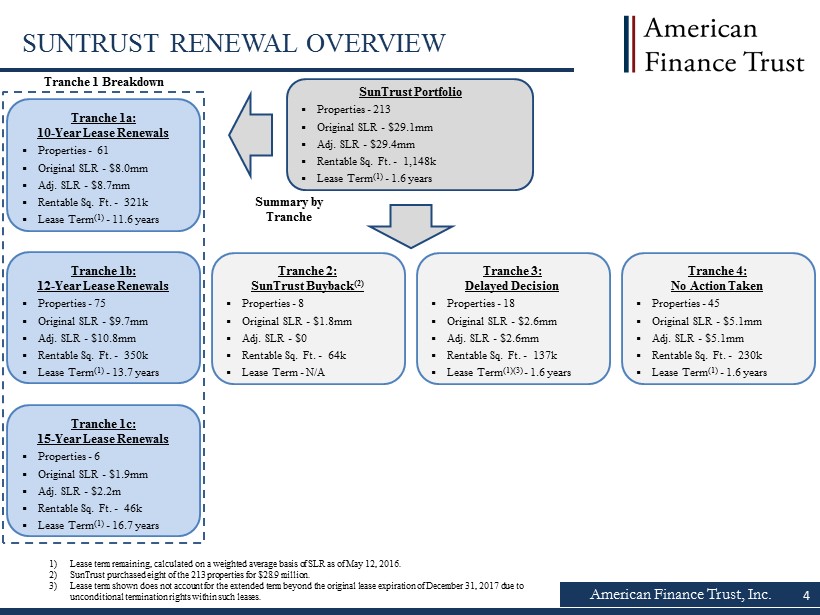

American Finance Trust, Inc. 4 SUNTRUST RENEWAL OVERVIEW 1) Lease term remaining, calculated on a weighted average basis of SLR as of May 12, 2016 . 2) SunTrust purchased eight of the 213 properties for $28.9 million. 3) Lease term shown does not account for the extended term beyond the original lease expiration of December 31, 2017 due to unconditional termination rights within such leases. SunTrust Portfolio ▪ Properties - 213 ▪ Original SLR - $29.1mm ▪ Adj. SLR - $29.4mm ▪ Rentable Sq. Ft. - 1,148k ▪ Lease Term (1) - 1.6 years Tranche 2: SunTrust Buyback (2) ▪ Properties - 8 ▪ Original SLR - $1.8mm ▪ Adj. SLR - $0 ▪ Rentable Sq . Ft. - 64k ▪ Lease Term - N/A Tranche 3: Delayed Decision ▪ Properties - 18 ▪ Original SLR - $2.6mm ▪ Adj. SLR - $2.6mm ▪ Rentable Sq . Ft. - 137k ▪ Lease Term (1)(3) - 1.6 years Tranche 4: No Action Taken ▪ Properties - 45 ▪ Original SLR - $5.1mm ▪ Adj. SLR - $5.1mm ▪ Rentable Sq . Ft. - 230k ▪ Lease Term (1) - 1.6 years Tranche 1a: 10 - Year Lease Renewals ▪ Properties - 61 ▪ Original SLR - $8.0mm ▪ Adj. SLR - $8.7mm ▪ Rentable Sq . Ft. - 321k ▪ Lease Term (1) - 11.6 years Tranche 1b: 12 - Year Lease Renewals ▪ Properties - 75 ▪ Original SLR - $9.7mm ▪ Adj. SLR - $10.8mm ▪ Rentable Sq . Ft. - 350k ▪ Lease Term (1) - 13.7 years Tranche 1c: 15 - Year Lease Renewals ▪ Properties - 6 ▪ Original SLR - $1.9mm ▪ Adj. SLR - $2.2m ▪ Rentable Sq . Ft. - 46k ▪ Lease Term (1) - 16.7 years Summary by Tranche Tranche 1 Breakdown

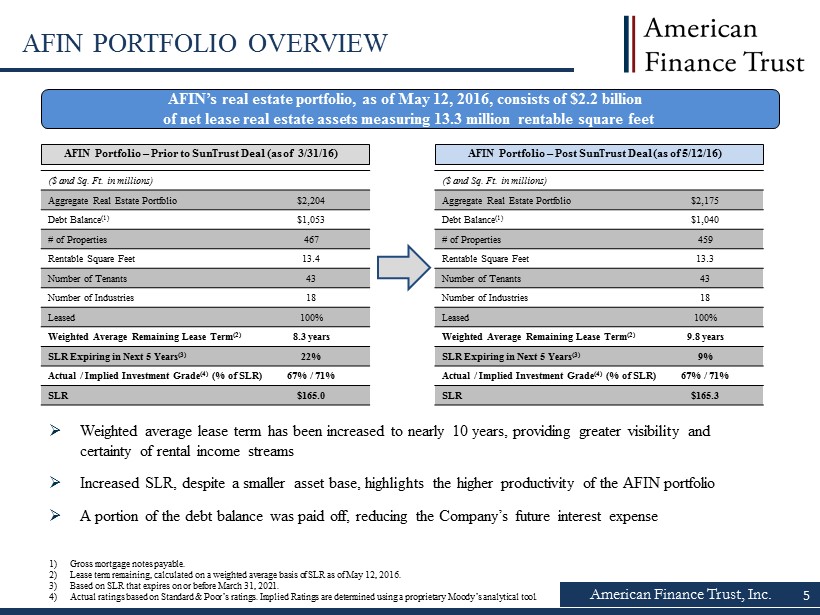

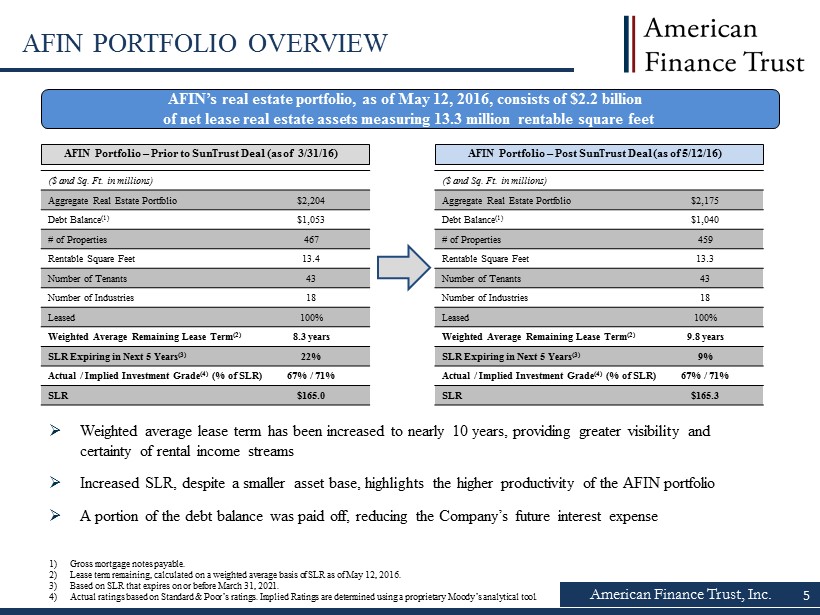

American Finance Trust, Inc. 5 AFIN PORTFOLIO OVERVIEW AFIN Portfolio – Prior to SunTrust Deal (as of 3/31/16) ($ and Sq. Ft. in millions) Aggregate Real Estate Portfolio $2,204 Debt Balance (1) $1,053 # of Properties 467 Rentable Square Feet 13.4 Number of Tenants 43 Number of Industries 18 Leased 100% Weighted Average Remaining Lease Term (2) 8.3 years SLR Expiring in Next 5 Years (3) 22% Actual / Implied Investment Grade (4) (% of SLR) 67% / 71% SLR $165.0 AFIN Portfolio – Post SunTrust Deal (as of 5/12/16) ($ and Sq. Ft. in millions) Aggregate Real Estate Portfolio $2,175 Debt Balance (1) $1,040 # of Properties 459 Rentable Square Feet 13.3 Number of Tenants 43 Number of Industries 18 Leased 100% Weighted Average Remaining Lease Term (2) 9.8 years SLR Expiring in Next 5 Years (3) 9% Actual / Implied Investment Grade (4) (% of SLR) 67% / 71% SLR $165.3 AFIN’s real estate portfolio, as of May 12, 2016, consists of $2.2 billion of net lease real estate assets measuring 13.3 million rentable square feet » Weighted average lease term has been increased to nearly 10 years, providing greater visibility and certainty of rental income streams » Increased SLR, despite a smaller asset base, highlights the higher productivity of the AFIN portfolio » A portion of the debt balance was paid off, reducing the Company’s future interest expense 1) Gross mortgage notes payable. 2) Lease term remaining, calculated on a weighted average basis of SLR as of May 12, 2016. 3) Based on SLR that expires on or before March 31, 2021. 4) Actual ratings based on Standard & Poor’s ratings . Implied Ratings are determined using a proprietary Moody’s analytical tool.

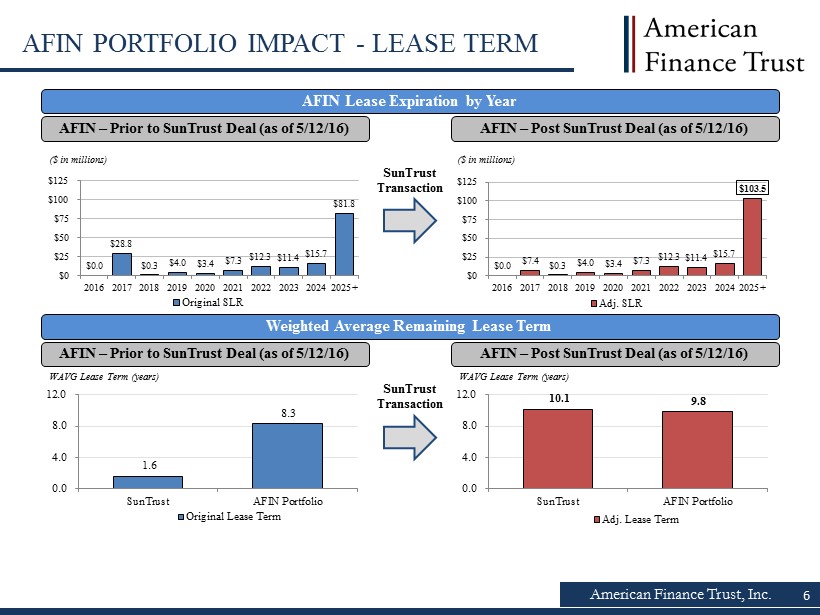

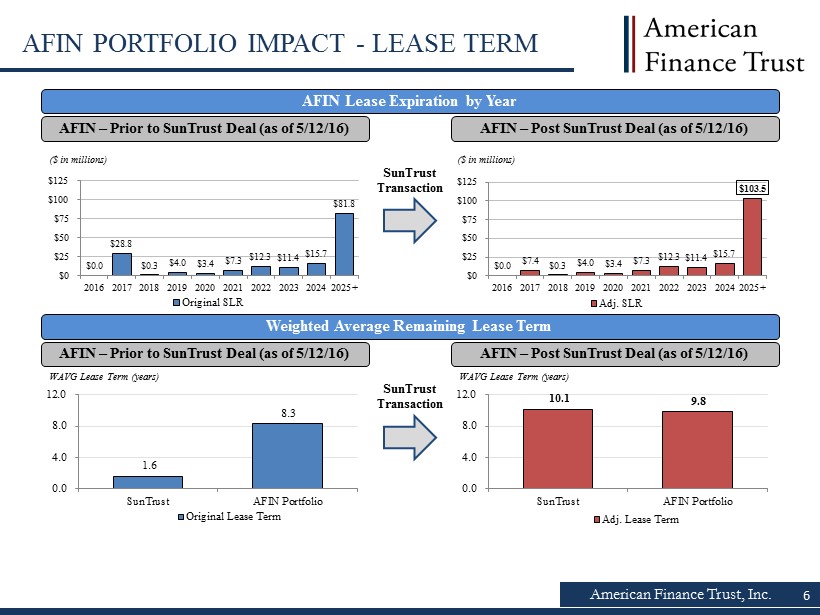

American Finance Trust, Inc. 6 AFIN PORTFOLIO IMPACT - LEASE TERM AFIN Lease Expiration by Year AFIN – Prior to SunTrust Deal (as of 5/12/16) AFIN – Post SunTrust Deal (as of 5/12/16) Weighted Average Remaining Lease Term AFIN – Prior to SunTrust Deal (as of 5/12/16 ) AFIN – Post SunTrust Deal (as of 5/12/16) $0.0 $28.8 $0.3 $4.0 $3.4 $7.3 $12.3 $11.4 $15.7 $81.8 $0 $25 $50 $75 $100 $125 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025+ Original SLR ($ in millions) $0.0 $7.4 $0.3 $4.0 $3.4 $7.3 $12.3 $11.4 $15.7 $103.5 $0 $25 $50 $75 $100 $125 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025+ Adj. SLR ($ in millions) 1.6 8.3 0.0 4.0 8.0 12.0 SunTrust AFIN Portfolio Original Lease Term WAVG Lease Term (years) 10.1 9.8 0.0 4.0 8.0 12.0 SunTrust AFIN Portfolio Adj. Lease Term WAVG Lease Term (years) SunTrust Transaction SunTrust Transaction

American Finance Trust, Inc. 7 AFIN PORTFOLIO - STRENGTH & DIVERSITY Property Type (1) Tenant Credit Rating (1 )(2) » Diverse, retail focused property mix » Over 71% Actual & Implied Investment Grade Tenant Ratings Tenant Industry (1) 1) Graphs percentages are based on $165.3 million of SLR as of May 12, 2016, which includes the new SunTrust lease terms . 2) Actual ratings reflect the tenant rating. Implied Ratings are determined using a proprietary Moody’s analytical tool which compares the risk metrics of the non - rated company to those of a company with an Actual Rating. A tenant with a parent that has an investment grade rating is included in implied investment grade. Ratings information is as of March 31, 2016 . » AFIN’s tenants operate in 18 different industries Retail 45.3% Office 29.3% Distribution 25.4% Retail Banking 19% Healthcare 15% Distribution 12% Financial Services 12% Refrigerated Warehousing 8% Supermarket 7% Restaurant 7% Home Maintenance 6% Pharmacy 4% Other 10% Actual IG 67.4% Implied IG 4.1% Actual Non - IG 20.2% Implied Non - IG and Not Rated 8.3%

American Finance Trust, Inc. 8 LEGAL NOTICES RISK FACTORS Investing in our common stock involves a high degree of risk. See the section entitled “Item 1A. Risk Factors” in AFIN’s Annual Report on Form 10 - K filed with the U.S. Securities and Exchange Commission (the “SEC”) on March 16, 2016 and the section entitled “Item 1A. Risk Factors” in AFIN’s Quarterly Report on Form 10 - Q filed with the SEC on May 13, 2016 for a discussion of the risks that should be considered in connection with your investment in AFIN. FORWARD - LOOKING STATEMENTS Certain statements made in this presentation are forward - looking statements. These forward - looking statements include statements regarding our intent, belief or current expectations and are based on various assumptions. These statements involve substanti al risks and uncertainties. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward - looking statements that we make. Forward - looking statements may include, but are not limited to, statements regarding stockholde r liquidity and investment value and returns. The words “anticipates,” “believes,” “expects,” “estimates,” “projects,” “plans, “in tends,” “may,” “will,” “would” and similar expressions are intended to identify forward - looking statements, although not all forward - loo king statements contain these identifying words. Actual results may differ materially from those contemplated by the forward - looking statement. Further, forward - looking statements speak only as of the date they are made, and we undertake no obligation to update or reverse any forward - looking statement to reflect changed assumptions, the occurrence of unanticipated events on changes to futur e operating results, unless required to do so by law.