Exhibit 99.2

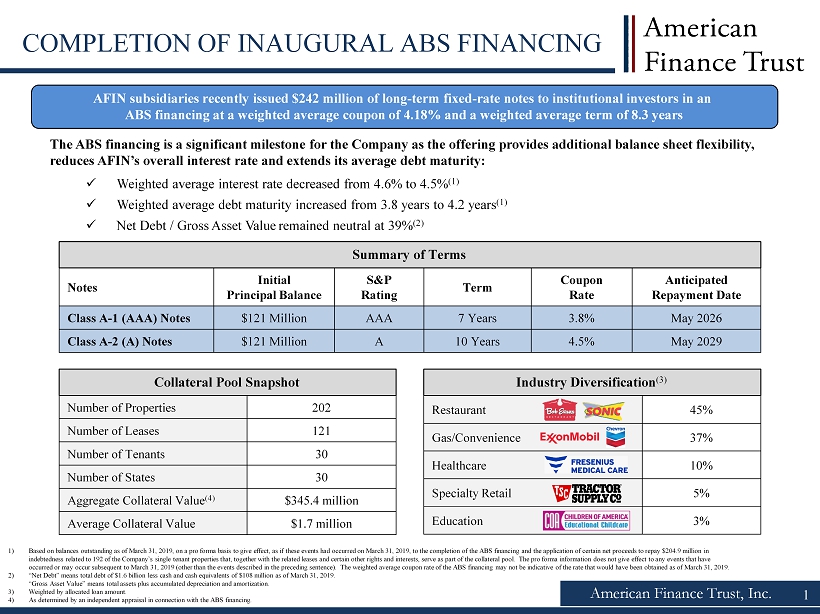

American Finance Trust, Inc. Notes Initial Principal Balance S&P Rating Term Coupon Rate Anticipated Repayment Date Class A - 1 (AAA) Notes $121 Million AAA 7 Years 3.8% May 2026 Class A - 2 (A) Notes $121 Million A 10 Years 4.5% May 2029 Summary of Terms AFIN subsidiaries recently issued $242 million of long - term fixed - rate notes to institutional investors in an ABS financing at a weighted average coupon of 4.18% and a weighted average term of 8.3 years The ABS financing is a significant milestone for the Company as the offering provides additional balance sheet flexibility, reduces AFIN’s overall interest rate and extends its average debt maturity: x Weighted average interest rate decreased from 4.6% to 4.5% (1) x Weighted average debt maturity increased from 3.8 years to 4.2 years (1) x Net Debt / Gross Asset Value remained neutral at 39% (2) 1 COMPLETION OF INAUGURAL ABS FINANCING Number of Properties 202 Number of Leases 121 Number of Tenants 30 Number of States 30 Aggregate Collateral Value (4) $345.4 million Average Collateral Value $1.7 million Collateral Pool Snapshot Restaurant 45% Gas/Convenience 37% Healthcare 10% Specialty Retail 5% Education 3% Industry Diversification (3) 1) Based on balances outstanding as of March 31, 2019, on a pro forma basis to give effect, as if these events had occurred on March 31, 2019, to the completion of the ABS financing and the application of certain net proceeds to repay $204.9 million in indebtedness related to 192 of the Company’s single tenant properties that, together with the related leases and certain other rights and interests, serve as part of the collateral pool. The pro forma information does not give effect to any events that have occurred or may occur subsequent to March 31, 2019 (other than the events described in the preceding sentence). The weighted average coupon rate of the ABS financing may not be indicative of the rate that would have been obtained as of March 31, 2019. 2) “Net Debt” means total debt of $1.6 billion less cash and cash equivalents of $108 million as of March 31, 2019. “Gross Asset Value” means total assets plus accumulated depreciation and amortization. 3) Weighted by allocated loan amount. 4) As determined by an independent appraisal in connection with the ABS financing.