UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number: 811-22802

FS Global Credit Opportunities Fund

(Exact name of registrant as specified in charter)

| | |

Cira Centre 2929 Arch Street, Suite 675 Philadelphia, Pennsylvania 19104 (Address of principal executive offices) | | 19104 (Zip code) |

Michael C. Forman

FS Global Credit Opportunities Fund

Cira Centre

2929 Arch Street, Suite 675

Philadelphia, Pennsylvania 19104

(Name and address of agent for service)

Registrant’s telephone number, including area code: (215) 495-1150

Date of fiscal year end: December 31

Date of reporting period: December 31, 2013

Item 1. Reports to Stockholders.

The annual report (the “Annual Report”) of FS Global Credit Opportunities Fund (the “Fund”) transmitted to shareholders pursuant to Rule 30e-1 under the Investment Company Act of 1940, as amended (the “1940 Act”), is as follows:

|

| |

|

|

|

WE EXPECT THAT FS GLOBAL CREDIT OPPORTUNITIES FUND WILL BE WELL POSITIONED TO TAKE ADVANTAGE OF MARKET DISLOCATIONS |

Fellow Shareholder,

I am pleased to be writing our first shareholder letter for FS Global Credit Opportunities Fund (the “Fund”). Against the backdrop of significant economic, political and social headwinds in January 2009, Franklin Square Capital Partners launched its first fund, FS Investment Corporation, with the vision of providing investors with access to asset classes, investment strategies and managers traditionally available to only the largest institutions, endowments and pension funds. While we remain optimistic about the future, we recognize that many of the headwinds faced in 2009 still weigh on the markets today. For patient investors with the experience and discipline necessary to navigate uncertain and volatile markets, we believe the current and longer-term macroeconomic environments present ideal investing opportunities.

To that end, Franklin Square launched the Fund in December 2013 with a significant sponsor investment of over $40 million from individuals and entities affiliated with Franklin Square and the Fund’s sub-adviser, GSO Capital Partners LP (“GSO”). The Fund is Franklin Square’s fourth collaboration with GSO, the credit platform of Blackstone. We believe that over the next several years, the challenges facing the global economy are likely to significantly impact the performance of many traditional asset classes and investment strategies, which have historically comprised a significant portion of investors’ portfolios. FS Global Credit Opportunities Fund seeks to provide investors with an alternative approach to global credit investing.

GLOBAL MARKET OPPORTUNITY

Since the financial crisis, large commercial banks that traditionally dominated the supply of credit to corporate borrowers generally have curtailed their lending due in part to increased regulation and regulatory oversight. The result has been a reduction in corporate lending and higher borrowing costs for most corporate borrowers. This shift is especially pronounced within Europe, where banks have historically accounted for over 50% of all European companies’ financing needs. While U.S. companies have largely managed to refinance or extend maturing loans and other debt obligations in recent years, European companies have yet to show significant progress. With European commercial banks having limited capacity to make new loans, we believe there will be significant opportunities as existing loans come due and need to be refinanced.

We expect the continued shift in the commercial banking model, sovereign deleveraging and persistently high unemployment will lead to future periods of market volatility and uncertainty. While we expect that the Fund will be well positioned to take advantage of market dislocations, our investment strategy seeks to generate attractive total returns in part by identifying dynamic corporate events for which the outcomes are often uncorrelated to the broader markets. We seek investment opportunities within various segments of the credit markets that we believe offer the greatest potential to generate high income and outsized total returns, while also providing downside protection.

|

| |

| |

| |

| |

WE BELIEVE NOW IS AN OPPORTUNE TIME TO EMBRACE THE BENEFITS OF OUR EVENT-DRIVEN, TOTAL RETURN STRATEGY |

AN ALTERNATIVE APPROACH TO GLOBAL CREDIT INVESTING

Just as Franklin Square transformed the business development company (“BDC”) industry with the launch of FS Investment Corporation, the first unlisted BDC, we are now looking to bring the same degree of innovation to the closed-end fund industry. FS Global Credit Opportunities Fund is Franklin Square’s first unlisted closed-end fund that seeks to take advantage of dislocations that arise in the credit markets, including those resulting from impending identifiable corporate events such as mergers, acquisitions or corporate reorganizations. Our event-driven strategy can create attractive investment opportunities when our view differs from that of the general market.

Successful implementation of event-driven strategies depends more heavily on the portfolio manager’s ability to consistently predict the outcome of events and identify pricing inefficiencies than on underlying macroeconomic fundamentals. Therefore, we expect the Fund’s investment strategy will provide meaningful diversification for investors’ portfolios, reduced correlation to the broader markets and an increased potential to generate positive performance in uncertain market environments.

Underlying our primary investment thesis are three fundamental tenets. First, we look to invest in companies that we believe have inherent value that is not properly reflected by the broader markets. Next, we seek out a catalyst to unlock that value. If no catalyst presents itself in the market, we proactively look for ways to create dynamic events. Finally, as with all of Franklin Square’s offerings, preservation of principal is a cornerstone of our asset management practice. While FS Global Credit Opportunities Fund represents a new fund structure and investment strategy within Franklin Square’s suite of fund offerings, we bring the same relentless focus on capital preservation and commitment to institutional-quality best practices and transparency that have served us well since our founding.

We believe that comprehensive financial analysis on a company-by-company basis and the flexibility to invest throughout the capital structures of both domestic and foreign companies are critical to achieving meaningful risk-adjusted returns for the Fund’s investors. The breadth and depth of the experience of Franklin Square and GSO, together with the wider resources of Blackstone and their relationships within the investment community, are expected to provide a competitive advantage in identifying and analyzing attractive investment opportunities worldwide.

By focusing on high conviction investment opportunities across the GSO / Blackstone platform, without respect to geographic constraints, we aim to build a portfolio that offers high potential returns with measured risk compared to more traditional investment strategies under current and expected economic conditions. We believe now is an opportune time to embrace the benefits of our innovative unlisted closed-end fund structure and our event-driven, total return strategy to position your portfolio to perform in uncertain markets.

|

| |

| |

| |

| |

THE FUND INVESTS PRIMARILY IN SECURED AND UNSECURED FLOATING AND FIXED RATE LOANS, BONDS AND OTHER CREDIT INSTRUMENTS |

We look forward to an exciting year in 2014 as we to continue to implement our differentiated strategy with the goal of preserving capital while generating high potential income and returns for our investors. Thank you for your support.

Sincerely,

MICHAEL C. FORMAN

Chairman & Chief Executive Officer

FS Global Credit Opportunities Fund

Officers

MICHAEL C. FORMAN

Chairman and Chief Executive Officer

WILLIAM GOEBEL

Chief Financial Officer

GERALD F. STAHLECKER

Executive Vice President

ZACHARY KLEHR

Executive Vice President

STEPHEN S. SYPHERD

Vice President, Treasurer and Secretary

SALVATORE FAIA

Chief Compliance Officer

Board of Trustees

MICHAEL C. FORMAN

Chairman and Chief Executive Officer

DAVID J. ADELMAN

Vice-Chairman

President and Chief Executive Officer,

Campus Apartments, Inc.

THOMAS J. GRAVINA

Trustee

Executive Chairman, GPX Enterprises, L.P.

WALTER W. BUCKLEY, III

Trustee

Chairman and Chief Executive Officer,

ICG Group, Inc.

BARBARA J. FOUSS

Trustee

Former Director of Strategic Initiatives and Chief Credit Policy Officer, Sun National Bank

DAVID L. COHEN

Trustee

Executive Vice President, Comcast Corporation

PHILIP E. HUGHES, JR.

Trustee

Vice-Chairman of Keystone Industries

OLIVER C. MITCHELL, JR.

Trustee

Attorney and Consultant

CHARLES P. PIZZI

Trustee

Retired President, Director and Chief

Executive Officer, Tasty Baking Company

Table of Contents

FS Global Credit Opportunities Fund

Annual Report for the Year Ended December 31, 2013

REPORT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

The Board of Trustees and Shareholders of FS Global Credit Opportunities Fund

We have audited the accompanying statement of assets and liabilities of FS Global Credit Opportunities Fund (the Fund), including the schedule of investments, as of December 31, 2013, and the related statements of operations, cash flows, changes in net assets, and the financial highlights for the period then ended. These financial statements and financial highlights are the responsibility of the Fund’s management. Our responsibility is to express an opinion on these financial statements and financial highlights based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements and financial highlights are free of material misstatement. We were not engaged to perform an audit of the Fund’s internal control over financial reporting. Our audits included consideration of internal control over financial reporting as a basis for designing audit procedures that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the effectiveness of the Fund’s internal control over financial reporting. Accordingly, we express no such opinion. An audit also includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements and financial highlights, assessing the accounting principles used and significant estimates made by management, and evaluating the overall financial statement presentation. Our procedures included confirmation of securities owned as of December 31, 2013, by correspondence with the custodian and brokers. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the financial statements and financial highlights referred to above present fairly, in all material respects, the financial position of FS Global Credit Opportunities Fund at December 31, 2013, the results of its operations, its cash flows, the changes in its net assets, and the financial highlights for the period then ended, in conformity with U.S. generally accepted accounting principles.

Philadelphia, Pennsylvania

February 26, 2014

1

FS Global Credit Opportunities Fund

Schedule of Investments

As of December 31, 2013

(in thousands, except share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Portfolio Company(a) | | Footnotes | | Industry | | Rate | | Floor | | | Maturity | | | Principal

Amount(b) | | | Amortized

Cost | | | Fair

Value(c) | |

Senior Secured Loans—First Lien—20.5% | | | | | | | | | | | | | | | | | | | | | | | | | | |

Avaya Inc. | | (d) | | Technology Hardware & Equipment | | L+675 | | | 1.3 | % | | | 3/31/18 | | | $ | 2,000 | | | $ | 2,020 | | | $ | 2,033 | |

Caesars Entertainment Operating Co. | | (d) | | Consumer Services | | L+425 | | | | | | | 1/26/18 | | | | 2,000 | | | | 1,892 | | | | 1,897 | |

Clear Channel Communications, Inc. | | (d) | | Media | | L+675 | | | | | | | 1/30/19 | | | | 2,000 | | | | 1,890 | | | | 1,914 | |

Clear Channel Communications, Inc. | | (d) | | Media | | L+750 | | | | | | | 7/30/19 | | | | 500 | | | | 489 | | | | 494 | |

ERC Ireland Holdings Ltd. | | (d) | | Telecommunication Services | | EURIBOR+300, 1.0% PIK | | | | | | | 9/30/17 | | | € | 2,000 | | | | 3,301 | | | | 3,278 | |

NGPL PipeCo LLC | | (d) | | Energy | | L+550 | | | 1.3 | % | | | 9/15/17 | | | $ | 407 | | | | 381 | | | | 380 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Senior Secured Loans—First Lien | | | | | | | | | | | | | | | | | | | | | 9,973 | | | | 9,996 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Senior Secured Loans—Second Lien—10.0% | | | | | | | | | | | | | | | | | | | | | | | | |

Templar Energy LLC | | (d) | | Energy | | L+700 | | | 1.0 | % | | | 11/25/20 | | | | 3,000 | | | | 3,019 | | | | 3,017 | |

Vantage Energy, LLC | | (d) | | Energy | | L+750 | | | 1.0 | % | | | 12/19/18 | | | | 1,846 | | | | 1,828 | | | | 1,846 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Senior Secured Loans—Second Lien | | | | | | | | | | | | | | | | | | | | | 4,847 | | | | 4,863 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Senior Secured Bonds—6.4% | | | | | | | | | | | | | | | | | | | | | | | | |

Caesars Entertainment Operating Co. | | | | Consumer Services | | 10.0% | | | | | | | 12/15/15 | | | | 1,000 | | | | 852 | | | | 865 | |

Energy Future Intermediate Holding Co. LLC | | | | Utilities | | 11.0% | | | | | | | 10/1/21 | | | | 2,000 | | | | 2,219 | | | | 2,226 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Senior Secured Bonds | | | | | | | | | | | | | | | | | | | | | 3,071 | | | | 3,091 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | | | | | | | | Number of

Shares | | | Cost | | | Fair

Value(c) | |

Equity/Other—0.9% | | | | | | | | | | | | | | | | | | | | | | | | | | |

Federal Home Loan Mortgage Corp., Series Z Preferred Equity | | (e) | | Real Estate | | 8.4% | | | | | | | | | | | 50,000 | | | | 421 | | | | 448 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

Total Equity/Other | | | | | | | | | | | | | | | | | | | | | 421 | | | | 448 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

TOTAL INVESTMENTS—37.8% | | | | | | | | | | | | | | | | | | | | $ | 18,312 | | | | 18,398 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

OTHER ASSETS IN EXCESS OF LIABILITIES—62.2% | | | | | | | | | | | | | | | | | | | | | | | | | 30,246 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

NET ASSETS—100.0% | | | | | | | | | | | | | | | | | | | | | | | | $ | 48,644 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) | Security may be an obligation of one or more entities affiliated with the named company. |

| (b) | Denominated in U.S. dollars unless otherwise noted. |

| (c) | Fair value determined by the Fund’s board of trustees (see Note 7). |

| (d) | Position or portion thereof unsettled as of December 31, 2013. |

| (e) | Security is non-income producing. |

See notes to financial statements.

2

FS Global Credit Opportunities Fund

Statement of Assets and Liabilities

(in thousands, except share and per share amounts)

| | | | |

| | | December 31,

2013 | |

Assets | | | | |

Investments, at fair value (amortized cost—$18,312) | | $ | 18,398 | |

Cash | | | 43,938 | |

Cash held by broker(1) | | | 1,000 | |

Expense reimbursement and additional support payment due from sponsor(2) | | | 459 | |

Interest receivable | | | 33 | |

Prepaid expenses | | | 118 | |

| | | | |

Total assets | | $ | 63,946 | |

| | | | |

Liabilities | | | | |

Payable for investments purchased | | $ | 14,833 | |

Shareholder distributions payable | | | 243 | |

Management fees payable | | | 65 | |

Administrative services expense payable | | | 9 | |

Accounting and administrative fees payable | | | 5 | |

Professional fees payable | | | 134 | |

Other accrued expenses and liabilities | | | 13 | |

| | | | |

Total liabilities | | $ | 15,302 | |

| | | | |

Net assets | | $ | 48,644 | |

| | | | |

Composition of net assets | | | | |

Common shares, $0.001 par value, unlimited shares authorized, 4,857,035 shares issued and outstanding | | | 5 | |

Capital in excess of par value | | | 48,566 | |

Accumulated net investment income (loss) | | | — | |

Net unrealized appreciation (depreciation) on investments and gain/loss on foreign currency | | | 73 | |

| | | | |

Net assets | | $ | 48,644 | |

| | | | |

Net asset value per common share at year end | | $ | 10.02 | |

| (1) | Represents cash held in a prime brokerage account with JPMorgan Chase Bank, N.A. |

| (2) | See Note 4 for a discussion of reimbursements and other amounts payable to the Fund by its investment adviser and affiliates. |

See notes to financial statements.

3

FS Global Credit Opportunities Fund

Statement of Operations

(in thousands)

| | | | |

| | | Period from

January 28, 2013

(Inception) to

December 31,

2013 | |

Investment income | | | | |

Interest income | | $ | 11 | |

| | | | |

Total investment income | | | 11 | |

| | | | |

Operating expenses | | | | |

Management fees | | | 65 | |

Administrative services expenses | | | 9 | |

Accounting and administrative fees | | | 5 | |

Professional fees | | | 135 | |

Organization costs | | | 22 | |

Other general and administrative expenses | | | 13 | |

| | | | |

Total operating expenses | | | 249 | |

Less: Expense reimbursement from sponsor(1) | | | (227 | ) |

| | | | |

Net operating expenses | | | 22 | |

| | | | |

Net investment income (loss) | | | (11 | ) |

| | | | |

Realized and unrealized gain/loss | | | | |

Net realized gain (loss) on investments | | | — | |

Net change in unrealized appreciation (depreciation) on investments | | | 86 | |

Net change in unrealized gain (loss) on foreign currency | | | (13 | ) |

| | | | |

Total net realized and unrealized gain (loss) on investments | | | 73 | |

Additional support payment from sponsor(1) | | | 232 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | $ | 294 | |

| | | | |

| (1) | See Note 4 for a discussion of reimbursements and other amounts payable to the Fund by its investment adviser and affiliates. |

See notes to financial statements.

4

FS Global Credit Opportunities Fund

Statement of Changes in Net Assets

(in thousands)

| | | | |

| | | Period from

January 28, 2013

(Inception) to

December 31,

2013 | |

Operations | | | | |

Net investment income (loss) | | $ | (11 | ) |

Net realized gain (loss) on investments | | | — | |

Net change in unrealized appreciation (depreciation) on investments | | | 86 | |

Net change in unrealized gain (loss) on foreign currency | | | (13 | ) |

Net increase from additional support payment from sponsor(1) | | | 232 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | 294 | |

| | | | |

Shareholder distributions(2) | | | | |

Distributions from net investment income | | | (243 | ) |

| | | | |

Net decrease in net assets resulting from shareholder distributions | | | (243 | ) |

| | | | |

Capital share transactions | | | | |

Issuance of common shares | | | 48,571 | |

Capital contributions of investment adviser | | | 22 | |

| | | | |

Net increase in net assets resulting from capital share transactions | | | 48,593 | |

| | | | |

Total increase in net assets | | | 48,644 | |

Net assets at beginning of period | | | — | |

| | | | |

Net assets at end of period | | $ | 48,644 | |

| | | | |

Accumulated net investment income (loss)(2) | | $ | — | |

| | | | |

| (1) | See Note 4 for a discussion of reimbursements and other amounts payable to the Fund by its investment adviser and affiliates. |

| (2) | See Note 5 for a discussion of the sources of distributions paid by the Fund. |

See notes to financial statements.

5

FS Global Credit Opportunities Fund

Statement of Cash Flows

(in thousands)

| | | | |

| | | Period from

January 28, 2013

(Inception) to

December 31,

2013 | |

Cash flows from operating activities | | | | |

Net increase (decrease) in net assets resulting from operations | | $ | 294 | |

Adjustments to reconcile net increase (decrease) in net assets resulting from operations to net cash used in operating activities: | | | | |

Purchases of investments | | | (18,311 | ) |

Net change in unrealized (appreciation) depreciation on investments | | | (86 | ) |

Accretion of discount | | | (1 | ) |

(Increase) decrease in cash held by broker | | | (1,000 | ) |

(Increase) decrease in expense reimbursement and additional support payment due from sponsor(1) | | | (459 | ) |

(Increase) decrease in interest receivable | | | (33 | ) |

(Increase) decrease in prepaid expenses | | | (118 | ) |

Increase (decrease) in payable for investments purchased | | | 14,833 | |

Increase (decrease) in management fees payable | | | 65 | |

Increase (decrease) in administrative services expense payable | | | 9 | |

Increase (decrease) in accounting and administrative fees payable | | | 5 | |

Increase (decrease) in professional fees payable | | | 134 | |

Increase (decrease) in other accrued expenses and liabilities | | | 13 | |

| | | | |

Net cash used in operating activities | | | (4,655 | ) |

| | | | |

Cash flows from financing activities | | | | |

Issuance of common shares | | | 48,571 | |

Capital contributions of investment adviser | | | 22 | |

| | | | |

Net cash provided by financing activities | | | 48,593 | |

| | | | |

Total increase (decrease) in cash | | | 43,938 | |

Cash at beginning of period | | | — | |

| | | | |

Cash at end of period | | $ | 43,938 | |

| | | | |

| (1) | See Note 4 for a discussion of reimbursements and other amounts payable to the Fund by its investment adviser and affiliates. |

See notes to financial statements.

6

FS Global Credit Opportunities Fund

Financial Highlights

(in thousands, except share and per share amounts)

| | | | |

| | | Period from

January 28,

2013

(Inception) to

December 31,

2013 | |

Per Share Data: | | | | |

Net asset value, beginning of period | | $ | 10.00 | |

Results of operations | | | | |

Net investment income (loss)(1)(2) | | | — | |

Net realized and unrealized appreciation (depreciation) on investments and gain (loss) on foreign currency and additional support payment from sponsor | | | 0.07 | |

| | | | |

Net increase (decrease) in net assets resulting from operations | | | 0.07 | |

| | | | |

Shareholder distributions(3) | | | | |

Distributions from net investment income | | | (0.05 | ) |

| | | | |

Net decrease in net assets resulting from shareholder distributions | | | (0.05 | ) |

| | | | |

Net asset value, end of period | | $ | 10.02 | |

| | | | |

Shares outstanding, end of period | | | 4,857,035 | |

| | | | |

Total return(4)(5) | | | 0.65 | % |

| | | | |

Ratios/Supplemental Data: | | | | |

Net assets, end of period | | $ | 48,644 | |

| | | | |

Ratio of net investment income (loss) to average net assets(6)(7) | | | (0.41 | )% |

| | | | |

Ratio of total operating expenses to average net assets(6) | | | 9.36 | % |

Ratio of expense reimbursement from sponsor to average net assets(6) | | | (8.53 | )% |

| | | | |

Ratio of net expenses to average net assets(6) | | | 0.83 | % |

| | | | |

Portfolio turnover(5) | | | 0.00 | % |

| | | | |

| (1) | The per share data was derived by using the average number of common shares outstanding during the period from December 12, 2013 (Commencement of Operations) to December 31, 2013. |

| (2) | Net investment loss for the period is less than $0.005 per common share. |

| (3) | The per share data for distributions reflects the actual amount of distributions paid per common share during the period. |

| (4) | Total return is historical and is calculated by determining the percentage change in net asset value, assuming the reinvestment of all distributions in additional common shares of the Fund at the Fund’s net asset value per share as of the share closing date occurring on or immediately following the distribution payment date. |

| (6) | Annualized. Average daily net assets for the period from December 12, 2013 (Commencement of Operations) to December 31, 2013 are used for this calculation. |

| (7) | Had the sponsor not reimbursed certain operating expenses, the ratio of net investment income (loss) to average net assets would have been (8.94)%. |

See notes to financial statements.

7

FS Global Credit Opportunities Fund

Notes to Financial Statements

(in thousands, except share and per share amounts)

Note 1. Principal Business and Organization

FS Global Credit Opportunities Fund, or the Fund, was organized as a Delaware statutory trust on January 28, 2013 and commenced operations on December 12, 2013 upon FS Global Credit Opportunities Fund—A, or Fund—A, and FS Global Credit Opportunities Fund—D, or Fund—D, and, together with Fund—A, the Companies, collectively raising aggregate net offering proceeds in excess of $2,500, or the minimum offering requirement, from the sale of common shares in their continuous public offerings to persons who were not affiliated with the Fund, the Companies, the Fund’s investment adviser, FS Global Advisor, LLC, or FS Global Advisor, or the investment sub-adviser to FS Global Advisor, GSO Capital Partners LP. FS Global Advisor is a private investment firm that is registered as an investment adviser under the Investment Advisers Act of 1940, as amended, and an affiliate of the Fund’s sponsor, Franklin Square Holdings, L.P., or Franklin Square Holdings. Prior to satisfaction of the minimum offering requirement, the Fund had no operations except for matters relating to its organization and registration as a non-diversified, closed-end management investment company. As of December 31, 2013, 87% and 13% of the Fund’s outstanding common shares of beneficial interest, par value $0.001 per share, or its common shares, were held by Fund—A and Fund—D, respectively.

The Fund is a non-diversified, closed-end management investment company registered under the Investment Company Act of 1940, as amended, or the 1940 Act, that intends to elect to be treated for federal income tax purposes, and intends to qualify annually thereafter, as a regulated investment company, or RIC, under Subchapter M of the Internal Revenue Code of 1986, as amended, or the Code.

The Fund’s primary investment objective is to generate an attractive total return consisting of a high level of current income and capital appreciation, with a secondary objective of capital preservation.

Note 2. Summary of Significant Accounting Policies

Basis of Presentation: The accompanying audited financial statements of the Fund have been prepared in accordance with U.S. generally accepted accounting principles, or GAAP. The Fund has evaluated the impact of subsequent events through the date the financial statements were issued and filed with the Securities and Exchange Commission, or the SEC.

Use of Estimates: The preparation of the Fund’s financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amounts of assets and liabilities, and disclosure of contingent assets and liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting period. Actual results could differ from those estimates. Many of the amounts have been rounded and all amounts are in thousands, except share and per share information.

Cash and Cash Equivalents: The Fund considers all highly liquid investments with original maturities of three months or less to be cash equivalents. The Fund’s cash and cash equivalents are maintained with high credit quality financial institutions.

Valuation of Portfolio Investments: The Fund determines the fair value of its investment portfolio each day that the New York Stock Exchange is open for business as of the close of the regular trading session. The Fund calculates the net asset value, or NAV, of its common shares, by subtracting liabilities (including accrued expenses or distributions) from the total assets of the Fund (the value of securities, plus cash or other assets, including interest and distributions accrued but not yet received) and dividing the result by the total number of its outstanding common shares. The Fund’s assets and liabilities will be valued in accordance with the principles set forth below.

8

FS Global Credit Opportunities Fund

Notes to Financial Statements (continued)

(in thousands, except share and per share amounts)

Note 2. Summary of Significant Accounting Policies (continued)

FS Global Advisor values the Fund’s assets in good faith pursuant to the Fund’s valuation policy and consistently applied valuation process, which was developed by the Fund’s valuation committee and approved by the Fund’s board of trustees, or the Board. Portfolio securities and other assets for which market quotes are readily available are valued at market value. In circumstances where market quotes are not readily available, the Board has adopted methods for determining the fair value of such securities and other assets, and has delegated the responsibility for applying the valuation methods to FS Global Advisor. On a quarterly basis, the Board reviews the valuation determinations made with respect to the Fund’s investments during the preceding quarter and evaluates whether such determinations were made in a manner consistent with the Fund’s valuation process.

Accounting Standards Codification Topic 820, Fair Value Measurements and Disclosure, or ASC Topic 820, issued by the Financial Accounting Standards Board, clarifies the definition of fair value and requires companies to expand their disclosure about the use of fair value to measure assets and liabilities in interim and annual periods subsequent to initial recognition. ASC Topic 820 defines fair value as the price that would be received from the sale of an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date. ASC Topic 820 also establishes a three-tier fair value hierarchy, which prioritizes the inputs used in measuring fair value. These tiers include: Level 1, defined as observable inputs such as quoted prices in active markets; Level 2, which includes inputs such as quoted prices for similar securities in active markets and quoted prices for identical securities where there is little or no activity in the market; and Level 3, defined as unobservable inputs for which little or no market data exists, therefore requiring an entity to develop its own assumptions.

When determining the fair value of an asset, FS Global Advisor seeks to determine the price that would be received from the sale of the asset in an orderly transaction between market participants at the measurement date, in accordance with ASC Topic 820. Fair value determinations are based upon all available inputs that FS Global Advisor deems relevant, which may include indicative dealer quotes, values of like securities, recent portfolio company financial statements and forecasts, and valuations prepared by third party valuation services. However, determination of fair value involves subjective judgments and estimates. Accordingly, the notes to the Fund’s financial statements refer to the uncertainty with respect to the possible effect of such valuations and any change in such valuations on the Fund’s financial statements.

The Fund expects that its portfolio will primarily consist of securities listed or traded on a recognized securities exchange or automated quotation system, or exchange-traded securities, or securities traded on a privately negotiated over-the-counter secondary market for institutional investors for which indicative dealer quotes are available, or OTC securities.

For purposes of calculating NAV, FS Global Advisor uses the following valuation methods:

| | • | | The market value of each exchange-traded security is the last reported sale price at the relevant valuation date on the composite tape or on the principal exchange on which such security is traded. |

| | • | | If no sale is reported for an exchange-traded security on the valuation date or if a security is an OTC security, the Fund values such securities using quotations obtained from an independent third-party pricing service, which provides prevailing bid and ask prices that are screened for validity by the service from dealers on the valuation date. For investments for which a third-party pricing service is unable to obtain quoted prices, the Fund will obtain bid and ask prices directly from dealers who make a market in such securities. In all such cases, securities are valued at the mid-point of the average bid and ask prices obtained from such sources. |

9

FS Global Credit Opportunities Fund

Notes to Financial Statements (continued)

(in thousands, except share and per share amounts)

Note 2. Summary of Significant Accounting Policies (continued)

| | • | | To the extent that the Fund holds investments for which no active secondary market exists and, therefore, no bid and ask prices can be readily obtained, the Fund will value such investments at fair value as determined in good faith by FS Global Advisor in accordance with the Fund’s valuation policy and pursuant to authority delegated by the Board as described below. In making such determination, FS Global Advisor may rely upon valuations obtained from an independent valuation firm. |

Below is a description of factors that may be considered when valuing securities for which no active secondary market exists.

Valuation of fixed income investments, such as loans and debt securities, depends upon a number of factors, including prevailing interest rates for like securities, expected volatility in future interest rates, call features, put features and other relevant terms of the debt. For investments without readily available market prices, these factors may be incorporated into discounted cash flow models to arrive at fair value. Other factors that may be considered include the borrower’s ability to adequately service its debt, the fair market value of the portfolio company in relation to the face amount of its outstanding debt and the quality of collateral securing its debt investments.

For convertible debt securities, fair value will generally approximate the fair value of the debt plus the fair value of an option to purchase the underlying security (the security into which the debt may convert) at the conversion price. To value such an option, a standard option pricing model may be used.

For equity interests, various factors may be considered in determining fair value, including multiples of earnings before interest, taxes, depreciation and amortization, or EBITDA, cash flows, net income, revenues or, in limited instances, book value or liquidation value. All of these factors may be subject to adjustments based upon the particular circumstances of a portfolio company or the Fund’s actual investment position. For example, adjustments to EBITDA may take into account compensation to previous owners or an acquisition, recapitalization, restructuring or other related items.

Other factors that may be considered in valuing securities include private merger and acquisition statistics, public trading multiples discounted for illiquidity and other factors, valuations implied by third-party investments in the portfolio companies, the acquisition price of such investment or industry practices in determining fair value. Size and scope of a portfolio company and its specific strengths and weaknesses, as well as any other factors deemed relevant in assessing fair value, may also be considered.

If the Fund receives warrants or other equity securities at nominal or no additional cost in connection with an investment in a debt security, the cost basis in the investment will be allocated between the debt securities and any such warrants or other equity securities received at the time of origination. Such warrants or other equity securities will subsequently be valued at fair value.

Portfolio securities that carry certain restrictions on sale will typically be valued at a discount from the public market value of the security, where applicable.

If events materially affecting the price of foreign portfolio securities occur between the time when their price was last determined on such foreign securities exchange or market and the time when the Fund’s NAV was last calculated (for example, movements in certain U.S. securities indices which demonstrate strong correlation to

10

FS Global Credit Opportunities Fund

Notes to Financial Statements (continued)

(in thousands, except share and per share amounts)

Note 2. Summary of Significant Accounting Policies (continued)

movements in certain foreign securities markets), such securities may be valued at their fair value as determined in good faith in accordance with procedures established by the Board. For purposes of calculating NAV, all assets and liabilities initially expressed in foreign currencies will be converted into U.S. dollars at prevailing exchange rates as may be determined in good faith by FS Global Advisor, under the supervision of the Board.

Revenue Recognition: Security transactions are accounted for on their trade date. The Fund records interest income on an accrual basis to the extent that it expects to collect such amounts. The Fund records dividend income on the ex-dividend date. The Fund does not accrue as a receivable interest or dividends on loans and securities if there is reason to doubt the collectability of such income. Loan origination fees, original issue discount and market discount are capitalized and such amounts are amortized as interest income over the respective term of the loan or security. Upon the prepayment of a loan or security, any unamortized loan origination fees and original issuance discount are recorded as interest income. Upfront structuring fees are recorded as fee income when earned. The Fund records prepayment premiums on loans and securities as fee income when it receives such amounts.

Net Realized Gains or Losses, Net Change in Unrealized Appreciation or Depreciation and Net Change in Unrealized Gains or Losses on Foreign Currency: Gains or losses on the sale of investments are calculated by using the specific identification method. The Fund measures realized gains or losses by the difference between the net proceeds from the repayment or sale and the amortized cost basis of the investment, without regard to unrealized appreciation or depreciation previously recognized. Net change in unrealized appreciation or depreciation reflects the change in portfolio investment values during the reporting period, including any reversal of previously recorded unrealized gains or losses, when gains or losses are realized. Net change in unrealized gains or losses on foreign currency reflects the change in the value of receivables or accruals during the reporting period due to the impact of foreign currency fluctuations.

Organization Costs: Organization costs include, among other things, the cost of formation, including the cost of legal services and other fees pertaining to the Fund’s organization. These costs are expensed as incurred. For the period from January 28, 2013 (Inception) to December 31, 2013, the Fund incurred organization costs of $22, which were paid on behalf of the Fund by Franklin Square Holdings and recorded as a contribution to capital (see Note 4).

Income Taxes: The Fund intends to elect to be treated for federal income tax purposes, and intends to qualify annually thereafter, as a RIC under Subchapter M of the Code. To qualify for and maintain RIC tax treatment, the Fund must, among other things, meet certain source-of-income and asset diversification requirements and distribute to its shareholders, for each taxable year, at least 90% of its “investment company taxable income,” which is generally the Fund’s net ordinary income plus the excess, if any, of realized net short-term capital gains over realized net long-term capital losses. As a RIC, the Fund will not have to pay corporate-level federal income taxes on any income that it distributes to its shareholders. The Fund intends to make distributions in an amount sufficient to maintain its RIC status each year and to avoid any federal income taxes on income so distributed. The Fund will also be subject to nondeductible federal excise taxes if it does not distribute at least 98% of net ordinary income, 98.2% of capital gain net income, if any, and any recognized and undistributed income from prior years for which it paid no federal income taxes.

Uncertainty in Income Taxes: The Fund evaluates its tax positions to determine if the tax positions taken meet the minimum recognition threshold in connection with accounting for uncertainties in income tax positions taken or expected to be taken for the purposes of measuring and recognizing tax benefits or liabilities in the

11

FS Global Credit Opportunities Fund

Notes to Financial Statements (continued)

(in thousands, except share and per share amounts)

Note 2. Summary of Significant Accounting Policies (continued)

financial statements. Recognition of a tax benefit or liability with respect to an uncertain tax position is required only when the position is “more likely than not” to be sustained assuming examination by taxing authorities. The Fund recognizes interest and penalties, if any, related to unrecognized tax liabilities as income tax expense in the Statement of Operations. During the period from January 28, 2013 (Inception) to December 31, 2013, the Fund did not incur any interest or penalties.

Distributions: Distributions to the Fund’s shareholders are recorded as of the record date. Subject to the discretion of the Board and applicable legal restrictions, the Fund intends to authorize and declare ordinary cash distributions on a weekly basis and to pay such distributions on either a monthly or quarterly basis. Net realized capital gains, if any, will be distributed or deemed distributed at least annually.

Note 3. Share Transactions

Below is a summary of transactions with respect to the Fund’s common shares during the period from January 28, 2013 (Inception) to December 31, 2013:

| | | | | | | | |

| | | Period from

January 28, 2013

(Inception) to

December 31, 2013 | |

| | | Shares | | | Amount | |

Proceeds from Issuance of Common Shares | | | 4,857,035 | | | $ | 48,571 | |

Common shares of the Fund are issued solely to Fund—A and Fund—D in private placement transactions that do not involve any “public offering” within the meaning of Section 4(a)(2) of, and/or Regulation D under, the Securities Act of 1933, as amended. During the period from January 28, 2013 (Inception) to December 31, 2013, the Fund issued 4,223,035 common shares to Fund—A and 634,000 common shares to Fund—D for proceeds of $42,231 and $6,340, respectively.

The Fund will repurchase common shares held by Fund—A and Fund—D to the extent necessary to accommodate repurchase requests under each Company’s share repurchase program. During the period from January 28, 2013 (Inception) to December 31, 2013, the Fund did not repurchase any of its common shares in connection with the Companies’ share repurchase programs.

Note 4. Related Party Transactions

Compensation of the Investment Adviser and its Affiliates

Pursuant to the amended and restated investment advisory agreement, dated as of October 9, 2013, by and between the Fund and FS Global Advisor, or the investment advisory agreement, FS Global Advisor is entitled to (a) an annual management fee of 2.0% of the average daily value of the Fund’s gross assets and (b) an incentive fee based on the Fund’s performance. The Fund commenced accruing fees under the investment advisory agreement on December 12, 2013, upon commencement of the Fund’s operations. Management fees are calculated and payable quarterly in arrears.

The incentive fee is calculated and payable quarterly in arrears based upon the Fund’s “pre-incentive fee net investment income” for the immediately preceding quarter, and is subject to a hurdle rate, expressed as a rate of return on the Fund’s “adjusted capital,” equal to 2.25% per quarter (or an annualized hurdle rate of 9.00%), subject to a “catch-up” feature. For this purpose, “pre-incentive fee net investment income” means interest income, dividend income and any other income accrued during the calendar quarter, minus the Fund’s operating

12

FS Global Credit Opportunities Fund

Notes to Financial Statements (continued)

(in thousands, except share and per share amounts)

Note 4. Related Party Transactions (continued)

expenses for the quarter (including the management fee, expenses reimbursed to FS Global Advisor under the administration agreement, dated as of July 15, 2013, by and between the Fund and FS Global Advisor, or the administration agreement, and any interest expense and distributions paid on any issued and outstanding preferred shares, but excluding the incentive fee). Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with paid-in-kind interest and zero coupon securities), accrued income that the Fund has not yet received in cash. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation. “Adjusted capital” means the cumulative gross proceeds received by the Fund from the issuance of common shares (including common shares issued in respect of reinvested distributions), reduced by amounts paid in connection with repurchases of common shares to fulfill the Fund’s obligations under the Companies’ share repurchase programs.

The calculation of the incentive fee for each quarter is as follows:

| | • | | No incentive fee is payable in any calendar quarter in which the Fund’s pre-incentive fee net investment income does not exceed the quarterly hurdle rate of 2.25%; |

| | • | | 100% of the Fund’s pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than or equal to 2.8125% in any calendar quarter (11.25% annualized) is payable to FS Global Advisor. This portion of the Fund’s pre-incentive fee net investment income which exceeds the hurdle rate but is less than or equal to 2.8125% is referred to as the “catch-up.” The “catch-up” provision is intended to provide FS Global Advisor with an incentive fee of 20.0% on all of the Fund’s pre-incentive fee net investment income when the Fund’s pre-incentive fee net investment income reaches 2.8125% in any calendar quarter; and |

| | • | | 20.0% of the amount of the Fund’s pre-incentive fee net investment income, if any, that exceeds 2.8125% in any calendar quarter (11.25% annualized) is payable to FS Global Advisor once the hurdle rate is reached and the catch-up is achieved (20.0% of all the Fund’s pre-incentive fee net investment income thereafter is allocated to FS Global Advisor). |

Under the administration agreement, the Fund reimburses FS Global Advisor for its actual costs incurred in providing administrative services to the Fund, including general ledger accounting, fund accounting, legal services, investor relations and other administrative services. FS Global Advisor is required to allocate the cost of these services to the Fund based on objective factors such as total assets, revenues and/or time allocations. At least annually, the Board will review the amount of the administrative services expenses reimbursable to FS Global Advisor to determine whether such amount is reasonable in relation to the services provided. In making this determination, the Board will, among other things, compare the total amount paid to FS Global Advisor for such services as a percentage of the Fund’s net assets to the same ratio as reported by other comparable investment companies. The Fund will not reimburse FS Global Advisor for any services for which it receives a separate fee or for any administrative expenses allocated to a controlling person of FS Global Advisor.

Franklin Square Holdings has funded organization costs in the amount of $22 for the period from January 28, 2013 (Inception) to December 31, 2013. These costs have been recorded by the Fund as a contribution to capital. The organization costs were charged to expense as incurred by the Fund (see Note 2). Under the terms of the administration agreement, upon satisfaction of the minimum offering requirement, FS Global Advisor became entitled to receive 1.5% of offering proceeds from the issuance of the Fund’s common

13

FS Global Credit Opportunities Fund

Notes to Financial Statements (continued)

(in thousands, except share and per share amounts)

Note 4. Related Party Transactions (continued)

shares until all organization and offering costs funded by FS Global Advisor and its affiliates (including Franklin Square Holdings) have been recovered. Any such reimbursements will be recorded by the Fund as a reduction of capital. FS Global Advisor has agreed to waive reimbursement of 1.5% of the net proceeds raised through December 31, 2013. As such, no liability is reflected for such reimbursement on the Fund’s financial statements.

The following table describes the fees and expenses accrued under the investment advisory agreement and the administration agreement during the period from January 28, 2013 (Inception) to December 31, 2013:

| | | | | | | | |

Related Party | | Source Agreement | | Description | | Period from

January 28, 2013

(Inception) to

December 31, 2013 | |

| | | |

FS Global Advisor | | Investment Advisory Agreement | | Management Fee(1) | | $ | 65 | |

| | | |

FS Global Advisor | | Investment Advisory Agreement | | Incentive Fee | | $ | — | |

| | | |

FS Global Advisor | | Administration Agreement | | Administrative Services Expenses(1) | | $ | 9 | |

| (1) | During the period from January 28, 2013 (Inception) to December 31, 2013, $65 in management fees and $9 in administrative services expenses were accrued and will be applied to offset the liability of Franklin Square Holdings under the expense reimbursement agreement (see “—Expense Reimbursement Agreement and Additional Support Payments”). |

Capital Contribution by FS Global Advisor

In March 2013, Michael C. Forman and David J. Adelman, the principals of FS Global Advisor, each contributed approximately $100 to purchase 5,000 common shares of beneficial interest of Fund—A and 5,000 common shares of beneficial interest of Fund—D, in each case at a price of $10.00 per share. The Companies, in turn, each purchased 10,000 common shares of the Fund at $10.00 per share. The principals will not tender for repurchase the common shares of the Companies held by them as long as FS Global Advisor remains the Fund’s investment adviser.

Potential Conflicts of Interest

FS Global Advisor’s senior management team is comprised of the same personnel as the senior management teams of the investment advisers to Franklin Square Holdings’ other sponsored investment funds, including FB Income Advisor, LLC, the investment adviser to FS Investment Corporation, FS Investment Advisor, LLC, the investment adviser to FS Energy and Power Fund, FSIC II Advisor, LLC, the investment adviser to FS Investment Corporation II, and FSIC III Advisor, LLC, the investment adviser to FS Investment Corporation III. As a result, such members provide investment advisory services to the Fund, FS Investment Corporation, FS Energy and Power Fund, FS Investment Corporation II and FS Investment Corporation III. While none of FS Global Advisor, FB Income Advisor, LLC, FS Investment Advisor, LLC, FSIC II Advisor, LLC or FSIC III Advisor, LLC is currently making private corporate debt investments for clients other than the Fund, FS Investment Corporation, FS Energy and Power Fund, FS Investment Corporation II and FS Investment Corporation III, respectively, any such entity may do so in the future. In the event that FS Global Advisor undertakes to provide investment advisory services to other clients in the future, it intends to allocate investment opportunities in a fair and equitable manner consistent with the Fund’s investment objectives and strategies, so

14

FS Global Credit Opportunities Fund

Notes to Financial Statements (continued)

(in thousands, except share and per share amounts)

Note 4. Related Party Transactions (continued)

that the Fund will not be disadvantaged in relation to any other client of FS Global Advisor or its management team. In addition, even in the absence of FS Global Advisor retaining additional clients, it is possible that some investment opportunities may be provided to FS Investment Corporation, FS Energy and Power Fund, FS Investment Corporation II and FS Investment Corporation III, rather than to the Fund.

Expense Reimbursement Agreement and Additional Support Payments

Pursuant to an expense support and conditional reimbursement agreement, dated as of August 20, 2013, by and between the Fund and Franklin Square Holdings, or the expense reimbursement agreement, Franklin Square Holdings has agreed to reimburse the Fund for expenses to ensure that the Fund bears a reasonable level of expenses in relation to its income. The purpose of this arrangement is to ensure that no portion of any ordinary cash distributions made by the Fund will be paid from offering proceeds or borrowings. However, because certain investments the Fund may make, including preferred and common equity investments, may generate dividends and other distributions to the Fund that are treated for tax purposes as a return of capital, a portion of the Fund’s ordinary cash distributions may also be deemed to constitute a return of capital for tax purposes to the extent that the Fund may use such dividends or other distribution proceeds as a source of distributions. Under those circumstances, Franklin Square Holdings will not reimburse the Fund for the portion of the Fund’s ordinary cash distributions that represent a return of capital for tax purposes, as the purpose of the expense reimbursement arrangement is not to prevent tax-advantaged distributions.

Under the expense reimbursement agreement, Franklin Square Holdings will reimburse the Fund quarterly in an amount equal to the difference between the cumulative ordinary cash distributions paid to the Fund’s shareholders in such quarter, less the sum of the Fund’s net investment income, net short-term capital gains and dividends and other distributions paid to the Fund on account of investments in portfolio companies (to the extent such amounts are not included in net investment income or net short-term capital gains) in such quarter.

For the period from January 28, 2013 (Inception) to December 31, 2013, the required reimbursement exceeded total operating expenses. The amount by which the required distribution exceeded total operating expenses is reflected as an additional support payment in the Statement of Operations. The additional support payment is considered ordinary income for tax purposes and therefore the Fund’s distributions to shareholders that were paid from such support payment are reflected as distributions from net investment income on the Statement of Changes in Net Assets.

Pursuant to the expense reimbursement agreement, the Fund will have a conditional obligation to reimburse Franklin Square Holdings for any amounts funded by Franklin Square Holdings under this arrangement if (and only to the extent that), during any fiscal quarter occurring within three years of the date on which Franklin Square Holdings funded such amount, the sum of the Fund’s net investment income, net short-term capital gains and the amount of any dividends and other distributions paid to the Fund on account of investments in portfolio companies (to the extent not included in net investment income or net short-term capital gains) exceeds the ordinary cash distributions paid by the Fund to shareholders in such quarter; provided, however, that (i) the Fund will only reimburse Franklin Square Holdings for expense support payments made by Franklin Square Holdings to the extent that the payment of such reimbursement (together with any other reimbursement paid during such fiscal year) does not cause “other operating expenses” (as defined below) (on an annualized basis and net of any expense support payments received by the Fund during such fiscal year) to exceed the lesser of (A) 1.75% of the Fund’s average net assets attributable to its common shares for the fiscal year-to-date period after taking such expense reimbursement payments into account and (B) the percentage of the Fund’s average net assets

15

FS Global Credit Opportunities Fund

Notes to Financial Statements (continued)

(in thousands, except share and per share amounts)

Note 4. Related Party Transactions (continued)

attributable to its common shares represented by “other operating expenses” during the fiscal year in which such expense support payment from Franklin Square Holdings was made (provided, however, that this clause (B) shall not apply to any reimbursement payment which relates to an expense support payment from Franklin Square Holdings made during the same fiscal year) and (ii) the Fund will not reimburse Franklin Square Holdings for expense support payments made by Franklin Square Holdings if the annualized rate of distributions per common share declared by the Fund is less than the annualized rate of distributions per common share declared by the Fund at the time Franklin Square Holdings made the expense support payment to which such reimbursement relates. “Other operating expenses” means the Fund’s total operating expenses, excluding the management fee, the incentive fee, organization and offering expenses, financing fees and costs, interest expense and extraordinary expenses. “Operating expenses” means all operating costs and expenses incurred, as determined in accordance with GAAP for investment companies.

The Fund or Franklin Square Holdings may terminate the expense reimbursement agreement at any time. Franklin Square Holdings has indicated that it expects to continue such reimbursements until it deems that the Fund has achieved economies of scale sufficient to ensure that the Fund bears a reasonable level of expenses in relation to its income.

The specific amount of expenses reimbursed by Franklin Square Holdings pursuant to the expense reimbursement agreement, if any, will be determined at the end of each fiscal quarter. Upon termination of the expense reimbursement agreement by Franklin Square Holdings, Franklin Square Holdings will be required to fund any amounts accrued thereunder as of the date of termination. Similarly, the conditional obligation of the Fund to reimburse Franklin Square Holdings pursuant to the terms of the expense reimbursement agreement shall survive the termination of such agreement by either party.

The following table reflects the expense reimbursement and additional support payments due from Franklin Square Holdings to the Fund as of December 31, 2013 that may become subject to repayment by the Fund to Franklin Square Holdings:

| | | | | | | | |

Quarter Ended | | Amount of Expense

Reimbursement and

Additional Support Payment | | Annualized “Other Operating

Expenses” Ratio as of the Date of

Support Payment | | Annualized Rate

of Distributions

Per Share(1) | | Reimbursement Eligibility Expiration |

| December 31, 2013 | | $459 | | 6.09% | | 8.68% | | December 31, 2016 |

| (1) | The annualized rate of distributions per share is expressed as a percentage equal to the projected annualized distribution amount as of December 31, 2013 (which is calculated by annualizing the regular weekly cash distribution per share as of December 31, 2013 without compounding), divided by the Fund’s NAV per share as of December 31, 2013. |

Franklin Square Holdings is controlled by the Fund’s chairman, president and chief executive officer, Michael C. Forman, and the Fund’s vice-chairman, David J. Adelman. There can be no assurance that the expense reimbursement agreement will remain in effect or that Franklin Square Holdings will reimburse any portion of the Fund’s expenses in future years.

FS Benefit Trust

On May 30, 2013, FS Benefit Trust was formed as a Delaware statutory trust for the purpose of awarding equity incentive compensation to employees of Franklin Square Holdings and its affiliates. In connection with

16

FS Global Credit Opportunities Fund

Notes to Financial Statements (continued)

(in thousands, except share and per share amounts)

Note 4. Related Party Transactions (continued)

Fund—A’s weekly closing occurring on December 12, 2013, FS Benefit Trust purchased approximately $71 of Fund—A’s common shares at a purchase price of $10.00 per common share, which represents Fund—A’s public offering price as of such date, net of selling commissions and dealer manager fees. The Fund issued 7,134 common shares to Fund—A in respect of the common shares purchased by FS Benefit Trust.

Note 5. Distributions

The following table reflects the cash distributions declared and payable on the Fund’s common shares during the year ended December 31, 2013:

| | | | |

| | | Distribution |

For the Year Ended | | Per Share | | Amount |

| December 31, 2013(1) | | $0.0502 | | $243 |

| (1) | Represents cash distributions per common share declared by the Fund for the period from December 12, 2013 (Commencement of Operations) to December 31, 2013. |

On January 13, 2014, the Board declared regular weekly cash distributions for January 2014 through March 2014. The regular weekly cash distributions, each in the amount of $0.016722 per common share, have been or will be paid monthly to shareholders of record as of weekly record dates previously determined by the Board. The timing and amount of any future distributions to shareholders are subject to applicable legal restrictions and the sole discretion of the Board.

Each of the Companies has adopted an “opt in” distribution reinvestment plan for its shareholders pursuant to which shareholders of each Company can elect to receive their cash distributions in additional common shares of such Company. To the extent that a Company’s shareholders reinvest their cash distributions, such Company will use the proceeds to purchase additional common shares of the Fund. As such, a portion of the cash distributions paid by the Fund (and subsequently paid by the Companies to their respective shareholders) may be reinvested in additional common shares of the Fund.

The Fund may fund its cash distributions to shareholders from any sources of funds available to it, including offering proceeds, borrowings, net investment income from operations, capital gains proceeds from the sale of assets, non-capital gains proceeds from the sale of assets, dividends or other distributions paid to the Fund on account of preferred and common equity investments in portfolio companies and expense reimbursements and additional support payments from Franklin Square Holdings. The Fund has not established limits on the amount of funds it may use from available sources to make distributions.

The Fund expects that for a period of time following commencement of its operations, which time period may be significant, substantial portions of the Fund’s distributions may be funded through the reimbursement of certain expenses and additional support payments by Franklin Square Holdings and its affiliates, including through the waiver of certain investment advisory fees by FS Global Advisor, that are subject to repayment by the Fund within three years. The purpose of this arrangement is to ensure that no portion of the Fund’s distributions to shareholders will be paid from offering proceeds or borrowings. Any such distributions funded through support payments or waivers of advisory fees are not based on the Fund’s investment performance and the Fund’s distributions can only be sustained if the Fund achieves positive investment performance in future

17

FS Global Credit Opportunities Fund

Notes to Financial Statements (continued)

(in thousands, except share and per share amounts)

Note 5. Distributions (continued)

periods and/or Franklin Square Holdings continues to make such payments or waivers of such fees. The Fund’s future repayments of amounts reimbursed or waived by Franklin Square Holdings and its affiliates will reduce the distributions that shareholders would otherwise receive in the future. There can be no assurance that the Fund will achieve the performance necessary to sustain its distributions or that the Fund will be able to pay distributions at a specific rate or at all. Franklin Square Holdings and its affiliates have no obligation to waive advisory fees or otherwise reimburse expenses in future periods. For the period from January 28, 2013 (Inception) to December 31, 2013, if Franklin Square Holdings had not reimbursed certain of the Fund’s expenses and provided additional support payments, 100% of the cash distributions paid to shareholders during such period would have been funded from offering proceeds or borrowings.

The following table reflects the sources of the cash distributions on a tax basis that the Fund has paid on its common shares during the period from January 28, 2013 (Inception) to December 31, 2013:

| | | | | | | | |

| | | Period from January 28, 2013

(Inception) to December 31, 2013 | |

Source of Distribution | | Distribution Amount | | | Percentage | |

Offering proceeds | | $ | — | | | | — | |

Borrowings | | | — | | | | — | |

Net investment income (prior to expense reimbursement and additional support payment)(1) | | | — | | | | — | |

Capital gains proceeds from the sale of assets | | | — | | | | — | |

Non-capital gains proceeds from the sale of assets | | | — | | | | — | |

Distributions on account of preferred and common equity | | | — | | | | — | |

Expense reimbursement and additional support payment from sponsor | | | 243 | | | | 100 | % |

| | | | | | | | |

Total | | $ | 243 | | | | 100 | % |

| | | | | | | | |

| (1) | During the period from January 28, 2013 (Inception) to December 31, 2013, 91% of the Fund’s gross investment income was attributable to cash interest earned and 9% was attributable to non-cash accretion of discount. |

The Fund’s net investment income on a tax basis for the period from January 28, 2013 (Inception) to December 31, 2013 was $11. As of December 31, 2013, the Fund had distributed all of its net investment income on a tax basis.

The difference between the Fund’s GAAP-basis net investment income and its tax-basis net investment income is due to the tax basis reversal of organization costs.

The following table sets forth a reconciliation between GAAP-basis net investment income and tax-basis net investment income during the period from January 28, 2013 (Inception) to December 31, 2013:

| | | | |

| | | Period from

January 28, 2013

(Inception) to

December 31, 2013 | |

GAAP-basis net investment income (loss) | | $ | (11 | ) |

Tax-basis reversal of organization costs | | | 22 | |

| | | | |

Tax-basis net investment income (loss) | | $ | 11 | |

| | | | |

18

FS Global Credit Opportunities Fund

Notes to Financial Statements (continued)

(in thousands, except share and per share amounts)

Note 5. Distributions (continued)

The Fund may make certain adjustments to the classification of shareholder’s equity as a result of permanent book-to-tax differences. During period from January 28, 2013 (Inception) to December 31, 2013, the Fund increased accumulated net investment loss by $254, decreased accumulated realized gains by $232 and decreased capital in excess of par value by $22.

The determination of the tax attributes of the Fund’s distributions is made annually as of the end of the Fund’s fiscal year based upon the Fund’s taxable income for the full year and distributions paid for the full year. The actual tax characteristics of distributions to shareholders are reported to shareholders annually on Form 1099-DIV.

As of December 31, 2013, the components of accumulated earnings on a tax basis were as follows:

| | | | |

| | | December 31,

2013 | |

Distributable ordinary income | | $ | — | |

Net unrealized appreciation (depreciation) on investments and gain/loss on foreign currency(1) | | | 73 | |

| | | | |

| | $ | 73 | |

| | | | |

| (1) | As of December 31, 2013, the gross unrealized appreciation on the Fund’s investments was $112 and the gross unrealized depreciation on the Fund’s investments and loss on foreign currency was $39. |

The aggregate cost of the Fund’s investments for federal income tax purposes totaled $18,312 as of December 31, 2013. The aggregate net unrealized appreciation (depreciation) on a tax basis was $86 as of December 31, 2013.

Note 6. Investment Portfolio

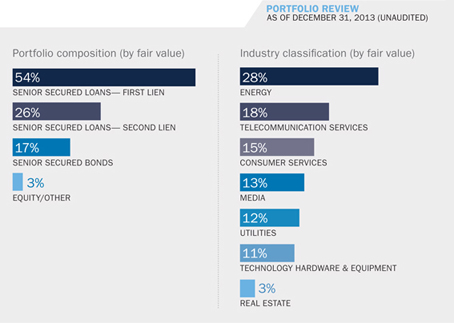

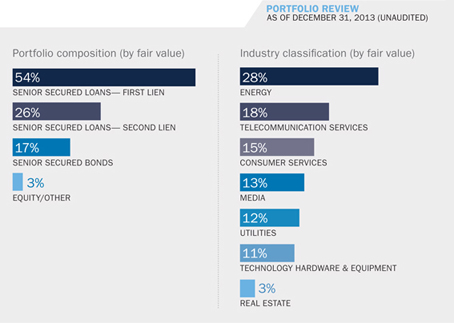

The following table summarizes the composition of the Fund’s investment portfolio at cost and fair value as of December 31, 2013:

| | | | | | | | | | | | |

| | | Amortized Cost(1) | | | Fair Value | | | Percentage

of Portfolio | |

Senior Secured Loans—First Lien | | $ | 9,973 | | | $ | 9,996 | | | | 54 | % |

Senior Secured Loans—Second Lien | | | 4,847 | | | | 4,863 | | | | 26 | % |

Senior Secured Bonds | | | 3,071 | | | | 3,091 | | | | 17 | % |

Equity/Other | | | 421 | | | | 448 | | | | 3 | % |

| | | | | | | | | | | | |

| | $ | 18,312 | | | $ | 18,398 | | | | 100 | % |

| | | | | | | | | | | | |

| (1) | Amortized cost represents the original cost adjusted for the amortization of premiums and/or accretion of discounts, as applicable, on investments. |

The Fund does not “control” and is not an “affiliate” of any of its portfolio companies, each as defined in the 1940 Act. In general, under the 1940 Act, the Fund would be presumed to “control” a portfolio company if it owned 25% or more of its voting securities and would be an “affiliate” of a portfolio company if it owned 5% or more of its voting securities.

19

FS Global Credit Opportunities Fund

Notes to Financial Statements (continued)

(in thousands, except share and per share amounts)

Note 6. Investment Portfolio (continued)

The Fund’s investment portfolio may contain loans that are in the form of lines of credit or revolving credit facilities, which require the Fund to provide funding when requested by portfolio companies in accordance with the terms of the underlying loan agreements. As of December 31, 2013, the Fund held no such investments. The Fund will maintain sufficient cash on hand to fund any such unfunded commitments should the need arise.

The table below describes investments by industry classification and enumerates the percentage, by fair value, of the total portfolio assets in such industries as of December 31, 2013:

| | | | | | | | |

Industry Classification | | Fair Value | | | Percentage

of Portfolio | |

Consumer Services | | $ | 2,762 | | | | 15 | % |

Energy | | | 5,243 | | | | 28 | % |

Media | | | 2,408 | | | | 13 | % |

Real Estate | | | 448 | | | | 3 | % |

Telecommunication Services | | | 3,278 | | | | 18 | % |

Technology Hardware & Equipment | | | 2,033 | | | | 11 | % |

Utilities | | | 2,226 | | | | 12 | % |

| | | | | | | | |

Total | | $ | 18,398 | | | | 100 | % |

| | | | | | | | |

The table below describes the geographic concentration of the Fund’s investment portfolio and enumerates the percentage, by fair value, of the total portfolio assets in such geographic locations as of December 31, 2013:

| | | | | | | | |

Geographic Location(1) | | Fair Value | | | Percentage

of Portfolio | |

United States | | $ | 15,120 | | | | 82 | % |

Europe | | | 3,278 | | | | 18 | % |

| | | | | | | | |

Total | | $ | 18,398 | | | | 100 | % |

| | | | | | | | |

| (1) | Geographic location based on the portfolio company’s headquarters or principal place of business. |

Note 7. Fair Value of Financial Instruments

Under existing accounting guidance, fair value is defined as the price that the Fund would receive upon selling an investment or pay to transfer a liability in an orderly transaction to a market participant in the principal or most advantageous market for the investment. This accounting guidance emphasizes that valuation techniques maximize the use of observable market inputs and minimize the use of unobservable inputs. Inputs refer broadly to the assumptions that market participants would use in pricing an asset or liability, including assumptions about risk. Inputs may be observable or unobservable. Observable inputs are inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on market data obtained from sources independent of the Fund. Unobservable inputs are inputs that reflect the assumptions market participants would use in pricing an asset or liability developed based on the best information available in the circumstances. The Fund classifies the inputs used to measure these fair values into the following hierarchy as defined by current accounting guidance:

Level 1: Inputs that are quoted prices (unadjusted) in active markets for identical assets or liabilities.

20

FS Global Credit Opportunities Fund

Notes to Financial Statements (continued)

(in thousands, except share and per share amounts)

Note 7. Fair Value of Financial Instruments (continued)

Level 2: Inputs that are quoted prices for similar assets or liabilities in active markets.

Level 3: Inputs that are unobservable for an asset or liability.

A financial instrument’s categorization within the valuation hierarchy is based upon the lowest level of input that is significant to the fair value measurement.

As of December 31, 2013, the Fund’s investments were categorized as follows in the fair value hierarchy:

| | | | |

Valuation Inputs | | Investments | |

Level 1—Price quotations in active markets | | $ | 448 | |

Level 2—Significant other observable inputs | | | — | |

Level 3—Significant unobservable inputs | | | 17,950 | |

| | | | |

| | $ | 18,398 | |

| | | | |

The Fund’s investments as of December 31, 2013 consisted primarily of debt securities that are traded on a private over-the-counter market for institutional investors. Except as described below, the Fund valued its investments by using the midpoint of the prevailing bid and ask prices from dealers on the date of the relevant period end, which were provided by an independent third-party pricing service and screened for validity by such service. One equity investment which is traded on an active public market was valued at its closing price as of December 31, 2013.

The Fund will periodically benchmark the bid and ask prices it receives from the third-party pricing service against the actual prices at which the Fund purchases and sells its investments. Based on the results of the benchmark analysis and the experience of the Fund’s management in purchasing and selling these investments in other investment funds managed by the sponsor, the Fund believes that these prices are reliable indicators of fair value. However, because of the private nature of this marketplace (meaning actual transactions are not publicly reported), the Fund believes that these valuation inputs are classified as Level 3 within the fair value hierarchy. The Fund may also use other methods to determine fair value for securities for which it cannot obtain prevailing bid and ask prices through third-party pricing services or independent dealers, including the use of an independent valuation firm. The Fund will periodically benchmark the valuations provided by the independent valuation firm against the actual prices at which the Fund purchases and sells its investments. The Fund’s valuation committee and Board reviewed the valuation determinations made with respect to these investments and determined that they were made in a manner consistent with the Fund’s valuation process.

21