- FSCO Dashboard

-

Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

FS Credit Opportunities (FSCO) 8-KRegulation FD Disclosure

Filed: 6 May 22, 1:44pm

FS Credit Opportunities Corp. Overview and listing preparations May 2022 Exhibit 99.2

1 FS Credit Opportunities Corp. (FSCO) listing overview 2 Why a listing makes sense now 3 Listing considerations 4 Timeline of key events 5 Investor resources Agenda

FS Credit Opportunities Corp. listing overview Company name On March 23, 2022, in preparation for the listing, the Fund was converted from a Delaware statutory trust into Maryland corporation and was renamed FS Credit Opportunities Corp Ticker symbol: FSCO Expected timeline April 28: filed a definitive proxy statement with the U.S. Securities and Exchange Commission Early May: commencement of shareholder proxy solicitation Q3 2022: targeted listing on the New York Stock Exchange, subject to market conditions and final Board approval Quarterly repurchase offer The Q1 2022 quarterly tender offer was the final regular quarterly tender offer Consistent with prior quarterly tender offers, following the first quarter tender, tendered accounts with a value less than $5,000 will be automatically repurchased. Investors do not need to take additional action. Fee structure changes & enhanced dividend Subject to shareholder approval, the investment advisory agreement will be amended upon a listing Reduction in management fee upon listing from 1.50% to 1.35% based on daily gross assets Hurdle rate for the calculation of the incentive fee to be expressed as a percentage of net assets upon listing (compared to adjusted capital currently), consistent with other publicly traded closed-end fund with an incentive fee. The reduction in management fee is expected to enhance the Fund’s net investment income, providing the Fund with the potential to sustain an annualized distribution yield of 7.25%+ at listing based on the Fund’s net asset value as of December 31, 2021. Post-listing liquidity Stockholders are being asked to approve a phased approach to the listing in an attempt to ease the anticipated downward pressure on the market price of the Fund’s shares in the period shortly following the listing. Subject to shareholder approval and final Board approval, shares will be available for trading based on the following schedule: At listing: up to 1/3 of shares held by all shareholders 90 days post-listing: up to 2/3 of shares held by all shareholders 180 days post-listing: all shares held by all shareholders The Board will have discretion to accelerate this phased trading schedule to the entire class of shareholders or, if not the entire class, the accelerated phased trading schedule would be based on an objective set of criteria, such as total shares held by shareholders.

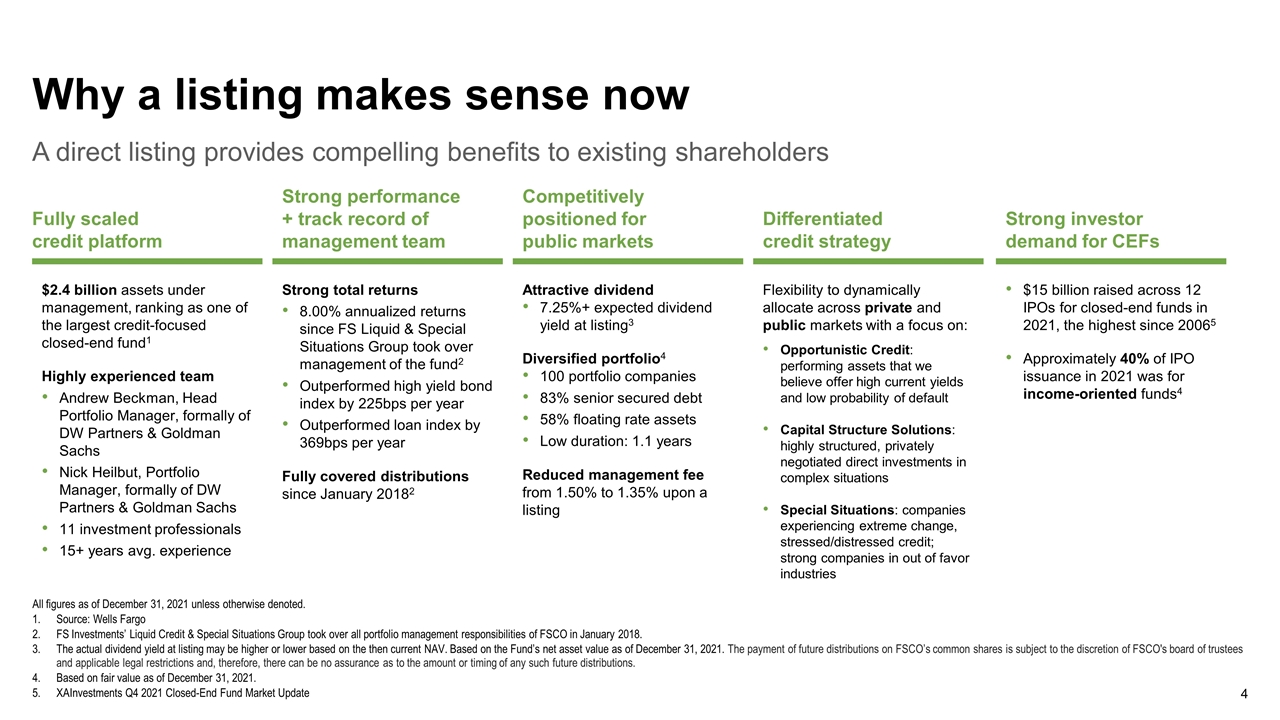

A direct listing provides compelling benefits to existing shareholders All figures as of December 31, 2021 unless otherwise denoted. Source: Wells Fargo FS Investments’ Liquid Credit & Special Situations Group took over all portfolio management responsibilities of FSCO in January 2018. The actual dividend yield at listing may be higher or lower based on the then current NAV. Based on the Fund’s net asset value as of December 31, 2021. The payment of future distributions on FSCO’s common shares is subject to the discretion of FSCO's board of trustees and applicable legal restrictions and, therefore, there can be no assurance as to the amount or timing of any such future distributions. Based on fair value as of December 31, 2021. XAInvestments Q4 2021 Closed-End Fund Market Update Why a listing makes sense now Fully scaled credit platform Strong performance + track record of management team Competitively positioned for public markets Differentiated credit strategy Strong investor demand for CEFs $2.4 billion assets under management, ranking as one of the largest credit-focused closed-end fund1 Highly experienced team Andrew Beckman, Head Portfolio Manager, formally of DW Partners & Goldman Sachs Nick Heilbut, Portfolio Manager, formally of DW Partners & Goldman Sachs 11 investment professionals 15+ years avg. experience Strong total returns 8.00% annualized returns since FS Liquid & Special Situations Group took over management of the fund2 Outperformed high yield bond index by 225bps per year Outperformed loan index by 369bps per year Fully covered distributions since January 20182 Attractive dividend 7.25%+ expected dividend yield at listing3 Diversified portfolio4 100 portfolio companies 83% senior secured debt 58% floating rate assets Low duration: 1.1 years Reduced management fee from 1.50% to 1.35% upon a listing Flexibility to dynamically allocate across private and public markets with a focus on: Opportunistic Credit: performing assets that we believe offer high current yields and low probability of default Capital Structure Solutions: highly structured, privately negotiated direct investments in complex situations Special Situations: companies experiencing extreme change, stressed/distressed credit; strong companies in out of favor industries $15 billion raised across 12 IPOs for closed-end funds in 2021, the highest since 20065 Approximately 40% of IPO issuance in 2021 was for income-oriented funds4 Low volatility of returns: [ ]% standard deviation and Sharpe ratio [ ]. Management fee to be reduced from 1.50% to 1.35% upon listing Structured solutions Skilled management team Andrew Beckman, Goldmand Deep experience in distressed investing Special situations Over []

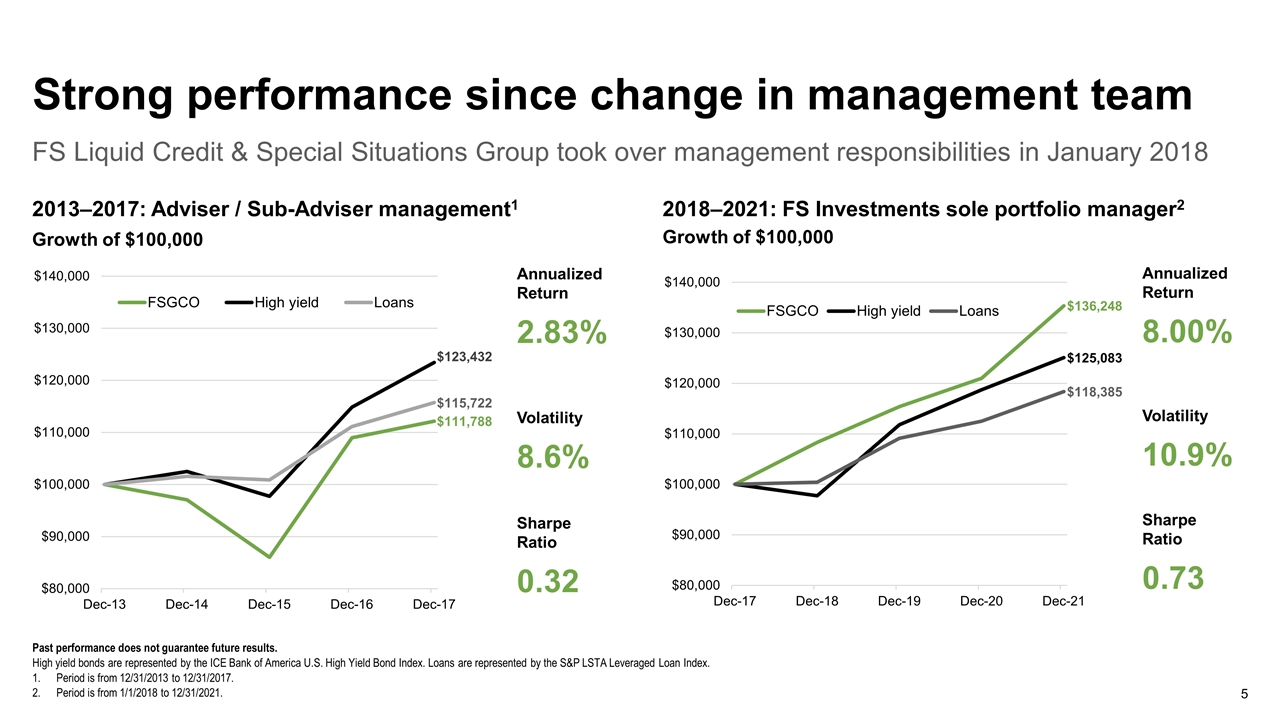

Strong performance since change in management team FS Liquid Credit & Special Situations Group took over management responsibilities in January 2018 2018–2021: FS Investments sole portfolio manager2 Growth of $100,000 2013–2017: Adviser / Sub-Adviser management1 Growth of $100,000 Past performance does not guarantee future results. High yield bonds are represented by the ICE Bank of America U.S. High Yield Bond Index. Loans are represented by the S&P LSTA Leveraged Loan Index. Period is from 12/31/2013 to 12/31/2017. Period is from 1/1/2018 to 12/31/2021. Adviser & Sub-adviser oversight Annualized Return 2.83% Volatility 8.6% Sharpe Ratio 0.32 Annualized Return 8.00% Volatility 10.9% Sharpe Ratio 0.73

Key considerations for the listing Direct listing vs. IPO Current NAV vs. public share price FSCO vs. public peers

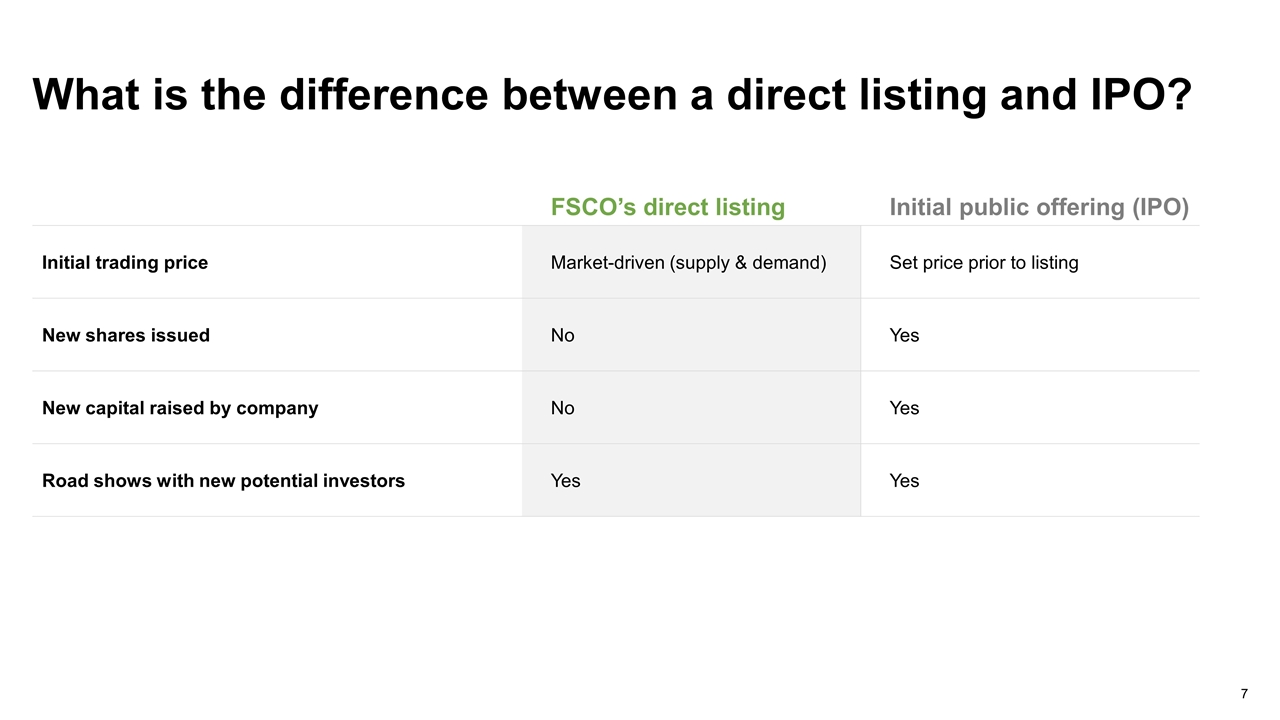

What is the difference between a direct listing and IPO? FSCO’s direct listing Initial public offering (IPO) Initial trading price Market-driven (supply & demand) Set price prior to listing New shares issued No Yes New capital raised by company No Yes Road shows with new potential investors Yes Yes

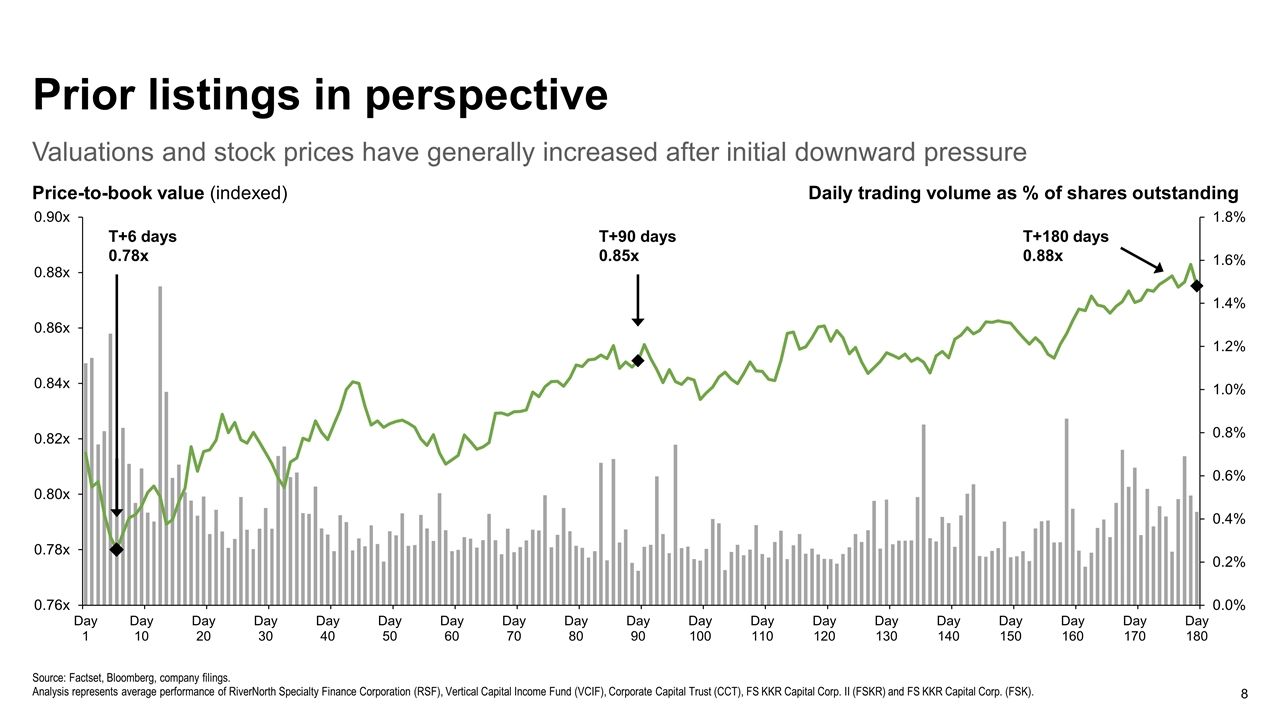

Valuations and stock prices have generally increased after initial downward pressure Price-to-book value (indexed) Daily trading volume as % of shares outstanding Source: Factset, Bloomberg, company filings. Analysis represents average performance of RiverNorth Specialty Finance Corporation (RSF), Vertical Capital Income Fund (VCIF), Corporate Capital Trust (CCT), FS KKR Capital Corp. II (FSKR) and FS KKR Capital Corp. (FSK). Prior listings in perspective

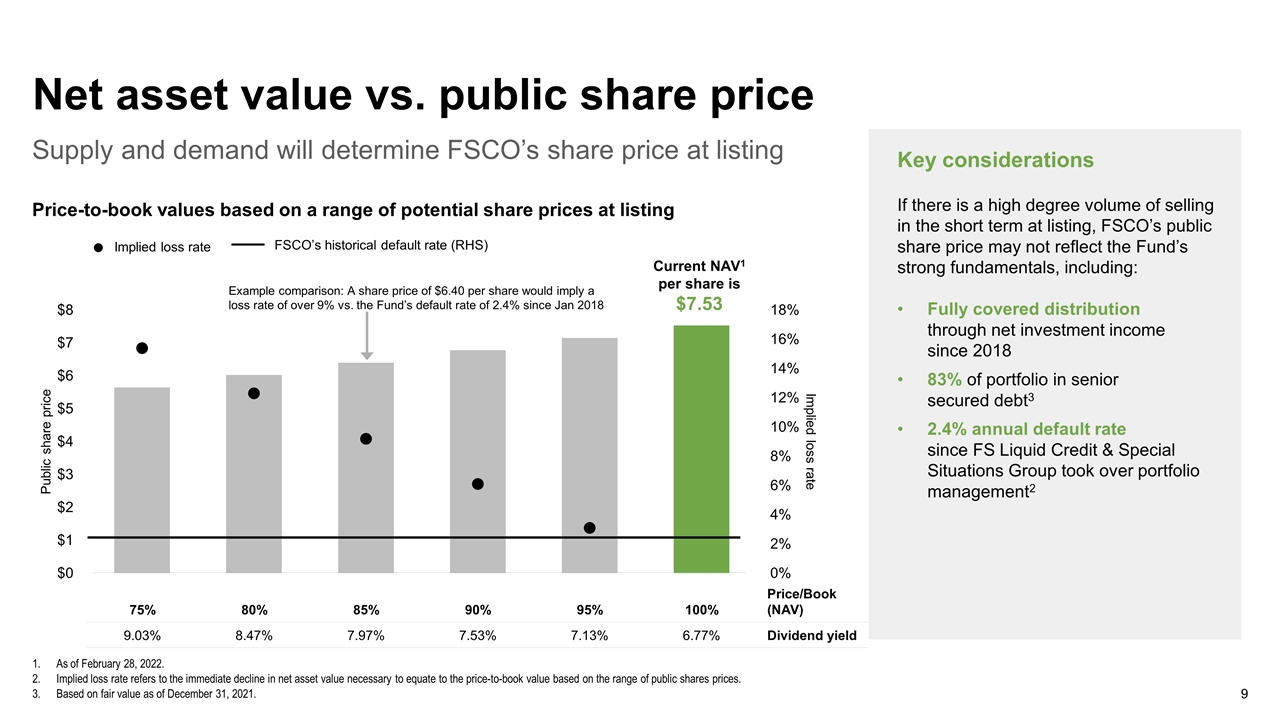

Supply and demand will determine FSCO’s share price at listing Price-to-book values based on a range of potential share prices at listing As of February 28, 2022. Implied loss rate refers to the immediate decline in net asset value necessary to equate to the price-to-book value based on the range of public shares prices. Based on fair value as of December 31, 2021. Net asset value vs. public share price 75% 80% 85% 90% 95% 100% Price/Book (NAV) 9.03% 8.47% 7.97% 7.53% 7.13% 6.77% Dividend yield Current NAV1 per share is $7.53 FSCO’s historical default rate (RHS) Key considerations If there is a high degree volume of selling in the short term at listing, FSCO’s public share price may not reflect the Fund’s strong fundamentals, including: Fully covered distribution through net investment income since 2018 83% of portfolio in senior secured debt3 2.4% annual default rate since FS Liquid Credit & Special Situations Group took over portfolio management2 Example comparison: A share price of $6.40 per share would imply a loss rate of over 9% vs. the Fund’s default rate of 2.4% since Jan 2018 Implied loss rate

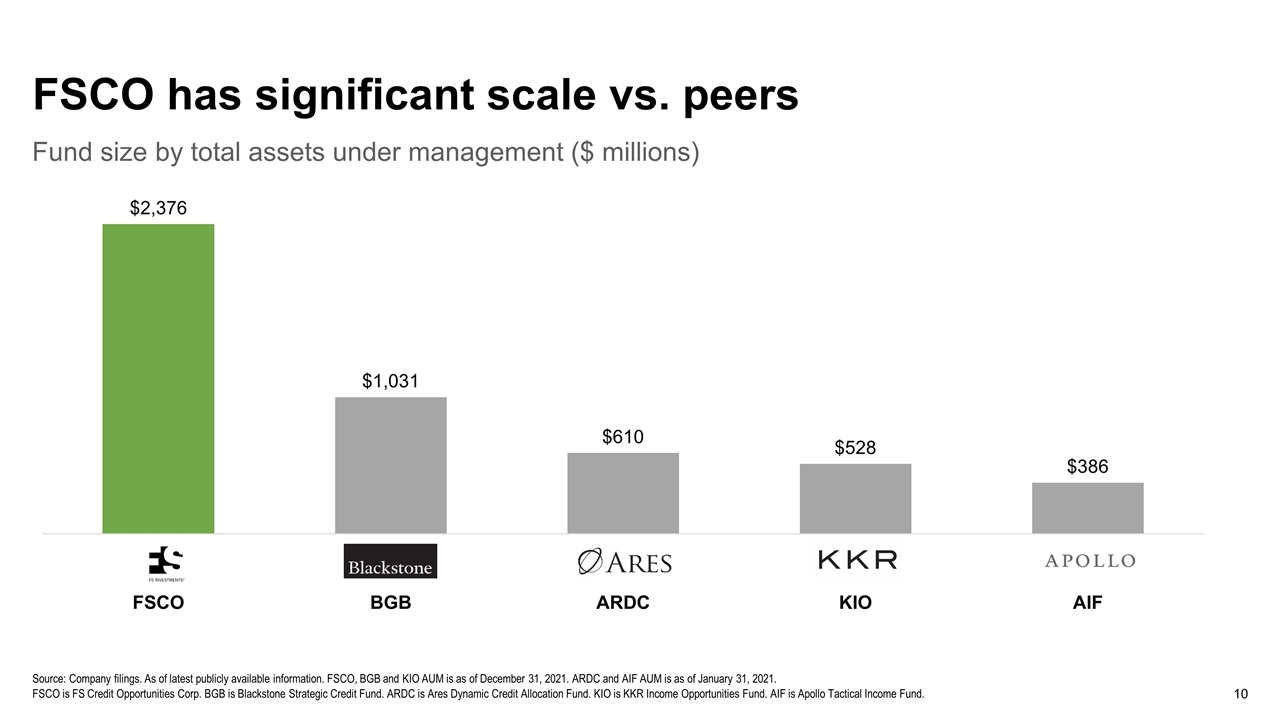

Fund size by total assets under management ($ millions) Source: Company filings. As of latest publicly available information. FSCO, BGB and KIO AUM is as of December 31, 2021. ARDC and AIF AUM is as of January 31, 2021. FSCO is FS Credit Opportunities Corp. BGB is Blackstone Strategic Credit Fund. ARDC is Ares Dynamic Credit Allocation Fund. KIO is KKR Income Opportunities Fund. AIF is Apollo Tactical Income Fund. FSCO has significant scale vs. peers

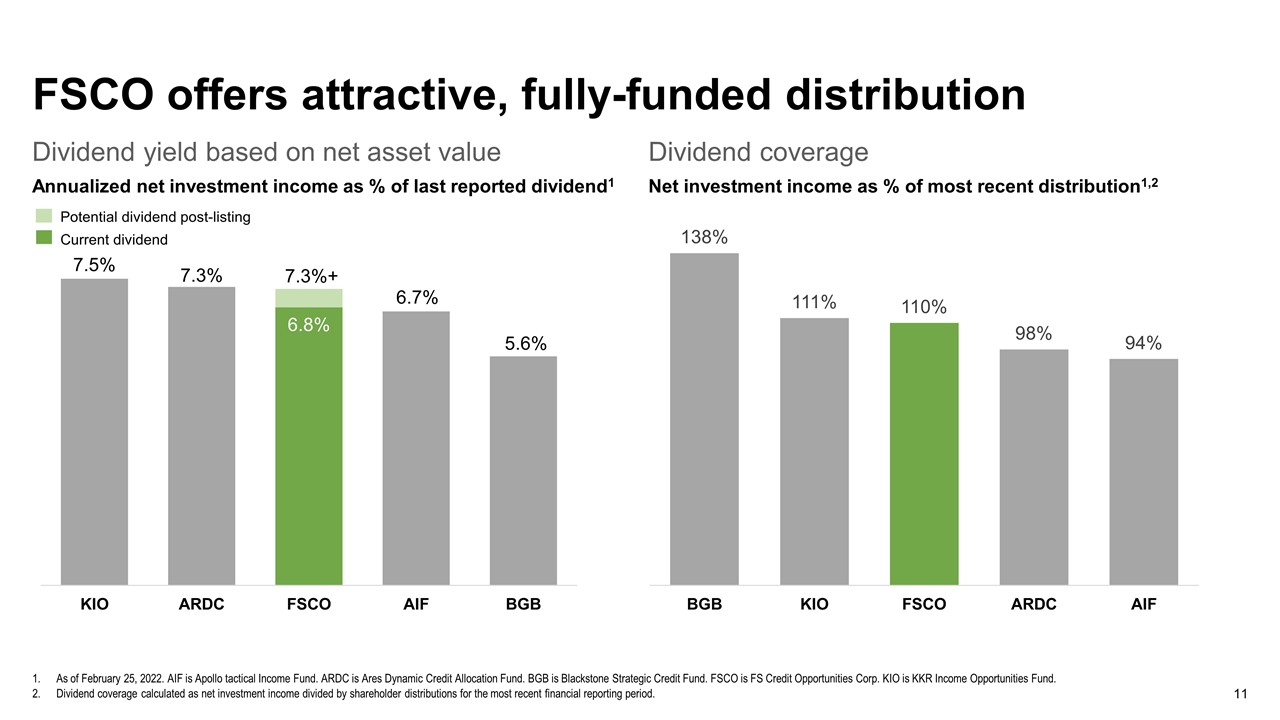

Dividend yield based on net asset value Annualized net investment income as % of last reported dividend1 Dividend coverage Net investment income as % of most recent distribution1,2 As of February 25, 2022. AIF is Apollo tactical Income Fund. ARDC is Ares Dynamic Credit Allocation Fund. BGB is Blackstone Strategic Credit Fund. FSCO is FS Credit Opportunities Corp. KIO is KKR Income Opportunities Fund. Dividend coverage calculated as net investment income divided by shareholder distributions for the most recent financial reporting period. FSCO offers attractive, fully-funded distribution Potential dividend post-listing Current dividend

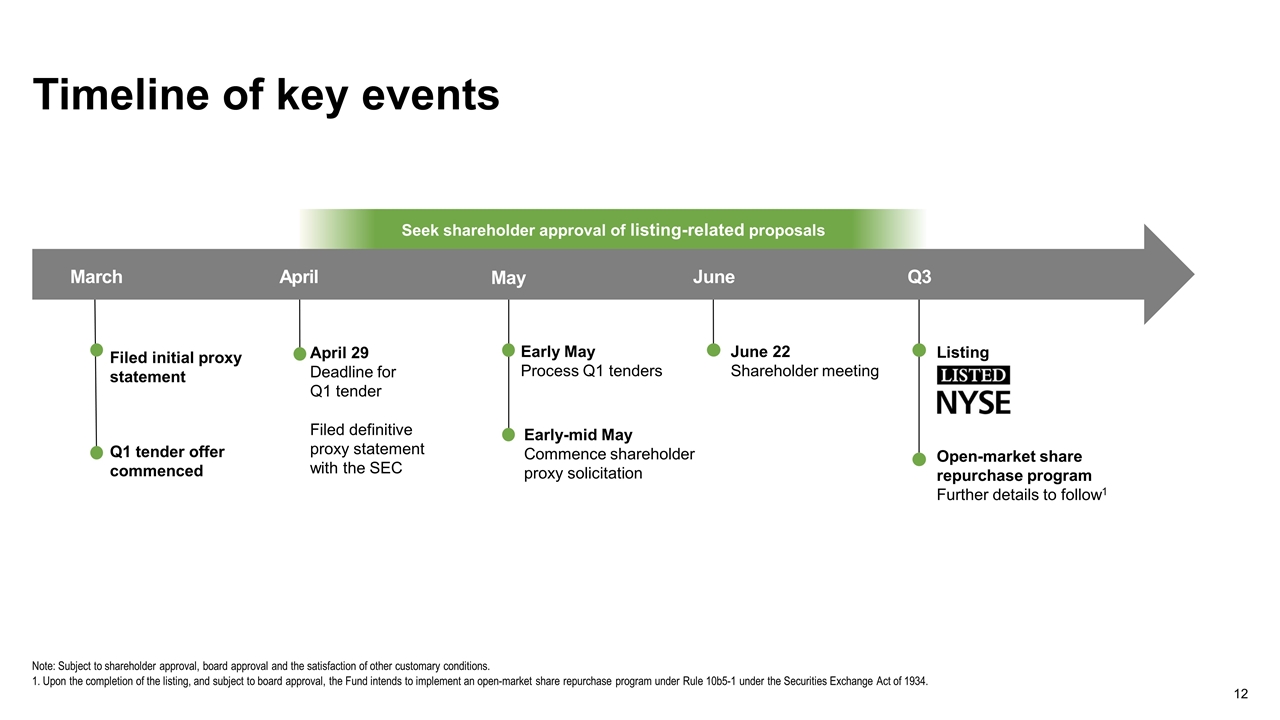

Early May Process Q1 tenders Seek shareholder approval of listing-related proposals Timeline of key events Note: Subject to shareholder approval, board approval and the satisfaction of other customary conditions. 1. Upon the completion of the listing, and subject to board approval, the Fund intends to implement an open-market share repurchase program under Rule 10b5-1 under the Securities Exchange Act of 1934. March April May June Q3 June 22 Shareholder meeting Q1 tender offer commenced Filed initial proxy statement April 29 Deadline for Q1 tender Filed definitive proxy statement with the SEC Listing Open-market share repurchase program Further details to follow1 Early-mid May Commence shareholder proxy solicitation

Investor resources www.fsproxy.com FAQs SEC filings ? Press Releases Presentation

FORWARD-LOOKING STATEMENTS Statements included herein may constitute “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended (the Securities Act), and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements with regard to future events or the future performance or operations of the Fund. Words such as “believes,” “expects,” “projects,” and “future” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors could cause actual results to differ materially from those projected in these forward-looking statements. Factors that could cause actual results to differ materially include changes in the economy, geo-political risks, risks associated with possible disruption to the Fund’s operations or the economy generally due to terrorism, natural disasters or pandemics, future changes in laws or regulations and conditions in the Fund’s operating area, unexpected costs, the ability of the Fund to complete the listing of the common stock of the Fund on a national securities exchange, the price at which the Fund’s shares of common stock may trade on a national securities exchange, and failure to list the common stock of the Fund on a national securities exchange. Some of these factors are enumerated in the filings the Fund made with the Securities and Exchange Commission (the SEC) and are also contained in the Prospectus. The inclusion of forward-looking statements should not be regarded as a representation that any plans, estimates or expectations will be achieved. Any forward-looking statements speak only as of the date of this communication. Except as required by federal securities laws, the Fund undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on any of these forward-looking statements. Disclosures

IMPORTANT INFORMATION The Company, its directors and certain of its officers may be deemed to be participants in the solicitation of proxies from shareholders in connection with the matters to be considered at the Company’s 2022 annual meeting (the “2022 Annual Meeting”). On April 28, 2002, the Company filed a definitive proxy statement with the SEC in connection with any such solicitation of proxies from shareholders. Stockholders are strongly encouraged to read the proxy statement as it contains important information. Information regarding the identity of potential participants, and their direct or indirect interests in the Company, by security holdings or otherwise, will be set forth in the proxy statement and any other materials to be filed with the SEC in connection with the 2022 Annual Meeting. Stockholders are able to obtain any proxy statement, any amendments or supplements to the proxy statement and other documents filed by the Company with the SEC for no charge at the SEC’s website at www.sec.gov. Copies are available at no charge at the Company’s website at https://fsinvestments.com/investments/all-investments/fsco/. Disclosures