- FSCO Dashboard

-

Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

FS Credit Opportunities (FSCO) DEF 14ADefinitive proxy

Filed: 17 May 24, 4:09pm

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ | Preliminary Proxy Statement | |

| ☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) | |

| ☒ | Definitive Proxy Statement | |

| ☐ | Definitive Additional Materials | |

| ☐ | Soliciting Material Pursuant to Rule 14a-12 | |

FS CREDIT OPPORTUNITIES CORP.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☒ | No fee required. | |||

| ☐ | Fee paid previously with preliminary materials | |||

| ☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

201 Rouse Boulevard

Philadelphia, Pennsylvania 19112

May 17, 2024

Dear Fellow Stockholder:

You are cordially invited to attend the 2024 Annual Meeting of Stockholders of FS Credit Opportunities Corp. (the “Company”) to be held on July 8, 2024 at 11:00 a.m., Eastern Time, at 201 Rouse Boulevard, Philadelphia, Pennsylvania 19112 (the “Annual Meeting”).

Your vote is very important! Your immediate response will help avoid potential delays and may save the Company significant additional expenses associated with soliciting stockholder votes.

The Notice of Annual Meeting of Stockholders and proxy statement accompanying this letter provide an outline of the business to be conducted at the Annual Meeting. At the Annual Meeting, you will be asked to:

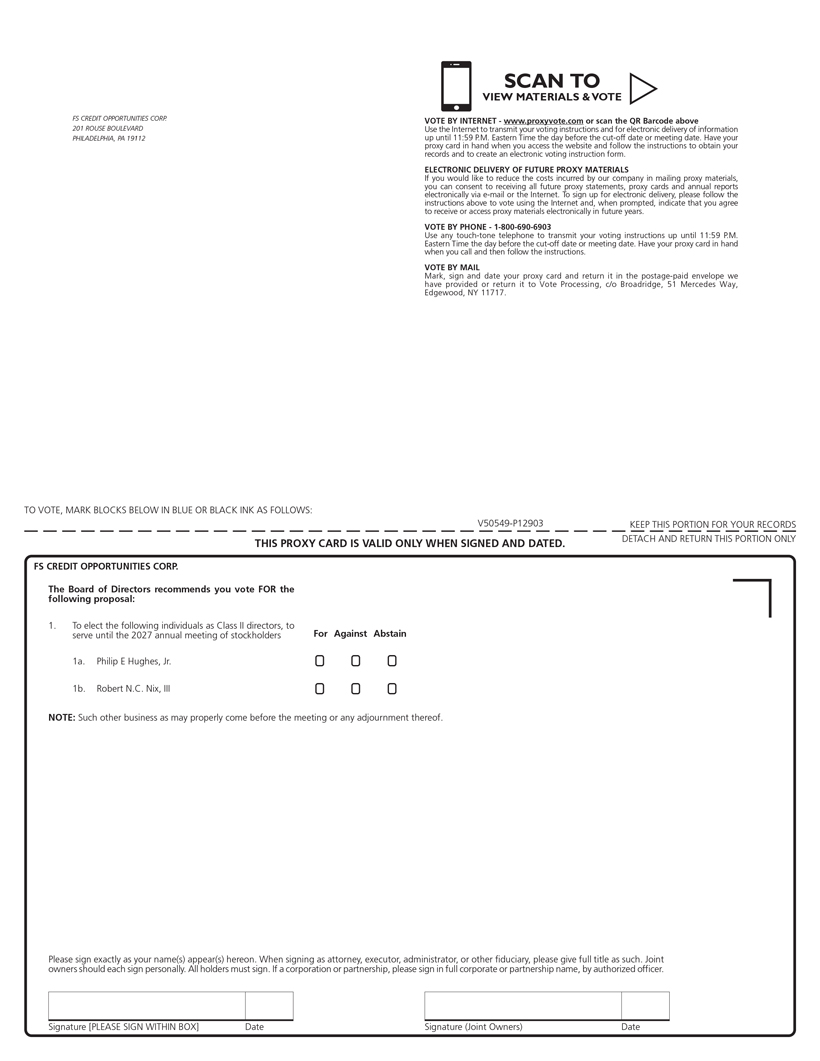

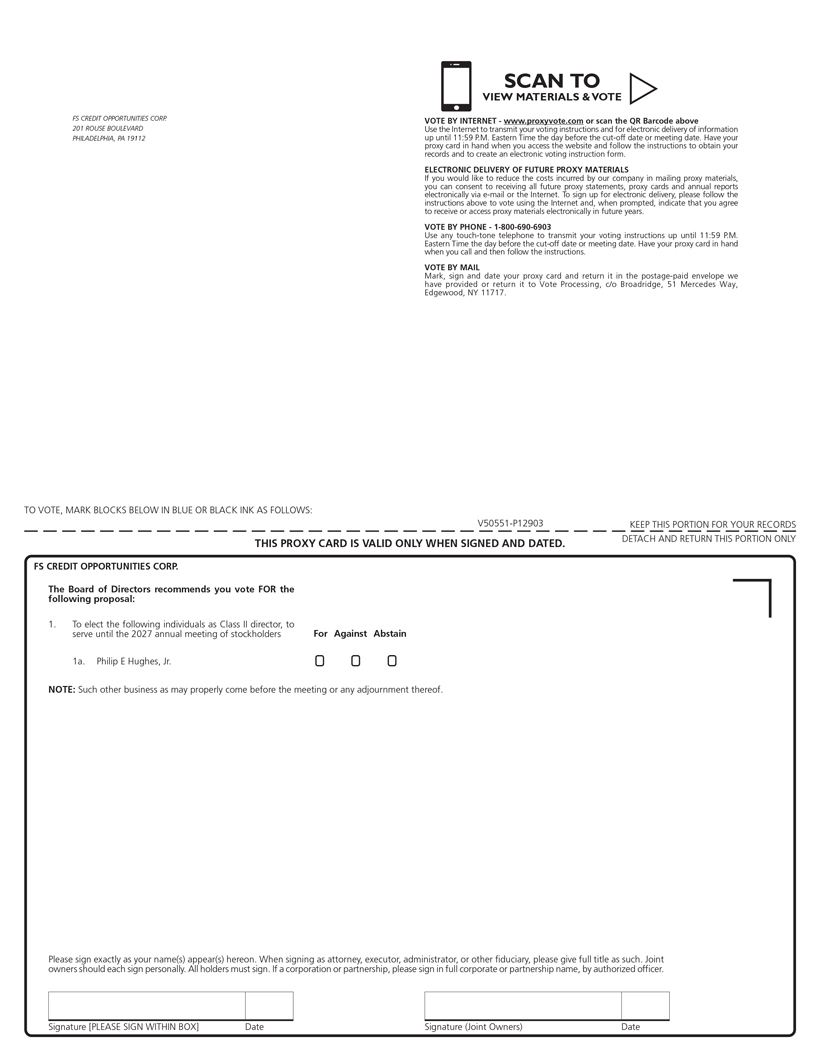

| (i) | elect the following individuals as Class II Directors, each of whom has been nominated for election for a three-year term expiring at the 2027 annual meeting of stockholders: (a) Philip E. Hughes, Jr. and (b) Robert N.C. Nix, III. |

In addition to this proposal, you may be asked to consider any other matters that properly may be presented at the Annual Meeting or any adjournment or postponement of the Annual Meeting, including proposals to adjourn the Annual Meeting with respect to proposals for which insufficient votes to approve were cast, and, with respect to such proposals, to permit further solicitation of additional proxies by the Company.

The Company’s board of directors unanimously recommends that you vote FOR the proposal to be considered and voted on at the Annual Meeting.

It is important that your shares be represented at the Annual Meeting. If you are unable to attend the Annual Meeting in person, I urge you to complete, date and sign the enclosed proxy card and promptly return it in the envelope provided. If you prefer, you can save time by voting through the Internet or by telephone as described in the proxy statement and on the enclosed proxy card.

Your vote and participation in the governance of the Company is very important.

Sincerely yours,

Michael C. Forman

Chairman and Chief Executive Officer

FS CREDIT OPPORTUNITIES CORP.

201 Rouse Boulevard

Philadelphia, Pennsylvania 19112

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held On July 8, 2024

To the Stockholders of FS Credit Opportunities Corp.:

NOTICE IS HEREBY GIVEN THAT the 2024 Annual Meeting of Stockholders of FS Credit Opportunities Corp., a Maryland corporation (the “Company”), will be held at 201 Rouse Boulevard, Philadelphia, Pennsylvania 19112, on July 8, 2024 at 11:00 a.m., Eastern Time (the “Annual Meeting”), to:

| (i) | elect the following individuals as Class II Directors, each of whom has been nominated for election for a three-year term expiring at the 2027 annual meeting of stockholders: (a) Philip E. Hughes, Jr. and (b) Robert N.C. Nix, III. |

The board of directors has fixed the close of business on May 15, 2024 as the record date for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and adjournments or postponements thereof.

The Company’s proxy statement and the proxy card are available at www.proxyvote.com. If you plan on attending the Annual Meeting and voting your shares in person, you will need to bring photo identification in order to be admitted to the Annual Meeting. If your shares are held through a broker and you attend the Annual Meeting in person, please bring a letter from your broker identifying you as the beneficial owner of the shares and authorizing you to vote your shares at the Annual Meeting. To obtain directions to the Annual Meeting, please call the Company at (877) 628-8575.

| By Order of the Board of Directors, |

Stephen S. Sypherd Vice President, Treasurer & Secretary |

| May 17, 2024 |

Stockholders are requested to execute and return promptly the accompanying proxy card, which is being solicited by the board of directors of the Company. You may execute the proxy card using the methods described in the proxy card. Executing the proxy card is important to ensure a quorum at the Annual Meeting. Stockholders also have the option to authorize their proxies by telephone or through the Internet by following the instructions printed on the proxy card. Proxies may be revoked at any time before they are exercised by submitting a written notice of revocation or a subsequently executed proxy, or by attending the Annual Meeting and voting in person.

FS CREDIT OPPORTUNITIES CORP.

201 Rouse Boulevard

Philadelphia, Pennsylvania 19112

ANNUAL MEETING OF STOCKHOLDERS

To Be Held On July 8, 2024

PROXY STATEMENT

GENERAL

This proxy statement is furnished in connection with the solicitation of proxies by the board of directors (the “Board”) of FS Credit Opportunities Corp., a Maryland corporation (the “Company”), for use at the 2024 Annual Meeting of Stockholders of the Company to be held at 11:00 a.m., Eastern Time, on July 8, 2024, at 201 Rouse Boulevard, Philadelphia, Pennsylvania 19112, and any adjournments or postponements thereof (the “Annual Meeting”). This proxy statement and the accompanying materials are being mailed on or about May 21, 2024 to stockholders of record described below and are available at www.proxyvote.com.

All properly executed proxies representing shares of common stock, par value $0.001 per share (the “Common Shares”), or shares of preferred stock of the Company (the “Preferred Shares”, and together with the Common Shares” the “Shares”)1 received prior to the Annual Meeting will be voted in accordance with the instructions marked thereon. If no specification is made, the Shares will be voted FOR the proposal to:

| (i) | elect the following individuals as Class II Directors, each of whom has been nominated for election for a three-year term expiring at the 2027 annual meeting of stockholders: (a) Philip E. Hughes, Jr. and (b) Robert N.C. Nix, III (the “Director Election Proposal”). |

Any stockholder who has given a proxy has the right to revoke it at any time prior to its exercise. Any stockholder who executes a proxy may revoke it with respect to any proposal by attending the Annual Meeting and voting his or her Shares in person, or by submitting a letter of revocation or a later-dated proxy to the Company at the above address prior to the date of the Annual Meeting.

Quorum

Stockholders of the Company are entitled to one vote for each Common Share or Preferred Share held. Under the Charter of the Company, one-third of the number of Shares entitled to cast votes, present in person or by proxy, constitutes a quorum for the transaction of business. Abstentions will be treated as Shares that are present for purposes of determining the presence of a quorum for transacting business at the Annual Meeting.

Adjournments

In the event that a quorum is not present at the Annual Meeting, the chairman of the Annual Meeting shall have the power to adjourn the Annual Meeting from time to time to a date not more than 120 days after the original record date without notice, other than the announcement at the Annual Meeting to permit further solicitation of proxies. Any business that might have been transacted at the Annual Meeting originally called may be transacted at any such adjourned session(s) at which a quorum is present.

| 1 | Unless otherwise specified, references to “Shares” refer to both the Common Shares and the Preferred Shares, and references to “stockholders” refer to holders of the Common Shares and the Preferred Shares, voting together as a single class. Each full outstanding Common Share or Preferred Share is entitled to one vote on each matter submitted to a vote at the Annual Meeting. |

1

If it appears that there are not enough votes to approve any proposal at the Annual Meeting, the chairman of the Annual Meeting may adjourn the Annual Meeting from time to time to a date not more than 120 days after the record date originally fixed for the Annual Meeting without notice, other than announcement at the Annual Meeting, to permit further solicitation of proxies. The persons named as proxies will vote those proxies for such adjournment.

If sufficient votes in favor of one or more proposals have been received by the time of the Annual Meeting, the proposals will be acted upon and such actions will be final, regardless of any subsequent adjournment to consider other proposals.

Record Date

The Board has fixed the close of business on May 15, 2024 as the record date (the “Record Date”) for the determination of stockholders entitled to notice of, and to vote at, the Annual Meeting and adjournments or postponements thereof. As of the Record Date, there were 198,355,867 Common Shares outstanding and 400,000 Preferred Shares outstanding.

Required Vote

Proposal | Vote Allowed and Impact | Vote Required | ||

| Proposal 1 - Director Election Proposal | Philip E. Hughes, Jr. is to be elected by the holders of the Common Shares and the Preferred Shares, voting together as a single class. Robert N.C. Nix, III is to be elected by the holders of the Preferred Shares. Abstentions and Shares represented by broker non-votes will not be included in determining the number of votes cast and, as a result, will not have any effect on the result of the vote with respect to the Director Election Proposal. There will be no cumulative voting with respect to the Director Election Proposal. | Each director nominee shall be elected by a plurality of all the votes cast at the Annual Meeting by stockholders of the class or classes entitled to vote on such nominee, provided that a quorum is present. Plurality voting means that the director nominee with the most votes for a particular seat is elected for that seat. Each Share may be voted for as many individuals as there are director nominees and for whose election the share is entitled to be voted. |

Broker Non-Votes and Voting Proxies

Shares for which brokers have not received voting instructions from the beneficial owners of the Shares and do not have, or choose not to exercise, discretionary authority to vote the Shares on certain proposals (which are considered “broker non-votes” with respect to such proposals) will be treated as Shares present for quorum purposes. Broker non-votes are not considered votes cast and thus have no effect on the Director Election Proposal.

Brokers holding Shares of the Company in “street name” for the benefit of the beneficial owners of the Shares will request the instructions of such beneficial owners of the Shares on how to vote their Shares on the Director Election Proposal before the Annual Meeting. The Company understands that, under the rules of the New York Stock Exchange (“NYSE”), such brokers may for certain “routine” matters, without instructions from the beneficial owners of the Shares, grant discretionary authority to the proxies designated by the Board to vote if no instructions have been received prior to the date specified in the broker’s request for voting instructions.

2

The Director Election Proposal is uncontested and is considered a “routine” matter under the rules of NYSE, and beneficial owners who do not provide proxy instructions or who do not return a proxy card may have their Shares voted by brokers in favor of the Director Election Proposal. A properly executed proxy card or other authorization by a beneficial owner of the Shares that does not specify how the beneficial owner’s Shares should be voted on the Director Election Proposal may be deemed an instruction to vote such shares in favor of the Director Election Proposal.

Householding

Mailings for multiple stockholders going to a single household are combined by delivering to that address, in a single envelope, a copy of the documents (annual reports, proxy statements, etc.) or other communications for all stockholders who have consented or are deemed to have consented to receiving such communications in such manner in accordance with the rules promulgated by the U.S. Securities and Exchange Commission (the “SEC”). If you do not want to continue to receive combined mailings of Company communications and would prefer to receive separate mailings of Company communications, and you are a registered stockholder, please contact the Company’s transfer agent, DST Systems, Inc. by phone at (877) 628-8575 or by mail to FS Credit Opportunities Corp., c/o DST Systems, Inc., P.O. Box 219095, Kansas City, Missouri 64121-9095. If you are a beneficial stockholder, you may contact the broker or bank where you hold the account to discontinue combined mailings of Company communications.

Voting

You may vote at the Annual Meeting in person or by proxy in accordance with the instructions provided below. You may also authorize a proxy by telephone or through the Internet using the toll-free telephone number or web address printed on your proxy card. Authorizing a proxy by telephone or through the Internet requires you to input the control number located on your proxy card. After inputting the control number, you will be prompted to direct your proxy to vote on each proposal. You will have an opportunity to review your directions and make any necessary changes before submitting your directions and terminating the telephone call or Internet link. Stockholders of the Company are entitled to one vote for each Share held.

When voting by proxy and mailing your proxy card, you are required to:

| • | indicate your instructions on the proxy card; |

| • | date and sign the proxy card; |

| • | mail the proxy card promptly in the envelope provided, which requires no postage if mailed in the United States; and |

| • | allow sufficient time for the proxy card to be received on or before 11:00 a.m., Eastern Time, on July 8, 2024. |

The Company’s proxy statement and the proxy card are available at www.proxyvote.com. If you plan on attending the Annual Meeting and voting your Shares in person, you will need to bring photo identification in order to be admitted to the Annual Meeting. If your Shares are held through a broker and you attend the Annual Meeting in person, please bring a letter from your broker identifying you as the beneficial owner of the Shares and authorizing you to vote your Shares at the Annual Meeting.

Other Information Regarding This Solicitation

The Company will bear the expense of the solicitation of proxies for the Annual Meeting, including the cost of preparing, printing and mailing this proxy statement, the accompanying Notice of Annual Meeting of Stockholders and the proxy card. The Company has requested that brokers, nominees, fiduciaries and other persons holding Shares in their names, or in the name of their nominees, which are beneficially owned by others, forward the proxy materials to, and obtain proxies from, such beneficial owners. The Company will reimburse such persons for their reasonable expenses in so doing.

3

In addition to the solicitation of proxies by mail, proxies may be solicited in person and by telephone or facsimile transmission by directors, officers or regular employees of the Company and its affiliates (without special compensation therefor). The Company has also retained Broadridge Investor Communication Solutions, Inc. to assist in the solicitation of proxies for an estimated fee of approximately $20,000, plus out-of-pocket expenses. Any proxy given pursuant to this solicitation may be revoked by notice from the person giving the proxy at any time before it is exercised. Any such notice of revocation should be provided in writing and signed by the stockholder in the same manner as the proxy being revoked and delivered to the Company’s proxy tabulator.

Annual Reports

The Company will furnish to its stockholders, free of charge, a copy of its most recent annual and semi-annual reports upon request to FS Credit Opportunities Corp., Attn: Investor Relations, 201 Rouse Boulevard, Philadelphia, PA 19112.

4

SECURITY OWNERSHIP OF MANAGEMENT AND CERTAIN BENEFICIAL OWNERS

The following table sets forth, as of May 1, 2024, the beneficial ownership of the Company’s current directors, executive officers, each person known to the Company to beneficially own 5% or more of the outstanding Common Shares, and all of the Company’s executive officers and directors as a group.

Except as set forth in Appendix A, to the knowledge of the Company, as of May 1, 2024, no person was the beneficial owner of more than 5% of the Company’s outstanding Preferred Shares. The Company’s current directors and executive officers do not own any of the Company’s outstanding Preferred Shares.

Beneficial ownership is determined in accordance with Rule 13d-3 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and includes voting or investment power with respect to the Shares. There are no Shares subject to options that are currently exercisable or exercisable within 60 days of May 1, 2024. Ownership information for those persons who beneficially own 5% or more of the Shares is based upon information furnished by the Company’s transfer agent and other information provided by such persons, if available.

| Common Shares Beneficially Owned as of May 1, 2024 | ||||||||

Name and Address of Beneficial Owner(1) | Number of Common Shares | Percentage (%)(2) | ||||||

Interested Directors | ||||||||

Michael C. Forman | 742,841 | (3) | * | |||||

Independent Directors | ||||||||

Keith Bethel | 14,000 | (4) | * | |||||

Walter W. Buckley, III | 15,861 | * | ||||||

Della Clark | 3,928 | * | ||||||

Barbara J. Fouss | 21,129.566 | * | ||||||

Philip E. Hughes, Jr. | 20,788 | * | ||||||

Robert N.C. Nix, III | 8,395 | (5) | * | |||||

Executive Officers | ||||||||

Edward T. Gallivan, Jr. | — | — | ||||||

Stephen S. Sypherd | 16,242 | |||||||

James F. Volk | — | — | ||||||

All directors and executive officers as a group (10 persons) | 843,184.566 | * | ||||||

| * | Less than one percent. |

| (1) | The address of each of the beneficial owners set forth above is c/o FS Credit Opportunities Corp., 201 Rouse Boulevard, Philadelphia, Pennsylvania 19112. |

| (2) | Based on a total of 198,355,867 Common Shares issued and outstanding on May 1, 2024. |

| (3) | 401,733 Shares held by MCFDA SCV LLC, a wholly-owned special purpose financing vehicle of which The 2011 Forman Investment Trust is a member and Michael C. Forman is the manager; 335,258 Shares held by FSH Seed Capital Vehicle I LLC, a wholly-owned special purpose financing subsidiary of Franklin Square Holdings, L.P. (“FS Investments”); and 5,850 Shares held in an IRA. Michael C. Forman disclaims ownership of any Shares held by FS Investments or any subsidiary thereof, that exceed his pecuniary interest therein, and the inclusion of these Shares in this report shall not be deemed an admission of beneficial ownership of all reported shares for purposes of this report, Section 16, or any other purpose. |

| (4) | 2,500 Shares held indirectly by spouse. |

| (5) | All Shares held in an IRA. |

5

DOLLAR RANGE OF SECURITIES BENEFICIALLY OWNED BY DIRECTORS

The following table sets forth, as of May 1, 2024, the dollar range of the Company’s equity securities that are beneficially owned by each member of the Board.

Name of Director | DollarRange of Equity Securities Beneficially Owned (1)(2)(3) | |||

Interested Directors: | ||||

Michael C. Forman | Over $100,000 | |||

Independent Directors: | ||||

Keith Bethel | $50,001-$100,000 | |||

Walter W. Buckley, III | $50,001-$100,000 | |||

Della Clark | $10,001-$50,000 | |||

Barbara J. Fouss | Over $100,000 | |||

Philip E. Hughes, Jr. | Over $100,000 | |||

Robert N.C. Nix, III | $50,001-$100,000 | |||

| (1) | Beneficial ownership has been determined in accordance with Rule 16a-1(a)(2) promulgated under the Exchange Act. |

| (2) | The dollar range of equity securities beneficially owned by the Company’s directors is calculated in accordance with the applicable account statement rules of The Financial Industry Regulatory Authority, Inc. |

| (3) | The dollar range of equity securities beneficially owned are: None, $1-$10,000, $10,001-$50,000, $50,001-$100,000 or over $100,000. |

6

PROPOSAL 1: ELECTION OF DIRECTOR NOMINEES

Background

Pursuant to the bylaws of the Company, the number of directors on the Board may not be fewer than one, as required by the Maryland General Corporation Law, or greater than twelve. The Board currently has seven Directors, each of whom will hold office for the term to which he or she was elected and until his or her successor is duly elected and qualified. Pursuant to the Charter, the seven Directors are currently divided into three classes (each a “Class”): Class I, Class II and Class III. Each class of Directors holds office for a three-year term. The current Class II Directors hold office for a term expiring at the Annual Meeting. The current Class III Directors hold office for a term expiring at the 2025 annual meeting. The current Class I Directors hold office for a term expiring at the 2026 annual meeting.

At the Annual Meeting, stockholders of the Company are being asked to consider the election of and Philip E. Hughes, Jr. and Robert N.C. Nix, III as Class II Directors. Each of Philip E. Hughes, Jr. and Robert N.C. Nix, III have been nominated for re-election for a three-year term expiring at the 2027 annual meeting of the stockholders. Each Director nominee has agreed to serve as a Director if re-elected and has consented to being named as a nominee. No person being nominated as a Director is being proposed for election pursuant to any agreement or understanding between such person and the Company.

Philip E. Hughes, Jr. is to be elected by the holders of the Common Shares and the Preferred Shares, voting together as a single class.

Robert N.C. Nix, III is to be elected by the holders of the Preferred Shares.

A stockholder can vote for, or withhold his or her vote from, any or all of the director nominees. In the absence of instructions to the contrary, it is the intention of the persons named as proxies to vote such proxy FOR the election of each of the director nominees named above. If any of the director nominees should decline or be unable to serve as a director, the persons named as proxies will vote for such other nominee as may be proposed by the Board’s Nominating and Corporate Governance Committee. The Board has no reason to believe that any of the persons named as director nominees will be unable or unwilling to serve.

Information about the Board and Director Nominees

The role of the Board is to provide general oversight of the Company’s business affairs and to exercise all of the Company’s powers except those reserved for the stockholders. The responsibilities of the Board also include, among other things, the oversight of the Company’s investment activities, the quarterly valuation of the Company’s assets, oversight of the Company’s financing arrangements and corporate governance activities.

A majority of the members of the Board are not “interested persons,” as defined in Section 2(a)(19) of the 1940 Act, of the Company or the Adviser, and are “independent” as defined by Rule 303A.00 in the NYSE Listed Company Manual. These individuals are referred to as the Company’s “independent directors”. Section 2(a)(19) of the 1940 Act defines an “interested person” to include, among other things, any person who has, or within the last two years had, a material business or professional relationship with the Company. The members of the Board who are not independent directors are referred to as “interested directors”. The Board is currently comprised of seven directors, six of whom are independent directors. The Board has determined that the following directors are independent directors: Keith Bethel, Walter W. Buckley, III, Della Clark, Barbara J. Fouss, Philip E. Hughes, Jr. and Robert N.C. Nix, III. Based upon information requested from each director and director nominee concerning his or her background, employment and affiliations, the Board has affirmatively determined that none of the independent directors has, or within the last two years had, a material business or professional relationship with the Company, other than in his or her capacity as a member of the Board or any Board committee or as a stockholder.

7

In considering each director and the composition of the Board as a whole, the Board seeks a diverse group of experiences, characteristics, attributes and skills, including diversity in gender, ethnicity and race that the Board believes enables a director to make a significant contribution to the Board, the Company and its stockholders. These experiences, characteristics, attributes and skills, which are more fully described below, include, but are not limited to, management experience, independence, financial expertise and experience serving as directors or trustees of other entities. The Board may also consider such other experiences, characteristics, attributes and skills as it deems appropriate, given the then-current needs of the Board and the Company.

These experiences, characteristics, attributes and skills relate directly to the management and operations of the Company. Success in each of these categories is a key factor in the Company’s overall operational success and creating stockholder value. The Company believes that directors and director nominees who possess these experiences, characteristics, attributes and skills are better able to provide oversight of the Company’s management and the Company’s long-term and strategic objectives. Below is a description of the experience, characteristics, attributes and skills of each director that led the Board to conclude that each such person should serve as a director. The Board also considered the specific experience described in each director’s biographical information, as disclosed below.

The following tables set forth certain information regarding the director nominees and the Company’s other independent directors and interested directors.

8

NOMINEES FOR CLASS II DIRECTORS

| Name, Address(1), Age and Position(s) with Company | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Registered Investment Companies in Fund Complex(2) Overseen by Director | Other Directorships | ||||

Independent | ||||||||

Philip E. Hughes, Jr. Age: 75 Director | Current term expires in 2027. Has served since June 2013. | Philip E. Hughes, Jr. serves as vice-chairman of Keystone Industries, an international manufacturing and distribution company, and has done so since November 2011. Mr. Hughes also serves as the president of Sovereign Developers, LP, a real estate development company, and has done so since he founded the company in 1999. In 2011, he formed, and currently operates, Philip E. Hughes, Jr., CPA, Esq. Accounting, Tax and Business Services, a professional services firm. He has served as president of Fox Park Corporation, which owns a retail shopping center, since 2005. Prior to these positions, Mr. Hughes served as a partner and head of the Philadelphia office of the accounting firm LarsonAllen LLP from 2000 to 2011. Mr. Hughes also served on the boards of trustees of FS Global Credit Opportunities Fund—A, FS Global Credit Opportunities Fund—D, FS Global Credit Opportunities Fund—T, FS Global Credit Opportunities Fund—ADV and FS Global Credit Opportunities Fund—T2, and presided in such roles from June 2013, June 2013, February 2016, February 2016 and March 2017, respectively, to December 2020, when they merged into FSGCO. He also served as a trustee and as the chair of its audit committee for FS Series Trust from 2017 to 2022. He also served as a director of VIST Financial Corporation from 2007 to 2012, when the bank was acquired by Tompkins Financial Corporation, and also served on the loan committee and audit committee, which he retired from in April, 2021. Further, Mr. Hughes served as a director of Madison Bank and Leesport Bank from 1989 to 2012, and served as chair of the audit committee and a member of the loan committee of each institution. He also is a member of several nonprofit organizations, including Merakey, a leading developmental behavioral health provider, and Inn Dwelling, Inc., an organization | One | FS Series Trust | ||||

9

| Name, Address(1), Age and Position(s) with Company | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Registered Investment Companies in Fund Complex(2) Overseen by Director | Other Directorships | ||||

that educates underprivileged young people. Mr. Hughes has been a member of the American Institute of Certified Public Accountants since 2000 and of the Pennsylvania Institute of Certified Public Accountants since 1990. Mr. Hughes has been a Certified Public Accountant since 1976, a member of the Bar of the Commonwealth of Pennsylvania since 1976 and a member of the Bar of the United States Tax Court since 1980. He received his bachelor’s degree in accounting from LaSalle University and his J.D. from Villanova University School of Law.

Mr. Hughes has extensive experience concerning financial reporting, accounting and controls, which, combined with his executive leadership roles and membership on various boards and audit committees, has provided him, in the opinion of the Board, with experience and insight which is beneficial to the Company. | ||||||||

Robert N.C. Nix, III Age: 69 Director | Current term expires in 2027. Has served since October 2019. | Robert N.C. Nix, III is currently the founder and owner of Pleasant News, Inc. (PNI), an airport concessionaire and management services operator with over 21 years of diversified project management, distribution, food and beverage operations and retail operations, and has served in such capacity since 1995. Mr. Nix previously served as counsel at Obermayer Rebmann Maxwell & Hippel LLP. In addition to these positions, Mr. Nix currently serves on the Board of Hyperion Bank, a community bank focusing on high-level customer service and being an active member of its neighborhood, as well as Board Chairman of Merakey (formerly known as NHS Corporation), a nonprofit corporation providing developmental behavioral health services. Mr. Nix previously served on the City of Philadelphia’s Board of Revision of Taxes, as well as on the boards of Parkside Recovery, the Fairmount Park Conservancy and the Schuylkill River Development Corporation. Mr. Nix also served on the boards of trustees of FS Global Credit Opportunities Fund—A, FS Global Credit Opportunities Fund—D, FS Global Credit Opportunities Fund—T, FS | One | None | ||||

10

| Name, Address(1), Age and Position(s) with Company | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Registered Investment Companies in Fund Complex(2) Overseen by Director | Other Directorships | ||||

Global Credit Opportunities Fund—ADV and FSGCO T—2, and served in such roles from October 2019 to December 2020, when they merged into FSGCO. Mr. Nix received his J.D. from the Nova Law Center and received his B.S. in Economics from the University of Pennsylvania.

Mr. Nix’s commitment as an innovator and leader in the Philadelphia community as well as his extensive service on the boards of various companies has provided him, in the opinion of the Board, with experience and insight which is beneficial to the Company. |

11

CLASS I AND CLASS III DIRECTORS

| Name, Address(1), Age and Position(s) with Company | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Registered Investment Companies in Fund Complex(2) Overseen by Director | Other Directorships | ||||

Independent | ||||||||

Barbara J. Fouss Age: 54 Director | Current term to expire in 2026. Has served since November 2013 | Barbara J. Fouss is currently the Executive Director of the Gravina Family Office, and previously served as a risk specialist for Provident Bank from January 2020 until March 2022. Prior to beginning her role at Provident, Ms. Fouss served as director of strategic initiatives of Sun National Bank, a national bank and a subsidiary of Sun Bancorp, Inc., from December 2012 to March 2013. Prior to beginning her role as director of strategic initiatives, Ms. Fouss served as Sun National Bank’s chief credit policy officer from August 2011 to November 2012, deputy chief credit policy officer from March 2008 to July 2011 and senior vice president and senior credit officer from 2003 to 2008. Prior to joining Sun National Bank, Ms. Fouss served as a vice president in the energy and power investment banking group of Wachovia Securities, the institutional capital markets and investment banking group of Wachovia Corporation (now Wells Fargo & Company), from 2000 to 2003. Ms. Fouss also served on the boards of trustees of FS Global Credit Opportunities Fund—A, FS Global Credit Opportunities Fund—D, FS Global Credit Opportunities Fund—T, FS Global Credit Opportunities Fund—ADV and FS Global Credit Opportunities Fund—T2, and served in such role from November 2013, November 2013, February 2016, February 2016 and March 2017, respectively, to December 2020, when they merged into the Company.

Ms. Fouss received her bachelor’s degree in business administration from Georgetown University.

Ms. Fouss has significant experience as an executive at various companies, including public and private companies. This experience has provided Ms. Fouss, in the opinion of the Board, with experience and insight which is beneficial to the Company. | One | None | ||||

12

| Name, Address(1), Age and Position(s) with Company | Term of Office and Length of Time Served | Principal Occupation(s) During Past 5 Years | Number of Registered Investment Companies in Fund Complex(2) Overseen by Director | Other Directorships | ||||

Walter W. Buckley, III Age: 64 Director | Current term to expire in 2026. Has served since June 2013 | Walter W. Buckley, III is a serial entrepreneur and currently serves as Managing Partner and Co-Founder of SEMCAP. From 1996 to 2018, Mr. Buckley previously served in various roles at Actua Corporation, a publicly-traded private equity and venture capital firm, including as co-founder, chairman of the board, chief executive officer and president. Prior to co-founding Actua, Mr. Buckley worked for Safeguard Scientifics, Inc., beginning in 1988 as a financial analyst, and later as vice president of acquisitions from 1991 to 1996. Mr. Buckley currently serves on the board of trustees of Camp Tecumseh and The Episcopal Academy, on the board of directors of the Vetri Community Partnership, on the advisory boards of the Carolina Entrepreneurial Initiative and the UNC Kenan-Flagler Business School, and as chairman of the board of directors of the Starfinder Foundation. In addition, he serves on the board of directors of several startups, including Diagnostic Bio Chips, Dropps and Margaux. He previously served as a director of Verticalnet, Inc. from 1996 to 2005. He also served on the boards of trustees of FS Global Credit Opportunities Fund—A, FS Global Credit Opportunities Fund—D, FS Global Credit Opportunities Fund—T, FS Global Credit Opportunities Fund—ADV and FS Global Credit Opportunities Fund—T2, and presided in such roles from June 2013, June 2013, February 2016, February 2016 and March 2017, respectively, to December 2020, when they merged into FSGCO. Mr. Buckley received his bachelor’s degree from the University of North Carolina.

Mr. Buckley has significant experience as an entrepreneur and senior executive at public and private organizations. This experience has provided Mr. Buckley, in the opinion of the Board, with experience and insight which is beneficial to the Company. | One | Actua Corporation |

13

| Name, Address(1), Age and Position(s) with Company | Term of Time Served | Principal Occupation(s) During Past 5 Years | Number of Registered Investment Companies in Fund Complex(2) Overseen by Director | Other Directorships | ||||

Keith Bethel Age: 57 Director | Current term expires in 2025. Has served since February 2023 | Keith Bethel is currently the founding partner for The Triple B Hospitality group, a $20M multi-state hospital company. Mr. Bethel previously served as Aramark’s Chief Growth Officer, responsible for leading overall growth strategies for the company’s food, facilities, and uniform services businesses in 19 countries. Additionally, Mr. Bethel led the Sales, Marketing, Account Retention, Pricing, and Field Activation functions of Aramark. Prior to this, Mr. Bethel served as Executive Vice President – Growth for Aramark’s Higher Education, Healthcare, and Facilities sector, where he was responsible for continuing to develop and drive Aramark’s growth strategy and support client business objectives while leading the sales and retention, strategic development, channel, and marketing teams. Mr. Bethel previously held a variety of positions throughout Aramark’s Education sector, including Regional Vice President for Higher Education, leading the East region, and Vice President of Compliance for Education (K-12), where he was responsible for the oversight and advancement of compliance to all Federal and State regulatory standards for U.S. and Canadian operations. In addition to these positions, Mr. Bethel Mr. Bethel currently serves as Chairman of the Board of Directors for The Philadelphia Urban League and is a board member of The Chamber of Commerce of Greater Philadelphia. Mr. Bethel earned his Master’s in Business Administration and Bachelor’s in Healthcare Administration from St. Joseph’s University in Philadelphia.

Mr. Bethel has significant experience as an executive at public company. This experience has provided Mr. Bethel, in the opinion of the Board, with experience and insight which is beneficial to the Company. | One | None | ||||

Della Clark Age: 70 Director | Current term expires in 2025. Has served since February 2023. | Della Clark’s currently serves as President of The Enterprise Center, a 501c(3) with a mission to cultivate and invest in minority entrepreneurs, a role she has held since 1992. Ms. Clark is also a partner at the Innovate Capital Growth Fund, an initiative focused on investing growth equity | One | None | ||||

14

| Name, Address(1), Age and Position(s) with Company | Term of Time Served | Principal Occupation(s) During Past 5 Years | Number of Registered Investment Companies in Fund Complex(2) Overseen by Director | Other Directorships | ||||

in minority and women-owned lower middle market businesses. In addition, Ms. Clark is a Senior Policy Fellow at the George V. Voinovich Center for Leadership and Public Affairs at Ohio University. In addition to these positions, Ms. Clark serves as a board member of the Philadelphia Equity Alliance, where she serves as Co-Chair, and as a Trustee of Drexel University. Ms. Clark received a B.S. from American University.

Ms. Clark’s experience in executive leadership roles and membership on various boards, has provided her, in the opinion of the Board, with experience and insight which is beneficial to the Company. | ||||||||

Interested | ||||||||

Michael C. Forman Age: 63 Chairman, President and Chief Executive Officer | Current term expires in 2025. Has served since January 2013 | Michael C. Forman is chairman and chief executive officer of FS Investments and has been leading the company since its founding. He has served as the chairman and chief executive officer of the Adviser since its inception. He currently serves as chairman, president and/or chief executive officer of other funds sponsored by FS Investments and its affiliates. Prior to founding FS Investments, Mr. Forman founded a private equity and real estate investment firm. He started his career as an attorney in the Corporate and Securities Department at the Philadelphia based law firm of Klehr Harrison Harvey Branzburg LLP. In addition to his career as an attorney and investor, Mr. Forman has been an active entrepreneur and has founded several companies, including companies engaged in the gaming, specialty finance and asset management industries. Mr. Forman is a member of a number of civic and charitable boards, including the Barnes Foundation Corporate Leadership, Children’s Hospital of Philadelphia, Philadelphia Equity Alliance, Drexel University, the Philadelphia Center City District Foundation and Cobbs Creek Foundation. Mr. Forman received his B.A., summa cum laude, from the University of Rhode Island, where he was elected Phi Beta Kappa, | Two | FS Series Trust; FS Credit Income Fund; FS Credit Real Estate Income Trust, Inc.; FS Specialty Lending Fund (f/k/a FS Energy and Power Fund); FS KKR Capital Corp.; and KKR FS Income Trust; KKR FS Income Trust – Select. | ||||

15

| Name, Address(1), Age and Position(s) with Company | Term of Time Served | Principal Occupation(s) During Past 5 Years | Number of Registered Investment Companies in Fund Complex(2) Overseen by Director | Other Directorships | ||||

and received his J.D. from Rutgers University. Mr. Forman has extensive experience incorporate and securities law and has founded and served in a leadership role of various companies, including the Adviser.

Mr. Forman’s experience and his positions as the Company’s and the Adviser’s chief executive officer make him a significant asset to the Company. |

| (1) | The address for each director nominee is c/o FS Credit Opportunities Corp., 201 Rouse Boulevard, Philadelphia, Pennsylvania 19112. |

| (2) | The registered investment companies in the “Fund Complex” consist of the Company and FS Specialty Lending Fund (f/k/a FS Energy and Power Fund). |

Risk Oversight and Board Structure

Board’s Role in Risk Oversight

Through its direct oversight role, and indirectly through its committees, the Board performs a risk oversight function for the Company consisting of, among other things, the following activities: (1) at regular and special Board meetings, and on an ad hoc basis as needed, receiving and reviewing reports related to the performance and operations of the Company; (2) reviewing and approving, as applicable, its compliance policies and procedures; (3) meeting with the portfolio management team to review investment strategies, techniques and the processes used to manage related risks; (4) overseeing the Company’s investment valuation process via its audit committee that operates pursuant to authority assigned to it by the Board; (5) meeting, or reviewing reports prepared by the representatives of key service providers, including the Company’s investment adviser, administrator, custodian and independent registered public accounting firm, to review and discuss the Company’s activities and to provide direction with respect thereto; (6) reviewing periodically, and at least annually, the Company’s fidelity bond, directors and officers, and errors and omissions insurance policies and such other insurance policies as may be appropriate; (7) overseeing the Company’s accounting and financial reporting processes, including supervision of the Company’s independent registered public accounting firm to ensure that they provide timely analyses of significant financial reporting and internal control issues; and (8) overseeing the services of the Company’s chief compliance officer to test its compliance procedures and those of its service providers.

The Board also performs its risk oversight responsibilities with the assistance of the Company’s chief compliance officer. The Board receives a quarterly report from the Company’s chief compliance officer, who reports on, among other things, the Company’s compliance with applicable securities laws and its internal compliance policies and procedures. In addition, the Company’s chief compliance officer prepares a written report annually evaluating, among other things, the adequacy and effectiveness of the compliance policies and procedures of the Company and certain of its service providers. The Company’s chief compliance officer’s report, which is reviewed by the Board, addresses at a minimum: (1) the operation and effectiveness of the compliance policies and procedures of the Company and certain of its service providers since the last report; (2) any material changes to such policies and procedures since the last report; (3) any recommendations for changes to such policies and procedures as a result of the Company’s chief compliance officer’s annual review;

16

and (4) any material compliance matters that have occurred since the date of the last report about which the Board would reasonably need to know to oversee the Company’s compliance activities and risks. The Company’s chief compliance officer also meets separately in executive session with the independent directors of the Company at least once each year. In addition to compliance reports from the Company’s chief compliance officer, the Board also receives reports and updates from legal counsel to the Company regarding legal, regulatory and governance matters.

Board Composition and Leadership Structure

Mr. Forman, who is an “interested person” of the Company as defined in Section 2(a)(19) of the 1940 Act, serves as both the chief executive officer of the Company and chairman of the Board. The Board believes that Mr. Forman, as co-founder and chief executive officer of the Company, is the director with the most knowledge of the Company’s business strategy and is best situated to serve as chairman of the Board. The Company’s Charter, as well as the 1940 Act requirement for closed-end funds, requires that a majority of the Board be persons other than “interested persons” of the Company, as defined in Section 2(a)(19) of the 1940 Act.

While the Company currently does not have a policy mandating a lead independent director, the Board believes that having an independent director fill the lead director role is appropriate. Mr. Buckley currently serves as lead independent director. The lead independent director, among other things, works with the chairman of the Board in the preparation of the agenda for each Board meeting and in determining the need for meetings of the Board, chairs any meeting of the independent directors in executive session, facilitates communications between other members of the Board and the chairman of the Board and/or the chief executive officer and otherwise consults with the chairman of the Board and/or the chief executive officer on matters relating to corporate governance and Board performance.

The Board has concluded that its structure is appropriate given the current size and complexity of the Company and the extensive regulation to which the Company is subject as a closed-end fund.

Board Meetings and Attendance

The Board met seven times during the fiscal year ended December 31, 2023, including four regular quarterly meetings. During the fiscal year ended December 31, 2023, each director, except for Mr. Forman, attended at least 75% of all meetings of the Board and Board committees on which he or she served (held during the period that such director served). The Company does not have a formal policy regarding director attendance at an annual meeting of stockholders.

Committees of the Board of Directors

The Board has established two standing committees of the Board, which consist of an Audit Committee and a Nominating and Corporate Governance Committee. The Board has not established a standing compensation committee because the executive officers of the Company do not receive any direct compensation from the Company. The Board, as a whole, participates in the consideration of director compensation and decisions on director compensation are based on, among other things, a review of data of comparable closed-end funds. The Board may also engage compensation consultants from time-to-time, following consideration of certain factors related to such consultants’ independence.

Audit Committee

The Board has established an Audit Committee that operates pursuant to a charter and consists of three members, including a Chairman of the Audit Committee. The Audit Committee members are Mr. Hughes (Chairman), Mr. Nix and Ms. Fouss, all of whom are independent. The Board has determined that Mr. Hughes is an “audit committee financial expert” as defined by Item 407(d)(5)(ii) of Regulation S-K promulgated under the

17

Exchange Act. The primary function of the Audit Committee is (i) to oversee the integrity of the Company’s accounting policies, financial reporting process and system of internal controls regarding finance and accounting policies, and (ii) to establish guidelines and make recommendations to the Board on matters relating to the valuation of the Company’s investments. The Audit Committee is responsible for selecting, engaging and discharging the Company’s independent accountants, reviewing the plans, scope and results of the audit engagement with the Company’s independent accountants, approving professional services provided by the Company’s independent accountants (including compensation therefor) and reviewing the independence of the Company’s independent accountants. The Audit Committee held eight meetings during the fiscal year ended December 31, 2023. The Audit Committee charter can be accessed via the Company’s website at https://fsinvestments.com/investments/fsco-corporate-governance/.

Nominating and Corporate Governance Committee

The Board has established a Nominating and Corporate Governance Committee that operates pursuant to a charter and currently consists of three members, including a Chairman of the Nominating and Corporate Governance Committee. The Nominating and Corporate Governance Committee members are Mr. Bethel, Ms. Clark and Mr. Nix, all of whom are independent. The primary function of the Nominating and Corporate Governance Committee is to consider and make recommendations to the Board regarding certain governance matters, including selection of directors for election by stockholders, selection of director nominees to fill vacancies on the Board or a committee thereof, development and revision, as appropriate, of applicable corporate governance documentation and practices and oversight of the evaluation of the Board. The Nominating and Corporate Governance Committee held one meeting during the fiscal year ended December 31, 2023.

When nominating director candidates, the Nominating and Corporate Governance Committee takes into consideration such factors as it deems appropriate in accordance with its charter. Among the qualifications considered in the selection of candidates, the Nominating and Corporate Governance Committee considers the following attributes and criteria of candidates: experience, including experience with investment companies and other organizations of comparable purpose, skills, expertise, diversity, including diversity of gender, race and national origin, personal and professional integrity, time availability in light of other commitments, conflicts of interest and such other relevant factors that the Nominating and Corporate Governance Committee considers appropriate in the context of the needs of the Board, including, when applicable, to enhance the ability of the Board or committees of the Board to fulfill their duties and/or to satisfy any independence or other applicable requirements imposed by law, rule, regulation or listing standard including, but not limited to, the 1940 Act and rules promulgated by the SEC. Each of the director nominees was approved by the members of the Nominating and Corporate Governance Committee and the entire Board.

The Nominating and Corporate Governance Committee considers candidates suggested by its members and other Board members, as well as the Company’s management and stockholders. A Company stockholder who wishes to recommend a prospective nominee for the Board must provide notice to the Secretary of the Company in accordance with the requirements set forth in the Company’s bylaws, which are described in greater detail under the heading “Submission of Stockholder Proposals.” Nominees for director who are recommended by stockholders will be evaluated in the same manner as any other nominee for director. The Nominating and Corporate Governance Committee charter can be accessed via the Company’s website at https://fsinvestments.com/investments/fsco-corporate-governance/.

Communications Between Interested Parties and the Board

The Board welcomes communications from interested parties. Interested parties may send communications to the Board or to any particular director to the following address: c/o FS Credit Opportunities Corp., 201 Rouse Boulevard, Philadelphia, Pennsylvania 19112. Interested parties should indicate clearly the director or directors to whom the communication is being sent so that each communication may be forwarded directly to the appropriate director(s).

18

Information about Executive Officers Who Are Not Directors

The following table sets forth certain information regarding the executive officers of the Company who are not directors of the Company. Each executive officer holds his office until his successor is chosen and qualified, or until his earlier resignation or removal.

Name, Address(1) and | Position(s) with | Length of Time | Principal Occupation(s) During Past Five Years | |||

Edward T. Gallivan, Jr. Age: 62 | Chief Financial Officer | Since 2018 | Edward T. Gallivan, Jr. has served as the Chief Financial Officer of the Company since 2018. Mr. Gallivan also serves as the chief financial officer of certain of the other funds sponsored by FS Investments. Prior to joining FS Investments, Mr. Gallivan was director of financial reporting at BlackRock and assistant treasurer of mutual funds at State Street Research & Management. Mr. Gallivan began his career as an auditor at the global accounting firm PwC where he practiced as a certified public accountant. Mr. Gallivan received his B.S. in Business Administration (Accounting) degree at Stonehill College. | |||

Stephen S. Sypherd Age: 47 | Vice President, Treasurer & Secretary | Since 2013 | Stephen S. Sypherd has served as the Vice President, Treasurer, and Secretary for the Company since 2013. He also serves as Secretary, General Counsel, Vice President and/ or Treasurer of other funds sponsored by FS Investments. Mr. Sypherd has also served in various senior officer capacities for FS Investments and its affiliated investment advisers, including as senior vice president from December 2011 to August 2014, general counsel since January 2013 and managing director since August 2014. He is responsible for legal and compliance matters across all entities and investment products of FS Investments. Prior to joining FS Investments, Mr. Sypherd served for eight years as an attorney at Skadden, Arps, Slate, Meagher & Flom LLP, where he practiced corporate and securities law. Mr. Sypherd received his B.A. in Economics from Villanova University and his J.D. from the Georgetown University Law Center, where he was an executive editor of the Georgetown Law Journal. He serves on the board of trustees of the University of the Arts where he is also the chairman of the audit committee (and on the executive and governance committees of that board). | |||

James F. Volk Age: 61 | Chief Compliance Officer | Since 2015 | James F. Volk has served as the Chief Compliance Officer of the Company since 2015. Mr. Volk also serves as the chief compliance officer of the other funds sponsored by FS Investments. He is responsible for all compliance and regulatory issues affecting the Company and the foregoing funds. Prior to joining FS Investments and its affiliated investment advisers in | |||

19

Name, Address(1) and | Position(s) with | Length of Time | Principal Occupation(s) During Past Five Years | |||

| October 2014, Mr. Volk was the chief compliance officer, chief accounting officer and head of traditional fund operations at SEI’s Investment Manager Services market unit. Mr. Volk was also formerly the assistant chief accountant at the SEC’s Division of Investment Management and a senior manager for PricewaterhouseCoopers. Mr. Volk graduated from the University of Delaware with a B.S. in Accounting and is currently an inactive Certified Public Accountant. |

| (1) | The address for each executive officer is c/o FS Credit Opportunities Corp., 201 Rouse Boulevard, Philadelphia, Pennsylvania 19112. |

Code of Business Conduct and Ethics

The Company has adopted a code of business conduct and ethics (as amended and restated, the “Code of Business Conduct and Ethics”) pursuant to Rule 17j-1 promulgated under the 1940 Act, which applies to, among others, its officers, including its chief executive officer and its chief financial officer, as well as the members of the Board. The Company’s Code of Business Conduct and Ethics can be accessed via the Company’s website at https://fsinvestments.com/investments/fsco-corporate-governance/. In addition, the Code of Business Conduct and Ethics is available on the EDGAR Database on the SEC’s Internet site at www.sec.gov. The Company intends to disclose any amendments to or waivers of required provisions of the Code of Business Conduct and Ethics on Form 8-K, as required by the Exchange Act and the rules and regulations promulgated thereunder.

Practice and Policies Regarding Personal Trading and Hedging of Company Equity

The Company has also established a policy designed to prohibit our officers, directors, and certain employees of the Adviser from purchasing or selling shares of the Company while in possession of material nonpublic information, or otherwise using such information for their personal benefit or in any manner that would violate applicable laws and regulations. The policy also prohibits all directors and officers from engaging in hedging or monetization transactions or similar arrangements with respect to the Company’s securities without prior approval of the Company’s chief compliance officer.

Compensation Discussion and Analysis

The Company’s executive officers do not receive any direct compensation from the Company. The Company does not currently have any employees and does not expect to have any employees. As an externally managed closed-end fund, services necessary for the Company’s business are provided by individuals who are employees of the Adviser or its affiliates or by individuals who are contracted by the Adviser, the Company or their respective affiliates to work on behalf of the Company pursuant to the terms of that certain amended and restated investment advisory agreement, effective as of November 14, 2022, between the Company and the Adviser (the “A&R Investment Advisory Agreement”) and that certain administration agreement, dated as of July 15, 2013 (the “Administration Agreement”), between the Company and the Adviser. Each of the Company’s executive officers is an employee of the Adviser or its affiliates and the day-to-day investment operations and administration of the Company’s portfolio are managed by the Adviser. In addition, the Company will reimburse the Adviser for its allocable portion of expenses incurred by the Adviser in performing its obligations under the A&R Investment Advisory Agreement and the Administration Agreement.

The A&R Investment Advisory Agreement and the Administration Agreement provide that the Adviser (and its officers, managers, partners, members (and their members, including the owners of their members), agents,

20

employees, controlling persons and any other person or entity affiliated with, or acting on behalf of, the Adviser) shall be entitled to indemnification (including reasonable attorneys’ fees and amounts reasonably paid in settlement) for any liability or loss suffered by the Adviser, and the Adviser shall be held harmless for any loss or liability suffered by the Company, arising out of the performance of any of its duties or obligations under the A&R Investment Advisory Agreement or the Administration Agreement, respectively, or otherwise as the Company’s investment adviser or administrator, respectively; provided, however, that the Adviser cannot be indemnified for any liability arising out of willful misfeasance, bad faith, or negligence in the performance of the Adviser’s duties or by reason of the reckless disregard of the Adviser’s duties and obligations under the A&R Investment Advisory Agreement or the Administration Agreement, as applicable.

Director Compensation

The Company does not pay compensation to its directors who also serve in an executive officer capacity for the Company or the Adviser. The Company’s directors who do not also serve in an executive officer capacity for the Company or the Adviser are entitled to receive annual cash retainer fees, fees for participating in quarterly Board and Board committee meetings and certain other Board and Board committee meetings, and annual fees for serving as a committee chairperson. These directors are Mr. Bethel, Mr. Buckley, Ms. Clark, Ms. Fouss, Mr. Hughes and Mr. Nix. Mr. Buckley also receives an annual retainer for his service as lead independent director.

Amounts payable under these fee arrangements for the Company are determined and paid quarterly in arrears as set forth below.

| Amount | ||||

Annual Board Retainer | $ | 100,000 | ||

Annual Lead Independent Director Retainer | $ | 25,000 | ||

Board Meeting Fees | $ | 2,500 | ||

Annual Committee Chair Retainers | ||||

Audit Committee | $ | 20,000 | ||

Nominating and Corporate Governance Committee | $ | 15,000 | ||

Committee Meeting Fees | $ | 1,000 | ||

The Company will also reimburse each of the above directors for all reasonable and authorized business expenses in accordance with its policies as in effect from time to time, including reimbursement of reasonable out-of-pocket expenses incurred in connection with attending each in-person Board meeting and each in-person Board committee meeting not held concurrently with a Board meeting.

The table below sets forth the compensation received by each current and former director from (i) the Company and (ii) all of the companies in the Fund Complex (as defined below), including the Company, in each case, that provided service during the fiscal year ended December 31, 2023. Our directors do not receive any retirement benefits from us.

| Name of Director | Fees Earned or Paid in Cash by the Company | Total Compensation from the Company | Total Compensation from the Fund Complex | |||||||||

Michael C. Forman | — | — | — | |||||||||

Keith Bethel | $ | 55,000.00 | $ | 55,000.00 | $ | 55,000.00 | ||||||

Walter W. Buckley, III | $ | 135,000.00 | $ | 135,000.00 | $ | 135,000.00 | ||||||

Della Clark | $ | 52,500.00 | $ | 52,500.00 | $ | 52,500.00 | ||||||

Barbara J. Fouss | $ | 114,000.00 | $ | 114,000.00 | $ | 114,000.00 | ||||||

Philip E. Hughes, Jr. | $ | 134,000.00 | $ | 134,000.00 | $ | 134,000.00 | ||||||

Robert N.C. Nix, III | $ | 130,000.00 | $ | 130,000.00 | $ | 130,000.00 | ||||||

21

Certain Relationships and Related Party Transactions

Compensation of the Investment Adviser and its Affiliates

Prior to November 14, 2022, pursuant to the investment advisory agreement, dated as of April 18, 2019, or the Investment Advisory Agreement, the Adviser was entitled to (a) an annual management fee of 1.50% of the Company’s average daily gross assets (gross assets equaled total assets set forth on the Company’s consolidated statement of assets and liabilities) and (b) an incentive fee based on the Company’s performance.

On November 14, 2022, the Company and the Adviser amended and restated the Investment Advisory Agreement, or the A&R Investment Advisory Agreement. Pursuant to the A&R Investment Advisory Agreement, effective as of November 14, 2022, the Adviser is entitled to (a) an annual management fee of 1.35% of the Company’s average daily gross assets (gross assets equals total assets set forth on the Company’s consolidated statement of assets and liabilities) and (b) an incentive fee based on the Company’s performance. Management fees are calculated and payable quarterly in arrears.

Under the A&R Investment Advisory Agreement, the incentive fee is calculated and payable quarterly in arrears based upon the Company’s “pre-incentive fee net investment income” for the immediately preceding quarter, and is subject to a preferred return rate, expressed as a rate of return on the Company’s net assets, equal to 1.50% per quarter (or an annualized hurdle rate of 6.00%), subject to a “catch-up” feature. For this purpose, “pre-incentive fee net investment income” means interest income, dividend income and any other income (including any other fees, such as commitment, origination, structuring, diligence and consulting fees or other fees that the Company receives from portfolio companies) accrued during the calendar quarter, minus the Company’s operating expenses for the quarter (including the management fee, expenses reimbursed to the Adviser under the Administration Agreement, and any interest expense and distributions paid on any issued and outstanding preferred shares, but excluding the incentive fee). Pre-incentive fee net investment income includes, in the case of investments with a deferred interest feature (such as original issue discount, debt instruments with paid-in-kind interest and zero coupon securities), accrued income that the Fund has not yet received in cash. Pre-incentive fee net investment income does not include any realized capital gains, realized capital losses or unrealized capital appreciation or depreciation.

The calculation of the incentive fee for each quarter under the A&R Investment Advisory Agreement is as follows:

| • | No incentive fee is payable in any calendar quarter in which the Company’s pre-incentive fee net investment income does not exceed the quarterly preferred return rate of 1.50% (6.00% annualized); |

| • | 100% of the Company’s pre-incentive fee net investment income, if any, that exceeds the preferred return rate but is less than or equal to 1.667% in any calendar quarter (6.667% annualized) is payable to the Adviser. This portion of the Company’s pre-incentive fee net investment income which exceeds the preferred return rate but is less than or equal to 1.667% is referred to as the “catch-up.” The “catch-up” provision is intended to provide the Adviser with an incentive fee of 10.0% on all of the Company’s pre-incentive fee net investment income when the Company’s pre-incentive fee net investment income reaches 1.667% in any calendar quarter; and |

| • | 10.0% of the amount of the Company’s pre-incentive fee net investment income, if any, that exceeds 1.667% in any calendar quarter (6.667% annualized) is payable to the Adviser once the preferred return rate and catch-up have been achieved (10.0% of all the Company’s pre-incentive fee net investment income thereafter is allocated to the Adviser). |

Under the Administration Agreement, the Company reimburses the Adviser for its actual costs incurred in providing administrative services to the Company, including the Adviser’s allocable portion of the compensation and related expenses of certain personnel of FS Investments providing administrative services to the Company on behalf of the Adviser. Such services include general ledger accounting, fund accounting, legal services, investor and government relations and other administrative services. The Adviser also performs, or oversees the

22

performance of, the Company’s corporate operations and required administrative services, which includes being responsible for the financial records that the Company is required to maintain and preparing reports to the Company’s stockholders and reports filed with the Securities and Exchange Commission, or the SEC. In addition, the Adviser assists the Company in calculating NAV, overseeing the preparation and filing of tax returns and the printing and dissemination of reports to the Company’s stockholders, and generally overseeing the payment of the Company’s expenses and the performance of administrative and professional services rendered to the Company by others. The Adviser is required to allocate the cost of these services to the Company based on factors such as assets, revenues and/or time allocations. At least annually, the Board reviews the methodology employed in determining how the expenses are allocated to the Company and the proposed allocation of administrative expenses among the Company and certain affiliates of the Adviser. The Board then assesses the reasonableness of such reimbursements for expenses allocated to the Company based on the breadth, depth and quality of such services as compared to the estimated cost to the Company of obtaining similar services from third-party service providers known to be available. In addition, the Board considers whether any single third-party service provider would be capable of providing all such services at comparable cost and quality. Finally, the Board compares the total amount paid to the Adviser for such services as a percentage of the Company’s net assets to the same ratio as reported by other comparable investment companies. The Company will not reimburse the Adviser for any services for which it receives a separate fee or for any administrative expenses allocated to a controlling person of the Adviser.

The following table describes the fees and expenses incurred under the Investment Advisory Agreement, A&R Investment Advisory Agreement and the Administration Agreement during the year ended December 31, 2023 (in thousands):

Related Party | Source Agreement | Description | Amount | |||||

The Adviser | Investment Advisory Agreement; A&R Investment Advisory Agreement | Management Fee(1) | $ | 28,413 | ||||

The Adviser | Investment Advisory Agreement; A&R Investment Advisory Agreement | Incentive Fee(2) | $ | 16,622 | ||||

The Adviser | Administration Agreement | Administrative Services Expenses(3) | $ | 4,706 | ||||

| (1) | During the year ended December 31, 2023, $28,500 in management fees were paid to the Adviser. As of December 31, 2023, $7,434 in management fees were payable to the Adviser. |

| (2) | During the year ended December 31, 2023, $16,848 in incentive fees were paid to the Adviser. As of December 31, 2023, $3,288 in incentive fees were payable to the Adviser. |

| (3) | During the year ended December 31, 2023, the Company paid $3,949 in administrative services expenses to the Adviser. |

Potential Conflicts of Interest

The Adviser’s senior management team is comprised of substantially the same personnel as the senior management teams of the investment advisers to the other fund in the Fund Complex. The registered investment companies in the Fund Complex currently consist of the Company and FS Specialty Lending Fund (f/k/a FS Energy and Power Fund). As a result, such personnel provide or expect to provide investment advisory services to certain other funds in the Fund Complex and such personnel may serve in similar or other capacities for the investment advisers to future investment vehicles in the Fund Complex. While the investment personnel of the Adviser are not currently providing investment advisory services for clients other than for the Fund Complex, they may do so in the future. In the event that the Adviser provides investment advisory services to other clients in the future, it intends to allocate investment opportunities in a fair and equitable manner consistent with the Company’s investment objectives and strategies, so that the Company will not be disadvantaged in relation to any other client of the Adviser or its management team. In addition, even in the absence of the Adviser retaining additional clients, it is possible that some investment opportunities may be provided to other entities in the Fund Complex, rather than to the Company.

23

Exemptive Relief

The Company has been granted exemptive relief by the SEC that permits the Company to participate in certain negotiated co-investments alongside other funds managed by the Adviser or certain of its affiliates, subject to certain conditions, including (i) that a majority of the Board who have no financial interest in the co-investment transaction and a majority of the Board who are not “interested persons,” as defined in the 1940 Act, approve the co-investment and (ii) that the price, terms and conditions of the co-investment will be identical for each fund participating pursuant to the exemptive relief.

Bridge Street CLO I Ltd., Bridge Street CLO II Ltd. and Bridge Street CLO III Ltd. (each a “CLO Issuer”) (in thousands)

The collateral manager and administrator of each CLO Issuer, FS Structured Products Advisor, LLC (“FSSPA”), is an affiliate of the Adviser. In accordance with an agreement between FSSPA and the Company, as long as the Company owns more than 4.99% of each CLO Issuer’s equity, FSSPA will reimburse the Company on a quarterly basis in an amount equal to the compensation received by FSSPA from each CLO Issuer for its collateral management and collateral administrator services less certain administrative costs borne by FSSPA during the relevant quarter as defined in the agreement.

Bridge Street Warehouse CLO I Ltd., or Bridge Street Warehouse CLO I, was a CLO Warehouse wholly- owned by the Company. Bridge Street Warehouse CLO I commenced operations on March 13, 2020 and financed the majority of its loan purchases using its warehouse financing facility during the warehouse phase and through January 28, 2021. On January 28, 2021, the CLO Warehouse phase terminated when the collateralized loan obligation vehicle, Bridge Street CLO I Ltd., or Bridge Street CLO I, issued to the market various tranches of notes in the amount of $353,700, including $28,200 principal to the Company for subordinated notes and rights to receive cash flows from collateral management fees. On such date, financing through the issuance of debt and equity securities was used to repay the warehouse financing facility.

Bridge Street Warehouse CLO II Ltd., or Bridge Street Warehouse CLO II, was a CLO Warehouse wholly- owned by the Company. Bridge Street Warehouse CLO II commenced operations on March 29, 2021 and financed the majority of its loan purchases using its warehouse financing facility during the warehouse phase and through September 2, 2021. On September 2, 2021, the CLO Warehouse phase terminated when the collateralized loan obligation vehicle, Bridge Street CLO II Ltd., or Bridge Street CLO II, issued to the market various tranches of notes in the amount of $355,950, including $28,560 principal to the Company for subordinated notes and rights to receive cash flows from collateral management fees. On such date, financing through the issuance of debt and equity securities was used to repay the warehouse financing facility.

Bridge Street Warehouse CLO III Ltd., or Bridge Street Warehouse CLO III, was a CLO Warehouse wholly- owned by the Company. Bridge Street Warehouse CLO III commenced operations on September 30, 2021 and financed the majority of its loan purchases using its warehouse financing facility during the warehouse phase and through December 28, 2022. On December 28, 2022, the CLO Warehouse phase terminated when the collateralized loan obligation vehicle, Bridge Street CLO III, issued to the market various tranches of notes in the amount of $349,500, including $27,600 principal to the Fund for subordinated notes and rights to receive cash flows from collateral management fees. On such date, Bridge Street CLO III, following a merger with Bridge Street Warehouse CLO III, used proceeds from its note issuance to repay the warehouse financing facility.

Independent Registered Public Accounting Firm

Ernst & Young LLP (“Ernst & Young”) is the Company’s independent registered public accounting firm. The appointment of Ernst & Young was previously recommended by the Audit Committee. The Company knows of no direct financial or material indirect financial interest of Ernst & Young in the Company. A representative of Ernst & Young is expected to be available to answer questions during the Annual Meeting and will have an

24

opportunity to make a statement if he or she desires to do. The Company engaged Ernst & Young to act as its independent registered public accounting firm for each of the fiscal years ended December 31, 2013 through December 31, 2023.

Fees

Set forth below are audit fees, audit related fees, tax fees and all other fees billed to the Company by Ernst & Young for professional services performed for the fiscal years ended December 31, 2023 and 2022: