Ivy High Income Opportunities Fund

(Names of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | | |

| | |

| ☑ | | No fee required. |

| | |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | | |

| | | (1) | | Title of each class of securities to which transaction applies: |

| | | |

| | | (2) | | Aggregate number of securities to which transaction applies: |

| | | |

| | | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | | |

| | | (4) | | Proposed maximum aggregate value of transaction: |

| | | |

| | | (5) | | Total fee paid: |

| | |

| ☐ | | Fee paid previously with preliminary materials. |

| | |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | | |

| | | (1) | | Amount Previously Paid: |

| | | |

| | | (2) | | Form, Schedule or Registration Statement No.: |

| | | |

| | | (3) | | Filing Party: |

| | | |

| | | (4) | | Date Filed: |

IVY HIGH INCOME OPPORTUNITIES FUND

6300 Lamar Avenue

Overland Park, Kansas 66202

February 4, 2021

Dear Shareholder:

Two separate special meetings of the shareholders of the Ivy High Income Opportunities Fund (the “Fund”) will be held via audio teleconference on April 1, 2021. The first meeting will be held at 1:30 p.m., Central Time (the “First Meeting”) and the second meeting will be held at 3:00 p.m., Central Time (the “Second Meeting”) (each, a “Meeting” and collectively, the “Meetings”). You are receiving this letter because you were a shareholder of record of the Fund as of January 22, 2021 (the “Record Date”).

The Meetings are being held to approve matters important to your Fund relating to Macquarie Group Limited’s (“Macquarie Group”) proposed acquisition of Waddell & Reed Financial, Inc. (“WDR”). On December 2, 2020, WDR, the parent company of Ivy Investment Management Company (“IICO”), and Macquarie Group, including its asset management division Macquarie Asset Management (together, “Macquarie”), announced that they had entered into an agreement whereby Macquarie will acquire WDR (the “Transaction”). The Transaction is subject to approval by WDR’s shareholders and customary closing conditions, including receipt of applicable regulatory approvals. Subject to such approvals and the satisfaction of certain other conditions, the Transaction is expected to close by mid-2021 (the “Closing”). Upon the Closing of the Transaction, the Fund’s investment advisory agreement will automatically terminate in accordance with its terms and applicable regulations.

In order to help ensure that the Fund’s investment program continues uninterrupted upon the Closing, I am asking for your vote at the Meetings on the following proposals affecting the Fund, as well as to transact such other business as may properly come before the Meetings or any adjournments thereof:

First Meeting Proposal:

1. To elect the Trustee nominees named in the accompanying proxy statement: Joseph Harroz, Jr., Ann D. Borowiec, Jerome D. Abernathy, Janet L. Yeomans and John A. Fry for Class I; Sandra A.J. Lawrence, Shawn K. Lytle, Thomas L. Bennett and Thomas K. Whitford for Class II; and H. Jeffrey Dobbs, Frances A. Sevilla-Sacasa, Christianna Wood and Joseph W. Chow for Class III, to hold office until the Fund’s 2023, 2021, and 2022 annual meeting, respectively, or until their respective successors are elected and duly qualified.

Second Meeting Proposals:

1. To approve a new investment advisory agreement for the Fund.

2. To approve sub-advisory agreements between Delaware Management Company, a series of Macquarie Investment Management Business Trust, and each of Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited and Macquarie Investment Management Europe Limited.

The Board of Trustees of the Fund have approved, and unanimously recommends that you vote FOR each proposal, including FOR all Trustee nominees.

Detailed information about the proposals is contained in the enclosed materials. Please review and consider the enclosed materials carefully, and then please take a moment to vote.

Due to the coronavirus outbreak (COVID-19) and to support the health and well-being of our shareholders, employees, and community, the Meetings will be conducted exclusively via audio teleconference. Any shareholder wishing to participate in the Meetings telephonically can do so. If you were a record holder of Fund shares as of the Record Date, please e-mail our proxy solicitor, Di Costa Partners, at meetinginfo@dicostapartners.com no later than 2:00 p.m. Eastern Time on March 31, 2021 to register. Please include the Fund’s name in the subject line and provide your name and address in the body of the e-mail. Di Costa Partners will then e-mail you the conference call dial-in information and instructions for voting during the Meetings. If you held Fund shares through an intermediary, such as a broker-dealer, as of the Record Date, and you want to participate in the Meetings, please e-mail Di Costa Partners

at meetinginfo@dicostapartners.com no later than 2:00 p.m. Eastern Time on March 31, 2021 to register. Please include the Fund’s name in the subject line and provide your name, address and proof of ownership as of the Record Date from your intermediary. Please be aware that if you wish to vote at the Meetings you must first obtain a legal proxy from your intermediary reflecting the Fund’s name, the number of Fund shares you held and your name and e-mail address. You may forward an e-mail from your intermediary containing the legal proxy or e-mail an image of the legal proxy to Di Costa Partners at meetinginfo@dicostapartners.com and put “Legal Proxy” in the subject line. Di Costa Partners will then e-mail you the conference call dial-in information and instructions for voting during the Meetings.

The conference call dial-in number will only be active for the date and time of the Meetings. If you have any questions prior to the Meetings, please call Di Costa Partners at the phone number provided below.

Whether or not you plan to attend the Meetings via audio teleconference, your vote is needed.

Attendance at the Meetings will be limited to shareholders of the Fund as of the close of business on January 22, 2021, the Record Date. You are entitled to receive notice of, and to vote at, each Meeting and any adjournment of each Meeting, even if you no longer hold shares of the Fund. Your vote is important no matter how many shares you own. It is important that your vote be received no later than the time of each Meeting.

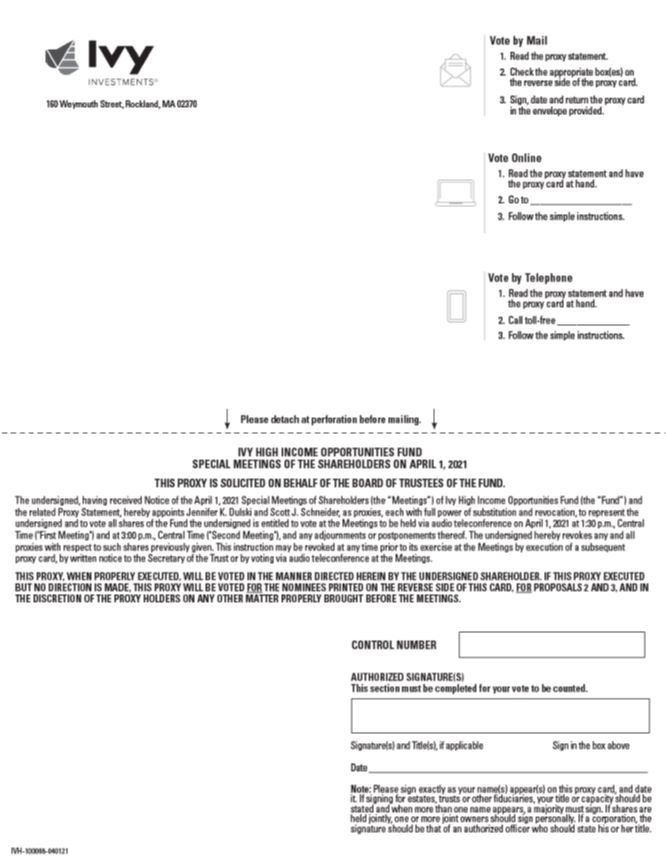

Voting is quick and easy. Everything you need is enclosed. You may vote by completing and returning your white proxy card in the enclosed postage-paid return envelope, by calling the toll-free telephone number listed on the enclosed white proxy card, or by visiting the Internet website listed on the enclosed white proxy card. You may receive more than one set of proxy materials if you hold shares in more than one account. Please be sure to vote each white proxy card you receive. If we do not hear from you, our proxy solicitor, Di Costa Partners, may contact you. This will ensure that your vote is counted even if you cannot or do not wish to attend the Meetings. If you have any questions about the proposals or how to vote, you may call Di Costa Partners at 833-892-6623 and a representative will assist you.

Your vote is important to us. Thank you for your response and for your investment.

| |

| Sincerely, |

Philip J. Sanders |

| President of the Fund |

Ivy High Income Opportunities Fund

6300 Lamar Avenue

Overland Park, Kansas 66202

NOTICE OF SPECIAL MEETINGS OF SHAREHOLDERS

NOTICE IS HEREBY GIVEN that two separate special meetings of the shareholders of the Ivy High Income Opportunities Fund (the “Fund”) will be held via audio teleconference on April 1, 2021. The first meeting will be held at 1:30 p.m., Central Time (the “First Meeting”) and the second meeting will be held at 3:00 p.m., Central Time (the “Second Meeting”) (each, a “Meeting” and collectively, the “Meetings”). At the Meetings, shareholders will be asked to consider and vote upon the following proposals (collectively, the “Proposals,” with each being a “Proposal”) and to act upon any other business which may properly come before the Meetings or any adjournment or postponement thereof:

| |

Shareholders Entitled to Vote |

First Meeting Proposal 1. To elect the Trustee nominees named in the accompanying proxy statement: Joseph Harroz, Jr., Ann D. Borowiec, Jerome D. Abernathy, Janet L. Yeomans and John A. Fry for Class I; Sandra A.J. Lawrence, Shawn K. Lytle, Thomas L. Bennett and Thomas K. Whitford for Class II; and H. Jeffrey Dobbs, Frances A. Sevilla-Sacasa, Christianna Wood and Joseph W. Chow for Class III, to hold office until the Fund’s 2023, 2021, and 2022 annual meeting, respectively, or until their respective successors are elected and duly qualified (the “Trustee Election Proposal”). Second Meeting Proposals 1. To approve a new investment advisory agreement for the Fund (the “New Investment Advisory Agreement Proposal”). 2. To approve sub-advisory agreements between Delaware Management Company, a series of Macquarie Investment Management Business Trust, and each of Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited and Macquarie Investment Management Europe Limited (the “Sub-Advisory Agreement Proposal”). | | All shareholders All shareholders All shareholders |

The Board of Trustees of the Fund (the “Board”) has approved and unanimously recommends that you vote FOR all nominees in the Trustee Election Proposal, FOR the New Investment Advisory Agreement Proposal and FOR the Sub-Advisory Agreement Proposal.

The Proposals are discussed in greater detail in the enclosed proxy statement. Please read the proxy statement carefully for information concerning the Proposals. The enclosed materials contain the Notice of Special Meetings of Shareholders (the “Notice”), proxy statement and white proxy card. A proxy card is, in essence, a ballot. When you vote your proxy, it tells us how you wish to vote on important issues relating to the Fund. If you complete, sign and return the white proxy card, we will vote it as you indicated. If you simply sign, date and return the enclosed white proxy card, but do not specify a vote, your proxy will be voted FOR the Proposals, including FOR each Trustee nominee.

Shareholders of record of the Fund at the close of business on January 22, 2021 (the “Record Date”) are entitled to receive notice of, and to vote at, each Meeting and any adjournments, postponements or delays thereof. It is important that your shares be voted at each Meeting. You may vote by telephone, Internet or by completing the enclosed white proxy card and returning it in the accompanying envelope as promptly as possible. You may also vote by attending the Meetings via audio teleconference.

REGARDLESS OF WHETHER YOU PLAN TO PARTICIPATE IN THE MEETINGS VIA AUDIO TELECONFERENCE, PLEASE SIGN, DATE AND RETURN THE ENCLOSED WHITE PROXY CARD IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE OR VOTE BY TELEPHONE OR THROUGH THE INTERNET PURSUANT TO THE INSTRUCTIONS ON THE ENCLOSED WHITE PROXY CARD.

If you attend the Meetings via audio teleconference and wish to vote at that time, you will be able to do so and your vote at the Meetings will revoke any proxy you may have submitted. Merely attending the Meetings via audio teleconference, however, will not revoke a previously given proxy.

Due to the coronavirus outbreak (COVID-19) and to support the health and well-being of our shareholders, employees, and community, the Meetings will be conducted exclusively via audio teleconference. Any shareholder wishing to participate in the Meetings telephonically can do so. If you were a record holder of Fund shares as of the Record Date, please send an e-mail to the Fund’s proxy solicitor, Di Costa Partners (“DCP”), at meetinginfo@dicostapartners.com no later than 2:00 p.m. Eastern Time on March 31, 2021 to register. Please include the Fund’s name in the subject line and provide your name and address in the body of the e-mail. DCP will then e-mail you the conference call dial-in information and instructions for voting during the Meetings. If you held Fund shares through an intermediary, such as a broker-dealer, as of the Record Date, and you want to participate in the Meetings, please e-mail DCP at meetinginfo@dicostapartners.com no later than 2:00 p.m. Eastern Time on March 31, 2021 to register. Please include the Fund’s name in the subject line and provide your name, address and proof of ownership as of the Record Date from your intermediary. Please be aware that if you wish to vote at the Meetings you must first obtain a legal proxy from your intermediary reflecting the Fund’s name, the number of Fund shares you held and your name and e-mail address. You may forward an e-mail from your intermediary containing the legal proxy or e-mail an image of the legal proxy to DCP at meetinginfo@dicostapartners.com and put “Legal Proxy” in the subject line. DCP will then e-mail you the conference call dial-in information and instructions for voting during the Meetings.

The conference call dial-in number will only be active for the date and time of the Meetings. If you have any questions prior to the Meetings, please call DCP at 833-892-6623.

YOUR VOTE IS EXTREMELY IMPORTANT. NO MATTER HOW MANY SHARES YOU OWN, PLEASE SEND IN THE WHITE PROXY CARD, OR VOTE BY TELEPHONE OR THE INTERNET TODAY.

Important Notice Regarding the Internet Availability of Proxy Materials for the Meetings. This Notice and the proxy statement are available on the internet at www.eproxyaccess.com/ivy2021. On this webpage, you will be able to access the Notice, the proxy statement, any accompanying materials and any amendments or supplements to the foregoing material that are required to be furnished to shareholders. We encourage you to access and review all of the important information contained in the proxy materials before voting.

| |

By Order of the Board of Trustees of Ivy High Income Opportunities Fund |

| Philip J. Sanders |

President of the Fund February 4, 2021 |

PROXY STATEMENT

For

IVY HIGH INCOME OPPORTUNITIES FUND

6300 Lamar Avenue

Overland Park, Kansas 66202

Dated February 4, 2021

PROXY STATEMENT

FOR THE SPECIAL MEETINGS OF SHAREHOLDERS

TO BE HELD ON APRIL 1, 2021

This proxy statement (“Proxy Statement”) is being furnished to you in connection with the solicitation of proxies by the Board of Trustees (the “Board”) of the Ivy High Income Opportunities Fund (the “Fund”) to be held via audio teleconference on April 1, 2021. The first meeting will be held at 1:30 p.m., Central Time (the “First Meeting”) and the second meeting will be held at 3:00 p.m., Central Time (the “Second Meeting”) (each, a “Meeting” and collectively, the “Meetings”).

The Proxy Statement provides you with information you should review before voting on the matters listed in the Notice of the Special Meetings of Shareholders. Much of the information in this Proxy Statement is required under rules of the U.S. Securities and Exchange Commission (“SEC”). If there is anything you do not understand, please contact us at our toll-free number 800-777-6472. This Proxy Statement, the Notice of Special Meetings of Shareholders and related white proxy card will be mailed to shareholders of the Fund beginning on or about February 8, 2021.

Proposals/Shareholders Entitled to Vote

The Meetings are being called to ask shareholders to consider and vote on the following proposals (collectively, the “Proposals,” with each referred to as a “Proposal”), which are described more fully below:

| | Shareholders Entitled to Vote |

First Meeting Proposal 1. To elect the Trustee nominees named in the accompanying proxy statement: Joseph Harroz, Jr., Ann D. Borowiec, Jerome D. Abernathy, Janet L. Yeomans and John A. Fry for Class I; Sandra A.J. Lawrence, Shawn K. Lytle, Thomas L. Bennett and Thomas K. Whitford for Class II; and H. Jeffrey Dobbs, Frances A. Sevilla-Sacasa, Christianna Wood and Joseph W. Chow for Class III, to hold office until the Fund’s 2023, 2021, and 2022 annual meeting, respectively, or until their respective successors are elected and duly qualified (the “Trustee Election Proposal”) | | All shareholders |

Second Meeting Proposals 1. To approve a new investment advisory agreement for the Fund (the “New Investment Advisory Agreement Proposal”). 2. To approve sub-advisory agreements between Delaware Management Company, a series of Macquarie Investment Management Business Trust, and each of Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited and Macquarie Investment Management Europe Limited (the “Sub-Advisory Agreement Proposal”). | | All shareholders All shareholders |

The Board has unanimously approved and recommends that you vote FOR all nominees in the Trustee Election Proposal, FOR the New Investment Advisory Agreement Proposal and FOR the Sub-Advisory Agreement Proposal.

Shareholders of record of the Fund as of the close of business on January 22, 2021 (the “Record Date”) are entitled to attend and to vote at the Meetings.

Due to the coronavirus outbreak (COVID-19) and to support the health and well-being of our shareholders, employees, and community, the Meetings will be conducted exclusively via audio teleconference. Instructions on how to vote whether you expect to attend the Meetings or not are provided under the section “VOTING PROCEDURES -How do I vote?” section of this Proxy Statement.

TO ASSURE THE PRESENCE OF A QUORUM AT EACH MEETING, PLEASE PROMPTLY EXECUTE AND RETURN THE ENCLOSED WHITE PROXY CARD. A SELF-ADDRESSED, POSTAGE-PAID ENVELOPE IS ENCLOSED FOR YOUR CONVENIENCE. ALTERNATIVELY, YOU MAY VOTE BY TELEPHONE OR THROUGH THE INTERNET AT THE NUMBER OR WEBSITE ADDRESS PRINTED ON THE ENCLOSED WHITE PROXY CARD.

IMPORTANT INFORMATION TO HELP YOU UNDERSTAND AND VOTE ON THE PROPOSALS

Below is a brief overview of the matters to be voted on at the Meetings. Your vote is important, no matter how large or small your holdings may be. Please read the full text of this Proxy Statement, which contains additional information about the Proposals, and keep it for future reference.

OVERVIEW

What is the Transaction and why am I being asked to vote?

On December 2, 2020, Waddell & Reed Financial, Inc. (“WDR”), the parent company of Ivy Investment Management Company (“IICO”), and Macquarie Group, including its asset management division Macquarie Asset Management (together, “Macquarie”), announced that they had entered into an agreement whereby Macquarie will acquire WDR (the “Transaction”). The Transaction is subject to approval by WDR’s shareholders and customary closing conditions, including receipt of applicable regulatory approvals. Subject to such approvals and the satisfaction of certain other conditions, the Transaction is expected to close by mid-2021 (the “Closing”). One condition to the Closing of the Transaction is that WDR receive consents from its investment management clients, including the Fund but excluding institutional clients, representing a specified percentage of WDR’s investment advisory fee revenues as of an agreed upon date. If WDR does not receive the requisite consents, and the condition is not waived, or if the Transaction is not consummated for any other reason, the Transaction will not be consummated and the Proposals will not be implemented. These conditions are more fully described in the Merger Agreement that WDR filed with the SEC on December 2, 2020 on Form 8-K, Exhibit 2.1.

Upon the Closing of the Transaction, the Fund’s investment advisory agreement will automatically terminate in accordance with its terms and applicable law. As a result, in connection with the Transaction it is proposed that your Fund be managed by Delaware Management Company (“DMC”), a series of Macquarie Investment Management Business Trust (“MIMBT”), pursuant to a new investment advisory agreement (the “New Investment Advisory Agreement”) and certain affiliated sub-advisers pursuant to new investment sub-advisory agreements with DMC (the “Sub-Advisory Agreements”). As part of the Transaction, the Fund will become part of the Delaware Funds by Macquarie fund complex under the purview of a combined board with members from your existing Board and from the Delaware Funds by Macquarie board of trustees. This proxy seeks your vote to effectuate such changes.

How will I as a Fund shareholder be affected by the Transaction?

Your Fund investment will not change as a result of the Transaction. You will still own the same Fund shares and the underlying value of those shares will not change as a result of the Transaction. The Fund’s portfolio manager will continue to manage your Fund according to the same objectives and policies as before, albeit as a Macquarie employee, and there are no plans to make significant changes to your Fund other than implementing Macquarie’s global investment platforms, which would entail the approval of the Sub-Advisory Agreements as described in the Sub-Advisory Agreement Proposal. Integrating the Fund onto the Delaware Funds by Macquarie platform will create a larger fund family that offers a broad range of equity, fixed-income, alternative and other investment options.

Is my Fund paying for the Transaction or this proxy solicitation?

No. The Fund will not bear any portion of the costs associated with the Transaction. All costs associated with this Proxy Statement and the Meetings, including proxy solicitation costs, legal fees, and the costs of printing and mailing this Proxy Statement, will be borne by WDR and Macquarie and their respective affiliates.

Will the Transaction be completed if the Proposals are not approved?

Provided all other conditions of the Transaction are met as described herein, the Closing may take place even if shareholders of the Fund do not approve the Proposals. If this should happen, the Board would consider what additional actions to take, which could include continuing to solicit approval of the Proposals. In addition, the Board will approve an interim investment advisory agreement (the “Interim Investment Advisory Agreement”) to permit continuity of management while solicitation continues. The terms of the Interim Investment Advisory Agreement are

identical to those of the current advisory agreement except for the parties and term and escrow provisions as required by applicable law.

Will the Proposals be implemented if the Transaction is not consummated?

No. If the Transaction is not consummated, the Proposals will not be implemented even if the Proposals are approved by shareholders. This means that if the Transaction is not consummated, the following will occur even if approved by shareholders: the Trustee nominees who are not current trustees will not serve as trustees of the Fund and the existing Board as currently comprised will continue to oversee the Fund and the New Investment Advisory Agreement and the Sub-Advisory Agreements will not take effect even if approved by shareholders.

Will the Proposals be implemented before the Closing of the Transaction?

No. If approved by shareholders, the Proposals, including the Trustee Election Proposal, will be implemented after the Closing of the Transaction.

How does the Board recommend that shareholders of the Fund vote on the Proposals?

The Board unanimously approved and recommends that you vote FOR all nominees in the Trustee Election Proposal, FOR the New Investment Advisory Agreement Proposal and FOR the Sub-Advisory Agreement Proposal.

Will one Proposal pass if the other Proposals are not approved?

Yes. None of the Proposals are contingent on the other Proposals being approved.

FIRST MEETING - PROPOSAL 1: TO ELECT THE TRUSTEE NOMINEES NAMED IN THE ACCOMPANYING PROXY STATEMENT: JOSEPH HARROZ, JR., ANN D. BOROWIEC, JEROME D. ABERNATHY, JANET L. YEOMANS AND JOHN A. FRY FOR CLASS I; SANDRA A.J. LAWRENCE, SHAWN K. LYTLE, THOMAS L. BENNETT AND THOMAS K. WHITFORD FOR CLASS II; AND H. JEFFREY DOBBS, FRANCES A. SEVILLA-SACASA, CHRISTIANNA WOOD AND JOSEPH W. CHOW FOR CLASS III

Why am I being asked to elect new Trustees?

Currently, the Board of Trustees of the Fund has nine members, eight of whom are Independent Trustees (as defined below). In connection with the Transaction, the Board has determined to increase the size of the Board to thirteen members, to be comprised of three (3) existing trustees of the Fund and ten (10) trustees from the Delaware Funds by Macquarie board. Among other things, the Board considered the background and experience of each Trustee nominee, including the Trustee nominee’s experience with the Fund or the Delaware Funds by Macquarie, and determined that each Trustee nominee would provide valuable continuity and enhance the Board’s oversight of the Fund following the completion of the Transaction. Information about the Trustee nominees, including age, principal occupations during the past five years, and other information, such as the Trustee nominees’ experience, qualifications, attributes, or skills, is set forth in this Proxy Statement .

SECOND MEETING - PROPOSAL 1: TO APPROVE A NEW INVESTMENT ADVISORY AGREEMENT FOR THE FUND

Why am I being asked to approve the proposed New Investment Advisory Agreement?

Upon the Closing of the Transaction, the Fund’s investment advisory agreement with IICO will automatically terminate in accordance with its terms and applicable regulations, as discussed below. To preserve continuity of investment advisory services to the Fund, the Board has recommended that you approve the proposed New Investment Advisory Agreement between the Fund and DMC.

DMC in turn has recommended, and the Board has approved, the appointment of certain DMC-affiliated sub-advisers (“Affiliated Sub-Advisers”), contingent upon shareholder approval of the Sub-Advisory Agreements as discussed below in the Sub-Advisory Agreement Proposal.

A discussion of the proposed New Investment Advisory Agreement is contained in the New Investment Advisory Agreement Proposal of the Proxy Statement, and the form of the proposed New Investment Advisory Agreement is attached hereto as Appendix E.

Who is DMC?

DMC is a series of MIMBT. MIMBT, a Delaware statutory trust, is an indirect, wholly-owned registered investment advisory subsidiary of Macquarie Group. DMC provides investment advisory services to registered investment companies within Delaware Funds by Macquarie, as well as to certain other affiliated registered investment companies.

Will my Fund’s contractual management fee rates increase?

No. The advisory fee schedule under the proposed New Investment Advisory Agreement with DMC is the same as the advisory fee schedule under the Fund’s current investment advisory agreement with IICO (the “Current Investment Advisory Agreement”).

Will the proposed New Investment Advisory Agreement result in any changes in the portfolio management, investment objective(s), or investment strategy of my Fund?

No. The proposed New Investment Advisory Agreement is not expected to result in any changes to the Fund’s investment objective or investment strategy. Further, it is currently anticipated that the portfolio manager for the Fund will continue in such roles upon the Closing, albeit as Macquarie employees. In addition, if the proposed Sub-Advisory Agreements are approved, DMC will utilize the Affiliated Sub-Advisers as described herein to leverage Macquarie’s global fixed income investment platform in providing advisory, trading and other services to the Fund.

How does the proposed New Investment Advisory Agreement with DMC differ from the Current Investment Advisory Agreement with IICO?

As described in the New Investment Advisory Agreement Proposal of the Proxy Statement, the proposed New Investment Advisory Agreement with DMC for the Fund is substantially similar to the Fund’s Current Investment Advisory Agreement with IICO. The services that your Fund will receive under the proposed New Investment Advisory Agreement are expected to be substantially similar to those provided under the Current Investment Advisory Agreement. Please see the New Investment Advisory Agreement Proposal for a comparison of the proposed New Investment Advisory Agreement and the Current Investment Advisory Agreement.

What will happen if shareholders of the Fund do not approve the proposed New Investment Advisory Agreement before consummation of the Transaction?

The Fund’s portfolio manager, as an employee of Macquarie, will manage your Fund under the Interim Investment Advisory Agreement, but DMC must place its compensation for advisory services during this interim period in escrow, pending shareholder approval of the New Investment Advisory Agreement. The Interim Investment Advisory Agreement is identical to the Current Investment Advisory Agreement, except for the parties and term and escrow provisions required by applicable regulations.

SECOND MEETING - PROPOSAL 2: TO APPROVE SUB-ADVISORY AGREEMENTS BETWEEN DELAWARE MANAGEMENT COMPANY, A SERIES OF MACQUARIE INVESTMENT MANAGEMENT BUSINESS TRUST, AND EACH OF MACQUARIE INVESTMENT MANAGEMENT AUSTRIA KAPITALANLAGE AG, MACQUARIE INVESTMENT MANAGEMENT GLOBAL LIMITED AND MACQUARIE INVESTMENT MANAGEMENT EUROPE LIMITED

Why am I being asked to approve the Sub-Advisory Agreement Proposal?

It is intended that DMC will utilize the Affiliated Sub-Advisers to access Macquarie’s global fixed income investment platform in providing advisory, trading and other services to the Fund as discussed in more detail in the section below titled “Introduction” under “SECOND MEETING – PROPOSAL 2”.

Who are the proposed sub-advisers?

DMC has proposed that the following Affiliated Sub-Advisers each be approved as sub-advisers for the Fund: Macquarie Investment Management Austria Kapitalanlage AG, Macquarie Investment Management Global Limited and Macquarie Investment Management Europe Limited. Each of these Affiliated Sub-Advisers is an affiliate of DMC and is part of Macquarie’s global fixed income investment platform.

How will the use of the Affiliated Sub-Advisers potentially benefit the Fund?

It is expected that the Affiliated Sub-Advisers will provide a long-term benefit to the Fund by providing the Fund with access to a global platform of investment professionals and advisory services with expertise in certain areas. If the proposed Sub-Advisory Agreements are approved, DMC will utilize the Affiliated Sub-Advisers as described herein to leverage Macquarie’s global fixed income investment platform in providing advisory, trading and other services to the Fund.

Will my Fund’s contractual management fee rates increase?

No. Under the terms of the Sub-Advisory Agreements DMC will pay the Affiliated Sub-Advisers directly out of the management fee it receives from the Fund. As previously discussed, the management fee which the Fund pays to DMC will remain unchanged. The Fund will not incur any additional expenses related to the use of the Affiliated Sub-Advisers.

What will happen if shareholders of the Fund do not approve the Sub-Advisory Agreement Proposal?

If shareholders of the Fund do not approve the Sub-Advisory Agreement Proposal, the Fund will be managed without the use of the Affiliated Sub-Advisers.

VOTING PROCEDURES

Why did you send me this booklet?

You are receiving this booklet because you were a shareholder the Fund as of the close of business on January 22, 2021 (the “Record Date”). This booklet includes the Proxy Statement. It provides you with information you should review before providing voting instructions on the matters listed above. The words “you” and “shareholder” are used in this Proxy Statement to refer to the person or entity that has voting rights or is being asked to provide voting instructions in connection with the shares.

Who is asking for my vote?

The Board has sent a Proxy Statement to you and all other shareholders of record who have a beneficial interest in the Fund as of the Record Date. The Board is soliciting your vote for the Proposals discussed herein.

Who is eligible to vote?

Shareholders holding an investment in shares of the Fund as of the close of business on the Record Date are eligible to vote. Shareholders of the Fund on the Record Date will be entitled to one vote for each share (and a proportional fractional vote for each fraction of a share held). No shares have cumulative voting rights in the election of Trustees.

How do I vote?

Due to the coronavirus outbreak (COVID-19) and to support the health and well-being of our shareholders, employees, and community, the Meetings will be conducted exclusively via audio teleconference. Any shareholder wishing to participate in the Meetings telephonically can do so. If you were a record holder of the Fund shares as of the Record Date, please email Di Costa Partners (“DCP”) at meetinginfo@dicostapartners.com no later than 2:00 p.m. Eastern Time on March 31, 2021 to register. Please include the Fund’s name in the subject line and provide your name and address in the body of the e-mail. DCP will then e-mail you the conference call dial-in information and instructions for voting during the Meetings. If you held Fund shares through an intermediary, such as a broker-dealer, as of the Record Date, and you want to participate in the Meetings, please email DCP at meetinginfo@dicostapartners.com no later than 2:00 p.m. Eastern Time on March 31, 2021 to register. Please include the Fund’s name in the subject line and provide your name, address and proof of ownership as of the Record Date from your intermediary. Please be aware that if you wish to vote at the Meetings you must first obtain a legal proxy from your intermediary reflecting the Fund’s name, the number of Fund shares you held and your name and e-mail address. You may forward an e-mail from your intermediary containing the legal proxy or e-mail an image of the legal proxy to DCP at meetinginfo@dicostapartners.com and put “Legal Proxy” in the subject line. DCP will then e-mail you the conference call dial-in information and instructions for voting during the Meetings.

The conference call dial-in number will only be active for the date and time of the Meetings. If you have any questions prior to the Meetings, please call Di Costa Partners at the phone number provided below.

If you do not expect to be present at the Meetings via audio teleconference and wish to vote your shares, please vote your proxy in accordance with the instructions included on the enclosed white proxy card. If your proxy is properly returned, shares represented by it will be voted at the Meetings in accordance with your instructions for the Proposals. If your proxy is properly executed and returned and no choice is specified on the white proxy card with respect to the Proposals, the proxy will be voted FOR the approval of the Proposals, including FOR the approval of each Trustee nominee, and in accordance with the judgment of the person appointed as proxy upon any other matter that may properly come before the Meetings. Shareholders who execute proxies may revoke or change their proxy at any time prior to the time it is voted by delivering a written notice of revocation, by delivering a subsequently dated proxy by mail, telephone or the Internet or by attending the Meetings via audio teleconference and voting at the Meetings. If you revoke a previous proxy, your vote will not be counted unless you attend the Meetings via audio teleconference and vote or legally appoint another proxy to vote on your behalf.

If you own your shares through a bank, broker-dealer or other third-party intermediary who holds your shares of record, and you wish to attend the Meetings via audio teleconference and vote your shares or revoke a previous proxy at the Meetings, you must request a legal proxy from such bank, broker-dealer or other third-party intermediary. If your proxy has not been revoked, the shares represented by the proxy will be cast at the Meetings and any adjournments thereof. Attendance by a shareholder at the Meetings via audio teleconference does not, in itself, revoke a proxy.

How many shares of the Fund were outstanding as of the Record Date?

At the close of business on January 22, 2021, the Fund had 16,570,234.6 common shares issued and outstanding.

How can I obtain more information about the Fund?

You may speak to a representative of DCP, who can assist you with any questions, by calling 833-892-6623. Copies of the Fund’s Annual Report for the most recently completed fiscal year previously have been mailed or made available to shareholders. This Proxy Statement should be read in conjunction with the Annual Report. You can obtain a copy of the Annual Report, without charge, by writing to the Fund or to Ivy Client Services at 6300 Lamar Avenue, Overland Park, Kansas 66202, or by calling 888-923-3355. You should receive the Annual Report within three business days of your request. Copies of the Annual Report are also available free of charge at www.ivyinvestments.com.

FIRST MEETING - PROPOSAL 1

THE TRUSTEE ELECTION PROPOSAL

Introduction

In connection with the Transaction, the Board has determined to increase the size of the Board to thirteen members, to be comprised of three (3) existing trustees of the Fund and ten (10) trustees from the Delaware Funds by Macquarie board of trustees. Among other things, the Board considered the background and experience of each Trustee nominee, including the Trustee’s experience with the Fund or the Delaware Funds by Macquarie, and determined that each Trustee nominee would provide valuable continuity and enhance the Board’s oversight of the Fund following the completion of the Transaction.

At the First Meeting, shareholders of the Fund will be asked to elect the following nominees to serve as Trustees on the Board of the Fund: Jerome D. Abernathy, Thomas L. Bennett, Ann D. Borowiec, Joseph W. Chow, H. Jeffrey Dobbs, John A. Fry, Joseph Harroz, Jr., Sandra A.J. Lawrence, Frances A. Sevilla-Sacasa, Thomas K. Whitford, Christianna Wood, Janet L. Yeomans, and Shawn K. Lytle (the “Trustee Nominees”).

The Board currently consists of nine Trustees: James M. Concannon, H. Jeffrey Dobbs, James D. Gressett, Joseph Harroz, Jr., Glendon E. Johnson, Jr., Sandra A.J. Lawrence, Frank J. Ross, Jr., Michael G. Smith, and Philip J. Sanders (the “Current Trustees”).

If each Trustee Nominee is approved, the Board of the Fund would consist of thirteen Trustees. Ten of the Trustee Nominees — Jerome D. Abernathy, Thomas L. Bennett, Ann D. Borowiec, Joseph W. Chow, John A. Fry, Frances A. Sevilla-Sacasa, Thomas K. Whitford, Christianna Wood, Janet L. Yeomans, and Shawn K. Lytle — would be added to the Board and are currently trustees on the Delaware Funds by Macquarie board. Three of the Trustee Nominees — Joseph Harroz, Jr., Sandra A.J. Lawrence, and H. Jeffrey Dobbs — currently serve on the Board and have previously been elected by shareholders of the Fund or appointed to serve by that Board, and would continue to serve on the Board after the Meetings. Except for Mr. Lytle, each Trustee would not be considered to be an “interested person” of the Fund (as such term is defined in the Investment Company Act of 1940, as amended (the “1940 Act”) (the “Independent Trustees” or “Independent Trustee Nominees”). Should Mr. Lytle be elected to the Board by shareholders, he would be considered an “interested” Trustee because of his position with Macquarie (the “Interested Trustee” or “Interested Trustee Nominee”).

At a meeting held on January 12, 2021, the Board, at the recommendation of the Fund’s Governance Committee, nominated each Trustee Nominee for election to the Board. Mr. Abernathy, Mr. Bennett, Ms. Borowiec, Mr. Chow, Mr. Dobbs, Mr. Fry, Mr. Harroz, Ms. Lawrence, Ms. Sevilla-Sacasa, Mr. Whitford, Ms. Wood, and Ms. Yeomans were recommended by the current Independent Trustees.

If elected, the Trustee Nominees will serve as Trustees effective only upon the Closing of the Transaction. If the Transaction is not consummated, the Trustee Nominees who are not Current Trustees will not serve as Trustees of the Fund, even if elected by shareholders.

Proposed Composition of the Board

Set forth below is the composition of the Board should each Trustee Nominee be approved by Shareholders at the First Meeting.

Class I Trustees(1) | Class II Trustees(2) | Class III Trustees(3) |

| Joseph Harroz, Jr. | Sandra A.J. Lawrence | H. Jeffrey Dobbs |

| Ann D. Borowiec | Shawn K. Lytle | Frances A. Sevilla-Sacasa |

| Jerome D. Abernathy | Thomas L. Bennett | Christianna Wood |

| Janet L. Yeomans | Thomas K. Whitford | Joseph W. Chow |

| John A. Fry | | |

| (1) | It is currently anticipated that the Class I Trustees will next stand for election at the Fund’s 2023 annual meeting of shareholders. |

| (2) | It is currently anticipated that the Class II Trustees will next stand for election at the Fund’s 2021 annual meeting of shareholders. |

| (3) | It is currently anticipated that the Class III Trustees will next stand for election at the Fund’s 2022 annual meeting of shareholders. |

Information about the Trustee Nominees

The persons named in the accompanying form of proxy intend to vote at the First Meeting (unless directed not to vote) FOR the election of each Trustee Nominee set forth below. All Trustee Nominees have indicated that they will serve on the Board, and the Board has no reason to believe that any of them will become unavailable to continue to serve as Trustees. If a Trustee Nominee declines or is unavailable to serve for any reason, the persons named as proxies will vote for such other Trustee Nominees nominated by the current Independent Trustees. The Trustee Nominees, if elected at the Meeting, will hold office for a term in accordance with their class or until their respective successors shall have been elected and duly qualified. Under the Declaration of Trust and Amended and Restated By-Laws, a Trustee may serve until his or her term expires, until he or she dies or resigns, or in the event of bankruptcy, adjudicated incompetence or other incapacity to perform the duties of the office, or his or her removal.

Independent Trustee Nominees

The twelve Independent Trustee Nominees, their term of office and length of time served (as applicable), their principal business occupations during the past five years, the number of portfolios overseen by the Independent Trustee Nominees (or the number of portfolios they will oversee should they be elected by shareholders, as applicable) and other directorships, if any, held by the Independent Trustee Nominees are shown below.

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S)

HELD OR TO BE HELD WITH

THE FUND | TRUSTEE

SINCE | PRINCIPAL

OCCUPATION(S)

DURING PAST

5 YEARS | NUMBER

OF FUNDS IN

FUND

COMPLEX

OVERSEEN OR TO BE OVERSEEN | OTHER

DIRECTORSHIPS

HELD DURING

PAST 5 YEARS |

Jerome D. Abernathy 100 Independence, 610 Market Street | Trustee | N/A | Managing Member, Stonebrook Capital Management, LLC (financial | 161 | None |

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S)

HELD OR TO BE HELD WITH

THE FUND | TRUSTEE

SINCE | PRINCIPAL

OCCUPATION(S)

DURING PAST

5 YEARS | NUMBER

OF FUNDS IN

FUND

COMPLEX

OVERSEEN OR TO BE OVERSEEN | OTHER

DIRECTORSHIPS

HELD DURING

PAST 5 YEARS |

Philadelphia, PA 19106-2354 1959 | | | technology: macro factors and databases) (January 1993–Present) | | |

Thomas L. Bennett 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1947 | Chair and Trustee | N/A | Private Investor (March 2004–Present) | 161 | None |

Ann D. Borowiec 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1958 | Trustee | N/A | Chief Executive Officer, Private Wealth Management (2011–2013) and Market Manager, New Jersey Private Bank (2005–2011)—J.P.Morgan Chase & Co. | 161 | Director—Banco Santander International (October 2016–December 2019) Director—Santander Bank, N.A. (December 2016– December 2019) |

Joseph W. Chow 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1953 | Trustee | N/A | Private Investor (April 2011–Present) | 161 | Director and Audit Committee Member—Hercules Technology Growth Capital, Inc. (July 2004–July 2014) |

H. Jeffrey Dobbs 6300 Lamar Avenue Overland Park, KS 66202 1955 | Trustee | 2019 | Global Sector Chairman, Industrial Manufacturing—KPMG LLP (2010-2015) | 161 | Director—Valparaiso University (2012-Present) Director—TechAccel LLC (2015-Present) (Tech R&D) Board Member—Kansas City Repertory Theatre (2015-Present) Board Member—PatientsVoices, Inc. (healthcare) (2018-Present) Kansas City Campus for Animal Care (2018-Present) Director—National Association of Manufacturers (2010- 2015) Director—The Children’s Center (2003-2015) Director—Metropolitan Affairs Coalition (2003-2015) Director—Michigan Roundtable for Diversity and Inclusion (2003-2015) Trustee—Ivy NextShares (2019) Trustee—Ivy VIP (2019- |

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S)

HELD OR TO BE HELD WITH

THE FUND | TRUSTEE

SINCE | PRINCIPAL

OCCUPATION(S)

DURING PAST

5 YEARS | NUMBER

OF FUNDS IN

FUND

COMPLEX

OVERSEEN OR TO BE OVERSEEN | OTHER

DIRECTORSHIPS

HELD DURING

PAST 5 YEARS |

| | | | | | Present) (28 portfolios overseen) Trustee—InvestEd Portfolios (2019-Present) (10 portfolios overseen) Trustee—Ivy Funds (2019- Present) 45 portfolios overseen) |

John A. Fry 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1960 | Trustee | N/A | President—Drexel University (August 2010–Present) President—Franklin & Marshall College (July 2002–June 2010) | 161 | Director; Compensation Committee and Governance Committee Member—Community Health Systems (May 2004–Present) Director—Drexel Morgan & Co.(2015–December 2019) Director and Audit Committee Member— vTv Therapeutics Inc. (2017–Present) Director and Audit Committee Member—FS Credit Real Estate Income Trust, Inc. (2018–Present) Director and Audit Committee Member—Federal Reserve Bank of Philadelphia (January 2020–Present) |

Joseph Harroz, Jr. 6300 Lamar Avenue Overland Park, KS 66202 1967 | Trustee | 2013 | President (2020-Present), Interim President (2019-2020), Vice President (2010-2019) and Dean (2010-2019)—College of Law, University of Oklahoma Managing Member—Harroz Investments, LLC, (commercial enterprises) (1998-2019) Managing Member—St. Clair, LLC (commercial enterprises) (2019-Present) | 161 | Director—OU Medicine, Inc. (2020-Present) Director and Shareholder—Valliance Bank (2007-Present) Director—Foundation Healthcare (formerly Graymark HealthCare) (2008-2017) Trustee—the Mewbourne Family Support Organization (2006-Present) (non-profit) Independent Director—LSQ Manager, Inc. (real estate) (2007-2016) Director—Oklahoma Foundation for Excellence (non-profit) (2008 -Present) Independent Chairman and Trustee—Waddell & Reed Advisors Funds (Independent |

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S)

HELD OR TO BE HELD WITH

THE FUND | TRUSTEE

SINCE | PRINCIPAL

OCCUPATION(S)

DURING PAST

5 YEARS | NUMBER

OF FUNDS IN

FUND

COMPLEX

OVERSEEN OR TO BE OVERSEEN | OTHER

DIRECTORSHIPS

HELD DURING

PAST 5 YEARS |

| | | | | | Chairman: 2015-2018; Trustee: 1998-2018) Independent Chairman and Trustee—Ivy NextShares (2016-2019) Independent Chairman and Trustee—Ivy VIP (Independent Chairman: 2015-Present; Trustee: 1998-Present) (28 portfolios overseen) Independent Chairman and Trustee—InvestEd Portfolios (Independent Chairman: 2015- Present; Trustee: 2001-Present) (10 portfolios overseen) Independent Chairman and Trustee—Ivy Funds (2013- Present) (45 portfolios overseen) |

Sandra A.J. Lawrence 6300 Lamar Avenue Overland Park, KS 66202 1957 | Trustee | 2019 | Retired Formerly, Chief Administrative Officer—Children’s Mercy Hospitals and Clinics (2016-2019); and CFO—Children’s Mercy Hospitals and Clinics (2005-2016) | 161 | Director—Hall Family Foundation (1993-Present) Director—Westar Energy (utility) (2004-2018) Trustee—Nelson-Atkins Museum of Art (non-profit) (2007-2020) Director—Turn the Page KC (non-profit) (2012-2016) Director—Kansas Metropolitan Business and Healthcare Coalition (non-profit) (2017-2019) Director—National Association of Corporate Directors (non-profit) (2017-Present) Director—American Shared Hospital Services (medical device) (2017-Present) Director—Evergy, Inc., Kansas City Power & Light Company, KCP&L Greater Missouri Operations Company, Westar Energy, Inc. and Kansas Gas and Electric Company (related utility companies) (2018-Present) |

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S)

HELD OR TO BE HELD WITH

THE FUND | TRUSTEE

SINCE | PRINCIPAL

OCCUPATION(S)

DURING PAST

5 YEARS | NUMBER

OF FUNDS IN

FUND

COMPLEX

OVERSEEN OR TO BE OVERSEEN | OTHER

DIRECTORSHIPS

HELD DURING

PAST 5 YEARS |

| | | | | | Director—Stowers (research) (2018); CoChair—Women Corporate, Directors (director education) (2018-2020) Trustee-Ivy NextShares (2019) Trustee—Ivy VIP (2019- Present) (28 portfolios overseen) Trustee—InvestEd Portfolios (2019-Present) (10 portfolios overseen) Trustee—Ivy Funds (2019- Present) (45 portfolios overseen) |

Frances A. Sevilla-Sacasa 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1956 | Trustee | N/A | Private Investor (January 2017–Present) Chief Executive Officer— Banco Itaú International (April 2012–December 2016) Executive Advisor to Dean (August 2011–March 2012) and Interim Dean (January 2011–July 2011)—University of Miami School of Business Administration President—U.S. Trust Bank of America Private Wealth Management (Private Banking) (July 2007–December 2008) | 161 | Director; New Senior Investment Group Inc. (real estate investment trust) (January 2021 – Present) Trust Manager and Audit Committee Chair—Camden Property Trust (August 2011–Present) Director; Strategic Planning and Reserves Committee and Nominating and Governance Committee Member—Callon Petroleum Company (December 2019–Present) Director; Audit Committee Member—Carrizo Oil & Gas, Inc. (March 2018–December 2019) |

Thomas K. Whitford 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1956 | Trustee | N/A | Vice Chairman (2010–April 2013)—PNC Financial Services Group | 161 | Director—HSBC North America Holdings Inc. (December 2013–Present) Director—HSBC USA Inc. (July 2014–Present) Director—HSBC Bank USA, National Association (July 2014–March 2017) Director—HSBC Finance |

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S)

HELD OR TO BE HELD WITH

THE FUND | TRUSTEE

SINCE | PRINCIPAL

OCCUPATION(S)

DURING PAST

5 YEARS | NUMBER

OF FUNDS IN

FUND

COMPLEX

OVERSEEN OR TO BE OVERSEEN | OTHER

DIRECTORSHIPS

HELD DURING

PAST 5 YEARS |

| | | | | | Corporation (December 2013–April 2018) |

Christianna Wood 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1959 | Trustee | N/A | Chief Executive Officer and President—Gore Creek Capital, Ltd. (August 2009–Present) | 161 | Director; Finance Committee and Audit Committee Member— H&R Block Corporation (July 2008–Present) Director; Investments Committee, Capital and Finance Committee and Audit Committee Member—Grange Insurance (2013–Present) Trustee; Chair of Nominating and Governance Committee and Member of Audit Committee—The Merger Fund (2013–Present), The Merger Fund VL (2013–Present), WCM Alternatives: Event-Driven Fund(2013–Present), and WCM Alternatives: Credit Event Fund (December 2017–Present) Director; Chair of Governance Committee and Audit Committee Member—International Securities Exchange (2010–2016) |

Janet L. Yeomans 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1948 | Trustee | N/A | Vice President and Treasurer (January 2006–July 2012), Vice President—Mergers & Acquisitions (January 2003–January 2006), and Vice President and Treasurer (July 1995–January 2003)—3M Company | 161 | Director; Personnel and Compensation Committee Chair; Member of Nominating, Investments, and Audit Committees for various periods throughout directorship—Okabena Company (2009–2017) |

Interested Trustee Nominee

The Interested Trustee Nominee, his term of office and length of time served (or the length of time served should he be elected by shareholders), his principal business occupations during the past five years, the number of portfolios overseen by the Interested Trustee Nominee (or the number of portfolios he will oversee should he be elected by shareholders) and other directorships, if any, held by the Interested Trustee Nominee are shown below. If elected, Mr. Lytle would be an Interested Trustee by virtue of his position as Global Head of Macquarie Investment Management and Head of Americas – Macquarie Group.

NAME,

ADDRESS AND

YEAR OF BIRTH

| POSITION(S) HELD OR TO BE HELD WITH

THE FUND | TRUSTEE

SINCE | PRINCIPAL

OCCUPATION(S) DURING PAST

5 YEARS | NUMBER

OF FUNDS IN

FUND

COMPLEX

OVERSEEN OR TO BE OVERSEEN | OTHER

DIRECTORSHIPS HELD |

Shawn K. Lytle 100 Independence, 610 Market Street Philadelphia, PA 19106-2354 1970 | Trustee | N/A | Global Head of Macquarie Investment Management (January 2019 – Present); Head of Americas of Macquarie Group (December 2017 – Present); Deputy Global Head of Macquarie Investment Management (2017 – 2019); President of Macquarie Investment Management Americas (2015 – 2017) | 161 | Trustee—UBS Relationship Funds, SMA Relationship Trust, and UBS Funds (May 2010– April 2015) |

Trustee Qualifications

The Governance Committee of the Board is responsible for identifying, evaluating and recommending candidates to the Board. The Governance Committee reviews the background and the educational, business and professional experience of candidates and the candidates’ expected contributions to the Board. Although the Board has not adopted a formal diversity policy, the Board nevertheless believes that the different perspectives, viewpoints, professional experience, education, and individual qualities of each director contribute to the Board’s diversity of experiences and bring a variety of complementary skills. It is the Trustees’ belief that this allows the Board, as a whole, to oversee the business of the Fund in a manner consistent with the best interests of the Fund’s shareholders.

The Board has determined that each Trustee Nominee is qualified to serve on the Board because of his or her specific attributes, including prior experience, background and skills. The Board considered that the Trustee Nominees’ familiarity and experience with the Fund, as members of the Board, or of DMC and its affiliates, as members of the Delaware Funds by Macquarie board, would result in the newly-constituted board having a breadth of knowledge that would enhance its ability to oversee the Fund upon Closing of the Transaction.

The following is a summary of various qualifications, experiences and skills of each Trustee Nominee that led to the Board’s conclusion that each Trustee Nominee should serve as a Trustee on the Board.

Independent Trustee Nominees

Jerome D. Abernathy – Mr. Abernathy has over 30 years of experience in the investment management industry. In selecting him to serve on the Board, the Independent Trustees noted and valued his extensive experience as a chief investment officer, director of research, trader, and analytical proprietary trading researcher. Mr. Abernathy received a B.S. in electrical engineering from Howard University and a Ph.D. in electrical engineering and computer science from Massachusetts Institute of Technology.

Thomas L. Bennett – Mr. Bennett has over 30 years of experience in the investment management industry, particularly with fixed income portfolio management and credit analysis. He has served in senior management for a number of money management firms. Mr. Bennett has also served as a board member of another investment company, an educational institution, nonprofit organizations, and for-profit companies. He has an M.B.A. from the University of Cincinnati. Mr. Bennett has been nominated to serve as Chair of the Board upon Closing of the Transaction.

Ann D. Borowiec – Ms. Borowiec has over 25 years of experience in the banking and wealth management industry. Ms. Borowiec also serves as a board member on several nonprofit organizations. In nominating her to the Board, the Independent Trustees found that her experience as a Chief Executive Officer in the private wealth management business at a leading global asset manager and private bank, including the restructuring of business lines and defining client recruitment strategies, complemented the skills of existing board members. Her experience would also provide

additional oversight skill in the area of fund distribution. Ms. Borowiec holds a B.B.A. from Texas Christian University and an M.B.A. from Harvard University.

Joseph W. Chow – Mr. Chow has over 30 years of experience in the banking and financial services industry. In nominating him to the Board, the Independent Trustees found that his extensive experience in business strategy in non-US markets complemented the skills of existing Board members and also reflected the increasing importance of global financial markets in investment management. The Independent Trustees also found that Mr. Chow’s management responsibilities as a former Executive Vice President of a leading global asset servicing and investment management firm as well as his experience as Chief Risk and Corporate Administration Officer would add helpful oversight skills to the Board’s expertise. Mr. Chow holds a B.A. degree from Brandeis University and M.C.P. and M.S. in Management degree from Massachusetts Institute of Technology.

H. Jeffrey Dobbs – Mr. Dobbs has more than 35 years of experience in the automotive, industrial manufacturing, financial services and consumer sectors. He also has served as a partner in a public accounting firm. Mr. Dobbs holds a degree in accounting from Valparaiso University. The Independent Trustees concluded that Mr. Dobbs is suitable to act as Trustee because of his extensive work in the global professional services industry, as well as his educational background.

John A. Fry – Mr. Fry has over 30 years of experience in higher education. He has served in senior management for three major institutions of higher learning including serving as president of a leading research university. Mr. Fry has also served as a board member of many nonprofit organizations and several for-profit companies. Mr. Fry has extensive experience in overseeing areas such as finance, investments, risk-management, internal audit, and information technology. He holds a B.A. degree in American Civilization from Lafayette College and an M.B.A. from New York University.

Joseph Harroz, Jr. – Mr. Harroz serves as the President of a state university, and also serves as a Director of a bank. He also has served as President and Director of a publicly-traded company, as Interim President and General Counsel to a state university system and as Dean of the College of Law of that state university. Mr. Harroz holds a B.A. degree from the University of Oklahoma and a J.D. from Georgetown University Law Center. Mr. Harroz has multiple years of service as a Trustee to the funds in the Ivy Fund Complex (the “Fund Complex”). The Independent Trustees concluded that Mr. Harroz is suitable to serve as Trustee because of his educational background, his work experience and the length of his service as a Trustee to the Fund.

Sandra A.J. Lawrence – Ms. Lawrence has been a member and chair of the board of several public corporations, closely-held corporations and charitable organizations. She also has more than 16 years of experience serving on the boards of public companies, including as Audit Committee Chair and Nominating/Governance Committee Chair, and has served as a chief financial officer and on investment and finance committees. She served as President of Stern Brothers, a municipal bond house, where she held NASD Series licenses 7, 24 and 63. Ms. Lawrence holds an A.B. from Vassar College, as well as master’s degrees from the Massachusetts Institute of Technology and Harvard Business School. The Independent Trustees concluded that Ms. Lawrence is suitable to serve as Trustee because of her work experience, financial background, academic background and service on corporate and charitable boards.

Frances A. Sevilla-Sacasa – Ms. Sevilla-Sacasa has over 30 years of experience in banking and wealth management. In nominating her to the Board, the Independent Trustees of the Fund found that her extensive international wealth management experience, in particular, complemented the skills of existing Board members and also reflected the increasing importance of international investment management not only for dollar-denominated investors but also for investors outside the US. The Independent Trustees also found that Ms. Sevilla-Sacasa’s management responsibilities as the former President and Chief Executive Officer of a major trust and wealth management company would add a helpful oversight skill to the Board’s expertise, and her extensive nonprofit board experience gave them confidence that she would make a meaningful, experienced contribution to the Board. Finally, in electing Ms. Sevilla-Sacasa to the Board, the Independent Trustees valued her perceived dedication to client service as a result of her overall career experience. Ms. Sevilla-Sacasa holds B.A. and M.B.A. degrees from the University of Miami and Thunderbird School of Global Management, respectively.

Thomas K. Whitford – Mr. Whitford has over 25 years of experience in the banking and financial services industry, and served as Vice Chairman of a major banking, asset management, and residential mortgage banking institution. In

nominating him to the Board, the Independent Trustees found that Mr. Whitford’s senior management role in wealth management and experience in the mutual fund servicing business would provide valuable current management and financial industry insight, in particular, and complemented the skills of existing Board members. The Independent Trustees also found that his senior management role in integrating company acquisitions, technology, and operations and his past role as Chief Risk Officer would add a helpful oversight skill to the Board’s expertise. Mr. Whitford holds a B.S. degree from the University of Massachusetts and an M.B.A. degree from The Wharton School of the University of Pennsylvania.

Christianna Wood – Ms. Wood has over 30 years of experience in the investment management industry. In selecting her to serve on the Board, the Independent Trustees noted and valued her significant portfolio management, corporate governance and audit committee experience. Ms. Wood received a B.A. in economics from Vassar College and an M.B.A. in finance from New York University.

Janet L. Yeomans – Ms. Yeomans has over 28 years of business experience with a large global diversified manufacturing company, including service as Treasurer for this company. In this role, Ms. Yeomans had significant broad-based financial experience, including global financial risk-management, investments, and mergers and acquisitions. She served as a board member of a for-profit company and also is a current board member of a hospital and a public university system. She holds degrees in mathematics and physics from Connecticut College, an M.S. in mathematics from Illinois Institute of Technology, and an M.B.A. from the University of Chicago.

Interested Trustee Nominee

Shawn K. Lytle – Mr. Lytle has over 20 years of experience in the investment management industry. He has been the Global Head of Macquarie Investment Management since January 2019 and Head of Americas – Macquarie Group since December 2017, and he is responsible for all aspects of Macquarie Investment Management’s business. He joined the firm as President of Macquarie Investment Management – Americas in 2015. Prior to that time, Mr. Lytle served in various executive management, investment management, and distribution positions at two major banking institutions. He holds a B.A. degree from The McDonough School of Business at Georgetown University. Mr. Lytle serves on the board of directors of the National Association of Securities Professionals (NASP), the Sustainability Accounting Standards Board, and he is a member of the board of governors for the Investment Company Institute (ICI). In November 2017, Mr. Lytle was named to the Black Enterprise list of “Most Powerful Executives in Corporate America.”

Board Structure and Related Matters

The Fund is governed by the Board, which is responsible for the overall management of the Fund. Such responsibility includes general oversight and review of the Fund’s investment activities, in accordance with Federal law and the law of the State of Delaware, as well as the stated policies of the Fund. The Board has appointed officers of the Fund and delegated to them the management of the day-to-day operations of the Fund, based on policies reviewed and approved by the Board, with general oversight by the Board.

Under the Declarations of Trust and By-laws, a Trustee’s term of office will terminate in the event of the death, resignation, removal, bankruptcy, adjudicated incompetence or other incapacity of the Trustee. The Fund holds an annual meeting of shareholders for the election or re-election of Trustees. Delaware law permits shareholders to remove Trustees under certain circumstances and requires the Fund to assist in shareholder communications.

If shareholders elect the Trustee Nominees, after the Closing of the Transaction, the Board will be comprised of twelve Independent Trustees (92%) and one Interested Trustee. The Board believes that having a majority of Independent Trustees on the Board is appropriate and in the best interests of the Fund’s shareholders. The Board also has nominated Thomas L. Bennett, an Independent Trustee Nominee, to serve as Independent Chair of the Board upon Closing of the Transaction. In that regard, Mr. Bennett’s responsibilities will include: setting an agenda for each meeting of the Board; presiding at all meetings of the Board and of the Independent Trustees; and serving as a liaison with other Trustees, the Fund’s officers and other management personnel, and counsel. The Independent Chair also performs such other duties as the Board may from time to time determine.

The Board generally holds four regularly scheduled meetings each year. The Board may hold special meetings, as needed, in person, by videoconference or by telephone, to address matters arising between regular meetings. The

Independent Trustees also hold four regularly scheduled meetings each year, during a portion of which management is not present, as well as a special meeting in connection with the Board’s annual consideration of the Fund’s management agreements, and may hold special meetings, as needed.

The Board has established a committee structure (described below) that includes four standing committees, the Audit Committee, the Governance Committee, the Investment Oversight Committee, and the Executive Committee, the first three of which are comprised solely of Independent Trustees. The Board periodically evaluates its structure and composition, as well as various aspects of its operations. The Board believes that its leadership structure, including its Independent Chair position and its committees, is appropriate for the Fund in light of, among other factors, the asset size and nature of the Fund, the number of Funds overseen by the Board, the arrangements for the conduct of the Fund’s operations, the number of Trustees, and the Board’s responsibilities.

Committees of the Board

The Board has established the following standing committees: Audit Committee, Executive Committee, Investment Oversight Committee and Governance Committee. The respective duties and current memberships of the standing committees are set forth below.

Audit Committee. The Audit Committee serves as an independent and objective party to monitor the Fund’s accounting policies, financial reporting and internal control system, as well as the work of the Fund’s independent registered public accounting firm. The Committee also serves to provide an open avenue of communication among the Fund’s independent registered public accounting firm, the internal accounting staff of IICO and the Board. As of the date of this Proxy Statement, the Audit Committee consists of James M. Concannon, H. Jeffrey Dobbs (Chair) and James D. Gressett.

Executive Committee. The Executive Committee acts as necessary on behalf of the full Board. When the Board is not in session, the Executive Committee has and may exercise any or all of the powers of the Board in the management of the business and affairs of the Fund except the power to increase or decrease the size of, or fill vacancies on, the Board, and except as otherwise provided by law. As of the date of this Proxy Statement, the Executive Committee consists of Glendon E. Johnson, Jr. and Philip J. Sanders.

Investment Oversight Committee. The Investment Oversight Committee reviews, among other things, the investment performance of the Fund, any proposed changes to the Fund’s investment policies, and the Fund’s market trading activities and portfolio transactions. As of the date of this Proxy Statement, the Investment Oversight Committee consists of Michael G. Smith (Chair), James M. Concannon, and Glendon E. Johnson, Jr.

Governance Committee. The Governance Committee evaluates, selects and recommends to the Board candidates to serve as Independent Trustees. The Governance Committee will consider candidates for Trustee recommended by Shareholders. Written recommendations with any supporting information should be directed to the Secretary of the Fund. The Governance Committee also oversees the functioning of the Board and its committees. As of the date of this Proxy Statement, the Governance Committee consists of Frank J. Ross, Jr. (Chair), James D. Gressett, Glendon E. Johnson, Jr. and Sandra A.J. Lawrence. The Board has adopted a written charter of the Governance Committee, which is attached as Appendix A.

During the fiscal year ended September 30, 2020, the Board met 7 times, the Executive Committee did not meet, the Audit Committee met 4 times, the Governance Committee met 7 times, and the Investment Oversight Committee met 4 times.

During the fiscal year ended September 30, 2020, each Current Trustee of the Fund attended at least 75% of the aggregate of: (i) all regular meetings of the Board; and (ii) all meetings of all committees of the Board on which the Trustee served.

Risk Oversight

Consistent with its responsibility for oversight of the Fund, the Board oversees the management of risks relating to the administration and operation of the Fund. The Board performs this risk management oversight directly and, as to certain matters, directly through its committees and through its Independent Trustees. The following provides an overview of the principal, but not all, aspects of the Board’s oversight of risk management for the Fund. The Board will continue this same level of risk management oversight following the Closing of the Transaction.

In general, the Fund’s risks include, among other things, investment risk, credit risk, liquidity risk, valuation risk, operational risk and regulatory compliance risk. The Board has adopted, and periodically reviews, policies and procedures designed to address these and other risks to the Fund. In addition, under the general oversight of the Board, IICO, any sub-advisers (if applicable) and other service providers to the Fund have themselves adopted a variety of policies, procedures and controls designed to address particular risks of the Fund. Different processes, procedures and controls are employed with respect to different types of risks.

The Board also oversees risk management for the Fund through review of regular reports, presentations and other information from officers of the Fund and other persons.

Senior officers of the Fund, senior officers of IICO and Waddell & Reed Services Company, doing business as WI Services Company (“WISC”) (collectively, “Ivy”), and the Fund’s Chief Compliance Officer (“CCO”) regularly report to the Board on a range of matters, including those relating to risk management. The Board also regularly receives reports from IICO with respect to the investments and securities trading of the Fund, reports from Fund management personnel regarding valuation procedures and reports from management’s Valuation Committee regarding the valuation of particular securities. In addition to regular reports from Ivy, the Board also receives reports regarding other service providers to the Fund, either directly or through Ivy or the Fund’s CCO, on a periodic or regular basis. At least annually, the Board receives a report from the Fund’s CCO regarding the effectiveness of the Fund’s compliance program. Also, on an annual basis, the Board receives reports, presentations and other information from Ivy in connection with the Board’s consideration of the renewal of each of the Fund’s agreements with Ivy.

Senior officers of the Fund and senior officers of Ivy also report regularly to the Audit Committee on Fund valuation matters, and on the Fund’s internal controls and accounting and financial reporting policies and practices. Ivy compliance and internal audit personnel also report regularly to the Audit Committee. In addition, the Audit Committee receives regular reports from the Fund’s independent registered public accounting firm on internal control and financial reporting matters. On at least a quarterly basis, the Independent Trustees meet separately with the Fund’s CCO to discuss matters relating to the Fund’s compliance program.

The Board’s role in risk oversight following the Closing of the Transaction is expected to be substantially the same as the above, albeit with respect to DMC as investment adviser, Delaware Distributors, L.P. (“DDLP”) as distributor, and other unaffiliated and Macquarie affiliated service providers.

Selection of Nominees

The Board’s Governance Committee makes Independent Trustee candidate recommendations to the Board pursuant to its charter. The Governance Committee evaluates a candidate’s qualification for Board membership and the independence of such candidate from IICO and other principal service providers. In connection with the Transaction, the Governance Committee also evaluated the Trustee Nominees’ independence from DMC and other Macquarie-affiliated service providers.

The Governance Committee evaluates candidates using certain criteria, considering, among other qualities, a high level of integrity, appropriate experience, a commitment to fulfill the fiduciary duties inherent in Board membership, and the extent to which potential candidates possess sufficiently diverse skill sets that would contribute to the Board’s overall effectiveness.

The Governance Committee considers prospective candidates from any reasonable source, including from recommendations by shareholders of the Fund. The Governance Committee initially evaluates prospective candidates

on the basis of preliminary information required of all preliminary candidates, considered in light of the criteria discussed above. Those prospective candidates that appear likely to be able to fill a significant need of the Board would be contacted by a Governance Committee member to discuss the position; if there appeared to be sufficient interest, a meeting with one or more Governance Committee members would be arranged. If the Governance Committee, based on the results of these contacts, believed it had identified a viable candidate, it would air the matter with the full group of Independent Trustees for input.

Any request by management to meet with the prospective candidate would be given appropriate consideration. The Fund has not paid a fee to third parties to assist in finding nominees.

Shareholders seeking to recommend one or more candidates to the Board should direct the names of such candidates they wish to be considered to the attention of the Fund’s Governance Committee, in care of the Fund’s Secretary, at the address of the Fund listed on the front page of this Proxy Statement. Such candidates will be considered with any other trustee candidates on the basis of the same criteria described above used to consider and evaluate candidates recommended by other sources.

For candidates to serve as Independent Trustees, independence from IICO (or Macquarie in this case), its affiliates and other principal service providers is critical, as is an independent and questioning mindset. The Governance Committee also considers whether the prospective candidates’ workloads would allow them to attend the vast majority of Board meetings, be available for service on Board committees, and devote the additional time and effort necessary to keep up with Board matters and the rapidly changing regulatory environment in which the Fund operates. Different substantive areas may assume greater or lesser significance at particular times, in light of the Board’s present composition and the Governance Committee’s (or the Board’s) perceptions about future issues and needs.

Ownership of Fund Shares