IVY HIGH INCOME OPPORTUNITIES FUND (NYSE: IVH)

6300 Lamar Avenue

Overland Park, Kansas 66202

NOTICE OF ANNUAL MEETING OF SHAREHOLDERS

To be held on August 30, 2019

Notice is hereby given to the shareholders of Ivy High Income Opportunities Fund (the “Fund”) that the Annual Meeting of Shareholders of the Fund (the “Annual Meeting”) will be held at 6300 Lamar Avenue, Overland Park, Kansas 66202 on August 30, 2019 at 10:00 A.M. (local time).

The Annual Meeting is being held for the following purposes:

1. To elect the Trustee nominees named in the accompanying proxy statement: H. Jeffrey Dobbs and Sandra Lawrence for Class II to hold office until the Fund’s 2021 annual meeting, and James M. Concannon, Frank J. Ross, Jr., and Philip J. Sanders for Class III to hold office until the Fund’s 2022 annual meeting, or until their respective successors are elected and duly qualified.

2. If properly presented, to vote on a shareholder proposal.

3. To transact such other business as may properly come before the Annual Meeting or any adjournments, postponements or delays thereof.

For the reasons set forth in the accompanying proxy statement, we are asking you to vote FOR your Fund’s nominees (Proposal 1) and AGAINST the shareholder proposal (Proposal 2), by filling out and signing the enclosed WHITE proxy card and returning it to us in the enclosed postage-paid envelope so that we know how you would like to vote.

These materials discuss the items to be voted on at the Annual Meeting, and contain the Notice of Annual Meeting of Shareholders, proxy statement and proxy card. A proxy card is, in essence, a ballot. When you vote your proxy, it tells us how you wish to vote on important issues relating to the Fund. If you complete, sign and return the WHITE proxy card, we will vote it as you indicated. If you simply sign, date and return the enclosed WHITE proxy card, but do not specify a vote on the proposals listed thereon, your proxy will be voted FOR the election of the Fund’s nominees to the position of Trustee (Proposal 1) and AGAINST the shareholder proposal (Proposal 2).

The Board of Trustees has fixed the close of business on June 25, 2019 as the record date for the determination of shareholders entitled to notice of, and to vote at, the Annual Meeting.

It is important that your shares be voted at the Annual Meeting. If you are unable to attend the Annual Meeting in person and wish to have your shares voted, you may vote by telephone, Internet or by filling in, signing and dating the enclosed WHITE proxy card and returning it in the accompanying envelope as promptly as possible.

By order of the Board of Trustees,

/s/ Jennifer K. Dulski

Jennifer K. Dulski

Secretary

Overland Park, Kansas

July 8, 2019

IT IS IMPORTANT THAT YOUR SHARES BE REPRESENTED AT THE ANNUAL MEETING IN PERSON OR BY PROXY. REGARDLESS OF WHETHER YOU PLAN TO ATTEND THE ANNUAL MEETING, PLEASE SIGN, DATE AND RETURN THE ENCLOSED WHITE PROXY CARD IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE OR VOTE BY TELEPHONE OR THROUGH THE INTERNET PURSUANT TO THE INSTRUCTIONS ON THE ENCLOSED WHITE PROXY CARD.

If you attend the Annual Meeting and wish to vote in person, you will be able to do so and your vote at the Annual Meeting will revoke any proxy you may have submitted. Merely attending the Annual Meeting, however, will not revoke a previously given proxy.

If you intend to attend the Annual Meeting in person and you are a record holder of the Fund’s shares, in order to gain admission you will be required to show valid photographic identification, such as your driver’s license. If you intend to attend the Annual Meeting in person and you hold your shares through a bank, broker or other custodian, in order to gain admission you will be required to show valid photographic identification, such as your driver’s license, and satisfactory proof of ownership of shares of the Fund, such as your voting instruction form (or a copy thereof) or broker’s statement indicating ownership as of a recent date. If you hold your shares in a brokerage account or through a bank or other nominee, you will not be able to vote in person at the Annual Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the Annual Meeting.

YOUR VOTE IS EXTREMELY IMPORTANT. NO MATTER HOW MANY OR HOW FEW SHARES YOU OWN, PLEASE SEND IN THE WHITE PROXY CARD(S), OR VOTE BY TELEPHONE OR THE INTERNET TODAY.

IVY HIGH INCOME OPPORTUNITIES FUND

PROXY STATEMENT

FOR

ANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON AUGUST 30, 2019

This proxy statement (“Proxy Statement”) is furnished to the holders of common shares of beneficial interest, par value $0.001 per share, of Ivy High Income Opportunities Fund (the “Fund”) in connection with the solicitation by the Board of Trustees of the Fund (the “Board”) of proxies to be voted at the Annual Meeting of Shareholders of the Fund to be held on August 30, 2019, and any adjournment, postponement or delay thereof (the “Annual Meeting”). The Annual Meeting will be held at 6300 Lamar Avenue, Overland Park, Kansas 66202 at 10:00 A.M. (local time).

This document gives you the information you need to vote on the matters listed on the accompanying Notice of Annual Meeting of Shareholders (“Notice of Annual Meeting”). Much of the information in this Proxy Statement is required under rules of the Securities and Exchange Commission (“SEC”). If there is anything you do not understand, please contact us at our toll-free number 1-800-777-6472.

The Notice of Annual Meeting, the enclosed proxy card and this Proxy Statement (collectively, the “Proxy Materials”) are first being mailed to the Fund’s shareholders on or about July 8, 2019.

Shareholders of record or beneficial owners as of the record date may obtain a free copy of the Annual Report for the fiscal year ended September 30, 2018 and the Semi-Annual Report for the period ended March 31, 2019, which have previously been mailed to shareholders, by writing Ivy Client Services at P.O. Box 29217, Shawnee Mission, Kansas 66201-9217 Attn: Investor Services & Support, by calling toll free 1-800-777-6472 or on the Internet at www.ivyinvestments.com.

| • | Why is a shareholder meeting being held? |

The common shares of the Fund are listed on the New York Stock Exchange (“NYSE”), and the rules of the NYSE require the Fund to hold an annual meeting of shareholders to elect Trustees each fiscal year.

| • | What matters will be voted on? |

Shareholders of the Fund are being asked to elect H. Jeffrey Dobbs and Sandra Lawrence as Class II Trustees, to hold office until the Fund’s 2021 annual meeting, or until their respective successors are elected and duly qualified, and to elect James M. Concannon, Frank J. Ross, Jr., and Philip J. Sanders as Class III Trustees, to hold office until the Fund’s 2022 annual meeting, or until their respective successors are elected and duly qualified (“Proposal 1”). Additionally, if properly presented, shareholders will be asked to vote on a shareholder proposal (“Proposal 2” or the “Shareholder Proposal”).

| • | Will my vote make a difference? |

Yes! Saba Capital Management, L.P. (“Saba”) has submitted a Shareholder Proposal that, if implemented, could significantly alter the corporate governance structure of the Fund. Your vote is important and could make a difference in the governance of the Fund, no matter how many shares you own.

| • | Who is asking for my vote? |

The enclosed WHITE proxy card is solicited by the Board for use at the Annual Meeting to be held on August 30, 2019, and, if the Annual Meeting is adjourned, postponed or delayed, at any later meeting(s), for the purposes stated in the Notice of Annual Meeting.

The Fund has contracted with Di Costa Partners (“DCP”) to assist with solicitation of proxies. The proxy solicitation is being made primarily by mail, but may also be made by officers or employees of the Fund or its investment adviser or affiliates, through telephone, facsimile, or other communications.

You may receive a different proxy statement from Saba (along with a proxy card), seeking approval of its shareholder proposal. Please discard any proxy card that you receive from Saba. Do not return it because doing so will cancel out your vote on the Fund’s WHITE proxy card.

| • | What is the voting requirement for each Proposal? |

The election of a Trustee requires the affirmative vote of a plurality of votes cast by the shareholders, in person or by proxy, at the Annual Meeting at which a quorum (i.e., one-third of the outstanding shares of the Fund entitled to vote at the Annual Meeting) is present in person or by proxy. For purposes of this vote on Proposal 1, a vote to withhold your vote (or a direction to a broker or other nominee to do so) is not considered to be a “vote cast” and therefore, will have no effect on the outcome of the Trustee election.

The approval of the Shareholder Proposal requires the affirmative vote of a majority of votes cast by the shareholders, in person or by proxy, at the Annual Meeting at which a quorum is present in person or by proxy. The Fund expects that broker-dealer firms holding shares of the Fund in “street name” for their customers will not be permitted by NYSE rules to vote on the Shareholder Proposal on behalf of their customers and beneficial owners in the absence of voting instructions from their customers and beneficial owners. Abstentions and “broker non-votes” (i.e., shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee has discretionary voting power on a particular matter) are not considered to be “votes cast” and therefore, will have no effect on the outcome of Proposal 2.

| • | How does the Board recommend that shareholders vote? |

The Board unanimously recommends that you vote “FOR” each Trustee nominee named in this Proxy Statement and “AGAINST” the Shareholder Proposal submitted by the shareholder.

The Board has reviewed the qualifications and backgrounds of the Board’s Trustee nominees and believes that each is experienced in overseeing investment companies or has the background and experience to be able to do so, and is familiar with the Fund, its investment strategies and operations, and its investment adviser. The Board has approved each Trustee nominee named in this Proxy Statement and believes his or her election is in your best interests as shareholders.

After careful and thoughtful consideration, the Board, including the independent Trustees who constitute a majority of the Fund’s Board, has unanimously determined that Proposal 2 is not in the best interests of the Fund or its shareholders.

The current Trustees and the Trustee nominees are highly qualified individuals who are committed to the Fund’s long-term ability to achieve its investment objective. The Board believes that the classified board structure continues to provide the Fund and its shareholders with important benefits, including maintaining the independence of the Board, and providing stability and continuity of management. Electing trustees to three-year terms enhances the independence of non-management trustees by providing them with a longer term of office. This longer term provides additional independence from management and from special interest groups, which may have an agenda contrary to the long-term interests of all shareholders. As a result, independent Trustees are able to make decisions that are in the best interest of Fund shareholders. The staggered board prevents a complete turnover of the Board, and a corresponding radical change in direction, in any one year.

Accordingly, and as described more fully in the “Opposition Statement of Ivy High Income Opportunities Fund” under Proposal 2, the Trustees unanimously recommend that you vote “AGAINST” the Shareholder Proposal for the Fund.

| • | Who is eligible to vote? |

Shareholders of record of the Fund at the close of business on June 25, 2019, are entitled to be present and to vote at the Annual Meeting or any adjournment, postponement or delay thereof. Shareholders on that date will be entitled to one vote on each matter to be voted on for each share held and a fractional vote with respect to each fractional share held. Shares represented by your duly executed proxy/proxies will be voted in accordance with your instructions. If you sign a WHITE proxy card, but do not fill in a vote, your shares will be “FOR ALL” the election of the Fund’s nominees to the position of Trustee (Proposal 1) and “AGAINST” the Shareholder Proposal (Proposal 2). If any other business is brought before the Annual Meeting, your shares will be voted at your proxy’s discretion unless you specify otherwise in your proxy.

| • | Who will bear the costs of proxy solicitation? |

The costs of soliciting proxies will be borne by the Fund.

| • | How do you vote your Shares? |

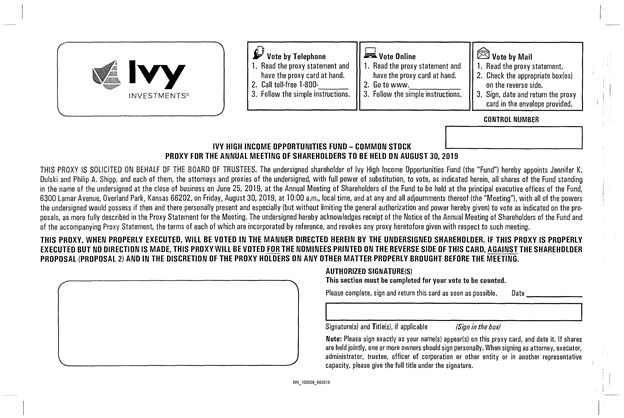

Whether or not you plan to attend the Annual Meeting, we urge you to complete, sign, date and return the enclosed WHITE proxy card in the postage-paid envelope provided, or vote via telephone or the Internet according to the instructions on the proxy card, so your shares will be represented at the Annual Meeting. The control number for telephone and Internet voting is printed on the proxy

card, which is used to match proxy cards with shareholders’ respective accounts and to ensure that, if a shareholder executed multiple proxy cards with respect to the Fund, shares are voted in accordance with the proxy card bearing the latest date.

If you attend the Annual Meeting and wish to vote in person, you will be able to do so. If you intend to attend the Annual Meeting in person and you are a record holder of the Fund’s shares, in order to gain admission you will be required to show valid photographic identification, such as your driver’s license. If you intend to attend the Annual Meeting in person and you hold your shares through a bank, broker or other custodian, in order to gain admission you will be required to show valid photographic identification, such as your driver’s license, and satisfactory proof of ownership of shares of the Fund, such as your voting instruction form (or a copy thereof) or broker’s statement indicating ownership as of a recent date. If you hold your shares in a brokerage account or through a bank or other nominee, you may not be able to vote in person at the Annual Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the Annual Meeting.

All shares represented by your duly executed proxy/proxies received prior to the Annual Meeting will be voted at the Annual Meeting in accordance with the instructions marked thereon or otherwise as provided therein. If any other business is brought before the Annual Meeting, your shares will be voted at your proxies’ discretion. If you return a signed WHITE proxy card without any voting instructions, your shares will be voted “FOR ALL” of the Fund’s Trustee Nominees and “AGAINST” the Shareholder Proposal in accordance with the recommendation of the Board.

Shareholders who execute proxy cards or record their voting instructions via telephone or the Internet may revoke their proxies at any time prior to the time they are voted by giving written notice to the Secretary of the Fund, by delivering a subsequently dated proxy (including via telephone or the Internet) prior to the date of the Annual Meeting or by attending and voting at the Annual Meeting. Merely attending the Annual Meeting, however, will not revoke a previously submitted proxy.

| • | How many shares of the Fund were outstanding as of the record date? |

At the close of business on June 25, 2019, the Fund had 16,570,234.602 common shares outstanding.

Proposal #1: Election of the Trustees

The rules of the NYSE require the Fund to hold an annual meeting of shareholders to elect Trustees each fiscal year. Shareholders of the Fund are being asked to elect H. Jeffrey Dobbs and Sandra Lawrence as Class II Trustees, to hold office until the Fund’s 2021 annual meeting, or until their respective successors are elected and duly qualified, and to elect James M. Concannon, Frank J. Ross, Jr., and Philip J. Sanders as Class III Trustees, to hold office until the Fund’s 2022 annual meeting, or until their respective successors are elected and duly qualified.

Composition of the Board of Trustees

The Trustees of the Fund are classified into three classes of Trustees. Set forth below are the current classes of Trustees:

| | Class I Trustees (1) | Class II Trustees (2) | Class III Trustees (3) | |

| | James D. Gressett Joseph Harroz, Jr. Glendon E. Johnson, Jr. | Henry J. Herrmann Michael G. Smith

Edward M. Tighe | James M. Concannon Frank J. Ross, Jr. | |

H. Jeffrey Dobbs and Sandra Lawrence are nominated to serve as Class II Trustees and Philip J. Sanders is nominated to serve as a Class III Trustee.

(1) | It is currently anticipated that the Class I Trustees will next stand for election at the Fund’s 2020 annual meeting of shareholders. |

(2)

| It is currently anticipated that the Class II Trustees will next stand for election at the Fund’s 2021 annual meeting of shareholders. |

(3)

| The Class III Trustees are standing for election at the Annual Meeting to serve until the Fund’s 2022 annual meeting of shareholders. |

The Trustee nominees, if elected at the Annual Meeting, will hold office for a term in accordance with their class or until their respective successors shall have been elected and duly qualified. The current Class I and Class II Trustees of the Fund, as set forth in the table above, will continue to serve under their current terms and will stand for re-election at subsequent annual meetings of shareholders as indicated above.

Unless authority is withheld, it is the intention of the persons named in the WHITE proxy card to vote the proxy “FOR” the election of each Trustee nominee named in this Proxy Statement. Each Trustee nominee named in this Proxy Statement has agreed to continue to serve as a Trustee of the Fund if elected at the Annual Meeting. If, however, a Trustee nominee declines or otherwise becomes unavailable for election, the proxy confers discretionary power on the person named therein to vote in favor of a substitute Trustee nominee as the Fund’s Governance Committee may select.

Certain information concerning the Trustees and the officers of the Fund is set forth in the table below. Messrs. Herrmann and Sanders are each an “interested” Trustee (as defined in Section 2(a)(19) of the Investment Company Act of 1940 (the “1940 Act”)). Independent Trustees are those who are not interested persons of (i) the Fund, (ii) the Fund’s investment adviser, Ivy Investment Management Company (“IICO”), a wholly owned subsidiary of Waddell & Reed Financial, Inc. (“WDR”), or (iii) a principal underwriter of the Fund and who satisfy the requirements contained in the definition of “independent” as defined in Rule 10A-3 under the Securities Exchange Act of 1934 (the “Independent Trustees”).

Trustees and the Trustee Nominees

The Fund is governed by the Board, which is currently comprised of eight Trustees, but which will be expanded to eleven Trustees as of the Annual Meeting. A majority of the Board are Independent Trustees. The Board elects the officers who are responsible for administering the Fund’s day-to-day operations. The Fund is part of the Ivy Funds complex (comprised of the Fund, as well as 45 portfolios within the Ivy Funds, 28 portfolios within the Ivy Variable Insurance Portfolios, three portfolios within Ivy NextShares and six portfolios within the InvestEd Portfolios) (the “Fund Complex”). Each Trustee/Trustee nominee also serves as a Trustee of the other funds in the Fund Complex.

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S) HELD WITH THE TRUST

| TRUSTEE SINCE | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS

| NUMBER OF FUNDS IN FUND COMPLEX OVERSEEN | OTHER DIRECTORSHIPS HELD DURING PAST 5 YEARS

|

| Independent Trustees/Trustee Nominees | | | | | |

James M. Concannon 6300 Lamar Avenue Overland Park, KS 66202 1947 | Trustee | 2017 | Professor of Law, Washburn University School of Law (1973 to present) | 83 | Director, Kansas Legal Services for Prisoners, Inc.; Director, US Alliance Corporation and wholly-owned subsidiaries; U.S. Alliance Life and Security Company, Dakota Capital Life Insurance Company, and U.S. Alliance Life and Security Corporation – Montana (Insurance) (2009 to present); Director, Kansas Appleseed, Inc.(non-profit community service) (2007 to present); Trustee, Ivy Funds (2017 to present) (45 portfolios overseen); Trustee, InvestEd Portfolios (2001 to present) (6 portfolios overseen); Trustee, Ivy Variable Insurance Portfolios (1997

to present) (28 portfolios overseen); Trustee, Ivy NextShares (2017 to present) (3 portfolios overseen); Trustee, Waddell & Reed Advisors Funds (“WRA Funds”) (1997-2018) |

NAME, ADDRESS AND YEAR OF BIRTH

| POSITION(S) HELD WITH THE TRUST | TRUSTEE SINCE | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS

| NUMBER OF FUNDS IN FUND COMPLEX OVERSEEN | OTHER DIRECTORSHIPS HELD DURING PAST 5 YEARS

|

H. Jeffrey Dobbs 6300 Lamar Avenue Overland Park, KS 66202 1955 | Trustee Nominee | 2019* | Global Sector Chairman, Industrial Manufacturing, KPMG LLP (2010-2015) | 83 | Director, Valparaiso University (2012 to present) Director, TechAccel LLC (2015 to present) (Tech R&D); Board Member, Kansas City Repertory Theatre (2015 to present); Board Member, PatientsVoices, Inc. (technology) (2018 to present); Director, National Associations of Manufacturers (2010-2015); Director, The Children’s Center (2003-2015); Director, Metropolitan Affairs Coalition (2003-2015); Director, Michigan Roundtable for Diversity and Inclusion (2003-2015); Director, Starlight Theatre (1999-2003); Director, Boys and Girls Club of Greater Kansas City (1999-2003); Director, United Way (1999-2003); Director, Lutheran High School of Indianapolis (1990-1996); Trustee, Ivy Funds (2019 to present) (45 portfolios overseen); Trustee, InvestEd Portfolios (2019 to present) (6 portfolios overseen); Trustee, Ivy Variable Insurance Portfolios (2019 to present) (28 portfolios overseen); Trustee, Ivy NextShares (2019 to present) (3 portfolios overseen) |

James D. Gressett 6300 Lamar Avenue Overland Park, KS 66202 1950 | Trustee | 2013 | Chief Executive Officer (CEO) of CalPac Pizza LLC (2011 to present); CEO of CalPac Pizza II LLC (2012 to present); CEO of PacPizza LLC (Pizza Hut franchise) (1999 to present); Member/CEO, Southern Pac Pizza LLC (2013 to present); Partner, Century Bridge Partners (real estate investments) (2007 to present); Manager, Hartley Ranch Angus Beef, LLC (2013 to present); President, Penn Capital Corp. (1995 to present); Partner, Penn Capital Partners (1999 to present) | 83 | Member/Secretary, The Metochoi Group LLC (1999 to present); Member/Chairman, Idea Homes LLC (homebuilding and development) (2013 to present); Trustee, Ivy Funds (2002 to present) (45 portfolios overseen); Trustee, InvestEd Portfolios (2017 to present) (6 portfolios overseen); Trustee, Ivy Variable Insurance Portfolios (2017 to present) (28 portfolios overseen); Trustee, Ivy NextShares (2016 to present) (3 portfolios overseen); Trustee, WRA Funds (2017-2018) |

NAME, ADDRESS AND YEAR OF BIRTH

| POSITION(S) HELD WITH THE TRUST

| TRUSTEE SINCE | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS

| NUMBER OF FUNDS IN FUND COMPLEX OVERSEEN | OTHER DIRECTORSHIPS HELD DURING PAST 5 YEARS

|

Joseph Harroz, Jr. 6300 Lamar Avenue Overland Park, KS 66202 1967 | Trustee Independent Chairman | 2013 2013 | Interim President, University of Oklahoma (2019 to present); Dean of the College of Law, Vice President, University of Oklahoma (2010 to 2019); Managing Member, Harroz Investments, LLC, (commercial enterprise investments) (1998 to present) | 83 | Director and Shareholder, Valliance Bank (2004 to present); Director, Foundation Healthcare (formerly, Graymark HealthCare) (2008-2017); Trustee, the Mewbourne Family Support Organization (2006 to present) (non-profit); Independent Director, LSQ Manager, Inc. (real estate) (2007-2016); Director, Oklahoma Foundation for Excellence (non-profit) (2008 to present); Independent Chairman and Trustee, Ivy Funds (Independent Chairman: 2006 to present; Trustee: 1998 to present) (45 portfolios overseen); Independent Chairman and Trustee, InvestEd Portfolios (Chairman: 2015 to present; Trustee: 2001 to present) (6 portfolios overseen); Independent Trustee and Chairman, Ivy Variable Insurance Portfolios (Chairman: 2015 to present; Trustee: 1998 to present) (28 portfolios overseen); Independent Chairman and Trustee, Ivy NextShares (2016 to present) (3 portfolios overseen); Independent Chairman and Trustee, WRA Funds (Chairman: 2015-2018; Trustee: 1998-2018) |

Glendon E. Johnson, Jr. 6300 Lamar Avenue Overland Park, KS 66202 1951 | Trustee | 2013 | Of Counsel, Lee & Smith, PC (law firm, emphasis on finance, securities, mergers and acquisition law) (1996 to present); Owner and Manager, Castle Valley Ranches, LLC (ranching) and Castle Valley Outdoors, LLC (hunting, fishing, outdoor recreation, lodging and corporate retreats) (1995 to present); Formerly, Partner, Kelly, Drye & Warren LLP (law firm) (1989-1996); Partner, Lane & Edson PC (law firm) (1987-1989) | 83 | Director, Thomas Foundation for Cancer Research (non-profit) (2005 to present); Director, Warriors Afield Legacy Foundation (2014 to present); Trustee, Ivy Funds (2002 to present) (45 portfolios overseen); Trustee, InvestEd Portfolios (2017 to present) (6 portfolios overseen); Trustee, Ivy Variable Insurance Portfolios (2017 to present) (28 portfolios overseen); Trustee, Ivy NextShares (2016 to present) (3 portfolios overseen); Trustee, WRA Funds (2017-2018) |

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S) HELD WITH THE TRUST

| TRUSTEE SINCE

| PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS

| NUMBER OF FUNDS IN FUND COMPLEX OVERSEEN

| OTHER DIRECTORSHIPS HELD DURING PAST 5 YEARS

|

Sandra Lawrence 6300 Lamar Avenue Overland Park, KS 66202 1957 | Trustee Nominee | 2019* | Chief Administrative Officer of Children’s Mercy Hospitals and Clinics (2016-2019); CFO of Children’s Mercy Hospitals and Clinics (2005-2016) | 83 | Director, Hall Family Foundation (1993 to present); Director, Westar Energy (2004 to present); Trustee, Nelson-Atkins Museum of Art (non-profit) (2007 to present); Director, Kansas Metropolitan Business and Healthcare Coalition (non-profit) (2017 to present); Director, National Association of Corporate Directors (non-profit) (2017 to present); Director, American Shared Hospital Services (2017 to present); Director, Evergy, Inc., Kansas City Power & Light Company, KCP&L Greater Missouri Operations Company, Westar Energy, Inc. and Kansas Gas and Electric Company (related utility companies) (2018 to present); Director, Stowers (research) (2018); Director, Turn the Page KC (non-profit) (2012-2016); Trustee, Ivy Funds (2019 to present) (45 portfolios overseen); Trustee, InvestEd Portfolios (2019 to present) (6 portfolios overseen); Trustee, Ivy Variable Insurance Portfolios (2019 to present) (28 portfolios overseen); Trustee, Ivy NextShares (2019 to present) (3 portfolios overseen) |

Frank J. Ross, Jr. 6300 Lamar Avenue Overland Park, KS 66202 1953 | Trustee | 2017 | Shareholder/Director, Polsinelli Shughart PC, a law firm (1980 to present) | 83 | Trustee, Ivy Funds (2017 to present) (45 portfolios overseen); Trustee, InvestEd Portfolios (2001 to present) (6 portfolios overseen); Trustee, Ivy Variable Insurance Portfolios (1996

to present) (28 portfolios overseen); Trustee, Ivy NextShares (2017 to present) (3 portfolios overseen); Trustee, WRA Funds (1996-2018) |

NAME, ADDRESS AND YEAR OF BIRTH | POSITION(S) HELD WITH THE TRUST

| TRUSTEE SINCE | PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS

| NUMBER OF FUNDS IN FUND COMPLEX OVERSEEN | OTHER DIRECTORSHIPS HELD DURING PAST 5 YEARS

|

Michael G. Smith 6300 Lamar Avenue Overland Park, KS 66202 1944 | Trustee | 2013 | Retired; formerly, with Merrill Lynch as Managing Director of Global Investor Client Strategy (1996-1998), Head of Regional Institutional Sales (1995-1996) and of U.S. Central Region (1986-1995, 1999) | 83 | Director of Executive Board, Cox Business School, Southern Methodist University (1998 to present); Director, Northwestern Mutual Funds (2003-2017); Director, CTMG, Inc. (clinical testing) (2008 to 2015); Trustee, Ivy Funds (2002 to present) (45 portfolios overseen); Trustee, InvestEd Portfolios (2017 to present) (6 portfolios overseen); Trustee, Ivy Variable Insurance Portfolios (2017 to present) (28 portfolios overseen); Trustee, Ivy NextShares (2016 to present) (3 portfolios overseen); Trustee, WRA Funds (2017-2018) |

Edward M. Tighe 6300 Lamar Avenue Overland Park, KS 66202 1942 | Trustee | 2013 | Retired; formerly, CEO and Director of Asgard Holdings, LLC (computer network and security services) (2002-2004); President, Citco Technology Management (1995-2000); CEO, Global Mutual Fund Services (1993-2000); Sr. Vice President, Templeton Global Investors (1988-1992) | 83 | Director, The Research Coast Principium Foundation, Inc. (non-profit) (2012-2015); Trustee, Ivy Funds (1999 to present) (45 portfolios overseen); Trustee, InvestEd Portfolios (2017 to present) (6 portfolios overseen); Trustee, Ivy Variable Insurance Portfolios (2017 to present) (28 portfolios overseen); Trustee, Ivy NextShares (2016 to present) (3 portfolios overseen) Trustee, WRA Funds (2017-2018) |

NAME, ADDRESS AND YEAR OF BIRTH

| POSITION(S) HELD WITH THE TRUST

| TRUSTEE SINCE

| PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS

| NUMBER OF FUNDS IN FUND COMPLEX OVERSEEN | OTHER DIRECTORSHIPS HELD DURING PAST 5 YEARS

|

| Interested Trustees | | | | | |

Henry J. Herrmann** 6300 Lamar Avenue Overland Park, KS 66202 1942 | Trustee | 2013 | Retired; Non-Executive Chairman of the Board, WDR (2016-2018); Formerly, Chairman of WDR (January 2010-2018); CEO of WDR (2005-2016); President, CEO and Chairman of IICO (2002-2016); President, CEO and Chairman of Waddell & Reed Investment Management Company (“WRIMCO”) (1993-2016); President and Trustee of each of the funds in the Fund Complex (for Ivy Funds: 2001-2016) | 83 | Director of WDR (1998 to present); Director, IICO (2002-2016); Director, WRIMCO (1991-2016); Director, WISC (2001-2016); Director, W&R Capital Management Group, Inc. (2008-2016); Director, WRI (1993-2016); Trustee, Ivy Funds (1998 to present) (45 portfolios overseen); Trustee, InvestEd Portfolios (2001 to present) (6 portfolios overseen); Trustee, Ivy Variable Insurance Portfolios (1998 to present) (28 portfolios overseen); Trustee, Ivy NextShares (2016 to present) (3 portfolios overseen); Trustee, WRA Funds (1998-2018); Director, Blue Cross Blue Shield of Kansas City (2007 to present) |

Philip J. Sanders*** 6300 Lamar Avenue Overland Park, KS 66202 1959 | Trustee Nominee President | 2019* 2016 | CEO of WDR (August 2016 to present); President, CEO and Chairman of IICO (August 2016 to present); President of each of the funds in the Fund Complex (August 2016 to present); CIO of WDR (February 2011 to present); CIO of IICO (August 2010 to present) | 83 | Trustee, Ivy Funds (2019 to present) (45 portfolios overseen); Trustee, InvestEd Portfolios (2019 to present) (6 portfolios overseen); Trustee, Ivy Variable Insurance Portfolios (2019 to present) (28 portfolios overseen); Trustee, Ivy NextShares (2019 to present) (3 portfolios overseen) |

| | | | | | |

| * | If elected by shareholders. |

| ** | Mr. Herrmann is “interested” by virtue of his former engagement as an officer of WDR or its wholly owned subsidiaries, including IICO, the Fund’s investment adviser. |

| *** | If elected, Mr. Sanders would be “interested” by virtue of his position as Chief Executive Officer of IICO and his personal ownership of shares of WDR. |

Trustee Qualifications

Following is a summary of various qualifications, experiences and skills of each Trustee and Trustee nominee (in addition to business experience during the past five years as set forth in the table above) that contributed to the Board’s conclusion that an individual should serve on the Board. References to the qualifications, attributes and skills of Trustees do not constitute the holding out of any Trustee as being an expert under Section 7 of the Securities Act of 1933, as amended, or the rules and regulations of the SEC.

James M. Concannon. Mr. Concannon has organizational management experience as the dean of a law school. He has served as an officer and on the boards of non-profit organizations. He has multiple years of service as a Trustee to the Fund Complex. The Board concluded that Mr. Concannon is suitable to serve as Trustee because of his academic background and the length of his service as a Trustee to the Fund and to other trusts within the Fund Complex.

H. Jeffrey Dobbs. Mr. Dobbs has over 35 years of experience in the automotive, industrial manufacturing, financial services and consumer sectors. He has also served as a partner in a public accounting firm. Mr. Dobbs holds a degree in accounting from

Valparaiso University. The Board concluded that Mr. Dobbs is suitable to act as Trustee because of his extensive work in the global professional services industry, as well as his educational background.

James D. Gressett. Mr. Gressett has served as the CEO of a closely-held corporation. He also has served as an accountant and partner in a public accounting firm. Mr. Gressett also has been a member and chairman of the boards of several closely-held corporations and charitable organizations. Mr. Gressett holds a B.B.A. of Accountancy degree from the University of Texas at Austin. He has multiple years of service as a Trustee to the Fund Complex. The Board concluded that Mr. Gressett is suitable to serve as Trustee because of his work experience, his academic background, his service on other corporate and charitable boards and the length of his service as a Trustee to the Fund and to other trusts within the Fund Complex.

Joseph Harroz, Jr. Mr. Harroz serves as Dean of the College of Law and Vice President of a state university, and also serves as a director of a bank. He also has served as a president and director of a publicly traded company and as General Counsel to a state university system. Mr. Harroz holds a B.A. degree from the University of Oklahoma and a J.D. from Georgetown University Law Center. Mr. Harroz has multiple years of service as a Trustee to the Fund Complex. The Board concluded that Mr. Harroz is suitable to serve as Trustee because of his educational background, his work experience and the length of his service as a Trustee to the Fund and to other trusts within the Fund Complex.

Henry J. Herrmann. Mr. Herrmann has extensive experience in the investment management business, both as a portfolio manager and as a member of senior management, and experience as a director of a publicly held company. He has multiple years of service as a Trustee and officer to the Fund Complex. The Board concluded that Mr. Herrmann is suitable to serve as Trustee because of his academic background, his extensive work experience in the financial services and investment management industry and the length of his service as a Trustee to the Fund and to other trusts within the Fund Complex.

Glendon E. Johnson, Jr. Mr. Johnson practiced law for over 30 years, specializing in corporate finance, securities and mergers and acquisitions, including representing and advising financial services companies and investment advisers and their boards. In addition, for over twelve years, he was involved in the acquisition, sale, financing, and daily business affairs of several financial service companies, including investment managers. He serves as a Director of the Thomas Foundation for Cancer Research. Mr. Johnson holds an Honors B.A. of Economics and Business from the University of Utah, and a J.D. from the University of Texas Law School at Austin, where he was a member and note and comment editor of the Texas Law Review. He has multiple years of service as a Trustee to the Fund Complex. The Board concluded that Mr. Johnson is suitable to serve as Trustee because of his extensive legal and business experience, academic background and the length of his service as a Trustee to the Fund and to other trusts within the Fund Complex.

Sandra Lawrence. Ms. Lawrence has been a member and chair of the boards of several closely-held corporations and charitable organizations. Ms. Lawrence holds an A.B. from Vassar College, as well as master’s degrees from the Massachusetts Institute of Technology and Harvard Business School. The Board concluded that Ms. Lawrence is suitable to serve as Trustee because of her work experience, her academic background and her service on corporate and charitable boards.

Frank J. Ross, Jr. Mr. Ross has experience as a business attorney and as the head of the business department of a major law firm. He has served as a member of a state banking board and on the boards of a private university, a private secondary school and various non-profit organizations. He has multiple years of service as a Trustee to the Fund Complex. The Board concluded that Mr. Ross is suitable to serve as Trustee because of his work experience and the length of his service as a Trustee to the Fund and to other trusts within the Fund Complex.

Philip J. Sanders. Mr. Sanders has extensive experience in the investment management business as a member of senior management. He has multiple years of service as an officer of the Fund Complex and as an officer of other mutual funds. The Board concluded that Mr. Sanders is suitable to serve as Trustee because of his extensive work experience in the financial services and investment management industry and the length of his service as an officer of the Fund Complex.

Michael G. Smith. Mr. Smith has over 40 years of experience in the financial services and investment management industry. He has served as a member and chairman of the boards of several mutual funds and charitable and educational organizations. Mr. Smith is a Chartered Financial Analyst and holds a B.B.A. of Finance degree and an M.B.A. degree from Southern Methodist University. He has multiple years of service as a Trustee to the Fund Complex. The Board concluded that Mr. Smith is suitable to act as Trustee because of his extensive work experience in the financial services and investment management industry, his educational and charitable organization experience, his educational background and the length of his service as a Trustee to the Fund and to other trusts within the Fund Complex.

Edward M. Tighe. Mr. Tighe has extensive experience in the mutual fund and information technology industries. He has held executive positions with U.S. mutual fund companies and served as a lead independent trustee on a different mutual fund board. Mr.

Tighe holds a B.S. of Finance degree from Boston University. He has multiple years of service as a Trustee to the Fund Complex. The Board concluded that Mr. Tighe is suitable to serve as Trustee because of his academic background, his extensive business experience and the length of his service as a Trustee to the Fund and to other trusts within the Fund Complex.

The Board’s Leadership Structure

The Fund is governed by its Board, which currently is comprised of eight Trustees, but will be expanded to eleven Trustees as of the Annual Meeting. The Board is responsible for the overall management of the Fund, which includes general oversight and review of the Fund’s investment activities, in accordance with Federal law and the law of the State of Delaware, as well as the stated policies of the Fund. The Board has appointed officers of the Fund and has delegated to them the management of the day-to-day operations of the Fund, based on policies reviewed and approved by the Board, with general oversight by the Board.

The Board is classified into three classes—Class I, Class II and Class III—as nearly equal in number as reasonably possible, with the Trustees in each class to hold office until their successors are elected and duly qualified. At each succeeding annual meeting of shareholders, the successors to the class of Trustees whose terms expire at that meeting shall be elected to hold office for terms expiring at the later of the annual meeting of shareholders held in the third year following the year of their election or the election and qualification of their successors.

Currently, seven members of the Board are Independent Trustees and Mr. Henry J. Herrmann is an interested Trustee. As of the Annual Meeting, the Board will be expanded to eleven members. If elected, Mr. Philip J. Sanders, a Trustee nominee, would serve as a second interested Trustee. An interested person of the Fund includes any person who is otherwise affiliated with the Fund or a service provider to the Fund, such as IICO, the Fund’s investment adviser. The Board believes that having a majority of Independent Trustees on the Board is appropriate and in the best interests of the Fund’s shareholders. However, the Board also believes that having Messrs. Herrmann and Sanders serve on the Board to bring their viewpoints is an important element in the Board’s decision-making process.

Under the Fund’s Amended and Restated Agreement and Declaration of Trust (the “Declaration of Trust”) and its Amended and Restated By-Laws (the “Bylaws”), a Trustee may serve as a Trustee until his or her term expires, until he or she dies or resigns, or in the event of bankruptcy, adjudicated incompetence or other incapacity to perform the duties of the office, or his or her removal. The Fund intends to hold annual meetings of shareholders so long as the common shares are listed on a national securities exchange and such meetings are required as a condition to such listing. Delaware law permits shareholders to remove Trustees under certain circumstances and requires the Fund to assist in shareowner communications.

The Board has elected Joseph Harroz, Jr., an Independent Trustee, to serve as Independent Chair of the Board. In that regard, Mr. Harroz’s responsibilities include setting an agenda for each meeting of the Board; presiding at all meetings of the Board and the Independent Trustees; and serving as a liaison with other Trustees, the Fund’s officers and other management personnel, and counsel to the Fund. The Independent Chair also performs such other duties as the Board may from time to time determine.

The Board holds four regularly scheduled in-person meetings each year. The Board may hold special meetings, as needed, either in person or by telephone, to address matters arising between regular meetings. The Independent Trustees also hold four regularly scheduled in-person meetings each year, during a portion of which management is not present, as well as a special telephonic meeting in connection with the Board’s consideration of the Fund’s management agreements, and may hold special meetings, as needed, either in person or by telephone.

The Board has established a committee structure (described below) that includes four standing committees: the Audit Committee, the Governance Committee, the Investment Oversight Committee and the Executive Committee, the first two of which are comprised solely of Independent Trustees. The Board annually evaluates its structure and composition, as well as the structure and composition of those committees. The Board believes that its leadership structure, including its Independent Chair position and its committees, is appropriate for the Fund in light of, among other factors, the asset size and nature of the Fund, the arrangements for the conduct of the Fund’s operations, the number of Trustees, and the Board’s responsibilities.

Risk Oversight

Consistent with its responsibility for oversight of the Fund, the Board oversees the management of risks relating to the administration and operation of the Fund. The Board performs this risk management oversight directly and, as to certain matters, directly through its committees and through its Independent Trustees. The following provides an overview of the principal, but not all, aspects of the Board’s oversight of risk management for the Fund.

In general, the Fund’s risks include, among other things, investment risk, credit risk, discount risk, liquidity risk, valuation risk, operational risk and regulatory compliance risk. The Board has adopted, and periodically reviews, policies and procedures designed to address these and other risks to the Fund. In addition, under the general oversight of the Board, IICO and other service providers to the Fund have themselves adopted a variety of policies, procedures and controls designed to address particular risks of the Fund. Different processes, procedures and controls are employed with respect to different types of risks.

The Board also oversees risk management for the Fund through review of regular reports, presentations and other information from officers of the Fund and other persons.

Senior officers of the Fund, senior officers of IICO and IICO’s affiliated companies (collectively, “Waddell”), and the Fund’s Chief Compliance Officer (“CCO”) regularly report to the Board on a range of matters, including those relating to risk management. The Board also regularly receives reports from IICO with respect to the investments and securities trading of the Fund and reports from Fund management personnel regarding valuation procedures. In addition to regular reports from Waddell, the Board also receives reports regarding other service providers to the Fund, either directly or through Waddell or the Fund’s CCO, on a periodic or regular basis. At least annually, the Board receives a report from the Fund’s CCO regarding the effectiveness of the Fund’s compliance program. Also, on an annual basis, the Board receives reports, presentations and other information from WDR.

Senior officers of the Fund and senior officers of Waddell also report regularly to the Audit Committee on Fund valuation matters and on the Fund’s internal controls and accounting and financial reporting policies and practices. Waddell compliance and internal audit personnel also report regularly to the Audit Committee. In addition, the Audit Committee receives regular reports from the Fund’s independent registered public accounting firm on internal control and financial reporting matters. On at least a quarterly basis, the Independent Trustees meet separately with the Fund’s CCO to discuss matters relating to the Fund’s compliance program.

Officers of the Fund

The following information relates to the executive officers of the Fund who are not Trustees. Fund officers receive no compensation from the Fund and are also officers or employees of IICO and may receive compensation in such capacities.

NAME, ADDRESS AND YEAR OF BIRTH

| POSITION(S) HELD WITH THE TRUST

| OFFICER

OF TRUST

SINCE | OFFICER

OF FUND

COMPLEX

SINCE*

| PRINCIPAL OCCUPATION(S) DURING PAST 5 YEARS

|

Jennifer K. Dulski 6300 Lamar Avenue Overland Park, KS 66202 1980 | Secretary | 2017 | 2017 | Secretary for each of the funds in the Fund Complex (2017 to present); Senior Vice President and Associate General Counsel of Waddell & Reed and Ivy Distributors, Inc. (“IDI”) (2018 to present) |

Philip J. Sanders 6300 Lamar Avenue Overland Park, KS 66202 1959 | President | 2016 | 2006 | CEO of WDR (August 2016 to present); President, CEO and Chairman of IICO and WRIMCO (August 2016 to present); President of each of the funds in the Fund Complex (August 2016 to present); CIO of WDR (February 2011 to present); CIO of IICO and WRIMCO (August 2010 to present) |

Joseph W. Kauten 6300 Lamar Avenue Overland Park, KS 66202 1969 | Vice President Treasurer Principal Accounting Officer Principal Financial Officer | 2013 2013 2013 2013 | 2006 2006 2006 2007 | Principal Financial Officer of each of the funds in the Fund Complex (2007 to present); Vice President and Treasurer of each of the funds in the Fund Complex (2006 to present); Principal Accounting Officer of each of the funds in the Fund Complex (2006-2017); Assistant Treasurer of each of the funds in the Fund Complex (2003-2006); Vice President of Waddell & Reed Services Company (2007 to present) |

Scott J. Schneider 6300 Lamar Avenue Overland Park, KS 66202 1968 | Vice President Chief Compliance Officer | 2013 2013 | 2006 2004 | Chief Compliance Officer (2004 to present) and Vice President (2006 to present) of each of the funds in the Fund Complex; Vice President of IICO and WRIMCO (2006 to present) |

Philip A. Shipp 6300 Lamar Avenue Overland Park, KS 66202 1969 | Assistant Secretary | 2013 | 2012 | Assistant Secretary of each of the funds in the Fund Complex (2012 to present); Senior Vice President of Waddell & Reed and IDI (2017 to present); Vice President of Waddell & Reed and IDI (2010-2016) |

| | | | | |

| * | This is the date when the officer first became an officer of one or more of the funds that are the predecessors to current funds within the Fund Complex (if applicable). |

Committees of the Board of Trustees

The Board has established the following standing committees: Audit Committee, Executive Committee, Investment Oversight Committee and Governance Committee. Mr. Harroz is an ex officio member of each committee of the Board. The respective duties and current memberships of the standing committees are:

Audit Committee. The Audit Committee serves as an independent and objective party to monitor the Fund’s accounting policies, financial reporting and internal control system, as well as the work of the Fund’s independent registered public accounting firm. The Committee also serves to provide an open avenue of communication among the Fund’s independent registered public accounting firm, the internal accounting staff of IICO and the Board. The Audit Committee consists of Edward M. Tighe (Chair), James M. Concannon and James D. Gressett. The report of the Audit Committee is set forth in Appendix A to this Proxy Statement and the Audit Committee Charter is included as Appendix B to this Proxy Statement.

Executive Committee. The Executive Committee acts as necessary on behalf of the full Board. When the Board is not in session, the Executive Committee has and may exercise any or all of the powers of the Board in the management of the business and affairs of the Fund except the power to increase or decrease the size of, or fill vacancies on, the Board, and except as otherwise provided by law. The Executive Committee consists of Henry J. Herrmann (Chair) and Glendon E. Johnson, Jr.

Investment Oversight Committee. The Investment Oversight Committee reviews, among other things, the investment performance of the Fund, any proposed changes to the Fund’s investment policies, and the Fund’s market trading activities and portfolio transactions. The Investment Oversight Committee consists of Michael G. Smith (Chair), James M. Concannon, Henry J. Herrmann and Glendon E. Johnson, Jr.

Governance Committee. The Governance Committee evaluates, selects and recommends to the Board candidates to serve as Independent Trustees. The Committee considers candidates for Trustee recommended by shareholders. Written recommendations with any supporting information should be directed to the Fund’s Secretary. The Governance Committee also oversees the functioning of the Board and its committees. The Governance Committee consists of Frank Ross, Jr. (Chairman), James D. Gressett and Glendon E. Johnson, Jr. The Governance Committee Charter is included as Appendix C to this Proxy Statement.

During the fiscal year ended September 30, 2018, the Board met seven times, and each of the Audit Committee, Governance Committee and Investment Oversight Committee met four times. The Executive Committee did not meet during the fiscal year ended September 30, 2018.

During the fiscal year ended September 30, 2018, each Trustee of the Fund attended at least 75% of the aggregate of: (i) all regular meetings of the Board; and (ii) all meetings of all committees of the Board on which the Trustee served.

Shareholder Communications to the Trustees

Shareholders and other interested parties may contact the Board or any Trustee by mail. Correspondence should be addressed to the Board or the Trustees with whom you wish to communicate by either name or title. All such correspondence should be sent to the attention of Jennifer K. Dulski, Secretary of the Fund, at 6300 Lamar Avenue, Overland Park, Kansas 66202.

Trustee/Trustee Nominee Beneficial Ownership of Securities

The following table sets forth, for each Trustee, the aggregate dollar range of equity securities owned by such Trustee in the Fund and in the aggregate of all funds with the Fund Complex as of September 30, 2018. The information as to beneficial ownership is based upon statements furnished by each Trustee.

| | | |

Independent Trustees/Trustee Nominees

| Dollar Range of Equity

Securities in the Fund | Aggregate Dollar Range of

Shares Owned of All Funds

in the Fund Complex |

| James M. Concannon | $0 | Over $100,000 |

| H. Jeffrey Dobbs | $0 | None |

| James D. Gressett | $0 | Over $100,000 |

| Joseph Harroz, Jr. | $0 | Over $100,000 |

| Glendon E. Johnson, Jr. | $0 | Over $100,000 |

| Sandra Lawrence | $0 | None |

| Frank J. Ross, Jr. | $0 | Over $100,000 |

| Michael G. Smith | $0 | Over $100,000 |

| Edward M. Tighe | $0 | Over $100,000 |

| Interested Trustees/Trustee Nominees | | |

| Henry J. Herrmann | $0 | Over $100,000 |

| Philip J. Sanders | $0 | None |

As of September 30, 2018, none of the Independent Trustees or Trustee nominees or any member of his or her immediate family owned beneficially or of record any securities in an investment adviser or principal underwriter of the Fund or a person (other than a registered investment company) directly or indirectly controlling, controlled by, or under common control with IICO.

Trustee Compensation

The fees paid to the Trustees are allocated among the funds within the Fund Complex based on each fund’s relative asset size. During the fiscal year ended September 30, 2018, the Trustees received (or were entitled to receive) the following fees for service as a Trustee of the Fund and each of the other funds within the Fund Complex. Messrs. Dobbs and Sanders and Ms. Lawrence do not currently serve as Trustees and have not received any compensation from the Fund.

| | | |

Independent Trustees(1) | Compensation

from the Fund | Aggregate

Compensation

from the Fund Complex(2) |

Jarold W. Boettcher(3) | $408.22 | $310,000 |

| James M. Concannon | $833.49 | $331,750 |

| James D. Gressett | $836.62 | $300,000 |

Joseph Harroz, Jr. (4) | $1,264.81 | $428,000 |

| Glendon E. Johnson, Jr. | $1,007.87 | $309,250 |

| Frank J. Ross, Jr. | $1,070.75 | $325,000 |

| Michael G. Smith | $584.05 | $328,000 |

| Edward M. Tighe | $642.45 | $328,000 |

| | | |

| Interested Trustee | | |

| Henry J. Herrmann | $0 | $0 |

(1) | The table reflects compensation for the fiscal year ended September 30, 2018. |

(2)

| No pension or retirement benefits have been accrued as a part of Fund expenses. |

(3)

| Retired as of December 31, 2018. |

(4)

| Mr. Harroz receives an additional annual fee of $100,000 for his services as Independent Chair of the Board and of the board of trustees of each of the other trusts within the Fund Complex. |

Of the totals listed in the “Aggregate Compensation” column above, the following amounts have been deferred:

| | Jarold W. Boettcher(1) | $183,000 |

| | James M. Concannon | $75,000 |

| | James D. Gressett | $50,000 |

| | Joseph Harroz, Jr. | $42,000 |

| | Glendon E. Johnson, Jr. | $0 |

| | Frank J. Ross, Jr. | $0 |

| | Michael G. Smith | $145,625 |

| | Edward M. Tighe | $128,000 |

| | Henry J. Herrmann | $0 |

(1) | Retired as of December 31, 2018. |

Mr. Herrmann does not receive compensation from the Fund. The officers, as well as Mr. Herrmann, are paid by IICO or its affiliates. If elected, Mr. Sanders will not receive compensation from the Fund.

Required Vote. Provided that a quorum is present at the Annual Meeting, either in person or by proxy, Trustees must be elected by not less than a plurality of the votes cast of the shares entitled to vote thereon. All voting rights are non-cumulative, which means that the holders of more than 50% of the shares voting for the election of Trustees can elect 100% of such Trustees if they choose to do so.

THE BOARD, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT YOU VOTE “FOR” EACH TRUSTEE NOMINEE NAMED IN THIS PROXY STATEMENT.

Proposal #2: Shareholder Proposal

Saba, a Fund shareholder (the “Shareholder Proponent”), has informed the Fund that it intends to submit the Shareholder Proposal at the Meeting and has requested that the Fund include the Shareholder Proposal in the Fund’s Proxy Materials. The non-binding Shareholder Proposal, exactly as received by the Fund, is set forth below, followed by Saba’s supporting statement for the Shareholder Proposal (the “Supporting Statement”), exactly as received by the Fund, which in turn is followed by the Board’s explanation of its reasons for opposing the Shareholder Proposal. The Board unanimously recommends that you vote AGAINST the Shareholder Proposal.

RESOLVED, that the shareholders of Ivy High Income Opportunities Fund (the “Trust”) request that the Board of Trustees of the Trust (the “Board”) take all necessary steps in its power to declassify the Board so that trustees are elected on an annual basis starting at the next annual meeting of shareholders. Such declassification shall be completed in a manner that does not affect the unexpired terms of the previously elected trustees.

Supporting Statement of the Shareholder Proponent

Corporate Governance

We believe the annual election of all trustees encourages board accountability to its shareholders and when trustees are held accountable for their actions, they perform better. This view is shared by most shareholders and institutional investors, who believe it to be the standard for corporate governance best practices. The vast majority of companies in the S&P 500 and Russell 1000 indexes elect all board members annually.

Currently, the Board is divided into three classes serving staggered three-year terms. It is our belief that the classification of the Board is strong proof that the Board is not acting in the best interests of shareholders. A classified board protects the incumbents, which in turn limits accountability to shareholders.

We are committed to improving the corporate governance of the Trust for the benefit of all shareholders. Declassification of the Board is a positive step which will allow more productive shareholder engagement and will help the Trust achieve its optimal valuation.

Saba has submitted a shareholder proposal to declassify the Board of the Trust, in an attempt to allow the Board to operate freely and in the best interest of shareholders.

For a greater voice in the Trust’s corporate governance and to increase the accountability of the Board to shareholders, we urge you to vote FOR this proposal.

The Shareholder Proponent is Saba Capital Management, L.P., 405 Lexington Avenue, 58th Floor, New York, NY 10174. Neither the Fund, its Board nor management is responsible for the contents of the Shareholder Proposal or the Supporting Statement of the Shareholder Proponent.

Statement of the Board of Trustees in Opposition of the Shareholder Proposal

After careful and thoughtful consideration, the Board, including the Independent Trustees who constitute a majority of the Fund’s Board, has unanimously determined that the Shareholder Proposal is not in the best interests of the Fund or its shareholders. Rather, the Board believes that its classified structure helps protect the Fund and its shareholders from undue influence by closed-end fund activists. Accordingly, the Board recommends that you vote “AGAINST” Proposal 2.

The Board’s Classified Structure Protects the Fund’s Shareholders

Your Board is comprised of highly qualified individuals who are committed to the Fund’s long‑term ability to achieve its investment objective. The Board believes that the classified board structure continues to provide the Fund and its shareholders with important benefits, including strengthening the independence of the Board and providing stability and continuity of management.

Absent the classified Board, however, an activist shareholder (or group of shareholders) could gain control of the Fund by acquiring or obtaining enough shares to replace the entire Board with its own nominees at a single annual meeting. This could result in radical changes to the way the Fund is operated—even changes to the closed-end structure that attracted shareholders to the Fund in the first place.

Advantages of the Classified Board

The Classified Board Enhances the Independence of the Independent Trustees. Electing Trustees, including particularly the Fund’s Independent Trustees, to three-year terms enhances the independence of the Independent Trustees by providing them with a longer term of office. This longer term provides additional independence from management and from closed‑end fund activists whose agendas may be contrary to the long-term interests of the Fund’s other shareholders. As a result, Independent Trustees with longer terms are able to make decisions that are in the best interest of all of the Fund’s shareholders. The classified board prevents a complete turnover of the Board, and a corresponding radical change in direction, in any one year.

The Classified Board Promotes Stability and Continuity. The Board has from inception been divided into three classes that serve staggered three-year terms. The Board is structured this way to provide stability, continuity, and independence, all of which enhance long-term planning. It also ensures that there are experienced Trustees serving on the Board who are familiar with the Fund, its operations and its investment strategy. A classified Board helps attract and retain Trustees who are willing to make long-term commitments of their time and energy. A classified board structure therefore provides the Fund with protection from activist shareholders with narrower interests that are not shared by the Fund’s other long-term investors.

The Classified Board Promotes Accountability to Shareholders. The Fund’s Board does not agree with the assertion that the classified board structure minimizes a Trustee’s accountability to the Fund’s shareholders. Trustees elected to three-year terms are just as accountable to shareholders as trustees elected annually, since all Trustees are required to uphold their fiduciary duties to the Fund and its shareholders regardless of their term. The Board has implemented measures to ensure accountability of the Trustees by providing for annual evaluations of Trustee independence and an annual self‑assessment of the Board’s performance. The Board reviews matters relating to the Fund, including performance and trading discounts, on an ongoing basis and seeks to balance the interests of all shareholders of the Fund. The Fund’s shareholders already have a variety of tools at their disposal to ensure that Trustees who are elected to the Board are accountable to them, including withholding votes from Trustees who are standing for election, or corresponding with the Trustees to express shareholder concerns. Shareholders have successfully used these accountability tools at many public companies, including closed-end investment companies like the Fund.

The Classified Board Structure is Recognized under the Investment Company Act. The Investment Company Act, which regulates the Fund’s activities and the composition of the Board, explicitly recognizes that classified boards facilitate the purposes of the Act1 — that investment companies should be managed and invest their assets in the interests of all shareholders, not just the narrower interests of activist investors at the expense of other long‑term shareholders who acquired their shares as part of a long-term investment strategy.

Your Board is Effectively Managing the Fund

The Fund Has Had Very Competitive Performance. Your Board actively oversees and monitors the Fund’s performance. In recent years, the Fund has had very competitive performance, both on an absolute basis and also relative to its Benchmark Index. As shown in the table below, through April 30, 2019, your Fund has surpassed its Benchmark Index for year-to-date, 1-year, 3‑ year, and 5-year performance measured at net asset value (“NAV”). In addition, your Fund has outperformed its Benchmark Index at market price for the year-to-date and 3‑year periods.

TOTAL RETURNS† BASED ON NET ASSET VALUE (through April 30, 2019)

| | | Name | YTD | 1 Year | 3 Year | 5 Year |

1 1940 Act § 16(a).

| | | Fund | 13.11% | 7.50% | 12.21% | 5.65% |

| | | Benchmark Index* | 8.90% | 6.71% | 7.77% | 4.84% |

TOTAL RETURNS† BASED ON MARKET PRICE (through April 30, 2019)

| Name | YTD | 1 Year | 3 Year | 5 Year |

| Fund | 16.35% | 5.79% | 11.69% | 4.67% |

Benchmark Index* | 8.90% | 6.71% | 7.77% | 4.84% |

| † Returns for periods of less than 1 year are not annualized. |

| * The Fund’s benchmark index is ICE BofAML US High Yield Index. The ICE BofAML U.S. High Yield Index tracks the performance of US dollar denominated below investment grade corporate debt publicly issued in the US domestic market. It is not possible to invest directly in an index. |

Past performance is not indicative of future results.

The Board Has Taken Actions to Address the Discount. Your Board has been proactive in monitoring the level of the Fund’s discount and in taking steps to narrow the difference between the market price of the Fund’s shares and their net asset value. The Trustees approved a share repurchase program that allows the Fund to repurchase its shares in the open market. The Fund repurchases shares pursuant to this program if the Adviser reasonably believes that such repurchases may enhance shareholder value. To date, the Fund has repurchased 876,388 shares.

Institutional Proxy Service Guidelines

The Board believes that the dynamics of closed-end funds are very different from those of operating companies in relation to classified boards, and this important difference needs to be taken into account in voting on the Shareholder Proposal. The Board believes that the institutional proxy service guidelines typically applied to classified board structures of operating companies should not apply to closed-end funds, which are more vulnerable to activist shareholders because of their relatively smaller capitalization as compared to exchange-listed operating companies.

If you utilize a proxy advisory firm, please consider carefully whether that firm’s recommendation takes into account the Board’s actions with regard to the Fund and the reasons for the Board’s opposition to this Shareholder Proposal. Investment advisers who have discretion to vote shares of the Fund held by their clients should independently assess the Board’s specific rationale for opposing this Shareholder Proposal when determining whether to follow the generic proxy voting guidelines issued by proxy advisory firms.

THE FUND’S BOARD, INCLUDING THE INDEPENDENT TRUSTEES, UNANIMOUSLY RECOMMENDS THAT SHAREHOLDERS VOTE “AGAINST” PROPOSAL 2.

Required Vote. Provided that a quorum is present at the Annual Meeting, either in person or by proxy, Proposal 2 must be approved by the holders of a majority of the shares cast.

Additional Information

Investment Adviser

IICO serves as the Fund’s investment adviser. IICO is a wholly owned subsidiary of WDR and is located at 6300 Lamar Avenue, P.O. Box 29217, Shawnee Mission, Kansas 66201-9217.

Administrator

Waddell & Reed Services Company, located at 6300 Lamar Avenue, Overland Park, Kansas 66202-4200, serves as the Fund’s administrator.

Further Information About Voting and the Annual Meeting

One-third of the outstanding shares of the Fund entitled to vote at the Annual Meeting shall constitute a quorum at the Annual Meeting for purposes of conducting business at the Annual Meeting. Abstentions and broker non-votes will be included for purposes of determining whether a quorum is present at the Annual Meeting.

The Board has fixed the close of business on June 25, 2019 as the record date for the determination of shareholders of the Fund entitled to notice of, and to vote at, the Annual Meeting. Shareholders of the Fund on that date will be entitled to one vote on each matter to be voted on for each share held and a fractional vote with respect to each fractional share with no cumulative voting rights.

Instructions regarding how to vote via telephone or the Internet are included on the enclosed WHITE proxy card. The required control number for Internet and telephone voting is printed on the enclosed WHITE proxy card. The control number is used to match proxy cards with shareholders’ respective accounts and to ensure that, if multiple proxy cards are executed, shares are voted in accordance with the proxy card bearing the latest date.

If you wish to attend the Annual Meeting and vote in person, you will be able to do so. If you intend to attend the Annual Meeting in person and you are a record holder of the Fund’s shares, in order to gain admission you will be required to show photographic identification, such as your driver’s license. If you intend to attend the Annual Meeting in person and you hold your shares through a bank, broker or other custodian, in order to gain admission you will be required to show photographic identification, such as your driver’s license, and satisfactory proof of ownership of shares of the Fund, such as your voting instruction form (or a copy thereof) or broker’s statement indicating ownership as of a recent date. If you hold your shares in a brokerage account or through a bank or other nominee, you will not be able to vote in person at the Annual Meeting unless you have previously requested and obtained a “legal proxy” from your broker, bank or other nominee and present it at the Annual Meeting.

All shares represented by properly executed proxies received prior to the Annual Meeting will be voted at the Annual Meeting in accordance with the instructions marked thereon or otherwise as provided therein. If any other business is brought before the Annual Meeting, your shares will be voted at the proxies’ discretion. If you sign the WHITE proxy card, but do not fill in a vote, your shares will be voted “FOR ALL” of the Funds’ Trustees and “AGAINST” the Shareholder Proposal, in accordance with the recommendation of the Board.

Shareholders who execute proxy cards or record their voting instructions via telephone or the Internet may revoke their proxies at any time prior to the time they are voted by giving written notice to the Secretary of the Fund, by delivering a subsequently dated proxy (including via telephone or the Internet) prior to the date of the Annual Meeting or by attending and voting at the Annual Meeting. Merely attending the Annual Meeting, however, will not revoke a previously submitted proxy.

Discretionary Voting

Broker-dealers that hold the Fund’s shares in “street name” for the benefit of their customers will request the instructions of such customers on how to vote their shares on the election of a Trustee. The Fund understands that, under the rules of the NYSE, such broker-dealer firms may for certain “routine” matters, without instructions from their customers and clients, grant discretionary authority to the proxies designated by the Board to vote if no instructions have been received prior to the date specified in the broker-dealer firm’s request for voting instructions. The election of a Trustee is a “routine” matter and beneficial owners who do not provide proxy instructions or who do not return a proxy card may have their shares voted by broker-dealer firms in favor of the proposal. Broker-dealers who are not members of the New York Stock Exchange may be subject to other rules, which may or may not permit them to vote your shares without instruction. We urge you to provide instructions to your broker or nominee so that your votes may be counted.

Because the Fund anticipates that the Shareholder Proposal will be contested, the Fund expects that broker-dealer firms holding shares of the Fund in “street name” for their customers will not be permitted by NYSE rules to vote on the Shareholder Proposal on behalf of their customers and beneficial owners in the absence of voting instructions from their customers and beneficial owners. As a result, the Fund expects to receive “broker non-votes” for Proposal 2 (i.e., shares held by brokers or nominees as to which (i) instructions have not been received from the beneficial owners or persons entitled to vote and (ii) the broker or nominee has discretionary voting power on a particular matter such as the election of trustees).

Proxy Solicitation

The Fund has contracted with Di Costa Partners (“DCP”) to assist with solicitation of proxies. The Fund anticipates that the cost of retaining DCP will be up to approximately $101,000.00, plus reimbursement of reasonable out-of-pocket expenses (which amount

is included in the estimate of total expenses below). DCP anticipates that approximately 25 of its employees or other persons will be involved in soliciting shareholders of the Fund.

In addition to solicitation services to be provided by DCP, the Fund’s officers and employees of the Fund’s investment adviser (none of whom will receive additional compensation therefor) may solicit proxies by telephone, mail, e-mail and personal interviews. Brokerage houses, banks and other fiduciaries may be requested to forward proxy solicitation material to their principals to obtain authorization for the execution of proxies, and will be reimbursed by the Fund for such out-of-pocket expenses.

Independent Registered Public Accounting Firm

Deloitte & Touche LLP (“Deloitte & Touche”) was selected as the Fund’s independent registered public accounting firm, to audit the accounts of the Fund for the fiscal year ended September 30, 2018. Representatives of Deloitte & Touche are not expected to attend the Annual Meeting. The Fund does not know of any direct or indirect financial interest of Deloitte & Touche in the Fund.

The following table shows the fees billed by Deloitte & Touche for audit and other services provided to the Fund for the fiscal years ended September 30, 2018 and 2017, respectively,

| | 2018 | 2017 |

Audit Fees(1) | $39,450 | $37,600 |

Audit-Related Fees(2) | - | - |

Tax Fees(3) | 4,455 | 4,325 |

All Other Fees(4) | - | - |

| Total | $43,905 | $41,925 |

(1)

| Audit fees category are those fees associated with the audit of the Fund’s annual financial statements or services that are normally provided in connection with statutory and regulatory filings or engagements and registration consents. All of the audit services for the fiscal years ended September 30, 2018 and 2017 were approved by the Audit Committee in accordance with its pre-approval policies and procedures. |

(2)

| Audit-related fees refer to the assurance and related services by the independent public accounting firm that are reasonably related to the performance of the Fund’s annual financial statements and are not otherwise included under the “audit fees” category above. |

(3)

| Tax fees refer to fees for professional services rendered by the registered principal accounting firm for tax compliance, tax advice and tax planning. |

(4)

| All other fees refer to fees related to internal control reviews, strategy and other consulting, financial information systems design and implementation, consulting on other information systems, and other tax services. |

Audit Committee’s Pre-Approval Policies and Procedures. The Fund’s Audit Committee pre-approves all audit services to be provided by the Fund’s independent registered public accounting firm. The Audit Committee pre-approves all non-audit services to be performed for the Fund by the Fund’s independent registered accounting firm; provided that the pre-approval requirement does not apply to non-audit services that (i) were not identified as such at the time of the pre-approval and (ii) do not aggregate more than 5% of total fees paid to the principal accountants by the Fund during the fiscal year in which the services are provided, if the Audit Committee approves the provision of such non-audit services prior to the completion of the audit.

The Audit Committee pre-approves all non-audit services to be performed by the Fund’s independent registered accounting firm for IICO, the Fund’s investment adviser (not including any sub-adviser whose role is primarily portfolio management and is subcontracted and overseen by IICO) or any entity controlling, controlled by, or under common control with IICO that provides ongoing services to the Fund if the engagement relates directly to the operations or financial reporting of the Fund; provided that the pre-approval requirement does not apply to non-audit services that (i) were not identified as such at the time of the pre-approval and (ii) do not aggregate more than 5% of total fees paid to the independent registered accounting firm by the Fund for all services and by IICO for non-audit services if the engagement relates directly to the operations or financial reporting of the Fund during the fiscal year in which those services are provided, if the Audit Committee approves the provision of such non-audit services prior to the completion of the audit.