As Submitted for Confidential Review to the Securities and Exchange Commission on February 13, 2014

Registration No. ________________

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT

UNDER THE SECURITIES ACT OF 1933

ARMADA WATER ASSETS, INC.

(Exact name of registrant as specified in its charter)

| Nevada | | 1389 | | 46-1255-999 |

(State or other jurisdiction of incorporation or organization) | | (Primary Standard Industrial Classification Code Number) | | (I.R.S. Employer Identification No.) |

2425 Fountain View Drive, Suite 300

Houston, Texas 77057

(832) 804-8312

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Maarten Propper

Chief Executive Officer

Armada Water Assets, Inc.

2425 Fountain View Drive, Suite 300

Houston, Texas 77057

(832) 804-8312

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Stephen M. Cohen, Esq. Stephen R. Brill, Esq. Fox Rothschild LLP 2000 Market Street Philadelphia, Pennsylvania 19103 (215) 299-2000 | | Mitchell S. Nussbaum, Esq. Angela M. Dowd, Esq. Loeb & Loeb, LLP 345 Park Avenue New York, New York 10154 (212) 407-4000 |

Approximate date of commencement of proposed sale to the public: As soon as practicable following the effectiveness of this Registration Statement.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box.¨

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering.¨

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer ¨ | Accelerated filer ¨ |

| | |

| Non-accelerated filer (Do not check if a smaller reporting company) ¨ | Smaller reporting company x |

CALCULATION OF REGISTRATION FEE

Title of Each Class of

Securities to be Registered | | Amount to be

Registered | | | Proposed

Maximum

Offering

Price Per Share | | | Proposed Maximum Aggregate Offering Price (1)(2) | | | Amount of Registration Fee (2) | |

| Common Stock(3) | | | | | | $ | | | | $ | | | | $ | | |

| Underwriter’s common stock purchase warrants(4)(5) | | | | | | $ | | | | $ | | | | | - | |

| Common stock included in underwriter’s common stock purchase warrants(3) | | $ | | | | $ | | | | $ | | | | $ | | |

| (1) | Estimated solely for purposes of calculating the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes shares that the underwriter has the option to purchase to cover over-allotments. See “Underwriting”. |

| (3) | Pursuant to Rule 416 under the Securities Act of 1933, as amended, the securities being registered hereunder include such indeterminate number of additional shares of common stock as may be issued after the date hereof as a result of stock splits, stock dividends or similar transactions. |

| (4) | No fee required pursuant to Rule 457(g) under the Securities Act of 1933, as amended. |

| (5) | Represents 5% of the shares to be sold in this offering including shares that may be sold upon exercise of the underwriter’s over-allotment option. The underwriter’s warrants are exercisable at a per share price equal to 125% of the common stock public offering price. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until the registration statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS | | SUBJECT TO COMPLETION | | DATED FEBRUARY 13, 2014 |

Shares

Common Stock

ARMADA WATER ASSETS, INC.

This is the initial public offering of Armada Water Assets, Inc. Prior to this offering, there has been no public market for our common stock. We anticipate that the initial public offering price of our shares of common stock will be between $ and $ per share.

We intend to apply to have our shares of common stock listed on the NYSE MKT under the symbol “ ”. No assurance can be given that such application will be approved.

We qualify as an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”) and, as such, may elect to comply with certain reduced public company reporting requirements for future filings. Please read the related disclosure on pages 29 and 30 of this prospectus.

Investing in our common stock involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus for a discussion of information that should be considered before investing in our common stock.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved the securities described herein or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

| | | Per Share | | | Total | |

| Public Offering Price | | $ | | | | $ | | |

| Underwriting discounts and commissions(1) | | $ | | | | $ | | |

| Proceeds to us, before expenses | | $ | | | | $ | | |

| (1) | The underwriter will receive compensation in addition to the underwriting discount. See “Underwriting” beginning on page 108 for a description of compensation payable to the underwriter by us. |

We have granted the underwriter an option to purchase up to an additional shares of our common stock from us at the public offering price, less the underwriting discounts and commissions, within 45 days from the date of this prospectus, to cover over-allotments of the shares, if any. If the underwriter exercises the option in full, the total underwriting discounts and commissions payable will be $ , and the total proceeds to us, before expenses, will be $ .

Delivery of the shares of common stock will be made on or about , 2014.

Aegis Capital Corp

The date of this prospectus is , 2014.

TABLE OF CONTENTS

| | Page |

| | |

| PROSPECTUS SUMMARY | 1 |

| | |

| RISK FACTORS | 11 |

| | |

| CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS | 32 |

| | |

| USE OF PROCEEDS | 32 |

| | |

| DETERMINATION OF OFFERING PRICE | 34 |

| | |

| DIVIDEND POLICY | 34 |

| | |

| CAPITALIZATION | 34 |

| | |

| DILUTION | 36 |

| | |

| MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 38 |

| | |

| BUSINESS | 49 |

| | |

| MANAGEMENT | 80 |

| | |

| EXECUTIVE COMPENSATION | 85 |

| | |

| SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 92 |

| | |

| CERTAIN RELATIONSHIPS AND RELATED PARTY TRANSACTIONS | 93 |

| | |

| DESCRIPTION OF SECURITIES | 95 |

| | |

| SHARES ELIGIBLE FOR FUTURE SALE | 106 |

| | |

| UNDERWRITING | 108 |

| | |

| LEGAL MATTERS | 118 |

| | |

| ADDITIONAL INFORMATION | 118 |

| | |

| INDEX TO CONSOLIDATED FINANCIAL STATEMENTS | 119 |

Please read this prospectus carefully. It describes our business, our financial condition and results of operations. We have prepared this prospectus so that you will have the information necessary to make an informed investment decision.

You should rely only on information contained in this prospectus. We have not, and the underwriter has not, authorized any other person to provide you with different information. This prospectus is not an offer to sell, nor is it seeking an offer to buy, these securities in any state where the offer or sale is not permitted. The information in this prospectus is complete and accurate as of the date on the front cover, but the information may have changed since that date. This prospectus may only be used where it is legal to offer and sell these securities.

Until , 2014 (the 25th day after the date of this prospectus), all dealers that effect transactions in these securities, whether or not participating in this offering, may be required to deliver a prospectus. This is in addition to the dealers’ obligation to deliver a prospectus when acting as underwriter, and with respect to their unsold allotments or subscriptions.

For investors outside the United States: Neither we nor the underwriter has done anything that would permit this offering or possession or distribution of this prospectus or any free writing prospectus we may provide to you in connection with this offering in any jurisdiction where action for that purpose is required, other than in the United States. You are required to inform yourselves about and to observe any restrictions relating to this offering and the distribution of this prospectus and any such free writing prospectus outside of the United States.

Industry and Market Data

In this prospectus, we rely on and refer to information and statistics regarding our industry. We obtained this statistical, market and other industry data and forecasts from publicly available information. While we believe that the statistical data, market data and other industry data and forecasts are reliable, we have not independently verified the data.

PROSPECTUS SUMMARY

This summary highlights information contained throughout this prospectus and is qualified in its entirety by reference to the more detailed information and financial statements included elsewhere herein. Because this is only a summary, it does not contain all of the information that may be important to you. You should carefully read the more detailed information contained in this prospectus, including our financial statements and related notes and the information set forth under the heading “Management’s Discussion and Analysis of Financial Condition and Results of Operations”. Our business involves significant risks. You should carefully consider the information under the heading “Risk Factors” beginning on page 11 of this prospectus.

As used in this prospectus, unless otherwise indicated, the terms “we,” “our,” “us,” “Company” and “Armada” refer to Armada Water Assets, Inc., and its subsidiaries

Overview

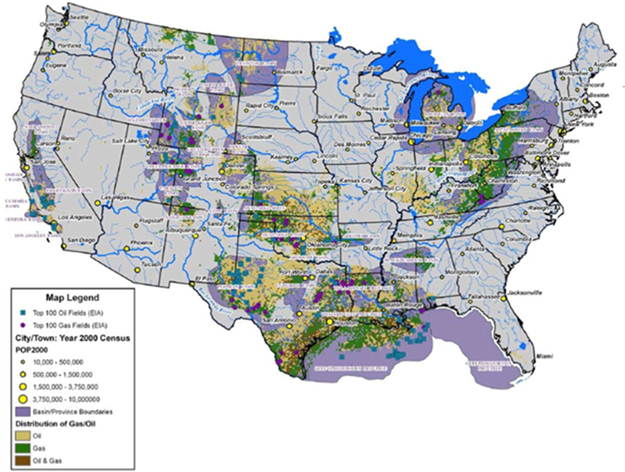

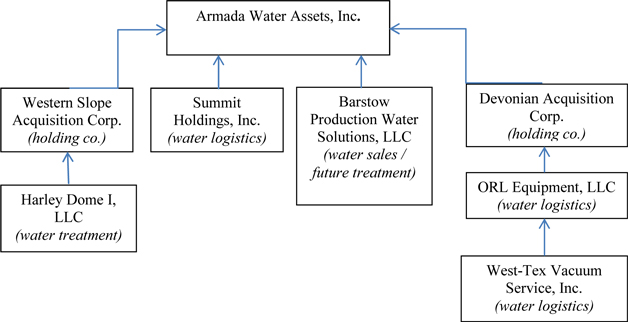

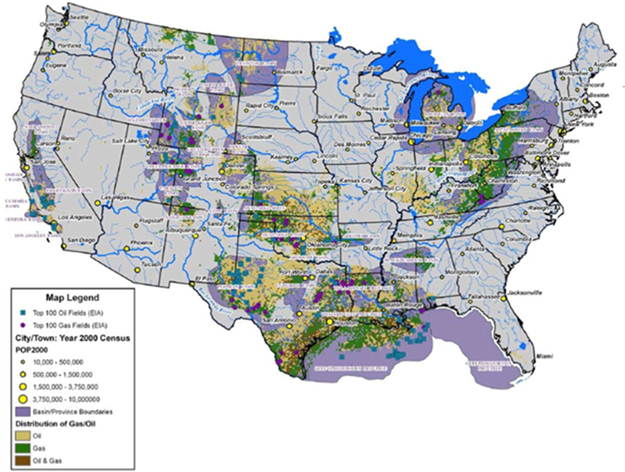

We are a newly-formed growth company that began operations in the first quarter of 2013 with the strategic objective of delivering aone-stop full water-cycle service solution consisting ofwater supply, treatment, disposal, handling and transport services, to the oil and gas industry. Our strategy was developed to capitalize on the growing demand for water supply and frac-flow back and produced water remediation services associated with the recent growth of, and technology changes within, the U.S. oil and gas industry.

During 2013, we acquired five businesses that we believe will form the basis for an all-inclusive operating platform of water supply, water logistics and water treatment solutions to the U.S. oil and gas industry. Through these acquisitions, we intend to offer a cost-effective, full water cycle service solution for the treatment and reuse of associated production water from producing oil and gas wells, as well as the flow-back water produced by hydraulic fracturing (often referred to as “frac-ing”) of geologic structures. We intend to do this by integrating and leveraging our prior acquisitions to organically expand the scope of our oil field services and to offer our proprietary water treatment solutions. We also intend to expand the size and scope of our service offerings through the further acquisition of established and synergistic businesses that provide for growth opportunities in key basins. The expected value drivers of our existing, and any future targeted businesses are: access to and development of proprietary treatment technologies and solutions; geographic proximity to active exploration and production fields; access to key customers that offer growth and cross-selling opportunities; and industry reputation and experience.

As we assemble, integrate and grow our operating platform, we are offering our customers a unique one-stop solution for their water supply, transport and treatment needs. When fully developed, we believe that our all- inclusive model will offer a compelling value proposition not otherwise readily available in the market, by materially reducing water transportation, disposal and procurement costs and further enabling the promotion of environmental responsibility and stewardship.

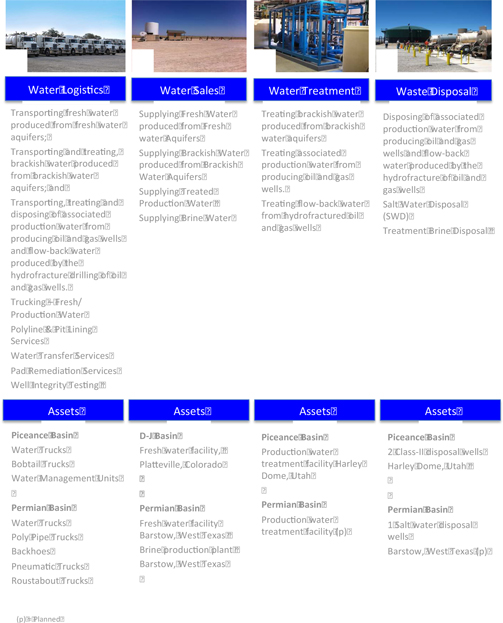

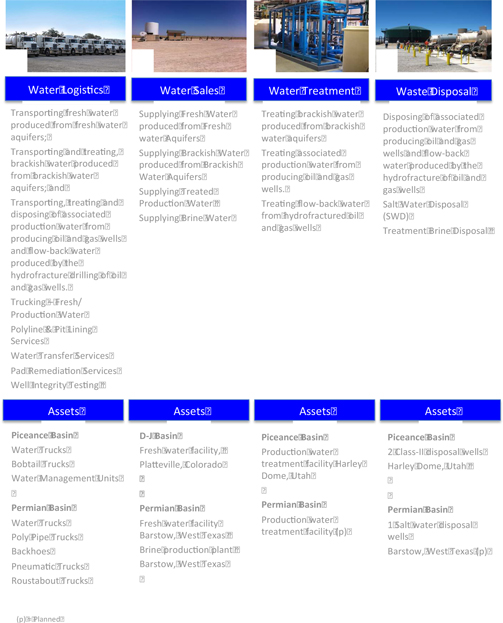

We are a service company organized along four distinct service lines: Water Logistics, Water Sales, Water Treatment and Water Disposal. Together these business lines offer our customers a full-service model for their oil-field water management needs. We currently serve customers in three key oil and gas basins – Permian, Peceance and DJ.

Our business lines are described in the chart below:

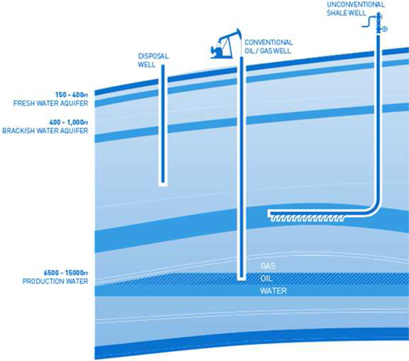

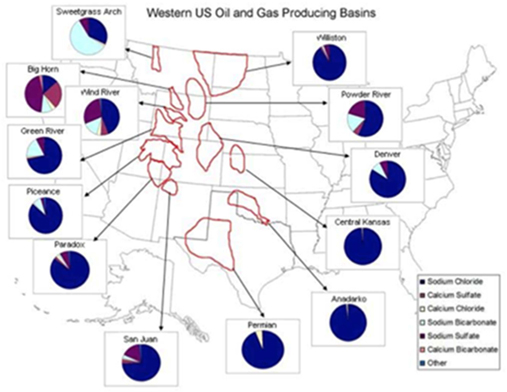

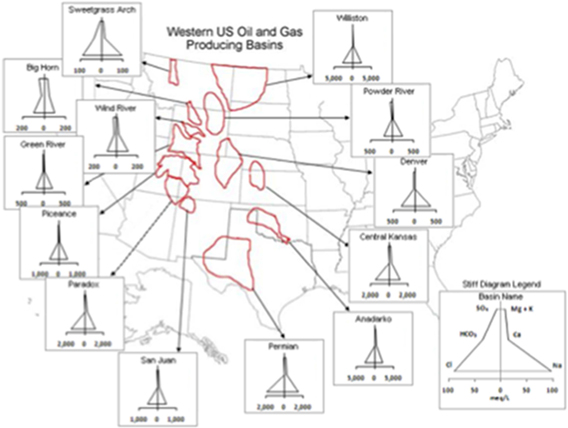

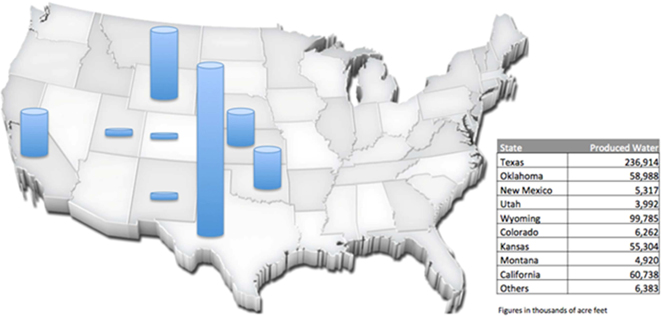

Industry and Market

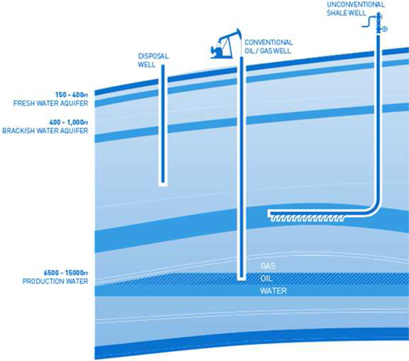

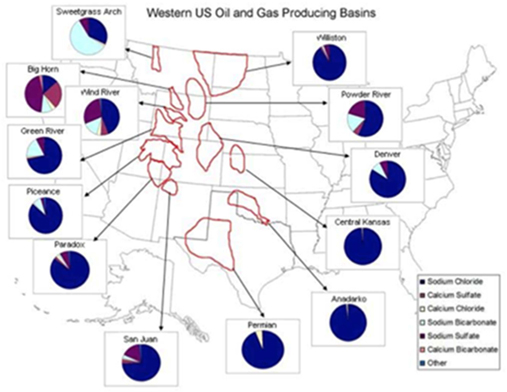

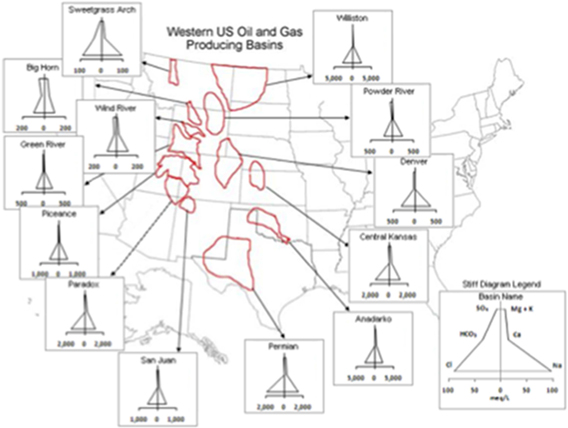

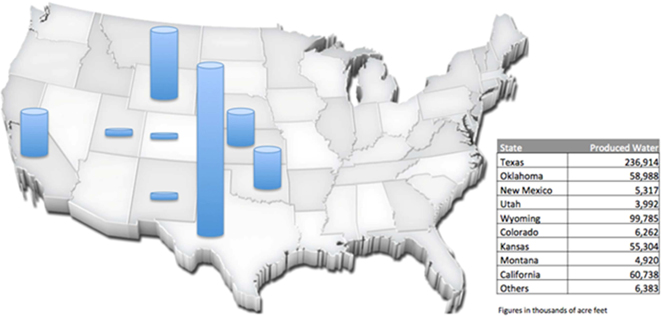

The market for water treatment in the U.S. oil and gas industry is very large and growing. According to the U.S. Energy Information Agency1, in 2009 there were an estimated 1,090,000 oil and gas wells producing about 21 billion barrels (bbl) of contaminated water annually in North America alone. In 2009, for every one barrel of oil and gas produced in the U.S. there was, on average, 7.6 barrels of produced water (i.e., water accompanying oil and gas extracted from wells). This ratio is expected to grow to approximately 12 barrels of produced water for every barrel of oil by 2015. The amount of produced water, and the contaminants and their concentrations present in produced water usually vary significantly over the lifetime of a field.

The handling, transportation, procurement, and disposal of production water and flow-back water in the oil and gas industry is one of the most significant short and long-term operational challenges facing every major and independent oil company that uses frac-ing techniques. This is particularly the case as handling, transporting, procuring and disposing of production water and flow-back water are some of the most material long term operational costs facing oil and gas operations. Transportation is believed to be the single largest cost for the producers, with industry sources estimating that: approximately 76% of transportation costs attributable to produced and flow-back waters; and approximately 26% of oil production costs attributable to the disposal of produced and flow-back water.

According to a study by Lux Research2, the flow back water cleanup market from hydraulic fracturing is forecast to grow nine-fold to $9 billion in 2020, a 28% annual growth rate, while in addition, the total value of the produced water market is set to grow from $5.0 billion in 2010 to $9.9 billion in 2025 - a compound annual growth rate of 4.7%.

For the first time, the oil and gas industry is now accepting that production water and flow-back water can be successfully treated, recycled and reused in hydraulic fracturing operations, thereby minimizing use of precious groundwater and underground water aquifers and the attendant costs. The residual oils, concentrated brine and “clean” water are all marketable commodities generated by the treatment process. We believe that production water and flow-back water can be delivered to central locations and efficiently and profitably separated into marketable derivatives; all to the benefit of the industry and the environment.

1 U.S. Energy Information Administration,United States Total Distribution of Wells by Rate Bracket, December 2012.

2 Lux Research,Risk and Reward in the Frack Water Market, May 2012.

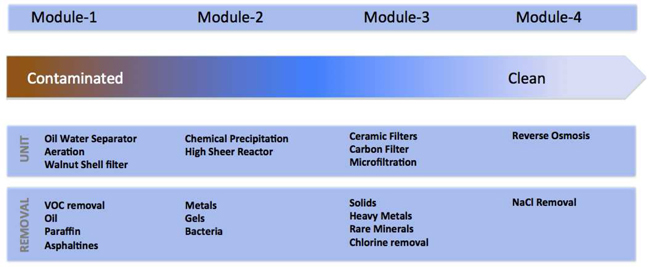

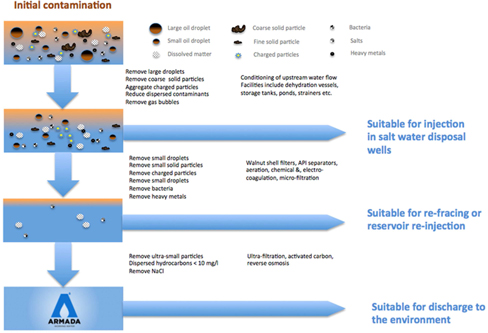

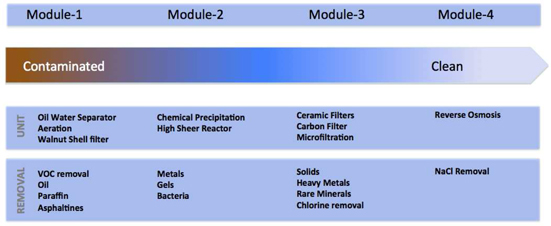

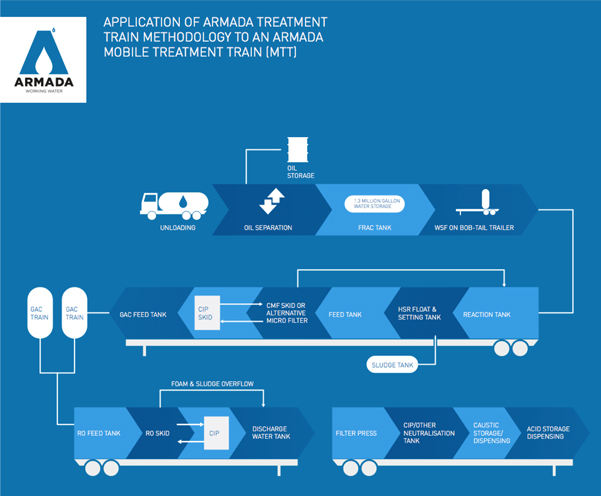

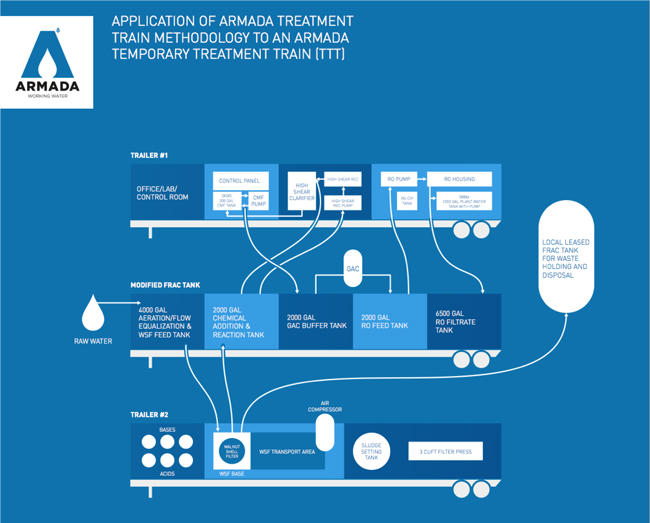

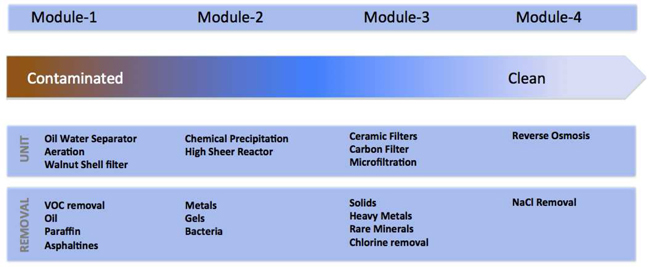

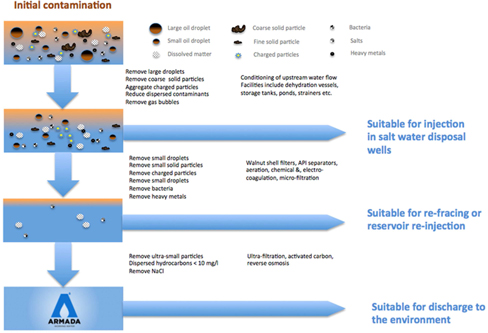

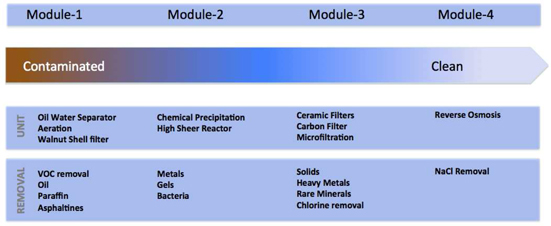

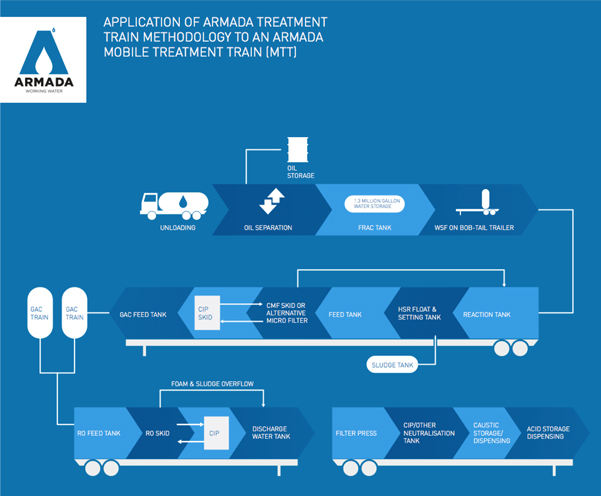

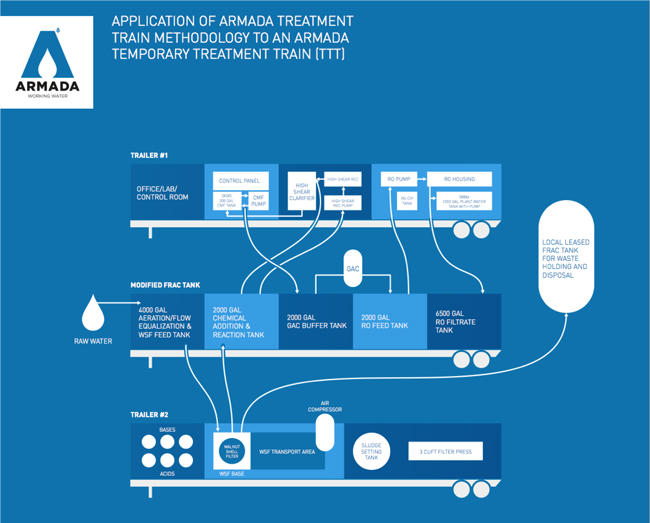

Our Water Treatment Solutions: The Armada Treatment Train System

We have recently completed construction of our first water treatment facility at our Harley Dome site. This facility houses our first generation proprietary “treatment train” system through which we intend to offer water treatment solutions that enable the complete treatment of contaminated production water and frac-flowback water. We expect to offer these solutions by using a “treatment train” system that consists of proprietary and sequenced processes, systems and equipment. Our treatment train has been designed with a modular approach incorporating separate components that can be serviced or interchanged without operational interruptions. This is intended to minimize footprint, reduce operating costs and to optimize operational efficiency. The treatment train combines a number of existing separation technologies, together with a proprietary mixing methodology to deliver an efficient cost-effective system that is scalable according to operational needs. At the heart of our treatment train system is an innovative high sheer reactor, which acts as a molecular accelerator, dynamically accelerating the natural vibration and spin of molecules in the process stream, which decreases the energetic barriers to separation. The proprietary process, when coupled with conventional separation techniques, is expected to produce a significant decrease in overall energy consumption, thereby significantly reducing operating and capital costs.

We are in the process of commissioning our first generation treatment train at our Harley Dome site. This includes initial stage mechanical and systems testing, with limited scale production runs. Commercial scale testing and customer deployment are expected by the second quarter of 2014. In addition, we are also in the design/engineering phase of the development of a second-generation treatment train and prototype test units are expected to be deployed in the third quarter of 2014.

Strengths and Competitive Advantages

We believe that the following are the strengths and competitive advantages of our company:

| · | Our proprietary treatment technology for produced and frac-flowback water has a cost structure that is competitive with current water disposal and handling practices. |

| · | Our holistic approach to our water treatment solutions ensures maximum operational flexibility for our customers while minimizing equipment footprint and operating costs and optimizing capital employed. |

| · | Our all-inclusive water-cycle service solution will materially reduce our customers’ water transportation, disposal and procurement costs, and we believe is unique to our competitive peer group in its breadth of coverage as most of our competitors do not offer a complete menu of oil field and water treatment solutions. |

| · | Our initial acquisitions provide a platform upon which material cross-selling opportunities may be realized along multiple lines of businesses and customers. |

| · | The customer base and relationships that our acquired oil field services and logistics businesses have should enable us to gain market awareness among significant targeted customers and accelerate the commercialization of our water treatment solutions. |

| · | Our management has extensive experience in the oil and gas service industry. We expect this will enable us to facilitate the execution of our business plan in the rapidly evolving produced and frac-flowback water segment of the oil and gas industry. |

Risk Factors

Investing in these securities involves a high degree of risk. As an investor you should be able to withstand a complete loss of your investment. You should carefully consider the information set forth in the “Risk Factors” section beginning on page 11 of this prospectus.

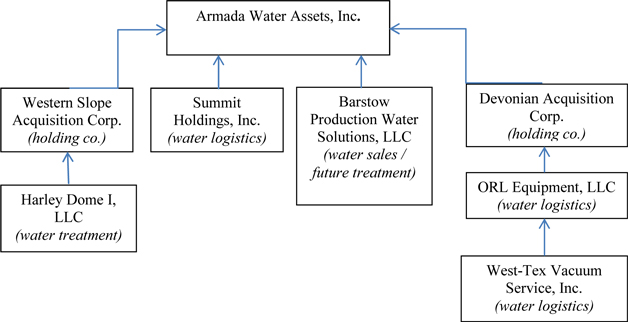

Company Data and Organizational Chart

Our principal executive offices are located at 2425 Fountain View Drive; Suite 300, Houston, Texas, and our telephone number is (832) 804-8312. We maintain a website at www.armadawater.com. Information contained on our website does not constitute part of this prospectus.

The Offering

| Common stock outstanding: | 7,451,588 shares (1) |

| Common stock offered by us: | shares |

| Over-allotment option to be offered by us | We have granted the underwriter the right to purchase up to additional shares of common stock from us at the public offering price less the underwriting discount within 45 days from the date of this prospectus to cover over-allotments. |

| Common stock to be outstanding after this offering: | shares (2) |

| Use of proceeds: | We intend to use the proceeds from this offering to satisfy certain indebtedness incurred by us in connection with our acquisitions, to repay certain short-term bridge notes, to pay the costs incurred in connection with the construction of our water treatment facility, for the continued technical and commercial development of our treatment train system, towards other capital expenditures, and for working capital and general corporate purposes. Please refer to the section entitled “Use of Proceeds” for additional information. |

| Underwriter Compensation Warrants | We will issue to the underwriter, upon closing of this offering, compensation warrants entitling the underwriter to purchase 5.0% of the aggregate number of shares of common stock issued in this offering, including shares issued pursuant to the exercise of the overallotment option. The underwriter warrants will have a term of five years and may be exercised commencing 12 months after the date of effectiveness of the Registration Statement on Form S-1 of which this prospectus forms a part. |

| Dividend policy | We do not anticipate declaring or paying any cash dividends on our common stock following our initial public offering. |

| Risk factors | Investing in our securities involves a high degree of risk. See “Risk Factors” beginning on page 11 of this prospectus. |

| Market for our Securities | We intend to apply for the listing of our common stock on NYSE MKT under the symbol “ ”. |

| Transfer Agent and Registrar | Island Stock Transfer |

(1) We recently completed a 1 for 3 reverse stock split of our common stock, whereby the holders of our common stock received one share of common stock for every three shares owned by such holders. Unless otherwise indicated in this prospectus, all numbers are reflected on a post-split basis.

The number of shares of our common stock to be outstanding immediately after this offering as shown above assumes: (i) that all of the shares offered hereby are sold; and (ii) that $2.5 million in principal amount of our convertible promissory notes are converted into additional shares of common stock, and is based on 7,451,588 shares of common stock outstanding as of February 6, 2014. This number of shares does not include shares of our common stock subject to the underwriter’s over-allotment option and also excludes the following:

| · | 808,333 shares of our common stock issuable upon exercise of stock options outstanding as of February 6, 2014, at a weighted average exercise price of $ ; |

| · | 2,000,000 shares of our common stock available for future awards pursuant to our long-term incentive plan; |

| · | 29,167 shares of our common stock issuable to certain officers upon completion of our initial public offering; |

| · | shares of our common stock issuable upon conversion, if at all, of our outstanding shares of Series A, Series B, Series C and Series D Preferred Stock; |

| · | shares of our common stock issuable upon the election of the holders, if at all, of$2.5 million principal amount of our indebtedness issued in connection with our acquisition of our Summit business unit; and |

| · | 272,500 shares of our common stock issuable upon exercise, if at all, of common stock purchase warrants outstanding as of February 6, 2014, at a weighted average exercise price of $ . See “Description of Securities.” |

(2)The number of shares of our common stock to be outstanding immediately after this offering as shown above assumes that all of the shares offered hereby are sold, but does not include shares of our common stock subject to the underwriter’s over-allotment option.

Summary Consolidated Financial Data

The following table sets forth our summary consolidated statement of operations data for the nine months ended September 30, 2013 and 2012, derived from our unaudited consolidated financial statements and related notes included elsewhere in this prospectus. Our financial statements are prepared and presented in accordance with generally accepted accounting principles in the United States. The results below in the statement of operations table include our historical results combined with those of our predecessors and are not necessarily indicative of the results to be expected for any future periods and our interim results are not necessarily indicative of the results to be expected for the full fiscal year. The pro forma as adjusted consolidated statement of operations include the shares issuable in this prospectus as if it occurred at the beginning of the period and the consolidated balance sheet data reflects the balance sheet data at September 30, 2013 as adjusted to reflect the issuance of shares of common stock in this offering at a price of $ per share. You should read this information together with the sections entitled “Capitalization,” “Management’s Discussion and Analysis of Financial Condition & Results of Operations” and our consolidated financial statements and related notes included elsewhere in this prospectus.

(dollars in thousands, except share and per share data)

| Statement of Operations Data: | | For the Nine

Months

Ending

September 30, | | | For the Nine

Months

Ending

September 30, | |

| | | 2013 | | | 2012 | |

| | | | | | | |

| Revenues | | $ | 12,518 | | | $ | 4,576 | |

| Total Operating Expenses | | | 17,051 | | | | 4,844 | |

| Loss from Operations before Non-Operating Expenses | | | (4,533 | ) | | | (268 | ) |

| Non-Operating Expenses | | | (874 | ) | | | (1 | ) |

| Pro-forma net (loss) | | $ | (5,407 | ) | | $ | (269 | ) |

| Pro-forma net (loss) per share of common stock | | $ | (1.02 | ) | | $ | (0.19 | ) |

| Basic and diluted weighted average shares of common stock outstanding used in computing net (loss) per share | | | 5,320,050 | | | | 1,387,833 | |

Balance Sheet Data:

| | | As of | |

| | | September 30, 2013 | |

| | | | | | Pro Forma | |

| | | Actual | | | As Adjusted(1)(2)(3) | |

| Cash and Cash Equivalents | | $ | 931,987 | | | $ | | |

| | | | | | | | | |

| Total Current Assets | | | 3,390,723 | | | | | |

| | | | | | | | | |

| Total Assets | | | 32,503,768 | | | | | |

| | | | | | | | | |

| Total Current Liabilities | | | 9,111,445 | | | | | |

| | | | | | | | | |

| Long Term Liabilities | | | 11,504,386 | | | | | |

| | | | | | | | | |

| Total Stockholders’ Equity | | $ | 11,567,937 | | | $ | | |

(1) A $1.00 increase (decrease) in the assumed initial public offering price of $ per share of our common stock, the midpoint of the estimated price range set forth on the cover of this prospectus, would increase (decrease) each of cash, total assets, and total stockholders’ equity by $ million, assuming the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same, and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us.

(2) Gives effect to the automatic conversion of $2,500,000 principal amount of convertible promissory notes into an aggregate of shares of common stock.

(3) Gives further effect to the issuance and sale of shares of common stock in this offering at the assumed initial public offering price of $ per share, the midpoint of the price range listed on the cover page of this prospectus, after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Each $1.00 increase (decrease) in the assumed initial public offering price of $ per share would increase (decrease) the pro forma as adjusted amount of each of cash and cash equivalents, working capital, total assets and total stockholders’ equity (deficit) by approximately $ , assuming that the number of shares offered by us, as set forth on the cover page of this prospectus, remains the same and after deducting estimated underwriting discounts and commissions and estimated offering expenses payable by us. Similarly, each increase (decrease) of 1.0 million shares in the number of shares offered by us at the assumed initial public offering price would increase (decrease) each of cash and cash equivalents, working capital, total assets and total stockholders’ equity (deficit) by approximately $ . The pro forma information discussed above is illustrative only and will be adjusted based on the actual initial public offering price and other terms of our initial public offering determined at pricing.

RISK FACTORS

An investment in our common stock involves a high degree of risk. You should carefully consider the following risk factors in addition to other information in this prospectus before purchasing our common stock. The risks and uncertainties described below are those that we currently deem to be material and that we believe are specific to our company, our industry and our stock. In addition to these risks, our business may be subject to risks currently unknown to us. If any of these or other risks actually occurs, our business may be adversely affected, the trading price of our common stock may decline and you may lose all or part of your investment.

Risks Related to Our Operations

We have acquired a number of businesses to form our operating platform, all of which must be integrated in our all-inclusive operating model.

During 2013, we implemented our business plan by acquiring a number of businesses and business opportunities that will form the foundation of our operating platform. Many of these acquired entities were suffering losses at the time we acquired them. Until we can reorganize and integrate these various businesses to create our planned all-inclusive operating model, and until we have the capital necessary to implement our business plan, we will continue to remain an early-stage stage company presenting material risks of investment. Although our management remains optimistic at our opportunities for growth and profits, we have a very limited history of operations upon which to evaluate our future prospects. We have a need to integrate diverse business units, an uncertain ability to develop commercial service offerings, and a history, although brief, of operating losses and significant capital needs. We are, in addition, faced with all of the risks associated with a company in the early stages of development.

We are subject to significant operating risks.

Our business is subject to numerous additional risks associated with a relatively new, low-capitalized company engaged in our business sector. Such risks include, but are not limited to, competition from well-established and well-capitalized companies, risks associated with pricing, volumes, drilling methods and continued demand within the oil and gas industry, regulatory and environmental risks, as well as unanticipated difficulties regarding the marketing and sale of our services. There can be no assurance that we will ever generate significant commercial sales or achieve profitability. Should this be the case, our common stock could become worthless and investors in our common stock or other securities could lose their entire investment.

In order to carry out our intended business plan, we will require the funding provided from this offering. As well, in order to continue our growth in the future, we will likely require significant additional funding to fund new acquisitions, and for the acquisition and development of new water treatment technologies and facilities. There is no guarantee that we will be able to raise any additional capital and we have no current arrangements for any such financing. The inability to obtain any such funding could materially affect our longer-term ability to implement our business plan.

We have a limited operating history and may never achieve profitability.

As of the date of this prospectus, we have limited financial information on which to evaluate our prospects. We had no operations in 2012 as our principal operations commenced in 2013; thus our 2012 historic audited financial statements provide no meaningful financial information about us.

For the nine months ended September 30, 2013, we incurred a net loss of $2.951 million on revenues of $6.074 million, and had a working capital deficit of $5.72 million. We do not believe, however, that our 2013 interim financial statements provide information meaningful to an understanding of our future prospects, since through September 30, 2013: (i) we remained in the early-stage of our development, having acquired our first operating businesses in February 2013; and (ii) during the periods presented our results of operations were generally not burdened by the significant expenses which we have only recently begun to incur as a result of our building the infrastructure necessary to operate as a larger enterprise with an anticipated public market, including the expense of building out our management team and the legal and accounting cost of our recent acquisition and financing activities.

We do not believe that the accompanying pro forma and historic financial statements of our acquired businesses, provide information meaningful to an understanding of our future prospects as, among others: (i) certain of these businesses were acquired not for their stand-alone earnings capacity, but rather for specific management, process, know-how or customer opportunities; and (ii) we have implemented a significant restructuring and reorganization of our various acquired businesses as we attempt to integrate and rationalize our diverse service offerings to create an all-inclusive operating platform.

Our operating losses and working capital deficit have raised substantial doubt regarding our ability to continue as a going concern.

Our operating losses and working capital deficit experienced during our early stages of operations raise substantial doubt about our ability to continue as a going concern. The perception of our ability to continue as a going concern may make it more difficult for us to obtain financing for the continuation of our operations and could result in the loss of confidence by investors, suppliers and employees.

The absence of any significant operating history for us makes forecasting our future revenue and expenses difficult, and we may be unable to adjust our spending in a timely manner to compensate for unexpected revenue shortfalls or unexpected expenses.

As a result of our limited consolidated operating history, it is difficult to accurately forecast our future revenue. In addition, we have limited meaningful historical financial data upon which to base planned operating expenses. Current and future expense levels are based on our operating plans and estimates of future revenue. Revenue and operating results are difficult to forecast because they generally depend on our ability to promote and sell our services. As a result, we may be unable to adjust our spending in a timely manner to compensate for any unexpected revenue shortfall, which would result in further substantial losses. We may also be unable to expand our operations in a timely manner to adequately meet demand to the extent it exceeds expectations.

We incurred substantial purchase money and other indebtedness in connection with our recent acquisitions.

In connection with our recent acquisitions of Barstow, Devonian and Western Slope, we issued purchase money notes in an aggregate amount of $7,500,000, of which approximately $6,625,000 in principal amount remains outstanding. These notes mature during February and April of 2016, respectively, and require quarterly payments of interest and principal thereunder to the extent of 25% of the respective stand-alone cash flow of Barstow, Devonian and Western Slope. Further, we are required to make an aggregate of approximately $3 million of mandatory prepayments on these notes to the extent any public offering yields net proceeds in excess of $15 million. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations-Background and Basis of Presentation.”

Further, in connection with our recent acquisition of Summit in June 2013, we issued purchase money indebtedness in an aggregate amount of $4,500,000, of which: (i) we have paid $1,323,346 in cash to date; (ii) we issued two promissory notes in an aggregate principal amount of $2,500,000, maturing in September 2016, and that through September 2014, are convertible into shares of our common stock at the price at which our common shares are sold in this offering; and (iii) we agreed to pay the balance of approximately $775,000 in installments during 2014, with $300,000 due upon completion of this offering.

In addition to the purchase money indebtedness issued, certain of our target businesses were acquired subject to additional indebtedness. ORL is obligated to repay, and we agreed to guaranty, a $1,250,000 revolving line of credit maturing on April 8, 2014, and a term loan in the principal amount of $650,000 maturing on February 8, 2018. Harley Dome is obligated to repay monthly interest and principal under a $1,000,000 purchase money note, the discounted principal balance of which is approximately $600,000. Harley Dome was also acquired subject to a mechanics lien in the amount of approximately $897,000. Western Slope is also obligated to pay $300,000 under a promissory note maturing on December 15, 2014 issued in connection with the prior acquisition of UB Water.

We have committed to make certain earnout payments in connection with our prior acquisitions.

In connection with our prior acquisitions, we have agreed to assume the obligation to pay the former owners of Barstow, Devonian and Harley Dome quarterly earnout payments over a period of five years equal to 20% of the amount by which the separate earnings before interest, taxes, depreciation and amortization (“EBITDA”) of Barstow, Devonian and Harley Dome exceed $2 million, $4 million and $3 million, respectively. The foregoing earnouts will require us to pay a portion of our cash flow so long as the necessary thresholds are met, which will reduce the amount of cash flow generated from operations that we may use to implement our business plan.

We may be required to repay our $1 million Summit Credit Facility.

In addition to the purchase money indebtedness issued as part of the acquisition, Summit was acquired under and subject to a $1,000,000 credit facility maturing on April 5, 2014. As of January 31, 2014, the outstanding balance of the credit facility was $889,030; however, the facility remained in technical default as our acquisition of Summit constituted a prohibited change of control under the facility. Although we have spoken with Summit’s lender and do not believe they intend to exercise any default rights, the technical default does expose us to a risk that Summit’s lender could assert a right of default and insist upon immediate acceleration of the credit facility.

We are party to a legal proceeding related to unpaid constructions costs by the former general contractor of our Utah property.

ER&PWD Joint Venture, LLC, a subsidiary of our Harley Dome business unit, is a party to a lawsuit related to unpaid construction costs charged by subcontractors in the construction of our Utah-based waste treatment facility. See “Business-Legal Proceedings.” ER&PWD was an early-stage participant in the organization of the waste treatment project, however, was neither the title owner nor a developer of the project. Third parties that served as general contractors of the project are also parties to the lawsuit. As ER & PWD had virtually no role in the project, we do not believe we are legally responsible for the damages asserted. Rather, we believe that the general contractors of the project are responsible for payment of the claims asserted, as they were responsible for hiring the sub-contractors and administering the project. Accordingly, we will vigorously defend against these claims. However, in connection with the lawsuit, a mechanics lien has been placed on the property on which the facility is located. In addition to the risk of a foreclosure, this encumbrance could also limit us in our efforts to raise capital or use the property as collateral in a loan transaction. While there is currently one proceeding outstanding related to this matter, there were additional unpaid subcontractors involved in the project and we cannot provide any assurance that such subcontractors will not file actions against us in the future.

If the foregoing case is not settled on terms favorable to us, we would continue to incur significant costs defending against this claim. The outcome of this legal proceeding is inherently uncertain and could be unfavorable to us.

Risks Related to our Acquisition Strategy

We may not be able to grow successfully through future acquisitions or successfully manage future growth.

Our business strategy includes growth through the acquisitions of other complementary businesses. We have previously acquired several businesses, many of which were losing money at the time of such acquisitions, to incorporate into our business plan. We may not be able to identify attractive acquisition opportunities or successfully acquire those opportunities identified. In addition, we may not be successful in integrating current or future acquisitions into our existing operations, which may result in unforeseen operational difficulties or diminished financial performance or require a disproportionate amount of our management’s attention. Even if we are successful in integrating our current or future acquisitions into our existing operations, we may not derive the benefits, such as operational or administrative synergies or earnings gains, that we expected from such acquisitions, which may result in the commitment of our capital resources without the expected returns on such capital. Also, competition for acquisition opportunities may escalate, increasing our cost of making further acquisitions or causing us to refrain from making additional acquisitions.

We may need to raise further capital to finance our acquisition strategy.

Our business strategy includes growth through the acquisitions of other complementary businesses. In order to complete acquisitions, we will need to raise additional funds in the future, and such funds may not be available on commercially reasonable terms, if at all. If we cannot raise enough funds on acceptable terms, we may not be able to fully implement our business plan, take advantage of future opportunities, or respond to competitive pressures or unanticipated requirements. This could seriously harm our business, financial condition and results of operations.

We depend on our management, without whose services our business operations could be adversely affected or cease.

At this time, our management is wholly responsible for the development and execution of our business plan. If our management should choose to leave us for any reason before we hire additional personnel, our operations could be adversely effected. Even if we are able to find additional personnel, it is uncertain whether we could find qualified management who could develop our business along the lines described herein or would be willing to work for compensation that we could afford.

We will need to increase the size of our organization, and may experience difficulties in managing growth.

We are a small company with a limited management team, and limited corporate infrastructure. We expect to continue to experience a period of significant expansion in headcount, facilities, infrastructure and overhead to address potential growth and market opportunities and to meet our new reporting requirements under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Future growth will impose significant added capital requirements, as well as added responsibilities on members of management, including the need to identify, recruit, maintain and integrate new personnel. Our future financial performance and our ability to compete effectively will depend, in part, on our ability to manage any future growth effectively.

We expect our operating expenses to increase substantially in the future as we attempt to grow our business, and we may need to raise additional funds to meet the demands of growth initiatives.

We expect that our operating expenses will increase substantially over the next 12 months as we endeavor to implement growth initiatives, both organically and through acquisitions. As a result, we may need to raise additional funds in the future, and such funds may not be available on commercially reasonable terms, if at all. If we cannot raise funds on acceptable terms, we may not be able to implement our business plan, take advantage of future opportunities, or respond to competitive pressures or unanticipated requirements. This could seriously harm our business, financial condition and results of operations.

In order to meet our capital needs, we may be required to make additional borrowings or be required to issue new debt securities in the capital markets. We can provide no assurances that we will be able to access the debt capital markets or do so on favorable terms. If new debt is added to our current debt levels, the related risks we now face could intensify, limiting our ability to refinance existing debt on favorable terms. We will depend primarily on operations to fund our expenses and to pay the principal and interest on our outstanding debt. Our ability to meet our expenses thus depends on our future performance, which will be affected by financial, business, economic, competitive, legislative, regulatory and other factors beyond our control. If we do not have enough money to pay the principal and interest on our outstanding debt, we may be required to refinance all or part of our existing debt, sell assets, borrow additional funds or sell additional equity. If our business does not generate sufficient cash flow from operations or if we are unable to incur indebtedness sufficient to enable us to fund our liquidity needs, we may be unable to plan for or respond to changes in our business that would prevent us from maintaining or increasing our business and cause our operating results and prospects to be affected adversely.

We may not be able to fully develop the water treatment solutions we are presently targeting.

We believe that one of our competitive advantages will be our ability to develop an all-inclusive oil field services business that offers proprietary and innovative water treatment systems and solutions. Towards that end, we have started the commissioning phase of our Harley Dome water treatment facility that includes a proprietary treatment train system for the treatment of contaminated production and flow-back water. We are also seeking to acquire other treatment and servicing solutions and technologies as we expand our business. These solutions, and other similar water remediation technologies, are a material component of our planned business model.

We are still in the initial testing phase of our treatment train system, and we have yet to fully deploy the facility or test the treatment train system at expected operating volumes; neither have we engaged independent engineers or our own personnel to conduct testing to determine long-term effectiveness; nor deployed these solutions with any customers to determine commercial acceptance. Accordingly, we can offer no assurances as to the long-term effectiveness or commercial viability thereof.

Our proposed water treatment solutions are unproven and may not achieve widespread market acceptance among our prospective customers. If we are unable to sell our water treatment systems, our business will suffer.

Our proposed water treatment systems and solutions have not been proven in a commercial context. Our solutions and processes for water treatment will compete with other forms of water treatment technologies that currently are in operation throughout the United States. Our water treatment solutions and the systems on which they are based may not achieve widespread market acceptance. Our success will depend on our ability to market our system and services to businesses on terms and conditions acceptable to us and to establish and maintain successful relationships with various water providers and state regulatory agencies.

We believe that market acceptance of our system will depend on many factors including:

| · | our current and future relationships with market participants within the oil and gas industry; |

| · | our team of experienced professionals; |

| · | the perceived advantages of our system over competing water treatment solutions; |

| · | the safety and efficacy of our system; |

| · | the availability of alternative water treatment solutions; |

| · | the pricing and cost effectiveness of our system; |

| · | our ability to access businesses and water providers that may use our system; |

| · | the effectiveness of our sales and marketing efforts; |

| · | publicity concerning our system and technology or competitive solutions; |

| · | timeliness in assembling and installing our system on or near customer sites; |

| · | our ability to respond to changes in regulations; and |

| · | our ability to provide effective service and maintenance of our systems to our customers’ satisfaction. |

If our system fails to achieve or maintain market acceptance or if new technologies are introduced by others that are more favorably received than our systems, are more cost effective, or otherwise render our systems obsolete, we may not be able to sell our systems. If we are unable to sell our systems, our business and prospects would suffer.

Our operations are subject to extensive environmental laws and regulations. Our operating costs may increase as a result of complying with environmental laws and regulations. We also could incur substantial costs as a result of violations of or liabilities under such laws and regulations.

Our existing and planned water operations are subject to extensive federal, state and local laws and regulations, which govern the protection of the environment, health and safety, water allocation rights, and the manner in which we collect, treat, discharge and dispose of wastewater. These requirements include the United States Clean Water Act of 1972, which we refer to as the “Clean Water Act”. We may also be required to obtain various environmental permits from regulatory agencies for our operations. Certain of these permits require substantial lead time to obtain and, once obtained, require that certain compliance tasks must be completed on a regular basis in order to maintain such licenses. State regulatory agencies also set conditions and standards for the water and wastewater services we deliver. If we deliver water or wastewater services to our customers that do not comply with regulatory standards, or otherwise violate environmental laws, regulations or permits, or other health and safety and water quality regulations, we could incur substantial fines, penalties or other sanctions or costs or damage to our reputation. In the most serious cases, regulators could force us to discontinue operations. We will incur substantial operating and capital costs on an ongoing basis to comply with environmental laws and regulations and other health and safety and water quality regulations. These laws and regulations, and their enforcement, have tended to become more stringent over time, and new or stricter requirements could increase our costs.

Although we may seek to recover ongoing compliance costs in our pricing, there can be no guarantee that such pricing may be sustained in the marketplace. We may also incur liabilities under environmental laws and regulations requiring us to investigate and clean up environmental contamination at our properties or at off-site locations where we have disposed of waste or caused adverse environmental impacts. The discovery of previously unknown conditions, or the imposition of cleanup obligations in the future, could result in significant costs, and could adversely affect our financial condition, results of operations, cash flow and liquidity. Such remediation losses may not be covered by our insurance policies and may make it difficult for us to secure insurance in the future at acceptable rates. If any remediation losses that are not covered by insurance are excessive, we may be required to significantly curtail our operations.

Our business depends on spending by the oil and natural gas industry in the United States, and this spending may be adversely affected by industry and financial market conditions that are beyond our control.

We will depend on our customers’ willingness to make operating and capital expenditures to explore, develop and produce oil and natural gas in the United States. Declines in these expenditures, due to the low oil and/or natural gas price environment or other factors, could result in project modification, delays or cancellations, general business disruptions, and delays in, or nonpayment of, amounts owed to us. Customers’ expectations for lower market prices for oil and natural gas, as well as the availability of capital for operating and capital expenditures, may also cause our customers to curtail spending, thereby reducing demand for our services. Industry conditions are influenced by numerous factors over which we have no control.

The volatility of the oil and natural gas industry and the impact on exploration and production activity could adversely impact the level of drilling activity by some of our customers or in some of the regions in which we operate. For example, in late 2011 and 2012, natural gas spot prices fell significantly, resulting in a decline in the number of active drilling rigs operating in many recognized shale deposits. This transition in exploration and production activity has caused and may continue to cause a decline in the demand for our services in affected regions where we operate or plan to operate, and may adversely affect the price of our services and the financial results of our operations. In addition, reduced discovery rates of new oil and natural gas reserves in our market areas also may have a negative long-term impact on our business, even in an environment of stronger oil and natural gas prices, due to reduced frac-ing activity and reduced production water from existing wells to the extent existing production is not replaced and the number of producing wells for us to service declines.

Improvements in or new discoveries of alternative energy technologies or frac-ing methodologies could have a material adverse effect on our financial condition and results of operations.

Because our business will depend on the level of activity in the oil and natural gas industry, any improvement in or new discoveries of alternative energy technologies (such as wind, solar, geothermal, fuel cells and biofuels) that increase the use of alternative forms of energy and reduce the demand for oil and natural gas could have a material adverse impact on our business, financial condition and results of operations. In addition, technological changes could decrease the quantities of, or eliminate the need for, water required frac-ing operations or otherwise affect demand for our services.

Increased regulation of hydraulic fracturing could result in the reduction in drilling and completing new oil and natural gas wells or minimize water use or disposal, which could adversely impact the demand for our services.

Demand for our services depends, in large part, on the level of exploration and production of oil and gas and the oil and gas industry’s willingness to purchase our services. Most of our anticipated customer base uses hydraulic fracturing to stimulate production from new oil and gas wells. Hydraulic fracturing is a process that is used to release hydrocarbons, particularly natural gas, from certain geological formations. The process involves the injection of water (typically mixed with significant quantities of sand and small quantities of chemical additives) under pressure into the formation to fracture the surrounding rock and stimulate movement of hydrocarbons through the formation. The process is subject to regulation by state and federal authorities and agencies, certain of whom are currently conducting comprehensive studies of the potential environmental impacts of hydraulic fracturing activities. Future federal, state or local laws or regulations could significantly restrict, or increase costs associated with hydraulic fracturing and make it more difficult or costly for producers to conduct hydraulic fracturing operations, which could result in a decline in exploration and production. New laws and regulations, and new enforcement policies by regulatory agencies, could also expressly restrict the quantities, sources and methods of water use and disposal in hydraulic fracturing and otherwise increase our costs and our customers’ cost of compliance, which could minimize water use and disposal needs even if other limits on drilling and completing new wells were not imposed. Any decline in exploration and production or any restrictions on water use and disposal could result in a decline in demand for our services and have a material adverse effect on our business, financial condition, results of operations and cash flows.

Our logistics business subjects us to the risks of operating within the trucking industry; the trucking industry is extremely competitive and fragmented.

One of our lines of business involves the transport of water via our road trucking and logistics unit. Thus, we are subject to the risks of operating within the trucking industry. The trucking industry is extremely competitive and fragmented. No single carrier in the water logistics market has a significant market share. We compete with many other carriers of varying sizes, customers’ private fleets, railroads and, in certain instances, with pipelines which may limit our growth opportunities and reduce profitability. Historically, competition has created downward pressure on the trucking industry’s pricing structure. Many trucking companies with which we compete have greater financial resources than we do.

We believe that one of the most significant competitive factors that impacts demand for our services is rates, and we may be forced to lower our rates based on our competitors’ pricing decisions, which would reduce our profitability. In fact, certain markets that we serve, or intend to serve, have experienced fierce price competition in recent years. With respect to our water logistics business, we also compete with intermodal transportation, pipelines and railroads. Intermodal transportation has increased in recent years. Growth in such forms of transport could adversely affect our market share, net sales and profit margins. Competition from non-trucking modes of transportation and from intermodal transportation would likely increase if state or federal fuel taxes were to increase without a corresponding increase in taxes imposed upon other modes of transportation.

Additional trends include current and anticipated consolidation among our competitors which may cause us to lose market share as well as put downward pressure on pricing. Some of our competitors are larger, have greater financial resources and have less debt than we do. As a result, those competitors may be better able to withstand a change in conditions within our industry and in the economy as a whole. If we do not compete successfully, our operating margins, financial condition, cash flows and profitability could be adversely affected.

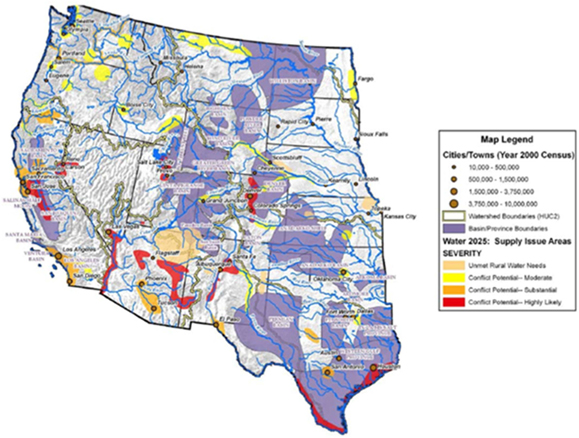

Our water logistics business may suffer if production shifts away from or slows in the shale regions in which we have or plan to have operations.

Our water logistics business currently serves customers in the oil, gas and hydraulic fracturing energy markets in the Western slope of Colorado and eastern Utah, the DJ basin area in central and northern Colorado, and the Permian basin. A shale region may yield only oil or gas or both commodities, depending upon the region. In the past, hydraulic fracturing activity has shifted among shales as the relative prices of oil and gas make drilling for one commodity more profitable than another. Oil or gas drilling may shift away from the shale regions in which we have operations because of these commodity price swings or for other reasons over which we have no control, such as resource discovery, new pipeline access, local drilling costs or state regulation. While certain business assets may be redistributed among shales, assets such as terminals, disposal wells and certain customer contracts are specific to discrete shale regions. Even business assets that may be redistributed or repurposed may require time and expenditures for conversion for optimal use in a different shale region or for a different service. A drilling shift away from or slowdown in shales in which we have assets could result in asset-related charges and decreased revenues and have a material adverse effect on our results of operations.

The trucking industry is subject to regulation, and changes in trucking regulations may significantly increase our costs.

As a motor carrier, we are subject to federal regulation by the Federal Motor Carrier Safety Administration, or “FMCSA,” a unit within the United States Department of Transportation, or “DOT”, and by various federal, state, and provincial agencies. These regulatory authorities exercise broad powers governing various aspects such as operating authority, safety, hours of service, hazardous materials transportation, financial reporting and acquisitions. There are additional regulations specifically relating to the trucking industry, including testing and specification of equipment, product-handling requirements and drug testing of drivers. Any downgrade in our DOT safety rating (as a result of the new CSA regulations described below or otherwise) could adversely affect our business.

In December 2010, the FMCSA began to rate individual driver safety performance inclusive of all driver violations over 3-year time periods under regulations known as the CSA. CSA is an FMCSA initiative designed to provide motor carriers and drivers with attention from FMCSA and state partners about their potential safety problems with an ultimate goal of achieving a greater reduction in large truck and bus crashes, injuries, and fatalities. Prior to these regulations, only carriers were rated by the DOT and the rating only included out-of-service violations and ticketed offenses associated with out-of-service violations.

The trucking industry is subject to possible regulatory and legislative changes that may affect the economics of the industry by requiring changes in operating practices, emissions or by changing the demand for common or contract carrier services or the cost of providing trucking services. Possible changes include:

| · | increasingly stringent environmental regulations, including changes intended to address climate change; |

| · | restrictions, taxes or other controls on emissions; |

| · | regulation specific to the hydraulic fracturing industry and logistics providers to the industry; |

| · | changes in the hours-of-service regulations, which govern the amount of time a driver may drive in any specific period; |

| · | requirements leading to accelerated purchases of new trailers; |

| · | mandatory limits on vehicle weight and size; |

| · | driver hiring restrictions; |

| · | increased bonding or insurance requirements; and |

| · | regulations imposed by the Department of Homeland Security. |

From time to time, various legislative proposals are introduced, including proposals to increase federal, state, or local taxes, including taxes on motor fuels and emissions, which may increase our or our independent affiliates’ operating costs, require capital expenditures or adversely impact the recruitment of drivers.

Restrictions on emissions or other climate change laws or regulations could also affect our customers that use significant amounts of energy or burn fossil fuels in producing or delivering the products we carry. We also could lose revenue if our customers divert business from us because we have not complied with their sustainability requirements.

The loss of qualified drivers or other personnel could limit our growth and negatively affect operations.

During periods of high trucking volumes, there is substantial competition for qualified drivers in the trucking industry. Regulatory requirements, including CSA (discussed above), and an improvement in the economy could reduce the number of eligible drivers. Furthermore, certain geographic areas have a greater shortage of qualified drivers than other areas. We operate, and intend to operate, in geographic areas where there have been driver shortages in the past. Difficulty in attracting qualified personnel, particularly qualified drivers, could require us to increase driver compensation, forego available customer opportunities and underutilize the trucks in our network. These actions could result in increased costs and decreased revenues. In addition, we may not be able to recruit other qualified personnel in the future.

Geopolitical conditions and global economic factors may adversely affect us.

Uncertain geopolitical conditions and global economic factors may adversely affect our business. Adverse factors affecting economic conditions worldwide have contributed to a general inconsistency in the oil and gas industry and may adversely impact our business, resulting in reduced demand for water remediation and supply in the oil and gas industry. The current and ongoing uncertainty of the international economic situation, civil unrest, terrorist activity and military actions may continue to adversely affect global economic conditions. Economic and market conditions could deteriorate as a result of any of the foregoing reasons. We may experience material adverse effects on our business, financial condition, results of operations and cash flows as a consequence of the foregoing factors.

Weather conditions, natural hazards, availability of water supplies and competing uses may interfere with our sources of water, demand for water services and our ability to supply water to customers.

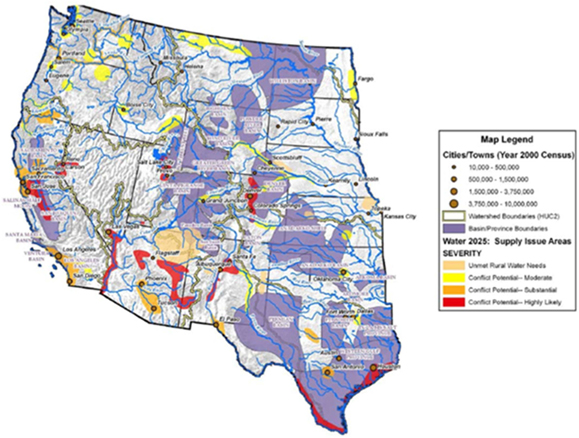

Our ability to meet the existing and future water demands of our customers depends on an adequate supply of water. In our Texas operations, we are deemed to own the water residing on or under our property. However, in certain other states, sources of public water supply, including rivers, lakes, streams and groundwater aquifers are held in the public trust and are not owned by private interests. As such, in those states, we would not expect to own the water that we use in our operations, and the availability of our water supply is established through allocation rights and passing-flow requirements set by governmental entities. Passing-flow requirements set minimum volumes of water that must pass through specified water sources, such as rivers and streams, in order to maintain environmental habitats and meet water allocation rights of downstream users. Allocation rights are imposed to ensure sustainability of major water sources and passing flow requirements are most often imposed on source waters from smaller rivers, lakes and streams. These requirements can change from time to time and adversely impact our water supply. Drought, overuse of sources of water, the protection of threatened species or habitats or other factors may limit the availability of ground and surface water.

Governmental restrictions on water use may also result in decreased use of water services, even if our water supplies are sufficient to serve our customers, which may adversely affect our financial condition and results of operations. Seasonal drought conditions that would impact our water services are possible across all of our service areas, and drought conditions currently exist in several areas of the United States. If a regional drought were to occur affecting our service areas and adjacent systems, governmental restrictions may be imposed on all systems within a region independent of the supply adequacy of any individual system. Following drought conditions, water demand may not return to pre-drought levels even after restrictions are lifted. Cool and wet weather may also reduce demand for water, thereby adversely affecting our financial condition, results of operations, cash flow and liquidity.

Service interruptions due to severe weather events are possible across all contemplated service areas. These include winter storms and freezing conditions in colder climate service areas, high wind conditions in service areas known to experience tornados, earthquakes in service areas known to experience seismic activity, high water conditions for facilities that could be located in or near designated flood plains, hurricanes in coastal service areas and severe electrical storms which are possible across all contemplated service areas. These weather events may affect the condition or operability of our facilities, limiting or preventing us from delivering water or wastewater services to our customers, or requiring us to make substantial capital expenditures to repair any damage. Any interruption in our ability to supply water or to collect, treat and properly dispose of wastewater, or any costs associated with restoring service, could adversely affect our financial condition and results of operations. Furthermore, losses from business interruptions or damage to our facilities might not be covered by our insurance policies and such losses may make it difficult for us to secure insurance in the future at acceptable rates.

Risks associated with the collection and delivery of water may impose significant costs.

If the water collection systems fail, overflow or do not operate properly, untreated wastewater or other contaminants could spill onto nearby properties or into nearby streams and rivers, causing damage to persons or property, injury to aquatic life and economic damages, which may not be recoverable in rates. This risk is most acute during periods of substantial rainfall or flooding, which are the main causes of sewer overflow and system failure. Liabilities resulting from such damage could adversely and materially affect our business, results of operations and financial condition. Moreover, in the event that we are deemed liable for any damage caused by overflow, our losses might not be covered by insurance policies, and such losses may make it difficult for us to secure insurance in the future at acceptable rates.

Contamination of our sources of water could result in service interruptions and human exposure to hazardous substances and subject us to civil or criminal enforcement actions, private litigation and cleanup obligations.

Our current and contemplated future water supplies could be subject to contamination, including contamination from naturally-occurring compounds, chemicals in groundwater systems, pollution resulting from man-made sources, such as perchlorate and methyl tertiary butyl ether (MTBE), and possible terrorist attacks. In the event that our water supply is contaminated, we may have to interrupt the use of that water supply until we are able to substitute the supply of water from another water source, including, in some cases, through the purchase of water from a third-party supplier. In addition, we may incur significant costs in order to treat the contaminated source through expansion of our current treatment facilities, or development of new treatment methods. If we are unable to substitute water supply in a cost-effective manner, our financial condition, results of operations, cash flow, liquidity and reputation may be adversely affected. We might not be able to recover costs associated with treating or decontaminating water supplies through our prices, or such recovery may not occur in a timely manner. Moreover, we could be held liable for environmental damage as well as damages arising from toxic tort or other lawsuits or criminal enforcement actions or other consequences arising out of human exposure to hazardous substances in our drinking water supplies.

Changes in laws and regulations over which we have no control can significantly affect our business and results of operations.

Any governmental entity that regulates our operations may enact new legislation or adopt new regulations or policies at any time, and new judicial decisions may change the interpretation of existing legislation or regulations at any time. The individuals who serve as regulators are elected or are political appointees. Therefore, elections which result in a change of political administration or new appointments may also result in changes in the individuals who serve as regulators and the policies of the regulatory agencies that they serve. New laws or regulations, new interpretations of existing laws or regulations, or changes in agency policy, including as a response to shifts in public opinion, or conditions imposed during the regulatory hearing process may affect our business in a number of ways.

Risks Related to Ownership of Common Stock and this Offering.

There is no current trading market for our common stock, and there is no assurance of an established public trading market, which would adversely affect the ability of our investors to sell their securities in the public market.

Our common stock is not currently listed or quoted for trading on any national securities exchange or national quotation system. We intend to apply for the listing of our common stock on the NYSE MKT in the future. There is no guarantee that the NYSE MKT, or any other securities exchange or quotation system, will permit our shares to be listed and traded. If we fail to obtain a listing on the NYSE MKT, we may seek quotation on the OTC Bulletin Board. The OTC Bulletin Board is an inter-dealer, over-the-counter market that provides significantly less liquidity than the NYSE MKT. Generally, the prices for securities traded solely on the OTC Bulletin Board may be difficult to obtain and holders of common stock may be unable to resell their securities at or near their original offering price or at any price.

The market price and trading volume of shares of our common stock may be volatile.

When and if a market develops for our securities, the market price of our common stock could fluctuate significantly for many reasons, including reasons unrelated to our specific performance, such as reports by industry analysts, investor perceptions, or announcements by our competitors regarding their own performance, as well as general economic and industry conditions. For example, to the extent that other large companies within our industry experience declines in their share price, our share price may decline as well. Fluctuations in operating results or the failure of operating results to meet the expectations of public market analysts and investors may negatively impact the price of our securities.

Quarterly operating results may fluctuate in the future due to a variety of factors that could negatively affect revenues or expenses in any particular quarter, including vulnerability of our business to a general economic downturn; changes in the laws that affect our products or operations; competition; compensation related expenses; application of accounting standards; and our ability to comply with all necessary regulatory permits and/or licenses to conduct our business. In addition, if the market price of our shares should ever drop significantly, stockholders could institute securities class action lawsuits against us, even though there may be no legal basis for any such lawsuit. A lawsuit against us could cause us to incur substantial costs and could divert the time and attention of our management and other resources.

We have provided registration rights to certain holders of our common stock that will require us to register their shares after the completion of this initial public offering. The exercise of these registration rights may substantially reduce the market price of our common stock and the existence of these rights may make it more difficult for us to effect future offerings.