UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

UNDER SECTION 12(B) OR (G) OF THE SECURITIES EXCHANGE ACT OF 1934

STL Marketing Group, Inc.

(Exact Name of Registrant as specified in its charter)

| Colorado | 20-4387296 |

| (State of Incorporation) | (IRS Employer ID No.) |

10 Boulder Crescent, Suite 102,

Colorado Springs, CO

80903

(Address of principal executive offices)

(719) 219-5797

(Registrant’s telephone number, including area code)

Securities to be Registered Under Section 12(b) of the Act:None

Securities to be Registered Under Section 12(g) of the Act:

Common Stock, $0.001 Par Value

(Title of each class to be so registered)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting Company. See definitions of “large accelerated filer,” “accelerated filer,” and “smaller reporting Company” in Rule 12b-2 of the Exchange Act:

| Large accelerated filer | [ ] | | | Accelerated filer | [ ] |

| Non Non-accelerated filer | [ ] | | | Smaller reporting Company | [X] |

Table of Contents

EXPLANATORY NOTE

You should rely only on the information contained in this registration statement or in a document referenced herein. We have not authorized anyone to provide you with any other information. You should assume that the information contained in this registration statement is accurate only as of the date hereof except where a specific date is set forth herein.

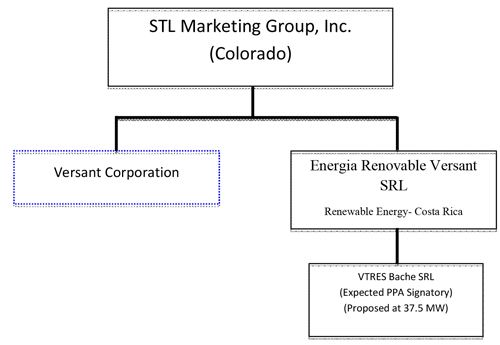

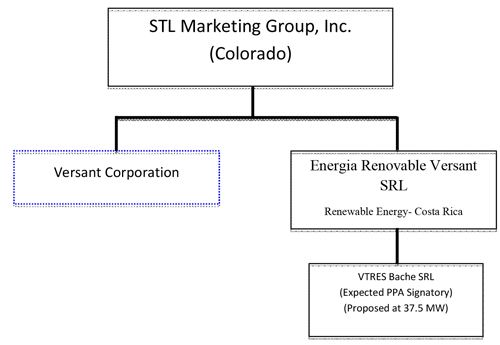

As used in this registration statement, unless the context otherwise requires, the terms the “Company,” “our Company,” “we,” “us,” “our,” or “STLK,” refer to STLK Marketing Group, Inc., a Colorado corporation and its subsidiaries, Versant Corporation, a Delaware corporation., Energia Renovable Versant SRL, a Costa Rican Corporation and VTRES Bache SRL, a Costa Rican corporation that handle operations in Costa Rica.

FORWARD-LOOKING STATEMENTS

Except for statements of historical fact, this registration statement contains “forward-looking statements. ” You can identify these forward-looking statements by words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “should,” “will,” “would” and similar words. These forward-looking statements express our future expectations and contain projections of our future results of operations and financial position. We believe that it is important to communicate our future expectations to our investors. However, there may be events in the future that we are not able to accurately predict or control that may cause our actual results and achievements to differ materially from the expectations we describe in our forward-looking statements. The occurrence of any such events could have a material adverse effect on our business, results of operations, financial position, market growth, services, products and licenses. See “Risk Factors” section of this registration statement. Further, since our common stock is considered a “penny stock,” we are ineligible to rely on the safe harbor for forward-looking statements provided in Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”).

WHERE YOU CAN FIND MORE INFORMATION ABOUT US

When this registration statement becomes effective, we will begin to file periodic reports, proxy statements, information statements and other documents with the United States Securities and Exchange Commission (the “SEC”). You may read and copy this information, for a copying fee, at the SEC’s Public Reference Room at 100 F Street, N.E., Washington, D.C. 20549. More information on the Public Reference Room can be obtained by calling the SEC at 1-800-SEC-0330. Our SEC filings will also be available to the public from commercial document retrieval services, and at the web site maintained by the SEC at http://www.sec.gov.

Our Internet website address ishttp://www.STLMarketingGroup.com. Information contained in our website does not constitute a part of this registration statement. When this registration statement becomes effective, we will make available, through a link to the SEC’s web site, electronic copies of the materials we file with the SEC (including our annual reports on Form 10-K, our quarterly reports on Form 10-Q, our current reports on Form 8-K, the Section 16 reports filed by our executive officers, directors and 10% stockholders, and amendments to those reports). To receive paper copies of our SEC filings, please contact us by mail at Investor Relations, STL Marketing Group, Inc.,10 Boulder Crescent, Suite 102, Colorado Springs, CO 80903, by email at info@v3rsant.com,or by calling us at (719) 219-5797.

ITEM 1. BUSINESS.

General Information

Our business address is10 Boulder Crescent, Suite 102, Colorado Springs, CO 80903. Our telephone number is (719) 219-5797 and our Internet website address iswww.StlMarketingGroup.com. The information contained in, or that can be accessed through, our website is not part of this registration statement.

History

STL Marketing Group, Inc. (the “Company,” “our Company,” “we,” “us,” “our,” or “STLK,” was incorporated under the laws of the State of Colorado on February 16, 1999under the original name of Fountain Colony Ventures, Inc. Fountain Colony Ventures, Inc. changed its name to SGT Ventures, Inc. in March 2006. In June 2006, SGT Ventures, Inc. changed its name to Stronghold Industries, Inc.. On October 30, 2007, Stronghold Industries, Inc. entered into a share purchase and exchange agreement with Image Worldwide, Inc. The Company name was officially changed with the Secretary of State to Image Worldwide, Inc. (“Image Worldwide”) on November 21, 2007. In 2008, Image Worldwide concentrated its business activities on helping clients create, market and promote their brands and image in print, online and at live events. Image Worldwide entered into a share exchange agreement with St. Louis Packaging Inc. on January 31, 2009. In April 2009, the Company changed its name to STL Marketing Group, Inc. On December 1, 2009, the Company sold majority of the STL Brands to Alliance Creative Group, Inc. In March of 2011, the Company entered into a distribution agreement with United Fuel Savers and purchased land in Texas for a potential business opportunity. On October 15th, 2012, the Company agreed to merge with Versant Corporation. On February 4, 2013 the Company entered into a share exchange agreement with Versant whereby Versant became the Company’s wholly owned operating subsidiary. The transaction is being accounted for as a reverse merger. Accordingly, the historical financial information going forward will be that of Versant Corporation and subsidiaries.

This is the current corporate organization:

STL Marketing Group, Inc. has been trading on the OTC Market Pink Sheets under the symbol ’STLK’ since April 2009.

COMPANY OVERVIEW

STL Marketing Group, Inc. (OTC: STLK), (the “Company”) is a Colorado corporation seeking to develop and operate clean, renewable energy facilities. The Company has two wholly owned subsidiaries in Costa Rica that handle the development of the business and are expected to operate the power generation plant within the country. Energia Renovable Versant SRL (“ERV”) is a 100% owned subsidiary and is used as a holding company for potential future operating companies. ERV will consolidate common tasks for the operating companies in Costa Rica. VTRES BACHE SRL (“VTRES”) is 100% owned by ERV. VTRES is the legal entity that will operate the first proposed wind farm on the site known as “Personna” in Costa Rica. These entities would then be managed by the Costa Rican holding company ERV.

Under its exclusive, long term land arrangement, the Company is seeking to develop its first field of 37.5 MW on 270 hectares on a site known as “BACHE”. It has also received up to three (3) hectares for the substation site/ facilities.

Energy Market in Costa Rica

Costa Rica is in need of inexpensive energy sources, as it does not posses any petroleum or coal and its natural gas reserves are, as of yet, largely untapped. As a result of this lack of petroleum, Costa Rica has had to develop new sources of renewable energy. The country already uses hydroelectric and geo thermal methods and, in 2007, set 2021 as the year it becomes carbon neutral. According toThe Economist Intelligence Unit, October 2nd, 2012, “In 2004, 46.7% of Costa Rica’s primary energy came from renewable sources, while 94% of its electricity was generated from hydroelectric power, wind farms and geothermal energy in 2006. A 3.5% tax on gasoline in the country is used for payments to compensate landowners for growing trees and protecting forests and its government is making further plans for reducing emissions from transport, farming and industry.”

Research shows that unfortunately, as much as 90% of the country’s hydroelectric facilities are reaching their useful life (50 years) and will need replacement or major maintenance. This is expected to place a serious burden on the country’s electric providers, as it will take much needed infrastructure investment away from new developments. This is already taking place, placing a greater emphasis and strain on the country’s petroleum-based 200 MW facility (“Garabito”).

It is estimated that Costa Rica is 8-10 years behind in developing the necessary electrical infrastructure to maintain pace with its needs. The largest State Owned Enterprise in electricity generates about $1 billion per year in revenue, however, over the past few decades, funds have been diverted to other governmental priorities. This has left the electrical development unfunded and the electrical projects are large, cumbersome and time consuming. According to most analyses in public records and published news articles, this infrastructure delay is based on the projected investment requirement of $10 billion for electric generation alone over the next decade. The largest, and most recognized, entity is the Instituto Costarricense de Electricidad (“ICE”). ICE’s role is to develop, operate and ensure that telecommunications and electric service and distribution are provided to the Country. ICE is a State Owned Enterprise.

ICE’s current legal framework allows it to invest about $850 million per year for its core businesses (based on current revenues). This means that about $350 million per year is allocated for electric generation (the remainder is split between electrical distribution- $150 million- and telecommunications- $350 million). This leaves the government with an approximate, and very conservative, shortfall of $5 billion for electric generation in the next decade ($10 billion in required investment, less $350 million in electric generation plus $150 in electrical distribution times 10 years, equals a $5 billion shortfall). Additionally, ICE’s current development costs are excessive. Its latest hydroelectric project was put into operation almost 6 years behind schedule and at a cost of more than $4.3 mm per MW. It’s two largest projects- Diquis and Reventazon- are unfunded and already behind schedule. These delays mean that about 900 MW will not come on-line in the next 10 years, further straining the need for electrical infrastructure.

Over the past 6 months, numerous complaints by the Costa Rican public have been made and the newspapers have covered the alarming rate hikes Grupo ICE has instituted as a result of the very high use of its main 200 MW thermic facility, Garabito. Garabito is used primarily in the summer months when the rains stop. Garabito uses petroleum based fuel and runs continuously as a result of the lack of water and alternative energy production like wind. During these months, according to an article dated March 26, 2013 in, La Republica, one of the major newspapers in Costa Rica, electric rates have risen 50-60% since 2007.

Legal / Regulatory Framework

The situation related to the state of the energy market in Costa Rica has highlighted to the public the limited existing legal framework that allows the private generation and sale of electricity. As a result, there has been a lot of discussion in the legislature on how to expand and strengthen private rights/ participation in the electric generation space. Currently, new laws are expected to improve the current legal framework in favor of private enterprise. However, these new laws are not expected for a few more years. Our business plan currently utilizes existing legislation and any future improvements would be a welcome benefit. We cannot guarantee that any such future improvements will ever take place.

The current legal framework allows a few options to generate electric power. Law 7200 / 7508 controls the provision of concessions for private enterprises and specifically delineates the process by which any private enterprise receives, operates and commercializes its concession. This law is applicable to limited capacity facilities selling to ICE in amounts less than 20 MW. Law 8345 specifically grants Costa Rican cooperatives the right to generate power and specifies other rights like the “right of way” and the power to appropriate via “eminent domain”. There are various cooperatives in the country charged with generation of power and, in some cases, other public services like street lighting, waste removal and sewage. These cooperatives bill their constituents directly, and as a group, handle half (50%) of the electrical distribution in the country with the other 50% is handled by ICE. The bylaws (as passed in Congress in Costa Rica), for these cooperatives, allow them to enter into agreements with private entities to develop their services. They do not need further legislative approval or bidding to enter into these agreements, so long as Costa Rican ownership levels are within the law (35%), that no Costa Rican government funds are used in the development, and that “a clear benefit is provided by entering into these arrangements”.

Similar laws are established for the Public Service companies- “Fuerza y Luz” (an ICE subsidiary), JASEC (“Cartago”) and ESPH (“Heredia”). These entities have their own legal framework. All are allowed private partnerships to generate electricity and all have the credit rating of the Costa Rican government (B+).

Off-Taker

The Company will utilize the current legal/regulatory framework in Costa Rica as the basis for its proposed power purchase agreement (the “Power Purchase Agreement”). On December 21st, 2012, the Company received a Letter of Interest from the Compañia Nacional de Fuerza y Luz (“CNFL” or the “Off-Taker”). CNFL is a private company 98% owned by Grupo ICE. Its market is “el valle central” or Central Valley, the area of San Jose and its environs. It is the largest market in the country with approximately 2 million customers in its general area.

The Company has negotiated key terms and conditions of the proposed Power Purchase Agreement. As a result of these negotiations, that include the price and term, the Company has tendered an official offer on April 16th, 2013. The parties have agreed in principle to a price (net of taxes) of $0.083/ kWh and a term of twenty-five years. The price of electricity for wind, as many other services, is regulated by ARESEP and the price is on the lower edge of the accepted pricing range in Costa Rica. Based on current information from the buyer, they expect to complete their internal process and expect to be able to execute the Power Purchase Agreement in the third quarter of 2013. There is no guarantee that the Off-Taker will execute the Power Purchase Agreement now or in the future. In the event that the Off-Taker does not execute the Power Purchase Agreement, there is no guarantee that the Company will be able to secure another Off-Taker on similar terms or at all.

Interconnection

Per the terms of our offer, CNFL will collect their electricity “at site” which means that they will be ensuring the interconnection and transport of the electricity to their substation. In our opinion this greatly reduces our risk, as CNFL is an entity that has, as ICE’s subsidiary, full control and rights to the high-tension transmission lines of Costa Rica. ICE is the exclusive agent for high-tension lines including access to this network. This high-tension network is how the electricity is delivered to CNFL’s grid and from there to its customers.

The substation, the area where the Company connects to the high transmission lines to transport the electricity is less than 300 meters from the Sistema de Interconexion Electricapara America Central orCentral American Electrical Interconnection System(“SIEPAC”) regional high-tension lines. This also means we do not have to pay the SIEPAC interconnection line costs, that interagency arrangement will be handled under CNFL/ ICE’s existing agreements. SIEPAC is a planned interconnection of the power grids of six Central American nations. Central America, where few electrical interconnections currently exist, and those that do are often old and unreliable, has been discussing plans to link the region’s electricity grids since 1987. The proposed project entails the construction of transmission lines connecting 37 million consumers in Panama, Costa Rica, Honduras, Nicaragua, El Salvador, and Guatemala. It is not clear if Belize, which buys much of its power from Mexico, will also be included. SIEPAC would cost about US$320 million without the interconnections with Mexico (US$40m), Belize (US$30m) and Panama (US$200m) and, back in 2003, was scheduled for completion in 2006. More recently, it has been estimated it would be completed in 2009. As of 2013, all but about 20 km in southern Costa Rica is operating.

Proponents of SIEPAC expect that interconnecting the nations’ electrical transmission grids will alleviate periodic power shortages in the region, reduce operating costs, optimize shared use of hydroelectric power, create a competitive energy market in the region, and attract foreign investment in power generation and transmission systems. It has been claimed that the cost of energy for consumers could drop as much as 20% from US$0.11 per kWh to US$0.09 per kWh as a result of the project. A feasibility study undertaken in 1995 by Power Technologies Inc. outlined various scenarios for the expansion of power demand and supply in the region and associated investments. The median scenario foresaw that SIEPAC would induce annual investments of US$700m over a 10-year period once the regional electricity market had begun operating.

SIEPAC is expected to create a 1,125-mile 230 kV transmission line, with a planned capacity of 300 MW between Guatemala and Panama, as well as improvements to existing systems. SIEPAC likely will involve upgrading links and building 230 kV links between Guatemala and Honduras, and Honduras and El Salvador.

Wind Studies

Wind studies have been conducted on the site for the past several years. There are six active wind measurement towers on site, each 80 meters high, gradually built since 2007. In addition, there are two older towers of 50 meters high, which are out of service today, but have provided data along with neighboring for reference into the overall wind mapping conditions of the Region. These stations offer different height levels of measurements for five years. The compiled data will be used for the revised Annual Energy Production Report (as defined below).

The Company engaged GL Garrad Hassan to evaluate and generate an Annual Energy Production Report with five different wind turbine generators (WTGs). According to the existing Garrad Annual Energy Production Report, the Company can generate approximately 135,000,000 kWh per year (P75). The Company has moved the site slightly to the north (approximately 5 km) to gain access to the interconnection lines. A new Annual Energy Production Report has been commissioned from Garrad Hassan. Other benefits of this land are:

| ● | Large enough to increase capacity (5,300 hectares of land). |

| ● | The land is level and generally flat. |

| ● | The SIEPAC regional (Central America) grid traverses through the property. This allows us to transport electricity to the power grid and to our final customers. |

Employees

As of July 30, 2013 the Company had 2 full-time employees and one full time consultant.

Reports to Security Holders.

| | 1. | The Company will file with the SEC reports as required under the Exchange Act and comply with the requirements of the Exchange Act. |

| | 2. | The public may read and copy any materials the Company files with the SEC in the SEC’s Public Reference Section, Room 1580, 100 F Street N.E., Washington, D.C. 20549. The public may obtain information on the operation of the Public Reference Section by calling the SEC at 1-800-SEC-0330. Additionally, the SEC maintains an Internet site that contains reports, proxy and information statements, and other information regarding issuers that file electronically with the SEC, which can be found at http://www.sec.gov. |

ITEM 1A. RISK FACTORS.

RISKS RELATED TO OUR BUSINESS

OUR AUDITORS HAVE EXPRESSED SUBSTANTIAL DOUBT ABOUT OUR ABILITY TO CONTINUE AS A “GOING CONCERN.” ACCORDINGLY, THERE IS SIGNIFICANT DOUBT ABOUT OUR ABILITY TO CONTINUE AS A GOING CONCERN.

As of December 31, 2012, we had an accumulated deficit of $1,574,530. A significant amount of capital will be necessary to advance the development of our projects to the point at which they will become commercially viable, and these conditions raise substantial doubt about our ability to continue as a going concern.

Our independent auditors included an explanatory paragraph regarding this uncertainty in their report on our financial statements as of December 31, 2012. These financial statements do not include any adjustments that might result from the uncertainty as to whether we will continue as a “going concern”. Our ability to continue status as a “going concern” is dependent upon our generating cash flow sufficient to fund operations. If we continue incurring losses and fail to achieve profitability, we may have to cease our operations. Our business plan may not be successful in addressing these issues.

WE HAVE GENERATED SUBSTANTIAL NET LOSSES AND NEGATIVE OPERATING CASH FLOWS SINCE OUR INCEPTION AND EXPECT TO CONTINUE TO DO SO AS WE BEGIN TO DEVELOP AND CONSTRUCT OUR FUTURE ENERGY PROJECTS.

We have generated substantial net losses and negative operating cash flows from operating activities since our operations commenced. We had accumulated losses of approximately $1,574,530 from our inception through December 31, 2012.

We expect that our net losses will continue and our cash used in operating activities will grow during the next several years, as compared with prior periods, as we increase our development activities. Energy projects, including wind farms, typically incur operating losses prior to commercial operation at which point the projects begin to generate positive operating cash flow. We also expect to incur additional costs, contributing to our losses and operating uses of cash, as we incur the incremental costs of operating as a fully reporting public company. Our costs may also increase due to factors such as higher than anticipated financing and other costs; increases in the costs of labor or materials; and major incidents or catastrophic events. If any of those factors occurs, our losses could increase significantly and the value of our common stock could decline. As a result, our net losses and accumulated deficit could increase significantly.

WE DO NOT HAVE SUFFICIENT CASH ON HAND. IF WE DO NOT GENERATE SUFFICIENT REVENUES FROM SALES, AMONG OTHER FACTORS, WE WILL BE UNABLE TO CONTINUE OUR OPERATIONS.

We estimate that within the next 12 months the Company will require a minimum of $10,000,000 to fund operations and develop the first wind park on site. Although we are seeking additional sources of debt or equity financing, there can be no assurances that we will be able to obtain any additional financing. We recognize that if we are unable to generate sufficient revenues or obtain debt or equity financing, we will not be able to earn profits and may not be able to continue operations.

There is limited history upon which to base any assumption as to the likelihood that we will prove to be successful, and we may not be able to generate enough operating revenues or ever achieve profitable operations. If we are unsuccessful in addressing these risks, our business will be adversely affected.

WE HAVE A LIMITED OPERATING HISTORY. IF WE ARE NOT SUCCESSFUL IN CONTINUING TO GROW THE BUSINESS, THEN WE MAY HAVE TO SCALE BACK OR EVEN CEASE ONGOING BUSINESS OPERATIONS.

We have no history of revenues from operations. We have yet to generate positive earnings and there can be no assurance that we will ever operate profitably. Operations will be subject to all the risks inherent in the establishment of a developing enterprise, such as difficulties in commercializing our wind energy power generation plant, and the uncertainties arising from the absence of a significant operating history. We may be unable to sign customer contracts or operate on a profitable basis. If the business plan is not successful, and we are not able to operate profitably, investors may lose some or all of their investment.

IF WE ARE UNABLE TO OBTAIN ADDITIONAL FUNDING, BUSINESS OPERATIONS WILL BE HARMED, AND IF WE DO OBTAIN ADDITIONAL FINANCING THEN EXISTING SHAREHOLDERS MAY SUFFER SUBSTANTIAL DILUTION.

We anticipate that we will need to raise substantial capital estimated in the amount of $10,000,000 to fund the development of the wind park. Additional capital will be required to effectively support the operations and otherwise implement overall business strategy. We currently do not have any contracts or commitments for additional financing. There can be no assurance that financing will be available in amounts or on terms acceptable to us, if at all. The inability to obtain additional capital will restrict our ability to grow and may reduce our ability to continue to conduct business operations. If we are unable to obtain additional financing, we will likely be required to curtail and possibly cease operations. Any additional equity financing may involve substantial dilution to then existing shareholders.

THE LOSS OF ONE OR MORE MEMBERS OF OUR SENIOR MANAGEMENT OR KEY EMPLOYEES MAY ADVERSELY AFFECT OUR ABILITY TO IMPLEMENT OUR STRATEGY.

We depend on our experienced management team and the loss of one or more key executives could have a negative impact on our business. Our success depends to a significant extent upon the continued services of Mr. Jose P. Quiros, our Chief Executive Officer. The loss of the services of Mr. Quiros could have a material adverse effect on our growth, revenues, and prospective business. Mr. Quiros does have an employment agreement with the Company and does have “key person” life insurance policies covering him.

In order to successfully implement and manage our business plan, we will be dependent upon, among other things, successfully recruiting qualified managerial and company personnel having experience in the small wind turbine business. Competition for qualified individuals is intense. Additionally, because the wind industry is relatively new, there is a scarcity of top-quality employees with experience in the wind industry, including qualified technical personnel with significant experience in the design, development, manufacture and construction of wind power generation plants, and we may face challenges hiring and retaining these types of employees.

We also depend on our ability to retain and motivate key employees and attract qualified new employees. There can be no assurance that we will be able to retain existing employees or that we will be able to find, attract and retain qualified personnel on acceptable terms. If we lose a member of the management team or a key employee, we may not be able to replace him or her. Integrating new employees into our management team and training new employees with no prior experience in the wind industry could prove disruptive to our operations, require a disproportionate amount of resources and management attention and ultimately prove unsuccessful. An inability to attract and retain sufficient technical and managerial personnel could limit or delay our development efforts, which could have a material adverse effect on our business, financial condition and results of operations.

WE NEED TO ESTABLISH AND MAINTAIN REQUIRED DISCLOSURE CONTROLS AND PROCEDURES AND INTERNAL CONTROLS OVER FINANCIAL REPORTING AND TO MEET THE PUBLIC REPORTING AND THE FINANCIAL REQUIREMENTS FOR OUR BUSINESS, WHICH WILL BE TIME CONSUMING FOR OUR MANAGEMENT.

Our management has a legal and fiduciary duty to establish and maintain disclosure controls and control procedures in compliance with the securities laws, including the requirements mandated by the Sarbanes-Oxley Act of 2002. The standards that must be met for management to assess the internal control over financial reporting as effective are new and complex, and require significant documentation, testing and possible remediation to meet the detailed standards. Because we have limited resources, we may encounter problems or delays in completing activities necessary to make an assessment of our internal control over financial reporting, and other disclosure controls and procedures. In addition, the attestation process by our independent registered public accounting firm is new and we may encounter problems or delays in completing the implementation of any requested improvements and receiving an attestation of our assessment by our independent registered public accounting firm. If we cannot assess our internal control over financial reporting as effective or provide adequate disclosure controls or implement sufficient control procedures, or our independent registered public accounting firm is unable to provide an unqualified attestation report on such assessment, investor confidence and share value may be negatively impacted.

IF WE CANNOT EFFECTIVELY MANAGE OUR INTERNAL GROWTH, OUR POTENTIAL BUSINESS PROSPECTS, REVENUES AND PROFIT MARGINS MAY SUFFER.

If we fail to effectively manage our internal growth in a manner that minimizes strains on our resources, we could experience disruptions in our operations and ultimately be unable to generate revenues or profits. We expect that we will need to significantly expand our operations to successfully implement our business strategy. As we add manufacturing, marketing, sales and installation and build our infrastructure, we expect that our operating expenses and capital requirements will increase. To effectively manage our growth, we must continue to expend funds to improve our operational, financial and management controls and our reporting systems and procedures. In addition, we must effectively expand, train and manage our employee base. If we fail in our efforts to manage our internal growth, our prospects, revenue and profit margins may suffer.

THE PRODUCTION OF WIND ENERGY DEPENDS HEAVILY ON SUITABLE WIND CONDITIONS. IF WIND CONDITIONS ARE UNFAVORABLE OR BELOW OUR ESTIMATES, OUR ELECTRICITY PRODUCTION, AND THEREFORE OUR REVENUES, MAY BE SUBSTANTIALLY BELOW OUR EXPECTATIONS.

The electricity produced and revenues generated by a wind energy project depend heavily on wind conditions, which are variable and difficult to predict. Operating results for projects vary significantly from period to period depending on the wind resource during the periods in question. We base our decisions about which sites to develop in part on the findings of long-term wind and other meteorological studies conducted in the proposed area, which measure the wind’s speed, prevailing direction and seasonal variations. Actual wind conditions, however, may not conform to the measured data in these studies and may be affected by variations in weather patterns, including any potential impact of climate change. Therefore, the electricity generated by our projects may not meet our anticipated production levels or the rated capacity of the turbines located there, which could adversely affect our business, financial condition and results of operations. If the wind resources at a project are below the average level we expect, our rate of return for the project would be below our expectations and we would be adversely affected. Projections of wind resources also rely upon assumptions about turbine placement, interference between turbines and the effects of vegetation, land use and terrain, which involve uncertainty and require us to exercise considerable judgment. We or our consultants may make mistakes in conducting these wind and other meteorological studies. Any of these factors could cause us to develop sites that have less wind potential than we had expected, or to develop sites in ways that do not optimize their potential, which could cause the return on our investment in these projects to be lower than expected.

If our wind energy assessments turn out to be wrong, our business could suffer a number of material adverse consequences, including:

| ● | | our energy production and sales may be significantly lower than we predict; |

| ● | | any future hedging arrangements may be ineffective or more costly; |

| ● | | we may not produce sufficient energy to meet future commitments to sell electricity as a result, we may have to pay damages; and |

| ● | | our projects may not generate sufficient cash flow to make payments of principal and interest as they become due on any future project-related debt, and we may have difficulty obtaining financing for future projects. |

NATURAL EVENTS MAY REDUCE ENERGY PRODUCTION BELOW OUR EXPECTATIONS.

A natural disaster, severe weather or an accident that damages or otherwise adversely affects any of our operations could have a material adverse effect on our business, financial condition and results of operations. Lightning strikes, icing, earthquakes, tornados, extreme wind, severe storms, wildfires and other unfavorable weather conditions or natural disasters could damage or require us to shut down our turbines or related equipment and facilities, impeding our ability to maintain and operate our facilities and decreasing electricity production levels and our revenues. Operational problems, such as degradation of turbine components due to wear or weather or capacity limitations on the electrical transmission network, can also affect the amount of energy we are able to deliver. Any of these events, to the extent not fully covered by insurance, could have a material adverse effect on our business, financial condition and results of operations.

OPERATIONAL PROBLEMS MAY REDUCE ENERGY PRODUCTION BELOW OUR EXPECTATIONS.

Spare parts for wind turbines and key pieces of electrical equipment may be hard to acquire or unavailable to us. Sources for some significant spare parts and other equipment are located outside of North America. If we were to experience a shortage of or inability to acquire critical spare parts, we could incur significant delays in returning facilities to full operation. In addition, we may not hold spare substation main transformers. These transformers are designed specifically for each wind energy project, and the current lead time to receive an order for this type of equipment is over eight months. If we had to replace any future substation main transformers, we could be unable to sell electricity from the affected wind energy project until a replacement is installed. That interruption to our business might not be fully covered by insurance.

WE FACE COMPETITION PRIMARILY FROM OTHER RENEWABLE ENERGY SOURCES AND, IN PARTICULAR, OTHER WIND ENERGY COMPANIES.

We believe our primary competitors are developers and operators focused on renewable energy generation, specifically wind energy companies. We will compete with other wind energy companies primarily for sites with good wind resources that can be built in a cost-effective manner. We will also compete for access to transmission or distribution networks. Because the wind energy industry in the United States is at an early stage, we will also compete with other wind energy developers for the limited pool of personnel with requisite industry knowledge and experience. Furthermore, in recent years, there have been times of increased demand for wind turbine related components, causing turbine suppliers to have difficulty meeting the demand. If these conditions return in the future, component manufacturers may give priority to other market participants, including our competitors, who may have resources greater than ours.

We compete with other renewable energy companies (and energy companies in general) for the financing needed to pursue our development plan. Once we have developed a project and put a project into operation, we may compete on price if we sell electricity into power markets at wholesale market prices. Depending on the regulatory framework and market dynamics of a region, we may also compete with other wind energy companies, as well other renewable energy generators, when we bid on or negotiate for a long-term power purchase agreement (“PPA”).

WE WILL ALSO COMPETE WITH TRADITIONAL ENERGY COMPANIES.

We will also compete with traditional energy companies. For example, depending on the regulatory framework and market dynamics of a region, we also compete with traditional electricity producers when we bid on or negotiate for a long-term PPA. Furthermore, technological progress in traditional forms of electricity generation (including technology that reduces or sequesters greenhouse gas emissions) or the discovery of large new deposits of traditional fuels could reduce the cost of electricity generated from those sources or make them more environmentally friendly, and as a consequence reduce the demand for electricity from renewable energy sources or render existing or future wind energy projects uncompetitive. Any of these developments could have a material adverse effect on our business, financial condition and results of operations.

NEGATIVE PUBLIC OR COMMUNITY RESPONSE TO WIND ENERGY PROJECTS IN GENERAL OR OUR PROJECTS SPECIFICALLY CAN ADVERSELY AFFECT OUR ABILITY TO DEVELOP OUR WIND FARM PROJECTS.

Negative public or community response to our wind energy projects can adversely affect our ability to develop, construct and operate our projects. This type of negative response can lead to legal, public relations and other challenges that impede our ability to meet our development and construction targets, achieve commercial operations for a project on schedule, address the changing needs of our projects over time, and generate revenues. If we are unable to develop, construct and operate the production capacity that we expect from our future development projects in our anticipated timeframes, it could have a material adverse effect on our business, financial condition and results of operations.

WE NEED GOVERNMENTAL APPROVAL FROM THE COSTA RICAN GOVERNMENT AND PERMITS TO CONSTRUCT AND OPERATE OUR PROJECTS. ANY FAILURE TO PROCURE AND/OR MAINTAIN NECESSARY PERMITS WOULD ADVERSELY AFFECT ONGOING DEVELOPMENT, CONSTRUCTION AND CONTINUING OPERATION OF OUR PROJECTS.

The design, construction and operation of wind energy projects are highly regulated, require various approvals from the government of Costa Rica and permits, including environmental approvals and permits, and may be subject to the imposition of related conditions that vary by jurisdiction. In some cases, these approvals and permits require periodic renewal, which we may not be able to successfully obtain. We cannot predict whether all permits required for a given project will be granted or whether the conditions associated with the permits will be achievable. The denial of a permit essential to a project or the imposition of impractical conditions would impair our ability to develop the project. In addition, we cannot predict whether the permits will attract significant opposition or whether the permitting process will be lengthened due to complexities and appeals. Delay in the review and permitting process for a project can impair or delay our ability to develop that project or increase the cost so substantially that the project is no longer attractive to us. In the future, we may experience delays in developing our future projects due to delays in obtaining non-appealable permits. If we were to commence construction in anticipation of obtaining the final, non-appealable permits needed for a project, we would be subject to the risk of being unable to complete the project if all the permits were not obtained. If this were to occur, we would likely lose a significant portion of our investment in the project and could incur a loss as a result. Any failure to procure and maintain necessary permits would adversely affect ongoing development, construction and continuing operation of our projects.

OUR DEVELOPMENT ACTIVITIES AND OPERATIONS ARE SUBJECT TO NUMEROUS ENVIRONMENTAL, HEALTH AND SAFETY LAWS AND REGULATIONS.

We are subject to numerous environmental, health and safety laws and regulations in each of the jurisdictions in which we intend to operate. These laws and regulations will require us to obtain approvals and maintain permits, undergo environmental impact assessments and review processes and implement environmental, health and safety programs and procedures to control risks associated with the citing, construction, operation and decommissioning of wind energy projects. For example, to obtain permits we could be required to undertake expensive programs to protect and maintain local endangered species. If such programs are not successful, we could be subject to penalties or to revocation of our permits. In addition, permits frequently specify permissible sound levels.

If we do not comply with applicable laws, regulations or permit requirements, we may be required to pay penalties or fines or curtail or cease operations of the affected projects. Violations of environmental and other laws, regulations and permit requirements, including certain violations of laws protecting migratory birds and endangered species, may also result in criminal sanctions or injunctions.

Environmental, health and safety laws, regulations and permit requirements may change or become more stringent. Any such changes could require us to incur materially higher costs than we have incurred to date. Our costs of complying with current and future environmental, health and safety laws, regulations and permit requirements, and any liabilities, fines or other sanctions resulting from violations of them, could adversely affect our business, financial condition and results of operations.

WE WILL RELY ON TRANSMISSION LINES AND OTHER TRANSMISSION FACILITIES THAT ARE OWNED AND OPERATED BY THIRD PARTIES. WHEREVER WE DEVELOP OUR OWN GENERATOR LEADS, WE WILL BE EXPOSED TO TRANSMISSION FACILITY DEVELOPMENT AND CURTAILMENT RISKS, WHICH MAY DELAY AND INCREASE THE COSTS OF OUR PROJECTS OR REDUCE THE RETURN TO US ON THOSE INVESTMENTS.

We will depend on electric transmission lines owned and operated by third parties to deliver the electricity we generate. Some of our projects may have limited access to interconnection and transmission capacity because there can be many parties seeking access to the limited capacity that may be available. We may not be able to secure access to this limited interconnection or transmission capacity at reasonable prices or at all. Moreover, a failure in the operation by third parties of these transmission facilities could result in our losing revenues because such a failure could limit the amount of electricity we deliver. In addition, our production of electricity may be curtailed due to third-party transmission limitations, reducing our revenues and impairing our ability to capitalize fully on a particular project’s potential. Such a failure could have a material adverse effect on our business, financial condition and results of operations.

In certain circumstances, we may develop our own generator leads in the future from our projects to available electricity transmission or distribution networks when such facilities do not already exist. In some cases, these facilities may cover significant distances. To construct such facilities, we need approvals, permits and land rights, which may be difficult or impossible to acquire or the acquisition of which may require significant expenditures. We may not be successful in these activities, and our projects that rely on such generator lead development may be delayed, have increased costs or not be feasible. Our failure in operating these generator leads could result in lost revenues because it could limit the amount of electricity we are able to deliver. In addition, we may be required by law or regulation to provide service over our facilities to third parties at regulated rates, which could constrain transmission of our power from the affected facilities, or we could be subject to additional regulatory risks associated with being considered the owner of a transmission line.

WE MAY BE UNABLE TO CONSTRUCT OUR WIND ENERGY PROJECTS ON TIME, AND OUR CONSTRUCTION COSTS COULD INCREASE TO LEVELS THAT MAKE A PROJECT TOO EXPENSIVE TO COMPLETE OR MAKE THE RETURN ON OUR INVESTMENT IN THAT PROJECT LESS THAN EXPECTED.

There may be delays or unexpected developments in completing our future wind energy projects, which could cause the construction costs of these projects to exceed our expectations. We may suffer significant construction delays or construction cost increases as a result of a variety of factors, including, without limitation,:

| | ● | failure to manufacture turbines on the required schedule; |

| | ● | failure to receive other critical components and equipment, including batteries, that meet our design specifications on schedule; |

| | ● | failure to complete interconnection to transmission networks; |

| | ● | failure to obtain all necessary rights to land access and use; |

| | ● | failure to receive quality and timely performance of third-party services; |

| | ● | failure to secure and maintain environmental and other permits or approvals; |

| | ● | appeals of environmental and other permits or approvals that we obtain; |

| | ● | failure to obtain capital to develop our planned wind farm projects; |

| | ● | shortage of skilled labor; |

| | ● | inclement weather conditions; |

| | ● | adverse environmental and geological conditions; and |

| | ● | force majeure or other events out of our control. |

Any of these factors could give rise to construction delays and construction costs in excess of our expectations. This could prevent us from completing construction of a project, cause defaults under any potential financing agreements or under PPAs that require completion of project construction by a certain time, cause the project to be unprofitable for us, or otherwise impair our business, financial condition and results of operations.

FUTURE LITIGATION OR ADMINISTRATIVE PROCEEDINGS RELATED TO OUR WIND FARM PROJECTS COULD HAVE A MATERIAL ADVERSE EFFECT ON OUR BUSINESS, FINANCIAL CONDITION AND RESULTS OF OPERATIONS.

In the future, we may be involved in legal proceedings, administrative proceedings, claims and/or litigation that arise in the ordinary course of business of wind farm projects. Individuals and interest groups may sue to challenge the issuance of a permit for a wind energy project or seek to enjoin construction of a wind energy project. In addition, we may be subject to legal proceedings or claims contesting the construction or operation of future wind energy projects. Unfavorable outcomes or developments relating to any such proceedings, such as judgments for monetary damages, injunctions or denial or revocation of permits, could have a material adverse effect on our business, financial condition and results of operations.

WE ARE NOT ABLE TO INSURE AGAINST ALL POTENTIAL RISKS AND MAY BECOME SUBJECT TO HIGHER INSURANCE PREMIUMS.

Our wind energy division will be exposed to the risks inherent in the construction and operation of wind energy projects, such as breakdowns, manufacturing defects, natural disasters, terrorist attacks and sabotage, not all of which is insurable. We may also be exposed to environmental risks. We will have insurance policies covering certain risks associated with our business. However, any such insurance policies will not cover losses as a result offorce majeure, natural disasters, terrorist attacks or sabotage, among other things. We do not expect to maintain insurance for certain environmental risks, such as environmental contamination with respect to our wind energy business. In addition, our insurance policies may be subject to annual review by our insurers and may not be renewed at all or on similar or favorable terms. A serious uninsured loss or a loss significantly exceeding the limits of our future insurance policies could have a material adverse effect on our business, financial condition and results of operations.

RISKS RELATED TO COMMON STOCK

POTENTIAL FUTURE FINANCINGS MAY DILUTE THE HOLDINGS OF OUR CURRENT SHAREHOLDERS.

In order to provide capital for the operation of our business, in the future we may enter into financing arrangements. These arrangements may involve the issuance of new shares of common stock, preferred stock that is convertible into common stock, debt securities that are convertible into common stock or warrants for the purchase of common stock. Any of these items could result in a material increase in the number of shares of common stock outstanding, which would in turn result in a dilution of the ownership interests of existing common shareholders. In addition, these new securities could contain provisions, such as priorities on distributions and voting rights, which could affect the value of our existing common stock.

WE CURRENTLY DO NOT INTEND TO PAY DIVIDENDS ON OUR COMMON STOCK. AS A RESULT, YOUR ONLY OPPORTUNITY TO ACHIEVE A RETURN ON YOUR INVESTMENT IS IF THE PRICE OF OUR COMMON STOCK APPRECIATES.

We currently do not expect to declare or pay dividends on our common stock. In addition, in the future we may enter into agreements that prohibit or restrict our ability to declare or pay dividends on our common stock. As a result, your only opportunity to achieve a return on your investment will be if the market price of our common stock appreciates and you sell your shares at a profit.

YOU MAY EXPERIENCE DILUTION OF YOUR OWNERSHIP INTEREST DUE TO THE FUTURE ISSUANCE OF ADDITIONAL SHARES OF OUR COMMON STOCK.

We are in a capital intensive business and we do not have sufficient funds to finance the growth of our natural gas, oil and wind energy divisions of our business or the construction costs of our development projects or to support our projected capital expenditures. As a result, we will require additional funds from future equity or debt financings, including tax equity financing transactions or sales of preferred shares or convertible debt, to complete the development of new projects and pay the general and administrative costs of our business. We may in the future issue our previously authorized and unissued securities, resulting in the dilution of the ownership interests of holders of our common stock. We are currently authorized to issue 2,600,000,000 shares of common stock and 1,401,925,000 shares of preferred stock with preferences and rights as determined by our board of directors. The potential issuance of such additional shares of common stock or preferred stock or convertible debt may create downward pressure on the trading price of our common stock. We may also issue additional shares of common stock or other securities that are convertible into or exercisable for common stock in future public offerings or private placements for capital raising purposes or for other business purposes. The future issuance of a substantial number of common shares into the public market, or the perception that such issuance could occur, could adversely affect the prevailing market price of our common shares. A decline in the price of our common shares could make it more difficult to raise funds through future offerings of our common shares or securities convertible into common shares.

THERE IS CURRENTLY A LIMITED PUBLIC MARKET FOR OUR COMMON STOCK. FAILURE TO DEVELOP OR MAINTAIN A TRADING MARKET COULD NEGATIVELY AFFECT ITS VALUE AND MAKE IT DIFFICULT OR IMPOSSIBLE FOR YOU TO SELL YOUR SHARES.

There has been a limited public market for our common stock and an active public market for our common stock may never develop. Failure to develop or maintain an active trading market could make it difficult for you to sell your shares or recover any part of your investment in us. Even if a market for our common stock does develop, the market price of our common stock may be highly volatile. In addition to the uncertainties relating to future operating performance and the profitability of operations, factors such as variations in interim financial results or various, as yet unpredictable, factors, many of which are beyond our control, may have a negative effect on the market price of our common stock.

“PENNY STOCK” RULES MAY MAKE BUYING OR SELLING OUR COMMON STOCK DIFFICULT.

If the market price for our common stock is below $5.00 per share, trading in our common stock will be subject to the “penny stock” rules. The SEC has adopted regulations that generally define a penny stock to be any equity security that has a market price of less than $5.00 per share, subject to certain exceptions. These rules would require that any broker-dealer that would recommend our common stock to persons other than prior customers and accredited investors, must, prior to the sale, make a special written suitability determination for the purchaser and receive the purchaser’s written agreement to execute the transaction. Unless an exception is available, the regulations would require the delivery, prior to any transaction involving a penny stock, of a disclosure schedule explaining the penny stock market and the risks associated with trading in the penny stock market. In addition, broker-dealers must disclose commissions payable to both the broker-dealer and the registered representative and current quotations for the securities they offer. The additional burdens imposed upon broker-dealers by such requirements may discourage broker-dealers from effecting transactions in our common stock, which could severely limit the market price and liquidity of our common stock.

ITEM 2. FINANCIAL INFORMATION.

This prospectus contains forward-looking statements which relate to future events or our future financial performance. In some cases, you can identify such forward-looking statements by terminology such as “may,” “should,” “expects,” “plans,” “anticipates,” “believes,” “estimates,” “predicts,” “potential,” or “continue” or the negative of these terms or other comparable terminology. Future filings with the SEC, future press releases and future oral or written statements made by us or with our approval that are not statements of historical fact may also contain forward-looking statements. Because such statements include risks and uncertainties, many of which are beyond our control, actual results may differ materially from those expressed or implied by such forward-looking statements. Some of the factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements are set forth in this section entitled “Financial Information” and elsewhere throughout this Form 10.

The following Management’s Discussion and Analysis of Financial Condition or Results of Operations (“MD&A”) of STL Marketing Group, Inc. provides an analysis of the Company’s financial statements for fiscal years ended December 31, 20012 and 2011 and for the three month period ended March 31, 2013.

The following information is supplementary to, and should be read in conjunction with the audited consolidated financial statements and notes thereto included elsewhere in this registration statement on Form 10. The discussion below contains forward-looking statements that involve risks and uncertainties. For additional information regarding some of these risks and uncertainties, please read “Forward Looking Statements” and Item 1A “Risk Factors” included elsewhere in this registration statement on Form 10.

Plan & Operations

The Company has maintained a small operating budget during the pre-Power Purchase Agreement process and plans to continue to operate with this efficiency until the project begins the planning & construction phase. Once the design and planning phase begins, the Company anticipates using its selected vendors to engage in providing the necessary deliverables to ensure a smooth project roll out. The overall management, oversight and financial functions are handled in-house and will remain that way throughout the life of the Power Purchase Agreement.

The Company maintains and constantly updates various key items in its assumptions, as well as the project timelines. This process allows us to maintain the financial projections, time frames and costs under constant supervision. Based on the current timelines, the Company hopes to begin operating the wind farm in late 2014.

The Company uses an “outsource” strategy to help control costs. The quality of services from companies like GL Garrad Hassan, Dycel (local General Contractor), GyGC (environmental team) etc. have allowed the company to pay for the services needed without adding payroll.

The Company plans to handle the Engineering, Procurement and Construction (“EPC”) itself. The Company uses the “best in class” approach to these professional services and does use a Request for Proposal (“RFP”) process to ensure costs are controlled with regard to its various professional services providers.

For example, we have received quotations from GL Garrad Hassan to be our “Owner’s Engineer” and plan to use this service to have the various senior professionals assist management and ensure the proper review and management of the construction phase. Architects, civil engineers, etc. are already pre-vetted and ready to begin the planning and engineering phase. Several General Contractors have been interviewed and provided quotations, the basis for our construction estimates, and we have a short list of partners prepared.

Once the wind farm has been developed, the Company will focus on the overall customer relations and top-level oversight, and will handle the financial and executive functions only. For the first 5-7 years, the operations of the wind farm will be managed under an Operations & Maintenance Agreement (“O&M Agreement”) with the manufacturer of the Wind Turbine Generators (“WTG”). This is standard operating procedure and a standard requirement for debt financing. As a result, the manufacturer of the WTG’s will provide the Operations & Maintenance of the wind farm machinery and coordinate with the Costa Rican SENSE (national center for electricity) during that time. This Operations & Maintenance Agreement assures all of the Company’s related parties- investors, banks, buyer- that the plant will meet the Service Level Assurances required for the provision of electricity.

We believe this is a sound practice for a variety of reasons, but primarily, it gives the Company time to be trained and have its in-country technicians trained by the manufacturer. It should be noted that this is a standard service provided by the manufacturers and they have the necessary support and technical centers to provide this service. As an example, one of the major US suppliers manages hundreds of wind farms and under an O&M Agreement has offered to train and manage the staff, apply its Standard Operating Procedures, as well as offer 24/7/365 monitoring from various Network Operations Centers, including their main site in Schenectady, New York. The other manufacturers offer similar services. We have used the “per year”, “per WTG” price for the highest service levels in the financial projections.

As the O&M Agreement nears expiration, the Company plans to conduct a review of the staff, its ability to manage the turbines and then undertake a Cost Benefit Analysis to decide whether to extend the O&M Agreement or continue the management on its own. We expect the O&M staff to be transitioned to the Company, if it decides to manage the field itself. This process is standard for most projects and is a very good mechanism to ensure our investors’ value is optimized.

Management feels this “outsource strategy” is the best medium term strategy to ensure the efficacy and production for both the investors and the off-taker. As such, the day-to-day technical management of the turbines including repairs, maintenance and even unscheduled repairs will be handled under performance requirements by the manufacturer of the towers.

The Company’s management will continuously be reviewing the performance of the towers, the site, as well as working on developing new fields and finding new buyers for the site’s continued development.

Activities Completed to Date:

The Company has completed a variety of key studies and advanced in some important areas. The recent move of the site a few kilometers north means the Company will be updating some of these studies. To date, the Company has achieved the following in various important areas:

| 1. | Annual Energy Production Report. The Company engaged GL Garrad Hassan, a premier global firm, to evaluate its wind data and generated a report to confirm the existence of what we believe is a substantial wind resource. |

| 2. | Topography. The Company undertook a wide range of topographical studies including contour lines, 10 km range around the site, in depth regional mapping. New topography is underway, but much of the regional material is adequate. |

| 3. | Environmental. The Company will need to receive approval from SETENA, Costa Rica’s environmental agency. We do not expect undue delay on this once we file the Environmental Impact Study, as our approach has been to provide more than the required information. The Company completed Biology/ Flora, Social/ Community, Archeology and preliminary Geological studies. The Company will update and review one final time before presenting the study to SETENA but have a good amount of progress made to date. |

| | | |

| | | Two advantages the Company enjoys: the wind farm is on agricultural land and we have had no indications of problems from previous community meetings. Indeed we count on strong community support. It takes approximately 6-8 months to receive approvals once the reports are filed, which coincides with our financial closing. |

| 4. | Local Governmental Support. The Company received all the preliminary permits from the municipality of La Cruz. We will be updating these for the site once we execute the Power Purchase Agreement. We already have the “Uso de Suelo” or zoning. Mayor Matias Gonzaga is a supporter of the project and assisting the Company fully. |

Results of Operations

Fiscal Years ended December 31, 2012 and 2011

For the years ended December 31, 2012 and 2011, the Company reported a net loss of $(627,349) and $(681,975), respectively. The change in net loss between the years ended December 31, 2012 and 2011 was primarily attributed to the following decrease in operating expenses due to our Costa Rican Investment Bank inappropriately withholding funds and delaying our fundraising process. Operating Expenses decreased by 18% during the year ended December 31, 2012, as compared to the year ended December 31, 2011. The $119,926 decrease in operating expenses is primarily attributed to the following decrease in operating expenses: compensation of $14,809 due to the cancellation of the Company’s retirement account, professional fees of $78,101 related to halting on professional studies, general and administrative of $27,016 related to absence of travel and marketing, and the Company had a loss on the relinquishment of a land lease of $58,725 due to cancelling the land contract.

The Company is still a development stage company and therefore has no revenues to date.

Three Months ended March 31, 2013 and 2012

For the periods ended March 31, 2013 and 2012, the Company reported a net loss of $(282,199) and $(163,665), respectively. The change in net loss between the periods ended March 31, 2013 and 2012 was due to the merger between STL Marketing Group Inc. and Versant Corporation. This attributes to an increase in interest expense of $36,841, as well as derivative liabilities of $99,193 for convertible debt acquired in the merger transaction.

Operating Expenses decreased by 11% during the period ended March 31, 2013, as compared to the period ended March 31, 2012. The $17,500 decrease in operating expenses is primarily attributable to the general and administrative operating expense of $15,616, due to lack of travel and marketing.

The Company is still a development stage company and therefore has no revenues to date.

Liquidity and Capital Resources

The following table summarizes total current assets, liabilities and working deficit at March 31, 2013 December 31, 2012 and December 31, 2011:

| | | Period ended | | | Years ended | | | | |

| | | March 31, 2013 | | | December 31, 2012 | | | December 31, 2011 | | | Increase/(Decrease) Mar. 2013 to Dec 2012 | |

| Current Assets | | $ | 6,652 | | | $ | 584 | | | $ | 27,309 | | | $ | 6,068 | |

| Current Liabilities | | $ | 3,234,622 | | | $ | 724,706 | | | $ | 232,255 | | | $ | 2,509,916 | |

| Working Deficit | | $ | (3,227,970 | ) | | $ | (724,122 | ) | | $ | (204,946 | ) | | $ | (2,503,848 | ) |

As of March 31, 2013, we had a working deficit of $3,227,970 as compared to December 31, 2012 of $724,122, an increase of $2,503,848. From December 31, 2012 to December 31, 2011 we had an increase of $519,176. The increase in working deficit for the period ended March 31, 2013, is primarily attributed to an increase in the Company’s liabilities related accrued payables and expenses of $250,030, liability to be settled in stock of $103,333, derivative liabilities of $1,754,334, additional convertible notes of $352,800, as well as notes and loans to related parties of $66,125 for cash used in operating activities during the period ended March 31, 2013.

Net cash used in operating activities for the period/years ended March 31, 2013, December 31, 2012 and 2011 was $(43,160), $(113,526) and $(566,915), respectively. The Net Loss for the period/years ended March 31, 2013, December 31, 2012 and 2011 was $(282,199), $(627,349) and $(681,975), respectively.

Net cash in all investing activities for the period ended March 31, 2013 was $14,806, as compared to the year ended December 31, 2012 was $42,500 and $(79,961) for the year ended December 31, 2011. The Company received cash of $1,131 from merger of STL Marketing Group, Inc. and Versant Corporation and paid cash of $13,675 for a loan to related party. For the year ended December 31, 2012 the Company received cash of $67,500 from proceeds in the disposition of the cancelled land lease contract and also invested $25,000 as a cash deposit for the STL Marketing Group, Inc. acquisition. The Company paid cash for property and equipment of $12,461 for the year ended December 31, 2011 and invested $67,500 for land rights.

Net cash provided by all financing activities for the period ended March 31, 2013 was $34,025 as compared to $44,251 and $673,205 for the years ended December 31, 2012 and 2011, respectively. During the period ended March 31, 2013, the Company sold 22,600,000 shares of common stock for net proceeds of $25,000, sold notes for the proceeds of $10,000 and made payments to the Company’s outstanding notes of $975. During the year ended December 31, 2012, the Company sold notes and loans for the net proceeds of $52,184 and made payments to the Company’s outstanding notes of $7,933. During the year ended December 31, 2011, the Company sold 1,800,000 shares of preferred stock for net proceeds of $530,001 (of which $195,400 net to the Company was inappropriately withheld by the Company’s then Costa Rican Investment Bank), sold 200,000 shares of common stock for the net proceeds of $170,000, sold notes to related parties for the proceeds of $13,500 and made payments to the Company’s outstanding notes of $10,296.

The estimated working capital requirement for the next twelve months is $1,250,000 with an estimated burn rate of $104,000 per month. The Company continues to proceed with the required field studies and engineering needed on the wind park.

Over the next twelve months the Company anticipates executing its Power Purchase Agreement, closing its debt financing and raising the estimated $10,000,000 of the private equity required to develop the first wind park on the site. Along with these tasks, the above figure would eliminate the existing debt to the Company of roughly $1,480,288, ensure all studies and necessary environmental, engineering and legal work estimated at $1,000,000 is required to ensure the timely installation of the wind turbine generators.

As reflected in the accompanying financial statements, the Company has a net loss and net cash used in operations of $282,199 and $14,806, respectively, for the period ended March 31, 2013.

The ability of the Company to continue its operations is dependent on Management’s plans to raise capitalsufficient to fund operations. Management’s plans include the raising of capital through debt and or equity markets with some additional funding through convertible notes. The Company may need to incur additional liabilities with certain related parties to sustain the Company’s existence.

The Company will require additional funding to finance its operations and its milestones. There can be no assurance that financing will be available or that the Company will be able to achieve its milestones.

Our auditors have expressed substantial doubt about the Company’s ability to continue as a “going concern”. The Company plans to raise additional debt and/or equity financing to allow us the ability to cover our current cash flow requirements and meet our obligations as they become due. There can be no assurances that financing will be available or if available, that it will be under favorable terms. In the event that we are unable to generate adequate revenues to cover expenses and cannot obtain additional financing in the near future, we may seek protection under bankruptcy laws. These financial statements do not include any adjustments that might result from the uncertainty as to whether we will continue as a “going concern”. Our ability to continue status as a “going concern” is dependent upon our generating cash flow sufficient to fund operations. If we continue incurring losses and fail to achieve profitability, we may have to cease our operations. Our business plan may not be successful in addressing these issues.

Off-Balance Sheet Arrangements

We do not have any off-balance sheet arrangements that have or are reasonably likely to have a current or future effect on our financial condition, or result in changes in financial condition, revenues or expenses, results or operations, liquidity, capital expenditures or capital resources that is material to investors.

ITEM 3. PROPERTIES.

Currently, the business is based in Colorado Springs, Colorado and operates their main office located at 10 Boulder Crescent, Suite 102, Colorado Springs, CO 80903. The office is approximately 973 square feet, which the Company pays $1,094 per month. The lease increased to $1,135 per month in November 2012. The remaining term of the lease is 1 year ending October 31st, 2013. The Company maintains a serviced office in Edificio Las Terrazas A, 5 to Piso, Plaza Roble, Escazu, San Jose, Costa Rica. This office is leased for $299.00 per month on a month to month basis.

The above facilities are expected to expand once the wind farm construction begins.

Energia Renovable Versant SRL, STLK’s subsidiary, has a lease agreement in Guanacaste, Costa Rica for its wind development project. This lease for over 5,300 hectares (over 13,000 acres) of land with a proven wind resource. The lease costs 4% of the energy generated and sold from the facility. No other payments are required for the lease.

ITEM 4. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT.

The following table sets forth, as of July 29, 2013, the number of shares of (i) common stock owned of record and beneficially by our current executive officers, directors and persons who hold 5% or more of the outstanding shares of common stock and Preferred Stock, respectively, of the Company, and all of our current directors and executive officers as a group. Amounts reported under “Number of Shares of Common Stock Beneficially Owned as of July 29, 2013” includes the number of shares that could be acquired through the conversion of any Preferred Stock or other convertible securities within sixty (60) days of this date. Except as otherwise indicated and subject to applicable community property laws, each owner has sole voting and investment power with respect to the securities listed. Further, unless otherwise indicated, each director’s, officer’s and beneficial owner’s address is c/o STL Marketing Group, Inc.,10 Boulder Crescent, Suite 102, Colorado Springs, CO 80903.

| Name and Address of Beneficial Owner(1) | | Shares | | | Total | |

| | | | | | | |

| Directors and named Executive Officers | | | | | | |

| | | | | | | |

| Jose P. Quiros(3) | | 100,000,000 | | | 30.49 | % |

| | | | | | | |

| Jaime L. Kniep | | 0 | | | 0 | % |

| | | | | | | |

| Ing. Pedro Quiros | | 0 | | | 0 | % |

| | | | | | | |

| All Directors and executive officers as a group (3 persons) | | 100,000,000 | | | 30.49 | %(2) |

| | | | | | | |

| Dr. Alvaro & Mary Liceaga(4) | | 39,282,360 | (4) | | 11.98 | % |

| | | | | | | |

| Edward Michael Liceaga(5) | | 29,031,170 | (5) | | 8.85 | % |

| | | | | | | |

| Ivy Akastsa(6) | | 66,183,338 | (6) | | 20.18 | % |

(1) Except as otherwise indicated, the persons named in this table have sole voting and investment power with respect to all shares of common stock shown as beneficially owned by them, subject to community property laws where applicable and to the information contained in the footnotes to this table.

(2) Pursuant to Rules 13d-3 and 13d-5 of the Exchange Act, beneficial ownership includes any shares as to which a shareholder has sole or shared voting power or investment power, and also any shares which the shareholder has the right to acquire within 60 days, including upon exercise of common shares purchase options or warrants. There are 327,955,269 shares of common stock issued and outstanding as of July 29, 2013including securities exercisable or convertible intoshares of Common Stock within sixty (60) days hereof for each stockholder.

(3) The shares are owned by Versant I, Inc. ,which is majority owned by our Chief Executive Officer, Mr. Jose P. Quiros.

(4) Dr. Alvaro & Mary Liceaga were issued a Convertible Note on November 5, 2007 that is currently convertible on demand into 39,282,360 shares of the Company’s common stock

(5) Edward Michael Liceaga was issued a Convertible Note on January 26, 2008 that is currently convertible on demand into 29,031,170 shares of the Company’s common stock.

(6) Ivy Akastsa purchased a Convertible Note, on December 4, 2011, originally issued on March 1, 2008 that is currently convertible on demand into 66,183,338 shares of the Company’s common stock.

ITEM 5. DIRECTORS, EXECUTIVE OFFICERS.

The following table contains information with respect to our directors and executive officers. To the best of our knowledge, none of our directors or executive officers has an arrangement or understanding with any other person pursuant to which he or she was selected as a director or officer. All directors hold office until the next annual meeting of stockholders or until their successors have been elected and qualified.

| Name | | Age | | Position |

| Jose P. Quiros | | 46 | | Chief Executive Officer, Director |

| | | | | |

| Jaime L. Kniep | | 36 | | Chief Financial Officer, Director |

| | | | | |

| Ing. Pedro P. Quiros | | 74 | | Chairman of the Board |

Jose P. Quiros, age 46 – Chief Executive Officer

Mr. Quiros has worked at a variety of industries and companies from start-ups to Fortune 1000 companies. He has operated companies in the UK, Dubai, India, Russia and the US. Most recently, Mr. Quiros was the Chief Operating Officer for CETIS, a telecommunications manufacturer from 2006 through 2010. While at Cetis, he undertook a multi continent expansion and completed two successful mergers & acquisitions.

Mr. Quiros received two Bachelor of Science from Barry University in Miami. He holds degrees in Economics/ Finance & International Business Management and graduated Summa Cum Laude. Mr. Quiros also attended the University of Miami School of Law.

Ing. Pedro P. Quiros, age 74, Chairman of the Board

Ing. Pedro P. Quiros (“Ing. Quiros”), began his career as a high level executive at the Instituto Costarricense de Electricidad (ICE). Over the past 50 years, he has had a varied career where he worked at a variety of multinational corporations such as Ascom-Timeplex, ITT, Harris Corporation, General Electric and GTECH to name a few. He has operated, restructured and started companies in more than a dozen countries including telecommunications systems in Saudi Arabia, Jordan, Brazil and Colombia. Most recently, Ing. Quiros served, from 2006 through 2010, as the Chief Executive Officer & Chairman of theInstituto Costarricense de Electricidad (Grupo ICE) where he oversaw that company’s telecommunications and electrical utilities companies. ICE has revenue of $1 billion, over twenty thousand employees and is Costa Rica’s predominant state owned telecommunications and energy company.

Ing. Quiros received his Bachelor’s Degree in Mathematics from St. Michael’s College, Vermont, (magna cum laude) and Bachelor’s Degree Electrical Engineering degree from Purdue University, Indiana.

Mrs. Jaime L. Kniep, age 36, Chief Financial Officer