| | | | | | |

| | 98 SAN JACINTO BLVD. SUITE 1500 AUSTIN, TEXAS 78701-4078 TEL +1 512.322.2500 FAX +1 512.322.2501 BakerBotts.com | | ABU DHABI AUSTIN BEIJING BRUSSELS DALLAS DUBAI HONG KONG | | HOUSTON

LONDON MOSCOW NEW YORK PALO ALTO RIYADH WASHINGTON |

April 19, 2013

Laura Lanza Tyson

TEL +1 (512) 322-2556

FAX +1 (512) 322-8377

laura.tyson@bakerbotts.com

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F. Street, N.E.

Washington, D.C. 20549

Attention: Mara L. Ransom

| | Re: | Tallgrass Energy Partners, LP (the “Partnership”) |

Registration Statement on Form S-1

File No. 333-187595

Ladies and Gentlemen:

This letter relates to the Partnership’s Registration Statement on Form S-1 (the “Registration Statement”), as amended through Amendment No. 2 filed on April 18, 2013. On behalf of the Partnership, we hereby submit for the Commission’s review the currently expected offering terms to be included in the Partnership’s preliminary prospectus (the “Preliminary Prospectus”) relating to the Partnership’s proposed initial public offering (the “Offering”), including the bona fide price range pursuant to Item 503(b)(3) of Regulation S-K. These pricing terms will be included in a future amendment to the Registration Statement. The provided terms are a bona fide estimate of the range of the minimum and maximum offering price and the maximum amount of securities to be offered as of April 19, 2013. Should the bona fide estimates of these terms change, the figures presented in future amendments to the Registration Statement may increase or decrease.

The Preliminary Prospectus will state that the initial offering price to the public of the Partnership’s common units (the “Common Units”) is expected to be between $21.00 and $23.00 per Common Unit, with a midpoint of $22.00 per Common Unit, based on 13,050,000 Common Units offered to the public in connection with the Offering and 24,300,000 Common Units expected to be outstanding upon completion of the Offering. As requested by the Commission, please find enclosed the relevant sections of the Registration Statement updated to reflect the price range and unit number information.

The Partnership seeks confirmation from the staff of the Division of Corporation Finance that it may launch its Offering with the price range specified herein and include such price range in a future filing of the Registration Statement.

April 19, 2013

To the extent that you have any questions regarding this letter, please do not hesitate to contact me at (512) 322-2556.

|

Very truly yours, |

|

| /s/ Laura L. Tyson |

Laura L. Tyson |

LLT:jr

Enclosures

| cc: | George E. Rider, Tallgrass Energy Partners, LP |

David P. Oelman, Vinson & Elkins, LLP

- 2 -

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities and it is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted

Subject to Completion, datedApril , 2013

PROSPECTUS

Tallgrass Energy Partners, LP

13,050,000 Common Units

Representing Limited Partner Interests

This is the initial public offering of our common units representing limited partner interests. We are offering 13,050,000 common units in this offering. We currently expect that the initial public offering price will be between $21.00 and $23.00 per common unit. Prior to this offering, there has been no public market for our common units. We have been approved to list our common units on the New York Stock Exchange under the symbol “TEP,” subject to official notice of issuance.

Investing in our common units involves risks. Please read “Risk Factors” beginning on page 25.

These risks include the following:

| • | | We may not have sufficient cash from operations to enable us to pay the minimum quarterly distribution to holders of our common and subordinated units. |

| • | | If we are unable to renew or replace expiring customer contracts at favorable rates or on a long-term basis, our financial condition, results of operations, cash flows and ability to make cash distributions to our unitholders will be adversely affected. |

| • | | Our operations are subject to extensive regulation by federal, state and local regulatory authorities. |

| • | | Our general partner and its affiliates, including Tallgrass GP Holdings, which owns our general partner and the general partner of Tallgrass Development, LP, have conflicts of interest with us and limited duties to us and our unitholders. |

| • | | Affiliates of our general partner are not limited in their ability to compete with us and have limited obligations to offer us the opportunity to acquire additional assets or businesses. |

| • | | You will experience immediate dilution in net tangible book value of $11.59 per common unit. |

| • | | Our partnership agreement restricts the remedies available to holders of our common units for actions taken by our general partner that might otherwise constitute breaches of fiduciary duty. |

| • | | Holders of our common units have limited voting rights and are not entitled to select our general partner or elect members of its board of directors. |

| • | | Our tax treatment depends on our status as a partnership for federal income tax purposes. If the IRS were to treat us as a corporation for federal income tax purposes, which would subject us to entity-level taxation, then our cash available for distribution to our unitholders would be substantially reduced. |

| • | | You will be required to pay taxes on your share of our income even if you do not receive any cash distributions from us. |

In addition, we qualify as an “emerging growth company” as defined in Section 2(a)(19) of the Securities Act of 1933 and, as such, are allowed to provide in this prospectus more limited disclosures than an issuer that would not so qualify. Furthermore, for so long as we remain an emerging growth company, we will qualify for certain limited exceptions from investor protection laws such as the Sarbanes Oxley Act of 2002 and the Investor Protection and Securities Reform Act of 2010. Please read “Risk Factors” and “Prospectus Summary—Implications of Being an Emerging Growth Company.”

| | | | | | | | |

| | | Per Common Unit | | | Total | |

Public Offering Price | | $ | | | | $ | | |

Underwriting Discount(1) | | $ | | | | $ | | |

Proceeds to Tallgrass Energy Partners, LP (Before Expenses) | | $ | | | | $ | | |

| (1) | Excludes a structuring fee of an aggregate of0.50% of the gross offering proceeds payable to Barclays Capital Inc. and Citigroup Global Markets Inc. Please read “Underwriting.” |

To the extent that the underwriters sell more than13,050,000 common units in this offering, the underwriters have the option to purchase up to an additional1,957,500 common units from Tallgrass Energy Partners, LP at the initial public offering price less underwriting discounts.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the common units to purchasers on or about , 2013, through the book-entry facilities of The Depository Trust Company.

| | | | | | |

| Barclays | | Citigroup | | BofA Merrill Lynch | | Deutsche Bank Securities |

| | | | | | |

| Credit Suisse | | Morgan Stanley | | RBC Capital Markets | | Wells Fargo Securities |

| | | |

| Baird | | | | | | Stifel |

Prospectus dated , 2013

PROSPECTUS SUMMARY

This summary highlights information contained elsewhere in this prospectus. It does not contain all of the information that you should consider before investing in the common units. You should read the entire prospectus carefully, including “Risk Factors” and the historical and pro forma financial statements and the notes to those financial statements included elsewhere in this prospectus. Unless indicated otherwise, the information presented in this prospectus assumes (1) an initial public offering price of $22.00 per common unit (the midpoint of the price range set forth on the cover page of this prospectus) and (2) that the underwriters do not exercise their option to purchase additional units. We include a glossary of some of the terms used in this prospectus as Appendix B. References in this prospectus to “Tallgrass,” “we,” “our,” “us” or like terms when used in a historical context refer to the businesses and assets of Tallgrass Interstate Gas Transmission, LLC and Tallgrass Midstream, LLC, each of which Tallgrass Development, LP is contributing to Tallgrass Energy Partners, LP in connection with this offering. When used in the present tense or prospectively, those terms refer to Tallgrass Energy Partners, LP and its subsidiaries. References to our “general partner” are to Tallgrass MLP GP, LLC, a Delaware limited liability company and our general partner. References to “Kelso” are to Kelso & Company and its affiliated investment funds and other entities under its control, and references to “EMG” are to The Energy & Minerals Group, its affiliated investment funds and other entities under its control. References to “Tallgrass GP Holdings” are to Tallgrass GP Holdings, LLC, a Delaware limited liability company owned by Kelso, EMG and certain members of our management team. Tallgrass GP Holdings is the sole owner of both our general partner and of the general partner of Tallgrass Development, LP. References in this prospectus to “Tallgrass Development” are to Tallgrass Development, LP and its subsidiaries and affiliates, other than our general partner and us. Please read “—Formation Transactions and Partnership Structure.”

Tallgrass Energy Partners, LP

Overview

We are a growth-oriented Delaware limited partnership formed by Tallgrass Development to own, operate, acquire and develop midstream energy assets in North America. We currently provide natural gas transportation and storage services for customers in the Rocky Mountain and Midwest regions of the United States through our Tallgrass Interstate Gas transportation system (referred to in this prospectus as the TIGT System) and provide processing services for customers in Wyoming through our Casper and Douglas natural gas processing and West Frenchie Draw natural gas treating facilities (collectively referred to in this prospectus as the Midstream Facilities). We intend to leverage our relationship with Tallgrass Development and utilize the significant experience of our management team to execute our growth strategy of acquiring midstream assets from Tallgrass Development and third parties, increasing utilization of our existing assets and expanding our systems through organic growth projects.

For the period from January 1, 2012 to November 12, 2012, we reported net income of approximately $51.5 million. For the period from November 13, 2012 to December 31, 2012, we incurred a net loss of approximately $1.4 million. For the year ended December 31, 2012, we generated Adjusted EBITDA of approximately $76.4 million. Adjusted EBITDA is a non-GAAP financial measure. For more information regarding Adjusted EBITDA and a reconciliation of Adjusted EBITDA to its most directly comparable GAAP measure, please read “Summary Historical and Pro Forma Financial and Operating Data—Non-GAAP Financial Measure.”

In November 2012, Tallgrass Development acquired from Kinder Morgan Energy Partners, L.P. (NYSE: KMP), or Kinder Morgan, a portfolio of midstream energy assets having an enterprise value of approximately $3.3 billion (based on the cash purchase price paid and Tallgrass Development’s proportionate share of the indebtedness of the acquired entities). Tallgrass Development will contribute the TIGT System and the

1

| | • | | the Trailblazer Pipeline, an approximately 439-mile interstate pipeline with a capacity of up to 862 MMcf/d, that transports natural gas from southeastern Wyoming to interconnections with the Natural Gas Pipeline Company of America and Northern Natural Gas Company pipeline systems in Nebraska; and |

| | • | | a 50% interest in, and operation of, the Rockies Express Pipeline, or the REX Pipeline, a modern approximately 1,698-mile natural gas pipeline with a long-haul design capacity of up to 1.8 Bcf/d, that extends from Opal, Wyoming and Meeker, Colorado to Clarington, Ohio. |

Tallgrass Development will also own an approximately 66% limited partner interest in us. In addition, Tallgrass Development is controlled by its general partner, Tallgrass Development GP, LLC, which is wholly-owned by Tallgrass GP Holdings, the sole owner of our general partner, which will own our 2% general partner interest and all of our incentive distribution rights, or IDRs. Upon the closing of this offering, we will enter into an omnibus agreement pursuant to which Tallgrass Development will grant us a right of first offer to acquire each of the Retained Assets. Other than these omnibus agreement provisions, Tallgrass Development is under no obligation to offer to sell us additional assets or to pursue acquisitions jointly with us, and we are under no obligation to buy the Retained Assets or any such additional assets or pursue any such joint acquisitions. However, given the significant economic interest in us held by Tallgrass Development and its affiliates following this offering, we believe Tallgrass Development will be incentivized to offer us the opportunity to acquire any additional midstream assets that it owns.

Business Strategies

Our principal business objective is to increase the quarterly cash distributions that we pay to our unitholders over time while ensuring the ongoing stability of our business. We expect to achieve this objective through the following business strategies:

| | • | | Growing our business by pursuing accretive acquisitions from Tallgrass Development and third parties. We intend to pursue acquisitions from Tallgrass Development that we expect will be sourced both from Tallgrass Development’s existing portfolio of midstream assets and from additions to its portfolio from expansion projects or acquisitions that it undertakes in the future. In addition, we will review acquisition opportunities from third parties as they become available. |

| | • | | Capitalizing on organic expansion opportunities. We continually evaluate economically attractive, organic expansion opportunities in existing or new areas of operation that will allow us to leverage our market position and other competitive strengths. We intend to pursue high-value accretive growth projects in growing areas that will provide diversification and economies of scale. |

| | • | | Maintaining and growing stable cash flows supported by long-term, fee-based contracts. We will seek to generate the majority of our cash flows pursuant to multi-year, firm contracts with creditworthy customers. We will continue to pursue opportunities to increase the fee-based component of our contract portfolio to minimize our direct commodity price exposure through contract renewal negotiations, acquisitions or other growth projects. |

| | • | | Maintain a conservative and flexible capital structure in order to pursue acquisition and expansion opportunities and lower our overall cost of capital. We intend to target credit metrics consistent with the profile of investment grade midstream energy companies. We intend to maintain a conservative and balanced capital structure which, when combined with our stable, fee-based cash flows, will afford us efficient access to the capital markets at a competitive cost of capital. |

5

Competitive Strengths

We believe we are well-positioned to successfully execute our business strategies because of the following competitive strengths:

| | • | | Stable cash flows supported by attractive contract mix and customer profile. A substantial majority of our revenue is produced under long-term contracts with high-quality customers. We believe this profile, along with our contract mix, gives us the ability to maintain a stable cash flow and thereby provides operating visibility and flexibility. |

| | • | | Strategic infrastructure with close proximity to demand markets and supply sources. We believe our assets represent an important link to end-user markets in the Midwest and are well positioned to continue to capture growing natural gas volumes in the Denver-Julesburg Basin and the Niobrara and Mississippi Lime shale formations. The TIGT System primarily provides transportation and storage services to on-system customers such as LDCs and other industrial users, including ethanol plants, and irrigation and grain drying operations, which depend on the TIGT System’s interconnections to their facilities and a majority of whom pay FERC-approved recourse rates. In addition, we believe the substantial number of interconnections with other energy infrastructure assets contributes to making the TIGT System a strategic part of the flow of natural gas in the Midwest. |

| | • | | Relationship with Tallgrass Development. We believe that Tallgrass Development and its affiliates, as the owners of a 66% limited partnership interest in us, a 2% general partner interest in us and all of our IDRs are motivated to promote and support the successful execution of our principal business objective and to pursue projects that directly or indirectly enhance the value of our assets through, for example, the right of first offer with respect to the Retained Assets, providing other acquisition opportunities and an executive team with significant industry and management expertise. |

| | • | | Financial flexibility to pursue expansion and acquisition opportunities. We believe our cash flows, unused borrowing capacity, and access to debt and equity capital markets will provide us financial flexibility to competitively pursue acquisition and expansion opportunities. At the consummation of this offering, we expect to have approximately $175 million of available borrowing capacity under our revolving credit facility to fund acquisitions, expansions and working capital needs. |

| | • | | Incentivized management team. Members of our management team are strongly incentivized to grow our business and cash flows through their indirect 25% interest in our general partner, which will own our 2.0% general partner interest and all of our IDRs following this offering. |

Risk Factors

An investment in our common units involves risks associated with our business, our regulatory and legal matters, our limited partnership structure and the tax characteristics of our common units. The following list of risk factors is not exhaustive. You should carefully consider the risks described in “Risk Factors” and the other information in this prospectus before deciding whether to invest in our common units.

Risks Related to Our Business

| | • | | We may not have sufficient cash from operations following the establishment of cash reserves and payment of fees and expenses to enable us to pay the minimum quarterly distribution to holders of our common and subordinated units. |

| | • | | The assumptions underlying the forecast of cash available for distribution that we include in “Our Cash Distribution Policy and Restrictions on Distributions” are inherently uncertain and are subject to significant risks and uncertainties that could cause actual results to differ materially from those forecasted. |

6

Tallgrass Development is controlled by its general partner, Tallgrass Development GP, LLC, which is wholly-owned by Tallgrass GP Holdings, the sole owner of our general partner. Tallgrass Development is led by its President and Chief Executive Officer, David G. Dehaemers, Jr., and a management team with significant midstream energy experience. Additionally, a significant portion of the Kinder Morgan employees formerly involved in the operation of the assets acquired by Tallgrass Development are now employed by Tallgrass Management, LLC, an affiliate of the general partner of Tallgrass Development, which we refer to in this prospectus as Tallgrass Management. We also share a management team with Tallgrass Development and, as a result, will have access to strong commercial relationships throughout the energy industry and a broad operational, commercial, technical, risk management and administrative infrastructure.

In exchange for the assets contributed to the Partnership by Tallgrass Development, we will (i) issue to Tallgrass Development 11,250,000 common units and 16,200,000 subordinated units, representing a 66% limited partner interest in us (62% if the underwriters exercise in full their option to purchase additional common units), (ii) assume from Tallgrass Development $400 million of indebtedness and (iii) pay to Tallgrass Development $85.5 million in cash as reimbursement for a portion of the capital expenditures made by Tallgrass Development to purchase the contributed assets. If and to the extent the underwriters exercise their option to purchase additional common units, the number of common units purchased by the underwriters pursuant to any exercise will be sold to the public and the net proceeds from such sale will be distributed to Tallgrass Development and any remaining common units not purchased by the underwriters pursuant to any exercise of the option will be issued to Tallgrass Development at the expiration of the option period. Our general partner will also receive its 2% general partner interest and the IDRs in exchange for the contribution of membership interests in Tallgrass MLP Operations, LLC to us.

At the closing of this offering, Tallgrass Development will own a 66% limited partner interest in us and its affiliates will own a 2% general partner interest in us and all of our IDRs. Given the significant ownership interests in us that will be retained by Tallgrass Development and its affiliates following this offering, we believe that they will be motivated to promote and support the successful execution of our business strategies, including through our potential acquisition of additional midstream assets from Tallgrass Development over time and the facilitation of accretive acquisitions from third parties, although Tallgrass Development is under no obligation to offer any assets or business opportunities to us, other than the obligation under the omnibus agreement to offer us the Retained Assets pursuant to the right of first offer, or accept any offer for its assets that we may choose to make.

At the closing of this offering, we will enter into an omnibus agreement with Tallgrass Development and our general partner that will govern our relationship with them regarding our right of first offer to acquire the Retained Assets as well as certain expense reimbursement and indemnification matters, among other things. Please read “Certain Relationships and Related Transactions—Agreements with Affiliates—Omnibus Agreement.”

Our Relationship with EMG and Kelso

EMG and Kelso collectively own 75% of Tallgrass GP Holdings, the owner of our general partner. Members of our management team own the remaining 25% interest in Tallgrass GP Holdings. EMG and Kelso acquired membership interests in Tallgrass Development GP as well as limited partner interests in Tallgrass Development in August 2012 in order to fund a portion of the cash purchase price paid by Tallgrass Development in connection with the acquisition of assets from Kinder Morgan. In connection with the closing of this offering, the members of Tallgrass Development GP formed Tallgrass GP Holdings to act as a holding company for Tallgrass Development GP and our general partner and will contribute their membership interests in Tallgrass Development GP to Tallgrass GP Holdings in exchange for identical membership interest percentages in Tallgrass GP Holdings.

8

EMG is the management company for a series of specialized private equity funds. EMG focuses on investing across various facets of the global natural resource industry including the upstream and midstream segments of the energy complex. EMG has approximately $6.2 billion of total investor commitments (including co-investments) with in excess of $3.1 billion deployed across the energy sector since inception.

Kelso is one of the oldest and most established firms specializing in private equity. Since 1980, Kelso has invested in over 115 companies in a broad range of industry sectors, including over $2.0 billion of equity invested in energy-related companies.

Management of Tallgrass Energy Partners, LP

We are managed and operated by the board of directors and executive officers of our general partner. Tallgrass GP Holdings is the sole owner of our general partner and has the right to appoint the entire board of directors of our general partner, including our independent directors. Unlike shareholders in a publicly traded corporation, our unitholders will not be entitled to select our general partner or elect the members of the board of directors of our general partner. All of the executive officers and a majority of the directors of our general partner are also officers and/or directors of Tallgrass GP Holdings. For information about the executive officers and directors of our general partner, please read “Management.” Upon completion of this offering, our general partner will have seven directors. Under the listing requirements of the New York Stock Exchange, or NYSE, the board of directors of our general partner will be required to have an audit committee consisting of at least three independent directors meeting the NYSE’s independence standards within one year following the completion of this offering. At least one of our independent directors will be appointed prior to the date our common units are listed for trading on the NYSE.

In order to maintain operational flexibility, our operations are conducted through, and our operating assets are owned by wholly-owned operating subsidiaries. However, neither we nor any of our wholly-owned operating subsidiaries have any employees. Although all of the employees that conduct our business are employed by Tallgrass Management, we sometimes refer to these individuals in this prospectus as our employees.

Neither our general partner nor Tallgrass Development’s general partner and its affiliates will receive any management fee or other compensation in connection with the management of our business, but we will reimburse our general partner for all expenses it incurs and payments it makes on our behalf pursuant to our partnership agreement. In addition, we will reimburse Tallgrass Development’s general partner and its affiliates for all expenses they incur and payments they make on our behalf pursuant to the omnibus agreement, including the costs of employee and director compensation and benefits as well as the cost of the provision of certain corporate, general and administrative services in each case to the extent properly allocable to us. Our partnership agreement provides that our general partner will determine in good faith which expenses are appropriately allocable to us. These expenses will vary with the size and scale of our operations, among other factors. We currently anticipate that reimbursable expenses will be approximately $46.8 million for the twelve months ended June 30, 2014 based on our current operations. Neither our partnership agreement nor our omnibus agreement limits the amount of expenses for which our general partner and its affiliates may be reimbursed. All reimbursements to our general partner and Tallgrass Development’s general partner and its affiliates will be made prior to cash distributions to our common unitholders. Our general partner is liable, as general partner, for all of our debts (to the extent not paid from our assets), except for indebtedness or other obligations that are made specifically nonrecourse to it. Whenever economically practical, our general partner intends to cause us to incur indebtedness or other obligations that are nonrecourse to it.

Following the closing of this offering, our general partner will own 826,531 general partner units representing a 2.0% general partner interest in us, which will entitle it to receive 2.0% of all the distributions we make. Our general partner will also own all of our IDRs, which will entitle it to increasing percentages, up to a maximum of 48.0%, of the cash we distribute in excess of $0.3048 per unit per quarter after the closing of our initial public offering. Please read “Certain Relationships and Related Transactions.”

9

Formation Transactions and Partnership Structure

At or prior to the closing of this offering, the following transactions, which we refer to as the formation transactions, will occur:

| | • | | Tallgrass Development will contribute 100% of the membership interests in each of Tallgrass Interstate Gas Transmission, LLC and Tallgrass Midstream, LLC to us; |

| | • | | we will (i) issue to Tallgrass Development 11,250,000 common units and 16,200,000 subordinated units, representing a 66% limited partner interest in us (62% if the underwriters exercise in full their option to purchase additional common units), (ii) assume from Tallgrass Development $400 million of indebtedness and (iii) pay to Tallgrass Development $85.5 million in cash as reimbursement for a portion of the capital expenditures made by Tallgrass Development to purchase the contributed assets; |

| | • | | we will issue to our general partner 826,531 general partner units, representing its initial 2.0% general partner interest in us, and all of our IDRs; |

| | • | | we will issue 13,050,000 common units to the public in this offering, representing a 32% limited partner interest in us (36% if the underwriters exercise in full their option to purchase additional common units), and will use the proceeds of this offering to pay expenses associated with this offering and to retire approximately $264.4 million of the debt assumed from Tallgrass Development; |

| | • | | we will enter into a new $400 million revolving credit facility, as described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—New Credit Facility,” and will borrow approximately $225 million, the proceeds of which will be used to repay the remaining approximately $135.6 million of debt assumed from Tallgrass Development, to pay origination fees related to our new revolving credit facility and to pay $85.5 million to Tallgrass Development as reimbursement for a portion of the capital expenditures made by Tallgrass Development to purchase the contributed assets, which Tallgrass Development acquired together with the Retained Assets for $1.8 billion; and |

| | • | | we will enter into an omnibus agreement with Tallgrass Development, its general partner and our general partner, which will address, among other things, our right of first offer to acquire the Retained Assets from Tallgrass Development, the provision of and the reimbursement for general and administrative and operating services and indemnification of certain items by Tallgrass Development. |

The number of common units to be issued to Tallgrass Development includes 1,957,500 common units that will be issued at the expiration of the underwriters’ option to purchase additional common units, assuming that the underwriters do not exercise their option. Any exercise of the underwriters’ option to purchase additional units would reduce the common units shown as issued to Tallgrass Development by the number to be purchased by the underwriters in connection with such exercise. If and to the extent the underwriters exercise their option to purchase additional common units, the number of common units purchased by the underwriters pursuant to any exercise will be sold to the public and the net proceeds from such sale will be distributed to Tallgrass Development and any remaining common units not purchased by the underwriters pursuant to any exercise of the option will be issued to Tallgrass Development at the expiration of the option period.

11

Ownership of Tallgrass Energy Partners, LP

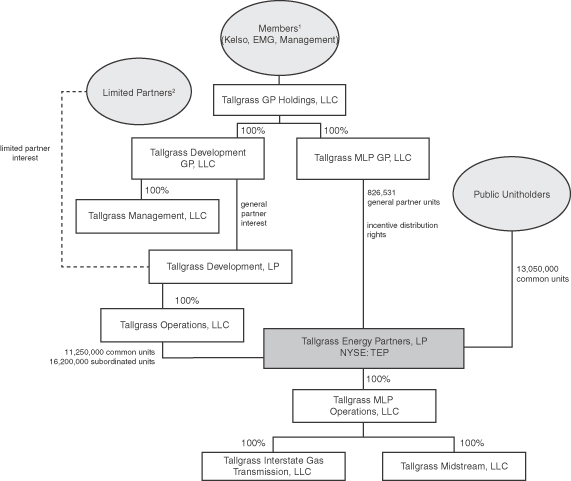

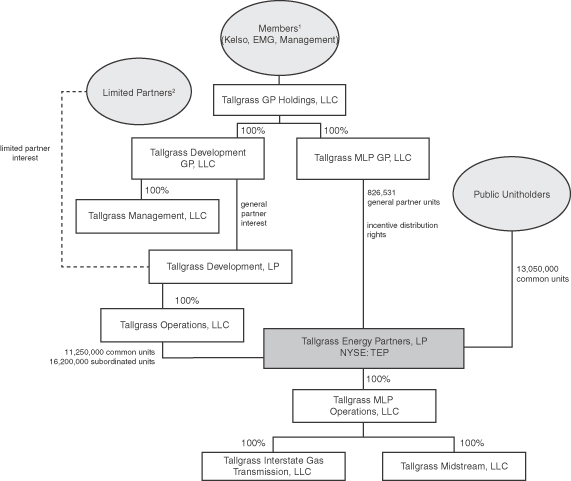

The following diagram depicts our simplified organizational and ownership structure after giving effect to the formation transactions and this offering.

| | | | |

Public Common Units(1) | | | 31.6 | % |

Tallgrass Development | | | | |

Common Units(1) | | | 27.2 | % |

Subordinated Units | | | 39.2 | % |

General Partner Units | | | 2.0 | % |

| | | | |

Total | | | 100.0 | % |

| | | | |

| (1) | Assumes no exercise of the underwriters’ option to purchase additional common units. Please read “—Formation Transactions and Partnership Structure” for a description of the impact of an exercise of the option on the common unit ownership percentages. |

| (1) | Tallgrass Holdings, LLC, an affiliate of EMG, owns approximately 38%. KIA VIII (Rubicon), L.P. and KEP VI AIV (Rubicon), LLC, affiliates of Kelso, own approximately 37%. Tallgrass KC, LLC, an entity owned by members of management, owns approximately 25%. Certain other investors own a de minimis percentage. |

| (2) | Tallgrass Holdings, LLC, an affiliate of EMG, owns approximately 39%. KIA VIII (Rubicon), L.P. and KEP VI AIV (Rubicon), LLC, affiliates of Kelso, own approximately 49%. MTP Energy KMAA LLC, an entity affiliated with Magnetar Capital, owns approximately 10%. A trust owned and controlled by our chief executive officer, David G. Dehaemers, Jr., owns approximately 2%. Certain other investors own a de minimis percentage. |

12

The Offering

Common units offered to the public | 13,050,000 common units, or 15,007,500 common units if the underwriters exercise their option to purchase additional common units in full. |

Units outstanding after this offering | 24,300,000 common units and 16,200,000 subordinated units, representing a 59% and 39% limited partner interest in us, respectively. If the underwriters do not exercise their option to purchase additional common units, we will issue an additional 1,957,500 common units to Tallgrass Development at the expiration of the option for no additional consideration. If and to the extent the underwriters exercise their option to purchase additional common units, the number of common units purchased by the underwriters pursuant to any exercise will be sold to the public and the net proceeds will be distributed to Tallgrass Development, and any remaining common units not purchased by the underwriters pursuant to any exercise of the option will be issued to Tallgrass Development at the expiration of the option period. Accordingly, the exercise of the underwriters’ option will not affect the total number of common units outstanding or the amount of cash needed to pay the minimum quarterly distribution on all units. Our general partner will own 826,531 general partner units, representing a 2.0% general partner interest in us. |

Use of proceeds | We intend to use the estimated net proceeds of approximately $264.4 million from this offering (assuming an initial public offering price of $22.00 per common unit, the midpoint of the price range set forth on the cover page of this prospectus), after deducting underwriting discounts, the structuring fee and offering expenses payable by us of approximately $22.7 million, to retire approximately $264.4 million of the indebtedness assumed from Tallgrass Development. |

| | At the closing of this offering, we intend to enter into a new $400 million revolving credit facility, as described in “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources—New Credit Facility,” and to borrow approximately $225 million, the proceeds of which will be used to: |

| | • | | retire the remaining approximately $135.6 million of indebtedness assumed from Tallgrass Development; |

| | • | | pay approximately $3.9 million in revolving credit facility origination fees; and |

| | • | | pay $85.5 million to Tallgrass Development as reimbursement for a portion of the capital expenditures made by Tallgrass Development to purchase the contributed assets, which Tallgrass Development acquired together with the Retained Assets for $1.8 billion. |

14

| | The indebtedness assumed from Tallgrass Development was used by Tallgrass Development to acquire certain assets from Kinder Morgan, including the assets being contributed to us in connection with this offering, in November 2012. Please read “Prospectus Summary—Our Relationship with Tallgrass Development.” Certain of the underwriters are lenders under the senior secured term loan under which the debt assumed from Tallgrass Development was initially borrowed and, in that respect, will indirectly receive a portion of the net proceeds from this offering. Please read “Underwriting.” |

| | If the underwriters exercise their option to purchase additional common units in full, the additional net proceeds will be approximately $40.4 million. The net proceeds from any exercise of such option will be distributed to Tallgrass Development. |

| | Please read “Use of Proceeds.” |

Cash distributions | We intend to pay the minimum quarterly distribution of $0.2875 per unit ($1.15 per unit on an annualized basis) to the extent we have sufficient cash from operations after establishment of cash reserves and payment of fees and expenses, including payments to our general partner and its affiliates. We refer to this cash as “available cash,” and we define its meaning in our partnership agreement, a copy of which is included in this prospectus as Appendix A. Our ability to pay the minimum quarterly distribution is subject to various restrictions and other factors described in more detail under the caption “Our Cash Distribution Policy and Restrictions on Distributions.” |

| | We will adjust the amount of our distribution for the period from the completion of this offering through June 30, 2013, based on the actual length of that period. |

| | Our partnership agreement requires us to distribute available cash each quarter in the following manner: |

| | • | | first, 98.0% to the holders of common units and 2.0% to our general partner, until each common unit has received the minimum quarterly distribution of $0.2875 plus any arrearages from prior quarters; |

| | • | | second, 98.0% to the holders of subordinated units and 2.0% to our general partner, until each subordinated unit has received the minimum quarterly distribution of $0.2875; and |

| | • | | third, 98.0% to all unitholders, pro rata, and 2.0% to our general partner, until each unit has received a distribution of $0.3048. |

| | If cash distributions to our unitholders exceed $0.3048 per unit in any quarter, our general partner, as the holder of our IDRs, will receive, in addition to distributions on its 2.0% general partner interest, increasing percentages, up to 48.0%, of the cash we distribute in |

15

| | excess of that amount. We refer to these distributions as “incentive distributions” because they incentivize our general partner to increase distributions to our unitholders. Please read “Provisions of Our Partnership Agreement Relating to Cash Distributions.” |

| | Prior to making distributions, we will reimburse our general partner and Tallgrass Development’s general partner and its affiliates for their provision of certain general and administrative services and any additional services we may request from them (including certain incremental costs and expenses we will incur as a result of being a publicly traded partnership) pursuant to our partnership agreement and the omnibus agreement. Please read “The Partnership Agreement— Reimbursement of Expenses” and “Certain Relationships and Related Transactions—Omnibus Agreement.” |

| | Pro forma cash available for distribution generated during the year ended December 31, 2012 was approximately $54.6 million. The amount of available cash we will need to pay the minimum quarterly distribution for four quarters on our common units, subordinated units and general partner units to be outstanding immediately after this offering will be approximately $47.5 million (or an average of approximately $11.9 million per quarter). As a result, we would have generated available cash sufficient to pay the full minimum quarterly distribution of $0.2875 per unit per quarter ($1.15 per unit on an annualized basis) on all of our common, subordinated and general partner units for the year ended December 31, 2012. Please read “Our Cash Distribution Policy and Restrictions on Distributions—Unaudited Adjusted Pro Forma Cash Available for Distribution for the Year Ended December 31, 2012.” |

| | We believe that, based on the financial forecasts and related assumptions included under the caption “Our Cash Distribution Policy and Restrictions on Distributions—Estimated Cash Available for Distribution for the Twelve-Month Period Ending June 30, 2014,” we will have sufficient cash available for distribution to make cash distributions for the twelve-month period ending June 30, 2014, at the minimum quarterly distribution rate of $0.2875 per unit per quarter ($1.15 per unit on an annualized basis) on all common units, subordinated units and general partner units. However, we do not have a legal obligation to pay quarterly distributions at our minimum quarterly distribution rate or at any other rate except as provided in our partnership agreement. There is no guarantee that we will distribute quarterly cash distributions to our unitholders in any quarter. Please read “Cash Distribution Policy and Restrictions on Distributions.” |

Subordinated units | Tallgrass Development will initially own all of our subordinated units. The principal difference between our common units and subordinated units is that in any quarter during the subordination period, holders of the subordinated units are not entitled to receive any distribution of |

16

| | available cash until the common units have received the minimum quarterly distribution plus any arrearages in the payment of the minimum quarterly distribution from prior quarters. If we do not pay distributions on our subordinated units, our subordinated units will not accrue arrearages for those unpaid distributions. |

Conversion of subordinated units | The subordination period will end on the first business day after , 2016 on which we have earned and paid at least $1.15 (the minimum quarterly distribution on an annualized basis) on each outstanding common unit, subordinated unit and general partner unit for each of three consecutive, non-overlapping four-quarter periods, provided that there are no arrearages on our common units at that time. |

| | Notwithstanding the foregoing, the subordination period will end on the first business day after we have earned and paid at least $1.725 (150% of the minimum quarterly distribution on an annualized basis) on each outstanding common, subordinated and general partner unit, and the related distribution on the IDRs, for any four-quarter period ending on or after , 2014, provided that there are no arrearages on our common units at that time. In addition, the subordination period will end (i) with respect to 50% of the subordinated units, on the first business day after we have earned and paid at least $0.3306 (115% of the minimum quarterly distribution) on each outstanding common, subordinated and general partner unit, and the related distribution on the IDRs, for any full quarter ending on or after , 2014 and (ii) with respect to 100% of the subordinated units, on the first business day after we have earned and paid at least $0.3594 (125% of the minimum quarterly distribution) on each outstanding common, subordinated and general partner unit, and the related distribution on the IDRs, for any full quarter ending on or after , 2014, in each case provided that there are no arrearages on our common units at that time. |

| | The subordination period also will end with respect to a holder of subordinated units upon the removal of our general partner other than for cause if no subordinated units or common units held by such holder of subordinated units or its affiliates are voted in favor of such removal. |

| | When the subordination period ends, all subordinated units not previously converted will convert into common units on a one-for-one basis, and all common units thereafter will no longer be entitled to arrearages. Please read “Provisions of Our Partnership Agreement Related to Cash Distributions—Subordination Period.” |

Our general partner’s right to reset the target distribution levels | Our general partner, as the initial holder of our IDRs, has the right, at any time when there are no subordinated units outstanding, if it has received incentive distributions at the highest level to which it is |

17

| | entitled (48.0%) for the prior four consecutive whole fiscal quarters, and the amount of the total distribution of available cash for each quarter did not exceed adjusted operating surplus for such quarter, to reset the initial target distribution levels at higher levels based on our cash distributions at the time of the exercise of the reset election. If our general partner transfers all or a portion of our IDRs in the future, then the holder or holders of a majority of our IDRs will be entitled to exercise this right. The following assumes that our general partner holds all of the IDRs at the time that a reset election is made. Following a reset election, the minimum quarterly distribution will be adjusted to equal the reset minimum quarterly distribution, and the target distribution levels will be reset to correspondingly higher levels based on the same percentage increases above the reset minimum quarterly distribution as the current target distribution levels. |

| | If our general partner elects to reset the target distribution levels, it will be entitled to receive a number of common units, as well as a number of general partner units necessary to maintain its general partner interest in us immediately prior to the reset election. The number of common units to be issued to our general partner will equal the number of common units that would have entitled the holder to an average aggregate quarterly cash distribution in the two quarters prior to the reset election equal to the average of the distributions to our general partner on the IDRs in such two quarters. Please read “Provisions of Our Partnership Agreement Relating to Cash Distributions—General Partner’s Right to Reset Incentive Distribution Levels.” |

Issuance of additional units | Our partnership agreement authorizes us to issue an unlimited number of additional units without the approval of our limited partners. Please read “Units Eligible for Future Sale” and “The Partnership Agreement—Issuance of Additional Partnership Interests.” |

Limited voting rights | Our general partner will manage and operate us. Unlike the holders of common stock in a corporation, you will have only limited voting rights on matters affecting our business. You will have no right to select our general partner or elect members of its board on an annual or other continuing basis. Our general partner may not be removed except by a vote of the holders of at least 66 2/3% of the outstanding units, including any units owned by our general partner and its affiliates, voting together as a single class. Upon closing of this offering, Tallgrass Development will own an aggregate of approximately 68% of our common and subordinated units. This will give Tallgrass Development the ability to prevent the involuntary removal of our general partner. Please read “The Partnership Agreement—Voting Rights.” |

Limited call right | If at any time our general partner and its affiliates own more than 80% of the outstanding common units, our general partner will have the right, but not the obligation, to purchase all, but not less than all, |

18

New York Stock Exchange listing | We have been approved to list our common units on the New York Stock Exchange under the symbol “TEP,” subject to official notice of issuance. |

Summary Historical and Pro Forma Financial and Operating Data

The following table shows summary historical financial and operating data of Tallgrass Midstream, LLC and Tallgrass Interstate Gas Transmission, LLC, which we refer to collectively as the Predecessor Entities. The combined financial statements of Tallgrass Midstream, LLC and Tallgrass Interstate Gas Transmission, LLC represent a carve-out financial statement presentation of two wholly-owned subsidiaries that were historically owned by Kinder Morgan. These entities were transferred to Tallgrass Development in connection with its acquisition of a portfolio of midstream assets from Kinder Morgan in November 2012 and will be contributed to us in connection with this offering. We refer to the Predecessor Entities as Tallgrass Energy Partners Pre-Predecessor, or TEP Pre-Predecessor, for periods prior to their acquisition by Tallgrass Development from Kinder Morgan on November 13, 2012, and as Tallgrass Energy Partners Predecessor, or TEP Predecessor, beginning on November 13, 2012. For more information, please read Note 1 to our historical audited combined financial statements included elsewhere in this prospectus.

The summary historical financial data of the Predecessor Entities presented as of and for the year ended December 31, 2011 and the period from January 1, 2012 to November 12, 2012 and the period from November 13, 2012 to December 31, 2012 are derived from the historical audited combined financial statements that are included elsewhere in this prospectus. The following table should be read together with, and is qualified in its entirety by reference to, the historical and unaudited pro forma financial statements and the accompanying notes included elsewhere in this prospectus. The table should also be read together with “Management’s Discussion and Analysis of Financial Condition and Results of Operations.”

The summary pro forma financial data presented as of and for the year ended December 31, 2012 was derived from the audited combined financial statements of our Predecessor included elsewhere in this prospectus. The pro forma adjustments have been prepared as if certain formation transactions to be effected at the closing of this offering had taken place at December 31, 2012, in the case of the pro forma balance sheet, and as of January 1, 2012 in the case of the pro forma statements of operations. Our unaudited pro forma financial statements give pro forma effect to the following items, among others:

| | • | | contribution of assets from Tallgrass Development accounted for as transactions between entities under common control. The adjustments reflect the fair value recognized at Tallgrass Development at the time of its acquisition of the Predecessor Entities on November 13, 2012; |

| | • | | Tallgrass Development’s contribution of 100% of the membership interests in each of Tallgrass Interstate Gas Transmission, LLC and Tallgrass Midstream, LLC to us; |

| | • | | our issuance of 11,250,000 common units and 16,200,000 subordinated units to Tallgrass Development, representing a 66% limited partner interest in us (62% if the underwriters exercise in full their option to purchase additional common units) and our assumption from Tallgrass Development of $400 million of indebtedness; |

| | • | | the issuance to our general partner of 826,531 general partner units, representing its initial 2.0% general partner interest in us, and all of our IDRs; |

| | • | | the issuance of 13,050,000 common units to the public in this offering, representing a 32% limited partner interest in us (36% if the underwriters exercise in full their option to purchase additional common units) and the use of the proceeds of this offering to pay expenses associated with this offering and to retire $264.4 of the debt assumed from Tallgrass Development, as described in “Use of Proceeds,” and |

20

| | • | | the closing of our new $400 million revolving credit facility under which we expect to borrow approximately $225 million at the closing of this offering, to pay origination fees related to our new revolving credit facility, to repay the remaining approximately $135.6 million of debt assumed from Tallgrass Development and to pay $85.5 million to Tallgrass Development as reimbursement for a portion of capital expenditures made by Tallgrass Development to purchase the contributed assets, which Tallgrass Development acquired together with the Retained Assets for $1.8 billion. |

The pro forma combined financial data do not give effect to the estimated $2.5 million in incremental annual general and administrative expenses that we expect to incur as a result of being a publicly traded partnership. In addition, the proposed pro forma statements do not give effect to the Pony Express Abandonmentwhich we currently expect to occur in the fourth quarter of 2013. For additional information on the Pony Express Abandonment, please see “Certain Relationships and Related Transactions—Contracts with Affiliates—Pony Express Abandonment.”

| | | | | | | | | | | | | | | | | | |

| | | TEP Pre-Predecessor | | | | | TEP Predecessor | | | Pro Forma | |

| | | Year Ended

Dec 31,

2011 | | | Period From

Jan 1

to Nov 12,

2012 | | | | | Period From

Nov 13

to Dec 31,

2012 | | | Year Ended

December 31,

2012 | |

| | | | | | | | | | | | | | (unaudited) | |

| | | (in thousands, except per unit and operating data) | |

Statements of Operations Data: | | | | | | | | | | | | | | | | | | |

Revenues | | $ | 307,043 | | | $ | 220,292 | | | | | $ | 35,288 | | | $ | 255,580 | |

Operating costs and expenses: | | | | | | | | | | | | | | | | | | |

Cost of sales and transportation services | | | 146,069 | | | | 98,585 | | | | | | 17,711 | | | | 116,296 | |

Operations and maintenance | | | 37,345 | | | | 32,768 | | | | | | 3,940 | | | | 36,708 | |

Depreciation and amortization | | | 22,726 | | | | 20,647 | | | | | | 4,086 | | | | 27,575 | |

General and administrative(1) | | | 16,044 | | | | 11,318 | | | | | | 7,133 | | | | 18,451 | |

Taxes, other than income taxes | | | 9,360 | | | | 6,861 | | | | | | 1,107 | | | | 7,968 | |

| | | | | | | | | | | | | | | | | | |

Total operating costs and expenses | | | 231,544 | | | | 170,179 | | | | | | 33,977 | | | | 206,998 | |

| | | | | | | | | | | | | | | | | | |

Operating income | | | 75,499 | | | | 50,113 | | | | | | 1,311 | | | | 48,582 | |

Other income (expense), net(2) | | | 203 | | | | 1 | | | | | | 482 | | | | 483 | |

Interest income (expense), net(3) | | | 2,101 | | | | 1,661 | | | | | | (3,201 | ) | | | (9,103 | ) |

| | | | | | | | | | | | | | | | | | |

Income (loss) before income taxes | | | 77,803 | | | | 51,775 | | | | | | (1,408 | ) | | | 39,962 | |

Texas margin taxes(4) | | | 296 | | | | 279 | | | | | | — | | | | — | |

| | | | | | | | | | | | | | | | | | |

Net Income (loss) to member/partners | | $ | 77,507 | | | $ | 51,496 | | | | | $ | (1,408 | ) | | $ | 39,962 | |

| | | | | | | | | | | | | | | | | | |

Net income per limited partners’ unit: | | | | | | | | | | | | | | | | | | |

Common units | | | | | | | | | | | | | | | | $ | 0.97 | |

Subordinated units | | | | | | | | | | | | | | | | $ | 0.97 | |

Balance Sheet Data (at period end): | | | | | | | | | | | | | | | | | | |

Property, plant and equipment, net | | $ | 719,009 | | | $ | 717,488 | | | | | $ | 669,476 | | | $ | 669,476 | |

Total assets | | | 772,896 | | | | 767,683 | | | | | | 1,035,814 | | | | 1,026,362 | |

Long-term debt | | | — | | | | — | | | | | | 390,491 | | | | 225,000 | |

Other long-term liabilities and deferred credits | | | 1,032 | | | | 1,535 | | | | | | 1,635 | | | | 1,635 | |

Total members’ equity/partners’ capital | | | 736,808 | | | | 727,479 | | | | | | 571,834 | | | | 732,073 | |

Cash Flow Data: | | | | | | | | | | | | | | | | | | |

Net cash provided by (used in): | | | | | | | | | | | | | | | | | | |

Operating activities | | $ | 90,505 | | | $ | 81,335 | | | | | $ | 10,705 | | | | | |

Investing activities | | | (9,960 | ) | | | (21,692 | ) | | | | | (12,687 | ) | | | | |

Financing activities | | | (80,545 | ) | | | (57,661 | ) | | | | | — | | | | | |

21

RISK FACTORS

Limited partner interests are inherently different from shares of capital stock of a corporation, although many of the business risks to which we are subject are similar to those that would be faced by a corporation engaged in similar businesses. We urge you to carefully consider the following risk factors together with all of the other information included in this prospectus in evaluating an investment in our common units.

If any of the following risks were to occur, our business, financial condition or results of operations could be materially adversely affected. In that case, we might not be able to pay the minimum quarterly distribution on our common units, the trading price of our common units could decline and you could lose all or part of your investment in us.

Risks Related to Our Business

We may not have sufficient cash from operations following the establishment of cash reserves and payment of fees and expenses, including cost reimbursements to our general partner and its affiliates, to enable us to pay the minimum quarterly distribution to holders of our common and subordinated units.

In order to pay the minimum quarterly distribution of $0.2875 per unit, or $1.15 per unit on an annualized basis, we will require available cash of approximately $11.9 million per quarter, or $47.5 million per year, based on the number of common, subordinated and general partner units to be outstanding immediately after completion of this offering. We may not have sufficient available cash from operating surplus each quarter to enable us to pay the minimum quarterly distribution. The amount of cash we can distribute on our units principally depends upon the amount of cash we generate from our operations, which will fluctuate from quarter to quarter based on, among other things:

| | • | | the level of firm transportation and storage capacity sold and the volume of natural gas we transport, store and process; |

| | • | | the level of production of oil and natural gas and the resultant market prices of natural gas and NGLs; |

| | • | | regional, domestic and foreign supply and perceptions of supply of natural gas; the level of demand and perceptions of demand in our end-user markets; and actual and anticipated future prices of natural gas and other commodities (and the volatility thereof), which may impact our ability to renew and replace firm transportation, storage and processing agreements; |

| | • | | regulatory action affecting the supply of, or demand for, natural gas, the rates we can charge on our assets, how we contract for services, our existing contracts, our operating costs or our operating flexibility |

| | • | | changes in the fees we charge for our services; |

| | • | | the effect of seasonal variations in temperature on the amount of natural gas that we transport, store, process and treat; |

| | • | | the relationship between natural gas and NGL prices and resulting effect on processing margins; |

| | • | | the realized pricing impacts on revenues and expenses that are directly related to commodity prices; |

| | • | | the level of competition from other midstream energy companies in our geographic markets; |

| | • | | the creditworthiness of our customers; |

| | • | | the level of our operating and maintenance costs; |

| | • | | damages to pipelines, facilities, related equipment and surrounding properties caused by earthquakes, floods, fires, severe weather, explosions and other natural disasters and acts of terrorism; |

| | • | | outages at our processing facilities; |

25

Any significant increase in maintenance and repair expenditures or loss of revenue due to the age or condition of our facilities could adversely affect our business and results of operations and our ability to make cash distributions to our unitholders.

Certain of our processing customers require credit support, some of which are currently provided through parent guarantees provided by Kinder Morgan or Tallgrass Development. We may incur additional costs associated with replacing those guarantees.

Certain of our processing customers require credit support, and some of this support is currently in the form of parent guarantees provided by Kinder Morgan or Tallgrass Development, the previous owners of Tallgrass Midstream, LLC. We expect to promptly replace the remaining Kinder Morgan guarantee with a guarantee of Tallgrass Development or to eliminate it altogether. To the extent we are required to replace the remaining guarantees with substitute credit support, we may incur additional costs, including costs associated with issuing letters of credit.

Restrictions in our new credit facility could adversely affect our business, financial condition, results of operations and ability to make quarterly cash distributions to our unitholders.

We expect to enter into a new credit facility in connection with the closing of this offering. Our new credit facility will limit our ability to, among other things:

| | • | | incur or guarantee additional debt; |

| | • | | redeem or repurchase units or make distributions under certain circumstances; |

| | • | | make certain investments and acquisitions; |

| | • | | incur certain liens or permit them to exist; |

| | • | | enter into certain types of transactions with affiliates; |

| | • | | merge or consolidate with another company; and |

| | • | | transfer, sell or otherwise dispose of assets. |

Our new credit facility also will contain covenants requiring us to maintain certain financial ratios. Our ability to meet those financial ratios and tests can be affected by events beyond our control, and we cannot assure you that we will meet those ratios and tests.

The provisions of our new credit facility may affect our ability to obtain future financing and pursue attractive business opportunities and our flexibility in planning for, and reacting to, changes in business conditions. In addition, a failure to comply with the provisions of our new credit facility could result in a default or an event of default that could enable our lenders to declare the outstanding principal of that debt, together with accrued and unpaid interest, to be immediately due and payable. If the payment of our debt is accelerated, our assets may be insufficient to repay such debt in full, and our unitholders could experience a partial or total loss of their investment. Please read “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources.”

Our future debt levels may limit our flexibility to obtain financing and to pursue other business opportunities.

At the closing of this offering, we intend to borrow approximately $225 million under our new credit facility to repay approximately $135.6 of the debt assumed from Tallgrass Development, to pay origination fees with respect to the revolving credit facility and to pay $85.5 million to Tallgrass Development as reimbursement for certain capital expenditures made in connection with the contributed assets as partial consideration for its contribution of assets to us in connection with this offering. Please read, “Prospectus Summary—Formation

45

Our partnership agreement requires that we distribute our available cash, which could limit our ability to grow and make acquisitions.

Our partnership agreement requires us to distribute our available cash to our unitholders. Accordingly, we will rely primarily upon external financing sources, including commercial bank borrowings and the issuance of debt and equity securities, to fund our acquisitions and expansion capital expenditures. As a result, to the extent we are unable to finance growth externally, our cash distribution policy will significantly impair our ability to grow.

In addition, because we intend to distribute our available cash, our growth may not be as fast as that of businesses that reinvest their available cash to expand ongoing operations. To the extent we issue additional units in connection with any acquisitions or expansion capital expenditures, the payment of distributions on those additional units may increase the risk that we will be unable to maintain or increase our per unit distribution level. There are no limitations in our partnership agreement, and we do not anticipate there being limitations in our new credit facility, on our ability to issue additional units, including units ranking senior to the common units. The incurrence of additional commercial borrowings or other debt to finance our growth strategy would result in increased interest expense, which in turn may impact the available cash that we have to distribute to our unitholders.

While our partnership agreement requires us to distribute our available cash, our partnership agreement, including provisions requiring us to make cash distributions contained therein, may be amended.

While our partnership agreement requires us to distribute our available cash, our partnership agreement, including provisions requiring us to make cash distributions therein, may be amended. Our partnership agreement generally may not be amended during the subordination period without the approval of our public common unitholders other than in certain circumstances where no unitholder approval is required. However, our partnership agreement can be amended with the consent of our general partner and the approval of a majority of the outstanding common units (including common units held by our general partner and its affiliates, including Tallgrass Development) after the subordination period has ended. At the closing of this offering, affiliates of our general partner will own, direct or indirectly, approximately 46% of our outstanding common units and 100% of our outstanding subordinated units. Please read “Security Ownership of Certain Beneficial Owners and Management.”

There is no existing market for our common units, and a trading market that will provide you with adequate liquidity may not develop. Following this offering, the market price of our common units may fluctuate significantly, and you could lose all or part of your investment.

Prior to this offering, there has been no public market for our common units. After this offering, there will be only 13,050,000 publicly traded common units, assuming no exercise of the underwriters’ over-allotment option. In addition, affiliates of our general partner will own 11,250,000 common units and 16,200,000 subordinated units, representing an aggregate of approximately 66% limited partner interest in us. We do not know the extent to which investor interest will lead to the development of a trading market or how liquid that market might be. You may not be able to resell your common units at or above the initial public offering price. Additionally, the lack of liquidity may result in wide bid-ask spreads, contribute to significant fluctuations in the market price of the common units and limit the number of investors who are able to buy the common units.

The initial public offering price for the common units will be determined by negotiations between us and the representatives of the underwriters and may not be indicative of the market price of the common units that will prevail in the trading market. The market price of our common units may decline below the initial public offering price. The market price of our common units may also be influenced by many factors, some of which are beyond our control, including:

| | • | | the level of our quarterly distributions; |

| | • | | our quarterly or annual earnings or those of other companies in our industry; |

53

| | • | | the loss of a large customer; |

| | • | | announcements by us or our competitors of significant contracts or acquisitions; |

| | • | | changes in accounting standards, policies, guidance, interpretations or principles; |

| | • | | general economic conditions; |

| | • | | the failure of securities analysts to cover our common units after this offering or changes in financial estimates by analysts; |

| | • | | future sales of our common units; and |

| | • | | other factors described in these “Risk Factors.” |

You will experience immediate dilution in net tangible book value of $11.59 per common unit.

The estimated initial public offering price of $22.00 per common unit (the mid-point of the price range set forth on the cover of this prospectus) exceeds our pro forma net tangible book value of $10.41 per unit. Based on the estimated initial public offering price of $22.00 per common unit, you will incur immediate dilution of $11.59 per common unit. This dilution results primarily because the assets contributed by Tallgrass Development are recorded in accordance with GAAP at their historical cost, and not their fair value. Please read “Dilution.”

The NYSE does not require a publicly traded partnership like us to comply with certain of its corporate governance requirements.

We intend to apply to list our common units on the NYSE. Unlike most corporations, we are not required by NYSE rules to have, and we do not intend to have, a majority of independent directors on our general partner’s board of directors or a compensation committee or a nominating and corporate governance committee. Additionally, any future issuance of additional common units or other securities, including to affiliates, will not be subject to the NYSE’s shareholder approval rules. Accordingly, unitholders will not have the same protections afforded to certain corporations that are subject to all of the NYSE corporate governance requirements. Please read “Management.”

If you are not an eligible taxable holder, you will not be entitled to allocations of income or loss or distributions or voting rights on your common units and your common units will be subject to redemption.

In order to avoid any material adverse effect on the maximum applicable rates that can be charged to customers by our subsidiaries on assets that are subject to rate regulation by the FERC or an analogous regulatory body, we have adopted certain requirements regarding those investors who may own our common units. Eligible holders are individuals or entities subject to United States federal income taxation on the income generated by us or entities not subject to United States federal income taxation on the income generated by us, so long as all of the entity’s owners are subject to such taxation. Please read “Description of the Common Units—Transfer of Common Units.” If a holder of our common units (other than affiliates of our general partner) is not a person who fits the requirements to be an eligible taxable holder, such holder will not receive allocations of income or loss or distributions or voting rights on its units and will run the risk of having its units redeemed by us at the market price calculated in accordance with our partnership agreement as of the date of redemption. The redemption price will be paid in cash or by delivery of a promissory note, as determined by our general partner. Please see “The Partnership Agreement—Redemption of Ineligible Holders.”

Our partnership agreement replaces our general partner’s fiduciary duties to holders of our common units with contractual standards governing its duties.

Our partnership agreement contains provisions that eliminate the fiduciary standards to which our general partner would otherwise be held by state fiduciary duty law and replace those duties with several different contractual standards. For example, our partnership agreement permits our general partner to make a number of

54

| | • | | our general partner will not be in breach of its obligations under the partnership agreement (including any duties to us or our unitholders) if a transaction with an affiliate or the resolution of a conflict of interest is: |

| | • | | approved by the conflicts committee of the board of directors of our general partner, although our general partner is not obligated to seek such approval; |

| | • | | approved by the vote of a majority of the outstanding common units, excluding any common units owned by our general partner and its affiliates; |

| | • | | determined by the board of directors of our general partner to be on terms no less favorable to us than those generally being provided to or available from unrelated third parties; or |

| | • | | determined by the board of directors of our general partner to be fair and reasonable to us, taking into account the totality of the relationships among the parties involved, including other transactions that may be particularly favorable or advantageous to us. |

In connection with a situation involving a transaction with an affiliate or a conflict of interest, any determination by our general partner or the conflicts committee must be made in good faith. If an affiliate transaction or the resolution of a conflict of interest is not approved by our common unitholders or the conflicts committee and the board of directors of our general partner determines that the resolution or course of action taken with respect to the affiliate transaction or conflict of interest satisfies either of the standards set forth in the third and fourth bullets above, then it will be presumed that, in making its decision, the board of directors acted in good faith, and in any proceeding brought by or on behalf of any limited partner or the partnership challenging such determination, the person bringing or prosecuting such proceeding will have the burden of overcoming such presumption. Please read “Conflicts of Interest and Duties.”

Holders of our common units have limited voting rights and are not entitled to select our general partner or elect members of its board of directors.

Unlike the holders of common stock in a corporation, unitholders have only limited voting rights on matters affecting our business and, therefore, limited ability to influence management’s decisions regarding our business. Unitholders will have no right on an annual or ongoing basis to select our general partner or elect its board of directors. Rather, the board of directors of our general partner, including the independent directors, will be appointed by Tallgrass GP Holdings, as a result of it owning our general partner, and not by our unitholders. Furthermore, if the unitholders are dissatisfied with the performance of our general partner, they will have little ability to remove our general partner. As a result of these limitations, the price at which the common units will trade could be diminished because of the absence or reduction of a takeover premium in the trading price. Our partnership agreement also contains provisions limiting the ability of unitholders to call meetings or to acquire information about our operations, as well as other provisions limiting the unitholders’ ability to influence the manner or direction of management.

Even if holders of our common units are dissatisfied, they cannot initially remove our general partner without its consent.

Unitholders initially will be unable to remove our general partner without its consent because our general partner and its affiliates will own sufficient units upon the closing of this offering to be able to prevent its removal. The vote of the holders of at least 66 2/3% of all outstanding common and subordinated units voting together as a single class is required to remove our general partner. Following the closing of this offering, Tallgrass Development will own an aggregate of approximately 68% of our outstanding common and subordinated units. This will give Tallgrass Development the ability to prevent the involuntary removal of our general partner. Also, if our general partner is removed without cause during the subordination period and units held by our general partner and its affiliates are not voted in favor of that removal, all remaining subordinated units will automatically convert into common units and any existing arrearages on our common units will be extinguished. A removal of our general partner under these circumstances would adversely affect our common

56

| | • | | the ratio of taxable income to distributions may increase; |

| | • | | the relative voting strength of each previously outstanding unit may be diminished; and |

| | • | | the market price of the common units may decline. |

Affiliates of our general partner may sell units in the public or private markets, and such sales could have an adverse impact on the trading price of the common units.

After the sale of the common units offered by this prospectus, assuming that the underwriters do not exercise their option to purchase additional common units, affiliates of our general partner will indirectly hold an aggregate of 11,250,000 common units and 16,200,000 subordinated units. All of the subordinated units will convert into common units at the end of the subordination period and may convert earlier under certain circumstances. In addition, we have agreed to provide our general partner and its affiliates with certain registration rights. The sale of these units in the public or private markets could have an adverse impact on the price of the common units or on any trading market that may develop.

Our general partner may limit its liability regarding our obligations.