Tallgrass Energy GP, LP

Tallgrass Energy Partners, LP

4200 W. 115th Street, Suite 350

Leawood, KS 66211-2609

Phone: 913.928.6060

July 8, 2016

U.S. Securities and Exchange Commission

Division of Corporation Finance

100 F. Street, N.E.

Washington, D.C. 20549

Attention: Mara L. Ransom

| | Re: | Tallgrass Energy GP, LP |

| | | Registration Statement on Form S-3 |

| | | Form 10-K for Fiscal Year Ended December 31, 2015 |

| | | Tallgrass Energy Partners, LP |

| | | Form 10-K for Fiscal Year Ended December 31, 2015 |

Ladies and Gentlemen:

Set forth below are the responses of Tallgrass Energy GP, LP (“TEGP”) and Tallgrass Energy Partners, LP (“TEP” and, together with TEGP, the “Partnerships”) to the comments contained in the letter from the staff (the “Staff”) of the Securities and Exchange Commission (the “Commission”), dated July 1, 2016, with respect to the above-captioned filings. “We,” “us,” “our” and similar terms refer to TEGP and/or TEP (and our respective subsidiaries), as designated by the subheadings herein or as the context requires.

For your convenience, we have repeated in bold type the comments and requests for additional information exactly as set forth in the comment letter. TEGP’s or TEP’s response to each comment or request is set forth immediately below the text of the applicable comment or request.

1

Tallgrass Energy GP, LP

Registration Statement on Form S-3

General

1. At this time, a review is open for your annual report on Form 10-K for the fiscal year ended December 31, 2015. We will coordinate any request for acceleration of effectiveness for this registration statement with resolution of all comments regarding the Form 10-K review. Please confirm your understanding in this regard.

Response: We acknowledge the Staff’s comment and confirm our understanding that the Commission will coordinate any request for acceleration of effectiveness for TEGP’s registration statement on Form S-3 (the “Registration Statement”) with resolution of all comments regarding TEGP’s Form 10-K review.

2. We note that certain selling security holders appear to be affiliates and operate effectively as the parent of the registrant. In this regard, we note your disclosure on page 8 that Holdings controls your business and affairs and that EMG, Kelso and Tallgrass KC own approximately 100% of the outstanding membership interests in Holdings. Given the large number of common shares being offered by these selling security holders and their relationship to you, we are concerned that this transaction may not be eligible to be made on a shelf basis under Rule 415(a)(1)(i) of the Securities Act and instead represents a primary offering. Accordingly, please revise to name these selling security holders as underwriters under the Securities Act of 1933. If you disagree, please provide us with a detailed legal analysis as to why this offering should be regarded as a secondary offering. For guidance, please consider Securities Act Rules Compliance and Disclosure Interpretation 212.15, available on our website at www.sec.gov.

Response: We acknowledge the Staff’s comment and respectfully disagree with regard to the characterization of EMG, Kelso and Tallgrass KC (collectively, the “Selling Security Holders”) as operating effectively as the “parent” of TEGP. While it is true that Holdings, in its capacity as sole member of TEGP’s general partner, effectively controls TEGP’s business and affairs, EMG, Kelso and Tallgrass KC are each separate owners of Holdings, none of whom can act individually to control the actions of Holdings or TEGP.

Pursuant to the terms of Holdings’ limited liability company agreement, EMG, Kelso and Tallgrass KC each have the right to designate two members of the board of managers of Holdings for so long as they maintain certain ownership percentages in Holdings. The board of managers of Holdings consists of six managers. Therefore, none of the Selling Security Holders, acting alone, are able to exert control over Holdings and its business or investment decisions, and to our knowledge there are no voting agreements or other arrangements between the Selling Security Holders to vote their interests together. We believe the analysis is similar to the so-called “rule of three” referenced in a 1987 no-action letter for Southland Corp. (August 10, 1987) (the “Southland No-Action Letter”), in which the Staff determined that where no person can act individually to cause the group to take a certain action, then none of the individuals will be deemed to have control. Although the Southland No-Action Letter was in the context of beneficial ownership reporting obligations, we believe the same concept is instructive with respect to the ownership and control of Holdings. None of the Selling Security Holders, acting alone, are able to exert control over Holdings and its business or investment decisions. None of the Selling Security Holders’ ownership percentages in Holdings are alone sufficient to establish

2

a majority over the other members, nor are the board designation rights of any of the Selling Security Holders sufficient to establish a majority of the board. The fact that their aggregate ownership of Holdings is nearly 100% is insufficient to establish a “control” relationship absent the ability by any one of them to act independently to direct actions by Holdings.

We considered Securities Act Rules Compliance and Disclosure Interpretation 212.15 in the preparation of the Registration Statement and determined that none of EMG, Kelso or Tallgrass KC would be considered a “parent” of TEGP. Pursuant to Rule 405 of the Securities Act, a parent of a specified person is “an affiliate controlling such person directly, or indirectly through one or more intermediaries.” As described above, none of the Selling Security Holders directly or indirectly controls TEGP. In addition, the Selling Security Holders do not have an “identity of interest” with the issuer. The filing of the Registration Statement satisfies TEGP’s contractual obligation to file a registration statement on Form S-3 as provided in that certain Registration Rights Agreement entered into by TEGP and the Selling Security Holders in connection with TEGP’s initial public offering in May 2015. Each Selling Security Holder has the separate right to determine when or if any sales would be made under the Registration Statement, and neither TEGP nor Holdings will receive any proceeds from the sale of Class A shares by the Selling Security Holders.

As stated in Compliance and Disclosure Interpretation 212.15, aside from parents and subsidiaries, affiliates of issuers are not necessarily treated as being the alter egos of the issuers. In this case, we believe it is clear that while EMG, Kelso and Tallgrass KC may be considered affiliates of TEGP, the offering of common shares by each of the Selling Security Holders is a secondary offering. As a result, we believe the existing disclosure in the Registration Statement is accurate.

Form 10-K For Fiscal Year Ended December 31, 2015

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Liquidity and Capital Resources Overview

Distributions, page 70

3. We note that you distribute 100% of your available cash at the end of each quarter to Class A shareholders. Given the importance to your investors of understanding the sustainability of your current level of cash distributions, please revise to discuss any known trends or uncertainties regarding your distributions so that your investors can assess your current and potential future ability to continue making cash distributions at current levels, or at all, or explain to us why you believe no such disclosures are necessary.

Response: Under our limited partnership agreement, we are required to distribute 100% of our available cash at the end of each quarter to Class A shareholders. As disclosed in the TEGP 10-K, TEGP’s sole cash-generating asset is an approximate 30.35% controlling membership interest in Tallgrass Equity, LLC (“Tallgrass Equity”). Tallgrass Equity’s sole cash-generating assets consist of the direct and indirect partnership interests in TEP, as detailed in the “Item 7, Management’s Discussion and Analysis of Financial Condition and Results of Operations—Overview” section of TEGP’s Form 10-K. TEGP has no operations outside of its indirect ownership interests in TEP. As such, TEGP’s results of operations will not differ materially from the results of operations of TEP. The most noteworthy reconciling items between TEGP’s

3

consolidated financial statements and TEP’s consolidated financial statements primarily relate to (i) the inclusion of the Tallgrass Equity revolving credit facility, (ii) the impact of TEGP’s election to be treated as a corporation for U.S. federal income tax purposes and (iii) the presentation of noncontrolling interests in Tallgrass Equity and TEP.

We considered the requirements to discuss known trends and uncertainties with respect to TEGP’s business and ability to make distributions, and believe that the relevant trends and uncertainties are those related to TEP’s underlying business, which is the sole source of cash-generating assets from which the distributions to TEGP’s Class A shareholders is derived. These trends and uncertainties are discussed under the caption “Factors and Trends Impacting our Business” beginning on page 59 of the TEGP 10-K. We do not believe that, at this time, there are any additional known trends or uncertainties unique to TEGP that would hinder TEGP’s ability to make these distributions in the future. However, we acknowledge that if trends or uncertainties unique to TEGP, such as an expected change in the Tallgrass Equity revolving credit facility or TEGP’s election to be treated as a corporation for U.S. federal income tax purposes, were expected to have a material impact on TEGP’s financial results or ability to make its cash distributions, additional disclosure would be included at such time.

We acknowledge the Staff’s comment and believe that it may be useful to investors to further clarify the relationship between the trends in TEP’s business and our ability to continue making distributions to TEGP’s Class A shareholders. We propose to make the following changes in future filings in order to address the Staff’s comment:

| | (i) | Revising the introductory paragraph at the beginning of “Factors and Trends Impacting Our Business” similar to the following: |

“Our sole cash-generating asset is an approximate 30.35% controlling membership interest in Tallgrass Equity. Tallgrass Equity’s sole cash-generating assets consist of direct and indirect partnership interests in TEP, as detailed above in “—Overview”. As a result, we expect to continue to be affected by certain key factors and trends impacting TEP’s business as described below. To the extent our underlying assumptions about, or interpretations of, available information prove to be incorrect, our actual results may vary materially from our expected results. Please read Item 1A. Risk Factors, Risks Related to TEP’s Business included in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on February 17, 2016.”

| | (ii) | Revising the discussion in “Distributions” to more clearly tie TEGP’s ability to make distributions to its Class A shareholders to the financial performance of TEP’s business, including the factors and trends that are expected to have a material impact on the business in future periods, similar to the following: |

“Distributions to our Class A shareholders. We distribute 100% of our available cash at the end of each quarter to Class A shareholders of record beginning with the quarter ended June 30, 2015. Our sole cash-generating asset is an approximate 30.35% controlling membership interest in Tallgrass Equity. Tallgrass Equity’s sole cash-generating assets consist of direct and indirect partnership interests in TEP, as detailed above in “—Overview”. Available cash is generally defined as all of our cash and cash equivalents on hand at the end of each quarter less reserves established in the discretion of our general partner for future requirements. For a discussion of factors and trends impacting TEP’s business, which in turn impacts our ability to pay cash distributions to our Class A shareholders, please see “—Factors and Trends Impacting Our Business” above.

4

Our distribution for the three months ended December 31, 2015, in the amount of $0.173 per Class A share, or $8.3 million in the aggregate, was declared on January 4, 2016 and paid on February 12, 2016 to Class A shareholders of record on January 29, 2016.”

Tallgrass Energy Partners, LP

Form 10-K for the Fiscal Year Ended December 31, 2015

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

Results of Operations, page 64

4. We note your risk factor disclosure on page 19 that your inability to renew or replace expiring customer contracts could adversely affect your results of operations. You further explain on page 20 that a number of your natural gas transportation and storage customers have opted not to renew their contracts for service on the TIGT system and the resulting impact on your average firm contracted capacity and revenue. Please tell us how you considered this factor in explaining the trends and uncertainties in your results of operations. Please also tell us, and consider disclosing in future filings, the volume amount of contracts that expire within 1 year and your expectations regarding the impact on volumes and fees.

Response: We acknowledge the Staff’s comment and confirm that we considered including disclosure regarding renewal rates on the TIGT system in explaining the trends and uncertainties in our results of operations and determined that this factor is not expected to have a material impact on TEP’s results of operations going forward.

We initially included this disclosure with respect to TIGT in TEP’s Form S-1 filed with the Commission on March 28, 2013, in connection with TEP’s initial public offering which closed in May 2013. As set forth in TEP’s Form S-1, TIGT’s average firm contracted capacity decreased from 842 MMcf/d for the year ended December 31, 2010 to 754 MMcf/d for the year ended December 31, 2012 and transportation services revenue decreased from $142.4 million to $106.3 million over the same period, primarily due to the loss of revenue from the non-renewal of transportation contracts. At the time the Form S-1 was filed, the TIGT system accounted for 51% of our Adjusted EBITDA for the period from November 13, 2012 to December 31, 2012, and we were seeing a trend that we expected to potentially continue to have a material impact on future financial results. The trend did continue. For the years ended 2013, 2014 and 2015, TIGT’s average firm contract capacity decreased from 679 MMcf/d, to 639 MMcf/d and to 621 MMcf/d, respectively.

However, over the past three years TEP has grown significantly, most notably through the acquisitions of the Trailblazer Pipeline, 98% of the membership interests in Tallgrass Pony Express Pipeline, LLC (“Pony Express”), and, most recently, a 25% membership interest in Rockies Express Pipeline LLC (“REX”). This has resulted in TIGT representing an increasingly smaller portion of TEP’s business. TIGT’s relative percentage of TEP’s Adjusted EBITDA decreased from approximately 51% as disclosed in TEP’s Form S-1, to 19% for the year ended December 31, 2015, a percentage which we expect to further decrease in 2016 as a result of our

5

recent acquisitions of a 31.3% membership interest in Pony Express and a 25% membership interest in REX. Therefore, for the year ended December 31, 2015, we did not believe that the historical trend of customer renewals on the TIGT system would have a material impact on future financial results of TEP.

As noted above, TIGT did experience a decline in customer renewals from 2013 to 2015, and we believed including a reference to this trend would help an investor better understand the potential risk of customer non-renewals. However, given the significant impact of TEP’s interest in REX on the Natural Gas Transportation & Logistics segment and TEP’s operations as a whole, and the increasing possibility that the TIGT system will not have a material impact on TEP’s future results, we will consider removing the risk factor disclosure with respect to this historical trend. We also acknowledge the Staff’s comment and will consider any future trends or uncertainties related to customer contract renewals and other related developments in TEP’s business and confirm that we will include discussions in both the risk factor sections and discussion of trends and uncertainties in future filings where material.

As of December 31, 2015, approximately 16% of TIGT’s long-term natural gas transportation contracts by volume, representing annual firm transportation revenue of approximately $7 million, were set to expire within 1 year. As a result of negotiated contract extensions and renewals, as of June 30, 2016, approximately 15% of TIGT’s long-term natural gas transportation contracts by volume, representing annual firm transportation revenue of approximately $3 million (due to a lower average throughput rate), were set to expire within 1 year. We do not expect the volume of contracts expiring in 2016 to have a material impact on volumes and fees going forward, as evidenced by this decrease over the first six months of this year.

Critical Accounting Policies

Impairment of Long-Lived Assets, page 74

5. We note your disclosure that you did not record any impairment charges on long-lived assets during the year ended December 31, 2015. We also note that on page 75 as it related to your evaluation of goodwill for impairment that you identified a potential impairment indicator with respect to the TMID reporting unit within the Processing and Logistics segment related to the decreased commodity prices and resulting drop in volumes anticipated from several producers for natural gas processing. Please tell us if you also considered this an indicator of a possible long-lived asset impairment and if you performed an evaluation of the long-lived assets in this segment for impairment. If so, please tell us the results of your evaluation.

Response: We acknowledge the Staff’s comment, and respectfully submit that as disclosed in our Critical Accounting Policies and Estimates on page 75, and Note 8 – Goodwill and Other Intangible Assets on page 100, we identified an impairment trigger as of December 31, 2015, at the TMID reporting unit. Pursuant to the guidance in ASC 360Property, Plant, and Equipment, management first tested the associated long-lived assets for impairment, noting that the undiscounted future cash flows significantly exceeded the asset group’s carrying value, indicating no impairment of the asset group. While the asset group had a remaining useful life of approximately 27 years, the carrying value of the long-lived assets would be recovered in less than 10 years based on the projected undiscounted cash flows. As these results indicated that the carrying value of the long lived assets was recoverable, no disclosure related to the long-lived asset impairment testing was made in our Form 10-K.

6

6. Please also revise your critical accounting policy to focus on the assumptions and uncertainties that underlie your critical accounting estimate. In addition, please include a qualitative and quantitative analysis of the sensitivity of reported results to changes in your assumptions, judgments, and estimates, including the likelihood of a material impairment charge if different reasonably likely assumptions were applied. For example, if reasonably likely changes in your commodity prices assumptions would have a material effect on your financial condition or results of operations, the impact that could result given the range of reasonably likely outcomes should be disclosed and quantified.

Response: We acknowledge the Staff’s comment and propose to repeat the Critical Accounting Policies and Estimates disclosure from our Form 10-K in our next Form 10-Q with the following additions to the “Impairment of Goodwill” discussion in order to address the Staff’s comment:

“While commodity prices do not have a significant direct exposure to the cash flows projected at TMID, the current commodity price environment has had an indirect impact on TMID’s business as certain producers have significantly reduced their anticipated volumes. Keeping all other assumptions constant, while an increase in the discount rate applied of approximately 1.38% or a decrease in overall cash flows by more than 16% would result in a step one failure, we do not believe that these represent reasonably likely assumptions. If the reporting unit fails step one in the future, we would be required to perform step two of the goodwill impairment test and up to $79.2 million of goodwill at the TMID reporting unit could be written off in the period that the impairment is triggered.”

Form 8-K filed February 17, 2016

7. Your disclosure of Adjusted EBITDA throughout your earnings release may not be consistent with Question 102.10 of the updated Compliance and Disclosure Interpretations on Non-GAAP Financial Measures issued on May 17, 2016. Please consider the above-mentioned Interpretations in their entirety when preparing the disclosures to be included in your next earnings release.

Response: TEP and TEGP acknowledge the Staff’s comment and the Compliance and Disclosure Interpretations issued on May 17, 2016 and confirm future earnings releases will comply with both Regulation G and the new guidance.

8. We note your discussion under Distribution Outlook and Guidance for TEGP that TEGP expects its cash distributions to Class A shareholders to grow at approximately two times the distribution growth rate of TEP’s cash distributions. Please explain to us the basis for this expectation.

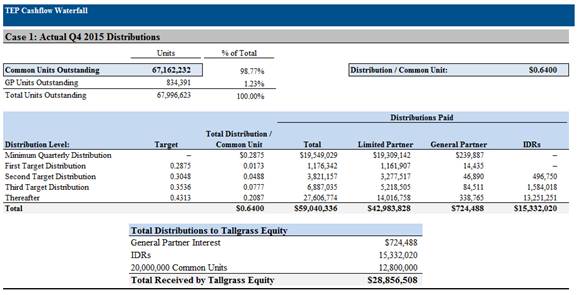

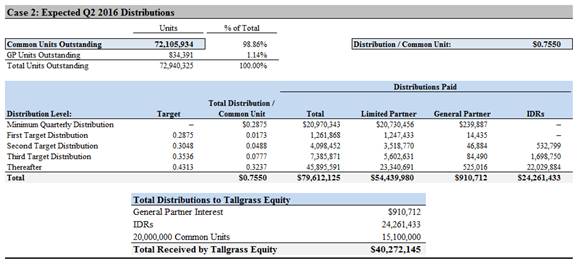

Response: TEP makes cash distributions to holders of its incentive distribution rights, general partner interests, and limited partner interests. Tallgrass Equity, through its 100% membership interest in TEP’s general partner, indirectly owns all of the incentive distribution rights of TEP and 834,391 general partner units in TEP. In addition, Tallgrass Equity directly owns 20,000,000 common units representing limited partner interests in TEP. Upon receipt of cash distributions from TEP arising from its ownership in each of these three classes of securities, Tallgrass Equity in turn makes cash distributions from available cash to TEGP based on TEGP’s approximate 30.35% interest in Tallgrass Equity. TEGP then makes cash distributions to its Class A shareholders from the cash distributions it has received as a result of its membership interests in Tallgrass Equity.

7

Because TEGP ultimately receives cash distributions arising out of Tallgrass Equity’s receipt of distributions from TEP on the incentive distribution rights, general partner interests, and limited partner interests, TEGP’s distribution growth rate will increase at a greater rate than TEP’s cash distributions to its limited partners alone. This is due primarily to Tallgrass Equity’s ownership of the incentive distribution rights, which entitle Tallgrass Equity to receive increasing percentages (up to a maximum of 48%) of any cash distributed by TEP in excess of $0.3048 per TEP common unit in any quarter. Alternatively, if TEP increases its number of outstanding common units and maintains the same distribution per common unit, the amount of the total distribution will increase, and therefore the amount of that distribution that is attributable to incentive distribution rights will increase as well.

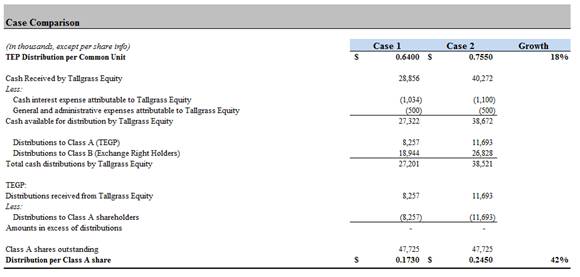

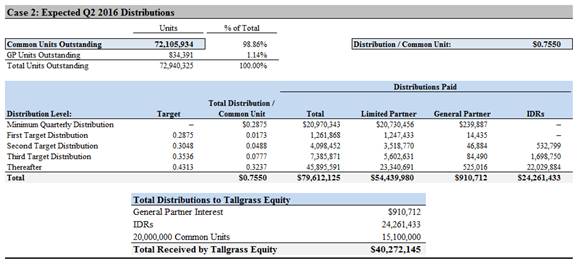

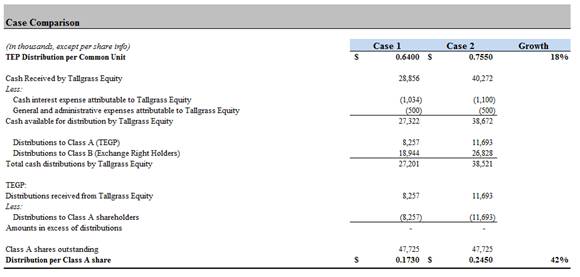

We projected the rate of TEP’s distributions would grow at approximately 20% per year through 2017 and that TEGP’s distributions would grow at approximately two times the distribution growth rate of TEP’s cash distributions, or approximately 40% for 2016. These projections were based upon (i) the expected growth in TEP’s distributions, (ii) expected increases in TEP’s units outstanding, both primarily associated with the acquisition of an incremental 31.3% interest in Pony Express effective January 1, 2016, and (iii) the impact of the foregoing on TEP’s incentive distribution rights. Based upon the incentive distribution rights calculations set forth above and TEGP’s expected distributions as a result of Tallgrass Equity’s ownership of TEP’s incentive distribution rights, TEGP is expected to experience a growth rate roughly two times greater than that of TEP. The following is an example that illustrates the growth in TEP and TEGP’s distributions from the fourth quarter of 2015 to the second quarter of 2016:

8

As shown in the tables above, TEP’s per unit distribution has grown from $0.64 to $0.755, representing a growth rate of 18%. TEGP’s per share distribution has grown from $0.173 to $0.245 during the same period, representing a growth rate of 42%. TEP’s distribution growth during this period is primarily attributable to TEP’s acquisition of an additional 31.3% membership interest in Pony Express effective January 1, 2016 and a 25% membership interest in TEX effective May 6, 2016. The higher growth rate of TEGP’s distributions relative to TEP’s distributions is the mathematical result of the distributions paid by TEP to Tallgrass Equity, with respect to its indirect ownership of TEP’s general partner interest and the incentive distribution rights, in accordance with TEP’s limited partnership agreement and as described in TEP’s Form 10-K and TEGP’s Form 10-K.

In connection with responding to the Staff’s comments, the Partnerships acknowledge that:

| | • | | the Partnerships are responsible for the adequacy and accuracy of the disclosure in their filings, |

| | • | | Staff comments or changes to disclosure in response to Staff comments do not foreclose the Commission from taking any action with respect to the filings, and |

9

| | • | | the Partnerships may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Should the Staff have any questions with respect to the foregoing responses or require further information, please contact the undersigned at (913) 928-6045 or Mollie Duckworth of Baker Botts L.L.P. at (512) 322-2551.

10

| | |

| Very truly yours, |

|

| TALLGRASS ENERGY PARTNERS, LP |

|

| By: Tallgrass MLP GP, LLC, its general partner |

| |

| By: | | /s/ Gary J. Brauchle |

| | Gary J. Brauchle |

| | Executive Vice President and Chief Financial Officer |

|

| TALLGRASS ENERGY GP, LP |

|

| By: TEGP Management, LLC, its general partner |

| |

| By: | | /s/ Gary J. Brauchle |

| | Gary J. Brauchle |

| | Executive Vice President and Chief Financial Officer |

| cc: | Mollie Duckworth, Baker Botts L.L.P. |

| | Christopher R. Jones, Vice President, General Counsel and Secretary |

11