EXHIBIT 2

|

| 750 Eleventh Street South Suite 202 Naples, FL 34102 (239) 777-0187 |

Mr. Marty Plourd

Director, President & Chief Executive Officer

Community West Bancshares

445 Pine Avenue

Goleta, CA 93117

October 5, 2021

Re: Director and Executive Officer Stock Ownership Requirements

Dear Marty:

We last spoke via teleconference on May 10, 2021. At that time, I raised concerns about certain members of the executive management team and board of directors who have not accumulated and maintained a meaningful equity ownership in Community West Bancshares (the “Company”). We discussed and agreed that significant equity ownership in the Company by executive officers and non-employee directors is in the best interest of the Company and serves to align the interests of officers and directors with those of Company stockholders.

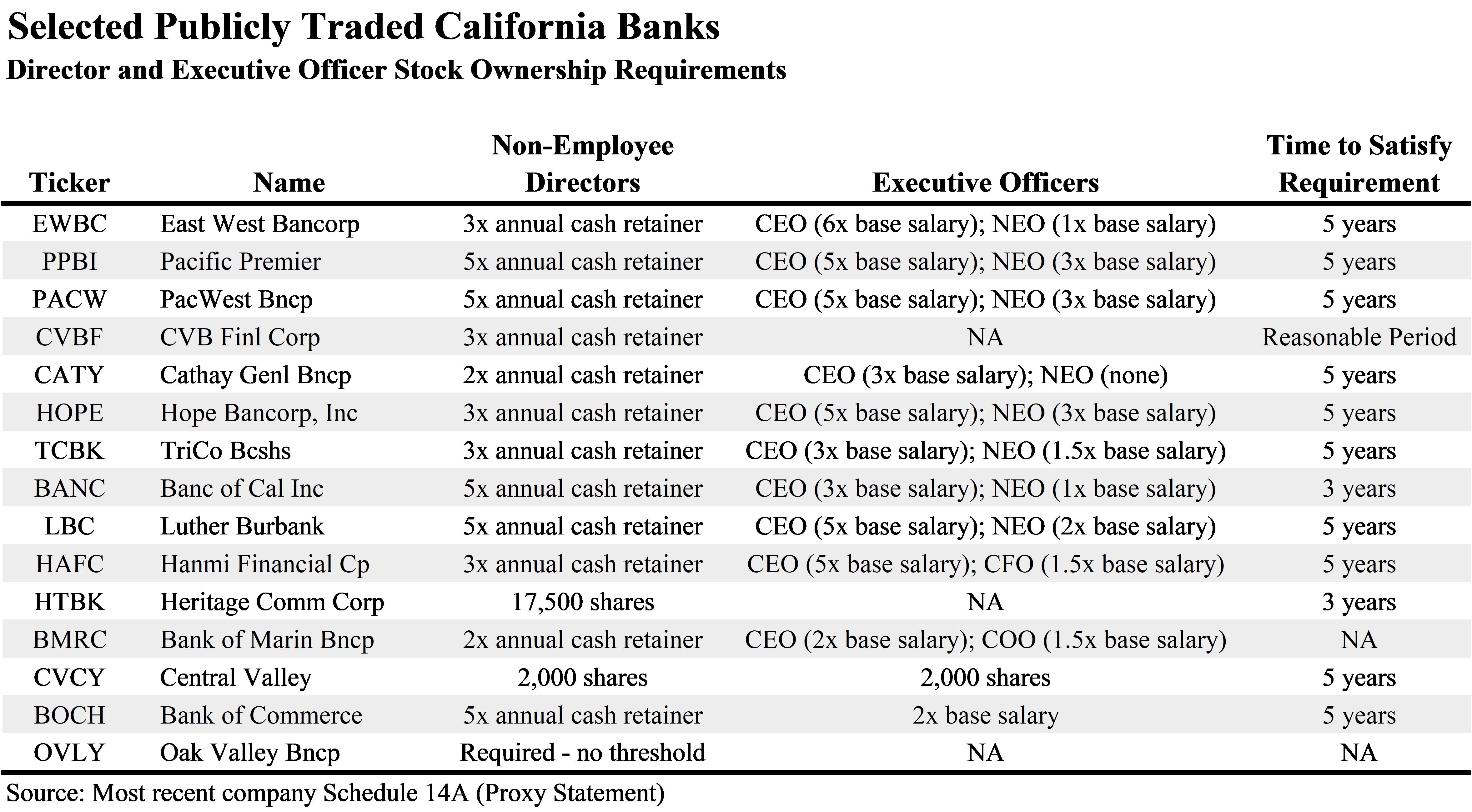

While some executive officers and non-employee directors hold a significant equity interest in the Company, others do not. The lack of a stock ownership requirement for all executive officers and non-employee directors is inconsistent with good corporate governance and the policies of most publicly traded California banks. As you can see from Exhibit A on page 2, many publicly traded California banks have stock ownership guidelines ranging from 2 – 5x the then-current annual base cash retainer for non-employee directors, 2 – 5x base salary for the Chief Executive Officer, and 1 – 3x base salary for other named executive officers. Compliance with these stock ownership guidelines is generally required to be achieved within 3 – 5 years from the date the executive officer becomes subject to the guidelines, or from the date the non-employee director joins the board. Common stock equivalents granted through the normal course of business, such as restricted stock, restricted stock units, and a portion of shares that may be acquired by exercise of vested in-the-money stock options, are typically treated as stock ownership for this purpose. However, common stock acquired with personal funds on the open market is the most effective way to directly align the interest of officers and directors with those of Company stockholders.

I propose the Board adopt specific guidelines and expectations regarding non-employee and executive officer stock ownership. For the avoidance of doubt, I would be very disappointed if the Company were to grant stock ownership, outside the normal course of business, to its officers and directors to satisfy any future ownership requirements. Please advise me on your plan to address this important aspect of corporate governance with the Board. If the Board chooses not to address this matter, I plan to assert my rights as a Company stockholder and submit this matter for proposal at the 2022 annual meeting of shareholders.

John W. Palmer

CC: Board of Directors of Community West Bancshares

| | 750 Eleventh Street South Suite 202 Naples, FL 34102 (239) 777-0187 |

EXHIBIT A: