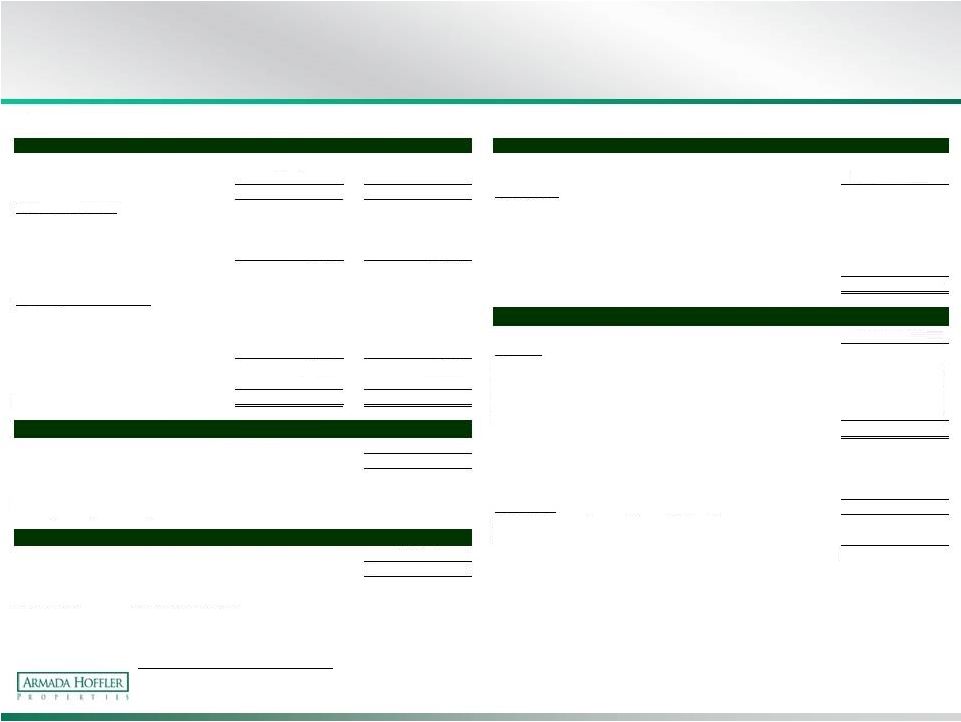

Stabilized Portfolio Summary Footnotes 17 1) The net rentable square footage for each of our office properties is the sum of (a) the square footages of existing leases, plus (b) for available space, management’s estimate of net rentable square footage based, in part, on past leases. The net rentable square footage included in office leases is generally determined consistently with the Building Owners and Managers Association, or BOMA, 1996 measurement guidelines. The net rentable square footage for each of our retail properties is the sum of (a) the square footages of existing leases, plus (b) for available space, the field verified square footage. 2) Percentage leased for each of our office and retail properties is calculated as (a) square footage under executed leases as of December 31, 2014, divided by (b) net rentable square feet, expressed as a percentage. Percentage leased for our multifamily properties is calculated as (a) total units occupied as of December 31, 2014, divided by (b) total units available, expressed as a percentage. 3) For the properties in our office and retail portfolios, annualized base rent is calculated by multiplying (a) base rental payments for executed leases as of December 31, 2014 (defined as cash base rents (before abatements) excluding tenant reimbursements for expenses paid by the landlord), by (b) 12. Annualized base rent per leased square foot is calculated by dividing (a) annualized base rent, by (b) square footage under commenced leases as of December 31, 2014. In the case of triple net or modified gross leases, annualized base rent does not include tenant reimbursements for real estate taxes, insurance, common area or other operating expenses. 4) Average net effective annual base rent per leased square foot represents (a) the contractual base rent for leases in place as of December 31, 2014, calculated on a straight-line basis to amortize free rent periods and abatements, but without regard to tenant improvement allowances and leasing commissions, divided by (b) square footage under commenced leases as of December 31, 2014. 5) As of December 31,2014, the Company occupied 18,984 square feet at this property at an annualized base rent of $529,746 or $27.90 per leased square foot, which amounts are reflected in the % leased, annualized base rent and annualized base rent per square foot columns in the table above. The rent paid by us is eliminated from our revenues in consolidation. In addition, effective March 1, 2013, the Company sublease approximately 5,000 square feet of space from a tenant at this property. 6) This property is subject to a triple net lease pursuant to which the tenant pays operating expenses, insurance and real estate taxes. 7) Includes square footage and annualized base rent pursuant to leases for space occupied by us. 8) As of December 31, 2014, the Company occupied 8,995 square feet at this property at an annualized base rent of $287,300, or $31.94 per leased square foot, which amounts are reflected in the % leased, annualized base rent and annualized base rent per square foot columns in the table above. The rent paid by us is eliminated from our revenues in consolidation. 9) Includes $32,460 of annualized base rent pursuant to a rooftop lease. 10) Reflects square footage and annualized base rent pursuant to leases for space occupied by AHH. 11) For this ground lease, the Company own the land and the tenant owns the improvements thereto. The Company will succeed to the ownership of the improvements to the land upon the termination of the ground lease. 12) The Company lease the land underlying this property from the owner of the land pursuant to a ground lease. The Company re-lease the land to our tenant under a separate ground lease pursuant to which our tenant owns the improvements on the land. 13) Tenants collectively lease approximately 139,356 square feet of land from us pursuant to ground leases. 14) Tenants collectively lease approximately 299,170 square feet of land from us pursuant to ground leases. 15) Tenants collectively lease approximately 105,988 square feet of land from us pursuant to ground leases. 16) Tenants collectively lease approximately 1,443,985 square feet of land from us pursuant to ground leases. 17) Tenant leases approximately 200,073 square feet of land from us pursuant to a ground lease. 18) The total square footage of our retail portfolio excludes the square footage of land subject to ground leases. 19) Units represent the total number of apartment units available for rent at December 31, 2014. 20) For the properties in our multifamily portfolio, annualized base rent is calculated by multiplying (a) base rental payments for the month ended December 31, 2014 by (b) 12. 21) Average monthly base rent per leased unit represents the average monthly rent for all leased units for the month ended December 31, 2014. 22) The Company lease the land underlying this property from the owner of the land pursuant to a ground lease. 23) The annualized base rent for The Cosmopolitan includes $885,000 of annualized rent from 15 retail leases at the property. |